5G NTN Market by Component (Hardware, Solutions, Services), End-Use Industry (Maritime, Aerospace and Defense, Government, Mining), Application (EMBB, URLLC, and MMTC), & Region (North America, Europe, APAC, MEA, Latin America) - Global Forecast to 2027

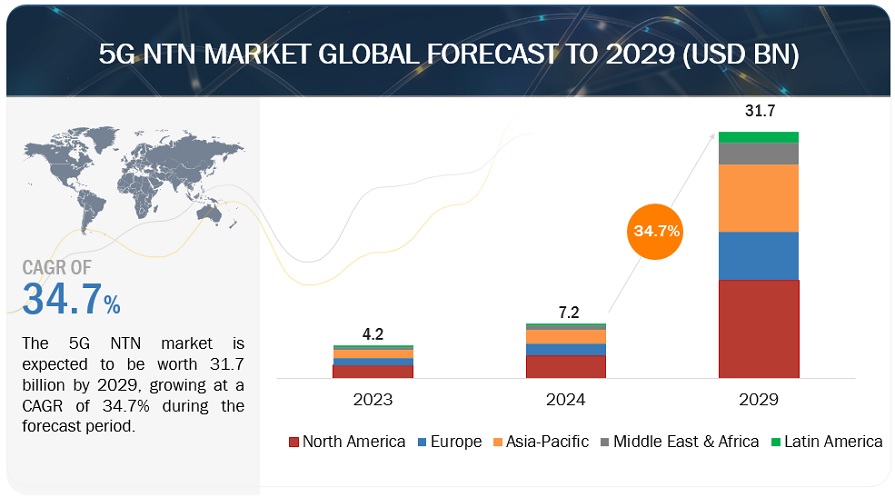

[204 Pages Report] The 5G NTN market size is projected to grow from USD 3.2 billion in 2022 to USD 16.1 billion by 2027, at a CAGR of 38.2% during the forecast period. The rising need for service continuity in underserved areas, such as mines, remote areas, sea, and other complex locations, is expected to drive the network evolution and expansion of 5G into the non-terrestrial network.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drive: 3GPP evolution toward NTN interworking and integration

Integration of terrestrial networks with NTNs, whether HAPS flying the stratosphere or satellites in LEO or GEO, is one of the new possibilities introduced in 5G. NTN function is vital to the 3GPP R17 standard. It is still evolving in 5G-Advanced and has become an essential component of the 3GPP R18 workplan. Direct satellite connection with mobile phones will be widely used in personal fields and numerous vertical industry application areas in the future, considerably expanding satellites' application scope. Convergence technology innovation is being actively pursued worldwide, the integration chain is being sped, and in-depth integration between the cellular satellite industries is being fostered. The integration of satellite networks with ground networks will have enormous commercial benefits.

Restraint: Meeting demand on ground stations

The radio components, such as gNB and relay, in space, the core network requires to be on the ground. This implies that the satellite or airborne platform must be linked to a ground station at some point. The challenge is how far it can travel before being disconnected from the ground station. Clearly, a satellite's distances before being disconnected from the ground station are limited. As a result, to cover a large area, it is required to have a large number of ground stations and satellites. One proposed solution for this scenario is to enable some satellites to connect to the core network indirectly through another satellite rather than a ground station. To accomplish this, it would necessitate the establishment of relay networks or mesh networks among the satellites. Certainly, this is theoretically achievable, and most satellite communication systems take this into consideration from the start. However, practically it would be difficult to implement. Such difficulties in implementation will restrain the growth of the 5G NTN market and also affect the players' investments in the ecosystem.

Opportunity: 5G NB-IoT NTN contributing to opening the world to high speed

The necessity for satellite-based communication to be included in 5G standards has never been higher. 5G NB-IoT NTN specifications will usher in a new era in the mobile network and global communications industries, enabling multiple industries to offer services globally via seamless 5G connectivity, even in remote regions with limited network coverage.

A high-speed space-based connection can greatly assist gas, oil, maritime, and agricultural companies. For instance, maritime industries struggle with connectivity and visibility as container ships cross the ocean, resulting in an unstable and unpredictable supply chain. NB-IoT contributions to 3GPP's NTN specifications are aimed at these businesses to address the issues they currently encounter because of low TN coverage.

