5G in Defense Market by Communication Infrastructure (Small Cell, Macro Cell), Core Network Technology, Platform (Land, Naval, Airborne), End User, Network Type, Chipset, Operational Frequency, Installation and Region 2027

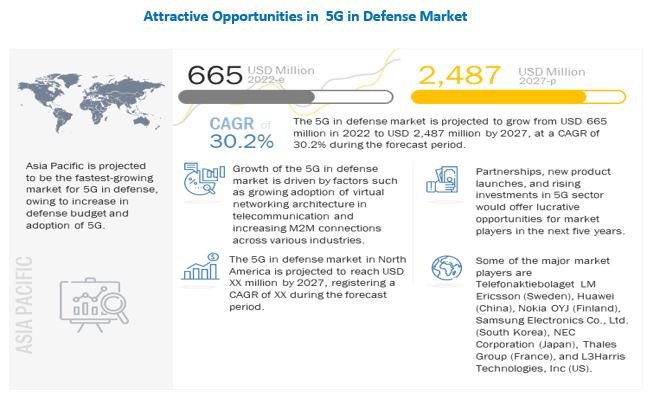

The global 5G in Defense Market was valued at $665 Million in 2021 and is estimated to grow from $946 million by 2023 to $2,487 million by 2027 at a CAGR (Compound Annual Growth Rate) of 30.2%, during forecast period.

Fifth-generation (5G) wireless system, or 5G mobile network, is an advanced telecommunication technology that enables high-speed data transfer and high system spectral efficiency (implies larger data volume) with relatively low battery consumption. It also offers the provision of connecting several devices simultaneously. 5G in defense would enhance intelligence, surveillance, and reconnaissance (ISR) systems and processing and enable new methods of command and control (C2). Factors such as the are the Higher network speed and lower latency in 5G , and growing adoption of autonomous and connected devices are driving factors assisting the growth of the 5G in Defense Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the 5G in Defense Market

The COVID-19 epidemic disrupted global economic conditions, particularly the implementation of commercial off-the-shelf (COTS) technologies such as 5G in the military.

Due to severe economic conditions and disruptions in the supply chain of crucial components, the development and testing of 5G technologies for the defense industry have been halted. The pandemic had a minor impact on communication system providers and operators due to delays in spectrum auctions, delays in regulatory timeframes, a restricted workforce for network roll-out, decreased capital and operational expenditures, and a reduction in technical improvements. However, several nations, such as the US and China, have made major investments in the implementation of 5G technology in the defense industry.

5G in defense Market Segment Overview

By Communication Infrastructure, the small cell segment is projected to dominate market

Small cell segment growth is attributed to the large-scale deployment of small cells by 5G network operator.

With the further introduction of the 5G network, the data connectivity speed is expected to increase significantly. As small cells can help facilitate 5G deployment, they are anticipated to play a pivotal role in the market for 5G communication infrastructure.

By platform, the airborne segment to lead 5G in defense market during the forecast period

By platform, the airborne segment is projected to register the highest CAGR of 34.5% during the forecast period. With advancements in 5G technology, airborne applications (such as drones) and mission-critical communications will be able to perform with increased efficiency.

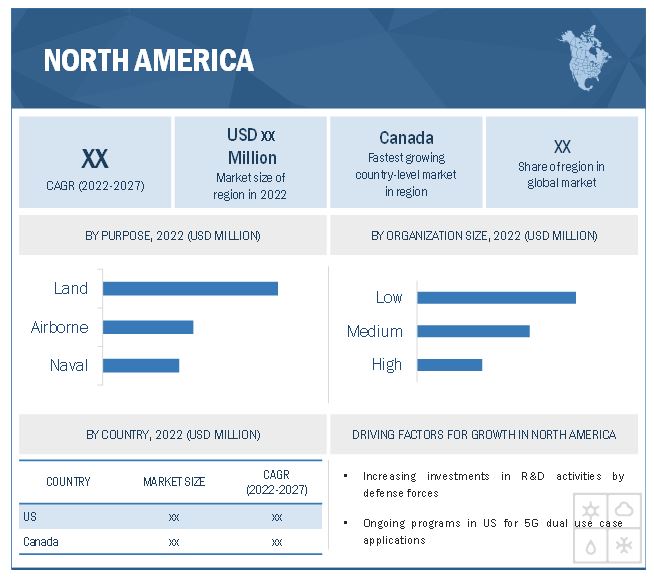

North America is projected to lead the 5G in defense market during the forecast period.

North America is estimated to lead the market during the forecast period owing to increased investments by the US Department of Defense in 5G technology.

The US is projected to be the largest developer and operator of 5G technology globally, resulting in a large share of the North American region in the global market. 5G technology in defense helps improve the processing and functioning of ISR (intelligence, surveillance & reconnaissance) systems, enables new command and control systems, enhances augmented and virtual reality applications, modernizes maintenance processes, and improves efficiency in logistics supply using technologies such as blockchain.

