5G Services Market by End User (Consumers and Enterprises), Enterprise (Manufacturing, Media and Entertainment, Transportation and Logistics, Government), Application, Communication Type (eMBB, MMTC, URLLC, and FWA) and Region - Global Forecast to 2027

5G Services Market Size, Key Insights & Analysis

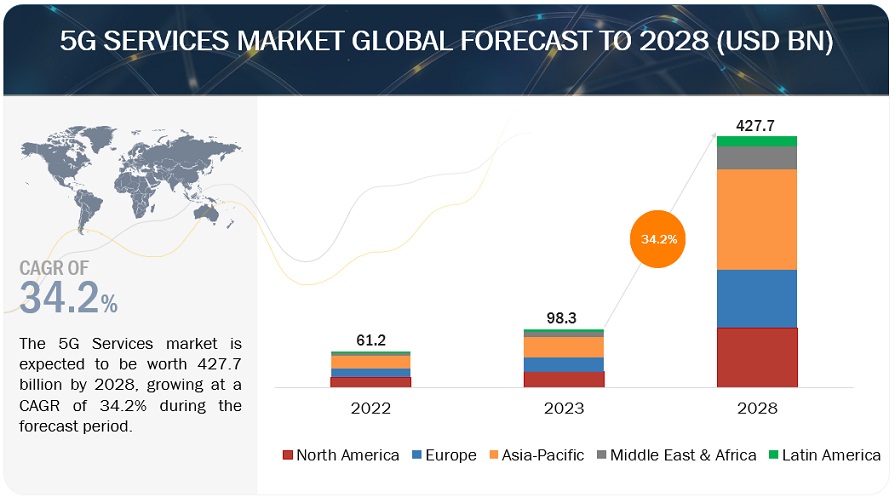

The global 5G Services Market size is expected to grow progressively over the anticipated frame, recording a CAGR of 25.3% during 2022 to 2027. The 5G services industry spending value will increase from $107.0 billion in 2022 to reach $331.1 billion by the end of 2027.

Due to high availability of 5G compatible devices and high investments of governments in 5G services, the 5G ecosystem is expected to witness a faster growth rate than other connectivity transformations. Other factors such as high number of applications being developed requiring low latency in connection have resulted in high adoption of 5G services in developing economies. Countries such as US and Canada are believed to have 90% 5G penetration among consumers. Countries in the APAC region are also developing 5G infrastructure on a massive scale and will soon have high 5G services usage in the future in all enterprise verticals.

To know about the assumptions considered for the study, Request for Free Sample Report

5G Services Market Growth Dynamics

Driver: Timely availability of 5G compatible devices from several vendors

As per Ericsson Mobility Report 2022, over 650 5G smartphone models have been launched, accounting for 50 percent of all 5G devices by form factor. 5G device shipments more than doubled in 2021 over 2020 and surpassed 615 million units shipped. There is a greater focus on smartphone standalone (SA) enablement, including 3CC New Radio (NR) carrier aggregation. Global smartphone shipments rose 6 percent in 2021 compared with 2020. Apart from improved device capabilities, a wider range of 5G smartphone models are now available in the mid-tier price segment. This means that 5G smartphones are becoming increasingly affordable for more market segments. This will drive the 5G services market as more and more users can afford the device and use the 5G network.

Restraint: High costs required for deployment of 5G network

New 5G technology requires new infrastructure to be installed for its operation. The costs of the 5G infrastructure depends heavily on the required throughput density, periodic interest rate, and base station price. The new 5G network requires huge investments in the infrastructure for which not all countries are able to afford, especially the under-developed and the developing ones. In the enterprise section, companies have to look at the budget and the security of 5G network is still under observation. These factors have led a slow down in the deployment of 5G services network.

Opportunity: To move beyond connectivity and collaborate across sectors to deliver new, rich services

The new 5G era can be characterized as the age of boundless connectivity for all and an intelligent automation, enriching people's lives and transforming industrial processes. The world today rely more on mobile connectivity, and 5G is expected to turbo-charge connectivity to deliver mobile data services. 5G networks will integrate with 4G and alternative network technologies to deliver a boundless, high-speed, reliable and secure broadband experience, and support a plethora of use cases for society. This technology has created an opportunity for telcos to move beyond connectivity and collaborate across sectors, such as finance, transport, retail, and health to deliver new, rich services. With 5G acting as a catalyst for innovation, it has allowed the industry, society, and individual to advance their digital ambitions. It has enabled machines to communicate without human intervention in an IoT capable of driving a near-endless array of services. It has facilitated safer, more efficient and cost-effective transport networks. It also aims to offer improved access to medical treatment by reliably connecting patients and doctors all over the globe. The 5G technology will enable richer, smarter, and more convenient living and working. Hence, 5G is an opportunity for telcos to create an agile, purpose-built network tailored to the different needs of citizens and the economy.

