5G Security Market by Component, Deployment Mode, Organization Size, End User, Network Component Security (RAN and Core Security), Architecture, Application, Vertical and Region - Global Forecast to 2027

Updated on : April 28, 2023

Market Overview

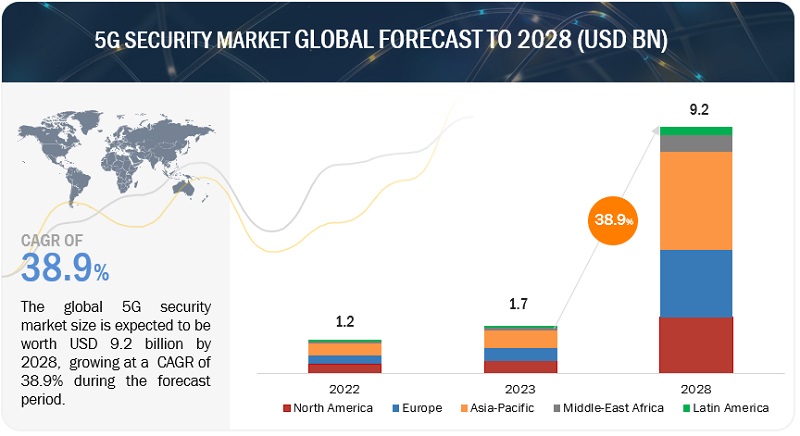

The global 5G security market size was valued at $1.3 billion in 2022 and is predicted to reach $7.2 billion by 2027, increasing at a CAGR of 41.6% from 2022 to 2027. Our analysis provides in-depth details on recent market developments, conferences, webinars, patent analysis, important stakeholder information, and pricing analysis in this new research report.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The outbreak of COVID-19 has significantly impacted operations in a few key verticals, such as manufacturing, logistics, hospitality, transportation, healthcare, and retail, and moderately impacted a few sectors, such as IT & telecom, energy & utilities, government, education, and BFSI. Hence, the impact of this factor on the market is expected to be moderate across global sectors.

5G Security Market Dynamics

Driver: Rising attacks on critical infrastructure

Hackers are targeting IoT devices and taking advantage of known vulnerabilities, such as those related to default username, password, and static code backdoor is on the rise. Nowadays, all verticals are adopting automation with the integration of IoT and high-speed networks. Critical infrastructures, such as electricity, water, and other important resources, are among the early adopters of technologies and are in the phase of automation. Automation, while making the operations much more efficient, has also made the systems prone to cyberattacks. The growing vulnerability of critical systems is now the prime concern of all governments. Either accidental or malicious interference with the controls of a nuclear reactor poses a severe threat to human life and property.

Restraint: Delay in standardization of spectrum allocation

The use of higher frequencies is a major advantage in the development of the 5G network. However, all high frequencies (radio spectrum) are already used for different applications, such as telecommunications services and government agencies. To develop 5G infrastructure, accessing these high-frequency spectrums is crucial. As it is already allocated for different applications, there is conflict in accessing these frequency bands. However, there is no clarity on the definite timeframe as to when wireless operators would be given access to these spectrums to implement 5G infrastructure. As of now, different regulations are being set by different government agencies across all regions. For instance, Ofcom (UK), UK’s communications regulator, has suggested allocating a 6 GHz frequency band for 5G infrastructure, while the Federal Communications Commission (FCC) in the US has allocated frequencies from ~24 GHz. In South Korea, the Ministry of Science and ICT auctioned 3.5 GHz and 28 GHz bands for 5G services in June 2018. This irregularity in spectrum allocation and the delay in agreement on spectrum use are the factors hampering the clarity of the exact security requirement, thereby increasing the network's vulnerability. The standardization of spectrum allocation across regions and countries is extremely important for the development of 5G infrastructure. It impacts the economies of scale and clarifies equipment vendors for developing suitable products.

Opportunity: Increasing operator investments for dynamic infrastructure

With increasing network attacks, many operators have focused on securing their carrier network. For instance, after the O2 Telefonica bank attack, the Spanish operator employed 1,000 security staff and 650 analysts in seven Security Operations Centers (SOCs) around the globe. Moreover, British Telecom (BT), authorized to accredit its systems and networks for UK government use, has 3,000 security professionals in 15 SOCs across the globe. BT denotes the use of AI to keep its customers’ data safe. Its machine-assisted cyber threat hunting technology uses visual interfaces to identify and understand cybersecurity threats for large amounts of data. These investments are carried out to improve the network security measures, thus, creating a huge opportunity for the growth of 5G security solutions.

Challenge: Uncertainty around ROI and other unprecedented challenges

5G deployments are in the introductory stage of their product life cycle with standalone solution-related transitioning that requires a significant amount of work. 5G ensures several advantages, such as CUPS and network slicing. Operators need end-to-end 5G networks to be expansible, high-performance, and flexible to efficiently deliver extensive services expected by users, which finally brings competitive advantages to operators. However, the challenges with 5G rollouts, which telcos face, include aligning with the company’s long-term interest in entering the industry and value proposition credibility with the target market segment. The level of market success also depends on the financial investment committed. However, telcos do not want to indulge in over-investments before experiencing RoI or real traction.

