3D Printing Plastics Market by Type (Photopolymer, ABS, PLA, Polyamide), Form (Powder, Liquid, Filament), Application, End-User Industry (Aerospace & Defense, Healthcare, Automotive, Electronics & Consumer Goods) and Region - Global Forecast to 2028

Get the updated report with forecasts to 2028 : Inquire Now

3D Printing Plastics Market

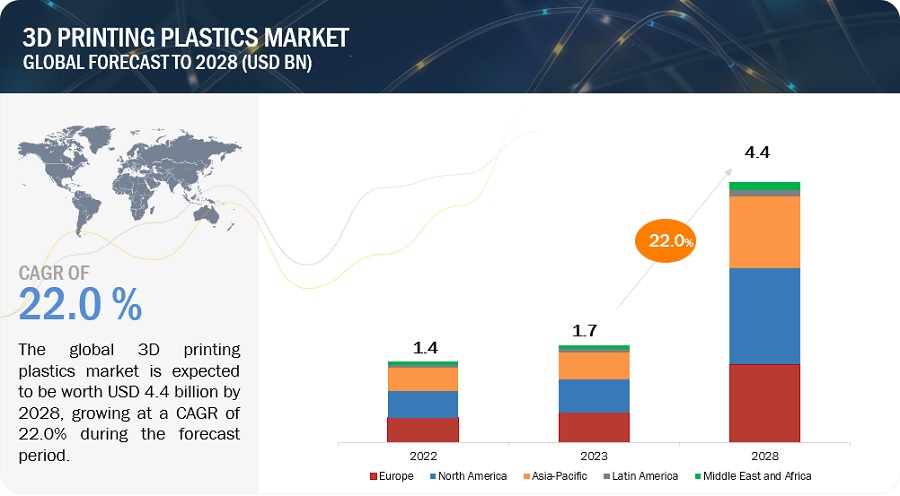

The global 3D printing plastics market was valued at USD 721 million in 2022 and is projected to reach USD 1,907 million by 2027, growing at a cagr 21.5% from 2022 to 2027. Development of application-specific grades of 3D printing plastics is expected to drive the growth of the market during the forecast period between 2022 to 2027. However, environmental concerns regarding disposal of 3D printed plastic products, and skepticism regarding acceptance of new technologies in emerging economies has negatively affected the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global 3D Printing Plastics Market

The 3D printing plastics market witnessed relatively slow growth in 2021 due to the novel coronavirus (COVID-19) pandemic. COVID-19 outbreak resulted in a viral pandemic affecting more than 200 countries worldwide. COVID-19's contagiousness and outbreak have resulted in a severe shortage of personal protective equipment (PPE) and medical supplies. The traditional medical device production line has been challenged by excessive global demand, and the need for a simple, low-cost, and rapid fabrication method is felt more than ever. In order to fill the gap and increase the production line of medical devices, manufacturers turned to additive manufacturing or 3D printing. Several previously/conventionally fabricated designs have been modified and redesigned to meet the COVID-19 3D printing requirement. However, other end use industries such as aerospace & defense, automotive, electronics and consumer goods, among others has seen decline in growth due to lockdowns implemented in various countries, especially in the North American, European and Asia Pacific regions, to prevent the spread of the deadly virus. Many manufacturing units of 3D printing plastic materials had to shut down their operations and manufacturing facilities across countries. This has led to a reduction in the production capacities of 3D printing plastic materials.

3D Printing Plastics Market Dynamics

Driver: Increased supply of 3D printing plastics due to forward integration of major polymer companies

3D printing technology is considered one of the important disruptive technologies of the present times. It is continuously expanding its base in various end-use industries such as aerospace & defense, healthcare, automotive, and electrical & electronics. The increased use of 3D printing technology in these industries is expected to contribute toward the growing demand for 3D printing materials such as 3D printing plastics. Initially, the suppliers of 3D printing plastics were intermediaries, which provided value additions to the products developed using 3D printing technology. The supply capacity of these intermediaries was low compared to the demand for 3D printing plastics. However, at present, the number of suppliers of 3D printing plastics is continuously increasing across the globe, thereby leading to a sufficient supply of 3D printing plastics to catering to their increasing demand from various industries. Polymer companies such as Arkema SA, Covestro AG, SABIC, Evonik AG, and Henkel have entered the 3D printing plastics market by carrying out their forward integration in the last few years. This is expected to further increase the supply of 3D printing plastics in the coming years, thereby leading to the growth of the market.

Restraint: Environmental concerns regarding the disposal of 3D-printed plastic products

Growing environmental concerns about the disposal of plastic materials around the world are expected to restrain the growth of the 3D printing plastics market during the forecast period. 3D printing appears to be a far more environmentally friendly manufacturing technique than traditional subtractive methods at first glance. Rather than sculpting from a single block of raw material, which results in offcuts and waste, 3D printers build objects layer by layer, using only the amount of material required. However, the accessibility of 3D technologies is a major source of concern when it comes to plastic pollution. Because 3D printers have rapid prototyping capabilities, manufacturers can produce in-house, reducing turnaround times and saving money; however, there are concerns that this could lead to an increase in the number of disposable products on the market.To prevent environmental pollution, 3D printing plastics, which are largely petroleum-derived materials, must be properly disposed of. Thus, the use of 3D printing plastics in 3D printing technologies is expected to face regulatory challenges in the long run from various environmental agencies around the world. This prompted major polymer manufacturers to conduct research and development for the innovation of biocompatible materials for 3D printing.

