Artificial Intelligence in Healthcare Market by Offering (Hardware, Software, Services), Technology (Machine Learning, NLP, Context-aware Computing, Computer Vision), Application, End User and Region - Global Forecast to 2028

Updated on : April 24, 2023

AI in Healthcare Market Size

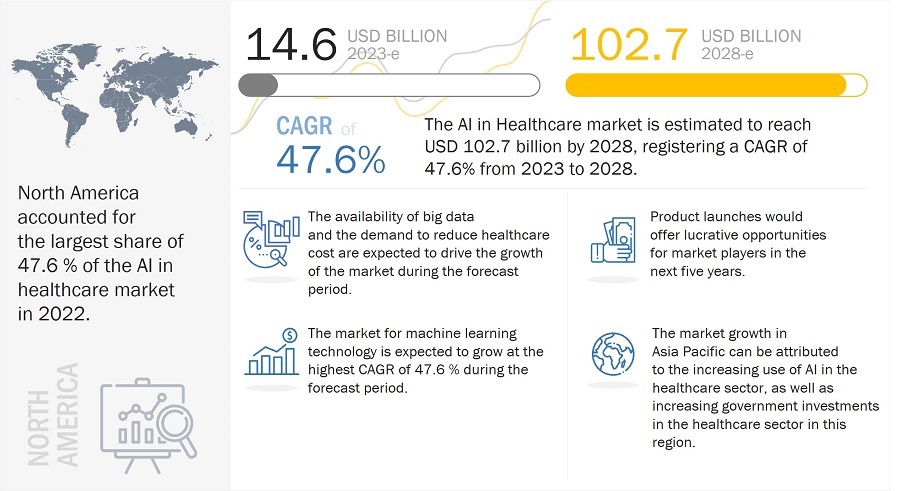

[300 Pages Report] The AI in Healthcare Market is projected to grow from USD 14.6 Billion in 2023 to USD 102.7 Billion by 2028; it is expected to grow at a CAGR of 47.6% during the forecast period.

AI in Healthcare Market Share

Rising need for improvised healthcare services due to the disparity between patients and the healthcare workforce will drive the AI in Healthcare market growth in coming years. Increasing efforts to reduce healthcare costs and the generation of large and complex healthcare datasets have allowed the development of AI in Healthcare, further strengthening the market growth. Integrating AI technology in healthcare operations enhances data-driven support to medical professionals. Using data and algorithms, AI efficiently identifies the pattern and delivers automated insights for applications such as managing medical records, health monitoring, digital consultation, and treatment design.

The objective of the report is to define, describe, and forecast the AI in Healthcare industry based on offering, technology, application, end user, and region.

Global AI in Healthcare Market Forecast

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Healthcare Market Dynamics

Drivers: Generation of large and complex healthcare datasets

In the healthcare industry, large and complex data, often called big data, comprises information generated from clickstream and web & social media interactions; readings from medical devices, such as sensors, electrocardiogram (ECGs), X-rays, and pulse oximeters; healthcare claims and other billing records; and Electronic medical records (EMRs), prescriptions, and biometric data, among other sources. Big data and emerging analytical solutions have grown exponentially in sophistication and adoption in the last decade as healthcare providers turned to Electronic Health Records (EHRs), digitized laboratory slides, and high-resolution radiology images. With the increasing digitization and the adoption of information systems in the healthcare industry, big data is generated at various stages of the care delivery process. As a result, healthcare is one of the top five big data industries, especially in the US. Increasing government initiatives to accelerate AI innovations in healthcare will further boost the market growth in the US. In June 2021, the National Science Foundation (NSF) and White House Office of Science and Technology Policy (OSTP) announced the establishment of the National Artificial Intelligence (AI) Research Resource Task Force, which will work on the roadmap of the expansion of educational tools and critical resources that will spur AI innovation nationwide.

Restraints: Lack of skilled AI workforce and ambiguous regulatory guidelines for e-medical software

AI is a complex system, and for developing, managing, and implementing AI systems, companies require a workforce with specific skill sets. For instance, personnel dealing with AI systems should be aware of technologies such as cognitive computing, ML and machine intelligence, deep learning, and image recognition. In addition, integrating AI solutions into existing systems is a challenging task requiring extensive data processing for replicating human brain behavior. Even a minor error can result in system failure or can adversely affect the desired result. Furthermore, the absence of professional standards and certifications in AI/ML technologies is restraining the growth of AI. Additionally, AI service providers are facing challenges regarding deploying/servicing their solutions at their customer sites. This is because of the lack of technology awareness and fewer AI experts.

