Augmented Reality and Virtual Reality Market by Technology Type (AR: Markerless, Marker-base; VR: Non-Immersive, Semi-immersive and Fully Immersive Technology), Device Type, Offering, Application, Enterprise, and Geography - Global Forecast to 2027

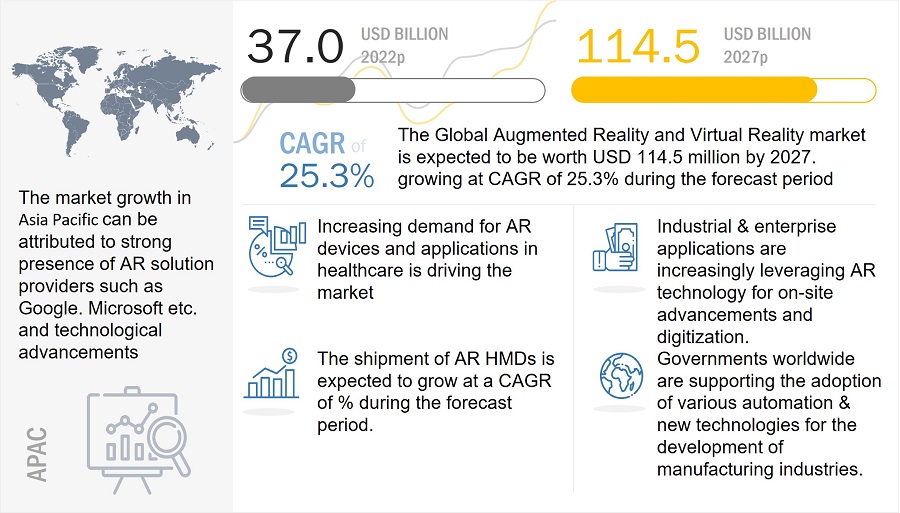

The Global Augmented reality and virtual reality market in the current year (2022), is expected to have a market size of USD 37.0 billion and can reach up to USD 114.5 billion by 2027, the end of 5 year forecast period at a market growth of 25.3% rate.

Innovatively put, the AR market & VR market's growth is propelled by a host of driving forces such as the expanding healthcare applications of augmented reality, the surging use of augmented reality and virtual reality in retail and e-commerce, generous government funding aimed at facilitating the growth of the AR and VR industry, strategic partnerships between augmented reality device manufacturers and diverse service industries, the phenomenal rise in the demand for virtual reality in e-learning and medical training, and the mounting need for virtual reality in manufacturing divisions.

Global Augmented Reality and Virtual Reality Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

AR and VR Market Dynamics

By Technology

For VR market, Gesture tracking devices are expected to grow at a faster rate

The virtual reality market for hardware devices under device segment is expected to grow faster in case of gesture-tracking devices. The gesture tracking devices can be used in medical training such as surgeries as well as to perform endoscopy, X-rays etc.

These devices can also be used in case of ftitness management by tracking all the gestures and movements warning about joint, muscles and postural defect in the user. This effective use of these devices in the medical field is set to increase the market share for these devices by the end of forecast period (2027). The growth rate of these devices is the highest due to the specified reasons.

For offering segmentation of AR and VR market, the software application market share is the maximum in the base year and projected year i.e. 2021 and 2022. The reason behind this large market share is that the software market is still developing and is at the boom, soecially after Covid-19, with increased virtual online shopping and virtual training. The software application market has akmost developed and significantly flousirshed. Due to this, the growth of software in AR and VR market will be stagnant in the forecast period (2022 – 2027).

By Regional

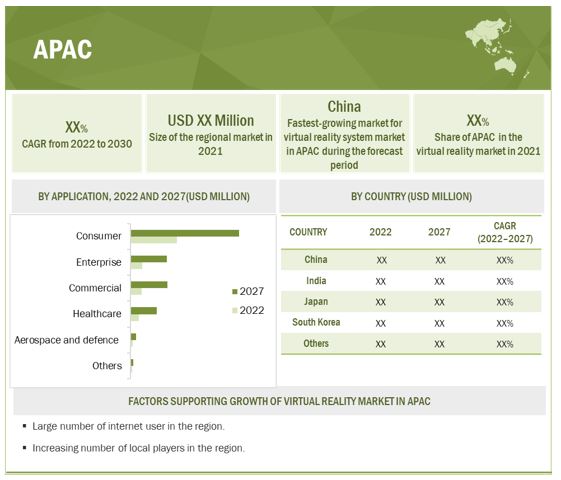

VR market to have large market share in Asia Pacific as well as faster growth rate in the forecast period.

In the base year i.e., the VR market share for virtual reality in Asia Pacific region was large due to the fact that a few countries in the region like China, Japan and South Korea have been focusing on training and medical assistance and e-learning for customers with the use of virtual reality technology.

But at the same time, countries like India are still on the verge to start adopting these technologies and inculcating them into different sectors and fields, which also leads to a depiction that the region will also show a faster growth rate in the virtual reality market in the region during the forecast period.

Augmented Reality Market Dynamics

Driver: Rising demands of augmented reality in retail and e-commerce AR Market

The pandemic has led to a sudden shift of shopping culture towards online shopping. Since during the pandemic, return policies on many websites were disabled, the virtual fitting rooms, virtual try-on for make-up and jewellery helped the customers to identify if the products really suit them. This helped to increased their convenience in shopping. The augmented reality technologies facilitate the customer satisfaction and hence, the convenince will lead to the increased demand in this sector, which helps to drive the market growth for augmented reality market.

The shopping application such as Loreal, which lets customers to try on make up virtually and Lenskart, which helps customers to identify how a set of glasses will look on them are a few prominent examples for augmented reality in e-commerce sector.

Restraint: Health issues associated with excessive usage of Augmented Reality Industry

With the advent of new gaming devices and technologies, AR-related health issues among gamers are increasing. augmented reality (AR) market games are highly interactive and keep the user engrossed with the game immensely for longer hours, causing issues such as anxiety, eye strain, obesity, and lack of concentration. The nature of AR technology is immersive and can induce anxiety or stress after wearing the AR headset for longer hours. Apart from stress, AR devices also expose users to harmful electromagnetic frequency radiation, which may cause illness. Researchers from the National Toxicology Program (NTP), a federal inter-agency program under the National Health Institutes (US), experimented on mice. This experiment demonstrated that subjects exposed to electromagnetic radiation might be more vulnerable to cancer. Therefore, excessive use of AR devices can cause health issues, limiting the growth of the market.

Opportunity: Opportunities in enterprise applications of AR Market

The opportunities in enterprise applications are huge. Huge investments from enterprises for smart manufacturing will be a major driver for the enterprise industry growth in the AR market. The companies having factories at different locations can use AR and employ a small number of engineers to manage a large setup. Remote collaboration using the AR technology to manage machines and other setups remotely would help manage enterprises effectively. Other important applications in the enterprise AR are with regard to the instructional use for technicians and other workers in enterprises. The use of head-up displays and smart helmets to understand blueprints and instructions to provide real-time data will help workers work efficiently.

For instance, Unilever, a global consumer goods manufacturer, approximated that it may lose nearly 330 years of domain expertise in one of its European factories due to the retirement of the company’s aging workforce. This would have resulted in the loss of domain expertise in its manufacturing facility and led to costly downtime in its manufacturing plants.

Unilever started working with ScopeAR, an AR training and knowledge solutions provider, to explore novel ways to decrease the downtime while attaining the optimum utility of a live AR support application. This application enables technicians to work together with experts remotely. Technicians can share their view of a situation with a remote professional to quickly and speedily respond to a problem and optimize their work process.

