Artificial Intelligence in Manufacturing Market by Offering (Hardware, Software, and Services), Industry, Application, Technology (Machine Learning, Natural Language Processing, Context-aware Computing, Computer Vision), & Region (2022-2027)

Updated on : May 10, 2023

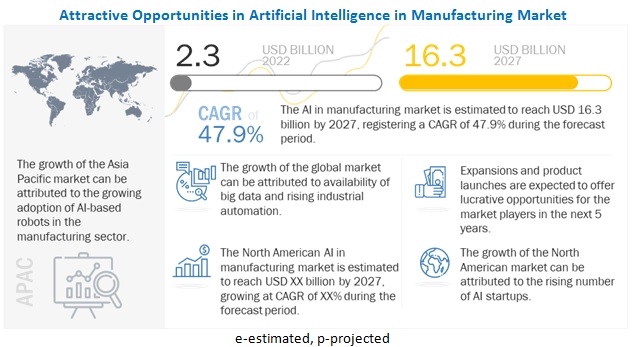

[270 Pages Report] The global Artificial intelligence in manufacturing market in terms of revenue was estimated to be worth USD 2.3 billion in 2022 and is poised to reach USD 16.3 billion by 2027, growing at a CAGR of 47.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

Factors such increasing awareness about passenger and vehicle safety are driving the growth of the AI in manufacturing industry during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Intelligence in Manufacturing Market Dynamics

Driver: Evolving industrial IoT and automation technologies

Industrial Internet of Things (IIoT) makes industrial processes efficient, productive, and innovative by enabling an architecture that provides real-time information about operational and business systems. The data that is derived from the IoT devices need to be converted into instructions that would instruct machines to perform specific activities. These instructions are designed by an AI system to learn human behavior through deep learning, context awareness, and natural language processing (NLP). AI-based systems take lesser time and can work continuously without error. As a result, manufacturing efficiency improves, which further helps in business growth. General Motors Company (US), a US-based car manufacturer, has installed industrial IoT devices in its automobile manufacturing plant to improve the body painting quality of cars. The system receives data through the IoT devices installed in the painting area in the factory.

These IoTs check the humidity level in the plant and transfer the data to an AI-based system. If the humidity level is not favorable for painting, the AI-based system moves the cars to other processes such as engine inspections, body parts checking, and electrical wearing. In this scenario, the actionable step is executed by the AI-based system, whereas the data is provided by the Industrial IoT. Similarly, Siemens (Germany) uses AI-based customized solutions for the autonomous optimization of gas turbines, monitoring of smart grids, and predictive maintenance of industrial facilities and harbors. IoT solutions are installed in different places in the plant to capture data. The AI-based system can significantly reduce the emission of toxic nitrogen oxides without affecting the performance of the turbine or shortening its service life. These solutions boost the productivity and efficiency of the manufacturing equipment. Therefore, IIoT plays a pivotal role in the adoption of AI-based solutions in the manufacturing industry.

Restraint: Reluctance among manufacturers to adopt AI-based technologies

AI in manufacturing market technologies offer manufacturers the tools that would help them better in predictive maintenance and machinery inspection processes. However, manufacturers are reluctant to adopt new technologies, mainly AI-based solutions, in their costly machines or equipment. Any mismanagement could add to the costs. Furthermore, many manufacturers are doubtful about the capabilities of AI-based solutions in terms of the accuracy of the maintenance and inspection processes. Considering these factors, it is slightly difficult to convince the manufacturers and make them understand that AI-based solutions are cost-efficient, effective, and safe. However, manufacturers are now increasingly accepting the potential benefits of AI-based solutions and the spectrum of applications they serve.

Moreover, the lack of adoption among small and medium-sized businesses (SMB), and slow return on investments are further waning the adoption of AI systems, especially among technologically advancing countries such as India and Brazil. The high cost of deployment of AI systems and limited awareness result in skepticism about the technology in manufacturers. Additionally, the lack of robust indigenous infrastructure, and lack of emphasis and investment in AI technology and infrastructure are further restricting the adoption of AI among SMBs.

Opportunity: Growing focus on boosting operational efficiency of manufacturing plants

AI-based predictive analytics can be used to minimize outages and improve plant utilization by anticipating demand and taking appropriate steps to match production with demand. AI-based algorithms help in reducing the underproduction materials to streamline supplies and maintain optimum inventory by integrating data with analytics. This AI-based inventory management eventually establishes a new pricing strategy for manufacturers. Global manufacturers have several plants in different parts of the world. An AI-enabled manufacturing plant can strategically connect all other plants in different locations, and if there is a production or demand fluctuation in one plant, the operations can be shifted to other facilities as needed by using an AI-based production planning application and routing algorithm. AI-based production planning can be used for a range of functions, such as optimizing supplies, preventive maintenance, and reduction of aftermarket costs. At present, manufacturers are increasingly focusing on boosting operational efficiency and are likely to adopt AI-based technology in their manufacturing plants, thereby helping in the growth of the AI in manufacturing market.

Challenge: Limited availability of skilled workforce, especially in developing countries

For developing, managing, and implementing AI systems that are complex in nature, companies require a workforce with certain skill sets. Personnel dealing with AI systems should be aware of technologies such as cognitive computing, ML, machine intelligence, deep learning, and image recognition. Scarcity of skilled workforce is a significant challenge in emerging economies as compared with AI-advanced countries such as the US, the UK, Japan, and Germany. A move toward AI-enabled factory floor would require manufacturers to reskill their existing workforce and develop, build, and train AI systems. In addition, the integration of AI solutions into existing systems is a difficult task, requiring extensive data processing for replicating a human brain behavior. Even a minor error can result in system failure or can adversely affect the desired result. Furthermore, the absence of professional standards and certifications in AI/ML technologies is restraining the growth of AI. Additionally, AI service providers are facing challenges with regard to deploying/servicing their solutions at their customers’ sites. This is because of the lack of technology awareness and expertise.

Semiconductor & Electronics Industry to register highest CAGR during forecast period

In the semiconductor & electronics industry, AI is used for production planning, quality control, and material movement. Implementing AI-based solutions is expected to benefit manufacturers in optimizing the production cost, technology implementation, and integration of components. The manufacturing of electronics equipment is a complex process and requires manufacturing-related data on a real-time basis. This data helps in planning and maintaining the production process efficiently. Thus, AI solutions help the companies operating in the semiconductor & electronics equipment industry to analyze the data collected at all points to aid improved decision-making for the manufacturing process and register the highest growth potential.