By Component, the services segment to have a higher growth during the forecast period

Services in the 5G security market have a key role to play. The changing trends in technologies have surged the need for services by end users. A 5G security network is new to telecom operators and enterprise customers and needs to be managed end-to-end. The deployment of 5G security networks requires expertise and special skill sets, which drive the demand for consulting, implementation, and support & maintenance services. These services help end users effectively secure their 5G network infrastructure to gain desirable business outcomes.

By Deployment mode, the cloud segment to dominate the market during the forecast period

Cloud is the fastest-growing deployment mode in the 5G security market, especially among SMEs, as it is cost-effective. SMEs, in particular, have implemented cloud services to focus on their core competencies rather than investing in the security infrastructure. Cloud-based solutions utilize detection and scrubbing technologies to detect and mitigate network cyberattacks. The cloud deployment type helps manage DNS, rerouting traffic, and safeguard the website traffic. Security Operations Centers (SOCs) help support and assist cyber threat management. By deploying 5G security solutions and services on the cloud, organizations can avoid spending on hardware, software, storage, and technical staff. The cloud deployment type is often used for both private and public clouds and may vary from case to case, depending on the client's requirement. Additionally, organizations can scale up or down, depending on their use of cloud-based 5G security services.

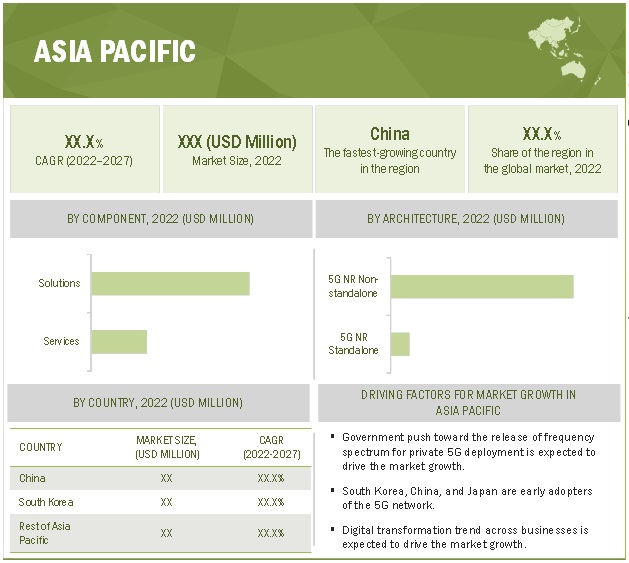

APAC to grow at the second-highest CAGR during the forecast period

The large population in the Asia Pacific has created an extensive pool of mobile subscribers for telecom companies. The region is the largest contributor to the total number of mobile subscribers across the globe and will add more subscribers to its network in the coming years. It is a diversified region that houses a wide range of countries moving toward digital transformation. The Asia Pacific region is set to dominate leading technologies, such as 5G, edge computing, blockchain, and 5G security. The main reason for the domination is the size, diversity, and the strategic lead taken by countries, which includes Singapore, South Korea, China, Australia, and Japan. Japan and China are the largest manufacturing economies that produce automobiles, IT products, networking products, and electronic products.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in 5G Security Market

The report includes the study of key Companies 5G security market. It profiles major vendors in the market. The major vendors in the market include

- Ericsson (Sweden)

- Palo Alto Networks (US)

- Cisco (US)

- Allot (Israel)

- Huawei (China)

- A10 Networks (US)

- Nokia (Finland)

- F5 Networks (US)

- Juniper Networks (US)

- Spirent (US).

The study includes an in-depth competitive analysis of these key players in the offering 5G security market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$1.3 billion |

|

Estimated Value by 2027 |

$7.2 billion |

|

Growth Rate |

41.6% CAGR |

|

Market Driver |

|

|

Market Opportunity |

|

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By component, deployment mode, organization size, end user, network component security, architecture, application, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of world |

This research report categorizes the 5G security market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

- Next Gen Firewall

- Data loss Prevention

- Antivirus/Antimalware

- Disturbed Denial of Service Protection

- Security Gateway

- Sandboxing

- Other Solutions

-

Services

- Consulting

- Implementation

- Support & Maintenance

By Deployment mode:

- On-Premises

- Cloud

By Organization Size:

- Large enterprises

- SMEs

By End User:

- Telecom Operators

- Enterprises

By Network Component Security:

- Radio Access Network Security

- Core Security

By Architecture:

- 5G NR Standalone

- 5G NR Non-Standalone

By Application:

- Virtual & Augmented Reality

- Connected Automotive

- Smart Manufacturing

- Wireless eHealth

- Smart Cities

By Vertical:

- Manufacturing

- Healthcare

- Energy & Utilities

- Reatil

- Automotive & Transportaition

- Public Safety

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- Rest of Asia Pacific

-

Rest of world

- Middle East and Africa

- Latin America

Recent Developments:

- In December 2021, Ericsson announced the launch of the Authentication Security Module. It is a module that helps communications service providers store crypto keys and algorithms in a Hardware Security Module (HSM), which augments security for markets and various use cases with more strict security requirements.