As a result, Unilever quoted that the company has witnessed a 50% decrease in its manufacturing plant’s downtime. Therefore, enterprise applications are anticipated to be significant areas that would offer AR-enabled device and application manufacturers opportunities to earn more business and contracts in the coming years. The enterprise sector’s major use cases include real-time monitoring, efficiency management, remote collaboration, and warehouse and logistics management.

Challenge: Provision of augmented reality industry in high-end devices

The major challenge faced by customers is the availability of these technologies in high end desktops, compputers, laptops and mobile phones, which makes it less accessible for a basic mediocre user and makes them deprived and unaware of the newer technological experiences. This lesser reach of these augmented reality technologies can be a challenge in the growth of the market, which needs to be addressed to focus on the growth of the market. Although the applications can be used on medium range devices as well, still the hardware and most of the augmented reality software applications are enabled on high-end devices. This can be a challenge for the AR market.

Virtual Reality Market Dynamics

Driver: Advancement of technologies and growing digitization of virtual reality industry

Advancements in technologies and digitization have been the major driver for the implementation of new technologies in applications such as industrial, retail, and healthcare. Continuous technological advancements have changed the way human beings live, communicate, travel, and learn. The technological advancements have helped organizations and businesses reduce production costs and save time to gain a competitive advantage. For instance, 3G and 4G have helped small businesses reach their target markets with a reduced cost of operations. The increased use of mobile phones has also helped drive the need for digitization. The new generation is generation C (connected) that has helped bring in a digital change across the world. Increased social networking has also contributed to the growth of digitization.

Restraint: Health issues due to excessive usage of VR devices

The virtual reality technologies, specially the virtual reality headsets are extensively used for gaming and e-sports for an immersive playing experience. This excessive usage of VR headsets leads to health issues like lack of concentration, dizziness, letharge, hearing and eyesight issues. The over use of these VR hardware devices will lead to health issues overall, and hence, this factor can pave a way to be a restraining factor in the growth of this market.

Opportunity: Penetration of HMDs in training of Virtual Reality Industry

Virtual reality devices and technologies can be used to supervise the workflow in a factory, ensuring timely activities and production. The virtual reality technologies can also be used by the supervisor in order to ensure safety of the workers by knowing their location as well as getting warnings for dangerous zones. The manager or supervisor in factories and industries can also conduct training sessions for the workers with the help of VR. This increasing usage of virtual reality in the factories serves as an opportunity for this virtual reality market to grow further in the coming years.

Challenge: Integration of VR ecosystem in low end devices

The manufacturers and system integrators in virtual reality technological field find it difficult to integrate these technologies for low end devices, which makes it inaccessible for middle income group or lower income group. Since major world population belongs to middle or lower income group, the unavailability of these technologies in low end devices is a challenge that this industry faces and this may affect the growth of the market altogether.

For VR market, Gesture tracking devices are expected to grow at a faster rate

The virtual reality market market for hardware devices under device segment is expected to grow faster in case of gesture-tracking devices. The gesture tracking devices can be used in medical training such as surgeries as well as to perform endoscopy, X-rays etc. These devices can also be used in case of ftitness management by tracking all the gestures and movements warning about joint, muscles and postural defect in the user. This effective use of these devices in the medical field is set to increase the market share for these devices by the end of forecast period (2027). The growth rate of these devices is the highest due to the specified reasons..

For offering segmentation of AR and VR market, the software application market share is the maximum in the base year and projected year i.e. 2021 and 2022. The reason behind this large market share is that the software market is still developing and is at the boom, soecially after Covid-19, with increased virtual online shopping and virtual training. The software application market has akmost developed and significantly flousirshed. Due to this, the growth of software in AR and VR market will be stagnant in the forecast period (2022 – 2027).

Virtual reality market to have large market share in Asia Pacific in 2021 as well as faster growth rate in the forecast period.

In the base year i.e., 2021, the market share for virtual reality in Asia Pacific region was large due to the fact that a few countries in the region like China, Japan and South Korea have been focusing on training and medical assistance and e-learning for customers with the use of virtual reality technology. But at the same time, countries like India are still on the verge to start adopting these technologies and inculcating them into different sectors and fields, which also leads to a depiction that the region will also show a faster growth rate in the virtual reality market in the region during the forecast period.

The outbreak and the spread of the COVID-19 have disturbed and disrupted the inventories of AR and VR devices and their component manufacturers and suppliers. For instance, the outbreak of COVID-19 in US resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown measures announced in several countries across the globe as they got impacted by the COVID-19 pandemic also led to a fall in inventories of the suppliers of AR and VR device components market. Although, there was a boom in the AR and VR industry due to the sudden shift of work culture toward online platforms.

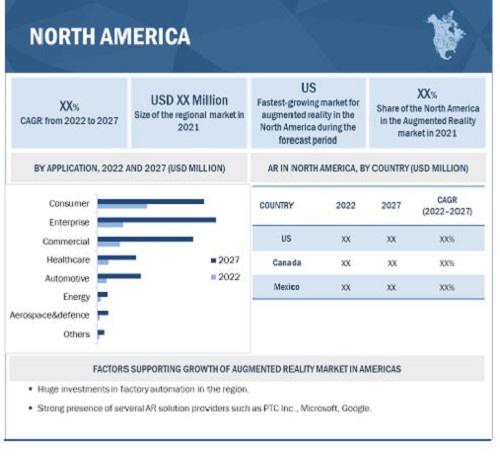

AR Snapshot: North America has the largest market share in 2021

To know about the assumptions considered for the study, download the pdf brochure

VR snapshot: Asia Pacific has maximum market share in 2021

Top 5 Key Market Players in AR and VR Companies

-

Google (US),

-

Microsoft (US),

-

Sony Corporation (Japan),

-

Samsung Electronics (South Korea),

-

HTC (Taiwan), Apple Inc., (US).

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the market.

Scope of the AR Market and VR Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 37.0 Billion |

| Projected Market Size | USD 114.5 Billion |

| Growth Rate | CAGR of 25.3% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Gesture Tracking Devices |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | VR hardware Segment |

| Highest CAGR Segment | Head-mounted Displays Segment |

Augmented & Virtual Reality Market Categorization

This report categorizes the AR Market and VR market based on technology, device type, offering, enterprise, application and region available at the regional and global level.

