Automated Guided Vehicle Market by Type (Tow Vehicles, Unit Load Carriers, Forklift Trucks, Assembly Line Vehicles, Pallet Trucks), Navigation Technology, Industry, and Region (2021-2026)

Updated on : April 24, 2023

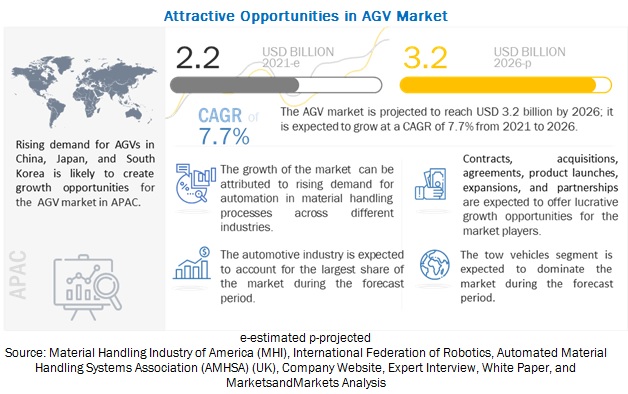

[238 Pages Report] The Automated Guided Vehicle Market is projected to grow from USD 2.2 billion in 2021 to USD 3.2 billion by 2026; it is expected to grow at a CAGR of 7.7% from 2021 to 2026. The growth of the AGV industry is propelled by increasing popularity of e-commerce and rising demand for automation in material handling across industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising focus on improving workplace safety

Employee safety is a prime concern in various industries, including logistics and warehousing, manufacturing, metals & heavy machinery, and automotive, as workers are required to accomplish potentially dangerous activities and work in environments that pose a threat to personal safety. In most of these industries, tasks such as loading, unloading, storage, and movement of goods are carried out manually, putting human workers at risk. AGVs ensure reduced instances of accidents and greater safety of workers.

Industries are focusing on improving workplace safety to eliminate accidents, reduce downtime, and increase productivity. There is growing awareness about AGVs, and an increasingly large number of companies are implementing AGVs in their warehouses. These vehicles are capable of lifting heavier weights and can transport materials without delay. Intelligent unmanned vehicles are less prone to errors and help companies reduce accidents and ensure safety at the workplace.

Restraint: Increasing preference for mobile robots over AGVs in retail and e-commerce industries

The e-commerce and retail industries are highly dependent on the logistics sector for their smooth operations. The companies in the e-commerce and retail industries are opting for automated material handling equipment for improving their operational efficiency. In the e-commerce industry, companies are using mobile robots for automating warehouse operations.

Mobile robots are used as self-driving logistics vehicles for indoor operations in the e-commerce and retail industries. They offer a new approach to warehouse automation because of their features such as mobile shelves, robotic drive units, sophisticated control software, and workstations to automate pick, pack, and ship processes. These portable solutions adapt to changes in product types and velocities, order prioritization, and other operational realities compared to conveyors, AGVs, carousels, and traditional ASRS. Also, the installation and commissioning cost of mobile robots is less as compared to AGVs and they are easier to install. These characteristics of mobile robots may limit the adoption of AGVs in the retail and e-commerce industries.

Opportunity: Growing adoption of industrial automation by SMEs

The initial cost of AGV solutions is high, depending on the integrated battery type and navigation technology. Small and medium-sized enterprises (SMEs) find it difficult to adopt automation technologies in material-handling due to the high initial cost, and these technologies are mostly affordable to large-scale industries. Factors such as rising labor costs (in developed economies like the US), quality concerns, and limited skilled workforce hinder the growth and profitability of these SMEs. Therefore, despite high initial capital investments, SMEs are moving toward automated warehouse operations as automation helps them compete globally with bigger market players. AGVs can help SMEs to be more competitive and deliver significantly enhanced levels of productivity, efficiency, and profitability. Many SMEs have started investing in AGVs to increase their global competitiveness. Similarly, SMEs from the e-commerce, automotive, food & beverages, pharmaceuticals, and chemicals industries are expected to deploy AGVs in the coming years.

