Airborne Radars Market by Technology (Software-defined Radar, Conventional Radar, Quantum Radar), Dimension (2D, 3D, 4D), Application, Platform, Waveform, Component, Frequency Band, Range, Installation Type, and Region (2020-2025)

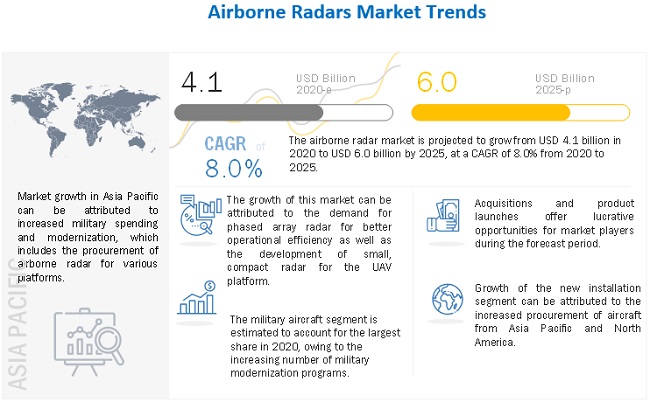

[279 Pages Report] The airborne radars market is projected to grow from USD 4.1 billion in 2020 to USD 6.0 billion by 2025, at a CAGR of 8.0% from 2020 to 2025. Some of the factors that are expected to fuel the growth of the airborne radars market include the increasing focus on obtaining precise intelligence during airborne surveillance to support decision making process.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Airborne radars market

The airborne radars market includes major players such as Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Israel Aerospace Industries (Israel), Leonardo SPA (Italy), BAE Systems (UK), Hensoldt AG (Germany), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, and Rest of World. COVID-19 has impacted their businesses as well.

The rapid spread of COVID-19 in Europe, the US & Asia Pacific has led to a significant drop in overall defense related budget allocations which led to depleted interests in military modernization programs globally. This resulted into stagnant demand for airborne radar globally, with a corresponding reduction in revenues for various airborne radar providers across all markets owing to late delivery, manufacturing shutdown, and limited availability of equipment. As per industry experts, the global airborne radar demand is anticipated to recover by 2022 fully.

Airborne Radars Market Dynamics

Driver: Increasing demand for phased array radar for better operational efficiency

Phased array radar are a revolution in radar technology, allowing for the accurate mapping of terrain in 3D due to the presence of a large number of small radiating elements in phased array antennas. These specialized antennas can focus the radars radiation into high-energy pencil-beams, which can be guided electronically in space without the need for physical movement of the antenna structure.

Phased array antennas have an advantage over parabolic antennas wherein the radar system can schedule the transmission and reception beams according to specific operational modes. These include low beams for long-range detection, multi-pulse beams for detection in clutter, and high beams for ballistic missile warning.

The growing demand for long-range radar that can function effectively in rough weather conditions is one of the major driving factors for phased array airborne radar. There are multiple manufacturers who offer phased array airborne radar products for commercial as well as military applications. For instance, the AN/APG-82(V)1, a type of phased array radar manufactured by Raytheon Technologies Corporation (US), can simultaneously detect, identify, and track multiple air and surface targets at long ranges which makes it suitable for a wide range of applications.

Restraint: High development and maintenance costs

Airborne radar are vital components of modern-day commercial and military aircraft, such as fighter jets, passenger aircraft, bombers, trainers, unmanned aerial vehicles, among others. However, high costs need to be incurred for their development and integration into the defense capabilities of any nation. Airborne radar combine various technologies and hardware systems such as software-defined radio and synthetic aperture radar, which need to be integrated into a working multi-domain platform. The development, installation, and maintenance of these systems are also expensive. Thus, both, the cost and time required for the development and deployment of these systems is a major factor restraining the growth of this market.

Opportunity: Increase in research & development in advanced airborne surveillance technologies

Improved system reliability is a crucial factor in the selection of an airborne radar by any country. The incorporation of advanced hardware units helps gather and distribute imagery across defense platforms such as combat vehicles and command headquarters. Both, commercial as well as military airborne surveillance systems have evolved with time and are still undergoing major advancements, such as the use of software defined radio and synthetic aperture radars. These surveillance radar are deployed in strategic locations to increase detection rates. State-of-the-art airborne surveillance radar with low false alarms have led countries with border disputes, drug trafficking problems, and illegal immigration to rely on them to assist in border protection. Thus, rising research & development activities in advanced airborne surveillance technologies are leading to a wide range of opportunities in defense sector applications.

In August 2020, JSC Radar mms developed a robotic helicopter-based search & rescue radar for military and commercial applications.

Challenge: Limited efficiency in extreme weather conditions

Airborne radar face tremendous challenges in terms of operating efficiency during rough weather conditions. Heavy rain and other forms of precipitation result in signal echoes that can prevent the target signals from reaching the radar receiver. Precipitation particles in the atmosphere also cause reflectivity phenomenon wherein the signal from the radar aimed at a target body reflects over these particles leading to false target signals. Wet hail, rain, and wet snow are more reflective than dry hail, ice crystals, or dry snow. Extreme weather leads to more intense precipitation, which subsequently leads to a lower distance coverage by the radar toward the target body. Such limitations of airborne radar in rough weather conditions pose a major challenge to market growth.

To know about the assumptions considered for the study, download the pdf brochure

Based on component, the digital signal processor segment is projected to grow at the highest CAGR during the forecast period.

The growth in the airborne radars market is expected to drive the growth of these different components proportionately. The requirement of advanced radar systems, as well as upgradation and modernization of conventional radar, will help grow the market for radar components. Thus, the growth rate of multiple components, such as transmitters, receivers, and power amplifiers, is expected to be in a similar range during the forecast period.

Based on platform, the UAVs segment is projected to grow at the highest CAGR during forecast period.

Based on platform, the UAVs segment is projected to grow at the highest CAGR during forecast period. The demand for sophisticated airborne radars to support airborne surveillance activities through UAVs by several defense organizations is driving the UAVs segment growth globally.

Based on technology, the software-defined radar (SDR) segment is projected to grow at the highest CAGR during forecast period

Growing demand for versatility of airborne radar in processing various tasks, such as signal generation, filtering, up and down conversion, etc., through software is driving the growth of this segment. Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), Leonardo SpA (Italy) and BAE Systems (US) are some of the major players that offer technologically advance airborne radars.