- In October 2021, Ericcson partnered with Singtel, a leading communications technology group in Singapore. This partnership will help accelerate 5G adoption across multiple industries and power industry partnerships to develop and deploy advanced 5G solutions in Singapore.

- In June 2021, Cisco announced the launch of its new IoT Router Portfolio. This product will help enterprise networks with the flexibility, security, and scalability needed for IoT and 5G deployment.

- In April 2021, Palo Alto Networks collaborated with DISH, a connectivity company based in the US. The collaboration will help DISH secure its 5G network. It will enable DISH to use container security and secure network slicing, real-time threat correlation, and dynamic security enforcement. It will also use a cloud-native security offering, which includes VM-series and CN-series Next-Generation Firewalls, as well as Prisma Cloud.

- In March 2021, Allot and Exetel decided to partner in the offering of parental control services to their residential customers based on Allot NetworkSecure. The engagement between Exetel and Allot is based on a recurring monthly fee derived from the actual number of subscribers using cybersecurity solutions.

Frequently Asked Questions (FAQ):

How big is the market for 5G security?

What is the estimated growth rate (CAGR) of the global 5G security market?

What are the major revenue pockets in the 5G security market currently?

Who are the major vendors in the 5G security market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL 5G SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

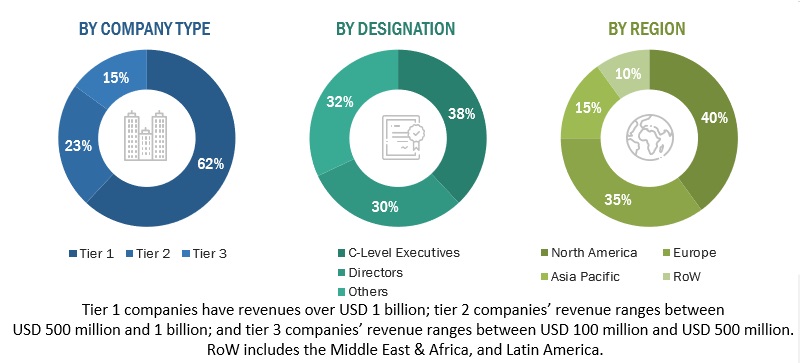

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH- SUPPLY-SIDE ANALYSIS (1/2)

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH - SUPPLY-SIDE ANALYSIS (2/2)

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): 5G SECURITY MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR STUDY

TABLE 3 ASSUMPTIONS FOR STUDY

2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 5G SECURITY MARKET, 2020–2027

FIGURE 8 LEADING SEGMENTS IN MARKET IN 2022

FIGURE 9 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2022

FIGURE 10 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 RISING SECURITY CONCERNS IN 5G NETWORKS TO DRIVE MARKET GROWTH

4.2 5G SECURITY MARKET, BY DEPLOYMENT MODE

FIGURE 12 ON-PREMISES SEMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICAN MARKET, 2022

FIGURE 13 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR LARGER MARKET SHARES IN NORTH AMERICA IN 2022

4.4 ASIA PACIFIC MARKET, 2022

FIGURE 14 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC IN 2022

4.5 MARKET, BY COUNTRY

FIGURE 15 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G SECURITY MARKET

5.2.1 DRIVERS

5.2.1.1 Security concerns in 5G network

FIGURE 17 5G SECURITY THREAT LANDSCAPE

5.2.1.2 Increasing IoT connections to pave way for mMTC with enhanced security requirement

FIGURE 18 GLOBAL INTERNET OF THINGS CONNECTIONS (BILLION)

5.2.1.3 Increasing ransomware attacks on IoT devices

5.2.1.4 Rising attacks on critical infrastructure

5.2.2 RESTRAINTS

5.2.2.1 Delay in standardization of spectrum allocation

5.2.2.2 Expensive security solutions impacting budget of SMEs

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing operator investments for dynamic infrastructure

