Artificial Intelligence (chipsets) Market by Technology (Machine Learning, Natural Language Processing, Computer Vision), Function (Training, Inference), Hardware (Processor, Memory, Network), End-user Industry and Region - Global Forecast to 2028

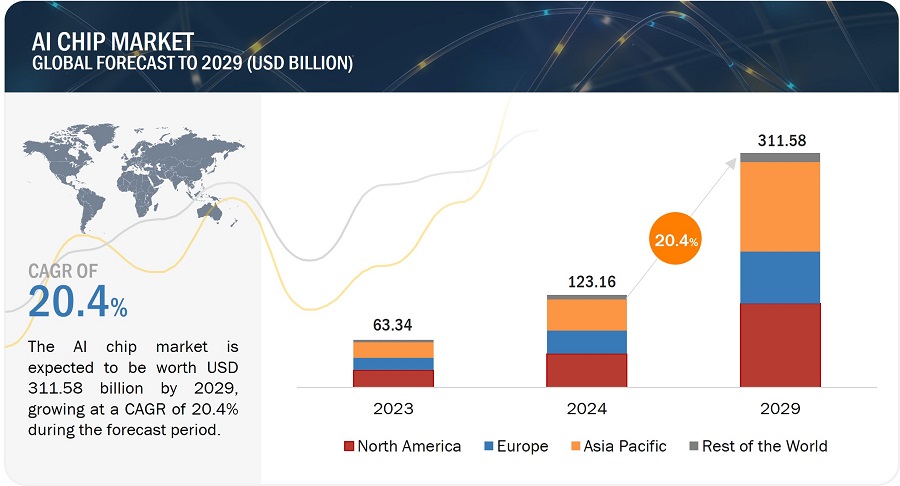

[245 Pages Report] The Global AI (chipsets) market is expected to be valued at USD 18.6 billion in 2023 and is projected to reach USD 64.5 billion by 2028; it is expected to grow at a

compound annual growth rate (CAGR) of 28.1% from 2023 to 2028.

AI has become a transformative technology across various industries. AI (chipsets) is purpose-built to deliver high-speed processing, low latency, and parallel computing capabilities, enabling faster and more responsive AI applications. Organizations are leveraging AI to automate processes, gain valuable insights from data, improve decision-making, enhance customer experiences, and drive innovation. As the adoption of AI continues to expand, there is a growing demand for specialized hardware that can efficiently process AI workloads, leading to the growth of the AI (chipsets) Industry.

Artificial Intelligence (chipsets) Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Intelligence (chipsets) market dynamics

Driver: The emerging trend of autonomous vehicles

Autonomous vehicles rely on a combination of sensors, cameras, radar, lidar, and other technologies to perceive their surroundings accurately. AI (chipsets) plays a crucial role in processing the vast amount of real-time data generated by these sensors. The chipsets accelerate perception tasks such as object detection, tracking, and classification, allowing the vehicle to make informed decisions based on the analyzed data. The need for powerful AI (chipsets) capable of handling complex perception tasks is essential to enable safe and efficient autonomous driving.

Autonomous vehicles employ sophisticated AI algorithms for mapping, path planning, and decision-making tasks. These algorithms require substantial computational power and efficient processing to handle driving lessons' complexity and real-time nature. AI (chipsets) is designed to deliver the high-performance computing needed to execute these complex algorithms efficiently, ensuring the smooth operation of autonomous vehicles.

Restraint: Lack of AI hardware experts and skilled workforce

Developing AI (chipsets) requires specialized knowledge and expertise in hardware design, architecture, and optimization for AI workloads. However, there is a need for more AI hardware experts who possess the necessary skills and experience to design and develop these chipsets. This expertise scarcity can slow the pace of innovation and product development in the AI (chipsets) market.

AI (chipsets) often incorporates specialized accelerators and custom architectures tailored for AI workloads. Designing and optimizing these components requires technical skills and knowledge that may be limited in the existing talent pool. The need for more skilled workers who can handle these specialized tasks can restrict the growth and development of AI (chipsets).

Opportunity: Surging demand for AI-based FPGA

FPGAs offer inherent flexibility and programmability compared to fixed-function ASICs (Application-Specific Integrated Circuits). This makes them suitable for handling diverse AI workloads and adapting to evolving AI algorithms. As AI models and algorithms continue to grow rapidly, the ability to reprogram and reconfigure FPGAs provides a competitive advantage in meeting the changing demands of AI applications.

Energy efficiency is critical in AI (chipsets), particularly in edge computing and IoT devices where power constraints exist. FPGAs can be power-optimized to deliver high performance per watt by leveraging parallel processing capabilities and fine-grained control over resources. The ability to optimize power consumption while maintaining performance is crucial for AI (chipsets), making AI-based FPGAs an attractive choice.

