Architectural Metal Coatings Market by Resin Type (Polyester, Fluoropolymer), Coil Coating Application (Roofing & Cladding, Wall Panels & Facades), Extrusion Coating Application (Curtain Walls, Store Front) and Region - Global Forecast to 2027

Architectural Metal Coatings Market

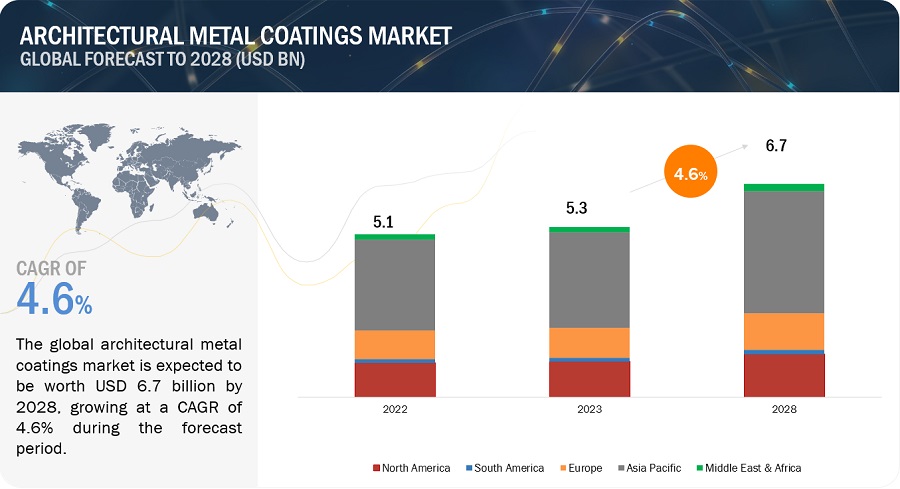

The global architectural metal coatings market was valued at USD 5.1 billion in 2022 and is projected to reach USD 6.4 billion by 2027, growing at a cagr 4.6% from 2022 to 2027. The growth of this market is attributed to the increase in demand from the construction industry, especially in emerging economies.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Architectural Metal Coatings Market

The global economy has entered the year 2022 in a weaker position than expected. As the new Omicron variant of COVID-19 spreads, countries have reimposed mobility restrictions. Rising prices of energy and supply disruptions have resulted in higher and more broad-based inflation than anticipated, notably in the US and many emerging markets and developing economies. The ongoing retrenchment of China’s real estate sector and slower-than-expected recovery of private consumption have also limited growth prospects.

Since the start of the COVID-19 pandemic, the prices of raw materials required for manufacturing architectural metal coatings have been very volatile. At the start of 2020, the production across various industries came to a halt, which led to a drop in the requirement of raw materials. There was a huge supply-demand gap in the initial quarter of 2020. The prices dropped during this period. The raw material manufacturers decreased their production output due to force majeures and production halts as the demand decreased for end-products.

Architectural Metal Coatings Market Dynamics

Driver: Increasing use of architectural metal coatings for wall cladding and roofing of buildings

Metal architecture is growing in popularity for wall applications in residential and commercial buildings. Metal cladding has various benefits over traditional materials. One of the most noticeable benefits is that metal cladding is effective for roofing projects. Metal is generally chosen for slanted roofs to assure moisture and snow slide off. It is one of the most attractive and strongest types of cladding available in the market today. Even if metal roof cladding may cost more than other types of roofs, it is very durable. Another big benefit of using metal cladding is its easy installation. Metal cladding sheets are lightweight and large, making it effortless to cover large surfaces with a single sheet.

Restraint: Increasing demand for substitution products such as bio-based polymers

Polymers used in extrusion coatings are LDPE, EVA, and PP, among others. The processing of these polymers can lead to the release of harmful by-products, which could also lead to an increase in the carbon footprint associated with the process. These polymers are also made from non-renewable resources. Hence, newer bio-based polymers made from agricultural by-products or feedstocks, such as corn starch, wood cellulose, vegetable fats & oils, and wheat fiber, are being used as substitutes. Bio-based polymers are available in two varieties: natural bio-based polymers and synthetic bio-based polymers. These have various advantages over conventionally used polymers, and studies have suggested a reduction of 42% of the carbon footprint with their use.

