Agricultural Micronutrients Market by Type (Zinc, Boron, Iron, Manganese, Molybdenum, and Copper), Mode of Application (Soil, Foliar, and Fertigation), Form (Chelated and Non-Chelated micronutrients), Crop Type and Region - Global Forecast to 2028

Speak to Analyst to get the Global Forecasts Data up to 2028

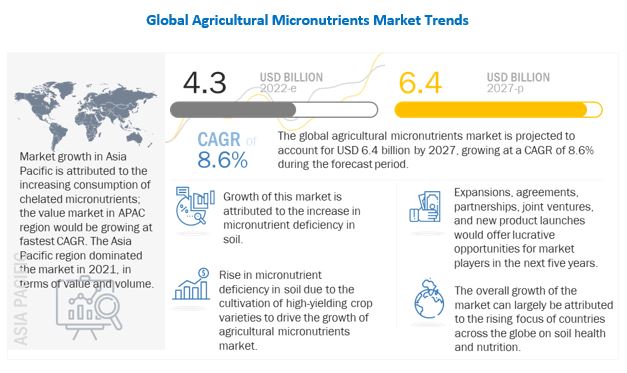

[309 Pages Report] The global agricultural micronutrients market size is projected to grow from USD 4.3 Billion in 2022 to USD 6.4 Billion by 2027, recording a compound annual growth rate (CAGR) of 8.6% during the forecast period. The rise in the global population, leads to rise in need for food security across the globe majorly in developing and underdeveloped countries in the world. These key factors that are projected to drive the growth of the agricultural micronutrients market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of covid-19 on soil fertility and micronutrients application

The type of soil, soil fertility levels within soil types, available nutrients ratios, crop type, and meteorological circumstances influence fertilizer application to crops. The COVID-19 pandemic’s impact on soil fertility is through human activities resulting from farmers’ delay in fertilizer application on time. Amid the COVID-19 pandemic, the need to further develop existing initiatives to increase agricultural input use efficiency, most especially fertilizer, through the adoption of innovations such as sensor and satellite technologies must be implemented. During the COVID-19 pandemic, the central aspect of agriculture to be considered is the impact of mineral fertilizer omissions on soil and production function. The essential plant nutrients of crops, nitrogen (N) and phosphorus (P) must be examined critically. The application of micronutrients to replenish the number of nutrients withdrawn by crop harvest is referred to as sustainable nutrient management. The closure of borders and lockdown prevents fertilizer importation.

The essential micronutrients required by plants in large quantities for growth and productivity are nitrogen (N), phosphorus (P), and potassium (K). China is the largest exporter of P (5.32 Mt) and the second-largest exporter of N fertilizers, respectively (5.56 Mt). The availability of nutrients in the soil for the crop or plant to uptake determines crop maturity and productivity. Because the plant absorbs nutrients from the earth, continuous cropping and harvesting lead to nutrient mining. However, applying the right number of fertilizers at the right time improves soil fertility and boosts crop yield. Fertilizers are imported from developed countries, particularly China, by most African countries. Fertilizers would not be exported in big amounts as a result of the COVID-19 epidemic and control measures implemented. Inadequate production and importation of fertilizers caused by covid 19 logistic constraints caused unsatisfactory yield in Africa.

In West and Central Africa, both ports and airports remain operational and close to non-essential travel for essential imports and exports. However, delays in loading, cargo, and unloading have been reported at various ports. Precautionary measures and frequent screening checks imposed on ship employees are among the causes for the delays discovered. Internal travel restrictions in most nations in the region, as well as lockdowns in several cities, are affected the flow of food and products within countries

Impact of covid-19 on crop yield

The coronavirus pandemic had an impact on crop output and yield due to farmers’ failure to apply fertilizer on time. Crop productivity is heavily influenced by key nutrients such as nitrogen and phosphorus. However, nitrogen (N) is the most common limiting factor in agricultural productivity, and the fertilization of phosphorus (P) has been known to increase the yield of crops in the last century.

Continuous nitrogen and phosphorus fertilizers can lead to nutrient losses in surface and subsurface water, resulting in nitrate leaching and eutrophication, both of which contribute to environmental contamination. Due to coronavirus pandemic restrictions, low availability of fertilizer and application can lead to improved farm management with consequentially reduced emissions of greenhouse gases (GHGs), including ammonia (NH3), nitrous oxide (N2O), emissions, and leaching of nitrate (NO3) into waters, along with overall improved nitrogen use efficiency and less heavy metal accumulation in soils.

Lockdowns imposed in countries as a result of the COVID-19 outbreak influenced long-term crop productivity. Farmers, farm laborers, service providers, extension agents, input suppliers, processors, and other agricultural value chain actors have been harmed as a result of their inability to perform their duties. These limits lead to failure to sow crops on time or to use the best quality and quantity of inputs, such as fertilizers, herbicides, and seeds, to undertake a variety of cultural practices, harvesting, and post-harvest activities. As a result, the amount of crop produced will be lowered, and the demand of consumers will not be met.

Agricultural micronutrients Market Dynamics

Driver: Increase in micronutrient deficiency in soil

Micronutrients are available in low proportions to the plant, and their deficiencies can lead to diseases in crops. Soils all over the globe are suffering imbalances and deficiencies of micronutrients; the main factors causing this are humidity, temperature, and soil pH. Higher pH levels in the soil reduce the availability of micronutrients in the soil. The governmental and non-governmental organizations are stressing the mineral fertilization practices to curb the shortages. According to FAO, around 50% of the mineral fertilizer nutrients are being consumed by countries such as China, the US, and India. According to the same source, the consumption of these nutrient fertilizers has been estimated to grow up to 199 million tonnes (219.3 million tons) by 2030. National food sufficiency has been obtained by many countries today; however, there still exists a need to provide people with nutrient-rich food through strengthening cultivation practices. The countries are now turning toward the use of “Integrated Nutrient Practices.”

The current challenges of malnutrition faced by humans correlate to the decreasing content of micronutrients in the soils. These can, however, be balanced using various products available in the market, such as straight, chelated, micronutrient mixtures, which help majorly in restoring the balance of soils.

