Agricultural Biologicals Market by Function, Product Type (Microbials, Macrobials, Semiochemicals, Natural products), Mode of Application (Foliar Spray, Soil and Seed treatment), Crop Type and Region - Global Forecast to 2028

Speak to Analyst to get the Global Forecasts Data up to 2028

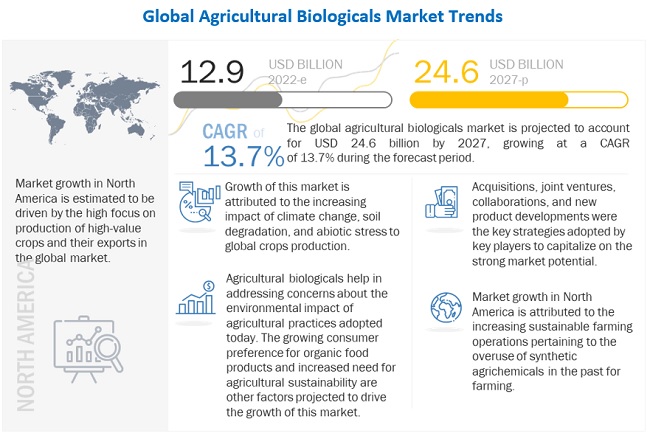

The global agricultural biologicals market in monetary terms was estimated to be worth $12.9 billion in 2022 and is poised to reach $24.6 billion by 2027, growing at a CAGR of 13.7% from 2022 to 2027. The agricultural biologicals market refers to the market for biological products used in agriculture. These products include microorganisms, enzymes, and biochemicals, as well as biofertilizers, biopesticides, and biostimulants. The market is driven by increasing demand for sustainable and environmentally friendly farming practices, as well as by growing awareness of the benefits of these products for crop health and yield. The increasing use of biopesticides and biofertilizers is also a major driver of the market, as they are seen as more environmentally friendly alternatives to traditional chemical pesticides and fertilizers. The market is also driven by growing concerns about food security and the need to increase crop yields to meet the demands of a growing global population.

Strong initiatives toward organic farming and the increasing awareness of environmental protection have encouraged the demand for agricultural biologicals in the agriculture industry. Factors such as degrading soil health due to the increasing usage of chemical-based crop protection methods, decreased productivity, and rising instances of pest infestations are the key factors contributing to the growth of the biologicals segment for crop protection and crop enhancement.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising trend for organically produced foods amongst consumers driving the demands for biologicals

Organic farming enables the production of high-quality, certified, controlled, and safe food. Consequently, it provides high economic and environmental benefits and preserves a healthy ecosystem. The interest of consumers in organic agricultural production has been growing at an unprecedented rate over the last few years. Rising consumers' awareness about the increasing use of pesticides and fertilizers in farm-grown vegetables has led to increased adoption of organic food products. According to a study by the Organic Trade Association in 2019, organic food products accounted for 90% of the overall organic product industry.

Restraint: Technological and environmental constraints for the use of biologicals

Agricultural biologicals have a short/limited shelf life and a high probability of contamination. One of the major problems in agricultural inoculation technology is the survival of microorganisms during storage; the other problematic parameters include direct exposure to sunlight, culture mediums, physiological state of the microorganisms when harvested, temperature maintenance during storage, and water activity inoculants that influence their shelf life.

Another problem while adding microbial inoculants to the soil is compatibility with other agricultural products, such as fungicides and pesticides. Different products can produce different results in terms of compatibility with agricultural microbials. Biofertilizers are generally mixed with fertilizers, as there may be compatibility issues between the chemicals used in fertilizers and biofertilizers.

Opportunity: Increasing importance of sustainable food production globally

Food companies are taking notice of this environment, and efforts such as “Field to Market or Farm to Table” are defining sustainable farming. The concept of bio-farming is actively gaining pace as it is based on the use of organic and biofertilizers (natural and manufactured) instead of using chemical fertilizers as well as the use of safe green pesticides and pesticides. By adopting sustainable practices, farmers reduce their reliance on non-renewable energy, reduce chemical use and save scarce resources. Keeping the land healthy and replenished can go a long way when considering the rising population and demand for food. Food companies are stepping up their sustainable efforts, collaborating with their suppliers, and fine-tuning their business models.

Challenge: High preference for agrochemicals among farmers across regions to inhibit the market growth

There are various advantages of adopting agricultural biologicals. Biologicals do not pose a risk to the other organisms that are beneficial to the growth of the crop but only target specific pests and related species. It also does not harm the farmers and offers the benefits of short field Restricted-Entry Interval (REI), due to which farmers can access the fields frequently. However, there are certain barriers to the adoption of biologicals. For instance, the conventional pesticide and fertilizer market is well-established and has various products in the market. Farmers are risk-averse to adopting biologicals, as they are accustomed to the use of conventional pesticides and fertilizers due to the perception of higher yield. In addition, farmers have a perception that biologicals are costlier than conventional products, which also poses a challenge to the adoption of biologicals.

The Biocontrol segment is estimated to account for the largest market share in the Agricultural Biologicals market.

Biocontrol involves using living organisms, such as insects, pathogens, or even grazing animals, to suppress weed infestation or plant diseases. Biocontrol is a broader term that includes biopesticides, biofungicides, bionematicides, and other biological methods of controlling plant pests. Key players such as BASF (Germany), Bayer (Germany), and Syngenta (Switzerland) are focusing on acquiring niche biopesticide companies to establish a strong presence in the biologicals sector. Also, these players are capitalizing on major deals, including R&D, new product launches, and distribution agreements, to strengthen their global presence in the biologicals market. With the growing importance of organic farming and sustainable agriculture, the market for biocontrol is projected to increase during the forecast period.

The Microbial subsegment in the product type segment is projected to account for the fastest growth during the forecast period.

Microbial biological control agents (MBCAs) have three distinct characteristics that make them interesting to farmers: (i) resistance management, (ii) restricted entry intervals, and (iii) residues. Because most MBCAs have numerous modes of action, there is less chance of a virus, insect, or weed developing resistance. As a result, MBCAs are a valuable tool in Integrated Pest Management (IPM) programs, where synergistic effects can be used to reduce chemical input or restore efficacy.

