Aircraft Engine Market Size, Share & Industry Growth Analysis Report by Type (Turboprop, Turbofan, Turboshaft, Piston Engine), Platform (Fixed wing, Rotary Wing, UAV), Component(Compressor, Turbine, Gear Box, Exhaust Nozzle, Fuel System), Technology, and Global Growth Driver and Industry Forecast to 2026

Updated on : May 12, 2023

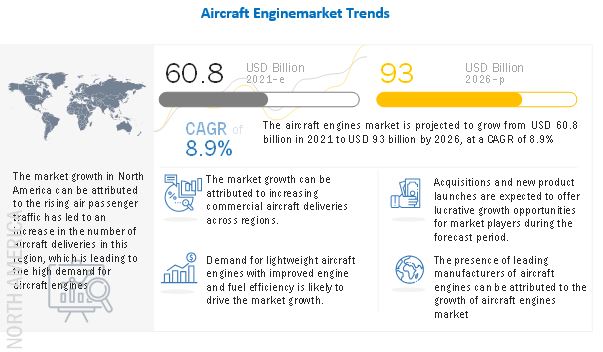

The Aircraft Engine Market was valued at $60,800 Million in 2021 and is estimated to grow from $75,100 Million USD in 2023 to $93,000 Million USD by 2026 at a CAGR (Compound Annual Growth Rate) of 8.9%. during the forecast period. Aircraft Engines can be used by different forms of aircraft to improve operational efficiency and be safer and more reliable. Aircraft engines are prominent in narrow-body aircraft, wide-body aircraft, private jets, transport aircraft, fighter aircraft, commercial and military helicopters, UAVs, etc.

Increasing commercial aircraft operations are most likely to drive the growth of aircraft engines in the future. Major countries in Asia Pacific, North America, and Europe are seeing a rise in military operations, which increases the demand for aircraft engines in military aircraft. Also, replacement services will also be a factor in driving the Aircraft Engine Industry. These engines will also emerge useful in UAVs.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Aircraft Engine Market

The COVID-19 and resultant lockdowns have adversely impacted the aviation industry. This pandemic has resulted in the standstill of aircraft as a mode of transport. According to the International Air Transport Association (IATA), every year, over 2 billion people take aircraft as their mode of transportation. Due to the outbreak of COVID-19, the year 2020 witnessed over 60% loss in global air traffic, which bought the aviation industry to a standstill. Several companies have already implemented policies to restrict non-essential travel to protect their employees. Remote and flexible working arrangements have been considered, and supply chains have become highly sophisticated and vital to the competitiveness of many companies. But their interlinked, global nature also makes them increasingly vulnerable to a range of risks, with more potential points of failure and less margin of error for absorbing delays and disruptions. New supply chain technologies are emerging, which can dramatically improve visibility across the end-to-end supply chain and support more supply chain agility and resiliency without the traditional overhead associated with risk management techniques.

The spread of COVID-19 has also compelled companies to implement a remote working and digital technologies for business continuation and fleet optimization. For example, aircraft companies and OEMs are using AI for predictive maintenance, intelligent scheduling, real-time analytics, and improving performance. Currently, companies like C3 AI (Redwood City, California) and Honeywell International Inc. provide software that are working on the fleet of the US Air Force and commercial aircraft carrier companies to provide data for timely maintenance using AI.

Aircraft Engine Industry Dynamics

Aircraft Engine Market Driver: Rising Demand for Fuel-Efficient Aircraft Engines

Airlines are looking forward to aircraft engines that provide greater fuel efficiency. Some emissions caused due to aviation, such as nitrous oxide, can be reduced by engines with greater fuel efficiency. Aircraft size also contributes to the factor of fuel consumption as the bigger the aircraft higher will be the fuel consumption. Therefore, aircraft manufacturers such as Airbus and Boeing tried to produce aircraft structures that are as fuel-efficient as possible. However, many airlines are still finding smaller body aircraft more fuel-efficient.

Hence, aircraft with smaller twin-engine widebodies like Boeing 787 and Airbus A350 are considered to be more fuel-efficient. As a result, their demand is rising across the aviation industry. Rolls-Royce manufactures engines such as Trent XWB that is dedicated to Airbus A350 aircraft as it provides the best balance. The engine provides features such as best fuel efficiency, longer lifecycle, and reduced weight with greater aerodynamics, which is the key factor for aircraft engines consuming less fuel during operation.

Aircraft Engine Market Opportunity: Engine Component Manufacturing Challenges

Aircraft engines and components related to them are some of the most critical components of an aircraft. Hence, manufacturing these components is also a challenge for OEMs and product manufacturers. These products must be manufactured under the regulatory and safety requirements of the aviation industry. So, the engine system has seen some evolution in manufacturing components from high-strength steels and titanium. Companies such as General Electric have invested more in finding technologies that could ease and fasten the process of aircraft engine manufacturing. They now use 3D printers to produce various components of aircraft engines such as fuel nozzles and fuel systems with the help of ceramics. The end process consists of a heat treatment test as components of an engine must withstand temperatures and absorb millions of foot-pounds of kinetic energy on an operation.

