Air Circuit Breaker Market by Voltage (Low Voltage, and Medium Voltage), Type (Air Blast Circuit Breaker, and Plain Air Circuit Breaker), Application (Industrial, Commercial, and Residential), and Region - Global Forecast to 2024

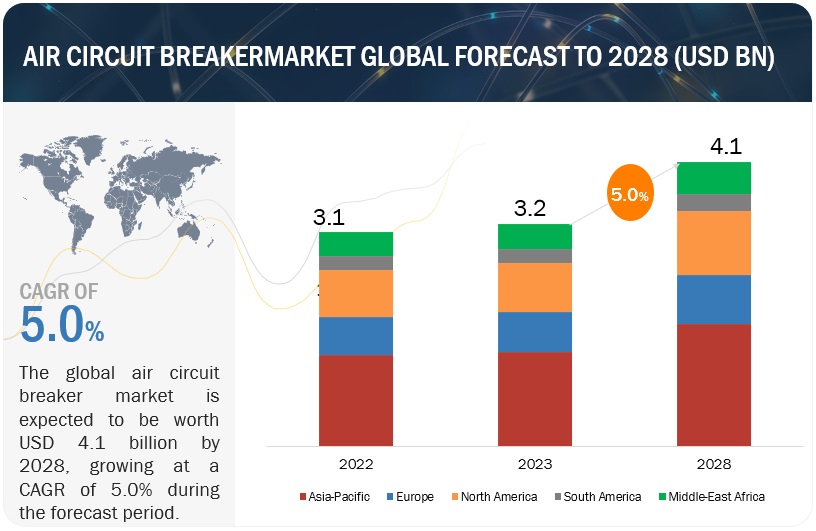

[151 Pages Report] The global air circuit breaker market size is projected to reach USD 3.9 billion by 2024 from an estimated USD 3.0 billion in 2019, at a CAGR of 5.2% during the forecast period. This growth is attributed to the increasing power generation from renewable energy sources and rising demand for reliable & secure power supply.

The air blast circuit breaker segment is expected to be the largest contributor to the market, by type, during the forecast period

The market is segmented by type into plain air circuit breakers, and air blast circuit breakers. The air blast circuit breaker segment accounted for the largest air circuit breaker market share in 2018, driven by demand from Asia Pacific.

The residential application is expected to be the fastest-growing market during the forecast period

The air circuit breaker, by application, is segmented based on the end-users it caters. The industrial segment was the largest market and is projected to maintain its position owing to the increasing demand for air circuit breakers from the manufacturing and process industries. However, in the future, the residential segment will compete with the industrial sector, due to the rise in the number of residential projects.

The low voltage segment is expected to be the largest contributor to the air circuit breaker market, by voltage, during the forecast period

The market has been categorized based on voltage segment into low and medium voltage. The low voltage segment comprises the largest share as it is utilized in end-use industries, such as power plants, industrial equipment, manufacturing industries, and distribution utilities, which mainly uses air circuit breakers. Thus, the market for low voltage constitutes the largest segment of the market.

Asia Pacific is expected to be the largest market during the forecast period

In this report, the air circuit breaker market study has been conducted for five regions, viz., North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Asia Pacific led the air circuit breaker industry, with the largest revenue share in 2018, and this trend is projected to continue until 2024. The market in North America will also play an important role in driving demand for air circuit breakers.

Key Market Players

The major players in the air circuit breaker market are ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Mitsubishi Electric (Japan), and Schneider Electric (France), among others.

ABB (Switzerland) is a key player in this segment. The company actively focuses on both organic and inorganic strategies to increase its global market share. For instance, in July 2017, the company signed an agreement with Svenska Kraftnδt and Energinet. Under the agreement, ABB upgraded the control and protection system for the Konti-Skan HVDC transmission link with its latest Ability Nodular Advanced Control for HVDC (MACH) technology.

Another major player in the market is Siemens (Germany). The company opts for a new product launch as its organic business strategy for increasing its clientele base globally. For instance, in November 2017, the company launched a compact size circuit breaker named 3WL10, which can manage rated currents up to 1,250 A. With this new product launch, Siemens now offers circuit breakers for almost all applications in four sizes and five performance classes from 630 to 6,300 A.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Voltage, Type, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Siemens (Germany), Eaton (Ireland), Mitsubishi Electric (Japan), Schneider Electric (France) |

This research report categorizes the market by voltage, type, application, and region.