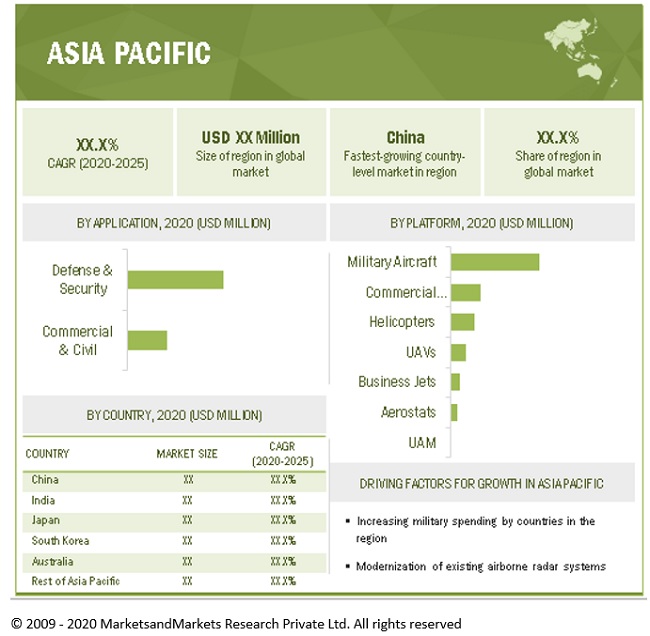

The airborne radars market in Asia Pacific is projected to grow at the highest CAGR from 2020 to 2025.

The Asia Pacific airborne radars market is projected to grow at the highest CAGR during the forecast period. The growth of the Asia Pacific airborne radars market is primarily driven by increasing focus on modernization of existing military systems by major economies in this region. In addition, factors including increasing geopolitical tensions and increased defense related expenditure are expected to drive the demand for airborne radar in the region.

The global airborne radars market is dominated by a few globally established players such as Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Hensoldt AG (Germany), Leonardo SPA (Italy), BAE Systems (UK), Israel Aerospace Industries (Israel), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, By Technology, By Platform, By Waveform, By Range, By Dimension, By Installation Type, By Application, By Frequency Band |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Hensoldt AG (Germany), Leonardo SPA (Italy), BAE Systems (UK), Israel Aerospace Industries (Israel), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US). and others. Total 25 Market Players |

The study categorizes the airborne radars market based on component, technology, platform, waveform, installation type, application, range, dimension, frequency band and region.

By Component

- Antenna

- Transmitter

- Duplexer

- Receiver

- Power Amplifier

- Digital Signal Processor

- Stabilization System

- Graphical User Interface

- Others

By Technology

- Software-defined Radar (SDR)

- Conventional RADAR

- Quantum Radar

By Platform

- Commercial Aircraft

- Military Aircraft

- Business Jets

- Helicopters

- UAVs

- UAM

- Aerostats

By Installation Type

- New Installation

- Upgradation

By Waveform

- Frequency Modulated Continuous Wave (FMCW)

- Doppler

- Ultra-wideband Impluse (UWB)

By Range

- Very long range

- Long range

- Medium range

- Short range

- Very short range

By Dimension

- 2D

- 3D

- 4D

By Frequency Band

- C-Band

- L-Band

- X-Band

- Ka-Band

- S-Band

- Ku-Band

- HF/VHF/UHF

- Multi-Band

By Application

- Commercial & Civil

- Defense & Security

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In January 2021, Hensoldt signed a collaboration agreement with BIRD Aerosystems (Israel) for the development of additional advanced capabilities for radar control and display (RCD) in the HENSOLDT PrecISR advanced multi-mode radar family

- In January 2021, Doosan Bobcat (South Korea) announced a strategic equity investment in Ainstein Systems (US). Doosan Bobcat is a manufacturer of construction, agriculture, landscaping, and ground maintenance equipment

- In January 2021, Northrop Grumman Corporation received a contract from the French government for the supply of E-2D Advanced Hawkeye airborne radar equipped command and control aircraft

- In September 2020, BAE Systems, along with Leonardo (Italy), was awarded a contract worth USD 420.6 million to develop and supply the European Common Radar System Mark 2 (ECRS Mk2) radar for the Royal Air Force's (RAF) Eurofighter Typhoons, based on Active Electronically Scanned Array (AESA) technology

- In June 2020, BAE Systems partnered with the Airforce Research Laboratory (AFRL) (US) for the development of next-generation radars, electronic warfare, and communication technology. With this partnership, the company will work on the development of defense-critical GaN technologies and provide Department of Defense (DoD) suppliers with access to support warfighters.

- In January 2020, Telephonics Corporation successfully developed and tested its MOSAIC Active Electronically Scanned Array (AESA) radar system with the US Navys MH-60S helicopter. The MOSAIC AESA radar is capable of performing continuous, scheduled Inverse Synthetic Aperture Radar (ISAR) imaging tasks while simultaneously conducting surveillance, detection, and tracking operations.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the airborne radars market?

The airborne radars market is expected to grow substantially owing to the growing trend of military modernization globally.

What are the key sustainability strategies adopted by leading players operating in the airborne radars market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the airborne radars market. The major players include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Leonardo SPA (Italy), BAE Systems (UK), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3Harris Technologies (US). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the airborne radars market?

Some of the major emerging technologies and use cases disrupting the market include integration of 3D and 4D technology in airborne radar applications.

Who are the key players and innovators in the ecosystem of the airborne radars market?

The key players in the airborne radars market include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Leonardo SPA (Italy), BAE Systems (UK), Saab AB (Sweden), Aselsan (Turkey), Elbit Systems (Israel) and L3 Harris Technologies (US) and others.

Which region is expected to hold the highest market share in the airborne radars market?

Airborne radars market in North America is projected to hold the highest market share during the forecast period due to the presence of several airborne radar providers in the region.

Which application is expected to drive the growth of the market in the coming years?