Challenge: Security concerns regarding 5G

5G wireless telecommunications infrastructure is built on legacy technologies, such as 4G LTE networks. Any vulnerabilities already existing in those networks will threaten the security of 5G networks. More components are also involved in implementing 5G technology, increasing access points and network edges. 5G technology infrastructure typically relies on cellular towers, beamforming, small cells, and cellular devices. This increases the digital attack surface. Also, many of these components lack physical security measures. Attacks on the 5G security protocol can cause network segments to crash and launch denial-of-service attacks. This network security flaw affects 5G network slicing, which enables operators to divide their 5G telecom network infrastructure into smaller portions. These portions are devoted to specific use cases. Examples include automotive, healthcare, and critical infrastructure. Thus security imposes a huge challenge on the 5G services market.

Among end users, enterprises segment to grow at the highest CAGR during the forecast period

By expanding the scope of wireless technologies and making devices more autonomous, 5G will be more inclusive, progressive, proven, and powerful than any previous generation of communications technology. There are a number of industries with particularly intense dynamics and business opportunities around 5G, such as telecommunications, media and entertainment, manufacturing, transportation, and public services. Each of these sectors has specific business issues linked to 5G and and therefore enterprise segment is expected to grow at the higher CAGR during the forecast period.

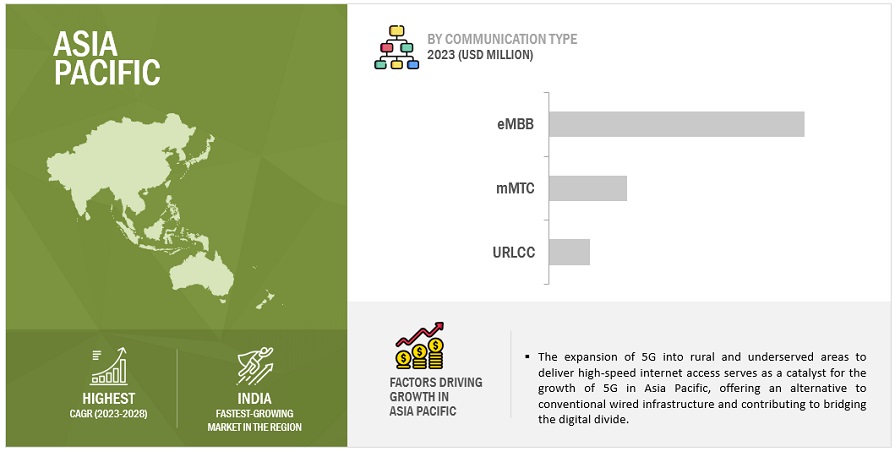

APAC to account for the largest market size during the forecast period

The countries in APAC have high investments done by the governments in 5G services. The high population of the countries in the region have also resulted in higher number of subscribers for 5G, thereby resulting in a higher Average Revenue Per User (ARPU) for 5G service providers. A high number of subscriber base has also increased the competition among the service providers, who are aiming to provide the best services to the consumers and enterprise sector. Countries such as China, South Korea, Australia and Japan have high technological growth. The presence of developed technological infrastructure is also one of the key reasons for the adoption of 5G services across all industry verticals. The network market in APAC is driven by the growing acceptance of cloud-based solutions, emerging technologies such as the IoT, and big data analytics and mobility.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in 5G Services Market

The major players operating in the 5G Services Market include AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), T-Mobile (US), China Telecom (China), Orange S.A (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica (Spain), KT (South Korea), Rogers (Canada), Bell Canada(Canada), Etisalat( UAE), STC (KSA), LG U+( South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), DISH (US), Reliance Jio(India), Rakuten (Japan), MTN ( South Africa), Airtel (India), and Telenor Group (Norway). These players have adopted various strategies to grow in the global 5G services market.

The study includes an in-depth competitive analysis of these key players in the 5G services market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Revenue Forecast Size in 2027 | $331.1 Billion |

| Market Size Value in 2022 | $107.0 Billion |

| Market Growth Rate | 25.3% CAGR |

| Fastest Growing Market | APAC |

| Market size available for years | 2018–2027 |

| Forecast units | Value (USD) Billion |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

| Segments covered | Communication type, end user, enterprise, application, and region. |

| Regions covered | North America, Europe, APAC, Middle East and Latin America |

| Companies covered | AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), T-Mobile (US), China Telecom (China), Orange S.A (France), Vodafone (UK) and many more. |

This research report categorizes the 5G services market to forecast revenue and analyze trends in each of the following submarkets:

Based on communication types:

- FWA

- eMBB

- URLLC

- MMTC

Based on end Users

- Consumers

- Enterprises

Based on Enterprises:

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Government

- Transportation and Logistics

- Healthcare

- Others

Based on regions:

- North America

- Europe

- APAC

- Middle East and Africa

- Latin America

Recent Developments:

- In September 2022, ZTE is collaborating with China Mobile Research Institute, China Transport Telecom & Information Group, the Beijing Branch of China Mobile, and other partners to showcase the world’s first 5G NTN (Non-Terrestrial Network) field trial at the 5G-Advanced Industry Development Summit in Beijing.