Restraint: Booming organic fertilizer industry

According to the “Megatrends in the Agri-Food Sector” report by the European parliament, the trend of food consumption in the developed countries is majorly seen shifting toward healthier foods coming from healthy and safe sources. Thus, people are increasingly becoming aware of the commercialization of agriculture and the extensive use of chemical and synthetic fertilizers, which can cause serious damage to human health. Therefore, in countries where the production of food is more than consumption, people tend to pay attention to the quality of their food. Around 181 countries are engaging in organic farming. According to the “World Organic Agriculture- Statistics and Emerging Trends” report 2017, there is 69.8 million hectares of farm area covered under organic farming, with the maximum being from Australia (35.6 million hectares), Argentina (3.4 million hectares), and China (3 million hectares). Around 2.9 million farmers work in this sector, majorly from India, Uganda, and Mexico.

The organic market is rising steeply and that too in the developed regions, with the important markets being countries such as the US, Germany, and France and an approximate market of USD 97 billion in 2017. Thus, with the growing organic market, the production of organic food would increase. The increase in organic food production would boost the demand for organic agriculture inputs such as organic fertilizers sourced from plant and animal origin. There is a rise in demand for organic fertilizer; therefore, it can be a potential competitor market to the manufacturing micronutrient businesses.

Opportunity: Development of biodegradable chelates

Due to the various known hazards of the non-biodegradable chelating agents, the emphasis on the production of biodegradable chelates is rising in the markets. NTA, EDDS, and ITS are the most recently developed and adopted agents widely being promoted in the markets instead of the non-biodegradable agents. These are mainly used more with objectives such as removal of the metals that can affect the plant and soil health and further to avoid the precipitation of these toxic metals into the soil.

Farmers in the region are eventually shifting from using commodity fertilizer products to specialty fertilizers, such as coated & encapsulated fertilizers, chelated, and slow release. These fertilizers provide high growth potential for increased yield and low water consumption. With support from government policies and subsidies, fertilizer manufacturers are producing agricultural chelates, which is seen to increase in emerging economies such as China and India.

Challenge: Poor awareness among the developing regions regarding the benefits of micronutrients

Smallholding farmers hold most of the agricultural lands all over the globe. According to the MarketsandMarkets insights, factors such as the shift of young population from cultivation toward service-based professions, reducing the number of farmers, and the average ages of the farmers all around the globe going on increasing; there is very a low number of farmers that are well educated and completely aware of the conditions of soils that they cultivate, and the best methods to get the maximum outputs. Thus, they are mostly unaware of the micronutrients existing or deficient in the soil, and the use of nutrients still happens to be a luxury in most countries.

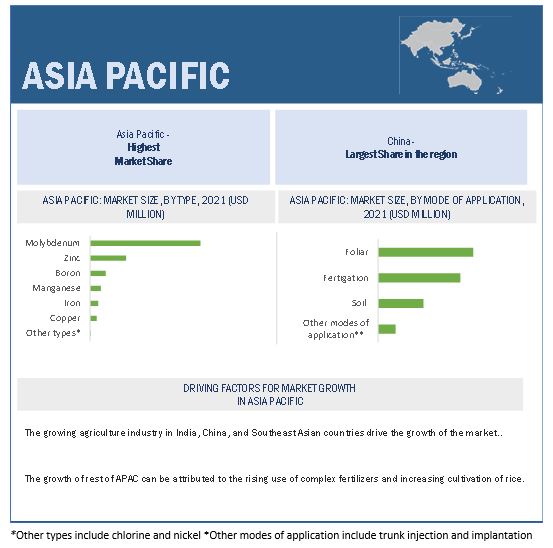

To capture the markets such as India, China, and Africa, which are among the developing nations, the governments, along with NGOs and private partnerships, take up awareness and education campaigns. This will help improve the production at the very base levels and improve soil fertility. In terms of usage, Asia Pacific is characterized to be the leading region for the micronutrients industry due to the growing agriculture industry, followed by North America and Europe, and then by the Middle Eastern and African regions.

By crop type, the fruits & vegetables segment is projected to be the fastest-growing segment in the agricultural micronutrients market during the forecast period.

The trend in the consumers for consuming fruits has witnessed a growth in the past two decades, and this trend is projected to continue in the coming years. The increasing exports of fruits & vegetables have led to rise an increase in the crop plantation area, which has resulted in a rise in their production levels. Hence, the crop sustaining and protecting the micronutrients market for fruits & vegetables is projected to witness significant growth.

By type, the zinc segment is projected to dominate the global market during the forecast period.

Soil nutrient deficiencies of zinc are vastly recorded in regions of Asia (India, China, and Indonesia), sub-Saharan Africa and the northwestern region of South America.

According to a report on “Scarcity of micronutrients in soil, feed, food, and mineral reserves” by “The Platform for Agriculture, Innovation & Society,” an estimated 800,000 people die every year from zinc deficiency, moreover growth retardation, loss of appetite, and impaired immune function is rising amongst zinc deficient people. The mineral reserves for raw material supply, seem to be most restrictive for zinc. At the current production rates of mining, the known reserves are sufficient for only 21 years. Thus, the market for the same is driven towards growth, as it is an important micronutrient and the governments across the globe are making efforts to curb its deficiency through increasing its content in the agricultural produce.

By form, the chelated segment is projected to be the fastest-growing segment in the agricultural micronutrients market during the forecast period.

Chelated micronutrients are organic molecules that combine with metal cation to form a ring-like structure. Chelated micronutrients are available in different ranges of soil pH. Some of the most used chelating agents during the production of synthetic micronutrient chelates are diethylene-triamine Penta-acetic acid (DTPA), ethylenediamine-N, N′-bis (2-hydroxyphenyl acetic acid) (EDDHA), and ethylene diamine-tetra-acetic acid (EDTA). Moreover, due to the stable nature of chelated compounds, the adoption of chelated micronutrients is projected to grow at a faster pace.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is projected to account for the largest share in the global market during the forecast period.

Asia Pacific accounted for the largest share, during the forecast period, in terms of volume and value, respectively. Increasing growth of high-value crops and rising awareness among farmers about the micronutrients are expected to provide more scope for market expansion. The government policies adopted by Asia Pacific countries and the large subsidies for fertilization and nutrition of crops, sometimes up to 100% for marginal farmers, provided on fertilizers are the major factors triggering the growth of this market in the region. The increasing agricultural practices and requirement of high-quality agricultural produce are factors that drive the micronutrient fertilizer market growth in the Asia Pacific region. Major crops produced in Asia include rice, sugar beet, fruits & vegetables, cereals, and grains; the region consumes 90% of the global rice produced.