Challenge: Technical challenges related to sensing elements

The real-time technical challenges related to any sensing element in material handling equipment could stop the entire process. For instance, an AGV will not react to provided commands effectively if the sensing element of the AGV is not installed correctly. Failure of the sensor in this system would halt the entire process as a sensor is the most critical element of any AGV system for navigation and other operations. Moreover, any fault in the control software may lead to improper functioning of the AGVs; this could delay the entire production process. Mechanical failures can result from improper maintenance, causing loss of production and performance. Hence, regular maintenance is crucial for the smooth functioning of AGVs.

Tow vehicles segment exhibited largest share of market in 2020.

Tow vehicles pull non-powered carts carrying huge loads. This is the most productive type of AGV used for towing and tugging as it can move heavier load with multiple trailers than a single fork truck. The load is placed in the vehicle either manually or automatically. Tow vehicles are used in pallet operations requiring frequent long-distance deliveries carrying high volumes of load, with or without intermediate pickup and drop points along the route. These vehicles are well designed and can operate at a pre-programmed speed, meeting production targets while maintaining safety regulations.

The vision guidance segment of the AGV market togrow at the highest CAGR during the forecast period.

Several companies offer AGVs using vision guidance for operation. For instance, Bastian Solutions provides vision guidance pallet truck and tow tractor AGVs. The vehicle stores a 3D map of the warehouse when it is driven in the warehouse and using this map it functions autonomously. It also pauses or slows down if any obstacle arrives in its path. These safety protocols make them ideal for heavy duty applications. Seegrid’s VGVs are equipped with 10 cameras that collect and store data points for creating a 3D map. This makes them reliable in dynamic environments and offer maneuverability in complex spaces.

To know about the assumptions considered for the study, download the pdf brochure

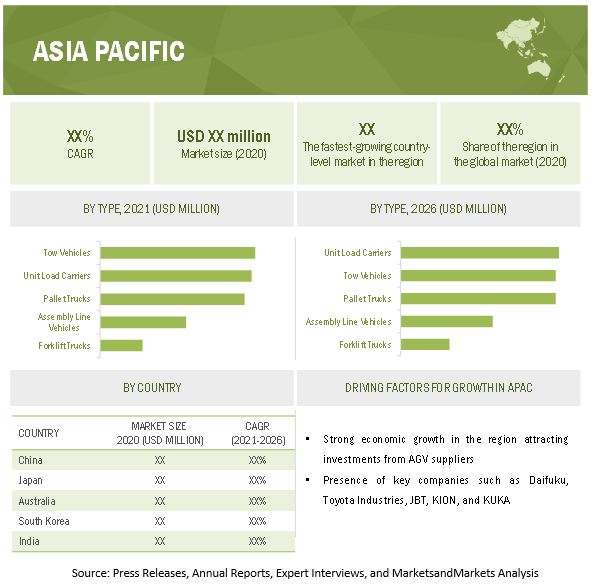

Asia Pacificis anticipated to grow at the highest CAGR during 2021-2026.

The AGV market in Asia Pacific is expected to grow at the highest CAGR during the forecast period due to growing awareness about automation and its success among users, thereby encouraging more companies to invest in these vehicles. Moreover, the strong economic growth in this region is attracting further investments from AGV suppliers for establishing sales and support facilities.

Key Market Players

The AGV players have implemented various types of organic as well as inorganic growth strategies, such as new product launches, contracts, agreements, collaborations, acquisitions and, business expansions, to strengthen their offerings in the market. The major playersin the AGV comapnies such as Daifuku (Japan), JBT (US), KION (Germany), KUKA (Germany), Toyota Industries (Japan), among others.

The study includes an in-depth competitive analysis of these key players in the AGV market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 2.2 Billion |

| Revenue Forecast in 2026 | USD 3.2 Billion |

| Growth Rate | 7.7% |

|

Years considered |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

CAGR |

7.7% |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

|

In this report, the overall AGV market has been segmented based on type, navigation technology, industry, and region.

