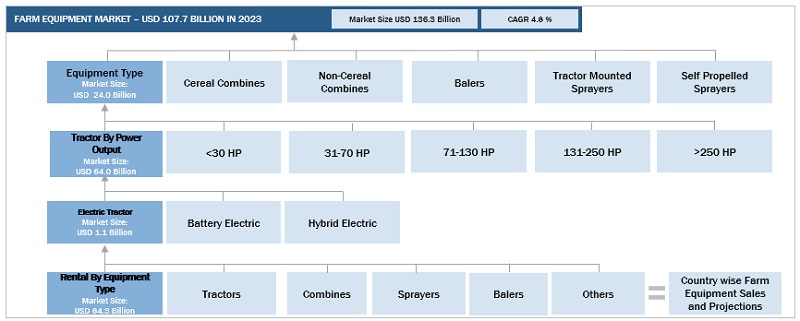

Farm Equipment Market by Tractor Power Output (<30, 31-70, 71-130, 131-250, >250HP), Tractor Drive Type, Autonomous Tractor, Electric Tractor (Hybrid, Electric), Farm Equipment (Combine, Baler, Sprayer), Implement, Rental & Region - Global Forecast to 2027

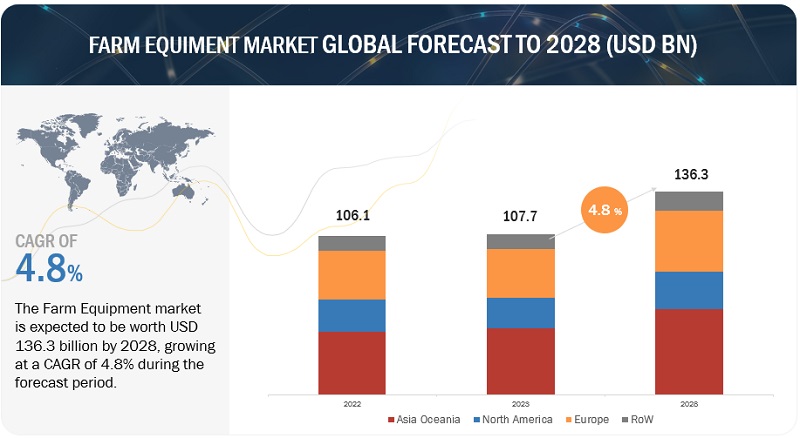

[349 Pages Report] The global farm equipment market is projected to grow from USD 111.8 billion in 2022 to USD 141.6 billion by 2027, at a CAGR of 4.8% during the forecast period. The farm mechanization has shown a significant growth in the recent past and top OEMs are too investing in the same, which would further drive the demand for agriculture equipment. Though the demand for farm equipment is growing in Europe, and North America, the Asia Oceania remains the key market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Government support with farm loan waivers/ credit finance

The implementation of farm loan waiver schemes encourages farmers to buy agriculture equipment. Governments launched various schemes in different parts of the world to relieve farmers from their loans and encourage farm mechanization. According to the Agricultural Policy Monitoring and Evaluation, 2019, conducted by Organisation for Economic Co-operation and Development (OECD), farm policies in 53 countries–all OECD, EU countries, and 12 key emerging economies – provided on average of USD 728 billion per year direct support to farmers from 2018-2020. For instance, the government of Maharashtra (India) announced the Mahatma Phule Farm Loan Waiver Scheme in December 2019. In March 2021, it also announced a scheme named Maharashtra Agro Business Network Project (Magnet) for small and marginal fruit and vegetable growers.

Government subsidies play an essential role in the agriculture sector of a country. For instance, the US Farm Service Agency (FSA) provides guaranteed and direct farm ownership and operating loans to family-size farmers who cannot obtain commercial credit from a bank, farm credit system institution, or other lenders. FSA loans can also be used to purchase land, livestock, equipment, feed, seed, and supplies. The US department of agriculture also announced various loan programs, including direct farm ownership down payment program. The maximum loan amount increased from USD 250,000 to USD 300,000, and the guaranteed amount on conservation loans increased from 75 to 80%. This has helped the farm equipment market to grow significantly.

RESTRAINT: Growth of rental market

The purchase of farm equipment such as tractors and harvesters is a major investment in agricultural activities and accounts for the maximum share of the global rental market. All the steps involved in designing, producing, and distributing the equipment require huge investments, which is reflected in the cost of the machinery made available to farmers. The inability of small farmers to invest a high amount result in the low penetration of farm equipment in emerging countries.

Farmers opt for renting farm machinery to increase productivity and turnaround time, which, in turn, increases the efficiency and profitability of the business. Renting farm equipment is cost-effective compared to purchasing the equipment on a standard loan from a financial institution. Thus, the global scarcity of farm labor and increasing labor wages worldwide have driven farm equipment rental services. The increasing adoption of advanced technologies in rental agriculture machinery plays a crucial role in improving operational efficiency and profitability. It helps small-scale farmers use high-priced farming equipment on a rental basis to produce a more efficient and enhanced variety of crops in less time.

Continuous R&D efforts have resulted in the development of advanced products capable of handling multiple tasks. Advanced machinery includes complex mechatronic systems that require specialized manufacturing and assembly processes. All the steps involved in designing, producing, and distributing the equipment require huge investments, which is reflected in the cost of the machinery made available to farmers. The farm equipment manufactuters are opting for mobile applications and renting the equipments through dealers. For instance, in February 2022, Sonalika Group providing the farm machinery and equipment on rent through Sonalika Agro Solutions App, through which farmers can rent the available advanced agricultural machinery according to their needs. In August 2021, Farmkart launches farm machinery rentals platform rent4farm. The rent4farm will help farmers rent high quality machinery and equipment at competitive rates. The inability of small farmers to invest a high amount contributes to the low penetration rate of farm equipment in developing countries. Farmers in emerging economies such as Asia-Oceania are reluctant to invest in expensive machinery. However, the adoption of farm equipment in North America and Europe is high due to the unavailability of labor and the high cost of farm labor. Manufacturers of agriculture equipment need to upgrade their products regularly, owing to the constantly changing emission norms, which increases the equipment cost. Thus, the high cost of agricultural machinery such as high horsepower (HP) tractors, combines, balers, and sprayers limit their sales and thereby slow down the growth of the farm equipment market, especially in emerging countries.

OPPORTUNITY: Precision agriculture

According to Economic Survey, Farm mechanization and crop productivity has a direct correlation as farm mechanization saves time and labor, reduces drudgery, cut down production cost in the long run, reduces postharvest losses and boosts crop output and farm income. The agriculture industry is under constant pressure to produce agricultural products to cater to the growing population, forcing farmers to focus on efficiency and productivity to drive business growth. Precision farming is becoming common among farmers who want to produce more with limited resources. This farming technique could effectively tackle the issue of high demand for food across geographies. This technique also allows farmers to improve their operational efficiency and increase production, thereby minimizing the gap between the supply and consumption of agricultural products. Effective use of agriculture machinery helps to increase productivity & production of output, undertake timely farm operations and enable the farmers to quickly rotate crops on the same land. Precision farming technology facilitates the efficient use of water, seeds, land, fertilizers, and agricultural equipment, which, in turn, improves the overall quantity and quality of yields.

The increasing R&D activities and launches of hybrid & electric tractors by several companies are expected to create growth opportunities for the agriculture sector. In August 2021, Solectrac launched the e70N tractor with 70 HP, 60 kWh electric tractor for USD 75,000. CNH Industrial’s Design Center displayed a STEYR Konzept hybrid tractor at Agritechnica 2019. John Deere showcased an autonomous tractor concept with a rated electric-power output of 500 kilowatts – about 680 horsepower at a European dealer meeting in 2019. In 2020, Kubota developed a fully electric driverless tractor known as the X tractor. This tractor was designed as part of the company's Agrirobo automated technology program. Proxecto Engineering Services (India) decided to venture into the farming territory with its flagship product, hybrid agri vehicle (HAV), scheduled in 2020 to help farmers in India. In October 2020, Fendt (Germany) launched the new 75-kW (100 hp.) electric tractor named Fendt e100 Vario with 10 hours operating capacity that can be recharged to 80% in just 40 minutes. Gridtractor (India) launched a tool to develop, implement, and maintain fleet electrification services for farms utilizing electric tractors and heavy farming equipment. The company helps the farmers integrate electric charging and vehicle to grid (V2G) technology into their agricultural operations.

