Anesthesia Equipment Market by Type (Anesthesia Devices (Workstation, Ventilators, Monitors), Disposables (Circuits, Endotraceal Tubes)), Application (Orthopedics, Neurology, Urology), End User (Hospitals, Clinics, ASC) & Region - Global Forecast to 2028

Updated on : June 14, 2023

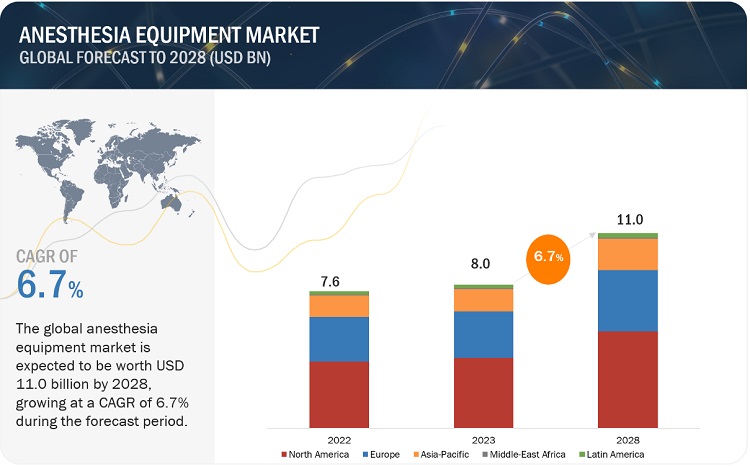

The global anesthesia equipment market in terms of revenue was estimated to be worth $8.0 billion in 2023 and is poised to reach $11.0 billion by 2028, growing at a CAGR of 6.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market can primarily be attributed to the growing geriatric population on a global level. Common age-related diseases and conditions include arthritis, osteoporosis, lumbar spinal stenosis (LSS), gastroesophageal reflux disease (GERD), and benign prostatic hypertrophy. LSS is extremely common among people aged 50 years and above, with most patients in this age group undergoing surgical procedures for its treatment. As per the American Academy of Orthopaedic Surgeons (AAOS), around 2.4 million Americans are expected to be affected by this condition by 2021. The growth in the geriatric population is thus expected to result in a surge in the total number of surgeries performed in the US.

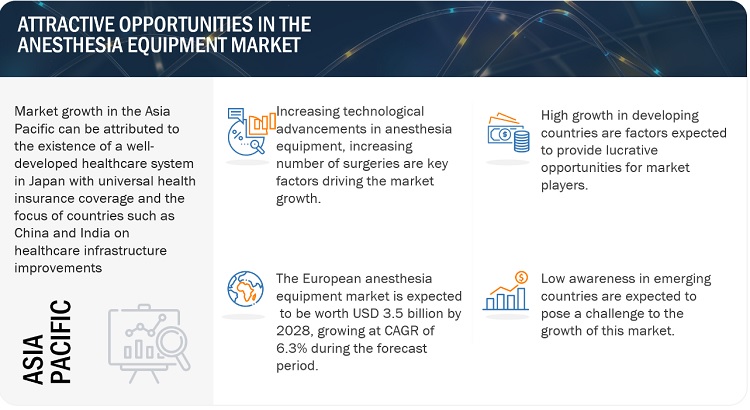

Attractive Opportunities in Anesthesia equipment Market

To know about the assumptions considered for the study, Request for Free Sample Report

Anesthesia Equipment Market Dynamics

Driver: Rising prevalence of chronic disorders

According to the WHO, cancer is the leading cause of death globally and was responsible for an estimated 10 million deaths in 2020. According to Cancer Research UK, an estimated 27.5 million new cancer cases will be reported in 2040, an increase of 61.7% compared to 2018. About 62.6% of the new cancer cases occurred in Africa, Asia, Latin America, and the Caribbean region in 2020; 72.6% of global cancer deaths also occurred in these regions in 2020. The increasing burden of cancer can be attributed to several factors, including population growth and aging, as well as the changing prevalence of certain causes of cancer linked to social and economic development. Based on these statistics, basic and translational cancer research continues to be of utmost importance. This is resulting in the growing demand for surgeries, hence boosting the anesthesia equipment industry growth.