With the increasing use of connected systems through IoT, a need for low-latency communication technology has risen. The allocation of a wide frequency band to the US military has opened new opportunities for system designers to develop 5G enabled components and enhance the operational efficiency of all related systems

Top Key Market Players in 5G in Defense Industry

The 5G in Defense Companies are dominated by a few globally established players such as

- Ericsson (Sweden),

- Huawei (China),

- Nokia Networks (Finland),

- Samsung (South Korea),

- NEC (Japan),

- Thales Group (France),

- L3Harris Technologies, Inc. (US),

- Raytheon Technologies (US),

- Ligado Networks (US), and

- Wind River Systems, Inc. (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

5G in Defense Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 665 million |

| Projected Market Size | USD 2487 million |

| Growth Rate | 30.2% |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

by operational frequency and by installation |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies covered |

|

5G in defense Market Dynamics

Driver: Growing adoption of autonomous and connected devices

5G technology can support up to 1 million devices in a square km range (approximately). This means multiple devices such as sensors can be connected to each other using a 5G network.

All autonomous systems or platforms work on a network through which data is transferred. This data is interpreted and then received by the systems through the network, which is used to take action by the autonomous systems. With a network that has higher speed and low latency, such systems will work more efficiently.

For instance, the communication between an unmanned aerial vehicle and its controller will be quick and efficient when on a 5G network compared to current communication systems. Autonomous platforms, such as armored vehicles and unmanned ground vehicles, can function efficiently with a secured 5G network.

The 5G network is observed to have improved the functioning of autonomous systems. Countries like China, the US, and Israel are testing and/or operating 5G technology within their military forces. European countries, such as France and Italy, are also looking forward to implementing 5G within their military forces. According to the Federation of American Scientists (FAS) report Artificial Intelligence and National Security, published in November 2020, the US Army planned to deploy a variety of robotic combat vehicles (RCVs) with various autonomous capabilities, such as navigation, surveillance, and IED removal. These gadgets would be used in conjunction with the optionally manned fighting vehicle.

In addition, the Navy has developed the rapid autonomy integration lab (RAIL) to build, assess, certify, and deploy new and enhanced autonomous systems. By delivering quicker speeds and more capacity, the 5G network is reported to have boosted the efficiency of autonomous systems. As a result, an increase in the adoption of autonomous systems and connected devices due to their improved and increased performance on the 5G network is likely to drive the market.

Restraint: Lack of standards and protocols for use of 5G

5G is an upcoming technology, and for developing, managing, and successfully implementing 5G infrastructure, companies require protocols and rules to follow. At present, very few countries are utilizing 5G in the military arena, resulting in a lack of standards and protocols.

There is a delay by the international community in the use of 5G for the military due to the unavailability of adequate hardware suppliers. Some of the major suppliers are Huawei (China), Nokia (Finland), and Ericsson (Sweden).

As the 5G infrastructure for defense is in the development phase, the companies involved in this technology have to face issues related to access to information, experimentation with military platforms, and availability of regulations for development and testing, among others. The shortage of skilled manpower is also an issue faced by defense firms. As 5G technology in the military is still in its early stage of lifecycle, the workforce possessing in-depth knowledge of this technology is limited. Thus, the impact of this restraining factor is likely to continue during the initial years of the forecast period.

Opportunity: Growth of IoT

Wide adoption and continuous advancements in the Internet of Things (IoT) are among the factors transforming various industries by connecting several types of devices, appliances, systems, and services.

IoT is among the use cases that the 5G network would support; for instance, it enables the communication between a large number of sensors and connected devices. IoT application requirements can be categorized as high power, low-latency applications (e.g., border surveillance), low power, and long-range IoT applications (e.g., smart base). To support these requirements of emerging IoT applications, categorized as massive machine-type communication and mission-critical applications, the 5G market is expected to gain traction. Also, the need to provide uninterrupted internet connectivity to an increasing number of devices, along with a reduction in power consumption, is driving the growth of the 5G market

Challenge: Security concerns on collaboration with 5G suppliers

Many countries, such as the US, Canada, France, Germany, and the UK, are looking forward to identifying potential 5G suppliers and integrators. Players such as Huawei, Nokia, and Ericsson have been dominating the 5G market.

Since the implementation is for defense purposes, the security of data and network is of utmost importance. The US is firm on not procuring hardware and solutions from unreliable sources, where data security can be a concern. It has decided to ban companies from China, especially Huawei. A similar request for a ban on Huawei has been made by the Canadian military to the government.

In the wake of strong competition between China and the US, the US is pressuring G7 countries to implement similar policies. European countries have directly not agreed to the ban of infrastructure from Chinese companies; however, they have planned for a limited period of contract. European countries prefer buying 5G devices from the European region to ensure data security. In Asia, countries like India are also looking forward to banning Chinese companies wherever data sensitivity is of concern.

Concerns regarding the sharing of sensitive data with private companies exist. A military maintains data of each of its operations and activities, and sharing that data with others may jeopardize its plans and security. There are also concerns about cloud-based storage services, which are vulnerable to cyber-attacks, leading to the loss of sensitive information.

