Adhesive & Sealants Market by Adhesives Formulating Technology (Water-Based, Solvent-Based, Hot-Melt, Reactive), Sealants Resin Type (Silicone, Polyurethane, Plastisol, Emulsion, Polysulfide, Butyl), Application, and Region - Global Forecast to 2028

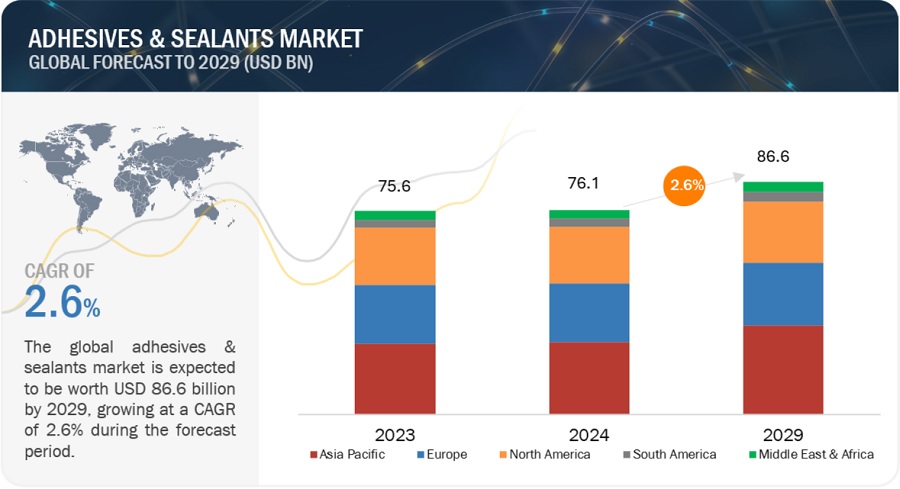

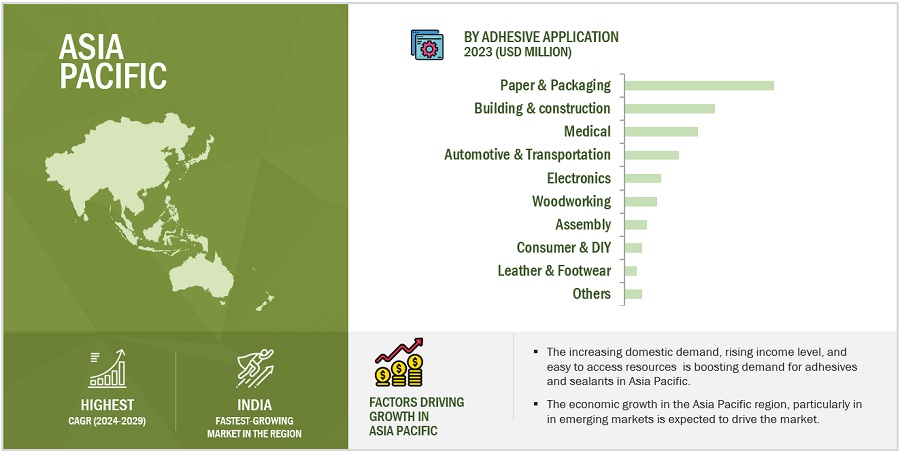

The global adhesives & sealants market size was USD 76.5 billion in 2023 and is projected to reach USD 95.0 billion by 2028, at a CAGR of 4.4%, between 2023 and 2028. The adhesives & sealants market is expected to be driven by the growth in emerging economies. The increasing number of applications of adhesives & sealants in the paper & packaging, automotive & transportation, and building & construction industries is likely to offer new growth opportunities for the market, globally. The adhesives and sealants market in India is predicted to develop at the fastest rate due to rising demand from the expanding packaging industry. In terms of adhesive demand, Asia Pacific is a developing market. China and India have been the main drivers behind the market's fast expansion in Asia Pacific and internationally. These nations' rise is linked to substantial economic growth and significant investments in the packaging, automotive, and transportation industries.

Attractive Opportunities in the Adhesives & Sealants Market

To know about the assumptions considered for the study, Request for Free Sample Report

Adhesives & Sealants Market Dynamics

Driver: Cooking appliances, washing appliances, refrigeration, and home comfort appliances are all part of the appliance sector. The sector is capital-intensive and fragmented, with numerous significant firms contending for market share. Increasing consumer incomes and frequent lifestyle changes boost appliance demand. Rising demand for smartphones, voice recognition technology, and artificial intelligence, combined with falling pricing, is driving up demand for consumer electronics.

A variety of factors, including rising consumer power, digitization, sustainability, consolidation, and a growing middle-class population, are driving the rapid rate of change in the worldwide market for home appliances. These developments place a premium on investments and economies of scale, while also creating significant possibilities in the appliance market.

