Air Brake System Market by Type (Disc & Drum), Component (Compressor, Governor, Tank, Air Dryer, Foot Valve, Brake Chamber & Slack Adjuster), Rolling Stock, Vehicle Type (Rigid Body, Heavy-Duty, Semi-Trailer & Bus), Region - Global Forecast to 2025

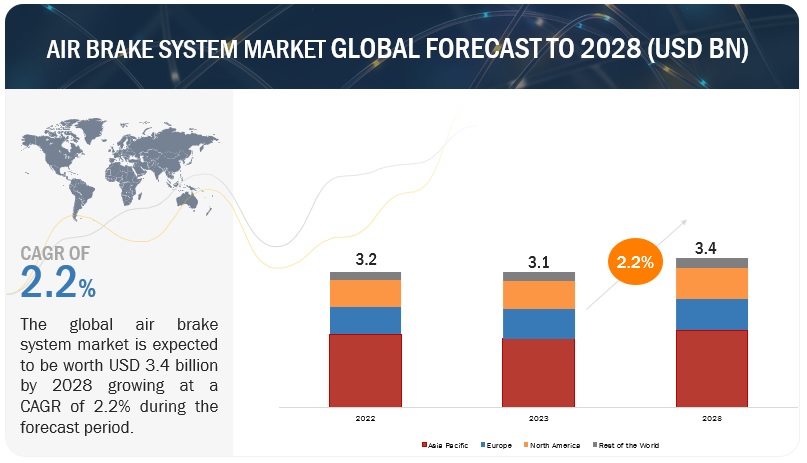

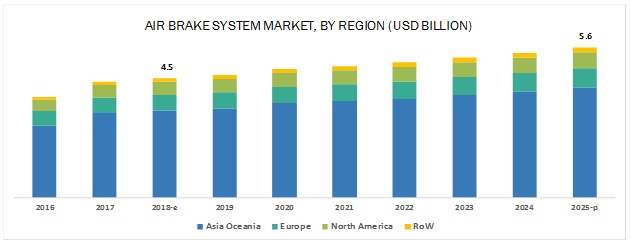

The air brake system market is estimated to be USD 4.5 billion in 2018 and is projected to reach USD 5.6 billion by 2025, at a CAGR of 3.31% during the forecast period. The study involves 4 main activities to estimate the current size of the air brake market. Exhaustive secondary research was done to collect information on the market, such as types and various air brake system components. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A bottom-up approach was employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Crunchbase, Bloomberg; and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the air brake system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (air brake system and component manufacturers) across major regions, namely, North America, Europe, Asia Oceania, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approach

The bottom-up approach has been used to estimate and validate the size of the air brake system market for on-highway vehicles. In this approach, the commercial vehicle production statistics for each vehicle type (trucks and buses) has been considered at the country and regional levels. The country-wise penetration of vehicles equipped with the air brake system was then derived with the help of model mapping. The penetration of the air brake system was validated by secondary and primary research.

To determine the market size, in terms of volume, the commercial vehicle production numbers were multiplied by the penetration rate of the air brake system. The air brake system market, in terms of volume, was then multiplied with the average selling price of the air brake system to derive the country-wise air brake market, by value. The summation of the country-level market gives the regional market and further summation of the regional market provides the global air brake market for on-highway vehicles.

Top-down approach

The top-down approach has been used to estimate and validate the regional market size, for the air brake system market, by brake type (disc and drum), in terms of volume. The market share of drum and disc brake systems, considered to arrive at the regional level market, has been verified through primary and secondary sources.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides in the air brake system market.

