Aircraft Gearbox Market by Application (Engine, Airframe), Type (Reduction, Accessory, Actuation, Tail Rotor, APU), End User (OEM, Aftermarket), Platform (Civil, Military), Component (Gears, Housing, Bearing), Region (2021-2026)

Updated on : May 12, 2023

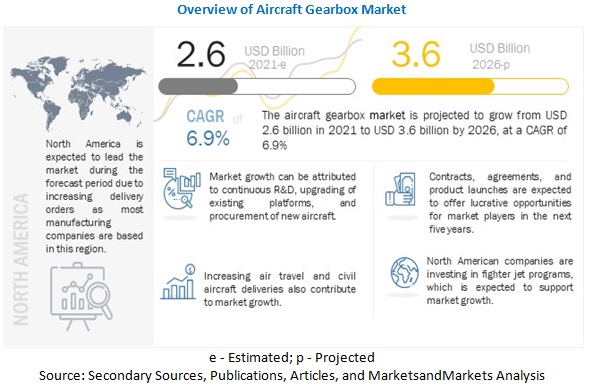

The Aircraft Gearbox Market was valued at $2,600 Million in 2021 and is estimated to grow from $2,800 Million USD in 2023 to $3,600 Million USD by 2026 at a CAGR (Compound Annual Growth Rate) of 6.9% in terms of value during the forecasted period.

The global Aircraft Gearbox Industry is expanding rapidly as the amount of commercial and military aircraft fleets grows. Aircraft gearboxes are transmission system components that work with shafts to change rotational speed and drive the accessories required for a working engine. According to data on air traffic during the previous two decades, aviation traffic has increased in developing countries such as India, the United Arab Emirates, and China. The aviation industry is looking for high-efficiency, lightweight aircraft fuel engines with improved performance. As a result, developing aircraft engines with increased fuel efficiency and gearbox performance is likely to drive the global aircraft gearbox market forward. The North American region will dominate the market due to the growing air traffic and replacing the existing airfleet with new ones.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on market

The COVID-19 impact has been analyzed for three scenarios: realistic, optimistic, and pessimistic. The realistic scenario has been considered for further calculations.

The aircraft gearbox market includes major companies such as Liebherr (Switzerland), Safran (France), Rexnord Aerospace (US), Triumph Group (US), The Timken Company (US), and United Technologies Corporation (US). These players have spread their business across various countries, including North America, Europe, Asia Pacific, and the Rest of the world. COVID-19 has impacted their businesses as well.

Aircraft gearbox manufacturers are experiencing short-term operational challenges due to supply chain bottlenecks and a lack of site access caused by the COVID-19 epidemic. COVID-19 has compelled governm ents to halt all assembly and manufacturing operations, including those in the aerospace industry. The complete lockdown situation in various nations due to COVID-19 has directly hampered defense organizations' acquisition of aircraft gearboxes from aircraft gearbox manufacturers. The COVID-19 epidemic is putting great financial strain on aviation gearbox manufacturers by increasing the aircraft gearbox inventory carrying cost. The COVID-19 outbreak made multiple roadblocks across the commercial sector and significantly impacted the global economy. The downturn in aviation travel during the crisis also brought significant challenges to the entry of gearboxes in airplanes. Passenger criteria were collapsed due to the adoption of rigorous travel restrictions. However, with the present removal of these limitations, the market forecast is expected to catch up in the following years.

Market Dynamics

Aircraft Gearbox Market Driver: Increase in Demand for Military Helicopters

Due to the aging of helicopter components and systems of military helicopters, their market is expected to grow. The development of new technologies such as next-generation compound and tilt helicopters is also expected to contribute to the growth of the military helicopters market, with a significant number of replacements and capability expansions. Approximately 21,000 military helicopters are currently operable in 153 countries, and over 3,500 new orders of military helicopters have been placed by over 60 countries as per the International Quality and Productivity Center, US.

One of the many enhancements in helicopters includes active electrically scanned arrays on combat helicopters. India, China, and South Korea have allocated substantial shares of their defense budgets to improve their defense power with such improved helicopters.

As per a report from IQ’s Global Military Helicopters, the Indian Air Force (IAF) inducted its first 4 CH-47F helicopters-which are part of a helicopter order of 15 Chinook helicopters-in March 2019. The IAF had also ordered 22 AH-64Es and 15 CH-47Fs, and the delivery of these helicopters was completed by April 2020. This increasing demand for helicopters will boost the demand for gearboxes as well.

Restraints: Backlogs in aircraft deliveries

The Boeing Company (US) and Airbus (France) are the major aircraft manufacturers operating globally, with many orders for new aircraft. However, their limited manufacturing capacity has led to a significant backlog of aircraft deliveries, amounting to more than 12,000 across the globe.

