Air Quality Monitoring System Market by Product (Indoor, Outdoor, Wearable), Sampling (Stack, Manual, Passive), Pollutants (Chemical, Particulate Matter, Biological), End User (Government, Petrochemical, Power Plant, Residential) & Region - Global Forecast to 2028

Updated on : July 11, 2023

Inquire Now to get the Global Forecasts Data upto 2028

The global air quality monitoring system market in terms of revenue was estimated to be worth $4.4 billion in 2021 and is poised to reach $5.9 billion by 2026, growing at a CAGR of 6.5% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is primarily driven by factors such as technological advancements in air quality monitoring systems, increasing public-private funding for effective air pollution monitoring, and increasing public awareness related to the environmental and healthcare implications of air pollution.

To know about the assumptions considered for the study, Request for Free Sample Report

Air Quality Monitoring System Market Dynamics

Driver: Favorable public and private initiatives for environmental conservation and public awareness

The public and private sector initiatives towards environmental conservation, public awareness, and pollution control have been driving the growth of the market. Governments of various countries are taking initiatives in the form of legislation to reduce air pollution and its effects. For example, the European Union has introduced the EU National Emissions Ceiling Directive to regulate air quality levels. The U.S. Environmental Protection Agency (EPA) has issued the National Ambient Air Quality Standards (NAAQS) to control the emissions from the sources of air pollution. In addition, the growing awareness about air pollution and its effects on human health is encouraging people to install air quality monitoring systems in their homes, offices, and other places. This is further propelling the growth of the market.

Opportunity: Continuous R&D and technological advancements

The market is expected to experience significant growth over the forecast period due to the increasing awareness of air pollution and the need for improved air quality. This is mainly due to the continuous R&D and technological advancements in the air quality monitoring system sector. The improved accuracy and cost-effectiveness of the systems has enabled the market to expand rapidly. Furthermore, government initiatives and regulations have also driven the growth of the market. For example, the US Environmental Protection Agency (EPA) has implemented regulations and standards to monitor air quality. The increasing demand for air quality monitoring systems from various industries such as oil and gas, energy and power, healthcare, and automotive is expected to drive the market growth. Additionally, the rise in investments in research and development activities is anticipated to create more growth opportunities for the market.

Restraint: High product cost

The high cost of air quality monitoring systems is a major restraint on the growth of the market. These systems are expensive and require a significant initial investment. This has deterred many potential buyers from investing in these systems. Additionally, the complexity of these systems and the need for skilled personnel to operate them are additional factors that have prevented the widespread adoption of these systems. Furthermore, the lack of awareness about the benefits of air quality monitoring systems among potential buyers has also hindered their uptake.

Challenge: Slow implementation of air pollution control reforms

Governments should focus on implementing air pollution control reforms through policies that prioritize the reduction of emissions from major sources of air pollution. These policies should include the establishment of emissions standards and regulations, the enforcement of clean air laws, the promotion of clean energy initiatives, and increased funding for air quality monitoring systems to improve air quality. In addition, governments should incentivize businesses to adopt clean air technologies and increase public awareness about the importance of air quality monitoring. Finally, governments should partner with organizations and businesses to facilitate the development of air pollution control plans and promote the use of clean air technologies.

To know about the assumptions considered for the study, download the pdf brochure

The indoor monitors segment accounted for the largest share of the global air quality monitoring system industry, by product.

On the basis of product, air quality monitoring system market is segmented into indoor monitors, outdoor monitors, and wearable monitors. The indoor monitors market is further subdivided into fixed and portable indoor monitors. The outdoor monitors market is also segmented into portable outdoor monitors, fixed outdoor monitors, dust and particulate matter monitors, and AQM stations. Indoor monitors commanded the largest share of the global AQM products market. The dominant position of this market segment can be attributed to the growing installation of AQM stations, initiatives to increase public awareness about the health implications of indoor air pollution, the increasing adoption of smart home and green-building technologies, and the growing preference for pollution-free indoor environments. Market growth is further aided by the continuous development and commercialization of innovative AQM technologies and government regulations mandating the regular monitoring of indoor air quality in working premises.