Report Objectives

- To define, describe, and forecast the global air brake system market, in terms of volume (000 units) and value (USD million)

- To define, describe, and forecast the air brake system OE market for on-highway vehicles, by value and volume, on the basis of component (compressor, governor, storage tank, air dryer, foot valve, brake chamber, and slake adjuster) at the regional level

- To define, describe, and forecast the air brake system OE market for on-highway vehicles, by volume, on the basis of brake type (disc and drum) at the regional level

- To define, describe, and forecast the air brake system OE market for on-highway vehicles, by value and volume, on the basis of on-highway vehicle type (rigid body, heavy-duty truck, semi-trailer, bus) at the regional level

- To define, describe, and forecast the air brake system OE market for construction and mining trucks at the regional level, in terms of value and volume, by component (compressor, governor, storage tank, air dryer, foot valve, brake chamber, and slake adjuster)

- To define, describe, and forecast the air brake system OE market for rolling stock at the regional level in terms of value and volume, by component (compressor, storage tank, drivers brake valve, brake cylinder, and brake pipe)

- To define, describe, and forecast the air brake system market, by value and volume, on the basis of region (Asia Oceania, Europe, North America, and the RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) in the global market

- To analyze the market share of the key players operating in the air brake market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the air brake system market

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

20162025 |

|

Base Year Considered |

2017 |

|

Forecast Period |

20182025 |

|

Forecast Units |

Value (USD million/billion) and Volume (000/million units) |

|

Segments Covered |

Component, brake type, on-highway vehicle type, construction & mining trucks, rolling stock, and region |

|

Geographies Covered |

Asia Oceania, Europe, North America, and the RoW |

|

Companies Covered |

Knorr-Bremse (Germany), Wabco (Belgium), Meritor (US), Haldex (Sweden), ZF (Germany) |

This research report categorizes the air brake market based on component, brake type, technology, on-highway vehicle type, industry vertical, and region.

Global Market, By Component

- Compressor

- Governor

- Storage tank

- Air dryer

- Foot valve

- Brake chamber

Global Market, By Brake Type

- Air Disc

- Air Drum

Global Market, By On-Highway Vehicle Type

- Rigid Body

- Heavy-duty Truck

- Semi-trailer

- Bus

Global Market for Rolling Stock, By Component

- Compressor

- Storage Tank

- Drivers Brake Valve

- Brake Cylinder

- Brake Pipe

Global Market for Construction & Mining Trucks, By Component

- Compressor

- Governor

- Storage Tank

- Air Dryer

- Foot Valve

- Brake Chamber

- Slake Adjuster

Global Market, By Region

- Asia Oceania

- Europe

- North America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Air Brake System Market for Rolling Stock, By Rolling Stock Type

- Diesel Locomotive

- DMU

- EMU

- Metros

- Passenger Coaches

- Freight Wagon

Note: The Global Market for Rolling Stock, By Rolling Stock Type will be further offered at the regional level for regions: Asia Oceania, Europe, North America, and RoW

Air Brake System Market for On-highway Vehicles, By Component

- Compressor

- Governor

- Storage Tank

- Air Dryer

- Foot Valve

- Brake Chamber

- Slake Adjuster

Note: The Global Market for On-highway Vehicles, By Component, will be further offered at the regional level for regions: Asia Oceania, Europe, North America, and RoW

Detailed Analysis and Profiling of Additional Market Players (Up to 3)

The Air Brake System Market is estimated to be USD 4.5 billion in 2018 and is projected to reach USD 5.6 billion by 2025, at a CAGR of 3.31% during the forecast period. Increasing heavy commercial vehicle demand, increasing number of railways, rising long-haul transportation, and upcoming safety-related regulatory compliances leading to the boost in air disc brakes in developed as well as developing countries are projected to drive the air brake industry.

Drum brake is expected to be the largest contributor in the global market, by brake type, during the forecast period

Drum brakes in commercial vehicles primarily comprise brake drum, brake shoe, and linings. The drum brakes are the oldest braking mechanisms, which have a maximum adoption rate in Asia Oceania and North America owing to the comparatively low cost than air disc brakes. In the present scenario, Asia Oceania and North America have an adoption rate of approximately 8590% and 8085% respectively for drum brakes in heavy-duty vehicles. Moreover, with rising focus toward safety and growing demand for high loading carrying capacity trucks mainly in developed regions such as Europe and North America, the market is shifting toward the deployment of air disc brakes. Europe is a prominent market for air disc brakes currently, and simultaneously the countries of North America and Asia Oceania are significantly adopting the deployment of air disc brake. Thus, increasing stringency in vehicle stopping distance related regulations, and the introduction of advanced braking mechanisms around the world would impact the growth of the air drum brakes in the coming years.