Opportunity: Increasing demand for bio-based grades of 3D printing plastics market

Some of the 3D printing plastics, which include PA11, PA12, and PLA, are derived from natural sources such as castor seeds, palm oil, and starches. Evonik AG is planning to introduce a bio-based grade of PA12, which is manufactured from palm oil. As palm oil is one of the major raw materials for the bio-based PA12, which is an important powdered 3D printing plastic, the development of bio-based grades of PA12 from palm oil is expected to contribute to the growth of the 3D printing plastics market across the globe. Governments of several agro-based countries are promoting the production of bio-based polymers to ensure the growth of their agriculture sectors. This is expected to encourage the use of bio-based plastics for 3D printing applications. Moreover, it will offer a strategic advantage to the manufacturers of bio-based grades of 3D printing plastics to set up their manufacturing plants in such countries

Challenge: High manufacturing costs of commercial grades of 3D printing plastics

Commercial grades of 3D printing plastics have high raw material costs due to several value additions to the base materials used in their production. In emerging economies, the production line for the distribution of raw materials used in the development of commercial grades of 3D printing plastics is still being established. Furthermore, value-added materials, such as carbon fiber and alumina, are expensive when combined with base materials. As a result, the high manufacturing costs of commercial grades of 3D printing plastics are posing a challenge to the global 3D printing plastics market..

3D Printing Plastics Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Photopolymer accounted for the largest market share, in terms of value and volume

Based on type, the 3D printing plastics market has been classified into photopolymer, ABS, PLA, Polyamide and others. The photopolymer segment of the 3D printing plastics market had the largest market share in 2021, in terms of value and volume. Photopolymers are transparent materials used in liquid form in the SLA technology. They are widely used for prototyping of static models in various end-use industries. The growth of the photopolymer segment can be attributed to the increasing adoption of photopolymers in jewelry and dental applications, owing to their transparent and high aesthetic values.

Filament form segment dominated the 3D printing plastics market, in terms of value and volume

Based on form, the 3D printing plastics market has been classified into powder, filament and liquid. The filament segment is expected to lead the 3D printing plastics market during the forecast period, in terms of value and volume. The growth of the filament can be attributed to the high demand of 3D printing plastics from China, Japan, India, and other countries and due to the wide adoption and ease of 3D printing through FDM technology. There is a huge demand for filament in medical devices, implants, automotive parts, and aircraft parts.

Prototyping application holds the major share in the 3D printing plastics market, in terms of value and volume

Based on application, the 3D printing plastics market has been segmented into prototyping, manufacturing, and others. The prototyping segment is the leading application of 3D printing plastics across the globe. 3D printing plastics are mainly used in the prototyping application to showcase how the 3D-printed object looks. The prototyping application is highly useful to increase the adoption of 3D printing across various sectors, such as automotive, aerospace & defense, healthcare, education, and construction.

Aerospace & defence end-use industry segment dominated the 3D printing plastics market, in terms of value and volume

Based on end use industry, the 3D printing plastics market has been segmented into aerospace & defense, healthcare, automotive, electronics & consumers, and others. The Aerospace & Defense segment led the overall 3D printing plastics market in 2021. There is an increased demand for biocompatible high performance plastics such as PA, PEI, PEEK & PEKK, PPSU, and reinforced plastics in automotive & defense industry.

North America held the largest market share in the 3D printing plastics market

North America is the largest market for 3D printing plastics, in terms of value and volume. The growth of the 3D printing plastics market in North America can be attributed to the presence of leading 3D printing plastic manufacturers, such as Stratasys, 3D Systems Corporation, and others in the country in this region. In addition, North America has the highest number of 3D printing startups focused on niche markets.

3D Printing Plastics Market Players

Some of the key players in the global 3D printing plastics market are 3D systems Corporation (US), Stratasys, Inc. (US), Covestro AG (Germany), Arkema S.A. (France), Evonik Industries (Germany), BASF SE (Germany), Solvay S.A. (Belgium), Henkel (Germany), EOS GmbH Electro Optical Systems (Germany), and SABIC (Saudi Arabia).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the 3D printing plastics industry. The study includes an in-depth competitive analysis of these key players in the 3D printing plastics market, with their company profiles, recent developments, and key market strategies.

3D Printing Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 721 million |

|

Revenue Forecast in 2027 |

USD 1,907 million |

|

CAGR |

21.5% |

|

Years considered for the study |

2018–2021 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD million), Volume (Tons) |

|

Segments |

Type, Form, Application, End-Use Industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

3D Systems Corporation (US), Stratasys, Inc. (US), Covestro AG (Germany), Arkema S.A. (France), Evonik Industries (Germany), BASF SE (Germany), Henkel (Germany), EOS GmbH Electro Optical Systems (Germany), Solvay S.A. (Belgium), SABIC (Saudi Arabia), E.I. du Pont de Nemours & Company (US), Shenzhen eSUN Industrial Co., Ltd. (China), Hunstman Corporation (US), CRP Technology S.r.L (Italy), and Formlabs Inc (US). |

This research report categorizes the 3D printing plastics market based on type, form, application, end-use industry and region.