- In February 2022, AT&T and IBM have announced plans to show the digital transformation potential of 5G wireless networking and edge computing. AT&T and IBM have created simulated environments for enterprise clients to physically experience the power of AT&T’s connectivity with hybrid cloud and AI technology from IBM.

- In January 2021, AT&T launched its 5G+ services in some popular areas and venues across Tampa, such as Channel District, Raymond James stadium, and Tampa International Airport in the US.

- In January 2021, Nokia partnered with China Mobile for the successful trialing of AI-powered RANs to predict bandwidth traffic and detect network anomalies to advance the 5G-RAN architecture.

- In January 2021, T-Mobile together with Ericsson and Nokia signed a five-year, multi-billion-dollar agreements to continue advancing and expanding the country’s largest 5G network.

- In February 2021, Verizon Business and Deloitte unveiled a 5G and MEC retail industry digital platform, which is designed to give retailers the ability to store data with near real-time analytics to improve customer engagement, inventory efficiency, and associate productivity.

Frequently Asked Questions (FAQ):

What is the projected market value of the global 5G services market?

The global market of 5G services is projected to reach USD 331.12 billion.

What is the estimated growth rate (CAGR) of the global 5G services market for the next five years?

The global 5G services market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.3% from 2022 to 2027.

What are the major revenue pockets in the 5G services market currently?

The countries in APAC have high investments done by the governments in 5G services. The high population of the countries in the region have also resulted in higher number of subscribers for 5G, thereby resulting in a higher Average Revenue Per User (ARPU) for 5G service providers. A high number of subscriber base has also increased the competition among the service providers, who are aiming to provide the best services to the consumers and enterprise sector. Countries such as China, South Korea, Australia and Japan have high technological growth. The presence of developed technological infrastructure is also one of the key reasons for the adoption of 5G services across all industry verticals. The network market in APAC is driven by the growing acceptance of cloud-based solutions, emerging technologies such as the IoT, and big data analytics and mobility.

Who are the major players operating in the 5G Services Market?

Major companies in the 5G services market are AT&T (US), China Mobile (China), SK Telecom (South Korea), Verizon (US), BT Group (UK), Deutsche Telekom (Germany), T-Mobile (US), China Telecom (China), Orange S.A (France), Vodafone (UK), China Unicom (China), Telstra (Australia), Telefonica (Spain), KT (South Korea), Rogers (Canada), Bell Canada(Canada), Etisalat( UAE), STC (KSA), LG U+( South Korea), NTT Docomo (Japan), KDDI (Japan), Telus (Canada), Swisscom (Switzerland), DISH (US), Reliance Jio(India), Rakuten (Japan), MTN ( South Africa), Airtel (India), and Telenor Group (Norway).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4.1 USD EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 5G SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: APPROACH 1 – SUPPLY-SIDE ANALYSIS (1/3)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - BOTTOM-UP (SUPPLY SIDE)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF 5G SERVICES REVENUE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE)

2.4 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 7 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

3.1 5G SERVICES MARKET: RECESSION IMPACT

FIGURE 8 MARKET TO WITNESS DECLINE IN Y-O-Y GROWTH IN 2022

FIGURE 9 MARKET: HOLISTIC VIEW

FIGURE 10 MARKET: GROWTH TREND

FIGURE 11 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 5G SERVICES MARKET

FIGURE 12 INCREASING DEMAND FOR ENHANCED MOBILE BROADBAND SERVICES TO DRIVE GROWTH

4.2 MARKET IN NORTH AMERICA, BY END USER AND COMMUNICATION TYPE

FIGURE 13 CONSUMERS AND FWA SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2022

4.3 MARKET IN EUROPE, BY END USER AND COMMUNICATION TYPE

FIGURE 14 CONSUMERS AND FWA SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN EUROPE IN 2022

4.4 MARKET IN ASIA PACIFIC, BY END USER AND COMMUNICATION TYPE

FIGURE 15 CONSUMERS AND EMBB SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: 5G SERVICES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing mobile network data traffic