By Type:

- Tow Vehicles

- Unit Load Carriers

- Pallet Trucks

- Assembly Line Vehicles

- Forklift Vehicles

- Others

By Navigation Technology:

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Optical Tape Guidance

- Vision Guidance

- Others

By Industry:

- Automotive

- Metals & Heavy Machinery

- Food & Beverages

- Chemicals

- Healthcare

- 3PL

- Semiconductors & Electronics

- Aviation

- E-commerce

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- Australia

- South Korea

- India

- Malaysia

- Taiwan

- Indonesia

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Africa

- Middle East

Recent Developments

- In March 2021, Toyota Industries partnered with All Nippon Airways (ANA) to test Japan’s first autonomous towing tractors at Saga Airport. The towing tractors use 2D/3D LiDAR sensors to automatically detect objects in their path and allow the vehicles to automatically adjust course.

- In February 2021, Daifuku partnered with AFT Industries, a Germany-based automation and conveyor technology company, to leverage the latter’s expertise for improving material handling systems for the automotive industry. The partnership will focus on opening new channels to meet the global demand for material handling systems from automotive manufacturers.

- In April 2020, EK Robotics launched the VARIO MOVE transport vehicle. It consists of a drive unit, which is flexibly equipped with different load handling attachments through universal interfaces.

Frequently Asked Questions (FAQ):

How big Automated Guided Vehicle Market?

The Automated Guided Vehicle Market is projected to grow from USD 2.2 billion in 2021 to USD 3.2 billion by 2026; it is expected to grow at a CAGR of 7.7% from 2021 to 2026.

Who are the top 5 players in the AGV market?

The major vendors operating in the AGV market include Daifuku, JBT, KUKA, KION, and Toyota Industries.

What is Asia Pacificis anticipated to grow at the highest CAGR during 2021-2026?

The AGV market in Asia Pacific is expected to grow at the highest CAGR during the forecast period due to growing awareness about automation and its success among users, thereby encouraging more companies to invest in these vehicles. Moreover, the strong economic growth in this region is attracting further investments from AGV suppliers for establishing sales and support facilities.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the major end-use industries of AGV?

Significant industries of AGV are automotive, metal & heavy machinery, food & beverages, chemicas, and healthcare.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 AUTOMATED GUIDED VEHICLE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

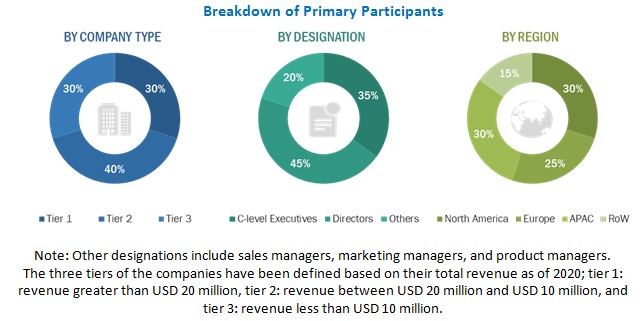

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE FROM PRODUCTS/SOLUTIONS OF AGV MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.4.2 LIMITATIONS

2.4.3 RISK ASSESSMENT

FIGURE 7 RISK ASSESSMENT OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 IMPACT ANALYSIS OF COVID-19 ON AGV MARKET

3.1 REALISTIC SCENARIO

TABLE 1 AGV MARKET, POST-COVID-19 REALISTIC SCENARIO, 2021–2026

3.2 PESSIMISTIC SCENARIO

TABLE 2 AGV MARKET: POST-COVID-19 PESSIMISTIC SCENARIO, 2021–2026

3.3 OPTIMISTIC SCENARIO

TABLE 3 AGV MARKET: POST-COVID-19 OPTIMISTIC SCENARIO, 2021–2026

FIGURE 9 TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AGV MARKET IN 2021

FIGURE 10 LASER GUIDANCE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET DURING FORECAST PERIOD

FIGURE 11 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF AGV MARKET IN 2021

FIGURE 12 AGV MARKET IN APAC TO GROW HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 APAC TO PROVIDE LUCRATIVE OPPORTUNITIES FOR AGV MARKET IN COMING YEARS