Key Market Players

Key players in this market include BASF SE (Germany), AkzoNobel (Netherlands), Nutrien, Ltd. (Canada), Yara International ASA (Norway), The Mosaic Company (US), Compass minerals international (US), and Valagro (Italy). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

Type, Crop type, Form, Mode of Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

BASF SE (Germany), AkzoNobel (Netherlands), Nutrien, Ltd. (Canada), Nufarm (Australia), Coromandel International Ltd. (India), Helena Chemical Company (US), Yara International ASA (Norway), The Mosaic Company (US), Haifa Group (Israel), Sapec SA (Belgium), Compass minerals international (US), Valagro (Italy), Zuari Agrochemicals Ltd (India), Stoller Enterprises Inc (US), Balchem (US), ATP Nutrition (Canada), Baicor LC (US), Corteva Inc (US), and BMS Micronutrient NV (Belgium). |

This research report categorizes the agricultural micronutrients market based on type, crop type, form, mode of application, and region.

Based on type, the market has been segmented as follows:

- Zinc

- Boron

- Iron

- Molybdenum

- Manganese

- Other types (Chlorine and Nickel)

Based on End Use, the market has been segmented as follows:

-

Non-agricultural Cereals & grains

- Corn

- Wheat

- Rice

- Other cereals & grains

- Fruits & vegetables

-

Oilseeds & pulses

- Soybean

- Canola

- Others

- Other crop types (Turfs, ornamentals, plantation crops, forages, and fiber crops)

Based on the form, the market has been segmented as follows:

- Chelated

- Non-Chelated

Based on the mode of application, the market has been segmented as follows:

- Foliar

- Fertigation

- Soil

- Other modes of application (Seed treatment, trunk injection, and implantation)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (RoW includes South Africa, Turkey, and Others in RoW)

Recent Developments

- In 2022 February, The Mosaic Company partnered with the Ethos Institute to support its supply chain partners to address their impact

- In 2022 February, Marrone Bio and Corteva Agriscience announced a distribution contract under which Corteva will be the exclusive European distributor for Kinsidro® Grow

- In 2021 September, Coromandel International Limited launched a new fertilizer GroShakti Plus a superior complex fertilizer, with ‘EnPhos Technology,’ in India.

- In 2021 March, The Mosaic Company entered a strategic partnership with Sound Agriculture to develop and distribute a nutrient efficiency product. The product will leverage Sound Agriculture’s bio-inspired chemistry that activates the soil microbiome to give plants access to important nutrients and allow growers to optimize fertilizer inputs. The co-developed product is expected to launch in the US by 2023, before rolling out to the Americas, with a focus on Brazil, Argentina, and Canada.

- In 2020 July, Haifa Group signed an agreement with AgrIOT. Haifa would invest in AgrIOT a sum of around USD 2 million against nearly 30% of the company and global exclusive distribution rights. AgrIOT’s technology was based on machine learning principles and managed to diagnose the precise shortfall in nutrient uptake based on a simple photograph that can be taken on any smartphone

- In 2019 February, Haifa Group launched NutriNet, a new online service for growers and agronomy experts, aiming to enhance the process of creating customized fertilization programs. This tool would help integrate the data regarding crops, soil type, water analysis, irrigation system setup, and other preferences of growers, which support the decision-making of farmers.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the agricultural micronutrients market and how intense is the competition?

The key players in this market include The Mosaic Company (US), BASF SE (Germany), Nutrien Ltd (Canada), AkzoNobel (Netherlands), Yara International ASA (Norway), Helena Chemical Company (US), Nufarm (Australia), Land O’Lakes (US), Brandt (US), Koch (US), FMC Corporation (US), and Balchem (US).

The agricultural micronutrients market is highly competitive with the leading companies working hard to devise strategies. The strong manufacturing regions such as Europe and North America show a high rise in the development of new companies in the market which strongly are emerging as ey exporters.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to agricultural micronutrients market would be

- Agricultural micronutrient manufacturers, formulators, and blenders

- Fertilizer traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to agricultural micronutrient manufacturers

- Agricultural co-operative societies

- Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Association (IFA)

- Micronutrient Manufacturers Association (MMA)

- The Fertilizer Institute (TFI)

- Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Association of American Plant Food Control Officials (AAFCO)

- European Commission

- Ministry of Agriculture (MOA), China

- Department of Agriculture, Forestry, and Fisheries (DAFF), South Africa

- US Department of Agriculture (USDA)

What are the potential challenges to the agricultural micronutrients market?

To capture the markets such as India, China, and Africa, which are among the developing nations, the governments, along with NGOs and private partnerships, take up awareness and education campaigns. This will help improve the production at the very base levels and improve soil fertility. In terms of usage, Asia Pacific is characterized to be the leading region for the micronutrients industry due to the growing agriculture industry, followed by North America and Europe, and then by the Middle Eastern and African regions.

What are the key market trends in the food agricultural micronutrients market?

There also exists significant geopolitics among the regions in terms of resources. This means that only three non-European countries are responsible for mining 50% of the zinc and manganese micronutrient resources and around 75% of molybdenum and boron. Thus, the rest of the regions must innovate methods to extract the nutrients from other sufficient resources.