For the airborne radars market, defense & security is projected to grow at the highest CAGR during the forecast period from 2020 to 2025. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 AIRBORNE RADAR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary details

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increase in conflicts and disputes globally

2.2.2.2 Rise in defense budgets of emerging economies

FIGURE 5 TOP 15 COUNTRIES IN TERMS OF MILITARY EXPENDITURE, 2019

2.3 MARKET DEFINITION & SCOPE

2.3.1 SEGMENT DEFINITIONS

2.3.1.1 Airborne radar market, by platform

2.3.1.2 Airborne radar market, by application

2.3.1.3 Airborne radar market, by component

2.3.1.4 Airborne radar market, by technology

2.3.1.5 Airborne radar market, by installation type

2.3.1.6 Airborne radar market, by waveform

2.3.1.7 Airborne radar market, by range

2.3.1.8 Airborne radar market, by frequency band

2.3.1.9 Airborne radar market, by dimension

2.4 MARKET SIZE ESTIMATION & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.1.1 COVID-19 impact on market analysis

2.4.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION: AIRBORNE RADAR MARKET

2.6 MARKET SIZING & FORECASTING

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS

2.9 RISKS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 9 DIGITAL SIGNAL PROCESSOR SEGMENT PROJECTED TO LEAD AIRBORNE RADAR MARKET FROM 2020 TO 2025

FIGURE 10 DEFENSE & SECURITY TO DOMINATE AIRBORNE RADAR MARKET DURING FORECAST PERIOD

FIGURE 11 3D RADAR SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

FIGURE 12 KU-BAND TO DOMINATE AIRBORNE RADAR MARKET DURING FORECAST PERIOD

FIGURE 13 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRBORNE RADAR MARKET

FIGURE 14 DEMAND FOR PHASED ARRAY RADAR FOR ENHANCED OPERATIONAL EFFICIENCY - KEY FACTOR DRIVING MARKET

4.2 AIRBORNE RADAR MARKET, BY PLATFORM

FIGURE 15 MILITARY AIRCRAFT SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

4.3 AIRBORNE RADAR MARKET, BY INSTALLATION TYPE

FIGURE 16 NEW INSTALLATION SEGMENT TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

4.4 AIRBORNE RADAR MARKET, BY WAVEFORM

FIGURE 17 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) SEGMENT TO COMMAND MAJOR SHARE DURING FORECAST PERIOD

4.5 AIRBORNE RADAR MARKET, MAJOR COUNTRIES

FIGURE 18 MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 AIRBORNE RADAR MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for phased array radar for better operational efficiency

5.2.1.2 Focus on development of compact radar for UAV platforms

5.2.1.3 Demand for advanced weather monitoring radar

5.2.1.4 Technological advancements in airborne radar systems

5.2.1.5 Significant investments by governments to upgrade existing fighter aircraft radar

5.2.1.6 Increasing use of airborne radar-based geological surveying

5.2.2 RESTRAINTS

5.2.2.1 High development and maintenance costs

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in research & development in advanced airborne surveillance technologies

5.2.3.2 Lightweight radar for unmanned aerial vehicles

5.2.4 CHALLENGES

5.2.4.1 Limited efficiency in extreme weather conditions

5.2.4.2 New jamming techniques

5.2.4.3 Stringent policies on cross-border trading

5.3 IMPACT OF COVID-19 ON AIRBORNE RADAR MARKET

FIGURE 20 IMPACT OF COVID-19 ON AIRBORNE RADAR MARKET

5.4 RANGES AND SCENARIOS

FIGURE 21 IMPACT OF COVID-19 ON AIRBORNE RADAR MARKET: 3 GLOBAL SCENARIOS

5.5 AIRBORNE RADAR MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 APPLICATIONS

FIGURE 22 MARKET ECOSYSTEM MAP: AIRBORNE RADAR

FIGURE 23 AIRBORNE RADAR MARKET: MARKET ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

5.7 AVERAGE SELLING PRICE OF AIRBORNE RADAR

TABLE 2 AVERAGE SELLING PRICE OF AIRBORNE RADAR IN 2020 (USD)

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRBORNE RADAR MANUFACTURERS

FIGURE 25 REVENUE SHIFT IN AIRBORNE RADAR MARKET

5.9 PORTERS FIVE FORCES ANALYSIS

TABLE 3 KEY AIRBORNE RADAR MARKET: PORTERS FIVE FORCES

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.1 USE CASE ANALYSIS: AIRBORNE RADAR

5.10.1 ELECTRONICALLY SCANNED ARRAY: INCREASED ADOPTION BY MAJOR ARMED FORCES

5.10.2 INTEGRATION OF SURVEILLANCE RADAR IN UAVS

5.11 TRADE ANALYSIS

TABLE 4 COUNTRY-WISE IMPORT, RADAR APPARATUS, 2018-2019 (USD THOUSAND),

TABLE 5 COUNTRY-WISE IMPORTS, RADAR APPARATUS, 2018-2019 (USD THOUSAND)

5.12 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS (Page No. - 79)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 SOFTWARE-DEFINED RADAR

6.2.2 MIMO (MULTIPLE-INPUTS/MULTIPLE-OUTPUTS)

6.2.3 3D & 4D RADAR

6.2.4 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

6.2.5 QUANTUM RADAR

6.2.6 LIDAR TECHNOLOGY

6.3 TECHNOLOGY ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS & PATENT REGISTRATIONS

TABLE 6 INNOVATIONS & PATENT REGISTRATIONS, 20162020

7 AIRBORNE RADAR MARKET, BY COMPONENT (Page No. - 84)

7.1 INTRODUCTION

FIGURE 26 DIGITAL SIGNAL PROCESSOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 7 AIRBORNE RADAR MARKET, BY COMPONENT, 20182025 (USD MILLION)

7.2 ANTENNAS

TABLE 8 ANTENNAS IN AIRBORNE RADAR MARKET, BY TYPE, 20182025 (USD MILLION)

7.2.1 PARABOLIC REFLECTOR ANTENNAS

7.2.1.1 High signal gain and directivity at narrow bandwidths drive demand

7.2.2 SLOTTED WAVEGUIDE ANTENNAS

7.2.2.1 Increasing demand for lightweight and portable airborne surveillance radar fuel segment growth

7.2.3 PLANAR PHASED ARRAY ANTENNAS

7.2.3.1 Growing adoption of tactical defense radar systems propel demand for these antennas

7.2.4 ACTIVE SCANNED ARRAY ANTENNAS

7.2.4.1 Increasing demand for reliable and efficient airborne surveillance radar fuel this segment

7.2.5 PASSIVE SCANNED ARRAY ANTENNAS

7.2.5.1 Ability to track multiple targets drives demand for passive scanned array antennas

7.3 TRANSMITTERS

TABLE 9 TRANSMITTERS IN AIRBORNE RADAR MARKET, BY TYPE, 20182025 (USD MILLION)

7.3.1 MICROWAVE TUBE-BASED TRANSMITTERS

7.3.1.1 Ability to transmit high-power microwaves drive demand

7.3.2 SOLID-STATE ELECTRONICS

7.3.2.1 Preferred for reliable signal transmission in critical weather conditions

7.4 DUPLEXERS

7.4.1 GROWING DEMAND FOR COMPACT RADAR SYSTEMS DRIVE SEGMENT

7.5 RECEIVERS

TABLE 10 RECEIVERS IN AIRBORNE RADAR MARKET, BY TYPE, 20182025 (USD MILLION)