FIGURE 13 ATTRACTIVE GROWTH OPPORTUNITIES IN AGV MARKET

4.2 AGV MARKET, BY TYPE

FIGURE 14 TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

4.3 AGV MARKET, BY INDUSTRY

FIGURE 15 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET IN 2021

4.4 AGV MARKET, BY NAVIGATION TECHNOLOGY AND REGION

FIGURE 16 LASER GUIDANCE SEGMENT AND EUROPE TO DOMINATE AGV MARKET IN 2021

4.5 AGV MARKET, BY REGION

FIGURE 17 AGV MARKET TO WITNESS HIGHEST CAGR IN CHINA AND MEXICO DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 AUTOMATED GUIDED VEHICLE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for automation solutions in material handling processes across industries

5.2.1.2 Growing demand for AGVs from e-commerce post COVID-19 outbreak

5.2.1.3 Rising focus on improving workplace safety

5.2.1.4 Marked shift to mass customization from mass production

FIGURE 19 IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation, maintenance, and switching costs associated with AGVs

5.2.2.2 Increasing preference for mobile robots over AGVs in retail and e-commerce industries

5.2.2.3 Decreased demand for automated guided vehicles owing to COVID-19

5.2.2.4 Lack of flexibility and obstacle resistance in AGVs

FIGURE 20 IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of industry 4.0 technologies in warehousing

5.2.3.2 Growing adoption of industrial automation by SMEs

5.2.3.3 Substantial growth of industrial sector in emerging economies

5.2.3.4 Presence of huge intralogistics sector in Southeast Asia

FIGURE 21 IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Low labor costs restricting adoption of AGVs in emerging economies

5.2.4.2 Technical challenges related to sensing elements

FIGURE 22 IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF AGV MARKET

5.4 ECOSYSTEM

FIGURE 24 ECOSYSTEM

TABLE 4 AGV MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 25 REVENUE SHIFT FOR AGV MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 AGV MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7 CASE STUDY ANALYSIS

TABLE 6 MARKET ASSESSMENT FOR CUSTOM-ENGINEERED AUTOMATED GUIDED VEHICLES

TABLE 7 MARKET ASSESSMENT FOR LARGE AGV FLEET

TABLE 8 MARKET ASSESSMENT FOR LASER-GUIDED TUGGER VEHICLE

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT

5.8.2 5G

5.8.3 MACHINE LEARNING

5.9 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE OF AGVS

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

FIGURE 26 IMPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

FIGURE 27 EXPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 28 TOP 10 COMPANIES/INSTITUTIONS WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 10 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 11 LIST OF FEW PATENTS IN AGV MARKET, 2019–2020

5.12 REGULATORY LANDSCAPE

5.12.1 SAFETY STANDARDS FOR AGVS

TABLE 12 SAFETY STANDARDS FOR AGVS

6 EMERGING TECHNOLOGIES AND APPLICATIONS OF AGVS (Page No. - 73)

6.1 INTRODUCTION

FIGURE 29 EMERGING TECHNOLOGIES USED IN AGVS

6.2 EMERGING TECHNOLOGIES USED IN AGVS

6.2.1 LIDAR SENSORS

6.2.1.1 LiDAR Sensors help to create 360-degree maps for AGVs

6.2.2 CAMERA VISION

6.2.2.1 AGVS can “see” with camera vision

6.2.3 DUAL MODE AGVS

6.2.3.1 Dual mode operation offers increased flexibility

6.3 LATEST APPLICATIONS OF AGVS

6.3.1 HOSPITALS

6.3.2 THEME PARKS

7 BATTERY TYPES AND CHARGING ALTERNATIVES FOR AGVS (Page No. - 76)

7.1 INTRODUCTION

7.2 TYPES OF BATTERIES USED IN AGVS

FIGURE 30 TYPES OF BATTERIES USED IN AGVS

7.2.1 LEAD-ACID BATTERY

7.2.2 LITHIUM-ION BATTERY

7.2.3 NICKEL-BASED BATTERY

7.2.4 OTHERS

7.3 BATTERY CHARGING ALTERNATIVES

7.3.1 AUTOMATIC AND OPPORTUNITY CHARGING

7.3.1.1 Wireless charging

7.3.2 BATTERY SWAP

7.3.2.1 Automatic battery swap

8 AGV OFFERINGS (Page No. - 79)

8.1 INTRODUCTION

FIGURE 31 AGV OFFERINGS

8.2 HARDWARE

8.3 SOFTWARE & SERVICES

9 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE (Page No. - 81)