Opportunity: Global players shifting production base to emerging economies

Developing economies such as Brazil, Russia, India, China, and South Africa (BRICS) are investing in infrastructural development and large-scale and long-term projects. The market in these economies is witnessing high growth compared to that in North America and Western Europe as the leading companies based in these regions are competing for growth opportunities in these developing countries. The market in Asia Pacific, is creating remarkable opportunities for companies such as Akzo Nobel, ArcelorMittal, and Tata Steel that are shifting their coil coating facilities from Sweden, France, Portugal, and the UK to countries such as China, Saudi Arabia, and India. Increasing demand and industrial growth in emerging economies are contributing to the expansion of the overall coatings market.

Challenge: Rising cost of raw materials

The lack of availability of key raw materials and substantial price increases are causing significant disruptions in the coatings industry. Solvents are a category where prices are going through the roof. Some examples in BCF’s (British Coatings Federation) monthly raw material prices survey show the largest increases in solvent prices in January 2021 versus the previous year- acetone (123%), n-butyl acetate (91%), IPA (41%), and n-butanol (54%). In January 2021, the British Coatings Federation issued a press release reporting acute price increases for epoxy resins, as much as 60% in Q3 of 2020. Other problems are affecting the market for polyester resins, such as factory closures in Sweden and Singapore as well as an explosion at a factory in China. There are also problems with bisphenol-A with stocks being diverted to polycarbonates.

Fluoropolymer is the fastest-growing resin type of the Architectural metal coatings market.

Fluorpolymer is the fastest-growing resin type of architectural metal coatings market in terms of both value and volume. The fluoropolymer architectural metal coatings have outstanding anti-weathering characteristics and are basically used on the exterior cladding of the metal for high-rise buildings and roofing for a wide range of commercial and residential applications. Fluoropolymers coatings come with a very long life of about 20– 40 year warranty, and some leading companies provide a lifetime warranty for the coatings. Thus, the long stability of fluoropolymer coatings is driving the architectural metal coatings market.

Curtain walls is the largest extrusion coating application of Architectural metal coatings market.

Curtain walls is the largest extrusion coating application as these are generally associated with large, multi-storey buildings. Curtain walls are architectural systems that are non-structural cladding systems for the external walls of buildings. Curtain walls separate the interior and the exterior; however, they only support their weight and the loads imposed on them (such as seismic loads and wind loads), which are transferred back to the primary building structure. This contradicts many forms of traditional construction where external walls are a fundamental part of the primary building structure. Commonly, curtain wall systems comprise a lightweight aluminum frame on which opaque or glazed infill panels can be fixed.

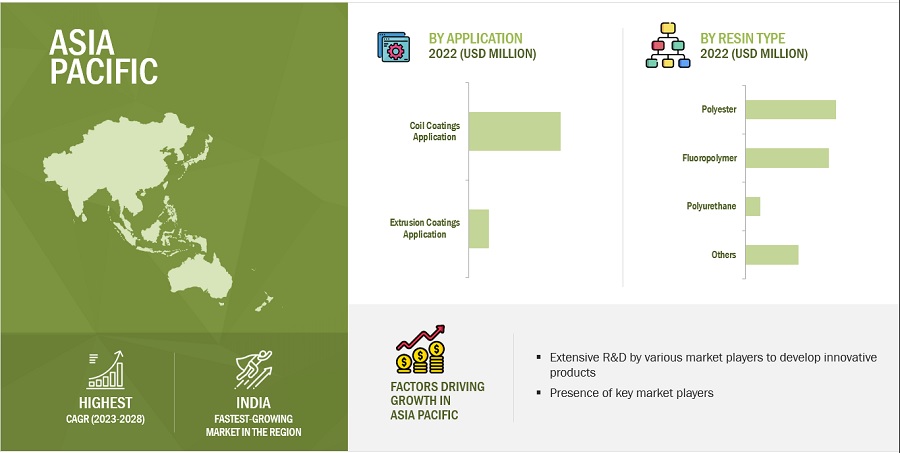

Asia Pacific is the largest architectural metal coatings market in the forecast period

Asia Pacific encompasses a diverse range of economies with different levels of economic development and multiple industries. The development of the market is mainly attributed to the high economic growth rate. Infrastructure project spending is expected to support construction industry growth in India. Increased focus on infrastructural development is offering support for the growth of the construction sector in the country. For developing the infrastructure in India, the governments of India and UAE made an agreement for the construction of IT towers, industrial parks, medical college, multipurpose towers, logistics centers, and a specialized hospital in Jammu & Kashmir.