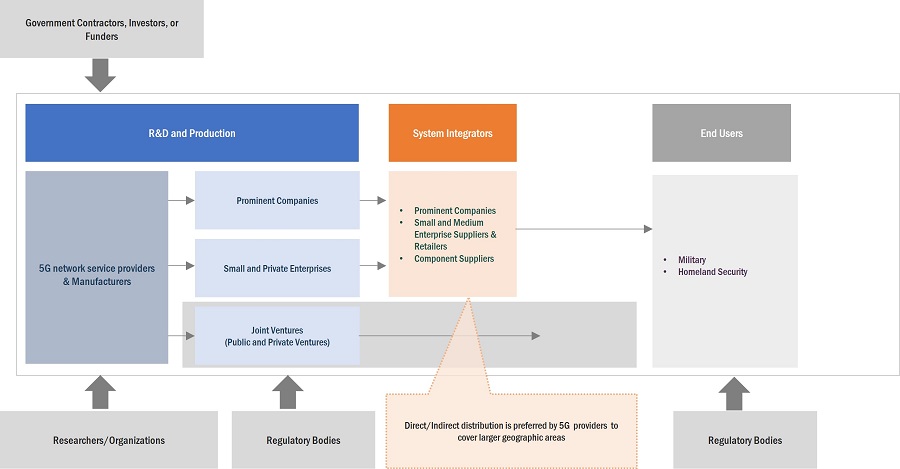

5g In Defense Market Ecosystem

Prominent companies providing weather forecasting services, private and small enterprises, distributors/suppliers/retailers, and end customers are the key stakeholders in the market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries using weather forecasting services serve as the major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

5G in defense Market Categorization

The study categorizes the 5G in defense market based on communication infrastructure, by core network technology, by platform, by end user, by network type, by chipset, by operational frequency, and by installation and Region.

5G in Defense Market by Communication Infrastructure

- Small cell

- Macro Cell

Core network technology

- Software-Defined Networking (SDN)

- Fog Computing (FC)

- Mobile Edge Computing (MEC)

- Network Functions Virtualization (NFV)

Platform

- Land

- Naval

- Airborne

End user

- Military

- Homeland security

Network type

- Enhanced Mobile Broadband (EMBB)

- Ultra-Reliable Low-Latency Communications (URLLC)

- Massive Machine Type Communications (MMTC)

Chipset

- Application-specific integrated circuit (ASIC) Chipset

- Radio Frequency Integrated Circuit (RFIC) Chipset

- Millimeter Wave (mmWave) Chipset

Operational Frequency

- Low

- Medium

- High

Installation

- New Implementation

- Upgradation

5G in Defense Market By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

Recent Developments in 5G in Defense Industry

- In February 2022, Ericsson and Mobily signed a Memorandum of Understanding to expand cutting-edge 5G use cases in the Kingdom of Saudi Arabia.

- In January 2022, Intelsat, the world's largest integrated satellite and terrestrial network operator, and Thales Alenia Space, a joint venture between Thales (67%) and Leonardo (33%), agreed to build two software-defined satellites to advance Intelsat's global fabric of software-defined GEO connectivity as part of its 5G software-defined network.

- In July 2021, GBL Systems Corporation (GBL), a leading provider of systems engineering, software services, and advanced technology solutions to the US Department of Defense (DoD), and Samsung Electronics America, Inc. announced the deployment of new 5G testbeds for Augmented Reality/Virtual Reality at US Army bases. The 5G testbeds are part of a larger DoD project announced in October 2020 that granted USD 600 million in contracts for 5G testing at several US military test locations.

- In July 2020, Deutsche Telekom entered into a contract with Ericsson for 5G Radio Access Network (RAN) deployment after Ericsson delivers successful modernization of their 2G/3G/4G networks.

- In April 2020, Omnispace announced that it had selected Thales Alenia Space, a joint venture between Thales (67%) and Leonardo (33%), to develop the initial component of its satellite-based Internet of Things (IoT) infrastructure. This will advance Omnispace’s vision to deliver a global hybrid communications network based on 3GPP standards. Thales Alenia Space will design and build an initial set of two satellites for operation in non-geostationary orbit (NGSO).

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the 5G in defense market?

Response: The 5G in defense market is expected to grow substantially owing to the growing adoption of autonomous and connected devices and higher network speed and lower latency in 5G.

What are the key sustainability strategies adopted by leading players operating in the 5G in defense market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the 5G in defense market. The major players include Ericsson (Sweden), Huawei (China), Nokia OYJ (Finland), Samsung (South Korea). These players have adopted various strategies, such as partnership, contracts and new product launches, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the 5G in defense market?

Response: Some of the major emerging technologies and use cases disrupting the market include Massive Internet of Things (mIoT) and Flexible network operations which has been successfully tested.

Who are the key players and innovators in the ecosystem of the 5G in defense market?

Response: The key players in the 5G in defense market include Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung (South Korea), NEC (Japan), Thales Group (France), L3Harris Technologies, Inc. (US), Raytheon Technologies (US), Ligado Networks (US), and Wind River Systems, Inc. (US).

Which region is expected to hold the highest market share in the 5G in the defense market?

Response: 5G in defense market in North America is projected to hold the highest market share during the forecast period due to the North American countries such as US which have increased investments by the US Department of Defense in 5G technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 STUDY SCOPE

1.3.1 5G IN DEFENSE MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 CURRENCY

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS & EXCLUSIONS

TABLE 1 MARKET: INCLUSIONS & EXCLUSIONS

1.5.1 YEARS CONSIDERED

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH FLOW

FIGURE 2 RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 SECONDARY SOURCES