Restraints : Environmental rules govern the manufacture of chemical and petroleum-based goods in Europe and North America. The manufacture of solvent-based goods in these regions is governed by organizations such as the Epoxy Resin Committee (ERC) and the European Commission (EC). This has an impact on manufacturing capacity in Europe and North America. Environmental laws are driving manufacturers to work on manufacturing environmentally friendly adhesives.

Opportunity: The USEPA (United States Environmental Protection Association), Europe's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), Leadership in Energy and Environmental Design (LEED), and other regional regulatory bodies have compelled adhesive and sealant manufacturers to create eco-friendly products with no- or low-VOC levels. Manufacturers have seen tremendous growth as a result of the transition towards more sustainable products. Henkel, a leading adhesives and sealants firm, provides solvent-free and environmentally friendly products such as H4500, H4710, H4720, and H3151.

There is an increasing need for ecologically friendly or green structures, which opens up the possibility of developing green and sustainable adhesive solutions produced from renewable, recycled, remanufactured, or biodegradable materials.

Challenges: The adhesives and sealants sector is subject to periodic changes in terms of standards and regulations. The Construction Products Regulation (CPR) established new rules for the marketing of construction products in the EU, such as Regulation (EU) No 305/2011. Manufacturers must shoulder the increased burden of labeling and documentation, as well as higher external testing expenses, as a result of the new laws. Additional material warnings concentrating on biocides and waste packaging are issued on a regular basis, causing regulatory requirements to shift. To commercialize their goods, adhesives, and sealants producers must follow the norms and evolving requirements. This presents a problem for producers.

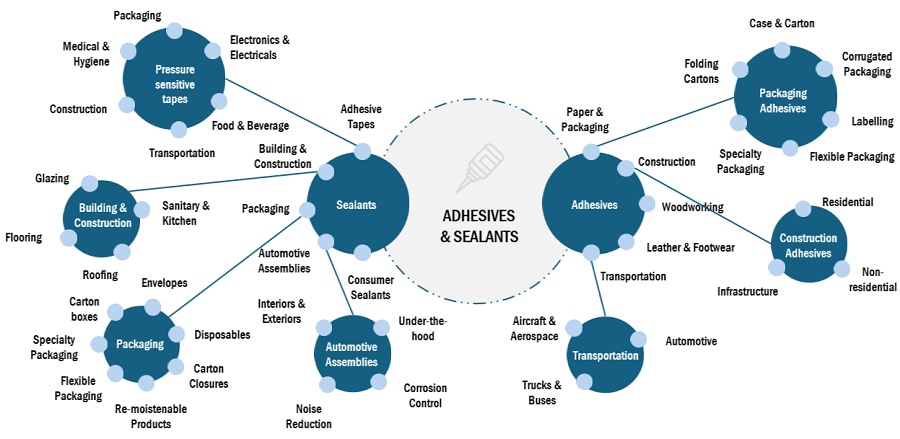

Adhesives & Sealants Market Ecosystem

Based on sealants application, the building & construction segment is estimated to account for the largest market share of the adhesives & sealants market

In terms of value and volume, the building and construction segment dominates the sealants industry. Sealants also serve as adhesives in a variety of applications. Sealants, for example, bind the glass to the building framework in structural glazing on glass-walled buildings. Sealants lack the great tensile strength of adhesives but offer improved longevity and reliability when subjected to high humidity, chemical assault, or electrical stress. Silicones allow for some movement between the bonded pieces, which helps to dissipate some of the shearing stresses caused by variances in the thermal expansion of different materials.

Based on sealants resin type, the silicone segment is anticipated to dominate the market

In recent years, the use of silicone sealants has risen. Butyl, neoprene, bituminous, and polyurethane sealants have been substituted by silicone in high-demand applications such as filling expansion joints in concrete highways. This is due to the fact that using a lower-performing sealer causes quick degradation of roadway concrete and the underlying rock substrate. The increased development of curtain wall structures has increased global demand for one- and two-component silicone sealants. Silicone sealants have grown in popularity in the electronics sector in recent years due to their increasing usage in protecting electronic components from heat, moisture, contamination, and unintentional damage. These sealants are used in appliances and electrical gadgets to secure connections and sensors.

The North American market is projected to contribute the largest share of the adhesives & sealants market.

Historically, North America has been a significant market for adhesives and sealants. In terms of product innovation, the area has also been a leader. The North American market's primary nations include the United States (the most dominating market, accounting for a substantial proportion), Canada, and Mexico. The United States has one of the world's major automotive marketplaces and is home to several worldwide car and automotive component manufacturers.