To know about the assumptions considered for the study, download the pdf brochure

Architectural Metal Coatings Market Players

The key players operating in the market are The Sherwin Williams Company (US), PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), and Nippon Paint Holdings Co. Ltd. (Japan).

Architectural Metal Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 5.1 Billion |

|

Revenue Forecast in 2027 |

USD 6.4 Billion |

|

CAGR |

4.6% |

|

Years Considered for the study |

2019-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

The Sherwin Williams Company (US), PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), and Nippon Paint Holdings Co. Ltd. (Japan). A total of 21 players have been covered. |

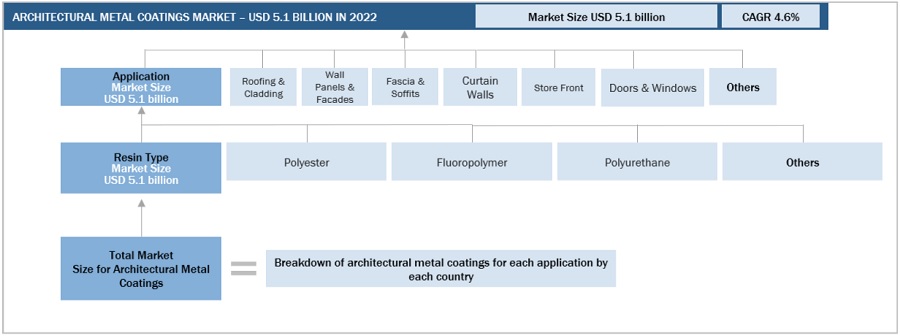

This research report categorizes the architectural metal coatings market based on Resin Type, Coil Coating Application, Extrusion Coating Application, and Region.

By Resin Type:

- Polyester

- Fluoropolymer

- Polyurethane

- Others

By Coil Coating Application:

- Roofing & Cladding

- Wall Panels & Facades

- Fascia & Soffits

- Others

By Extrusion Coating Application:

- Curtain Walls

- Store Front

- Doors & Windows

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2021, AkzoNobel launched CERAM-A-STAR 1050 Select, the leading coil coating technology with a standard color palette program to optimize business and make color complexity a thing of the past.

- In November 2020, Sherwin-Williams announces its new Fluropon Metal Trends Color Collection featuring eight curated color families: gold and brass, bronze, silver and nickel, blackened steel, copper, steel, zinc, and anodized. All of the colors in this collection mimic the classic esthetic of natural and anodized metals with the long-lasting performance of its flagship Fluropon architectural coating system for architectural metal products.

Frequently Asked Questions (FAQ):

What is the current size of the global architectural metal coatings market?

Architectural metal coatings market is projected to grow from USD 5.1 billion in 2022 and is projected to reach USD 6.4 billion by 2027, at a CAGR of 4.6%, between 2022 and 2027 period.

Who are the major players of Architectural metal coatings market?

Companies such as are The Sherwin Williams Company (US), PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), and Nippon Paint Holdings Co. Ltd. (Japan) are the major players in the market.

Which segment has the potential to register the highest market share for Architectural metal coatings market?

Curtain walls is the largest extrusion coating segment, in terms of both value and volume, in 2021.

Which is the fastest-growing region in the market?

