ALD Equipment Market by Film Type (Oxide, Metal, Sulfide, Nitride), Deposition Method, Application (Semiconductor) (More-than-Moore, Research & Development Facilities, More Moore), Application (Non-semiconductor) and Region - Global Forecast to 2027

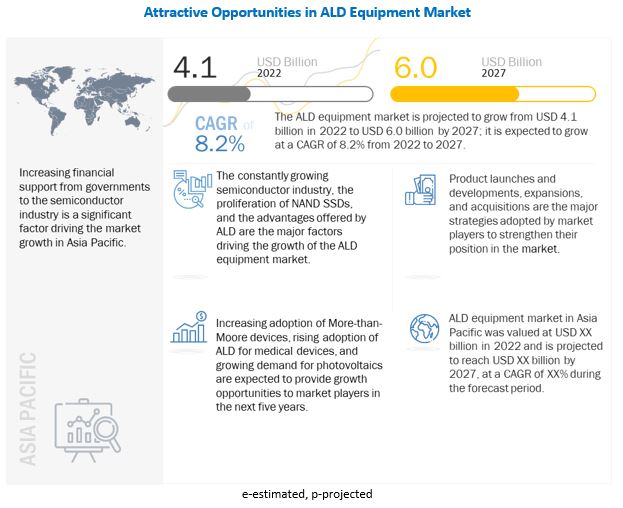

The ALD equipment market is estimated to be worth USD 4.1 billion in 2022 and is projected to reach USD 6.0 billion by 2027, at a CAGR of 8.2% during the forecast period. Constantly developing semiconductor industry, proliferation of 3D NAND SSDs and the advantages offered by ALD are the key factors driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

ALD Equipment Market Segment Overview

Medical applications to register the highest CAGR during forecast period

The rising demand for smart and connected healthcare solutions, wearables, and implants is expected to drive the ALD equipment market growth for medical applications.

ALD is a suitable deposition method for medical devices as most of the materials used in ALD are biocompatible. The adoption of ultra-thin biocompatible ALD coatings also improves adhesion to the bone and protects patients from leakages from the implant to the body. Such advantages offered by ALD make it highly suitable for medical applications

Flouride films to register the highest CAGR during forecast period

In recent years, there has been an increasing demand for ALD of fluorides as they have a low refractive index and facilitate improved transmission at UV and IR wavelengths, making them highly suitable for optical applications.

Compounds such as aluminum fluoride can also be used for developing protective coatings on lithium-ion batteries. High-performance mirrors at UV wavelengths require transparent dielectrics as protective coatings to prevent oxidation. Decreasing the thickness of protective layers subsequently reduces absorption losses. ALD of metal fluorides ensures superior transmission at UV wavelengths and facilitates the deposition of ultra-thin films to prevent absorption losses.

More Moore applications to account for the largest share of the ALD equipment market during forecast period

The increasing usage of various logic devices and memory technologies is a significant factor expected to drive the ALD equipment market growth for More Moore applications.

In recent years, there has been a surge in demand for 3D NAND flash memory technology. The use of 3D NAND flash memory facilitates increased storage speed without the need of reducing the chip size. The increasing demand for 3D NAND flash memory technology, logic devices, and interconnect technologies is expected to drive the ALD equipment industry growth.

To know about the assumptions considered for the study, download the pdf brochure

Top 5 Key Market Players in ALD Equipment Market

-

ASM International N.V. (Netherlands),

-

Tokyo Electron Limited (Japan),

-

Applied Materials, Inc. (US),

-

Lam Research Corporation (US),

-

Veeco Instruments Inc. (US).

ALD Equipment Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Deposition Method, Film Type, Application (Non-semiconductor), and Application (Semiconductor) |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the ALD equipment market are Kurt J. Lesker Company (US), Optorun Co., Ltd. (Japan), CVD Equipment Corporation (US), Eugene Technology Co. Ltd. (South Korea), and Beneq (Finland) |

ALD Equipment Market Dynamics

Driver: Constantly developing semiconductor industry

The emergence of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and 5G have led to a significant increase in the development of data-driven solutions.