Aircraft Engine Market Restrain: Rising Demand for Zero-Emission Aircraft

According to Fox News, in 2018, United Airlines started printing its inflight magazine on a lighter piece of paper, which helped in reducing the weight of the magazine by 1 ounce. During that period, United Airlines had 744 mainline aircraft with a seating capacity of 210. This initiative helped save 170,000 gallons of fuel for that particular year, which ultimately resulted in profit. The airline industry profit margins are too low, and with the rising demand for aircraft, more than half of the revenue generated goes into fuel. Hence, the alternative to a conventional aircraft engine, which is an electric engine, holds a promise to eliminate the cost of fuel significantly, which will also help in saving the environment as well. Therefore, the rising demand for electric aircraft engines will be an opportunity for aircraft engine manufacturers during the forecast period

Aircraft Engine Market Challenge: Stringent Regulatory Environment for Aircraft Engine Manufacturing and MRO

The aerospace industry has very strict policies regarding the safety of both passengers and aircraft. Therefore, the aviation industry has made regulatory standards to undertake these issues and keeps on modifying them to achieve the best safety standard for the safety and improvement of the aviation industry. Hence, aircraft engine manufacturers also have to make new product developments to keep up with these standards.

One of these regulatory standards can be seen in the replacement of heavier engine components with components made of lighter metals. Thus, maintenance services offered by key players in the aircraft engines market act as a necessary service to keep up with the safety and regulatory standards of the aviation sector.

By Type, Turbofan Aircraft Engine Type is Projected to Witness a Higher CAGR During the Forecast Period

The major types of aircraft engines commonly used in an aircraft are turboprop, turbofan, turboshaft, and piston engine. The turbofan engine is projected to grow at the highest CAGR due to the rising demand for business jets. The turboprop are also projected to grow owing to the gaining attention among various aircraft as these consume less fuel than other types of engines.

Based on Aircraft Type, Fixed Wing is Projected to Have the Largest Share During the Forecast Period

Based on aircraft type, the aircraft engine market is segmented into fixed-wing, rotary-wing, and unmanned aerial vehicles.A fixed-wing aircraft generates a forward thrust and is heavier than other aircraft that use wings to generate lift for flying. A fixed-wing aircraft uses forward airspeed to generate the lift. In a fixed-wing aircraft, the wings are not always static, and the pilot does not always have to fly the aircraft. Some basic examples of unmanned fixed-wing aircraft are kites and gliders, while the examples of fixed-wing aircraft flown by pilots are airplanes and seaplanes. The major components of a fixed-wing aircraft are fuselage, fixed wings, vertical, and horizontal stabilizer, along with the engine and its component. A flying wing aircraft has no tail or definite fuselage. Blended wing bodies have wings that blend into the fuselage which produces more lift and less drag.

Based on Technology, Conventional Aircraft Engine Projected to Have Largest Share During the Forecast Period

The aircraft engine has been divided into two major types according to its use and functionality in the aviation industry: conventional aircraft engines and hybrid aircraft engines. Currently, key players in the aircraft engines market are major players in the conventional aircraft engines market. However, with increasing demand for more functionality from a typical aircraft engine, many emerging players are bringing in innovative developments to provide aircraft engines that provide operators with more efficiency and are more reliable than the existing aircraft engines.Majority of the aircraft engines are either piston aircraft engines or gas turbine aircraft engines. Some major types of aircraft engines are turboprop aircraft engines, turbofan aircraft engines, turboshaft aircraft engines, and piston aircraft engines.

These conventional aircraft engines are used in a wide variety of aircraft such as narrow-body, wide-body commercial aircraft, helicopters, UAVs, military aircraft, and others. Hence, with the rising demand for commercial and military aircraft in the aviation industry, the demand for conventional aircraft engines will continue to grow.

The North American Market is Projected to Contribute the Largest Share From 2021 to 2026

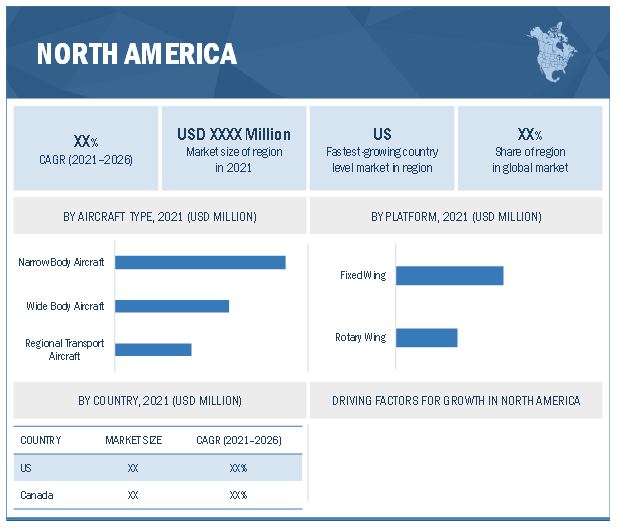

North America is projected to be the largest regional share of the aircraft engine market during the forecast period. In North America, the U.S. and Canada are the two countries considered for the study. The aviation industry is one of the most profitable industries in North America. Major aircraft manufacturers such as Boeing (U.S.) and Bombardier (Canada) are based in this region. The high disposable incomes of consumers in North America have contributed to the rise in air travel, which, in turn, is leading to an increase in air passenger traffic. This rise in air passenger traffic has led to an increase in the number of aircraft deliveries in this region, which is leading to the high demand for aircraft engines. The region has been benefiting from low oil prices, improved efficiency in aircraft operations, and a steady labor market. Thus, the profitability of airline owners is higher in North American countries. These are the factors due to which North America will be the largest market for aircraft engines.

