3D Imaging Market by Component (Hardware, Solutions, and Services), Deployment Mode, Organization Size, Vertical (Manufacturing, Media and Entertainment, and Architecture and Construction), and Region - Global Forecast to 2025

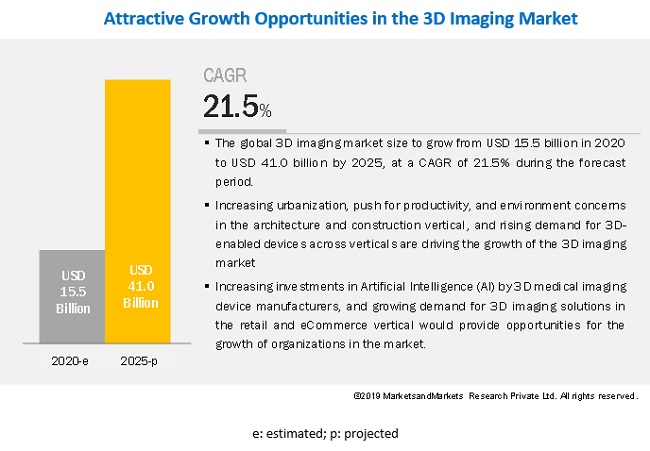

[216 Pages Report] The global 3D imaging market size to grow from USD 15.5 billion in 2020 to USD 41.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 21.5% during the forecast period. The major growth factors of the 3D imaging market are the increasing demand for 3D image sensors from verticals, such as manufacturing, automotive, and media and entertainment. The growing demand for 3D accelerometers in smart phones and gaming consoles is also expected to drive the market growth.

Among solutions, the 3D layout and animation segment to grow at the highest CAGR during the forecast period

The 3D imaging market consist of several software used for the creation of 3D animation, which can range from professional high-end ones to the affordable low-end versions. 3D layout and animation represent the spatial relation between the size and location of the object. Animation basically shows the sequential description of the object, how it will move, and change over time. This solution is increasingly being adopted across diverse verticals, such as media and entertainment and construction to offer improved services for end users. 3D imaging companies, such as Autodesk offer the 3ds Max and Maya solutions for media, entertainment, and gaming verticals to enhance their animation and motion pictures quality. Adobe offers 3D animation software that helps photographers to create animated clips and fluid spatial effects that enhance photo quality. The software provides various designing tools for various vendors in the gaming industry to enhance their 3D model.

Cloud deployment mode to grow at a rapid pace during the forecast period

Most vendors in the 3D imaging market offer cloud-based 3D imaging solutions to maximize profits and automate the equipment maintenance process, effectively. The adoption of cloud-based 3D imaging solutions is expected to grow, owing to benefits, such as easy maintenance of image data generated, cost-effectiveness, agility, flexibility, scalability, and effective management of these solutions. Companies prefer to adopt cloud-based 3D imaging solutions, as these support their regional, cross-regional or cross-country data recovery strategies. This enables them to ensure resilience in case of disasters.

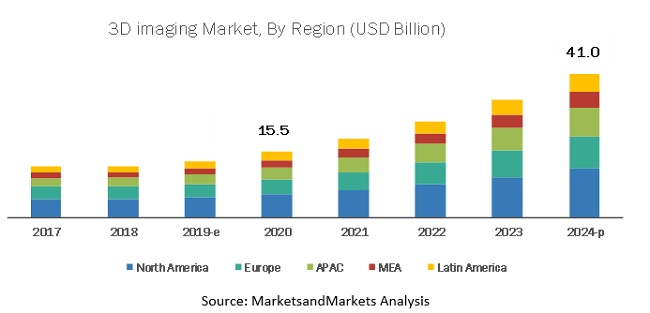

North America to hold the highest market share during the forecast period

North America is expected to hold the highest share in the global 3D imaging market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The region is witnessing significant developments in the market. North America is projected to hold the largest market size during the forecast period. Key factors favoring the growth of the market in North America include increasing investments for Research and Development (R&D) process and widespread adoption of the 3D technology in the region. The growing number of 3D imaging players across regions is expected to drive the market growth further. Major North American vendors in the market are GE Healthcare (US), Autodesk (US), Trimble (US), FARO (US), Google (US), Adobe (US), HP (US), Lockheed Martin (US), Able Software (US), Esri (US), Bentley Systems (US), Pixologic (US).

