Advanced Analytics Market by Component (Solutions and Services), Business Function (Sales & Marketing, Operations), Type (Big Data Analytics, Risk Analytics), Deployment Mode (On-premises and Cloud), Vertical and Region - Global Forecasts to 2026

Advanced Analytics Market Size

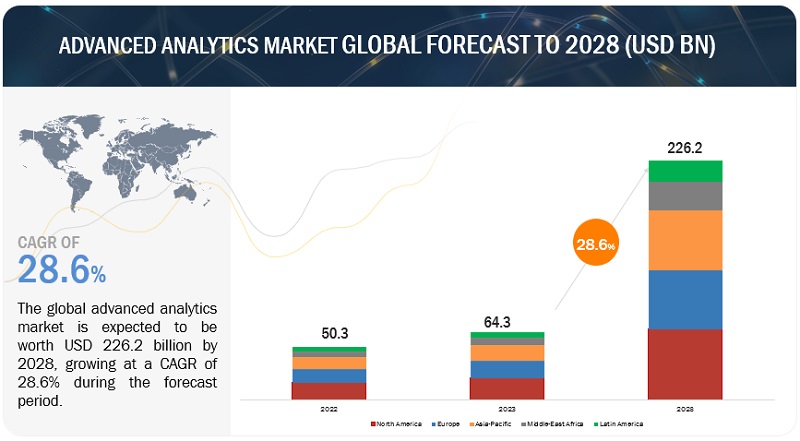

The global advanced analytics market size is projected to reach USD 89.8 billion by 2026 from USD 33.8 billion in 2021, at a CAGR of 21.6% during the forecast period.

Advanced Analytics Market Share

The major factors driving the growth of the advanced analytics market are the advent of ML and AI to offer personalized customer experiences and the growing need to preclude fraudulent activities during the pandemic. The proliferation of internet coupled with the rising usage of connected and integrated technologies and the increasing demand for real-time analytical solutions to track and monitor COVID-19 spread are the major factors adding value to the advanced analytics offerings, which is expected to provide opportunities for enterprises operating in various verticals in the advanced analytics market. Cloud adoption is said to have increased in recent times because vendors are making use of Software-as-a-Service (SaaS) to deliver cloud-based solutions. Business users are always on the lookout to ensure they are providing the most effective yet economical solutions. Cloud-based solutions provide the ability to outsource the operational IT work to another company. The complex data ecosystem leading to data breaches and security issues and lack of advanced analytical knowledge among the workforces may hinder the overall growth of the advanced analytics market.

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced Analytics Market Growth Dynamics

Driver: Advent of machine learning and artificial intelligence to offer personalized customer experiences

Advanced analytics is the key to understanding the data and extracting the crucial information needed to unlock customer insights. AI and ML are two emerging technologies with advanced analytics capabilities that can help companies achieve their business goals. Organizations are increasingly focusing on the re-engineering of businesses with the help of the immense power of the internet and digital technology. The adoption of digital operations assists advanced analytics solution providers to find newer ways to tackle the evolving challenges. Due to the digital transformation of retail and eCommerce businesses, operating costs have reduced and had positively impacted the advanced analytics market growth. The advent of AI and ML has enhanced organizations’ ability to gather information, analyze it, and make quick decisions with minimum human intervention. Organizations are also adopting AI systems to speed up investment decisions. For instance, Fukoku Mutual Life Insurance has adopted AI to calculate payouts. AI systems analyze and suggest Governance, Risk Management, and Compliance (GRC)- related changes. Hence, they help in monitoring and collecting the appropriate quality of data to meet regulatory standards. The introduction and implementation of ML and AI have helped providers in understanding customer perceptions by analyzing the data gathered from multiple sources. Enterprises have shifted their focus to deliver a unified customer experience across all channels and provide offers in real time by analyzing customer buying patterns.

Restraint: Inability to quantify RoI

RoI relies on gained value, which is often linked with customer satisfaction and process improvements, it becomes increasingly difficult to quantify, due to which advanced analytics might not be the top priority for management when budgets are set. Higher upfront investments make it further challenging to build a business case; the overall data processing cost consists of software, services, and software licensing costs. The efficacy of certain complex deployments also depends upon ongoing support, upgrades, and associated professional and managed services. Many organizations halt or delay their speech processing projects when they become aware of the overall resource requirements. Costly pricing structures have restricted the growth of advanced analytics deployments among SMEs. However, cloud-based deployments as well as flexible pricing and scaled-down versions of advanced analytics solutions are slowly changing the scenario.

Opportunity: Proliferation of internet coupled with the rising usage of connected and integrated technologies

The proliferation of the internet and the availability of various means to access the internet have led to a massive increase in data volumes generated. This would help in the advancement and expansion of high-speed internet services. Globalization and economic growth are also playing major roles in driving greater data generation worldwide. With the rise in touchpoints and the need for collecting data to understand consumer behavior, every touch by a consumer has become an important data point that can be processed to reveal user behavior. With the exponential rise in individual and organizational data, businesses are now deploying data scientists and analysts for processing collected data. This is compelling firms to invest in advanced analytics. The rise in connected and integrated technologies has provided a platform to advanced analytics solution vendors for leveraging the development and unprecedented growth of the internet. The eCommerce sector has modified the traditional shopping behavior of customers. Dedicated email campaigns, online/social media advertising, and cognitive customer analysis are key enablers driving sales and increasing customer loyalty. With connected devices coming to the forefront, retailers are focusing on the real-time analysis of customers’ shopping behavior and market basket analysis for analyzing consumers’ perception, which can be used for building tailor-made offers to increase customer retention. With the rise in the global IoT analytics demand in the retail vertical, the market is expected to offer unprecedented growth opportunities to advanced analytics vendors.

Challenge: Lack of advanced analytical knowledge among the workforces

The enormous value proposition harnessed around using advanced analytical computations stems from using predictive and prescriptive analytics. However, still, the usage of the technology is very little. Enterprises have still not been able to come to terms with the massive adoption of the technologies that are futuristic and to promise the next course of action that can be taken in the disruptive world. Prescriptive analytics, which promises enhanced decision-making and empowers business users to choose one among many viable options using an optimization approach, ML, and other tools in deciding a solution, still hovers around in the infancy stage. As per data scientists across the world, the cause of apprehension of adopting advanced technology is the low level of skillsets among.

