AI in Pathology Market by Component (Software, Scanners), Neural Network (CNN, GAN, RNN), Application (Drug Discovery, Diagnosis, Prognosis, Workflow, Education), End User (Pharma, Biotech, Hospital Labs, Research), & Region - Global Forecast to 2028

Updated on : July 11, 2023

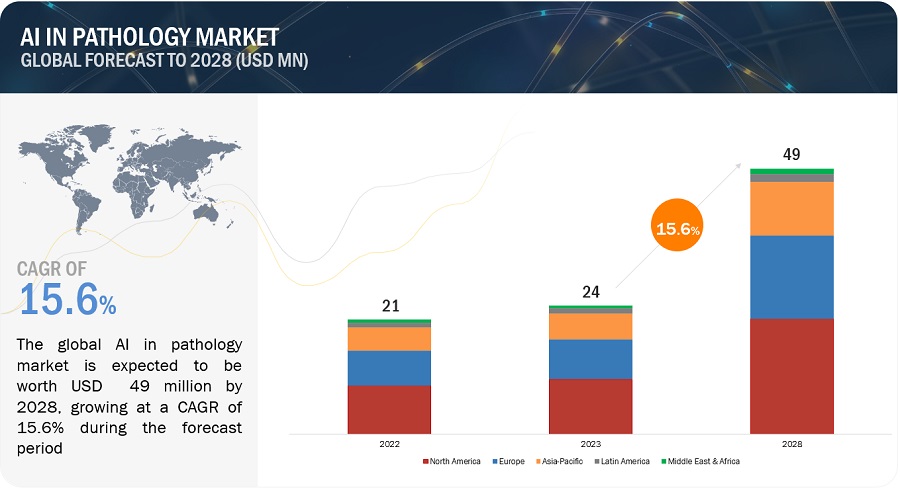

The global AI in pathology market in terms of revenue was estimated to be worth $24 million in 2023 and is poised to reach $49 million by 2028, growing at a CAGR of 15.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. AI algorithms can analyse digital pathology images to detect and classify various abnormalities, such as tumours, cancerous cells, and tissue structures. This application assists pathologists in identifying and quantifying important features, leading to more accurate diagnoses and treatment decisions. AI in pathology offers several benefits, including improved accuracy, increased efficiency, and enhanced patient care. By leveraging large datasets and training algorithms on vast amounts of annotated pathology images, AI systems can assist pathologists in detecting and characterizing abnormalities, making diagnoses, and predicting patient outcomes.

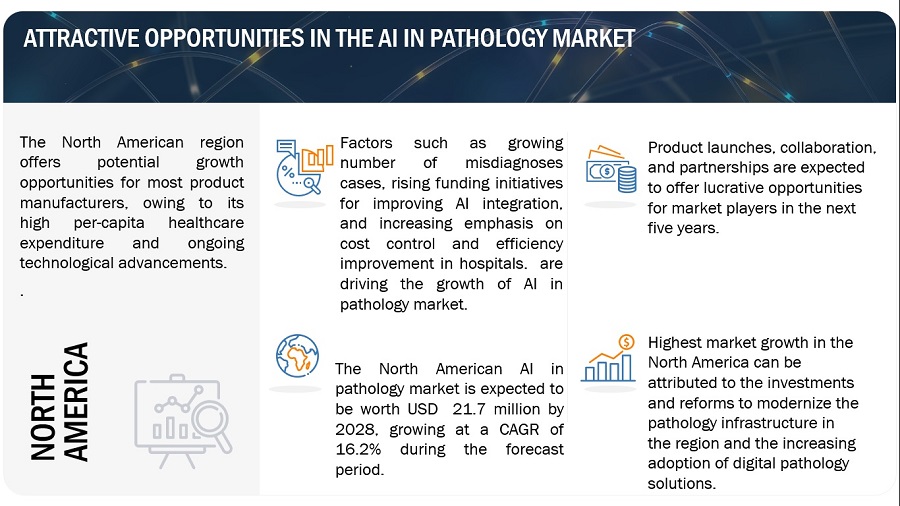

Other factors driving market growth include the rising demand for technologically advanced solutions, a growing number of misdiagnoses, rising funding initiatives for improving patient care quality, and increasing emphasis on cost control and efficiency improvement in hospitals. However, high setup and operational costs, interoperability issues, are expected to restrain market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Pathology Market Dynamics