Restraint: Unfavorable reimbursement scenario

Currently, the healthcare system in developing countries faces many challenges due to rising healthcare costs, increasing incidence of chronic diseases, and the growing geriatric population (coupled with the growth in age-related disorders). To counter these challenges, governments in a number of countries are focusing on redesigning their healthcare reimbursement systems. In Asian countries, there is very limited or no reimbursement available (except in Japan). Thus, limited or decreasing reimbursement rates in developed countries and undefined reimbursement policies in emerging countries restrict the adoption of surgical procedures globally. This, in turn, is restraining the demand for anesthesia equipment during the forecast period.

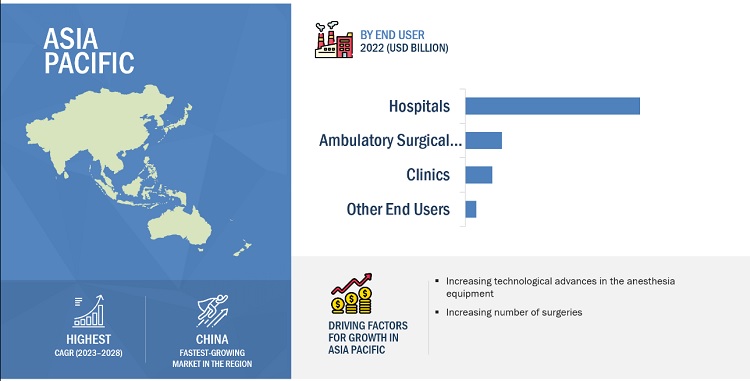

Opportunity: High growth in developing countries

An increase in the per capita income and healthcare expenses in developing markets across APAC and Latin America has increased patient access to advanced healthcare treatments. However, some countries in the APAC and Latin America rely heavily on purchasing medical devices from developed countries such as the US, Japan, Germany, and Ireland. This represents significant growth opportunities for players operating in the anesthesia equipment industry. According to the World Bank, Asia accounts for more than half of the world’s population. Authorities in various developing countries in this region are planning to establish new healthcare delivery models, such as day-care centers, single-specialty hospitals, and long-term care centers, to serve larger population sections. Many private enterprises are also taking steps to cater to the needs of modern and well-equipped state-run healthcare facilities in these countries. In China, the private hospital sector is expected to maintain double-digit growth over the coming years owing to regulatory changes, market demand, and capital investments. In the private hospitals segment, specialty hospitals are witnessing high growth.

Challenge: Hospital budget cuts

In recent years, changes in regulatory policies in major markets such as the US have significantly affected hospital budgets. The Affordable Care Act (ACA), implemented in the US in 2010, has brought tighter federal regulations, forcing many hospitals to curtail their capital expenditure budgets. Similar budgetary cuts are observed in hospitals in the European region, mainly due to the economic slowdown in the past few years. Owing to such budget cuts, many hospitals cannot afford costly medical devices and prefer lower-priced alternatives (such as refurbished devices) or undertake upgradation of existing medical equipment and devices. The rising cost of prescription drugs and a sharp decline in the proposed budget allocations for Health and Human Services in the US have significantly reduced hospital budgets. A study by the American Hospital Association estimates that federal payment cuts to hospitals would amount to USD 218 billion by 2028, forcing hospitals to allocate smaller budgets annually.

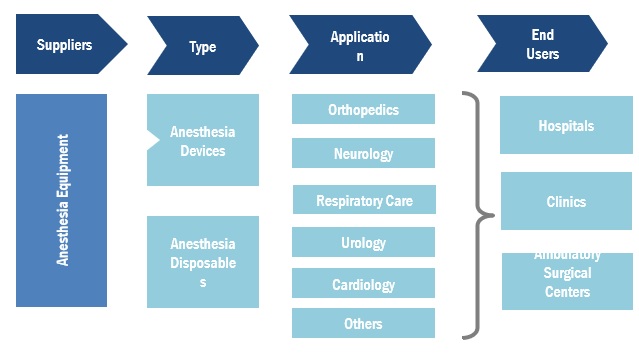

Anesthesia Equipment Market Ecosystem

Leading players in this market include well-established and financially stable manufacturers of anesthesia equipment. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US).