CHALLENGE: Rapidly changing emission norms and mandates

CNH Industrial, John Deere, and AGCO have expressed concerns about emission regulations in different parts of the world. The implementation of emission norms may limit the sales of construction and agricultural machinery. With amendments in emission regulations, significant investments are required in R&D. Each market has its emission norms that increase complexity while designing components, mainly engines.

The Indian government implemented the BS Term IV regulation,in March 2022, the TREM IV emission norms are slated to be applicable for tractors with a capacity more than 50 HP. However, a big proportion of the overall industry (<50 HP) would continue to be governed by TREM IIIA norms, impacting only ~10% of the overall Indian tractor industry volumes. Thus, changing emission regulations to comply with government regulations may challenge the sale of tractors. Furthermore, It is expected that stricter emission norms for farm equipment that conform to Euro Stage IV may result in prices of these equipment being increased by 10-15%.

Farm Equipment Market Ecosystem

The ecosystem analysis highlights farm equipment market players, primarily represented by component manufacturers, manufacturers, and dealers.

Role of Companies in Farm Equipment Market Ecosystem

|

COMPANY |

ROLE IN ECOSYSTEM |

|

Cummins |

Component Manufacturer |

|

Deutz |

Component Manufacturer |

|

FPR Industrial |

Component Manufacturer |

|

Carraro |

Component Manufacturer |

|

YTO France |

Component Manufacturer |

|

ZF TRW |

Component Manufacturer |

|

Daedong |

Component Manufacturer |

|

Yanmar |

Component Manufacturer |

|

John Deere |

Farm Equipment Manufacturer |

|

Mahindra & Mahindra |

Farm Equipment Manufacturer |

|

AGCO Corporation |

Farm Equipment Manufacturer |

|

CLAAS |

Farm Equipment Manufacturer |

|

Kubota |

Farm Equipment Manufacturer |

|

TAFE |

Farm Equipment Manufacturer |

|

SDF Group |

Farm Equipment Manufacturer |

|

Yanmar |

Farm Equipment Manufacturer |

|

Zetor Tractors |

Farm Equipment Manufacturer |

|

JCB |

Farm Equipment Manufacturer |

|

SEMA Equipment Inc |

Dealer |

|

Farol |

Dealer |

|

Baldwin Tractor & Equipment |

Dealer |

|

RDO Equipment Co. |

Dealer |

|

Brandt Holdings |

Dealer |

|

Sterling |

Dealer |

|

Farm Equipment Headquarters, Inc. |

Dealer |

|

Reynolds |

Dealer |

|

Titan Machinery |

Dealer |

|

Forrester Farm Equipment |

Dealer |

|

Everglades Equipment Group |

Dealer |

31–70 HP segment estimated to be the largest market during the forecast period

The 31–70 HP segment is expected to command the largest share of the farm equipment market. The increasing farm mechanization largely driven by government policies such as loan waivers/schemes/policies is expected to drive the 31-70 HP market in emerging countries. The 31-70 HP tractors segment is estimated to contribute ~33% of total tractor sales in 2022. The increasing farm mechanization in emerging countries driven by government efforts is expected to drive the market. The rising demand for high-powered tractors and the growing network of dealers with proper marketing are other factors expected to boost the market globally.

Four wheel drive segment to grow at the fastest CAGR from 2022 to 2027

The demand for four-wheel drive tractors is expected to grow in the future with the changing requirements in farming activities such as covering a larger acre of land or the need to pull large-size implements. The availability of low-powered tractors with four-wheel drive is expected to be a major factor for their growing demand. John Deere Model 5050 D is a low-powered tractor that delivers 50 HP and is available in four-wheel drive. In 2021, Sonalika Tractors (India) launched its advanced Tiger DI 75 four-wheel drive tractor with CRDs (Common Rail Diesel System) technology. Sonalika has also introduced the Tiger DI 65 four-wheel drive tractor customized with twin benefits to deliver 65 HP power and an economy of 55 HP. Both the new models are available in 4W and 2W drive versions.

To know about the assumptions considered for the study, download the pdf brochure

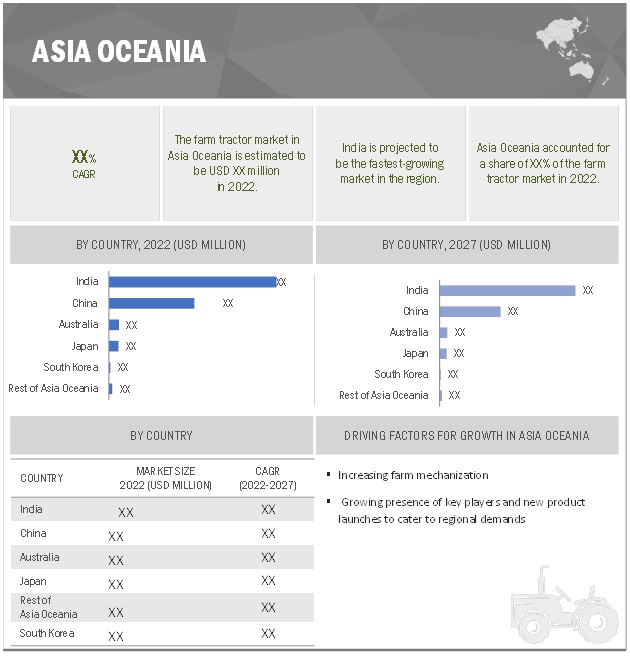

Asia Oceania is estimated to be the largest market in 2022

The Asia Oceania region includes China, India, Japan, South Korea, Australia, and the rest of Asia Oceania for the market analysis.

In addition to high containerized transportation, factors such as increasing Gross Domestic Product (GDP), infrastructure investments, rising per capita income, growing inclination toward mechanization, and government initiatives for FDI have created more opportunities for the farming business, in turn driving the farm tractor market in the Asia Oceania region. Asia Oceania is expected to lead the farm tractor market during the forecast period. Countries considered under Asia Oceania are India, Japan, China, South Korea, Australia, and the Rest of Asia Oceania. The increasing farm mechanization driven by government efforts and subsidies/loan waivers is expected to drive farm tractor sales in India. The Rest of Asia Oceania covers countries like Vietnam, Australia, Malaysia, Singapore, Indonesia, and the Philippines.

Key Market Players

The farm equipment market is led by established players, such as John Deere (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS (Germany). These companies have adopted several strategies to gain traction in the market. They have expanded in various geographical locations through mergers & acquisitions, expansions, and entered into joint ventures/collaborations with other industry players to sustain their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market size: |

USD 111.8 billion in 2022 to USD 141.6 billion by 2027 |

|

Growth Rate: |

4.8% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Function, Farm Tractor Rental Market by Power Output, By Equipment Type, by Drive Type, Autonomous Tractor by Power Output, Electric Tractor Market by Propulsion, Farm Equipment Rental Market by Region. |

|

Geographies Covered: |

North America, Europe, Asia Pacific, and Rest of the World |

|

Report Highlights:

|

Experts from related industries and suppliers have been interviewed to understand the future trends of farm equipment market. |

|

Key Market Opportunities: |

Precision agriculture |

|

Key Market Drivers: |

Government support with farm loan waivers/ credit finance |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the farm equipment market :

Farm Tractor Market, By Power Output:

- <30 HP

- 31–70 HP

- 71–130 HP

- 131–250 HP

- >250 HP

Farm Tractor Market, By Drive Type

- Two-wheel

- Four-wheel

Farm Implements Market, By Function

- Plowing & Cultivating

- Sowing & Planting

- Plant Protection & Fertilizing

- Harvesting & Threshing

- Others

Farm Equipment Market, By Equipment Type

- Cereal Combines

- Non-Cereal Combines

- Balers

- Tractor-mounted Sprayers

- Self-propelled Sprayers

Farm Equipment Rental Market, By Equipment Type

- Tractors

- Combines

- Sprayers

- Balers

- Others

Farm Tractor Rental Market, By Power Output

- <30 HP

- 31–70 HP

- 71–130 HP

- 131–250 HP

- >250 HP

Farm Tractor Rental Market, By Drive Type

- Two-wheel

- Four-wheel

Autonomous Tractor Market, By Power Output

- <30 HP

- 31-100 HP

- >100 HP

Electric Tractor Market, By Propulsion

- Battery Electric

- Hybrid Electric

By Region

- Asia Oceania

- North America

- Europe

- Rest of the World [RoW]

Recent Developments

- In January 2022, John Deere revealed a fully autonomous 8R tractor. The new tractor features with TruSet-enabled chisel plow, GPS guidance system, and new advanced technologies including six pairs of stereo cameras enabling 360-degree obstacle detection and calculation of distance, and a deep neural network that classifies each pixel of each image in 100 milliseconds.