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Engine Companies - Key Market Players

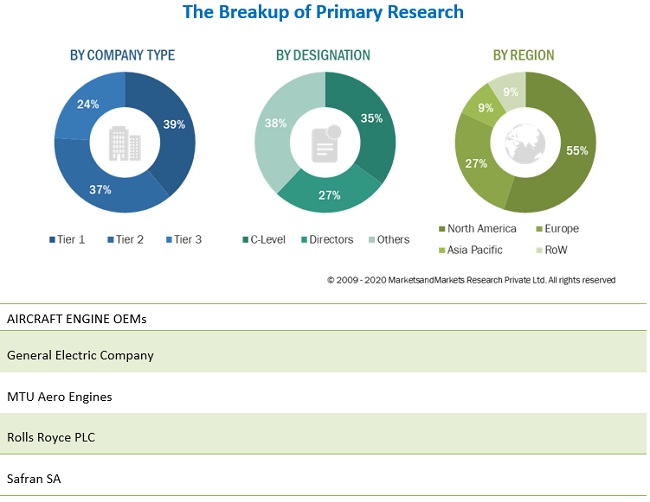

The Aircraft Engine Companies are dominated by globally established players such as General Electric Company (US), Safran SA (France), Honeywell International Inc (US), MTU Aero Engine (Germany), and Rolls Royce PLC (UK).

Aircraft Engine Industry Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 60.8 Billion |

|

Projected Market Size |

USD 92.9 Billion |

|

Growth Rate |

8.9% |

|

Forecast Period |

2021-2026 |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Platform, By Type, By Technology, By Component, By Region |

|

Geographies covered |

|

|

Companies covered |

Safran SA (France), General Electric Company (US), Rolls Royce (UK), Honeywell International Inc (US) and MTU Aero Engine (Germany) |

The study categorizes the aircraft engine market based on Type, Component, Platform, Technology, and Region.

Aircraft Engines Market By Type

- Turboprop

- Turbofan

- Turboshaft

- Piston Engine

By Component

- Compressor

- Turbine

- Gearbox

- Exhaust System

- Fuel System

- Others

By Platform

- Fixed Wing Aircraft

- Rotary Wing Aircraft

- Unmanned Ariel Vehicles

Technology

- Conventional

- Hybrid

Aircraft Engines Market By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Latin America

Recent Developments

- Safran Helicopter Engines and ST Engineering signed a Memorandum of Understanding (MoU) in February 2022 to perform research on the use of Sustainable Aviation Fuel (SAF) in helicopter engines. The study's goal is to help helicopter operators transition from traditional fossil fuels to SAF.

- Embraer, Widere, and Rolls-Royce signed a research cooperation agreement in February 2022 to perform a 12-month study and investigate breakthrough sustainable technologies for regional planes, with an emphasis on building hypothetical zero-emissions aircraft.

Frequently Asked Questions (FAQs):

What Are Your Views on the Growth Prospect of the Aircraft Engine Market?

Response:The COVID-19 pandemic had a significant impact on the aircraft engine market owing to a slump in the aviation sector, resulting in lower aircraft engine deliveries in 2020 and 2021. The high backlog of aircraft OEMs in the commercial, military, and general aviation sectors, on the other hand, is likely to boost the market throughout the projection period.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Aircraft Engine Market?

Response:The aircraft engine market is extremely consolidated, with only a few companies controlling the commercial and military aircraft divisions. General Electric Company (through GE Aviation), Raytheon Technologies Corporation (via Pratt & Whitney), Rolls-Royce Holding PLC, Safran SA, and MTU Aero Engines AG are some of the major aviation engines industry companies. The aforementioned companies, as well as joint ventures such as CFM International (GE Aviation and Safran), International Aero Engines (Pratt & Whitney, Japanese Aero Engine Corporation, and MTU Aero Engines), and Engine Alliance (General Electric and Pratt & Whitney), supply engines for major commercial and military aircraft programs.

What Are Thedrivers Disrupting the Aircraft Engine Market?