Many companies extensively focus on research & development (R&D) activities to develop advanced solutions using such technologies. This has led to increased demand for ICs to be embedded in devices to develop advanced, efficient, and smart solutions. Moreover, the growing trend of lightweight, miniaturized, and fast electronic devices have created a surge in demand for complex and compact ICs. This is expected to drive the ALD equipment market growth as ALD facilitates the deposition of very thin nano-layers on a wide range of substrates. Deposition of thin films and coatings using ALD enables the development of smaller ICs by maintaining their standard performance.

Restraint: Requirement of skilled workforce

Front-end wafer fabrication processes in manufacturing semiconductors such as lithography, wafer surface conditioning, wafer cleaning, and deposition are highly complex and require skilled technicians.

The growing demand for semiconductor devices from many end-user industries such as consumer electronics and automotive has been creating ample growth opportunities for market players. However, the shortage of skilled technicians for such processes has not enabled the market players to exploit the opportunities to their fullest. The requirement of a skilled workforce to implement such complex processes is a major factor negatively affecting the market growth.

Opportunity: Rising demand for photovoltaics

Due to the rapid depletion of resources, there has been a surge in demand for renewable energy sources. According to International Energy Agency (IEA), renewable energy accounted for 28% of the total energy globally in 2021.

With the help of PV cells and solar panels, energy from the sun can be converted into electricity. Due to the increasing energy crisis, there has been an increase in demand for solar energy in the last decade. The growing demand for photovoltaics is expected to create lucrative opportunities for market players offering solutions for ALD. In solar cells, ALD films can be used as surface passivation layers, buffer layers, window layers, absorber layers, and hole/electron contacts. Increasing demand for photovoltaics is expected to drive the market growth for ALD.

Challenge: Technical difficulties and process complexity

Processes involved in manufacturing semiconductors need clean rooms and clean equipment. Even a tiny amount of dust can hamper the process and result in a heavy financial loss.

Delay in supply due to errors during manufacturing may result in additional losses and order cancelations. A few common challenges associated with semiconductor manufacturing include defects associated with raw materials, mechanical integrity, and problems at the chip level. Moreover, advanced and innovative technologies are needed at the fabrication stage to produce high-quality semiconductor devices and ICs. The growing trend of miniaturization has significantly increased the complexity of wafers due to the presence of multiple patterns at the chip level. ALD needs a very high degree of cleanliness. However, it is difficult to maintain cleanliness in ALD when process nodes are extremely small. Moreover, technicians must ensure that there should not be any leakage during ALD as the gases used in the production processes can be hazardous. The increasing number of challenges involved while manufacturing semiconductors may impede the market growth for ALD.

ALD Equipment Market Categorization

The study segments the ALD equipment market based on deposition method, film type, application (non-semiconductor), and application (semiconductor) at the regional and global level.

By Deposition Method

- Plasma-enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- Powder ALD

- Others

By Film Type

- Oxide Films

- Metal Films

- Sulfide Films

- Nitride Films

- Fluoride Films

By Application (Non-semiconductor)

- Medical

- Energy

- Conventional Optics

- Coating

By Application (Semiconductor)

- More-than Moore

- Research & Development Facilities

- More Moore

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In June 2022, Applied Materials announced the acquisition of Picosun Oy, a global leader in ALD based in Finland. With this acquisition, Applied Materials aims to harness Picosun’s capabilities to provide innovative solutions for the IoT, communications, automotive, sensor, and power markets. This acquisition would broaden Applied Materials’ portfolio related to specialty chips

- In March 2022, ASM International N.V. acquired Reno Sub-Systems Inc. (Reno), a company that offers RF matching sub-systems for equipment used to manufacture semiconductors. With this acquisition, ASMI aims to enhance its portfolio of plasma products with the help of Reno’s RF generators and matching networks

