Asset Integrity Management Market by Service Type (NDT, RBI, Corrosion Management, Pipeline Integrity Management, HAZID Study, Structural Integrity Management, RAM Study), Industry and Region - 2026

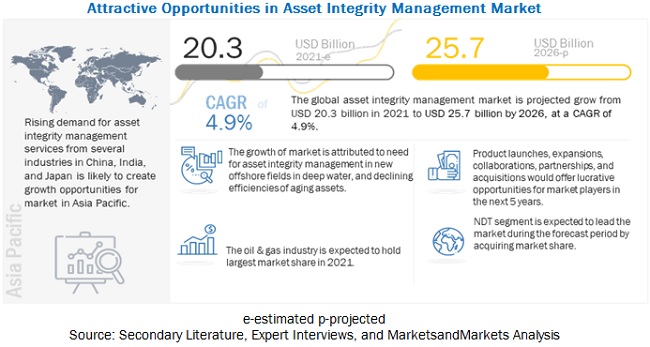

The global asset integrity management market size is projected to reach USD 25.7 billion by 2026 at a CAGR of 4.9% during the forecast period.

Factors such as stringent safety regulations and quality control requirements laid down by governments, and climatic changes affecting the operations of various industries, thereby driving the asset integrity management industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Asset Integrity Management Market

The pandemic has impacted several industries across the world, and the oil & gas industry is no exception. The global petroleum product consumption decreased significantly due to travel restrictions and economic slowdown. The crisis in the oil & gas industry has substantially impacted several workers and communities who are dependent on its revenues. The industry players are struggling with the oil price war, declining demand, business stability, and employee safety, and need to focus on developing a flexible business model, which can lead to long-term resilience.

The demand for electricity from the industrial sector has been reduced significantly due to the COVID-19 pandemic. Governments across the world were compelled to reduce business activities in response to the virus outbreak. Plant-wide asset inspection and repair work is on hold and mostly in favor of high-priority production-related assets only. The current COVID-19 strategy of mitigation through working at home and social distancing is resulting in a growing backlog of inspection and maintenance work. Moreover, the situation is forcing asset inspection management services providers to perform critical asset inspections with fewer personnel. However, the adoption of key digital strategies such as remote inspection and remote collaboration is expected to help organizations to maintain safe and productive assets

Asset Integrity Management MarketDynamics

Driver: Climatic changes giving rise to operational disturbances in various industries

Climatic changes over a period largely affect the operations of the oil & gas and power industries. Various industries and governments are progressively recognizing the need for climate adaptation planning and its inclusion in the overall risk management strategy. Climatic changes are inevitable and need to be considered at the time of risk planning to avoid major setbacks or hazardous accidents. Risk-based inspection of the assets in the oil & gas and power generation plants help to understand the risks involved in the forecasted climatic changes and the damage caused by such changes previously. Asset integrity management services help decision-makers to plan risk management strategies, thus decreasing the effects of climatic changes on plant operations.

Restraint: High initial costs and complexities with installation

Asset integrity management services are used for monitoring assets throughout their entire life cycle, which helps make decisions regarding maintenance activities to avoid breakdowns and disastrous events. Installation of the systems required for asset integrity management services is complex and involves careful consideration of certain trade-offs flanked by short-term and long-term benefits. A fundamental review of the expectations of stakeholders is considered while implementing these solutions, which is supported by a consistent and scalable method for determining the criticality and value of assets.

Opportunity: Thriving power sector in developing nations

The power industry is expected to generate the maximum demand for asset integrity management services in the future. Developing countries such as China, India, and Mexico are undergoing infrastructure development on a large scale, especially in the power generation sector. Most of this growth is focused in regions where strong economic growth is driving demand, particularly in Asia. According to the data published by the World Nuclear Association (as of September 2020), the electricity generation capacity, specifically nuclear power generation, in Asia is growing remarkably. In this region, there are about 135 operational nuclear reactors, and about 35 are under construction; additionally, firms are planning to build 60-70 more. Increase in the number of nuclear power plants and the subsequent rise in the demand for machines used in these plants would present opportunities for asset integrity management service and NDT companies to develop solutions suitable for the nuclear power generation industry.

Challenge: Lack of skilled personnel for operating asset integrity management systems and software

Asset integrity management involves several techniques, hardware, and software, which need to be operated and administered by skilled individuals. Specially trained and educated workforce is required for operating software and equipment carrying out the inspection of asset integrity. Labors have to be trained specifically for these operations and require ample of relevant experience. Experience and training provide them the ability to operate and make appropriate and timely decisions for ensuring the smooth operation of the plants.

