Application Delivery Controller Market by Type (Hardware-based, Virtual), Service (Integration and Implementation, Training, Support, and Maintenance), Organization Size (SME, Large Enterprise), Vertical, and Region - Global Forecast to 2024

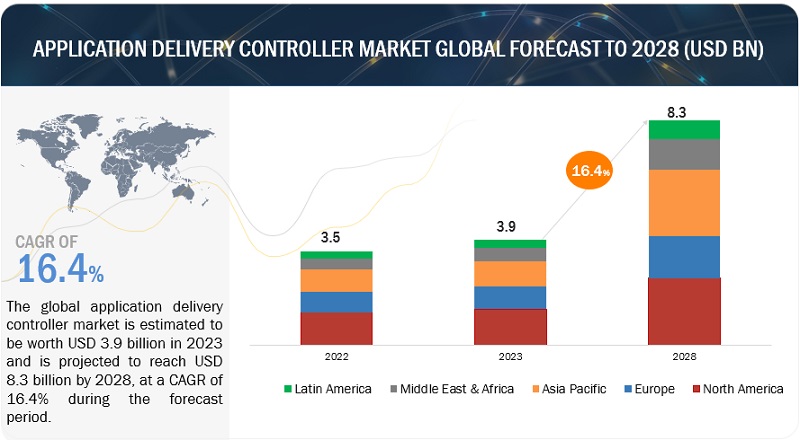

[115 Pages Report] The global application delivery controller market expected to grow from USD 2.4 billion in 2019 to USD 3.9 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 10.0% during the forecast period.

Major growth drivers for the market include several advantages of application delivery controller such as improved performance by distributing traffic among multiple servers, optimizing resources by efficiently allocating traffic based on application types, and ensuring application and data-access consistency.

To know about the assumptions considered for the study, Request for Free Sample Report

By type, the virtual application delivery controller to have a higher CAGR in the application delivery controller market during the forecast period

The virtual application delivery controller segment is estimated to grow at a higher CAGR during the forecast period. It offers a cost-effective alternative with greater control when compared to the traditional application delivery controllers. Software-defined networking and virtualization have enabled more flexible deployments of application delivery controllers functionality. At the same time, the advent of multi-cloud environments and micro-services, such as containers, are changing the makeup of enterprise data centers. Virtual application delivery controllers also offer network and application innovations such as clustering, intelligent architecture, and deep packet inspection. These components ensure that applications run smoothly and effectively. The advantages of virtual application delivery controllers include simplified infrastructure, reduced costs, increased productivity, and enhanced end user experience.

Rise in internet traffic to drive the adoption of application delivery controller

With the rise in Internet traffic, business applications, and the number of Internet-enabled devices, application delivery controllers provide the front-end intelligence that supplements and enhances business application flows. In addition to traditional load balancing, application delivery controllers provide a host of features that maintain the availability, speed, and security of Internet-based applications. More advanced application delivery controllers offer critical data center functions such as application acceleration, layer 4-7 load balancing, application health-checks, SSL offload, DNS application firewalls, and DDoS protection. Application delivery controller distributes traffic load to a number of servers.

To know about the assumptions considered for the study, download the pdf brochure

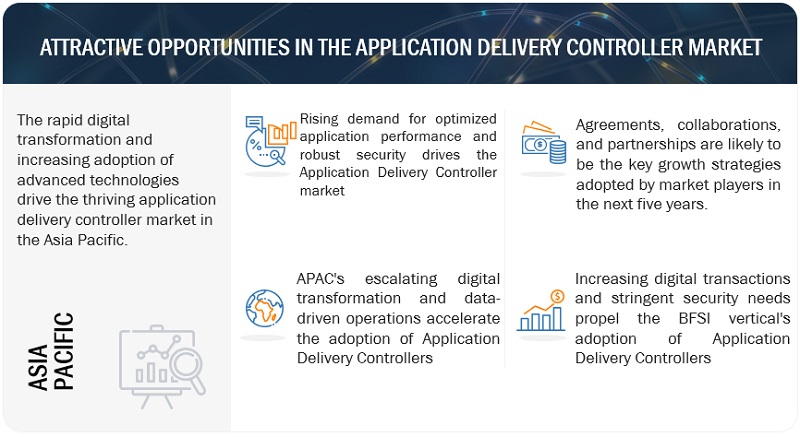

Asia Pacific (APAC) to account for the largest market size during the forecast period

Countries such as China, Japan, Australia, India, and Singapore are expected to contribute a significant market share for the market in APAC. Rising internet traffic, growing focus on virtualization, and the popularity of using infrastructure-as-a-service solutions are major growth drivers for the market in APAC. China, Japan, and India have significant potential for the global application delivery controller vendors because of the availability of significant proportion of end user verticals, favorable economic conditions by extending services to these regions, multifold increase in the adoption rate of virtualization environment-based applications, and absence of intense competition for market entrants. The APAC application delivery controller market is still at its nascent stage; however, rising organizational needs and growing popularity of workstation flexibility are expected to drive the market at a significant rate among the developing countries across the APAC region.