By Type:

- Photopolymers

- ABS

- PLA

- Polyamide

- Others

By Form:

- Powder

- Filament

- Liquid

By Application:

- Prototyping

- Manufacturing

- Others

By End-Use Industry:

- Aerospace & Defense

- Healthcare

- Automotive

- Electronics & Consumer Goods

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In March 2022, 3D Systems, the leading additive manufacturing solutions provider, and the Saudi Arabian Industrial Investments Company (Dussur) have signed an agreement intended to expand the use of additive manufacturing (AM) within the Kingdom of Saudi Arabia and surrounding geographies, including the Middle East and North Africa.

- In March 2022, Evonik launched VESTAKEEP iC4800 3DF, a new osteoconductive PEEK filament for 3D printed filaments during the AAOS trade show in Chicago, USA.

- In March 2022, the specialty chemicals company Evonik and Australia’s 3D printer manufacturer Asiga announced their collaboration in photopolymer-based 3D printing. Both companies aim to drive forward 3D printing large-scale industrial manufacturing by extending today’s capabilities of photo-curing technologies.

- In February 2022, 3D Systems announced that it has entered into an agreement to acquire Titan Additive LLC (Titan Robotics), the Colorado-based designer and fabricator of large-format, industrial 3D printers. With this acquisition, 3D Systems will expand the strength and breadth of its polymer AM solutions portfolio to address new applications in markets such as Foundries, Consumer Goods, Service Bureaus, Transportation & Motorsports, Aerospace & Defense, and General Manufacturing.

- In November 2021, Arkema renews its partnership and collaboration with SEQENS for the development of Medical IMPEKK PEKK for long-term implants, ideal for use in 3D printing.

- In October 2021, BASF Forward AM announced the launch of its Ultrafuse Flexible Filament portfolio of materials for extrusion-based polymer 3D printers.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the 3D printing plastics market?

Development of application-specific grades of 3D printing plastics and mass customization is driving the market.

Which is the largest country-level market for 3D printing plastics?

US is the largest 3D printing plastics market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of 3D printing plastics?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of 3D printing plastics.

What are the challenges in the 3D printing plastics market?

High manufacturing costs of commercial grades of 3D printing plastics is the major challenge in the 3D printing plastics market.

Which type of 3D printing plastics holds the largest market share?

Photopolymer type hold the largest share in terms of value and volume, in the 3D printing plastics market.

How is the 3D printing plastics market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

3D systems Corporation (US), Stratasys, Inc. (US), Covestro AG (Germany), Arkema S.A. (France), Evonik Industries (Germany), BASF SE (Germany), Solvay S.A. (Belgium), Henkel (Germany), EOS GmbH Electro Optical Systems (Germany), and SABIC (Saudi Arabia).

What is the biggest restraint in the 3D printing plastics market?

Environmental concerns regarding the disposal of 3D-printed plastic products is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 3D PRINTING PLASTICS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

FIGURE 1 3D PRINTING PLASTICS MARKET: RESEARCH DESIGN

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews – top 3D printing plastics manufacturers

2.2.2.2 Breakdown of primary interviews

2.2.2.3 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 2 3D PRINTING PLASTICS MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 3 3D PRINTING PLASTICS MARKET: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 4 3D PRINTING PLASTICS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 5 PHOTOPOLYMER SEGMENT LED 3D PRINTING PLASTICS MARKET IN 2021

FIGURE 6 FILAMENT FORM LED 3D PRINTING PLASTICS MARKET IN 2021

FIGURE 7 PROTOTYPING APPLICATION LED 3D PRINTING PLASTICS MARKET IN 2021

FIGURE 8 AEROSPACE & DEFENSE END-USE INDUSTRY LED 3D PRINTING PLASTICS MARKET IN 2021

FIGURE 9 CHINA TO BE FASTEST-GROWING MARKET FOR 3D PRINTING PLASTICS DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA LED GLOBAL 3D PRINTING PLASTICS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN 3D PRINTING PLASTICS MARKET

FIGURE 11 HIGH DEMAND FROM AEROSPACE & DEFENSE INDUSTRY TO DRIVE 3D PRINTING PLASTICS MARKET

4.2 3D PRINTING PLASTICS MARKET, BY TYPE

FIGURE 12 PHOTOPOLYMER ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 3D PRINTING PLASTICS MARKET, BY FORM

FIGURE 13 FILAMENT WAS LARGEST FORM IN 2021

4.4 3D PRINTING PLASTICS MARKET, BY APPLICATION

FIGURE 14 PROTOTYPING WAS LARGEST APPLICATION IN 2021

4.5 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

FIGURE 15 AEROSPACE & DEFENSE END-USE INDUSTRY LED 3D PRINTING PLASTICS MARKET IN 2021

4.6 3D PRINTING PLASTICS MARKET, BY KEY COUNTRIES

FIGURE 16 MARKET IN CHINA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN 3D PRINTING PLASTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Increased supply of 3D printing plastics due to forward integration of major polymer companies

5.2.1.2 Development of application-specific grades of 3D printing plastics

5.2.1.3 Mass customization

5.2.1.4 Initiatives undertaken by governments of different countries to support adoption of 3D printing technologies in various industries