Challenge: Propagation delay and low latency due to the large distance between satellites and terrestrial UE

The propagation delay significantly impacts system performance in NTN communications and is one of the significant issues for URLLC applications and essential communications, i.e., public safety. The latency from the NTN gateway to the NTN terminal (regenerative payload) via the spaceborne or airborne platform (transparent payload) or vice-versa is characterized as propagation delay. The process induces long latency owing to the large distance between terrestrial UE and the satellite. The propagation delay is also affected by the NTN platform altitude, the NTN gateway position and elevation angle, and the NTN terminal position.

By end-use industry, aerospace & defense to register higher CAGR during the forecast period

Increasing adoption of innovative technology and digitalized solutions are the key factors for success in the aerospace and defense industry. 5G NTN solutions are focused on enhancing 5G coverage to support various applications in this industry and provide high-speed internet connectivity to aircraft passengers to ensure the same level of connectivity in the plane as on the ground. In the defense sector, the need for a 5G NTN system will play an important role in supporting application areas, which include static communication, deployable CIS for expeditionary operations, land operations, real-time remote surgery, and maritime operations.

By component, solutions to account for the largest market share during the forecast period

5G NTN solutions can help operators provide a great connectivity experience using 5G technologies while lowering operational expenses. The 5G NTN solutions, by integrating with satellite communication, can provide excellent network coverage without the limitation of boundaries. Various leading players offer 5G NTN test solutions to check the reliability, affordability, and efficiency of the system before launching it into the space. Test solutions are useful to resolve challenges faced by companies to test the scalability of the system, compatibility of the system to cover long distances, mobility, movement of satellite, speed, quality, and reliability of the system to meet the demand, and its capability for multi-layer communication.

By location, remote area to register higher CAGR during the forecast period

NTN system will extend the network coverage to diverse locations without terrestrial coverage and ensure connectivity in rural areas where there is little or no Internet access and industries operating in remote areas, such as oil and gas exploration and mining. To support remote working, remote education adoption of 5G solutions and services is increased. Various companies are focusing on redefining the rules and policies to enable remote working and workers' movement from urban to rural areas. They are deploying satellites in LEO, MEO, and GEO to provide network coverage in remote areas with cost attractiveness and feasible technical complexity. The vision of 5G NTN in a remote area is to deploy a highly distributed network and network connectivity in an emergency and safety situation.