Key market players

Major vendors in the global 3D imaging market include GE Healthcare (US), Autodesk (US), STMicroelectronics (Switzerland), Panasonic (Japan), and Sony (Japan), Philips (Netherland), Trimble (US), FARO (US), , Google (US), Adobe (US), HP (US), Dassault Systemes (France), Lockheed Martin (US), Topcon (Japan), Able Software (US), Maxon (Germany), Esri (US), Bentley Systems (US), Pixologic (US), Pix4D (Switzerland). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global market.

STMicroelectronics (Switzerland) offers amplifiers, comparators, automotive microcontrollers, data converters, diodes, rectifiers, Micro-Electro-Mechanical Systems (MEMS), sensors, motor drives, transistors, and thyristors. These products are used in automobiles, personal electronics, communications equipment, and Internet of Things (IoT) devices. The company operates through three business segments: automotive and discrete group; analog, MEMS, and sensors group; and microcontrollers and digital Integrated CircuitsGroup. The automotive and discrete group segment comprises automotive ICs and discrete power transistor products, while the analog, MEMS, and sensors group includes analog ICs and smart power products for industrial, computer, and personal electronics markets. The microcontrollers and digital ICs group consists of microcontrollers, Electrically Erasable Programmable Read-Only Memories, and aerospace and defense products that include components for microwave and millimeter-wave solutions. The company offers position sensors through its analog, MEMS, and sensors group segment. Using the Time-of-Flight (ToF) principle, the company developed and patented its own technology called FlightSense to offer a new generation of high-accuracy proximity sensors.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

GE Healthcare (US), Autodesk (US), STMicroelectronics (Switzerland), Panasonic (Japan), and Sony (Japan), Philips (Netherland), Trimble (US), FARO (US), , Google (US), Adobe (US), HP (US), Dassault Systθmes (France), Lockheed Martin (US), Topcon (Japan), Able Software (US), Maxon (Germany), Esri (US), Bentley Systems (US), Pixologic (US), and Pix4D (Switzerland). |

This research report categorizes the market based on components, deployment modes, organization size, verticals, and regions.

By component, the 3D imaging market is divided into the following segments:

- Solutions

- 3D modeling

- 3D scanning

- 3D layout and animation

- 3D visualization and rendering

- Hardware

- 3D display

- 3D sensors

- Services

- Managed Services

- Profession Services

- Consulting

- Deployment and Integration

- Support and Maintenance

By deployment mode, the 3D imaging market is divided into the following segments:

- Cloud

- On-premises

By organization size, the 3D imaging market is divided into the following segments:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By vertical, the 3D imaging market is divided into the following segments:

- Aerospace and Defense

- Automotive and Transportation

- Manufacturing

- Healthcare and Life Sciences

- Architecture and Construction

- Media and Entertainment

- Retail and Consumer Goods

- Others (Energy and Utilities, Education, Agricultural irrigation, and BFSI)

By region, the 3D imaging market is divided into the following segments:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

- Middle East and Africa (MEA)

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Critical questions answered by the report:

- What are the current trends driving the 3D imaging market?

- In which vertical are most industrial companies deploying 3D imaging solutions?

- Where will recent developments of market vendors take the industry in the mid- to long-term?

- Who are the top vendors in the market, and what is their competitive analysis?

- What are the drivers and challenges faced by vendors in the market?

Frequently Asked Questions (FAQ):

What is 3D Imaging?

3D imaging is the process of creating the illusion of depth in an image. Technological advancements and evolution of specialized inspection techniques in industrial applications, have enabled users to obtain accurate and timeless 3D data on objects, by providing 3D images for testing purposes.

What are the top vendors in 3D Imaging market?

Major vendors offering 3D Imaging and services includes GE Healthcare, Autodesk, STMicroelectronics, Panasonic, Sony, Trimble, FARO, Philips, Google, Adobe, HP. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the market.

What is the market size of 3D Imaging market?

The global 3D imaging market size to grow from USD 15.5 billion in 2020 to USD 41.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 21.5% during the forecast period. The major growth factors of the 3D imaging market are the increasing demand for 3D image sensors from verticals, such as manufacturing, automotive, and media and entertainment. The growing demand for 3D accelerometers in smart phones and gaming consoles is also expected to drive the market growth

Which industry verticals are adopting 3D Imaging solutions and services?

The top industry verticals adopting 3D Imaging and services include aerospace and defense, automotive and transportation, manufacturing, healthcare and life sciences, and architecture and construction. Rising demand for 3D-enabled devices across verticals, and increasing urbanization, push for productivity, and environment concerns in the architecture and construction vertical to drive the adoption of 3D imaging solutions and services.