Based on Technology, the AR and VR Market been Segmented as follows:

-

AR technology:

-

Marker-based AR technology:

- Active marker

- Passive marker

-

Markerless AR technology

- Model-base tracking

- Image processing based tracking

- Anchor-based AR

-

Marker-based AR technology:

-

VR Technology

- Non-immersive technology

- Semi-immersive and fully immersive technology

Based on Offering, the Augmented Reality and Virtual Reality Market been Segmented as follows:

-

Hardware

-

Sensors

- Accelerometers

- Gyroscopes

- Magnetometers

- Proximity sensors

-

Semiconductor components:

- Controllers and processors

- Integrated Circuits

- Display and projectors

- Position trackers

- Cameras

-

Others

- Computers

- Video generators and combiners

-

Sensors

-

Software

- Software development kits

- Cloud-based servies

Based on Device, the AR Market and VR Market been Segmented as follows:

-

AR devices

-

Head-mounted displays

- AR smart glasses

- Smart helmets

- Heads-up display

-

Head-mounted displays

-

VR devices

- Head-mounted displays

- Gesture-tracking devices

- Displays and projectors

Based on Application, the Augmented Reality and Virtual Reality Market been Segmented as follows:

-

Consumer

- Gaming

- Sports

-

Entertainment

- Theme parks

- Museums

- Art exhibitions and gelleries

-

Commercial

-

Retail and e-commerce

- Beauty and cosmetics

- Apparel fitting

- Jewellery

- Grocery shopping

- Footwear

- Furniture

- Travel and tourism

- E-learning

-

Retail and e-commerce

-

Enterprise

- Manufacturing

-

Healthcare

- Surgery

- Fitness management

- Patient care management

- Pharmacy management

- Medical training and education

- Radiology

- Aerospace and Defence

- Automotive

- Energy

-

Others

- Construction

- Agriculture

- Telecom/IT services

- Transportation and Logistics

- Public Safety

Based on Enterprise, the AR and VR Market been Segmented as follows:

- Small enterprise

- Medium enterprise

- Large enterprise

Based on Region, the Augmented Reality and Virtual Reality Market been Segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

See Also:

- Japan Augmented Reality and Virtual Reality Industry to Grow at a CAGR 30.6% from 2022 to 2027

- China Augmented Reality and Virtual Reality Industry to Grow at a CAGR 32.0% from 2022 to 2027

- France Augmented Reality and Virtual Reality Industry to Grow at a CAGR 23.6% from 2022 to 2027

- Germany Augmented Reality and Virtual Reality Industry to Grow at a CAGR 29.0% from 2022 to 2027

- South Korea Augmented Reality and Virtual Reality Industry to Grow at a CAGR 30.1% from 2022 to 2027

- UK Augmented Reality and Virtual Reality Industry to Grow at a CAGR 26.4% from 2022 to 2027

Recent Developments

- In February 2022, HTC Vive announced Viveverse, a cross-platform metaverse, which is an open source VR metaverse composed of various interactive worlds, apps, games. It enables the users to travel between various platforms like Vive Sync and Engage.

- In January 2022, Sony enhanced its already existing product – VR headset – PSVR headset. Sony claimed to develop a PSVR headset for better experience of virtual reality in PlayStation as the PSVR headset will connect directly into PlayStation 5 console.

- In January 2022, HTC announced wrist tracker for Vive Focus 3 which is a wearable device, that helps in tracking through infrared LEDs that are tracked optically through the device’s onboard camera sensors. Tracker motion, trajectories can be tracked even if tracker is out of camera view by using high frequency IMU data and advanced kinetic model.

- In December 2021, Google introduced and added a brand-new addition to its AR device collection by developing AR smart glasses which adds extra information, animation, videos, and more realistic experiences to the users by overlaying computer generated or digital information on user’s real world.

- In October 2021, HTC announced the launch of another product in its AR and VR hardware product portfolio. It announced the launch of VR glasses which, unlike other VR glasses or headsets, focused on physical and mental wellness rather than gaming. It is sleek, lightweight, and gives a lighter and passive entertainment to the users as it is enables with 3D virtual reality and 3D spatial audio as well.

- In September 2021, Samsung launched an AR based virtual Hands-On shopping experience post Covid-19 to facilitate smoother online shopping; it allows users to have interactive environment to shop Samsung products.

Frequently Asked Questions (FAQ):

What is the current size of the global AR and VR market?

The global AR and VR market is projected to grow from USD 37.0 billion in 2022 to USD 114.5 billion by 2027; it is expected to grow at a CAGR of 25.3% from 2022 to 2027.

Who are the key players in the global AR and VR market?

Companies such as Google (US), Microsoft (US), Sony Corporation (Japan), Samsung Electronics (South Korea), HTC (Taiwan), Apple Inc., (US), PTC Inc., (US), Seiko Epson (Japan), Oculus VR (by Facebook (US)), Lenovo (China). These companies cater to the requirements of their customers by providing advanced AR and VR devices and software/applications with a presence in multiple countries.

What is the COVID-19 impact on AR and VR device and component suppliers?

COVID-19 forced the world to shift towards a remote work culture, be it for schools, universities or corporates, which led to a boom in the AR and VR market due to increased virtual training, education and shopping along with industry training and supervision with the use of AR and VR devices. But it has a negative impact too. Covid-19 not only impacted the operations and manufacturing of the various AR and VR devices and component manufacturers companies, but also affected the businesses of their suppliers and distributors. The key companies operating in this market, have also witnessed the impact of the pandemic in their inventories for AR and VR device components during the first half of 2020.

What are the opportunities for the existing players and for those who are planning to enter various stages of the AR and VR value chain?

There are various opportunities for the existing players to enter the value chain of AR and VR industry. Some of these include the partnerships between telecom players and AR manufacturers to reduce latency to imperceptible levels, rise in demand for AR in architecture, increasing demand for VR in training and education, high growth of AR and VR in travel, tourism and enterprise applications. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES IN NEW VERSION

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 AR AND VR INDUSTRY: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 4 AR & VR MARKET ECOSYSTEM : RESEARCH DESIGN

FIGURE 5 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 6 AR & VR INDUSTRY : RESEARCH METHODOLOGY

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (demand side)

FIGURE 8 AUGMENTED & VIRTUAL REALITY MARKET : BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE CALCULATION BY BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 10 AUGMENTED & VIRTUAL REALITY MARKET : TOP-DOWN APPROACH

FIGURE 11 MARKET SIZE CALCULATION BY TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 13 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 14 AUGMENTED REALITY MARKET, 2018–2027 (USD MILLION)

FIGURE 15 VIRTUAL REALITY MARKET, 2018–2027 (USD MILLION)

3.1 IMPACT OF COVID-19 ON AUGMENTED REALITY AND VR MARKET INDUSTRY

FIGURE 16 COVID-19 IMPACT ON AR MARKET

FIGURE 17 COVID-19 IMPACT ON MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 18 HEAD-MOUNTED DISPLAYS TO HOLD LARGEST SHARE OF MARKET IN 2022

FIGURE 19 CONSUMER APPLICATION TO LEAD MARKET FROM 2022 TO 2027

FIGURE 20 NORTH AMERICA HELD LARGEST SIZE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 21 GROWING DEMAND FOR AR IN HEALTHCARE AND ENTERPRISE APPLICATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 22 GROWING USE OF VIRTUAL REALITY IN CONSUMER APPLICATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

FIGURE 23 CONSUMER APPLICATION AND CHINA TO HOLD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2027

4.4 MARKET, BY COUNTRY

FIGURE 24 MARKET TO GROW AT HIGHEST CAGR IN CHINA DURING FORECAST PERIOD

4.5 AR MARKET, BY COUNTRY

FIGURE 25 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS: AR & VR MARKET ECOSYSTEM

FIGURE 26 DEMAND FOR AR APPLICATIONS IN HEALTHCARE AND RETAIL SECTORS TO DRIVE MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Increasing demand for AR devices and applications in healthcare