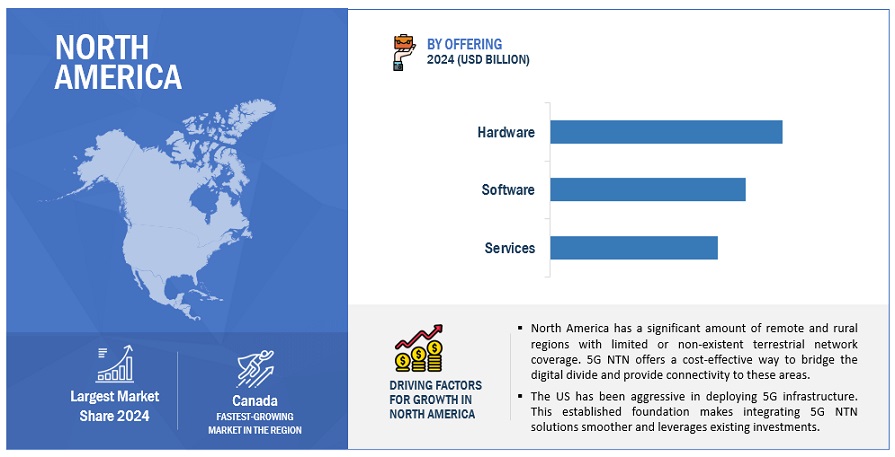

North America to account for the largest market share during the forecast period

North America is expected to hold the largest share of the overall 5G NTN market. The US has high adoption of 5G NTN technology in this region. The factors that are popularizing the need for 5G NTN solutions in this region include the adoption of smart connected devices, the Industrial Internet of Everything (IIoE), and the increasing commercialization of 5G services. According to The Mobile Economy report published by Global System for Mobile Communication (GSMA), in 2022, the percentage of 5G connection in North America was 14%, which is expected to reach 64% by the end of 2025.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The 5G NTN market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in this market include Qualcomm Technologies, Inc (US), Gilat Satellite Networks (Israel), SoftBank Group Corporation (Japan), Thales Group (France), Thales Alena Space (France), Rohde & Schwarz GmbH & Co KG (Germany), Keysight Technologies, Inc (US), MediaTek Inc. (Taiwan), Anritsu Corporation (Japan), SES S.A. (Luxembourg), EchoStar Corporation (EchoStar) (US), SpaceX (US), AST & Science, LLC (US), ZTE Corporation (China), OneWeb (UK), GateHouse SatCom A/S (Denmark), Omnispace, LLC (US), Nelco Limited (US), Inmarsat Global Limited (UK), Skylo Technologies (US), Globalstar, Inc (US), Spirent Communications (Spirent) (UK), Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Intelsat US LLC (US), and Telefonica S.A. (Spain), Viasat Inc, (US), Telesat (Canada). The study includes an in-depth competitive analysis of these key market players along with their profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market size value in 2022 | USD 3.2 Billion |

| Revenue forecast by 2027 | USD 16.1 Billion |

| Growth Rate (CAGR) | CAGR of 38.2% from 2022 to 2027 |

| Market size available for years | 2022-2027 |

| Base year considered | 2022 |

| Forecast period | 2022-2027 |

| Forecast units | Value (USD Million/Billion) |

| Segments covered | By component, platform, application, end-use industry, location, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Qualcomm Technologies, Inc (US), Gilat Satellite Networks (Israel), SoftBank Group Corporation (Japan), Thales Group (France), Thales Alena Space (France), Rohde & Schwarz GmbH & Co KG (Germany), Keysight Technologies, Inc (US), MediaTek Inc. (Taiwan), Anritsu Corporation (Japan), SES S.A. (Luxembourg), EchoStar Corporation (EchoStar) (US), SpaceX (US), AST & Science, LLC (US), ZTE Corporation (China), OneWeb (UK), GateHouse SatCom A/S (Denmark), Omnispace, LLC (US), Nelco Limited (US), Inmarsat Global Limited (UK), Skylo Technologies (US), Globalstar, Inc (US), Spirent Communications (Spirent) (UK), Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Intelsat US LLC (US), and Telefonica S.A. (Spain), Viasat Inc, (US), Telesat (Canada). |

This research report categorizes the 5G NTN market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Hardware

- Solutions

- Services

By Platform:

- UAS Platform

- LEO Satellite

- MEO Satellite

- GEO Satellite

By Application

- EMBB

- URLLC

- MMTC

By End-Use Industry

- Maritime

- Aerospace and Defense

- Government

- Mining

- Other End-use industries

By Location

- Urban

- Rural

- Remote

- Isolated

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- India

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2022, MediaTek and Rohde & Schwarz collaborated to signify the potential of 5G NTN technology to expand the network coverage of 5G communication anywhere at any time. MediaTek used the test solutions offered by Rohde & Schwarz to ensure the excellent functioning of satellites and other related terminals and base stations.

- In July 2022, Qualcomm, Ericsson, and Thales collaborated to test and validate 5g NTN for smartphone-based use cases. Qualcomm will provide test phones to verify the accessibility of 5G smartphones to 5G NTN in the future.

- In April 2022, Thales Alenia Space and Omnispace partnered together to launch Omnispace Spark-2 into orbit. Omnispace Spark-2 will be used to validate the successful development and implementation of the global non-terrestrial network offered by Omnispace.

Frequently Asked Questions (FAQ):

What is a 5G NTN?

Non-Terrestrial Networks (NTN) are able to satisfy requests for anywhere and anytime connection by offering wide-area coverage and ensuring service availability, continuity, and scalability. The NTN family includes satellite communication networks, High-Altitude Platform Systems (HAPS), and air-to-ground networks.

Which countries are considered in the North American region?

The report includes an analysis of the US and Canada in the North American region.

Which are the key drivers supporting the growth of the 5G NTN market?