The chemical pollutant segment, by pollutant, accounted for the largest share of the global air quality monitoring system industry

On the basis of types of pollutant monitored by air quality monitoring devices, air quality monitoring system market is segmented into chemical pollutant, physical pollutants, and biological pollutants. The chemical pollutants segment is further segmented into nitrogen oxides (NOx), sulfur oxides (SOX), carbon oxides (COX), volatile organic compounds (VOCs), and other chemical pollutants. The chemical pollutants segment commanded the largest share of this market, by pollutant. Market growth is attributed to the rising levels of chemical air pollutants globally. In addition, the implementation of and the need to comply with stringent pollution monitoring and control regulations, growing public awareness, and the development and commercialization of innovative sensors are supporting the growth of this market segment.

Stack monitoring, by sampling method, is expected to grow with the highest growth rate in the global air quality monitoring system industry

On the basis of sampling method, air quality monitoring system market is segmented into active/continuous monitoring, intermittent monitoring, passive monitoring, manual monitoring, and stack monitoring. The active/continuous monitoring segment commanded the largest share of this market, whereas the stack monitoring segment is projected to grow at the highest CAGR during the forecast period. The low operational cost of stack monitoring, the increasing government emphasis on regulatory compliance for industrial pollution monitoring, and the rising emphasis on pollution monitoring and control are factors expected to support the growth of this market. However, the limited procedural accuracy of stack monitoring, caused by environmental conditions such as humidity and temperature, is expected to restrain market growth to a certain extent.

The Asia Pacific region of the air quality monitoring system industry is expected to grow at the highest CAGR during the forecast period

On the basis of region, the air quality monitoring system market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia-Pacific market is expected to register the highest growth in the forecast period. Countries in this market are witnessing growth in their GDPs and a significant rise in disposable income among the middle-class population. This has led to increased expenditure by various regional government on air quality monitoring activities, modernization of industrial and public infrastructures, and rising penetration of cutting-edge environmental monitoring technologies. All of these factors contribute to the high CAGR of the region.

The dominant players in the global air quality monitoring system market are Thermo Fisher Scientific (US), Emerson Electric (US), General Electric (US), Siemens AG (Germany), Teledyne Technologies (US), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Spectris plc (UK), 3M Company (US), Honeywell International Inc (US), HORIBA, Ltd. (Japan), Merck KGaA (Germany), TSI Incorporated (US), Tisch Environmental (US), and Testo (Germany), among others.

Thermo Fisher Scientific (US) is one of the leading providers in this market. Its vast product range and wide geographical presence across key markets like North America, Europe, the APAC, and Africa are the key factor accounting for its large share in this market. Thermo Fisher has a robust product portfolio consisting of gas analyzers, air samplers, monitoring systems, particulate matter monitors, probes and other accessories, and focuses on vigorous R&D activities and continuous product development. Recently in March 2021, the company launched the Thermo Scientific AerosolSense Sampler which is a surveillance solution for in-air pathogens, including SARS-CoV-2. Other recent product launches include Orbitrap exploris GC 240 MS, Orbitrap Exploris GC-MS, TriPLus 500 gas chromatorgraphy headspace autosampler, SOLA iQ total sulfur analyzer and TSQ 9000 triple quadrupole GC-MS systems, among others. Their products are manufactured according to international safety standards, thus making firm a leading player in this market.