What are the regulations impacting the 3D Imaging Market?

The acts or regulations having impact on the growth of 3D imaging market include General Data Protection Regulation, Health Insurance Portability and Accountability Act (HIPAA), Health Information Technology for Economic and Clinical Health Act, California Consumer Privacy Act, Sarbanes-Oxley Act Of 2002, and Payment Card Industry Data Security Standard. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.3 MARKET BREAKUP AND DATA TRIANGULATION

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.3 MARKET FORECAST

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE MARKET

4.2 TOP 3 VERTICALS

4.3 3D IMAGING MARKET, BY REGION

4.4 NORTH AMERICA 3D IMAGING MARKET, BY COMPONENT AND VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising demand for 3D-enabled devices across verticals

5.2.1.2 Increasing urbanization, push for productivity, and environment concerns in the architecture and construction vertical

5.2.2 RESTRAINTS

5.2.2.1 High maintenance costs of 3D imaging hardware

5.2.2.2 Interoperability issues with 3D imaging solutions and hardware

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing investments in AI by 3D medical imaging device manufacturers

5.2.3.2 High demand for 3D imaging solutions in the retail and eCommerce vertical

5.2.4 CHALLENGES

5.2.4.1 High power consumption requirements for 3D image processing

5.2.4.2 Impact of Coronavirus outbreak on the global economy

5.3 USE CASES

5.3.1 TATA INTERACTIVE SYSTEMS (TIS) COLLABORATED WITH AUTODESK TO INNOVATE ELEARNING WITH 3D ANIMATION

5.3.2 JP CULLEN ADOPTED TRIMBLE SOLUTIONS TO BUILD HIGHER QUALITY PRODUCT WITH 3D MODELING

5.3.3 KOBELCO CONSTRUCTION MACHINERY COLLABORATED WITH DASSAULT SYSTΘMES TO MANAGE ITS GLOBAL MANUFACTURING OPERATIONS

5.3.4 FEOPS COLLABORATED WITH DASSAULT SYSTΘMES TO IMPROVE OUTCOMES IN HEART VALVE REPLACEMENT

5.3.5 TRUEPOINT PROVIDED 3D LASER SCANNING AND MODELING SERVICES FOR A POWER PLANT IN MICHIGAN

5.3.6 CHINA RAILWAY DESIGN CORPORATION ADOPTED DASSAULT SYSTΘMES 3DEXPERIENCE PLATFORM TO DESIGN THEIR RAILWAY PROJECTS

5.3.7 BIOLITE ADOPTED AUTODESK SOFTWARE TO CREATE ELECTRICITY GENERATING BIOMASS STOVES FOR IMPROVING PUBLIC HEALTH

5.4 REGULATORY COMPLIANCES

5.4.1 GENERAL DATA PROTECTION REGULATION

5.4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

5.5 3D IMAGING TECHNIQUES

5.6 3D IMAGING APPLICATIONS

5.6.1 CONSUMER ELECTRONICS

5.6.1.1 Smartphones

5.6.1.2 Wearable electronics

5.6.1.3 Television

5.6.1.4 Tablets

5.6.1.5 Others

5.6.2 HEALTHCARE

5.6.2.1 MRI or scan

5.6.2.2 Surgery

5.6.2.3 Telemedicine

5.6.2.4 Tomosynthesis

5.6.3 AEROSPACE AND DEFENSE

5.6.3.1 Volumetric 3D display

5.6.3.2 3D acoustic sensors

5.6.3.3 3D LIDAR

5.6.4 INDUSTRIAL ROBOTICS

5.6.4.1 Tier management

5.6.4.2 Real-time 3D imaging sensing

5.6.5 MEDIA AND ENTERTAINMENT

5.6.5.1 3D animation

5.6.5.2 3D gaming

5.6.6 AUTOMOTIVE AND TRANSPORTATION

5.6.6.1 Time-of-Flight

5.6.6.2 Lane departure warning system

5.6.6.3 Blind spot viewing

5.6.6.4 Pedestrian detection

