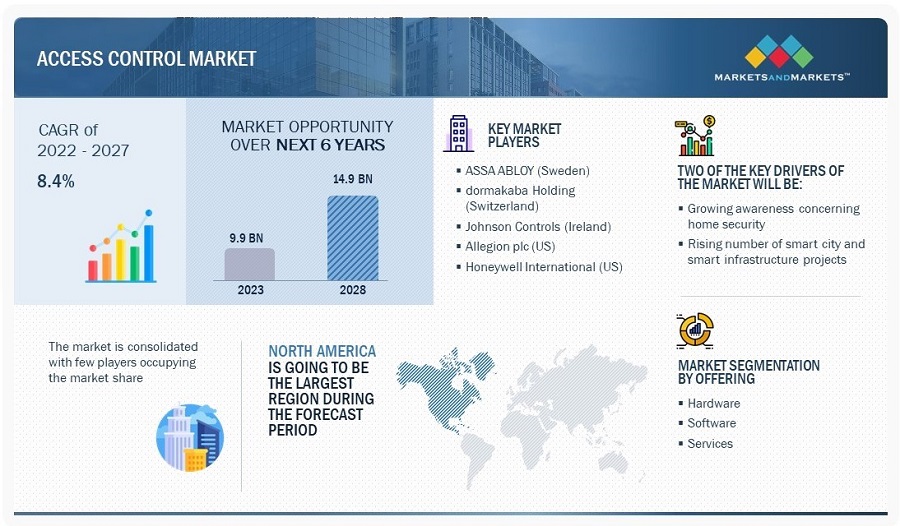

Access Control Market by Offering (Hardware-Card-based, Biometric, & Multi-technology Readers, Electronic Locks, Controllers; Software; Services), ACaaS (Hosted, Managed, Hybrid), Vertical and Region- Global Forecast to 2028

[255 Pages Report] The global Access Control Market size is projected to grow from USD 9.9 billion in 2023 to USD 14.9 billion by 2028; it is expected to grow at a CAGR of 8.4% from 2023 to 2028.

The extensive use of access control in home security and ongoing technological advancements and increasing deployment of wireless security systems across all verticals are responsible to drive market growth during the forecast period. Factors such as rising demand for collaborative growing implementation of mobile-based access control in long run are fueling the market growth for access control industry.

Access Control Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Access Control Market Dynamics

Driver: Increasing adoption of IoT-based security systems with cloud computing platforms

IoT has enhanced the quality and efficiency of automation systems by allowing them to exchange data securely and linking smart objects to the internet. Connected security systems communicate with devices through the cloud, which helps to monitor key areas remotely. Moreover, IoT-based security systems are safe because they are authenticated with passwords to avoid hacking. Several businesses are shifting their traditional practices to IoT as the technology can be used in numerous solutions, such as smart alarm systems and smart garage door openers.

Restraint: Security and privacy concerns related to unauthorized access and data breaches in access control environment

The growing number of cybercrimes and terrorist attacks globally has led to increased concerns regarding the safety and security of assets and people. In most industries, physical and logical security are separate departments as their requirements and approaches are different. Inadequate access control causes intruders to gain unauthorized access to organizational data. Intruder breaching can be attributed directly to a lack of proper access control service.

Opportunity: Growing implementation of mobile-based access control

There are several benefits associated with mobile access control. Besides offering a convenient way of entering a building, it also gives property managers and staff a simple and efficient way to manage access permissions. Key areas where mobile-based access control can be used are:

- Multifamily apartment buildings

- Commercial and mixed-use properties

- Gated communities

- The integration of biometrics with mobile devices enhances the level of security in various applications. Biometrics-enabled smartphones represent a complementary new platform, and it is perceived that it will expand the market for authentication systems and improve user security and convenience.

Challenge: Low awareness among users about availability and benefits of advanced security solutions

For centuries, access control systems have been existing in their simplest form as mechanical locks; with technology’s evolution, there have been various improvements and innovations. Access control systems now leverage technologies such as biometrics, radio frequency (RF), near-field communication (NFC), cloud computing, and Bluetooth. However, the need for training and testing and the cost of implementing smart locks erode their attractiveness to end-users. Low awareness regarding newly developed wireless locks and their extended benefits when integrated with the cloud act as a challenge to the growth of this market.