Challenge: Data privacy concerns in AI platforms

AI platforms often require access to large datasets, including personal and sensitive information. This raises concerns about data security and protection. If the data used for training AI models is not adequately safeguarded, it can be vulnerable to unauthorized access, breaches, or misuse. This can lead to privacy violations, identity theft, or other forms of data abuse.

AI platforms often involve the sharing of data across organizations or even international borders. However, data privacy regulations can vary across jurisdictions, making it challenging to ensure compliance and protect user privacy. Adhering to diverse legal frameworks while enabling data sharing and collaboration poses a significant challenge for AI (chipsets) companies.

Artificial Intelligence (chipsets) Market Ecosystem

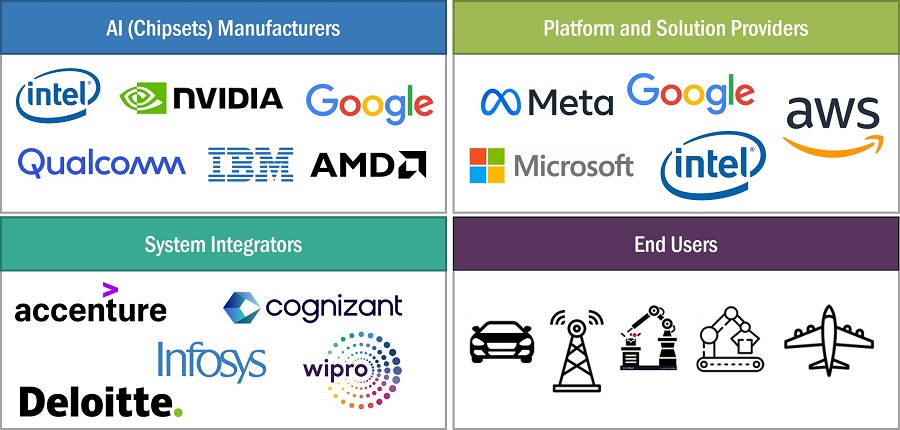

The Artificial Intelligence (chipsets) market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Intel Corporation from the US, Nvidia Corporation from the US, Qualcomm Technologies Incorporated from the US, Advanced Micro Devices, Inc. from the US, and Alphabet Inc. from the US.

Based on technology, the Artificial Intelligence (chipsets) market for Natural Language Processing to hold the second highest CAGR during the forecast period

The exponential growth of digital data, including unstructured data like text, presents both challenges and opportunities. NLP technology combined with AI (chipsets) can efficiently analyze and extract insights from vast amounts of textual data, enabling businesses to uncover valuable information, trends, and patterns hidden within text documents. Powered by AI (chipsets), NLP technology automates language-intensive tasks previously performed manually. This includes functions like document summarization, information extraction, sentiment analysis, and content generation. Automating these tasks improves efficiency, reduces errors, and frees up human resources for more complex and strategic work.

Based on hardware, the processor segment to hold the highest market share from 2023 to 2028

AI applications often require high-performance computing capabilities to handle massive amounts of data and complex computations. General-purpose processors, such as CPUs (Central Processing Units), may not be optimized for the specific requirements of AI workloads. Specialized processors, such as Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and Neural Processing Units (NPUs), are designed to deliver parallel processing and optimized performance for AI tasks. The growing demand for high-performance computing in AI applications is driving the growth of the AI (chipsets) processor market.

Training function for Artificial Intelligence (chipsets) market to grow at the highest CAGR during the forecast period.

The demand for AI-driven applications and services is rising across various industries, such as healthcare, finance, e-commerce, autonomous vehicles, and more. Training AI models requires substantial computational power, and AI (chipsets) provide the specialized hardware needed to accelerate and optimize the training process.