5.2.2 RESTRAINTS

5.2.2.1 Environmental concerns regarding disposal of 3D-printed plastic products

5.2.2.2 Skepticism regarding acceptance of new technologies in emerging economies

5.2.2.3 Required certifications for the use of specific grades of 3D printing plastics for particular applications in critical industries

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for bio-based grades of 3D printing plastics

5.2.3.2 Growing demand for composite grades of 3D printing plastics in various industrial applications

5.2.4 CHALLENGES

5.2.4.1 Evolving 3D printing technologies

5.2.4.2 High manufacturing costs of commercial grades of 3D printing plastics

5.3 INDUSTRY TRENDS

5.3.1 PORTER'S FIVE FORCE ANALYSIS

FIGURE 18 3D PRINTING PLASTICS MARKET: PORTER’S FIVE FORCE ANALYSIS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 BARGAINING POWER OF BUYERS

5.3.6 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 IMPACT OF PORTER’S FIVE FORCE ANALYSIS ON 3D PRINTING PLASTICS MARKET

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

5.4.2 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

5.5 SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM: 3D PRINTING PLASTICS MARKET

5.7 VALUE CHAIN ANALYSIS

FIGURE 21 3D PRINTING PLASTICS MARKET: VALUE CHAIN ANALYSIS

5.7.1 RAW MATERIALS

5.7.2 MANUFACTURING

5.7.3 APPLICATIONS AND END-USE INDUSTRIES

5.8 TECHNOLOGY ANALYSIS

TABLE 2 COMPARISON OF DIFFERENT 3D PRINTING PROCESSES

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY END-USE INDUSTRY

TABLE 3 AVERAGE SELLING PRICES OF KEY PLAYERS (USD/KG)

5.9.2 AVERAGE SELLING PRICE TREND

TABLE 4 3D PRINTING PLASTICS: AVERAGE SELLING PRICE

5.10 3D PRINTING PLASTICS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 5 3D PRINTING PLASTICS MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

5.10.1 OPTIMISTIC SCENARIO

5.10.2 PESSIMISTIC SCENARIO

5.10.3 REALISTIC SCENARIO

5.11 KEY MARKETS FOR IMPORT/EXPORT

5.11.1 US

5.11.2 GERMANY

5.11.3 FRANCE

5.11.4 UK

5.11.5 CHINA

5.12 IMPACT OF COVID-19

5.12.1 HEALTHCARE

5.12.2 AEROSPACE & DEFENSE

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

TABLE 6 3D PRINTING PLASTICS MARKET: GLOBAL PATENTS

FIGURE 22 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 23 GLOBAL PATENT PUBLICATION TREND ANALYSIS, 2011-2021

5.13.4 INSIGHTS

5.13.5 LEGAL STATUS OF PATENTS

FIGURE 24 3D PRINTING PLASTICS MARKET: LEGAL STATUS OF PATENTS

5.13.6 JURISDICTION ANALYSIS

FIGURE 25 JURISDICTION ANALYSIS

5.13.7 TOP APPLICANT ANALYSIS

FIGURE 26 HEILONGJIANG XINDA ENTERPRISE GROUP CO. LTD. HAS HIGHEST NUMBER OF PATENTS

5.13.8 LIST OF PATENTS BY HEILONGJIANG XINDA ENTERPRISE GROUP CO. LTD.

5.13.9 LIST OF PATENTS BY JIANGSU HAOYU ELECTRONIC TECHNOLOGY CO., LTD.

5.13.10 LIST OF PATENTS BY GUANGXI FENGDA 3D TECH CO LTD.

5.13.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 7 3D PRINTING PLASTICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 TARIFF AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16 CASE STUDY ANALYSIS

5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 27 REVENUE SHIFT FOR 3D PRINTING PLASTICS MARKET

6 3D PRINTING PLASTICS MARKET, BY TYPE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 28 PHOTOPOLYMER TO LEAD 3D PRINTING PLASTICS MARKET DURING FORECAST PERIOD

TABLE 12 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 13 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 15 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.2 PHOTOPOLYMER

6.2.1 LEADING MATERIAL IN SLA TECHNOLOGY

FIGURE 29 NORTH AMERICA TO BE LEADING 3D PRINTING PLASTICS MARKET FOR PHOTOPOLYMER

6.2.2 PHOTOPOLYMER: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 16 PHOTOPOLYMER: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 17 PHOTOPOLYMER: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 PHOTOPOLYMER: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 19 PHOTOPOLYMER: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 ABS

6.3.1 HIGH DEMAND IN COMMERCIAL APPLICATIONS

FIGURE 30 NORTH AMERICA TO BE LEADING 3D PRINTING PLASTICS MARKET FOR ABS

6.3.2 ABS: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 20 ABS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 21 ABS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 ABS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 23 ABS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 PLA

6.4.1 SIGNIFICANT DEMAND FOR BIOCOMPATIBLE MATERIALS IN HEALTHCARE INDUSTRY TO BOOST THIS SEGMENT

FIGURE 31 ASIA PACIFIC TO BE LARGEST 3D PRINTING PLASTICS MARKET FOR PLA

6.4.2 PLA: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 24 PLA: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 25 PLA: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 PLA: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 27 PLA: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.5 POLYAMIDE