The market for corrosion management to grow at the highest CAGR from 2021 to 2026

Corrosion management involves cathodic protection, protective coating, chemical injection, and corrosion monitoring. Failure to manage corrosion properly imparts a huge impact on assets. Hence, it is imperative to indulge in effective corrosion management and recognize and mitigate corrosion problems as they become evident. The amplifying need to protect aging infrastructure across industries is driving the demand for corrosion management services. Use of advanced data analytics, the internet of things (IoT), and data visualization tools are set to transform corrosion management services and solutions from costly and presumptive to predictive and data-driven.

Asset integrity management market for the power industry to exhibit high growth during the forecast period

The asset integrity management services in the power industry are used for ensuring the efficient and optimal working of power plants. Since a number of complex equipment and components are involved in the industry, the chances of their failure and unplanned shutdown also increase. Unplanned shutdown of a power plant can have disastrous effects for end-user industries and organizations. Thus, the implementation of asset integrity management services is a must to keep the power plants running. The need to meet the demand for energy due to rapid industrialization and growing population especially in Asia Pacific have led to an increase in the number of power plants and, consequently, the demand for asset integrity management services.

To know about the assumptions considered for the study, download the pdf brochure

The asset integrity management market in Asia Pacific to grow at the highest CAGR during the forecast period

The asset integrity management market in Asia Pacific is expected to grow at the highest CAGR from 2021 to 2026. The growth of the market is primarily driven by the increasing demand for oil and gas and the rise in merger and acquisition activities, which have increased investments in the regional energy sector. Advancements in terms of economic growth, infrastructural development, and construction of power plants boost the asset integrity management market in Asia Pacific. Exhibitions and associations in Asia Pacific countries support the adoption of asset integrity management services. Such events include the Asset Integrity Management Asia Summit (Singapore) and the Structural Integrity Management Summit Asia Pacific (Malaysia) held annually in August and September, respectively.

Asset Integrity Management Companies - Key Market Players

The asset integrity management players have implemented various types of organic as well as inorganic growth strategies, such as new product launches, partnerships, contracts, acquisitions and, expansions, to strengthen their offerings in the market. The major players in the asset integrity management market are SGS (Switzerland), Bureau Veritas (France), Intertek Group (UK), TechnipFMC (UK), Aker Solutions (Norway), Applus Services (Spain), among others.

The study includes an in-depth competitive analysis of these key players in the asset integrity management market with their company profiles, recent developments, and key market strategies.

Asset Integrity Management Market Scope:

|

Report Metric |

Details |

|

Years considered |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Service Type, Industry, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

SGS (Switzerland), Bureau Veritas (France), Intertek Group (UK), TechnipFMC (UK), Aker Solutions (Norway), Rosen Swiss (Switzerland), LifeTech (UK), EM&I (UK), Metegrity (Canada), TWI (UK), TÜV SÜD (Germany). A total of 26 players covered. |

In this report, the overall asset integrity management market has been segmented based on service type, industry, and region.

By Service Type:

- Non-Destructive Testing (NDT)

- Risk-Based Inspection (RBI)

- Corrosion Management

- Pipeline Integrity Management

- Hazard Identification (HAZID) Study

- Structural Integrity Management

- Reliability, Availability, And Maintainability (RAM) study

- Others

By Industry:

- Oil & gas

- Power

- Mining

- Aerospace

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Norway

- Rest of Europe

-

Asia Pacific (Asia Pacific)

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World (RoW)

-

Middle East

- Saudi Arabia

- UAE

- Rest of Middle East

- Africa

- South America

-

Middle East

Recent Developments in Asset Integrity Management Industry

- In June 2021, Bureau Veritas signed a contract with Veolia, an energy services company, to provide technical verifications at all sites. Bureau Veritas will also provide inspection services of the equipment, diagnostics and regulatory check and consultation in a three-year agreement contract.

- In November 2020, Aker Solutions received a contract from Equinor, an energy company, in Brazil. The contract is of 4 years in which Aker Solutions will provide maintenance and modifications service at Peregrino field to extend the life of Equinor’s assets

- In August 2020, SGS partnered with Oilfield Production Enhancement Consulting Services Ltd. (OPECS) – a consultancy company based in Aberdeen, UK, to jointly deliver SGS ARPIN workflow consultancy services. They will also provide consultancy for hydraulic fracturing, well stimulation and geomechanics to support energy companies in optimizing their drilling and stimulation work.

Frequently Asked Questions (FAQ):

Which region is expected to generate the largest revenue during the forecast period?

North America is expected to generate the largest revenue during the forecast period

Does this report include the impact of COVID-19 on the asset integrity management market?

Yes, the report includes the impact of COVID-19 on the asset integrity management market. It illustrates the post- COVID-19 market scenario.

Who are the top five players in the asset integrity management services market?