Asia Pacific is projected to be the fastest-growing market for architectural metal coatings market during the forecast period. Despite the challenges in the economy, the construction industry of Asia Pacific recorded significant growth in 2021. The demand for residential construction remained strong in large economies such as China and India. Also, infrastructure construction experienced more important investments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSION

1.2.2 MARKET EXCLUSION

1.2.3 MARKET SCOPE

FIGURE 1 ARCHITECTURAL METAL COATINGS MARKET SEGMENTATION

1.2.4 REGIONS COVERED

1.2.5 YEARS CONSIDERED FOR STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 ARCHITECTURAL METAL COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 ARCHITECTURAL METAL COATINGS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RISK ANALYSIS ASSESSMENT

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.8 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 1 ARCHITECTURAL METAL COATINGS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 POLYESTER IS LARGEST RESIN SEGMENT OF ARCHITECTURAL METAL COATINGS MARKET

FIGURE 7 WALL PANELS & FACADES ACCOUNT FOR LARGEST SHARE IN COIL COATINGS APPLICATION SEGMENT OF ARCHITECTURAL METAL COATINGS MARKET

FIGURE 8 CURTAIN WALLS ACCOUNT FOR LARGEST SHARE IN EXTRUSION COATINGS APPLICATION SEGMENT OF ARCHITECTURAL METAL COATINGS MARKET

FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING ARCHITECTURAL METAL COATINGS MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN ARCHITECTURAL METAL COATINGS MARKET

FIGURE 10 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ARCHITECTURAL METAL COATINGS MARKET, BY RESIN TYPE

FIGURE 11 POLYESTER RESIN TO BE LARGEST SEGMENT

4.3 ARCHITECTURAL METAL COATINGS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 12 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.4 ASIA PACIFIC ARCHITECTURAL METAL COATINGS MARKET, BY RESIN TYPE AND KEY COUNTRIES, 2021

FIGURE 13 POLYESTER SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.5 GLOBAL ARCHITECTURAL METAL COATINGS MARKET, BY MAJOR COUNTRIES

FIGURE 14 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ARCHITECTURAL METAL COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth of construction industry in emerging economies

5.2.1.2 Increasing use of architectural metal coatings for wall cladding and roofing of buildings

5.2.1.3 Government investments in infrastructure projects

5.2.2 RESTRAINTS

5.2.2.1 Emergence of low-cost products

5.2.2.2 Increasing demand for substitute products such as bio-based polymers

5.2.3 OPPORTUNITIES

5.2.3.1 Global players shifting production base to emerging economies

5.2.3.2 Increasing demand for fluoropolymer coatings for architectural applications

5.2.4 CHALLENGES

5.2.4.1 Rising cost of raw materials

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 ARCHITECTURAL METAL COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS OF ARCHITECTURAL METAL COATINGS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 TRENDS AND FORECAST OF GDP

TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), 2020–2027

5.4.2 TRENDS AND FORECASTS OF GLOBAL CONSTRUCTION INDUSTRY

FIGURE 17 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.5 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.6 PRICING ANALYSIS

FIGURE 19 AVERAGE PRICE COMPETITIVENESS IN ARCHITECTURAL METAL COATINGS MARKET, BY REGION

5.7 ARCHITECTURAL METAL COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

TABLE 4 ARCHITECTURAL METAL COATINGS MARKET: SUPPLY CHAIN

FIGURE 20 ARCHITECTURAL METAL COATINGS MARKET: ECOSYSTEM

5.8 YC AND YCC SHIFT

5.9 TRADE ANALYSIS

TABLE 5 EXPORT DATA ON PAINTS AND VARNISHES, INCL. ENAMELS AND LACQUERS, BASED ON SYNTHETIC POLYMERS OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (USD THOUSAND)

TABLE 6 IMPORT DATA ON PAINTS AND VARNISHES, INCL. ENAMELS AND LACQUERS, BASED ON SYNTHETIC POLYMERS OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (USD THOUSAND)

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 21 NUMBER OF PATENTS PUBLISHED, 2017–2022

5.10.3 TOP JURISDICTION

FIGURE 22 PATENTS PUBLISHED BY JURISDICTIONS, 2017–2022

5.10.4 TOP APPLICANTS

FIGURE 23 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017–2022

TABLE 7 RECENT PATENTS BY OWNERS

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1: MAYNARD H. JACKSON JR. INTERNATIONAL TERMINAL HARTSFIELD-JACKSON INTERNATIONAL AIRPORT ATLANTA, GEORGIA