Compressor is anticipated to grow at the highest rate for the period from 2018 to 2025 in this market for rolling stock, by component

With the continuously growing population and urbanization, the demand for convenient and affordable means of transport has also increased significantly. Further, recent growth in infrastructure spending by developed and developing countries has resulted in an increased demand for high-speed and fast trains. For instance, countries such as Japan, Germany, and the UK plan to connect their key cities with high-speed trains. These high-speed trains and other train types are equipped with air brakes because of their fail-safe mechanisms and lower usage of oil in the actuation system. Hence, rising infrastructural funding would lead to the expansion of railway networks with a higher number of electric and high-speed trains. These factors collectively spur the demand for compressors and other components of the air brake system in the rolling stock segment.

Brake chamber is estimated to be the largest market for air brake system during the forecast period.

The brake chamber market is projected to lead the global component market for on-highway vehicle type in 2018. The number of slake adjusters is maximum among all the air brake components. Different vehicle types such as rigid body, heavy-duty trucks, semi-trailers, and buses have 6 to 8 units of slake adjusters per vehicle. Hence, the rise in production of heavy trucks and buses would directly increase the number of brake chamber units, which, in turn, will drive the demand for brake chambers in the air brake system market.

Asia Oceania expected to account for the largest market size during the forecast period.

The Asia Oceania region is expected to be the largest market for air brake system during the forecast period owing to their largest heavy commercial vehicle production compared to other regions. China is the leading air brake system owing to the higher production of heavy-duty trucks across all heavy trucks type. Also, rising industrialization and urbanization in developing countries such as China and India along with rising awareness for vehicle and driver safety would fuel the demand for the Asia Oceania air brake system market.

Key Players

The key players in the air brake system market are Knorr-Bremse (Germany), Wabco (Belgium), Meritor (US), Haldex (Sweden), ZF (Germany), Wabtec (US), and Nabtesco (Japan). These players have adopted various growth strategies to diversify their global presence and increase their respective market share. The major strategies include new product developments and expansions. Knorr-Bremse adopted the strategies of new product development, partnership, and acquisition to retain its leading position in the air brake industry. In August 2018, Knorr-Bremse introduced 2 new disc brakesSYNACT and NEXTTfor future generations of heavy-duty commercial vehicles. Compared to its predecessor, SYNACT offers new dimensions of performance and weight. Further, Knorr-Bremse also acquired Intellectual Property Rights (IPR) for the development and production of friction materials for rail vehicles and industrial applications from Federal-Mogul.

Key questions addressed by the report

- Which air brake components in on-highway and construction & mining trucks are expected to dominate in the future?

- How are the industry players addressing the challenge of maintaining a balance between performance and cost of an air brake system?

- When is the air disc brake expected to be a mass adoption for the air brake system market, especially in the Asia Oceania region?

- What is the market size of the air brake system for construction & mining trucks?

- What are the key components of the air brake system in rolling stocks?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach: Air Brake Market for On-Highway Vehicles

2.4.2 Bottom-Up Approach: Air Brake Market for Construction & Mining Trucks

2.4.3 Bottom-Up Approach: Air Brake Market for Rolling Stock

2.4.4 Top-Down Approach: Air Brake Market, By Brake Type

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 38)

4.1 Air Brake System Global Market & Forecast

4.2 Market, By Region

4.3 Market, By Component

4.4 Market, By Brake Type

4.5 Market, By Vehicle Type

4.6 Market for Construction and Mining Trucks, By Component

4.7 Market for Rolling Stock, By Component

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Sales & Production of Commercial Vehicles and Off-Highway Trucks