The foliar spray segment is estimated to account for the largest market share in the market during the forecast period.

Foliar sprays are absorbed 20 times faster by plants than soil-applied nutrients. Foliar applications aid plants in compensating for soil deficiencies such as low fertility and low soil temperature during the growing season. Plants that are subjected to other types of stress, such as drought, heat, cold, mechanical or insect damage, or diseases, benefit from foliar. Foliar feeding can be scheduled to encourage and/or enhance key stages of the plant’s life cycle, such as seedling emergence, rapid growth phases, blooming, fruiting, and seed development. Many crops benefit from 6-8 sprays of foliar feeding per season.

The fruits and vegetables segment is estimated to account for the fastest market growth in the Agricultural Biologicals market during the forecast period.

Fruits and vegetable cultivation is expensive, especially as they require irrigation and staking. Farmers are increasingly seeking items that can assist them in achieving consistently outstanding results. This is driving demand for biostimulants, which can increase crop quality by extending the shelf-life, improving color, and improving the shape of fruits and vegetables.

To know about the assumptions considered for the study, download the pdf brochure

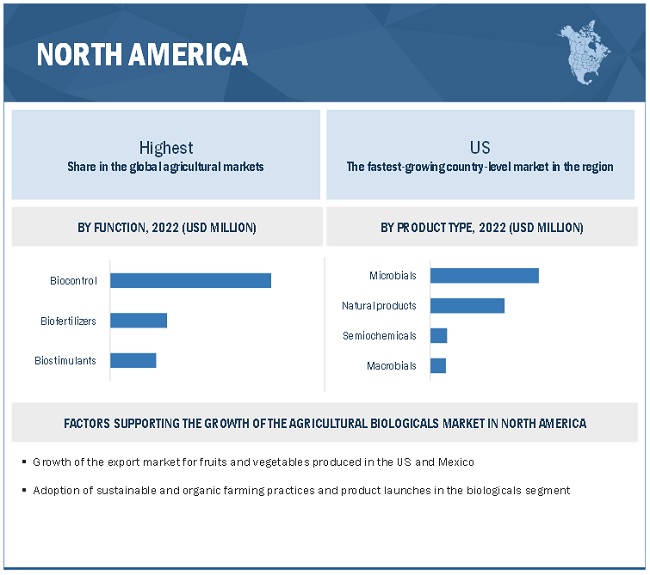

North America is projected to account for the largest share in the market during the forecast period.

Increasing acreage for field crops, such as wheat, cotton, and soybean, and the increasing case of infestation by plant pathogens on these crops are the key factors expected to drive the growth of the biocontrol market in this region. In addition, easy regulation frameworks for biopesticides registration in the US is one of the key factors driving the growth of the North American biocontrol market.

Key Market Players

The key players in this market include BASF (Germany), Syngenta (Switzerland), Bayer AG (Germany), UPL (India), Marrone Bio Innovation, Inc (US), Gowan Company (US), Vegalab SA (Switzerland), Lallemand Inc (Canada), Valent Bioscience (US), Koppert Biologicals System (Netherlands), Biovert S.L. (Spain), Trade Corporation International (Spain), Stockton Bio AG (Israel), Biolchim SPA (Italy), and Rhizobacter (Argentina). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

Function, Product type, Mode of Application, Crop Type, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

BASF (Germany), Syngenta (Switzerland), Bayer AG (Germany), UPL (India), Marrone Bio Innovation, Inc (US), Gowan Company (US), Vegalab SA (Switzerland) |

|

Major driving factors |

|

This research report categorizes the Agricultural Biologicals market based on type, application, form, source, and region.

Based on Function, the market has been segmented as follows:

- Biocontrol

- Biostimulants

- Biofertilizers

Based on Product type, the market has been segmented as follows:

- Microbials

- Macrobials

- Semiochemicals

- Natural Products

Based on the Mode of Application, the market has been segmented as follows:

- Foliar spray

- Soil treatment

- Seed treatment

Based on the Crop type, the market has been segmented as follows:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and vegetables

- Other crop types

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & Africa)

Recent Developments

- In October 2021, BASF collaborated with Vipergen, a global leader in research services, to apply technology to discover new active ingredients for sustainable crop protection products more efficiently and quickly.

- In October 2020, Syngenta Group announced the acquisition of Valagro, a leading biologicals company. Valagro would continue to operate as an independent brand in the market within the Syngenta Crop Protection business. Valagro’s well-established portfolio in biostimulants and specialty nutrients would complement both Syngenta Crop Protection's current range of biostimulants and biocontrols, as well as its future pipeline of biological solutions.

- In February 2020, Bayer AG collaborated with Meiogenix (France) to focus on agricultural research & development using plant breeding and genome editing technologies.

- In October 2021, UPL announced a long-term strategic collaboration with Chr. Hansen, a global bioscience company, to develop microbial-based BioSolutions (including biostimulants and biopesticides) that would help growers around the world fight pests and diseases and improve crop quality and yields.

- In August 2021, Marrone Bio Innovation’s collaboration with Terramera would provide a unique platform to bring existing and new biologicals to market supported by Terramera’s artificial intelligence-based screening platform of novel adjuvants, Plant Intelligence Engine, and Actigate technology, proprietary green chemistry that delivers active ingredients directly into target cells.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Agricultural Biologicals Market?

The global agricultural biologicals market size is projected to reach USD 24.6 billion by 2027.

What is the estimated growth rate (CAGR) of the global Agricultural Biologicals Market for the next five years?

The global agricultural biologicals market is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2022 to 2027.

What are the major revenue pockets in the Agricultural Biologicals Market currently?