What are the key development strategies undertaken by companies in the agricultural micronutrients market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players to achieve differential positioning in the global market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS AND EXCLUSIONS PERTAINING TO THE AGRICULTURAL MICRONUTRIENTS MARKET

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES, 2018–20221

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.8.1 AGRICULTURAL MICRONUTRIENTS MARKET – GLOBAL FORECAST TO 2027

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 MARKET FOR AGRICULTURAL MICRONUTRIENTS: RESEARCH DESIGN CHART

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 3 EXPERT INSIGHTS

2.1.2.1 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 4 AGRICULTURAL MICRONUTRIENTS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 13 AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET SIZE, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET SIZE, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 17 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 18 INCREASE IN THE MICRONUTRIENT DEFICIENCY IN SOIL ACROSS THE GLOBE IS EXPECTED TO PROPEL THE MARKET

4.2 MARKET FOR AGRICULTURAL MICRONUTRIENTS: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 19 VIETNAM PROJECTED TO BE THE FASTEST-GROWING MARKET FOR AGRICULTURAL MICRONUTRIENTS DURING THE FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET FOR AGRICULTURAL MICRONUTRIENTS, BY KEY TYPE & COUNTRY

FIGURE 20 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2022

4.4 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE

FIGURE 21 MOLYBDENUM TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.5 MARKET FOR AGRICULTURAL MICRONUTRIENTS, BY CROP TYPE

FIGURE 22 FRUITS & VEGETABLES IS PROJECTED TO DOMINATE THE MARKET FOR AGRICULTURAL MICRONUTRIENTS DURING THE FORECAST PERIOD

4.6 MARKET FOR AGRICULTURAL MICRONUTRIENTS, BY MODE OF APPLICATION

FIGURE 23 ASIA PACIFIC TO DOMINATE ALL MODES OF APPLICATION OF AGRICULTURAL MICRONUTRIENTS IN 2022

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 AGRICULTURAL MICRONUTRIENTS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in micronutrient deficiency in soil

5.2.1.2 Rise in focus on crop production and quality

5.2.1.3 Supporting policies from the government

5.2.2 RESTRAINTS

5.2.2.1 Booming organic fertilizer industry

5.2.2.2 Bio-accumulation of non-biodegradable chelates

5.2.3 OPPORTUNITIES

5.2.3.1 Development of biodegradable chelates

5.2.4 CHALLENGES

5.2.4.1 Poor awareness among the developing regions regarding the benefits of micronutrients

5.2.4.2 Need for sustainable sourcing of raw materials

5.3 MACROECONOMIC INDICATORS

5.3.1 DECREASE IN ARABLE LAND AROUND THE GLOBE

FIGURE 25 GLOBAL DECREASE IN PER CAPITA ARABLE LANDS, 1960–2050 (HA)

5.3.2 GROWTH IN PRODUCTION OF HIGH-VALUE CROPS

FIGURE 26 AREA HARVESTED, BY CROP TYPE, 2014–2020 (HA)

5.3.3 RISE IN IMPORTANCE OF MICRONUTRIENTS IN HUMAN CONSUMPTION

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 IMPACT OF COVID-19 ON FERTILIZER IMPORTATION AND SUPPLY CHAIN

5.4.2 IMPACT OF COVID-19 ON SOIL FERTILITY AND FERTILIZER APPLICATION

5.4.3 IMPACT OF COVID-19 ON SOIL FERTILITY AND FERTILIZER APPLICATION

5.5 TRENDS & DISRUPTIONS IMPACTING CONSUMERS’ BUSINESSES

FIGURE 27 REVENUE SHIFT FOR THE AGRICULTURAL MICRONUTRIENTS MARKET

5.6 PRICING ANALYSIS

FIGURE 28 GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET AVERAGE SELLING PRICE (ASP), BY REGION, 2018–2021 (USD/TON)

FIGURE 29 GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET AVERAGE SELLING PRICE (ASP), BY TYPE, 2018–2021 (USD/TON)

5.7 VALUE CHAIN ANALYSIS

FIGURE 30 MARKET FOR AGRICULTURAL MICRONUTRIENTS: VALUE CHAIN ANALYSIS

5.7.1 RESEARCH & DEVELOPMENT

5.7.2 REGISTRATION

5.7.3 FORMULATION & MANUFACTURING

5.7.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALE SERVICES

5.8 MARKET ECOSYSTEM/MARKET MAP

FIGURE 31 AGRICULTURAL MICRONUTRIENTS MARKET: PRODUCT R&D AND PRODUCTION ARE VITAL COMPONENTS OF THE SUPPLY CHAIN

TABLE 5 FERTILIZERS MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 32 AGRICULTURAL MICRONUTRIENTS MARKET MAP

5.9 TECHNOLOGY ANALYSIS

5.9.1 NEW ENVIRONMENTALLY FRIENDLY BIO-BASED MICRONUTRIENT FERTILIZER BY BIOSORPTION

5.9.2 PRECISION TECHNOLOGY IN FERTILIZER APPLICATION

5.10 PATENT ANALYSIS

FIGURE 33 MARKET FOR AGRICULTURAL MICRONUTRIENTS: INCREASE IN PATENT GRANTS, 2010–2021

TABLE 6 MARKET FOR AGRICULTURAL MICRONUTRIENTS: KEY APPLICANTS FOR MICRONUTRIENT FERTILIZERS, 2018–2021

TABLE 7 LIST OF IMPORTANT PATENTS FOR MICRONUTRIENTS, 2018–2020

5.11 TRADE ANALYSIS

5.11.1 IMPORT ANALYSIS

FIGURE 34 AGRICULTURAL MICRONUTRIENTS MARKET: IMPORT VALUE, 2017-2020 (USD THOUSAND)

5.11.2 EXPORT ANALYSIS

FIGURE 35 MARKET FOR AGRICULTURAL MICRONUTRIENTS: EXPORT VALUE, 2017-2020 (USD THOUSAND)

5.12 KEY CONFERENCES AND EVENTS

TABLE 8 LIST OF CONFERENCES & EVENTS ON MICRONUTRIENTS, 2021

5.13 TARIFF & REGULATORY LANDSCAPE

5.13.1 NORTH AMERICA

5.13.1.1 US

5.13.2 ASIA PACIFIC

5.13.2.1 Australia

5.13.2.2 China

5.13.3 SOUTH AFRICA

5.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MARKET FOR AGRICULTURAL MICRONUTRIENTS: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 THREAT OF NEW SUBSTITUTES

5.14.3 BARGAINING POWER OF SUPPLIERS

5.14.4 BARGAINING POWER OF BUYERS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 CASE STUDIES

5.15.1 NEW ENVIRONMENT-FRIENDLY FERTILIZER INCREASED THE BIOAVAILABILITY OF MICRONUTRIENTS

5.15.2 SOIL MICRONUTRIENT AVAILABILITY IN GRONINGEN, NETHERLANDS

6 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE (Page No. - 86)