5.2.1.1.1 Increasing Population Around the Globe

5.2.1.1.2 Increased Urbanization

5.2.1.1.3 Increased Industrialization

5.2.1.1.4 Increased Infrastructural Spending

5.2.1.2 Increased Railways and High-Speed Trains

5.2.1.3 Fail-Safe Nature of Air Brakes Over Hydraulic Brakes

5.2.2 Restraints

5.2.2.1 High Cost of Air Brakes Over Hydraulic Brakes

5.2.2.2 Increased Stopping Distance Over Hydraulic Brakes

5.2.2.3 Increasing Focus on Electric Trucks and Buses

5.2.3 Opportunities

5.2.3.1 Regulations Related to Load Carrying Capacity and Mandates on Air Brakes Installation

5.2.4 Challenges

5.2.4.1 Freezing of Air Brakes at Low Temperature

6 Air Brake System Market, By Component (Page No. - 50)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and RoW

6.1 Introduction

6.2 Compressor

6.2.1 Asia Oceania is Estimated to Lead the Compressor Market

6.3 Governor

6.3.1 Increasing Number of Heavy Commercial Vehicles Around the World Will Boost the Demand of Governors

6.4 Storage Tank

6.4.1 Increasing Trucks With High Load Carrying Capacity Would Require More Number of Storage Tanks

6.5 Air Dryer

6.5.1 Europe and North America Have Freezing Temperatures in Many Areas That Consequently Boost the Need of Air Dryers

6.6 Foot Valve

6.6.1 Rest of the World is Anticipated to Grow at the Highest Rate for Foot Valve

6.7 Brake Chamber

6.7.1 Asia Oceania is Estimated to Be the Leading Brake Chamber Market in 2018

6.8 Slake Adjuster

6.8.1 With Rising Heavy Commercial Vehicle Production, Slack Adjuster Market is Projected to Witness Growth in Coming Years

7 Air Brake System Market, By Brake Type (Page No. - 62)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and RoW

7.1 Introduction

7.2 Air Drum Brake

7.2.1 Marginal Growth in the Demand of Drum Brake for Heavy Commercial Vehicles at A Global Level

7.3 Air Disc Brake

7.3.1 Air Disc Brakes are Growing at A Significant Rate Worldwide Owing to Its Durability and Less Stopping Distance

8 Air Brake System Market, By Vehicle Type (Page No. - 66)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and RoW

8.1 Introduction

8.2 Rigid Body Truck

8.2.1 Asia Oceania is Projected to Be the Largest Market in Rigid Body Trucks Segment for Air Brake System

8.3 Heavy-Duty Truck

8.3.1 Heavy-Duty Trucks are Anticipated to Hold the Largest Share in Air Brake Market

8.4 Semi-Trailer

8.4.1 Semi-Trailers are Projected to Be the Fastest for Air Brake Market From 2018 to 2025

8.5 Bus

8.5.1 Asia Oceania Accounted Maximum Installation Rate in 2018 of Air Brake System in Buses

9 Air Brake System Market for Construction and Mining Trucks, By Component (Page No. - 74)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and RoW

9.1 Introduction

9.2 Compressor

9.2.1 North America is Estimated to Lead the Compressor Market

9.3 Governor

9.3.1 Usually Number of Governors Installed are Equal to Number of Compressors in Construction and Mining Trucks

9.4 Storage Tank

9.4.1 Construction and Mining Trucks Would Have Higher Number of Storage Tanks Due to Its Rigorous Working Conditions

9.5 Air Dryer

9.5.1 North America Lead the Air Dryer Market for Construction and Mining Trucks in 2018

9.6 Foot Valve

9.6.1 Every Rigid and Articulated Dump Truck Have A Single Foot Valve, With Variation in the Sizes Depending on Vehicle Type

9.7 Brake Chamber

9.7.1 Number of Axles in Trucks are Directly Proportional to Number of Brake Chambers

9.8 Slake Adjuster

9.8.1 Slack Adjuster Market Witness Growth Especially in North America and Europe in Coming Years

10 Air Brake System Market for Rolling Stock, By Component (Page No. - 86)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America and RoW