7.5.1 ANALOG RECEIVERS

7.5.1.1 Advantages offered by digital receivers lead to lower demand for analog receivers

7.5.2 DIGITAL RECEIVERS

7.5.2.1 Easy to design, compact, and more reliable compared to analog receivers

7.6 POWER AMPLIFIERS

TABLE 11 POWER AMPLIFIERS IN AIRBORNE RADAR MARKET, BY TYPE, 20182025 (USD MILLION)

7.6.1 TRAVELING WAVE TUBE AMPLIFIERS

7.6.1.1 Demand for large bandwidth capable radar drive this segment

7.6.2 SOLID-STATE POWER AMPLIFIERS

7.6.2.1 Widely used for applications that require narrow bandwidth and low voltage

TABLE 12 SOLID-STATE POWER AMPLIFIERS IN AIRBORNE RADAR MARKET, BY TYPE, 20182025 (USD MILLION)

7.6.2.2 GALLIUM ARSENIDE

7.6.2.2.1 Growing demand for low power consuming electronic warfare boosts segment

7.6.2.3 GALLIUM NITRIDE (GAN)

7.6.2.3.1 GaN-based power amplifiers primarily operate in micrometer and millimeter-wave range

7.6.2.3.1.1 Gallium nitride on silicon carbide (GAN-ON-SIC)

7.6.2.3.1.2 Gallium nitride high power amplifiers (GAN HPA)

7.7 DIGITAL SIGNAL PROCESSORS

7.7.1 INCREASING USE OF FPGA AND GPU DRIVES DIGITAL SIGNAL PROCESSORS

7.8 GRAPHICAL USER INTERFACES

7.8.1 GROWING DEMAND FOR INTERACTIVE CONTROL PANELS FROM BUSINESS JETS

7.8.1.1 Control panels

7.8.1.2 Graphic panels

7.8.1.3 Displays

7.9 STABILIZATION SYSTEMS

7.9.1 GROWING DEMAND FOR 360-DEGREE FULL ROTATIONAL RADAR SYSTEMS

7.10 OTHERS

8 AIRBORNE RADAR MARKET, BY PLATFORM (Page No. - 94)

8.1 INTRODUCTION

FIGURE 27 MILITARY AIRCRAFT SEGMENT TO DOMINATE AIRBORNE RADAR MARKET DURING FORECAST PERIOD

TABLE 13 AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

8.2 MILITARY AIRCRAFT

TABLE 14 AIRBORNE RADAR MARKET FOR MILITARY AIRCRAFT, BY TYPE, 20182025 (USD MILLION)

TABLE 15 AIRBORNE RADAR MARKET FOR MILITARY AIRCRAFT, BY REGION, 20182025 (USD MILLION)

8.2.1 FIGHTER AIRCRAFT

8.2.1.1 High adoption of airborne surveillance radar for defense and national security

8.2.2 TRANSPORT AIRCRAFT

8.2.2.1 High demand for airborne radar for navigation purposes

8.2.3 TRAINER AIRCRAFT

8.2.3.1 Increase in demand for advanced trainer aircraft to train pilots and aircrew

8.2.4 RECONNAISSANCE AIRCRAFT

8.2.4.1 Adoption of modern intelligence, surveillance, and reconnaissance technologies on the rise

8.2.5 SPECIAL MISSION AIRCRAFT

8.2.5.1 Increasing need to detect cross-border infiltration drives segment growth

8.3 COMMERCIAL AIRCRAFT

TABLE 16 AIRBORNE RADAR MARKET FOR COMMERCIAL AIRCRAFT, BY TYPE, 20182025 (USD MILLION)

TABLE 17 AIRBORNE RADAR MARKET FOR COMMERCIAL AIRCRAFT, BY REGION, 20182025 (USD MILLION)

8.3.1 NARROW-BODY AIRCRAFT

8.3.1.1 Cost-effective operations drive segment growth

8.3.2 NEW MIDSIZE AIRCRAFT

8.3.2.1 Development of large capacity commercial aircraft boosts segment

8.3.3 WIDE-BODY AIRCRAFT

8.3.3.1 Rising demand for intercontinental air travel fuels growth of segment

8.4 BUSINESS JETS

TABLE 18 AIRBORNE RADAR MARKET FOR BUSINESS JETS, BY REGION, 20182025 (USD MILLION)

8.5 HELICOPTERS

TABLE 19 AIRBORNE RADAR MARKET FOR HELICOPTERS, BY PLATFORM, 20182025 (USD MILLION)

TABLE 20 AIRBORNE RADAR MARKET FOR HELICOPTERS, BY REGION, 20182025 (USD MILLION)

8.5.1 COMMERCIAL HELICOPTERS

8.5.1.1 Demand from tourism and emergency rescue services on the rise

8.5.2 MILITARY HELICOPTERS

8.5.2.1 Technological advancements underway in stealth helicopters equipped with modern ISR and radar systems

8.6 UAV

TABLE 21 AIRBORNE RADAR MARKET FOR UAVS, BY PLATFORM, 20182025 (USD MILLION)

TABLE 22 AIRBORNE RADAR MARKET FOR UAVS, BY REGION, 20182025 (USD MILLION)

8.6.1 COMMERCIAL UAVS

8.6.1.1 Demand for scientific research boosts market

8.6.2 MILITARY UAVS

TABLE 23 AIRBORNE RADAR MARKET FOR MILITARY UAV, BY TYPE, 20182025 (USD MILLION)

8.6.2.1 Small UAVs

8.6.2.2 Tactical UAVs

8.6.2.3 Strategic UAVs

8.6.2.3.1 Medium-altitude long endurance (male) UAVs

8.6.2.3.1.1 Increased use of MALE UAVs for short-range reconnaissance and surveillance missions fuels market for male UAVs

8.6.2.3.2 High-altitude long endurance (Hale) UAVs

8.6.2.3.2.1 Increased use of HALE UAVs in military applications presents opportunities for these UAVs

TABLE 24 AIRBORNE RADAR MARKET FOR STRATEGIC UAVS, BY TYPE, 20182025 (USD MILLION)