The agricultural biologicals market is growing in North America due to the increasing applications in the agricultural sector for the adoption in fields, vegetables, and fruit crops. The governments in the North American region have made the registration of biopesticides products more efficient through the development of modified test methodologies and clear guidance documents. This helps key companies to develop new products and register them before commercialization.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.1.1 MARKET DEFINITION

1.2 MARKET SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 GEOGRAPHIC SCOPE

1.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 2 KEY DATA FROM PRIMARY SOURCES

2.1.2.1 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON END USER, BY REGION)

2.2.2 APPROACH TWO (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 6 COVID-19: THE GLOBAL PROPAGATION

FIGURE 7 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 8 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 9 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 10 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 58)

TABLE 3 AGRICULTURAL BIOLOGICALS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 11 MARKET FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET FOR AGRICULTURAL BIOLOGICALS, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET FOR AGRICULTURAL BIOLOGICALS, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET FOR AGRICULTURAL BIOLOGICALS, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET FOR AGRICULTURAL BIOLOGICALS: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 BRIEF OVERVIEW OF THE AGRICULTURAL BIOLOGICALS MARKET

FIGURE 16 SHIFT TOWARD SUSTAINABLE AGRICULTURE DRIVES THE GROWTH OF THE MARKET

4.2 MARKET FOR AGRICULTURAL BIOLOGICALS, BY REGION

FIGURE 17 NORTH AMERICA TO DOMINATE THE AGRICULTURAL BIOLOGICALS MARKET FROM 2022 TO 2027 (USD MILLION)

FIGURE 18 EUROPE TO GROW AT A SIGNIFICANT CAGR FROM 2022 TO 2027 (KT)

4.3 MARKET FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION

FIGURE 19 BIOCONTROL SEGMENT IS ESTIMATED TO BE THE LARGEST THROUGHOUT THE FORECAST PERIOD (USD MILLION)

FIGURE 20 BIOSTIMULANTS ARE PROJECTED TO GROW AT A SIGNIFICANT CAGR THROUGHOUT THE FORECAST PERIOD (KT)

4.4 MARKET FOR AGRICULTURAL BIOLOGICALS, BY PRODUCT TYPE

FIGURE 21 MICROBIAL-BASED AGRICULTURAL BIOLOGICALS ARE ESTIMATED TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD (USD MILLION)

4.5 MARKET FOR AGRICULTURAL BIOLOGICALS, BY MODE OF APPLICATION

FIGURE 22 THE FOLIAR SPRAY SEGMENT IS ESTIMATED TO BE THE LARGEST THROUGHOUT THE FORECAST PERIOD (USD MILLION)

4.6 MARKET FOR AGRICULTURAL BIOLOGICALS, BY CROP TYPE

FIGURE 23 THE APPLICATION OF AGRICULTURAL BIOLOGICALS IN FRUITS & VEGETABLES IS ESTIMATED TO BE THE LARGEST THROUGHOUT THE FORECAST PERIOD (USD MILLION)

4.7 NORTH AMERICA: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION AND KEY COUNTRY

FIGURE 24 THE BIOCONTROL SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN AGRICULTURAL BIOLOGICALS MARKET IN 2022

FIGURE 25 MARKETS IN THE US, BRAZIL, AND FRANCE ARE PROJECTED TO GROW AT THE HIGHEST RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 MACRO INDICATORS

5.2.1 INCREASE IN ORGANIC AGRICULTURAL PRACTICES

FIGURE 26 GLOBAL ORGANIC AGRICULTURE, BY REGION, 2019

FIGURE 27 TOP TEN COUNTRIES WITH HIGHEST INCREASE IN AREAS UNDER ORGANIC LANDS, 2019 (HECTARES)

5.3 MARKET DYNAMICS

FIGURE 28 HIGH COSTS IN THE DEVELOPMENT OF SYNTHETIC CROP PROTECTION PRODUCTS TO DRIVE THE GROWTH OF THE MARKET

5.3.1 DRIVERS

5.3.1.1 Regulatory pressures and harmful effects associated with synthetic plant protection products

FIGURE 29 RISING PESTICIDES USAGE GLOBALLY, 2015–2019 (TONNES)

FIGURE 30 GLOBAL AGROCHEMICALS USAGE, BY TYPE, 2015–2019 (TONNES)

5.3.1.2 Rise in resistance development in various pest and insect species estimated to drive the consumption of natural biocontrol protection in agriculture

5.3.1.3 Rising trend for organically produced foods amongst consumers driving the demand for biologicals

FIGURE 31 GLOBAL CONSUMPTION OF ORGANIC FOOD AND BEVERAGE PRODUCTS, 2016-2022 (USD MILLION)

5.3.2 RESTRAINTS

5.3.2.1 Technological and environmental constraints for the use of biologicals

5.3.3 OPPORTUNITIES

5.3.3.1 Advancements in microbial research undertaken by key players across regions to drive the market growth

FIGURE 32 INCREASE IN PATENTS GRANTED FOR AGRICULTURAL BIOLOGICALS, 2015-2019

5.3.3.2 Increasing importance of sustainable food production globally

5.3.4 CHALLENGES

5.3.4.1 High preference for agrochemicals among farmers across regions to inhibit the market growth

5.3.4.2 Presence of counterfeit products in the market across regions inhibits the market growth

6 INDUSTRY TRENDS (Page No. - 77)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 SOURCING AND PRODUCTION

6.2.3 PROCESSING AND MANUFACTURING

6.2.4 MARKETING, SALES, LOGISTICS, AND RETAIL

FIGURE 33 VALUE CHAIN ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET: SOURCING AND PRODUCTION KEY CONTRIBUTORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 34 SUPPLY CHAIN ANALYSIS

6.4 PATENT ANALYSIS

FIGURE 35 NUMBER OF PATENTS APPROVED FOR AGRICULTURAL BIOLOGICALS IN THE GLOBAL MARKET, 2011–2021

FIGURE 36 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR AGRICULTURAL BIOLOGICALS, 2016-2022

TABLE 4 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL BIOLOGICALS, 2020–2021

6.5 MARKET ECOSYSTEM

FIGURE 37 AGRICULTURAL BIOLOGICALS: ECOSYSTEM VIEW

FIGURE 38 AGRICULTURAL BIOLOGICALS: MARKET MAP

6.6 TRADE ANALYSIS

FIGURE 39 IMPORT DATA OF BIOFERTILIZERS FOR KEY COUNTRIES, 2016–2020 (THOUSAND USD)