FIGURE 17 GLOBAL MOBILE DATA TRAFFIC

5.2.1.2 Need to transform mobile broadband experience

5.2.1.3 Accelerated digital transformation of verticals

TABLE 1 EMERGING USE CASES SUPPORTED BY 5G NETWORK

5.2.1.4 Development of smart infrastructure

5.2.1.5 Timely availability of 5G-compatible devices from several vendors

5.2.2 RESTRAINTS

5.2.2.1 High costs for deployment of 5G network

5.2.3 OPPORTUNITIES

5.2.3.1 To move beyond connectivity and collaborate across sectors to deliver new, rich services

5.2.3.2 Increasing demand for high reliability and low latency networks

FIGURE 18 TIME-CRITICAL USE CASES COMMON ACROSS SECTORS

5.2.3.3 Unleashing massive IoT ecosystem and critical communications services

5.2.4 CHALLENGES

5.2.4.1 Delay in spectrum harmonization across geographies

5.2.4.2 Security concerns regarding 5G

5.3 CASE STUDY ANALYSIS

5.3.1 VODAFONE

5.3.2 SK TELECOM

5.3.3 CHINA MOBILE

5.3.4 TELEFONICA

5.3.5 AT&T

5.4 TECHNOLOGY ANALYSIS

5.4.1 INTRODUCTION

5.4.2 WI-FI

5.4.3 WIMAX

5.4.4 NETWORK SLICING IN RADIO ACCESS NETWORK

5.4.5 NETWORK SLICING IN CORE NETWORK

5.4.6 NETWORK SLICING IN TRANSPORT NETWORK

5.4.7 SMALL CELL NETWORKS

5.4.8 LONG-TERM EVOLUTION NETWORK

FIGURE 19 LTE NETWORK LAUNCHED WORLDWIDE (2019)

5.4.9 CITIZENS BROADBAND RADIO SERVICE

FIGURE 20 THREE-TIER MODEL FOR CITIZENS’ BROADBAND RADIO SERVICE SPECTRUM ACCESS

5.4.10 MULTEFIRE

5.5 REGULATORY IMPLICATIONS

5.5.1 GENERAL DATA PROTECTION REGULATION

5.5.2 CALIFORNIA CONSUMER PRIVACY ACT

5.5.3 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

5.5.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.5.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.5.6 HEALTH LEVEL SEVEN

5.5.7 GRAMM-LEACH-BLILEY ACT

5.5.8 SARBANES-OXLEY ACT

5.5.9 SOC 2

5.5.10 COMMUNICATIONS DECENCY ACT

5.5.11 DIGITAL MILLENNIUM COPYRIGHT ACT

5.5.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.5.13 LANHAM ACT

5.6 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 21 5G SERVICES MARKET: VALUE CHAIN ANALYSIS

5.6.1 5G INFRASTRUCTURE VENDORS

5.6.2 5G MOBILE CHIPSET AND TECHNOLOGY PROVIDERS

5.6.3 MOBILE CARRIERS

5.6.4 MOBILE DEVICE MAKERS

5.6.5 END USERS

5.7 ECOSYSTEM

TABLE 2 5G SERVICES MARKET: SUPPLY CHAIN ANALYSIS

5.8 PRICING ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 PORTER’S FIVE FORCES MODEL

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 COMPETITIVE RIVALRY

6 5G SERVICES MARKET, BY APPLICATION (Page No. - 70)

6.1 INTRODUCTION

6.1.1 APPLICATION: MARKET DRIVERS

6.2 SMART CITIES

6.2.1 LOW LATENCY AND HIGH SPEED OF 5G TO SUPPORT VARIOUS IOT-ENABLED APPLICATIONS

6.2.1.1 Smart signaling and traffic management systems

6.2.1.2 Smart parking

6.2.1.3 Water and waste management

6.3 CONNECTED FACTORIES

6.3.1 5G CONNECTIVITY TO BE USEFUL IN M2M COMMUNICATION

6.3.1.1 Connected machinery and sensors

6.3.1.2 Asset tracking

6.3.1.3 Workforce tracking

6.3.1.4 Incident management and communication

6.4 SMART BUILDINGS

6.4.1 5G TO ENHANCE CONNECTIVITY OF ALL SMART BUILDING INFRASTRUCTURE

6.4.1.1 Connected HVAC

6.4.1.2 Smart homes

6.4.1.3 Digital content management

6.5 CONNECTED VEHICLES

6.5.1 VEHICLE-TO-INFRASTRUCTURE TO BE ADDRESSED BY 5G

6.5.1.1 Autonomous vehicles

6.5.1.2 Vehicle telematics

6.5.1.3 Freight information system

6.6 CONNECTED HEALTHCARE

6.6.1 5G TO PROVIDE STRONG CONNECTIVITY TO ALL HEALTHCARE APPLICATIONS

6.6.1.1 Clinical operations and workflow management

6.6.1.2 Inpatient monitoring

6.6.1.3 Connected imaging

6.6.1.4 Medication management

6.7 CONNECTED RETAIL

6.7.1 5G TO PROMOTE AND IMPLEMENT AR/VR SHOPPING AND IN-STORE EXPERIENCE

6.7.1.1 Advertising and marketing

6.7.1.2 Point of sale

6.7.1.3 Video surveillance and safety

6.8 SMART UTILITIES

6.8.1 5G INTEGRATED WITH SMART UTILITIES TO BRING SHIFT IN INTELLIGENT ENERGY MANAGEMENT

6.9 OTHER APPLICATIONS

6.9.1 BFSI AND AGRICULTURE TO IMPROVE BECAUSE OF 5G IMPLEMENTATION

7 5G SERVICES MARKET, BY END USER (Page No. - 79)