Scope of the Air Quality Monitoring System Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$4.4 billion |

|

Estimated Value by 2026 |

$5.9 billion |

|

Growth Rate |

Poised to grow at a CAGR of 6.5% |

|

Market Driver |

Favorable public and private initiatives for environmental conservation and public awareness |

|

Market Opportunity |

Continuous R&D and technological advancements |

This research report categorizes the air quality monitoring system market to forecast revenue and analyze trends in each of the following submarkets:

By Sampling Method

- Active/Continuous Monitoring

- Manual Monitoring

- Passive Monitoring

- Intermittent monitoring

- Stack Monitoring

By Pollutant

- Chemical Pollutant

- Nitrogen Oxides

- Sulfur Oxides

- Carbon Oxides

- Volatile Organic Compounds

- Other Chemical Pollutants

- Physical Pollutant

- Biological Pollutant

By Product

- Indoor monitors

- Fixed Indoor Monitors

- Portable Indoor Monitors

- Outdoor monitors

- Portable Outdoor Monitors

- Fixed Outdoor Monitors

- Dust & Particulate Matter Monitors

- AQM Stations

- Wearable Monitors

By End User

- Government Agencies & Academic Institutes

- Government and Residential Users

- Petrochemical Industry

- Power Generation Plants

- Pharmaceutical Industry

- Smart City Authorities

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments of Air Quality Monitoring System Industry

- In September 2020, Spektris (UK) launched the new ULTRA Series gas analyzer at Semicon Taiwan 2020

- In February 2020, TSI Incorporated (US) introduced BlueSky Air Quality Monitor(Model 8143) to measure PM1, PM2.5, PM4 and PM10 mass concentrations, as well as temperature and humidity.

- In March 2019, Emerson Electric (US) launched Rosemount CT4400 Continuous Gas Analyzer with Quantum Cascade Laser (QCL) and Tunable Diode Laser (TDL) analyzer for Continuous emission monitoring

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the air quality monitoring system market?

The air quality monitoring system market boasts a total revenue value of $5.9 billion by 2026.

What is the estimated growth rate (CAGR) of the air quality monitoring system market?

The global air quality monitoring system market has an estimated compound annual growth rate (CAGR) of 6.5% and a revenue size in the region of $4.4 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 INTRODUCTION

FIGURE 1 RESEARCH DESIGN: AIR QUALITY MONITORING SYSTEM INDUSTRY

2.2 SECONDARY & PRIMARY RESEARCH METHODOLOGY

2.2.1 SECONDARY RESEARCH

2.2.2 PRIMARY RESEARCH

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3.1 PRODUCT-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: MARKET

2.3.2 PRIMARY RESEARCH VALIDATION

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 6 GLOBAL MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 7 AIR QUALITY MONITORING SYSTEM MARKET, BY SAMPLING METHOD, 2021 VS. 2026 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY POLLUTANT, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 10 GLOBAL MARKET SHARE, BY REGION (2020)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 AIR QUALITY MONITORING SYSTEM INDUSTRY OVERVIEW

FIGURE 11 SUPPORTIVE GOVERNMENT INITIATIVES TO MONITOR AND CONTROL THE LEVEL OF HARMFUL AIR POLLUTANTS ARE DRIVING THE MARKET GROWTH

4.2 EUROPE: AIR QUALITY MONITORING SYSTEM MARKET, BY SAMPLING METHOD AND REGION

FIGURE 12 ACTIVE/CONTINUOUS MONITORING SEGMENT HELD THE LARGEST SHARE OF THE EUROPEAN SYSTEM MARKET IN 2020

4.3 GLOBAL MARKET, BY POLLUTANT

FIGURE 13 NITROUS OXIDES SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 14 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 KEY MARKET DRIVERS