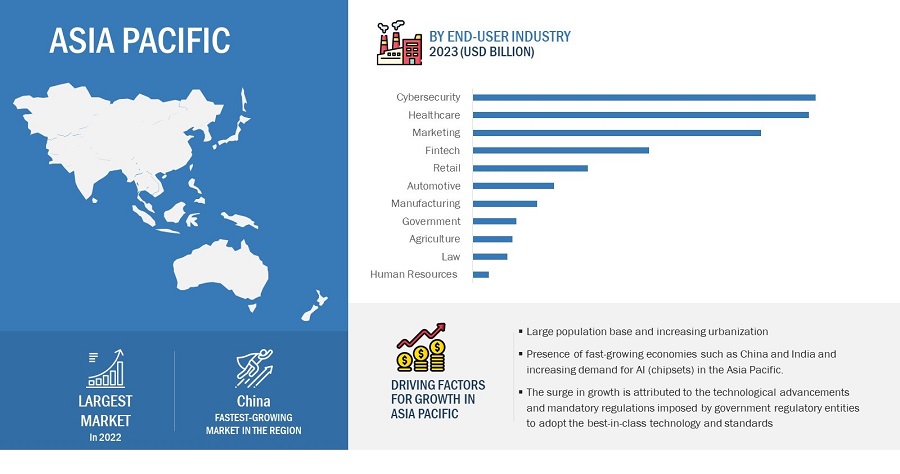

Cybersecurity industry for Artificial Intelligence (chipsets) market to hold the second largest market share from 2023 to 2028

Cybersecurity threats are becoming more sophisticated and complex, requiring advanced technologies to detect and mitigate them effectively. AI (chipsets) offers the computational power and efficiency needed to analyze large volumes of data, identify patterns, and detect anomalies in real-time, helping to enhance cybersecurity defenses. AI (chipsets) enables automation in cybersecurity processes, such as malware detection, intrusion detection, and log analysis. By automating these tasks, AI-powered cybersecurity systems can free up human resources, reduce response times, and improve efficiency in identifying and mitigating threats.

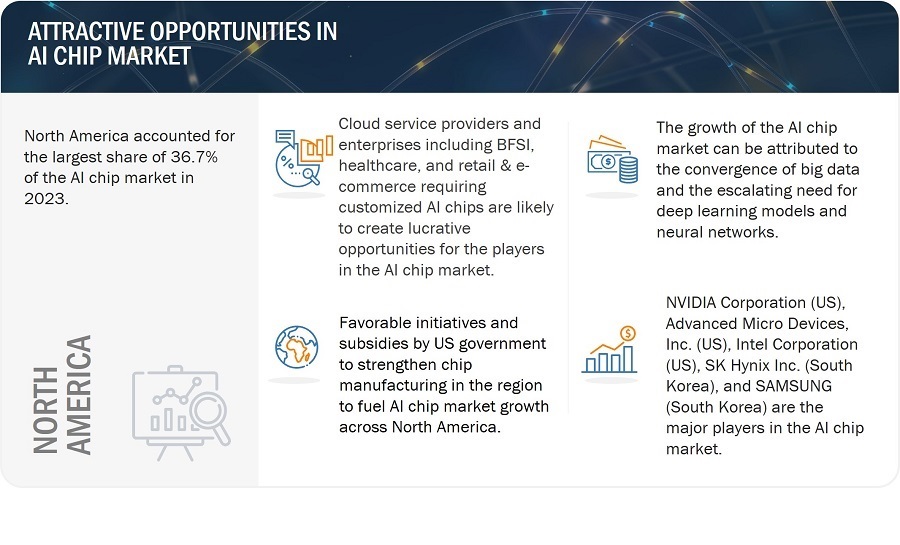

Artificial Intelligence (chipsets) market in Asia Pacific to hold the highest CAGR during the forecast period

Asia Pacific is witnessing a rapid digital transformation across various sectors, including healthcare, finance, manufacturing, retail, and transportation. This transformation is driving the adoption of AI technologies, leading to an increased demand for AI (chipsets) to power AI applications and services.

Asia Pacific has a vibrant AI startup ecosystem, with emerging companies focused on developing AI applications and technologies. These startups are driving the demand for AI (chipsets), seeking high-performance and energy-efficient hardware solutions to power their AI innovations.

Various industries in Asia Pacific, including healthcare, finance, automotive, retail, and agriculture, are increasingly adopting AI technologies to improve operational efficiency, enhance customer experiences, and drive innovation. AI (chipsets) is critical in powering AI applications in these industries, contributing to the market’s growth.

Artificial Intelligence (chipsets) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top AI (chipsets) Companies - Key Market Players

The Artificial Intelligence (chipsets) companies is dominated by players such as Intel Corporation (US), Nvidia Corporation (US), Qualcomm Technologies Incorporation (US), Micron Technology, Inc. (US), Advanced Micro Devices, Inc. (US), and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Technology, Function, Hardware, and End-User Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Intel Corporation (US), Nvidia Corporation (US), Qualcomm Technologies Inc. (US), Micron Technology, Inc. (US), Advanced Micro Devices, Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Apple Inc. (US), IBM (US), Alphabet, Inc. (US), Huawei Technologies (China). (Total of 25 players are profiled) |

Artificial Intelligence (chipsets) Market Highlights

The study categorizes the Artificial Intelligence (chipsets) market based on the following segments:

|

Segment |

Subsegment |

|

By technology |

|

|

By function |

|

|

By hardware |

|

|

By end-user |

|

|

By Region |

|

Recent Developments

- In November 2022, Nvidia announced a collaboration with Microsoft. As a part of this collaboration, companies will build one of the most powerful AI supercomputers in the world, powered by Microsoft Azure’s advanced supercomputing infrastructure combined with NVIDIA GPUs, networking, and a whole stack of AI software to help enterprises train, deploy and scale AI, including oversized, state-of-the-art models.