6.5.1 GROWING DEMAND FOR LASER SINTERING TECHNOLOGY TO DRIVE THIS SEGMENT

FIGURE 32 EUROPE TO BE LEADING 3D PRINTING PLASTICS MARKET FOR POLYAMIDE

6.5.2 POLYAMIDE: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 28 POLYAMIDE: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 29 POLYAMIDE: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 POLYAMIDE: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 31 POLYAMIDE: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHERS

6.6.1 OTHER TYPES: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 32 OTHER TYPES: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 33 OTHER TYPES: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 OTHER TYPES: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 35 OTHER TYPES: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 3D PRINTING PLASTICS MARKET, BY FORM (Page No. - 105)

7.1 INTRODUCTION

FIGURE 33 FILAMENT SEGMENT TO LEAD 3D PRINTING PLASTICS DURING FORECAST PERIOD

TABLE 36 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 37 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 38 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 39 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

7.2 POWDER

7.2.1 LEADING MARKET PLAYERS ENCOURAGING USE OF POWDER FORM

FIGURE 34 NORTH AMERICA TO BE LEADING MARKET FOR POWDER FORM OF 3D PRINTING PLASTICS

7.2.2 POWDER FORM: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 40 POWDER FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 41 POWDER FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 POWDER FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 43 POWDER FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 FILAMENT

7.3.1 HIGH DEMAND FOR FILAMENT IN MEDICAL DEVICES, IMPLANTS, AUTOMOTIVE PARTS, AND AIRCRAFT PARTS

FIGURE 35 ASIA PACIFIC TO BE LEADING MARKET FOR FILAMENT FORM OF 3D PRINTING PLASTICS

7.3.2 FILAMENT FORM: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 44 FILAMENT FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 45 FILAMENT FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 FILAMENT FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 47 FILAMENT FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 LIQUID

7.4.1 SIGNIFICANT USE IN HEALTHCARE, AEROSPACE & DEFENSE, AND ELECTRICAL & ELECTRONICS INDUSTRIES

FIGURE 36 NORTH AMERICA TO BE LARGEST MARKET FOR LIQUID FORM OF 3D PRINTING PLASTICS

7.4.2 LIQUID FORM: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 48 LIQUID FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 49 LIQUID FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 LIQUID FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 51 LIQUID FORM: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 3D PRINTING PLASTICS MARKET, BY APPLICATION (Page No. - 114)

8.1 INTRODUCTION

FIGURE 37 PROTOTYPING TO LEAD 3D PRINTING PLASTICS MARKET DURING FORECAST PERIOD

TABLE 52 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 53 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 55 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 PROTOTYPING

8.2.1 DEMAND FROM AUTOMOTIVE SECTOR TO PROPEL MARKET IN THIS SEGMENT

FIGURE 38 NORTH AMERICA TO BE LARGEST MARKET IN PROTOTYPING APPLICATION

8.2.2 PROTOTYPING: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 56 PROTOTYPING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 57 PROTOTYPING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 PROTOTYPING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 59 PROTOTYPING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 MANUFACTURING

8.3.1 ADOPTION OF 3D PRINTING IN MASS PRODUCTION OF COMPONENTS TO DRIVE MARKET IN THIS SEGMENT

FIGURE 39 NORTH AMERICA TO BE LARGEST MARKET IN MANUFACTURING APPLICATION

8.3.2 MANUFACTURING: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 60 MANUFACTURING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 61 MANUFACTURING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MANUFACTURING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 63 MANUFACTURING: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 OTHERS

8.4.1 OTHER APPLICATIONS: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 64 OTHER APPLICATIONS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 65 OTHER APPLICATIONS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 OTHER APPLICATIONS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 67 OTHER APPLICATIONS: 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY (Page No. - 123)

9.1 INTRODUCTION

FIGURE 40 AEROSPACE & DEFENSE END-USE INDUSTRY TO LEAD 3D PRINTING PLASTICS DURING FORECAST PERIOD

TABLE 68 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 69 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 70 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 71 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.2 AEROSPACE & DEFENSE

9.2.1 3D PRINTING PLASTICS USED FOR MANUFACTURING COMPLEX COMPONENTS AND EQUIPMENT IN THIS INDUSTRY

TABLE 72 NUMBER OF NEW AIRPLANES REQUIRED, BY REGION, 2019–2038

FIGURE 41 EUROPE TO LEAD 3D PRINTING PLASTICS MARKET FOR AEROSPACE & DEFENSE END-USE INDUSTRY DURING FORECAST PERIOD

9.2.2 AEROSPACE & DEFENSE END-USE INDUSTRY: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 73 3D PRINTING PLASTICS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 74 3D PRINTING PLASTICS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 3D PRINTING PLASTICS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2022–2027 (TON)

TABLE 76 3D PRINTING PLASTICS MARKET SIZE IN AEROSPACE & DEFENSE END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.3 HEALTHCARE

9.3.1 ADVANCED GRADES OF 3D PRINTING PLASTICS SPECIFICALLY DEVELOPED FOR THIS INDUSTRY

FIGURE 42 ASIA PACIFIC TO LEAD 3D PRINTING PLASTICS MARKET IN HEALTHCARE END-USE INDUSTRY

9.3.2 HEALTHCARE END-USE INDUSTRY: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 77 3D PRINTING PLASTICS MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 78 3D PRINTING PLASTICS MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 3D PRINTING PLASTICS MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2022–2027 (TON)