5.2.1.1 Active government initiatives for air pollution monitoring and control

5.2.1.2 Growing concerns over rising air pollution

5.2.1.3 Favorable public and private initiatives for environmental conservation and public awareness

5.2.2 KEY MARKET RESTRAINTS

5.2.2.1 High product costs

5.2.2.2 Technical limitations associated with a majority of AQM products

5.2.3 KEY MARKET OPPORTUNITIES

5.2.3.1 Continuous R&D and technological advancements

5.2.3.2 Expected post-COVID-19 expansion of the petrochemical and power generation industries

5.2.4 KEY MARKET CHALLENGES

5.2.4.1 Slow implementation of air pollution control reforms

5.2.4.2 Availability of alternate monitoring solutions

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 OVERVIEW

TABLE 1 AIR QUALITY MONITORING SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 BARGAINING POWER OF BUYERS

5.3.6 DEGREE OF COMPETITION

5.4 REGULATORY SCENARIO

5.4.1 WHO

TABLE 2 WHO AIR QUALITY GUIDELINES

5.4.2 US

TABLE 3 US EPA AIR QUALITY STANDARDS

5.4.3 EUROPEAN UNION

5.4.3.1 Existing air quality legislation in the EU

5.4.3.2 The EU and international air pollution policies

TABLE 4 EU AIR QUALITY STANDARDS

5.4.4 OTHERS

5.4.4.1 India

5.4.4.2 China

5.5 ECOSYSTEM COVERAGE

5.6 VALUE CHAIN ANALYSIS

5.7 COVID-19 IMPACT ON THE AIR QUALITY MONITORING MARKET

5.8 PRICING ANALYSIS

5.9 PATENTS PUBLISHED

6 AIR QUALITY MONITORING SYSTEM MARKET, BY SAMPLING METHOD (Page No. - 69)

6.1 INTRODUCTION

TABLE 5 AIR QUALITY MONITORING SYSTEM MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

6.2 ACTIVE/CONTINUOUS MONITORING

6.2.1 UNMET NEED OF CEMS IN DEVELOPING COUNTRIES TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 6 MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 MANUAL MONITORING

6.3.1 AVAILABILITY OF BETTER AND ACCURATE ALTERNATIVES TO RESTRICT THE GROWTH OF THIS MARKET SEGMENT

TABLE 7 MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 PASSIVE MONITORING

6.4.1 COST-EFFECTIVENESS AND EASE OF USE AS COMPARED TO OTHER METHODS SUPPORTING THE GROWTH OF THIS MARKET SEGMENT

TABLE 8 MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 INTERMITTENT MONITORING

6.5.1 INABILITY TO PROVIDE REAL-TIME DATA USING INTERMITTENT MONITORING TO HAMPER THE GROWTH OF THIS MARKET SEGMENT

TABLE 9 MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 STACK MONITORING

6.6.1 DEMAND FOR STACK MONITORING IS INCREASING DUE TO HIGH EFFICIENCY AND LOW OPERATIONAL COSTS

TABLE 10 STACK MONITORING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 AIR QUALITY MONITORING SYSTEM MARKET, BY POLLUTANT (Page No. - 76)

7.1 INTRODUCTION

TABLE 11 TYPE OF AIR POLLUTANTS AND THEIR EFFECTS ON HEALTH AND ENVIRONMENT

TABLE 12 AIR QUALITY MONITORING SYSTEM MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

7.2 CHEMICAL POLLUTANTS

TABLE 13 GLOBAL MARKET FOR CHEMICAL POLLUTANTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 GLOBAL MARKET FOR CHEMICAL POLLUTANTS, BY REGION, 2019–2026 (USD MILLION)

7.2.1 NITROGEN OXIDES

7.2.1.1 Growing awareness about air pollution aided by private-public investments to drive the growth of this market segment

TABLE 15 GLOBAL MARKET FOR NITROGEN OXIDES, BY REGION, 2019–2026 (USD MILLION)

7.2.2 SULFUR OXIDES

7.2.2.1 Expansion of the petrochemical and power generation industries to drive the demand for sulfur oxide monitors

TABLE 16 SULFUR DIOXIDE EMISSIONS FROM HOTSPOTS, 2018 (KT/YEAR)

TABLE 17 MARKET FOR SULFUR OXIDES, BY REGION, 2019–2026 (USD MILLION)

7.2.3 CARBON OXIDES

7.2.3.1 Countries aiming to achieve net-zero carbon emission to support the growth of this market segment

TABLE 18 AIR QUALITY MONITORING SYSTEM INDUSTRY FOR CARBON OXIDES, BY REGION, 2019–2026 (USD MILLION)