The anesthesia circuits (breathing circuits) segment of the anesthesia equipment industry is expected to register the highest CAGR during the forecast period.

Based on type, the anesthesia equipment market is segmented into anesthesia circuits (breathing circuits), anesthesia masks, endotracheal tubes (ETTS), laryngeal mask airways (LMAS), and other accessories. In 2022, the anesthesia circuits (breathing circuits) segment is expected to register the highest CAGR during the forecast period. These anesthesia disposables are essential for maintaining a sterile environment, preventing infections, and ensuring patient safety during anesthesia procedures. They are designed to be convenient, cost-effective, and eliminate the need for cleaning and sterilization which is fueling the demand for these products.

The cardiology segment of anesthesia equipment industry is estimated to grow at a higher CAGR during the forecast period.

Based on application, the anesthesia equipment market is segmented into orthopedics, neurology, respiratory care, urology, cardiology, and others. The cardiology segment is estimated to grow at a higher CAGR during the forecast period. Growth in this segment can be attributed to the the aging population, which is more susceptible to cardiac conditions, and the rising adoption of minimally invasive cardiac interventions.

The ambulatory surgical centers segment of the anesthesia equipment industry is expected to grow at the highest CAGR during the forecast period.

Based on the end user, the anesthesia equipment market is segmented into hospitals, clinics, ambulatory surgical centers, and other end users. In 2022, ambulatory surgical centers segment is expected to grow at the highest CAGR during the forecast period. the growing number of outpatient visits. Ambulatory surgical centers are well-equipped with critical care devices and instruments. Moreover, these outpatient settings are associated with reduced patient stays.

APAC is estimated to be the fastest-growing region for anesthesia equipment industry.

The global anesthesia equipment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for anesthesia equipment. The high growth in this market can majorly be attributed to the rising number of hospitals and increasing healthcare expenditure, the significant growth in patient volume, and the demand for healthcare services.

To know about the assumptions considered for the study, download the pdf brochure

The anesthesia equipment market is dominated by a few globally established players such as GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US). Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market, such as product launches and approvals, expansions, collaborations, and acquisitions.

Scope of the Anesthesia Equipment Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$8.0 billion |

|

Projected Revenue by 2028 |

$11.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.7% |

|

Market Driver |

Rising prevalence of chronic disorders |

|

Market Opportunity |

High growth in developing countries |

The study categorizes the anesthesia equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Anesthesia Devices

- Anesthesia Workstation

- Anesthesia Delivery Machines

- Anesthesia Ventilators

- Anesthesia Monitors

- Other Devices

-

Anesthesia Disposables

- Anesthesia Circuits (Breathing Circuits)

- Anesthesia Masks

- Endotracheal Tubes (ETTS)

- Laryngeal Mask Airways (LMAS)

- Other Accessories

By Application

- Orthopedics

- Neurology

- Respiratory Care

- Urology

- Cardiology

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Anesthesia Equipment Industry

- In April 2022, GE Healthcare received the FDA pre-market approval (PMA) for its End-tidal (Et) Control software for general anesthesia delivery on its Aisys CS2Anesthesia Delivery System.

- In May 2022, Fisher & Paykel Healthcare expands offering in anesthesia with the release of the Optiflow Switch and Optiflow Trace.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global anesthesia equipment market?

The global anesthesia equipment market boasts a total revenue value of $11.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global anesthesia equipment market?