The major vendors operating in the asset integrity management services market include SGS (Switzerland), Bureau Veritas (France), Intertek Group (UK), TechnipFMC (UK), Aker Solutions (Norway).

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Norway, and the rest of European countries.

Which is the largest revenue-generating end-use industry during the forecast period?

The oil & gas industry is expected to generate the largest revenue during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ASSET INTEGRITY MANAGEMENT MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 ASSET INTEGRITY MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE FROM PRODUCTS/SOLUTIONS OF ASSET INTEGRITY MANAGEMENT MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

2.4.2 LIMITATIONS

2.4.3 RISK ASSESSMENT

FIGURE 8 RISK ASSESSMENT OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 IMPACT OF COVID-19 ON ASSET INTEGRITY MANAGEMENT MARKET

3.1 REALISTIC SCENARIO

TABLE 1 ASSET INTEGRITY MANAGEMENT MARKET, POST-COVID-19 REALISTIC SCENARIO, 2021–2026 (USD MILLION)

3.2 PESSIMISTIC SCENARIO

TABLE 2 ASSET INTEGRITY MANAGEMENT MARKET, POST-COVID-19 PESSIMISTIC SCENARIO, 2021–2026 (USD MILLION)

3.3 OPTIMISTIC SCENARIO

TABLE 3 ASSET INTEGRITY MANAGEMENT MARKET, POST-COVID-19 OPTIMISTIC SCENARIO, 2021–2026 (USD MILLION)

FIGURE 10 NDT SEGMENT EXPECTED TO CAPTURE LARGEST MARKET SHARE IN 2021

FIGURE 11 OIL & GAS INDUSTRY DOMINATED ASSET INTEGRITY MANAGEMENT MARKET IN 2020

FIGURE 12 NORTH AMERICA TO HOLD LARGEST MARKET SHARE BY 2026

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ASIA PACIFIC TO PROVIDE LUCRATIVE OPPORTUNITIES FOR ASSET INTEGRITY MANAGEMENT MARKET

FIGURE 13 ATTRACTIVE GROWTH OPPORTUNITIES IN ASSET INTEGRITY MANAGEMENT MARKET

4.2 ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE

FIGURE 14 NDT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY AND REGION

FIGURE 15 OIL & GAS INDUSTRY AND NORTH AMERICA TO DOMINATE MARKET BY 2026

4.4 ASSET INTEGRITY MANAGEMENT MARKET, BY REGION

FIGURE 16 INDIA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ASSET INTEGRITY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Decreasing efficiencies of aging assets and requirement for operational safety

5.2.1.2 Recognition of new offshore fields and subsequent increase in demand for asset integrity management services

5.2.1.3 Climatic changes give rise to operational disturbances across industries

FIGURE 18 POTENTIAL RISKS POSED BY CLIMATIC CHANGES TO OIL AND GAS INDUSTRY

5.2.1.4 Strict safety regulations and quality control requirements

FIGURE 19 IMPACT ANALYSIS OF DRIVERS FOR ASSET INTEGRITY MANAGEMENT MARKET

5.2.2 RESTRAINTS

5.2.2.1 High initial costs and complexities with installation

FIGURE 20 PDCA FRAMEWORK FOR ASSET INTEGRITY MANAGEMENT

5.2.2.2 Adverse impact of harsh environmental conditions in the Middle East and Arctic regions

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS FOR ASSET INTEGRITY MANAGEMENT MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for renewable sources of energy

5.2.3.2 Growth of power sector in emerging nations

5.2.3.3 Confluence of cloud technology and asset integrity management services

FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES FOR ASSET INTEGRITY MANAGEMENT MARKET

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled workforce to manage asset integrity management systems and software

FIGURE 23 IMPACT ANALYSIS OF CHALLENGE FOR ASSET INTEGRITY MANAGEMENT MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: ASSET INTEGRITY MANAGEMENT MARKET

5.4 ECOSYSTEM

FIGURE 25 ECOSYSTEM OF ASSET INTEGRITY MANAGEMENT MARKET

TABLE 4 ASSET INTEGRITY MANAGEMENT MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 26 REVENUE SHIFT FOR ASSET INTEGRITY MANAGEMENT MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 ASSET INTEGRITY MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7 CASE STUDY ANALYSIS