Software segment to hold largest share of AI in manufacturing market during the forecast period

Software itself can run specific applications without using any additional hardware. The AI-related additional hardware is needed in the case of faster calculations in manufacturing, e.g., in predictive analysis and machine inspection, quality control, and fieldwork. However, for the rest of the applications, the software can run the entire algorithm. The software is developed using AI technologies, such as machine learning, semi-supervised learning, supervised learning, unsupervised learning, natural language processing, computer vision, and deep learning. Rising demand for software, especially in predictive maintenance and quality control applications, and widening application scope of AI in the manufacturing sector are the prime factors fueling the growth of the market for AI platforms.

Rising adoption of AI-based quality control systems to drive market growth

AI-based quality control applications enable plant operators to quickly detect property variations during the production time. These AI-based applications of quality control rely on 3- and 2-dimensional data, which is collected by a laser-based aggregate scanning system that converts data into digital images. These wavelet-based features are used as inputs to an artificial neural network, which is used to assign a predefined class to the sample. This quality control helps a plant operator to verify the quality of products. In case there is a problem with the product, the AI-based system separates the object from the conveyer belt. This AI-based quality control system is widely used in the pharmaceutical, food & beverage, and semiconductor industries. Mostly machine learning, computer vision, and context-aware computing technologies are used in quality control applications in a manufacturing plant.

Presence of world-leading manufacturing companies boosts AI in manufacturing market growth in Japan

Japan has launched an initiative—Industrial Value Chain Initiative—to explore advanced technologies. Mitsubishi Electric, Fujitsu, Nissan Motor, and Panasonic are among the top companies that cater to major businesses in the electric, IT, machinery, and automobile fields. Connected machines and transport robots are being used on the shop floor of companies such as Toyota for a long time. Moreover, the ministries have been promoting IT projects in the country. Japan is strong in information and communication technology, manufacturing processes, automotive and machinery industries, automatization and robot technologies and electronic parts. Furthermore, Japan-based companies Fujitsu (Japan) and Hitachi (Japan) are renowned providers of big data and cybersecurity solutions to diverse sectors, ranging from agriculture to manufacturing and services. This has resulted in the adoption of AI in manufacturing industries in Japan. Japan established a phased development plan for AI to develop and apply data-powered AI in various fields; to build an AI ecosystem by connecting different fields.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The AI in manufacturing companies is dominated by a few globally established players such as NVIDIA (US), IBM (US), Intel (US), Siemens (Germany), General Electric (US), Google (US), Microsoft Corporation (US), and Micron Technology (US).

AI in Manufacturing Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.3 Billion in 2022 |

| Projected Market Size | USD 16.3 Billion in 2027 |

| Growth Rate | CAGR of 47.9% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Evolving Industrial IOT and Automation Technologies |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Software Segment |

| Highest CAGR Segment | Semiconductor & Electronics Industry Segment |

The study categorizes the head-up display market based on offering, technology, application, industry and geography.

By Offering:

- Hardware

- Software

- Services

By Technology:

- Machine Learning

- Natural Language Processing

- Context-aware Computing

- Computer Vision

By Application:

- Predictive maintenance and machinery inspection

- Inventory optimization

- Production planning

- Field services

- Quality control

- Cybersecurity

- Industrial robots

- Reclamation

By Industry:

- Automotive

- Energy & Power

- Semiconductor & Electronics

- Pharmaceutical

- Heavy Metals & Machine Manufacturing

- Food & Beverage

- Others (textile, aerospace and mining)

By Region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In January 2022, NVIDIA launched GeForce RTX 3050, a product that brings next-generation graphics and AI to games. The RTX line-up uses ray tracing technology for real-time, cinematic quality rendering. The product also features deep learning super sampling and boosts frame rate.

- In December 2021, IBM launched IBM Z and Cloud Modernization Center a digital platform with a wide range of tools and resources, as well as ecosystem partners, which will help users accelerate the modernization of data, processes, and applications in an open hybrid cloud architecture.

- In September 2021, Siemens launched Industrial Edge Ecosystem a vendor-independent and digital, cross manufacturer app store. It is an IT platform that enables the scalable development of IT technologies and apps in the production environment.

Frequently Asked Questions (FAQ):

What is the current size of the global head-up display market?

The artificial intelligence in manufacturing market is projected to grow from USD 2.3 billion in 2022 to USD 16.3 billion by 2027; it is expected to grow at a CAGR of 47.9% from 2022 to 2027.

Why artificial intelligence is used manufacturing ?

Artificial intelligence (AI) in manufacturing is defined as the replication of human intelligence used to communicate with machines, extract data from fields, analyze the extracted data, and perform required tasks. Tasks ranging from material movement to machinery inspection and self-diagnostics, which are usually performed by human labor or robots with the help of human intelligence, can be performed by AI-based systems in less time, at lower cost, and without human intervention..

What is the impact of covid-19 on the artificial intelligence in manufacturing market for automotive industry?

Vehicle production has suffered in leading countries across the world owing to supply shortages and production suspensions caused by the spread of the COVID-19. The demand for new vehicles in pandemic-affected countries has dropped and is still not expected to pick up owing to the imposition of lockdowns to contain the spread of the virus. Global vehicle production fell by 20–25% in 2020 owing to the progression of COVID-19. This, in turn, has hampered the growth of the head-up display market worldwide. However, global automobile production is expected to increase from 2022 onward, but the demand side is expected to fully recover by 2027.

However, currently, it is unclear what impact the current semiconductor shortage would have on the artificial intelligence in manufacturing market. As a result, the global semiconductor shortage is expected to be a key challenge for the growth of the artificial intelligence in manufacturing market for automotive industry.

What are the technological trends going in the artificial intelligence in manufacturing market?

AI in manufacturing market has been segmented based on technology into machine learning (ML), natural language processing (NLP), context-aware computing, and computer vision. ML is further classified into deep learning, supervised learning, unsupervised learning, reinforcement learning, and others (semi-supervised learning and federated learning).

Which are the major companies in the artificial intelligence in manufacturing market?