10.1 Introduction

10.2 Compressor

10.2.1 Number of Compressors in Rolling Stock Ranges From 1 to 4 Depending on Different Type.

10.3 Storage Tank

10.3.1 Asia Oceania Leads the Storage Tank Market for Rolling Stock Segment

10.4 Drivers Brake Valve

10.4.1 Every Rail Cabin has A Single Driver Brake Valve, Irrespective of Different Rolling Stock Type

10.5 Brake Cylinder

10.5.1 Number of Brake Cylinders Varies With Architecture of Railway Bogies

10.6 Brake Pipe

10.6.1 Every Brake Cylinder is Connected to the Brake Pipe in A Rolling Stock

11 Air Brake System Market, By Region (Page No. - 94)

Note - The Chapter is Further Segmented at Regional and Country Level By Vehicle Type: Rigid Body Truck, Heavy-Duty Truck, Semi-Trailer, and Bus.

11.1 Introduction

11.2 Air Brake Market, By Region

11.3 Asia Oceania

11.3.1 China

11.3.1.1 China is the Largest Market for Air Brake System in Asia Oceania

11.3.2 Japan

11.3.2.1 Japan is the Second Largest Air Brake Market, By On-Highway Vehicle Type

11.3.3 South Korea

11.3.3.1 Rigid Body Trucks Leads the Air Brake Market in South Korea

11.3.4 India

11.3.4.1 India is the Fastest Market for Air Brake System in Asia Oceania

11.3.5 Rest of Asia Oceania

11.3.5.1 Heavy-Duty Truck has Prominent Share in Air Brake Market for This Segment

11.4 Europe

11.4.1 Germany

11.4.1.1 Germany Leads the European Air Brake Market Under the Review Period

11.4.2 France

11.4.2.1 Heavy-Duty Truck is A Promising Market Opportunity for Air Brake System in France

11.4.3 UK

11.4.3.1 Rigid Body Truck is Expected to Be the Fastest Growing Market

11.4.4 Spain

11.4.4.1 Semi-Trailer is Estimated to Be the Dominant Air Brake Market in Spain

11.4.5 Russia

11.4.5.1 Heavy-Duty Truck is Major Air Brake Market, By Vehicle Type in Russia

11.4.6 Turkey

11.4.6.1 Turkey is the Fastest Market for Air Brake System in Europe

11.4.7 Rest of Europe

11.4.7.1 Heavy-Duty Truck is Leading Vehicle Type for Air Brake System Market in Rest of Europe

11.5 North America

11.5.1 US

11.5.1.1 US is Expected to Have the Largest North American Market

11.5.2 Mexico

11.5.2.1 Mexico is the Fastest Growing and Second Largest Market for Air Brake System in North America

11.5.3 Canada

11.5.3.1 Heavy-Duty Truck Have High Demand of Air Brake System Market in Canada

11.6 RoW

11.6.1 Argentina

11.6.1.1 Heavy-Duty Truck is Expected to Have the Largest Market Share in Argentina.

11.6.2 Brazil

11.6.2.1 Brazil is Largest Market for Air Brake System in RoW

11.6.3 Rest of RoW

11.6.3.1 Heavy-Duty Truck is Expected to Have the Largest Market Over the Forecast Period

12 Competitive Landscape (Page No. - 124)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Partnerships & Supply Contracts