5.2.3.2 Demand for private 5G across enterprises, governments, and industrial sectors

5.2.4 CHALLENGES

5.2.4.1 Uncertainty around ROI and other unprecedented challenges

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 4 5G SECURITY MARKET: CUMULATIVE GROWTH ANALYSIS

5.4 INDUSTRY TRENDS

5.4.1 VALUE CHAIN

FIGURE 19 MARKET: VALUE CHAIN ANALYSIS

5.4.1.1 Telecom Original Equipment Manufacturers

5.4.1.2 5G Radio

5.4.1.3 5G Security

5.4.1.4 5G transport

5.4.1.5 NFV/SDN/Cloud

5.4.1.6 System Integrators/Managed Service Providers

5.4.1.7 End Users

5.4.2 ECOSYSTEM

FIGURE 20 5G SECURITY MARKET: ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.4.3 PORTER’S FIVE FORCES MODEL

TABLE 6 MARKET: PORTER’S FIVE FORCES MODEL

FIGURE 21 5G SECURITY PORTER’S FIVE FORCES MODEL

5.4.3.1 Threat of New Entrants

5.4.3.2 Threat of Substitutes

5.4.3.3 Bargaining Power of Buyers

5.4.3.4 Bargaining Power of Suppliers

5.4.3.5 Rivalry Among Existing Competitors

5.4.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.4.1 Key Stakeholders in Buying Process

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS (%)

5.4.4.2 Buying Criteria

FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.4.5 IMPACT OF CERTIFICATIONS ON 5G SECURITY

5.4.6 TECHNOLOGY ANALYSIS

5.4.6.1 Wi-Fi

5.4.6.2 WIMAX

5.4.6.3 Network Slicing in Radio Access Network

5.4.6.4 Network Slicing in Core Network

5.4.6.5 Network Slicing in Transport Network

5.4.6.6 Small Cell Networks

5.4.6.7 LTE Network

FIGURE 24 LTE NETWORK LAUNCHED WORLDWIDE (2021)

5.4.6.8 Citizens Broadband Radio Service (CBRS)

FIGURE 25 THREE-TIER MODEL FOR CBRS SPECTRUM ACCESS

5.4.6.9 MulteFire

5.4.7 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 26 REVENUE SHIFT FOR 5G SECURITY MARKET

5.4.8 PATENT ANALYSIS

FIGURE 27 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 9 TOP TWENTY PATENT OWNERS

FIGURE 28 NUMBER OF PATENTS GRANTED IN TEN YEARS, 2012-2021

5.4.9 PRICING ANALYSIS

5.4.10 USE CASES

5.4.10.1 Case study 1: Mobile service provider implemented A10 Networks’ solution to scale out security for massive 5G-rollout

5.4.10.2 Case study 2: City of Williamsburg implemented Palo Alto Networks’ solution to prevent cyber threats

5.4.10.3 Case study 3: Ericsson helped Erillisverkot to provide next-generation public safety networks

5.4.11 KEY CONFERENCES & EVENTS IN 2022

TABLE 10 5G SECURITY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.4.12 TARIFF AND REGULATORY IMPACT

5.4.12.1 General Data Protection Regulation (GDPR)

5.4.12.2 California Consumer Privacy Act (CCPA)

5.4.12.3 Payment Card Industry Data Security Standard (PCI DSS)

5.4.12.4 Health Insurance Portability and Accountability Act (HIPAA)

5.4.12.5 Digital Imaging and Communications in Medicine (DICOM)

5.4.12.6 Health Level Seven (HL7)

5.4.12.7 Gramm-Leach-Bliley (GLB) Act

5.4.12.8 Sarbanes-Oxley (SOX) Act

5.4.12.9 SOC2

5.4.12.10 Communications Decency Act (CDA)

5.4.12.11 Digital Millennium Copyright Act (DMCA)

5.4.12.12 Anti-Cybersquatting Consumer Protection Act (ACPA)

5.4.12.13 Lanham Act

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 5G SECURITY MARKET, BY COMPONENT (Page No. - 83)

6.1 INTRODUCTION

FIGURE 29 MARKET SCENARIO: OPTIMISTIC, REALISTIC, AND PESSIMISTIC

TABLE 16 MARKET SCENARIO: OPTIMISTIC, REALISTIC, AND PESSIMISTIC

FIGURE 30 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 SOLUTIONS

FIGURE 31 DDOS PROTECTION SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 COMPONENT: MARKET, BY SOLUTIONS, 2020–2027 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 NEXT-GENERATION FIREWALL

TABLE 20 NEXT-GENERATION FIREWALL: 5G SECURITY MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 DATA LOSS PREVENTION

TABLE 21 DATA LOSS PREVENTION: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.3 ANTIVIRUS/ANTIMALWARE

TABLE 22 ANTIVIRUS/ANTIMALWARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.4 DISTRIBUTED DENIAL OF SERVICE PROTECTION

TABLE 23 DISTRIBUTED DENIAL OF SERVICE PROTECTION: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.5 SECURITY GATEWAY

TABLE 24 SECURITY GATEWAY: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.6 SANDBOXING

TABLE 25 SANDBOXING: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.7 OTHER SOLUTIONS

TABLE 26 OTHER SOLUTIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SERVICES

TABLE 27 COMPONENT: 5G SECURITY MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 28 SERVICES: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 CONSULTING

TABLE 29 CONSULTING: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 IMPLEMENTATION

TABLE 30 IMPLEMENTATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3 SUPPORT & MAINTENANCE