9.1 INTRODUCTION

FIGURE 32 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

FIGURE 33 TOW VEHICLES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET IN 2021

TABLE 13 AGV MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 AGV MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2 TOW VEHICLES

9.2.1 TOW VEHICLES CAN CARRY A LIMITED VARIETY OF LOADS AND OFTEN HAVE A SIMPLER GUIDE PATH

TABLE 15 AGV MARKET FOR TOW VEHICLES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 16 AGV MARKET FOR TOW VEHICLES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 17 AGV MARKET FOR TOW VEHICLES, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 18 AGV MARKET FOR TOW VEHICLES, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 19 AGV MARKET FOR TOW VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 AGV MARKET FOR TOW VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.3 UNIT LOAD CARRIERS

9.3.1 UNIT LOAD CARRIERS ARE IDEAL FOR HANDLING LARGE VOLUMES OF LOAD

TABLE 21 AGV MARKET FOR UNIT LOAD CARRIERS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 22 AGV MARKET FOR UNIT LOAD CARRIERS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 23 AGV MARKET FOR UNIT LOAD CARRIERS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 AGV MARKET FOR UNIT LOAD CARRIERS, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 25 AGV MARKET FOR UNIT LOAD CARRIERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 AGV MARKET FOR UNIT LOAD CARRIERS, BY REGION, 2021–2026 (USD MILLION)

9.4 PALLET TRUCKS

9.4.1 PALLET TRUCKS ARE IDEAL FOR GROUND-LEVEL OPERATIONS

TABLE 27 AGV MARKET FOR PALLET TRUCKS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 28 AGV MARKET FOR PALLET TRUCKS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 29 AGV MARKET FOR PALLET TRUCKS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 30 AGV MARKET FOR PALLET TRUCKS, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 31 AGV MARKET FOR PALLET TRUCKS, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 AGV MARKET FOR PALLET TRUCKS, BY REGION, 2021–2026 (USD MILLION)

9.5 ASSEMBLY LINE VEHICLES

9.5.1 ASSEMBLY LINE VEHICLES ARE USED TO CARRY OUT SERIAL ASSEMBLY OPERATIONS

TABLE 33 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 34 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 35 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 36 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 37 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 AGV MARKET FOR ASSEMBLY LINE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.6 FORKLIFT TRUCKS

9.6.1 FORKLIFT TRUCKS ARE USED FOR FLOOR-TO-FLOOR AND FLOOR-TO-RACKING OPERATIONS

TABLE 39 AGV MARKET FOR FORKLIFT TRUCKS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 40 AGV MARKET FOR FORKLIFT TRUCKS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 41 AGV MARKET FOR FORKLIFT TRUCKS, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 42 AGV MARKET FOR FORKLIFT TRUCKS, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 43 AGV MARKET FOR FORKLIFT TRUCKS, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 AGV MARKET FOR FORKLIFT TRUCKS, BY REGION, 2021–2026 (USD MILLION)

9.7 OTHERS

TABLE 45 AGV MARKET FOR OTHER TYPES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 46 AGV MARKET FOR OTHER TYPES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 47 AGV MARKET FOR OTHER TYPES, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 48 AGV MARKET FOR OTHER TYPES, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 49 AGV MARKET FOR OTHER TYPES, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 AGV MARKET FOR OTHER TYPES, BY REGION, 2021–2026 (USD MILLION)

10 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY (Page No. - 103)

10.1 INTRODUCTION

FIGURE 34 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

FIGURE 35 LASER GUIDANCE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET IN 2026

TABLE 51 AGV MARKET, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 52 AGV MARKET, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

10.2 LASER GUIDANCE

10.2.1 LASER GUIDANCE AGV – THE MOST ACCURATE AND FLEXIBLE SYSTEM

TABLE 53 AGV MARKET FOR LASER GUIDANCE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 54 AGV MARKET FOR LASER GUIDANCE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.3 MAGNETIC GUIDANCE