5.11.2 CASE STUDY 2: DAVID L. LAWRENCE CONVENTION CENTER PITTSBURGH, PENNSYLVANIA

5.11.3 CASE STUDY 3: DEL VALLE HIGH SCHOOL

5.12 TECHNOLOGY ANALYSIS

5.13 KEY CONFERENCES & EVENTS IN 2022-2024

TABLE 8 ARCHITECTURAL METAL COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 ARCHITECTURAL METAL COATINGS MARKET, BY RESIN TYPE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 24 POLYESTER REMAINS LARGEST RESIN TYPE FOR ARCHITECTURAL METAL COATINGS

TABLE 13 ARCHITECTURAL METAL COATINGS, BY RESIN TYPE, RATINGS

TABLE 14 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 15 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

6.2 POLYESTER

6.2.1 LARGEST SEGMENT SUPPORTED BY GROWING CONSTRUCTION INDUSTRY

TABLE 16 POLYESTER-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 17 POLYESTER-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

6.3 FLUOROPOLYMER

6.3.1 DEMAND FOR FLUOROPOLYMER-BASED COATINGS DRIVEN BY THEIR LONG STABILITY

TABLE 18 FLUOROPOLYMER-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 19 FLUOROPOLYMER-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

6.4 POLYURETHANE

6.4.1 GROWING CONSTRUCTION ACTIVITIES TO INCREASE DEMAND FOR POLYURETHANE RESIN

TABLE 20 POLYURETHANE-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 21 POLYURETHANE-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

6.5 OTHERS

TABLE 22 OTHER RESINS-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 23 OTHER RESINS-BASED ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

7 ARCHITECTURAL METAL COATINGS MARKET, BY COIL COATINGS APPLICATION (Page No. - 90)

7.1 INTRODUCTION

FIGURE 25 WALL PANELS & FACADES TO BE LARGEST COIL COATINGS APPLICATION

TABLE 24 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 25 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 26 COIL COATINGS: ARCHITECTURAL METAL COATINGS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 27 COIL COATINGS: ARCHITECTURAL METAL COATINGS MARKET, BY REGION, 2019–2027 (KILOTON)

7.2 ROOFING & CLADDING

7.2.1 INCREASE IN USE OF PRE-PAINTED METAL ROOFING DRIVING MARKET

TABLE 28 ROOFING & CLADDING: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 29 ROOFING & CLADDING: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

7.3 WALL PANELS & FACADES

7.3.1 WALL PANELS & FACADES HAVING LARGEST MARKET SHARE DUE TO THEIR POPULARITY IN COMMERCIAL AND INDUSTRIAL CONSTRUCTION

TABLE 30 WALL PANELS & FACADES: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 31 WALL PANELS & FACADES: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

7.4 FASCIA & SOFFITS

7.4.1 FASTEST-GROWING SEGMENT OF MARKET

TABLE 32 FASCIA & SOFFITS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 33 FASCIA & SOFFITS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

7.5 OTHERS

TABLE 34 OTHER APPLICATIONS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 35 OTHER APPLICATIONS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

8 ARCHITECTURAL METAL COATINGS MARKET, BY EXTRUSION COATINGS APPLICATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 26 CURTAIN WALLS TO BE LARGEST EXTRUSION COATINGS APPLICATION

TABLE 36 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 37 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 38 EXTRUSION COATINGS: ARCHITECTURAL METAL COATINGS MARKET, BY REGION, 2019–2027 (USD MILLION)

TABLE 39 EXTRUSION COATINGS: ARCHITECTURAL METAL COATINGS MARKET, BY REGION, 2019–2027 (KILOTON)

8.2 CURTAIN WALLS

8.2.1 LARGEST APPLICATION AS THESE ARE GENERALLY ASSOCIATED WITH LARGE, MULTI-STORY BUILDINGS

TABLE 40 CURTAIN WALLS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 41 CURTAIN WALLS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

8.3 STORE FRONT

8.3.1 FLUOROPOLYMER, POLYESTER, SILICONE MODIFIED POLYESTER, AND PVDF MAJORLY USED IN STORE FRONT

TABLE 42 STORE FRONT: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 43 STORE FRONT: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

8.4 DOORS & WINDOWS

8.4.1 HIGH DEMAND FOR COATINGS FOR DOORS & WINDOWS FROM ASIA PACIFIC REGION

TABLE 44 DOORS & WINDOWS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 45 DOORS & WINDOWS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