FIGURE 40 EXPORT DATA OF BIOFERTILIZERS FOR KEY COUNTRIES, 2016–2020 (THOUSAND USD)

6.7 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 5 MARKET FOR AGRICULTURAL BIOLOGICALS: DETAILED LIST OF CONFERENCES & EVENTS

6.8 TECHNOLOGY ANALYSIS

6.8.1 TECHNOLOGICAL ADVANCEMENTS FOR LIQUID BIOFERTILIZERS

6.9 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE AGRICULTURAL BIOLOGICAL MARKET

FIGURE 41 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE AGRICULTURAL BIOLOGICAL MARKET

6.10 PRICING ANALYSIS

6.10.1 INTRODUCTION

FIGURE 42 PRICING ANALYSIS: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017-2021 (USD PER/TON)

FIGURE 43 BIOCONTROL: PRICING ANALYSIS FOR PEA PROTEIN MARKET, BY REGION, 2017-2021 (USD PER/TON)

FIGURE 44 BIOFERTILIZERS: PRICING ANALYSIS FOR PEA PROTEIN MARKET, BY REGION, 2017-2021 (USD PER/TON)

FIGURE 45 BIOSTIMULANTS: PRICING ANALYSIS FOR PEA PROTEIN MARKET, BY REGION, 2017-2021 (USD PER/TON)

6.11 CASE STUDY ANALYSIS

6.11.1 INCREASE IN DEMAND FOR EASY-TO-USE INOCULANTS BY CONSUMERS

TABLE 6 IDENTIFICATION OF MARKET OPPORTUNITIES FOR AGRICULTURAL BIOLOGICALS IN NORTH AMERICA

6.11.2 HIGH ADOPTION OF ORGANIC GROWTH STRATEGIES BY KEY PLAYERS

6.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS

6.12.1 DEGREE OF COMPETITION

6.12.2 THREAT OF NEW ENTRANTS

6.12.3 THREAT OF SUBSTITUTES

6.12.4 BARGAINING POWER OF SUPPLIERS

6.12.5 BARGAINING POWER OF BUYERS

6.12.6 INTENSITY OF COMPETITIVE RIVALRY

6.13 REGULATORY FRAMEWORK

6.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.13.2 US

6.13.3 CANADA

6.13.3.1 Laboratory Services

6.13.4 EUROPE

6.13.5 INDIA

6.13.6 AUSTRALIA

7 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION (Page No. - 107)

7.1 INTRODUCTION

FIGURE 46 GLOBAL FRUITS AND VEGETABLES PRODUCTION, 2015 – 2018 (USD BILLION)

FIGURE 47 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

TABLE 11 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 12 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 13 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION, 2017–2020 (KT)

TABLE 14 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY FUNCTION, 2021–2027 (KT)

7.1.1 AGRICULTURAL BIOLOGICAL MARKET: COVID-19 IMPACT ANALYSIS - BY FUNCTION

TABLE 15 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

TABLE 16 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

TABLE 17 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

7.2 CROP PROTECTION

7.2.1 INCREASING DEMAND FOR SUSTAINABLE AGRICULTURAL PRACTICES IS DRIVING THE MARKET GROWTH

TABLE 18 BIOLOGICAL CROP PROTECTION METHODS

7.2.2 BIOCONTROL

7.2.2.1 The usage of biocontrol methods in integrated pest management programs is projected to drive the growth of the market

TABLE 19 APPROACHES OF BIOCONTROL

TABLE 20 BIOCONTROL: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 BIOCONTROL: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 22 BIOCONTROL: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (KT)

TABLE 23 BIOCONTROL: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (KT)

7.3 CROP ENHANCEMENT

7.3.1 BIOFERTILIZERS

7.3.1.1 The ability of biofertilizers to enhance the fertility of the soil, crop productivity, and tolerance is a major factor that fuels their demand

TABLE 24 BIOFERTILIZERS: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 BIOFERTILIZERS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 26 BIOFERTILIZERS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (KT)

TABLE 27 BIOFERTILIZERS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (KT)

7.3.2 BIOSTIMULANTS

7.3.2.1 The increase in seaweed production in Europe to drive the biostimulants market in the region

TABLE 28 MAJOR SOURCES OF BIOSTIMULANTS

TABLE 29 BIOSTIMULANTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 BIOSTIMULANTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 31 BIOSTIMULANTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (KT)

TABLE 32 BIOSTIMULANTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (KT)

8 AGRICULTURAL BIOLOGICALS MARKET, BY PRODUCT TYPE (Page No. - 120)

8.1 INTRODUCTION

FIGURE 48 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 34 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.1.1 AGRICULTURAL BIOLOGICAL MARKET: COVID-19 IMPACT ANALYSIS - BY PRODUCT TYPE

TABLE 35 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICALS MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

TABLE 36 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

TABLE 37 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

8.2 MICROBIALS

8.2.1 THE ABILITY TO INCREASE THE NUTRIENT AVAILABILITY IN THE SOIL AND ENHANCE PLANT YIELD TO DRIVE THE GROWTH OF THE MICROBIALS SEGMENT

TABLE 38 MICROBIALS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 MICROBIALS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

8.3 MACROBIALS

8.3.1 REQUIREMENT FOR HIGH-END DISTRIBUTION LOGISTICS AND SHORT SHELF-LIFE HAMPER THE GROWTH OF MACROBIALS

TABLE 40 MACROBIALS: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 MACROBIALS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

8.4 SEMIOCHEMICALS

8.4.1 THE FEATURES OF NON-TOXICITY, SPECIES-SPECIFIC, AND EFFICIENCY ARE EXPECTED TO DRIVE THE DEMAND FOR SEMIOCHEMICALS

TABLE 42 SEMIOCHEMICALS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 SEMIOCHEMICALS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

8.5 NATURAL PRODUCTS

8.5.1 WIDE APPLICATION AND USAGE AREAS OF NATURAL PRODUCTS TO DRIVE THEIR DEMAND

TABLE 44 NATURAL PRODUCTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 NATURAL PRODUCTS: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