8.6.2.4 Special-purpose UAVs

8.6.2.4.1 Increasing investment in the field of UAVs drives demand

8.6.3 AEROSTATS

8.6.3.1 Need for surveillance to monitor border disputes and drug trafficking fuels demand

TABLE 25 AIRBORNE RADAR MARKET FOR AEROSTATS, BY REGION, 20182025 (USD MILLION)

8.6.4 URBAN AIR MOBILITY(UAM)

8.6.4.1 Development of urban airborne mobility solutions under smart city projects drives market

TABLE 26 AIRBORNE RADAR MARKET FOR UAM, BY REGION, 20182025 (USD MILLION)

9 AIRBORNE RADAR MARKET, BY APPLICATION (Page No. - 107)

9.1 INTRODUCTION

FIGURE 28 DEFENSE & SECURITY SEGMENT TO DOMINATE DURING FORECAST PERIOD

TABLE 27 AIRBORNE RADAR MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

9.2 COMMERCIAL & CIVIL

9.2.1 SCIENTIFIC RESEARCH

9.2.1.1 Airborne radar used in atmospheric science and geophysics

9.2.2 AIRPORT PERIMETER SECURITY

9.2.2.1 Global requirement for drone detection radar on the rise

9.2.3 CRITICAL INFRASTRUCTURE

9.2.3.1 Need for intruder detection systems at ports & harbors drives market

9.2.4 WEATHER MONITORING

9.2.4.1 Demand for precise weather monitoring high from agriculture and aviation

9.2.5 NAVIGATION

9.2.5.1 Need for precise navigation for commercial aircraft and helicopters boosts market

9.2.6 COLLISION AVOIDANCE

9.2.6.1 Wide-scale use of radar on flights to avoid incoming objects during rough weather

9.2.7 OTHERS

TABLE 28 COMMERCIAL & CIVIL AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 29 COMMERCIAL & CIVIL AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

9.3 DEFENSE & SECURITY

9.3.1 PERIMETER SECURITY

9.3.1.1 Upgradation to autonomous perimeter security systems fuels market

9.3.2 ISR

9.3.2.1 Need for actionable intelligence to ensure safety against unauthorized targets drives segment

9.3.3 AIR DEFENSE

9.3.3.1 Need for ballistic missile defense systems drives growth of market

9.3.4 BATTLEFIELD SURVEILLANCE

9.3.4.1 Use of surveillance drones to gather battlefield intelligence is high

9.3.5 SEARCH & RESCUE

9.3.5.1 Integration of radar with EO/IR systems

9.3.6 WEATHER MONITORING

9.3.6.1 Demand for accurate and precise weather forecasting drives demand for radar

9.3.7 NAVIGATION

9.3.7.1 Advent of advanced solid-state power amplifier (SSPA) and digital technology drive this segment

TABLE 30 DEFENSE & SECURITY AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 31 DEFENSE & SECURITY AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

10 AIRBORNE RADAR MARKET, BY WAVEFORM (Page No. - 114)

10.1 INTRODUCTION

FIGURE 29 FMCW SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

TABLE 32 AIRBORNE RADAR MARKET, BY WAVEFORM, 20182025 (USD MILLION)

10.2 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW)

10.2.1 INCREASED DEPENDENCY ON LOW POWER TRANSMISSION DEVICES DRIVES SEGMENT

10.3 DOPPLER

TABLE 33 DOPPLER AIRBORNE RADAR MARKET, BY TYPE, 20202025 (USD MILLION)

10.3.1 CONVENTIONAL DOPPLER RADAR

10.3.1.1 Conventional Doppler radars widely used to monitor weather conditions

10.3.2 PULSE-DOPPLER RADAR

10.3.2.1 Pulse-Doppler combines features of pulse radar and continuous-wave radar

10.4 ULTRA-WIDEBAND IMPULSE

10.4.1 DEMAND FOR DETECTION OF HUMANS BEHIND OBSTACLES FOR SURVEILLANCE AND SECURITY DRIVES SEGMENT

11 AIRBORNE RADAR MARKET, BY TECHNOLOGY (Page No. - 119)

11.1 INTRODUCTION

FIGURE 30 SOFTWARE-DEFINED RADAR EXPECTED TO LEAD AIRBORNE RADAR MARKET FROM 2020 TO 2025

TABLE 34 AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

11.2 SOFTWARE-DEFINED RADAR

11.2.1 ADOPTION OF SOFTWARE-DEFINED RADAR DRIVEN BY LOW WEIGHT, SPEED, AND CUSTOMIZABILITY

TABLE 35 SOFTWARE-DEFINED AIRBORNE RADAR MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 36 SOFTWARE-DEFINED AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

11.2.2 PHASED ARRAY RADAR

TABLE 37 PHASED-ARRAY RADAR: SOFTWARE-DEFINED AIRBORNE RADAR MARKET, BY TECHNOLOGY, 2018-2025 (USD MILLION)

11.2.2.1 Active electronically scanned array (AESA)

11.2.2.1.1 AESA gaining importance due to advanced tracking and detection capabilities

11.2.2.2 Passive electronically scanned array (PESA)

11.2.2.2.1 Need for rapid surveillance over large areas quickly drives segment

11.2.3 MIMO

11.2.3.1 Growing focus on achieving multiple identifiable targets with airborne radar

11.3 QUANTUM RADAR

11.3.1 SEGMENT SLATED TO GROW RAPIDLY ON STABILIZATION OF TECH

11.4 CONVENTIONAL RADAR

11.4.1 SIMPLISTIC DESIGN OF CONVENTIONAL RADAR LIMITS APPLICATION IN DETECTION AND IMAGING

TABLE 38 CONVENTIONAL AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12 AIRBORNE RADAR MARKET, BY FREQUENCY BAND (Page No. - 125)

12.1 INTRODUCTION

FIGURE 31 KA BAND SEGMENT TO PROGRESS AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

12.2 C BAND

12.2.1 C BAND FINDS APPLICATION IN LONG-RANGE MILITARY SURVEILLANCE APPLICATIONS

TABLE 40 C BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.3 L BAND

12.3.1 L BAND WIDELY USED IN ASSET TRACKING

TABLE 41 L BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.4 X BAND

12.4.1 X BAND EXTENSIVELY USED FOR SITUATIONAL AWARENESS IN MILITARY APPLICATIONS

TABLE 42 X BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.5 KA BAND

12.5.1 HIGHLY FOCUSED AND POWERFUL SIGNAL OF KA BAND RESULT IN IMPROVED ACCURACY

TABLE 43 KA BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.6 S BAND

12.6.1 S BAND SEES WIDE-SCALE USE IN AIRBORNE MARITIME SURVEILLANCE

TABLE 44 S BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.7 KU BAND

12.7.1 WIDE BEAM COVERAGE AND HIGHER THROUGHPUT OF KU BAND COMPARED TO LOWER BANDS DRIVES SEGMENT GROWTH

TABLE 45 KU BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.8 HF/UHF/VHF BANDS