By Voltage:

- Low Voltage

- Medium Voltage

By Type:

- Air Blast Circuit Breaker

- Plain Air Circuit Breaker

By Application:

- Industrial

- Commercial

- Residential

By Region:

- Europe

- North America

- Asia Pacific

- Middle East & Africa

- South America

Key Questions Addressed by the Report

- What are the industry trends that will be seen over the next five years?

- Which of the air circuit breaker market elements will lead by 2024?

- Which of the application segment will have the maximum opportunity to grow during the forecast period?

- Which will be the leading region with the highest market share by 2024?

- How are companies implementing organic and strategies to gain increased market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

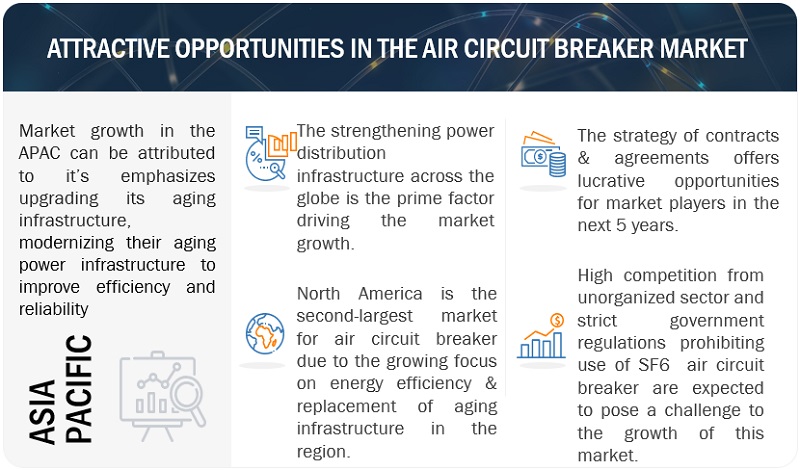

What are the attractive opportunities in the Air-Circuit breaker market in the next 5 years?

Rising need for reliable and secure power supply and increasing share of renewable power in the electricity portfolio are expected to drive the market during 2019 and 2024. Other opportunities behind the growth of the market are ageing electrical infrastructure, rising power demand and smart city projects.

Which type of Air-Circuit Breaker will lead by 2024?

Air Blast Circuit breaker segment is projected to dominate the market by 2024. Rising investments in the power distribution sector and increased renewable energy projects are likely to drive the market over the forecast period.

Which type of Air-Circuit Break by Voltage will lead the market by 2024?

Low-voltage air-circuit breaker is expected to dominate the market until 2024. Increasing automation and demand from industrial segment are expected to drive the segment during the forecast period.

Which type of Air-Circuit Break by Application will lead the market by 2024?

Industrial Air-Circuit Breakers are expected o dominate the market until 2024. Increase in industrialization trend in developing countries is expected to drive this market.

Which region will lead the Air-Circuit Breaker Market by 2024?

Asia-Pacific region is expected to dominate the market in 2024 with majority market share. Increasing power requirements coupled with rising power infrastructure and surging construction projects in Asia Pacific are expected to drive the air circuit breaker market during the forecast period.

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.1.1 Key Data From Primary Sources

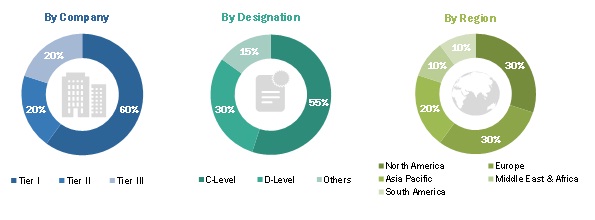

2.1.1.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Demand-Side Analysis

2.3 Data Triangulation

2.3.1 Assumptions

2.3.2 Forecast

2.3.3 Supply-Side Analysis

2.3.3.1 Assumptions and Calculation

2.4 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Air Circuit Breaker Market

4.2 Air Circuit Breaker Market, By Type

4.3 Air Circuit Breaker Market, By Voltage

4.4 Asia Pacific Air Circuit Breaker Market, By Application & Country

4.5 Air Circuit Breaker Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Power Generation From Renewable Energy Sources