- In September 2020, Lam Research Corporation launched the Striker FE ALD system that is highly suited for manufacturing high aspect-ratio chip architectures. The system uses ICEFill technology for filling structures in 3D NAND, logic devices, and DRAM chips

- In September 2019, Tokyo Electron Limited announced the merger of TEL FSI, Inc. and TEL Epion Inc., subsidiaries of Tokyo Electron U.S. Holdings, Inc. (US). With the merger of these subsidiaries, the company optimized and enhanced manufacturing processes and improved operational efficiency

- In May 2017, Veeco Instruments Inc. announced the acquisition of Ultratech, Inc., a leading supplier of lithography, laser processing, and inspection systems used in the production of LEDs and other semiconductor devices. With this acquisition, Veeco strengthened its product portfolio of advanced packaging lithography systems

Frequently Asked Questions (FAQ):

What is the current size of the global ALD equipment market?

The ALD equipment market is estimated to be worth USD 4.1 billion in 2022 and is projected to reach USD 6.0 billion by 2027, at a CAGR of 8.2% during the forecast period. Constantly developing semiconductor industry, proliferation of 3D NAND SSDs and the advantages offered by ALD are the key factors driving the market growth.

Who are the winners in the global ALD equipment market?

Companies such as ASM International N.V. (Netherlands), Tokyo Electron Limited (Japan), Applied Materials, Inc. (US), Lam Research Corporation (US), Veeco Instruments Inc. (US), fall under the winners category.

What are some of the technological advancements in the market?

Challenges such as the availability of precursors and other complexities involved in the process, such as the use of vacuum conditions, have adversely impacted the adoption of ALD at a very large scale. However, in recent years, there has been increased adoption of liquid atomic layer deposition (LALD), a liquid phase equivalent of ALD, to overcome several difficulties encountered during ALD. This technique has deposition temperature and rates significantly lower than conventional gas-phase ALD techniques.

What are the opportunities pertaining to the ALD equipment market?

Increasing adoption of More-than-Moore devices, growing use of ALD for medical devices and rising demand for photovoltaics are expected to provide growth opportunities for market platers.

What are the key strategies adopted by market players to strengthen their position in the market?

Product launches, mergers, acquisitions, and partnerships are some of the major strategies adopted by the market players to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.1.1 Inclusions and exclusions at company level

1.2.1.2 Inclusions and exclusions at regional level

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 ALD EQUIPMENT MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 ALD EQUIPMENT MARKET: GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 ALD EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Key data from primary sources

2.1.2.5 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

FIGURE 4 ALD EQUIPMENT MARKET: RESEARCH APPROACH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 FACTOR ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 1)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 2)

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 ALD EQUIPMENT MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 PLASMA-ENHANCED ALD TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 OXIDE FILMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 MORE-THAN-MOORE APPLICATIONS TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 13 MEDICAL APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 14 ALD EQUIPMENT MARKET IN ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 15 GROWING SEMICONDUCTOR INDUSTRY TO CONTRIBUTE SIGNIFICANTLY TO MARKET GROWTH

4.2 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD

FIGURE 16 PLASMA-ENHANCED ALD TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 ALD EQUIPMENT MARKET, BY FILM TYPE

FIGURE 17 OXIDE FILMS TO HOLD LARGEST MARKET SHARE BETWEEN 2022 AND 2027

4.4 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR)

FIGURE 18 MORE-THAN-MOORE APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR)

FIGURE 19 ENERGY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 ALD EQUIPMENT MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY, 2021

FIGURE 20 SEMICONDUCTOR APPLICATIONS AND US HELD LARGEST MARKET SHARES IN NORTH AMERICA IN 2021

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS: ALD EQUIPMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Constantly developing semiconductor industry

FIGURE 22 GLOBAL SEMICONDUCTOR TRADE, 2019–2023

5.2.1.2 Proliferation of 3D NAND SSDs

5.2.1.3 Advantages offered by ALD

TABLE 1 ALD AND CVD COMPARISON

FIGURE 23 IMPACT ANALYSIS OF DRIVERS ON ALD EQUIPMENT MARKET

5.2.2 RESTRAINTS

5.2.2.1 High costs and capital expenditure

5.2.2.2 Requirement for skilled workforce

FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS ON ALD EQUIPMENT MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of More-than-Moore devices