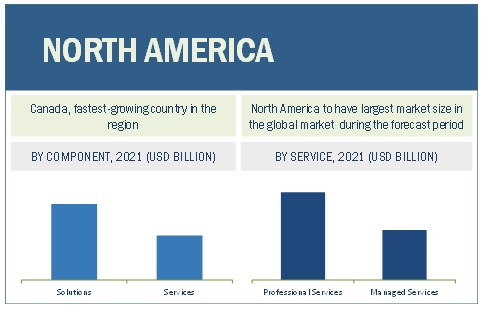

The solution segment is expected to account for the largest market share during the forecast period

The global advanced analytics market by component has been segmented into solution and services. The market size of the solutions segment is expected to hold a larger market share, while the services segment is projected to grow at a higher CAGR during the forecast period. . With the increasing popularity of online shopping and the rising social network penetration, the demand for advanced analytics solutions is anticipated to rise substantially during the forecast period. Digitization acts as a major factor in the industry that was able to create an ecosystem that promotes the business to adopt these advanced solutions for improved business insights.

North America to account for largest market size during the forecast period

In North America, advanced analytics solutions and services are highly effective in most organizations and verticals due to the increasing need to provides businesses with a way to operationalize and get more value from data assets. Europe is gradually advancing toward incorporating advanced analytics within its market. APAC is showing a substantial rise in the adoption of advanced analytics solutions and services during the forecast period, while Latin America and MEA are slowly picking up advanced analytics due to its benefits for various industries to get user insights in real-time.

To know about the assumptions considered for the study, download the pdf brochure

Advanced Analytics Market - Key Players

IBM (US), Oracle (US), SAS Institute (US), SAP (Germany), FICO (US), KNIME (Switzerland), Microsoft (US), Altair (US), RapidMiner (US), AWS (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Teradata (US), Adobe (US), Absolutdata (US), Moody’s Analytics (US), Qlik (US), Databricks (US), Dataiku (US), Kinetica (US), H2O.ai (US), Domino Data Lab (US), DataRobot (US), DataChat (US), Imply (US), Promethium (US), Siren (Ireland), Tellius (US), SOTA Solutions (Germany), and Vanti Analytics (Israel).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value for 2021 |

US $33.8 billion |

|

Market size value for 2026 |

US $89.8 billion |

|

CAGR Growth Rate |

21.6% |

|

Largest Market |

North America |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Business Function, Type, Deployment Mode, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Advanced Analytics Market Drivers |

|

|

Advanced Analytics Market Opportunities |

|

|

Companies covered |

IBM (US), Oracle (US), SAS Institute (US), SAP (Germany), FICO (US), KNIME (Switzerland), Microsoft (US), Altair (US), RapidMiner (US), AWS (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Teradata (US), Adobe (US), Absolutdata (US), Moody’s Analytics (US), Qlik (US), Databricks (US), Dataiku (US), Kinetica (US), H2O.ai (US), Domino Data Lab (US), DataRobot (US), DataChat (US), Imply (US), Promethium (US), Siren (Ireland), Tellius (US), SOTA Solutions (Germany), and Vanti Analytics |

This research report categorizes the Advanced Analytics market based on components, types, business functions, organization size, deployment mode, vertical, and region.

Advanced Analytics Market By Component:

- Solution

-

Services

-

Professional Services

- Training and Consulting

- System integration and implementations

- Support and Maintenance

- Managed Services

-

Professional Services

By Business Function

- Marketing and Sales

- Finance

- Human Resource (HR)

- Operations

- Supply Chain

Advanced Analytics Market By Type:

- Big Data Analytics

- Predictive Analytics

- Customer Analytics

- Statistical Analytics

- Risk Analytics

- Prescriptive Analytics

- Other Types

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Vertical

- Banking Finance Services and Insurance (BFSI)

- IT and Telecom

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Defence

- Manufacturing

- Media and Entertainment

- Other Verticals

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- India

- Japan

- China

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2021, IBM integrated streaming analytics on its Cloud Park for Data as a Service (DaaS). This service adds a tool or other types of interfaces that runs in IBM Cloud and provides APIs that can use outside of Cloud Pak for DaaS.

- In November 2021, Samsung Securities selected Oracle Cloud Infrastructure (OCI) to underpin its digital innovation strategy. The company has secured the flexibility, reliability, and high-performance capabilities it required to effectively run advanced analytics in the rapidly changing financial market environment. It is now able to analyze the derivatives in near real-time, to maximize customer profits. Through its transition to the cloud, Samsung Securities is able to gain access to flexible, secure, and high-performance computing resources.

- In May 2021, SaS will reinforce the foundation for data and analytics success by incorporating new data management solutions into its powerful, cloud native sasviya platform.

- In September 2021, SAP released a new version of SAP Analytics Cloud 2021.20. It updates new dashboard and analytics platform services to enhance user experience.

- 1In October 2021 Altair announced significant enhancements to its integrated portfolio of simulation and design tools. This update to Altair’s simulation software suite is focused on accelerating simulation-driven design and unleashing the power of AI by embedding augmented intelligence in the broadest possible range of Computer-Aided Engineering (CAE) tools.

- In December 2021, FICO and Sistemas Críticos, announced the launch of BSafe Platform SaaS, which combines the fraud prevention technologies of FICO Falcon Fraud Manager and TenS a proprietary Sistemas Críticos platform, on the Cloud for any type of company/institution, notwithstanding of size and industry. It combines with predictive analytics and AI to offer comprehensive fraud prevention, security, and compliance management which focus on the customer lifecycle.

- In December 2021, CVS Health and Microsoft announced a new strategic alliance to reimagine personalized care and accelerate digital transformation. It focuses on developing innovative solutions to help the consumers improve their health.

Frequently Asked Questions (FAQ):

What is Advanced Analytics?

Advanced analytics describes the sophisticated analysis of data using complex techniques to forecast trends and predict events. It uses state-of-the-art tools, such as ML and AI technologies and complex statistical analyses and algorithms to examine the rising big data and identify patterns to discover deeper insights. Advanced analytics uses quantitative and qualitative methods to uncover relationships, trends, correlations, and outliers. Advanced analytics tools cover data mining, ML, cohort analysis, cluster analysis, retention analysis, complex event analysis, predictive analysis, regression analysis, sentiment analysis, and time series analysis. experience.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and other European countries in the European region.

Which are the Deployment mode in Advanced Analytics market?