7.2.4 VOLATILE ORGANIC COMPOUNDS

7.2.4.1 VOC monitors hold a modest market share due to a limited preference for these monitors in developed countries

TABLE 19 GLOBAL MARKET FOR VOLATILE ORGANIC COMPOUNDS, BY REGION, 2019–2026 (USD MILLION)

7.2.5 OTHER CHEMICAL POLLUTANTS

TABLE 20 GLOBAL MARKET FOR OTHER CHEMICAL POLLUTANTS, BY REGION, 2019–2026 (USD MILLION)

7.3 PHYSICAL POLLUTANTS

7.3.1 HIGH PRODUCT COSTS TO RESTRICT THE DEMAND FOR MONITORING SYSTEMS USED FOR PHYSICAL POLLUTANTS

TABLE 21 MARKET FOR PHYSICAL POLLUTANTS, BY REGION, 2019–2026 (USD MILLION)

7.4 BIOLOGICAL POLLUTANTS

7.4.1 SUSTAINED PUBLIC-PRIVATE INVESTMENTS ARE SUPPORTING PRODUCT DEVELOPMENT FOR THE MONITORING OF BIOLOGICAL POLLUTANTS

TABLE 22 MARKET FOR BIOLOGICAL POLLUTANTS, BY REGION, 2019–2026 (USD MILLION)

8 AIR QUALITY MONITORING SYSTEM MARKET, BY PRODUCT (Page No. - 90)

8.1 INTRODUCTION

TABLE 23 GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

8.2 INDOOR MONITORS

TABLE 24 INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 26 INDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 27 INDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 28 INDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.1 FIXED INDOOR MONITORS

8.2.1.1 Rising public awareness about air pollution to drive the growth of this market segment

TABLE 29 FIXED INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 30 FIXED INDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 31 FIXED INDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 32 FIXED INDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.2 PORTABLE INDOOR MONITORS

8.2.2.1 Ease-of-use and portability of these devices will drive their demand

TABLE 33 PORTABLE INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 34 PORTABLE INDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 35 PORTABLE INDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 36 PORTABLE INDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 OUTDOOR MONITORS

TABLE 37 OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 39 OUTDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 40 OUTDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 41 OUTDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.1 PORTABLE OUTDOOR MONITORS

8.3.1.1 Public-private investments and initiatives to support research and development to drive the growth of this market segment

TABLE 42 PORTABLE OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 43 PORTABLE OUTDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 44 PORTABLE OUTDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 45 PORTABLE OUTDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.2 FIXED OUTDOOR MONITORS

8.3.2.1 Stringent government regulations to drive the growth of this market segment

TABLE 46 FIXED OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 47 FIXED OUTDOOR MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 48 FIXED OUTDOOR MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 49 FIXED OUTDOOR MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.3 DUST & PARTICULATE MATTER MONITORS

8.3.3.1 Delayed implementation of government regulations in developing countries to hamper the growth of this market segment

TABLE 50 DUST & PARTICULATE MATTER MONITORS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 51 DUST & PARTICULATE MATTER MONITORS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 52 DUST & PARTICULATE MATTER MONITORS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 53 DUST & PARTICULATE MATTER MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.4 AQM STATIONS

8.3.4.1 Growing number of AQM stations are being installed across the globe to monitor and control air pollution

TABLE 54 AQM STATIONS MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 55 AQM STATIONS MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 56 AQM STATIONS MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 57 AQM STATIONS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 WEARABLE MONITORS

8.4.1 ADVANTAGES SUCH AS EASE-OF-USE AND PERSONAL AIR QUALITY MONITORING TO DRIVE THE DEMAND FOR WEARABLE MONITORS

TABLE 58 WEARABLE MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 59 WEARABLE MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 60 WEARABLE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 61 WEARABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