5.2.3.2 Growing use of ALD for medical devices

5.2.3.3 Rising demand for photovoltaics

FIGURE 25 ANNUAL GROWTH OF RENEWABLE ENERGY GENERATION, BY SOURCE, 2018–2020

FIGURE 26 IMPACT ANALYSIS OF OPPORTUNITIES IN ALD EQUIPMENT MARKET

5.2.4 CHALLENGES

5.2.4.1 Technical difficulties and process complexity

FIGURE 27 IMPACT ANALYSIS OF CHALLENGES ON ALD EQUIPMENT MARKET

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS: ALD EQUIPMENT MARKET

TABLE 2 ALD EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

5.4 ALD EQUIPMENT MARKET: ECOSYSTEM

FIGURE 29 ALD EQUIPMENT MARKET ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 LIQUID ATOMIC LAYER DEPOSITION (LALD)

5.5.2 ADVANCEMENTS IN ALD

5.6 PRICING ANALYSIS

TABLE 3 ASP OF ALD SYSTEMS

FIGURE 30 ASP TREND FOR LARGE VOLUME PRODUCTION OF ALD SYSTEMS

5.7 PATENT ANALYSIS

TABLE 4 PATENTS FILED BETWEEN JANUARY 2011–DECEMBER 2021

FIGURE 31 NUMBER OF PATENTS GRANTED FOR ALD

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS GRANTED DURING REVIEW PERIOD

TABLE 5 TOP 20 PATENT OWNERS DURING REVIEW PERIOD

TABLE 6 KEY PATENTS RELATED TO ALD

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 ALD EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS, 2021

FIGURE 34 IMPACT OF PORTER’S FIVE FORCES ON ALD EQUIPMENT MARKET, 2021

TABLE 7 ALD EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS –2021

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.10 CASE STUDIES

5.10.1 DEVELOPMENT OF TWO-POSITION, THREE-WAY PILOT VALVE SUITABLE FOR ALD

TABLE 10 TLX TECHNOLOGIES: SOLENOID FOR ALD

5.10.2 DEVELOPING 300 MM ALD TECHNOLOGY

TABLE 11 PICOSUN: 300 MM ALD TECHNOLOGY IN COLLABORATION WITH STMICROELECTRONICS

5.11 TRADE ANALYSIS

TABLE 12 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021 (USD BILLION)

FIGURE 37 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

TABLE 13 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021 (USD BILLION)

FIGURE 38 MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS WITH IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 TARIFFS

TABLE 14 MFN TARIFFS FOR PRODUCTS UNDER HS CODE 848620 EXPORTED BY US

5.12.2 REGULATIONS

5.12.2.1 Restriction of Hazardous Substances (RoHS) Directive

5.12.2.2 Electronic Waste

5.12.3 STANDARDS

5.12.3.1 International Organization of Standardization (ISO)

6 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD (Page No. - 75)

6.1 INTRODUCTION

TABLE 15 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2018–2021 (USD MILLION)

FIGURE 39 PLASMA-ENHANCED ALD TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2022–2027 (USD MILLION)

6.2 PLASMA-ENHANCED ALD (PEALD)

6.2.1 FACILITATES SEQUENTIAL DEPOSITION AT LOWER TEMPERATURES

TABLE 17 PLASMA-ENHANCED ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

FIGURE 40 SEMICONDUCTOR APPLICATIONS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 18 PLASMA-ENHANCED ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.3 THERMAL ALD

6.3.1 ALLOWS ACCURATE THICKNESS CONTROL AT HIGH TEMPERATURES

TABLE 19 THERMAL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 THERMAL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.4 SPATIAL ALD