- In November 2021, John Deere developed new material collection systems and mechanical grappleS for compact utility tractors. The New Frontier MG20F Mechanical Grapple offers a quick-attach solution for fast installation and features a 1,200-pound (544 kg) lift capacity.

- In December 2021, New Holland Agriculture designed a Straddle Tractor to meet the demanding requirements of the narrow vineyards typical of the premium wine growing regions such as Champagne, Médoc, and Burgundy.

- In August 20201, AGCO Corporation brand Massey Ferguson launched VE Series planters. The series consists of rigid and folding-frame planters to narrow transport and track planters that offer growers straightforward, dependable, durable planters to deliver consistent, accurate seed placement for optimum yields.

- In November 2021, CLAAS developed new flagship TORION 1913 and TORION 2014 models. They feature more engine power, higher lift capacity, and an even greater loading height.

Frequently Asked Questions (FAQ):

How big is the farm equipment industry?

The global farm equipment market is projected to grow from USD 111.8 billion in 2022 to USD 141.6 billion by 2027, at a CAGR of 4.8% during the forecast period.

Which application is currently leading the Farm Equipment Market?

Farm Tractor is leading in the Farm Equipment Market.

Many companies are operating in the Farm Equipment Market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The farm equipment market is led by established players, such as John Deere (US), AGCO Corporation (US), CNH Industrial (Netherlands), Kubota Corporation (Japan), and CLAAS (Germany). These companies adopted new product launches, acquisition, and joint venture strategies to gain traction in the Farm Equipment Market.

How is the demand for Farm Equipment varies by region?

Asia Oceania is estimated to be the largest market for Farm Equipment during the forecast period. The growth of the Farm Equipment market in Asia Oceania is mainly attributed to the higher demand for Farm Equipment from India and China due to higher population and increasing farm mechanization.

What are the growth opportunities for the Farm Equipment supplier?

The demand for Four wheel drive, would create growth opportunities for the Farm Equipment Market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 SUMMARY OF CHANGES

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.2 LIST OF KEY SECONDARY SOURCES TO ESTIMATE FARM EQUIPMENT MARKET

2.1.3 KEY DATA FROM SECONDARY SOURCES

2.1.4 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.5 LIST OF PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 FARM TRACTOR MARKET SIZE: BOTTOM-UP APPROACH (POWER OUTPUT AND REGION)

2.2.2 TOP-DOWN APPROACH

FIGURE 6 FARM TRACTOR MARKET SIZE: TOP-DOWN APPROACH (FARM TRACTOR, BY DRIVE TYPE)

FIGURE 7 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 8 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF JOHN DEERE REVENUE ESTIMATION

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

TABLE 1 ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 59)

3.1 PRE- VS POST-COVID-19 SCENARIO

FIGURE 10 PRE- & POST-COVID-19 SCENARIO: FARM EQUIPMENT MARKET, 2018–2027 (USD MILLION)

TABLE 2 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2027 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 11 MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN FARM EQUIPMENT MARKET

FIGURE 12 GROWING MECHANIZATION IN FARMING AND CONTRACT FARMING TO DRIVE MARKET

4.2 MARKET, BY EQUIPMENT TYPE

FIGURE 13 CEREAL COMBINES MARKET EXPECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4.3 FARM TRACTOR MARKET, BY DRIVE TYPE

FIGURE 14 FOUR WHEEL DRIVE MARKET EXPECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4.4 FARM TRACTOR MARKET, BY POWER OUTPUT

FIGURE 15 31-70 HP TRACTORS PROJECTED TO LEAD MARKET

4.5 FARM IMPLEMENTS MARKET, BY FUNCTION

FIGURE 16 PLOWING & CULTIVATING PROJECTED TO LEAD MARKET

4.6 AUTONOMOUS TRACTOR MARKET, BY POWER OUTPUT

FIGURE 17 <30 HP TRACTORS EXPECTED TO DOMINATE AUTONOMOUS SEGMENT OWING TO MAJOR APPLICATIONS IN VINEYARDS

4.7 ELECTRIC TRACTOR MARKET, BY PROPULSION

FIGURE 18 BATTERY ELECTRIC TRACTORS EXPECTED TO DRIVE MARKET OWING TO BETTER ROI

4.8 FARM EQUIPMENT RENTAL MARKET, BY EQUIPMENT TYPE

FIGURE 19 TRACTORS SEGMENT TO COMMAND HIGHEST SHARE IN FARM EQUIPMENT RENTAL MARKET IN 2022

4.9 FARM TRACTOR RENTAL MARKET, BY DRIVE TYPE

FIGURE 20 TWO-WHEEL DRIVE SEGMENT TO COMMAND HIGHEST SHARE IN FARM TRACTOR RENTAL MARKET IN 2022

4.10 FARM TRACTOR RENTAL MARKET, BY POWER OUTPUT

FIGURE 21 31-70 HP TO DOMINATE FARM TRACTOR RENTAL MARKET FROM 2022–2027

4.11 MARKET, BY REGION

FIGURE 22 ASIA OCEANIA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 FARM EQUIPMENT MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Government support with farm loan waivers/credit finance

TABLE 3 SCHEMES LAUNCHED BY GOVERNMENT OF INDIA

5.2.1.2 OEM/sales incentives to support dealer service and rental operations

5.2.1.3 Contract farming

TABLE 4 CHARACTERISTICS OF TRANSACTIONAL AND CONTRACT FARMING

FIGURE 24 US FARMS WITH CONTRACTS, 2020

FIGURE 25 US VALUE OF PRODUCTION UNDER CONTRACT, 2020

TABLE 5 SAMPLE SIZE AND PREVALENCE OF CONTRACT FARMING, 2019

5.2.1.4 Increase in farm mechanization

FIGURE 26 MECHANIZATION RATE AND CONTRIBUTION OF AGRICULTURE INDUSTRY TO GDP IN MAJOR GEOGRAPHIES, 2020

TABLE 6 MECHANIZATION RATE IN INDIA FOR SEVERAL AGRICULTURAL ACTIVITIES, 2020

TABLE 7 PATTERN OF ASSISTANCE IN VARIOUS SCHEMES OF GOVERNMENT OF INDIA

TABLE 8 SUPPORT FROM REGIONAL GOVERNMENTS

5.2.2 RESTRAINTS

5.2.2.1 Growth of rental market

TABLE 9 JOHN DEERE: HARVESTERS RENTAL RATES IN US, 2020 (USD)

TABLE 10 JOHN DEERE: RENTAL RATES IN US, 2020 (USD)

5.2.2.2 High equipment cost in emerging economies

TABLE 11 PRICES OF TRACTORS IN US, 2020 (USD)

TABLE 12 PRICES OF VARIOUS FARM EQUIPMENT IN US, 2020 (USD)