5.2.1.2 Increasing Demand for Energy Storage and Decentralized Power Generation

5.2.1.3 Rising Needs for Reliable and Secure Power Supply Worldwide

5.2.2 Restraints

5.2.2.1 Lack of Efficient Government Policies Pertaining to Air Circuit Breakers

5.2.2.2 Growing Competition From the Unorganized Sector of the Air Circuit Breaker Market

5.2.3 Opportunities

5.2.3.1 Aging Electrical Infrastructure and Rising Electricity Demand

5.2.3.2 Development of Smart Cities

5.2.4 Challenges

5.2.4.1 Rising Concerns Related to the Security of Power Grids

6 Air Circuit Breaker Market, By Voltage (Page No. - 42)

6.1 Introduction

6.2 Low-Voltage Air Circuit Breaker

6.2.1 Increasing Automation and Demand From Industrial Segment are Driving the Adoption of Low-Voltage Air Circuit Breakers

6.3 Medium-Voltage Air Circuit Breaker

6.3.1 Increasing Renewable Generation and Growing Power Distribution Infrastructure are Expected to Drive the Market During the Forecast Period

7 Air Circuit Breaker Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Plain Air Circuit Breaker

7.2.1 Rapid Industrialization and Increasing Demand From Low-Voltage Segment are Driving the Adoption of Plain Air Circuit Breakers

7.3 Air Blast Circuit Breaker

7.3.1 Rising Power Distribution Investments are Expected to Drive the Market During the Forecast Period

8 Air Circuit Breaker Market, By Application (Page No. - 50)

8.1 Introduction

8.2 Industrial Air Circuit Breaker

8.2.1 Increasing Trend of Industrialization in Developing Countries is Driving the Adoption of Industrial Air Circuit Breakers

8.3 Commercial Air Circuit Breaker

8.3.1 Increasing Commercial Areas Globally are Expected to Drive the Market During the Forecast Period

8.4 Residential Air Circuit Breaker

8.4.1 Use of Smart Technology is Driving the Adoption of Residential Air Circuit Breakers

9 Air Circuit Breaker Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 By Voltage

9.2.2 By Type

9.2.3 By Application

9.2.4 By Country

9.2.4.1 US

9.2.4.1.1 Increasing Government Initiatives to Invest in Smart Energy Infrastructure Offer the Highest Growth Potential for the Air Circuit Breaker Industry in North America

9.2.4.2 Canada

9.2.4.2.1 Rising Demand for Power Distribution Equipment and Increasing Industrialization are Expected to Drive the Air Circuit Breaker Industry in Canada

9.2.4.3 Mexico

9.2.4.3.1 Increased Government Efforts to Expand Power Generation Capacities Boost the Growth of the Air Circuit Breaker Industry

9.3 Europe

9.3.1 By Voltage

9.3.2 By Type

9.3.3 By Application

9.3.4 By Country

9.3.4.1 UK

9.3.4.1.1 Increasing Power Demand and Expansion in the Power Distribution Network Would Provide Growth Opportunities for the Air Circuit Breaker Industry

9.3.4.2 Germany

9.3.4.2.1 Renewable Energy Capacity Development Supported By Smart Grid Development is Driving the Air Circuit Breaker Industry

9.3.4.3 Russia

9.3.4.3.1 Government Initiatives to Upgrade Aging Power Infrastructure Would Drive the Air Circuit Breaker Industry

9.3.4.4 France

9.3.4.4.1 Increasing Investments in the Manufacturing Sector Boost the Demand for the Air Circuit Breaker Industry

9.3.4.5 Rest of Europe

9.4 Asia Pacific

9.4.1 By Voltage

9.4.2 By Type

9.4.3 By Application

9.4.4 By Country

9.4.4.1 China

9.4.4.1.1 Increased Government Spending in Power Generation Projects and Smart Grids is Contributing to the Growth of Air Circuit Breakers Market

9.4.4.2 Japan

9.4.4.2.1 Increasing Investments in Renewable Energy Projects and Infrastructure Development Would Create Lucrative Opportunities for the Air Circuit Breaker Industry

9.4.4.3 India

9.4.4.3.1 Increasing Government Initiatives to Upgrade the Existing Power Grids and Rising Electricity Demand Boost the Growth of Air Circuit Breakers

9.4.4.4 South Korea

9.4.4.4.1 Increasing Infrastructure Developments Boost the Growth of Air Circuit Breakers During the Forecast Period

9.4.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 By Voltage

9.5.2 By Type

9.5.3 By Application

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.1.1 Robust Infrastructural Development and the Rising Demand for Renewable Energy Would Boost the Demand for the Air Circuit Breaker Industry in Brazil