Opportunities: Growing potential for AI based tools for elderly care

With the growth in the geriatric population, the incidence of various age-related diseases is expected to increase worldwide. To counter this and efficiently handle the growing burden on their respective healthcare systems, governments in several countries are increasingly focusing on adopting novel technologies. AI is one such technology that provides enhanced services, such as real-time patient data collection and monitoring for emergency care, as well as offers preventive healthcare recommendations. Moreover, AI-based tools can use health and wellness services, such as mobile applications, to monitor the movement and activities of ss. Also, the efficient implementation of in-home health monitoring and health information access, personalized health management, and the use of treatment devices (such as better hearing aids and visual assistive devices) and physical assistive devices (such as intelligent walkers) are possible with the implementation of AI-based tools. Thus, there is a growing interest in the use of AI-based technologies to support the physical, emotional, social, and mental health of the elderly across the world.

Challenges: Lack of curated healthcare data

The performance of AI algorithms majorly depends on the quality and availability of data. Therefore, limited access to data in healthcare acts as a barrier for the AI in Healthcare market. As medical data is more often difficult to access and collect, medical professionals do not prefer the data collection process as it might interrupt their workflow. Thereby, the collection of data is often incomplete.

Electronic healthcare record (EHR) systems are mostly incompatible with government-certified providers offering their services to various healthcare facilities and hospitals. Therefore, it results in the collection of data that is localized instead of integrating patients’ medical history across healthcare providers. Without high-quality and large data sets, it isn't easy to build useful AI algorithms.

Services to witness highest demand in the AI in Healthcare market

AI is a complex method as it requires the implementation of sophisticated algorithms for a wide range of applications in patient data and risk analysis, lifestyle management and monitoring, precision medicine, in-patient care and hospital management, medical imaging and diagnostics, drug discovery, and virtual assistants, among others. Hence, for the successful deployment of AI, there is a need for deployment and integration, and support and maintenance services.

Most companies that manufacture and develop AI systems and software provide both online and offline support, depending on the applications. The companies operating in the AI services in Healthcare market include Microsoft (US), Johnson & Johnson Services, Inc. (US), Medtronic (US), Siemens Healthineers (Germany), and Koninklijke Philips (Netherlands). These companies offer assistance for the installation, training, and support of AI systems, along with online assistance and post-maintenance of software, and provide required services.

Medical Imaging & diagnostics segment to create lucrative growth opportunities in AI in Healthcare Market during the forecast period

Multiple leading technology players and healthcare companies are developing AI solutions for applications in healthcare. Philips Healthcare (Netherlands), Agfa-Gevaert (Belgium), GE Company (US), and Siemens Healthineers (Germany) have started integrating AI into their medical imaging software systems. For instance, in collaboration with NVIDIA Corporation, GE has 500,000 imaging devices in use worldwide. These devices use AI to speed up the process of analyzing CT scans with improved accuracy. Siemens Healthineers’ AI-Rad Companion Chest CT is a software assistant that uses AI for CT.

The software measures and identifies organs and lesions in thorax CT scans, and automatically generates a quantitative report to help increase the efficiency and correct diagnosis in radiology. Higher automation, increased productivity, standardized processes, and more accurate diagnosis can be achieved by integrating AI in traditional medical imaging methods. The computational capabilities can process images with greater speed and accuracy at scale.

Hospitals & Healthcare Providers to cater majority of the share in AI in Healthcare Market

In care provider settings, AI can be utilized to predict and prevent readmissions, manage chronic diseases, drive clinical decision support tools, and improve operations. AI-based tools, such as voice recognition software and clinical decision support systems, help streamline workflow processes in hospitals, lower cost, improve care delivery, and enhance the patient experience. Clinical decision support systems (CDSS) were one of the first successful applications of AI, focusing primarily on the diagnosis of a patient's condition based on symptoms and demographic information.

Hospitals in the US and Europe have begun using AI to assist hospitalized patients. These tools enable patients to request periodic check-ups on the status of their recovery. There is a significant increase in the adoption of technologies, especially Electronic Medical Records (EMR) systems, by healthcare organizations, thus generating ample patient data.