The North American adhesives and sealants market is heavily controlled by the Environmental Protection Agency (EPA), which is responsible for product monitoring and marketing. During the projected period, these factors are likely to play a major influence in boosting the adhesives & sealants market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Huntsman Corporation (US), Illinois Tool Works Inc. (US), Avery Dennison Corporation (US), Dow Inc. (US), and Wacker Chemie AG (Germany) are the key players operating in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Adhesives Formulating Technology, By Sealants Resin Type, By Application, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M (US), Huntsman Corporation (US), Illinois Tool Works Inc. (US), Avery Dennison Corporation (US), Dow Inc. (US), and Wacker Chemie AG (Germany) |

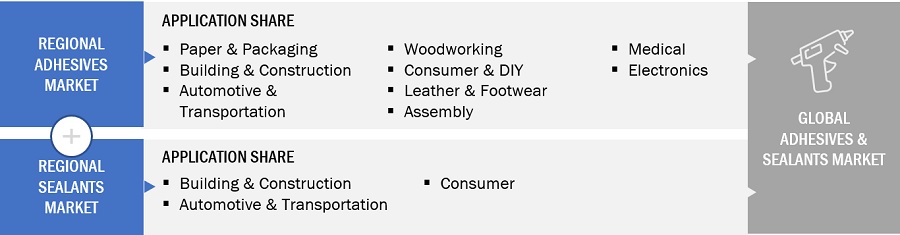

Based on adhesive formulating technology, the adhesives & sealants market has been segmented as follows:

- Water-Based

- Solvent-Based

- Hot-Melt

- Reactive and Others

Based on sealants resin types, the adhesives & sealants market has been segmented as follows:

- Silicone

- Polyurethane

- Plastisol

- Emulsion

- Polysulfide

- Butyl

- Others

Based on applications, the adhesives & sealants market has been segmented as follows:

-

Sealants

- Building & Construction

- Automotive & Transportation

- Consumers

- Others

-

Adhesives

- Paper & Packaging

- Building & Construction

- Woodworking

- Automotive & Transportation

- Consumer & DIY

- Leather & Footwear

- Assembly

- Medical

- Electronics

- Others

Based on the region, the adhesives & sealants market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2021, Wacker presented silicone adhesive gels and liquid silicone rubber for medical applications. SILPURAN 2114 and SILPURAN 2122 permit reliable and skin-friendly fixation of wound dressings and therapeutic devices.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the adhesives & sealants market in terms of new applications, production, and sales?

Various major, medium-sized, and small-scale business firms operate in the industry on a global basis. Numerous companies are always inventing and producing new items, as well as moving into developing regions where demand is increasing, resulting in increased sales.

Which countries contribute more to the adhesives & sealants market?

US, UK, Canada, and Germany are major countries considered in the report.

What is the total CAGR expected to be recorded for the adhesives & sealants market during 2023-2028?

The CAGR is expected to record 4.4% from 2023-2028

Does this report cover the different sealants resin type of the adhesives & sealants market?

Yes, the report covers the different forms of adhesives & sealants.

Does this report cover the different adhesive formulating technology of adhesives & sealants?

Yes, the report covers different adhesive formulating technology of adhesives & sealants. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

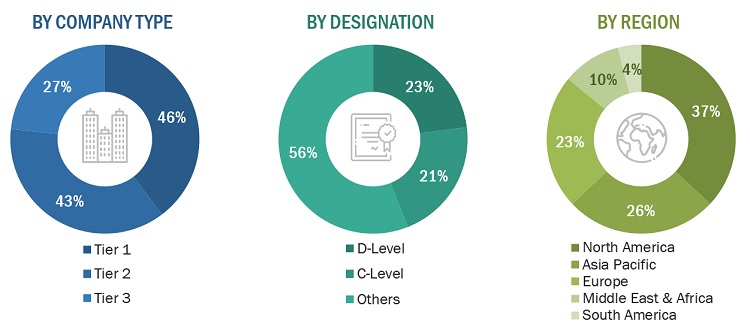

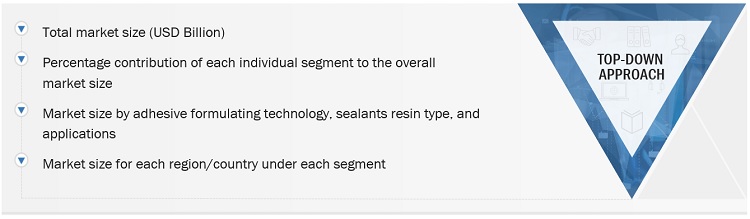

The study involved four major activities in estimating the current size of the adhesives & sealants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering adhesives & sealants information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the adhesives & sealants market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the adhesives & sealants market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from adhesives & sealants vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to application, technology, resin type, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using adhesives & sealants were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of adhesives & sealants and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

Sika AG |

Director |

|

Huntsman Corporation |

Project Manager |

|

Dow Inc |

Individual Industry Expert |

|

BASF SE |

Director |

Market Size Estimation

The research methodology used to estimate the size of the adhesives & sealants market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of adhesives & sealants.