The deployment mode in the advanced analytics market includes on-premises and cloud. Deployment refers to the setting-up of an IT infrastructure with hardware, operating systems, and applications that are required to manage the IT ecosystem. Advanced analytics solution can be deployed on any one deployment mode based on security, availability, and scalability. Mostly advanced analytics solutions are getting deployed on the cloud as it offers advantages, such as pay-per-use and low installation and maintenance costs. This deployment mode is expected to show high growth soon. Advanced analytics workbenches are cloud-based solutions that allow users to explore data in depth and use advanced modeling and insight-visualization techniques.

What are the various vertical in Advanced Analytics market?

The Advanced Analytics market has been segmented based on verticals into BFSI, healthcare and life sciences, IT and telecom, retail and consumer goods, manufacturing, government and defense, transportation and logistics, media and entertainment, and other verticals (education, energy and utilities, and travel and hospitality).

Who are the Major vendors in the Advanced Analytics market?

Some of the major vendors in the Advanced Analytics market include IBM (US), Oracle (US), SAS Institute (US), SAP (Germany), FICO (US), KNIME (Switzerland), Microsoft (US), Altair (US), RapidMiner (US), AWS (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Teradata (US), Adobe (US), Absolutdata (US), Moody’s Analytics (US), Qlik (US), Databricks (US), Dataiku (US), Kinetica (US), H2O.ai (US), Domino Data Lab (US), DataRobot (US), DataChat (US), Imply (US), Promethium (US), Siren (Ireland), Tellius (US), SOTA Solutions (Germany), and Vanti Analytics (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 57)

2.1 RESEARCH DATA

FIGURE 6 ADVANCED ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE ADVANCED ANALYTICS MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF ADVANCED ANALYTICS THROUGH OVERALL ADVANCED ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

2.9.1 IMPACT OF COVID-19 PANDEMIC:

3 EXECUTIVE SUMMARY (Page No. - 74)

TABLE 4 GLOBAL ADVANCED ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2020 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 MARKET SNAPSHOT, BY COMPONENT

FIGURE 17 MARKET SNAPSHOT, BY SERVICE

FIGURE 18 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 19 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 20 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 21 MARKET SNAPSHOT, BY TYPE

FIGURE 22 MARKET SNAPSHOT, BY BUSINESS FUNCTION

FIGURE 23 MARKET SNAPSHOT, BY VERTICAL

FIGURE 24 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 81)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE ADVANCED ANALYTICS MARKET

FIGURE 25 ADVENT OF MACHINE LEARNING AND ARTIFICIAL INTELLIGENCE TO OFFER PERSONALIZED CUSTOMER EXPERIENCES TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET: TOP THREE TYPES

FIGURE 26 BIG DATA ANALYTICS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 27 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

4.4 MARKET IN NORTH AMERICA, TOP THREE TYPES AND VERTICALS

FIGURE 28 BIG DATA ANALYTICS TYPE AND BFSI VERTICAL TO ACCOUNT FOR THE LARGEST SHARES IN THE MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 84)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ADVANCED ANALYTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising adoption of big data and other related technologies

5.2.1.2 Advent of machine learning and artificial intelligence to offer personalized customer experiences

5.2.1.3 Growing need to preclude fraudulent activities during the pandemic

5.2.2 RESTRAINTS

5.2.2.1 Inability to quantify RoI

5.2.2.2 Concerns related to data privacy and security due to the pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Proliferation of internet coupled with the rising usage of connected and integrated technologies

5.2.3.2 Increasing demand for real-time analytical solutions to track and monitor COVID-19 spread

5.2.4 CHALLENGES

5.2.4.1 Complex data ecosystem leading to data breaches and security issues

5.2.4.2 Ownership and privacy of collected data

5.2.4.3 Lack of advanced analytical knowledge among the workforces

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 INDUSTRY TRENDS

5.3.1 ADVANCED ANALYTICS TECHNIQUES

5.3.1.1 Data mining

5.3.1.2 Machine learning

5.3.1.3 Cohort analysis

5.3.1.4 Cluster analysis

5.3.1.5 Retention analysis

5.3.2 ECOSYSTEM

FIGURE 30 ADVANCED ANALYTICS MARKET: ECOSYSTEM

5.3.3 SUPPLY CHAIN ANALYSIS

FIGURE 31 SUPPLY CHAIN ANALYSIS

TABLE 6 MARKET: SUPPLY CHAIN

5.3.4 MARKET: COVID-19 IMPACT

FIGURE 32 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2021

5.3.5 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE MARKET

FIGURE 33 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.6 REGULATORY IMPLICATIONS

5.3.6.1 General Data Protection Regulation

5.3.6.2 Market Abuse Regulation

5.3.6.3 Revision of Markets in Financial Instruments Directive

5.3.6.4 European Banking Regulations

5.3.6.5 Health Insurance Portability and Accountability Act

5.3.6.6 California Consumer Privacy Act

5.3.6.7 Office of Communications

5.3.6.8 Polish Civil Code

5.3.6.9 Federal Communications Commission

5.3.6.10 Basel

5.3.7 CASE STUDY ANALYSIS

5.3.7.1 Education: Use Cases

5.3.7.1.1 Case Study 1: San Francisco University has selected Oracle Fusion Cloud EPM to streamline the budgeting and planning process

5.3.7.1.2 Case Study 2: Shorelight used RapidMiner to create a workflow, automate the series of questions traditionally asked by the visa guides, and create a risk profile

5.3.7.2 Retail and consumer goods: Use cases

5.3.7.2.1 Case Study 3: Fine Hygienic Holding choose Oracle Cloud for its data and application to transform and automate the core business processes

5.3.7.2.2 Case Study 4: DEUTZ implemented SAP Analytics Cloud as a central analytics platform for BI

5.3.7.3 Media and entertainment: Use cases

5.3.7.3.1 Case Study 5: Scaling a small data team using ML

5.3.7.4 Healthcare and life sciences: Use cases

5.3.7.4.1 Case Study 6: Innocens aims to reduce neonate mortality rates and helps speed sepsis diagnosis using hidden trends found in patient’s data

5.3.7.4.2 Case Study 7: Fleury has selected FICO Forecaster to improve the demand forecasting and resource allocation process

5.3.7.5 Banking financial service and insurance: Use cases

5.3.7.5.1 Case Study 8: Danske Bank is modernizing with IBM Knowledge Watson Catalog to provide unified solutions across data quality, governance, and privacy