Key Application Delivery Controller Market Players

Major vendors in the global market include F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks (US), Kemp Technologies (US), Cloudflare (US), Brocade Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US).

F5 Networks is one of the leading players in the market. A series of F5 devices, often located in widespread data centers within the same enterprise, can work in concert by sharing a common operating system and control language. This holistic approach is termed as application delivery networking. F5 Networks has devised its growth in the global market using organic and inorganic growth strategies. The company helps end users with vendor guidelines, best practices to adhere to security, and regulatory standards.

A10 Networks provides reliable security with a range of high-performance application networking solutions that help organizations ensure that their data center applications and networks remain highly available, accelerated, and secure. It mostly has offerings in application delivery controllers, such as threat protection system, carrier-grade networking, cloud and virtualization, network management solution, security, DDoS, Sicherheit, and encrypted traffic inspection. A10 Networks has implemented various organic strategies to strengthen its foothold in the application delivery controller market. The company has launched and upgraded its products and services over time to enhance its product portfolio.

Scope of the Application Delivery Controller Market Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Types, Services, Organization Sizes, Verticals, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Brocade Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US) |

The research report categorizes the application delivery controller market to forecast the revenues and analyze the trends in each of the following subsegments:

Application Delivery Controller Market By Type

- Hardware-based application delivery controller

- Virtual application delivery controller

By Service

- Implementation and Integration

- Training, support, and maintenance

Application Delivery Controller Market By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- BFSI

- IT and telecom

- Government and public sector

- Healthcare and life sciences

- Manufacturing

- Retail and consumer goods

- Energy and utilities

- Media and entertainment

- Others (education, and travel and hospitality)

Application Delivery Controller Market By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- Australia and New Zealand (ANZ)

- Japan

- China

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

Recent Developments

- In May 2019, F5 networks inaugurated a new Center of Excellence (CoE) for product development in HITEC City, Hyderabad. The CoE will play a crucial role in adopting new operating models, infrastructure options, and services to set the pace for digital transformation initiatives for F5’s customers around the world. The CoE will also assist in the development of F5’s core solution areas and advance its cloud capabilities.

- In May 2019, F5 announced that it has acquired NGINX, the commercial company behind the popular open-source web server, for USD 670 million. F5’s acquisition of NGINX strengthened its growth trajectory by accelerating its software and multi-cloud transformation.

- In April 2019, Instart and F5 partnered to deliver customers end-to-end reliability, performance, and control to enable exceptional web experiences.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming verticals for the application delivery controller market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

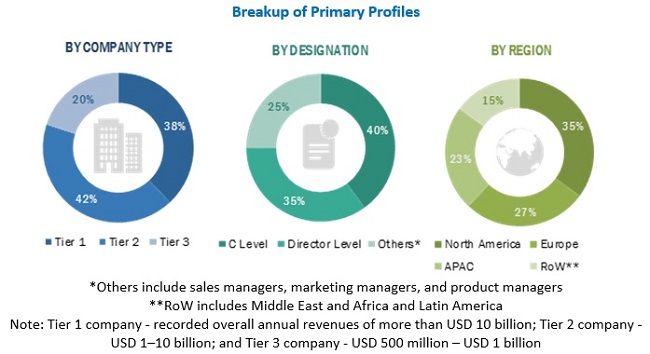

2.1.2.1 Breakup of Primary Profiles

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Growth Opportunities in the Application Delivery Controller Market

4.2 Market By Vertical, 2019

4.3 Market By Type, 2019

4.4 Market Investment Scenario

5 Market Dynamics (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digital Transformation Driving the Next Wave of Application Delivery Controllers

5.2.1.2 Rise in Internet Traffic Fueling the Adoption of Application Delivery Controller

5.2.2 Restraints

5.2.2.1 Limited Bandwidth Providers and Lack of Access to High-Speed Internet

5.2.3 Opportunities

5.2.3.1 Rise in Adoption of Ai, Iot, and Software Defined Technologies

5.2.3.2 Greater Involvement Expected Between Vars and the Vendors in Application Delivery Controller Market

5.2.4 Challenges

5.2.4.1 Backward Compatibility Issues With the Existing Network Infrastructure

6 Application Delivery Controller Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Hardware-Based Application Delivery Controller

6.2.1 Hardware-Based Application Delivery Controllers Help in Reducing Complexities of Infrastructure Management With A Single Application Delivery Network Solution for All Applications