The key drivers supporting the growth of the 5G NTN market include solving the problem of extreme coverage extension and 3GPP evolution toward NTN interworking and integration.

What are some of the technological advancements in the market?

Integration of terrestrial network with NTNs, whether HAPS flying the stratosphere or satellite in LEO or GEO, is one of the new possibilities introduced in 5G. NTN is still evolving in 5G-Advance and has become an essential component of 3GPP R18 workplan. NTN is dividen into two workgroups: NTN-IoT and NTN-NR. The NTN-IoT focuses on low-complexity NB-IoT/eMTC terminal satellite IoT services, such as global asset tracking for sea containers or other terminals outside cellular network coverage.

Who are the key vendors in the 5G NTN market?

The key vendors operating in the 5G NTN market include Qualcomm Technologies, Inc (US), Gilat Satellite Networks (Israel), SoftBank Group Corporation (Japan), Thales Group (France), Thales Alena Space (France), Rohde & Schwarz GmbH & Co KG (Germany), Keysight Technologies, Inc (US), MediaTek Inc. (Taiwan), Anritsu Corporation (Japan), SES S.A. (Luxembourg), EchoStar Corporation (EchoStar) (US), SpaceX (US), AST & Science, LLC (US), ZTE Corporation (China), OneWeb (UK), GateHouse SatCom A/S (Denmark), Omnispace, LLC (US), Nelco Limited (US), Inmarsat Global Limited (UK), Skylo Technologies (US), Globalstar, Inc (US), Spirent Communications (Spirent) (UK), Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Intelsat US LLC (US), and Telefonica S.A. (Spain), Viasat Inc, (US), Telesat (Canada). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 5G NTN MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 5G NTN MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 3 5G NTN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES IN 5G NTN MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 FACTOR ASSESSMENT

TABLE 3 FACTOR ASSESSMENT: 5G NTN MARKET

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 10 5G NTN MARKET SIZE, 2022–2027 (USD MILLION)

FIGURE 11 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY PLATFORM, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY END-USE INDUSTRY, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY LOCATION, 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 5G NTN MARKET OVERVIEW

FIGURE 17 INCREASING USE OF ECOMMERCE AND COMMERCE PLATFORMS TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY LOCATION AND APPLICATION

FIGURE 18 RURAL AND EMBB SEGMENTS TO ACCOUNT FOR LARGEST MARKET SIZES IN NORTH AMERICA IN 2022

4.3 ASIA PACIFIC: MARKET, BY LOCATION AND APPLICATION

FIGURE 19 RURAL AND EMBB SEGMENTS TO ACCOUNT FOR LARGEST MARKET SIZES IN ASIA PACIFIC IN 2022

4.4 EUROPE: MARKET, BY LOCATION AND APPLICATION

FIGURE 20 RURAL AND EMBB SEGMENTS TO ACCOUNT FOR LARGEST MARKET SIZES IN EUROPE IN 2022

4.5 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 21 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G NTN MARKET

5.2.1 DRIVERS

5.2.1.1 Need to address extreme coverage extension

5.2.1.2 3GPP evolution toward NTN interworking and integration

5.2.2 RESTRAINTS

5.2.2.1 Meeting demand on ground stations

5.2.3 OPPORTUNITIES

5.2.3.1 Need for NTN in evolution toward 5G and 6G

5.2.3.2 5G NB-IoT NTN contributing to global high speed

5.2.4 CHALLENGES

5.2.4.1 Propagation delay and low latency due to large distance between satellites and terrestrial UE

5.2.4.2 Doppler frequency shift owing to mobility issues

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 5G NTN MARKET: SUPPLY CHAIN