9 AGRICULTURAL BIOLOGICALS MARKET, BY MODE OF APPLICATION (Page No. - 130)

9.1 INTRODUCTION

FIGURE 49 AGRICULTURAL BIOLOGICAL MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 46 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

9.1.1 AGRICULTURAL BIOLOGICALS MARKET: COVID-19 IMPACT ANALYSIS - BY MODE OF APPLICATION

TABLE 48 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

TABLE 49 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

TABLE 50 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

9.2 FOLIAR SPRAY

9.2.1 FOLIAR SPRAYS ARE EFFECTIVE DUE TO THEIR DIRECT ACTION ON LEAVES AND INCREASED CROP YIELD

TABLE 51 BIOSTIMULANTS USED FOR VARIOUS CROPS

TABLE 52 FOLIAR SPRAY: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 FOLIAR SPRAY: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

9.3 SEED TREATMENT

9.3.1 SEED TREATMENT INCREASES YIELD, MINIMIZES STRESS, AND PROTECTS SEEDS FROM EARLY SEASON

TABLE 54 SEED TREATMENT: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 SEED TREATMENT: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

9.4 SOIL TREATMENT

9.4.1 BENEFITS OF REVIVING LOST AND DEGRADED SOIL HEALTH DRIVING THE USE OF SOIL TREATMENT BIOLOGICALS

TABLE 56 SOIL TREATMENT: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 SOIL TREATMENT: MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY REGION, 2021–2027 (USD MILLION)

10 AGRICULTURAL BIOLOGICALS MARKET, BY CROP TYPE (Page No. - 139)

10.1 INTRODUCTION

10.2 MACROINDICATORS

10.2.1 ADOPTION OF ORGANIC AGRICULTURAL CROPS GLOBALLY

FIGURE 50 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

10.2.2 BAN ON THE USE OF CHEMICAL-BASED PESTICIDES

FIGURE 51 AGRICULTURAL BIOLOGICAL MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 58 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 59 MARKET SIZE FOR AGRICULTURAL BIOLOGICALS, BY CROP TYPE, 2021–2027 (USD MILLION)

10.3 AGRICULTURAL BIOLOGICALS MARKET: COVID-19 IMPACT ANALYSIS - BY CROP TYPE

TABLE 60 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

TABLE 61 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

TABLE 62 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

10.4 CEREALS & GRAINS

10.4.1 WHEAT IS ONE OF THE MOST TARGETED CEREALS FOR PESTS

TABLE 63 COMMON PLANT DISEASES IN WHEAT

FIGURE 52 GLOBAL CEREAL PRODUCTION, 2015 – 2018 (USD BILLION)

TABLE 64 AGRICULTURAL BIOLOGICALS MARKET SIZE FOR CEREALS & GRAINS, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET SIZE FOR CEREALS & GRAINS, BY REGION, 2021–2027 (USD MILLION)

10.5 OILSEEDS & PULSES

10.5.1 THE DEMAND FOR BIOLOGICALS REMAINS HIGH TO ENHANCE THE SELF SUFFICIENCY IN PRODUCTION AND PRODUCTIVITY OF OILSEEDS AND PULSES

TABLE 66 MARKET SIZE FOR OILSEEDS & PULSES, BY REGION, 2017–2020 (USD MILLION)

TABLE 67MARKET SIZE FOR OILSEEDS AND PULSES, BY REGION, 2021–2027 (USD MILLION)

10.6 FRUITS & VEGETABLES

10.6.1 GROWING DEMAND FOR HIGH-QUALITY EXPORTS OF FRUITS AND VEGETABLES IS EXPECTED TO DRIVE THE DEMAND FOR BIOLOGICALS IN THE GLOBAL MARKET

FIGURE 53 GLOBAL FRUITS AND VEGETABLES PRODUCTION, 2015 – 2018 (USD BILLION)

TABLE 68 LIST OF BIOLOGICAL CONTROL AGENTS USED FOR THE MANAGEMENT OF INSECT PESTS OF VEGETABLE CROPS

TABLE 69 MAJOR CROPS AFFECTED BY ROOT-KNOT NEMATODES

TABLE 70 MARKET SIZE FOR FRUITS & VEGETABLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 AGRICULTURAL BIOLOGICAL MARKET SIZE FOR FRUITS AND VEGETABLES, BY REGION, 2021–2027 (USD MILLION)

10.7 OTHER CROP TYPES

10.7.1 BIOLOGICALS TO INCREASE THE QUALITY OF LAWNS, GOLF AND TURFGRASSES AND ALSO INCREASE TURF TOLERANCE TO ENVIRONMENTAL STRESS

TABLE 72 MARKET SIZE FOR OTHER CROP TYPES, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET SIZE FOR OTHER CROP TYPES, BY REGION, 2021–2027 (USD MILLION)

11 AGRICULTURAL BIOLOGICALS MARKET, BY REGION (Page No. - 154)

11.1 INTRODUCTION

FIGURE 54 THE US EXPECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE AGRICULTURAL BIOLOGICAL MARKET IN 2022

TABLE 74 GLOBAL AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 GLOBAL MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 76 GLOBAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 77 GLOBAL MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 78 GLOBAL MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 79 GLOBAL MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 80 GLOBAL MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 GLOBAL MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 82 GLOBAL MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 83 GLOBAL MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.2 AGRICULTURAL BIOLOGICAL MARKET: COVID-19 IMPACT ANALYSIS - BY REGION

TABLE 84 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 85 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 86 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE AGRICULTURAL BIOLOGICAL MARKET, BY REGION, 2019–2022 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 55 NORTH AMERICA: AGRICULTURAL BIOLOGICALS MARKET SNAPSHOT, 2022

TABLE 87 NORTH AMERICA: AGRICULTURAL BIOLOGICAL MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: AGRICULTURAL BIOLOGICAL MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.3.1 US