Driver: Technology advancements in deep learning have enabled a synergy with artificial intelligence (AI) in pathology space

Pattern recognition and image processing advancements have created synergies between AI technology and modern pathology. Deep convolutional neural networks have shown exceptional performance in image classification. The term "digital pathology" refers to improved slide-scanning techniques combined with AI-based algorithms for detecting, segmenting, scoring, and diagnosing digitized whole-slide images.

Quantifying and standardizing clinical outcomes in pathology remains a difficulty. Computer-assisted technologies are used to accurately grade, stage, classify, and quantify responses to treatment. When given vast input data or high-quality training sets, neural network algorithms perform effectively. Such conditions were met using a digitized database of more than 100,000 clinical photos of skin disease, and a deep convolutional neural network was effectively trained to categorize skin lesions comparable to current pathology quality standards. A mechanistic understanding of the complex layers is not required with such an intuitive image-based analysis, and the approach might be applied to patient-based mobile phone platforms to improve early identification and cancer prevention. Specific deep neural network modules will eventually replace chosen steps of the standard pathology workflow. Among different computational image-recognition tasks, deep learning already performs exceptionally well in segmentation tasks such as nuclei, epithelia, or tubules, immune infiltration by lymphocyte classification, cell cycle characterization and mitosis quantification, and tumor grading. The transformation to a digital pathology lab will result in more accurate drug response prediction and prognosis of this underlying disease over time.

Restraint: High cost of digital pathology systems

The significant initial investment required to establish digital pathology systems poses a hurdle for the adoption of AI, as AI heavily relies on these systems for data acquisition and analysis. A typical digital pathology system, consisting of a slide scanner, an image server, and software, can cost anywhere from USD 500,000 to USD 1,500,000. The scanner alone carries an average price tag of around USD 250,000. In the Asia Pacific region, the average cost of a digital pathology scanner ranges from USD 110,000 to USD 130,000. While large hospitals with substantial capital budgets can afford these systems, pathologists and academic institutes with limited budgets or inadequate IT support often find them financially out of reach. Healthcare providers, especially in developing countries like India, Brazil, and Mexico, face financial constraints that hinder their ability to invest in such expensive technologies. Furthermore, the efficient operation and maintenance of digital pathology systems require trained personnel. The combination of high costs and a scarcity of skilled operators is anticipated to restrict the adoption of these systems. Consequently, the incorporation of AI into pathology will be hindered in the absence of widespread adoption of digital pathology systems.

The global transition to digital pathology in clinical settings, as well as the adoption of AI in pathology, has been sluggish. While some countries like the Netherlands and Scandinavian nations have made significant progress in this field, Germany and the US, for example, are lagging behind.

Opportunity: Shortage of skilled pathologists

Increasing prevalence of disease has increased the demand of pathology services in clinical applications. However, there exists a disparity between the availability and requirement of pathologists on a global scale, particularly in Africa and Asia. Concurrently, laboratories face the challenge of handling a rising volume of specimens with a limited workforce. These circumstances are anticipated to impede the progress of the cancer diagnostics market.

AI in pathology enables medical practitioners to remotely share important information with pathologists beyond geographical boundaries securely and timely. Since, the demand for pathology services is growing rapidly, the number of trained pathologists is not keeping pace. This shortage results in an increased workload for pathologists, longer turnaround times for diagnostic reports, leading to higher stress levels and potential delays in diagnosis. AI in pathology can alleviate this burden by automating routine tasks, assisting in slide analysis, and providing decision support. AI algorithms can quickly analyze digital pathology images, identify potential abnormalities, and provide preliminary findings. This allows pathologists to focus on complex cases, reducing turnaround times and improving overall efficiency. By augmenting pathologists' capabilities, AI can help mitigate the impact of the shortage on patient care.