12.8.1 HF/UHF/VHF BANDS WITNESS INCREASING USE IN EARLY WARNING SYSTEMS

TABLE 46 HF/UHF/VHF BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

12.9 MULTI BAND

12.9.1 MULTI BAND USED FOR COHERENT DETECTION & TRACKING OF MOVING TARGETS

TABLE 47 MULTI BAND AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

13 AIRBORNE RADAR MARKET, BY RANGE (Page No. - 132)

13.1 INTRODUCTION

FIGURE 32 VERY LONG-RANGE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 48 AIRBORNE RADAR MARKET, BY RANGE, 20182025 (USD MILLION)

13.2 LONG-RANGE (200 KM TO 500 KM)

13.2.1 LONG-RANGE RADAR WIDELY USED FOR LONG-DISTANCE TRACKING OF BALLISTIC MISSILES

13.3 VERY LONG-RANGE (ABOVE 500 KM)

13.3.1 VERY LONG-RANGE RADAR ASSIST IN TRACKING AIR-BREATHING TARGETS

13.4 MEDIUM-RANGE (50 KM TO 200 KM)

13.4.1 HIGH DEMAND FOR MEDIUM-RANGE AIRBORNE RADAR ACROSS DEFENSE & SECURITY APPLICATIONS

13.5 SHORT-RANGE (10 KM TO 50 KM)

13.5.1 SHORT-RANGE RADAR USED PRIMARILY IN COMMERCIAL APPLICATIONS OR WEATHER MONITORING

13.6 VERY SHORT-RANGE (< 10 KM)

13.6.1 VERY SHORT-RANGE RADAR PREFERRED FOR MONITORING OF CRITICAL INFRASTRUCTURE

14 AIRBORNE RADAR MARKET, BY DIMENSION (Page No. - 136)

14.1 INTRODUCTION

FIGURE 33 3D SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 AIRBORNE RADAR MARKET SIZE, BY DIMENSION, 20182025 (USD MILLION)

14.2 2D

14.2.1 2D RADAR EXTENSIVELY USED IN EARLY WARNING AND CONTROL SYSTEMS

14.3 3D

14.3.1 HIGH TARGET LOCATION ACCURACY DRIVES 3D RADAR SEGMENT GROWTH

14.4 4D

14.4.1 4D RADAR FINDS WIDE-SCALE USE IN AUTONOMOUS TACTICAL SURVEILLANCE VEHICLES

15 AIRBORNE RADAR MARKET, BY INSTALLATION TYPE (Page No. - 139)

15.1 INTRODUCTION

FIGURE 34 NEW INSTALLATION OF AIRBORNE RADAR TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

TABLE 50 AIRBORNE RADAR MARKET SIZE, BY INSTALLATION TYPE, 20182025 (USD MILLION)

15.2 NEW INSTALLATION

15.2.1 EXTENSIVE FOCUS ON PROCUREMENT OF NEW ADVANCED AIRBORNE RADAR TO IMPROVE MILITARY CAPABILITIES

TABLE 51 NEW INSTALLATION MARKET FOR AIRBORNE RADAR, BY REGION, 20182025 (USD MILLION)

15.3 UPGRADATION

15.3.1 IMPROVEMENT IN EXISTING AIRBORNE RADAR CAPABILITIES THROUGH INTEGRATION OF MODERN COMPONENTS UNDERWAY

TABLE 52 UPGRADATION MARKET FOR AIRBORNE RADAR, BY REGION, 20182025 (USD MILLION)

16 REGIONAL ANALYSIS (Page No. - 142)

16.1 INTRODUCTION

16.2 AIRBORNE RADAR MARKET: THREE GLOBAL SCENARIOS

FIGURE 35 GLOBAL SCENARIOS OF AIRBORNE RADAR MARKET

FIGURE 36 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 53 AIRBORNE RADAR MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 54 AIRBORNE PLATFORM VOLUME ANALYSIS, 20182025

16.3 NORTH AMERICA

16.3.1 COVID-19 IMPACT ON NORTH AMERICA

16.3.2 PESTE ANALYSIS: NORTH AMERICA

FIGURE 37 NORTH AMERICA: AIRBORNE RADAR MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 56 NORTH AMERICA: AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

TABLE 57 NORTH AMERICA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 58 NORTH AMERICA: AIRBORNE RADAR MARKET, BY COMMERCIAL & CIVIL APPLICATION, 20182025 (USD MILLION)

TABLE 59 NORTH AMERICA: AIRBORNE RADAR MARKET, BY DEFENSE & SECURITY APPLICATION, 20182025 (USD MILLION)

TABLE 60 NORTH AMERICA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 61 NORTH AMERICA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.3.3 US

16.3.3.1 Fighter aircraft fleet modernization programs increase demand for airborne radar in US

FIGURE 38 US: MILITARY SPENDING, 20142021 (USD BILLION)

TABLE 62 US: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 63 US: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 64 US: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 65 US: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.3.4 CANADA

16.3.4.1 Increasing R&D investment drives market growth in Canada

FIGURE 39 CANADA: MILITARY SPENDING, 20142019 (USD BILLION)

TABLE 66 CANADA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 67 CANADA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 68 CANADA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 69 CANADA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4 EUROPE

16.4.1 COVID-19 IMPACT ON EUROPE

16.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 40 EUROPE AIRBORNE RADAR MARKET SNAPSHOT

TABLE 70 EUROPE: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 71 EUROPE: AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

TABLE 72 EUROPE: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 73 EUROPE: AIRBORNE RADAR MARKET, BY COMMERCIAL & CIVIL APPLICATION, 20182025 (USD MILLION)

TABLE 74 EUROPE: AIRBORNE RADAR MARKET, BY DEFENSE & SECURITY APPLICATION, 20182025 (USD MILLION)

TABLE 75 EUROPE: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 76 EUROPE: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 77 EUROPE: AIRBORNE RADAR MARKET, BY COUNTRY, 20182025 (USD MILLION)

16.4.3 RUSSIA

16.4.3.1 Russia increasing investments in digitizing VHF and UHF radar systems to improve counter-stealth capability

TABLE 78 RUSSIA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 79 RUSSIA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 80 RUSSIA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 81 RUSSIA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4.4 GERMANY