8.5 OTHERS

TABLE 46 OTHER APPLICATIONS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 47 OTHER APPLICATIONS: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

9 ARCHITECTURAL METAL COATINGS MARKET, BY REGION (Page No. - 107)

9.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO BE FASTEST-GROWING ARCHITECTURAL METAL COATINGS MARKET

TABLE 48 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

TABLE 49 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY REGION, 2019–2027 (KILOTON)

TABLE 50 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 51 ARCHITECTURAL METAL COATINGS MARKET SIZE, BY APPLICATION, 2019–2027 (KILOTON)

9.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SNAPSHOT

TABLE 52 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (KILOTON)

TABLE 54 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 56 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 58 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.2.1 CHINA

9.2.1.1 Significant increase in investments in real estate and non-residential construction to boost market

TABLE 60 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 61 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 62 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 63 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 64 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 65 CHINA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.2.2 OTHER ASIA PACIFIC

TABLE 66 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 67 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 68 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 69 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 70 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 71 OTHER ASIA PACIFIC: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.2.2.1 India

9.2.2.1.1 Number of government initiatives to fuel market

9.2.2.2 Japan

9.2.2.2.1 Steady growth in construction industry to propel market

9.2.2.3 South Korea

9.2.2.3.1 Significant expenditure on construction projects to boost demand for architectural metal coatings

9.2.2.4 Indonesia

9.2.2.4.1 High demand from construction industry to drive market

9.2.2.5 Rest of Asia Pacific

9.3 EUROPE

FIGURE 29 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SNAPSHOT

TABLE 72 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 73 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (KILOTON)

TABLE 74 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 75 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 76 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 77 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 78 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 79 EUROPE: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Low interest rates contributing to growth of construction sector

9.3.2 RUSSIA

9.3.2.1 Crisis with Ukraine likely to impact market

9.3.3 FRANCE

9.3.3.1 Annual population growth rate to generate demand for residential construction, leading to an increase in use of architectural metal coatings

9.3.4 UK

9.3.4.1 Growing construction sector to boost demand for architectural metal coatings

9.3.5 SPAIN

9.3.5.1 Recovery in construction industry to increase demand for architectural metal coatings

9.3.6 REST OF EUROPE

9.4 NORTH AMERICA

FIGURE 30 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (KILOTON)

TABLE 82 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 84 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 86 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.4.1 US

9.4.1.1 Presence of major manufacturers fueling growth of architectural metal coatings market

9.4.2 CANADA

9.4.2.1 Residential construction to be major contributor to growth of market

9.4.3 MEXICO

9.4.3.1 Mexican construction industry to be driven by investments in infrastructure, energy, and commercial construction projects

9.5 MIDDLE EAST & AFRICA

TABLE 88 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (KILOTON)

TABLE 90 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 92 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 94 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.5.1 SAUDI ARABIA

9.5.1.1 Increasing population and urbanization fueling market

9.5.2 SOUTH AFRICA

9.5.2.1 Substantial demand for architectural metal coatings witnessed in building projects

9.5.3 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

TABLE 96 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 97 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COUNTRY, 2019–2027 (KILOTON)

TABLE 98 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (USD MILLION)

TABLE 99 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY RESIN TYPE, 2019–2027 (KILOTON)

TABLE 100 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 101 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY COIL COATINGS APPLICATION, 2019–2027 (KILOTON)

TABLE 102 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (USD MILLION)

TABLE 103 SOUTH AMERICA: ARCHITECTURAL METAL COATINGS MARKET SIZE, BY EXTRUSION COATINGS APPLICATION, 2019–2027 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Easy availability of raw materials to propel architectural metal coatings market

9.6.2 ARGENTINA

9.6.2.1 Increasing population and improved economic conditions to fuel market

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 141)

10.1 INTRODUCTION

TABLE 104 OVERVIEW OF STRATEGIES ADOPTED BY KEY ARCHITECTURAL METAL COATING PLAYERS (2017–2022)

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PARTICIPANTS

10.2.4 PERVASIVE

FIGURE 31 ARCHITECTURAL METAL COATINGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ARCHITECTURAL METAL COATINGS MARKET