6.1 INTRODUCTION

FIGURE 36 MOLYBDENUM PROJECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 10 AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 11 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.1.1 COVID-19 IMPACT ON THE AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE

6.1.1.1 Optimistic Scenario

TABLE 12 OPTIMISTIC SCENARIO: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2019–2022 (USD MILLION)

6.1.1.2 Realistic Scenario

TABLE 13 REALISTIC SCENARIO: MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

6.1.1.3 Pessimistic Scenario

TABLE 14 PESSIMISTIC SCENARIO: MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

6.2 ZINC

6.2.1 ZINC-BASED FERTILIZER DEMAND IS STABLE IN THE MARKET AS IT IS A SCARCE NUTRIENT

TABLE 15 ZINC-BASED MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 16 ZINC-BASED MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 BORON

6.3.1 COMPLEX SOIL CONDITIONS AND PLANT PHYSIOLOGIES MAKE IT DIFFICULT TO MANAGE BORON SUPPLEMENTATION

FIGURE 37 GLOBAL BORON PRODUCTION RATES, 2020

TABLE 17 BORON-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 BORON: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 IRON

6.4.1 UNABSORBABLE EXISTENT FORM OF IRON FUELS DEMAND IN THE AGRICULTURAL SECTOR

TABLE 19 IRON-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 20 IRON-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.5 MOLYBDENUM

6.5.1 DEMAND FOR MOLYBDENUM TO BE HIGHER AMONG THE FARMERS UNDERTAKING LEGUMINOUS CROPS

TABLE 21 MOLYBDENUM-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 MOLYBDENUM-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.6 COPPER

6.6.1 COPPER HAS A MAJOR ROLE IN CARBOHYDRATE AND NITROGEN METABOLISM

TABLE 23 COPPER-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 COPPER-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.7 MANGANESE

6.7.1 IRREGULAR DEPOSITS OF MANGANESE ACROSS REGIONS FUEL DEMAND IN REGIONS EXPERIENCING A DEFICIT

TABLE 25 MANGANESE-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 MANGANESE: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.8 OTHER TYPES

TABLE 27 OTHER AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 OTHER AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE (Page No. - 100)

7.1 INTRODUCTION

FIGURE 38 AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 29 MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 30 MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE AGRICULTURAL MICRONUTRIENTS MARKET, BY CROP TYPE

7.1.1.1 Optimistic Scenario

TABLE 31 OPTIMISTIC SCENARIO: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY CROP TYPE, 2019–2022 (USD MILLION)

7.1.1.2 Realistic Scenario

TABLE 32 REALISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2019–2022 (USD MILLION)

7.1.1.3 Pessimistic Scenario

TABLE 33 PESSIMISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2019–2022 (USD MILLION)

7.2 CEREALS & GRAINS

7.2.1 MICRONUTRIENT DEFICIENCIES IN MAJOR STAPLE CROPS TO DRIVE MARKET

7.2.1.1 Corn

7.2.1.2 Wheat

7.2.1.3 Rice

7.2.1.4 Other cereals & grains

TABLE 34 AGRICULTURAL MICRONUTRIENTS MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 MARKET SIZE IN CEREALS & GRAINS, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 CEREALS & GRAINS: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 37 CEREALS & GRAINS: MARKET SIZE , BY SUBTYPE, 2022–2027 (USD MILLION)

7.3 FRUITS & VEGETABLES

7.3.1 CONCERN REGARDING BALANCED NUTRITION TO DRIVE APPLICATION IN FRUITS AND VEGETABLES

TABLE 38 AGRICULTURAL MICRONUTRIENTS MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 MARKET SIZE IN FRUITS & VEGETABLES, BY REGION, 2022–2027 (USD MILLION)

7.4 OILSEEDS & PULSES

7.4.1 RISE IN DEMAND FROM THE FEED INDUSTRY FOR OILSEEDS TO PROMOTE THE APPLICATION OF MICRONUTRIENTS

7.4.1.1 Soybean

7.4.1.2 Canola

7.4.1.3 Other oilseeds & pulses

TABLE 40 AGRICULTURAL MICRONUTRIENTS MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 MARKET SIZE IN OILSEEDS & PULSES, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 OILSEEDS & PULSES: MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 43 OILSEEDS & PULSES: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

7.5 OTHER TYPES

TABLE 44 AGRICULTURAL MICRONUTRIENTS MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 MARKET SIZE IN OTHER CROP TYPES, BY REGION, 2022–2027 (USD MILLION)

8 AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM (Page No. - 114)

8.1 INTRODUCTION

FIGURE 39 NON-CHELATED SEGMENT PROJECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY FORM, 2017–2021 (USD MILLION)

TABLE 47 MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE AGRICULTURAL MICRONUTRIENTS MARKET, BY FORM

8.1.1.1 Optimistic Scenario

TABLE 48 OPTIMISTIC SCENARIO: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY FORM, 2019–2022 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE 49 REALISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 50 PESSIMISTIC SCENARIO: MARKET SIZE, BY FORM, 2019–2022 (USD MILLION)

8.2 CHELATED MICRONUTRIENTS

8.2.1 HIGHER BIOAVAILABILITY OF MICRONUTRIENTS DRIVES ADOPTION OF CHELATED MICRONUTRIENTS

TABLE 51 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 54 CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.2.1.1 Ethylene Diamine-tetra-acetic acid (EDTA)

TABLE 55 EDTA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 EDTA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.1.2 Ethlyenediamine Di-2-Hydroxyphenyl Acetate (EDDHA)

TABLE 57 EDDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 EDDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.1.3 Diethylene-triamine penta-acetic acid (DTPA)

TABLE 59 DTPA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 DTPA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.1.4 Iminodisuccinic Acid (IDHA)

TABLE 61 IDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 IDHA-BASED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.1.5 Other Chelated Micronutrients

TABLE 63 OTHER CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 OTHER CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 NON-CHELATED MICRONUTRIENTS

8.3.1 CHEAPER RATES OF NON-CHELATED MICRONUTRIENTS TO DRIVE PREFERENCE

TABLE 65 NON-CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 NON-CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION (Page No. - 126)