7.1 INTRODUCTION

FIGURE 22 ENTERPRISES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY END USER, 2020–2027 (USD BILLION)

7.1.1 END USER: MARKET DRIVERS

7.2 CONSUMERS

7.2.1 SMARTPHONES AND APPLICATIONS TO EXPERIENCE REVOLUTIONARY IMPROVEMENTS

TABLE 5 CONSUMERS: MARKET, BY REGION, 2020–2027 (USD BILLION)

7.3 ENTERPRISES

7.3.1 LATENCY-DEPENDENT AND TIME-SENSITIVE APPLICATIONS TO BENEFIT FROM EDGE COMPUTING

TABLE 6 ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD BILLION)

8 5G SERVICES MARKET, BY COMMUNICATION TYPE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 23 URLLC SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 7 MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

8.1.1 COMMUNICATION TYPE: MARKET DRIVERS

8.2 FIXED WIRELESS ACCESS

8.2.1 FWA TO DISRUPT BROADBAND ECOSYSTEM AND DELIVER INTERNET VIA DIRECT WIRELESS CONNECTION

TABLE 8 FIXED WIRELESS ACCESS: MARKET, BY REGION, 2020–2027 (USD BILLION)

8.3 ENHANCED MOBILE BROADBAND

8.3.1 EMBB TO ENABLE NEW DATA-DRIVEN EXPERIENCES REQUIRING HIGH DATA RATES

TABLE 9 ENHANCED MOBILE BROADBAND: MARKET, BY REGION, 2020–2027 (USD BILLION)

8.4 MASSIVE MACHINE-TYPE COMMUNICATIONS

8.4.1 MMTC TO PROVIDE INCREASED DATA RATE AND BETTER COVERAGE

TABLE 10 MASSIVE MACHINE-TYPE COMMUNICATIONS: RVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

8.5 ULTRA-RELIABLE LOW-LATENCY

8.5.1 URLL TO ENSURE MORE EFFICIENT SCHEDULING OF DATA TRANSFER

TABLE 11 ULTRA-RELIABLE, LOW-LATENCY: MARKET, BY REGION, 2020–2027 (USD BILLION)

9 5G SERVICES MARKET, BY ENTERPRISE (Page No. - 89)

9.1 INTRODUCTION

9.1.1 ENTERPRISE: MARKET DRIVERS

FIGURE 24 HEALTHCARE TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

9.2 MANUFACTURING

9.2.1 5G TO HELP MANUFACTURING SECTOR IMPROVE PRODUCT LIFECYCLE MANAGEMENT

TABLE 13 MANUFACTURING: MARKET, BY REGION, 2020–2027 (USD BILLION)

9.3 MEDIA AND ENTERTAINMENT

9.3.1 5G TO PROVIDE HIGH-QUALITY AUDIO-VISUAL SERVICES

TABLE 14 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2020–2027 (USD BILLION)

9.4 GOVERNMENT

9.4.1 5G TO IMPROVE SMART PUBLIC SERVICES AND ENHANCE MILITARY OPERATIONS

TABLE 15 GOVERNMENT: MARKET, BY REGION, 2020–2027 (USD BILLION)

9.5 ENERGY AND UTILITIES

9.5.1 REAL-TIME MONITORING THROUGH 5G TO REDUCE BILL-SHOCKS AND OPERATIONAL COSTS

TABLE 16 ENERGY AND UTILITIES: 5G SERVICES MARKET, BY REGION, 2020–2027 (USD BILLION)

9.6 TRANSPORTATION AND LOGISTICS

9.6.1 VEHICLE-TO-EVERYTHING COMMUNICATIONS TO LEAD TO AUTONOMOUS DRIVING

TABLE 17 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2020–2027 (USD BILLION)

9.7 HEALTHCARE

9.7.1 5G TO IMPROVE DIAGNOSIS REQUIRING MULTIPLE CONNECTIONS AT REMOTE SITE

TABLE 18 HEALTHCARE: MARKET, BY REGION, 2020–2027 (USD BILLION)