The global anesthesia equipment market has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $8.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.6.2 SCOPE-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANESTHESIA EQUIPMENT MARKET OVERVIEW

4.2 ANESTHESIA EQUIPMENT INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS

4.3 ANESTHESIA EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

4.4 ANESTHESIA EQUIPMENT INDUSTRY: REGIONAL MIX

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY INSIGHTS

6.1 INTRODUCTION

6.2 TRENDS/ DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

6.3 SUPPLY/ VALUE CHAIN ANALYSIS

6.4 ECOSYSTEM MAP

6.5 TECHNOLOGY ANALYSIS

6.6 TRADE ANALYSIS

6.7 KEY CONFERENCES & EVENTS IN 2022-2023

6.8 TARIFF AND REGULATORY LANDSCAPE

6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

6.8.2 NORTH AMERICA

6.8.3 EUROPE

6.8.4 ASIA PACIFIC

6.9 PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT FROM NEW ENTRANTS

6.9.2 THREAT FROM SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 KEY STAKEHOLDERS & BUYING CRITERIA

6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

6.10.2 BUYING CRITERIA

6.11 PATENT ANALYSIS

6.12 CASE STUDY

6.13 PRICING ANALYSIS

7 ANESTHESIA EQUIPMENT MARKET, BY PRODUCT, 2020 – 2027 (USD MILLION)

7.1 INTRODUCTION

7.2 ANESTHESIA DELIVERY MACHINES AND WORKSTATIONS

7.2.1 BY TYPE

7.2.1.1 PORTBALE

7.2.1.2 STANDALONE

7.2.2 BY VALUE

7.2.2.1 VALUE

7.2.2.2 PREMIUM

7.2.2.3 SUPER VALUE

7.2.2.4 SUPER PREMIUM

7.3 ANESTHESIA MONITORS

7.4 ANESTHESIA VENTILATORS

7.5 ANESTHESIA DISPOSABLES & ACCESSORIES

7.5.1 ANESTHESIA CIRCUITS

7.5.2 ANESTHESIA MASKS

7.5.3 ENDOTRACHEAL TUBES (ETTS)

7.5.4 OTHER CONSUMABLES AND ACCESSORIES

8 ANESTHESIA EQUIPMENT MARKET, BY APPLICATION, 2020 – 2027 (USD MILLION)

8.1 INTRODUCTION

8.2 ORTHOPEDICS

8.3 NEUROLOGY

8.4 RESPIRATORY CARE

8.5 UROLOGY

8.6 CARDIOLOGY

8.7 OTHERS

9 ANESTHESIA EQUIPMENT MARKET, BY END USER, 2020 – 2027 (USD MILLION)

9.1 INTRODUCTION

9.2 HOSPITALS

9.3 CLINICS

9.4 AMBULATORY SERVICE CENTERS

10 ANESTHESIA EQUIPMENT MARKET, BY REGION, 2020 – 2027 (USD MILLION)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 INDIA

10.4.4 REST OF ASIA-PACIFIC

10.5 LATIN AMERICA

10.6 MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/ RIGHT TO WIN

11.3 REVENUE SHARE ANALYSIS- TOP 5 PLAYERS

11.4 MARKET SHARE ANALYSIS

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 PERVASIVE PLAYERS

11.6.3 EMERGING LEADERS

11.6.4 PARTICIPANTS

11.7 COMPETITIVE BENCHMARKING

11.8 COMPANY FOOTPRINTS

11.9 COMPETITIVE SCENARIO AND TRENDS

11.9.1 PRODUCT LAUNCHES & APPROVALS

11.9.2 DEALS

11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

(Business Overview, Financial Information, Products Offered, Recent Developments and MnM View) *

12.1 GE HEALTHCARE

12.2 BEIJING AEONMED CO., LTD.

12.3 DRAGERWERK AG & CO. KGAA

12.4 KONINKLIJKE PHILIPS NV

12.5 MEDTRONIC PLC

12.6 GETINGE

12.7 HEYER MEDICAL AG

12.8 AMBU AS

12.9 BECTON DICKINSON AND COMPANY

12.10 SUNMED

12.11 FISHER & PAYKEL HEALTHCARE

12.12 MEDLINE INDUSTRIES

12.13 COMEN MEDICAL

12.14 ALLIED MEDICAL LTD

12.15 BPL MEDICAL TECHNOLOGIES

12.16 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

12.17 MEDEC INTERNATIONAL BV

12.18 MEDITEC INTERNATIONAL ENGLAND LTD.

12.19 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

12.20 PENLON LIMITED

12.21 B. BRAUN MELSUNGEN AG

* Financial Information and MnM View would be provided for public listed companies only.