NVIDIA (US), IBM (US), Intel (US), Siemens (Germany), General Electric (US), Google (US), Microsoft Corporation (US), and Micron Technology (US) are the players dominating the global artificial intelligence in manufacturing market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 ARTIFICIAL INTELLIGENCE IN MANUFACTURING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION OF AI IN MANUFACTURING MARKET (BOTTOM-UP)

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION OF AI IN MANUFACTURING MARKET (TOP-DOWN)

2.2.2.1 Approach for capturing the market share by top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

2.5.1 AI IN MANUFACTURING MARKET: LIMITATIONS AND ASSOCIATED RISKS

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

2.6 LIMITATIONS

FIGURE 7 LIMITATIONS FOR RESEARCH STUDY

TABLE 3 MARKET FORECASTING METHODOLOGY ADOPTED FROM 2022 TO 2027

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 SOFTWARE SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

FIGURE 9 MACHINE LEARNING SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

FIGURE 10 PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION APPLICATION SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

FIGURE 11 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

3.1 COVID-19 IMPACT ANALYSIS: AI IN MANUFACTURING MARKET

FIGURE 13 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR AI IN MANUFACTURING MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN AI IN MANUFACTURING MARKET

FIGURE 14 RISING INDUSTRIAL AUTOMATION TO DRIVE MARKET GROWTH

4.2 AI IN MANUFACTURING MARKET, BY OFFERING

FIGURE 15 SOFTWARE SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

4.3 AI IN MANUFACTURING MARKET, BY TECHNOLOGY

FIGURE 16 MACHINE LEARNING SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET FROM 2022 TO 2027

4.4 ASIA PACIFIC AI IN MANUFACTURING MARKET, BY INDUSTRY AND COUNTRY

FIGURE 17 AUTOMOTIVE SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC AI IN MANUFACTURING MARKET IN 2021

4.5 AI IN MANUFACTURING MARKET, BY COUNTRY

FIGURE 18 SPAIN TO REGISTER HIGHEST CAGR IN AI IN MANUFACTURING MARKET BETWEEN 2022 AND 2027 (IN TERMS OF VALUE)

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INCREASINGLY LARGE AND COMPLEX DATASETS AND INDUSTRY TRENDS SUCH AS IOT AND AUTOMATION ARE DRIVING MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Intensifying need to handle increasingly large and complex dataset

5.2.1.2 Evolving industrial IoT and automation technologies

5.2.1.3 Improving computing power of AI chipsets

5.2.1.4 Increasing venture capital investments in manufacturing AI space

5.2.2 RESTRAINTS

5.2.2.1 Reluctance among manufacturers to adopt AI-based technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Growing focus on boosting operational efficiency of manufacturing plants

5.2.3.2 Application of AI for intelligent business processes

5.2.3.3 Adoption of automation technologies to mitigate effects of COVID-19

5.2.4 CHALLENGES

5.2.4.1 Limited availability of skilled workforce, especially in developing countries

5.2.4.2 Concerns regarding data privacy

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 4 IMPACT OF EACH FORCE ON AI IN MANUFACTURING MARKET

5.4 PRICING ANALYSIS

FIGURE 20 ASP OF PROCESSORS, 2018–2021 (USD)

TABLE 5 ASP RANGE OF PROCESSOR TYPES, 2018–2021 (USD)

5.5 TRADE ANALYSIS

5.5.1 EXPORT SCENARIO OF AUTOMATIC DATA PROCESSING MACHINES

TABLE 6 AUTOMATIC DATA PROCESSING MACHINES EXPORT, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

5.5.2 IMPORT SCENARIO OF AUTOMATIC DATA PROCESSING MACHINES

TABLE 7 IMPORT DATA: AUTOMATIC DATA PROCESSING MACHINES, BY KEY COUNTRY, 2016–2020 (USD THOUSAND)

5.6 TARIFFS AND REGULATORY LANDSCAPE

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 AI ECOSYSTEM

FIGURE 21 AI IN MANUFACTURING MARKET: ECOSYSTEM ANALYSIS

TABLE 12 AI IN MANUFACTURING MARKET ECOSYSTEM

5.8 AI IN MANUFACTURING MARKET: CASE STUDIES

5.8.1 SIEMENS GAMESA USES FUJITSU’S AI SOLUTION TO ACCELERATE INSPECTION OF TURBINE BLADES

5.8.2 VOLVO USES MACHINE LEARNING-DRIVEN DATA ANALYTICS FOR PREDICTING BREAKDOWN AND FAILURES

5.8.3 ROLLS-ROYCE IS USING MICROSOFT CORTANA INTELLIGENCE FOR PREDICTIVE MAINTENANCE

5.8.4 PAPER PACKAGING FIRM USED SIGHT MACHINE’S ENTERPRISE MANUFACTURING ANALYTICS TO IMPROVE PRODUCTION

5.9 PATENT ANALYSIS

FIGURE 22 NUMBER OF PATENTS GRANTED PER YEAR OVER LAST 10 YEARS

TABLE 13 TOP 20 PATENT OWNERS

FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 14 IMPORTANT PATENT REGISTRATIONS, 2015–2020

5.10 REVENUE SHIFT IN AI IN MANUFACTURING MARKET

5.11 REGULATORY STANDARDS

5.11.1 STANDARDS IN ITS/C-ITS

TABLE 15 SECURITY AND PRIVACY STANDARDS DEVELOPED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

5.12 SUPPLY CHAIN ANALYSIS

FIGURE 24 AI IN MANUFACTURING MARKET VALUE CHAIN

5.13 TECHNOLOGY ANALYSIS

5.14 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 16 AI IN MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022–2023)

5.15 KEY STAKEHOLDER AND BUYING PROCESS AND/OR BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.15.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 18 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 ARTIFICIAL INTELLIGENCE (AI) IN MANUFACTURING MARKET, BY OFFERING (Page No. - 91)

6.1 INTRODUCTION

FIGURE 27 GLOBAL AI IN MANUFACTURING HARDWARE MARKET, 2020–2027 (MILLION UNITS)

FIGURE 28 SOFTWARE SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

TABLE 19 AI IN MANUFACTURING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 20 AI IN MANUFACTURING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 21 AI IN MANUFACTURING MARKET, BY HARDWARE, 2018–2021 (USD MILLION)