9.1 INTRODUCTION

FIGURE 40 AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 67 MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 68 MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE AGRICULTURAL MICRONUTRIENTS MARKET, BY MODE OF APPLICATION

9.1.1.1 Optimistic Scenario

TABLE 69 OPTIMISTIC SCENARIO: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

9.1.1.2 Realistic Scenario

TABLE 70 REALISTIC SCENARIO: MARKET SIZE, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

9.1.1.3 Pessimistic Scenario

TABLE 71 PESSIMISTIC SCENARIO: MARKET SIZE, BY MODE OF APPLICATION, 2019–2022 (USD MILLION)

9.2 SOIL

9.2.1 REDUCED COST AND UNIFORM DISTRIBUTION OF MICRONUTRIENTS TO PROMOTE SOIL MODE OF APPLICATION

TABLE 72 SOIL APPLICATION MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 73 SOIL APPLICATION MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 FOLIAR

9.3.1 LOW RATES OF APPLICATION AND IMMEDIATE RESPONSE TO APPLIED NUTRIENTS TO DRIVE FOLIAR APPLICATION

TABLE 74 FOLIAR APPLICATION MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 FOLIAR APPLICATION MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 FERTIGATION

9.4.1 IMPROVED NUTRIENT USE EFFICIENCY TO DRIVE THE FERTIGATION APPLICATION

TABLE 76 FERTIGATION APPLICATION MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 FERTIGATION APPLICATION MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHER MODES OF APPLICATION

TABLE 78 OTHER MODES OF APPLICATION MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 OTHER MODES OF APPLICATION MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION (Page No. - 136)

10.1 INTRODUCTION

FIGURE 41 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN THE ASIA PACIFIC, 2022–2027

TABLE 80 AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 81 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION

10.1.1.1 Optimistic Scenario

TABLE 82 OPTIMISTIC SCENARIO: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY REGION, 2019–2022 (USD MILLION)

10.1.1.2 Realistic Scenario

TABLE 83 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

10.1.1.3 Pessimistic Scenario

TABLE 84 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 42 NORTH AMERICA: AGRICULTURAL MICRONUTRIENTS MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Sustainable agriculture systems and stringent environmental regulations to drive the market in the US

TABLE 101 US: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 102 US: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 US: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 104 US: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.2.2 CANADA

10.2.2.1 Boron and zinc deficiencies in the soil to promote application of agricultural micronutrients

TABLE 105 CANADA: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 108 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.2.3 MEXICO

10.2.3.1 Increase in government focus toward sustainable agriculture to drive demand for agricultural micronutrients

TABLE 109 MEXICO: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 110 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 111 MEXICO: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 112 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3 EUROPE

TABLE 113 EUROPE: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 117 EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 120 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 121 EUROPE: MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.3.1 FRANCE

10.3.1.1 Increase in organic farming practices to promote the use of agricultural micronutrients in France

TABLE 129 FRANCE: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 FRANCE: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 132 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.2 GERMANY

10.3.2.1 Rise in demand for agricultural micronutrients due to increase in boron deficiencies in German soils

TABLE 133 GERMANY: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 136 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.3 POLAND

10.3.3.1 Prevalence of unfertile acid soils and low content of available nutrients to drive market in Poland

TABLE 137 POLAND: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 138 POLAND: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 139 POLAND: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 140 POLAND: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.4 SPAIN

10.3.4.1 High export rate of organic food products to drive the demand for agricultural micronutrients in Spain

TABLE 141 SPAIN: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 142 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 143 SPAIN: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 144 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.5 UK

10.3.5.1 Adoption of the agronomic bio-fortification process to drive the demand for micronutrients in the UK

TABLE 145 UK: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 146 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 147 UK: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 148 UK: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.6 ITALY

10.3.6.1 Greater demand for cereals & grains in feed and food to drive the growth in Italy

TABLE 149 ITALY: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 150 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 ITALY: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 152 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.3.7 REST OF EUROPE

TABLE 153 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 156 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET SNAPSHOT

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 169 ASIA PACIFIC: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Multiple soil nutrient deficiencies in driving the demand for agricultural micronutrients

TABLE 173 CHINA: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 176 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4.2 INDIA

10.4.2.1 Government initiatives for restoring the micronutrient availability in the soil to drive the market

TABLE 177 INDIA: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 178 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 179 INDIA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 180 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4.3 AUSTRALIA

10.4.3.1 Shift toward nutritionally balanced food products to promote the application of agricultural micronutrients

TABLE 181 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 182 AUSTRALIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 AUSTRALIA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 184 AUSTRALIA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4.4 JAPAN

10.4.4.1 Cultivation of micronutrient-efficient genotypes to drive the demand for agricultural micronutrients

TABLE 185 JAPAN: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 186 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 187 JAPAN: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 188 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4.5 VIETNAM

10.4.5.1 High erosion rates of the soil to drive the growth of the agricultural micronutrients market

TABLE 189 VIETNAM: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 190 VIETNAM: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 191 VIETNAM: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 192 VIETNAM: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.4.6 REST OF ASIA PACIFIC

TABLE 193 REST OF ASIA PACIFIC: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 196 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.5 SOUTH AMERICA

TABLE 197 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 198 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 199 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 200 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 201 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 202 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 203 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 204 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 205 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 206 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 207 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 208 SOUTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 209 SOUTH AMERICA: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 210 SOUTH AMERICA: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 211 SOUTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 212 SOUTH AMERICA: MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Demand for export of agricultural products to drive the market in Brazil

TABLE 213 BRAZIL: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 214 BRAZIL: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 216 BRAZIL: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.5.2 ARGENTINA

10.5.2.1 Growth in awareness among farmers about the benefits of micronutrients to drive market in Argentina

TABLE 217 ARGENTINA: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 218 ARGENTINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 219 ARGENTINA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 220 ARGENTINA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.5.3 REST OF SOUTH AMERICA

TABLE 221 REST OF SOUTH AMERICA: AGMARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 222 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 223 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 224 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.6 REST OF THE WORLD

TABLE 225 ROW: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 226 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 227 ROW: MARKET SIZE, BY COUNTRY, 2017–2021 (KT)