Thus, the alarming shortage of pathologists is expected to result in the increased utilization of AI in pathology for providing remote pathological consultation and services.

Number of Inhabitants Per Pathologist, By Country, 2020

|

Country |

Number of Inhabitants per Pathologist |

|

US |

25,325 |

|

Canada |

20,658 |

|

Germany |

47,989 |

|

Switzerland |

35,355 |

Source: Cancer Research UK, NCBI, and the Journal of the American Medical Association

Challenge: Lack of sufficient data to train the AI algorithms

AI algorithms require large, diverse, and well-annotated datasets for training and validation. However, acquiring such datasets in pathology can be challenging due to factors like data privacy regulations, data fragmentation across multiple healthcare systems, and the need for expert annotations. Ensuring the availability of high-quality data remains a significant challenge for developing accurate and reliable AI models.

Most AI systems require many high-quality training photos. Ideally, these training images should be "labelled" (i.e., annotated). This essentially means that in all images, a pathologist must manually designate the region of interest (i.e., abnormalities or malignancy). Annotation is best conducted by professionals. Aside from the time constraints, human annotations are frequently an expensive impediment in app development. Crowdsourcing may be cheaper and quicker but has the potential to introduce noise. Pathologists may find careful annotation of huge numbers of photos, it is not only tedious, but also gets difficult when working with low resolution or blurry images, slow networks, and feature ambiguity. Active learning used to annotation could make this laborious work easier. Now, there are just a few publicly available datasets with labelled photos that can be used for this purpose.

Moreover, deep learning, which allows for the learning of very complex visual cues, has created a buzz around AI, as it has been able to address complicated computer vision challenges that were previously thought to be out of reach. As pathology is a visual task it is understandable that academia and “pure” technology companies are now working heavily on deep learning approaches for pathology. The variances between different patient types are the main issue for any pathological AI system. In a sick condition, no two patient samples are alike. To distinguish between different cell types, which is something that any machine learning system must do (even if it is hidden in some obscure features in a deep learning network), we notice that the same cell type has different characteristics in different patients, which are frequently contradictory. Machine learning model performance evaluation guidelines help assure suitable clinical efficacy and safety profile to be employed in patient care for pathology organizations with resources to generate laboratory developed tests. There are illness entities that have been reclassified throughout time, tumor diagnoses where grading has altered with updated American Joint Committee on Cancer (AJCC) staging standards, and other entities that have a considerable degree of interobserver variability. In these cases, pathology data training can be highly noisy and not generalizable to external data. Generalizability will need to be credibly evaluated for models to perform with high quality at various deployment sites.

Ai In Pathology Market Ecosystem

The ecosystem market map of the overall AI in pathology industry comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. It includes products and services. The manufacturers of various products include the organizations involved in the entire process of research, product development, optimization, and launch. Distributors include third parties and e-commerce sites linked with organizations for the distribution of products and software. The services are offered to end-users by vendors either directly or in collaboration with a third party.

Software segment was the fastest growing segment in the component type of AI in pathology industry in 2022.

The global AI in pathology market is divided into two main components: software and scanners. In 2022, the software segment emerged as the segment with highest growth rate in the global market. This significant share can be attributed to the widespread acceptance and utilization of AI-based software by pathologists. The software segment offers several advantages, including high adaptability, interoperability, and the automation of various pathology tasks such as image analysis, data extraction, and report generation. These factors drive the adoption and advancement of AI software in pathology, presenting substantial potential for advancements in disease detection, diagnosis, and treatment planning.