TABLE 6 MARKET ASSESSMENT FOR ASSET AND MAINTENANCE MANAGEMENT IMPROVEMENT PROGRAM

TABLE 7 MARKET ASSESSMENT FOR INTEGRITY AND MAINTENANCE SOLUTION

TABLE 8 MARKET ASSESSMENT FOR REMAINING LIFE ASSESSMENT FOR TRANSMISSION PIPELINES

TABLE 9 MARKET ASSESSMENT FOR CUMULATIVE RISK MANAGEMENT

TABLE 10 MARKET ASSESSMENT FOR RESTORING ASSET HEALTH

TABLE 11 MARKET ASSESSMENT FOR INTEGRATED RISK ASSESSMENT SYSTEM

TABLE 12 MARKET ASSESSMENT FOR INTEGRATED ASSET LIFE SOLUTION

5.8 PATENT ANALYSIS

FIGURE 27 TOP 10 COMPANIES/INSTITUTIONS WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 13 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

FIGURE 28 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 14 LIST OF FEW PATENTS IN ASSET INTEGRITY MANAGEMENT MARKET, 2020–2021

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

FIGURE 29 IMPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.9.2 EXPORT SCENARIO

FIGURE 30 EXPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.10 TECHNOLOGY ANALYSIS

5.10.1 IOT, ROBOTICS, AND BIG DATA – DRIVING DIGITAL TRANSFORMATION IN ASSET INTEGRITY MANAGEMENT MARKET

5.10.2 PHASED ARRAY ULTRASONIC TESTING AND 3D LASER SCANNING

5.10.3 GEOGRAPHIC INFORMATION SYSTEMS

5.10.4 MACHINE LEARNING AND ADVANCED ANALYTICS

5.11 PRICING ANALYSIS

5.12 REGULATORY LANDSCAPE

5.12.1 SAFETY STANDARDS FOR ASSET INTEGRITY MANAGEMENT

TABLE 15 SAFETY STANDARDS FOR ASSET INTEGRITY MANAGEMENT

6 EQUIPMENT REQUIRING ASSET INTEGRITY MANAGEMENT (Page No. - 71)

6.1 INTRODUCTION

6.2 VESSELS, PIPING, AND PRESSURE PLANTS

6.3 FIRE AND SAFETY SYSTEMS

6.4 ELECTRICAL SYSTEMS

6.5 ROTATING EQUIPMENT

6.6 RELIEF AND VENT SYSTEMS

6.7 INSTRUMENTATION AND CONTROL SYSTEMS

7 ASSET INTEGRITY MANAGEMENT IN VARIOUS OIL & GAS SECTORS (Page No. - 74)

7.1 INTRODUCTION

FIGURE 31 OIL & GAS SECTORS USING ASSET INTEGRITY MANAGEMENT SERVICES

7.2 UPSTREAM SECTOR

7.2.1 US UPSTREAM OPERATOR OPTS FOR INTEGRITY MANAGEMENT PROGRAM

7.3 MIDSTREAM SECTOR

7.3.1 PIPELINES: PRIMARY MEDIUM OF TRANSPORT OF OIL

7.3.2 USE OF SHIPS FOR OIL TRANSPORTATION

7.3.3 ON APP DIGITAL TRANSFORMATION SUPPORT FOR US-BASED MIDSTREAM NATURAL GAS COMPANY

7.4 DOWNSTREAM SECTOR

7.4.1 TAILORED RISK MANAGEMENT APPLICATION FOR MOL GROUP

8 OFFERINGS IN ASSET INTEGRITY MANAGEMENT MARKET (Page No. - 78)

8.1 INTRODUCTION

FIGURE 32 OFFERINGS IN ASSET INTEGRITY MANAGEMENT MARKET

8.2 HARDWARE

8.3 SOFTWARE

8.4 SERVICES

9 ASSET INTEGRITY MANAGEMENT METHODOLOGIES (Page No. - 81)

9.1 INTRODUCTION

9.2 RELIABILITY-CENTERED MAINTENANCE

9.3 ROOT CAUSE ANALYSIS

9.4 RELIABILITY ANALYTICS

9.5 LIFE CYCLE ASSESSMENT/EXTENSION

9.6 FITNESS FOR SERVICE

9.7 FAILURE MODES, EFFECTS & CRITICALITY ANALYSIS

9.8 FINITE ELEMENT ANALYSIS

9.9 SAFETY INTEGRITY LEVEL STUDY

10 ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE (Page No. - 84)

10.1 INTRODUCTION

FIGURE 33 ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE

TABLE 16 ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 17 ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

10.2 NON-DESTRUCTIVE TESTING (NDT)

10.2.1 NDT CONTRIBUTES SIGNIFICANT SHARE TO THE MARKET

FIGURE 34 NDT METHODS

TABLE 18 NDT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 19 NDT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 35 NORTH AMERICA TO LEAD NDT MARKET DURING FORECAST PERIOD

TABLE 20 NDT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 NDT MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 RISK-BASED INSPECTION (RBI)