5.4 ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 INTRODUCTION

5.5.2 INTERNET OF THINGS

5.6 CASE STUDY ANALYSIS

5.6.1 CASE STUDY 1: ERICSSON, QUALCOMM, AND THALES PROVIDED GLOBAL COVERAGE THROUGH 5G SMARTPHONES

5.6.2 CASE STUDY 2: SMART AND OMNISPACE TEAMED UP TO EXPLORE SPACE-BASED 5G TECHNOLOGIES

5.6.3 CASE STUDY 3: T-MOBILE AND SPACEX COLLABORATED TO PROVIDE TEXT COVERAGE AND OFFER NO DEAD ZONES

5.6.4 CASE STUDY 4: ZTE CORPORATION AND CHINA MOBILE SHOWCASED FIRST 5G NTN FIELD TRIAL

5.6.5 CASE STUDY 5: APPLE PARTNERED WITH GLOBALSTAR TO DELIVER EMERGENCY SOS SERVICES THROUGH SATELLITE COMMUNICATIONS

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPES OF PATENTS

TABLE 5 PATENTS FILED, 2019–2022

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY, 2019–2022

5.7.3.1 Top applicants

FIGURE 25 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

TABLE 6 US: TOP TEN PATENT OWNERS IN 5G NTN MARKET, 2019–2022

TABLE 7 LIST OF FEW PATENTS IN MARKET, 2020–2022

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES MODEL

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.1.1 North America

5.9.1.1.1 US

5.9.1.1.2 Canada

5.9.1.2 Europe

5.9.1.3 Asia Pacific

5.9.1.3.1 China

5.9.1.3.2 Australia

5.9.1.3.3 Japan

5.9.1.4 Middle East & Africa

5.9.1.4.1 Saudi Arabia

5.10 TRENDS AND DISRUPTIONS IN 5G NTN MARKET

FIGURE 26 TRENDS AND DISRUPTIONS IN MARKET

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

5.11.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA

TABLE 15 KEY BUYING CRITERIA

5.12 KEY CONFERENCES & EVENTS

TABLE 16 MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6 5G NTN MARKET, BY COMPONENT (Page No. - 66)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 29 SOLUTIONS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 SHIFT TOWARD 5G NTN HARDWARE INSTALLATION TO ENHANCE NETWORK COVERAGE

TABLE 18 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTIONS

6.3.1 COMPANIES TO OFFER SOLUTIONS TO TEST CAPABILITY OF 5G NTN SYSTEM BEFORE DEPLOYMENT

TABLE 19 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 RISING DEMAND FOR SERVICES TO PROVIDE UNINTERRUPTED CONNECTIVITY IN UNDERSERVED AREAS

TABLE 20 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 5G NTN MARKET, BY PLATFORM (Page No. - 70)

7.1 INTRODUCTION

7.1.1 PLATFORM: MARKET DRIVERS

FIGURE 30 LEO SATELLITE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 UAS PLATFORM

7.2.1 SUPPORTING AIRBORNE COMMUNICATION AT ALTITUDES FROM 8 TO 50 KM TO DRIVE DEMAND FOR UAS PLATFORM

TABLE 22 UAS PLATFORM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LEO SATELLITE

7.3.1 LEO PROVIDES CONNECTIVITY COVERAGE AT ALTITUDES RANGING FROM 300 TO 1,500 KM

TABLE 23 LEO SATELLITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 MEO SATELLITE

7.4.1 MEO SATELLITE TO HELP REDUCE RF POWER REQUIREMENTS AND COMMUNICATION DELAY

TABLE 24 MEO SATELLITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 GEO SATELLITE

7.5.1 LEADING COMPANIES TO SUPPORT GEO PLATFORM FOR 5G NTN TECHNOLOGY

TABLE 25 GEO SATELLITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 5G NTN MARKET, BY APPLICATION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 31 MMTC SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.1.1 APPLICATION: MARKET DRIVERS

8.2 EMBB

8.2.1 NEED TO OFFER HIGH-SPEED BROADBAND CONNECTIVITY IN DENSELY POPULATED AREAS TO DRIVE DEMAND

TABLE 27 EMBB: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 MMTC

8.3.1 MMTC DEVELOPED FOR SCALABLE AND EFFICIENT CONNECTIVITY OF MANY DEVICES

TABLE 28 MMTC: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 URLLC

8.4.1 URLLC TO PROVIDE DATA TRANSMISSION WITH HIGH RELIABILITY IN 5G NTN SYSTEM

TABLE 29 URLLC: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 5G NTN MARKET, BY END-USE INDUSTRY (Page No. - 79)

9.1 INTRODUCTION

9.1.1 END-USE INDUSTRY: MARKET DRIVERS

FIGURE 32 AEROSPACE AND DEFENSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