5.2.3 OPPORTUNITIES

5.2.3.1 Precision agriculture

5.2.3.2 Increasing R&D and adoption of electric tractors

5.2.4 CHALLENGES

5.2.4.1 Rapidly changing emission norms and mandates

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TRADE ANALYSIS

TABLE 14 IMPORT TRADE DATA, KEY COUNTRIES, 2020 (USD)

TABLE 15 EXPORT TRADE DATA, KEY COUNTRIES, 2020 (USD)

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 28 REVENUE SHIFT FOR MARKET

5.6 CASE STUDIES

5.6.1 CASE STUDY: TRUCKER AND CATTLE FARMER BENEFIT FROM TELESKID EFFICIENCY

5.6.2 CASE STUDY: KUBOTA UNVEILED PROTOTYPE OF COMPLETE ELECTRIC AUTONOMOUS TRACTOR

5.6.3 CASE STUDY: JOHN DEERE PREVIEWED X9 COMBINE HARVESTER

5.6.4 CASE STUDY: STEYR UNVEILED HYBRID CONCEPT TRACTOR

5.6.5 CASE STUDY: AGRIROBO UNMANNED AUTONOMOUS AGRICULTURAL MACHINERY

5.7 PATENT ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS: MARKET

5.9 MARKET ECOSYSTEM

TABLE 16 ROLE OF COMPANIES IN MARKET ECOSYSTEM

5.9.1 REGULATORY ANALYSIS: EMISSION REGULATIONS

5.9.1.1 Farm Equipment

FIGURE 30 NON-ROAD MOBILE MACHINERY EMISSION REGULATION OUTLOOK, 2019–2025

5.9.2 AVERAGE SELLING PRICE (ASP) ANALYSIS, BY POWER OUTPUT AND REGION

TABLE 17 ASP: <30 HP TRACTORS: PRICE RANGE ANALYSIS, BY REGION, 2021 (USD)

TABLE 18 ASP: 31-70 HP TRACTORS: PRICE RANGE ANALYSIS, BY REGION, 2021 (USD)

TABLE 19 ASP: 71-130 HP TRACTORS: PRICE RANGE ANALYSIS, BY REGION, 2021 (USD)

TABLE 20 ASP: 131-250 HP TRACTORS: PRICE RANGE ANALYSIS, BY REGION, 2021 (USD)

TABLE 21 ASP: >250 HP TRACTORS: PRICE RANGE ANALYSIS, BY REGION, 2021 (USD)

5.9.3 FARM EQUIPMENT: TECHNOLOGY TREND

5.9.3.1 Farm Equipment Automation

5.9.3.2 Agriculture 5.0

TABLE 22 CROP DATA MANAGEMENT SOFTWARE APPLICATIONS

5.9.4 MARKET SCENARIO

FIGURE 31 MARKET SCENARIO, 2018–2027 (USD BILLION)

5.9.4.1 Realistic scenario

TABLE 23 MARKET (REALISTIC SCENARIO), BY REGION, 2018–2027 (USD BILLION)

5.9.4.2 Low impact scenario

TABLE 24 MARKET (LOW IMPACT SCENARIO), BY REGION, 2018–2027 (USD BILLION)

5.9.4.3 High impact scenario

TABLE 25 MARKET (HIGH IMPACT SCENARIO), BY REGION, 2018–2027 (USD BILLION)

6 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 99)

6.1 ASIA OCEANIA EXPECTED TO DOMINATE FARM EQUIPMENT MARKET

6.2 KEY FOCUS AREAS OF ELECTRIC FARM TRACTORS

6.3 FOUR-WHEEL DRIVE TRACTORS FOR FUTURE APPLICATIONS - KEY FOCUS AREA

6.4 GROWTH OF AUTONOMOUS TRACTORS IN COMING YEARS

6.5 CONCLUSION

7 FARM TRACTOR MARKET, BY POWER OUTPUT (Page No. - 102)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET, BY POWER OUTPUT, 2022 VS. 2027 (USD MILLION)

TABLE 26 MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 27 MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 28 MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

7.2 <30 HP

7.2.1 SMALL FARM SIZE IN SEVERAL COUNTRIES TO DRIVE SEGMENT

TABLE 30 <30 HP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 31 <30 HP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 32 <30 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 <30 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 31–70 HP

7.3.1 FAVORABLE GOVERNMENT SUBSIDIES AND LOAN WAIVERS

TABLE 34 31–70 HP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 35 31–70 HP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 36 31–70 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 31–70 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 71–130 HP

7.4.1 SUITABLE FOR LARGE FARMLANDS

TABLE 38 71–130 HP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 39 71–130 HP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 40 71–130 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 71–130 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 131–250 HP

7.5.1 EUROPE - LEADING MARKET FOR 131–250 HP TRACTORS

TABLE 42 131–250 HP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 43 131–250 HP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 44 131–250 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 131–250 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 >250 HP

7.6.1 ESSENTIAL IN ORGANIZED FARMING ACTIVITIES

TABLE 46 >250 HP: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 47 >250 HP: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 48 >250 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 >250 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 FARM TRACTOR MARKET, BY DRIVE TYPE (Page No. - 114)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 33 MARKET, BY DRIVE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 50 MARKET, BY DRIVE TYPE, 2018–2021 (‘000 UNITS)

TABLE 51 MARKET, BY DRIVE TYPE, 2022–2027 (‘000 UNITS)

TABLE 52 MARKET, BY DRIVE TYPE, 2018–2021 (USD MILLION)

TABLE 53 MARKET, BY DRIVE TYPE, 2022–2027 (USD MILLION)

8.2 TWO-WHEEL DRIVE

8.2.1 SUITABLE FOR SOWING, PASTURE TOPPING, AND FERTILIZER APPLICATION

TABLE 54 TWO-WHEEL DRIVE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 55 TWO-WHEEL DRIVE: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 56 TWO-WHEEL DRIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 TWO-WHEEL DRIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 FOUR-WHEEL DRIVE

8.3.1 INCREASING LAUNCHES OF LOW-POWERED FOUR-WHEEL DRIVE TRACTORS

TABLE 58 FOUR-WHEEL DRIVE: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 59 FOUR-WHEEL DRIVE: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 60 FOUR-WHEEL DRIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 FOUR-WHEEL DRIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 FARM EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 121)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 62 MARKET, BY EQUIPMENT TYPE, 2018–2021 (‘000 UNITS)

TABLE 63 MARKET, BY EQUIPMENT TYPE, 2022–2027 (‘000 UNITS)

TABLE 64 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

9.2 CEREAL COMBINES

9.2.1 INCREASING FARM MECHANIZATION TO DRIVE SEGMENT

TABLE 66 CEREAL COMBINES MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 67 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 68 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 NON-CEREAL COMBINES

9.3.1 IMPROVED SILAGE QUALITY TO DRIVE DEMAND FOR FORAGE HARVESTERS

TABLE 70 NON-CEREAL COMBINES MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 71 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 72 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 BALERS

9.4.1 MINIMAL WASTAGE AND HIGH PRODUCTIVITY

TABLE 74 BALERS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 75 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 76 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 SELF-PROPELLED SPRAYERS

9.5.1 LARGE-SCALE DEMAND FOR FERTILIZERS TO BOOST DEMAND

TABLE 78 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 79 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 80 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 TRACTOR-MOUNTED SPRAYERS

9.6.1 USED IN SMALL AND MID-SIZED FARMS FOR BETTER MANEUVERABILITY

TABLE 82 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 83 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 84 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2022–2027 (USD MILLION)

10 FARM IMPLEMENTS MARKET, BY FUNCTION (Page No. - 134)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY FUNCTION, 2022 VS. 2027 (USD MILLION)

TABLE 86 MARKET, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 87 MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

10.2 PLOWING & CULTIVATING

10.2.1 INCREASE POROSITY OF SOIL AND ENHANCE WATER ABSORPTION

TABLE 88 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SOWING & PLANTING

10.3.1 REDUCES OVERALL COSTS INCURRED BY FARMERS

TABLE 90 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 PLANT PROTECTION & FERTILIZING

10.4.1 INCREASING CROP PRODUCTION AND ENHANCED FOOD QUALITY

TABLE 92 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 HARVESTING & THRESHING