10.3.1 RBI ENABLES SIGNIFICANT COST OPTIMIZATION AND SAFETY ENHANCEMENT OF FACTORIES

FIGURE 36 INTERNATIONAL STANDARDS AND RECOMMENDED PRACTICES FOR IMPLEMENTATION OF RBI

TABLE 22 RBI MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 23 RBI MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 37 RBI MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 24 RBI MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 RBI MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 CORROSION MANAGEMENT

10.4.1 CORROSION MANAGEMENT ENABLES PROTECTION AGAINST AGING INFRASTRUCTURE OF PLANTS

FIGURE 38 TYPES OF CORROSION

FIGURE 39 ELEMENTS OF CORROSION MANAGEMENT

TABLE 26 CORROSION MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 27 CORROSION MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 28 CORROSION MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 CORROSION MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 PIPELINE INTEGRITY MANAGEMENT

10.5.1 PIPELINE INTEGRITY MANAGEMENT SYSTEMS HELP DETERMINE SAFETY AND RELIABILITY OF PIPELINES

TABLE 30 PIPELINE INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 31 PIPELINE INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 32 PIPELINE INTEGRITY MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 PIPELINE INTEGRITY MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 HAZARD IDENTIFICATION (HAZID) STUDY

10.6.1 HAZID STUDY SIGNIFICANTLY USED IN OIL & GAS INDUSTRY OWING TO ITS EXPOSURE TO HAZARDOUS ENVIRONMENT

TABLE 34 HAZID STUDY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 35 HAZID STUDY MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 36 HAZID STUDY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 HAZID STUDY MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 STRUCTURAL INTEGRITY MANAGEMENT (SIM)

10.7.1 SIM ENHANCES OPERATIONAL EFFECTIVENESS BY IMPROVED HSE PERFORMANCE

FIGURE 40 STRUCTURAL INTEGRITY MANAGEMENT PROCESS

TABLE 38 STRUCTURAL INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 39 STRUCTURAL INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 40 STRUCTURAL INTEGRITY MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 STRUCTURAL INTEGRITY MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 RELIABILITY, AVAILABILITY AND MAINTAINABILITY (RAM) STUDY

10.8.1 RAM STUDY HELPS IN DETERMINING PROBABLE CAUSES OF PRODUCTION LOSSES

FIGURE 41 STEPS INVOLVED IN RAM STUDY

TABLE 42 RAM STUDY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 43 RAM STUDY MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 44 RAM STUDY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 RAM STUDY MARKET, BY REGION, 2021–2026 (USD MILLION)

10.9 OTHERS

TABLE 46 OTHER ASSET INTEGRITY MANAGEMENT SERVICES MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 47 OTHER ASSET INTEGRITY MANAGEMENT SERVICES MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 48 OTHER ASSET INTEGRITY MANAGEMENT SERVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 OTHER ASSET INTEGRITY MANAGEMENT SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

11 ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY (Page No. - 108)

11.1 INTRODUCTION

FIGURE 42 ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY

FIGURE 43 OIL & GAS INDUSTRY TO LEAD ASSET INTEGRITY MANAGEMENT MARKET BY 2026

TABLE 50 ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.2 OIL & GAS

FIGURE 44 INTEGRITY SERVICES FOR VARIOUS ASSETS

TABLE 52 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 53 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 54 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

11.2.1 PLANT LOCATION OF OIL & GAS INDUSTRY

FIGURE 45 ASSET INTEGRITY MANAGEMENT MARKET, BY PLANT LOCATION

FIGURE 46 OFFSHORE SUBSEGMENT TO DOMINATE ASSET INTEGRITY MANAGEMENT MARKET DURING FORECAST PERIOD

TABLE 56 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY PLANT LOCATION, 2017–2020 (USD MILLION)

TABLE 57 ASSET INTEGRITY MANAGEMENT MARKET FOR OIL & GAS INDUSTRY, BY PLANT LOCATION, 2021–2026 (USD MILLION)

11.2.1.1 Onshore

11.2.1.1.1 Robotic systems benefit onshore oil storage tank inspection

11.2.1.2 Offshore

11.2.1.2.1 Asset integrity management imperative in offshore plants for smooth working operation

FIGURE 47 ASSET INTEGRITY MANAGEMENT APPROACH FOR OFFSHORE LOCATIONS

11.2.1.3 Subsea

11.2.1.3.1 Digital twin technology used to reduce cost of asset ownership at subsea locations

11.3 POWER

TABLE 58 ASSET INTEGRITY MANAGEMENT MARKET FOR POWER, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 59 ASSET INTEGRITY MANAGEMENT MARKET FOR POWER, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 60 ASSET INTEGRITY MANAGEMENT MARKET FOR POWER, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 ASSET INTEGRITY MANAGEMENT MARKET FOR POWER, BY REGION, 2021–2026 (USD MILLION)