TABLE 22 AI IN MANUFACTURING MARKET, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 23 AI IN MANUFACTURING MARKET FOR HARDWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 AI IN MANUFACTURING MARKET FOR HARDWARE, BY REGION, 2022–2027 (USD MILLION)

6.2.1 PROCESSOR

6.2.1.1 High parallel processing capabilities and computing power to fuel adoption of processors

FIGURE 29 GPU SUB-SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 25 AI IN MANUFACTURING MARKET, BY PROCESSOR, 2018–2021 (USD MILLION)

TABLE 26 AI IN MANUFACTURING MARKET, BY PROCESSOR, 2022–2027 (USD MILLION)

6.2.1.1.1 Microprocessor unit (MPU)

6.2.1.1.2 Graphics processing unit (GPU)

6.2.1.1.3 Field programmable gate array (FPGA)

6.2.1.1.4 Application-specific integrated circuit (ASIC)

6.2.2 MEMORY

6.2.2.1 Rising high-bandwidth memory requirements to drive market growth

6.2.3 NETWORK

6.2.3.1 Growing use of ethernet adaptors and interconnects to drive market growth

6.3 SOFTWARE

TABLE 27 AI IN MANUFACTURING MARKET FOR OFFERING, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 28 AI IN MANUFACTURING MARKET FOR OFFERING, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 29 AI IN MANUFACTURING MARKET FOR SOFTWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 AI IN MANUFACTURING MARKET FOR SOFTWARE, BY REGION, 2022–2027 (USD MILLION)

6.3.1 AI SOLUTIONS

6.3.1.1 Rising use of list processing and programming in logic languages to fuel adoption of AI solutions

TABLE 31 AI IN MANUFACTURING MARKET FOR SOLUTIONS, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 32 AI IN MANUFACTURING MARKET FOR SOLUTIONS, BY DEPLOYMENT, 2022–2027 (USD MILLION)

6.3.1.2 On-premise

6.3.1.3 Cloud

6.3.2 AI PLATFORM

6.3.2.1 Natural language processing, image recognition, voice recognition, and predictive analytics features to fuel adoption of AI platforms

TABLE 33 AI IN MANUFACTURING MARKET FOR SOFTWARE, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 34 AI IN MANUFACTURING MARKET FOR SOFTWARE, BY PLATFORM, 2022–2027 (USD MILLION)

6.3.2.2 Machine learning framework

6.3.2.3 Application program interface (API)

6.4 SERVICES

TABLE 35 AI IN MANUFACTURING MARKET, BY SERVICES, 2018–2021 (USD MILLION)

TABLE 36 AI IN MANUFACTURING MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 37 AI IN MANUFACTURING MARKET FOR SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 AI IN MANUFACTURING MARKET FOR SERVICES, BY REGION, 2022–2027 (USD MILLION)

6.4.1 DEPLOYMENT AND INTEGRATION

6.4.1.1 Increasing demand for deployment and integration as a key service for configuring AI systems in manufacturing to drive market growth

6.4.2 SUPPORT AND MAINTENANCE

6.4.2.1 Growing demand for support and maintenance service to eliminate issues related to operations after installation and training to drive market growth

7 ARTIFICIAL INTELLIGENCE (AI) IN MANUFACTURING MARKET, BY TECHNOLOGY (Page No. - 106)

7.1 INTRODUCTION

FIGURE 30 MACHINE LEARNING SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET BETWEEN 2022 AND 2027

TABLE 39 AI IN MANUFACTURING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 40 AI IN MANUFACTURING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 MACHINE LEARNING

7.2.1 ADVANCEMENTS IN DEEP LEARNING AND SUPERVISED LEARNING TECHNOLOGIES TO DRIVE MARKET GROWTH

TABLE 41 AI IN MANUFACTURING MARKET FOR MACHINE LEARNING, BY TYPE, 2018–2021 (USD MILLION)

TABLE 42 AI IN MANUFACTURING MARKET FOR MACHINE LEARNING, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 AI IN MANUFACTURING MARKET FOR MACHINE LEARNING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 AI IN MANUFACTURING MARKET FOR MACHINE LEARNING, BY APPLICATION, 2022–2027 (USD MILLION)

7.2.2 DEEP LEARNING

7.2.2.1 Rapid adoption of robotics in manufacturing industry to drive growth of AI in manufacturing market for deep learning

7.2.3 SUPERVISED LEARNING

7.2.3.1 Image recognition and predictive and predictive analytics applications to play major role in market growth

7.2.4 REINFORCEMENT LEARNING

7.2.4.1 Ability of reinforcement learning to maximize performance of systems and software to drive market growth

7.2.5 UNSUPERVISED LEARNING

7.2.5.1 Capability of unsupervised learning to find patterns in large datasets to drive market growth

7.2.6 OTHERS

7.3 NATURAL LANGUAGE PROCESSING

7.3.1 DEVELOPMENTS IN NATURAL LANGUAGE PROCESSING FOR REAL-TIME TRANSLATION TO DRIVE MARKET GROWTH

TABLE 45 AI IN MANUFACTURING MARKET FOR NATURAL LANGUAGE PROCESSING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 AI IN MANUFACTURING MARKET FOR NATURAL LANGUAGE PROCESSING, BY APPLICATION, 2022–2027 (USD MILLION)

7.4 CONTEXT-AWARE COMPUTING

7.4.1 DEVELOPMENT OF SOPHISTICATED HARD AND SOFT SENSORS TO BOOST GROWTH OF CONTEXT-AWARE COMPUTING SEGMENT

TABLE 47 AI IN MANUFACTURING MARKET FOR CONTEXT-AWARE COMPUTING, BY TYPE, 2018–2021 (USD MILLION)

TABLE 48 AI IN MANUFACTURING MARKET FOR CONTEXT-AWARE COMPUTING, BY TYPE, 2022–2027 (USD MILLION)

TABLE 49 AI IN MANUFACTURING MARKET FOR CONTEXT-AWARE COMPUTING, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 AI IN MANUFACTURING MARKET FOR CONTEXT-AWARE COMPUTING, BY APPLICATION, 2022–2027 (USD MILLION)

7.5 COMPUTER VISION

7.5.1 CAPABILITY OF COMPUTER VISION TO ANALYZE INFORMATION OF DIFFERENT GEOMETRIC SHAPES, VOLUMES, AND PATTERNS AND PROVIDE VISUAL FEEDBACK TO USERS TO FUEL MARKET GROWTH