5.2.1.2 Growing demand for AR in retail and e-commerce sectors due to COVID-19

FIGURE 27 ADOPTION OF AR IN RETAIL BY ESTABLISHMENTS

5.2.1.3 Rising investments in augmented reality market ecosystem

5.2.2 RESTRAINTS

5.2.2.1 Security and privacy issues associated with AR

5.2.2.2 Health issues associated with excessive usage of AR

5.2.3 OPPORTUNITIES

5.2.3.1 Partnerships between telecom players and AR manufacturers to reduce latency to imperceptible levels

5.2.3.2 Rise in demand for AR in architecture

5.2.3.3 Opportunities in enterprise applications

5.2.3.4 High growth of travel & tourism industry

5.2.4 CHALLENGES

5.2.4.1 Display latency and limited field of view

5.2.4.2 Overcoming social challenges to increase adoption rate

5.2.4.3 Reconfiguration of applications for different platforms

5.3 MARKET DYNAMICS: VR MARKET INDUSTRY

FIGURE 28 HIGH DEMAND FOR VR APPLICATIONS IN GAMING AND ENTERTAINMENT SECTORS TO DRIVE MARKET GROWTH

5.3.1 DRIVERS

5.3.1.1 Penetration of HMDs in gaming and entertainment sectors after COVID-19

5.3.1.2 High investments in market

5.3.1.3 Advancement of technologies and growing digitization

5.3.1.4 Availability of affordable VR devices

5.3.1.5 Growing adoption of HMDs in different industries

5.3.2 RESTRAINTS

5.3.2.1 Display latency and energy consumption affect overall performance of VR devices

5.3.2.2 Health concerns relating to low resolution and lack of movement

5.3.2.3 Trade restrictions imposed between US and China

5.3.3 OPPORTUNITIES

5.3.3.1 Penetration of HMDs in healthcare and architectural applications

5.3.3.2 Use of VR in aerospace & defense for training and simulation

5.3.3.3 Increasing demand for VR HMDs in healthcare due to COVID-19

5.3.4 CHALLENGES

5.3.4.1 Developing user-friendly VR systems

5.3.4.2 Adverse impact of lockdowns due to COVID-19 on commercial trade

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES RELATED TO AUGMENTED REALITY MARKET

5.5 ECOSYSTEM/MARKET MAP

TABLE 1 AUGMENTED AND VIRTUAL REALITY MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 HIGH ADOPTION OF AR SMART GLASSES TO IMPROVE WORK EFFICIENCY

5.6.1.1 Case study: Unilever’s AR remote assistance and knowledge sharing

5.6.2 INCREASED DEMAND FOR AR FOR RUGGED DISPLAY APPLICATIONS

5.6.2.1 Case study: Crescent partnered with Arbor Technology to manufacture rugged AR and VR devices

5.6.3 MICRODISPLAYS FOR VR

5.6.3.1 Case study: LOMID Project

5.6.3.2 Case study: Kopin’s micro display for VR HMD

5.6.4 MOBILE AR TECHNOLOGY

5.6.4.1 Case study: Better warehouse operations for DHL supply chain’s AR

5.6.5 MONITOR-BASED TECHNOLOGY

5.6.5.1 Case study: AR outdoor system developed jointly by GRINTEC GmbH and Graz University of Technology

5.6.6 NEAR-EYE-BASED TECHNOLOGY

5.6.6.1 Case study: FMT AB, a construction and excavation company, uses near eye-based AR technology to assist efficient construction activities

5.6.7 WEBAR

5.6.7.1 Case Study: WebAR

5.7 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN: AUGMENTED AND MARKET

5.8 PATENT ANALYSIS

TABLE 2 NOTABLE PATENTS PERTAINING TO AUGMENTED AND MARKET

TABLE 3 NUMBER OF PATENTS REGISTERED RELATED TO AUGMENTED AND VIRTUAL REALITY MARKET IN LAST 10 YEARS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 32 NO. OF PATENTS GRANTED PER YEAR, 2012–2021

5.9 REGULATORY LANDSCAPE

5.9.1 GLOBAL

5.10 TRADE ANALYSIS

FIGURE 33 IMPORT DATA OF SPECTACLES, GOGGLES, AND THE LIKE, CORRECTIVE, PROTECTIVE, OR OTHER (EXCLUDING SPECTACLES FOR EYESIGHT TESTING, CONTACT LENSES, AND SPECTACLE LENSES, FRAMES, AND MOUNTINGS), BY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 34 EXPORT DATA OF SPECTACLES, GOGGLES, AND THE LIKE, CORRECTIVE, PROTECTIVE, OR OTHER (EXCLUDING SPECTACLES FOR EYESIGHT TESTING, CONTACT LENSES, AND SPECTACLE LENSES, FRAMES, AND MOUNTINGS), BY COUNTRY, 2016–2019 (USD THOUSAND)

5.11 CASE STUDY ANALYSIS

5.11.1 L&T PARTNERED WITH INGAGE TECHNOLOGY TO TRAIN WORKERS

5.11.2 MOBIDEV CREATED AR APP TO INCREASE CUSTOMER ENGAGEMENT

5.11.3 RUFFLES COULD INCREASE SALES WITH AR GAME—AMIGO

5.11.4 BEP SURFACE TECHNOLOGIES OPTED FOR VIRTUAL REALITY FOR THEIR DESIGN AND MANUFACTURING PROCESSES

5.11.5 UNILEVER’S AR USE CASE: REMOTE ASSISTANCE AND KNOWLEDGE SHARING

5.11.6 BOEING’S AR USE CASE: WIRING OF AIRPLANE

5.12 KEY CONFERENCES & EVENTS DURING 2022-2023

TABLE 4 AUGMENTED & VIRTUAL REALITY MARKET : DETAILED LIST OF CONFERENCES & EVENTS

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 AUGMENTED REALITY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 INTENSITY OF COMPETITIVE RIVALRY

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 BARGAINING POWER OF SUPPLIERS

5.13.5 THREAT OF NEW ENTRANTS

5.14 AVERAGE SELLING PRICE (ASP) ANALYSIS

FIGURE 35 AVERAGE PRICING FOR AR MARKET

FIGURE 36 AVERAGE PRICING FOR MARKET

6 AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY ENTERPRISE (Page No. - 107)

6.1 INTRODUCTION

6.2 SMALL ENTERPRISES

6.3 MEDIUM ENTERPRISES

6.4 LARGE ENTERPRISES

7 MARKET, BY TECHNOLOGY (Page No. - 110)

7.1 INTRODUCTION

7.2 AUGMENTED REALITY TECHNOLOGY

TABLE 6 COMPARISON BETWEEN MARKER-BASED AND MARKERLESS AR

7.2.1 MARKER-BASED AUGMENTED REALITY

7.2.1.1 Case study: Vectrona provided mixed reality experiences for US Air Force training

7.2.1.2 Passive marker

7.2.1.2.1 Passive markers are widely used type of marker-based AR

7.2.1.3 Active marker

7.2.1.3.1 Active markers use LED to track objects

7.2.1.3.2 Case study: The Code Work (TCW) project for augmented reality

7.2.2 MARKERLESS AUGMENTED REALITY

7.2.2.1 Model-based tracking

7.2.2.1.1 Model-based tracking depends on camera movements

7.2.2.1.2 Case study: Cavanna AR app

7.2.2.2 Image processing-based tracking

7.2.2.2.1 Image processing-based tracking requires optical scanners or cameras for processing images

7.2.2.2.2 Case study: PAPER.plus brings in image processing-based tracking for markerless AR technology

7.2.3 ANCHOR-BASED AUGMENTED REALITY

7.2.3.1 Anchor-based AR is used to overlay virtual images in real space

7.2.3.2 Case study: Sotheby’s International Realty

7.3 VIRTUAL REALITY TECHNOLOGY

FIGURE 37 SEMI- AND FULLY IMMERSIVE TECHNOLOGIES TO DOMINATE VIRTUAL REALITY MARKET DURING FORECAST PERIOD

TABLE 7 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 8 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.3.1 NON-IMMERSIVE TECHNOLOGY