Since the engines are procured during the final assembly of an aircraft, a backlog in aircraft production leads to a delay in aircraft engine consumption. Therefore, a delay in aircraft production is expected to restrain the market growth during the forecast period.

Aircraft Gearbox Market Opportunities: Increased Investments in Geared Turbofan Engines

Pratt & Whitney invested USD 10 billion over 20 years to perfect geared turbofan (GTF) technology for its PurePower engine. The primary differences between a regular and a geared turbofan are the fan blade diameter, reduced number of parts, and the addition of a planetary gearbox. This combination has resulted in developing an engine with significantly lower fuel consumption, emission, and noise. A geared turbofan reduces NOx emissions and micro-particulate pollution by reducing the fuel consumption of turbofans by 30%, cutting emissions being released into the atmosphere. Pratt PurePower has resulted in a 16% gain in fuel efficiency, a 50% reduction in carbon emission, and a 75% decrease in noise.

Rolls Royce announced its Geared Turbofan aircraft engine, UltraFan, powered by a power engine gearbox, Power Gearbox (PGB), in September 2017. UltraFan is expected to be 25% more fuel-efficient and ready for commercial flight service by 2025. According to an Aviation Week article in June 2017, Boeing has indicated that it is looking for a geared turbofan specifically for its next airliner midsize airplane (NMA), possibly to be called the Boeing 797.

Pratt’s PW1100G-JM engine for the Airbus A320neo family of aircraft and PW1500G engine for the Bombardier CSeries is certified. The PW1400G-JM engine for the Irkut MC-21 aircraft, the PW1200G engine for the Mitsubishi Regional Jet, and the PW1900G for the Embraer E190-E2 is in testing. The PW1100G-JM began powering revenue flights in January 2016.

Such innovations are driving the market for geared turbofan engines and by extension, the aircraft gearbox market.

Challenges: Spalling, Frosting, and Manufacturing Defects

The prime purpose of a gearbox is to reliably transmit torque and rotary motion between a prime mover and a driven piece of equipment at an acceptable level of noise, vibration, and temperature. Gear failure may be caused due to excessive wear or a more high-level breakage. The major defects that occur in aircraft gearboxes are due to frosting, spalling, and manufacturing defects. Spalling leads to pits that are shallow and large in diameter. It often occurs in a medium-hard material, as well as in highly loaded, fully hardened material. Excessively high-contact stresses cause spalling; pits break away rapidly and form large irregular voids. Contact stress which causes the formation of pits on the gear surface can be reduced below the endurance limit of the material.

The frosting is another common challenge that aircraft gearboxes face; the wear pattern appears frosted. The surface appears to be a field of very fine micro-pits less than 0.0001 in depth. Excessive heat in the gear mesh causes this condition, leading to lubrication breakdown. Gear failure in the aircraft gearbox is categorized as a CAT 1 problem, which could lead to a major catastrophe and hence, needs immediate attention.

Often, the gear elements are redesigned since spalling is evidence that gears do not have sufficient surface capacity. Redesigning is always a challenge to suppliers as the manufacturing process contributes significantly to the cost and quality of equipment. In the case of a gearbox, the cost associated with manufacturing is high. This can be attributed to the high cost of labor and raw materials. Gears are high-precision components and require skilled labor to be properly manufactured. Poorly manufactured gear teeth can cause noise and excessive vibration during operation. Skilled labor is therefore essential, and manufacturers incur substantial costs when acquiring and retaining the same. Additionally, it is difficult for manufacturers to cope with fluctuating raw material prices. Thus, the high costs associated with repairing or redesigning gearboxes are a challenge for the market.

The Accessory Segment is Projected to Lead the Market During the Forecast Period Based on Gearbox Type

Based on gearbox type, the aircraft gearbox market has been segmented into the accessory gearbox, reduction gearbox, actuation gearbox, tail rotor gearbox, auxiliary power unit gearbox, and others. With rising technological improvements, the market share of the auxiliary gearbox segment has the largest share in the gearbox type segment. Aside from powering hydraulic, pneumatic, and electrical systems in aircraft, an accessory gearbox is used to power fuel and oil pumps, tacho-generators, and various other devices essential for effective engine performance. The increased number of commercial aircraft deliveries will impact industry growth.

The Engine Application Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Based on application, the enginesegment is projected to grow at the highest CAGR during the forecast period. The requirement for high-powered engines and their components is also driving the growth of the aircraft gearbox market.The engine is an important component of the aircraft propulsion system since it helps generate the thrust required to the aircraft wings, which provide the lift for an aircraft. Engines require a significant thrust during takeoff and landing; gearboxes help these aircraft engines achieve high thrust, which drives the aircraft to move forward. The engine segment is further classified into turboprop, turbofan, turboshaft, and piston engines. Factor impacting market growth is the increasing use of piston engines in applications and multiple propeller reduction units in turboprop engines.