9.5.4.2 Argentina

9.5.4.2.1 Rapid Expansion in Power Infrastructure and Increasing Construction Activities are Expected to Drive the Market

9.5.4.3 Chile

9.5.4.3.1 Investments in Industrial Development Followed By Renewable Energy Investments are Driving the Air Circuit Breaker Industry in the Country

9.5.4.4 Rest of South America

9.6 Middle East & Africa

9.6.1 By Voltage

9.6.2 By Type

9.6.3 By Application

9.6.4 By Country

9.6.4.1 Saudi Arabia

9.6.4.1.1 Increase in Industrial Development Followed By Investments in Smart Grid Developments is Driving the Air Circuit Breaker Industry in Saudi Arabia

9.6.4.2 UAE

9.6.4.2.1 Increasing Demand for Electricity and Rising Need for Modernizing the Aging Power Distribution Network

9.6.4.3 Kuwait

9.6.4.3.1 Increasing Investments in Renewable Energy Development are Expected to Dominate the Air Circuit Breaker Industry in Kuwait

9.6.4.4 South Africa

9.6.4.4.1 Increasing Smart Grid Investments Boost the Growth of the Air Circuit Breaker Industry in South Africa

9.6.4.5 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging

10.3 Market Share Analysis, 2018

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Contracts & Agreements

10.4.3 Investments & Expansions

10.4.4 Mergers & Acquisitions

10.4.5 Partnerships & Collaborations

11 Company Profiles (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 ABB

11.2 Eaton

11.3 Fuji Electric

11.4 Larsen & Toubro

11.5 Mitsubishi Electric

11.6 Siemens

11.7 Schneider Electric

11.8 Hitachi

11.9 C&S Electric

11.10 Hyundai Electric

11.11 CG

11.12 Entec Electric & Electronic

11.13 WEG

11.14 LSIS

11.15 Havells

11.16 Legrand

11.17 HPL

11.18 Federal

11.19 Terasaki Electric

11.20 Romac

11.21 Annexure

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 144)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (101 Tables)

Table 1 Air Circuit Breaker Market Snapshot Terminology, By Voltage: Inclusions & Exclusions

Table 2 Market Snapshot Terminology, By Application: Inclusions & Exclusions

Table 3 Air Circuit Breaker Demand and Air Circuit Breaker Cost are the Determining Factors for the Global Market

Table 4 Air Circuit Breaker Market Snapshot

Table 5 Market Size, By Voltage, 20172024 (USD Million)

Table 6 Low-Voltage Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 7 Medium-Voltage Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 8 Market Size, By Type, 20172024 (USD Million)

Table 9 Plain Air Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 10 Air Blast Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 11 Air Circuit Breaker Market Size, By Application, 20172024 (USD Million)

Table 12 Industrial Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 13 Commercial Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 14 Residential Circuit Breaker: Market Size, By Region, 20172024 (USD Million)

Table 15 Market Size, By Region, 20172024 (USD Million)

Table 16 North America: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 17 North America: Market Size, By Type, 20172024 (USD Million)

Table 18 North America: Market Size, By Application, 20172024 (USD Million)

Table 19 North America: Market Size, By Country, 20172024 (USD Million)

Table 20 US: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 21 US: Market Size, By Type, 20172024 (USD Million)

Table 22 US: Market Size, By Application, 20172024 (USD Million)

Table 23 Canada: Market Size, By Voltage, 20172024 (USD Million)

Table 24 Canada: Market Size, By Type, 20172024 (USD Million)

Table 25 Canada: Market Size, By Application, 20172024 (USD Million)

Table 26 Mexico: Market Size, By Voltage, 20172024 (USD Million)

Table 27 Mexico: Market Size, By Type, 20172024 (USD Million)

Table 28 Mexico: Market Size, By Application, 20172024 (USD Million)

Table 29 Europe: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 30 Europe: Market Size, By Type, 20172024 (USD Million)

Table 31 Europe: Market Size, By Application, 20172024 (USD Million)

Table 32 Europe: Market Size, By Country, 20172024 (USD Million)

Table 33 UK: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 34 UK: Market Size, By Type, 20172024 (USD Million)

Table 35 UK: Market Size, By Application, 20172024 (USD Million)

Table 36 Germany: Market Size, By Voltage, 20172024 (USD Million)