TABLE 51 AI IN MANUFACTURING MARKET FOR COMPUTER VISION, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 AI IN MANUFACTURING MARKET FOR COMPUTER VISION, BY APPLICATION, 2022–2027 (USD MILLION)

8 ARTIFICIAL INTELLIGENCE (AI) IN MANUFACTURING MARKET, BY APPLICATION (Page No. - 119)

8.1 INTRODUCTION

FIGURE 31 PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2027

TABLE 53 AI IN MANUFACTURING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 AI IN MANUFACTURING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION

8.2.1 EXTENSIVE USE OF COMPUTER VISION AND MACHINE LEARNING TECHNOLOGIES IN PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION APPLICATION TO DRIVE MARKET GROWTH

TABLE 55 AI IN MANUFACTURING MARKET FOR PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 AI IN MANUFACTURING MARKET FOR PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 AI IN MANUFACTURING MARKET FOR PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 58 AI IN MANUFACTURING MARKET FOR PREDICTIVE MAINTENANCE AND MACHINERY INSPECTION, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.3 INVENTORY OPTIMIZATION

8.3.1 CAPABILITY OF AI TO PERFORM IN-PLANT LOGISTICS IN MANUFACTURING INDUSTRY TO FUEL MARKET GROWTH FOR INVENTORY OPTIMIZATION

FIGURE 32 NORTH AMERICA HELD LARGEST SHARE OF AI IN MANUFACTURING MARKET FOR INVENTORY OPTIMIZATION IN 2021

TABLE 59 AI IN MANUFACTURING MARKET FOR INVENTORY OPTIMIZATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 AI IN MANUFACTURING MARKET FOR INVENTORY OPTIMIZATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 AI IN MANUFACTURING MARKET FOR INVENTORY OPTIMIZATION, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 62 AI IN MANUFACTURING MARKET FOR INVENTORY OPTIMIZATION, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.4 PRODUCTION PLANNING

8.4.1 EXTENSIVE USE OF BIG DATA IN PRODUCTION PLANNING APPLICATION TO FUEL MARKET GROWTH

TABLE 63 AI IN MANUFACTURING MARKET FOR PRODUCTION PLANNING, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 AI IN MANUFACTURING MARKET FOR PRODUCTION PLANNING, BY REGION, 2022–2027 (USD MILLION)

TABLE 65 AI IN MANUFACTURING MARKET FOR PRODUCTION PLANNING, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 66 AI IN MANUFACTURING MARKET FOR PRODUCTION PLANNING, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.5 FIELD SERVICES

8.5.1 GROWING USE OF FIELD SERVICES IN HEAVY METALS & MACHINE MANUFACTURING, OIL & GAS, AND ENERGY & POWER INDUSTRIES TO DRIVE MARKET GROWTH

FIGURE 33 NORTH AMERICA TO HOLD LARGEST SHARE OF AI MANUFACTURING MARKET FOR FIELD SERVICES DURING FORECAST PERIOD

TABLE 67 AI IN MANUFACTURING MARKET FOR FIELD SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 AI IN MANUFACTURING MARKET FOR FIELD SERVICES, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 AI IN MANUFACTURING MARKET FOR FIELD SERVICES, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 70 AI IN MANUFACTURING MARKET FOR FIELD SERVICES, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.6 QUALITY CONTROL

8.6.1 RISING ADOPTION OF AI-BASED QUALITY CONTROL SYSTEMS IN PHARMACEUTICAL, FOOD & BEVERAGE, AND SEMICONDUCTOR INDUSTRIES TO DRIVE MARKET GROWTH

TABLE 71 AI IN MANUFACTURING MARKET FOR QUALITY CONTROL, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 AI IN MANUFACTURING MARKET FOR QUALITY CONTROL, BY REGION, 2022–2027 (USD MILLION)

FIGURE 34 MACHINE LEARNING TECHNOLOGY SEGMENT TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET FOR QUALITY CONTROL FROM 2022 TO 2027

TABLE 73 AI IN MANUFACTURING MARKET FOR QUALITY CONTROL, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 74 AI IN MANUFACTURING MARKET FOR QUALITY CONTROL, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.7 CYBERSECURITY

8.7.1 GROWING ADOPTION OF AUTOMATION IN WORK PROCESSES TO DRIVE MARKET GROWTH

TABLE 75 AI IN MANUFACTURING MARKET FOR CYBERSECURITY, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 AI IN MANUFACTURING MARKET FOR CYBERSECURITY, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 AI IN MANUFACTURING MARKET FOR CYBERSECURITY, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 78 AI IN MANUFACTURING MARKET FOR CYBERSECURITY, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.8 INDUSTRIAL ROBOTS

8.8.1 RISING ADOPTION OF INDUSTRIAL ROBOTS IN MANUFACTURING INDUSTRY TO ACCELERATE PRODUCTION PROCESSES, ENHANCE EFFICIENCY, AND MINIMIZE PRODUCTION COSTS TO DRIVE MARKET GROWTH

FIGURE 35 APAC TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET FOR INDUSTRIAL ROBOTS APPLICATION DURING FORECAST PERIOD

TABLE 79 AI IN MANUFACTURING MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 AI IN MANUFACTURING MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 AI IN MANUFACTURING MARKET FOR INDUSTRIAL ROBOTS, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 82 AI IN MANUFACTURING MARKET FOR INDUSTRIAL ROBOTS, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.9 RECLAMATION

8.9.1 GROWING ADOPTION OF COMPUTER VISION AND MACHINE LEARNING TECHNOLOGIES IN RECLAMATION APPLICATION TO ELIMINATE HUMAN–MACHINE INTERACTION TO DRIVE MARKET GROWTH

TABLE 83 AI IN MANUFACTURING MARKET FOR RECLAMATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 AI IN MANUFACTURING MARKET FOR RECLAMATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 AI IN MANUFACTURING MARKET FOR RECLAMATION, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 86 AI IN MANUFACTURING MARKET FOR RECLAMATION, BY TECHNOLOGY, 2022–2027 (USD MILLION)