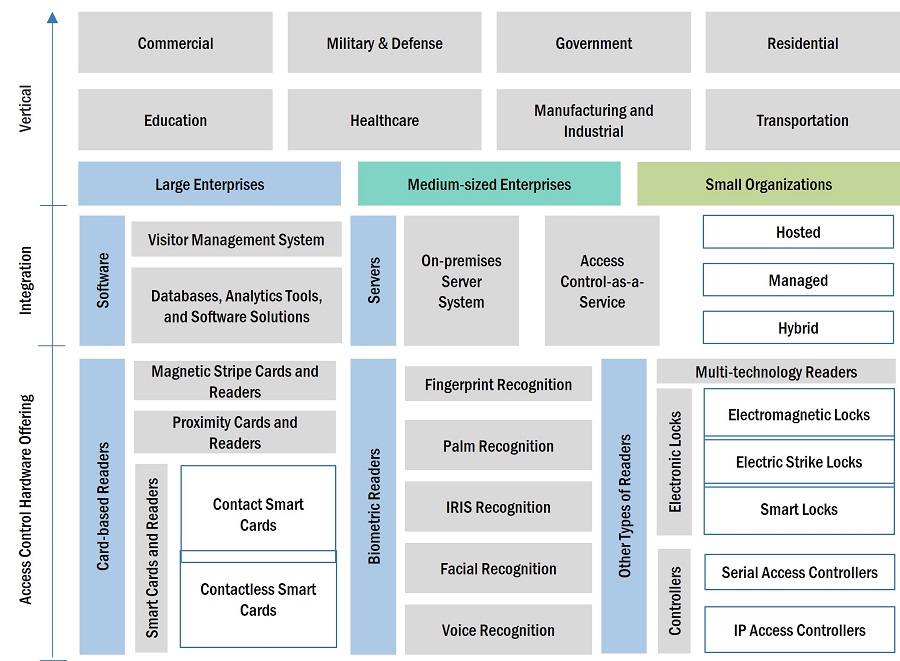

Access Control Market Ecosystem

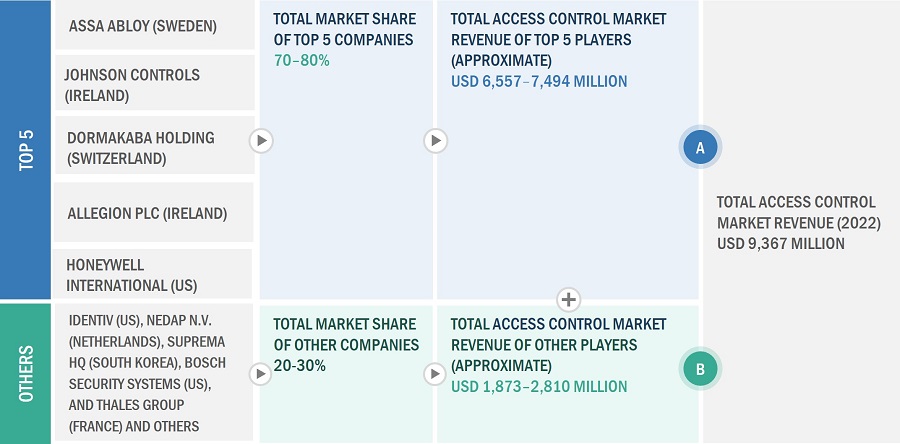

The access control market is highly competitive. It is marked by the presence of a few tier-1 companies, such as ASSA ABLOY (Sweden), Johnson Controls (Ireland), dorm Akaba Holding (Switzerland), Allegion plc (Ireland), Honeywell International (US), and Neap (Netherlands). These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable access control solutions.

Software by offering to register highest CAGR during forecast period

The software market, by offering, is estimated to grow at the highest CAGR during the forecast period. The software enables configuring a security system with support for an unlimited number of workstations, cardholders, and users. It also provides various features and functions to restrict access to resources or information based on the user's identity and permissions. Access control software is commonly used in industries such as healthcare, finance, and government, where sensitive information needs to be protected from unauthorized access.

Based on access control as a service, managed Acaras is expected to witness highest growth during the forecast period

The managed Acaras market is expected to grow at the highest CAGR during the forecast period. The key feature of managed services is that all operational processes can be controlled off-site by a team of highly skilled personnel. It means the end-user can be guaranteed that their data is secure, and they can only focus on their most critical business functions.

Residential vertical to grow at highest CAGR during the forecast period.

The residential vertical is expected to witness the highest growth rate during the forecast period. The increasing theft and burglary rates globally have led to security becoming a major concern for individuals, residential complexes, and private residential buildings.