10.5.1 HIGH DEMAND IN EMERGING ECONOMIES

TABLE 94 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHER IMPLEMENTS

10.6.1 SPECIFIC FARMING APPLICATIONS TO DRIVE DEMAND

TABLE 96 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 97 MARKET, BY REGION, 2022–2027 (USD MILLION)

11 FARM EQUIPMENT RENTAL MARKET, BY EQUIPMENT TYPE (Page No. - 143)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 36 MARKET, BY EQUIPMENT TYPE, 2022 VS 2027 (USD MILLION)

TABLE 98 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 99 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

11.2 TRACTORS

11.2.1 INCREASING COLLABORATION BETWEEN OEMS AND APPLICATION COMPANIES

TABLE 100 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 COMBINES

11.3.1 DEMAND FOR HIGHER PRODUCTIVITY EXPECTED TO DRIVE MARKET

TABLE 102 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 SPRAYERS

11.4.1 BETTER EFFICIENCY IN FARM OPERATIONS

TABLE 104 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 BALERS

11.5.1 INCREASING PREFERENCE FOR ROUND BALERS WITH PRE-CUTTING SYSTEMS

TABLE 106 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 OTHER EQUIPMENT

11.6.1 HIGH COST OF EQUIPMENT TO DRIVE FARMERS TO RENT OTHER EQUIPMENT

TABLE 108 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 MARKET, BY REGION, 2022–2027 (USD MILLION)

12 FARM TRACTOR RENTAL MARKET, BY POWER OUTPUT (Page No. - 152)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY POWER OUTPUT, 2022 VS. 2027 (USD MILLION)

TABLE 110 MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 111 MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

12.2 <30 HP

12.2.1 DEMAND FOR UTILITY/COMPACT TRACTORS IS EXPECTED TO DRIVE <30 HP RENTAL MARKET

TABLE 112 <30 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 <30 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 31–70 HP

12.3.1 MODERATELY POWERED AND ARE EASY TO USE

TABLE 114 31–70 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 31–70 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 71–130 HP

12.4.1 AMERICAS - LARGEST RENTAL MARKET FOR FARM TRACTORS WITH 71-130 HP

TABLE 116 71–130 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 71–130 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 131–250 HP

12.5.1 HIGH DEMAND IN EUROPE TO PERFORM LARGE-SCALE AGRICULTURAL OPERATIONS

TABLE 118 131–250 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 131–250 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 >250 HP

12.6.1 INCREASING DEMAND FOR COMMERCIAL FARMING EXPECTED TO DRIVE >250 HP MARKET

TABLE 120 >250 HP: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 >250 HP: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 FARM TRACTOR RENTAL MARKET, BY DRIVE TYPE (Page No. - 161)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 38 MARKET, BY DRIVE TYPE, 2022–2027 (USD MILLION)

TABLE 122 MARKET, BY DRIVE TYPE, 2018–2021 (USD MILLION)

TABLE 123 MARKET, BY DRIVE TYPE, 2022–2027 (USD MILLION)

13.2 TWO-WHEEL DRIVE

13.2.1 INCREASED DEMAND FOR RENTAL SERVICES IN EMERGING COUNTRIES EXPECTED TO DRIVE 2WD RENTAL MARKET

TABLE 124 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 125 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 FOUR-WHEEL DRIVE

13.3.1 GROWING DEMAND FOR HIGH-POWERED TRACTORS EXPECTED TO DRIVE THIS MARKET

TABLE 126 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 127 MARKET, BY REGION, 2022–2027 (USD MILLION)

14 AUTONOMOUS TRACTOR MARKET, BY POWER OUTPUT (Page No. - 167)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 39 MARKET, BY POWER OUTPUT, 2022–2030 (USD MILLION)

TABLE 128 MARKET, BY POWER OUTPUT, 2022–2025 (‘000 UNITS)

TABLE 129 MARKET, BY POWER OUTPUT, 2026–2030 (‘000 UNITS)

TABLE 130 MARKET, BY POWER OUTPUT, 2022–2025 (USD MILLION)

TABLE 131 MARKET, BY POWER OUTPUT, 2026–2030 (USD MILLION)

14.2 <30 HP

14.2.1 SMALLER FARM SIZES EXPECTED TO DRIVE DEMAND IN ASIA OCEANIA

TABLE 132 <30 HP: MARKET, BY REGION, 2022–2025 (‘000 UNITS)

TABLE 133 <30 HP: MARKET, BY REGION, 2026–2030 (‘000 UNITS)

TABLE 134 <30 HP: MARKET, BY REGION, 2022–2025 (USD MILLION)

TABLE 135 <30 HP: MARKET, BY REGION, 2026–2030 (USD MILLION)

14.3 31–100 HP

14.3.1 DEMAND DRIVEN BY COMMERCIAL FARMING WITH LARGE FARM SIZES

TABLE 136 31-100 HP: MARKET, BY REGION, 2022–2025 (‘000 UNITS)

TABLE 137 31-100 HP: MARKET, BY REGION, 2026–2030 (‘000 UNITS)

TABLE 138 31-100 HP: MARKET, BY REGION, 2022–2025 (USD MILLION)

TABLE 139 31-100 HP: MARKET, BY REGION, 2026–2030 (USD MILLION)

14.4 >100 HP

14.4.1 INCREASING POPULARITY OF COMMERCIAL FARMING TO DRIVE SEGMENT

TABLE 140 >100 HP: MARKET, BY REGION, 2022–2025 (‘000 UNITS)

TABLE 141 >100 HP: MARKET, BY REGION, 2026–2030 (‘000 UNITS)

TABLE 142 >100 HP: MARKET, BY REGION, 2022–2025 (USD MILLION)

TABLE 143 >100 HP: MARKET, BY REGION, 2026–2030 (USD MILLION)

15 ELECTRIC TRACTOR MARKET, BY PROPULSION (Page No. - 176)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 40 MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

TABLE 144 MARKET, BY PROPULSION, 2018–2021 (UNITS)

TABLE 145 MARKET, BY PROPULSION, 2022–2027 (UNITS)

TABLE 146 MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 147 MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

15.2 BATTERY ELECTRIC

15.2.1 USED FOR REDUCTION IN EMISSIONS

TABLE 148 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 149 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 150 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 151 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.3 HYBRID ELECTRIC

15.3.1 INCREASE IN DEMAND FOR MEDIUM- AND HEAVY-DUTY TRACTORS TO DRIVE SEGMENT

TABLE 152 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 153 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 154 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 155 MARKET, BY REGION, 2022–2027 (USD MILLION)

16 FARM TRACTOR MARKET, BY REGION (Page No. - 184)

16.1 INTRODUCTION

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS

16.1.3 INDUSTRY INSIGHTS

FIGURE 41 MARKET, BY REGION, 2022 VS 2027 (USD MILLION)

TABLE 156 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 157 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 158 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 159 MARKET, BY REGION, 2022–2027 (USD MILLION)

16.2 ASIA OCEANIA

16.2.1 THE ASIA OCEANIA REGION INCLUDES CHINA, INDIA, JAPAN, SOUTH KOREA, AUSTRALIA, AND THE REST OF ASIA OCEANIA FOR THE MARKET ANALYSIS.