Based on the Platform, the Civil Aircraft Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Based on the platform, the aircraft gearbox market has been segmented into civil and military. The civil aircraft segment has witnessed significant growth in the past few years due to the increasing air traffic and rising disposable income of the global middle-class population. Increased demand for new aircraft worldwide is also fueling the growth of the civil aircraft segment. The civil aircraft segment has been further categorized into commercial passenger/cargo aircraft, general aviation aircraft, and civil helicopters.

The market for commercial airplane gearboxes will increase as new variations of existing projects emerge. Another element influencing segment expansion is the growing size of the commercial aircraft fleet. According to Forecast International's Aerospace Portal, the commercial aircraft inventory in the United States increased to 7,381 aircraft in 2019, up from 7,356 aircraft in 2018.

To know about the assumptions considered for the study, download the pdf brochure

The North America Region is Projected to Lead the Aircraft Gear Box Market in the Forecast Period

With the growing need for lightweight and fuel-efficient piston and turboprop engine aircraft, North America is expected to emerge as a profit-generating source for the aviation gearbox industry. The United States has the most manufacturing capital in the aerospace industry due to the greater availability of various OEMs, gearbox and component suppliers, distributors, and engine makers. The increasing amount of R&D investments in airplane gearboxes is a significant driver promoting the regional market area. The strong presence and expanding initiatives of several well-known aircraft manufacturers, including Lockheed Martin, will boost the product demand.

Aircraft Gearbox Industry Companies: Top Key Market Players

The Aircraft Gearbox Companies are dominated by globally established players such as Liebherr (Switzerland), Safran (France), Rexnord Aerospace (US), Triumph Group (US), The Timken Company (US), and United Technologies Corporation (US) are the key players in the market.

Aircraft Gearbox Market Report Scope:

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 2.6 Billion |

|

Revenue Forecast in 2026 |

USD 3.6 Billion |

|

Growth Rate |

6.9% |

|

Forecast Period |

2021-2026 |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By End user, By Platform, By Type, By Application, By Component |

|

Geographies covered |

|

|

Leading Companies |

Liebherr (Switzerland), Safran (France), Rexnord Aerospace (US), Triumph Group (US), The Timken Company (US), United Technologies Corporation (US).and others. Total 16 Market Players |

The study categorizes the Aircraft gearbox market based on end user, platform, type, application, component with region.

By end user

- OEM

- Aftermarket

By Platform

- Civil

- Military

By Type

- Accessory

- Reduction

- Actuation

- Tail Rotor

- Auxiliary Power Unit

- Others

By Component

- Gear

- Housing

- Bearings

- Others

By Application

- Engine

- Airframe

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- Collins Aerospace Systems accepted a contract with Saab Automobile AB in June 2019 to supply power and control systems for the Boeing T-X trainer, including the Auxiliary Power Engine Control Unit (APECU) and the aircraft's Power Take Off (PTO) shaft.

- Liebherr was awarded a contract by Boeing Commercial Airplanes in October 2018 to supply electronic components of the main gear steering system for 777X and 777 aircraft.

- Safran Landing Systems signed a long-term contract with Lufthansa Technik AG for A380 landing gear services in March 2020. The collaboration aided in the delivery of optimal solutions for all parts of the superjumbo jet's landing gear.

Frequently Asked Questions (FAQs):

Which Are the Major Systems Considered in This Study?

The aircraft gearboxhas been segmented into

|

By Type |

|

|

By Platform |

|

|

By Component |

|

|

By Application |

|

|

By End User |

|

Can a Detailed Explanation of the Research Methodology Be Provided?

Throughout a scheduled call, a full explanation of the research methodology can be presented. It will also allow us to thoroughly answer all your questions. Multiple methodologies have been used to comprehend the market's holistic view to provide a concise summary and understanding.

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What Kind of Information is Provided in the Competitive Landscape Section?

The competitive landscape provides an overview of the prevailing competitive scenario in the aircraft gearbox market. It includes a trend analysis that was carried out based on the revenue of the various business segments of key players in this market. In addition, a benchmarking of the growth strategies adopted by key players was undertaken. It offers a comprehensive analysis of developments such as contracts, joint ventures, partnerships, and agreements, and acquisitions

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 AIRCRAFT GEARBOX MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 USD EXCHANGE RATES

1.6 INCLUSIONS AND EXCLUSIONS

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key insights from primary respondents

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand from aftermarket

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in manufacturing technology

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Regional aircraft gearbox markets

2.4.1.2 Aircraft gearbox market, by type

2.4.1.3 Aircraft gearbox market, by end user

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 PRICING ANALYSIS

2.5 TRIANGULATION & VALIDATION

2.5.1 TRIANGULATION THROUGH SECONDARY

2.5.2 TRIANGULATION THROUGH PRIMARIES

FIGURE 5 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 6 ENGINE SEGMENT PROJECTED TO LEAD AIRCRAFT GEARBOX MARKET DURING FORECAST PERIOD