11.3.1 RENEWABLE ENERGY

11.3.1.1 Continuous investments in renewable energy widens scope of asset integrity management

TABLE 62 CHALLENGES FACED BY RENEWABLE ENERGY PLANTS

FIGURE 48 SUSTAINABLE ASSET INTEGRITY MANAGEMENT ACTIVITIES

11.4 MINING

11.4.1 GROWING DEMAND FOR PREVENTIVE MAINTENANCE IN MINING DUE TO COST BENEFITS BOOSTS MARKET

TABLE 63 ASSET INTEGRITY MANAGEMENT MARKET FOR MINING, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 64 ASSET INTEGRITY MANAGEMENT MARKET FOR MINING, BY SERVICE TYPE, 2021–2026 (USD MILLION)

FIGURE 49 ASIA PACIFIC TO HOLD LARGEST SHARE OF ASSET INTEGRITY MANAGEMENT MARKET FOR MINING DURING FORECAST PERIOD

TABLE 65 ASSET INTEGRITY MANAGEMENT MARKET FOR MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 ASSET INTEGRITY MANAGEMENT MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

11.5 AEROSPACE

11.5.1 NDT TO BE CRUCIAL FOR SAFETY IN AEROSPACE INDUSTRY

TABLE 67 ASSET INTEGRITY MANAGEMENT MARKET FOR AEROSPACE, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 68 ASSET INTEGRITY MANAGEMENT MARKET FOR AEROSPACE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 69 ASSET INTEGRITY MANAGEMENT MARKET FOR AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 ASSET INTEGRITY MANAGEMENT MARKET FOR AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

11.6 OTHERS

TABLE 71 ASSET INTEGRITY MANAGEMENT MARKET FOR OTHERS, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 72 ASSET INTEGRITY MANAGEMENT MARKET FOR OTHERS, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 73 ASSET INTEGRITY MANAGEMENT MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 ASSET INTEGRITY MANAGEMENT MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 130)

12.1 INTRODUCTION

FIGURE 50 GEOGRAPHIC SNAPSHOT: ASSET INTEGRITY MANAGEMENT MARKET

FIGURE 51 NORTH AMERICA TO DOMINATE ASSET INTEGRITY MANAGEMENT MARKET BY 2026

TABLE 75 ASSET INTEGRITY MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 ASSET INTEGRITY MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 52 ASSET INTEGRITY MANAGEMENT MARKET: NORTH AMERICA

TABLE 77 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 US projected to contribute largest share to North American market during forecast period

12.2.2 CANADA

12.2.2.1 Market growth in Canada supported by growth in oil & gas and mining industries

12.2.3 MEXICO

12.2.3.1 Increasing oil production aids growth of market in Mexico

12.3 EUROPE

FIGURE 53 ASSET INTEGRITY MANAGEMENT MARKET: EUROPE

TABLE 83 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 84 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 86 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 EUROPE: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 UK

12.3.1.1 Energy transition deal in UK to create new market opportunities

12.3.2 GERMANY

12.3.2.1 Energy transition and oil imports aid market growth in Germany

12.3.3 FRANCE

12.3.3.1 Substantial growth of renewable energy expected to fuel demand for asset integrity management services

12.3.4 NORWAY

12.3.4.1 Increasing oil exports from Norway to propel asset integrity management market growth

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

FIGURE 54 ASSET INTEGRITY MANAGEMENT MARKET: ASIA PACIFIC

TABLE 89 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 90 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 92 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Asia Pacific market to get stronger due to China being largest LNG importer worldwide

12.4.2 JAPAN

12.4.2.1 Japanese market driven by major dependency on oil & natural gas to meet energy demand

12.4.3 INDIA

12.4.3.1 Doubling of pipeline networks in next 5 years to fuel market in India

12.4.4 REST OF ASIA PACIFIC

12.5 REST OF THE WORLD

FALSE

TABLE 95 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 96 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 97 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 98 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 99 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 REST OF THE WORLD: ASSET INTEGRITY MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 Foreign investments in energy sector to propel market growth in Brazil

12.5.2 MIDDLE EAST

TABLE 101 MIDDLE EAST: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MIDDLE EAST: ASSET INTEGRITY MANAGEMENT MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.2.1 Saudi Arabia

12.5.2.1.1 Saudi Arabia positioned as key contributor for market growth in Middle East

12.5.2.2 UAE

12.5.2.2.1 Presence of major oil & gas companies in UAE to support market growth

12.5.2.3 Rest of Middle East

12.5.3 AFRICA

12.5.3.1 Mining industry in Africa to push asset integrity management market

13 COMPETITIVE LANDSCAPE (Page No. - 156)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

TABLE 103 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES

13.3 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 56 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN ASSET INTEGRITY MANAGEMENT MARKET