FIGURE 42 ASIA OCEANIA: MARKET SNAPSHOT

TABLE 160 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 161 ASIA OCEANIA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 162 ASIA-OCEANIA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 163 ASIA OCEANIA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

16.2.2 AUSTRALIA

16.2.2.1 Government assistance to farmers expected to drive market

TABLE 164 AUSTRALIA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 165 AUSTRALIA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 166 AUSTRALIA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 167 AUSTRALIA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.2.3 CHINA

16.2.3.1 Favorable government policies to subsidize tractor sales

TABLE 168 CHINA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 169 CHINA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 170 CHINA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 171 CHINA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.2.4 INDIA

16.2.4.1 Rise in farm mechanization expected to drive Indian farm tractor market

TABLE 172 INDIA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 173 INDIA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 174 INDIA: FARM TRACTOR MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 175 INDIA: FARM TRACTOR MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.2.5 JAPAN

16.2.5.1 Focus on encouraging agricultural co-operatives

TABLE 176 JAPAN: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 177 JAPAN: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 178 JAPAN: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 179 JAPAN: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.2.6 SOUTH KOREA

16.2.6.1 Debt restructuring plans for farmers to influence South Korean farm tractor market

TABLE 180 SOUTH KOREA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 181 SOUTH KOREA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 182 SOUTH KOREA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 183 SOUTH KOREA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.2.7 REST OF ASIA OCEANIA

16.2.7.1 Favorable government policies drive farm tractors market in Rest of Asia Oceania

TABLE 184 REST OF ASIA OCEANIA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 185 REST OF ASIA OCEANIA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 186 REST OF ASIA OCEANIA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 187 REST OF ASIA OCEANIA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3 EUROPE

FIGURE 43 EUROPE: MARKET SNAPSHOT

TABLE 188 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 189 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 190 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 191 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

16.3.1 FRANCE

16.3.1.1 Shortage of labor expected to drive French farm tractor market

TABLE 192 FRANCE: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 193 FRANCE: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 194 FRANCE: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 195 FRANCE: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.2 GERMANY

16.3.2.1 Increasing demand for high-powered tractors expected to fuel German market

TABLE 196 GERMANY: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 197 GERMANY: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 198 GERMANY: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 199 GERMANY: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.3 ITALY

16.3.3.1 Increasing popularity of precision agriculture expected to propel market in Italy

TABLE 200 ITALY: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 201 ITALY: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 202 ITALY: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 203 ITALY: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.4 POLAND

16.3.4.1 Farm subsidies in Poland expected to drive market

TABLE 204 POLAND: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 205 POLAND: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 206 POLAND: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 207 POLAND: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.5 RUSSIA

16.3.5.1 Small and medium-sized farms to support Russian market

TABLE 208 RUSSIA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 209 RUSSIA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 210 RUSSIA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 211 RUSSIA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.6 SPAIN

16.3.6.1 Shortage of labor and increasing focus on precision agriculture to fuel market in Spain

TABLE 212 SPAIN: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 213 SPAIN: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 214 SPAIN: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 215 SPAIN: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.7 TURKEY

16.3.7.1 Larger farm sizes and favorable government policies to accelerate market in Turkey

TABLE 216 TURKEY: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 217 TURKEY: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 218 TURKEY: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 219 TURKEY: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.8 UK

16.3.8.1 Demand for high-powered tractors to push UK market

TABLE 220 UK: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 221 UK: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 222 UK: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 223 UK: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.3.9 REST OF EUROPE

16.3.9.1 Financial aid from governments expected to drive Rest of Europe market

TABLE 224 REST OF EUROPE: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 225 REST OF EUROPE: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 226 REST OF EUROPE: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 227 REST OF EUROPE: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.4 NORTH AMERICA

FIGURE 44 NORTH AMERICA:MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 228 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 229 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 230 NORTH AMERICA:MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 231 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

16.4.1 CANADA

16.4.1.1 Government investment in crop production to expand market in Canada

TABLE 232 CANADA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 233 CANADA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 234 CANADA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 235 CANADA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.4.2 MEXICO

16.4.2.1 Government support and presence of OEMs fuel market in Mexico

TABLE 236 MEXICO: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 237 MEXICO: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 238 MEXICO: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 239 MEXICO: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.4.3 US

16.4.3.1 Presence of key players expected to amplify tractors market in US

TABLE 240 US: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 241 US: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 242 US: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 243 US: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.5 REST OF THE WORLD (ROW)

FIGURE 45 REST OF THE WORLD: MARKET, BY COUNTRY, 2022 VS 2027 (USD MILLION)

TABLE 244 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 245 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 246 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 247 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

16.5.1 ARGENTINA

16.5.1.1 Focus of key players on manufacturing tractors

TABLE 248 ARGENTINA: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 249 ARGENTINA: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 250 ARGENTINA: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 251 ARGENTINA: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.5.2 BRAZIL

16.5.2.1 Increasing export of tractors drive market in Brazil

TABLE 252 BRAZIL: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 253 BRAZIL: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 254 BRAZIL: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 255 BRAZIL: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

16.5.3 OTHERS IN ROW

16.5.3.1 Exports of produce and government subsidies accelerate market

TABLE 256 OTHERS IN ROW: MARKET, BY POWER OUTPUT, 2018–2021 (‘000 UNITS)

TABLE 257 OTHERS IN ROW: MARKET, BY POWER OUTPUT, 2022–2027 (‘000 UNITS)

TABLE 258 OTHERS IN ROW: MARKET, BY POWER OUTPUT, 2018–2021 (USD MILLION)

TABLE 259 OTHERS IN ROW: MARKET, BY POWER OUTPUT, 2022–2027 (USD MILLION)

17 COMPETITIVE LANDSCAPE (Page No. - 233)

17.1 OVERVIEW

17.2 FARM EQUIPMENT MARKET SHARE ANALYSIS, 2020

TABLE 260 MARKET SHARE ANALYSIS, 2020

FIGURE 46 MARKET SHARE, 2020

17.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 47 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2018-2020

17.4 COMPANY EVALUATION QUADRANT: FARM EQUIPMENT SUPPLIERS

17.4.1 STAR

17.4.2 EMERGING LEADERS

17.4.3 PERVASIVE

17.4.4 PARTICIPANTS

TABLE 261 MARKET: COMPANY PRODUCT FOOTPRINT, 2020

TABLE 262 FARM TRACTOR MARKET: COMPANY PROPULSION FOOTPRINT, 2020

TABLE 263 MARKET: COMPANY REGION FOOTPRINT, 2020

FIGURE 48 COMPETITIVE EVALUATION MATRIX: FARM EQUIPMENT SUPPLIERS, 2020

FIGURE 49 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

17.5 COMPETITIVE SCENARIO

17.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 264 NEW PRODUCT DEVELOPMENTS, 2018–2022

17.5.2 DEALS

TABLE 265 DEALS, 2018–2022

17.5.3 OTHER DEVELOPMENTS

TABLE 266 OTHER DEVELOPMENTS, 2018–2021

17.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

TABLE 267 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2018 TO 2021

18 COMPANY PROFILES (Page No. - 263)

18.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

18.1.1 JOHN DEERE

TABLE 268 JOHN DEERE: BUSINESS OVERVIEW

FIGURE 50 JOHN DEERE: COMPANY SNAPSHOT

TABLE 269 JOHN DEERE: PRODUCTS OFFERED

TABLE 270 JOHN DEERE: DEALS

TABLE 271 JOHN DEERE: NEW PRODUCT DEVELOPMENTS

18.1.2 CNH INDUSTRIAL

TABLE 272 CNH INDUSTRIAL: BUSINESS OVERVIEW

FIGURE 51 CNH INDUSTRIAL: COMPANY SNAPSHOT

TABLE 273 CNH INDUSTRIAL: PRODUCTS OFFERED

TABLE 274 CNH INDUSTRIAL: NEW PRODUCT DEVELOPMENTS

TABLE 275 CNH INDUSTRIAL: DEALS

TABLE 276 CNH INDUSTRIAL: OTHER DEVELOPMENTS

18.1.3 MAHINDRA & MAHINDRA

TABLE 277 MAHINDRA & MAHINDRA: BUSINESS OVERVIEW

FIGURE 52 MAHINDRA & MAHINDRA: COMPANY SNAPSHOT

TABLE 278 MAHINDRA & MAHINDRA: PRODUCTS OFFERED

TABLE 279 MAHINDRA & MAHINDRA: NEW PRODUCT DEVELOPMENTS

TABLE 280 MAHINDRA & MAHINDRA: DEALS

TABLE 281 MAHINDRA & MAHINDRA: OTHER DEVELOPMENT

18.1.4 AGCO CORPORATION

TABLE 282 AGCO CORPORATION: BUSINESS OVERVIEW

FIGURE 53 AGCO CORPORATION: COMPANY SNAPSHOT

TABLE 283 AGCO CORPORATION: PRODUCTS OFFERED

TABLE 284 AGCO CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 285 AGCO CORPORATION: DEALS

