AI in Medical Diagnostics Market by Component (Software, Service), Application (In Vivo, Radiology, Neurology, CT, MRI, X - ray, IVD), End User (Hospital, Diagnostic Imaging Center, Diagnostic Laboratory) & Region - Global Forecast to 2027

Updated on : July 11, 2023

The global AI in Medical Diagnostics Market in terms of revenue was estimated to be worth $1.0 billion in 2022 and is poised to reach $5.5 billion by 2027, growing at a CAGR of 39.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The application of AI in medical diagnostics is growing at a fast pace owing to factors such as rising government initiatives to drive the adoption of AI-based technologies, increasing adoption of AI solutions by radiologists to reduce work pressure, the influx of big data, availability of funding for AI-based startups, and the growing number of cross-industry partnerships & collaborations. However, the lack of a skilled AI workforce, ambiguity in regulations, and the reluctance among medical practitioners to adopt these solutions are factors expected to restrain the market growth.

Global AI in Medical Diagnostics Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

AI In Medical Diagnostics Market Dynamics

Driver: Influx of big data

With the increasing digitization and adoption of information systems in the healthcare industry, big data (large and complex data) is generated at various stages of the care delivery process. In the medical diagnostics industry, big data comprises information generated from clickstream and web & social media interactions; readings from medical devices, such as sensors, ECGs, X-rays, healthcare claims, and other billing records; and biometric data, among other sources. Big data and analytical solutions have grown exponentially in sophistication and adoption in the last decade with the growing adoption of EHRs, digitized laboratory slides, and high-resolution radiology images among healthcare providers. Healthcare is one of the top five big data industries, especially in the US. In the coming years, the volume of big data in medical diagnostics is expected to increase due to the use of bidirectional patient portals, which allow patients to upload data and images to their EMRs. The need to efficiently manage the ever-increasing volume of large and complex medical diagnostic data is compelling the healthcare industry to turn its focus toward various AI-based solutions

Restraint: Reluctance among medical practitioners to adopt AI-based technologies

Extensive growth in digital health has enabled healthcare providers to assist patients through novel treatment approaches. AI technologies offer doctors tools that help them diagnose and effectively treat patients better. However, there is an observed reluctance among doctors in the acceptance of new technologies. For instance, medical practitioners have a misconception that AI will replace doctors in the coming years. Doctors and radiologists believe that skills such as empathy and persuasion are human skills; thus, technologies cannot completely rule out the presence of a doctor. Additionally, there is a concern that patients may be excessively inclined toward these technologies and may forgo necessary in-person treatments, which might also challenge long-term doctor-patient relationships. Several healthcare professionals have doubts about AI capabilities in accurately diagnosing patient conditions. Therefore, it is challenging to convince providers that AI-based solutions are cost-effective, efficient, and safe solutions that offer doctors convenience and better patient care. However, healthcare providers are increasingly accepting the potential benefits of AI-based solutions and the spectrum of applications it serves. Hence, there is a possibility that in the coming years, doctors and radiologists will be more inclined toward AI-based technologies in healthcare.

Challenge: Budgetary constraints

Overcoming financial constraints is the biggest challenge for healthcare organizations, especially in emerging economies where it is always a struggle to secure budgets for IT over medical equipment. The high cost of imaging equipment and implementation & licensing costs of AI software are the major factors restraining market growth, specifically in countries where the reimbursement scenario is poor. For instance, most healthcare facilities in developing countries cannot afford AI solutions due to high installation and maintenance costs. This factor is limiting the adoption of new or technologically advanced systems. Also, implementation and subscription/licensing fees form a major financial burden on end users. Owing to these budget constraints, small healthcare facilities cannot afford these solutions. This, in turn, is expected to negatively impact the growth of AI in the medical diagnostics market.