- In October 2022, Intel and HashiCorp joined forces to aid customers in enhancing their cloud migration efforts. By leveraging Intel's Xeon Scalable accelerators, developers will receive Sentinel policy recommendations from HashiCorp's products, enabling them to optimize workloads and maximize their cloud strategy's cost-effectiveness, performance, and security.

- In October 2022, NSF announced a partnership with Micron to support semiconductor design and manufacturing workforce development.

- In October 2022, Samsung announced the launch of its latest LPDDR5X DRAM with the industry’s fastest speed of 8.5 gigabits per second.

- In April 2022, AMD signed a definitive agreement to acquire Pensando Systems Inc. (US) to add chips and software to route information inside computer systems and expand its data center solutions capabilities.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the Artificial Intelligence (chipsets) market?

Some of the major driving factors for the growth of this market include Increasing data traffic and the need for high computing power, the Emerging trend of autonomous vehicles, the Increasing adoption of industrial robots, and the Rising focus on parallel computing in AI data centers. Moreover, Surging demand for AI-based FPGA and the Growing adoption of AI-based solutions for defense systems are some of the critical opportunities for the Artificial Intelligence (chipsets) market.

Which region is expected to hold the highest market share?

North America will dominate the market share in 2023, showcasing strong demand for Artificial Intelligence (chipsets) in the region. AI adoption across industries, technological advancements, vital AI research and development, the presence of tech giants, and investments and funding are key factors driving the growth of the region's Artificial Intelligence (chipsets) market.

Who are the leading players in the global Artificial Intelligence (chipsets) market?

Companies such as Intel Corporation (US), Nvidia Corporation (US), Qualcomm Technologies Incorporation (US), Micron Technology, Inc. (US), and Advanced Micro Devices, Inc. (US) are the leading players in the market. Additionally, these companies gain a competitive edge in the market by employing various strategies, including introducing new products, undertaking developments, forming partnerships, making acquisitions, and fostering collaborations. These approaches provide them with distinct advantages over other companies operating in the same industry.

What are some of the technological advancements in the market?

AI (chipsets) is becoming more powerful, with higher computational capabilities and larger memory capacities. This allows for faster processing of AI workloads and the ability to handle more complex and extensive models, enabling advanced AI applications and deep learning tasks. AI (chipsets) is adopting mixed-precision computing techniques, which combine high-precision and low-precision calculations for improved performance and efficiency. AI (chipsets) can achieve faster processing speeds and reduced energy consumption by utilizing lower precision for specific calculations while maintaining accuracy. Additionally, Manufacturers are developing power-efficient designs that can handle intensive AI computations while minimizing power consumption. This enables AI applications to run on devices with limited power resources, such as smartphones, IoT, and edge devices.

What is the impact of the global recession on the market?

The demand for AI chipsets and related components in end-use markets relies heavily on operators and organizations investing in consulting, rebuilding, or upgrading their networking systems. Economic downturns and reduced capital spending can negatively impact the sales, profitability, and adoption of AI chipsets, including CPUs, GPUs, ASICs, FPGAs, storage, and memory devices, across consumer, commercial, and industrial environments. The continuation of existing capital spending cannot be guaranteed, and there is a risk of decreased spending during recessions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the artificial intelligence (chipsets) market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Association for the Advancement of Artificial Intelligence (AAAI) |