FIGURE 7 ACCESSORY GEARBOXES TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 8 OEM SEGMENT TO ACCOUNT FOR LARGEST SHARE IN AIRCRAFT GEARBOX MARKET DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA TO HOLD DOMINANT SHARE OF AIRCRAFT GEARBOX MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRCRAFT GEARBOX MARKET, 2021–2026

FIGURE 10 INCREASE IN AIRCRAFT DELIVERIES WILL DRIVE AIRCRAFT GEARBOX MARKET GROWTH FROM 2021 TO 2026

4.2 AIRCRAFT GEARBOX MARKET, BY COMPONENT

FIGURE 11 GEAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 AIRCRAFT GEARBOX MARKET, BY PLATFORM

FIGURE 12 CIVIL AIRCRAFT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 AIRCRAFT GEARBOX MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for new aircraft

FIGURE 14 AIRCRAFT DELIVERIES, BY REGION & TYPE, 2020-2039

5.2.1.2 Increase in demand for lightweight aircraft components

5.2.1.3 Increasing demand for military helicopters

TABLE 1 INCREASING MILITARY EXPENDITURE BY EMERGING ECONOMIES, 2014-2020 (USD BILLION)

5.2.2 RESTRAINTS

5.2.2.1 Using turboprop engines at high altitudes

5.2.2.2 Existing backlogs in aircraft deliveries

TABLE 2 ORDER BACKLOGS OF TOP AIRCRAFT MANUFACTURERS, 2020

5.2.3 OPPORTUNITIES

5.2.3.1 Increased investments in geared turbofan engines

TABLE 3 FUEL-BURN AND EMISSIONS REDUCTION GOALS: ADVISORY COUNCIL FOR AVIATION RESEARCH AND INNOVATION IN EUROPE (ACARE)

5.2.3.2 Increased R&D in open-rotor engine configuration

5.2.4 CHALLENGES

5.2.4.1 High cost associated with introducing new technological concepts

5.2.4.2 Spalling, frosting, and manufacturing defects

5.3 RANGES AND SCENARIOS

FIGURE 15 IMPACT OF COVID-19 ON THE MARKET: GLOBAL SCENARIOS

5.4 IMPACT OF COVID-19 ON AIRCRAFT GEARBOX MARKET

FIGURE 16 IMPACT OF COVID-19 ON AIRCRAFT GEARBOX MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to June 2021

TABLE 4 KEY DEVELOPMENTS IN AIRCRAFT GEARBOX MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to March 2021

TABLE 5 KEY DEVELOPMENTS IN THE AIRCRAFT GEARBOX MARKET, JANUARY 2020 TO DECEMBER 2020

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT GEARBOX MANUFACTURERS

FIGURE 17 REVENUE SHIFT IN AIRCRAFT GEARBOX MARKET

5.6 AVERAGE SELLING PRICE ANALYSIS

5.7 AIRCRAFT GEARBOX MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 18 AIRCRAFT GEARBOX MARKET ECOSYSTEM MAP

TABLE 6 AIRCRAFT GEARBOX MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 INCREASING USE OF COMPOSITES AND METAL ALLOYS

5.8.2 USE OF LOW CORROSIVE MATERIALS AND CORROSION PROTECTION AGENTS

5.9 USE CASE ANALYSIS

5.9.1 USE CASE: THERMAL PERFORMANCE ANALYSIS OF GAS TURBINE AERO ENGINE ACCESSORY GEARBOXES

5.9.2 USE CASE: REAL-TIME DATA ACQUISITION AND CONTROL SYSTEM

5.1 VALUE CHAIN ANALYSIS OF AIRCRAFT GEARBOX MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.11 OPERATIONAL DATA

TABLE 7 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019–2038

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 AIRCRAFT GEARBOX MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 20 AIRCRAFT GEARBOX MARKET: PORTER’S FIVE FORCE ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 TARIFF AND REGULATORY LANDSCAPE

5.14 TRADE ANALYSIS

TABLE 9 GEARS AND GEARING FOR MACHINERY: COUNTRY-WISE IMPORTS, 2019-2020 (USD)

TABLE 10 GEARS AND GEARING FOR MACHINERY: COUNTRY-WISE EXPORTS, 2019-2020 (USD)

6 INDUSTRY TRENDS (Page No. - 73)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 PLANETARY GEARBOX FOR GEARED TURBOFAN (GTF)

6.2.1.1 Pratt & Whitney’s PurePower engine

TABLE 11 PRATT & WHITNEY GEARED TURBOFAN (GTF) PUREPOWER ENGINE FAMILY RANGE

6.2.1.2 Rolls Royce Geared UltraFan

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 3D PRINTING PROCESS

6.5 WHO TO WHOM ANALYSIS OF AIRCRAFT GEARBOX MARKET

6.6 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 12 INNOVATION & PATENT REGISTRATIONS (2018-2021)