11.3.1.1 Favorable regulatory frameworks enabling convenient registration of biocontrol

TABLE 97 US: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 98 US: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increasing adoption of biological in greenhouses and support from the government for promoting integrated pest management practices

TABLE 99 CROPS INFESTED BY INSECT PESTS IN CANADA

TABLE 100 CANADA: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 101 CANADA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Demand for manure is expected to drive the growth of the biofertilizers segment

TABLE 102 MEXICO: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 103 MEXICO: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4 EUROPE

TABLE 104 EUROPE: AGRICULTURAL BIOLOGICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Increasing organic farming leading to a surge in demand for agricultural biologicals

TABLE 114 GERMANY: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 Increased government initiatives and favorable regulatory environment

TABLE 116 FRANCE: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4.3 SPAIN

11.4.3.1 Increased infestation of citrus leading to a surge in the use of biologicals

TABLE 118 VARIOUS CITRUS DISEASES CAUSED BY PATHOGENS

TABLE 119 SPAIN: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 120 SPAIN: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Increase in focus on integrated pest management

TABLE 121 ITALY: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 122 ITALY: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4.5 UK

11.4.5.1 Naturally occurring seaweed-based biofertilizers driving the growth of biofertilizers

TABLE 123 UK: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 124 UK: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.4.6 REST OF EUROPE

11.4.6.1 Increase in the production of vegetable crops to meet the growing domestic demand

TABLE 125 REST OF EUROPE: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 126 REST OF EUROPE: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.5 ASIA PACIFIC

TABLE 127 ASIA PACIFIC: AGRICULTURAL BIOLOGICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.5.1 CHINA

11.5.1.1 China’s pesticide reduction policies leading to increased recommendations for biological control

TABLE 137 CHINA: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 138 CHINA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.5.2 JAPAN

11.5.2.1 New product launches catering to the need for sustainable agriculture

TABLE 139 JAPAN: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Favorable government regulations driving the market for biocontrol, biofertilizers, and biopesticides

TABLE 141 BIOCONTROL USED AGAINST MAJOR PESTS IN INDIA

TABLE 142 INDIA: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 143 INDIA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.5.4 AUSTRALIA

11.5.4.1 Impact of pathogens on the Australian horticulture industry and Australian Government’s hefty investments

TABLE 144 AUSTRALIA: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 145 AUSTRALIA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.5.5 REST OF ASIA PACIFIC

11.5.5.1 Production of vegetable crops catering to the growing domestic demand

TABLE 146 REST OF ASIA PACIFIC: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.6 SOUTH AMERICA

FIGURE 56 SOUTH AMERICA: AGRICULTURAL BIOLOGICAL MARKET SNAPSHOT, 2022

TABLE 148 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 150 SOUTH AMERICA: MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 151 SOUTH AMERICA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 152 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 153 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 156 SOUTH AMERICA: MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 157 SOUTH AMERICA: MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Increasing awareness and adoption of organic methods for cultivation

TABLE 158 BRAZIL: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 159 BRAZIL: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Deteriorating agricultural conditions rapidly recovering with the use of biocontrol, biofertilizers, and agricultural technology solutions

TABLE 160 ARGENTINA: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 161 ARGENTINA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

11.6.3.1 Less nitrogen content in the soil driving the market for biofertilizers

TABLE 162 REST OF SOUTH AMERICA: AGRICULTURAL BIOLOGICAL MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 163 REST OF SOUTH AMERICA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.7 REST OF THE WORLD (ROW)

TABLE 164 ROW: AGRICULTURAL BIOLOGICALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 ROW: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 166 ROW: MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 167 ROW: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 168 ROW: MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 169 ROW: MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 170 ROW: MARKET, BY MODE OF APPLICATION, 2017–2020 (USD MILLION)

TABLE 171 ROW: MARKET, BY MODE OF APPLICATION, 2021–2027 (USD MILLION)

TABLE 172 ROW: MARKET, BY CROP TYPE, 2017–2020 (USD MILLION)

TABLE 173 ROW: MARKET, BY CROP TYPE, 2021–2027 (USD MILLION)

11.7.1 SOUTH AFRICA

11.7.1.1 Large number of organic farmers and supportive government policies to widen the scope of the biological industry

TABLE 174 SOUTH AFRICA: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 175 SOUTH AFRICA: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

11.7.2 OTHERS IN ROW

11.7.2.1 Countries looking forward to increasing agricultural outputs with sustainable farming practices and organic alternatives

TABLE 176 OTHERS IN ROW: AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 177 OTHERS IN ROW: MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 207)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

TABLE 178 AGRICULTURAL BIOLOGICALS MARKET: DEGREE OF COMPETITION

12.3 KEY PLAYER STRATEGIES

12.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 57 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.5.1 SYNGENTA AG

12.5.2 BASF SE

12.5.3 UPL

12.5.4 BAYER AG

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 58 AGRICULTURAL BIOLOGICALS MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.7 PRODUCT FOOTPRINT

TABLE 179 COMPANY, BY FUNCTION FOOTPRINT

TABLE 180 COMPANY, BY TYPE FOOTPRINT

TABLE 181 COMPANY, BY REGIONAL FOOTPRINT

TABLE 182 COMPANY: OVERALL FOOTPRINT

12.8 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 STARTING BLOCKS

12.8.3 RESPONSIVE COMPANIES

12.8.4 DYNAMIC COMPANIES

TABLE 183 AGRICULTURAL BIOLOGICALS: DETAILED LIST OF KEY START-UPS/SMES

FIGURE 59 AGRICULTURAL BIOLOGICALS: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

FIGURE 60 AGRICULTURAL BIOLOGICAL MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