6.4.1 ENERGY, PACKAGING, AND TEXTILE INDUSTRIES TO PROVIDE GROWTH OPPORTUNITIES

TABLE 21 SPATIAL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 SPATIAL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.5 ROLL-TO-ROLL ALD

6.5.1 LOWER COST TO INCREASE DEMAND FOR ROLL-TO-ROLL ALD

TABLE 23 ROLL-TO-ROLL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 ROLL-TO-ROLL ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.6 POWDER ALD

6.6.1 NEED TO IMPROVE PRODUCT LIFETIME TO DRIVE MARKET GROWTH

TABLE 25 POWDER ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 26 POWDER ALD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.7 OTHERS

TABLE 27 OTHERS: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 OTHERS: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7 ALD EQUIPMENT MARKET, BY FILM TYPE (Page No. - 82)

7.1 INTRODUCTION

TABLE 29 ALD EQUIPMENT MARKET, BY FILM TYPE, 2018–2021 (USD MILLION)

FIGURE 41 OXIDE FILMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 30 ALD EQUIPMENT MARKET, BY FILM TYPE, 2022–2027 (USD MILLION)

7.2 OXIDE FILMS

7.2.1 GROWING NUMBER OF APPLICATIONS FACILITATE ALD OF OXIDE FILMS

7.3 METAL FILMS

7.3.1 RISING DEMAND FOR 3D NAND SSDS TO DRIVE MARKET GROWTH

7.4 SULFIDE FILMS

7.4.1 INCREASED ADOPTION IN BATTERIES TO BOOST USE OF SULFIDE FILMS

7.5 NITRIDE FILMS

7.5.1 MAINLY USED AS METAL BARRIERS FOR COPPER INTERCONNECTS

7.6 FLUORIDE FILMS

7.6.1 LOW REFRACTIVE INDEX AND SUPERIOR TRANSMISSION PROPERTIES AT UV WAVELENGTHS MAKE ALD OF FLUORIDES

8 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR) (Page No. - 86)

8.1 INTRODUCTION

TABLE 31 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2018–2021 (USD MILLION)

FIGURE 42 ENERGY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 32 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 33 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2018–2021 (USD MILLION)

TABLE 34 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2022–2027 (USD MILLION)

TABLE 35 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 43 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 38 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 39 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 41 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 42 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 43 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 NON-SEMICONDUCTOR: ALD EQUIPMENT MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

8.2 ENERGY

8.2.1 ALD DEVELOPS HIGHLY CONFORMAL FILMS WITH PRECISE THICKNESS CONTROL

TABLE 45 ENERGY: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 ENERGY: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 MEDICAL

8.3.1 RISING NUMBER OF MEDICAL APPLICATIONS FACILITATES USE OF ALD

TABLE 47 MEDICAL: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MEDICAL: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 CONVENTIONAL OPTICS

8.4.1 ABILITY TO DEPOSIT ON COMPLEX SUBSTRATES PROPELS MARKET GROWTH

TABLE 49 CONVENTIONAL OPTICS: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 CONVENTIONAL OPTICS: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 COATING

8.5.1 ALD USED FOR COATING APPLICATIONS ON THERMALLY FRAGILE POLYMER SUBSTRATES

TABLE 51 COATING: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 COATING: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR) (Page No. - 96)

9.1 INTRODUCTION

TABLE 53 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR), 2018–2021 (USD MILLION)

FIGURE 44 MORE-THAN-MOORE APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 54 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 55 SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2018–2021 (USD MILLION)

TABLE 56 SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2022–2027 (USD MILLION)

TABLE 57 SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 SEMICONDUCTOR: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 59 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 60 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 61 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 62 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 63 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 65 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN REST OF THE WORLD, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 SEMICONDUCTOR: ALD EQUIPMENT MARKET IN REST OF THE WORLD, BY REGION, 2022–2027 (USD MILLION)

9.2 MORE-THAN-MOORE

9.2.1 INCREASED ADOPTION OF MORE-THAN-MOORE DEVICES FOR AI AND 5G TECHNOLOGIES

TABLE 67 MORE-THAN-MOORE: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

FIGURE 45 CMOS IMAGE SENSORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 68 MORE-THAN-MOORE: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.2 MEMS AND SENSORS