TABLE 286 AGCO CORPORATION.: OTHER DEVELOPMENT

18.1.5 KUBOTA CORPORATION

TABLE 287 KUBOTA CORPORATION: BUSINESS OVERVIEW

FIGURE 54 KUBOTA CORPORATION: COMPANY SNAPSHOT

TABLE 288 KUBOTA CORPORATION: PRODUCTS OFFERED

TABLE 289 KUBOTA CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 290 KUBOTA CORPORATION: DEALS

TABLE 291 KUBOTA CORPORATION.: OTHER DEVELOPMENT

18.1.6 CLAAS KGAA MBH

TABLE 292 CLAAS KGAA MBH: BUSINESS OVERVIEW

FIGURE 55 CLAAS KGAA MBH: COMPANY SNAPSHOT

TABLE 293 CLAAS KGAA MBH: PRODUCTS OFFERED

TABLE 294 CLAAS KGAA MBH: NEW PRODUCT DEVELOPMENTS

TABLE 295 CLAAS KGAA MBH: DEALS

TABLE 296 CLAAS KGAA MBH: OTHER DEVELOPMENT

18.1.7 ISEKI & CO., LTD.

TABLE 297 ISEKI & CO., LTD.: BUSINESS OVERVIEW

FIGURE 56 ISEKI & CO., LTD.: COMPANY SNAPSHOT

TABLE 298 ISEKI & CO., LTD.: PRODUCTS OFFERED

TABLE 299 ISEKI & CO., LTD.: DEALS

18.1.8 ESCORTS LIMITED

TABLE 300 ESCORTS LIMITED: BUSINESS OVERVIEW

FIGURE 57 ESCORTS LIMITED: COMPANY SNAPSHOT

TABLE 301 ESCORTS LIMITED: PRODUCTS OFFERED

TABLE 302 ESCORTS LIMITED: NEW PRODUCT DEVELOPMENTS

TABLE 303 ESCORTS LIMITED: DEALS

18.1.9 SDF GROUP

TABLE 304 SDF GROUP: BUSINESS OVERVIEW

FIGURE 58 SDF GROUP: COMPANY SNAPSHOT

TABLE 305 SDF GROUP: PRODUCTS OFFERED

TABLE 306 SDF GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 307 SDF GROUP: DEALS

TABLE 308 SDF GROUP: OTHER DEVELOPMENT

18.1.10 YANMAR HOLDINGS CO., LTD.

TABLE 309 YANMAR HOLDINGS CO., LTD.: BUSINESS OVERVIEW

FIGURE 59 YANMAR HOLDINGS CO., LTD.: COMPANY SNAPSHOT

TABLE 310 YANMAR HOLDINGS CO., LTD.: PRODUCTS OFFERED

TABLE 311 YANMAR HOLDINGS CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 312 YANMAR HOLDINGS CO., LTD.: DEALS

TABLE 313 YANMAR HOLDINGS CO., LTD.: OTHER DEVELOPMENT

18.2 OTHER PLAYERS

18.2.1 JCB

TABLE 314 JCB: COMPANY OVERVIEW

18.2.2 TRACTORS AND FARM EQUIPMENT LIMITED

TABLE 315 TRACTORS AND FARM EQUIPMENT LIMITED: COMPANY OVERVIEW

18.2.3 SONALIKA GROUP

TABLE 316 SONALIKA GROUP: COMPANY OVERVIEW

18.2.4 TONG YANG MOOLSAN (TYM)

TABLE 317 TONG YANG MOOLSAN (TYM): COMPANY OVERVIEW

18.2.5 DAEDONG INDUSTRIAL COMPANY LTD.

TABLE 318 DAEDONG INDUSTRIAL COMPANY LTD.: COMPANY OVERVIEW

18.2.6 EXEL INDUSTRIES

TABLE 319 EXEL INDUSTRIES: COMPANY OVERVIEW

18.2.7 BUCHER INDUSTRIES

TABLE 320 BUCHER INDUSTRIES: COMPANY OVERVIEW

18.2.8 ZETOR TRACTORS

TABLE 321 ZETOR TRACTORS: COMPANY OVERVIEW

18.2.9 ARGO TRACTORS S.P.A.

TABLE 322 ARGO TRACTORS S.P.A.: COMPANY OVERVIEW

18.2.10 CONCERN TRACTOR PLANTS

TABLE 323 CONCERN TRACTOR PLANTS: COMPANY OVERVIEW

18.2.11 AMAZONE H. DREYER GMBH & CO. KG

TABLE 324 AMAZONE H. DREYER GMBH & CO. KG: COMPANY OVERVIEW

18.2.12 ALAMO GROUP INC.

TABLE 325 ALAMO GROUP INC.: COMPANY OVERVIEW

18.2.13 BUHLER INDUSTRIES INC.

TABLE 326 BUHLER INDUSTRIES INC.: COMPANY OVERVIEW

18.2.14 AUTONOMOUS TRACTOR CORPORATION

TABLE 327 AUTONOMOUS TRACTOR CORPORATION: COMPANY OVERVIEW

18.2.15 CHANGZHOU DONGFENG AGRICULTURAL MACHINERY GROUP CO., LTD.

TABLE 328 CHANGZHOU DONGFENG AGRICULTURAL MACHINERY GROUP CO., LTD.: COMPANY OVERVIEW

18.2.16 CHINA NATIONAL MACHINERY INDUSTRY CORPORATION

TABLE 329 CHINA NATIONAL MACHINERY INDUSTRY CORPORATION: COMPANY OVERVIEW

18.2.17 WEICHAI LOVOL HEAVY INDUSTRY CO., LTD

TABLE 330 WEICHAI LOVOL HEAVY INDUSTRY CO., LTD: COMPANY OVERVIEW

18.2.18 KRONE GMBH & CO. KG

TABLE 331 KRONE GMBH & CO. KG: COMPANY OVERVIEW

18.2.19 VERMEER CORPORATION

TABLE 332 VERMEER CORPORATION: COMPANY OVERVIEW

18.2.20 PÖTTINGER LANDTECHNIK GMBH

TABLE 333 PÖTTINGER LANDTECHNIK GMBH: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

19 APPENDIX (Page No. - 339)

19.1 INSIGHTS OF INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.4 AVAILABLE CUSTOMIZATIONS

19.4.1 FARM EQUIPMENT MARKET, BY POWER TYPE & COUNTRY

19.4.1.1 Asia Oceania

19.4.1.1.1 China

19.4.1.1.2 India

19.4.1.1.3 Japan

19.4.1.1.4 South Korea

19.4.1.1.5 Australia

19.4.1.1.6 Rest of Asia Oceania

19.4.1.2 Europe

19.4.1.2.1 Germany

19.4.1.2.2 France

19.4.1.2.3 UK

19.4.1.2.4 Spain

19.4.1.2.5 Russia

19.4.1.2.6 Italy

19.4.1.2.7 Poland

19.4.1.2.8 Turkey

19.4.1.2.9 Rest of Europe

19.4.1.3 North America

19.4.1.3.1 US

19.4.1.3.2 Canada

19.4.1.3.3 Mexico

19.4.1.4 Rest of the World

19.4.1.4.1 Brazil

19.4.1.4.2 Argentina

19.4.1.4.3 Others

19.4.2 ELECTRIC TRACTOR MARKET, BY POWER OUTPUT & COUNTRY

19.4.2.1 Asia Oceania

19.4.2.1.1 China

19.4.2.1.2 India

19.4.2.1.3 Japan

19.4.2.1.4 South Korea

19.4.2.1.5 Australia

19.4.2.1.6 Rest of Asia Oceania

19.4.2.2 Europe

19.4.2.2.1 Germany

19.4.2.2.2 France

19.4.2.2.3 UK

19.4.2.2.4 Spain

19.4.2.2.5 Russia

19.4.2.2.6 Italy

19.4.2.2.7 Poland

19.4.2.2.8 Turkey

19.4.2.2.9 Rest of Europe

19.4.2.3 North America

19.4.2.3.1 US

19.4.2.3.2 Canada

19.4.2.3.3 Mexico

19.4.2.4 Rest of the World

19.4.2.4.1 Brazil

19.4.2.4.2 Argentina

19.4.2.4.3 Others

19.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

The study involves four main activities to estimate the current size of the farm equipment market.