9.8 OTHER ENTERPRISES

9.8.1 BFSI AND AGRICULTURE TO EXPERIENCE REVOLUTIONARY GROWTH IN TERMS OF COMMUNICATION AND CONTENT

TABLE 19 OTHER ENTERPRISES: MARKET, BY REGION, 2020–2027 (USD BILLION)

10 5G SERVICES MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 25 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 26 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: RECESSION IMPACT

TABLE 20 NORTH AMERICA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 21 NORTH AMERICA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 22 NORTH AMERICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

TABLE 23 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

10.2.3 US

10.2.3.1 Leading 5G service providers operating across US to drive market

10.2.3.2 US: Regulatory norms

TABLE 24 US: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 25 US: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 26 US: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.2.4 CANADA

10.2.4.1 Government initiatives to develop sustainable 5G network in Canada

10.2.4.2 Canada: Regulatory norms

TABLE 27 CANADA: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 28 CANADA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 29 CANADA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.3 EUROPE

10.3.1 EUROPE: 5G SERVICES MARKET DRIVERS

10.3.2 EUROPE: RECESSION IMPACT

TABLE 30 EUROPE: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 31 EUROPE: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 32 EUROPE: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

TABLE 33 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

10.3.3 UK

10.3.3.1 Early adoption of 5G technology and digital transformation initiatives to drive market

10.3.3.2 UK: Regulatory norms

TABLE 34 UK: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 35 UK: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 36 UK: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.3.4 GERMANY

10.3.4.1 Government initiatives to drive 5G services market in Germany

10.3.4.2 Germany: Regulatory norms

TABLE 37 GERMANY: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 38 GERMANY: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 39 GERMANY: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.3.5 REST OF EUROPE

10.3.5.1 Collaboration of telecom operators to propel growth of market

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: 5G SERVICES MARKET DRIVERS

10.4.2 ASIA PACIFIC: RECESSION IMPACT

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 40 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 41 ASIA PACIFIC: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 42 ASIA PACIFIC: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

TABLE 43 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

10.4.3 CHINA

10.4.3.1 Government initiatives to drive 5G services market

10.4.3.2 China: Regulatory norms

TABLE 44 CHINA: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 45 CHINA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 46 CHINA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.4.4 JAPAN

10.4.4.1 Presence of strong base of technologically advanced verticals to boost 5G services

10.4.4.2 Japan: Regulatory norms

TABLE 47 JAPAN: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 48 JAPAN: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 49 JAPAN: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.4.5 AUSTRALIA

10.4.5.1 High investments of telecom companies in 5G to drive market

TABLE 50 AUSTRALIAN BUSINESS SUMMARY, BY INDUSTRY (JUNE 2019)

10.4.5.2 Australia: Regulatory norms

TABLE 51 AUSTRALIA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 52 AUSTRALIA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 53 AUSTRALIA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.4.6 SOUTH KOREA

10.4.6.1 Presence of 5G-enabled mobile manufacturers to drive market

10.4.6.2 South Korea: Regulatory norms

TABLE 54 SOUTH KOREA: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 55 SOUTH KOREA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 56 SOUTH KOREA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.4.7 REST OF ASIA PACIFIC

10.4.7.1 Growing demand for internet and data services to drive market

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: 5G SERVICES MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: RECESSION IMPACT

TABLE 57 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 58 MIDDLE EAST AND AFRICA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 59 MIDDLE EAST AND AFRICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

TABLE 60 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

10.5.3 KSA

10.5.3.1 Vision 2030 to create huge opportunities

10.5.3.2 KSA: Regulatory norms

TABLE 61 KSA: MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 62 KSA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 63 KSA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.5.4 UAE

10.5.4.1 Projects to implement smart city initiatives to create opportunities

10.5.4.2 UAE: Regulatory norms

TABLE 64 UAE: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 65 UAE: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 66 UAE: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: RECESSION IMPACT

TABLE 67 LATIN AMERICA: 5G SERVICES MARKET, BY END USER, 2020–2027 (USD BILLION)

TABLE 68 LATIN AMERICA: MARKET, BY ENTERPRISE, 2020–2027 (USD BILLION)

TABLE 69 LATIN AMERICA: MARKET, BY COMMUNICATION TYPE, 2020–2027 (USD BILLION)

TABLE 70 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

10.6.3 BRAZIL

10.6.3.1 National action plan for IOT to fuel demand for 5G technology

10.6.3.2 Brazil: Regulatory norms

10.6.4 MEXICO

10.6.4.1 Availability of technical expertise and proximity to US to drive 5G services market

10.6.4.2 Mexico: Regulatory norms

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 141)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 28 MARKET EVALUATION FRAMEWORK, 2019–2022