7.3.1.1 Use of non-immersive technology in VR software development set to drive market

TABLE 9 MARKET FOR NON-IMMERSIVE TECHNOLOGY, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 10 VR MARKET FOR NON-IMMERSIVE TECHNOLOGY, BY OFFERING, 2022–2027 (USD MILLION)

7.3.2 SEMI-IMMERSIVE AND FULLY IMMERSIVE TECHNOLOGY

7.3.2.1 Fully immersive technology would be driven by demand for VR HMDs

7.3.2.2 Case study: JBHXR & PIXO providing complete VR solution for enterprises

TABLE 11 MARKET FOR SEMI- AND FULLY IMMERSIVE TECHNOLOGIES, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 12 MARKET FOR SEMI- AND FULLY IMMERSIVE TECHNOLOGIES, BY OFFERING, 2022–2027 (USD MILLION)

8 AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY OFFERING (Page No. - 121)

8.1 INTRODUCTION

FIGURE 38 AUGMENTED REALITY MARKET FOR HARDWARE EXPECTED TO GROW AT HIGHER CAGR THAN SOFTWARE DURING FORECAST PERIOD

TABLE 13 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 14 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

8.2 HARDWARE

FIGURE 39 DISPLAYS & PROJECTORS TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY HARDWARE COMPONENT, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY HARDWARE COMPONENT, 2022–2027 (USD MILLION)

FIGURE 40 MARKET FOR HARDWARE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

FIGURE 41 MARKET FOR DISPLAYS AND PROJECTORS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY HARDWARE, 2018–2021 (USD MILLION)

TABLE 20 MARKET, HARDWARE, 2022–2027 (USD MILLION)

8.2.1 SENSORS

8.2.1.1 Sensors are widely used in AR & VR devices for detecting motion, velocity, magnetic field, and presence of object

8.2.1.1.1 Accelerometers

8.2.1.1.2 Gyroscopes

8.2.1.1.3 Magnetometers

8.2.1.1.4 Proximity sensors

8.2.2 SEMICONDUCTOR COMPONENTS

8.2.2.1 Controller is most important component of AR and VR devices

8.2.2.1.1 Controllers and processors

8.2.2.1.2 Integrated circuits

8.2.3 DISPLAYS AND PROJECTORS

8.2.3.1 Displays & projectors hold major share of AUGMENTED & VIRTUAL REALITY MARKET

8.2.4 POSITION TRACKERS

8.2.4.1 Position trackers are used for maintaining accuracy in AR and VR devices

8.2.5 CAMERAS

8.2.5.1 Cameras are crucial components to measure depth and amplitude of objects

8.2.6 OTHERS

8.2.7 IMPACT OF COVID-19 ON HARDWARE MARKET

8.3 SOFTWARE

8.3.1 SDK WILL PLAY CRUCIAL ROLE IN AR & VR SOFTWARE MARKET

8.3.1.1 Software development kits

8.3.1.1.1 Case study: Arcore for Tendar

8.3.1.2 Cloud-based services

8.3.1.2.1 Case study: VR Group boosts cloud application performance and reduces costs

FIGURE 42 CONSUMER APPLICATIONS EXPECTED TO HOLD LARGEST SIZE OF AUGMENTED REALITY MARKET FOR SOFTWARE DURING FORECAST PERIOD

TABLE 21 MARKET FOR SOFTWARE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 MARKET FOR SOFTWARE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 23 VIRTUAL REALITY MARKET FOR SOFTWARE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR SOFTWARE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.2 AUGMENTED REALITY SOFTWARE FUNCTIONS

8.3.2.1 Workflow optimization and remote collaboration are most trending AR solutions

8.3.2.1.1 Remote collaboration

8.3.2.1.2 Case study: AkzoNobel adopts AMA’s AR solution to take remote collaboration to next level

8.3.2.1.3 Workflow optimization

8.3.2.1.4 Documentation

8.3.2.1.5 Visualization

8.3.2.1.6 3D modeling

8.3.2.1.7 Case study: Development of 3D Models for Interior Design AR App

8.3.2.1.8 Navigation

8.4 VIRTUAL REALITY CONTENT CREATION

8.4.1 VR CONTENT CREATION IS KEY TO STRENGTHENING VR TECHNOLOGY AND GROWTH OF VR HARDWARE DEVICES

8.4.2 CASE STUDY: DEPLOYING GAMIFICATION AND VR IN ACTIVE SHOOTER TRAINING COURSE BY INNO-VERSITY

9 AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY DEVICE TYPE (Page No. - 139)

9.1 INTRODUCTION

9.2 AUGMENTED REALITY DEVICES

FIGURE 43 MARKET FOR HEAD-MOUNTED DISPLAYS HAS LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 25 MARKET, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 27 MARKET, BY DEVICE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 28 MARKET, BY DEVICE TYPE, 2022–2027 (THOUSAND UNITS)

9.2.1 HEAD-MOUNTED DISPLAYS

9.2.1.1 Case Study: Inova Mount Vernon Hospital puts emergency room patients at ease

TABLE 29 AR MARKET FOR HMD, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR HMD, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.1.2 Augmented Reality smart glasses

9.2.1.2.1 AR smart glasses are widely adopted across companies to improve work efficiency

9.2.1.2.2 Case study – North AR glasses for travel experience

9.2.1.3 Smart helmets

9.2.1.3.1 Smart helmets are widely adopted in construction sector to optimize workflow

9.2.1.3.2 Case study

9.2.2 HEAD-UP DISPLAYS

9.2.2.1 Head-up display devices are anticipated to commercialize in 2020

9.2.2.2 Case study: Navdy hired Aavid, Thermal division of Boyd Corporation to manage HUDs in varying thermal conditions

TABLE 31 AUGMENTED REALITY HUD MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 AUGMENTED REALITY HUD MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 VIRTUAL REALITY DEVICES

FIGURE 44 MARKET FOR GESTURE-TRACKING DEVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 34 VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2022–2027 (USD MILLION)

FIGURE 45 MARKET FOR GESTURE-TRACKING DEVICES TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD, IN TERMS OF SHIPMENT

TABLE 35 MARKET, BY DEVICE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 36 MARKET, BY DEVICE TYPE, 2022–2027 (THOUSAND UNITS)

9.3.1 HEAD-MOUNTED DISPLAYS

9.3.1.1 Use of HMDs in gaming and entertainment is major driver for growth of VR hardware devices

TABLE 37 VIRTUAL REALITY HMDS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 VIRTUAL REALITY HMDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.2 GESTURE-TRACKING DEVICES

9.3.2.1 Gesture-tracking devices play crucial role in healthcare and gaming applications

9.3.2.2 Case study

9.3.2.2.1 Data gloves

9.3.2.2.2 Others

TABLE 39 AUGMENTED & VIRTUAL REALITY MARKET FOR GESTURE-TRACKING DEVICES, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR GESTURE-TRACKING DEVICES, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.3 PROJECTORS & DISPLAY WALLS

9.3.3.1 Projectors and display walls are new growth avenues in VR hardware market

9.3.3.2 Case study: Juntendo University, Sakura Campus

9.3.3.3 Case study: Barrier-Free VR Spectating

TABLE 41 MARKET FOR PROJECTORS & DISPLAY WALLS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR PROJECTORS & DISPLAY WALLS, BY APPLICATION, 2022–2027 (USD MILLION)