9.2.2.1 Growing adoption in automotive and consumer electronics applications

9.2.3 RF DEVICES

9.2.3.1 Proliferation of RF devices to create opportunities for adoption of ALD

9.2.4 ADVANCED PACKAGING

9.2.4.1 Growing need to protect packaged or unpackaged devices from electrical contacts

9.2.5 POWER DEVICES

9.2.5.1 Increased adoption of GaN power devices in PEALD

9.2.6 PHOTONICS (LED & VCSEL)

9.2.6.1 Growing demand for LEDs and VCSELs in various applications

9.2.7 CMOS IMAGE SENSORS

9.2.7.1 Demand for CMOS image sensors for consumer electronics applications

9.3 RESEARCH & DEVELOPMENT FACILITIES

9.3.1 EMERGING APPLICATIONS TO CREATE OPPORTUNITIES FOR ALD ADOPTION AT RESEARCH & DEVELOPMENT FACILITIES

9.4 MORE MOORE

9.4.1 PROLIFERATION OF LOGIC AND MEMORY DEVICES TO ENHANCE ADOPTION OF MORE MOORE

10 ALD EQUIPMENT MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 46 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 47 ASIA PACIFIC TO LEAD ALD EQUIPMENT MARKET DURING FORECAST PERIOD

TABLE 69 ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 48 NORTH AMERICA: ALD EQUIPMENT MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing solar power generation demand and government initiatives

TABLE 77 US: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 US: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Advancements in photonics industry

TABLE 79 CANADA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 CANADA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Growing demand for semiconductor chips in consumer electronics and automotive industries

TABLE 81 MEXICO: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 MEXICO: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 49 EUROPE: ALD EQUIPMENT MARKET SNAPSHOT

TABLE 83 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 84 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2018–2021 (USD MILLION)

TABLE 86 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 87 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Favorable government initiatives and established automotive and medical industries

TABLE 89 GERMANY: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 GERMANY: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Demand for advanced healthcare products

TABLE 91 UK: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 UK: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Advanced transportation and communication industries

TABLE 93 FRANCE: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 94 FRANCE: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 95 REST OF EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 REST OF EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

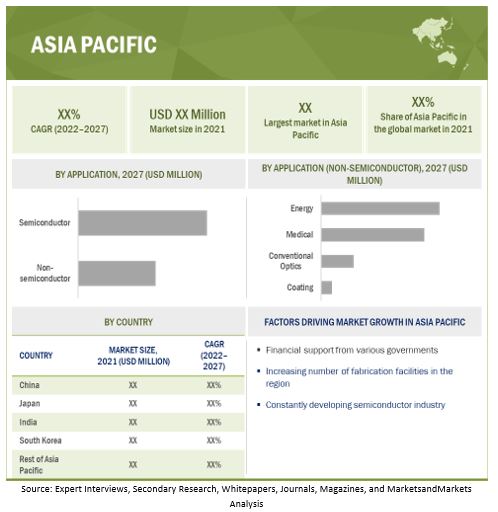

10.4 ASIA PACIFIC

FIGURE 50 ASIA PACIFIC: ALD EQUIPMENT MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2018–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Favorable government initiatives and availability of inexpensive workforce

TABLE 103 CHINA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 CHINA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Presence of market players and IDMs

TABLE 105 JAPAN: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 JAPAN: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing investments related to More-than-Moore devices

TABLE 107 INDIA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 INDIA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 High manufacturing capability of players and favorable government initiatives

TABLE 109 SOUTH KOREA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 SOUTH KOREA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 111 REST OF ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 113 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2018–2021 (USD MILLION)

TABLE 116 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2022–2027 (USD MILLION)

TABLE 117 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 REST OF THE WORLD: ALD EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Increasing focus on semiconductor business and favorable investments