16.4.4.1 Need to detect and restrict illegal immigrants through UAV-based surveillance drives market in Germany

TABLE 82 GERMANY: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 83 GERMANY: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 84 GERMANY: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 85 GERMANY: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4.5 UK

16.4.5.1 UK focused on replacing existing radar systems with advanced early warning and control systems

TABLE 86 UK: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 87 UK: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 88 UK: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 89 UK: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4.6 ITALY

16.4.6.1 Demand for surveillance drones for ISR missions high in Italy

TABLE 90 ITALY: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 91 ITALY: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 92 ITALY: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 93 ITALY: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4.7 FRANCE

16.4.7.1 Rise in demand for airborne surveillance radar for command & control in France

TABLE 94 FRANCE: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 95 FRANCE: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 96 FRANCE: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 97 FRANCE: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.4.8 REST OF EUROPE

16.4.8.1 Increased demand for border surveillance and threat detection drive market in Rest of Europe

TABLE 98 REST OF EUROPE: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 99 REST OF EUROPE: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 100 REST OF EUROPE: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 101 REST OF EUROPE: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5 ASIA PACIFIC

16.5.1 COVID-19 IMPACT ON ASIA PACIFIC

16.5.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 41 ASIA PACIFIC AIRBORNE RADAR MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 103 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

TABLE 104 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 105 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY COMMERCIAL & CIVIL APPLICATION, 20182025 (USD MILLION)

TABLE 106 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY DEFENSE & SECURITY APPLICATION, 20182025 (USD MILLION)

TABLE 107 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 108 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 109 ASIA PACIFIC: AIRBORNE RADAR MARKET, BY COUNTRY, 20182025 (USD MILLION)

16.5.3 CHINA

16.5.3.1 Development of advanced early-warning aircraft radar boosts market in China

TABLE 110 CHINA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 111 CHINA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 112 CHINA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 113 CHINA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5.4 AUSTRALIA

16.5.4.1 Rise in demand to replace existing 737-based E-7 radar jets in Australia

TABLE 114 AUSTRALIA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 115 AUSTRALIA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 116 AUSTRALIA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 117 AUSTRALIA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5.5 INDIA

16.5.5.1 Market in India driven by procurement of advanced airborne warning and control system

TABLE 118 INDIA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 119 INDIA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 120 INDIA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 121 INDIA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5.6 JAPAN

16.5.6.1 Uplifting of self-imposed defense equipment export ban presents growth opportunities for market in Japan

TABLE 122 JAPAN: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 123 JAPAN: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 124 JAPAN: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 125 JAPAN: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5.7 SOUTH KOREA

16.5.7.1 Market in South Korea fueled by need for advanced radar to detect stealth aircraft

TABLE 126 SOUTH KOREA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 127 SOUTH KOREA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 128 SOUTH KOREA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 129 SOUTH KOREA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.5.8 REST OF ASIA PACIFIC

16.5.8.1 Increased demand for border surveillance drives demand in Rest of Asia Pacific

TABLE 130 REST OF ASIA PACIFIC: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.6 MIDDLE EAST & AFRICA

16.6.1 MIDDLE EAST & AFRICA COVID-19 IMPACT

16.6.2 PESTLE ANALYSIS: MIDDLE EAST& AFRICA

FIGURE 42 MIDDLE EAST AIRBORNE RADAR MARKET SNAPSHOT

TABLE 134 MIDDLE EAST: AIRBORNE RADAR MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 135 MIDDLE EAST: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 136 MIDDLE EAST: AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

TABLE 137 MIDDLE EAST: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 138 MIDDLE EAST: AIRBORNE RADAR MARKET, BY COMMERCIAL & CIVIL APPLICATION, 20182025 (USD MILLION)

TABLE 139 MIDDLE EAST: AIRBORNE RADAR MARKET, BY DEFENSE & SECURITY APPLICATION, 20182025 (USD MILLION)

TABLE 140 MIDDLE EAST: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 141 MIDDLE EAST: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.6.3 TURKEY

16.6.3.1 Increasing focus on procuring low-altitude airborne surveillance radar drives market in Turkey

TABLE 142 TURKEY: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 143 TURKEY: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 144 TURKEY: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 145 TURKEY: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.6.4 SAUDI ARABIA

16.6.4.1 Demand for fighter aircraft with airborne warning and control system capabilities drives market in Saudi Arabia

TABLE 146 SAUDI ARABIA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 147 SAUDI ARABIA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 148 SAUDI ARABIA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 149 SAUDI ARABIA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.6.5 ISRAEL

16.6.5.1 Market in Israel driven by presence of major manufacturers of airborne radar

TABLE 150 ISRAEL: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 151 ISRAEL: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 152 ISRAEL: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 153 ISRAEL: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.6.6 SOUTH AFRICA

16.6.6.1 Increased geopolitical instability expected to boost market in South Africa

TABLE 154 SOUTH AFRICA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 155 SOUTH AFRICA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 156 SOUTH AFRICA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 157 SOUTH AFRICA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.7 LATIN AMERICA

FIGURE 43 LATIN AMERICA AIRBORNE RADAR MARKET SNAPSHOT

TABLE 158 LATIN AMERICA: AIRBORNE RADAR MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 159 LATIN AMERICA: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 160 LATIN AMERICA: AIRBORNE RADAR MARKET, BY FREQUENCY BAND, 20182025 (USD MILLION)

TABLE 161 LATIN AMERICA: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 162 LATIN AMERICA: AIRBORNE RADAR MARKET, BY COMMERCIAL & CIVIL APPLICATION, 20182025 (USD MILLION)

TABLE 163 LATIN AMERICA: AIRBORNE RADAR MARKET, BY DEFENSE & SECURITY APPLICATION, 20182025 (USD MILLION)

TABLE 164 LATIN AMERICA: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 165 LATIN AMERICA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.7.1 BRAZIL

16.7.1.1 Ongoing military modernization propels market in Brazil

TABLE 166 BRAZIL: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 167 BRAZIL: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 168 BRAZIL: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 169 BRAZIL: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

16.7.2 MEXICO

16.7.2.1 Market in Mexico fueled by demand for advanced fighter aircraft with airborne warning and control system capabilities

TABLE 170 MEXICO: AIRBORNE RADAR MARKET, BY PLATFORM, 20182025 (USD MILLION)

TABLE 171 MEXICO: AIRBORNE RADAR MARKET, BY APPLICATION, 20182025 (USD MILLION)