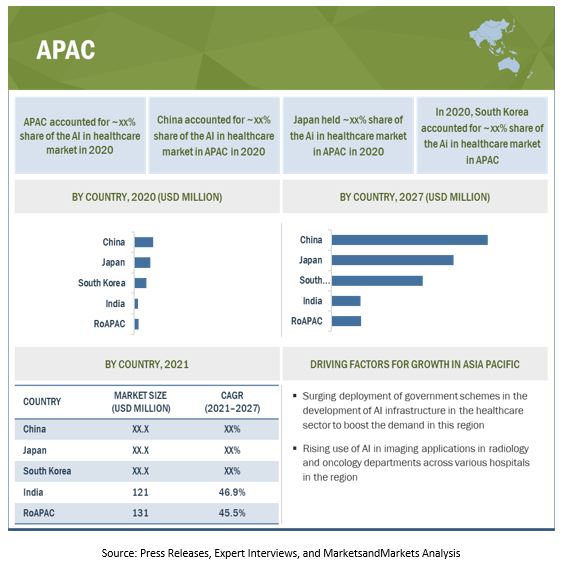

AI in Healthcare market to witness the highest demand in North American region

The US is considered one of the major contributors to the North American market as it is one of the leading countries in the world to imbibe AI technology across its healthcare system. Cross-industry participation in the healthcare domain, along with a significant increase in venture capital investments, is encouraging several new players to enter the AI in Healthcare market in the region. For instance, in October 2021, Navina (US) a startup company developing AI-driven platform for primary care, secured USD 15 million in its series A funding round. To date, the company has raised USD 22 million. These investments help the company to accelerate its development in AI and ML technology.

Artificial Intelligence in Healthcare Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the AI in Healthcare companies include Intel Corporation (US), Koninklijke Philips N.V., (Netherlands), Microsoft (US), Siemens Healthineers (Germany), and NVIDIA Corporation (US) among others.

AI in Healthcare Market Report Scope

|

Report Metric |

Details |

| Market size value in 2023 | USD 14.6 Billion |

| Market size value in 2028 | USD 102.7 Billion |

| CAGR (2023-2028) | 47.6% |

|

Years Considered |

2023–2028 |

|

On Demand Data Available |

2030 |

|

Forecast Period |

2022–2028 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Technology, Application, End User and Geography |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Total 32 Major Players profiled are covered in the report. |

Artificial Intelligence in Healthcare Market Highlights

This report categorizes the AI in Healthcare market based on offering, technology, application, end user, and geography.

|

Segment |

Subsegment |

|

AI in Healthcarer Market, by Offering: |

|

|

AI in Healthcare Market, by Technology: |

|

|

AI in Healthcare Market, by Application: |

|

|

AI in Healthcare Market, by End User: |

|

|

AI in Healthcare Market, by Region: |

|

Recent Developments

- In January 2023, Amazon Web Services, Inc. announced its Strategic Collaboration Agreement (SCA) with Slalom, LLC to develop vertical solutions and accelerators on AWS for their customers in healthcare, life sciences, financial services, energy, and media and entertainment industries.

- In November 2022, GE Healthcare at Radiological Society of North America’s (RSNA) 2021 Annual Meeting unveiled its 60 innovative technology solutions for diagnostics, patient screening, guidance, therapy planning, and monitoring. With this, the company has accelerated its healthcare innovation with artificial intelligence (AI) and digital solutions.

- In November 2022, Google Inc. announced its partnership with iCAD, which operates in mammography artificial intelligence (AI). Through this partnership, the company will integrate its AI technology into iCAD’s breast imaging AI solutions portfolio. This strategic initiative will help the company advance its innovation and expand mammography technology through cloud-based solutions.

- In October 2022, Google Inc announced the launch of its new Medical Imaging Suite, which helps in the accessibility and interoperability of radiology and other imaging data. It is designed to offer flexible options for cloud on-prem or edge deployment, which allows the organizations to achieve diverse sovereignty, privacy requirements, and data security

Frequently Asked Questions (FAQ):

What is AI in Healthcare Market Revenue Streams?

The AI in Healthcare Market refers to the use of artificial intelligence (AI) technology in healthcare applications. This includes using AI for diagnosis and treatment, drug discovery, medical research, personalized medicine, and administrative tasks. Revenue impact is anticipated to be USD 102.7 Billion by 2028; growing at a CAGR of 47.6%.

What are the benefits of AI in healthcare?