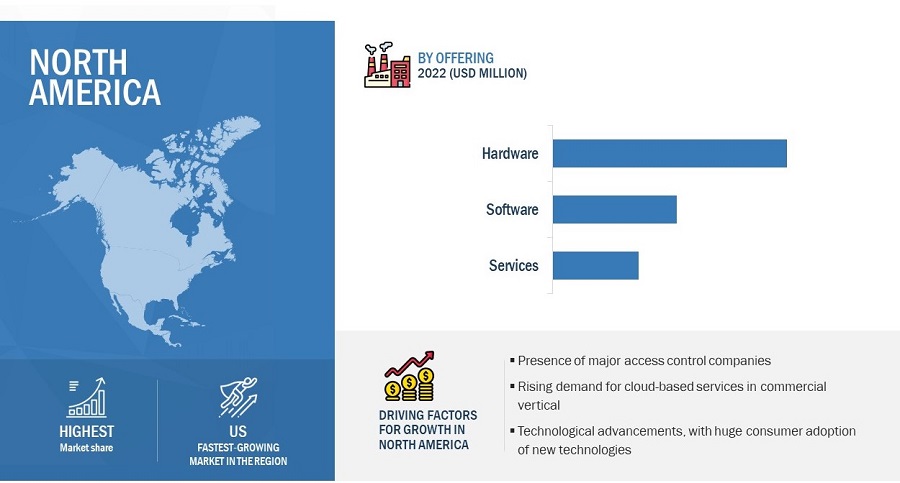

North America by region to witness highest growth rate.

North America is more advanced than other regions in terms of the implementation of access control systems. Companies in the US, Canada, and Mexico are making efforts to enhance their expertise and develop innovative access control systems and services. Honeywell International (US), AMAG Technologies, Inc. (US), Cross Match Technologies, Inc. (US), and 3M Cogent, Inc. (US) are the key players offering access control in this region.

Access Control Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The access control companies such as dormakaba Holding (Switzerland), ASSA ABLOY (Sweden), Allegion plc (Ireland), Johnson Controls (Ireland), and Honeywell International (US). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions to grow in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2023 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, By Model, By Offering, Access Control as a Service, By Vertical and By Region |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies covered |

The key players operating in the access control market ASSA ABLOY (Sweden), Johnson Controls (Ireland), dormakaba Holding (Switzerland), Allegion plc (Ireland), Honeywell International (US), Identiv (US), Nedap N.V. (Netherlands), Suprema HQ (South Korea), Bosch Security Systems (US), and Thales Group (France) |

Access Control Market Highlights

The study categorizes the access control market based on By Type, By Model, By Offering, Access Control as a Service, By Vertical and By Region

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Vertical: |

|

|

By Type: |

|

|

By Acaras: |

|

|

By Model: |

|

|

By Region: |

|

Recent Developments

- In February 2023, Johnson Controls (Ireland) and Alcatraz AI (US) collaborated for an intelligent frictionless access control solution. With this collaboration, the integration of the Johnson Controls CURE 9000 solution and Rock from Alcatraz AI will provide powerful AI-enabled facial authentication technology for fast and accurate access control.

- In February 2023, Identic (US) partnered with Trace-ID (Spain), a UHF RFID technology and solutions provider. The partnership expanded Ident’s manufacturing footprint, enabling the company to add to its extensive product portfolio, further strengthening its position as a global leader in RFID technology.

- In January 2023, Abloy Oy, a part of ASSA ABLOY (Sweden), introduced ABLOY Key Deposit for Keyless Access. It enables keyless access to properties with a smartphone via a Bluetooth Low Energy (BLE) connection. With this device, property managers can grant different user groups access to properties via the users’ mobile phones—without needing key logistics—and access control.

Frequently Asked Questions (FAQ):

Which are the major companies in the access control market? What are their major strategies to strengthen their market presence?

dorm Akaba Holding (Switzerland), ASSA ABLOY (Sweden), Allegion plc (Ireland), Johnson Controls (Ireland), and Honeywell International (US) are some of the major companies operating in access control market. Inorganic growth was the key strategies adopted by these companies to strengthen their access control market presence.

What are the drivers for access control market?

Drivers for the access control market are:

- Growing awareness concerning home security

- Rising number of smart infrastructure and smart city projects

- Ongoing technological advancements and increasing deployment of wireless security systems.

- Increasing adoption of IoT-based security systems with cloud computing platforms.

What are the challenges in the access control market?

High installation, maintenance, and ownership costs of access control system and Security and privacy concerns related to unauthorized access and data breach in access control environment are some of the challenges faced by access control market.

What are the technological trends going in the access control market?

Thermal imaging cameras, facial recognition cameras are some of the technological trends in access control market.

What is the total CAGR expected to be recorded for the access control market during 2023-2028?