Response: The growing need for more comfortable and time-efficient passenger and cargo transportation drives the growth of this industry. The use of aircraft engines in the military sector to combat terrorism, illegal infiltration, drug trafficking, and other threats is also a key driver of the aircraft engine industry. However, obstacles such as expensive manufacturing and maintenance costs, as well as a shortage of production facilities, limit the market's expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AIRCRAFT ENGINE MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT ENGINE MARKET

1.5 CURRENCY & PRICING

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 2 AIRCRAFT ENGINE MARKET TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

2.3 MARKET SCOPE

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH (DEMAND SIDE)

2.4.2 AIRCRAFT ENGINE MARKET

FIGURE 5 MARKET SIZE CALCULATION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)

2.4.3 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION & VALIDATION

FIGURE 9 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE FACTORS

2.7 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 10 AIRCRAFT ENGINE MARKET SHARE, BY PLATFORM, 2021

FIGURE 11 AIRCRAFT ENGINE MARKET SHARE, BY COMPONENT, 2021

FIGURE 12 AIRCRAFT ENGINE MARKET SHARE, BY TECHNOLOGY, 2021

FIGURE 13 AIRCRAFT ENGINE MARKET SHARE, BY TYPE, 2021

FIGURE 14 AIRCRAFT ENGINE MARKET IN ASIA PACIFIC IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRCRAFT ENGINE MARKET

FIGURE 15 INCREASING NUMBER OF AIRCRAFT DELIVERIES EXPECTED TO DRIVE AIRCRAFT ENGINE MARKET FROM 2021 TO 2026

4.2 AIRCRAFT ENGINE MARKET, BY COMPONENT

FIGURE 16 TURBINE SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

4.3 AIRCRAFT ENGINE, BY TECHNOLOGY

FIGURE 17 CONVENTIONAL AIRCRAFT SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

4.4 AIRCRAFT ENGINE, BY TYPE

FIGURE 18 TURBOFAN SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

4.5 AIRCRAFT ENGINE, BY PLATFORM

FIGURE 19 FIXED-WING SEGMENT PROJECTED TO LEAD FROM 2021 TO 2026

4.6 AIRCRAFT ENGINE, BY COUNTRY

FIGURE 20 SAUDI ARABIA PROJECTED TO BE FASTEST GROWING MARKET DURING 2021–2026

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 AIRCRAFT ENGINE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing operations in commercial aircraft industry

5.2.1.2 Rising demand for fuel-efficient aircraft engines

5.2.2 RESTRAINTS

5.2.2.1 High cost of aircraft engines

5.2.2.2 Engine component manufacturing challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for zero-emission aircraft

5.2.3.2 Growing demand of UAVs for commercial and military applications

FIGURE 22 FIXED-WING UAV MARKET, 2019-2026 (USD MILLION)

5.2.4 CHALLENGES

5.2.4.1 COVID-19 disrupting operations of the aircraft engine supply chain

5.2.4.2 Stringent regulatory environment for aircraft engine manufacturing and MRO

5.3 COVID-19 IMPACT ON AIRCRAFT ENGINE MARKET

5.4 RANGES AND SCENARIOS

5.5 TECHNOLOGY ANALYSIS

5.5.1 FULL AUTHORITY DIGITAL ENGINE CONTROL (FADEC)

5.5.2 PREDICTIVE MAINTENANCE

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT ENGINE

FIGURE 23 REVENUE SHIFT IN AIRCRAFT ENGINE

5.7 MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 24 MARKET ECOSYSTEM MAP: AIRCRAFT ENGINE

TABLE 2 AIRCRAFT ENGINE ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: AIRCRAFT ENGINE

5.9 PORTER’S FIVE FORCES MODEL

TABLE 3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES: AIRCRAFT ENGINE

5.10 CASE STUDY ANALYSIS

5.10.1 AIRCRAFT ENGINE WEIGHT REDUCTION THROUGH TECHNOLOGY

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 FEDERAL AVIATION ADMINISTRATION ON ENGINE CERTIFICATION TEST AND ANALYSIS

6 INDUSTRIAL TRENDS (Page No. - 70)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

FIGURE 27 EMERGING TRENDS

6.2.1 HYBRID ENGINES

6.2.2 CERAMIC MATRIX COMPOSITE TECHNOLOGY

6.2.3 PREDICTIVE MAINTENANCE

6.2.4 TECHNOLOGICAL ADVANCEMENTS AND CONTINUOUS IMPROVEMENT

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS AND PATENT REGISTRATIONS, 2012-2020

TABLE 4 INNOVATIONS AND PATENT REGISTRATIONS

7 AIRCRAFT ENGINE, BY TYPE (Page No. - 74)

7.1 INTRODUCTION

FIGURE 29 TURBOFAN SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 5 AIRCRAFT ENGINE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 AIRCRAFT ENGINE, BY TYPE, 2021–2026 (USD MILLION)

7.2 TURBOPROP

7.3 TURBOFAN

7.4 TURBOSHAFT

7.5 PISTON ENGINE

8 AIRCRAFT ENGINE, BY PLATFORM (Page No. - 77)

8.1 INTRODUCTION

FIGURE 30 FIXED-WING SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 7 AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 8 AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2 FIXED WING

TABLE 9 COMMERCIAL AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 10 COMMERCIAL AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2.1 COMMERCIAL AVIATION