5.3.7.5.2 Case Study 9: KCB chose Oracle Exadata to consolidate all transaction processing and data warehouse workloads

5.3.7.6 IT and telecom: Use cases

5.3.7.6.1 Case Study 10: Worldpay uses FICO tools to gain better insights into onboarding decisions

5.3.7.6.2 Case Study 11: Improve customer segmentation due to multiple data sources and different business needs

5.3.7.7 Transportation and logistics: Use cases

5.3.7.7.1 Case Study 12: Visualize and predict the status of the fleet

5.3.7.8 Government and defense: Use cases

5.3.7.8.1 Case Study 13: HAN University implemented Qlik analytics solutions to promote BI skills within all the coursework

5.3.7.9 Energy and utilities: Use cases

5.3.7.9.1 Case Study 14: Pöyry Choose FICO Xpress Optimization, part of Fico Decision Management Suite to provide customers with data-driven energy analyses and long-range predictions

5.3.7.9.2 Case Study 15: Rising need to optimize debt collection processes and improve recovery of receivables

5.4 TECHNOLOGY ANALYSIS

5.4.1 ADVANCED ANALYTICS AND AI

5.4.2 ADVANCED ANALYTICS AND ML

5.4.3 ADVANCED ANALYTICS AND IOT

5.4.4 ADVANCED ANALYTICS AND BLOCKCHAIN

5.5 PATENT ANALYSIS

5.5.1 METHODOLOGY

5.5.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2018–2021

5.5.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 34 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.5.4 TOP APPLICANTS

FIGURE 35 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.6 PRICING MODEL ANALYSIS, 2021

TABLE 8 ADVANCED ANALYTICS MARKET: PRICING MODEL ANALYSIS, 2021

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMPACT OF EACH FORCE ON THE MARKET

FIGURE 36 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.7.6 SCENARIO

TABLE 10 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE MARKET

6 ADVANCED ANALYTICS MARKET, BY COMPONENT (Page No. - 116)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 37 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTION

6.2.1 INCREASING POPULARITY OF ONLINE SHOPPING AND RISING SOCIAL NETWORK PENETRATION TO BOOST THE DEMAND FOR THE ADVANCED ANALYTICS SOLUTION ACROSS THE GLOBE

TABLE 13 SOLUTION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 SOLUTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 16 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 SERVICES: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 39 TRAINING AND CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: ADVANCED ANALYTICS SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: ADVANCED ANALYTICS SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.1 Training and consulting services

6.3.1.1.1 Training and consulting services are needed in the initial phase of implementing advanced analytics solutions based on their business needs and going market trends

TABLE 23 TRAINING AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 TRAINING AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 System integration and implementation services

6.3.1.2.1 Advanced analytics solutions must be integrated with existing systems; this requires the right level of connectors and back-end integration capabilities

TABLE 25 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 SYSTEM INTEGRATION AND DEPLOYMENT SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.3 Support and maintenance services

6.3.1.3.1 Growing need to upgrade the existing system and assistance to the installed solutions to drive the growth of support and maintenance services across the globe

TABLE 27 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Enterprises must ensure the provision of certain services for their clients to maintain their market position in the market

TABLE 29 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION (Page No. - 129)

7.1 INTRODUCTION

7.1.1 BUSINESS FUNCTIONS: COVID-19 IMPACT

FIGURE 40 OPERATIONS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 31 MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

7.2 MARKETING AND SALES

7.2.1 WITH THE EVER-INCREASING DATA OF CUSTOMERS BASED ON ONLINE PURCHASES, WEB CLICKS, SOCIAL MEDIA ACTIVITIES, AND SMART CONNECTED DEVICES TO DRIVE THE ADOPTION OF ADVANCED ANALYTICS SOLUTION TO ENHANCE MARKETING AND SALES BUSINESS FUNCTION WITHIN THE ORGANIZATION

TABLE 33 MARKETING AND SALES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 MARKETING AND SALES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 FINANCE

7.3.1 ADVANCED ANALYTICS SUPPORTS FINANCIAL FIRMS TO TRACK OUTSTANDING INVOICES AND AUTOMATE THE FOLLOW-UP PROCESS TO ENSURE INVOICES ARE PAID AND CLOSED ON TIME

TABLE 35 FINANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 FINANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 HUMAN RESOURCES

7.4.1 INCREASING NEED TO PREDICT EMPLOYEE PERFORMANCE AND IDENTIFY HIDDEN TALENT FOR ORGANIZATIONS WOULD DRIVE THE ADOPTION OF ADVANCED ANALYTICS SOLUTION FOR THE HUMAN RESOURCES BUSINESS FUNCTION IN AN ORGANIZATION

TABLE 37 HUMAN RESOURCES: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 HUMAN RESOURCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 OPERATIONS

7.5.1 INCREASING NEED TO IMPROVE LOCATION AND DISTRIBUTION CENTER PERFORMANCE USING ALL THE RELEVANT DATA, RANGING FROM EXCEL SPREADSHEETS TO BOOST THE GROWTH OF ADVANCED ANALYTICS SOLUTIONS

TABLE 39 OPERATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 OPERATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 SUPPLY CHAIN

7.6.1 INCREASING NEED TO ADDRESS THE CHALLENGES OF ANALYZING PRODUCTION PROCESSES IN ORGANIZATIONS THAT MAY INCREASE ROI TO DRIVE THE ADOPTION OF ADVANCED ANALYTICS SOLUTION

TABLE 41 SUPPLY CHAIN: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 SUPPLY CHAIN: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 ADVANCED ANALYTICS MARKET, BY TYPE (Page No. - 138)

8.1 INTRODUCTION

8.1.1 TYPES: COVID-19 IMPACT

FIGURE 41 RISK ANALYTICS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.2 BIG DATA ANALYTICS

8.2.1 BIG DATA ANALYTICS USES ADVANCED ANALYTICS TECHNIQUES TO UNCOVER TRENDS, PATTERNS, AND CORRELATIONS IN LARGE AMOUNTS OF RAW DATA, MAKING DATA-INFORMED DECISIONS

TABLE 45 BIG DATA ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 BIG DATA ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 PREDICTIVE ANALYTICS