7 AIRCRAFT GEARBOX MARKET, BY END USER (Page No. - 83)

7.1 INTRODUCTION

FIGURE 22 OEM SEGMENT TO LEAD AIRCRAFT GEARBOX MARKET DURING FORECAST PERIOD

TABLE 13 AIRCRAFT GEARBOX MARKET, BY END USER, 2017–2026 (USD MILLION)

7.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

7.2.1 INCREASING AIRCRAFT DELIVERIES TO DRIVE OEM DEMAND

7.3 AFTERMARKET

7.3.1 INCREASING AIRCRAFT FLEET SIZE DRIVES DEMAND FOR AIRCRAFT GEARBOX AFTERMARKET

8 AIRCRAFT GEARBOX MARKET, BY PLATFORM (Page No. - 86)

8.1 INTRODUCTION

FIGURE 23 CIVIL AIRCRAFT TO DOMINATE AIRCRAFT GEARBOX MARKET DURING FORECAST PERIOD

TABLE 14 AIRCRAFT GEARBOX MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

8.2 CIVIL

TABLE 15 CIVIL AIRCRAFT GEARBOX MARKET, BY TYPE, 2017–2026 (USD MILLION)

8.2.1 BUSINESS AND GENERAL AVIATION AIRCRAFT

8.2.1.1 Business and General Aviation aircraft used for flight training and other activities

8.2.2 COMMERCIAL AVIATION

TABLE 16 COMMERCIAL AVIATION AIRCRAFT GEARBOX MARKET, BY TYPE, 2017–2026 (USD MILLION)

8.2.2.1 Narrow-body aircraft

8.2.2.1.1 Increase in commercial aircraft deliveries expected to drive narrow-body aircraft market

8.2.2.2 Regional transport aircraft

8.2.2.2.1 Regional transport aircraft are majorly used to cover short-to-medium distance routes

8.2.2.3 Wide-body aircraft

8.2.2.3.1 Increasing deliveries of wide body aircraft for international flights

8.2.2.4 Very large aircraft

8.2.2.4.1 Very large aircraft are majorly used for long haul flights

8.2.3 CIVIL HELICOPTERS

8.2.3.1 Increase in the deliveries of commercial helicopters to drive the civil helicopters segment

8.3 MILITARY

TABLE 17 MILITARY AIRCRAFT GEARBOX MARKET, BY TYPE, 2017–2026 (USD MILLION)

8.3.1 FIGHTER JETS

8.3.1.1 Increasing procurement of fighter jets by countries in Asia Pacific

8.3.2 MILITARY HELICOPTERS

8.3.2.1 Military helicopters majorly used for medical evacuation and ground target attacks

8.3.3 TRANSPORT AIRCRAFT

8.3.3.1 Transport Aircraft used for airlifting troops & weapons in defense missions

9 AIRCRAFT GEARBOX MARKET, BY TYPE (Page No. - 92)

9.1 INTRODUCTION

FIGURE 24 ACCESSORY GEARBOX SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 18 AIRCRAFT GEARBOX MARKET, BY TYPE, 2017–2026 (USD MILLION)

9.2 ACCESSORY GEARBOX

9.2.1 ACCESSORY GEARBOXES MAJORLY USED IN ENGINES

9.3 REDUCTION GEARBOX

9.3.1 REDUCTION GEARBOX MAINLY USED TO REDUCE SPEED

9.4 ACTUATION GEARBOX

9.4.1 BOEING, AIRBUS, AND BOMBARDIER USE ACTUATION GEARBOXES FOR HIGH LIFTING

9.5 TAIL ROTOR GEARBOX

9.5.1 TAIL ROTOR GEARBOXES USED FOR POWER TRANSMISSION IN HELICOPTERS

9.6 AUXILIARY POWER UNIT GEARBOX

9.6.1 AUXILIARY POWER UNIT GEARBOXES USED IN AUXILIARY GEARBOX FOR POWER TRANSMISSION

9.7 OTHERS

10 AIRCRAFT GEARBOX MARKET, BY APPLICATION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 25 ENGINE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 19 AIRCRAFT GEARBOX MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

10.2 ENGINE

TABLE 20 AIRCRAFT GEARBOX MARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