9.2 MARITIME

9.2.1 ENHANCED 5G NETWORK COVERAGE TO SUPPORT TRACKING AND MONITORING IN MARITIME

TABLE 31 MARITIME: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AEROSPACE AND DEFENSE

9.3.1 OFFERS SAME LEVEL OF CONNECTIVITY FOR AIRCRAFT PASSENGERS AS ON GROUND

TABLE 32 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 GOVERNMENT

9.4.1 5G NTN SOLUTIONS IMPROVE SAFETY AND SECURITY OF GOVERNMENT NETWORK

TABLE 33 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 MINING

9.5.1 SEAMLESS NTN-BASED 5G CONNECTIVITY IN MINES.TO ENSURE SAFETY OF WORKERS

TABLE 34 MINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHER END-USE INDUSTRIES

TABLE 35 OTHER END-USE INDUSTRIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 5G NTN MARKET, BY LOCATION (Page No. - 85)

10.1 INTRODUCTION

10.1.1 LOCATION: MARKET DRIVERS

FIGURE 33 REMOTE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 MARKET, BY LOCATION, 2022–2027 (USD MILLION)

10.2 URBAN

10.2.1 DEMAND FOR HIGH-SPEED INTERNET IN SMART INFRASTRUCTURE TO DRIVE URBAN MARKET

TABLE 37 URBAN: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 RURAL

10.3.1 BETTER CONNECTIVITY TO BRIDGE DIGITAL DIVIDED IN RURAL AREAS

TABLE 38 RURAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 REMOTE

10.4.1 BETTER COVERAGE TO SUPPORT MOVEMENT OF URBAN WORKERS TO REMOTE AREAS

TABLE 39 REMOTE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 ISOLATED

10.5.1 CAPABILITY TO PROVIDE 5G COVERAGE IN UNSERVED AND ISOLATED AREAS TO AUGMENT MARKET

TABLE 40 ISOLATED: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 5G NTN MARKET, BY REGION (Page No. - 90)

11.1 INTRODUCTION

FIGURE 34 MARKET: REGIONAL SNAPSHOT, 2022

FIGURE 35 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 41 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 36 NORTH AMERICA MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Remarkable growth of smart connected devices to boost market growth

11.2.3 CANADA

11.2.3.1 Improvement in network connectivity in rural areas to drive market

TABLE 48 CANADA: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 49 CANADA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 50 CANADA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 51 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 52 CANADA: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

TABLE 53 EUROPE: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 5G deployment to help reduce carbon emission

TABLE 59 UK: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 60 UK: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 61 UK: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 62 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 63 UK: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 74 licenses released by German regulator released to develop 5G network

11.3.4 FRANCE

11.3.4.1 Rising need to expand 5G coverage to boost market growth

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 64 ASIA PACIFIC: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Successful field trial of 5G NTN to demonstrate communication services

11.4.3 INDIA

11.4.3.1 Increasing focus on smart infrastructure development to lead to adoption of 5G NTN

TABLE 70 INDIA: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 71 INDIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 72 INDIA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 73 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 74 INDIA: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Increasing demand for 5G and 6G wireless technology to drive market

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 75 MIDDLE EAST & AFRICA: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA: MARKET, BY SUBREGION, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.2.1 Government initiatives to enhance 5G network coverage to grow demand for solutions

TABLE 81 MIDDLE EAST: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 82 MIDDLE EAST: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 MIDDLE EAST: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 84 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 MIDDLE EAST: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

11.5.2.2 Saudi Arabia

11.5.2.2.1 CITC to accelerate deployment of 5G in Saudi Arabia

11.5.3 AFRICA

11.5.3.1 Large players to invest in African countries to expand their footprint

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 86 LATIN AMERICA: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 89 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

TABLE 91 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Increased investment in digital infrastructure to drive demand for 5G NTN solutions

TABLE 92 BRAZIL: 5G NTN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 BRAZIL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 94 BRAZIL: MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 95 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 BRAZIL: MARKET, BY LOCATION, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Hughes Network System selected by various companies to enhance network connectivity

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 123)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 97 OVERVIEW OF STRATEGIES BY KEY PLAYERS IN 5G NTN MARKET