TABLE 80 3D PRINTING PLASTICS MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.4 AUTOMOTIVE

9.4.1 HIGH DEMAND FOR PROTOTYPING AUTOMOTIVE COMPONENTS TO DRIVE MARKET

TABLE 81 AUTOMOBILE PRODUCTION STATISTICS, BY REGION (2019)

FIGURE 43 EUROPE TO LEAD 3D PRINTING PLASTICS MARKET IN AUTOMOTIVE END-USE INDUSTRY DURING FORECAST PERIOD

9.4.2 AUTOMOTIVE END-USE INDUSTRY: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 82 3D PRINTING PLASTICS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 83 3D PRINTING PLASTICS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 3D PRINTING PLASTICS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2022–2027 (TON)

TABLE 85 3D PRINTING PLASTICS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.5 ELECTRONICS & CONSUMER GOODS

9.5.1 HIGH DEMAND FOR MANUFACTURING COMPLEX DESIGNS IN ELECTRONICS & CONSUMER GOODS TO AUGMENT MARKET GROWTH

FIGURE 44 NORTH AMERICA TO LEAD 3D PRINTING PLASTICS MARKET IN ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY

9.5.2 ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 86 3D PRINTING PLASTICS MARKET SIZE IN ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2018–2021 (TON)

TABLE 87 3D PRINTING PLASTICS MARKET SIZE IN ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 3D PRINTING PLASTICS MARKET SIZE IN ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2022–2027 (TON)

TABLE 89 3D PRINTING PLASTICS MARKET SIZE IN ELECTRONICS & CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHERS

9.6.1 OTHER END-USE INDUSTRIES: 3D PRINTING PLASTICS MARKET, BY REGION

TABLE 90 3D PRINTING PLASTICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (TON)

TABLE 91 3D PRINTING PLASTICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 3D PRINTING PLASTICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (TON)

TABLE 93 3D PRINTING PLASTICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

10 3D PRINTING PLASTICS MARKET, BY REGION (Page No. - 139)

10.1 INTRODUCTION

FIGURE 45 CHINA TO BE FASTEST-GROWING 3D PRINTING PLASTICS MARKET DURING FORECAST PERIOD

TABLE 94 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 95 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 97 3D PRINTING PLASTICS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SNAPSHOT

10.2.1 NORTH AMERICA: 3D PRINTING PLASTICS MARKET, BY TYPE

TABLE 98 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 99 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 101 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 NORTH AMERICA: 3D PRINTING PLASTICS MARKET, BY FORM

TABLE 102 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 103 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 105 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

10.2.3 NORTH AMERICA: 3D PRINTING PLASTICS MARKET, BY APPLICATION

TABLE 106 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 107 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 109 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4 NORTH AMERICA: 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

TABLE 110 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 111 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 113 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.2.5 NORTH AMERICA: 3D PRINTING PLASTICS MARKET, BY COUNTRY

TABLE 114 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 115 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 117 NORTH AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.5.1 US

10.2.5.1.1 Growing manufacturing sector in country to contribute to market growth

TABLE 118 US: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 119 US: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 120 US: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 121 US: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.2.5.2 Canada

10.2.5.2.1 Favorable government initiatives to be governing factor for market growth

TABLE 122 CANADA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 123 CANADA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 124 CANADA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 125 CANADA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 47 EUROPE: 3D PRINTING PLASTICS MARKET SNAPSHOT

10.3.1 EUROPE: 3D PRINTING PLASTICS MARKET, BY TYPE

TABLE 126 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 127 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 129 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 EUROPE: 3D PRINTING PLASTICS MARKET, BY FORM

TABLE 130 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 131 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 132 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 133 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

10.3.3 EUROPE: 3D PRINTING PLASTICS MARKET, BY APPLICATION

TABLE 134 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 135 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 136 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 137 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 EUROPE: 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

TABLE 138 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 139 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 140 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 141 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3.5 EUROPE: 3D PRINTING PLASTICS MARKET, BY COUNTRY

TABLE 142 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 143 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 145 EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.5.1 Germany

10.3.5.1.1 Germany leading the European 3D printing plastics market

TABLE 146 GERMANY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 147 GERMANY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 148 GERMANY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 149 GERMANY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3.5.2 UK

10.3.5.2.1 Government initiatives to unleash potential of 3D printing industry in country

TABLE 150 UK: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 151 UK: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 152 UK: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 153 UK: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3.5.3 France

10.3.5.3.1 High demand from aerospace & defense industry to propel market

TABLE 154 FRANCE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 155 FRANCE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 156 FRANCE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 157 FRANCE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3.5.4 Italy

10.3.5.4.1 Demand from transportation and aerospace & defense industries to support market growth

TABLE 158 ITALY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 159 ITALY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 160 ITALY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 161 ITALY: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.3.5.5 Rest of Europe

TABLE 162 REST OF EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 163 REST OF EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 164 REST OF EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 165 REST OF EUROPE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SNAPSHOT

10.4.1 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET, BY TYPE

TABLE 166 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 167 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 169 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET, BY FORM

TABLE 170 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 171 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 172 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 173 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

10.4.3 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET, BY APPLICATION

TABLE 174 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 175 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 177 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

TABLE 178 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 179 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 180 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 181 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4.5 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET, BY COUNTRY