10 AUGMENTED REALITY AND VIRTUAL REALITY MARKET, BY APPLICATION (Page No. - 155)

10.1 INTRODUCTION

FIGURE 46 AR MARKET, BY APPLICATION

FIGURE 47 CONSUMER APPLICATION TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 43 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 APPLICATIONS OF AUGMENTED REALITY

10.2.1 CONSUMER

TABLE 45 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR CONSUMER APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR CONSUMER APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 50 AUGMENTED REALITY MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 51 MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR CONSUMER APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR CONSUMER APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.2.1.1 Gaming

10.2.1.1.1 Augmented reality enhances interactivity in gaming and provides immersive experience to gamers

10.2.1.1.2 Case study: Ruffles unites Brazil’s youth with Amigo AR game

10.2.1.2 Sports & entertainment

10.2.1.3 Case study: Xmas ARchy’s AR Portal

10.2.1.3.1 Entertainment applications

10.2.1.3.1.1 Museums (archaeology)

10.2.1.3.1.2 Case study: AR in museums

10.2.1.3.1.3 Theme parks

10.2.1.3.1.4 Art galleries and exhibitions

10.2.1.3.1.5 Case study: Jaunauce Palace team recruited Overly to bring back pieces from Leonardo da Vinci, Raphael, and Bertel Thorvaldsen in augmented reality

TABLE 57 USE CASES OF AUGMENTED REALITY IN CONSUMER APPLICATIONS

10.2.2 COMMERCIAL

TABLE 58 MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 60 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2018–2019 (USD MILLION)

TABLE 61 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 AUGMENTED REALITY MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.2.2.1 Retail & e-commerce

10.2.2.1.1 Jewelry

10.2.2.1.1.1 Augmented reality enables consumers to try before they buy and improves consumer buying experience

10.2.2.1.1.2 Case study: PC Jewelers Revamps Store Experience

10.2.2.1.2 Beauty and cosmetics

10.2.2.1.2.1 Virtual testing of cosmetic products is key driver for market in beauty and cosmetics

10.2.2.1.2.2 Case study: e.l.f. sees higher conversion for online consumers using 3D try-on

10.2.2.1.3 Apparel fitting

10.2.2.1.3.1 Virtual trial rooms are gaining consumer attention

10.2.2.1.3.2 Case study: Visual fitting room – TryNDBuy in Bangalore

10.2.2.1.4 Grocery shopping

10.2.2.1.4.1 Augmented reality provides personalized product tips in grocery application

10.2.2.1.5 Footwear

10.2.2.1.5.1 Virtual try before you buy feature drives growth of market in footwear

10.2.2.1.5.2 Case study: Virtual try-on shoes

10.2.2.1.6 Furniture & lighting design

10.2.2.1.6.1 Reduced product exchange rate through augmented reality drives growth of augmented reality market in furniture & lighting design

10.2.2.1.6.2 Case study: Slate and JigSpace are disrupting furniture design industry with AR model viewers and 3D product visualization software

10.2.2.2 Travel & Tourism

10.2.2.2.1 Augmented reality plays crucial role in enhancing traveling experience

10.2.2.2.2 Case study: Using AR for travel mobile app development

10.2.2.3 E-learning

10.2.2.3.1 Augmented reality increases student interaction and enhances learning experience

TABLE 70 USE CASES OF AUGMENTED REALITY IN COMMERCIAL APPLICATION

10.2.3 ENTERPRISE (MANUFACTURING)

10.2.3.1 Augmented reality aids enterprises in providing better training by visualizing content

10.2.3.2 Case study: Boeing cuts production time by 25% with Skylight on glass

TABLE 71 MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 AR MARKET FOR ENTERPRISE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR ENTERPRISE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 AUGMENTED REALITY MARKET FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 83 USE CASES OF AUGMENTED REALITY IN ENTERPRISE APPLICATION

10.2.4 HEALTHCARE

TABLE 84 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 85 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 86 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 AUGMENTED REALITY MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 MARKET FOR HEALTHCARE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 MARKET FOR HEALTHCARE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.2.4.1 Surgery

10.2.4.1.1 Augmented healthcare apps can help save lives and treat patients seamlessly irrespective of severity of issues

10.2.4.1.2 Case study: AR in surgeries

10.2.4.2 Fitness management

10.2.4.2.1 Augmented reality adds interactivity and fun to workouts

10.2.4.2.2 Case study: AR in fitness

10.2.4.3 Patient care management

10.2.4.3.1 Remote consulting feature drives growth of augmented reality for patient care management

10.2.4.3.2 Case study: AR in patient management

10.2.4.4 Pharmacy management

10.2.4.4.1 Requirement for better scheduling flow of medicines drives growth of augmented reality in pharmacy management

10.2.4.4.2 Case study: AR in pharmacy management

10.2.4.5 Medical training and education

10.2.4.5.1 Augmented reality enriches learning experience and amplifies interactivity

10.2.4.5.2 Case study: AR in medical education

10.2.4.6 Others

10.2.4.6.1 AR helps radiologists perceive 3D image data more precisely for interventional and diagnostic radiology

TABLE 96 USE CASES OF AUGMENTED REALITY IN HEALTHCARE APPLICATION

10.2.5 AEROSPACE & DEFENSE

10.2.5.1 AR is being used to gain competitive advantage over enemies

10.2.5.2 Case study: US Air Force adopts immersive mixed reality training to fuel better engagement, learning retention, and outcomes

TABLE 97 AR MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 99 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 101 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 102 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 103 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 105 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 109 USE CASES OF AUGMENTED REALITY IN AEROSPACE & DEFENSE APPLICATION

10.2.6 ENERGY

10.2.6.1 Growing need to improve safety in oil & gas sector drives augmented reality market for energy sector

10.2.6.2 Case study: Siemens Energy’s remote assistance

TABLE 110 MARKET FOR ENERGY APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 111 MARKET FOR ENERGY APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 112 MARKET FOR ENERGY APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 MARKET FOR ENERGY APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 114 MARKET FOR ENERGY APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 MARKET FOR ENERGY APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 MARKET FOR ENERGY APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 MARKET FOR ENERGY APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 MARKET FOR ENERGY APPLICATION IN ASIA PACIFIC, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 119 MARKET FOR ENERGY APPLICATION IN ASIA PACIFIC, BY COUNTRY 2022–2027 (USD MILLION)

TABLE 120 AUGMENTED REALITY MARKET FOR ENERGY APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 MARKET FOR ENERGY APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 122 USE CASES OF AUGMENTED REALITY IN ENERGY APPLICATION

10.2.7 AUTOMOTIVE

10.2.7.1 Emergence of ADAS drives demand for AR-based HUD technology

10.2.7.2 Case study: AR in heads-up displays for Visteon HUD

TABLE 123 MARKET FOR AUTOMOTIVE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 124 MARKET FOR AUTOMOTIVE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 125 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 127 MARKET FOR AUTOMOTIVE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MARKET FOR AUTOMOTIVE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 MARKET FOR AUTOMOTIVE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 MARKET FOR AUTOMOTIVE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 131 AUGMENTED REALITY MARKET FOR AUTOMOTIVE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 MARKET FOR AUTOMOTIVE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 133 MARKET FOR AUTOMOTIVE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 134 MARKET FOR AUTOMOTIVE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 135 USE CASES OF AUGMENTED REALITY IN AUTOMOTIVE APPLICATIONS

10.2.8 OTHERS

TABLE 136 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 137 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 138 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 139 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 140 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 AUGMENTED REALITY MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 143 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 144 MARKET FOR OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 145 MARKET FOR OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 146 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 147 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.2.8.1 Agriculture