6.3 Virtual Application Delivery Controller

6.3.1 Virtual Application Delivery Controller Helps Reduce Cost and Can Be Deployed On-Demand

7 Application Delivery Controller Market, By Service (Page No. - 38)

7.1 Introduction

7.2 Integration and Implementation

7.2.1 Integration and Implementation Services Help Leverage Existing Workflows and Enable Organizations to Adopt Application Delivery Controller Solutions Successfully

7.3 Training, Support, and Maintenance

7.3.1 Training, Support, and Maintenance Services Help Companies in Understanding Market Trends, Changing Business Conditions, and Client Insights

8 Application Delivery Controller Market, By Organization Size (Page No. - 42)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 Enhanced Reliability, Better Scalability, User-Friendly Capabilities, Easy Integration, Increased Agility, and Improved Efficiency are the Main Factors Encouraging SMEs to Adopt Application Delivery Controllers at A Rapid Pace

8.3 Large Enterprises

8.3.1 Demand for Flexible, Scalable, and Convenient Services By Large Enterprises to Encourage Market Players to Come Up With Newer Technologies and Innovative Solutions

9 Application Delivery Controller Market, By Vertical (Page No. - 46)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 Rising Development and Reforms to Fuel the Adoption of Application Delivery Controller in the BFSI Vertical

9.3 IT and Telecom

9.3.1 Need for Undisrupted Connectivity in the IT and Telecom Vertical to Drive the Demand for Application Delivery Controller Solutions

9.4 Government and Public Sector

9.4.1 Growing Cyber Threats and Need for Ensuring High Availability of Critical Infrastructure to Fuel the Adoption of Application Delivery Controller Solutions in Government and Public Sector Vertical

9.5 Retail and Consumer Goods

9.5.1 Application Delivery Controllers Promise to Provide Hassle-Free Online Shopping Experience to the Customers

9.6 Manufacturing

9.6.1 Application Delivery Controllers Help in Providing Full Data Visibility and Ensuring Data Security in the Manufacturing Sector

9.7 Energy and Utilities

9.7.1 Application Delivery Controllers Help in Reducing the Load on Power and Streamline the IT Infrastructure of the Energy Utilities Vertical

9.8 Media and Entertainment

9.8.1 Application Delivery Controllers Help in Delivering A Secure and Reliable Video Content to the Media and Entertainment Verticals

9.9 Healthcare and Life Sciences

9.9.1 Growing Demand to Reduce Downtime and Secure Patient Data to Fuel the Adoption of Application Delivery Controllers in the Healthcare and Life Sciences Vertical

9.1 Others

10 Application Delivery Controller Market, By Region (Page No. - 57)

10.1 Introduction

10.2 North America

10.2.1 Stable Economy and Technological Enhancements in North America Driving the Adoption of Application Delivery Controllers

10.3 Europe

10.3.1 Need to Optimize Application Load Balancing and Performance While Providing Protection From an Ever-Expanding List of Intrusions and Attacks to Drive the Market in Europe

10.4 Asia Pacific

10.4.1 Need to Minimize the Expenditure on IT Infrastructure and Distribute the Network Traffic Equally Driving the Adoption of Application Delivery Controllers in Asia Pacific

10.5 Middle East and Africa

10.5.1 Improvement in IT Infrastructure and Adoption of Advanced Technologies to Drive the Adoption of Application Delivery Controller Industry in the MEA Region

10.6 Latin America

10.6.1 IT Infrastructure Deployments and Adoption of New Technologies to Drive the Adoption of Cost-Effective and Efficient Application Delivery Controller Solutions in Latin America

11 Competitive Landscape (Page No. - 73)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Dynamic Differentiators

11.1.3 Innovators

11.1.4 Emerging Companies

11.2 Competitive Scenario

11.2.1 Partnerships, Agreements, and Collaborations

11.2.2 New Product Launches

11.2.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 78)

12.1 F5 Networks

(Business Overview, Products, Solutions, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Citrix Systems

12.3 A10 Networks

12.4 Fortinet

12.5 Radware

12.6 Webscale

12.7 Barracuda Networks

12.8 Total Uptime Technologies

12.9 Array Networks

12.10 Cloudflare

12.11 Kemp Technologies

12.12 Brocade

12.13 Riverbed

12.14 Evanssion

12.15 Nfware

12.16 Snapt

*Details on Business Overview, Products, Solutions, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 108)

13.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.2 Available Customizations

13.3 Related Reports

13.4 Author Details

List of Tables (51 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Application Delivery Controller Market Size, By Type, 2017–2024 (USD Million)

Table 4 Hardware-Based Application Delivery Controller: Market Size By Region, 2017–2024 (USD Million)

Table 5 Virtual Application Delivery Controller: Market Size By Region, 2017–2024 (USD Million)

Table 6 Market Size, By Service, 2017–2024 (USD Million)