12.3.3 Expansions

12.3.4 Mergers & Acquisitions

13 Company Profiling (Page No. - 132)

(Overview, Product Offerings, Recent Developments & SWOT Analysis)*

13.1 Knorr-Bremse

13.2 Wabco

13.3 Meritor

13.4 Haldex

13.5 ZF

13.6 Wabtec

13.7 Nabtesco

13.8 TSE Brakes

13.9 Federal-Mogul

13.10 Sorl Auto Parts

13.11 Additional Companies

13.11.1 North America

13.11.1.1 Sealco

13.11.1.2 Silverbackhd

13.11.1.3 Fort Garry Industries

13.11.1.4 Fritec

13.11.2 Europe

13.11.2.1 Mahle Aftermarket

13.11.2.2 Aventics

13.11.2.3 Knott

13.11.2.4 Kongsberg

13.11.3 Asia Oceania

13.11.3.1 Tata Autocomp

13.11.3.2 MEI Brakes

*Details on Overview, Product Offerings, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 160)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.4.1 Air Brake System Market for Rolling Stock, By Rolling Stock Type

Note: The Air Brake Market for Rolling Stock, By Rolling Stock Type Will Be Further Offered at Regional Level for Regions: Asia Oceania, Europe, North America, and RoW.

14.4.1.1 Diesel Locomotive

14.4.1.2 DMU

14.4.1.3 EMU

14.4.1.4 Metro

14.4.1.5 Passenger Coaches

14.4.1.6 Freight Wagon

14.4.2 Air Brake System Market for On-Highway Vehicles, By Component

Note: The Air Brake Market for On-Highway Vehicles, By Component Will Be Further Offered at Regional Level for Regions: Asia Oceania, Europe, North America, and RoW

14.4.2.1 Compressor

14.4.2.2 Governor

14.4.2.3 Storage Tank

14.4.2.4 Air Dryer

14.4.2.5 Foot Valve

14.4.2.6 Brake Chamber

14.4.2.7 Slake Adjuster

14.4.3 Detailed Analysis and Profiling of Additional Market Players (Up to 3)

14.5 Related Reports

14.6 Author Details

List of Tables (106 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Population Increase From 2000 to 2017 (In Million)

Table 3 Urbanization Rate in Key Countries, 20102025 (Percent)

Table 4 Number of Components in Each Vehicle Type

Table 5 Air Brake System Market, By Component, 20162025 (Thousand Units)

Table 6 Market, By Component, 20162025 (USD Million)

Table 7 Compressor: Market, By Region, 20162025 (Thousand Units)

Table 8 Compressor: Air Brake Market, By Region, 20162025 (USD Million)

Table 9 Governor: Market, By Region, 20162025 (Thousand Units)

Table 10 Governor: Air Brake Market, By Region, 20162025 (USD Million)

Table 11 Storage Tank: Market, Region, 20162025 (Thousand Units)

Table 12 Storage Tank: Air Brake Market, By Region, 20162025 (USD Million)

Table 13 Air Dryer: Market, By Region, 20162025 (Thousand Units)

Table 14 Air Dryer: Air Brake Market, By Region, 20162025 (USD Million)

Table 15 Foot Valve: Market, By Region, 20162025 (Thousand Units)

Table 16 Foot Valve: Air Brake Market, By Region, 20162025 (USD Million)

Table 17 Brake Chamber: Market, By Region, 20162025 (Thousand Units)

Table 18 Brake Chamber: Air Brake Market, By Region, 20162025 (USD Million)

Table 19 Slake Adjuster: Market, By Region, 20162025 (Thousand Units)

Table 20 Slake Adjuster: Air Brake Market, By Region, 20162025 (USD Million)

Table 21 Market, By Brake Type, 20162025 (Thousand Units)

Table 22 Air Drum Brake: Market, By Region, 20162025 (Thousand Units)

Table 23 Air Disc Brake: Market, By Region, 20162025 (Thousand Units)

Table 24 Vehicle Definition By Gvwr

Table 25 Air Brake System Market, By Vehicle Type, 20162025 (Thousand Units)

Table 26 Market, By Vehicle Type, 20162025 (USD Million)

Table 27 Rigid Body Truck: Air Brake Market, By Region, 20162025 (Thousand Units)

Table 28 Rigid Body Truck: Market, By Region, 20162025 (USD Million)

Table 29 Heavy-Duty Truck: Air Brake Market, By Region, 20162025 (Thousand Units)