Table 37 Germany: Market Size, By Type, 20172024 (USD Million)

Table 38 Germany: Market Size, By Application, 20172024 (USD Million)

Table 39 Russia: Market Size, By Voltage, 20172024 (USD Million)

Table 40 Russia: Market Size, By Type, 20172024 (USD Million)

Table 41 Russia: Market Size, By Application, 20172024 (USD Million)

Table 42 France: Market Size, By Voltage, 20172024 (USD Million)

Table 43 France: Market Size, By Type, 20172024 (USD Million)

Table 44 France: Market Size, By Application, 20172024 (USD Million)

Table 45 Rest of Europe: Market Size, By Voltage, 20172024 (USD Million)

Table 46 Rest of Europe: Market Size, By Type, 20172024 (USD Million)

Table 47 Rest of Europe: Market Size, By Application, 20172024 (USD Million)

Table 48 Asia Pacific: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 49 Asia Pacific: Market Size, By Type, 20172024 (USD Million)

Table 50 Asia Pacific: Market Size, By Application 20172024 (USD Million)

Table 51 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 52 China: Market Size, By Voltage, 20172024 (USD Million)

Table 53 China: Market Size, By Type, 20172024 (USD Million)

Table 54 China: Market Size, By Application, 20172024 (USD Million)

Table 55 Japan: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 56 Japan: Market Size, By Type, 20172024 (USD Million)

Table 57 Japan: Market Size, By Application, 20172024 (USD Million)

Table 58 India: Market Size, By Voltage, 20172024 (USD Million)

Table 59 India: Market Size, By Type, 20172024 (USD Million)

Table 60 India: Market Size, By Application, 20172024 (USD Million)

Table 61 South Korea: Market Size, By Voltage, 20172024 (USD Million)

Table 62 South Korea: Market Size, By Type, 20172024 (USD Million)

Table 63 South Korea: Market Size, By Application, 20172024 (USD Million)

Table 64 Rest of Asia Pacific: Market Size, By Voltage, 20172024 (USD Million)

Table 65 Rest of Asia Pacific: Market Size, By Type, 20172024 (USD Million)

Table 66 Rest of Asia Pacific: Market Size, By Application, 20172024 (USD Million)

Table 67 South America: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 68 South America: Market Size, By Type, 20172024 (USD Million)

Table 69 South America: Market Size, By Application, 20172024 (USD Million)

Table 70 South America: Market Size, By Country, 20172024 (USD Million)

Table 71 Brazil: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 72 Brazil: Market Size, By Type, 20172024 (USD Million)

Table 73 Brazil: Market Size, By Application, 20172024 (USD Million)

Table 74 Argentina: Market Size, By Voltage, 20172024 (USD Million)

Table 75 Argentina: Market Size, By Type, 20172024 (USD Million)

Table 76 Argentina: Market Size, By Application, 20172024 (USD Million)

Table 77 Chile: Market Size, By Voltage, 20172024 (USD Million)

Table 78 Chile: Market Size, By Type, 20172024 (USD Million)

Table 79 Chile: Market Size, By Application, 20172024 (USD Million)

Table 80 Rest of South America: Market Size, By Voltage, 20172024 (USD Million)

Table 81 Rest of South America: Market Size, By Type, 20172024 (USD Million)

Table 82 Rest of South America: Market Size, By Application, 20172024 (USD Million)

Table 83 Middle East & Africa: Air Circuit Breaker Market Size, By Voltage, 20172024 (USD Million)

Table 84 Middle East & Africa: Market Size, By Type, 20172024 (USD Million)

Table 85 Middle East & Africa: Market Size, By Application, 20172024 (USD Million)

Table 86 Middle East & Africa: Market Size, By Country, 20172024 (USD Million)

Table 87 Saudi Arabia: Market Size, By Voltage, 20172024 (USD Million)

Table 88 Saudi Arabia: Market Size, By Type, 20172024 (USD Million)

Table 89 Saudi Arabia: Market Size, By Application, 20172024 (USD Million)

Table 90 UAE: Market Size, By Voltage, 20172024 (USD Million)

Table 91 UAE: Market Size, By Type, 20172024 (USD Million)

Table 92 UAE: Market Size, By Application, 20172024 (USD Million)

Table 93 Kuwait: Market Size, By Voltage, 20172024 (USD Million)