12.9 COMPETITIVE SCENARIO

12.9.1 NEW PRODUCT LAUNCHES

TABLE 184 MARKET FOR AGRICULTURAL BIOLOGICALS: NEW PRODUCT LAUNCHES, JULY 2018–MARCH 2021

12.9.2 DEALS

TABLE 185 MARKET FOR AGRICULTURAL BIOLOGICALS: DEALS, JUNE 2018–OCTOBER 2021

12.9.3 OTHERS

TABLE 186 MARKET FOR AGRICULTURAL BIOLOGICALS: EXPANSIONS, MAY 2017

13 COMPANY PROFILES (Page No. - 227)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 BASF SE

TABLE 187 BASF SE: BUSINESS OVERVIEW

FIGURE 61 BASF SE: COMPANY SNAPSHOT

TABLE 188 BASF SE: PRODUCTS OFFERED

TABLE 189 BASF SE: NEW PRODUCT LAUNCHES

TABLE 190 BASF SE: DEALS

13.1.2 SYNGENTA AG

TABLE 191 SYNGENTA AG: BUSINESS OVERVIEW

FIGURE 62 SYNGENTA AG: COMPANY SNAPSHOT

TABLE 192 SYNGENTA AG: PRODUCTS OFFERED

TABLE 193 SYNGENTA AG: NEW PRODUCT LAUNCHES

TABLE 194 SYNGENTA AG: DEALS

13.1.3 BAYER AG

TABLE 195 BAYER AG: BUSINESS OVERVIEW

FIGURE 63 BAYER AG: COMPANY SNAPSHOT

TABLE 196 BAYER AG: PRODUCTS OFFERED

TABLE 197 BAYER AG: NEW PRODUCT LAUNCHES

TABLE 198 BAYER AG: DEALS

13.1.4 UPL

TABLE 199 UPL: BUSINESS OVERVIEW

FIGURE 64 UPL: COMPANY SNAPSHOT

TABLE 200 UPL: PRODUCTS OFFERED

TABLE 201 UPL: NEW PRODUCT LAUNCHES

TABLE 202 UPL: DEALS

13.1.5 MARRONE BIO INNOVATIONS, INC.

TABLE 203 MARRONE BIO INNOVATIONS, INC.: BUSINESS OVERVIEW

FIGURE 65 MARRONE BIO INNOVATIONS, INC.: COMPANY SNAPSHOT

TABLE 204 MARRONE BIO INNOVATIONS, INC.: PRODUCTS OFFERED

TABLE 205 MARRONE BIO INNOVATIONS, INC.: NEW PRODUCT LAUNCHES

TABLE 206 MARRONE BIO INNOVATIONS, INC.: DEALS

TABLE 207 MARRONE BIO INNOVATIONS, INC.: OTHERS

13.1.6 GOWAN COMPANY

TABLE 208 GOWAN COMPANY: BUSINESS OVERVIEW

TABLE 209 GOWAN COMPANY: PRODUCTS OFFERED

TABLE 210 GOWAN COMPANY: DEALS

13.1.7 VEGALAB SA

TABLE 211 VEGALAB SA.: BUSINESS OVERVIEW

TABLE 212 VEGALAB SA.: PRODUCTS OFFERED

13.1.8 LALLEMAND INC.

TABLE 213 LALLEMAND INC.: BUSINESS OVERVIEW

TABLE 214 LALLEMAND INC.: PRODUCTS OFFERED

TABLE 215 LALLEMAND INC.: NEW PRODUCT LAUNCHES

13.1.9 VALENT BIOSCIENCES LLC

TABLE 216 VALENT BIOSCIENCES LLC: BUSINESS OVERVIEW

TABLE 217 VALENT BIOSCIENCES LLC: PRODUCTS OFFERED

TABLE 218 VALENT BIOSCIENCES LLC: DEALS

TABLE 219 VALENT BIOSCIENCES LLC: OTHERS

13.1.10 KOPPERT BIOLOGICAL SYSTEM

TABLE 220 KOPPERT BIOLOGICAL SYSTEM: BUSINESS OVERVIEW

TABLE 221 KOPPERT BIOLOGICAL SYSTEM: PRODUCTS OFFERED

13.2 START-UPS/SMES/OTHER PLAYERS

13.2.1 BIOVERT S.L.

TABLE 222 BIOVERT S.L.: BUSINESS OVERVIEW

TABLE 223 BIOVERT S.L.: PRODUCTS OFFERED

TABLE 224 BIOVERT S.L.: NEW PRODUCT LAUNCHES

13.2.2 TRADE CORPORATION INTERNATIONAL

TABLE 225 TRADE CORPORATION INTERNATIONAL: BUSINESS OVERVIEW

TABLE 226 TRADE CORPORATION INTERNATIONAL: PRODUCTS OFFERED

TABLE 227 TRADECORP INTERNATIONAL: DEALS

TABLE 228 TRADECORP INTERNATIONAL: OTHERS

13.2.3 STOCKTON BIO-AG

TABLE 229 STOCKTON BIO-AG: BUSINESS OVERVIEW

TABLE 230 STOCKTON BIO-AG: PRODUCTS OFFERED

TABLE 231 STOCKTON BIO-AG: DEALS

13.2.4 BIOLCHIM SPA

TABLE 232 BIOLCHIM SPA: BUSINESS OVERVIEW

TABLE 233 BIOLCHIM SPA: PRODUCTS OFFERED

13.2.5 RIZOBACTER

TABLE 234 RIZOBACTER: BUSINESS OVERVIEW

TABLE 235 RIZOBACTER: PRODUCTS OFFERED

TABLE 236 RIZOBACTER: NEW PRODUCT LAUNCHES

TABLE 237 RIZOBACTER: DEALS

13.2.6 SYMBORG

13.2.7 VERDESIAN LIFE SCIENCES

13.2.8 AXEB BIOTECH

13.2.9 PLANT RESPONSE

13.2.10 PIVOT BIO

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 AGRICULTURAL BIOLOGICALS MARKET, CUSTOMIZATION DATA (Page No. - 284)

14.1 INTRODUCTION

TABLE 238 EUROPE: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 239 EUROPE: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 240 SPAIN: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 241 SPAIN: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 242 FRANCE: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 243 FRANCE: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 244 ITALY: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 245 ITALY: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 246 GERMANY: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 247 GERMANY: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 248 UK: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 249 UK: AGRICULTURAL BIOLOGICAL MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 250 REST OF EUROPE: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 251 REST OF EUROPE: AGRICULTURAL BIOLOGICAL MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