8.2.1.1 Narrow-body aircraft (NBA)

8.2.1.1.1 Rising air traffic driving growth

8.2.1.2 Wide-body aircraft (WBA)

8.2.1.2.1 Increasing international passenger air travel

8.2.1.3 Regional transport aircraft (RTA)

8.2.1.3.1 Rising demand for regional transport aircraft in the US and Asia Pacific

8.2.2 BUSINESS AND GENERAL AVIATION

TABLE 11 BUSINESS AND GENERAL AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 12 BUSINESS AND GENERAL AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2.2.1 Business jets

8.2.2.1.1 Increase in corporate activities globally to drive demand

8.2.2.2 Light aircraft

8.2.2.2.1 Advancements in technology for general aviation to drive demand

8.2.3 MILITARY AVIATION

TABLE 13 MILITARY AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 14 MILITARY AVIATION: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2.3.1 Fighter aircraft

8.2.3.1.1 Growing national security to drive the market

8.2.3.2 Transport aircraft

8.2.3.2.1 Increasing use of transport aircraft in military operations to drive demand

8.2.3.3 Special mission aircraft

8.2.3.3.1 Growing defense spending and territorial disputes to drive demand

8.3 ROTARY WING

TABLE 15 ROTARY WING: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 16 ROTARY WING: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.3.1 COMMERCIAL HELICOPTERS

8.3.1.1 Expanding applications of commercial helicopters

8.3.2 MILITARY HELICOPTERS

8.3.2.1 Advanced military helicopters equipped with next-generation sensors

8.4 UNMANNED AERIAL VEHICLES

TABLE 17 UAV: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 18 UAV: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

9 AIRCRAFT ENGINE, BY COMPONENT (Page No. - 86)

9.1 INTRODUCTION

FIGURE 31 TURBINE SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 19 AIRCRAFT ENGINE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 20 AIRCRAFT ENGINE, BY COMPONENT, 2021–2026 (USD MILLION)

9.2 TURBINE

9.3 COMPRESSOR

9.4 GEARBOX

9.5 EXHAUST SYSTEM

9.6 FUEL SYSTEM

9.7 OTHERS

10 AIRCRAFT ENGINE, BY TECHNOLOGY (Page No. - 90)

10.1 INTRODUCTION

FIGURE 32 CONVENTIONAL SEGMENT PROJECTED TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 21 AIRCRAFT ENGINE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 22 AIRCRAFT ENGINE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2 CONVENTIONAL

10.3 HYBRID

11 REGIONAL ANALYSIS (Page No. - 93)

11.1 INTRODUCTION

FIGURE 33 AIRCRAFT ENGINE MARKET: REGIONAL SNAPSHOT

11.1.1 IMPACT OF COVID-19 ON AIRCRAFT ENGINE, BY REGION

11.1.2 DEMAND SIDE

TABLE 23 DEMAND SIDE: AIRCRAFT ENGINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 DEMAND SIDE: AIRCRAFT ENGINE, BY REGION, 2021–2026 (USD MILLION)

11.1.3 SUPPLY SIDE

TABLE 25 SUPPLY SIDE: AIRCRAFT ENGINE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 SUPPLY SIDE: AIRCRAFT ENGINE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS

FIGURE 34 NORTH AMERICA: AIRCRAFT ENGINE SNAPSHOT

11.2.2 DEMAND SIDE

TABLE 27 DEMAND SIDE: NORTH AMERICA: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 28 DEMAND SIDE: NORTH AMERICA: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 29 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 30 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 31 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 32 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 33 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 34 DEMAND SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 35 DEMAND SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 36 DEMAND SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.3 SUPPLY SIDE

TABLE 37 SUPPLY SIDE: NORTH AMERICA: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 38 SUPPLY SIDE: NORTH AMERICA: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 SUPPLY SIDE: NORTH AMERICA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 40 SUPPLY SIDE: NORTH AMERICA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 41 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 43 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 44 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 45 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 46 SUPPLY SIDE: NORTH AMERICA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 47 SUPPLY SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 48 SUPPLY SIDE: NORTH AMERICA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.4 US

11.2.4.1 Presence of leading OEMs to drive the market

11.2.4.2 Demand side

TABLE 49 DEMAND SIDE: US: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 50 DEMAND SIDE: US: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 51 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 52 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 53 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 54 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 55 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 56 DEMAND SIDE: US: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 57 DEMAND SIDE: US: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 58 DEMAND SIDE: US: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.4.3 Supply side

TABLE 59 SUPPLY SIDE: US: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 60 SUPPLY SIDE: US: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 61 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 62 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 63 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 64 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 65 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 66 SUPPLY SIDE: US: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 67 SUPPLY SIDE: US: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 68 SUPPLY SIDE: US: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.5 CANADA

11.2.5.1 Aircraft modernization programs expected to drive the market

11.2.5.2 Demand side

TABLE 69 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 70 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 71 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 74 DEMAND SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.2.5.3 Supply side

TABLE 75 SUPPLY SIDE: CANADA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 76 SUPPLY SIDE: CANADA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 77 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 78 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 79 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 SUPPLY SIDE: CANADA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 81 SUPPLY SIDE: CANADA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 82 SUPPLY SIDE: CANADA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 35 EUROPE: AIRCRAFT ENGINE SNAPSHOT