The CAGR is expected to record a CAGR of 8.4% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

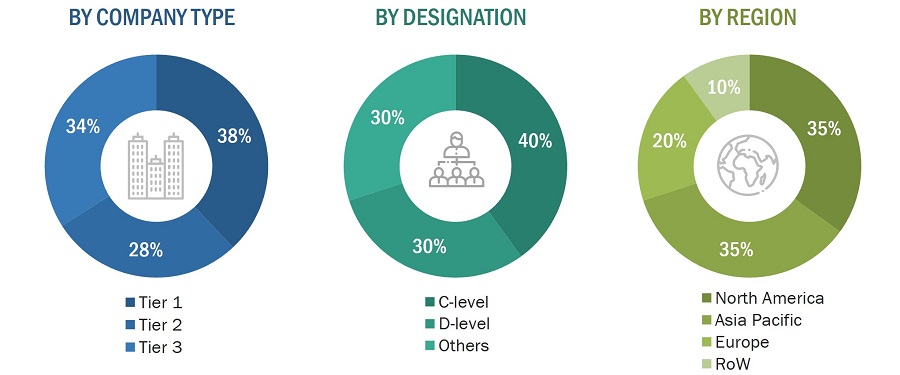

The study involved four major activities in estimating the size of the access control market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the access control market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East & Africa and South America).

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

Breakdown of Primaries

|

Particulars |

Intended Participants and Key Opinion Leaders |

|

Primary Interview Breakup |

|

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the overall access control market size and the various dependent submarkets. The key players involved in the access control market have been identified through secondary research, and their market shares in the respective geographies have been determined through primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to derive the final quantitative and qualitative data. This data is consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the access control market from the revenues of the key players and their market share. The key players such as ASSA ABLOY (Sweden), Johnson Controls (Ireland), dormakaba Holding (Switzerland), Allegion plc (Ireland), Honeywell International (US), Identiv (US), Nedap N.V. (Netherlands), Suprema HQ (South Korea), Bosch Security Systems (US), and Thales Group (France) were studied, and market estimations were done considering the shipment and average selling price (ASP) of various verticals.

Market Size Estimation Top-Down approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

For the calculation of specific market segments, the most appropriate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the market size obtained.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained in the previous section, the total market was split into several segments and subsegments. Data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Market Definition

Access control is a security technique that regulates communication between users and systems. It restricts the entry of unauthorized individuals into restricted areas to protect people and assets. An access control system provides secure access to physical resources by validating user credentials. Every vertical has specific security requirements—from excluding intruders and limiting access to dangerous or sensitive areas to protecting valuable assets and equipment or ensuring the safety of secluded areas.

Key Stakeholders

- Suppliers of raw materials and manufacturing equipment

- Providers and manufacturers of components

- Providers of software solutions

- Manufacturers and providers of devices

- Original equipment manufacturers (OEMs)

- ODM and OEM technology solution providers

- Suppliers and distributors of access control devices

- System integrators

- Middleware providers

- Assembly, testing, and packaging vendors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the access control industry

- Technology investors

- Governments, regulatory bodies, and financial institutions

- Venture capitalists, private equity firms, and startups

- End-users

The main objectives of this study are as follows:

- To define, describe, and forecast the access control market, in terms of value, based on access control as a service, offering, and vertical

- To define, describe, and forecast the market, in terms of volume, based on hardware component

- To provide information on the different models and types of access control systems

- To forecast the market size, in terms of value, with regard to four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the market’s value chain

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To provide the competitive landscape of the market

- To analyze competitive developments such as product launches and developments, partnerships, acquisitions, contracts, expansions, and R&D in the market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Access Control Market

I have significant interest in understanding the access control market and its market specifically related to the service market.

We have an opportunity in representing a new ACaaS technology and we're interested the market opportunities that are potentially available. Also we would like to understand the market size and future trends for the same.

Please provide example = physical access control (PAC) card reader market (by type) in US Dollars ($) for 2015.

We have started working with access control company and we want to know more about this kind of business. We want to know more about the use of this market in applications other than commercial. Also would like to understand the market opportunities in APAC.

I need a customized report for only Benelux region. Also wanted to check if I can buy certain sections of the report and cost for the same.

I am researcher from and I am currently writing a work on access control systems, their development and potential market. Can you provide us with the potential applications in this field?

I want to get a better understanding for the access control market in APAC region specially for commercial applications

I am a PM for access control systems and need more qualitative information about the global access control market. I would like to understand the start-ups offering advanced systems at lower costs.

We are planning and developing other products for the access control market and we need to understand the market better. We would like to see where exactly our product lies and the application areas of the same. Also, we would like to know about the major players and their offerings in this market space.

We are biometric reader company and provide it specifically for commercial applications. I would like to know the market size, trends, in this market.