Table 30 Heavy-Duty Truck: Market, By Region, 20162025 (USD Million)

Table 31 Semi Trailer: Air Brake Market, Region, 20162025 (Thousand Units)

Table 32 Semi Trailer: Market, By Region, 20162025 (USD Million)

Table 33 Bus: Air Brake Market, By Region, 20162025 (Thousand Units)

Table 34 Bus: Market for Bus, By Region, 20162025 (USD Million)

Table 35 Air Brake Market for Construction and Mining Trucks, By Component, 20162025 (Thousand Units)

Table 36 Global Market for Construction and Mining Trucks, By Component, 20162025 (USD Thousand)

Table 37 Compressor: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 38 Compressor: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 39 Governor: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 40 Governor: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 41 Storage Tank: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 42 Storage Tank: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 43 Air Dryer: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 44 Air Dryer: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 45 Foot Valve: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 46 Foot Valve: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 47 Brake Chamber: Air Brake Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 48 Brake Chamber: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 49 Slake Adjuster: Air Brake System Market for Construction and Mining Trucks, By Region, 20162025 (Thousand Units)

Table 50 Slake Adjuster: Market for Construction and Mining Trucks, By Region, 20162025 (USD Thousand)

Table 51 Market for Rolling Stock, By Component, 20162025 (Thousand Units)

Table 52 Compressor: Market for Rolling Stock, By Region, 20162025 (Thousand Units)

Table 53 Storage Tank: Market for Rolling Stock, By Region, 20162025 (Thousand Units)

Table 54 Drivers Brake Valve: Market for Rolling Stock, By Region, 20162025 (Thousand Units)

Table 55 Brake Cylinder: Market for Rolling Stock, By Region, 20162025 (Thousand Units)

Table 56 Brake Pipe: Market for Rolling Stock, By Region, 20162025 (Thousand Units)

Table 57 Market, By Region, 20162025 (Thousand Units)

Table 58 Market, By Region, 20162025 (USD Million)

Table 59 Asia Oceania: Market, By Country, 20162025 (Thousand Units)

Table 60 Asia Oceania: Market, By Country, 20162025 (USD Million)

Table 61 China: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 62 China: Market, By Vehicle Type, 20162025 (USD Million)

Table 63 Japan: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 64 Japan: Market, By Vehicle Type, 20162025 (USD Million)

Table 65 South Korea: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 66 South Korea: Market, By Vehicle Type, 20162025 (USD Million)

Table 67 India: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 68 India: Market, By Vehicle Type, 20162025 (USD Million)

Table 69 Rest of Asia Oceania: Air Brake Market, By Vehicle Type, 20162025 (Thousand Units)

Table 70 Rest of Asia Oceania: Air Brake Market, By Vehicle Type, 20162025 (USD Million)

Table 71 Europe: Market, By Country, 20162025 (Thousand Units)

Table 72 Europe: Market, By Country, 20162025 (USD Million)

Table 73 Germany: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 74 Germany: Market, By Vehicle Type, 20162025 (USD Million)

Table 75 France: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 76 France: Market, By Vehicle Type, 20162025 (USD Million)

Table 77 UK: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 78 UK: Market, By Vehicle Type, 20162025 (USD Million)

Table 79 Spain: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 80 Spain: Market, By Vehicle Type, 20162025 (USD Million)

Table 81 Russia: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 82 Russia: Market, By Vehicle Type, 20162025 (USD Million)

Table 83 Turkey: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 84 Turkey: Market, By Vehicle Type, 20162025 (USD Million)

Table 85 Rest of Europe: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 86 Rest of Europe: Market, By Vehicle Type, 20162025 (USD Million)

Table 87 North America: Market, By Country, 20162025 (Thousand Units)

Table 88 North America: Market, By Country, 20162025 (USD Million)

Table 89 US: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 90 US: Market, By Vehicle Type, 20162025 (USD Million)

Table 91 Mexico: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 92 Mexico: Market, By Vehicle Type, 20162025 (USD Million)