10.4 SME MATRIX, 2021

10.4.1 RESPONSIVE COMPANIES

10.4.2 PROGRESSIVE COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 DYNAMIC COMPANIES

FIGURE 33 ARCHITECTURAL METAL COATINGS MARKET: EMERGING COMPANIES’ COMPETITIVE LEADERSHIP MAPPING, 2021

10.5 COMPETITIVE BENCHMARKING

TABLE 105 ARCHITECTURAL METAL COATINGS MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 106 ARCHITECTURAL METAL COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 107 COMPANY EVALUATION MATRIX: ARCHITECTURAL METAL COATINGS

10.6 ARCHITECTURAL METAL COATINGS MARKET SHARE ANALYSIS

FIGURE 34 ARCHITECTURAL METAL COATINGS MARKET SHARE ANALYSIS, 2021

TABLE 108 ARCHITECTURAL METAL COATINGS MARKET SHARE, BY DEGREE OF COMPETITION, 2021

10.7 REVENUE ANALYSIS

FIGURE 35 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2017–2021

10.7.1 THE SHERWIN-WILLIAMS COMPANY

10.7.2 PPG INDUSTRIES, INC.

10.7.3 AKZONOBEL N.V.

10.7.4 AXALTA COATING SYSTEMS

10.7.5 NIPPON PAINT HOLDINGS CO. LTD.

10.8 COMPETITIVE SITUATION AND TRENDS

TABLE 109 ARCHITECTURAL METAL COATINGS MARKET: PRODUCT LAUNCHES, 2017–2022

TABLE 110 ARCHITECTURAL METAL COATINGS MARKET: DEALS, 2017–2022

11 COMPANY PROFILES (Page No. - 155)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 MAJOR COMPANIES

11.1.1 THE SHERWIN-WILLIAMS COMPANY

TABLE 111 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 36 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

TABLE 112 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

TABLE 113 THE SHERWIN-WILLIAMS COMPANY: DEALS

11.1.2 PPG INDUSTRIES INC.

TABLE 114 PPG INDUSTRIES INC.: COMPANY OVERVIEW

FIGURE 37 PPG INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 115 PPG INDUSTRIES INC.: PRODUCT LAUNCHES

TABLE 116 PPG INDUSTRIES INC.: DEALS

11.1.3 AKZONOBEL N.V.

TABLE 117 AKZONOBEL N.V.: COMPANY OVERVIEW

FIGURE 38 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 118 AKZONOBEL N.V.: PRODUCT LAUNCHES