Opportunity: Increasing focus on developing human-aware AI systems

The actual projections aimed during the emergence of AI technologies were to make them human-aware, i.e., developing models with the characteristics of human thinking. However, creating interactive and scalable machines remains a challenge for the developers of AI machines. Additionally, rise in human interference with AI techniques and interest to discover the machine learning process has introduced new research challenges, i.e., interpretation and presentation challenges such as issues with automating parts and intelligent control of crowdsourcing. Interpretation challenges include challenges AI machines have in understanding human input, such as knowledge and specific directives. Presentation challenges include issues related to delivering the AI system’s output and feedback mechanisms . Thus, developing human-aware AI systems remains the foremost opportunity for AI developers

Software segment of AI In Medical Diagnostics Industry, is expected to grow at the highest rate during the forecast period

The worldwide AI In Medical Diagnostics Market is divided into software and services based on component. The services segment dominated the market, while the software segment is estimated to grow at a higher CAGR during the forecast period. Software solutions provide healthcare providers a competitive edge over others, despite the challenges of being short-staffed and facing increasing imaging scan volumes.

In Vivo Diagnostic segment of AI In Medical Diagnostics Industry, accounted for the largest share

The AI In Medical Diagnostics Market is divided based on applications into in vivo and in vitro diagnostics. The in vivo diagnostics segment commanded the largest share of this market. The large share of this segment can be attributed to the growing adoption of AI solutions by medical and healthcare industry, as these solutions help reduce human errors and improve treatment efficacy.

The Hospitals segment of AI In Medical Diagnostics Industry, is expected to grow with the highest CAGR during the forecast period

Based on end users, the AI In Medical Diagnostics Market is segmented into hospitals, diagnostic imaging centers, diagnostic laboratories, and other end users. The hospitals segment commanded the largest share of this market. The large share of this segment can be attributed to the rising number of diagnostic imaging treatments performed in hospitals or used as standard procedures, the rising inclination of hospitals toward the automation and digitization of radiology patient workflow, increasing adoption of minimally invasive procedures in hospitals and healthcare facilities to improve the quality of patient care and focus on patient centric care , and the rising adoption of advanced imaging modalities to improve workflow .

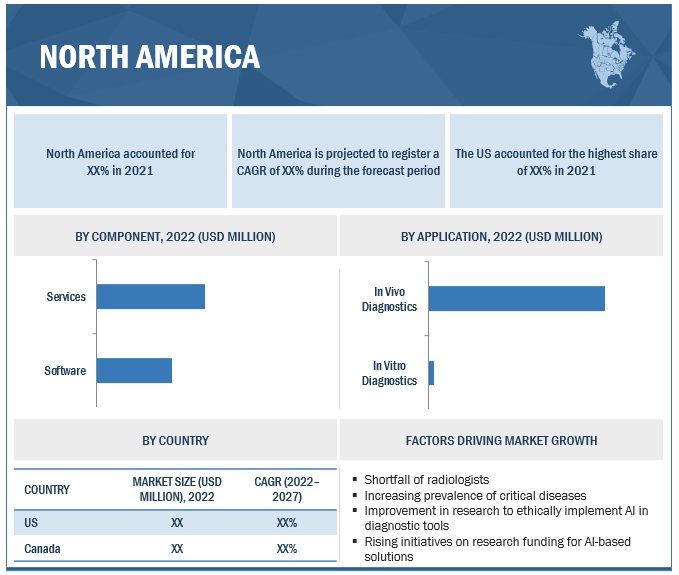

North America accounted for the largest share of the global AI In Medical Diagnostics Industry.