5.6.7 SECURITY AND SURVEILLANCE

5.6.7.1 Face detection

5.6.7.2 Skin texture analysis

5.6.7.3 Biometrics

5.7 3D MODELING TECHNIQUES

5.8 3D DISPLAY

5.9 3D SENSORS

5.1 3D IMAGING: EMERGING TRENDS

5.10.1 3D PRINTING

5.10.2 TIME-OF-FLIGHT APPLICATIONS

5.10.3 SHEET-OF-LIGHT APPLICATIONS

5.10.4 3D X-RAY IMAGING

5.10.5 ROBOTICS

5.11 FUTURE OUTLOOK

5.11.1 THE MOVE FROM 3D IMAGING TO 4D IMAGING

5.11.2 ROLE OF ADJACENT TECHNOLOGIES IN 3D IMAGING

5.11.2.1 AI in 3D imaging

5.11.2.2 IoT in 3D imaging

5.11.2.3 Blockchain in 3D imaging

6 3D IMAGING MARKET, BY COMPONENT (Page No. - 69)

6.1 INTRODUCTION

6.2 HARDWARE

6.2.1 3D DISPLAY

6.2.2 3D IMAGE SENSORS

6.2.2.1 CMOS 3D image sensors

6.2.2.2 3D electro-optical image sensors

6.2.2.3 3D TOF image sensors

6.3 SOLUTIONS

6.3.1 3D MODELING

6.3.2 3D SCANNING

6.3.3 3D LAYOUT AND ANIMATION

6.3.4 3D VISUALIZATION AND RENDERING

6.3.5 IMAGE RECONSTRUCTION

6.4 SERVICES

6.4.1 MANAGED SERVICES

6.4.2 PROFESSIONAL SERVICES

6.4.2.1 Consulting

6.4.2.2 Support and maintenance

6.4.2.3 Deployment and integration

7 3D IMAGING MARKET, BY DEPLOYMENT MODE (Page No. - 86)

7.1 INTRODUCTION

7.2 ON-PREMISES

7.3 CLOUD

8 3D IMAGING MARKET, BY ORGANIZATION SIZE (Page No. - 90)

8.1 INTRODUCTION

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9 3D IMAGING MARKET, BY VERTICAL (Page No. - 94)

9.1 INTRODUCTION

9.2 AEROSPACE AND DEFENSE

9.3 AUTOMOTIVE AND TRANSPORTATION

9.4 MANUFACTURING

9.5 HEALTHCARE AND LIFE SCIENCES

9.6 ARCHITECTURE AND CONSTRUCTION

9.7 MEDIA AND ENTERTAINMENT

9.8 RETAIL AND ECOMMERCE

9.9 OTHER VERTICALS

10 3D IMAGING MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 UNITED STATES

10.2.2 CANADA

10.3 EUROPE

10.3.1 UNITED KINGDOM

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 INDIA

10.4.4 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 KINGDOM OF SAUDI ARABIA

10.5.2 UNITED ARAB EMIRATES

10.5.3 SOUTH AFRICA

10.5.4 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 BRAZIL

10.6.2 MEXICO

10.6.3 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 148)

11.1 MICROQUADRANT OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

12 COMPANY PROFILES (Page No. - 150)

12.1 INTRODUCTION

(Business overview, Solutions and Services offered, Recent developments, SWOT analysis & Right-to-win)*

12.2 GE HEALTHCARE

12.3 AUTODESK

12.4 STMICROELECTRONICS

12.5 PANASONIC

12.6 SONY

12.7 TRIMBLE

12.8 FARO

12.9 PHILIPS

12.10 GOOGLE

12.11 ADOBE

12.12 HP

12.13 DASSAULT SYSTΘMES

12.14 LOCKHEED MARTIN

12.15 TOPCON

12.16 ABLE SOFTWARE

12.17 MAXON

12.18 ESRI

12.19 BENTLEY SYSTEMS

12.20 PIXOLOGIC

12.21 PIX4D

*Details on Business overview, Solutions and Services offered, Recent developments, SWOT analysis & Right-to-win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 204)

13.1 INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

LIST OF TABLES (107 Tables)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20172019

TABLE 2 FACTOR ANALYSIS

TABLE 3 GLOBAL 3D IMAGING MARKET SIZE AND GROWTH RATE, 20182025 (USD MILLION, Y-O-Y %)