8.3.1 PREDICTIVE ANALYTICS HELPS ORGANIZATIONS EFFECTIVELY ANTICIPATE AND PROACTIVELY PLAN FOR FUTURE EVENTS FOR ENHANCED PRODUCTIVITY

TABLE 47 PREDICTIVE ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 PREDICTIVE ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 CUSTOMER ANALYTICS

8.4.1 CUSTOMER ANALYTICS USES ADVANCED ANALYTICS TECHNIQUES TO GAIN CUSTOMER INSIGHTS IN REAL TIME AND OPTIMIZE THE CUSTOMER INTERACTIONS

TABLE 49 CUSTOMER ANALYTICS: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 CUSTOMER ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 STATISTICAL ANALYTICS

8.5.1 GROWING NEED TO UNCOVER PATTERNS AND TRENDS USING DATA INTERPRETATION TECHNIQUES TO DRIVE THE DEMAND FOR STATISTICAL ANALYTICS IN THE MARKET

TABLE 51 STATISTICAL ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 STATISTICAL ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 RISK ANALYTICS

8.6.1 RISING NEED TO IMPROVE RISK ASSESSMENTS AND DETECT FRAUD TO DRIVE THE GROWTH OF RISK ANALYTICS IN THE MARKET

TABLE 53 RISK ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 RISK ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.7 PRESCRIPTIVE ANALYTICS

8.7.1 PRESCRIPTIVE ANALYTICS USES OPTIMIZATION AND SIMULATION ALGORITHMS TO ALLOW COMPANIES TO ASSESS A NUMBER OF POSSIBLE OUTCOMES BASED UPON THEIR ACTIONS

TABLE 55 PRESCRIPTIVE ANALYTICS: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 PRESCRIPTIVE ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.8 OTHER TYPES

TABLE 57 OTHER TYPES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 OTHER TYPES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 151)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 42 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 59 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

9.2 ON-PREMISES

9.2.1 DATA-SENSITIVE ORGANIZATIONS TO ADOPT THE ON-PREMISES DEPLOYMENT MODE TO DEPLOY ADVANCED ANALYTICS SOLUTIONS

TABLE 61 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 CLOUD

9.3.1 CLOUD DEPLOYMENT MODE PROVIDES MULTIPLE BENEFITS, SUCH AS REDUCED OPERATIONAL COSTS, SIMPLE DEPLOYMENTS, AND HIGHER SCALABILITY

TABLE 63 CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 157)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 43 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 65 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 66 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.2 LARGE ENTERPRISES

10.2.1 EFFECTIVE USE OF ADVANCED ANALYTICS TECHNIQUES IS CAPABLE OF TRANSFORMING DATA INTO DELIVERABLE INFORMATION THAT WILL DRIVE THE ADOPTION OF ADVANCED ANALYTICS SOLUTION AMONG LARGE ENTERPRISES

TABLE 67 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 68 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10.3.1 ADOPTION OF NEW TECHNOLOGIES TO FIX ISSUES FOR ENHANCING BUSINESS PROCESSES TO BOOST THE DEMAND FOR ADVANCED ANALYTICS AMONG SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 69 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 70 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 ADVANCED ANALYTICS MARKET, BY VERTICAL (Page No. - 163)

11.1 INTRODUCTION

11.1.1 VERTICALS: COVID-19 IMPACT

FIGURE 44 HEALTHCARE AND LIFE SCIENCES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

11.1.2 MAJOR USE CASES: BY VERTICAL

TABLE 71 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 72 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.1 ADVANCED ANALYTICS IDENTIFIES NEW BUSINESS OPPORTUNITIES, DESIGNING CUSTOMER VALUE PROPOSITIONS AND CONSTRUCTING NEW BUSINESS MODELS ACROSS THE BFSI VERTICAL

TABLE 73 BFSI: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 74 BFSI: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 IT AND TELECOM

11.3.1 GROWING PENETRATION OF SMARTPHONES, COUPLED WITH THE INCREASE IN THE NUMBER OF SERVICE PROVIDERS, HAVE CREATED THE DEMAND TO ADOPT ADVANCED ANALYTICS SOLUTION AMONG THE TELECOM INDUSTRY

TABLE 75 IT AND TELECOM: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 76 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4 RETAIL AND CONSUMER GOODS

11.4.1 RISING NEED TO ENHANCE CUSTOMER EXPERIENCE, EMPLOYEE EFFICIENCY, AND THE OVERALL FUNCTIONING OF THE BUSINESS TO BOOST THE DEMAND FOR ADVANCED ANALYTICS ACROSS RETAIL AND CONSUMER GOODS SECTORS

TABLE 77 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 78 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

11.5.1 NEED TO IMPROVE PATIENT MANAGEMENT, MONITORING, AND ENHANCE PATIENT EXPERIENCE ARE DRIVING THE ADOPTION OF ADVANCED ANALYTICS ACROSS THE HEALTHCARE AND LIFE SCIENCES VERTICAL

TABLE 79 HEALTHCARE AND LIFE SCIENCES: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 80 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.6 TRANSPORTATION AND LOGISTICS

11.6.1 GROWING TO MANAGE TRAFFIC AND HANDLE COMPLEX SUPPLY CHAIN OPERATIONS WILL GIVE A BOOST TO THE GROWTH OF ADVANCED ANALYTICS ACROSS THE TRANSPORTATION AND LOGISTICS VERTICAL

TABLE 81 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 82 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.7 GOVERNMENT AND DEFENSE

11.7.1 RISING NEED TO MANAGE CRITICAL DATA AND DELIVER ENHANCED SERVICES TO THE CITIZENS TO DRIVE THE GROWTH OF ADVANCED ANALYTICS AMONG GOVERNMENT AND DEFENSE INDUSTRY

TABLE 83 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 84 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.8 MANUFACTURING

11.8.1 ADVANCED ANALYTICS USED IN THE MANUFACTURING VERTICAL HELPS IMPROVE DECISION-MAKING AND ENHANCE PERFORMANCE

TABLE 85 MANUFACTURING: ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 86 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.9 MEDIA AND ENTERTAINMENT

11.9.1 MEDIA AND ENTERTAINMENT VERTICAL LEVERAGES ADVANCED ANALYTICS SOLUTION TO ENHANCE CONTENT AND CUSTOMER VIEWING EXPERIENCE

TABLE 87 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 88 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.10 OTHER VERTICALS

TABLE 89 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 90 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 ADVANCED ANALYTICS MARKET, BY REGION (Page No. - 181)