9 ARTIFICIAL INTELLIGENCE (AI) IN MANUFACTURING MARKET, BY INDUSTRY (Page No. - 138)

9.1 INTRODUCTION

FIGURE 36 AUTOMOTIVE SEGMENT HELD LARGEST SHARE OF AI IN MANUFACTURING MARKET IN 2022

TABLE 87 AI IN MANUFACTURING MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 AI IN MANUFACTURING MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2 AUTOMOTIVE

9.2.1 INCREASED DEPLOYMENT OF MACHINE LEARNING AND COMPUTER VISION TECHNOLOGIES IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET GROWTH

TABLE 89 AI IN MANUFACTURING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 AI IN MANUFACTURING MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.3 ENERGY & POWER

9.3.1 GROWING USE OF AI-BASED SOLUTIONS IN ENERGY & POWER INDUSTRY TO INCREASE PRODUCTION OUTPUT AND REDUCE DOWNTIME TO DRIVE MARKET GROWTH

FIGURE 37 ASIA PACIFIC TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET FOR ENERGY & POWER INDUSTRY BY 2027

TABLE 91 AI IN MANUFACTURING MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 AI IN MANUFACTURING MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.4 PHARMACEUTICAL

9.4.1 EXTENSIVE USAGE OF COMPUTER VISION TECHNOLOGY FOR QUALITY CONTROL APPLICATION IN PHARMACEUTICAL INDUTRY TO DRIVE MARKET GROWTH

TABLE 93 AI IN MANUFACTURING MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 AI IN MANUFACTURING MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.5 HEAVY METALS & MACHINE MANUFACTURING

9.5.1 INCREASED USE OF ROBOTICS IN HEAVY METALS & MACHINE MANUFACTURING INDUSTRY TO DRIVE MARKET GROWTH

FIGURE 38 ASIA PACIFIC TO HOLD LARGEST SHARE OF AI IN MANUFACTURING MARKET FOR HEAVY METALS & MACHINE MANUFACTURING INDUSTRY DURING FORECAST PERIOD

TABLE 95 AI IN MANUFACTURING MARKET FOR HEAVY METALS & MACHINE MANUFACTURING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 AI IN MANUFACTURING MARKET FOR HEAVY METALS & MACHINE MANUFACTURING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.6 SEMICONDUCTOR & ELECTRONICS

9.6.1 INCREASED USE OF COMPUTER VISION TECHNOLOGY IN SEMICONDUCTOR & ELECTRONICS INDUSTRY TO DRIVE MARKET GROWTH

TABLE 97 AI IN MANUFACTURING MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 AI IN MANUFACTURING MARKET FOR SEMICONDUCTOR & ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.7 FOOD & BEVERAGE

9.7.1 GROWING ADOPTION OF INDUSTRIAL ROBOTS, IOT, AND BIG DATA IN FOOD & BEVERAGE INDUSTRY TO FUEL MARKET GROWTH

TABLE 99 AI IN MANUFACTURING MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 AI IN MANUFACTURING MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHERS

TABLE 101 AI IN MANUFACTURING MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 AI IN MANUFACTURING MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 151)

10.1 INTRODUCTION

FIGURE 39 CHINA, SOUTH KOREA, AND US ARE EMERGING AS NEW HOTSPOTS IN AI IN MANUFACTURING MARKET

FIGURE 40 APAC TO DOMINATE AI IN MANUFACTURING MARKET DURING FORECAST PERIOD

TABLE 103 AI IN MANUFACTURING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 AI IN MANUFACTURING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 41 SNAPSHOT: AI IN MANUFACTURING MARKET IN NORTH AMERICA

TABLE 105 AI IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 AI IN MANUFACTURING MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR HARDWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 108 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR HARDWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 109 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR SOFTWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR SOFTWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR SERVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 AI IN MANUFACTURING MARKET IN NORTH AMERICA FOR SERVICES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 AI IN MANUFACTURING MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 114 AI IN MANUFACTURING MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Speedy adoption of IIoT and industrial robots is boosting adoption of AI

TABLE 115 AI IN MANUFACTURING MARKET IN US, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 116 AI IN MANUFACTURING MARKET IN US, BY OFFERING, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Emergence of various AI-based startups is supporting growth of AI in manufacturing market in Canada

TABLE 117 AI IN MANUFACTURING MARKET IN CANADA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 118 AI IN MANUFACTURING MARKET IN CANADA, BY OFFERING, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Inflow of investments in manufacturing sector fosters market growth in Mexico

TABLE 119 AI IN MANUFACTURING MARKET IN MEXICO, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 120 AI IN MANUFACTURING MARKET IN MEXICO, BY OFFERING, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 42 SNAPSHOT: AI IN MANUFACTURING MARKET IN EUROPE

TABLE 121 AI IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 AI IN MANUFACTURING MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 43 GERMANY HELD LARGEST SHARE OF AI IN MANUFACTURING MARKET IN EUROPE FOR HARDWARE IN 2021

TABLE 123 AI IN MANUFACTURING MARKET IN EUROPE FOR HARDWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 AI IN MANUFACTURING MARKET IN EUROPE FOR HARDWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 AI IN MANUFACTURING MARKET IN EUROPE FOR SOFTWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 AI IN MANUFACTURING MARKET IN EUROPE FOR SOFTWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 127 AI IN MANUFACTURING MARKET IN EUROPE FOR SERVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 AI IN MANUFACTURING MARKET IN EUROPE FOR SERVICES, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 129 AI IN MANUFACTURING MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 130 AI IN MANUFACTURING MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Implementation of big data in manufacturing plants has resulted in adoption of AI-based solutions in Germany

TABLE 131 AI IN MANUFACTURING MARKET IN GERMANY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 132 AI IN MANUFACTURING MARKET IN GERMANY, BY OFFERING, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Favorable environment for R&D; has led to innovations in field of AI in manufacturing in UK

TABLE 133 AI IN MANUFACTURING MARKET IN UK, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 134 AI IN MANUFACTURING MARKET IN UK, BY OFFERING, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Proliferation of AI startups augments market growth in France

TABLE 135 AI IN MANUFACTURING MARKET IN FRANCE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 136 AI IN MANUFACTURING MARKET IN FRANCE, BY OFFERING, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Adoption of smart factory and AI-based solutions by manufacturers spurs market growth in Italy