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

FIGURE 37 MARKET: KEY VENDORS

12.4 COMPETITIVE BENCHMARKING

TABLE 98 PRODUCT FOOTPRINT WEIGHTAGE

TABLE 99 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 100 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 101 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

TABLE 102 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES, BY REGION

TABLE 103 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS, BY REGION

12.5 MARKET RANKING OF KEY PLAYERS IN 5G NTN MARKET

TABLE 104 MARKET RANKING OF KEY PLAYERS, 2022

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 38 MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 39 5G NTN MARKET (STARTUPS/SMES): COMPANY EVALUATION MATRIX, 2022

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 105 PRODUCT LAUNCHES, FEBRUARY 2019–MAY 2022

12.8.2 DEALS

TABLE 106 DEALS, AUGUST 2020–AUGUST 2022

13 COMPANY PROFILES (Page No. - 137)

13.1 MAJOR PLAYERS

(Business Overview, Solutions, Products & Services Offered, Recent Developments, MnM View)*

13.1.1 QUALCOMM

TABLE 107 QUALCOMM: BUSINESS OVERVIEW

FIGURE 40 QUALCOMM: COMPANY SNAPSHOT

TABLE 108 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 109 QUALCOMM: PRODUCT LAUNCHES

TABLE 110 QUALCOMM: DEALS

13.1.2 GILAT SATELLITE NETWORKS

TABLE 111 GILAT SATELLITE NETWORKS: BUSINESS OVERVIEW

FIGURE 41 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

TABLE 112 GILAT SATELLITE NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 113 GILAT SATELLITE NETWORKS: DEALS

13.1.3 SOFTBANK

TABLE 114 SOFTBANK: BUSINESS OVERVIEW

FIGURE 42 SOFTBANK: COMPANY SNAPSHOT

TABLE 115 SOFTBANK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 116 SOFTBANK: PRODUCT LAUNCHES

TABLE 117 SOFTBANK: DEALS

13.1.4 THALES

TABLE 118 THALES: BUSINESS OVERVIEW

FIGURE 43 THALES: COMPANY SNAPSHOT

TABLE 119 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.5 THALES ALENIA SPACE

TABLE 120 THALES ALENIA SPACE: BUSINESS OVERVIEW

TABLE 121 THALES ALENA SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 122 THALES ALENIA SPACE: PRODUCT LAUNCHES

TABLE 123 THALES ALENIA SPACE: DEALS

13.1.6 ROHDE & SCHWARZ

TABLE 124 ROHDE & SCHWARZ: BUSINESS OVERVIEW

TABLE 125 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 126 ROHDE & SCHWARZ: DEALS

13.1.7 KEYSIGHT TECHNOLOGIES

TABLE 127 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 44 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 128 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 129 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

13.1.8 MEDIATEK

TABLE 130 MEDIATEK: BUSINESS OVERVIEW

FIGURE 45 MEDIATEK: COMPANY SNAPSHOT

TABLE 131 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 132 MEDIATEK: DEALS

13.1.9 ANRITSU

TABLE 133 ANRITSU: BUSINESS OVERVIEW

FIGURE 46 ANRITSU: COMPANY SNAPSHOT

TABLE 134 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 135 ANRITSU: PRODUCT LAUNCHES

TABLE 136 ANRITSU: DEALS

13.1.10 SES

TABLE 137 SES: BUSINESS OVERVIEW

FIGURE 47 SES: COMPANY SNAPSHOT

TABLE 138 SES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.11 ECHOSTAR

TABLE 139 ECHOSTAR: BUSINESS OVERVIEW

FIGURE 48 ECHOSTAR: COMPANY SNAPSHOT

TABLE 140 ECHOSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 141 ECHOSTAR: PRODUCT LAUNCHES

TABLE 142 ECHOSTAR: DEALS

13.2 OTHER KEY PLAYERS

13.2.1 SPACEX

13.2.2 AST SPACEMOBILE

13.2.3 ZTE

13.2.4 ONEWEB

13.2.5 GATEHOUSE

13.2.6 OMNISPACE

13.2.7 NELCO

13.2.8 INMARSAT

13.2.9 SKYLO

13.2.10 GLOBALSTAR

13.2.11 SPIRENT

13.2.12 ERICSSON

13.2.13 NOKIA

13.2.14 INTELSAT

13.2.15 TELEFONICA

13.2.16 VIASAT

13.2.17 TELESAT

*Details on Business Overview, Solutions, Products & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 186)