13.4 MARKET SHARE ANALYSIS (2020)

FIGURE 57 ASSET INTEGRITY MANAGEMENT MARKET SHARE ANALYSIS, 2020

13.5 COMPANY EVALUATION QUADRANT, 2020

13.5.1 STAR

13.5.2 PERVASIVE

13.5.3 EMERGING LEADER

13.5.4 PARTICIPANT

FIGURE 58 ASSET INTEGRITY MANAGEMENT MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

13.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE

13.6.2 RESPONSIVE

13.6.3 DYNAMIC

13.6.4 STARTING BLOCK

FIGURE 59 ASSET INTEGRITY MANAGEMENT MARKET (GLOBAL) SME EVALUATION QUADRANT, 2020

13.7 ASSET INTEGRITY MANAGEMENT MARKET: COMPANY FOOTPRINT

TABLE 104 COMPANY FOOTPRINT

TABLE 105 COMPANY INDUSTRY FOOTPRINT

TABLE 106 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 107 COMPANY REGION FOOTPRINT

13.8 COMPETITIVE SCENARIO

TABLE 108 ASSET INTEGRITY MANAGEMENT MARKET: PRODUCT LAUNCHES, JUNE 2019−JULY 2020

TABLE 109 ASSET INTEGRITY MANAGEMENT MARKET: DEALS, FEBRUARY 2019−AUGUST 2020

TABLE 110 ASSET INTEGRITY MANAGEMENT MARKET: OTHERS, APRIL 2020−JUNE 2021

14 COMPANY PROFILES (Page No. - 170)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Product launches, Deals, Others, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

14.1.1 SGS

TABLE 111 SGS: BUSINESS OVERVIEW

FIGURE 60 SGS: COMPANY SNAPSHOT

14.1.2 BUREAU VERITAS

TABLE 112 TABLE 6 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 61 BUREAU VERITAS: COMPANY SNAPSHOT

14.1.3 INTERTEK GROUP

TABLE 113 INTERTEK GROUP: BUSINESS OVERVIEW

FIGURE 62 INTERTEK GROUP: COMPANY SNAPSHOT

14.1.4 TECHNIPFMC

TABLE 114 TECHNIPFMC: BUSINESS OVERVIEW

FIGURE 63 TECHNIPFMC: COMPANY SNAPSHOT

14.1.5 AKER SOLUTIONS

TABLE 115 AKER SOLUTIONS: BUSINESS OVERVIEW

FIGURE 64 AKER SOLUTIONS: COMPANY SNAPSHOT

14.1.6 APPLUS SERVICES

TABLE 116 APPLUS SERVICES: BUSINESS OVERVIEW

FIGURE 65 APPLUS SERVICES: COMPANY SNAPSHOT

14.1.7 DNV

TABLE 117 DNV: BUSINESS OVERVIEW

FIGURE 66 DNV: COMPANY SNAPSHOT

14.1.8 JOHN WOOD GROUP

TABLE 118 JOHN WOOD GROUP: BUSINESS OVERVIEW

FIGURE 67 JOHN WOOD GROUP: COMPANY SNAPSHOT

14.1.9 OCEANEERING INTERNATIONAL

TABLE 119 OCEANEERING INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 68 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