TABLE 252 SOUTH AFRICA: AGRICULTURAL BIOLOGICALS MARKET SIZE, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 253 SOUTH AFRICA: AGRICULTURAL BIOLOGICAL MARKET SIZE, BY FUNCTION, 2021–2027 (USD MILLION)

15 ADJACENT & RELATED MARKETS (Page No. - 289)

15.1 INTRODUCTION

15.2 BIOSTIMULANTS MARKET

15.2.1 LIMITATIONS

15.2.2 MARKET DEFINITION

15.2.3 MARKET OVERVIEW

15.2.4 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT

TABLE 254 BIOSTIMULANTS MARKET SIZE, BY ACTIVE INGREDIENT, 2016–2020 (USD MILLION)

TABLE 255 BIOSTIMULANTS MARKET SIZE, BY ACTIVE INGREDIENT, 2021–2026 (USD MILLION)

15.2.5 BIOSTIMULANTS MARKET, BY REGION

TABLE 256 BIOSTIMULANTS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 257 BIOSTIMULANTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

15.3 BIOFERTILIZERS MARKET

15.3.1 LIMITATIONS

15.3.2 MARKET DEFINITION

15.3.3 MARKET OVERVIEW

15.3.4 BIOFERTILIZERS MARKET, BY TYPE

TABLE 258 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 259 BIOFERTILIZERS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

15.3.5 BIOFERTILIZERS MARKET, BY REGION

TABLE 260 BIOFERTILIZERS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 261 BIOFERTILIZERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 297)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

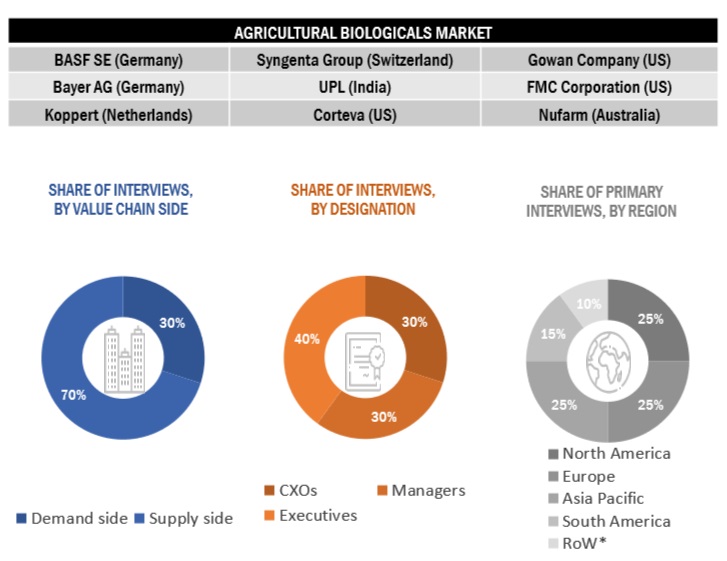

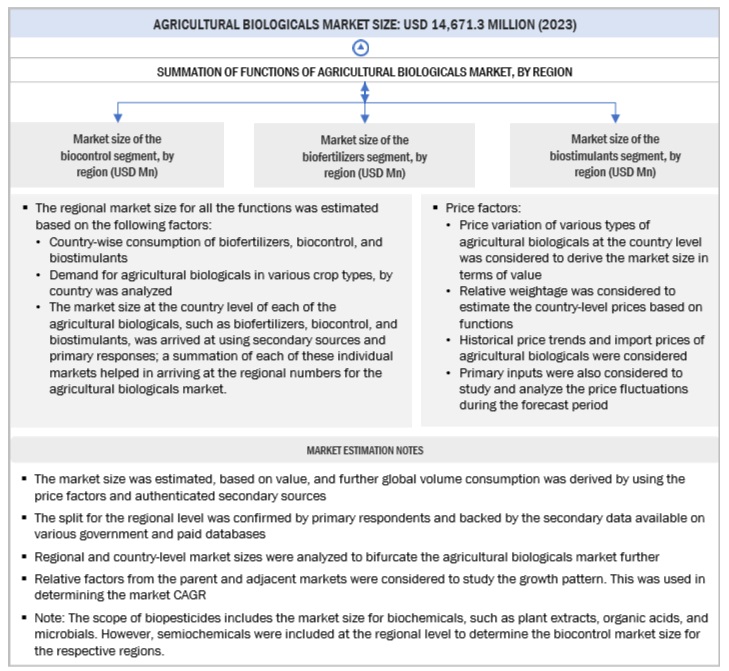

The study involved four major steps in estimating the size of the Agricultural Biologicals market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Biological Products Industry Alliance (BPIA), The Fertilizer Institute, EUVEPRO (European Vegetable Protein Association), Biopesticide Industry Alliance (BPIA), International Biocontrol Manufacturers Association (IBMA), Japan Biocontrol Association, US Environmental Protection Agency (US EPA) and the Saskatchewan Pulse Growers Association were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall Agricultural Biological market comprises several stakeholders in the supply chain, which include global and regional food producers, organic farmers, horticultural producers, food and beverage retailers, food safety regulation and inspection authorities. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional food products dealers and manufacturers, and plant-based beverage manufacturers. The primary sources from the supply side include manufacturers of food ingredients, Agricultural Biologicals processing units, research institutions involved in R&D, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

Top-Down

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the sizes of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the Agricultural Biological market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market sizes obtained for each segment.

Bottom-Up

- With the bottom-up approach, Agricultural Biologicals for each type, form, and application were added up to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on types in regions. From this, we derived the market sizes, in terms of volume, for each region and type of Agricultural Biologicals.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the Agricultural Biological market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

Global Agricultural Biologicals Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the overall Agricultural Biologicals and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the Agricultural Biologicals market, with respect to function, product type, mode of application, crop types and regional markets, over a five-year period, ranging from 2021 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the Agricultural Biologicals market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the Agricultural Biologicals market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Geographical Analysis

- Further breakdown of the Rest of Europe Agricultural Biologicals market, by key country

- Further breakdown of the Rest of Asia Pacific Agricultural Biologicals market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Biologicals Market