10.3.1 MAGNETIC GUIDANCE AGVS OFFER SAFEST AND MOST RELIABLE TRANSPORTATION

TABLE 55 AGV MARKET FOR MAGNETIC GUIDANCE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 56 AGV MARKET FOR MAGNETIC GUIDANCE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.4 INDUCTIVE GUIDANCE

10.4.1 INDUCTIVE GUIDANCE AGVS WORK IN TOUGHEST INDUSTRIAL SETUPS

TABLE 57 AGV MARKET FOR INDUCTIVE GUIDANCE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 58 AGV MARKET FOR INDUCTIVE GUIDANCE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.5 OPTICAL TAPE GUIDANCE

10.5.1 OPTICAL TAPE GUIDANCE – EASY AND CONVENIENT SOLUTION FOR AGVS

TABLE 59 AGV MARKET FOR OPTICAL TAPE GUIDANCE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 60 AGV MARKET FOR OPTICAL TAPE GUIDANCE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.6 VISION GUIDANCE

10.6.1 VISION GUIDED VEHICLES PROVIDE RELIABILITY IN DYNAMIC ENVIRONMENTS AND MANEUVERABILITY IN COMPLEX SPACES

TABLE 61 AGV MARKET FOR VISION GUIDANCE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 62 AGV MARKET FOR VISION GUIDANCE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

10.7 OTHERS

TABLE 63 AGV MARKET FOR OTHER NAVIGATION TECHNOLOGIES, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 64 AGV MARKET FOR OTHER NAVIGATION TECHNOLOGIES, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

11 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY (Page No. - 115)

11.1 INTRODUCTION

FIGURE 36 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

FIGURE 37 AUTOMOTIVE SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET FROM 2021 TO 2026

TABLE 65 AGV MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 66 AGV MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.2 AUTOMOTIVE

11.2.1 AUTOMOTIVE INDUSTRY—LARGEST CONTRIBUTOR TO GLOBAL AGV MARKET

FIGURE 38 EUROPE TO LEAD AGV MARKET FOR AUTOMOTIVE FROM 2021 TO 2026

TABLE 67 AGV MARKET FOR AUTOMOTIVE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 68 AGV MARKET FOR AUTOMOTIVE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 69 AGV MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 AGV MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

11.3 METALS & HEAVY MACHINERY

11.3.1 AGVS EASE WORKFLOW IN METALS & HEAVY MACHINERY INDUSTRIES

TABLE 71 AGV MARKET FOR METALS & HEAVY MACHINERY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 AGV MARKET FOR METALS & HEAVY MACHINERY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 AGV MARKET FOR METALS & HEAVY MACHINERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 AGV MARKET FOR METALS & HEAVY MACHINERY, BY REGION, 2021–2026 (USD MILLION)

11.4 FOOD & BEVERAGES

11.4.1 MORE AGVS ADOPTED TO MEET INCREASING GLOBAL FOOD DEMAND

FIGURE 39 EUROPE TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET FOR FOOD & BEVERAGES FROM 2021 TO 2026

TABLE 75 AGV MARKET FOR FOOD & BEVERAGES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 AGV MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 77 AGV MARKET FOR FOOD & BEVERAGES, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 AGV MARKET FOR FOOD & BEVERAGES, BY REGION, 2021–2026 (USD MILLION)

11.5 CHEMICALS

11.5.1 INCREASING CHEMICAL PRODUCTION LEADING TO MORE AGV ADOPTION

TABLE 79 AGV MARKET FOR CHEMICALS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 AGV MARKET FOR CHEMICALS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 AGV MARKET FOR CHEMICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 AGV MARKET FOR CHEMICALS, BY REGION, 2021–2026 (USD MILLION)

11.6 HEALTHCARE

11.6.1 AGVS HAVE GAINED RELEVANCE IN HEALTHCARE DUE TO COVID-19 PANDEMIC

FIGURE 40 UNIT LOAD CARRIERS SEGMENT TO OVERTAKE TOW VEHICLE SEGMENT IN AGV MARKET FOR HEALTHCARE BY 2026

TABLE 83 AGV MARKET FOR HEALTHCARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 AGV MARKET FOR HEALTHCARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 AGV MARKET FOR HEALTHCARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 AGV MARKET FOR HEALTHCARE, BY REGION, 2021–2026 (USD MILLION)