2.3 PRIMARY DATA

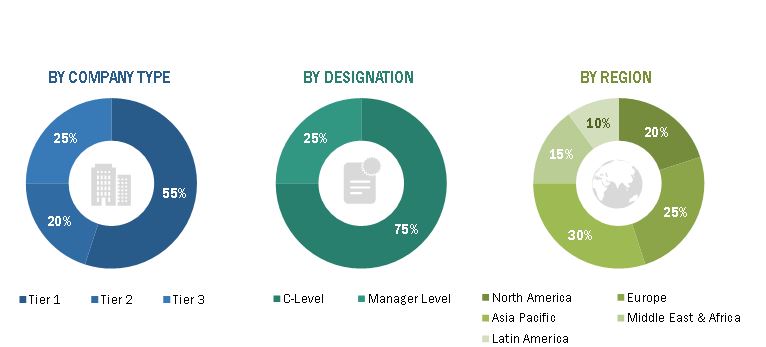

2.3.1 PRIMARY SOURCES

2.3.1.1 Insights from industry experts

2.3.1.2 Breakdown of primaries: by company type, designation, and region

TABLE 2 DETAILS OF PRIMARY INTERVIEWEES

2.4 FACTOR ANALYSIS

2.4.1 INTRODUCTION

2.4.2 DEMAND-SIDE INDICATORS

2.4.3 SUPPLY-SIDE INDICATORS

2.4.3.1 Financial trends of major US defense contractors

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP

2.5.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.7 GROWTH RATE ASSUMPTIONS

2.8 ASSUMPTIONS

2.9 RISKS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 6 BY COMMUNICATION INFRASTRUCTURE, SMALL CELL SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 7 BY PLATFORM, AIRBORNE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA ESTIMATED TO LEAD MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN 5G IN DEFENSE MARKET

FIGURE 9 INCREASING BUDGET ALLOCATIONS FOR R&D OF 5G NETWORK DRIVES MARKET GROWTH

4.2 MARKET, BY CHIPSET

FIGURE 10 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) CHIPSET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY OPERATIONAL FREQUENCY

FIGURE 11 HIGH SEGMENT TO LEAD 5G IN DEFENSE MARKET DURING FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 12 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 5G IN DEFENSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing adoption of autonomous and connected devices

5.2.1.2 Digital transformation initiatives in businesses, paving way for advanced wireless networks

FIGURE 14 EMERGING TECHNOLOGY ADOPTION IN DIGITAL TRANSFORMATION

5.2.1.3 Higher network speed and lower latency in 5G

5.2.1.4 Demand for information processing for big data analytics

5.2.1.5 Transition from on-premises legacy systems to cloud-based solutions

5.2.2 RESTRAINTS

5.2.2.1 Lack of standards and protocols for use of 5G

5.2.2.2 High cost involved in 5G infrastructure deployment

5.2.2.3 Cybersecurity threats to 5G network

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of IoT

5.2.3.2 Increased defense budgets of different countries for unmanned systems

5.2.3.3 Technological advancements in 5G network

5.2.3.4 Upsurge in business use cases across manufacturing, oil & gas, mining, and government sectors

TABLE 3 NETWORK USE CASES BY VARIOUS INDUSTRIES

5.2.4 CHALLENGES

5.2.4.1 Heat dissipation in massive multiple input and multiple output (MIMO)

5.2.4.2 Inter-cell interference management

5.2.4.3 Issues related to spectrum allocation

5.2.4.4 Security concerns on collaboration with 5G suppliers

5.3 RANGES AND SCENARIOS

FIGURE 15 COVID-19 IMPACT ON MARKET: GLOBAL SCENARIOS

5.4 COVID-19 IMPACT ON 5G IN DEFENSE MARKET

FIGURE 16 COVID-19 IMPACT ON MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2021 to March 2022

TABLE 4 KEY DEVELOPMENTS IN MARKET 2021-2022

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2021 to March 2022

TABLE 5 KEY DEVELOPMENTS IN MARKET, JANUARY 2021 TO MARCH 2022

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

FIGURE 17 REVENUE SHIFT IN MARKET

5.6 OPERATIONAL DATA

TABLE 6 COMPARISON BETWEEN ENABLING TECHNOLOGIES

5.7 5G IN DEFENSE MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 18 MARKET ECOSYSTEM MAP

TABLE 7 MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 PORTABLE & TRANSPORTABLE 5G BASE STATIONS

5.8.2 NON-STANDALONE 5G NETWORK

5.8.3 STANDALONE 5G NETWORK

5.9 USE CASE ANALYSIS

5.9.1 USE CASE: AUTOMATED INDUSTRIAL DRONES

5.9.2 USE CASE: 5G EMERGENCY RESCUE PLATFORM

5.9.3 USE CASE: ENHANCED MOBILE BROADBAND (EMBB)

5.9.4 USE CASE: CRITICAL COMMUNICATIONS (CC) AND ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS (URLLC)

5.9.5 USE CASE: MASSIVE INTERNET OF THINGS (MIOT)

5.10 VALUE CHAIN ANALYSIS OF 5G IN DEFENSE MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 20 MARKET: PORTER’S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITION

5.11.6 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.12 TARIFF AND REGULATORY LANDSCAPE

TABLE 10 5G: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 TRADE ANALYSIS

5.13.1 EXPORT SCENARIO OF TELEPHONE PARTS

FIGURE 22 TELEPHONE PARTS EXPORT, BY KEY COUNTRY, 2016-2020 (USD MILLION)

5.13.2 IMPORT SCENARIO OF TELEPHONE PARTS

FIGURE 23 TELEPHONE PARTS IMPORT, BY KEY COUNTRY, 2016-2020 (USD MILLION)