TABLE 137 AI IN MANUFACTURING MARKET IN ITALY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 138 AI IN MANUFACTURING MARKET IN ITALY, BY OFFERING, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Accelerating adoption of AI-based predictive maintenance system in manufacturing sector in Spain spurs market growth

TABLE 139 AI IN MANUFACTURING MARKET IN SPAIN, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 140 AI IN MANUFACTURING MARKET IN SPAIN, BY OFFERING, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 141 AI IN MANUFACTURING MARKET IN REST OF EUROPE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 142 AI IN MANUFACTURING MARKET IN REST OF EUROPE, BY OFFERING, 2022–2027 (USD MILLION)

10.4 APAC

FIGURE 44 SNAPSHOT: AI IN MANUFACTURING MARKET IN ASIA PACIFIC

TABLE 143 AI IN MANUFACTURING MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 AI IN MANUFACTURING MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 AI IN MANUFACTURING MARKET IN APAC FOR HARDWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 AI IN MANUFACTURING MARKET IN APAC FOR HARDWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 AI IN MANUFACTURING MARKET IN APAC FOR SOFTWARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 148 AI IN MANUFACTURING MARKET IN APAC FOR SOFTWARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 149 AI IN MANUFACTURING MARKET IN APAC FOR SERVICES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 150 AI IN MANUFACTURING MARKET IN APAC FOR SERVICES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 151 AI IN MANUFACTURING MARKET IN APAC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 152 AI IN MANUFACTURING MARKET IN APAC, BY INDUSTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rapid adoption of AI in well-established manufacturing sector underpins market growth in China

TABLE 153 AI IN MANUFACTURING MARKET IN CHINA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 154 AI IN MANUFACTURING MARKET IN CHINA, BY OFFERING, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Presence of world-leading manufacturing companies boosts AI in manufacturing market growth in Japan

TABLE 155 AI IN MANUFACTURING MARKET IN JAPAN, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 156 AI IN MANUFACTURING MARKET IN JAPAN, BY OFFERING, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Introduction of automation in manufacturing industries is driving market for AI in manufacturing in South Korea

TABLE 157 AI IN MANUFACTURING MARKET IN SOUTH KOREA, BY OFFERING, 2018–2021 (USD MILLION))

TABLE 158 AI IN MANUFACTURING MARKET IN SOUTH KOREA, BY OFFERING, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 AI in manufacturing industry is still in its nascent stage in India

TABLE 159 AI IN MANUFACTURING MARKET IN INDIA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 160 AI IN MANUFACTURING MARKET IN INDIA, BY OFFERING, 2022–2027 (USD MILLION)

10.4.5 REST OF APAC

TABLE 161 AI IN MANUFACTURING MARKET IN REST OF APAC, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 162 AI IN MANUFACTURING MARKET IN REST OF APAC, BY OFFERING, 2022–2027 (USD MILLION)

10.5 ROW

FIGURE 45 SNAPSHOT: AI IN MANUFACTURING MARKET IN ROW

TABLE 163 AI IN MANUFACTURING MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 164 AI IN MANUFACTURING MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 165 AI IN MANUFACTURING MARKET IN ROW FOR HARDWARE, BY REGION, 2018–2021(USD MILLION)

TABLE 166 AI IN MANUFACTURING MARKET IN ROW FOR HARDWARE, BY REGION, 2022–2027 (USD MILLION)

TABLE 167 AI IN MANUFACTURING MARKET IN ROW FOR SOFTWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 168 AI IN MANUFACTURING MARKET IN ROW FOR SOFTWARE, BY REGION, 2022–2027 (USD MILLION)

TABLE 169 AI IN MANUFACTURING MARKET IN ROW FOR SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 170 AI IN MANUFACTURING MARKET IN ROW FOR SERVICES, BY REGION, 2022–2027 (USD MILLION)

TABLE 171 AI IN MANUFACTURING MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 172 AI IN MANUFACTURING MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Surging investments in IT infrastructure to favor AI in manufacturing market growth in South America

TABLE 173 AI IN MANUFACTURING MARKET IN SOUTH AMERICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 174 AI IN MANUFACTURING MARKET IN SOUTH AMERICA, BY OFFERING, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Growing manufacturing expenditure in Israel, Middle East, and North Africa is key driver for AI in manufacturing market

TABLE 175 AI IN MANUFACTURING MARKET IN MIDDLE EAST & AFRICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 176 AI IN MANUFACTURING MARKET IN MIDDLE EAST & AFRICA, BY OFFERING, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 190)

11.1 INTRODUCTION

11.2 REVENUE ANALYSIS: TOP COMPANIES

FIGURE 46 DOMINANCE OF TOP 3 PLAYERS IN AI IN MANUFACTURING MARKET IN LAST 3 YEARS

11.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 177 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN AI IN MANUFACTURING MARKET

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 178 AI IN MANUFACTURING MARKET: DEGREE OF COMPETITION

FIGURE 47 AI IN MANUFACTURING MARKET SHARE, BY COMPANY (2021)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

11.5.4 PARTICIPANT

FIGURE 48 AI IN MANUFACTURING MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

11.6 AI IN MANUFACTURING MARKET: COMPANY FOOTPRINT

11.6.1 APPLICATION AND REGIONAL FOOTPRINT OF TOP PLAYERS

TABLE 179 APPLICATION AND REGIONAL FOOTPRINT OF TOP COMPANIES

TABLE 180 APPLICATION FOOTPRINT OF COMPANIES

TABLE 181 REGIONAL FOOTPRINT OF COMPANIES

11.7 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2021

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 49 AI IN MANUFACTURING MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

11.8 COMPETITIVE SITUATIONS & TRENDS

TABLE 182 AI IN MANUFACTURING MARKET: PRODUCT LAUNCHES

TABLE 183 AI IN MANUFACTURING MARKET: DEALS

11.9 COMPETETIVE BENCHMARKING

TABLE 184 AI IN MANUFACTURING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 185 AI IN MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12 COMPANY PROFILE (Page No. - 212)

(Business Overview, Products Offered, Product Launches, Deals, Recent Developments, and MnM View)*