Table 94 Kuwait: Market Size, By Type, 20172024 (USD Million)

Table 95 Kuwait: Market Size, By Application, 20172024 (USD Million)

Table 96 South Africa: Market Size, By Voltage, 20172024 (USD Million)

Table 97 South Africa: Market Size, By Type, 20172024 (USD Million)

Table 98 South Africa: Market Size, By Application, 20172024 (USD Million)

Table 99 Rest of Middle East & Africa: Market Size, By Voltage, 20172024 (USD Million)

Table 100 Rest of Middle East & Africa: Market Size, By Type, 20172024 (USD Million)

Table 101 Rest of Middle East & Africa: Market Size, By Application, 20172024 (USD Million)

List of Figures (36 Figures)

Figure 1 Air Circuit Breaker: Research Design

Figure 2 Data Triangulation

Figure 3 Air Circuit Breaker Market: Market Estimation

Figure 4 Air Blast Circuit Breaker Segment is Expected to Hold the Largest Share of the Air Circuit Breaker Market, By Type, During the Forecast Period

Figure 5 Low-Voltage Segment is Expected to Lead the Air Circuit Breaker Market, By Voltage, During the Forecast Period

Figure 6 Industrial Segment is Expected to Lead the Air Circuit Breaker Market, By Application, During the Forecast Period

Figure 7 Asia Pacific Dominated the Air Circuit Breaker Industry (By Value) in 2018

Figure 8 Rising Need for Reliable and Secure Power Supply and Increasing Share of Renewable Power in Electricity Portfolio Mix are Expected to Drive the Air Circuit Breaker Market, 20192024

Figure 9 Air Blast Circuit Breaker Segment is Projected to Dominate the Air Circuit Breaker Industry, By Type, Until 2024

Figure 10 Low-Voltage Segment is Projected to Dominate the Air Circuit Breaker Industry, By Voltage, Until 2024

Figure 11 Industrial and China Dominated the Asia Pacific Air Circuit Breaker Industry in 2018

Figure 12 Middle East & Africa Air Circuit Breaker Industry is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Air Circuit Breaker Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Rise in Global Investments in the Field of Renewable Energy

Figure 15 Air Circuit Breaker (Value), By Voltage, 2018

Figure 16 Air Circuit Breaker (Value), By Type, 2018

Figure 17 Air Circuit Breaker (Value), By Application, 2018

Figure 18 Regional Snapshot: the Air Circuit Breaker Industry in the Middle East & Africa is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Air Circuit Breaker Industry Share (Value), By Region, 2018

Figure 20 North America: Regional Snapshot

Figure 21 Asia Pacific: Regional Snapshot

Figure 22 Key Developments in the Air Circuit Breaker Industry, During July 2016September 2019

Figure 23 Air Circuit Breaker: (Global) Competitive Leadership Mapping 2018

Figure 24 Market Share Analysis, 2018

Figure 25 ABB: Company Snapshot

Figure 26 Eaton: Company Snapshot

Figure 27 Fuji Electric: Company Snapshot

Figure 28 Larsen & Toubro: Company Snapshot

Figure 29 Mitsubishi Electric : Company Snapshot

Figure 30 Siemens: Company Snapshot

Figure 31 Schneider Electric: Company Snapshot

Figure 32 Hitachi: Company Snapshot

Figure 33 CG : Company Snapshot

Figure 34 WEG: Company Snapshot

Figure 35 LSIS: Company Snapshot

Figure 36 Havells: Company Snapshot

This study involved four major activities in estimating the current size of the air circuit breaker market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as Power data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and offshore decommissioning journal to identify and collect information useful for a technical, market-oriented, and commercial study of the air circuit breaker market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The air circuit breaker market comprises several stakeholders such as companies related to the industry, consulting companies in the power sector, power companies, government & research organizations, organizations, forums, alliances & associations, air circuit breaker service providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the air circuit breaker expenditure across regions, investments by key power companies, and maturing of the renewable energy sector. Moreover, the demand is also driven by a change in rules and regulations, and active participation from environmental bodies have pushed the air circuit breaker. The supply side is characterized by the contracts & agreements, new product launches, investments and expansions, and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global air circuit breaker market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the air circuit breaker activities.

Report Objectives

- To define, describe, and forecast the global air circuit breaker market by type, voltage, application, and region, in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, future prospects, and the contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product launches, and partnerships & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Air Circuit Breaker Market