TABLE 4 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 5 HARDWARE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 6 HARDWARE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 7 3D DISPLAY MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 8 3D IMAGING MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 9 3D IMAGE SENSORS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 3D MODELING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 13 3D SCANNING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 14 3D LAYOUT AND ANIMATION MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 15 3D VISUALIZATION AND RENDERING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 16 IMAGE RECONSTRUCTION MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 17 3D IMAGING MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 18 SERVICES: 3D IMAGING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 19 MANAGED SERVICES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: 3D IMAGING MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 22 3D IMAGING MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 23 ON-PREMISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 24 CLOUD: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 25 3D IMAGING MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 28 3D IMAGING MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 29 AEROSPACE AND DEFENSE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 30 AUTOMOTIVE AND TRANSPORTATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 31 MANUFACTURING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 32 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 33 ARCHITECTURE AND CONSTRUCTION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 34 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 35 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 36 OTHER VERTICALS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 37 3D IMAGING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 38 NORTH AMERICA: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 20182025 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY HARDWARE, 20182025 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 48 UNITED STATES: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 49 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 50 CANADA: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 52 EUROPE: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY SOLUTION, 20182025 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY HARDWARE, 20182025 (USD MILLION)

TABLE 55 EUROPE: MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 62 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 63 GERMANY: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 64 FRANCE: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 66 ASIA PACIFIC: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 20182025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY HARDWARE, 20182025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 76 CHINA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 77 JAPAN: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 78 INDIA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 79 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 20182025 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HARDWARE, 20182025 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 90 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 93 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 94 LATIN AMERICA: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 20182025 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY HARDWARE, 20182025 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY 3D IMAGE SENSOR TYPE, 20182025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 102 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 103 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 104 BRAZIL: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 105 MEXICO: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 106 REST OF LATIN AMERICA: 3D IMAGING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 107 EVALUATION CRITERIA

LIST OF FIGURES (72 Figures)

FIGURE 1 3D IMAGING MARKET: RESEARCH DESIGN

FIGURE 2 DATA TRIANGULATION

FIGURE 3 3D IMAGING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY SIDE): REVENUE OF HARDWARE/SOLUTIONS/SERVICES OF THE 3D IMAGING MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL HARDWARE/SOLUTIONS/SERVICES OF THE 3D IMAGING MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF 3D IMAGING SOLUTIONS THROUGH THE OVERALL 3D IMAGING SPENDING

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 BOTTOM-UP (DEMAND SIDE)

FIGURE 8 3D IMAGING MARKET SNAPSHOT, BY COMPONENT

FIGURE 9 MARKET SNAPSHOT, BY HARDWARE

FIGURE 10 MARKET SNAPSHOT, BY 3D IMAGE SENSOR TYPE

FIGURE 11 MARKET SNAPSHOT, BY SOLUTION

FIGURE 12 MARKET SNAPSHOT, BY SERVICE

FIGURE 13 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 14 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 15 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 16 MARKET SNAPSHOT, BY VERTICAL

FIGURE 17 MARKET SNAPSHOT, BY REGION

FIGURE 18 RISING DEMAND FOR 3D-ENABLED DEVICES ACROSS VERTICALS AND INCREASING URBANIZATION TO DRIVE THE 3D IMAGING MARKET GROWTH

FIGURE 19 MANUFACTURING VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 20 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 21 HARDWARE COMPONENT AND HEALTHCARE AND LIFE SCIENCES VERTICAL TO ACCOUNT FOR THE HIGHEST SHARES IN THE NORTH AMERICA 3D IMAGING MARKET IN 2020

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 3D IMAGING MARKET

FIGURE 23 3D IMAGING TECHNIQUES

FIGURE 24 3D IMAGING APPLICATIONS IN CONSUMER ELECTRONICS

FIGURE 25 3D IMAGING APPLICATIONS IN HEALTHCARE

FIGURE 26 3D IMAGING APPLICATIONS IN AEROSPACE AND DEFENSE

FIGURE 27 3D IMAGING APPLICATIONS IN INDUSTRIAL ROBOTICS

FIGURE 28 3D IMAGING APPLICATIONS IN MEDIA AND ENTERTAINMENT

FIGURE 29 3D IMAGING APPLICATIONS IN AUTOMOTIVE AND TRANSPORTATION

FIGURE 30 3D IMAGING APPLICATIONS IN SECURITY AND SURVEILLANCE

FIGURE 31 TYPES OF 3D MODELING

FIGURE 32 TYPES OF 3D DISPLAY TECHNOLOGY

FIGURE 33 TYPES OF 3D SENSOR TECHNOLOGY

FIGURE 34 SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 35 3D IMAGE SENSORS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 36 3D TIME-OF-FLIGHT IMAGE SENSORS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 37 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 39 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 40 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 41 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 42 MANUFACTURING VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 43 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 44 CHINA TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 45 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 47 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN NORTH AMERICA