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 WI-FI

6.2.2 WIMAX

6.2.3 SMALL CELL NETWORK

6.2.4 LTE NETWORK

6.2.5 MULTEFIRE

6.2.6 PRIVATE 5G

6.2.7 INCREASED BANDWIDTH TO DELIVER UNINTERRUPTED AVAILABILITY, RELIABILITY, AND SECURITY

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 MULTI-BAND, MULTI-MISSION (MBMM) ANTENNA

6.4.2 AI AND COGNITIVE APPLICATIONS

6.4.3 MACHINE LEARNING

6.4.4 DEEP LEARNING

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 11 INNOVATION & PATENT REGISTRATIONS (2019-2022)

7 5G IN DEFENSE MARKET, BY COMMUNICATION INFRASTRUCTURE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 25 BY COMMUNICATION INFRASTRUCTURE, SMALL CELL SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

7.2 SMALL CELL

7.2.1 SMALL CELLS CAN PROVIDE COVERAGE UP TO 2 KM

7.3 MACRO CELL

7.3.1 MACRO CELLS PROVIDE RADIO ACCESS COVERAGE OVER LARGE NETWORK AREA

8 5G IN DEFENSE MARKET, BY CORE NETWORK TECHNOLOGY (Page No. - 81)

8.1 INTRODUCTION

TABLE 14 MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 15 MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

FIGURE 26 BY CORE NETWORK TECHNOLOGY, FOG COMPUTING SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

8.2 SOFTWARE-DEFINED NETWORKING (SDN)

8.2.1 SDN ALLOWS REAL-TIME CHANGES IN TELECOM NETWORKS THROUGH CENTRALIZED CONTROL SYSTEM

8.3 FOG COMPUTING (FC)

8.3.1 FC DISTRIBUTES COMPUTE, COMMUNICATION, CONTROL, STORAGE, AND DECISION-MAKING CLOSER TO ORIGIN OF DATA

8.4 MOBILE EDGE COMPUTING (MEC)

8.4.1 MEC ENABLES CLOUD COMPUTING CAPABILITIES AND IT SERVICE ENVIRONMENT AT CELLULAR NETWORK EDGE

8.5 NETWORK FUNCTIONS VIRTUALIZATION (NFV)

8.5.1 NFV IS ADVANCED NETWORK TECHNOLOGY THAT EMPLOYS VIRTUALIZED NETWORK SERVICES

9 5G IN DEFENSE MARKET, BY PLATFORM (Page No. - 86)

9.1 INTRODUCTION

FIGURE 27 BY PLATFORM, AIRBORNE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 17 MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

9.2 LAND

9.2.1 NEED FOR 5G CAPABILITIES FOR VOICE AND DATA TRANSMISSION TO SUPPORT MISSIONS

9.2.2 ARMORED FIGHTING VEHICLES

9.2.3 UNMANNED GROUND VEHICLES

9.2.4 COMMAND AND CONTROL SYSTEMS

9.2.5 OTHERS

9.3 NAVAL

9.3.1 RELIABLE COMMUNICATION WITH SMALL AND LARGE NAVAL COMBATANTS AND SUPPORT SHIPS

9.3.2 MILITARY SHIPS AND SUBMARINES

9.3.3 UNMANNED MARITIME VEHICLES

9.3.4 OTHERS

9.4 AIRBORNE

9.4.1 NEED FOR HIGH DEFINITION ISR VIDEO DATA TRANSFER FUELING DEMAND

9.4.2 MILITARY AIRCRAFT

9.4.3 UNMANNED AERIAL VEHICLES

9.4.4 OTHERS

10 5G IN DEFENSE MARKET, BY NETWORK TYPE (Page No. - 92)

10.1 INTRODUCTION

FIGURE 28 MARKET SIZE, BY NETWORK TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 18 MARKET SIZE, BY NETWORK TYPE, 2019–2021 (USD MILLION)

TABLE 19 MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

10.2 ENHANCED MOBILE BROADBAND (EMBB)

10.2.1 EMBB SUPPORTS MACRO AND SMALL CELLS

10.3 MASSIVE MACHINE TYPE COMMUNICATION (MMTC)

10.3.1 MMTC LEVERAGES BENEFITS OF ULTRA-LOW-COST M2M

10.4 ULTRA-RELIABLE LOW-LATENCY COMMUNICATION (URLLC)

10.4.1 URLLC PROVIDES ULTRA-RESPONSIVE CONNECTIONS

11 5G IN DEFENSE MARKET, BY CHIPSET (Page No. - 96)

11.1 INTRODUCTION

FIGURE 29 BY CHIPSET, MILLIMETER WAVE (MMWAVE) CHIPSET SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 MARKET SIZE, BY CHIPSET, 2019–2021 (USD MILLION)

TABLE 21 MARKET SIZE, BY CHIPSET, 2022–2027 (USD MILLION)

11.2 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) CHIPSET

11.2.1 CUSTOM-MADE CHIPSETS FROM SCRATCH FOR SPECIFIC APPLICATIONS

11.3 RADIO FREQUENCY INTEGRATED CIRCUIT (RFIC) CHIPSET

11.3.1 MEDIUM OPERATING FREQUENCY RANGES FROM 4 GHZ TO 6 GHZ

11.4 MILLIMETER WAVE (MMWAVE) CHIPSET

11.4.1 DEALS WITH FREQUENCY BANDS FROM 30 GHZ TO 300 GHZ

12 5G IN DEFENSE MARKET, BY OPERATIONAL FREQUENCY (Page No. - 99)