TABLE 31 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 5G SECURITY MARKET, BY DEPLOYMENT MODE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 32 CLOUD DEPLOYMENT MODE TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 32 MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

7.2 ON-PREMISES

TABLE 33 ON-PREMISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 CLOUD

TABLE 34 CLOUD: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 5G SECURITY MARKET, BY ORGANIZATION SIZE (Page No. - 99)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 33 LARGE ENTERPRISES SEGMENT TO LEAD MARKET GROWTH DURING FORECAST PERIOD

TABLE 35 MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 5G SECURITY MARKET, BY END USER (Page No. - 103)

9.1 INTRODUCTION

FIGURE 34 ENTERPRISES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 38 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.1.1 END USER: MARKET DRIVERS

9.1.2 END USER: COVID-19 IMPACT

9.2 TELECOM OPERATORS

9.2.1 STATE OF 5G COMMERCIALIZATION

TABLE 39 GLOBAL 5G LAUNCH

TABLE 40 TELECOM OPERATORS: CAPITAL EXPENDITURE, 2017–2019 (USD MILLION)

TABLE 41 TELECOM OPERATORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 ENTERPRISES

TABLE 42 NUMBER OF INDUSTRY, BY SECTOR

TABLE 43 GLOBAL PRIVATE LTE AND 5G SPECTRUM, BY COUNTRY

TABLE 44 ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 5G SECURITY MARKET, BY NETWORK COMPONENT SECURITY (Page No. - 114)

10.1 INTRODUCTION

FIGURE 35 CORE SECURITY SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 45 MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

10.1.1 NETWORK COMPONENT SECURITY: MARKET DRIVERS

10.1.2 NETWORK COMPONENT SECURITY: COVID-19 IMPACT

10.2 RADIO ACCESS NETWORK SECURITY

TABLE 46 RADIO ACCESS NETWORK SECURITY: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 CORE SECURITY

TABLE 47 CORE SECURITY: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 5G SECURITY MARKET, BY ARCHITECTURE (Page No. - 118)

11.1 INTRODUCTION

FIGURE 36 5G NR STANDALONE TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

11.1.1 ARCHITECTURE: MARKET DRIVERS

11.1.2 ARCHITECTURE: COVID-19 IMPACT

11.2 5G NR STANDALONE

TABLE 49 5G NR STANDALONE: MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 5G NR NON-STANDALONE

TABLE 50 5G NR NON-STANDALONE: MARKET, BY REGION, 2020–2027 (USD MILLION)

12 5G SECURITY MARKET, BY APPLICATION (Page No. - 122)

12.1 INTRODUCTION

FIGURE 37 WIRELESS EHEALTH SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.1.1 APPLICATION: MARKET DRIVERS

12.1.2 APPLICATION: COVID-19 IMPACT

12.2 VIRTUAL & AUGMENTED REALITY

TABLE 52 VIRTUAL & AUGMENTED REALITY: MARKET, REGION, 2020–2027 (USD MILLION)

12.3 CONNECTED AUTOMOTIVE

TABLE 53 CONNECTED AUTOMOTIVE: MARKET, REGION, 2020–2027 (USD MILLION)

12.4 SMART MANUFACTURING

TABLE 54 SMART MANUFACTURING: MARKET, REGION, 2020–2027 (USD MILLION)

12.5 WIRELESS EHEALTH

TABLE 55 WIRELESS EHEALTH: MARKET, REGION, 2020–2027 (USD MILLION)

12.6 SMART CITIES

TABLE 56 SMART CITIES: MARKET, REGION, 2020–2027 (USD MILLION)

13 5G SECURITY MARKET, BY VERTICAL (Page No. - 127)

13.1 INTRODUCTION

FIGURE 38 MEDIA & ENTERTAINMENT SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 57 MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

13.1.1 VERTICAL: MARKET DRIVERS

13.1.2 VERTICAL: COVID-19 IMPACT

13.2 MANUFACTURING

TABLE 58 MANUFACTURING: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.3 HEALTHCARE

TABLE 59 HEALTHCARE: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.4 ENERGY & UTILITIES

TABLE 60 ENERGY & UTILITIES: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.5 RETAIL

TABLE 61 RETAIL: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.6 AUTOMOTIVE & TRANSPORTATION

TABLE 62 AUTOMOTIVE & TRANSPORTATION: 5G SECURITY MARKET, BY REGION, 2020–2027 (USD MILLION)

13.7 PUBLIC SAFETY

TABLE 63 PUBLIC SAFETY: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.8 MEDIA & ENTERTAINMENT

TABLE 64 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

13.9 OTHER VERTICALS

TABLE 65 OTHER VERTICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

14 5G SECURITY MARKET, BY REGION (Page No. - 136)

14.1 INTRODUCTION

14.1.1 REGION: COVID-19 IMPACT

FIGURE 39 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

TABLE 66 MARKET, BY REGION, 2020–2027 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 NORTH AMERICA: 5G SECURITY MARKET DRIVERS