*List of companies provided above is tentative, it may change during the course of study.

13 APPENDIX

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the anesthesia equipment market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Extensive primary research was conducted after obtaining information regarding the anesthesia equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from anesthesia equipment vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. The primary sources from the supply side and demand side are detailed below.

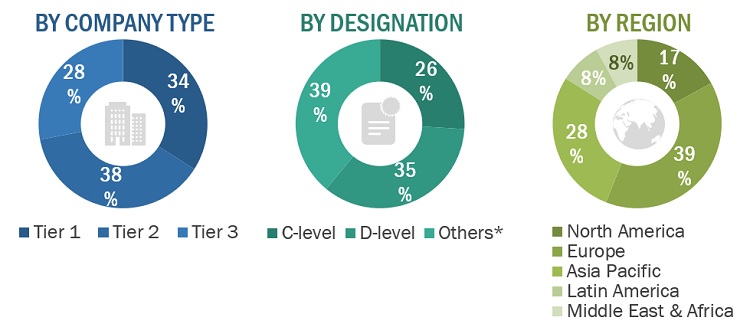

A breakdown of the primary respondents is provided below:

Breakdown of Primary Interviews: Supply-Side Participants, by Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

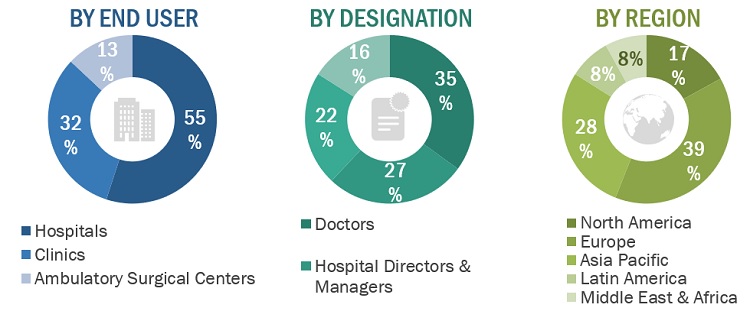

Breakdown of Primary Interviews: Demand-Side Participants, by End User, Designation, and Region

Note: Others include department heads, research scientists, and professors.

Market Size Estimation

The total size of the anesthesia equipment market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Global Anesthesia Equipment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Anesthesia Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

Anesthesia equipment refers to a collection of medical devices and instruments used during the administration and monitoring of anesthesia to ensure the safety and comfort of patients undergoing surgical procedures or other medical interventions. These devices are designed to deliver anesthetic agents, control the patient's airway, monitor vital signs, and provide respiratory support as needed.

Key Stakeholders

- Manufacturers of anesthesia equipment and related devices

- Suppliers and distributors of anesthesia equipment

- Hospitals, clinics, and medical colleges

- Independent surgeons and private offices of physicians

- Ambulatory surgery centers (ASCs)

- Teaching hospitals and academic medical centers

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Objectives of the Study

- To describe, analyze, and forecast the anesthesia equipment industry, by type, application, end user, and region.

- To describe and forecast the anesthesia equipment market for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the anesthesia equipment market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players.

- To profile key players and comprehensively analyze their market shares and core competencies2 in the anesthesia equipment market.

- To analyze competitive developments such as collaborations, acquisitions, product launches, expansions, and R&D activities in the anesthesia equipment market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE anesthesia equipment market into Austria, Finland, and others

- Further breakdown of the RoLATAM anesthesia equipment market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the anesthesia equipment market

- Competitive leadership mapping for established players in the US

Growth opportunities and latent adjacency in Anesthesia Equipment Market