9 AIR QUALITY MONITORING SYSTEM MARKET, BY END USER (Page No. - 117)

9.1 INTRODUCTION

TABLE 62 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 GOVERNMENT AGENCIES AND ACADEMIC INSTITUTES

9.2.1 ACTIVE INITIATIVES TO CONTROL AIR POLLUTION DRIVING THE GROWTH OF THIS END-USER SEGMENT

TABLE 63 GLOBAL MARKET FOR GOVERNMENT AGENCIES AND ACADEMIC INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

9.3 COMMERCIAL AND RESIDENTIAL USERS

9.3.1 INCREASING AWARENESS AND TECHNOLOGICAL ADVANCEMENTS ARE DRIVING THE GROWTH OF THIS END-USER SEGMENT

TABLE 64 AIR QUALITY MONITORING SYSTEM INDUSTRY FOR COMMERCIAL AND RESIDENTIAL USERS, BY REGION, 2019–2026 (USD MILLION)

9.4 PETROCHEMICAL INDUSTRY

9.4.1 STRINGENT GOVERNMENT REGULATIONS TO CURB AIR POLLUTION DRIVING THE GROWTH OF THIS END-USER SEGMENT

TABLE 65 GLOBAL MARKET FOR THE PETROCHEMICAL INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

9.5 POWER GENERATION PLANTS

9.5.1 EFFORTS BY NATIONAL AND INTERNATIONAL AGENCIES TO CONTROL EMISSIONS FROM POWER PLANTS TO DRIVE MARKET GROWTH

TABLE 66 GLOBAL MARKET FOR POWER GENERATION PLANTS, BY REGION, 2019–2026 (USD MILLION)

9.6 SMART CITY AUTHORITIES

9.6.1 INCREASING USE OF AQM PRODUCTS IN SMART CITY PROJECTS DRIVING THE GROWTH OF THIS END-USER SEGMENT

TABLE 67 GLOBAL MARKET FOR SMART CITY AUTHORITIES, BY REGION, 2019–2026 (USD MILLION)

9.7 PHARMACEUTICAL INDUSTRY

9.7.1 GROWTH IN THIS END-USER SEGMENT WOULD BE RESTRAINED DUE TO THE RELUCTANCE TO ADOPT EMISSION STANDARDS

TABLE 68 MARKET FOR THE PHARMACEUTICAL INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

9.8 OTHER END USERS

TABLE 69 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

10 AIR QUALITY MONITORING SYSTEM MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

TABLE 70 AIR QUALITY MONITORING SYSTEM INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 16 NORTH AMERICA: MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: CHEMICAL POLLUTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US is the largest market for air quality monitoring systems in North America

TABLE 81 US: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 82 US: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 US: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 US: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 85 US: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Active government participation in air quality management is supporting the growth of the AQM systems market in Canada

TABLE 86 CANADA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 87 CANADA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 CANADA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 CANADA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 90 CANADA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 93 EUROPE: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: CHEMICAL POLLUTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 99 EUROPE: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany dominates the AQM systems market in Europe

TABLE 101 GERMANY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 102 GERMANY: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 GERMANY: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 GERMANY: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 105 GERMANY: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Faster adoption of technologies and positive government initiatives to support market growth in the UK

TABLE 106 UK: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 107 UK: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 UK: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 UK: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 110 UK: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High pollution levels driving the adoption of AQM systems in France

TABLE 111 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 FRANCE: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 FRANCE: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 FRANCE: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 115 FRANCE: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing focus on curbing air pollution levels to drive the adoption of AQM systems in Italy

TABLE 116 ITALY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 117 ITALY: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ITALY: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ITALY: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 120 ITALY: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising public-private initiatives will increase the growth of the AQM systems market in Spain

TABLE 121 SPAIN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 122 SPAIN: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 SPAIN: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 SPAIN: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 125 SPAIN: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 126 ROE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 127 ROE: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 ROE: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 ROE: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 130 ROE: FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 17 APAC: MARKET SNAPSHOT