North America accounted for the largest share of the AI In Medical Diagnostics Market. However, the Asia Pacific market is projected to register the highest CAGR of 42.6% during the forecast period. The high growth rate of the Asia Pacific market can primarily be attributed to the growth strategies adopted by key players in emerging markets, digitization of medical diagnostics infrastructure, rising geriatric population, rise in prevalence of cancer, and the implementation of favorable government initiatives.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players in this market are Microsoft (US), NVIDIA (US), IBM (US), Intel Corporation (US), Google, Inc.(Subsidiary of Alphabet, Inc) (US), Siemens Healthineers (Germany), GE Healthcare (US), Digital Diagnostics, Inc (US), Xilinx (US), InformAI LLC (US), HeartFlow, Inc (US), Enlitic, Inc (US), Day Zero Diagnostics, Inc(US), Aidence (Netherlands), Butterfly Network, Inc. (US), Prognos Health (US), Nanox AI (Israel), Viz.ai, Inc (US), Quibin (Spain), Qure.ai (India), Therapixel (France), Aidoc (Israel), Koninklijke Philips N.V. (Netherlands), Lunit. Inc (South Korea), EchoNous Inc. (US).

Scope of the AI in Medical Diagnostics Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.0 billion |

|

Projected Revenue by 2027 |

$5.5 billion |

|

Revenue Rate |

poised to grow at a CAGR of 39.9% |

|

Market Driver |

Influx of big data |

|

Market Opportunity |

Increasing focus on developing human-aware AI systems |

The study categorizes the AI in medical diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Software

- Services

By Application

-

In Vivo diagnostics

-

By Specialty

- Radiology

- Cardiology

- Neurology

- Obstetrics/gynecology

- Ophthalmology

- Other specialties

-

By Modality

- Computed tomography

- X-Ray

- Magnetic resonance imaging

- Ultrasound

- Other modalities

-

By Specialty

- In Vitro diagnostics

By End User

- Hospitals

- Diagnostics Imaging Centers

- Diagnostics Laboratories

- Other End User

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- RoW

Recent Developments of AI in Medical Diagnostics Industry

- In 2021, Microsoft (US) partnered with Truveta (US) that will apply the power of Microsoft Azure and AI to help Truveta achieve its vision of saving lives with data.

- In 2021, IBM (US) collaborated with Humana Inc. (US). Humana deploys IBM’s Watson Assistant for Health Benefits; this is an AI-enabled virtual agent built in the IBM Watson Health Cloud.

- In 2020, Intel (US) partnered with the Maricopa County Community College District (MCCCD) (US) to launch the first Intel-designed AI associate degree program in the US. It enabled thousands of students to land healthcare, automotive, industrial, and aerospace careers.

- As of December 2019, Google's DeepMind division (US) is working with the Moorfields Eye Hospital in the UK. This development aims to improve prior eye disease research and assist eye doctors in assessing the risk of a patient’s eye problem and directing them to medical care based on the urgency of the condition.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the AI in medical diagnostics market?

The AI in medical diagnostics market boasts a total revenue value of $5.5 billion by 2027.

What is the estimated growth rate (CAGR) of the AI in medical diagnostics market?

The global AI in medical diagnostics market has an estimated compound annual growth rate (CAGR) of 39.9% and a revenue size in the region of $1.0 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 MARKETS COVERED

FIGURE 1 AI IN MEDICAL DIAGNOSTICS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.6.1 SCOPE-RELATED LIMITATIONS

1.6.2 METHODOLOGY-RELATED LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key industry insights

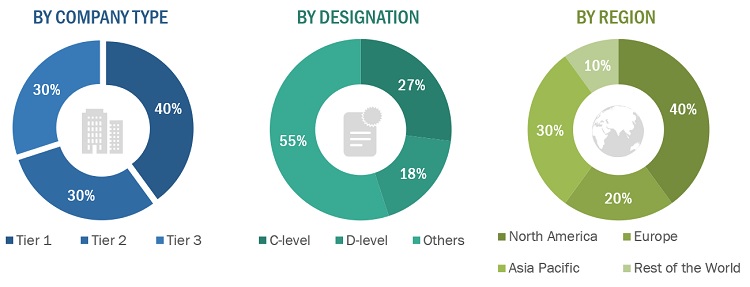

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6 MARKET SIZE ESTIMATION

TABLE 1 FACTOR ANALYSIS

FIGURE 7 AI IN MEDICAL DIAGNOSTICS MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 TOP-DOWN APPROACH

2.3 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 STUDY ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 11 GLOBAL MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 AI IN MEDICAL DIAGNOSTICS MARKET OVERVIEW

FIGURE 15 RISING VOLUME OF DIAGNOSTIC IMAGING PROCEDURES AND INFLUX OF BIG DATA TO DRIVE MARKET

4.2 NORTH AMERICA: MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 16 IN VIVO DIAGNOSTICS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICA IN 2021

4.3 GLOBAL MARKET SHARE, BY APPLICATION, 2022 VS. 2027

FIGURE 17 IN VIVO DIAGNOSTICS TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 ASIA PACIFIC REGION TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

FIGURE 19 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Influx of big data

5.1.1.2 Growing number of cross-industry partnerships & collaborations

5.1.1.3 Increasing demand for AI-based solutions to reduce work pressure on radiologists

5.1.1.4 Rising government initiatives to drive AI-based technologies

5.1.1.5 Availability of funding for AI-based startups

5.1.2 RESTRAINTS

5.1.2.1 Reluctance among medical practitioners to adopt AI-based technologies

5.1.2.2 Inadequate AI workforce and ambiguous regulatory guidelines for medical software

5.1.3 OPPORTUNITIES

5.1.3.1 Untapped emerging markets

5.1.3.2 Growing potential of AI in imaging diagnostics for COVID-19

5.1.3.3 Increasing focus on developing human-aware AI systems

5.1.4 CHALLENGES

5.1.4.1 Budgetary constraints

5.1.4.2 Unstructured healthcare data

5.1.4.3 Data privacy concerns

5.1.4.4 Limited interoperability for AI solutions

5.2 VALUE CHAIN ANALYSIS

FIGURE 20 GLOBAL MARKET: VALUE CHAIN

5.3 CASE STUDIES

5.3.1 FOCUS ON IMPROVING WORKFLOW EFFICACY AND REDUCING BURDEN ON RADIOLOGISTS

TABLE 3 USE CASE 1: REDUCING BURDEN ON RADIOLOGISTS BY DEVELOPING AND TESTING AN AI MODEL TO READ LARGE ULTRASOUND DATA

5.3.2 IMPROVED TRIAGE

TABLE 4 USE CASE 2: PRECISION DRIVEN HEALTH DEVELOPED ML-MODEL TO IMPROVE WORK TRIAGE OF CARDIOLOGISTS (2019)

5.4 ECOSYSTEM COVERAGE

FIGURE 21 AI IN MEDICAL DIAGNOSTICS: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

TABLE 5 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

5.6 REGULATIONS

5.6.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

5.6.2 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

5.6.3 CONSUMER PRIVACY PROTECTION ACT OF 2017

5.6.4 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

5.6.5 FUTURE OF LIFE INSTITUTE’S ASILOMAR AI PRINCIPLES

5.6.6 THE EUROPEAN MEDICAL DEVICES REGULATION (EU) 2017/745 AND IN-VITRO DIAGNOSTIC MEDICAL DEVICES REGULATION (EU) 2017/746, IN COMBINATION WITH GENERAL DATA PROTECTION REGULATION 2016/679

5.6.7 CYBERSECURITY LAW OF PEOPLE'S REPUBLIC OF CHINA

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 AI IN MEDICAL DIAGNOSTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8 INDUSTRY TRENDS

5.8.1 ARTIFICIAL INTELLIGENCE IN HEALTHCARE

5.8.1.1 Key to AI in Healthcare: Data

5.8.1.2 AR and MR in Healthcare Settings

5.8.1.3 Healthcare Privacy and Security in 2022

5.9 PRICING ANALYSIS

5.10 KEY CONFERENCES AND EVENTS (2022−2023)

TABLE 7 GLOBAL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END USERS

5.11.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR END USERS

TABLE 9 KEY BUYING CRITERIA FOR END USERS

6 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY COMPONENT (Page No. - 62)

6.1 INTRODUCTION

TABLE 10 GLOBAL MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

6.2 SOFTWARE

6.2.1 USE OF AI PLATFORMS IN SOFTWARE TO ENHANCE DECISION-MAKING AND SIMPLIFY WORKFLOWS

TABLE 11 AI IN MEDICAL DIAGNOSTICS SOFTWARE MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SERVICES

6.3.1 RISING NEED FOR DEPLOYMENT & INTEGRATION OF AI SYSTEMS TO SUPPORT MARKET GROWTH

TABLE 12 AI IN MEDICAL DIAGNOSTICS SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY APPLICATION (Page No. - 65)

7.1 INTRODUCTION

TABLE 13 GLOBAL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 IN VIVO DIAGNOSTICS

TABLE 14 GLOBAL MARKET FOR IN VIVO DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION)

7.2.1 IN VIVO DIAGNOSTIC APPLICATIONS MARKET, BY SPECIALTY

TABLE 15 GLOBAL MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

7.2.1.1 Radiology

7.2.1.1.1 AI-based diagnostic tools to reduce work pressure on radiologists

TABLE 16 AI IN MEDICAL DIAGNOSTICS FOR IN VIVO RADIOLOGY, BY REGION, 2020–2027 (USD MILLION)

7.2.1.2 Cardiology

7.2.1.2.1 Rising complexities associated with CVD to drive market

TABLE 17 GLOBAL MARKET FOR IN VIVO CARDIOLOGY, BY REGION, 2020–2027 (USD MILLION)

7.2.1.3 Neurology

7.2.1.3.1 Increasing prevalence of critical brain disorders to drive market

TABLE 18 GLOBAL MARKET FOR IN VIVO NEUROLOGY, BY REGION, 2020–2027 (USD MILLION)

7.2.1.4 Obstetrics/Gynecology

7.2.1.4.1 Rising use of minimally invasive techniques in gynecology procedures to drive market

TABLE 19 GLOBAL MARKET FOR IN VIVO OBSTETRICS/GYNECOLOGY, BY REGION, 2020–2027 (USD MILLION)

7.2.1.5 Ophthalmology

7.2.1.5.1 Rising need for early detection & prevention of eye diseases to drive market

TABLE 20 GLOBAL MARKET FOR IN VIVO OPHTHALMOLOGY, BY REGION, 2020–2027 (USD MILLION)

7.2.1.6 Other specialties

TABLE 21 MARKET FOR OTHER SPECIALTIES, BY REGION, 2020–2027 (USD MILLION)

7.2.2 IN VIVO DIAGNOSTIC APPLICATIONS MARKET, BY MODALITY

TABLE 22 MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

7.2.2.1 Computed tomography

7.2.2.1.1 Rising availability of cardiac CT devices enabled with AI solutions to drive market

TABLE 23 MARKET FOR COMPUTED TOMOGRAPHY, BY REGION, 2020–2027 (USD MILLION)

7.2.2.2 X-ray

7.2.2.2.1 Innovative AI solutions for x-ray imaging by key players to drive market

TABLE 24 MARKET FOR X-RAY, BY REGION, 2020–2027 (USD MILLION)

7.2.2.3 Magnetic resonance imaging (MRI)

7.2.2.3.1 Rising technological advancements to drive adoption of AI in MRI

TABLE 25 MARKET FOR MAGNETIC RESONANCE IMAGING, BY REGION, 2020–2027 (USD MILLION)

7.2.2.4 Ultrasound

7.2.2.4.1 Increasing prevalence of ovarian cancer to drive market demand

TABLE 26 MARKET FOR ULTRASOUND, BY REGION, 2020–2027 (USD MILLION)

7.2.2.5 Other modalities

TABLE 27 MARKET FOR OTHER MODALITIES, BY REGION, 2020–2027 (USD MILLION)

7.3 IN VITRO DIAGNOSTICS

7.3.1 INCREASING ADOPTION OF POINT-OF-CARE TESTING IN EMERGING ECONOMIES TO SUPPORT MARKET GROWTH

TABLE 28 AI IN MEDICAL DIAGNOSTICS FOR IN VITRO DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION)

8 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY END USER (Page No. - 77)

8.1 INTRODUCTION

TABLE 29 AI IN MEDICAL DIAGNOSTICS MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 INSTALLATION OF ADVANCED AI DIAGNOSTIC IMAGING SOLUTIONS TO DRIVE MARKET

TABLE 30 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

8.3 DIAGNOSTIC IMAGING CENTERS

8.3.1 GROWING NUMBER OF PRIVATE IMAGING CENTERS TO DRIVE MARKET

TABLE 31 GLOBAL MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2020–2027 (USD MILLION)

8.4 DIAGNOSTIC LABORATORIES

8.4.1 RISING SPECIMEN TEST VOLUME TO DRIVE MARKET

TABLE 32 GLOBAL MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

8.5 OTHER END USERS

TABLE 33 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

9 ARTIFICIAL INTELLIGENCE IN MEDICAL DIAGNOSTICS MARKET, BY REGION (Page No. - 81)

9.1 INTRODUCTION

TABLE 34 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing volume of imaging procedures to drive market growth

TABLE 41 US: AI IN MEDICAL DIAGNOSTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 42 US: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 43 US: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 44 US: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 45 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Research grants and improved academics in radiology to drive market growth

TABLE 46 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 47 CANADA: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 48 CANADA: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 49 CANADA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 50 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 51 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Rising government support to drive adoption of AI in medical diagnostics

TABLE 57 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 GERMANY: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 59 GERMANY: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 60 GERMANY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 61 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing number of radiography procedures to drive market growth

TABLE 62 UK: AI IN MEDICAL DIAGNOSTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 63 UK: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 64 UK: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 65 UK: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 66 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Availability of funding for companies to enhance AI research in medical imaging

TABLE 67 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 FRANCE: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 69 FRANCE: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing volume of EHRs and EMRs due to rising geriatric population to drive demand for AI solutions

TABLE 72 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 ITALY: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 74 ITALY: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 75 ITALY: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 76 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 REST OF EUROPE

TABLE 77 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 REST OF EUROPE: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 80 REST OF EUROPE: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 81 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: AI IN MEDICAL DIAGNOSTICS MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Rising use of AI in clinical decision-making to drive market

TABLE 88 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 CHINA: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 90 CHINA: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 91 CHINA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 92 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Presence of strong healthcare infrastructure to drive uptake of advanced AI solutions

TABLE 93 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 JAPAN: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 95 JAPAN: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 96 JAPAN: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 97 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Favorable government initiatives for R&D investments to drive market for AI

TABLE 98 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 99 INDIA: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 100 INDIA: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 101 INDIA: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 102 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 103 REST OF ASIA PACIFIC: AI IN MEDICAL DIAGNOSTICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 REST OF ASIA PACIFIC: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 107 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 REST OF THE WORLD

9.5.1 RISING INITIATIVES TO STABILIZE HEALTHCARE SYSTEMS TO DRIVE UPTAKE OF AI-BASED TOOLS

TABLE 108 REST OF THE WORLD: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 REST OF THE WORLD: MARKET FOR IN VIVO DIAGNOSTICS, BY SPECIALTY, 2020–2027 (USD MILLION)

TABLE 110 REST OF THE WORLD: MARKET FOR IN VIVO DIAGNOSTICS, BY MODALITY, 2020–2027 (USD MILLION)

TABLE 111 REST OF THE WORLD: MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 118)

10.1 OVERVIEW

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 113 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 26 REVENUE ANALYSIS OF KEY PLAYERS

10.4 RANKING OF PLAYERS, 2021

FIGURE 27 MARKET: RANKING OF KEY COMPANIES (2021)

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 28 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

10.6 COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 RESPONSIVE COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 29 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS (2021)

10.7 COMPETITIVE BENCHMARKING

TABLE 114 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 115 GLOBAL MARKET: APPLICATION FOOTPRINT OF KEY PLAYERS

TABLE 116 GLOBAL MARKET: REGIONAL FOOTPRINT OF KEY PLAYERS

10.8 COMPETITIVE SCENARIO

TABLE 117 AI IN MEDICAL DIAGNOSTICS MARKET: PRODUCT LAUNCHES, 2019–2022

TABLE 118 KEY DEALS, JANUARY 2019–JULY 2022

11 COMPANY PROFILES (Page No. - 134)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 MICROSOFT

TABLE 119 MICROSOFT: BUSINESS OVERVIEW

FIGURE 30 MICROSOFT: COMPANY SNAPSHOT (2021)

11.1.2 NVIDIA

TABLE 120 NVIDIA: BUSINESS OVERVIEW

FIGURE 31 NVIDIA: COMPANY SNAPSHOT

11.1.3 IBM

TABLE 121 IBM: BUSINESS OVERVIEW

FIGURE 32 IBM: COMPANY SNAPSHOT

11.1.4 INTEL CORPORATION

TABLE 122 INTEL: BUSINESS OVERVIEW

FIGURE 33 INTEL: COMPANY SNAPSHOT

11.1.5 GOOGLE (SUBSIDIARY OF ALPHABET, INC.)

TABLE 123 GOOGLE: BUSINESS OVERVIEW

FIGURE 34 GOOGLE: COMPANY SNAPSHOT

11.1.6 SIEMENS HEALTHINEERS

TABLE 124 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

FIGURE 35 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

11.1.7 GE HEALTHCARE

TABLE 125 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 36 GE HEALTHCARE: COMPANY SNAPSHOT

11.1.8 DIGITAL DIAGNOSTICS, INC (FORMERLY KNOWN AS IDX)

TABLE 126 DIGITAL DIAGNOSTICS: BUSINESS OVERVIEW

11.1.9 XILINX

TABLE 127 XILINX: BUSINESS OVERVIEW

FIGURE 37 XILINX: COMPANY SNAPSHOT

11.1.10 INFORMAI LLC

TABLE 128 INFORMAI: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 HEARTFLOW, INC

11.2.2 ENLITIC, INC

11.2.3 DAY ZERO DIAGNOSTICS, INC

11.2.4 AIDENCE

11.2.5 BUTTERFLY NETWORK, INC.

11.2.6 PROGNOS HEALTH

11.2.7 NANOX AI

11.2.8 VIZ.AI, INC

11.2.9 QUIBIM

11.2.10 QURE.AI

11.2.11 THERAPIXEL

11.2.12 AIDOC

11.2.13 KONINKLIJKE PHILIPS N.V.

11.2.14 LUNIT. INC

11.2.15 ECHONOUS INC.

12 APPENDIX (Page No. - 172)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the AI in medical diagnostics market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the global market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, directories, and databases (Dun & Bradstreet, Bloomberg Businessweek, and Factiva, among others) to identify and collect information useful for the technical, market-oriented, and commercial study of AI in the medical diagnostics market. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global of AI in medical diagnostics market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Hospitals, Clinics and Other Healthcare Facilities, Diagnostic laboratories and Diagnostics Imaging Center, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, and Rest of the world. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenues. As of 2021, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the AI in medical diagnostics market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

- Revenues of individual companies were gathered from public sources and databases

- The shares of the global market players were gathered from secondary sources to the extent available. In certain cases, the shares of the businesses were ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling prices, and geographic reach and strength

- Individual shares or revenue estimates were validated through expert interviews

- All percentage shares, splits, and breakdowns for the global market were determined by using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated and verified quantitative and qualitative data

- The gathered market data was consolidated and added with detailed inputs and analysis and presented in this report

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the AI in medical diagnostics market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the global market.

Report Objectives

- To define, describe, and forecast artificial intelligence in the medical diagnostics market based on component, application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market .

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments concerning four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW).

- To profile the key players and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, collaborations, and approvals in AI medical diagnostics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI in Medical Diagnostics Market