14.2.2 NORTH AMERICA: REGULATIONS

14.2.2.1 HIPAA

14.2.2.2 CCPA

14.2.2.3 Federal Information Security Management Act (FISMA)

14.2.2.4 Federal Information Processing Standards (NIST)

FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.2.3 UNITED STATES

14.2.3.1 Rapid growth in technology innovations and network infrastructure to drive market growth

TABLE 78 UNITED STATES: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 79 UNITED STATES: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 80 UNITED STATES: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 81 UNITED STATES: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 82 UNITED STATES: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 83 UNITED STATES: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 84 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 85 UNITED STATES: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 86 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 87 UNITED STATES: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

14.2.4 CANADA

14.2.4.1 Public private partnerships and increased government initiatives to drive market growth

TABLE 88 CANADA: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 89 CANADA: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 90 CANADA: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 91 CANADA: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 92 CANADA: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 93 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 94 CANADA: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 95 CANADA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 96 CANADA: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 97 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

14.3 EUROPE

14.3.1 EUROPE: 5G SECURITY MARKET DRIVERS

14.3.2 EUROPE: REGULATIONS

14.3.2.1 European Market Infrastructure Regulation (EMIR)

14.3.2.2 GDPR

14.3.2.3 European Committee for Standardization (CEN)

14.3.2.4 European Technical Standards Institute (ETSI)

14.3.2.5 Other Regulations

TABLE 98 EUROPE: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.3.3 UNITED KINGDOM

14.3.3.1 Increased investments and presence of major telecommunications vendors to drive market growth

TABLE 109 UNITED KINGDOM: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 110 UNITED KINGDOM: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 111 UNITED KINGDOM: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 112 UNITED KINGDOM: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 113 UNITED KINGDOM: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 114 UNITED KINGDOM: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 115 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 116 UNITED KINGDOM: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 117 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

14.3.4 GERMANY

14.3.4.1 Need for stringent security across networks due to increase in cyberattacks to drive market growth

14.3.5 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 ASIA PACIFIC: 5G SECURITY MARKET DRIVERS

14.4.2 ASIA PACIFIC: REGULATIONS

14.4.2.1 Privacy Commissioner for Personal Data (PCPD)

14.4.2.2 Act on the Protection of Personal Information (APPI)

14.4.2.3 Critical Information Infrastructure (CII)

14.4.2.4 International Organization for Standardization (ISO) 27001

14.4.2.5 Personal Data Protection Act (PDPA)

14.4.2.6 Other Regulations

FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 119 ASIA PACIFIC: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

14.4.3 CHINA

14.4.3.1 Government initiatives and huge investments in network infrastructure to drive market growth

14.4.3.2 China: Regulatory Norms

14.4.4 SOUTH KOREA

14.4.4.1 Rapid growth in technology innovations and need for faster communications to drive market growth

14.4.5 REST OF ASIA PACIFIC

14.5 REST OF WORLD

TABLE 130 REST OF WORLD: 5G SECURITY MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 131 REST OF WORLD: MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 132 REST OF WORLD: MARKET, BY SERVICE, 2020–2027 (USD MILLION)

TABLE 133 REST OF WORLD: MARKET, BY NETWORK COMPONENT SECURITY, 2020–2027 (USD MILLION)

TABLE 134 REST OF WORLD: MARKET, BY ARCHITECTURE, 2020–2027 (USD MILLION)

TABLE 135 REST OF WORLD: MARKET, BY END USER, 2020–2027 (USD MILLION)

TABLE 136 REST OF WORLD: MARKET, BY DEPLOYMENT MODE, 2020–2027 (USD MILLION)

TABLE 137 REST OF WORLD: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 138 REST OF WORLD: MARKET, BY ORGANIZATION SIZE, 2020–2027 (USD MILLION)

TABLE 139 REST OF WORLD: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 140 REST OF WORLD: MARKET, BY SUB-REGION, 2020–2027 (USD MILLION)

14.5.1 MIDDLE EAST & AFRICA

14.5.1.1 Public private partnerships and investments from major vendors to drive market growth

14.5.1.2 Middle East & Africa: 5G Security Market Drivers

14.5.1.3 Middle East & Africa: Regulatory Norms

14.5.1.3.1 Israeli Privacy Protection Regulations (Data Security), 5777–2017

14.5.1.3.2 Cloud Computing Framework (CCF)

14.5.1.3.3 GDPR Applicability in the KSA

14.5.1.3.4 Protection of Personal Information (POPI) Act

14.5.2 LATIN AMERICA

14.5.2.1 Increased government investments toward 5G security infrastructure to drive market growth

14.5.2.2 Latin America: 5G Security Market Drivers

14.5.2.3 Latin America: Regulatory Norms

14.5.2.3.1 Brazil Data Protection Law

14.5.2.3.2 Federal Law on Protection of Personal Data Held by Individuals

15 COMPETITIVE LANDSCAPE (Page No. - 182)

15.1 OVERVIEW

15.2 MARKET EVALUATION FRAMEWORK

FIGURE 42 MARKET EVALUATION FRAMEWORK, 2019–2021

15.3 COMPETITIVE SCENARIO AND TRENDS

15.3.1 PRODUCT LAUNCHES

TABLE 141 5G SECURITY MARKET: PRODUCT LAUNCHES, 2019–2021

15.3.2 DEALS

TABLE 142 MARKET: DEALS, 2019-2021

15.3.3 OTHERS

TABLE 143 MARKET: OTHERS, 2020

15.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 144 5GMARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET

15.5 HISTORICAL REVENUE ANALYSIS

FIGURE 44 HISTORICAL REVENUE ANALYSIS, 2017–2021

15.6 COMPANY EVALUATION MATRIX OVERVIEW

15.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 145 PRODUCT FOOTPRINT WEIGHTAGE

15.7.1 STAR

15.7.2 EMERGING LEADERS

15.7.3 PERVASIVE

15.7.4 PARTICIPANTS

FIGURE 45 5G SECURITY MARKET, COMPANY EVALUATION MATRIX, 2022

15.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 146 COMPANY PRODUCT FOOTPRINT

TABLE 147 COMPANY COMPONENT FOOTPRINT

TABLE 148 COMPANY VERTICAL FOOTPRINT

TABLE 149 COMPANY REGION FOOTPRINT

15.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 46 RANKING OF KEY PLAYERS IN 5G SECURITY MARKET, 2022

15.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 47 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 150 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

15.10.1 PROGRESSIVE COMPANIES

15.10.2 RESPONSIVE COMPANIES

15.10.3 DYNAMIC COMPANIES

15.10.4 STARTING BLOCKS

FIGURE 48 STARTUP/SME EVALUATION MATRIX

15.11 COMPETITIVE BENCHMARKING FOR SME/STARTUP

TABLE 151 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 152 5G SECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

16 COMPANY PROFILES (Page No. - 202)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

16.1 KEY PLAYERS

16.1.1 ERICSSON

TABLE 153 ERICSSON: BUSINESS OVERVIEW

FIGURE 49 ERICSSON: COMPANY SNAPSHOT

TABLE 154 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 ERICSSON: PRODUCT LAUNCHES

TABLE 156 ERICSSON: DEALS

TABLE 157 ERICSSON: OTHERS

16.1.2 PALO ALTO NETWORKS

TABLE 158 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 50 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 159 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 PALO ALTO NETWORKS: PRODUCT LAUNCHES

TABLE 161 PALO ALTO NETWORKS: DEALS

16.1.3 CISCO

TABLE 162 CISCO: BUSINESS OVERVIEW

FIGURE 51 CISCO: COMPANY SNAPSHOT

TABLE 163 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 CISCO: PRODUCT LAUNCHES

TABLE 165 CISCO: DEALS

16.1.4 ALLOT

TABLE 166 ALLOT: BUSINESS OVERVIEW

FIGURE 52 ALLOT: COMPANY SNAPSHOT

TABLE 167 ALLOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 ALLOT: PRODUCT LAUNCHES

TABLE 169 ALLOT: DEALS

16.1.5 HUAWEI

TABLE 170 HUAWEI: BUSINESS OVERVIEW

FIGURE 53 HUAWEI: COMPANY SNAPSHOT

TABLE 171 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 HUAWEI: PRODUCT LAUNCHES

TABLE 173 HUAWEI: DEALS

16.1.6 A10 NETWORKS

TABLE 174 A10 NETWORKS: BUSINESS OVERVIEW

FIGURE 54 A10 NETWORKS: COMPANY SNAPSHOT

TABLE 175 A10 NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 A10 NETWORKS: PRODUCT LAUNCHES

16.1.7 NOKIA

TABLE 177 NOKIA: BUSINESS OVERVIEW

FIGURE 55 NOKIA: COMPANY SNAPSHOT

TABLE 178 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 NOKIA: PRODUCT LAUNCHES

TABLE 180 NOKIA: DEALS

TABLE 181 NOKIA: OTHERS

16.1.8 F5 NETWORKS

TABLE 182 F5 NETWORKS: BUSINESS OVERVIEW

FIGURE 56 F5 NETWORKS: COMPANY SNAPSHOT

TABLE 183 F5 NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 F5 NETWORKS: PRODUCT LAUNCHES

TABLE 185 F5 NETWORKS: DEALS

TABLE 186 F5 NETWORKS: OTHERS

16.1.9 JUNIPER NETWORKS

TABLE 187 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 57 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 188 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 189 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 190 JUNIPER NETWORKS: DEALS

16.1.10 SPIRENT

TABLE 191 SPIRENT: BUSINESS OVERVIEW

FIGURE 58 SPIRENT: COMPANY SNAPSHOT

TABLE 192 SPIRENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 193 SPIRENT: PRODUCT LAUNCHES