We are looking to explore and answer some critical questions for our business these include the following and mainly examining the US marketplace Amount of companies / % of total companies currently using some form of 2 factor authentication Estimated total amount of employees (or %) using 2 factor authentication at their workplace currently The access control market size including mobile access control Amount of access control readers(biometric), panels and electronic locks sold in US marketplace.

Get a better sense of what is the adoption rate of access control vs. mechanical locks for small, medium, and large businesses, and the key drivers that they consider in making such decisions.

We are looking for a detailed and comprehensive market research report on global access control market, specially focused on Turkish market. We request a sample and information about your research's Turkish market.

I want to have access to information about the market size of some particular business , which will help me in conducting feasibility studies of different projects

Access Control Market by Product (Cards & Readers, Biometrics, Controllers, Management Software), Application (Commercial, Residential, Military & Defense, Government, Industrial, Healthcare, Education) & By Geography – Global Forecast & Analysis to 2020. I would like to understand the detailed scope of the market to see if our product lies in any of your offerings.

How do you think the integrators will deal with electronic locks. Specifically, wireless electronic solutions?

I would like to deep dive in the market in North America specifically for US and Canada. Which is the major application for access control in these regions? How cloud computing would impact the market?

Most interested in asset management systems / locker systems and key management systems. Has it been covered?

Understanding the dynamics of the market to identify if investments in this sector is a viable option. Can you provide us with the detailed opportunities in next 5 years and 10 years time frame? Will IoT really impact the market?

Sizing of the US market with specific visibility to: commercial real estate (office buildings vice warehouses), multi family buildings and ideally a break out of installation vs. ongoing recurring revenue for a ACaaS or Managed Access Control service.

We want to know the detailed segment market share(in numbers) of different region in terms of facial recognition access control market. Is it possible to provide the numbers for various regions specifically for facial recognition?

We are a leading facial recognition company, where the access control market is a strategic one for us. What are the early adaptors in various technologies for various regions. We would like to partner with other access control providers in various regions.

Would it be possible for us to just purchase a table from this report that shows the access controls market split by component? Also would like to know the market by card-based readers and biometric readers.

We are providers of access control systems and are expanding our scope in industrial and transportation applications. Could you provide us with the market related information for the same?

I'd like to know whether this report includes the following data and read before buying it. 1.Company Information in the Access Control Market. 2.Market share by companies. How the adoption of IoT-based security systems with cloud computing platforms impact the overall market?

We are building several new schools and I am researching types of access control systems to implement at our new facilities. Can you provide us with the major providers, systems, and their cost for the same?

Researching to determine how we expand our services into this market from an installation perspective. Which would be the major target areas and regions in this market?

I would like some market size and growth trends for the smart padlock market within Wireless access control Market. Is possible to track such niche market?

the report is very interesting, I want to know more about Access Control Market and make decisions about which manufacturers to make alliances with.

I would like to better understand what the market size is for South Africa as well as Africa in relation to Access Control market. Also would like to understand the trends in IoT and its impact in South Africa.

I would like to have information and reports related to Safety and Physical Security Market for the region EMEA.

What would be the price of the report if we were to only purchase the segments with the product definitions, and the US market? Does the section on the US market include market size breakdown by product? Can this inquiry please be expedited? We are ideally hoping to make a purchase by the end of the day.

I am interested in the vertical markets, such as office/enterprises/corporate as well as a breakdown of total revenue for Access Control, Video Surveillance, and Intruder alarms. Can you provide it?

I am specifically interested in the growth in access control market growth for Africa more specifically for the SADC member states. Mainly with regard to the Garage and Gate Access systems, but would like a link to this Webinar.

I am specifically interested in the growth in access control market growth for APAC market. What all has been included in the scope of the report? What are the varies components and services considered in the report?

I need the report for my project on Access control management. Kindly help me out with a copy.

Hi, I'm currently writing my thesis paper, which is about access control. I would like to have some information in regards to how much the access control market grosses (and forecasts, if possible). Are you willing to provide me with a free sample? It would be much appreciated.

We are a research facility and we frequently need to provide market estimates for research proposals. We would require the report and understand the market dynamics and their impact on various segments.

Working hard towards setting up a new startup for access and control systems. I needed help covering any information possible. I am struggling with market research and access to manufacturers at the moment. Any help will be greatly appreciated.

Need information on Access Control from a System Integrators perspective.

Hi there, I would like to get more insight of the access control market in UK. Also would like to understand the market share of UK in Europe and global market.

I am looking for the US Access control market size in total and would like to see Bio Metric market size in the US as well as the global market.