TABLE 182 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 183 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 184 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 185 ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.5.1 China

10.4.5.1.1 China to lead 3D printing plastics market in Asia Pacific

TABLE 186 CHINA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 187 CHINA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 188 CHINA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 189 CHINA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4.5.2 Japan

10.4.5.2.1 High demand from automotive and electrical & electronics industries to drive market

TABLE 190 JAPAN: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 191 JAPAN: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 192 JAPAN: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 193 JAPAN: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4.5.3 South Korea

10.4.5.3.1 Automotive and aerospace & defense industries to boost market

TABLE 194 SOUTH KOREA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 195 SOUTH KOREA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 196 SOUTH KOREA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 197 SOUTH KOREA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4.5.4 India

10.4.5.4.1 Make in India initiative to boost penetration of 3D printing plastics in manufacturing sector

TABLE 198 INDIA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 199 INDIA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 200 INDIA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 201 INDIA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.4.5.5 Rest of Asia Pacific

TABLE 202 REST OF ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 203 REST OF ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 205 REST OF ASIA PACIFIC: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET, BY TYPE

TABLE 206 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 207 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 209 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET, BY FORM

TABLE 210 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 211 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 213 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

10.5.3 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET, BY APPLICATION

TABLE 214 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 215 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 217 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.4 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

TABLE 218 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 219 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 221 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.5.5 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET, BY COUNTRY

TABLE 222 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 223 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 224 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 225 MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.5.1 South Africa

10.5.5.1.1 Second-largest market for 3D printing plastics in region

TABLE 226 SOUTH AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 227 SOUTH AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 228 SOUTH AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 229 SOUTH AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.5.5.2 UAE

10.5.5.2.1 Infrastructural growth to enhance market growth

TABLE 230 UAE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 231 UAE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 232 UAE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 233 UAE: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.5.5.3 Rest of Middle East & Africa

TABLE 234 REST OF MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 235 REST OF MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 236 REST OF MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 237 REST OF MIDDLE EAST & AFRICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: 3D PRINTING PLASTICS MARKET, BY TYPE

TABLE 238 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 239 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 240 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 241 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.6.2 LATIN AMERICA: 3D PRINTING PLASTICS MARKET, BY FORM

TABLE 242 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (TON)

TABLE 243 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2018–2021 (USD MILLION)

TABLE 244 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 245 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

10.6.3 LATIN AMERICA: 3D PRINTING PLASTICS MARKET, BY APPLICATION

TABLE 246 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

TABLE 247 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 248 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 249 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.6.4 LATIN AMERICA: 3D PRINTING PLASTICS MARKET, BY END-USE INDUSTRY

TABLE 250 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 251 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 252 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 253 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.6.5 LATIN AMERICA: 3D PRINTING PLASTICS MARKET, BY COUNTRY

TABLE 254 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

TABLE 255 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 256 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 257 LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.5.1 Mexico

10.6.5.1.1 Increasing use of 3D printing plastics in healthcare and aerospace & defense to boost market

TABLE 258 MEXICO: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 259 MEXICO: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 260 MEXICO: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 261 MEXICO: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.6.5.2 Brazil

10.6.5.2.1 Increasing government investments in infrastructure to fuel demand for 3D printing plastics

TABLE 262 BRAZIL: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 263 BRAZIL: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 264 BRAZIL: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 265 BRAZIL: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

10.6.5.3 Rest of Latin America

TABLE 266 REST OF LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

TABLE 267 REST OF LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 268 REST OF LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

TABLE 269 REST OF LATIN AMERICA: 3D PRINTING PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 206)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS

FIGURE 49 SHARE OF TOP COMPANIES IN 3D PRINTING PLASTICS MARKET

TABLE 270 DEGREE OF COMPETITION: 3D PRINTING PLASTICS MARKET

11.3 MARKET RANKING

FIGURE 50 RANKING OF TOP FIVE PLAYERS IN 3D PRINTING PLASTICS MARKET

11.4 MARKET EVALUATION FRAMEWORK

TABLE 271 3D PRINTING PLASTICS MARKET: NEW PRODUCT DEVELOPMENTS/LAUNCHES, 2017–2021

TABLE 272 3D PRINTING PLASTICS MARKET: DEALS, 2017–2021

TABLE 273 3D PRINTING PLASTICS MARKET: OTHER DEVELOPMENTS, 2017–2021

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

11.6 COMPANY EVALUATION MATRIX

TABLE 274 COMPANY PRODUCT FOOTPRINT

TABLE 275 COMPANY TYPE FOOTPRINT

TABLE 276 COMPANY FORM FOOTPRINT

TABLE 277 COMPANY APPLICATION FOOTPRINT

TABLE 278 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 279 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE BENCHMARKING

TABLE 280 3D PRINTING PLASTICS MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 281 3D PRINTING PLASTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.7.1 STAR

11.7.2 PERVASIVE

11.7.3 PARTICIPANTS

11.7.4 EMERGING LEADERS

FIGURE 51 3D PRINTING PLASTICS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

11.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN 3D PRINTING PLASTICS MARKET

11.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN 3D PRINTING PLASTICS MARKET

11.8 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 54 3D PRINTING PLASTICS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

12 COMPANY PROFILES (Page No. - 224)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent developments, New product launches/developments, Deals, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats)*