11.7 3PL

11.7.1 3PL INDUSTRY RELIES ON AGVS FOR DAY-TO-DAY OPERATIONS

TABLE 87 AGV MARKET FOR 3PL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 AGV MARKET FOR 3PL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 89 AGV MARKET FOR 3PL, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 AGV MARKET FOR 3PL, BY REGION, 2021–2026 (USD MILLION)

11.8 SEMICONDUCTORS & ELECTRONICS

11.8.1 SEMICONDUCTOR INDUSTRY GROWTH TO LEAD TO INCREASED AGV DEMAND

FIGURE 41 APAC TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET FOR SEMICONDUCTORS & ELECTRONICS FROM 2021 TO 2026

TABLE 91 AGV MARKET FOR SEMICONDUCTORS & ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 AGV MARKET FOR SEMICONDUCTORS & ELECTRONICS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 AGV MARKET FOR SEMICONDUCTORS & ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 94 AGV MARKET FOR SEMICONDUCTORS & ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

11.9 AVIATION

11.9.1 AGVS FACILITATE EASY AEROSPACE MANUFACTURING AND ASSEMBLY OPERATIONS

TABLE 95 AGV MARKET FOR AVIATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 AGV MARKET FOR AVIATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 97 AGV MARKET FOR AVIATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 AGV MARKET FOR AVIATION, BY REGION, 2021–2026 (USD MILLION)

11.10 E-COMMERCE

11.10.1 E-COMMERCE INDUSTRY IS ADOPTING AGVS FOR MATERIAL HANDLING OPERATIONS

FIGURE 42 TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET FOR E-COMMERCE INDUSTRY FROM 2021 TO 2026

TABLE 99 AGV MARKET FOR E-COMMERCE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 AGV MARKET FOR E-COMMERCE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 AGV MARKET FOR E-COMMERCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 AGV MARKET FOR E-COMMERCE, BY REGION, 2021–2026 (USD MILLION)

11.11 OTHERS

TABLE 103 AGV MARKET FOR OTHERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 AGV MARKET FOR OTHERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 AGV MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 AGV MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 141)

12.1 INTRODUCTION

FIGURE 43 CHINA AND MEXICO TO GROW AT HIGHEST CAGR IN AGV MARKET FROM 2021 T0 2026

TABLE 107 AGV MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 AGV MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 44 SNAPSHOT: AGV MARKET IN NORTH AMERICA

TABLE 109 AGV MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 110 AGV MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 AGV MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 AGV MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 AGV MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 114 AGV MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 US to account for largest size of AGV market in North America

12.2.2 CANADA

12.2.2.1 Automotive industry to make maximum contribution to AGV market growth in Canada

12.2.3 MEXICO

12.2.3.1 Well-established manufacturing sector to underpin AGV market growth in Mexico

12.3 EUROPE

FIGURE 45 SNAPSHOT: AUTOMATED GUIDED VEHICLE MARKET IN EUROPE

TABLE 115 AGV MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 116 AGV MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 117 AGV MARKET IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 118 AGV MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 AGV MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 120 AGV MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Presence of AGV manufacturing companies to support AGV market growth in Germany

12.3.2 UK

12.3.2.1 Demand from automotive sector to aid AGV market growth in UK

12.3.3 FRANCE

12.3.3.1 E-commerce industry to fuel AGV market growth in France

12.3.4 REST OF EUROPE

12.4 APAC

FIGURE 46 SNAPSHOT: AUTOMATED GUIDED VEHICLE MARKET IN ASIA PACIFIC

TABLE 121 AGV MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 AGV MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 123 AGV MARKET IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 124 AGV MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 125 AGV MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 126 AGV MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Foreign investments to provide strong ground for growth of AGV market in China