Table 7 Integration and Implementation: Market Size By Region, 2017–2024 (USD Million)

Table 8 Training, Support, and Maintenance: Market Size By Region, 2017–2024 (USD Million)

Table 9 Market Size, By Organization Size, 2017–2024 (USD Million)

Table 10 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 11 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 12 Market Size, By Vertical, 2017–2024 (USD Million)

Table 13 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 14 IT and Telecom: Market Size By Region, 2017–2024 (USD Million)

Table 15 Government and Public Sector: Market Size By Region, 2017–2024 (USD Million)

Table 16 Retail and Consumer Goods: Market Size By Region, 2017–2024 (USD Million)

Table 17 Manufacturing: Application Delivery Controller Market Size, By Region, 2017–2024 (USD Million)

Table 18 Energy and Utilities: Market Size By Region, 2017–2024 (USD Million)

Table 19 Media and Entertainment: Market Size By Region, 2017–2024 (USD Million)

Table 20 Healthcare and Life Sciences: Market Size By Region, 2017–2024 (USD Million)

Table 21 Others: Market Size By Region, 2017–2024 (USD Million)

Table 22 Market Size, By Region, 2017–2024 (USD Million)

Table 23 North America: Market Size, By Type, 2017–2024 (USD Million)

Table 24 North America: Market Size By Service, 2017–2024 (USD Million)

Table 25 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 26 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 27 North America: Market Size By Country, 2016–2023 (USD Million)

Table 28 Europe: Application Delivery Controller Market Size, By Type, 2017–2024 (USD Million)

Table 29 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 30 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 33 Asia Pacific: Market Size, By Type, 2017–2024 (USD Million)

Table 34 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 38 Middle East and Africa: Application Delivery Controller Market Size, By Type, 2017–2024 (USD Million)

Table 39 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 40 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 41 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 42 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 43 Latin America: Market Size, By Type, 2017–2024 (USD Million)

Table 44 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 45 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 46 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 47 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 48 Evaluation Criteria

Table 49 Partnerships, Agreements, and Collaborations, 2018–2019

Table 50 New Product Launches, 2018

Table 51 Mergers and Acquisitions, 2016–2019

List of Figures (31 Figures)

Figure 1 Application Delivery Controller Market: Research Design

Figure 2 Application Delivery Controller Software Market: Bottom-Up and Top-Down Approaches

Figure 3 Competitive Leadership Mapping: Criteria Weightage

Figure 4 Global Market Size, 2017–2024 (USD Million)

Figure 5 Segments With the Highest CAGR in the Market

Figure 6 North America to Account for the Highest Market Share in 2019

Figure 7 Digital Transformation to Drive the Next Wave of Application Delivery Controllers

Figure 8 IT and Telecom to have the Highest Market Share in 2019

Figure 9 Hardware-Based Application Delivery Controller to Hold the Highest Market Share in 2019

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Application Delivery Controller Market

Figure 11 Virtual Application Delivery Controller Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Training, Support, and Maintenance Segment to Grow at A Higher CAGR During the Forecast Period

Figure 13 Small and Medium-Sized Enterprises Segment to Register A Higher CAGR During the Forecast Period

Figure 14 Retail and Consumer Goods Vertical to Register the Highest CAGR During the Forecast Period

Figure 15 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Application Delivery Controller Market (Global), Competitive Leadership Mapping, 2019

Figure 19 Companies Adopted New Product Launches and Acquisitions as the Key Growth Strategies During 2016–2019

Figure 20 F5 Networks: Company Snapshot

Figure 21 F5 Networks: SWOT Analysis

Figure 22 Citrix Systems: Company Snapshot

Figure 23 Citrix Systems: SWOT Analysis

Figure 24 A10 Networks: Company Snapshot

Figure 25 A10 Networks: SWOT Analysis

Figure 26 Fortinet: Company Snapshot

Figure 27 Fortinet: SWOT Analysis

Figure 28 Radware: Company Snapshot

Figure 29 Radware: SWOT Analysis

Figure 30 Webscale: SWOT Analysis

Figure 31 Barracuda Networks: Company Snapshot

The study involved 4 major activities to estimate the current market size of the application delivery controller market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers such as Cisco Cloud Index; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. Secondary sources considered for the study included Factiva and D&B Hoovers. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing application delivery controller software and hardware. The primary sources from the demand side included the end users of the application delivery controller, including Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Application Delivery Controller Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the application delivery controller market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

- The market numbers are generated using an excel based model further validated and verified by industry experts.

- Several factors are considered to articulate more information about the market trend.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the application delivery controller market.

Report Objectives

- To define, segment, and project the global market size of the application delivery controller market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the application delivery controller market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in Application Delivery Controller Market

Exhaustive coverage on the topic.

What is the future of software application delivery and open source application delivery?