10.2.8.1.1 Augmented reality assists farmers in implementing new techniques with better learning experience

10.2.8.1.2 Case study: AR in agriculture

10.2.8.2 Construction

10.2.8.2.1 3D models required for construction projects can be better illustrated with augmented reality

10.2.8.2.2 Case study: AR in construction

10.2.8.3 Transportation & logistics

10.2.8.3.1 AR technology is widely adopted in transportation & logistics sector to document trading activities

10.2.8.4 Public safety

10.2.8.4.1 Augmented reality-based 3D maps aid police personnel in enhancing public safety

10.2.8.5 Telecom/IT data centers

10.2.8.5.1 Requirement of advanced network infrastructure in telecom/IT data centers would help drive AR software market for this vertical

10.2.8.5.2 Case study: AR in telecom

10.2.8.5.3 Case study: Service IT Direct utilizes CareAR to power Smart Handz

TABLE 148 USE CASES OF AUGMENTED REALITY IN OTHER APPLICATIONS

10.3 VIRTUAL REALITY APPLICATIONS

FIGURE 48 VR MARKET FOR COMMERCIAL APPLICATIONS TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 149 VIRTUAL REALITY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 CONSUMER

10.3.1.1 Gaming and entertainment applications are major drivers for market growth

TABLE 151 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 152 MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 153 MARKET FOR CONSUMER APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 154 MARKET FOR CONSUMER APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 155 MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 158 MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 MARKET FOR CONSUMER APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 MARKET FOR CONSUMER APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 161 MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 162 VIRTUAL REALITY MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.1.1.1 Gaming and entertainment

10.3.1.1.2 Sports

10.3.1.1.3 Case study: VR in sports

10.3.1.2 Use cases of virtual reality in consumer applications

10.3.2 COMMERCIAL

10.3.2.1 Retail and e-commerce to drive commercial applications in augmented & virtual reality market

TABLE 163 MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 164 MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 165 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 166 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 167 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 168 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 169 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 170 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 171 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 172 MARKET FOR COMMERCIAL APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 173 MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 174 VIRTUAL REALITY MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.2.1.1 Retail & e-commerce

10.3.2.1.2 Case study: Kellogg’s has perfected product placement with VR

10.3.2.1.3 Education and training

10.3.2.1.4 Case study: Virtual reality in classrooms

10.3.2.1.5 Travel and tourism

10.3.2.1.6 Case study: Thomas Cook’s virtual reality holiday ‘Try Before You Fly’

10.3.2.1.7 Advertising

10.3.2.1.8 Case study: New York Times takes news to new level

10.3.2.2 Use cases of virtual reality in commercial applications

10.3.3 ENTERPRISE (MANUFACTURING)

10.3.3.1 Increased use of VR technology and devices in industrial facilities to drive enterprise application in market

10.3.3.2 Case study: BEP Surface Technologies is using VR for growth

TABLE 175 VR MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 176 MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 177 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 178 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 179 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 180 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 181 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 182 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 183 MARKET FOR ENTERPRISE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 184 MARKET FOR ENTERPRISE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 185 MARKET FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 186 MARKET FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.3.3 Use cases of virtual reality in enterprise (manufacturing)

10.3.4 HEALTHCARE

10.3.4.1 Patient care management and medical training & education are major applications driving growth of VR in healthcare

TABLE 187 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 188 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 189 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 190 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 191 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 192 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 193 MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 194 VIRTUAL REALITY MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 195 MARKET FOR HEALTHCARE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 196 MARKET FOR HEALTHCARE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 197 MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 198 MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.4.1.1 Surgery

10.3.4.1.2 Case study: VR in surgeries

10.3.4.1.3 Patient care management

10.3.4.1.4 Case study: VR in patient care management

10.3.4.1.5 Fitness management

10.3.4.1.6 Pharmacy management

10.3.4.1.7 Medical training and education

10.3.4.1.8 Case study: GE Healthcare uses VR for training

10.3.4.2 Use cases of virtual reality in healthcare

10.3.5 AEROSPACE & DEFENSE

10.3.5.1 Simulation training to be major growth factor of VR in aerospace & defense

TABLE 199 VR MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 200 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 201 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 202 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 203 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 204 VIRTUAL REALITY MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 205 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 206 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 207 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 208 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 209 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 210 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.5.2 Use cases of virtual reality in aerospace & defense

10.3.6 OTHERS

TABLE 211 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2018–2021 (USD MILLION)

TABLE 212 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2022–2027 (USD MILLION)

TABLE 213 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 214 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 215 VIRTUAL REALITY MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 216 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 217 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 218 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 219 MARKET FOR OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 220 MARKET FOR OTHER APPLICATIONS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 221 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 222 AUGMENTED REALITY AND VIRTUAL REALITY MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.3.6.1 Automotive

10.3.6.2 Case study: AUDI lets customers “Enter Sandbox”

10.3.6.3 Real estate (architecture and building design)

10.3.6.4 Case study: Immersive visualization for architectural designs

10.3.6.5 Geospatial mining

10.3.6.6 Case study: Use of VR in Lihir Gold Mine

10.3.6.7 Use cases of virtual reality in other applications

11 GEOGRAPHICAL ANALYSIS (Page No. - 248)

11.1 INTRODUCTION

FIGURE 49 GEOGRAPHIC SNAPSHOT: AUGMENTED REALITY MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 50 GEOGRAPHIC SNAPSHOT: MARKET IN ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 223 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 224 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 225 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 226 VR MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 51 NORTH AMERICA: SNAPSHOT OF AR MARKET

TABLE 227 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 228 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 229 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 230 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 52 NORTH AMERICA: SNAPSHOT OF VIRTUAL REALITY MARKET

TABLE 231 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 232 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 233 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 234 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Strong presence of AR & VR companies to drive market

11.2.1.2 Case study: Showstopping technology by Cisco

11.2.2 CANADA

11.2.2.1 Increasing investments in cutting-edge technologies to fuel growth

11.2.2.2 Case study: Training using virtual reality

11.2.3 MEXICO

11.2.3.1 Evolving industries to drive market growth

11.3 EUROPE

11.3.1 CASE STUDY: QUOTIDIANAMENTE –ITALIAN PROJECT, WHICH COMBINES VR WITH DISABILITIES

FIGURE 53 EUROPE: SNAPSHOT OF AUGMENTED REALITY MARKET

TABLE 235 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 236 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 237 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 238 AR MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 54 EUROPE: SNAPSHOT OF VIRTUAL REALITY MARKET

TABLE 239 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 240 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 241 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 242 VR MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 High adoption of new technologies in manufacturing to drive market

11.3.2.2 Case study: VR technologies adopted by Volkswagen

11.3.3 FRANCE

11.3.3.1 High adoption in retail to enhance market growth

11.3.3.2 Case study: 3D makeup try-on by L’Oreal

11.3.4 UK

11.3.4.1 Continuous focus on digitalization likely to drive market growth

11.3.4.2 Case study: Lloyd’s Register’: VR safety and performance

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 55 ASIA PACIFIC: SNAPSHOT OF AUGMENTED REALITY MARKET

TABLE 243 MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 244 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 245 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 246 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 56 ASIA PACIFIC: SNAPSHOT OF VIRTUAL REALITY MARKET

TABLE 247 AR & VR MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 248 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 249 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 250 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Huge number of local players producing AR & VR devices to drive market growth