14.1.10 FLUOR

TABLE 120 TABLE 39 FLUOR: BUSINESS OVERVIEW

FIGURE 69 FLUOR: COMPANY SNAPSHOT

14.2 OTHER PLAYERS

14.2.1 ROSEN SWISS

TABLE 121 ROSEN SWISS: COMPANY OVERVIEW

14.2.2 LIFETECH ENGINEERING

TABLE 122 LIFETECH ENGINEERING: COMPANY OVERVIEW

14.2.3 EM&I

TABLE 123 EM&I: COMPANY OVERVIEW

14.2.4 METEGRITY

TABLE 124 METEGRITY: COMPANY OVERVIEW

14.2.5 DACON INSPECTION TECHNOLOGIES

TABLE 125 DACON INSPECTION TECHNOLOGIES: COMPANY OVERVIEW

14.2.6 FORCE TECHNOLOGY NORWAY

TABLE 126 FORCE TECHNOLOGY NORWAY: COMPANY OVERVIEW

14.2.7 TWI

TABLE 127 TWI: COMPANY OVERVIEW

14.2.8 TÜV SÜD

TABLE 128 TÜV SÜD: COMPANY OVERVIEW

14.2.9 OES

TABLE 129 OES: COMPANY OVERVIEW

14.2.10 BELL ENERGY SERVICES UK

TABLE 130 BELL ENERGY SERVICES UK: COMPANY OVERVIEW

14.2.11 ABS GROUP

TABLE 131 ABS GROUP: COMPANY OVERVIEW

14.2.12 VELOSI ASSET INTEGRITY

TABLE 132 VELOSI ASSET INTEGRITY: COMPANY OVERVIEW

14.2.13 AXESS GROUP

TABLE 133 AXESS GROUP: COMPANY OVERVIEW

14.2.14 ELEMENT MATERIALS TECHNOLOGY

TABLE 134 ELEMENT MATERIALS TECHNOLOGY: COMPANY OVERVIEW

14.2.15 RINA

TABLE 135 RINA: COMPANY OVERVIEW

14.2.16 ASSET INTEGRITY ENGINEERING

TABLE 136 ASSET INTEGRITY ENGINEERING: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKET (Page No. - 224)

15.1 MACHINE CONDITION MONITORING MARKET

15.2 INTRODUCTION

FIGURE 70 MACHINE CONDITION MONITORING MARKET, BY MONITORING PROCESS

FIGURE 71 ONLINE CONDITION MONITORING SEGMENT TO LEAD MACHINE CONDITION MONITORING MARKET FROM 2021 TO 2026

TABLE 137 MACHINE CONDITION MONITORING MARKET, BY MONITORING PROCESS, 2017–2020 (USD MILLION)

TABLE 138 MACHINE CONDITION MONITORING MARKET, BY MONITORING PROCESS, 2021–2026 (USD MILLION)

15.3 ONLINE CONDITION MONITORING

15.3.1 ONLINE CONDITION MONITORING SYSTEMS DELIVER REAL-TIME MACHINERY HEALTH INFORMATION TO PLANT OPERATORS

TABLE 139 ONLINE MACHINE CONDITION MONITORING MARKET, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 140 ONLINE MACHINE CONDITION MONITORING MARKET, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

TABLE 141 ONLINE MACHINE CONDITION MONITORING MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 142 ONLINE MACHINE CONDITION MONITORING MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 143 ONLINE MACHINE CONDITION MONITORING MARKET, BY REGION, 2017–2020 (USD MILLION)

FIGURE 72 ONLINE MACHINE CONDITION MONITORING MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 144 ONLINE MACHINE CONDITION MONITORING MARKET, BY REGION, 2021–2026 (USD MILLION)

15.4 PORTABLE CONDITION MONITORING

15.4.1 EMERGENCE OF PORTABLE CONDITION MONITORING AS COST-EFFECTIVE CONDITION MONITORING PROCESS

TABLE 145 PORTABLE MACHINE CONDITION MONITORING MARKET, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 146 PORTABLE MACHINE CONDITION MONITORING MARKET, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

TABLE 147 PORTABLE MACHINE CONDITION MONITORING MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

FIGURE 73 POWER GENERATION SEGMENT TO HOLD LARGEST SIZE OF PORTABLE MACHINE CONDITION MONITORING IN 2026

TABLE 148 PORTABLE MACHINE CONDITION MONITORING MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 149 PORTABLE MACHINE CONDITION MONITORING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 150 PORTABLE MACHINE CONDITION MONITORING MARKET, BY REGION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 234)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

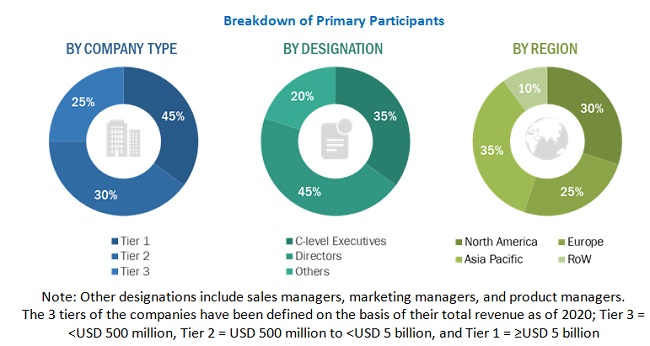

The study involves four major activities for estimating the size of the asset integrity management market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the asset integrity management market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, & professional associations have been used to identify and collect information for an extensive technical and commercial study of the asset integrity management market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the asset integrity management market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the asset integrity management market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, and forecast the global asset integrity management market, in terms of value, by service type, industry, and region

- To forecast the market size for four main regions, namely North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market, namely, drivers, restraints, opportunities, and challenges

- To study and analyze the impact of COVID-19 on the market during the forecast period

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the asset integrity management ecosystem, along with market trends and use cases

- To elaborate on asset integrity management in various oil and gas sectors, including upstream, midstream, and downstream sectors

- To describe the components of asset integrity management services

- To strategically profile key players and comprehensively analyze their core competencies2 along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product launches, acquisitions, partnerships, and expansions in the global market

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Asset Integrity Management Market