12.1 INTRODUCTION

FIGURE 30 BY OPERATIONAL FREQUENCY, HIGH SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 MARKET SIZE, BY OPERATIONAL FREQUENCY, 2019–2021 (USD MILLION)

TABLE 23 MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

12.2 LOW

12.2.1 LOW OPERATIONAL FREQUENCY OFFERS COVERAGE AND CAPACITY BENEFITS

12.3 MEDIUM

12.3.1 MEDIUM OPERATIONAL FREQUENCY RANGES FROM 4 GHZ TO 6 GHZ

12.4 HIGH

12.4.1 HIGH OPERATIONAL FREQUENCY ESSENTIAL TO MEET ULTRA-HIGH BROADBAND SPEEDS PROJECTED FOR 5G

13 5G IN DEFENSE MARKET, BY INSTALLATION (Page No. - 102)

13.1 INTRODUCTION

FIGURE 31 BY INSTALLATION, NEW IMPLEMENTATION SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 MARKET SIZE, BY INSTALLATION, 2019–2021 (USD MILLION)

TABLE 25 MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

13.2 UPGRADATION

13.2.1 5G ARCHITECTURE UPGRADATION OPERATES IN MASTER-SLAVE CONFIGURATION

13.3 NEW IMPLEMENTATION

13.3.1 NEW IMPLEMENTATION NETWORK PROVIDES END-TO-END 5G EXPERIENCE TO USERS

14 5G IN DEFENSE MARKET, BY END USER (Page No. - 105)

14.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY END USER, 2022 VS. 2027 (USD MILLION)

TABLE 26 MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 27 MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

14.2 MILITARY

14.2.1 5G WILL ENHANCE MILITARY CAPABILITIES AND HELP MAINTAIN TECHNOLOGICAL ADVANTAGE ON BATTLEFIELD

14.3 HOMELAND SECURITY

14.3.1 5G TO ENHANCE SURVEILLANCE AND TRAINING CAPABILITIES

15 5G DEFENSE SERVICES MARKET (Page No. - 108)

15.1 INTRODUCTION

15.2 MARKET DYNAMICS

FIGURE 33 5G IN DEFENSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

15.2.1 DRIVERS

15.2.1.1 Rise in demand for reliable and ultra-low latency connectivity services

15.2.1.2 Rapid development of connected IoT devices

15.2.1.3 Continuous increase in data traffic

15.2.2 RESTRAINTS

15.2.2.1 Cost involved in 5G infrastructure deployment

15.2.3 OPPORTUNITIES

15.2.3.1 Infrastructural development initiatives, such as smart cities

15.2.4 CHALLENGES

15.2.4.1 Issues related to global spectrum

15.3 STAKEHOLDERS IN 5G SERVICES

16 REGIONAL ANALYSIS (Page No. - 111)

16.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC 5G IN DEFENSE MARKET PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

16.2 NORTH AMERICA

16.2.1 COVID-19 IMPACT ON NORTH AMERICA

16.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 35 NORTH AMERICA: 5G IN DEFENSE MARKET SNAPSHOT

TABLE 30 NORTH AMERICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: 5G IN DEFENSE MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY NETWORK TYPE, 2019–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2019–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY INSTALLATION, 2019–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

16.2.3 US

16.2.3.1 Development programs related to adoption of 5G dual use cases to drive market

FIGURE 36 US: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 46 US: 5G IN DEFENSE MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 47 US: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 51 US: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.2.4 CANADA

16.2.4.1 Government support one of key factors driving market in Canada

FIGURE 37 CANADA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 52 CANADA: 5G IN DEFENSE MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.3 EUROPE

16.3.1 COVID-19 IMPACT ON EUROPE

16.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 38 EUROPE: 5G IN DEFENSE MARKET SNAPSHOT

TABLE 55 EUROPE: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 61 EUROPE: 5G IN DEFENSE MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY NETWORK TYPE, 2019–2021 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2019–2021 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY INSTALLATION, 2019–2021 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

16.3.3 RUSSIA

16.3.3.1 Increasing investment in AI to improve C2 and decision making

FIGURE 39 RUSSIA: DEFENSE BUDGET, 2010–2020

TABLE 71 RUSSIA: 5G IN DEFENSE MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 72 RUSSIA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 73 RUSSIA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.3.4 GERMANY

16.3.4.1 Increasing investment in R&D for advanced military capabilities

FIGURE 40 GERMANY: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 74 GERMANY: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 76 GERMANY: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.3.5 UK

16.3.5.1 Increasing investment in next-generation tactical communication and information system driving market

FIGURE 41 UK: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 77 UK: 5G IN DEFENSE MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 78 UK: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 79 UK: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.3.6 FRANCE

16.3.6.1 Technological advancements to drive market

FIGURE 42 FRANCE: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 80 FRANCE: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 81 FRANCE: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 82 FRANCE: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 83 FRANCE: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 84 FRANCE: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 85 FRANCE: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.3.7 ITALY

16.3.7.1 Attractive market for private 5G

FIGURE 43 ITALY: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 86 ITALY: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 87 ITALY: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 88 ITALY: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.4 ASIA PACIFIC

16.4.1 COVID-19 IMPACT ON ASIA PACIFIC

16.4.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: 5G IN DEFENSE MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY NETWORK TYPE, 2019–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2019–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY INSTALLATION, 2019–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