11.1.4 AXALTA COATING SYSTEMS, LLC

TABLE 119 AXALTA COATING SYSTEMS, LLC: COMPANY OVERVIEW

FIGURE 39 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

TABLE 120 AXALTA COATING SYSTEMS, LLC: DEALS

11.1.5 NIPPON PAINT HOLDINGS CO. LTD.

TABLE 121 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY OVERVIEW

FIGURE 40 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY SNAPSHOT

TABLE 122 NIPPON PAINT HOLDINGS CO. LTD.: DEALS

11.1.6 BECKERS GROUP

TABLE 123 BECKERS GROUP: COMPANY OVERVIEW

FIGURE 41 BECKERS GROUP: COMPANY SNAPSHOT

TABLE 124 BECKERS GROUP: DEALS

11.1.7 KANSAI PAINT CO., LTD.

TABLE 125 KANSAI PAINTS CO., LTD.: COMPANY OVERVIEW

FIGURE 42 KANSAI PAINT CO. LTD.: COMPANY SNAPSHOT

11.1.8 WACKER CHEMIE AG

TABLE 126 WACKER CHEMIE AG: COMPANY OVERVIEW

FIGURE 43 WACKER CHEMIE AG: COMPANY SNAPSHOT

11.1.9 HEMPEL A/S

TABLE 127 HEMPEL A/S: COMPANY OVERVIEW

FIGURE 44 HEMPEL A/S: COMPANY SNAPSHOT

TABLE 128 HEMPEL A/S: PRODUCT LAUNCHES

TABLE 129 HEMPEL A/S: DEALS

11.1.10 NOROO COIL COATINGS CO., LTD.

TABLE 130 NOROO COIL COATINGS CO., LTD.: COMPANY OVERVIEW

FIGURE 45 NOROO COIL COATINGS CO., LTD.: COMPANY SNAPSHOT

11.2 OTHER COMPANIES

11.2.1 YUNG CHI PAINT & VARNISH MFG. CO., LTD.

TABLE 131 YUNG CHI PAINT & VARNISH MFG. CO., LTD.: COMPANY OVERVIEW

11.2.2 JOTUN A/S

TABLE 132 JOTUN A/S: COMPANY OVERVIEW

11.2.3 ALCEA S.P.A.

TABLE 133 ALCEA S.P.A.: COMPANY OVERVIEW

11.2.4 TITAN COATINGS, INC.

TABLE 134 TITAN COATINGS, INC.: COMPANY OVERVIEW

11.2.5 REPLASA ADVANCED MATERIALS, SA

TABLE 135 REPLASA ADVANCED MATERIALS, SA: COMPANY OVERVIEW

11.2.6 KCC CORPORATION

TABLE 136 KCC CORPORATION: COMPANY OVERVIEW

11.2.7 KFCC (JIANGSU COPRO NEW MATERIALS CO., LTD.)

TABLE 137 KFCC (JIANGSU COPRO NEW MATERIALS CO., LTD.): COMPANY OVERVIEW

11.2.8 KGE GROUP

TABLE 138 KGE GROUP: COMPANY OVERVIEW

11.2.9 CONTINENTAL COATINGS INC.

TABLE 139 CONTINENTAL COATINGS INC.: COMPANY OVERVIEW

11.2.10 JIANGSU LANLING CHEMICAL GROUP CO., LTD.

TABLE 140 JIANGSU LANLING CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

11.2.11 LINUO GROUP

TABLE 141 LINUO GROUP: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 203)

12.1 KEY INDUSTRY TAKEAWAYS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involves four major activities in estimating the current market size of architectural metal coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The architectural metal coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in application areas, such as coil coating and extrusion coating. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

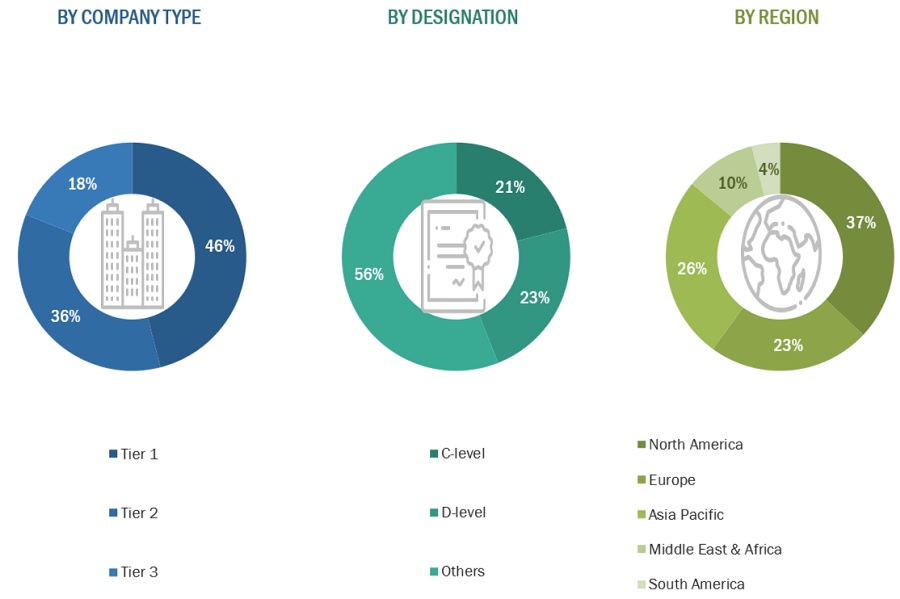

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the architectural metal coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Architectural Metal Coatings Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the architectural metal coatings market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size by resin type, extrusion coating application, and coil coating application

- To forecast the market size with respect to five main regions: Asia Pacific, Europe, North America, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launches, acquisitions, expansions, joint ventures, and partnerships, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1

Note: 1. Core competencies1 of companies are determined in terms of their key developments and key strategies adopted by them to sustain their position in the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the architectural metal coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Architectural Metal Coatings Market

I need architectural metal coatings market report for North American region.