10.2.1 TURBOFAN

10.2.1.1 Turbofan majorly used for aircraft propulsion

10.2.2 TURBOSHAFT

10.2.2.1 Turboshaft engines widely used in helicopters

10.2.3 TURBOPROP

10.2.3.1 Turboprop engine used in business and general aviation applications

10.2.4 PISTON ENGINE

10.2.4.1 Piston engines see wide-scale use in ultralight aircraft

10.3 AIRFRAME

10.3.1 AIRFRAME GEARBOXES USED TO CONTROL AIRCRAFT POSITION

11 AIRCRAFT GEARBOX MARKET, BY COMPONENT (Page No. - 100)

11.1 INTRODUCTION

FIGURE 26 HOUSING SEGMENT TO COMMAND LARGEST SHARE OF AIRCRAFT GEARBOX MARKET DURING FORECAST PERIOD

TABLE 21 AIRCRAFT GEARBOX MARKET, BY COMPONENT, 2017–2026 (USD MILLION)

11.2 GEAR

11.2.1 SEGMENT GROWTH DRIVEN BY USE OF DIFFERENT TYPES

11.3 HOUSING

11.3.1 HOUSING MAJORLY USED TO SUPPORT AIRCRAFT GEAR DRIVE ASSEMBLY

11.4 BEARINGS

11.4.1 BEARINGS USED IN MAJOR APPLICATIONS SUCH AS ENGINES, LANDING GEAR, FLIGHT CONTROL

11.5 OTHERS

12 REGIONAL ANALYSIS (Page No. - 103)

12.1 INTRODUCTION

FIGURE 27 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF AIRCRAFT GEARBOX OEM MARKET IN 2021

FIGURE 28 NORTH AMERICA TO DOMINATE AIRCRAFT GEARBOX AFTERMARKET IN 2021

TABLE 22 AIRCRAFT GEARBOX OEM MARKET, BY REGION, 2017–2026 (USD MILLION)

TABLE 23 AIRCRAFT GEARBOX AFTERMARKET, BY REGION, 2017–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 COVID-19 IMPACT ON NORTH AMERICA

12.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 29 NORTH AMERICA AIRCRAFT GEARBOX OEM MARKET SNAPSHOT

FIGURE 30 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET SNAPSHOT

TABLE 24 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 26 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 28 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: AIRCRAFT GEARBOX OEM MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY COUNTRY, 2017–2026 (USD MILLION)

12.2.3 US

12.2.3.1 Increase in commercial aircraft deliveries boosts growth of market in US

TABLE 38 US: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 39 US: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 40 US: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 41 US: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 42 US: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 43 US: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 44 US: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 45 US: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 46 US: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 47 US: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Increase in demand for lightweight and fuel-efficient aircraft fuels OEM market in Canada

TABLE 48 CANADA: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 49 CANADA: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 50 CANADA: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 51 CANADA: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 52 CANADA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 53 CANADA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 54 CANADA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 55 CANADA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 56 CANADA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.3 EUROPE

12.3.1 COVID-19 IMPACT ON EUROPE

12.3.2 PESTLE ANALYSIS

FIGURE 31 EUROPE: AIRCRAFT GEARBOX OEM MARKET SNAPSHOT

FIGURE 32 EUROPE: AIRCRAFT GEARBOX AFTERMARKET SNAPSHOT

TABLE 57 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 58 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 59 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 60 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 61 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 62 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 63 EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

TABLE 64 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 65 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 66 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 67 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 68 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 69 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 70 EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY COUNTRY, 2017–2026 (USD MILLION)

12.3.3 UK

12.3.3.1 Replacement of existing aircraft fleets with advanced aircraft drives market in UK

TABLE 71 UK: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 72 UK: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 73 UK: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 74 UK: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 75 UK: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Market in France drive by presence of major aircraft manufacturers such as Airbus

TABLE 76 FRANCE: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 77 FRANCE: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 78 FRANCE: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 79 FRANCE: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 80 FRANCE: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 81 FRANCE: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 82 FRANCE: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 83 FRANCE: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 84 FRANCE: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 85 FRANCE: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Aviation industry in Italy growing by air freight and passenger volume

TABLE 86 ITALY: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 87 ITALY: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 88 ITALY: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 89 ITALY: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 90 ITALY: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 91 REST OF EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 92 REST OF EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 93 REST OF EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 95 REST OF EUROPE: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 96 REST OF EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 97 REST OF EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 98 REST OF EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 99 REST OF EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 100 REST OF EUROPE: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 COVID-19 IMPACT ON ASIA PACIFIC

12.4.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET SNAPSHOT

FIGURE 34 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET SNAPSHOT

TABLE 101 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 103 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 104 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 105 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 107 ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY COUNTRY, 2017–2026 (USD MILLION)

12.4.3 RUSSIA

12.4.3.1 Increase in defense spending to drive market in Russia

TABLE 115 RUSSIA: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 116 RUSSIA: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 117 RUSSIA: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 118 RUSSIA: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 119 RUSSIA: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 120 RUSSIA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 121 RUSSIA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 122 RUSSIA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 123 RUSSIA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 124 RUSSIA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Increasing demand for aircraft fuels growth of market in China