11.3.2 DEMAND SIDE

TABLE 83 DEMAND SIDE: EUROPE: AIRCRAFT ENGINE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 84 DEMAND SIDE: EUROPE: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 DEMAND SIDE: EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 86 DEMAND SIDE: EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.3 SUPPLY SIDE

TABLE 87 SUPPLY SIDE: EUROPE: AIRCRAFT ENGINE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 SUPPLY SIDE: EUROPE: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 SUPPLY SIDE: EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 90 SUPPLY SIDE: EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 91 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 92 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 93 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 94 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 95 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 96 SUPPLY SIDE: EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 97 SUPPLY SIDE: EUROPE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 98 SUPPLY SIDE: EUROPE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.4 UK

11.3.4.1 Advancing technologies in air travel to drive the market

11.3.4.2 Demand side

TABLE 99 DEMAND SIDE: UK: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 100 DEMAND SIDE: UK: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 101 DEMAND SIDE: UK: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 102 DEMAND SIDE: UK: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.4.3 Supply side

TABLE 103 SUPPLY SIDE: UK: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 SUPPLY SIDE: UK: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 105 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 106 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 107 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 108 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 109 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 110 SUPPLY SIDE: UK: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 111 SUPPLY SIDE: UK: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 112 SUPPLY SIDE: UK: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Heavy investments in aviation industry to drive the market

11.3.5.2 Demand side

TABLE 113 DEMAND SIDE: FRANCE: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 114 DEMAND SIDE: FRANCE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 115 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 116 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 117 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 118 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 119 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 120 DEMAND SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 121 DEMAND SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 122 DEMAND SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.5.3 Supply side

TABLE 123 SUPPLY SIDE: FRANCE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 124 SUPPLY SIDE: FRANCE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 125 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 126 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 127 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 128 SUPPLY SIDE: FRANCE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 129 SUPPLY SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 SUPPLY SIDE: FRANCE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.6 GERMANY

11.3.6.1 Rising expenditure in air travel and connectivity to drive the market

11.3.6.2 Demand side

TABLE 131 DEMAND SIDE: GERMANY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 132 DEMAND SIDE: GERMANY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 133 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 134 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 135 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 136 DEMAND SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.6.3 Supply side

TABLE 137 SUPPLY SIDE: GERMANY: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 138 SUPPLY SIDE: GERMANY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 139 SUPPLY SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 140 SUPPLY SIDE: GERMANY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 141 SUPPLY SIDE: GERMANY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 142 SUPPLY SIDE: GERMANY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.7 ITALY

11.3.7.1 High demand for commercial helicopters to drive the market

11.3.7.2 Demand side

TABLE 143 DEMAND SIDE: ITALY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 144 DEMAND SIDE: ITALY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 145 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 146 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 147 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 148 DEMAND SIDE: ITALY: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 149 DEMAND SIDE: ITALY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 150 DEMAND SIDE: ITALY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.8 RUSSIA

11.3.8.1 Increasing military budget for manufacturing advanced aircraft to drive the market

11.3.8.2 Demand side

TABLE 151 DEMAND SIDE: RUSSIA: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 152 DEMAND SIDE: RUSSIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 153 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 154 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 155 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 156 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 157 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 158 DEMAND SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 159 DEMAND SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 160 DEMAND SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.8.3 Supply side

TABLE 161 SUPPLY SIDE: RUSSIA: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 162 SUPPLY SIDE: RUSSIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 163 SUPPLY SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 164 SUPPLY SIDE: RUSSIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 165 SUPPLY SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 166 SUPPLY SIDE: RUSSIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.9 REST OF EUROPE

11.3.9.1 Demand side

TABLE 167 DEMAND SIDE: REST OF EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 168 DEMAND SIDE: REST OF EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 169 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 170 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 171 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 172 DEMAND SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.3.9.2 Supply side

TABLE 173 SUPPLY SIDE: REST OF EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 174 SUPPLY SIDE: REST OF EUROPE: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 175 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 176 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 177 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 SUPPLY SIDE: REST OF EUROPE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4 ASIA-PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: AIRCRAFT ENGINE SNAPSHOT

11.4.2 DEMAND SIDE

TABLE 179 DEMAND SIDE: ASIA PACIFIC: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 180 DEMAND SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 181 DEMAND SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 182 DEMAND SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 183 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 184 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 185 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 186 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 187 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 188 DEMAND SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 189 DEMAND SIDE: ASIA PACIFIC: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 190 DEMAND SIDE: ASIA PACIFIC: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.3 SUPPLY SIDE

TABLE 191 SUPPLY SIDE: ASIA PACIFIC: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 192 SUPPLY SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 193 SUPPLY SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 194 SUPPLY SIDE: ASIA PACIFIC: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 195 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 196 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 197 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 198 SUPPLY SIDE: ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Growing demand for aerospace products to drive the market

11.4.4.2 Demand side

TABLE 199 DEMAND SIDE: CHINA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 200 DEMAND SIDE: CHINA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 201 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 202 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 203 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 204 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 205 DEMAND SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.4.3 Supply side