16.4.3 CHINA

16.4.3.1 Increasing use of 5G in military applications driving market

FIGURE 45 CHINA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 105 CHINA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 106 CHINA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 110 CHINA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.4.4 JAPAN

16.4.4.1 Growing security threats and need for advanced communication capabilities driving market

FIGURE 46 JAPAN: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 111 JAPAN: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 112 JAPAN: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 113 JAPAN: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.4.5 SOUTH KOREA

16.4.5.1 Focusing on acquiring various surveillance and reconnaissance assets

FIGURE 47 SOUTH KOREA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 114 SOUTH KOREA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 115 SOUTH KOREA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 116 SOUTH KOREA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 117 SOUTH KOREA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 118 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 119 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.4.6 INDIA

16.4.6.1 Ongoing modernization of Indian defense to fuel market growth

FIGURE 48 INDIA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 120 INDIA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 121 INDIA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 122 INDIA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.4.7 AUSTRALIA

16.4.7.1 High demand for modern digital technologies in military equipment

FIGURE 49 AUSTRALIA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 123 AUSTRALIA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 124 AUSTRALIA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 125 AUSTRALIA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.5 MIDDLE EAST & AFRICA

16.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

16.5.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 50 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET SNAPSHOT

TABLE 126 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET SIZE, BY NETWORK TYPE, 2019–2021 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2019–2021 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET SIZE, BY INSTALLATION, 2019–2021 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

16.5.3 ISRAEL

16.5.3.1 Strong trilateral relationship with US and India to drive market

FIGURE 51 ISRAEL: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 142 ISRAEL: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 143 ISRAEL: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 144 ISRAEL: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.5.4 SAUDI ARABIA

16.5.4.1 Increased military expenditure to drive market

FIGURE 52 SAUDI ARABIA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 145 SAUDI ARABIA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2019–2021 (USD MILLION)

TABLE 146 SAUDI ARABIA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 147 SAUDI ARABIA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 148 SAUDI ARABIA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 149 SAUDI ARABIA: MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 150 SAUDI ARABIA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.5.5 TURKEY

16.5.5.1 High demand for modern digital technologies in military equipment

FIGURE 53 TURKEY: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 151 TURKEY: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 152 TURKEY: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 153 TURKEY: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.5.6 SOUTH AFRICA

16.5.6.1 High demand for modern digital technologies in military equipment

FIGURE 54 SOUTH AFRICA: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 154 SOUTH AFRICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 155 SOUTH AFRICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 156 SOUTH AFRICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.6 LATIN AMERICA

16.6.1 COVID-19 IMPACT ON LATIN AMERICA

16.6.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 55 LATIN AMERICA: MARKET SNAPSHOT

TABLE 157 LATIN AMERICA: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY OPERATIONAL FREQUENCY, 2022–2027 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

16.6.3 BRAZIL

16.6.3.1 Expansion of telecommunication needs driving market

FIGURE 56 BRAZIL: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 165 BRAZIL: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 166 BRAZIL: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 167 BRAZIL: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

16.6.4 MEXICO

16.6.4.1 Need for advanced communication systems to drive market

FIGURE 57 MEXICO: DEFENSE BUDGET, 2010–2020 (USD BILLION)

TABLE 168 MEXICO: MARKET SIZE, BY COMMUNICATION INFRASTRUCTURE, 2022–2027 (USD MILLION)

TABLE 169 MEXICO: MARKET SIZE, BY CORE NETWORK TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 170 MEXICO: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

17 COMPETITIVE LANDSCAPE (Page No. - 176)

17.1 INTRODUCTION

TABLE 171 KEY DEVELOPMENTS BY LEADING PLAYERS IN MARKET BETWEEN 2018 AND 2021

17.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 58 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

17.3 MARKET SHARE ANALYSIS

FIGURE 59 MARKET: MARKET SHARE ANALYSIS

TABLE 172 MARKET: DEGREE OF COMPETITION

17.4 COMPANY EVALUATION QUADRANT

FIGURE 60 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

17.4.1 STAR

17.4.2 PERVASIVE

17.4.3 EMERGING LEADER

17.4.4 PARTICIPANT

17.5 COMPANY EVALUATION QUADRANT (SME)

FIGURE 61 MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

17.5.1 PROGRESSIVE COMPANIES

17.5.2 RESPONSIVE COMPANIES

17.5.3 STARTING BLOCKS

17.5.4 DYNAMIC COMPANIES

TABLE 173 5G IN DEFENSE: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 174 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

17.5.5 COMPETITIVE BENCHMARKING

TABLE 175 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 176 COMPANY PLATFORM FOOTPRINT