12.1 INTRODUCTION

FIGURE 45 INDIA TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 46 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 91 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 92 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: COVID-19 IMPACT

12.2.2 NORTH AMERICA: REGULATIONS

12.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

12.2.2.2 Gramm–Leach–Bliley Act

12.2.2.3 Health Insurance Portability and Accountability Act of 1996

12.2.2.4 Health Level Seven (HL7)

12.2.2.5 Occupational Safety and Health Administration (OSHA)

12.2.2.6 Federal Information Security Management Act

12.2.2.7 Federal Information Processing Standards

12.2.2.8 California Consumer Privacy Act

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 93 NORTH AMERICA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 102 NORTH AMERICA: ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.3 UNITED STATES

12.2.3.1 Rapid adoption of technology and use of digitally innovative solutions drive the growth of the advanced analytics market in the US

TABLE 111 UNITED STATES: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Digital transformation of businesses into data-driven organizations to drive the growth of the advanced analytics market in Canada

TABLE 113 CANADA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 114 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: COVID-19 IMPACT

12.3.2 EUROPE: REGULATIONS

12.3.2.1 General Data Protection Regulation

12.3.2.2 Payment Card Industry Data Security Standard

12.3.2.3 European Committee for Standardization

TABLE 115 EUROPE: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 126 EUROPE: ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.3.1 Advanced IT infrastructure, coupled with the advent of disruptive technologies, will drive the growth of advanced analytics solutions in the UK

TABLE 133 UNITED KINGDOM: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 High skilled labor force and rising government initiatives are the key factors driving the adoption of advanced analytical solutions in Germany

TABLE 135 GERMANY: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Increasing technological development in AI acts as a driving factor toward the adoption of advanced analytics technology in France

TABLE 137 FRANCE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 138 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 139 REST OF EUROPE: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: COVID-19 IMPACT

12.4.2 ASIA PACIFIC: REGULATIONS

12.4.2.1 Personal Data Protection Act

12.4.2.2 Act on the Protection of Personal Information (APPI)

12.4.2.3 International Organization for Standardization 27001

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Increase in technology innovations and digitalization drives the growth of the advanced analytics market in India

TABLE 159 INDIA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 160 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Advancements in innovative technologies, coupled with strong IT infrastructure, to drive the growth of the advanced analytics market in Japan

TABLE 161 JAPAN: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 162 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.5 CHINA

12.4.5.1 Technological development and rising government support to drive the growth of the advanced analytics market in China

TABLE 163 CHINA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 165 REST OF ASIA PACIFIC: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.2.2 GDPR Applicability in KSA

12.5.2.3 Protection of Personal Information Act

TABLE 167 MIDDLE EAST AND AFRICA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.5.3 KINGDOM OF SAUDI ARABIA

12.5.3.1 Adoption of technology and transformation to data-driven economy drives the growth of advanced analytics solution in the country

TABLE 185 KINGDOM OF SAUDI ARABIA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 186 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5.4 UNITED ARAB EMIRATES

12.5.4.1 Country witnesses the increasing trend toward the adoption of AI and analytics technologies that boost the growth of the market

TABLE 187 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5.5 SOUTH AFRICA

12.5.5.1 Growing digitalization and rising government support to drive the growth of advanced analytics solution in the African market

TABLE 189 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 190 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 191 REST OF MEA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 192 REST OF MEA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: COVID-19 IMPACT

12.6.2 LATIN AMERICA: REGULATIONS

12.6.2.1 Brazil Data Protection Law

12.6.2.2 Argentina Personal Data Protection Law No. 25.326

12.6.2.3 Federal Law on Protection of Personal Data Held by Individuals

TABLE 193 LATIN AMERICA: ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 202 LATIN AMERICA: ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Rising need to enhance the business efficiency, coupled with the growing utility of IoT analytics, to drive the growth of the advanced analytics market in Brazil

TABLE 211 BRAZIL: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6.4 MEXICO

12.6.4.1 Government initiatives toward technological development to drive the growth of the advanced analytics market in Mexico

TABLE 213 MEXICO: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 214 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6.5 REST OF LATIN AMERICA

TABLE 215 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 216 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 245)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

13.3 REVENUE ANALYSIS

FIGURE 49 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

13.4 MARKET SHARE ANALYSIS

FIGURE 50 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 217 ADVANCED ANALYTICS MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 51 KEY MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2021

13.6 COMPETITIVE BENCHMARKING

13.6.1 COMPANY PRODUCT FOOTPRINT

FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE ADVANCED ANALYTICS MARKET

TABLE 218 COMPANY OFFERING FOOTPRINT

TABLE 219 COMPANY REGION FOOTPRINT

FIGURE 54 ADVANCED ANALYTICS: COMPETITIVE BENCHMARKING OF TOP 10 KEY PLAYERS

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 55 STARTUP/SME ADVANCED ANALYTICS MARKET EVALUATION QUADRANT, 2021

13.8 STARTUP/SME COMPETITIVE BENCHMARKING

13.8.1 COMPANY PRODUCT FOOTPRINT

FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF STARTUP/SME IN THE MARKET

FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF STARTUP/SME IN THE MARKET

TABLE 220 STARTUP/SME COMPANY OFFERING FOOTPRINT

TABLE 221 STARTUP/SME COMPANY REGION FOOTPRINT

TABLE 222 MARKET: DETAILED LIST OF KEYS STARTUP/SMES

FIGURE 58 ADVANCED ANALYTICS: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES

TABLE 223 MARKET: PRODUCT LAUNCHES, APRIL 2020–AUGUST 2021

13.9.2 DEALS

TABLE 224 ADVANCED ANALYTICS MARKET: DEALS, MAY 2019–OCTOBER 2021

14 COMPANY PROFILES (Page No. - 262)

14.1 INTRODUCTION

(Business and Financial Overview, Solutions/ Services Offered, Recent Developments, COVID-19 development, and MnM View)*

14.2 IBM

TABLE 225 IBM: BUSINESS AND FINANCIAL OVERVIEW

FIGURE 59 IBM: COMPANY SNAPSHOT

TABLE 226 IBM: SOLUTIONS OFFERED

TABLE 227 IBM: SERVICES OFFERED

TABLE 228 IBM: DEALS

14.3 ORACLE

TABLE 229 ORACLE: BUSINESS OVERVIEW

FIGURE 60 ORACLE: COMPANY SNAPSHOT

TABLE 230 ORACLE: SOLUTIONS OFFERED

TABLE 231 ORACLE: SERVICES OFFERED

TABLE 232 ORACLE: DEALS

14.4 SAS INSTITUTE

TABLE 233 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 61 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 234 SAS INSTITUTE: SOLUTIONS OFFERED