TABLE 206 SUPPLY SIDE: CHINA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 207 SUPPLY SIDE: CHINA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 208 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 209 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 210 SUPPLY SIDE: CHINA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Modernization plan for armed forces to drive the market

11.4.5.2 Demand side

TABLE 211 DEMAND SIDE: INDIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 212 DEMAND SIDE: INDIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 213 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 214 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINE IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 215 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 216 DEMAND SIDE: INDIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 217 DEMAND SIDE: INDIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 218 DEMAND SIDE: INDIA: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.6 JAPAN

11.4.6.1 Growing in-house development of aircraft to drive the market

11.4.6.2 Demand side

TABLE 219 DEMAND SIDE: JAPAN: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 DEMAND SIDE: JAPAN: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 222 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 223 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 224 DEMAND SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 225 DEMAND SIDE: JAPAN: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 226 DEMAND SIDE: JAPAN: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.6.3 Supply side

TABLE 227 SUPPLY SIDE: JAPAN: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 228 SUPPLY SIDE: JAPAN: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 229 SUPPLY SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 230 SUPPLY SIDE: JAPAN: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.7 AUSTRALIA

11.4.7.1 Increasing air traffic and new aircraft deliveries to drive the market

11.4.7.2 Demand side

TABLE 231 DEMAND SIDE: AUSTRALIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 232 DEMAND SIDE: AUSTRALIA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 233 DEMAND SIDE: AUSTRALIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 234 DEMAND SIDE: AUSTRALIA: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.8 SOUTH KOREA

11.4.8.1 Modernizing programs in aviation industry to drive the market

11.4.8.2 Demand side

TABLE 235 DEMAND SIDE: SOUTH KOREA: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 236 DEMAND SIDE: SOUTH KOREA: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 237 DEMAND SIDE: SOUTH KOREA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 238 DEMAND SIDE: SOUTH KOREA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.4.9 REST OF ASIA PACIFIC

11.4.9.1 Demand side

TABLE 239 DEMAND SIDE: REST OF ASIA PACIFIC: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 240 DEMAND SIDE: REST OF ASIA PACIFIC: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 241 DEMAND SIDE: REST OF ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE MARKET, BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 242 DEMAND SIDE: REST OF ASIA PACIFIC: FIXED WING AIRCRAFT ENGINE MARKET, BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 PESTLE ANALYSIS: LATIN AMERICA

11.5.2 DEMAND SIDE

TABLE 243 DEMAND SIDE: LATIN AMERICA: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 244 DEMAND SIDE: LATIN AMERICA: AIRCRAFT ENGINE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 DEMAND SIDE: LATIN AMERICA: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 246 DEMAND SIDE: LATIN AMERICA: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 247 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 248 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 249 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 250 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 251 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 252 DEMAND SIDE: LATIN AMERICA: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.5.3 BRAZIL

11.5.3.1 Presence of OEMs and growing opportunities for airlines to drive the market

11.5.3.2 Demand side

TABLE 253 DEMAND SIDE: BRAZIL: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 254 DEMAND SIDE: BRAZIL: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 255 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 256 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 257 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020- (USD MILLION)

TABLE 258 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN BUSINESS AND GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 259 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 260 DEMAND SIDE: BRAZIL: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.6 MIDDLE EAST

11.6.1 PESTLE ANALYSIS: MIDDLE EAST

11.6.2 DEMAND SIDE

TABLE 261 DEMAND SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 262 DEMAND SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 263 DEMAND SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 264 DEMAND SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 265 DEMAND SIDE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 266 DEMAND SIDE: FIXED WING AIRCRAFT ENGINE IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 267 DEMAND SIDE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 268 DEMAND SIDE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.6.3 SUPPLY SIDE

TABLE 269 SUPPLY SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 270 SUPPLY SIDE: MIDDLE EAST: AIRCRAFT ENGINE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 TURKEY

11.6.4.1 Significant rise in military spending and development of UAVs to drive the market

11.6.4.2 Demand side

TABLE 271 DEMAND SIDE: TURKEY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 272 DEMAND SIDE: TURKEY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 273 DEMAND SIDE: TURKEY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 274 DEMAND SIDE: TURKEY: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.6.4.3 Supply side

TABLE 275 SUPPLY SIDE: TURKEY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 276 SUPPLY SIDE: TURKEY: AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 277 SUPPLY SIDE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 278 SUPPLY SIDE: ROTARY WING AIRCRAFT ENGINE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11.6.5 ISRAEL

11.6.5.1 Increased spending in R&D of UAVs for military and commercial applications to drive the market

11.6.5.2 Demand side

TABLE 279 DEMAND SIDE: ISRAEL: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 280 DEMAND SIDE: ISRAEL: AIRCRAFT ENGINE MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 281 DEMAND SIDE: ISRAEL: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 282 DEMAND SIDE: ISRAEL: FIXED WING AIRCRAFT ENGINE MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 174)

12.1 INTRODUCTION

12.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 37 MARKET RANKING OF LEADING PLAYERS IN AIRCRAFT ENGINE MARKET, 2021