TABLE 131 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 ASIA PACIFIC: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: CHEMICAL POLLUTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 139 APAC: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 140 APAC: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan dominates the APAC AQM systems market

TABLE 141 JAPAN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 142 JAPAN: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 JAPAN: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 JAPAN: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 145 JAPAN: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Stringent government scrutiny for the entry of private players to hamper market growth

TABLE 146 CHINA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 147 CHINA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 CHINA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 CHINA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 150 CHINA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Active government involvement in air pollution monitoring and control driving market growth in India

TABLE 151 INDIA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 152 INDIA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 INDIA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 INDIA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 155 INDIA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Increased air pollution due to bushfires is compelling the Australian government to take strict measures to monitor and control air pollution

TABLE 156 AUSTRALIA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 157 AUSTRALIA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 AUSTRALIA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 AUSTRALIA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 160 AUSTRALIA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Low awareness about air quality enhancement is resulting in the low penetration of AQM systems in South Korea

TABLE 161 SOUTH KOREA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 162 SOUTH KOREA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 SOUTH KOREA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 SOUTH KOREA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 165 SOUTH KOREA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 166 ROAPAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 167 ROAPAC: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 168 ROAPAC: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 ROAPAC: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 170 ROAPAC: FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 171 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 LATIN AMERICA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: CHEMICAL POLLUTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Shortage of skilled technicians to restrain market growth in Brazil

TABLE 181 BRAZIL: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 182 BRAZIL: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 BRAZIL: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 BRAZIL: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 185 BRAZIL: MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Low adoption of advanced technologies to hinder market growth in Mexico

TABLE 186 MEXICO: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 187 MEXICO: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 MEXICO: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 MEXICO: AIR QUALITY MONITORING SYSTEM MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 190 MEXICO: AIR QUALITY MONITORING SYSTEM SMARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 191 ROLA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 192 ROLA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 ROLA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 194 ROLA: MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 195 ROLA: AIR QUALITY MONITORING SYSTEM MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 SLOW IMPLEMENTATION OF GOVERNMENT REGULATIONS TO RESTRAIN MARKET GROWTH IN THE REGION

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: INDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: OUTDOOR MONITORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY SAMPLING METHOD, 2019–2026 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY POLLUTANT, 2019–2026 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: CHEMICAL POLLUTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 203 MEA: MARKET FOR COMMERCIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 204 MEA: AIR QUALITY MONITORING SYSTEM MARKET FOR RESIDENTIAL USERS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 208)

11.1 OVERVIEW

FIGURE 18 KEY DEVELOPMENTS IN THE AIR QUALITY MONITORING SYSTEM INDUSTRY (2018 TO 2021)

11.2 MARKET SHARE ANALYSIS: GLOBAL MARKET, BY KEY PLAYER (2020)

FIGURE 19 THERMO FISHER SCIENTIFIC HELD THE LEADING POSITION IN THE AIR QUALITY MONITORING SYSTEM INDUSTRY IN 2020

11.3 COMPANY EVALUATION QUADRANT

11.3.1 TERMINOLOGY/NOMENCLATURE

11.3.1.1 Stars

11.3.1.2 Emerging leaders

11.3.1.3 Pervasive players

11.3.1.4 Participants

FIGURE 20 AIR QUALITY MONITORING SYSTEM INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 21 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (SME/START-UPS)

11.4 COMPETITIVE SCENARIO (2018–2021)

TABLE 205 NEW PRODUCT LAUNCHES

TABLE 206 DEALS

TABLE 207 EXPANSIONS

12 COMPANY PROFILES (Page No. - 216)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 THERMO FISHER SCIENTIFIC, INC.

TABLE 208 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 22 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2020)

12.1.2 SIEMENS AG

TABLE 209 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 23 SIEMENS AG: COMPANY SNAPSHOT (2020)

12.1.3 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 210 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

FIGURE 24 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2020)

12.1.4 EMERSON ELECTRIC CO.

TABLE 211 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 25 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT (2020)