12.1 KEY PLAYERS

12.1.1 NVIDIA

TABLE 186 NVIDIA: BUSINESS OVERVIEW

FIGURE 50 NVIDIA: COMPANY SNAPSHOT

12.1.2 IBM

TABLE 187 IBM: BUSINESS OVERVIEW

FIGURE 51 IBM: COMPANY SNAPSHOT

12.1.3 INTEL

TABLE 188 INTEL: BUSINESS OVERVIEW

FIGURE 52 INTEL: COMPANY SNAPSHOT

12.1.4 SIEMENS

TABLE 189 SIEMENS: BUSINESS OVERVIEW

FIGURE 53 SIEMENS: COMPANY SNAPSHOT

12.1.5 GENERAL ELECTRIC (GE) COMPANY

TABLE 190 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 54 GENERAL ELECTRIC: COMPANY SNAPSHOT

12.1.6 GOOGLE

TABLE 191 GOOGLE: BUSINESS OVERVIEW

FIGURE 55 GOOGLE: COMPANY SNAPSHOT

12.1.7 MICROSOFT CORPORATION

TABLE 192 MICROSOFT CORPORATION: BUSINESS OVERVIEW

FIGURE 56 MICROSOFT CORPORATION: COMPANY SNAPSHOT

12.1.8 MICRON TECHNOLOGY

TABLE 193 MICRON TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 57 MICRON TECHNOLOGY: COMPANY SNAPSHOT

12.1.9 AMAZON WEB SERVICES (AWS)

TABLE 194 AWAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 58 AMAZON WEB SERVICES: COMPANY SNAPSHOT

12.1.10 SIGHT MACHINE

TABLE 195 SIGHT MACHINE: BUSINESS OVERVIEW

12.2 OTHER COMPANIES

12.2.1 PROGRESS SOFTWARE CORPORATION (DATARPM)

12.2.2 AIBRAIN

12.2.3 GENERAL VISION

12.2.4 ROCKWELL AUTOMATION

12.2.5 CISCO SYSTEMS

12.2.6 MITSUBISHI ELECTRIC

12.2.7 ORACLE

12.2.8 SAP

12.2.9 VICARIOUS

12.2.10 UBTECH ROBOTICS

12.2.11 AQUANT

12.2.12 BRIGHT MACHINES

12.2.13 RETHINK ROBOTICS GMBH

12.2.14 SPARKCOGNITION

12.2.15 FLUTURA

* Business Overview, Products Offered, Product Launches, Deals, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 263)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

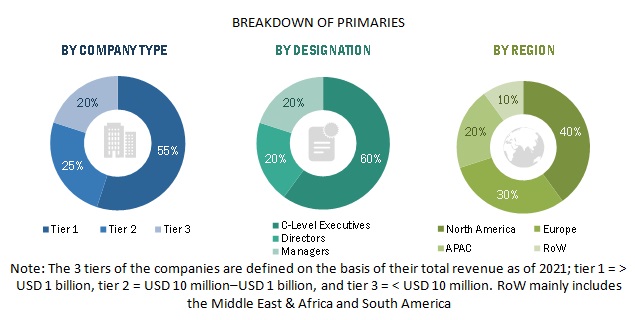

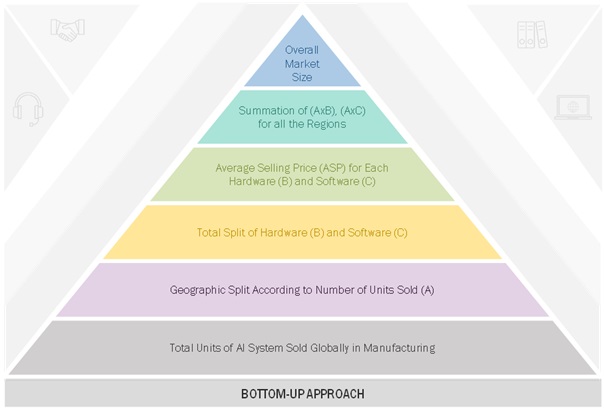

The study involved four major activities in estimating the size of the artificial intelligence in manufacturing market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations (such as Institute of Electrical and Electronics Engineers (IEEE), European Association for Artificial Intelligence, , Canadian Artificial Intelligence Association, Data Science Association, International Association for Artificial Intelligence and Law (IAAIL); white papers, AI related marketing journals, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases.

Secondary research has been conducted to obtain key information about the supply chain of the display industry, monetary chain of the market, the total pool of key players, and market segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both market- and technology oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the artificial intelligence in manufacturing market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- (manufacturing industries) and supply-side (artificial intelligence hardware, software and service providers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (the Middle East & Africa). Approximately 70% and 30% of primary interviews have been conducted from the supply and demand side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the artificial intelligence in manufacturing market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various process industries that are using or are expected to implement AI in manufacturing along with the related hardware, software, and services at their production floor

- Analyzing each industry along with the related major companies and system integrators, as well as identifying the service providers for the implementation of AI products and services

- Estimating and understanding the demand generated by industries in the overall AI in manufacturing market; this helps in understanding the demand generated by the industries and related companies for both pre- and post-COVID-19 scenarios

- Tracking the ongoing and upcoming implementation of AI in manufacturing projects by process industries and forecasting the market based on these developments and anticipated changes in the demand in the post-COVID-19 scenario

- Conducting multiple discussions with key opinion leaders to understand the types of contracts, services, AI products and services, and software deployed by the companies in the AI in manufacturing market; these discussions help in analyzing the break-up of the scope of work carried out by each major company in the overall AI in manufacturing market and understand the impact of COVID-19

- Analyzing the AI-based systems in the manufacturing companies as per their countries and then combining this information to get the market estimate by regions

- Verifying the estimate at every level through discussions with key opinion leaders, such as CXOs, directors, and operation managers, and then finally with the domain experts based within MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

- Carrying out multiple discussions with key opinion leaders to understand the technologies used in head-up displays, raw materials used to develop them, and products wherein they are deployed, and analyze the break-up of the scope of work carried out by key manufacturers of head-up displays and related software solution providers

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the AI in manufacturing market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To describe and forecast the artificial intelligence (AI) in manufacturing market, in terms of value, based on offering, technology, application, and industry

- To describe and forecast the AI in manufacturing market, in terms of value, based on region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research and development (R&D) in the AI in manufacturing market

- To analyze the impact of the COVID-19 on the artificial intelligence (AI) in manufacturing market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence in Manufacturing Market

To understand potential of AI in manufacturing Industry.