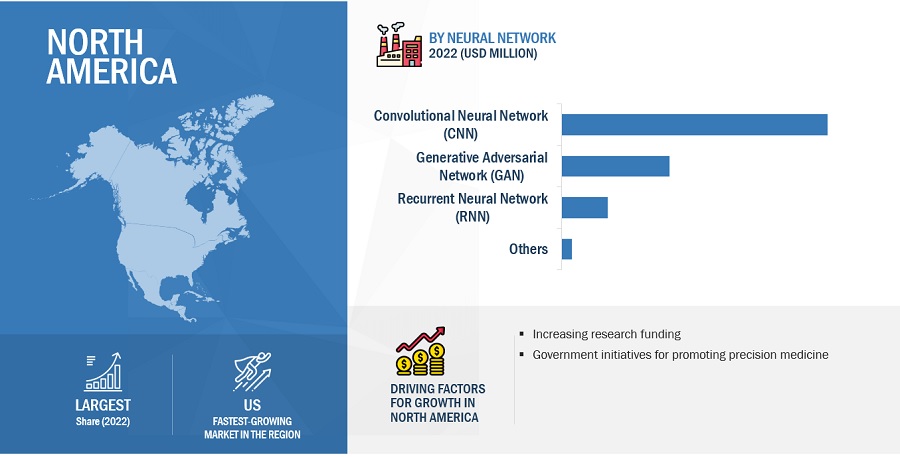

Convolutional neural network (CNN) is the fastest growing segment in the AI in pathology industry in 2022.

The AI in pathology market is categorized into different neural network types, including generative adversarial network (GAN), convolutional neural network (CNN), recurrent neural network (RNN), and others. In 2022, the convolutional neural network segment is projected to exhibit the highest growth rate. The remarkable growth rate of this segment can be attributed to its exceptional ability to analyze intricate visual data, such as pathology images, extract pertinent features, and provide precise diagnoses. Additionally, CNN facilitates the localization and segmentation of regions of interest within images, while also possessing the capability to continuously learn and enhance its performance over time by leveraging new data and incorporating feedback from pathologists.

North America region of the AI in pathology industry to witness the highest growth rate during the forecast period.

The North American AI in pathology market is projected to grow at the highest CAGR during the forecast period. Market growth in the North America region is mainly driven by factors such as the investments and reforms to modernize the pathology infrastructure in the region and the increasing adoption of digital pathology solutions. The other factors augmenting market growth in this region are the ongoing expansion of the healthcare infrastructure and the growing market availability of advanced AI technologies.

To know about the assumptions considered for the study, download the pdf brochure

The products and software market are dominated by a few globally established players such as include Koninklijke Philips N.V. (Netherlands), F. Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (US) among others.

Scope of the AI in Pathology Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$24 million |

|

Projected Revenue by 2028 |

$49 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 15.6% |

|

Market Driver |

Technology advancements in deep learning have enabled a synergy with artificial intelligence (AI) in pathology space |

|

Market Opportunity |

Shortage of skilled pathologists |

The study categorizes AI in pathology market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Introduction

- Software

- Scanners

By Neural Network

- Introduction

- Generative adversarial networks (GANs)

- Convolutional neural networks (CNNs)

- Recurrent neural networks (RNNs)

- Others

By Application

- Introduction

- Drug Discovery

- Disease Diagnosis & Prognosis

- Clinical Workflow

- Training & Education

By End User

- Introduction

- Pharmaceutical & Biotechnology Companies

- Hospitals & Reference Laboratories

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest Of Europe

-

Asia Pacific

- Japan

- China

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments of AI in Pathology Industry

- In April 2023, Indica Labs Inc. (US) signed an agreement with Lunit Inc. (South Korea). The agreement helped to provide a fully interoperable solution between Indica Labs' HALO AP image management software platform and Lunit's suite of AI pathology products.

- In March 2022, Ibex Medical Analytics Ltd. (Isarel) had partnered with Dedalus Group (Italy). Through this partnership, the company aimed to bring the power of artificial intelligence to digital pathology.

- In January 2022, Aiforia Technologies Plc (Finland) collaborated with Mayo Clinic (US). Under this collaboration, AI-powered pathology research support architecture was established at the Mayo Clinic to enable faster results and scalable studies in translational research.