TABLE 125 CHINA: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 126 CHINA: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 127 CHINA: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 128 CHINA: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 129 CHINA: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 130 CHINA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 131 CHINA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 132 CHINA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 133 CHINA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 134 CHINA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Increase in defense spending drives growth of Indian aircraft gearbox market

TABLE 135 INDIA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 136 INDIA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 137 INDIA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 138 INDIA: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 139 INDIA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.4.6 JAPAN

12.4.6.1 Presence of Mitsubishi Aircraft Corporation Fuels Japanese aircraft gearbox market

TABLE 140 JAPAN: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 141 JAPAN: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 142 JAPAN: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 143 JAPAN: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 144 JAPAN: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Replacement of old aircraft to drive market in Rest of Asia Pacific

TABLE 145 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 146 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX OEM MARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.5 REST OF THE WORLD

12.5.1 COVID-19 IMPACT ON REST OF THE WORLD

12.5.2 PESTLE ANALYSIS

TABLE 155 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY REGION, 2017–2026 (USD MILLION)

TABLE 156 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY REGION, 2017–2026 (USD MILLION)

TABLE 157 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 158 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 159 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 160 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 161 REST OF THE WORLD: AIRCRAFT GEARBOX OEM MARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 162 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 163 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY ENGINE TYPE, 2017–2026 (USD MILLION)

TABLE 164 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 165 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 166 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 167 REST OF THE WORLD: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.5.3 LATIN AMERICA

12.5.3.1 Rise of low-cost carriers such as Volaris and Interjet boosts market in Latin America

TABLE 168 LATIN AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 170 LATIN AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 172 LATIN AMERICA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.5.4 MIDDLE EAST

12.5.4.1 Increasing demand for narrow-body aircraft drives Middle East market

TABLE 173 MIDDLE EAST: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 174 MIDDLE EAST: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 175 MIDDLE EAST: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 176 MIDDLE EAST: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 177 MIDDLE EAST: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

12.5.5 AFRICA

12.5.5.1 Expanding fleet of turboprop engine aircraft for commercial applications fuels African market

TABLE 178 AFRICA: AIRCRAFT GEARBOX AFTERMARKET, BY APPLICATION, 2017–2026 (USD MILLION)

TABLE 179 AFRICA: AIRCRAFT GEARBOX AFTERMARKET, BY TYPE, 2017–2026 (USD MILLION)

TABLE 180 AFRICA: AIRCRAFT GEARBOX AFTERMARKET, BY PLATFORM, 2017–2026 (USD MILLION)

TABLE 181 AFRICA: AIRCRAFT GEARBOX AFTERMARKET, BY CIVIL AIRCRAFT TYPE, 2017–2026 (USD MILLION)

TABLE 182 AFRICA: AIRCRAFT GEARBOX AFTERMARKET, BY MILITARY AIRCRAFT TYPE, 2017–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 170)

13.1 INTRODUCTION

TABLE 183 KEY DEVELOPMENTS BY LEADING AIRBORNE COUNTERMEASURE SYSTEMS PLAYERS (2018 – 2021)

13.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 35 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST 5 YEARS

13.3 MARKET SHARE ANALYSIS

FIGURE 36 AIRCRAFT GEARBOX: MARKET SHARE ANALYSIS 2020

TABLE 184 AIRCRAFT GEARBOX MARKET: DEGREE OF COMPETITION

13.4 COMPANY EVALUATION QUADRANT

FIGURE 37 AIRCRAFT GEARBOX MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

13.4.1 STAR

13.4.2 PERVASIVE

13.4.3 EMERGING LEADER

13.4.4 PARTICIPANT

13.5 COMPETITIVE BENCHMARKING

TABLE 185 COMPANY PRODUCT FOOTPRINT (16 COMPANIES)

TABLE 186 COMPANY PLATFORM FOOTPRINT

TABLE 187 COMPANY END USER FOOTPRINT

TABLE 188 COMPANY REGION FOOTPRINT

13.6 COMPETITIVE SCENARIO AND TRENDS

13.6.1 DEALS

TABLE 189 AIRCRAFT GEARBOX MARKET: DEALS, 2018–2021

14 COMPANY PROFILES (Page No. - 182)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 SAFRAN

TABLE 190 SAFRAN: BUSINESS OVERVIEW

FIGURE 38 SAFRAN: COMPANY SNAPSHOT

TABLE 191 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 SAFRAN: DEALS

14.2 LIEBHERR

TABLE 193 LIEBHERR: BUSINESS OVERVIEW

FIGURE 39 LIEBHERR: COMPANY SNAPSHOT

TABLE 194 LIEBHERR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 LIEBHERR: DEALS