Global Adhesives & Sealants Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Adhesives & Sealants Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Adhesives & sealants are chemical formulations used to adhere and seal materials. Adhesives are primarily used to bond materials together while sealants seal spaces that exist between the surfaces. There is a wide acceptance of adhesives & sealants in paper & packaging, building & construction, woodworking, consumer & DIY, automotive & transportation, leather & footwear, assembly, and other applications.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the adhesives & sealants market based on adhesives formulating technology, sealants resin type, application, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the adhesives & sealants market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the adhesives & sealants market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the adhesives & sealants Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Adhesive & Sealants Market

Market dynamics, growth trends, key manufacturers, and raw material analysis, different applications present in the market

General information on Adhesives Market

Oil & Gas market in India, Future of Telecom in India, Railways and Power. Manufacturers of sealant, adhesives , putty etc in india

Data on potential market assessment of cable glands, sealant, putty etc in the segments such as Oil & Gas, Power, energy, Railways and Telecom Markets in India.

Require report list of seanat, adhesive, weld-crete, PU foam, and others

General information on European adhesives and sealants market

Report title not mentioned

Interested in global market.

General information on Adhesives & Sealants market by material

Global Adhesives: Market Revenue, By Applications,2011 – 2018 ($Million) Sealants: Market Revenue, By Applications,2011 – 2018 ($Million) and for Europe

Market data for global Superplasticizers market

sample data needed for demand drivers of adhesives and sealants industry in india

Interested in Woodflooring adhesives and Sealants.

Looking for global adhesie market breakdown by Suppliers and future growth prospects

Global adhesive market split by suppliers (% share) by technology PUR, epoxy , acrylic etc. and future growth rate

Adhesives (non consturction). i.e. Cyanoacylates, Epoxys, PVAs, PUs, SMPs, etc, for small job "repair and create" use.

How big is the Adhesives And Sealants Market ? Do you have information on Adhesives And Sealants Market Size upto 2030 ? Report Attributes, Report coverage, Revenue forecast. Need this data at the earliest. Can you help ?

Interested in forecast, historical, per capita of global adhesives and sealants market

Interested in thermoset adhesives such as PU or polycarbonate

Thermoset adhesives, specifically those that are polycarbonate polyol based or polyurethanes and chemistries

Market value of adhesive market by technology (solvent, hotmelt, water based) in Thailand.

interetsed to about lamination adhesives market in UAE in terms of market size , current local production size and expected growth for the next 3 years (flexible packaging segment )

Purchase inquiry for Adhesives & Sealants market report

Market potential of Tile Adhesives in India, with a focus on Southern Region for a startup.

Specific information on application of Adhesives & Sealants for electrically conductive, thermal, and UV-cured

Need broad understanding of entire adhesives and sealants industry

Find general informations about Adhesives and Sealants market.

Bonding techniques in Fabric and future outlook

Interested in Tire Sealant, Hot melt Adhesive, Pressure sensitive adhesive

Adhesive and sealant for Tire Application

Contact Adhesive Market

Coverage of off the shelf reports adhesive portfolio. Also wants to lear about overall global market of adhesive

Needed Adhesive market for book report

Interested in comparitive study of natural adhesives vs their polymeric counterparts

Global adhesive market and trends

Adhesives sales growth from 2012 to 2018 along with technology growth.

Interested in Polyamide,Polyurethane,Water Based,Solventless and Solvent Based Adhesive for flexible packaging lamination

Information on Oil and Gas Sealant Market

General information on specialty adhesives market

SOLVENT-BASED ADHESIVES MARKET

Information on India Adhesives market by Volume and Value

Interested in market for Malaysia, Indonesia, Hongkong, Singapore, and Thailand

required more information

General information on two reports i.e. adhesive and sealant & ink additives

Interested in bottle label market

Report on Adhesives/sealants market

Specific information for construction silicones, Polyurethane adhesives (1K, 2K- 1/2), MS-Polymers, Plastisoles in the automotive industry

Market information on acrylic adhesive market globally

Interested in Adhesives & Sealants Market report

hot melt i.e. technology, industry, and equipment. Future technology as well if possible.

Specific information on hot melt

Customer identification for Vinyl Acetate/Ethylene (VAE) Emulsion and 1,4 BDO

Sample of Hot Melt Adhesive

Looking for insights on footwear adhesives market

Specific information on poland adhesives

Cut-off report available?

Information on scope of our study with a small description

General information on adhesives and sealants market in electronics application

Sealants market by type and Application

Can I get a citation reference for this report?

Information in adhesives and sealents market

Global polyisobutylene adhesive market

Information on Cable Sealing compounds market potential, Electrical Cabinet manufacturers, Oil & Gas market in India

Adhesives + sealants in: Agriculture/Construction/Filtration/Appliances/Medical/White goods/Wind energy.