12.1.1 3D SYSTEMS CORPORATION

TABLE 282 3D SYSTEMS CORPORATION: COMPANY OVERVIEW

FIGURE 55 3D SYSTEMS CORPORATION: COMPANY SNAPSHOT

12.1.2 ARKEMA S.A.

TABLE 283 ARKEMA S.A.: COMPANY OVERVIEW

FIGURE 56 ARKEMA S.A.: COMPANY SNAPSHOT

12.1.3 BASF SE

TABLE 284 BASF SE: COMPANY OVERVIEW

FIGURE 57 BASF SE: COMPANY SNAPSHOT

12.1.4 STRATASYS, LTD.

TABLE 285 STRATASYS, LTD.: COMPANY OVERVIEW

FIGURE 58 STRATASYS, LTD.: COMPANY SNAPSHOT

12.1.5 COVESTRO AG

TABLE 286 COVESTRO AG: COMPANY OVERVIEW

FIGURE 59 COVESTRO AG: COMPANY SNAPSHOT

12.1.6 SHENZHEN ESUN INDUSTRIAL CO., LTD.

TABLE 287 SHENZHEN ESUN INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

12.1.7 SOLVAY S.A.

TABLE 288 SOLVAY S.A.: COMPANY OVERVIEW

FIGURE 60 SOLVAY S.A..: COMPANY SNAPSHOT

12.1.8 EVONIK INDUSTRIES AG

TABLE 289 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 61 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

12.1.9 EOS GMBH ELECTRO OPTICAL SYSTEMS

TABLE 290 EOS GMBH ELECTRO OPTICAL SYSTEMS: COMPANY OVERVIEW

12.1.10 FORMLABS, INC.

TABLE 291 FORMLABS, INC.: COMPANY OVERVIEW

12.1.11 E.I. DU PONT DE NEMOURS & COMPANY

TABLE 292 E.I. DU PONT DE NEMOURS & COMPANY: COMPANY OVERVIEW

FIGURE 62 E.I. DU PONT DE NEMOURS & COMPANY: COMPANY SNAPSHOT

12.1.12 SABIC

TABLE 293 SABIC: COMPANY OVERVIEW

FIGURE 63 SABIC: COMPANY SNAPSHOT

12.1.13 CRP TECHNOLOGY S.R.L

TABLE 294 CRP TECHNOLOGY S.R.L: COMPANY OVERVIEW

12.1.14 HENKEL AG

TABLE 295 HENKEL AG: COMPANY OVERVIEW

FIGURE 64 HENKEL AG: COMPANY SNAPSHOT

12.1.15 HUNTSMAN CORPORATION

TABLE 296 HUNTSMAN CORPORATION: COMPANY OVERVIEW

FIGURE 65 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 OXFORD PERFORMANCE MATERIALS, INC

TABLE 297 OXFORD PERFORMANCE MATERIALS, INC: COMPANY OVERVIEW

12.2.2 ENVISIONTEC GMBH

TABLE 298 ENVISIONTEC GMBH: COMPANY OVERVIEW

12.2.3 LEHMAN & VOSS & CO.KG

TABLE 299 LEHMAN & VOSS & CO.KG: COMPANY OVERVIEW

12.2.4 ZORTRAX

TABLE 300 ZORTRAX: COMPANY OVERVIEW

12.2.5 ULTIMAKER B.V.

TABLE 301 ULTIMAKER B.V.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments, New product launches/developments, Deals, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 293)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

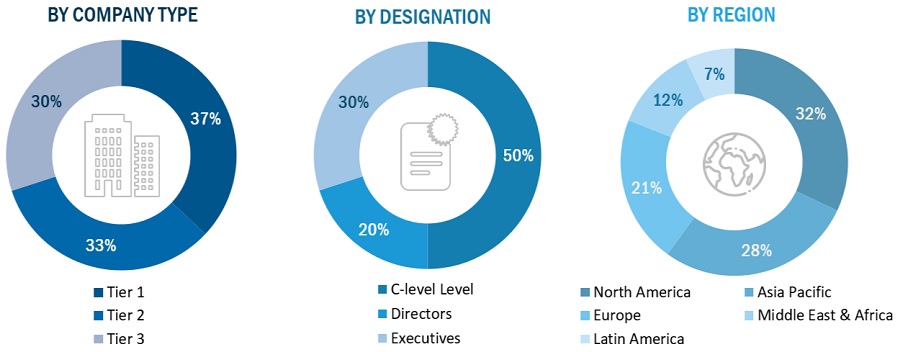

The study involves two major activities in estimating the current size of the 3D printing plastics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the 3D printing plastics market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total 3D printing plastics market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall 3D printing plastics market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structures & waterfronts and other applications.

Report Objectives

- To analyze and forecast the global 3D printing plastics market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type, form, application, and end-use industry.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific 3D printing plastics market

- Further breakdown of Rest of European 3D printing plastics market

- Further breakdown of Rest of Middle East & Africa 3D printing plastics market

- Further breakdown of Rest of Latin American 3D printing plastics market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Printing Plastics Market

Market trends on global 3D printing aerospce market

3D printing plastics market, potential by application

Specific detail on 3-D printing market

Specific information for clients about 3D-Printing markets and filament markets

General information on 3D Printing Plastics Market