14.3 THE TIMKEN COMPANY

TABLE 196 THE TIMKEN COMPANY: BUSINESS OVERVIEW

FIGURE 40 THE TIMKEN COMPANY: COMPANY SNAPSHOT

TABLE 197 THE TIMKEN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 198 THE TIMKEN COMPANY: DEALS

14.4 REXNORD AEROSPACE

TABLE 199 REXNORD AEROSPACE: BUSINESS OVERVIEW

FIGURE 41 REXNORD AEROSPACE: COMPANY SNAPSHOT

TABLE 200 REXNORD AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 201 REXNORD AEROSPACE: DEALS

14.5 TRIUMPH GROUP

TABLE 202 TRIUMPH GROUP: BUSINESS OVERVIEW

FIGURE 42 TRIUMPH GROUP: COMPANY SNAPSHOT

TABLE 203 TRIUMPH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 TRIUMPH GROUP: DEALS

14.6 SKF AB

TABLE 205 SKF AB: BUSINESS OVERVIEW

FIGURE 43 SKF AB COMPANY SNAPSHOT

TABLE 206 SKF AB PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 207 SKF AB: DEALS

14.7 UNITED TECHNOLOGIES CORPORATION

TABLE 208 UNITED TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

TABLE 209 UNITED TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 210 UNITED TECHNOLOGIES CORPORATION: DEALS

14.8 PBS VELKÁ BÍTEŠ

TABLE 211 PBS VELKÁ BÍTEŠ: BUSINESS OVERVIEW

TABLE 212 PBS VELKÁ BÍTEŠ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.9 CEF INDUSTRIES

TABLE 213 CEF INDUSTRIES: BUSINESS OVERVIEW

TABLE 214 CEF INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.10 AERO GEAR

TABLE 215 AERO GEAR: BUSINESS OVERVIEW

TABLE 216 AERO GEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 AERO GEAR: DEALS

14.11 ZF LUFTFAHRTTECHNIK GMBH

TABLE 218 ZF LUFTFAHRTTECHNIK GMBH: BUSINESS OVERVIEW

TABLE 219 ZF LUFTFAHRTTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 ZF LUFTFAHRTTECHNIK GMBH: DEALS

14.12 AVION

TABLE 221 AVION: BUSINESS OVERVIEW

TABLE 222 AVION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.13 NORTHSTAR AEROSPACE

TABLE 223 NORTHSTAR AEROSPACE: BUSINESS OVERVIEW

TABLE 224 NORTHSTAR AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.14 AEROCONTROLEX GROUP

TABLE 225 AEROCONTROLEX GROUP: BUSINESS OVERVIEW

TABLE 226 AEROCONTROLEX GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.15 AERO GEARBOX INTERNATIONAL

TABLE 227 AERO GEARBOX INTERNATIONAL: BUSINESS OVERVIEW

TABLE 228 AERO GEARBOX INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.16 AVIO AERO

TABLE 229 AVIO AERO: BUSINESS OVERVIEW

TABLE 230 AVIO AERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 AVIO AERO: DEALS

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 217)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

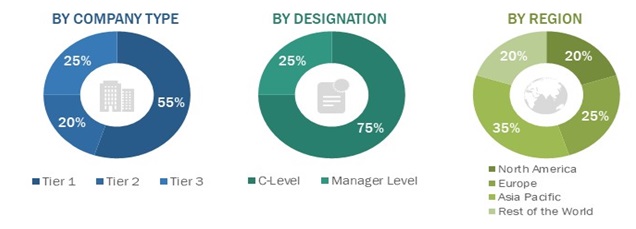

The study involved various activities in estimating the market size for Aircraft gearbox. Exhaustive secondary research was undertaken to collect information on the Aircraft gearbox market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Aircraft gearbox market.

Secondary Research

The market share of companies in the Aircraft gearbox market was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the Aircraft gearbox market included government sources, such as the US Department of Defense (DoD); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the Aircraft gearbox market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the Aircraft gearbox market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, and Rest of the world. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

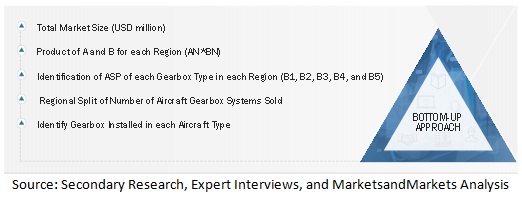

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the Aircraft gearbox market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Aircraft gearbox market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global the Aircraft gearbox market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Aircraft gearbox market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Aircraft gearbox market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the Aircraft gearbox market based on deployment,upgrade, application, technology and region.

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and rest of the world along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the Aircraft gearbox market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the Aircraft gearbox market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Aircraft gearbox market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft gearbox market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Gearbox Market

I am looking for a suitable partner to help understand the market for aerospace gears used in transmission systems. Will be great if I can speak to someone from your team, to discuss in detail.