- In December 2021, F. Hoffmann-La Roche Ltd. (Switzerland) launched its artificial intelligence (AI)-based digital pathology algorithms to help pathologists evaluate breast cancer markers such as Ki-67, ER, and PR.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global AI in pathology market?

The global AI in pathology market boasts a total revenue value of $49 million by 2028.

What is the estimated growth rate (CAGR) of the global AI in pathology market?

The global AI in pathology market has an estimated compound annual growth rate (CAGR) of 15.6% and a revenue size in the region of $24 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, annual reports, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the AI in pathology market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

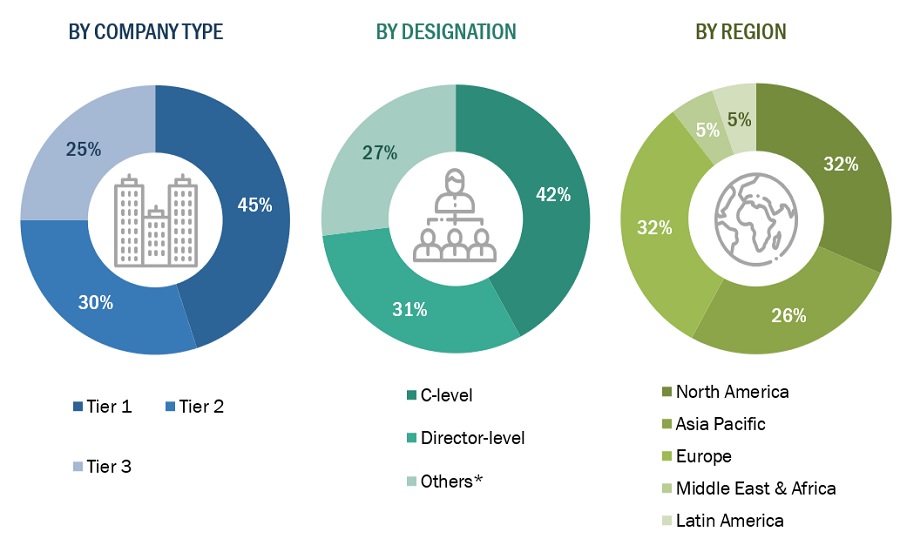

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the AI in pathology market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, research institutes and hospitals (small, medium-sized, and large hospitals).

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the AI in pathology market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

The size of the AI in pathology market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the market were gathered from secondary sources to the extent available. In certain cases, shares of AI in pathology businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the market was determined by extrapolating the Market share data of major companies.

Market Definition

The AI in pathology market refers to the commercial space where companies develop, market, and provide products and services that incorporate artificial intelligence technologies specifically designed for pathology applications. This market focuses on leveraging AI algorithms, machine learning techniques, and advanced computational tools to enhance and automate various aspects of the pathology workflow.

This report provides a close look at AI in pathology industry. It offers applications in drug discovery, disease diagnosis & prognosis, clinical workflow, and training & education.

Key Stakeholders

- Pathologists

- Suppliers and Distributors of Digital Pathology Equipment

- AI system providers

- Medical research and biotechnology companies

- Pharmaceutical companies and CROs

- Hospitals and clinics

- Laboratories

- Regulatory Bodies

- Medical Research Institutes

- Artificial Intelligence (AI) in pathology solution providers

- Universities and research organizations

- Forums, alliances, and associations

- Academic research institutes

- Technology Providers

- Healthcare Payers

Global AI in pathology market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the market by component, neural network, application, end user, and region.

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the market.

- To benchmark players operating in the market using the Competitive Leadership Mapping framework, which analyzes key market players and start-ups on various parameters within the broad categories of market share/rank and product/service footprint.

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; mergers & acquisitions; product developments; and geographical expansions in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific AI in pathology market into India, Australia, Taiwan, New Zealand, Thailand, South Korea, Singapore, Malaysia, and other countries

- Further breakdown of the Rest of Europe's AI in pathology market into Spain, Italy, Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Growth opportunities and latent adjacency in AI in Pathology Market