11.3 KEY MARKET DEVELOPMENTS

11.3.1 NEW SERVICE LAUNCHES

TABLE 71 5G SERVICES MARKET: SERVICE LAUNCHES (2019–2022)

11.3.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 72 MARKET: PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2019–2022)

11.3.3 OTHERS

TABLE 73 MARKET: OTHERS (2020–2021)

11.4 MARKET SHARE ANALYSIS

FIGURE 29 MARKET SHARE ANALYSIS OF 5G SERVICES PLAYERS

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 30 REVENUE ANALYSIS OF TOP MARKET PLAYERS

11.6 RANKING OF KEY PLAYERS IN MARKET, 2022

FIGURE 31 RANKING OF KEY PLAYERS, 2022

11.7 COMPANY EVALUATION QUADRANT

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

FIGURE 32 5G SERVICES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

11.7.5 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

TABLE 74 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN MARKET

11.8 STARTUP/SME EVALUATION QUADRANT

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

11.8.5 STARTUP/SME EVALUATION MATRIX, 2022

FIGURE 33 5G SERVICES MARKET: STARTUP/SME EVALUATION MATRIX, 2022

12 COMPANY PROFILES (Page No. - 158)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

12.1 KEY PLAYERS

12.1.1 AT&T

TABLE 75 AT&T: BUSINESS OVERVIEW

TABLE 76 AT&T: SERVICES OFFERED

FIGURE 34 AT&T: COMPANY SNAPSHOT

TABLE 77 AT&T: SERVICE LAUNCHES

TABLE 78 AT&T: DEALS

12.1.2 CHINA MOBILE

TABLE 79 CHINA MOBILE: BUSINESS OVERVIEW

FIGURE 35 CHINA MOBILE: COMPANY SNAPSHOT

TABLE 80 CHINA MOBILE: SERVICES OFFERED

TABLE 81 CHINA MOBILE: DEALS

12.1.3 SK TELECOM

TABLE 82 SK TELECOM: BUSINESS OVERVIEW

FIGURE 36 SK TELECOM: COMPANY SNAPSHOT

TABLE 83 SK TELECOM: SERVICES OFFERED

TABLE 84 SK TELECOM: DEALS

12.1.4 VERIZON

TABLE 85 VERIZON: BUSINESS OVERVIEW

FIGURE 37 VERIZON: COMPANY SNAPSHOT

TABLE 86 VERIZON: SERVICES OFFERED

TABLE 87 VERIZON: DEALS

12.1.5 BT GROUP

TABLE 88 BT GROUP: BUSINESS OVERVIEW

FIGURE 38 BT GROUP: COMPANY SNAPSHOT

TABLE 89 BT GROUP: SERVICES OFFERED

TABLE 90 BT GROUP: DEALS

12.1.6 DEUTSCHE TELEKOM

TABLE 91 DEUTSCHE TELEKOM: SERVICES OFFERED

FIGURE 39 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

TABLE 92 DEUTSCHE TELEKOM: SERVICE LAUNCHES

TABLE 93 DEUTSCHE TELEKOM: DEALS

TABLE 94 DEUTSCHE TELEKOM: OTHERS (JANUARY 2019–FEBRUARY 2021)

12.1.7 T-MOBILE

TABLE 95 T-MOBILE BUSINESS OVERVIEW

FIGURE 40 T-MOBILE: COMPANY SNAPSHOT

TABLE 96 T-MOBILE: SERVICES OFFERED

TABLE 97 T-MOBILE: SERVICE LAUNCHES

TABLE 98 T-MOBILE: DEALS

TABLE 99 T-MOBILE: OTHERS (JANUARY 2019–FEBRUARY 2021)

12.1.8 CHINA TELECOM

TABLE 100 CHINA TELECOM: BUSINESS OVERVIEW

FIGURE 41 CHINA TELECOM: COMPANY SNAPSHOT

TABLE 101 CHINA TELECOM: SERVICES OFFERED

TABLE 102 CHINA TELECOM: DEALS

12.1.9 ORANGE S.A.

TABLE 103 ORANGE S.A.: BUSINESS OVERVIEW

FIGURE 42 ORANGE S.A.: COMPANY SNAPSHOT

TABLE 104 ORANGE S.A.: SERVICES OFFERED

TABLE 105 ORANGE S.A.: SERVICE LAUNCHES

TABLE 106 ORANGE S.A.: DEALS

TABLE 107 ORANGE S.A.: OTHERS

12.1.10 VODAFONE

TABLE 108 VODAFONE: BUSINESS OVERVIEW

FIGURE 43 VODAFONE: COMPANY SNAPSHOT

TABLE 109 VODAFONE: SERVICES OFFERED

TABLE 110 VODAFONE: SERVICE LAUNCHES

TABLE 111 VODAFONE: DEALS

12.1.11 CHINA UNICOM

12.1.12 TELSTRA

12.1.13 TELEFONICA

12.1.14 KT

12.1.15 ROGERS

12.1.16 BELL CANADA

12.1.17 ETISALAT

12.1.18 STC

12.1.19 LG U+

12.1.20 NTT DOCOMO

12.1.21 KDDI

12.1.22 TELUS

12.1.23 SWISSCOM

12.2 OTHER PLAYERS

12.2.1 DISH

12.2.2 RELIANCE JIO

12.2.3 RAKUTEN

12.2.4 MTN

12.2.5 AIRTEL

12.2.6 TELENOR GROUP

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 214)