TABLE 235 SAS INSTITUTE: DEALS

14.5 SAP

TABLE 236 SAP: BUSINESS OVERVIEW

FIGURE 62 SAP: COMPANY SNAPSHOT

TABLE 237 SAP: SOLUTIONS OFFERED

TABLE 238 SAP: SERVICES OFFERED

TABLE 239 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 240 SAP: DEALS AND OTHERS

14.6 FICO

TABLE 241 FICO: BUSINESS OVERVIEW

FIGURE 63 FICO: COMPANY SNAPSHOT

TABLE 242 FICO: SOLUTIONS OFFERED

TABLE 243 FICO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 244 FICO: DEALS

14.7 KNIME

TABLE 245 KNIME: BUSINESS OVERVIEW

TABLE 246 KNIME: SOLUTIONS OFFERED

14.8 MICROSOFT

TABLE 247 MICROSOFT: BUSINESS OVERVIEW

FIGURE 64 MICROSOFT: COMPANY SNAPSHOT

TABLE 248 MICROSOFT: SOLUTIONS OFFERED

TABLE 249 MICROSOFT: SERVICES OFFERED

TABLE 250 MICROSOFT: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 251 MICROSOFT: DEALS AND OTHERS

14.9 ALTAIR

TABLE 252 ALTAIR: BUSINESS OVERVIEW

FIGURE 65 ALTAIR: COMPANY SNAPSHOT

TABLE 253 ALTAIR: SOLUTIONS OFFERED

TABLE 254 ALTAIR: SERVICES OFFERED

TABLE 255 ALTAIR: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 256 ALTAIR: DEALS

14.10 RAPIDMINER

TABLE 257 RAPIDMINER: BUSINESS OVERVIEW

TABLE 258 RAPIDMINER: SOLUTIONS OFFERED

TABLE 259 RAPIDMINER: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 260 RAPIDMINER: DEALS

14.11 AWS

TABLE 261 AWS: BUSINESS OVERVIEW

FIGURE 66 AWS: COMPANY SNAPSHOT

TABLE 262 AWS: SOLUTION OFFERED

TABLE 263 AWS: SERVICES OFFERED

TABLE 264 AWS: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 265 AWS: DEALS

Business and Financial Overview, Solutions/ Services Offered, Recent Developments, COVID-19 development, and MnM View might not be captured in case of unlisted companies.

14.12 SALESFORCE

14.13 TIBCO SOFTWARE

14.14 ALTERYX

14.15 TERADATA

14.16 ADOBE

14.17 ABSOLUTDATA ANALYTICS

14.18 MOODY’S ANALYTICS

14.19 QLIK

14.20 DATABRICKS

14.21 DATAIKU

14.22 KINETICA

14.23 SMES/STARTUP COMPANIES

14.23.1 H2O.AI

14.23.2 DOMINO DATA LAB

14.23.3 DATAROBOT

14.23.4 DATACHAT

14.23.5 IMPLY

14.23.6 PROMETHIUM

14.23.7 SIREN

14.23.8 TELLIUS

14.23.9 SOTA SOLUTIONS

14.23.10 VANTI ANALYTICS

15 ADJACENT AND RELATED MARKETS (Page No. - 315)

15.1 INTRODUCTION

15.2 SPEECH ANALYTICS MARKET - GLOBAL FORECAST TO 2025

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Speech analytics market, by component

TABLE 266 SPEECH ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 267 SPEECH ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.2.2.2 Speech analytics market, by service

TABLE 268 SPEECH ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 269 SPEECH ANALYTICS MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

15.2.2.3 Speech analytics market, by application

TABLE 270 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 271 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.2.2.4 Speech analytics market, by deployment mode

TABLE 272 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 273 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

15.2.2.5 Speech analytics market, by organization size

TABLE 274 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 275 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.2.2.6 Speech analytics market, by vertical

TABLE 276 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 277 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

15.2.2.7 Speech analytics market, by region

TABLE 278 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 279 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15.3 PREDICTIVE ANALYTICS MARKET - GLOBAL FORECAST TO 2026

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Predictive analytics market, by component

TABLE 280 PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 281 PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

15.3.2.2 Predictive analytics market, by solution

TABLE 282 PREDICTIVE ANALYTICS MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 283 PREDICTIVE ANALYTICS MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

15.3.2.3 Predictive analytics market, by service

TABLE 284 PREDICTIVE ANALYTICS MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 285 PREDICTIVE ANALYTICS MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

15.3.2.4 Predictive analytics market, by deployment mode

TABLE 286 PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 287 PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

15.3.2.5 Predictive analytics market, by organization size

TABLE 288 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 289 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

15.3.2.6 Predictive analytics market, by vertical

TABLE 290 PREDICTIVE ANALYTICS MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 291 PREDICTIVE ANALYTICS MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

15.3.2.7 Predictive analytics market, by region

TABLE 292 PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 293 PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 329)

16.1 INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The research study for the advanced analytics market involved extensive secondary sources, directories, and several journals, including International Journal of Data Analytics (IJDA), Journal of Big Data Analytics in Transportation, and International Journal of Business Analytics (IJBAN). Primary sources were industry experts from the core and related industries, preferred advanced analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Advanced analytics spending of various countries was extracted from the respective sources. Secondary research was used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionalities, applications, verticals, and regions, and key developments from both market-and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and advanced analytics expertise; related key executives from advanced analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using advanced analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of advanced analytics solutions and services, which would impact the overall advanced analytics market.

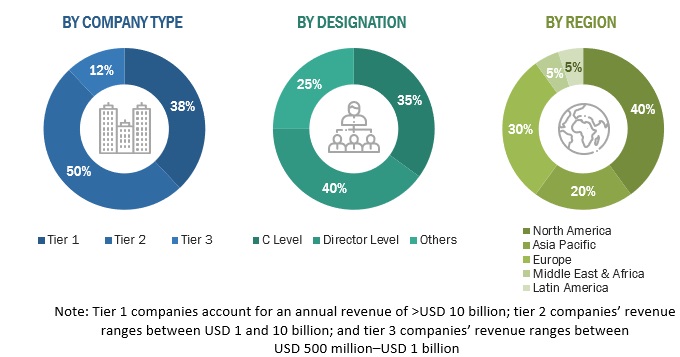

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the Advanced Analytics market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sales of solutions and services.