FIGURE 48 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN EUROPE

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 50 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN ASIA PACIFIC

FIGURE 51 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN MIDDLE EAST AND AFRICA

FIGURE 52 3D LAYOUT AND ANIMATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN LATIN AMERICA

FIGURE 53 3D IMAGING MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 54 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 55 GE HEALTHCARE: SWOT ANALYSIS

FIGURE 56 AUTODESK: COMPANY SNAPSHOT

FIGURE 57 AUTODESK: SWOT ANALYSIS

FIGURE 58 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 59 STMICROELECTRONICS: SWOT ANALYSIS

FIGURE 60 PANASONIC: COMPANY SNAPSHOT

FIGURE 61 PANASONIC: SWOT ANALYSIS

FIGURE 62 SONY: COMPANY SNAPSHOT

FIGURE 63 SONY: SWOT ANALYSIS

FIGURE 64 TRIMBLE: COMPANY SNAPSHOT

FIGURE 65 TRIMBLE: SWOT ANALYSIS

FIGURE 66 FARO: COMPANY SNAPSHOT

FIGURE 67 FARO: SWOT ANALYSIS

FIGURE 68 PHILIPS: COMPANY SNAPSHOT

FIGURE 69 GOOGLE: COMPANY SNAPSHOT

FIGURE 70 ADOBE: COMPANY SNAPSHOT

FIGURE 71 HP: COMPANY SNAPSHOT

FIGURE 72 DASSAULT SYSTΘMES: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of the 3D imaging market. An extensive secondary research was done to collect information on the market, peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Journal American College of Radiology, Journal of Imaging Science and Technology, and The International Journal on Imaging Processing have been referred to, for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; Research and Development (R&D) organizations; regulatory bodies; and databases. Journals, repositories, and resources from the International Journal of Computer Vision, were referred to understand the integration of 3D imaging.

Primary Research

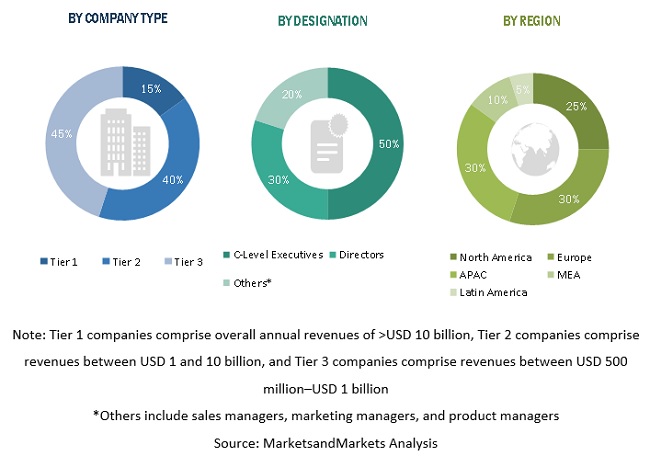

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information of the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors, from business development, marketing, product development/innovation teams, and related key executives from 3D imaging vendors, system integrators, professional service providers, industry associations, and geographic information system consultants and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the 3D imaging market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage, shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To analyze the market by component, deployment mode, organization size, vertical, and region for the 3D imaging market

- To define, segment, and project the global market size for market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To project the size of the market and its submarkets, in terms of value, for the five regions including North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions and fundings, new product launches, mergers and acquisitions, strategic partnerships, and agreements, in the 3D imaging market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American 3D imaging market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in 3D Imaging Market

Indepth understanding of the 3D market and all verticals and also how it may pertain to Medical 3D use.

Gather insights into 3D Imaging Market by Display Technology (Anaglyphy, Stereoscopy, Auto-stereoscopy), Imaging Solution (3D Modeling, 3D Scanning), Hardware (3D Display, 3D Sensor), Industry Vertical, Region and it's Global Forecast to 2020.

Gather insights into 3D Imaging Market by Display Technology (Anaglyphy, Stereoscopy, Auto-stereoscopy), Imaging Solution (3D Modeling, 3D Scanning), Hardware (3D Display, 3D Sensor), Industry Vertical, Region and it's Global Forecast to 2020.

Interested in the 3D measurement, scanning, imaging and surveying technology companies and markets.

Understanding market potential for 3D modelling market

Gather insights into 3D scanning and printing services.