https://www.aaai.org/ |

|

European Association for Artificial Intelligence (EurAI) |

https://www.eurai.org/ |

|

AI Association of Patent and Trademark Attorneys (AIPAT) |

https://www.aipat.jp/ |

|

Data Science Association |

https://www.datascienceassn.org/ |

|

International Association for Artificial Intelligence and Law (IAAIL) |

https://www.iaail.org/ |

|

JELIA - European Conference on Logics in Artificial Intelligence |

https://www.jelia.eu/ |

|

German Research Center for Artificial Intelligence (DFKI) |

https://www.dfki.de/ |

|

Swedish Artificial Intelligence Society |

https://www.sais.se/ |

|

RoboHow (Europe Union) |

https://robohow.eu/ |

|

Chinese Association for Artificial Intelligence |

https://caai.cn/ |

Primary Research

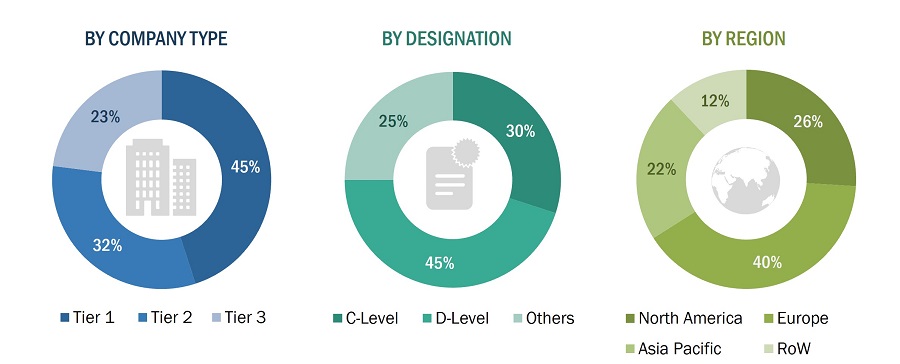

Extensive primary research was conducted after gaining knowledge about the current scenario of the Artificial Intelligence (chipsets) market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Artificial Intelligence (chipsets) market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

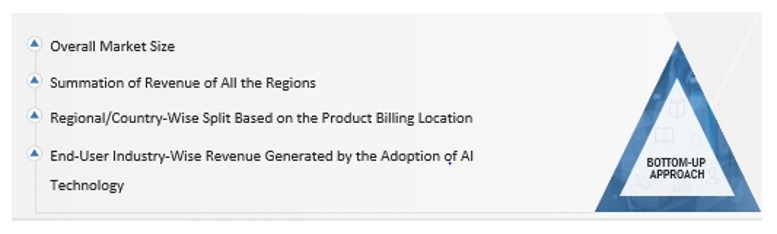

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the Artificial Intelligence (chipsets) market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-user industries using or expected to implement AI (chipsets)

- Analyzing each end-user industry and application, along with the significantly related companies and hardware providers, and identifying service providers for the implementation of AI

- Estimating the AI (chipsets) market for end-user industries

- Understanding the demand generated by companies operating across different end-use applications

- Tracking the ongoing and upcoming implementation of projects based on AI by end-user industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of AI technology-based products designed and developed by end-user industries. This information would help analyze the breakdown of the scope of work carried out by each significant company in the AI (chipsets) market

- Arriving at the market estimates by examining AI (chipsets) companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the forecasts at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

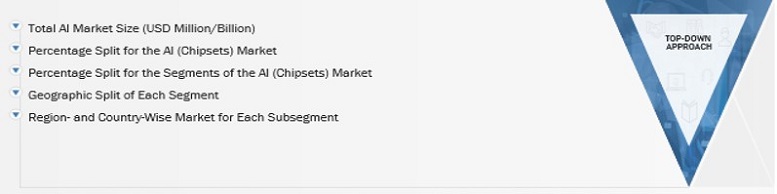

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures in various end-user industries' ecosystems. Additionally, listing key developments, analyzing updated technology and software in the marketplace, as well as evaluating the market by further splitting it into various AI technologies

- Building and developing the information related to the market revenue generated by critical AI (chipsets) manufacturers.

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of AI (chipsets) products in various end-user industries.

- Estimating geographic splits using secondary sources based on multiple factors, such as the number of players in a specific country and region, the type of AI (chipsets), and the level of services offered in end-user industries

- The impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

AI chipset, also known as an AI processor or neural processing unit (NPU), is a specialized hardware component designed to accelerate the processing of artificial intelligence (AI) workloads. These workloads involve computationally intensive tasks such as machine learning, deep learning, natural language processing, and computer vision.

AI (chipsets) is used in various applications, including self-driving cars, robotics, image and speech recognition, and virtual assistants. As the demand for AI processing continues to grow, chip manufacturers are developing increasingly powerful and specialized AI (chipsets) to meet the needs of the industry.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- Semiconductor product designers and fabricators

- Application providers

- AI solution providers

- AI platform providers

- Business providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To define, describe, and forecast the AI (chipsets) market by value based on technology, hardware, function, and end-user industry.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To forecast the size and market segments of the AI (chipsets) market by volume based on hardware.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a market value chain analysis.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To explore the opportunities in the market for stakeholders and describe the market’s competitive landscape.

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the AI (chipsets) market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Further country-level analysis of the Artificial Intelligence (chipsets) market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the Artificial Intelligence (chipsets) market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence (chipsets) Market