TABLE 119 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Growing emphasis on renewable energy

TABLE 121 SOUTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 SOUTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

TABLE 123 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 51 COMPANIES ADOPTED PRODUCT LAUNCH AS KEY GROWTH STRATEGY FROM 2017–2022

11.2.1 ORGANIC/INORGANIC STRATEGIES

11.2.2 PRODUCT PORTFOLIO

11.2.3 GEOGRAPHIC PRESENCE

11.2.4 MANUFACTURING FOOTPRINT

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 124 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ALD EQUIPMENT MARKET, 2021

11.4 HISTORICAL REVENUE ANALYSIS, 2017–2021

FIGURE 52 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN ALD EQUIPMENT MARKET, 2017–2021 (USD BILLION)

11.5 KEY COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 53 ALD EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY FOOTPRINT

TABLE 125 COMPANY PRODUCT FOOTPRINT

TABLE 126 COMPANY FILM TYPE FOOTPRINT

TABLE 127 COMPANY APPLICATION FOOTPRINT

TABLE 128 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE SCENARIOS AND TRENDS

FIGURE 54 COMPETITIVE SCENARIO, 2017–2022

11.7.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 129 ALD EQUIPMENT MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, 2018–2022

11.7.2 DEALS

TABLE 130 ALD EQUIPMENT MARKET: DEALS (CONTRACTS, PARTNERSHIPS, AND MERGERS & ACQUISITIONS), 2017–2022

11.7.3 OTHERS

TABLE 131 ALD EQUIPMENT MARKET, OTHERS, 2018–2022

12 COMPANY PROFILES (Page No. - 146)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats)*

12.2.1 ASM INTERNATIONAL N.V.

TABLE 132 ASMI: COMPANY OVERVIEW

FIGURE 55 ASMI: COMPANY SNAPSHOT

TABLE 133 ASMI: PRODUCT LAUNCHES

TABLE 134 ASMI: DEALS

TABLE 135 ASMI: OTHERS

12.2.2 TOKYO ELECTRON LIMITED

TABLE 136 TEL: COMPANY OVERVIEW

FIGURE 56 TEL: COMPANY SNAPSHOT

TABLE 137 TEL: DEALS

TABLE 138 TEL: OTHERS

12.2.3 APPLIED MATERIALS, INC.

TABLE 139 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

FIGURE 57 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

TABLE 140 APPLIED MATERIALS: PRODUCT LAUNCHES

TABLE 141 APPLIED MATERIALS: DEALS

TABLE 142 APPLIED MATERIALS: OTHERS

12.2.4 LAM RESEARCH CORPORATION

TABLE 143 LAM RESEARCH CORPORATION: COMPANY OVERVIEW

FIGURE 58 LAM RESEARCH CORPORATION: COMPANY SNAPSHOT

TABLE 144 LAM RESEARCH CORPORATION: PRODUCT LAUNCHES

TABLE 145 LAM RESEARCH CORPORATION: OTHERS

12.2.5 VEECO INSTRUMENTS INC.

TABLE 146 VEECO: COMPANY OVERVIEW

FIGURE 59 VEECO: COMPANY SNAPSHOT

TABLE 147 VEECO: DEALS

TABLE 148 VEECO: OTHERS

12.2.6 KURT J. LESKER COMPANY

TABLE 149 KURT J. LESKER COMPANY: COMPANY OVERVIEW

TABLE 150 KURT J. LESKER COMPANY: DEALS

TABLE 151 KURT J. LESKER COMPANY: OTHERS

12.2.7 OPTORUN CO., LTD.

TABLE 152 OPTORUN: COMPANY OVERVIEW

FIGURE 60 OPTORUN: COMPANY SNAPSHOT

TABLE 153 OPTORUN: PRODUCT LAUNCHES

TABLE 154 OPTORUN: DEALS

TABLE 155 OPTORUN: OTHERS

12.2.8 CVD EQUIPMENT CORPORATION

TABLE 156 CVD EQUIPMENT CORPORATION: COMPANY OVERVIEW

FIGURE 61 CVD EQUIPMENT CORPORATION: COMPANY SNAPSHOT

TABLE 157 CVD EQUIPMENT CORPORATION: PRODUCT LAUNCHES

TABLE 158 CVD EQUIPMENT CORPORATION: DEALS

12.2.9 EUGENE TECHNOLOGY CO. LTD.

TABLE 159 EUGENE TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

FIGURE 62 EUGENE TECHNOLOGY CO. LTD.: COMPANY SNAPSHOT

TABLE 160 EUGENE TECHNOLOGY CO. LTD.: PRODUCT LAUNCHES