TABLE 177 COMPANY APPLICATION FOOTPRINT

TABLE 178 COMPANY REGION FOOTPRINT

17.6 COMPETITIVE SCENARIO AND TRENDS

17.6.1 PRODUCT LAUNCHES

TABLE 179 MARKET: PRODUCT LAUNCHES, 2018–2022

17.6.2 DEALS

TABLE 180 MARKET: DEALS, 2018–2022

18 COMPANY PROFILES (Page No. - 199)

18.1 INTRODUCTION

18.2 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

18.2.1 TELEFONAKTIEBOLAGET LM ERICSSON

TABLE 181 TELEFONAKTIEBOLAGET LM ERICSSON: BUSINESS OVERVIEW

FIGURE 62 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY SNAPSHOT

TABLE 182 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCT LAUNCHES

18.2.2 HUAWEI

TABLE 183 HUAWEI: BUSINESS OVERVIEW

18.2.3 NOKIA OYJ

TABLE 184 NOKIA OYJ: BUSINESS OVERVIEW

FIGURE 63 NOKIA OYJ: COMPANY SNAPSHOT

TABLE 185 NOKIA OYJ: DEALS

18.2.4 NEC CORPORATION

TABLE 186 NEC CORPORATION: BUSINESS OVERVIEW

FIGURE 64 NEC CORPORATION: COMPANY SNAPSHOT

TABLE 187 NEC CORPORATION: DEALS

18.2.5 SAMSUNG ELECTRONICS CO., LTD.

TABLE 188 SAMSUNG ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 65 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 189 SAMSUNG ELECTRONICS CO., LTD.: DEALS

18.2.6 THALES GROUP

TABLE 190 THALES GROUP: BUSINESS OVERVIEW

FIGURE 66 THALES GROUP: COMPANY SNAPSHOT

TABLE 191 THALES GROUP: DEALS

18.2.7 L3HARRIS TECHNOLOGIES, INC.

TABLE 192 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

18.2.8 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 193 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 68 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 194 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

18.2.9 INTELSAT

TABLE 195 INTELSAT: BUSINESS OVERVIEW

TABLE 196 INTELSAT: DEALS

18.2.10 QUALCOMM, INC.

TABLE 197 QUALCOMM, INC.: BUSINESS OVERVIEW

FIGURE 69 QUALCOMM, INC. COMPANY SNAPSHOT

18.2.11 CISCO SYSTEMS, INC.

TABLE 198 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 70 CISCO SYSTEMS, INC. COMPANY SNAPSHOT

18.2.12 VERIZON COMMUNICATIONS, INC.

TABLE 199 VERIZON COMMUNICATIONS, INC.: BUSINESS OVERVIEW

FIGURE 71 VERIZON COMMUNICATIONS, INC.: COMPANY SNAPSHOT

TABLE 200 VERIZON COMMUNICATIONS, INC.: DEALS

18.2.13 DEUTSCHE TELEKOM AG

TABLE 201 DEUTSCHE TELEKOM AG: BUSINESS OVERVIEW

18.2.14 ORANGE SA

TABLE 202 ORANGE SA: BUSINESS OVERVIEW

FIGURE 72 ORANGE SA: COMPANY SNAPSHOT

18.2.15 GOGO, INC.

TABLE 203 GOGO, INC.: BUSINESS OVERVIEW

FIGURE 73 GOGO, INC.: COMPANY SNAPSHOT

18.2.16 LIGADO NETWORKS

TABLE 204 LIGADO NETWORKS: BUSINESS OVERVIEW

TABLE 205 LIGADO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 LIGADO NETWORKS: DEALS

18.2.17 WIND RIVER SYSTEMS, INC.

TABLE 207 WIND RIVER SYSTEMS, INC.: BUSINESS OVERVIEW

18.2.18 ANALOG DEVICES, INC.

TABLE 208 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

FIGURE 74 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

TABLE 209 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

TABLE 210 ANALOG DEVICES, INC.: DEALS

18.2.19 INTEL CORPORATION

TABLE 211 INTEL CORPORATION: BUSINESS OVERVIEW

FIGURE 75 INTEL CORPORATION: COMPANY SNAPSHOT

18.3 OTHER PLAYERS

18.3.1 SMARTSKY NETWORKS

TABLE 212 SMARTSKY NETWORKS: COMPANY OVERVIEW

18.3.2 AEROMOBILE COMMUNICATIONS

TABLE 213 AEROMOBILE COMMUNICATIONS: COMPANY OVERVIEW

18.3.3 T-MOBILE US, INC

TABLE 214 T-MOBILE US, INC.: COMPANY OVERVIEW

18.3.4 TELECOM ITALIA

TABLE 215 TELECOM ITALIA: COMPANY OVERVIEW

18.3.5 MARVELL

TABLE 216 MARVELL: COMPANY OVERVIEW

18.3.6 MEDIATEK, INC.

TABLE 217 MEDIATEK, INC.: COMPANY OVERVIEW

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

19 APPENDIX (Page No. - 252)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the 5G in the defense Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred for this research study included government sources, such as the Federal Aviation Industry (FAA), European Aviation Safety Agency (EASA), General Civil Aviation Authority (GCAA), International Air Transport Association (IATA), and corporate filings, such as annual reports, investor presentations, and financial statements of trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various industry trends, network type, end user, installation, chipset, core network technology, platform, operational frequency, and region. Stakeholders from the demand side included government telecommunication organizations, system integrators, technology providers, and service providers. Extensive primary research was conducted after obtaining information regarding the 5G in defense market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across six regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. This primary data was obtained through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the 5G in the defense market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global 5G in defense Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the 5G in defense Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the 5G in the defense market.

Report Objectives

- To describe, segment, and forecast the size of the 5G in the defense market based on communication infrastructure, core network technology, platform, end-user, network type, chipset, operational frequency, and installation in terms of value

- To describe and forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify prevailing industry trends, market trends, and technology trends related to the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the market by identifying key market players

- To analyze competitive developments, such as contracts, new product launches, and acquisitions, in the 5G in defense market

- To identify the detailed financial position, key products/services, and major developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the 5G in defense market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the 5G in defense Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G in Defense Market