13.1 5G INFRASTRUCTURE MARKET

13.1.1 MARKET DEFINITION

13.1.2 LIMITATIONS

13.1.3 MARKET OVERVIEW

13.1.4 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE

TABLE 112 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 113 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 114 REST OF THE WORLD: 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 115 5G INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

13.1.5 5G INFRASTRUCTURE MARKET, BY REGION

TABLE 116 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: 5G INFRASTRUCTURE MARKET, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 118 CANADA: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 119 MEXICO: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 120 EUROPE: 5G INFRASTRUCTURE MARKET, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 121 GERMANY: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 122 REST OF EUROPE: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 123 REST OF EUROPE: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: 5G INFRASTRUCTURE MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: 5G INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 128 JAPAN: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 129 JAPAN: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 131 REST OF THE WORLD: 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 132 REST OF THE WORLD: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 133 REST OF THE WORLD: 5G INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

TABLE 134 REST OF THE WORLD: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 136 SOUTH AMERICA: 5G INFRASTRUCTURE MARKET, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

13.2 LTE AND 5G BROADCAST MARKET

13.2.1 MARKET DEFINITION

13.2.2 LIMITATIONS

13.2.3 MARKET OVERVIEW

13.2.4 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY

TABLE 137 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 138 5G BROADCAST MARKET, BY END USER, 2015–2024 (USD MILLION)

13.2.5 LTE AND 5G BROADCAST MARKET, BY REGION

TABLE 139 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 140 NORTH AMERICAN LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 141 NORTH AMERICAN 5G BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 142 EUROPEAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 143 EUROPE: LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 144 ASIA PACIFIC: LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 145 ROW: LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

14 APPENDIX (Page No. - 228)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

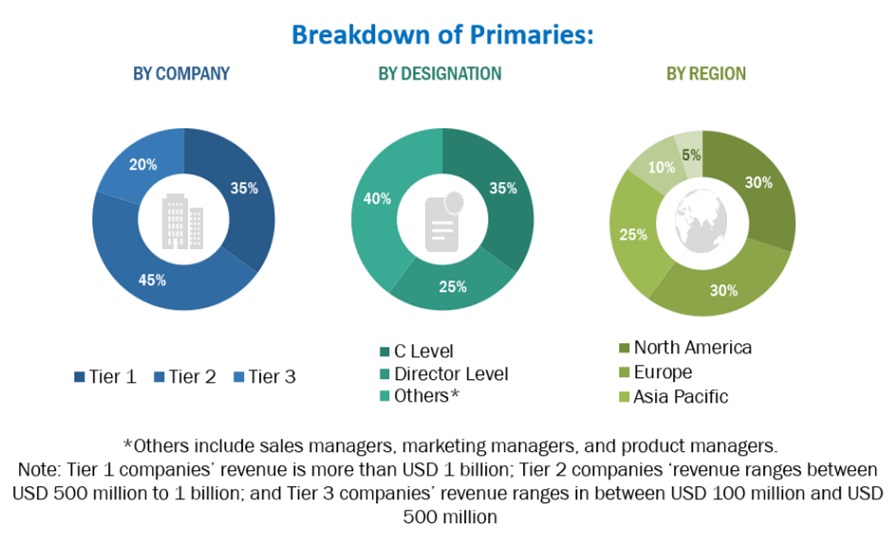

The study involved four major activities in estimating the current market size for the 5G services. Exhaustive secondary research was done to collect information on the 5G services. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the 5G services.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS) and Scientific.Net; and various associations, including the European Association of Next Generation Telecommunications Innovators (EANGTI) and International Telecommunication Union (ITU) were referred to, for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market’s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Cellular M2Mmarket. The primary sources from the demand side included telecom operators, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from telecom and government associations.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the 5G services. The first approach involves the estimation of the market size by summing up companies’ revenue generated through the sale of 5G services. The top-down and bottom-up approaches were used to estimate and validate the size of the 5G services and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer services in the 5G services was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The aggregate of all companies’ revenues was extrapolated to reach the overall market size. Further, each sub segment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the 5G services market by communication type, end user, enterprise, application, and region.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa, and Latin America.

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global 5G services market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Services Market