TABLE 228 ROW: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 229 ROW: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 230 ROW: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 231 ROW: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 232 ROW: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 233 ROW: MARKET SIZE, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 234 ROW: MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 235 ROW: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 236 ROW: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 237 ROW: CHELATED AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 238 ROW: MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 239 ROW: MARKET SIZE, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 240 ROW: MARKET SIZE, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 Depleting arable land and poor financial support result in slow market growth in South Africa

TABLE 241 SOUTH AFRICA: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 242 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 243 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 244 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.6.2 TURKEY

10.6.2.1 Increase in iron and zinc deficiencies drives the growth of micronutrients in Turkey

TABLE 245 TURKEY: MARKET SIZE FOR AGRICULTURAL MICRONUTRIENTS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 246 TURKEY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 247 TURKEY: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 248 TURKEY: MARKET SIZE, BY TYPE, 2022–2027 (KT)

10.6.3 OTHERS IN ROW

TABLE 249 OTHERS IN ROW: AGRICULTURAL MICRONUTRIENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 250 OTHERS IN ROW: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 251 OTHERS IN ROW: MARKET SIZE, BY TYPE, 2017–2021 (KT)

TABLE 252 OTHERS IN ROW: MARKET SIZE, BY TYPE, 2022–2027 (KT)

11 COMPETITIVE LANDSCAPE (Page No. - 232)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 253 AGRICULTURAL MICRONUTRIENTS: DEGREE OF COMPETITION, 2020

11.3 KEY PLAYER STRATEGIES

FIGURE 44 AGRICULTURAL MICRONUTRIENTS: KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE AGRICULTURAL MICRONUTRIENTS MARKET, 2018–2021

11.4 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD MILLION)

11.5 COVID-19-SPECIFIC COMPANY RESPONSE

11.5.1 YARA INTERNATIONAL ASA

11.5.2 NUTRIEN LTD

11.5.3 THE MOSAIC COMPANY

11.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.6.1 DYNAMIC DIFFERENTIATORS

11.6.2 INNOVATORS

11.6.3 VISIONARY LEADERS

11.6.4 EMERGING COMPANIES

FIGURE 46 MARKET FOR AGRICULTURAL MICRONUTRIENTS: COMPETITIVE LEADERSHIP MAPPING, 2021

11.7 START-UP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 47 AGRICULTURAL MICRONUTRIENTS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS, 2016–2021

11.8 PRODUCT FOOTPRINT

TABLE 254 AGRICULTURAL MICROBIALS: COMPANY PRODUCT TYPE FOOTPRINT

TABLE 255 AGRICULTURAL MICROBIALS: COMPANY APPLICATION FOOTPRINT

TABLE 256 AGRICULTURAL MICROBIALS: COMPANY REGIONAL FOOTPRINT

11.9 COMPETITIVE SCENARIO

11.9.1 NEW PRODUCT LAUNCHES

TABLE 257 NEW PRODUCT LAUNCHES, 2017–2021

11.9.2 DEALS

TABLE 258 DEALS, 2018–2022

11.9.3 OTHERS

TABLE 259 OTHERS, 2017–2019

12 COMPANY PROFILES (Page No. - 250)

(Business overview, Products offered, Recent Developments, Right to win)*

12.1 BASF SE

TABLE 260 BASF SE: BUSINESS OVERVIEW

FIGURE 48 BASF SE: COMPANY SNAPSHOT

TABLE 261 BASF SE: DEALS

TABLE 262 BASF SE: OTHERS

12.2 AKZONOBEL (NOURYON)

TABLE 263 AKZONOBEL: BUSINESS OVERVIEW

FIGURE 49 AKZONOBEL: COMPANY SNAPSHOT

TABLE 264 AKZONOBEL: DEALS

TABLE 265 AKZONOBEL: OTHERS

12.3 NUTRIEN LTD.

TABLE 266 NUTRIEN LTD.: BUSINESS OVERVIEW

FIGURE 50 NUTRIEN LTD: COMPANY SNAPSHOT

TABLE 267 NUTRIEN LTD. : DEALS

12.4 NUFARM

TABLE 268 NUFARM LTD.: BUSINESS OVERVIEW

FIGURE 51 NUFARM: COMPANY SNAPSHOT

12.5 YARA INTERNATIONAL ASA

TABLE 269 YARA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 52 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

TABLE 270 YARA INTERNATIONAL : DEALS

TABLE 271 YARA INTERNATIONAL : OTHERS

12.6 COROMANDEL INTERNATIONAL LTD

TABLE 272 COROMANDEL INTERNATIONAL LTD: BUSINESS OVERVIEW

12.7 LAND O’ LAKES

TABLE 273 LAND 0’ LAKES: BUSINESS OVERVIEW

FIGURE 54 LAND O’ LAKES: COMPANY SNAPSHOT

TABLE 274 LAND 0’ LAKES: DEALS

12.8 HELENA CHEMICAL COMPANY

TABLE 275 HELENA CHEMICAL COMPANY: BUSINESS OVERVIEW

12.9 THE MOSAIC COMPANY

TABLE 276 THE MOSAIC COMPANY: BUSINESS OVERVIEW

FIGURE 55 THE MOSAIC COMPANY: COMPANY SNAPSHOT

TABLE 277 THE MOSAIC COMPANY: NEW PRODUCT LAUNCHES

TABLE 278 THE MOSAIC COMPANY:MARKET: DEALS

TABLE 279 THE MOSAIC COMPANY:MARKET: OTHERS

12.10 HAIFA GROUP

TABLE 280 HAIFA GROUP: BUSINESS OVERVIEW

TABLE 281 HAIFA GROUP: NEW PRODUCT LAUNCHES

TABLE 282 HAIFA GROUP: DEALS

TABLE 283 HAIFA GROUP: OTHERS

12.11 SAPEC S.A.

TABLE 284 SAPEC S.A.: BUSINESS OVERVIEW

12.12 COMPASS MINERALS INTERNATIONAL

TABLE 285 COMPASS MINERALS INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 56 COMPASS MINERALS INTERNATIONAL: COMPANY SNAPSHOT