12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

FIGURE 38 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN AIRCRAFT ENGINE MARKET, 2020

12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

FIGURE 39 REVENUE ANALYSIS OF LEADING PLAYERS IN AIRCRAFT ENGINE MARKET, 2020

12.5 COMPETITIVE OVERVIEW

TABLE 283 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE AIRCRAFT ENGINE MARKET BETWEEN 2017 AND 2021

12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 284 COMPANY PRODUCT FOOTPRINT

TABLE 285 COMPANY TECHNOLOGY FOOTPRINT

TABLE 286 COMPANY INDUSTRY FOOTPRINT

TABLE 287 COMPANY REGION FOOTPRINT

12.7 COMPANY EVALUATION QUADRANT

12.7.1 STAR

12.7.2 EMERGING LEADER

12.7.3 PERVASIVE

12.7.4 PARTICIPANT

FIGURE 40 AIRCRAFT ENGINE MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

12.8 COMPETITIVE SCENARIO

12.8.1 DEALS

TABLE 288 DEALS, 2016-2021

12.8.2 PRODUCT LAUNCHES

TABLE 289 PRODUCT LAUNCHES, 2017-2020

13 COMPANY PROFILES (Page No. - 185)

13.1 KEY PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, MnM View, Key strengths/Right to win, Strategic choices, and Weaknesses and competitive threats)*

13.1.1 GENERAL ELECTRIC COMPANY

TABLE 290 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 41 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 291 GENERAL ELECTRIC COMPANY: DEALS

13.1.2 ROLLS-ROYCE PLC.

TABLE 292 ROLLS-ROYCE HOLDING PLC: BUSINESS OVERVIEW

FIGURE 42 ROLLS ROYCE PLC: COMPANY SNAPSHOT

TABLE 293 ROLLS ROYCE HOLDINGS PLC: DEALS

13.1.3 COLLINS AEROSPACE

TABLE 294 COLLINS AEROSPACE: BUSINESS OVERVIEW

FIGURE 43 COLLINS AEROSPACE: COMPANY SNAPSHOT

TABLE 295 COLLINS AEROSPACE: DEALS

13.1.4 SAFRAN SA

TABLE 296 SAFRAN SA: BUSINESS OVERVIEW

FIGURE 44 SAFRAN SA: COMPANY SNAPSHOT

TABLE 297 SAFRAN SA: DEALS

13.1.5 HONEYWELL INTERNATIONAL, INC.

TABLE 298 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 45 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

13.1.6 ENGINE ALLIANCE LLC

TABLE 299 ENGINE ALLIANCE LLC.: BUSINESS OVERVIEW

13.1.7 TEXTRON INC.

TABLE 300 TEXTRON INC. BUSINESS OVERVIEW

FIGURE 46 TEXTRON INC: COMPANY SNAPSHOT

TABLE 301 TEXTRON INC: DEALS

13.1.8 INTERNATIONAL AERO ENGINES

TABLE 302 INTERNATIONAL AERO ENGINES: BUSINESS OVERVIEW

13.1.9 MTU AERO ENGINES

TABLE 303 MTU AERO ENGINES: BUSINESS OVERVIEW

FIGURE 47 MTU AERO ENGINES: COMPANY SNAPSHOT

TABLE 304 MTU AERO ENGINES: DEALS

13.1.10 PRATT AND WHITNEY

TABLE 305 PRATT AND WHITNEY: BUSINESS OVERVIEW

TABLE 306 PRATT AND WHITNEY: DEALS

13.1.11 BARNES GROUP INC.

TABLE 307 BRANES GROUP INC.: BUSINESS OVERVIEW

FIGURE 48 BARNES GROUP INC.: COMPANY SNAPSHOT

13.1.12 WILLIAMS INTERNATIONAL

TABLE 308 WILLIAMS INTERNATIONAL: BUSINESS OVERVIEW

13.1.13 UEC AVIADVIGATEL

TABLE 309 UEC AVIADVIGATEL: BUSINESS OVERVIEW

13.1.14 IHI CORPORATION

TABLE 310 IHI CORPORATION: BUSINESS OVERVIEW

FIGURE 49 IHI CORPORATION.: COMPANY SNAPSHOT

13.1.15 LYCOMING ENGINES

TABLE 311 LYCOMING ENGINES CORPORATION: BUSINESS OVERVIEW

*Details on Business Overview, Products/solutions/services offered, Recent Developments, MnM View, Key strengths/Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 216)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the aircraft engine market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); International Electrotechnical Commission (IEC); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft engine vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft engine were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft engine and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft engine market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aircraft engine Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aircraft engine market.

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft engine market based on vertical, input voltage, form factor, output power, output voltage, output number, product type, isolation working voltage and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft engine market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft engine market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aircraft engine Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Engine Market

As part of my leadership program, I am running a project for GE Aviation and I need to start with a competitive analysis and a market trend research. Thanks

Hello Sir, We are interested in buying this report. However, before putting the order, we would like to know if your methodology fits our requirements. I saw that you have the number of the market size of 68.05 billion for the engine market. Please share with us the methodology and how you reached this number. Thanks, Marco