TABLE 172 MEXICO: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 20182025 (USD MILLION)

TABLE 173 MEXICO: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 20182025 (USD MILLION)

17 COMPETITIVE LANDSCAPE (Page No. - 201)

17.1 INTRODUCTION

TABLE 174 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRBORNE RADAR MARKET BETWEEN 2018 AND 2020

FIGURE 44 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

17.2 COMPETITIVE LEADERSHIP MAPPING

17.2.1 STAR

17.2.2 EMERGING LEADER

17.2.3 PERVASIVE

17.2.4 PARTICIPANT

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING, 2019

17.2.5 COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES)

17.2.5.1 Progressive companies

17.2.5.2 Responsive companies

17.2.5.3 Dynamic companies

17.2.5.4 Starting blocks

FIGURE 46 COMPETITIVE LEADERSHIP MAPPING, (STARTUPS/SME) 2019

17.3 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 47 MARKET SHARE ANALYSIS OF TOP PLAYERS IN AIRBORNE RADAR MARKET, 2019

17.4 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2019

FIGURE 48 RANKING OF TOP PLAYERS IN AIRBORNE RADAR MARKET, 2019

FIGURE 49 REVENUE ANALYSIS OF AIRBORNE RADARS MARKET PLAYERS, 2015-2019

17.5 COMPETITIVE SCENARIO

17.5.1 NEW PRODUCT LAUNCHES

TABLE 175 NEW PRODUCT LAUNCHES, 2018-2021

17.5.2 DEALS, 20172021

TABLE 176 DEALS, 20152020

17.5.3 OTHERS

TABLE 177 OTHERS, 2017-2021

18 COMPANY PROFILES (Page No. - 217)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

18.1 KEY PLAYERS

18.1.1 RAYTHEON TECHNOLOGIES CORPORATION

FIGURE 50 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 178 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

18.1.2 LOCKHEED MARTIN CORPORATION

FIGURE 51 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 179 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

18.1.3 SAAB AB

FIGURE 52 SAAB AB: COMPANY SNAPSHOT

TABLE 180 SAAB AB: BUSINESS OVERVIEW

18.1.4 BAE SYSTEMS PLC.

FIGURE 53 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 181 BAE SYSTEMS PLC: BUSINESS OVERVIEW

18.1.5 THE BOEING COMPANY

FIGURE 54 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 182 THE BOEING COMPANY: BUSINESS OVERVIEW

18.1.6 NORTHROP GRUMMAN CORPORATION

FIGURE 55 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 183 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

18.1.7 LEONARDO SPA

FIGURE 56 LEONARDO SPA: COMPANY SNAPSHOT

TABLE 184 LEONARDO S.P.A : BUSINESS OVERVIEW

18.1.8 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI)

FIGURE 57 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI): COMPANY SNAPSHOT

TABLE 185 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI): BUSINESS OVERVIEW

18.1.9 THALES GROUP

FIGURE 58 THALES GROUP: COMPANY SNAPSHOT

TABLE 186 THALES GROUP: BUSINESS OVERVIEW

18.1.10 ASELSAN A.S.

FIGURE 59 ASELSAN A.S.: COMPANY SNAPSHOT

TABLE 187 ASELSAN A.S.: BUSINESS OVERVIEW

18.1.11 SRC, INC.

TABLE 188 SRC, INC: BUSINESS OVERVIEW

18.1.12 HENSOLDT AG

TABLE 189 HENSOLDT AG : BUSINESS OVERVIEW

18.1.13 ELBIT SYSTEMS LTD

FIGURE 60 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 190 ELBIT SYSTEMS LTD: BUSINESS OVERVIEW

18.1.14 INDRA COMPANY

FIGURE 61 INDRA COMPANY: COMPANY SNAPSHOT

TABLE 191 INDRA COMPANY: BUSINESS OVERVIEW

18.1.15 HONEYWELL INC.

FIGURE 62 HONEYWELL INC.: COMPANY SNAPSHOT

TABLE 192 HONEYWELL INC.: BUSINESS OVERVIEW

18.1.16 L3HARRIS TECHNOLOGIES

FIGURE 63 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 193 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

18.1.17 TELEPHONICS CORPORATION

TABLE 194 TELEPHONICS CORPORATION :BUSINESS OVERVIEW

18.1.18 MITSUBISHI ELECTRIC

FIGURE 64 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 195 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

18.1.19 AIRBUS GROUP

FIGURE 65 AIRBUS GROUP: COMPANY SNAPSHOT

TABLE 196 AIRBUS GROUP: BUSINESS OVERVIEW

18.1.20 AINSTEIN RADAR SYSTEMS

TABLE 197 AINSTEIN RADAR SYSTEMS: BUSINESS OVERVIEW

18.1.21 OPTIMARE SYSTEMS GMBH

TABLE 198 OPTIMARE SYSTEMS GMBH: BUSINESS OVERVIEW

18.1.22 BHARAT ELECTRONICS LTD (BEL)

FIGURE 66 BHARAT ELECTRONICS LTD: COMPANY SNAPSHOT

TABLE 199 BHARAT ELECTRONICS LTD.: BUSINESS OVERVIEW

18.1.23 JSC RADAR MMS

TABLE 200 JSC RADAR MMS: BUSINESS OVERVIEW

18.1.24 METASENSING

TABLE 201 METASENSING: BUSINESS OVERVIEW

18.1.25 GARMIN LIMITED

FIGURE 67 GARMIN LIMITED: COMPANY SNAPSHOT

TABLE 202 GARMIN LIMITED: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

19 APPENDIX (Page No. - 273)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

The study involved various activities in estimating the market size for airborne radar. Exhaustive secondary research was undertaken to collect information on the airborne radars market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the airborne radars market.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, Secondary sources include Publications of Statista, Clarksons Research, the International Maritime Organization (IMO), the Stockholm International Peace Research Institute (SIPRI), and the US Department of Defense: Publications, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the airborne radars market.

Primary Research

The airborne radars market comprises several stakeholders such as army, navy, air forces, regulatory bodies, research institutes and organizations, wholesalers, retailers, and distributors of airborne radar components in its supply chain. The supply side is characterized by technological advancements taking place in the field of airborne radar such as the phased array, and 4D radar. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the airborne radars market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the airborne radars market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the airborne radars market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the airborne radars market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the airborne radars market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the airborne radars market based on technology, application, platform, waveform, frequency band, range, dimension, installation type, component, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the airborne radars market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the airborne radars market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the airborne radars market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the airborne radars market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airborne Radars Market