12.1.5 GE POWER

TABLE 212 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 26 GE POWER: COMPANY SNAPSHOT (2020)

12.1.6 3M

TABLE 213 3M: BUSINESS OVERVIEW

FIGURE 27 3M: COMPANY SNAPSHOT (2020)

12.1.7 HORIBA, LTD.

TABLE 214 HORIBA, LTD.: BUSINESS OVERVIEW

FIGURE 28 HORIBA, LTD.: COMPANY SNAPSHOT (2020)

12.1.8 MERCK KGAA

TABLE 215 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 29 MERCK KGAA: COMPANY SNAPSHOT (2020)

12.1.9 SPECTRIS

TABLE 216 SPECTRIS: BUSINESS OVERVIEW

FIGURE 30 SPECTRIS: COMPANY SNAPSHOT (2020)

12.1.10 TSI

TABLE 217 TSI: BUSINESS OVERVIEW

12.1.11 TESTO SE & CO. KGAA

TABLE 218 TESTO SE & CO. KGAA: BUSINESS OVERVIEW

12.1.12 HONEYWELL INTERNATIONAL INC.

TABLE 219 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 31 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT (2020)

12.1.13 AGILENT TECHNOLOGIES, INC.

TABLE 220 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 32 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2020)

12.1.14 PERKINELMER INC.

TABLE 221 PERKINELMER INC.: BUSINESS OVERVIEW

FIGURE 33 PERKINELMER INC.: COMPANY SNAPSHOT (2020)

12.1.15 TISCH ENVIRONMENTAL, INC.

TABLE 222 TISCH ENVIRONMENTAL, INC.: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER COMPANIES

12.2.1 AEROQUAL LIMITED

12.2.2 FORBES MARSHALL

12.2.3 PLUME LABS

12.2.4 ATMOTUBE

12.2.5 HANGZHOU ZETIAN TECHNOLOGY CO., LTD.

13 APPENDIX (Page No. - 278)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the air quality monitoring systems market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global air quality monitoring systems market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as CROs, hospitals, transplant centers, healthcare service providers, commercial service providers, academia, and research organizations) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 20% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 80%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

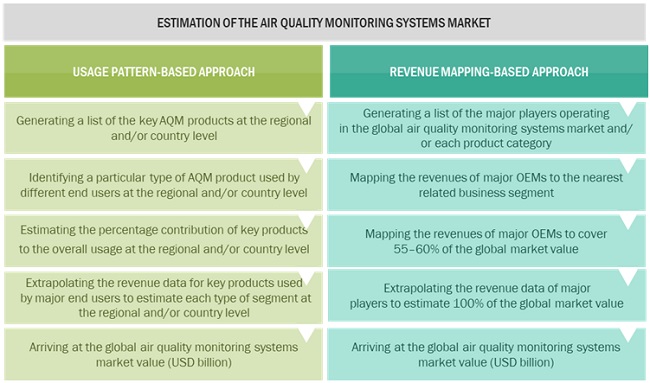

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global air quality monitoring systems market and other dependent submarkets.

- The key players in the global air quality monitoring systems market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global air quality monitoring systems market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After deriving the overall Air quality monitoring systems market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Report Objectives:

- To define, describe, and forecast the global air quality monitoring systems market by product, sampling method, pollutant, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall air quality monitoring systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players operating in the market

- To forecast the revenue of market segments with respect to five key regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East and Africa.

- To profile the key market players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product launches; agreements, partnerships, and joint ventures; mergers & acquisitions; and research & development activities in the air quality monitoring systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global air quality monitoring systems market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe air quality monitoring systems market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific air quality monitoring systems market into New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American air quality monitoring systems market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Quality Monitoring System Market

Which factors are playing a key role in the global growth of Air Quality Monitoring System Market?

Which are the main growth restraining factors for the Air Quality Monitoring System Market?

Can you elaborate more on the emerging trends in the Global Air Quality Monitoring System Market?