TABLE 286 COMPASS MINERALS INTERNATIONAL:: NEW PRODUCT LAUNCHES

TABLE 287 COMPASS MINERALS INTERNATIONAL: DEALS

TABLE 288 COMPASS MINERALS INTERNATIONAL: OTHERS

12.13 VALAGRO

TABLE 289 VALAGRO: BUSINESS OVERVIEW

TABLE 290 VALAGRO:DEALS

TABLE 291 VALAGRO:OTHERS

12.14 ZUARI AGROCHEMICALS LTD

TABLE 292 ZUARI AGROCHEMICALS LTD: BUSINESS OVERVIEW

FIGURE 57 ZUARI AGROCHEMICALS LTD: COMPANY SNAPSHOT

12.15 STOLLER ENTERPRISES INC

TABLE 293 STOLLER ENTERPRISES INC: BUSINESS OVERVIEW

12.16 BALCHEM

TABLE 294 BALCHEM: BUSINESS OVERVIEW

FIGURE 58 BALCHEM: COMPANY SNAPSHOT

12.17 ATP NUTRITION

TABLE 295 ATP NUTRITION: BUSINESS OVERVIEW

12.18 BAICOR LC

TABLE 296 BAICOR LC: BUSINESS OVERVIEW

12.19 CORTEVA INC

TABLE 297 CORTEVA INC: BUSINESS OVERVIEW

FIGURE 59 CORTEVA INC: COMPANY SNAPSHOT

12.2 BMS MICRONUTRIENTS NV

TABLE 298 BMS MICRONUTRITION NV: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, Right to win might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 299)

13.1 INTRODUCTION

TABLE 299 ADJACENT MARKETS FOR AGRICULTURAL MICRONUTRIENTS

13.2 LIMITATIONS

13.3 AGRICULTURAL CHELATES MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 AGRICULTURAL CHELATES MARKET, BY TYPE

13.4.1 INTRODUCTION

TABLE 300 AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

13.5 AGRICULTURAL CHELATES MARKET, BY REGION

13.5.1 INTRODUCTION

TABLE 301 AGRICULTURAL CHELATES MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

14 APPENDIX (Page No. - 302)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

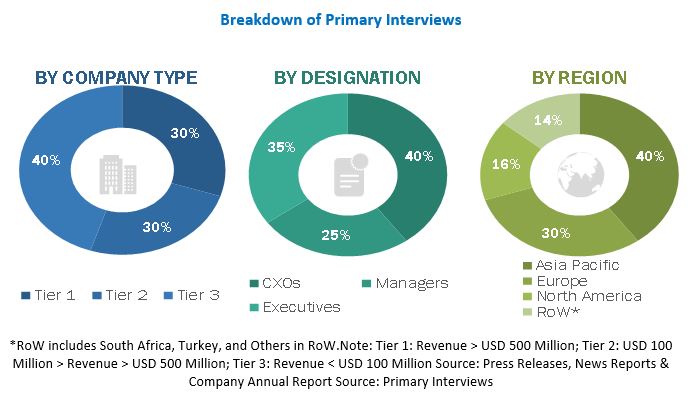

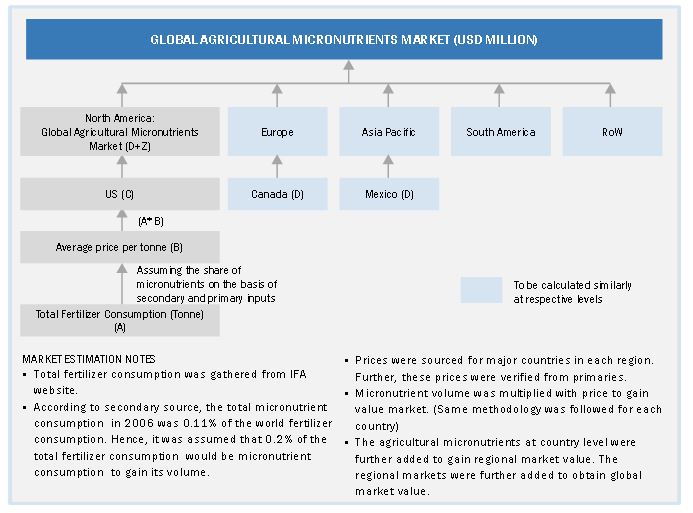

The study involved four major steps in estimating the size of the agricultural micronutrients market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as micronutrient manufacturers, formulators and blenders, Agricultural co-operative societies, Commercial research & development (R&D) organizations and financial institutions, Food and Agriculture Organization (FAO), International Fertilizer Association (IFA), Micronutrient Manufacturers Association (MMA), Government agricultural departments and regulatory bodies such as the US Environmental Protection Agency (EPA), US Department of Agriculture (USDA), Animal and Plant Health Inspection Service (APHIS), and Canadian Food Inspection Agency (CFIA) were referred to identify and collect information for this study.

The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall agricultural micronutrients market comprises several stakeholders in the supply chain, which include global and regional micronutrients, dealers, as well as manufacturers of fertilizers. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional agricultural micronutrients dealers and manufacturers. The primary sources from the supply side include agricultural micronutrients processing units, research institutions involved in R&D, and key opinion leaders.

The market is driven potentially by factors such as decreasing arable lands around the globe, growing production of high-value crops, and raising the micronutrient content in human consumption. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches have also been used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

Top-Down

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the sizes of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural micronutrients market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market sizes obtained for each segment.

Bottom-Up

- With the bottom-up approach, agricultural micronutrients for each type, crop type, form, and mode of application were added up to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on types in regions. From this, we derived the market sizes, in terms of volume and value, for each region and type of agricultural micronutrients.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the agricultural micronutrients market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

Global agricultural micronutrients Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the agricultural micronutrients and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the agricultural micronutrients market, with respect to type, crop type, form, mode of application, and regional markets, over a five-year period, ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the agricultural micronutrients market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the agricultural micronutrients market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for agricultural micronutrients into Belgium, Romania, Russia, and Scandinavian countries

- Further breakdown of the Rest of Asia Pacific market for agricultural micronutrients into Indonesia, Malaysia, South Korea, and Thailand

- Further breakdown of the Rest of South America market agricultural micronutrients into Chile, Colombia, Uruguay, and Peru

- Further breakdown of other countries in the RoW market for agricultural micronutrients into Egypt, Nigeria, Saudi Arabia, Iran, and Kenya

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Micronutrients Market