11.4.1.2 Case study: IoT Solutions Limited developed AR learning platform

11.4.2 INDIA

11.4.2.1 Increasing awareness of advanced technology plays crucial role in market growth

11.4.2.2 Case study: Sony Pictures Entertainment (SPE) India used augmented reality to creatively engage users to promote Men in Black

11.4.3 JAPAN

11.4.3.1 High growth of healthcare sector to fuel market growth

11.4.3.2 Case study: Japan Eyewear’s JINS Holdings

11.4.4 SOUTH KOREA

11.4.4.1 Digital revolution in industrial sector to drive market growth

11.4.5 REST OF APAC

11.4.5.1 Case study: Castlery in Singapore adopted AR VR technologies to keep up with its business in furniture

11.5 ROW

TABLE 251 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 252 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 253 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 254 AR MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 255 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 256 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 257 VR MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 258 VIRTUAL REALITY MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Oil & gas and mining to fuel growth of AR and VR devices

11.5.1.2 Case study: Travel experiences with ILTM

11.5.2 SOUTH AMERICA

11.5.2.1 Growing consumer market to drive market growth

12 COMPETITIVE LANDSCAPE (Page No. - 284)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 259 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 RANKING FOR AR MARKET PLAYERS

FIGURE 57 RANKING OF THE TOP 5 PLAYERS IN AUGMENTED REALITY MARKET

12.4 RANKING FOR AR & VR MARKET PLAYERS

FIGURE 58 RANKING OF TOP 5 PLAYERS IN MARKET

12.5 COMPANY EVALUATION QUADRANT: AR MARKET

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 59 MARKET COMPANY EVALUATION QUADRANT, 2021

12.6 COMPANY EVALUATION QUADRANT: MARKET

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 60 VIRTUAL REALITY MARKET COMPANY EVALUATION QUADRANT, 2021

12.7 COMPANY FOOTPRINT

TABLE 260 OVERALL COMPANY FOOTPRINT

TABLE 261 FOOTPRINT OF DIFFERENT COMPANIES FOR TECHNOLOGY

TABLE 262 FOOTPRINT OF DIFFERENT COMPANIES FOR OFFERING

TABLE 263 FOOTPRINT OF DIFFERENT COMPANIES IN VARIOUS REGIONS

12.8 START-UP EVALUATION MATRIX: AR AND VR MARKET

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 61 AUGMENTED REALITY AND VIRTUAL REALITY MARKET, STARTUP/SME EVALUATION MATRIX, 2021

12.9 COMPETITIVE SITUATIONS AND TRENDS

12.9.1 PRODUCT LAUNCHES

TABLE 264 PRODUCT LAUNCHES, 2020–2022

12.9.2 DEALS

TABLE 265 DEALS, 2020–2022

13 COMPANY PROFILING (Page No. - 302)

13.1 KEY PLAYERS

(Business Overview, Solutions, Products & Services strategies, Deals, Recent Developments, MnM View)*

13.1.1 GOOGLE

TABLE 266 GOOGLE: COMPANY SNAPSHOT

FIGURE 62 GOOGLE: COMPANY SNAPSHOT

13.1.2 MICROSOFT

TABLE 267 MICROSOFT: COMPANY SNAPSHOT

FIGURE 63 MICROSOFT: COMPANY SNAPSHOT

13.1.3 SONY

TABLE 268 SONY: COMPANY SNAPSHOT

FIGURE 64 SONY: COMPANY SNAPSHOT

13.1.4 OCULUS (META PLATFORMS)

TABLE 269 OCULUS (META PLATFORMS): COMPANY SNAPSHOT

13.1.5 SAMSUNG ELECTRONICS

TABLE 270 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 65 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

13.1.6 HTC

TABLE 271 HTC: COMPANY SNAPSHOT

FIGURE 66 HTC: COMPANY SNAPSHOT

13.1.7 APPLE

TABLE 272 APPLE: COMPANY SNAPSHOT

FIGURE 67 APPLE: COMPANY SNAPSHOT

13.1.8 PTC INC.

TABLE 273 PTC INC.: COMPANY SNAPSHOT

FIGURE 68 PTC INC.: COMPANY SNAPSHOT

13.1.9 SEIKO EPSON

TABLE 274 SEIKO EPSON: COMPANY SNAPSHOT

FIGURE 69 SEIKO EPSON: COMPANY SNAPSHOT

13.1.10 LENOVO

TABLE 275 LENOVO: COMPANY SNAPSHOT

FIGURE 70 LENOVO: COMPANY SNAPSHOT

13.2 OTHER PLAYERS

13.2.1 WIKITUDE GMBH

13.2.2 EON REALITY

13.2.3 MAXST

13.2.4 MAGIC LEAP INC.

13.2.5 BLIPPAR

13.2.6 UPSKILL

13.2.7 ATHEER INC.

13.2.8 VUZIX

13.2.9 CYBERGLOBE SYSTEMS

13.2.10 LEAP MOTION (ULTRALEAP)

13.2.11 SIXSENSE ENTERPRISES

13.2.12 NINTENDO

13.2.13 PSIOUS

13.2.14 MARXENT LABS, LLC

13.2.15 INGLOBE TECHNOLOGIES

13.2.16 META COMPANY

13.2.17 NIANTIC

13.2.18 AUGMENT SAS

13.2.19 MINDMAZE

13.2.20 FIRSTHAND TECHNOLOGY

13.2.21 WORLDVIZ

13.2.22 VIRTUIX

13.2.23 SURVIOS

13.2.24 INTEL CORPORATION

13.2.25 REALWEAR

13.2.26 MERGE LABS

13.2.27 SPACEVR

13.2.28 VIRTUALLY LIVE

13.2.29 XIAOMI CORPORATION

13.2.30 PANASONIC CORPORATION

13.2.31 DYNABOOK AMERICAS, INC.

13.2.32 OPTINVENT

13.2.33 WAYRAY

13.2.34 SCOPE AR

13.2.35 CONTINENTAL

13.2.36 VISTEON CORPORATION

13.2.37 TALEPSPIN

13.2.38 SCANTA

13.2.39 CRAFTARS

13.2.40 APPENTUS TECHNOLOGIES

13.2.41 BIDON GAMES STUDIO

*Details on Business Overview, Solutions, Products offered & Services strategies, Delas, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 369)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities for estimating the size of the AR and VR market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the augmented & virtual reality market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the AR and VR industry began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves augmented reality and virtual reality magazines, journals. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the augmented & virtual reality market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

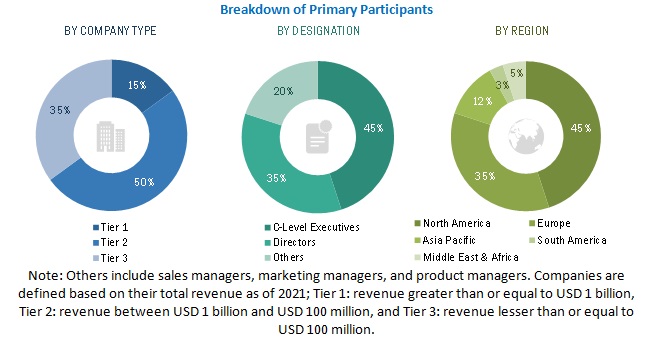

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the AR and VR market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of AR and VR industry and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The supply chain and the size of the augmented & virtual reality market, in terms of value, have been determined through primary and secondary research processes.

- Several primary interviews have been conducted with key opinion leaders related to AR and VR market including key OEMs, IDMs, and Tier I suppliers and software developers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Augmented & Virtual Reality Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation