Artificial Lift Market by Type (ESP, PCP, Rod Lift, Gas Lift), Mechanism (Pump Assisted (Positive Displacement, Dynamic Displacement), Gas Assisted), Well Type (Horizontal, Vertical), Application (Onshore, Offshore) and Region - Global Forecast to 2027

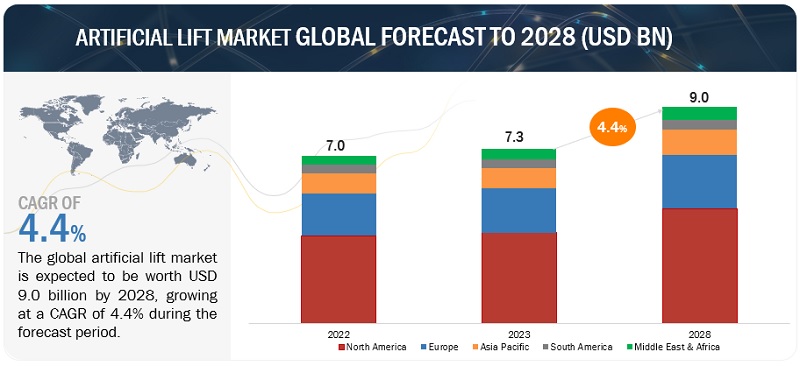

The Artificial Lift market is expected to expand in the coming years as a result of rising demand for oil and gas, the expansion of unconventional reserves, technological advancements, and government regulations. The global artificial lift market in terms of revenue was estimated to be worth $6.9 billion in 2022 and is poised to reach $8.7 billion by 2027, growing at a CAGR of 4.8% from 2022 to 2027.

Artificial Lift Market Share

The artificial lift market share is an important indicator of the industry's performance and progress. The use of technology and processes to elevate oil or gas from a well to the surface, particularly when natural pressure in the reservoir is insufficient to drive the hydrocarbons to the surface, is referred to as artificial lift. Artificial lift market share is driven by factors like as oil and gas pricing, technological improvements, and demand for oil and gas. With rising global energy demand, the artificial lift market is likely to expand rapidly in the next years. A few significant players dominate the artificial lift market, including Schlumberger, Baker Hughes, GE Oil & Gas, and Weatherford International. These businesses are investing in R&D to improve their products and services and increase their market presence.

To know about the assumptions considered for the study, Request for Free Sample Report

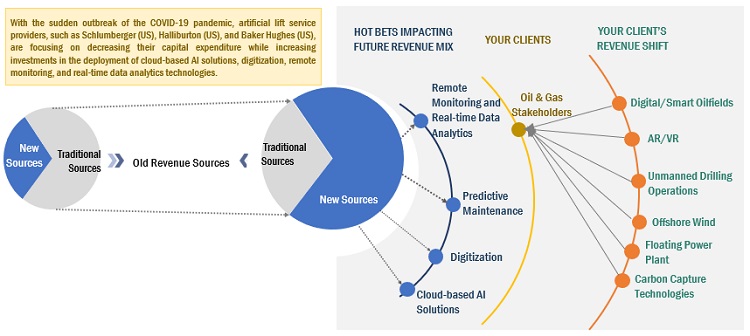

COVID-19 Impact on Artificial Lift Market

The worldwide spread of COVID-19 has slowed down the growth of numerous industries. The effects of the COVID-19 pandemic, including actions taken by businesses and governments to contain the spread of the virus, have resulted in a significant and swift reduction in demand for oil and gas. As of February 07, 2022, 223 countries have been impacted by the pandemic, and the governments of individual countries have ordered nationwide lockdowns. This has resulted in a considerable decline in transportation and related activities, hampering the demand for oil and gas. According to the IEA report, the geopolitical events increased the supply of low-priced oil to the global market, and at the same time, the demand declined due to the outbreak of the pandemic, leading to a collapse in oil prices in March 2020. These events together hampered the demand for oil and natural gas, as well as for oil field services and products, and caused significant volatility in oil prices. As of December 31, 2019, West Texas Intermediate’s (WTI) oil price was at USD 61.1, and by March 23, 2020, it was at USD 23.4, falling by more than 60.0%. As of April 2020, OPEC and other oil-producing countries had agreed to reduce oil production by 10 million bpd, which is about 23.0% of their production levels.

The effects of the pandemic have led to disruptions in upstream oil and gas operations, such as exploration and production. The crisis has forced some existing production facilities to halt their operations, as low oil prices are uneconomical for production. Additionally, a rapid build-up of oil stocks has saturated the available storage capacity in some parts of the world, even leading to negative prices. Several artificial lift providers had filed for bankruptcy protection and are restructuring capital assets. Besides, they have witnessed sharp declines in revenue in 2020 compared to 2019. For instance, in 2020, Halliburton (US) reported a 55.1% decrease in its revenue, whereas Schlumberger (US), Baker Hughes (US), and Weatherford (US) witnessed a decline of 39.5%, 15.1%, and 34.5%, respectively, in their annual revenues.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Heavy oil production

Heavy oil is liquid petroleum of less than 20°API gravity or more than 200 cP viscosity at reservoir conditions. Heavy oil is typically heated to lower its viscosity and pump it to the surface. The most commonly used form of artificial lift for extracting heavy oil is Progressive Cavity Pumps (PCPs). PCPs offer cost-effective production for sandy and viscous oil wells. Other forms of artificial lift to efficiently lift viscous oils that encourage heavy oil production include rod pumps and jet pumps. Significant heavy oil reserves are present in Canada, Venezuela, Mexico, China, and Colombia. Canada and Venezuela are key countries involved in the production of heavy oil globally. Thus, production activities in these countries are driving the artificial lift market. One of the primary methods of heavy oil production is the thermal recovery process, such as Steam Assisted Gravity Drainage (SAGD). Equipment abrasion and flow assurance are the two main challenges in SAGD, thereby requiring the accompaniment of artificial lifts for successful completion. Therefore, the continuous production of heavy oil in Canada, Venezuela, Mexico, China, and Colombia is driving the market in these countries.

Restraints: Decreasing CAPEX of oilfield operators and upstream service providers

Activities such as upstream exploration, development, and production, in addition to the capital investments by oil & gas players, are the major determinants of artificial lift demand. These activities are impacted by the oil & gas price fluctuations. In addition to the supply and demand of oil & gas resources, factors such as government regulations and policies concerning upstream E&P activities, weather conditions, and natural disasters also influence the price of the oil & gas resources. The oil and gas companies may reduce or defer major expenditures based on the perception of long-term low oil and natural gas prices, as many large-scale development projects initiated are for a long duration. The prolonged reduction in crude oil prices or expectations of such reduction is expected to hamper the growth of the artificial lift market.

Furthermore, the growth of the market is directly affected by the decline in capital expenditures by oilfield operators and service providers, leading to a decrease in demand for artificial lift systems.

Opportunities: Digitalization and automation

Well-related problems ranging from small leaks to structural failures have steadily increased over the past decade due to aging fields and the rising complexity of wells. These well integrity issues have led oil and gas companies to focus more on safety. Thus, they are adopting new digitization strategies to restructure their operations, which will enable them to perform a better analysis of well conditions and reduce operational costs.

The oilfield service providers are designing and developing new and enhanced oil recovery solutions to meet the rising demand for completion and intervention solutions from upstream operators in the artificial lift market. Oilfield service providers such as Schlumberger and Halliburton are capitalizing on their capabilities to enhance their portfolio and operations through digitalization and automation. For instance, in 2017, Schlumberger introduced a cloud-based SaaS that helps users optimize their E&P assets. Similarly, in 2020, Baker Hughes, in collaboration with C3, launched BHC3, an AI-based production optimization solution with well integrity & health monitoring/assessment features.

Challenges: Application of ALMs in horizontal wells

Most of the existing oil & gas wells were vertically drilled. Aging vertical wells require ALMs to produce liquid hydrocarbons and/or dewater the gas wells. Nowadays, horizontal drilling is becoming more popular, and artificial lift service providers are facing challenges in using ALMs in horizontal wells. Applying ALMs in shale assets with deep and long horizontal sections can be challenging. Most of the ALMs are designed to work in vertical sections of the wells. So, these methods must be developed to sweep and lift fluids from the deviated and/or horizontal portions. Water, which is used to fracture the wells, is produced back from the formations to reduce backpressure and clear flow paths for gas and oil production. Often some of the sand used to cover fracture openings is produced with this water during formations. Both water and sand must be artificially lifted from the wells.

Several methods of artificial lift have been deployed in these wells, ranging from rod pumps to electric submersible pumps and gas lifts. Some have proven to be more successful than others, depending on the application. All these lift methods are time-proven to produce oil & gas from vertical and deviated wellbores, and companies are trying to execute the lessons learned from these experiences to produce oil from horizontal wells.

By type, the rod lift segment is expected to grow at the highest rate during the forecast period.

The rod lift segment, owing to its increasing applications in onshore applications, is expected to grow at the highest rate during the forecast period. This high growth is further reinforced by the developments pertaining to unconventional oil & gas resources.

By mechanism, the pump assisted segment is expected to register a higher CAGR than the gas assisted segment during the forecast period.

The high growth rate of the pump assisted segment, which includes both positive displacement and dynamic displacement pumps, can be attributed to the increasing adoption of electric submersible pumps and progressive cavity pumps. The technological advancements across these pumps will further have a positive effect on the growth of the pump assisted mechanism segment.

By application, the offshore segment is projected to register a higher CAGR than the onshore segment during the forecast period.

The offshore segment of the artificial lift market is expected to grow at a higher CAGR than the onshore segment during the forecast period. The higher growth rate can be attributed to the rise in upstream activities pertaining to the deepwater and ultra-deepwater fields.

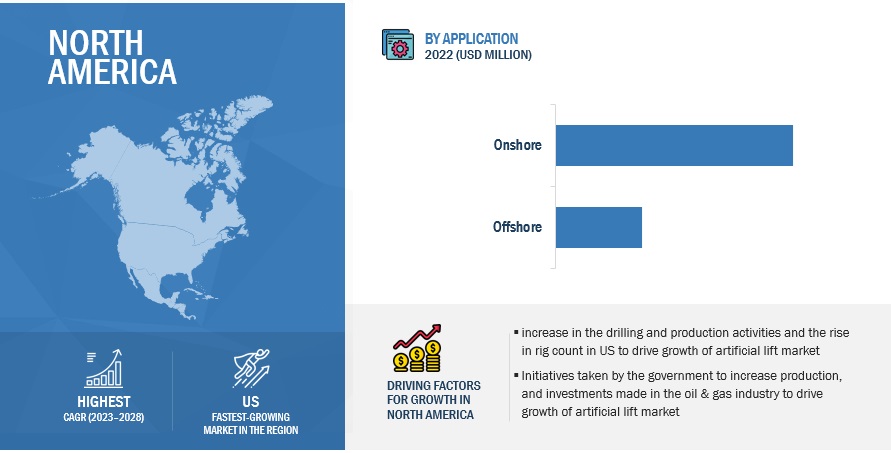

North America is expected to be the largest market during the forecast period.

North America is expected to be the largest and the fastest-growing market for artificial lift systems during the forecast period. The market growth in this region is characterized by rising upstream activities related to unconventional oil & gas resources like shale & tight oil and gas sources.

Key Market Players

The major players in the artificial lift market are Schlumberger Limited (US), Halliburton (US), Baker Hughes Company (US), NOV Inc (US), and Weatherford (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Coverage |

Details |

|

Market size: |

USD 6.9 billion in 2022 to USD 8.7 billion by 2027 |

|

Growth Rate: |

4.8% |

|

Largest Market: |

North America |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Type, Mechanism, Well Type, Application, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Digitalization and automation |

|

Key Market Drivers: |

Heavy oil production |

This research report categorizes the market based on type, mechanism, well type, application, and region

Based on type, the artificial lift market has been segmented as follows:

- Rod Lift

- Electric Submersible Pumps

- Progressive Cavity Pumps

- Gas Lift Systems

- Others

Based on mechanism, the market has been segmented as follows:

-

Pump Assisted

- Positive Displacement

- Dynamic Displacement

- Gas Assisted

Based on well type, the market has been segmented as follows:

- Horizontal

- Vertical

Based on application, the market has been segmented as follows:

- Onshore

- Offshore

Based on the region, the market has been segmented as follows:

- North America

- South America

- Asia Pacific

- Europe

- Middle East & Africa

Recent Developments

- In January 2022, Unbridled ESP systems, a subsidiary of ChampionX, introduced High Rise series pumps for minimizing carbon emissions during ESP operations. This product is used in unconventional well-completion operations.

- In November 2021, Halliburton signed an MOU with Cairn Oil & Gas, one of the leading oil and gas exploration and production companies. Under this partnership, both companies will jointly develop new technologies to help Cairn Oil & Gas to achieve its target of increasing recoverable reserve to 300 mmboe from 30 mmboe. This partnership will help Cairn Oil & Gas increase its domestic production of crude oil.

- In October 2021, Baker Hughes inaugurated a regional hub of oilfield services (OFS) located in King Salman Energy Park (SPARK). The new facility will support ongoing customer activities for three OFS product lines, ensuring high-quality service delivery and positioning BHGE for future growth in the region.

- In September 2021, Schlumberger Limited entered into an agreement with AVEVA to integrate Agora edge technologies and cloud-based digital solutions to help the oil operators optimize their oil & gas production.

- In August 2021, Schlumberger Limited introduced Optic*Schlumberger fiber-optic solution. It provides instantaneous and continuous measurement and gives actionable insights, which leads to higher efficiency, operational performance, and reduced environmental impact.

Frequently Asked Questions (FAQ):

What is the current size of the artificial lift market?

The size of the global artificial lift market is USD 6.9 billion in 2022.

What are the major drivers for the artificial lift market?

Increasing global oil demand and growing requirement to maximize the production potential of mature oil & gas fields.

Which is the fastest-growing region during the forecasted period in the artificial lift market?

North America is estimated to be the largest and the fastest-growing market for artificial lift during the forecast period.

Which is the fastest-growing segment, by type, during the forecast period?

The rod lift segment is estimated to be the largest and the fastest growing segment by type. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 ARTIFICIAL LIFT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARIES

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DEMAND-SIDE ANALYSIS

2.4.1 KEY INFLUENCING FACTORS/DRIVERS

2.4.1.1 Well count

2.4.1.2 Rig count

FIGURE 6 CRUDE OIL PRICE VS. RIG COUNT

2.4.1.3 Production

FIGURE 7 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION

2.4.1.4 Crude oil prices

FIGURE 8 CRUDE OIL PRICE TREND

2.4.2 DEMAND-SIDE METRICS

FIGURE 9 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR ARTIFICIAL LIFTS

2.4.2.1 Assumptions for demand-side analysis

2.5 SUPPLY-SIDE ANALYSIS

FIGURE 10 METRICS CONSIDERED FOR ASSESSING SUPPLY OF MARKET

FIGURE 11 SUPPLY-SIDE ANALYSIS

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 1 ARTIFICIAL LIFT MARKET SNAPSHOT

FIGURE 12 ROD LIFTS SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 13 PUMP-ASSISTED SEGMENT TO DOMINATE MARKET IN 2022

FIGURE 14 HORIZONTAL SEGMENT TO REGISTER HIGHEST GROWTH FROM 2022 TO 2027

FIGURE 15 ONSHORE SEGMENT WILL CONTINUE TO DOMINATE ARTIFICIAL LIFT MARKET IN 2027

FIGURE 16 NORTH AMERICA DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN ARTIFICIAL LIFT MARKET

FIGURE 17 REDEVELOPMENT OF MATURE OILFIELDS ALONG WITH NEW OFFSHORE OILFIELD DISCOVERIES TO DRIVE MARKET

4.2 ARTIFICIAL LIFT MARKET, BY REGION

FIGURE 18 NORTH AMERICA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4.3 MARKET SHARE, BY TYPE

FIGURE 19 ROD LIFTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.4 MARKET SHARE, BY MECHANISM

FIGURE 20 PUMP-ASSISTED SEGMENT DOMINATED MARKET IN 2021

4.5 MARKET SHARE, BY WELL TYPE

FIGURE 21 VERTICAL WELL SEGMENT DOMINATED MARKET, BY WELL TYPE, IN 2021

4.6 MARKET SHARE, BY APPLICATION

FIGURE 22 ONSHORE LARGEST APPLICATION SEGMENT OF MARKET

4.7 NORTH AMERICA: MARKET, BY APPLICATION AND COUNTRY

FIGURE 23 ONSHORE APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 ARTIFICIAL LIFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advancements in upstream activities concerning unconventional oil & gas reserves

5.2.1.2 Growing requirement for maximizing production potential of mature fields

5.2.1.3 Increase in global oil demand

FIGURE 25 GLOBAL OIL DEMAND, 2019–2026

TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2019–2026

5.2.1.4 Rise in heavy oil production

5.2.2 RESTRAINTS

5.2.2.1 Decreasing Capex of oilfield operators and upstream service providers

FIGURE 26 CAPITAL EXPENDITURE OF OILFIELD OPERATORS, 2017–2021

FIGURE 27 CAPITAL EXPENDITURE OF OIL & GAS SERVICE PROVIDERS, 2016–2021

5.2.3 OPPORTUNITIES

5.2.3.1 New oilfield discoveries

5.2.3.2 Digitalization and automation

5.2.4 CHALLENGES

5.2.4.1 Transition toward adoption of renewable energy sources

FIGURE 28 RENEWABLE CAPACITY ADDITIONS, BY COUNTRY/REGION, 2019–2021

5.2.4.2 Application of ALMs in horizontal wells

TABLE 3 HORIZONTAL WELL: ARTIFICIAL LIFT METHODS

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN ARTIFICIAL LIFT MARKET

FIGURE 29 REVENUE SHIFT OF ARTIFICIAL LIFT SERVICE PROVIDERS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 ARTIFICIAL LIFT MANUFACTURERS

5.4.3 ARTIFICIAL LIFT SERVICE PROVIDERS

5.4.4 OILFIELD OPERATORS

5.5 ECOSYSTEM/MARKET MAP

TABLE 4 ARTIFICIAL LIFT MARKET ECOSYSTEM

5.6 KEY CONFERENCES AND EVENTS

TABLE 5 LIST OF CONFERENCES AND EVENTS IN MARKET, 2022–2023

5.7 REGULATORY ANALYSIS

5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY COUNTRY

TABLE 9 MARKET: REGULATIONS

5.8 PATENT ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 ARTIFICIAL LIFT MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT OF SUBSTITUTES

5.9.5 DEGREE OF COMPETITION

5.10 TECHNOLOGY ANALYSIS

5.11 PRICING ANALYSIS

FIGURE 32 ARTIFICIAL LIFT OPEX, BY TYPE (USD)

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.12.2 BUYING CRITERIA

FIGURE 34 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

TABLE 12 KEY BUYING CRITERIA FOR ARTIFICIAL LIFT TYPES

5.13 CASE STUDY ANALYSIS

5.13.1 NOVOMET’S IMPACTFUL PERFORATION SOLUTION IN ECUADOR

TABLE 13 IMPORT DATA FOR ROTARY PUMPS, 2019–2021 (USD MILLION)

TABLE 14 EXPORT DATA FOR ROTARY PUMPS, 2019–2021 (USD MILLION)

6 ARTIFICIAL LIFT MARKET, BY TYPE (Page No. - 81)

6.1 INTRODUCTION

TABLE 15 COMPARISON OF ARTIFICIAL LIFT METHODS

FIGURE 35 ARTIFICIAL LIFT MARKET SHARE, BY TYPE, 2021

TABLE 16 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 17 MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 ROD LIFTS

6.2.1 RISE IN USE OF ARTIFICIAL ROD LIFTS IN OIL & GAS INDUSTRY FOR OIL DRILLING

TABLE 18 ROD LIFTS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 ROD LIFTS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 ELECTRICAL SUBMERSIBLE PUMPS

6.3.1 EFFICIENT MANUFACTURING DESIGN AND OPERATIONAL CHARACTERISTICS TO SUPPORT ADOPTION

TABLE 20 ELECTRICAL SUBMERSIBLE PUMPS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 ELECTRICAL SUBMERSIBLE PUMPS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 GAS LIFT SYSTEMS

6.4.1 LOW OPERATING COSTS TO BOOST MARKET GROWTH

TABLE 22 GAS LIFT SYSTEMS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 GAS LIFT SYSTEMS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 PROGRESSIVE CAVITY PUMPS

6.5.1 DEMAND FOR PROGRESSIVE CAVITY PUMPS IN SHALLOW WELLS EXPECTED TO RISE

TABLE 24 PROGRESSIVE CAVITY PUMPS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 PROGRESSIVE CAVITY PUMPS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.6 OTHERS

TABLE 26 OTHERS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 ARTIFICIAL LIFT MARKET, BY MECHANISM (Page No. - 90)

7.1 INTRODUCTION

FIGURE 36 ARTIFICIAL LIFT MARKET SHARE, BY MECHANISM, 2021

TABLE 28 MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 29 MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

7.2 PUMP ASSISTED

TABLE 30 PUMP ASSISTED: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 31 PUMP ASSISTED: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

TABLE 32 PUMP ASSISTED: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 PUMP ASSISTED: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.1 POSITIVE DISPLACEMENT

7.2.1.1 Increasing adoption of rod lift pumps and PCPs in North America and Middle East & Africa to drive market

TABLE 34 POSITIVE DISPLACEMENT: PUMP-ASSISTED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 POSITIVE DISPLACEMENT: PUMP-ASSISTED MARKET, BY REGION, 2020–2027 (USD MILLION)

7.2.2 DYNAMIC DISPLACEMENT

7.2.2.1 Rise in multistage drilling operations to drive market

TABLE 36 DYNAMIC DISPLACEMENT: PUMP-ASSISTED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 DYNAMIC DISPLACEMENT: PUMP-ASSISTED MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 GAS ASSISTED

7.3.1 MORE VERTICAL GAS WELLS ADOPTING GAS-ASSISTED SYSTEMS

TABLE 38 GAS ASSISTED: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 GAS ASSISTED: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 ARTIFICIAL LIFT MARKET, BY WELL TYPE (Page No. - 97)

8.1 INTRODUCTION

FIGURE 37 ARTIFICIAL LIFT MARKET SHARE, BY WELL TYPE, 2021

TABLE 40 MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 41 MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

8.2 HORIZONTAL

8.2.1 ESPS, JET PUMPS, AND PCPS USED IN HORIZONTAL WELL DRILLING

TABLE 42 HORIZONTAL WELL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 HORIZONTAL WELL: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 VERTICAL

8.3.1 VERTICAL WELL DRILLING CONSIDERED CONVENTIONAL METHOD OF OIL & GAS EXTRACTION

TABLE 44 VERTICAL WELL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 VERTICAL WELL: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 ARTIFICIAL LIFT MARKET, BY APPLICATION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 38 ARTIFICIAL LIFT MARKET SHARE, BY APPLICATION, 2021

TABLE 46 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 47 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 ONSHORE

9.2.1 REDEVELOPMENT OF MATURE ONSHORE OILFIELDS ALONG WITH GROWING SHALE ACTIVITIES TO DRIVE MARKET

TABLE 48 ONSHORE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 ONSHORE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 OFFSHORE

9.3.1 MATURING SHALLOW OILFIELDS DRIVING OFFSHORE MARKET

TABLE 50 OFFSHORE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 OFFSHORE: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 ARTIFICIAL LIFT MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

FIGURE 39 ARTIFICIAL LIFT MARKET SHARE, BY REGION, 2021

FIGURE 40 NORTH AMERICA LARGEST AND FASTEST-GROWING MARKET

10.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: ARTIFICIAL LIFT MARKET SNAPSHOT

10.2.1 BY TYPE

TABLE 54 NORTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 BY MECHANISM

TABLE 56 NORTH AMERICA: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.2.3 BY PUMP-ASSISTED MECHANISM

TABLE 58 NORTH AMERICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2020–2027 (USD MILLION)

10.2.4 BY WELL TYPE

TABLE 60 NORTH AMERICA: MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

10.2.5 BY APPLICATION

TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.6 BY COUNTRY

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.6.1 US

10.2.6.1.1 Increasing exploration and production of shale and tight oil reserves to drive market

TABLE 66 US: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 67 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 US: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 69 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.6.2 Canada

10.2.6.2.1 Increasing exploration and drilling of oil sands and offshore wells to provide lucrative growth opportunities

TABLE 70 CANADA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 71 CANADA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 CANADA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 73 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.6.3 Mexico

10.2.6.3.1 Increasing focus on redeveloping mature fields to offer growth opportunities

TABLE 74 MEXICO: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 MEXICO: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 MEXICO: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 77 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3 EUROPE

FIGURE 42 EUROPE: ARTIFICIAL LIFT MARKET SNAPSHOT

10.3.1 BY TYPE

TABLE 78 EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.2 BY MECHANISM

TABLE 80 EUROPE: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.3.3 BY PUMP-ASSISTED MECHANISM

TABLE 82 EUROPE: MARKET, BY PUMP-ASSISTED MECHANISM, 2016–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY PUMP-ASSISTED MECHANISM, 2020–2027 (USD MILLION)

10.3.4 BY WELL TYPE

TABLE 84 EUROPE: MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

10.3.5 BY APPLICATION

TABLE 86 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.6 BY COUNTRY

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.6.1 Russia

10.3.6.1.1 Investments in Arctic offshore to drive offshore market in Russia

TABLE 90 RUSSIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 91 RUSSIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 RUSSIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 93 RUSSIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.6.2 UK

10.3.6.2.1 Redevelopment of brownfields to drive market in UK

TABLE 94 UK: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 UK: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 97 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.6.3 Norway

10.3.6.3.1 Rising offshore exploration and production in Norwegian Continental Shelf (NCS) to support market growth

TABLE 98 NORWAY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 NORWAY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 NORWAY: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 101 NORWAY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.6.4 Rest of Europe

TABLE 102 REST OF EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 BY TYPE

TABLE 106 ASIA PACIFIC: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.2 BY MECHANISM

TABLE 108 ASIA PACIFIC: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.4.3 BY PUMP-ASSISTED MECHANISM

TABLE 110 ASIA PACIFIC: MARKET, BY PUMP-ASSISTED MECHANISM, 2016–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY PUMP-ASSISTED MECHANISM, 2020–2027 (USD MILLION)

10.4.4 BY WELL TYPE

TABLE 112 ASIA PACIFIC: MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

10.4.5 BY APPLICATION

TABLE 114 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6 BY COUNTRY

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.6.1 China

10.4.6.1.1 Depleting giant oil & gas fields and increasing crude oil imports favor implementation of artificial lifts in China

TABLE 118 CHINA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 119 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 CHINA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6.2 Indonesia

10.4.6.2.1 Enhanced oil recovery applications to drive market

TABLE 122 INDONESIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 INDONESIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 INDONESIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 125 INDONESIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6.3 Malaysia

10.4.6.3.1 Rising deepwater explorations and increasing oil & gas production from existing fields to drive market

TABLE 126 MALAYSIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 127 MALAYSIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 MALAYSIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 129 MALAYSIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6.4 India

10.4.6.4.1 Increase in crude oil imports to drive market

TABLE 130 INDIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 INDIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6.5 Rest of Asia Pacific

TABLE 134 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY TYPE

TABLE 138 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5.2 BY MECHANISM

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.5.3 BY PUMP-ASSISTED MECHANISM

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2016–2019 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2020–2027 (USD MILLION)

10.5.4 BY WELL TYPE

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

10.5.5 BY APPLICATION

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6 BY COUNTRY

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.6.1 Angola

10.5.6.1.1 Increasing oil production activities to drive market in Angola

TABLE 150 ANGOLA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 151 ANGOLA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 ANGOLA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 153 ANGOLA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.2 Oman

10.5.6.2.1 New oil discoveries from Omani companies to drive market

TABLE 154 OMAN: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 155 OMAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 OMAN: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 157 OMAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.3 Nigeria

10.5.6.3.1 Development of mature oil & gas fields and exploration & production activities in deep and ultra deepwater to boost market

TABLE 158 NIGERIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 159 NIGERIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 NIGERIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 161 NIGERIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.4 Saudi Arabia

10.5.6.4.1 Increasing crude oil production from declining reserves to drive adoption of artificial lifts

TABLE 162 SAUDI ARABIA: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 163 SAUDI ARABIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 SAUDI ARABIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 165 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.5 Kuwait

10.5.6.5.1 Upcoming investments for development of oilfields to boost market

TABLE 166 KUWAIT: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 167 KUWAIT: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 KUWAIT: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 169 KUWAIT: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.6 UAE

10.5.6.6.1 Employment of EOR and artificial lift techniques at existing oilfields offer lucrative opportunities

TABLE 170 UAE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 UAE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 UAE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 173 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.6.7 Rest of Middle East & Africa

TABLE 174 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY TYPE

TABLE 178 SOUTH AMERICA: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 179 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.6.2 BY MECHANISM

TABLE 180 SOUTH AMERICA: MARKET, BY MECHANISM, 2016–2019 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.6.3 BY PUMP-ASSISTED MECHANISM

TABLE 182 SOUTH AMERICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2016–2019 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET, BY PUMP-ASSISTED MECHANISM, 2020–2027 (USD MILLION)

10.6.4 BY WELL TYPE

TABLE 184 SOUTH AMERICA: MARKET, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET, BY WELL TYPE, 2020–2027 (USD MILLION)

10.6.5 BY APPLICATION

TABLE 186 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.6 BY COUNTRY

TABLE 188 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.6.1 Venezuela

10.6.6.1.1 Lucrative government laws for exploration and production activities to boost market

TABLE 190 VENEZUELA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 191 VENEZUELA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 VENEZUELA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 193 VENEZUELA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.6.2 Brazil

10.6.6.2.1 Increasing offshore exploration and production activities to boost market

TABLE 194 BRAZIL: ARTIFICIAL LIFT MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 195 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 BRAZIL: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 197 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.6.3 Colombia

10.6.6.3.1 Increasing exploration and production activities owing to favorable regulatory reforms to drive market

TABLE 198 COLOMBIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 199 COLOMBIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 COLOMBIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 201 COLOMBIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.6.4 Ecuador

10.6.6.4.1 Increasing production from oil reserves to drive demand for artificial lifts

TABLE 202 ECUADOR: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 203 ECUADOR: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 204 ECUADOR: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 205 ECUADOR: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6.6.5 Rest of South America

TABLE 206 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 207 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 209 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 169)

11.1 OVERVIEW

FIGURE 43 KEY DEVELOPMENTS IN MARKET, 2017 TO 2022

11.2 MARKET SHARE ANALYSIS

TABLE 210 ARTIFICIAL LIFT MARKET: DEGREE OF COMPETITION

FIGURE 44 MARKET SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2021

11.3 MARKET EVALUATION FRAMEWORK

TABLE 211 MARKET EVALUATION FRAMEWORK, 2017–2022

11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 45 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2017–2021

11.5 RECENT DEVELOPMENTS

11.5.1 DEALS

TABLE 212 ARTIFICIAL LIFT MARKET: DEALS

11.5.2 PRODUCT LAUNCHES

TABLE 213 MARKET: PRODUCT LAUNCHES

11.5.3 OTHER DEVELOPMENTS

TABLE 214 MARKET: OTHER DEVELOPMENTS

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 46 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.7 COMPANY FOOTPRINT ANALYSIS

TABLE 215 TYPE FOOTPRINT OF COMPANIES

TABLE 216 MECHANISM FOOTPRINT OF COMPANIES

TABLE 217 REGIONAL FOOTPRINT OF COMPANIES

12 COMPANY PROFILES (Page No. - 181)

12.1 KEY COMPANIES

12.1.1 SCHLUMBERGER LIMITED

12.1.1.1 Business and financial overview

TABLE 218 SCHLUMBERGER LIMITED: BUSINESS OVERVIEW

FIGURE 47 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

12.1.1.2 Products & services offered

12.1.1.3 Recent developments

TABLE 219 SCHLUMBERGER LIMITED: DEALS

TABLE 220 SCHLUMBERGER LIMITED: PRODUCT LAUNCHES

12.1.1.4 MnM view

12.1.1.4.1 Key strengths/right to win

12.1.1.4.2 Strategic choices made

12.1.1.4.3 Weaknesses and competitive threats

12.1.2 WEATHERFORD

12.1.2.1 Business and financial overview

TABLE 221 WEATHERFORD: BUSINESS OVERVIEW

FIGURE 48 WEATHERFORD: COMPANY SNAPSHOT

12.1.2.2 Products & services offered

12.1.2.3 Recent developments

TABLE 222 WEATHERFORD: DEALS

TABLE 223 WEATHERFORD: PRODUCT LAUNCHES

12.1.2.4 MnM view

12.1.2.4.1 Key strengths/right to win

12.1.2.4.2 Strategic choices made

12.1.2.4.3 Weaknesses and competitive threats

12.1.3 BAKER HUGHES COMPANY

12.1.3.1 Business and financial overview

TABLE 224 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

FIGURE 49 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

12.1.3.2 Products & services offered

12.1.3.3 Recent developments

TABLE 225 BAKER HUGHES COMPANY: DEALS

TABLE 226 BAKER HUGHES: OTHER DEVELOPMENTS

12.1.3.4 MnM view

12.1.3.4.1 Key strengths/right to win

12.1.3.4.2 Strategic choices made

12.1.3.4.3 Weaknesses and competitive threats

12.1.4 HALLIBURTON

12.1.4.1 Business and financial overview

TABLE 227 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 50 HALLIBURTON: COMPANY SNAPSHOT

12.1.4.2 Products & services offered

12.1.4.3 Recent developments

TABLE 228 HALLIBURTON: DEALS

12.1.4.4 MnM view

12.1.4.4.1 Key strengths/right to win

12.1.4.4.2 Strategic choices made

12.1.4.4.3 Weaknesses and competitive threats

12.1.5 NOV INC.

12.1.5.1 Business and financial overview

TABLE 229 NOV INC.: BUSINESS OVERVIEW

FIGURE 51 NOV INC.: COMPANY SNAPSHOT

12.1.5.2 Products & services offered

12.1.5.3 MnM view

12.1.5.3.1 Key strengths/right to win

12.1.5.3.2 Strategic choices made

12.1.5.3.3 Weaknesses and competitive threats

12.1.6 EBARA CORPORATION

12.1.6.1 Business and financial overview

TABLE 230 EBARA CORPORATION: BUSINESS OVERVIEW

FIGURE 52 EBARA CORPORATION: COMPANY SNAPSHOT

12.1.6.2 Products & services offered

12.1.6.3 Recent developments

TABLE 231 EBARA CORPORATION: DEALS

TABLE 232 EBARA CORPORATION: PRODUCT LAUNCHES

TABLE 233 EBARA CORPORATION: OTHER DEVELOPMENTS

12.1.7 TENARIS

12.1.7.1 Business and financial overview

TABLE 234 TENARIS: BUSINESS OVERVIEW

FIGURE 53 TENARIS: COMPANY SNAPSHOT

12.1.7.2 Products & services offered

12.1.7.3 Recent developments

TABLE 235 TENARIS: DEALS

TABLE 236 TENARIS: PRODUCT LAUNCHES

12.1.8 DISTRIBUTIONNOW

12.1.8.1 Business and financial overview

TABLE 237 DISTRIBUTIONNOW: BUSINESS OVERVIEW

FIGURE 54 DISTRIBUTIONNOW: COMPANY SNAPSHOT

12.1.8.2 Products & services offered

12.1.8.3 Recent developments

TABLE 238 DISTRIBUTIONNOW: DEALS

12.1.9 CHAMPIONX

12.1.9.1 Business and financial overview

TABLE 239 CHAMPIONX: BUSINESS OVERVIEW

FIGURE 55 CHAMPIONX: COMPANY SNAPSHOT

12.1.9.2 Products & services offered

12.1.9.3 Recent developments

TABLE 240 CHAMPIONX: DEALS

TABLE 241 CHAMPIONX: PRODUCT LAUNCHES

12.1.10 BORETS

12.1.10.1 Business overview

TABLE 242 BORETS: BUSINESS OVERVIEW

12.1.10.2 Products & services offered

12.1.10.3 Recent developments

TABLE 243 BORETS: DEALS

12.1.11 OILSERV

12.1.11.1 Business and financial overview

TABLE 244 OILSERV: BUSINESS OVERVIEW

12.1.11.2 Products & services offered

12.1.12 NOVOMET

12.1.12.1 Business and financial overview

TABLE 245 NOVOMET: BUSINESS OVERVIEW

12.1.12.2 Products & services offered

12.1.13 JJ TECH

12.1.13.1 Business overview

TABLE 246 JJ TECH: BUSINESS OVERVIEW

12.1.13.2 Products & services offered

12.1.14 CAMCO

12.1.14.1 Business overview

TABLE 247 CAMCO: BUSINESS OVERVIEW

12.1.14.2 Products & services offered

12.1.14.3 Recent developments

TABLE 248 CAMCO: OTHER DEVELOPMENTS

12.1.15 RIMERA GROUP

12.1.15.1 Business overview

TABLE 249 RIMERA GROUP: BUSINESS OVERVIEW

12.1.15.2 Products & services offered

12.1.15.3 Recent developments

TABLE 250 RIMERA GROUP: DEALS

TABLE 251 RIMERA GROUP: PRODUCT LAUNCHES

12.2 OTHER PLAYERS

12.2.1 MRC GLOBAL INC.

12.2.2 ALKHORAYEF PETROLEUM

12.2.3 CAIRN OIL & GAS

12.2.4 ACCESSESP

12.2.5 VALIANT ARTIFICIAL LIFT SOLUTIONS

13 APPENDIX (Page No. - 229)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

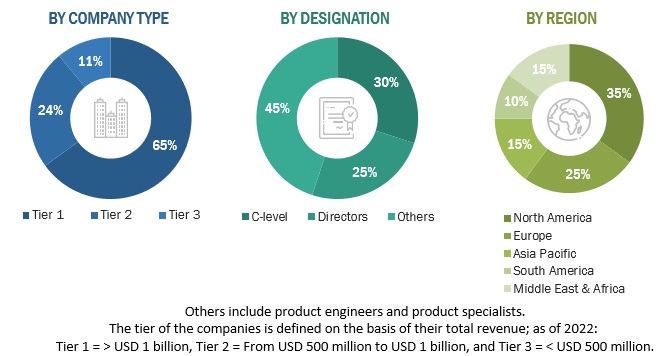

This study involved two major activities in estimating the current size of the artificial lift market. Exhaustive secondary research was carried out to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The research study on the market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Atomic Energy Agency (IAEA), Nuclear Energy Agency, and others, to identify and collect information useful for this technical, market-oriented, and commercial study of the market. The other secondary sources included press releases, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market.

The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Artificial lift Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from the demand side. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the artificial lift market based on type, mechanism, well type, and application

- To forecast the market size in four key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions to the overall market size

- To analyze the market opportunities for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players and core competencies

- To track and analyze competitive developments in the market, including contracts, agreements, expansions, investments, partnerships, collaborations, mergers, and acquisitions

Hydraulic lift & Its impact on Artificial Lift Market

Hydraulic and artificial lift systems are two distinct technologies used in a variety of industries. Hydraulic lifts are commonly used in the construction and automotive industries to lift heavy loads or vehicles. In the oil and gas industry, artificial lift systems are used to lift oil or gas from the wellbore to the surface. The artificial lift market is a global industry that provides solutions for oil and gas production. There are various types of artificial lift systems on the market, including electric submersible pumps (ESP), rod pumps, gas lift systems, and hydraulic lift systems. Because hydraulic lift systems are inefficient compared to other artificial lift systems, they are not widely used in the oil and gas industry. However, some hydraulic lift systems have been used in the past to extract oil or gas from wells with low production rates or wellhead pressures.

By extending the reach of Hydraulic lift services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Vertical transportation in high-rise buildings: With the construction of taller and taller buildings, the demand for reliable and efficient vertical transportation systems is growing.

- Urban air mobility: Hydraulic lifts can be used to lift these aircraft and drones to the required height before take-off and after landing.

- Space exploration: Hydraulic lifts can play a crucial role in space exploration by transporting heavy payloads to space stations or other planets.

- Warehouse automation: Hydraulic lifts can be used to move heavy goods to different levels of the warehouse, making it easier for workers to retrieve and store items.

- Underwater exploration: Hydraulic lifts can be used to lift underwater vehicles and equipment to the surface for maintenance and repairs.

The top players in the Hydraulic lift market are Schindler Group, Otis Elevator Company, ThyssenKrupp Elevator, KONE Corporation, Mitsubishi Electric Corporation, Fujitec Co. Ltd., Hitachi, Ltd.

Some of the key industries that are going to get impacted because of the growth of Hydraulic lift are,

1. Warehousing and Logistics: Hydraulic lifts are already used in warehouses to move goods from one level to another.

2. Agriculture: Hydraulic lifts can be used in agriculture for tasks such as lifting and moving heavy equipment or materials.

3. Automotive: Automotive companies are already using hydraulic lifts for car maintenance and repairs.

4. Healthcare: Hydraulic lifts are commonly used in hospitals and nursing homes to move patients from one location to another.

5. Energy: Hydraulic lifts are used in the energy industry for tasks such as lifting and moving heavy equipment or materials.

6. Aerospace: Hydraulic lifts are used in the aerospace industry for tasks such as lifting and moving heavy equipment or materials.

Speak to our Analyst today to know more about Hydraulic lift Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Lift Market