Key market players were not limited to such as IBM (US), Oracle (US), SAS Institute (US), SAP (Germany), FICO (US), KNIME (Switzerland), Microsoft (US), Altair (US), RapidMiner (US), AWS (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Teradata (US), Adobe (US), Absolutdata (US), Moody’s Analytics (US), Qlik (US), Databricks (US), Dataiku (US), Kinetica (US), H2O.ai (US), Domino Data Lab (US), DataRobot (US), DataChat (US), Imply (US), Promethium (US), Siren (Ireland), Tellius (US), SOTA Solutions (Germany), and Vanti Analytics.

The market players were identified through extensive secondary research, and their revenue contribution in respective regions was determined through primary and secondary research.

- The entire procedure included studying annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Advanced Analytics market by component (solution and services), type, business function, organization size, deployment mode, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Advanced Analytics market

- To analyze the impact of the COVID-19 pandemic on the Advanced Analytics market

Advanced Analytics Tools Market & Its Impact on the Advanced Analytics Market:

The Advanced Analytics tools market is a subset of the larger Advanced Analytics Market. The Advanced Analytics Market encompasses all products and services related to advanced analytics, including tools, software, platforms, and services used for data analysis, statistical modeling, predictive analytics, and data mining.

The Advanced Analytics tools market is expected to have a significant impact on the Advanced Analytics Market in several ways:

- Increased adoption of advanced analytics: The availability of powerful and easy-to-use advanced analytics tools is likely to lead to increased adoption of advanced analytics solutions by businesses of all sizes. This, in turn, will drive the growth of the overall Advanced Analytics Market.

- Greater efficiency in data analysis: Advanced analytics tools can automate data analysis processes and provide insights into complex data sets quickly and accurately. This will lead to greater efficiency in data analysis, enabling businesses to make data-driven decisions faster.

- Increased competition among vendors: As the Advanced Analytics tools market grows, more vendors are likely to enter the market, leading to increased competition. This competition is likely to result in better quality tools, more features, and lower prices, benefiting businesses and consumers alike.

- Greater customization and flexibility: Advanced analytics tools can be customized to meet the specific needs of different industries and businesses. As the Advanced Analytics tools market grows, vendors are likely to offer more customization options, leading to greater flexibility in the tools available.

Overall, the growth of the Advanced Analytics tools market is likely to lead to increased adoption of advanced analytics solutions, greater efficiency in data analysis, increased competition among vendors, and greater customization and flexibility in the tools available, all of which will have a positive impact on the Advanced Analytics Market.

New Business Opportunities in Advanced Analytics Tools Market:

The Advanced Analytics tools market presents several new business opportunities, including:

- Development of specialized tools: As the demand for advanced analytics tools grows, there is an opportunity for businesses to develop specialized tools to meet the specific needs of different industries and businesses. For example, there may be a demand for advanced analytics tools that are specifically designed for healthcare, finance, or retail.

- Integration with other technologies: There is an opportunity for businesses to develop advanced analytics tools that can integrate with other technologies, such as artificial intelligence (AI), machine learning (ML), and big data platforms. These integrations can enhance the capabilities of advanced analytics tools and provide businesses with more comprehensive insights.

- Cloud-based tools: There is an increasing trend towards cloud-based tools in the Advanced Analytics Market. Businesses can take advantage of this trend by developing cloud-based advanced analytics tools that offer scalability, cost-effectiveness, and ease of use.

- Consulting services: As businesses adopt advanced analytics tools, there is likely to be a demand for consulting services to help businesses optimize their use of these tools. Businesses can offer consulting services to help other businesses implement and use advanced analytics tools effectively.

- Mobile apps: There is an opportunity for businesses to develop mobile apps that offer advanced analytics capabilities, allowing businesses to access insights on-the-go. This can be particularly useful for sales teams, field workers, and other professionals who need access to data and insights while working remotely.

Overall, the Advanced Analytics tools market presents several new business opportunities for businesses to develop specialized tools, integrate with other technologies, offer consulting services, and develop mobile apps, among other possibilities.

Some of the top companies in the Advanced Analytics tools market are SAS Institute Inc, IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Alteryx Inc., Tableau Software Inc., QlikTech International AB, TIBCO Software Inc., and Teradata Corporation.

Industries Getting Impacted in the Future by Advanced Analytics Tools Market:

The Advanced Analytics tools market is expected to impact various industries in the future, including:

- Healthcare: Advanced analytics tools can help healthcare providers analyze patient data and develop personalized treatment plans.

- Finance: Advanced analytics tools can help financial institutions analyze customer data, detect fraud, and improve risk management.

- Retail: Advanced analytics tools can help retailers analyze customer data, optimize pricing strategies, and improve supply chain management.

- Manufacturing: Advanced analytics tools can help manufacturers analyze production data, optimize processes, and improve quality control.

- Energy: Advanced analytics tools can help energy companies analyze data from smart meters, optimize energy production, and improve energy efficiency.

Future Advanced Analytics Tools Market Trends:

Some of the future Advanced Analytics tools market trends are:

- Augmented Analytics: The use of augmented analytics, which leverages machine learning and AI to automate the analytics process, will become increasingly prevalent.

- Cloud-Based Analytics: Cloud-based analytics will continue to grow in popularity as businesses look to reduce costs and increase scalability. Cloud-based analytics solutions offer flexibility and can be easily integrated with other cloud-based tools and services.

- Embedded Analytics: Embedded analytics, which integrates analytics capabilities directly into business applications and workflows, will become more widespread.

- Natural Language Processing: Natural language processing (NLP) capabilities will become increasingly important in Advanced Analytics tools. NLP enables users to interact with analytics tools using natural language, making it easier for business users to access and understand data.

- Predictive Maintenance: Predictive maintenance, which uses advanced analytics to predict equipment failure before it occurs, will become more prevalent in industries such as manufacturing and energy.

- Edge Analytics: Edge analytics, which processes data on devices at the edge of a network rather than in the cloud, will become more important in industries such as healthcare and manufacturing.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Advanced Analytics market

- Further breakup of the European market