- Exhaustive secondary research was done to collect information on the market, such as, farm tractor market by power output, farm tractor market by drive type, farm equipment market, by equipment type, implements market, by function, farm equipment rental market, by equipment type, farm tractor rental market, by power output, farm tractor rental market, by drive type, farm tractor market, by region, electric tractor market, by propulsion, autonomous tractor market, by power output.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study included the Association of Equipment Manufacturers (AEM); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and farm equipment associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

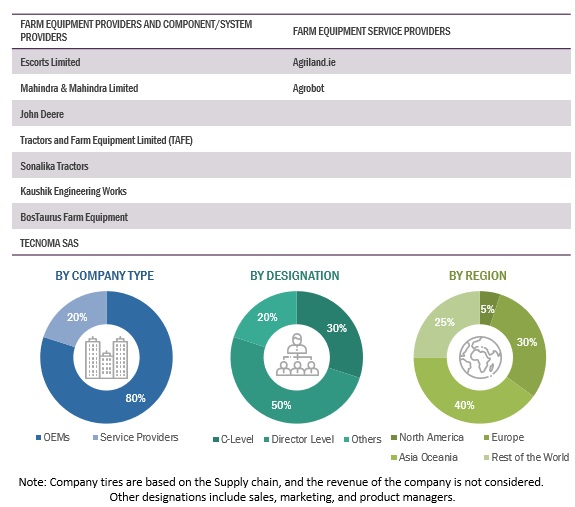

Primary Research

Extensive primary research was conducted after acquiring an understanding of the farm equipment market scenario through secondary research. Several primary interviews were conducted with market experts from farm equipment providers, component/system providers, and end-user organizations across three major regions, namely, North America, Europe, and Asia Oceania. 100% of the primary interviews were conducted from the farm equipment providers and component/system providers. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administrations, were contacted to provide a holistic viewpoint in the report while canvassing primaries.After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- A detailed market estimation approach was followed to estimate and validate the value and volume of the farm equipment market and other dependent submarkets, as mentioned below:

- The bottom-up approach was used to estimate and validate the size of the farm tractor market. The farm equipment market size by power output, in terms of volume, was derived by multiplying the region-level breakup for each type with region-level farm tractor sales. The farm tractor market size by power output, in terms of volume, was derived by multiplying the region-level breakup for each power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) with region-level farm tractor sales.

- The region-level farm equipment market by power output, by volume, was multiplied with the region-level average selling price (ASP) for each application to get the farm tractor market for each application by value.

- The summation of the region-level market would give the global farm tractor market, by power output. The total value of each region was then summed up to derive the total value of the farm tractor market by power output.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

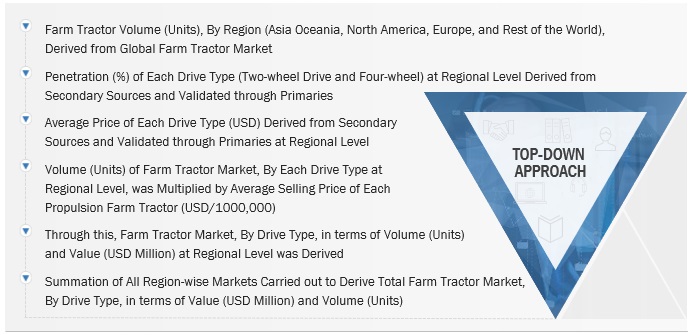

- The top-down approach was used to estimate and validate the market by drive type in terms of volume and value. The farm tractor market value (USD million) by region (Asia oceania, North America, Europe, and RoW) was derived from the global farm tractor market. The penetration of each drive type (two wheel drive and four wheel drive) at the regional level was derived from secondary sources and validated through primaries. The penetration of each drive type was multiplied by the regional farm tractor market to get the farm tractor market value (USD million) for each region. A summation of all region-wise markets was carried out to derive the total farm tractor market value (USD million) by drive type. The top-down approach was followed by farm equipment market by equipment type, farm implements market, by function etc.

Farm Tractor Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Farm Tractor Market Size: Top-Down Approach

Report Objectives

- To define, describe, and forecast the farm equipment market, in terms of volume (’000 units) and value (USD million)

-

To define, describe, and forecast the farm tractors market, by value and volume, based on

- Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at country and regional levels

- Drive type (two-wheel and four-wheel) at the regional level

- Region [Asia Oceania, Europe, North America, and the Rest of the World (RoW)], along with key countries in each of these regions

- To define, describe, and forecast the farm equipment market, by value, based on equipment type (cereal combines, non-cereal combines, balers, self-propelled sprayers, and tractor-mounted sprayers)

- To define, describe, and forecast the implements market, by value, based on function (plowing & cultivating, sowing & planting, plant protection & fertilizing, harvesting & threshing, and others) at the regional level

- To define, describe, and forecast the farm equipment rental market (tractors, combines, sprayers, balers, and other equipment) at the regional level

-

To define, describe, and forecast the farm tractor rental market, by value, based on

- Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP) at the regional level

- Drive type (two-wheel and four-wheel) at the regional level

- To define, describe, and forecast the autonomous tractor market, by value and volume, based on power output (<30 HP, 31–100 HP, and >100 HP) at the regional level

- To define, describe, and forecast the electric tractor market, by value and volume, based on propulsion (battery electric and hybrid electric) at the regional level

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the farm equipment market

- To analyze the impact of COVID-19 on the farm equipment market

- To analyze the market share of the key players in the farm equipment market

- To strategically analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend, regulatory analysis, and the COVID-19 impact

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Farm Equipment Market, By Application & Country

-

Asia Oceania

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Oceania

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Poland

- Turkey

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Argentina

- Others

Farm Equipment Market, By Type & Country

-

Asia Oceania

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Oceania

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Poland

- Turkey

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Argentina

- Others

detailed analysis and profiling of additional market players (UP TO 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Farm Equipment Market

What are the Farm Equipment Market government efforts in emerging countries to increase farm mechanization?

MarketsandMarkets report in Farm Equipment was updated in Jan 2022, and it covers the market trends and growth factors with respect to Farm Equipment Market. It also covered the Market estimations of Farm Equipment’s in terms of Value (USD Million)and Volume (‘000 Units) by Tractor Power Output/ Tractor Drive Type/ Autonomous Tractor/ Electric Tractor/ Farm Equipment/ Implement/ Rental at regional and country level for the period 2016-2027. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. Our report is primarily a demand-based coverage that states the Historic, Current and Future revenues at a regional and country level for which we had contacted several primary respondents from supply and demand side of the business to obtain the qualitative and quantitative information. We have forecasted the market size both in terms of Volume (Units) and Value (USD Million) till year 2027, which is broken down by Farm tractor market by Power Output, Farm tractor market by Drive Type, Farm equipment market, by equipment type, Implements market, by function, Farm equipment Rental market, Farm equipment market by region, Farm equipment Rental market by region.Farm Equipment Market report for your kind evaluation. Based on our conversation, I understood your company Quality Tractor Parts Ltd. being the Ireland's leading national and international tractor parts supplier and the importer & distributor for new and replacement parts for agricultural tractors you are currently looking to understand available total addressable market for these equipment’s globally, which is precisely covered in our report with profiles of the top leading Farm Equipment Manufacturer and Component Manufacturers.

How emerging markets offering revenue expansion opportunities in Farm Equipment Market?

I want to understand the current and future Global market/business potential of Farm Equipments - Tractor attachments

we are looking for No. of Tractor Engines manufactured /forecasted in the coming years for the Tractor segment in India. We are supplying some components for Engine Assly.