Table 93 Canada: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 94 Canada: Market, By Vehicle Type, 20162025 (USD Million)

Table 95 RoW: Market, By Country, 20162025 (Thousand Units)

Table 96 RoW: Market, By Country, 20162025 (USD Million)

Table 97 Argentina: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 98 Argentina: Market, By Vehicle Type, 20162025 (USD Million)

Table 99 Brazil: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 100 Brazil: Market, By Vehicle Type, 20162025 (USD Million)

Table 101 Rest of RoW: Market, By Vehicle Type, 20162025 (Thousand Units)

Table 102 Rest of RoW: Air Brake System Market, By Vehicle Type, 20162025 (USD Million)

Table 103 New Product Developments, 20162018

Table 104 Partnerships & Supply Contracts,2015- 2018

Table 105 Expansions, 20162017

Table 106 Mergers & Acquisitions, 2015-2018

List of Figures (41 Figures)

Figure 1 Market Segmentation: Air Brake System

Figure 2 Air Brake System Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Air Brake Market for On-Highway Vehicles

Figure 6 Bottom-Up Approach: Air Brake Market for Construction & Mining Trucks

Figure 7 Bottom-Up Approach: Air Brake Market for Rolling Stock

Figure 8 Top-Down Approach: Air Brake Market, By Brake Type

Figure 9 Data Triangulation

Figure 10 Air Brake System : Market Outlook

Figure 11 Market, By Region, 2018 vs 2025 (USD Billion)

Figure 12 Attractive Opportunities in the Market

Figure 13 Asia Oceania Accounts for the Largest Share of the Market in 2018 (USD Billion)

Figure 14 Brake Chamber is Anticipated to Lead Component Market, 2018 vs 2022 vs 2025 (USD Million)

Figure 15 Air Disc Brake is Estimated to Grow at the Highest Rate, 2017-2025 (Million Units)

Figure 16 Heavy-Duty Truck to Have Majority Share in the Market, 2018 vs 2025 (USD Billion)

Figure 17 Compressor Holds the Largest Share in the Market for Construction & Mining Segment, 2018 vs 2022 vs 2025 (USD Million)

Figure 18 Brake Cylinder & Brake Pipe Leads the Air Brake System Component Market for Rolling Stock, 2018 vs 2025 (Thousand Units)

Figure 19 Air Brake System : Market Dynamics

Figure 20 Growing Population of Selected Countries, 1980-2017

Figure 21 Market, By Component, 2018 vs 2025 (USD Million)

Figure 22 Market, By Brake Type, 2018 vs 2025 (Thousand Units)

Figure 23 Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 24 Market for Construction and Mining Trucks, By Component, 2018 vs 2025 (USD Thousand)

Figure 25 Market for Rolling Stock, By Component, 2018 vs 2025 (Thousand Units)

Figure 26 Market, 2018 vs 2022 vs 2025 (USD Million)

Figure 27 Asia Oceania: Air Brake Market Snapshot

Figure 28 Europe: Air Brake Market: Snapshot

Figure 29 North America: Air Brake Market, By Country, 2018-2025 (USD Million)

Figure 30 RoW: Air Brake Market, By Country, 2018-2025 (USD Million)

Figure 31 Companies Adopted New Product Development as the Key Growth Strategy, 20152018

Figure 32 Air Brake Market Share, for on Highway Vehicles, 2017

Figure 33 Knorr-Bremse: Company Snapshot

Figure 34 Wabco: Company Snapshot

Figure 35 Meritor: Company Snapshot

Figure 36 Haldex: Company Snapshot

Figure 37 ZF: Company Snapshot

Figure 38 Wabtec: Company Snapshot

Figure 39 Nabtesco: Company Snapshot

Figure 40 Federal-Mogul: Company Snapshot

Figure 41 Sorl Auto Parts: Company Snapshot

Growth opportunities and latent adjacency in Air Brake System Market

Can you please share the sample report for Air Brake system as we need to buy the report for Air Brake System.