14.1 MARITIME SATELLITE COMMUNICATION

14.1.1 MARKET OVERVIEW

14.1.2 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT

TABLE 143 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 144 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 145 SOLUTIONS: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2016–2018 (USD MILLION)

TABLE 146 SOLUTIONS: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 147 SERVICES: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2016–2018 (USD MILLION)

TABLE 148 SERVICES: MARITIME SATELLITE COMMUNICATION MARKET, BY REGION, 2019–2025 (USD MILLION)

14.1.3 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION

TABLE 149 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 150 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 151 VERY SMALL APERTURE TERMINAL: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET, BY REGION, 2016–2018 (USD MILLION)

TABLE 152 VERY SMALL APERTURE TERMINAL: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET, BY REGION, 2019–2025 (USD MILLION)

14.1.4 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE

TABLE 153 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 154 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE, 2019–2025 (USD MILLION)

14.1.5 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER

TABLE 155 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER, 2016–2018 (USD MILLION)

TABLE 156 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER, 2019–2025 (USD MILLION)

14.2 NANOSATELLITE AND MICROSATELLITE MARKET

14.2.1 MARKET DEFINITION

14.2.2 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT

TABLE 157 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 158 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

14.2.3 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE

TABLE 159 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 160 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE, 2022–2027 (USD MILLION)

14.2.4 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE

TABLE 161 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 162 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

14.2.5 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION

TABLE 163 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 164 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.2.6 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORBIT

TABLE 165 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 166 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

14.2.7 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY

TABLE 167 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 168 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 198)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

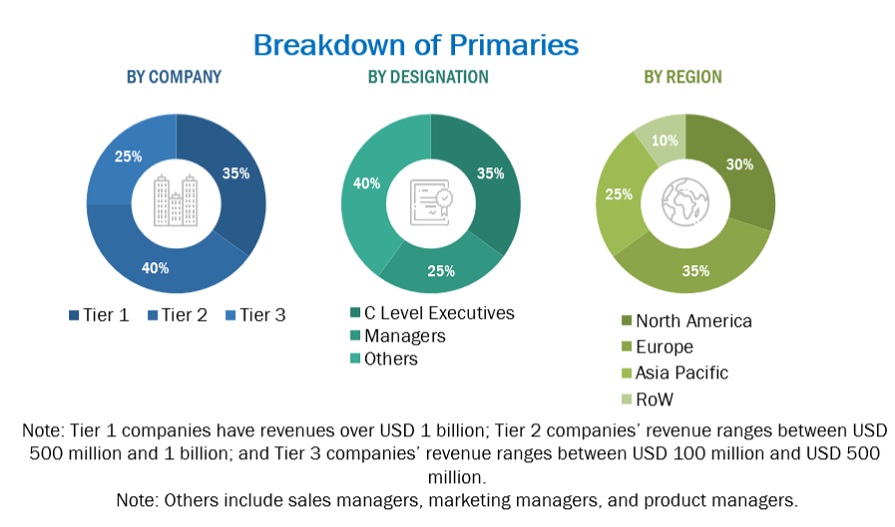

This research study involved extensive secondary sources, directories, and databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the 5G NTN market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess prospects.

Secondary Research

The market size of the companies offering 5G NTN to various telecom operators was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports of Qualcomm; press releases of various companies, such as Thales, Ericsson, and Gilat; and white papers, journals, and certified publications and articles from recognized authors, directories, and databases, such as 5G Americas and GSM Association.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the 5G NTN market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end-users who use 5G NTN, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of 5G NTN, which is expected to affect the overall 5G NTN market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the 5G NTN market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players as well as interviews with experts for key insights (quantitative and qualitative).

The percentage share, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the 5G NTN market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

5G NTN Market: Bottom-up Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the 5G NTN market based on component, platform, application, end-use industry, location, and region from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the 5G NTN market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G NTN Market