AI has the potential to improve healthcare outcomes, reduce costs, and increase efficiency. For example, AI can help clinicians make more accurate diagnoses, identify high-risk patients, and develop personalized treatment plans. It can also automate administrative tasks, such as scheduling appointments and managing medical records.

What are the challenges of implementing AI in healthcare?

Challenges of implementing AI in healthcare include concerns about data privacy and security, lack of interoperability among healthcare systems and data sources, and the need for regulatory oversight to ensure that AI systems are safe and effective. Additionally, there may be resistance from clinicians and patients who are not familiar with AI technology.

Who are the key players in the AI in healthcare market?

Some of the key players in the AI in healthcare market include Intel Corporation, Koninklijke Philips N.V., Microsoft, Siemens Healthineers, and NVIDIA Corporation among others.

What is the future outlook for the AI in healthcare market?

The AI in healthcare market is expected to continue to grow rapidly in the coming years, driven by increasing demand for AI-powered solutions to improve healthcare outcomes and reduce costs. The development of new AI technologies and the increasing availability of healthcare data are also expected to drive market growth. However, challenges related to data privacy and security, regulatory oversight, and clinician and patient acceptance of AI technology will need to be addressed in order to realize the full potential of AI in healthcare.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

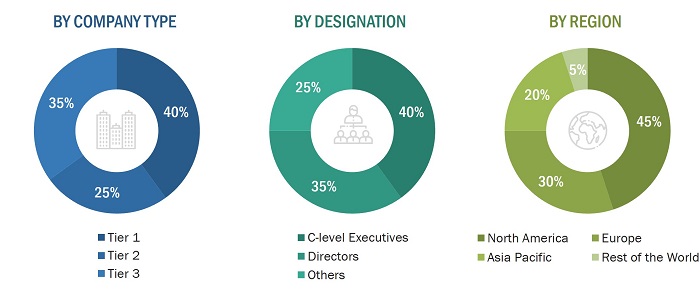

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the AI in Healthcare market. This research study involved the extensive use of secondary sources, directories, and databases (Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource) for identifying and collecting information useful for this extensive technical, market-oriented, and commercial market. In-depth interviews have been conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. Key players in market have been identified through secondary research, and their market rankings have been determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In secondary research, various sources have been referred to for identifying and collecting information important for this study. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, AI in healthcare products-related journals, and certified publications; articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research was conducted after understanding and analyzing the AI in Healthcare market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, APAC, and RoW. RoW comprises the Middle East, Africa, and South America. Approximately 25% of the primary interviews were conducted with the demand-side vendors and 75% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 80% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to AI in Healthcare market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

AI in Healthcare Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Outlook and Growth Artificial Intelligence in Healthcare and AI in medicine market Approach

Artificial intelligence (AI) has the potential to transform healthcare in numerous ways, from improving diagnostics and patient outcomes to reducing costs and increasing efficiency. The use of AI in healthcare is expected to grow significantly in the coming years, as the technology becomes more advanced and more widely adopted.

One of the areas where AI is already making a big impact is in medical imaging. AI algorithms can analyze medical images such as X-rays, CT scans, and MRIs to identify patterns and detect abnormalities. This can help doctors make more accurate diagnoses and develop more effective treatment plans. Another area where AI is being used in healthcare is in drug discovery. AI algorithms can help identify potential drug candidates and simulate how they will interact with the human body, which can speed up the drug development process and reduce costs.

AI is also being used to improve patient care by analyzing large amounts of data from electronic health records (EHRs) to identify patterns and trends. This can help doctors make more informed decisions about patient care, and can also help healthcare organizations identify areas where they can improve care and reduce costs. The report cites the increasing adoption of AI by healthcare organizations, the growing volume of healthcare data, and the need to reduce healthcare costs as the key drivers of this growth.

Artificial Intelligence in Healthcare market is going to impact the ai in medicine market?

The Artificial Intelligence (AI) in Healthcare market and the AI in Medicine market are closely related, as both are focused on the application of AI technologies to improve healthcare outcomes. The AI in Healthcare market is expected to have a significant impact on the AI in Medicine market, as it will drive the adoption of AI technologies across the healthcare industry.

One of the key factors driving the growth of market is the increasing availability of healthcare data, including electronic health records, medical imaging data, and genomic data. These large datasets are a rich source of information that can be used to train AI algorithms to identify patterns and make predictions. As the AI in Healthcare market continues to grow, there will be an increasing demand for AI solutions that can analyze these large datasets and provide actionable insights.