TABLE 194 SPIRENT: DEALS

16.1.11 FORTINET

16.1.12 MOBILEUM

16.1.13 TREND MICRO

16.1.14 ZTE

16.1.15 AKAMAI TECHNOLOGIES

16.1.16 COLT TECHNOLOGY SERVICES

16.1.17 CLAVISTER

16.1.18 RADWARE

16.1.19 AT&T

16.1.20 RISCURE

16.1.21 AVAST

16.1.22 G+D MOBILE SECURITY

16.1.23 CHECKPOINT SOFTWARE TECHNOLOGIES

16.1.24 FORGE ROCK

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16.2 SMES/STARTUPS

16.2.1 POSITIVE TECHNOLOGIES

16.2.2 CELLWIZE

16.2.3 BENU NETWORKS

16.2.4 SUAVEI

16.2.5 CACHENGO

16.2.6 BROADFORWARD

16.2.7 TRILOGY

16.2.8 MOVANDI

16.2.9 DEEPSIG

16.2.10 EDGEQ

16.2.11 ALCAN SYSTEMS

16.2.12 MIXCOMM

16.2.13 MICROAMP SOLUTIONS

17 ADJACENT/RELATED MARKETS (Page No. - 263)

17.1 INTRODUCTION

17.1.1 LIMITATIONS

17.2 5G SERVICES MARKET

17.2.1 MARKET DEFINITION

17.2.2 MARKET OVERVIEW

17.2.2.1 5G services market, by end user

TABLE 195 5G SERVICES MARKET SIZE, BY END USER, 2020–2026 (USD BILLION)

TABLE 196 CONSUMERS: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

TABLE 197 ENTERPRISES: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

17.2.2.2 5G services market, by communication type

TABLE 198 5G SERVICES MARKET SIZE, BY COMMUNICATION TYPE, 2020–2026 (USD BILLION)

TABLE 199 FIXED WIRELESS ACCESS: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

TABLE 200 ENHANCED MOBILE BROADBAND: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

TABLE 201 MASSIVE MACHINE-TYPE COMMUNICATIONS: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

TABLE 202 ULTRA-RELIABLE LOW-LATENCY: 5G SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD BILLION)

17.2.2.3 5G services market, by enterprise

TABLE 203 5G SERVICES MARKET SIZE, BY ENTERPRISE, 2020–2026 (USD BILLION)

17.2.2.4 5G services market, by region

17.2.3 5G IOT MARKET

17.2.3.1 Market definition

17.2.3.2 Market overview

17.2.3.3 5G IoT market, by component

TABLE 204 5G IOT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

17.2.3.4 5G IoT market, by network type

TABLE 205 5G IOT MARKET SIZE, BY NETWORK TYPE, 2020–2026 (USD MILLION)

TABLE 206 5G STANDALONE: 5G IOT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 207 5G NON-STANDALONE: 5G IOT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

17.2.3.5 5G IoT market, by end user

TABLE 208 5G IOT MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

17.2.3.6 5G IoT market, by region

TABLE 209 5G IOT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

17.2.4 5G CORE MARKET

17.2.4.1 Market definition

17.2.4.2 Market overview

17.2.4.3 5G Core market, by component

TABLE 210 5G CORE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 211 SOLUTIONS: 5G CORE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 212 5G CORE MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

17.2.4.4 5G Core market, by deployment model

TABLE 213 5G CORE MARKET SIZE, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

17.2.4.5 5G Core market, by network function

TABLE 214 5G CORE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

17.2.4.6 5G Core market, by end user

TABLE 215 5G CORE MARKET SIZE, BY NETWORK FUNCTION, 2020–2025 (USD MILLION)

17.2.4.7 5G Core market, by region

18 APPENDIX (Page No. - 276)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the 5G security market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the 5G security market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources; journals and various associations, have also been referred to for consolidating the report.

Secondary research was mainly used to obtain key information about industry insights, market’s monetary chain, the overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the 5G security market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing 5G security software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the 5G security market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the 5G security solutions and services. This procedure has studied top market players' annual and financial reports and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

The bottom-up procedure was employed to arrive at the overall size of the 5G security market from the revenues of key players (companies) and their market shares. The calculation was done based on estimations and by verifying key companies’ revenue through extensive primary interviews. Calculations based on the revenues of the key companies identified led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of other individual segments (component, network component security, architecture, deployment mode, organization size, application, end user, vertical, and region) via the percentage splits of the market’s segments from secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained. Market shares were then estimated for each company to verify revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall parent market size and its segments’ market size were determined and confirmed using this study.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global 5G security market by component, deployment mode, organization size, end user, network component security, architecture, application, vertical, and region from 2022 to 2027, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to four main regions: North America, Europe, Asia Pacific (APAC) and Rest of World (RoW).

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall 5G security market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the 5G security market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Security Market