TABLE 161 EUGENE TECHNOLOGY CO. LTD.: DEALS

12.2.10 BENEQ

TABLE 162 BENEQ: COMPANY OVERVIEW

TABLE 163 BENEQ: PRODUCT LAUNCHES

TABLE 164 BENEQ: DEALS

TABLE 165 BENEQ: OTHERS

12.3 OTHER PLAYERS

12.3.1 ENCAPSULIX

12.3.2 FORGE NANO INC.

12.3.3 WONIK IPS

12.3.4 SENTECH INSTRUMENTS GMBH

12.3.5 TEMPRESS

12.3.6 LOTUS APPLIED TECHNOLOGY

12.3.7 NCD CO., LTD.

12.3.8 JIANGSU LEADMICRO GUIDE NANO EQUIPMENT TECHNOLOGY CO., LTD.

12.3.9 NANO-MASTER, INC.

12.3.10 NAURA TECHNOLOGY GROUP CO., LTD.

12.3.11 OXFORD INSTRUMENTS PLC

12.3.12 SAMCO INC.

12.3.13 CN1 CO., LTD.

12.3.14 SHOWA SHINKU CO., LTD.

12.3.15 ANRIC TECHNOLOGIES

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 185)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

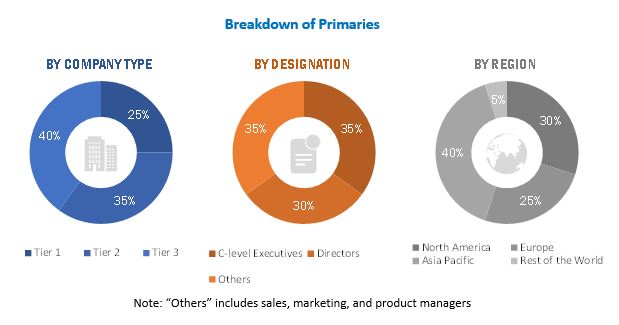

The research study involved 4 major activities in estimating the size of the ALD equipment market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include, corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, whitepapers, journals based on atomic layer deposition, certified publications, and articles from recognized authors and databases.

In the ALD equipment market report, the top-down as well as the bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the ALD equipment market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the ALD equipment market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, major developments in the key market area have been considered

- Analyzing major manufacturers of ALD equipment and studying their product portfolios and understanding different applications of the solutions offered by them

- Analyzing the trends related to the adoption of ALD equipment for different applications

- Tracking the recent and upcoming developments in the ALD equipment market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to know about different types of deposition methods and film types used in ALD and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall ALD equipment market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The ALD equipment market size has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the size of the atomic layer deposition (ALD) equipment market, by deposition method, film type, and application (semiconductor and non-semiconductor), in terms of value

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the ALD equipment market

- To study the complete value chain and related industry segments and perform a value chain analysis of the ALD equipment market landscape

- To strategically analyze macro and micromarkets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze the supply chain, ecosystem, case studies, key stakeholders and buying criteria, pricing data, patents and innovations, technology, and trade data (export and import data) related to the ALD equipment market and analyzing the market using Porter’s five forces

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To profile key players in the market and comprehensively analyze their market shares/ranking and core competencies

- To analyze competitive developments such as product launches/developments, expansions, acquisitions, and research and development (R&D) activities carried out by players in the ALD equipment market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ALD Equipment Market