The growth of market is also expected to have an impact on the development of new AI technologies for medicine. The healthcare industry is a major source of demand for AI technologies, and the challenges faced by healthcare organizations, such as the need to improve patient outcomes and reduce costs, are driving the development of new AI solutions.

Some futuristic growth use-cases of AI in medicine market?

The potential use-cases of AI in medicine are vast and varied. As the technology continues to evolve and become more advanced, we can expect to see even more innovative applications in the future. Here are some futuristic growth use-cases of AI in medicine:

-

Precision Medicine: AI has the potential to revolutionize the practice of precision medicine, which involves tailoring medical treatments to individual patients based on their unique characteristics. AI can help identify genetic markers that are associated with particular diseases or conditions, and can also analyze large datasets to identify patterns that can be used to develop personalized treatment plans.

-

Virtual Healthcare Assistants: AI-powered virtual assistants can help patients manage their health and wellness by providing personalized advice and guidance. These assistants can be integrated with wearable devices and other health monitoring tools to provide real-time feedback and advice based on the patient's health data.

-

Predictive Analytics: AI can be used to analyze large datasets to predict future health outcomes, such as the likelihood of developing a particular disease or condition. This can help healthcare providers identify high-risk patients and develop proactive treatment plans.

-

Automated Diagnosis: AI can help automate the process of diagnosis by analyzing medical images, lab test results, and other health data to identify patterns and detect abnormalities. This can help healthcare providers make more accurate and efficient diagnoses.

-

Robot-Assisted Surgery: AI-powered robots can assist surgeons during complex procedures by providing real-time feedback and guidance. These robots can also be programmed to perform routine procedures, freeing up surgeons to focus on more complex cases.

-

Drug Discovery: AI can help accelerate the drug discovery process by analyzing large datasets of molecular and genetic data to identify potential drug candidates. This can help reduce the time and cost associated with developing new drugs.

Industries That Will Be Impacted in the Future by AI in medicine

AI in medicine has the potential to impact a wide range of industries in the future, beyond just the healthcare and pharmaceutical industries. Here are some of the industries that are likely to be impacted by AI in medicine:

-

Insurance: The use of AI in medicine can help insurance companies more accurately assess risk and develop personalized insurance plans based on an individual's health status.

-

Agriculture: AI can be used to develop more efficient farming practices and to analyze crop data to predict and prevent crop diseases.

-

Automotive: AI can be used to develop better safety systems in cars, including driver monitoring and collision avoidance systems that can detect and respond to medical emergencies.

-

Retail: AI can be used to analyze shopping data to develop personalized wellness plans for customers based on their health history and preferences.

-

Education: AI can be used to develop personalized learning plans for students with medical conditions, and to analyze data on student health to identify patterns and trends.

-

Government: AI can be used to develop more effective public health strategies and to analyze data on population health to identify areas of need.

Report Objectives

- To describe and forecast the artificial intelligence (AI) in Healthcare market, in terms of value, by offering, technology, application, and end user

- To describe and forecast the AI in Healthcare market, in terms of value, for four main regions— North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a comprehensive overview of the value chain of market ecosystem

- To provide a detailed impact of the recession on market, its segments, and the market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the AI in Healthcare ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the AI in Healthcare market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence in Healthcare Market

Interested about how AI will change the treatment process and its benefits.

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI?

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI?

We have specific interests in global AI in healthcare market and the US AI in healthcare market. Any further details related to market size of AI for early disease detection (for global and USA) would be appreciated.

I am looking to purchase this report to see the implications of AI on the workforce in Norway.

I am interested in understanding the market size and related insights on computer-assisted physician documentation (CAPD), clinical documentation improvement (CDI), computer-assisted coding (CAC), ambient voice and voice assistants, NLP, and machine learning for clinical, operational, and financial healthcare scenarios in AI in healthcare.

I am an automation enthusiast and would like to understand the impact of AI in healthcare. Could you provide me some brochure and sample to get into details.

I am conducting a research project on AI in healthcare as a part of my MHA/MBA marketing course. Could you share some relevant information in the form of sample brochure and estimated cost of the report, post discount mentioned on the website?

We are redeveloping our chart for Artificial Intelligence in Healthcare Market. Does your report covers regional market insights.