12.4.2 JAPAN

12.4.2.1 Escalating labor costs and broad industrial base support AGV market growth in Japan

12.4.3 AUSTRALIA

12.4.3.1 Manufacturing and mining industries to drive AGV market growth in Australia

12.4.4 SOUTH KOREA

12.4.4.1 Global AGV companies expanding to South Korea is driving AGV market ahead

12.4.5 INDIA

12.4.5.1 Manufacturing industries are contributing to AGV market growth in India

12.4.6 MALAYSIA

12.4.6.1 Electronics industry favoring AGV market growth in Malaysia

12.4.7 TAIWAN

12.4.7.1 Semiconductors industry substantiates growth of AGV market in Taiwan

12.4.8 INDONESIA

12.4.8.1 Rapid industrial development in Indonesia is supporting AGV market growth

12.4.9 REST OF APAC

12.5 ROW

TABLE 127 AGV MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 128 AGV MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 129 AGV MARKET IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 130 AGV MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 131 AGV MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 132 AGV MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 South America to dominate to AGV market in RoW during forecast period

12.5.2 AFRICA

12.5.2.1 Rising adoption of warehouse automation solutions in various industries to increase AGV adoption in Africa

12.5.3 MIDDLE EAST

12.5.3.1 Middle East region has limited growth opportunities for AGV market

13 COMPETITIVE LANDSCAPE (Page No. - 168)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/ RIGHT-TO-WIN

TABLE 133 OVERVIEW OF STRATEGIES ADOPTED BY AGV VENDORS

13.3 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 47 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN AGV MARKET

13.4 MARKET SHARE ANALYSIS (2020)

TABLE 134 AGV MARKET: MARKET SHARE ANALYSIS (2020)

13.5 COMPANY EVALUATION QUADRANT, 2020

13.5.1 STAR

13.5.2 PERVASIVE

13.5.3 EMERGING LEADER

13.5.4 PARTICIPANT

FIGURE 48 AGV MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

13.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE

13.6.2 RESPONSIVE

13.6.3 DYNAMIC

13.6.4 STARTING BLOCK

FIGURE 49 AGV MARKET (GLOBAL) SME EVALUATION QUADRANT, 2020

13.7 AGV MARKET: COMPANY FOOTPRINT

TABLE 135 COMPANY FOOTPRINT

TABLE 136 COMPANY INDUSTRY FOOTPRINT

TABLE 137 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 138 COMPANY REGION FOOTPRINT

13.8 COMPETITIVE SCENARIO

TABLE 139 AGV MARKET: PRODUCT LAUNCHES, APRIL 2020−AUGUST 2021

TABLE 140 AGV MARKET: DEALS, SEPTEMBER 2020−SEPTEMBER 2021

TABLE 141 AGV MARKET: OTHERS, MARCH 2019−JULY 2021

14 COMPANY PROFILES (Page No. - 182)

14.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

14.1.1 DAIFUKU

TABLE 142 DAIFUKU: BUSINESS OVERVIEW

FIGURE 50 DAIFUKU: COMPANY SNAPSHOT

TABLE 143 DAIFUKU: PRODUCT OFFERINGS

TABLE 144 DAIFUKU: DEALS

TABLE 145 DAIFUKU: OTHERS

14.1.2 JBT

TABLE 146 JBT: BUSINESS OVERVIEW

FIGURE 51 JBT: COMPANY SNAPSHOT

TABLE 147 JBT: PRODUCT OFFERINGS

TABLE 148 JBT: DEALS

14.1.3 KION

TABLE 149 KION: BUSINESS OVERVIEW

FIGURE 52 KION: COMPANY SNAPSHOT

TABLE 150 KION: PRODUCT OFFERINGS

TABLE 151 KION: OTHERS

14.1.4 TOYOTA INDUSTRIES

TABLE 152 TOYOTA INDUSTRIES: BUSINESS OVERVIEW

FIGURE 53 TOYOTA INDUSTRIES: COMPANY SNAPSHOT

TABLE 153 TOYOTA INDUSTRIES: PRODUCT OFFERINGS

TABLE 154 TOYOTA INDUSTRIES: DEALS

TABLE 155 TOYOTA INDUSTRIES: OTHERS

14.1.5 KUKA

TABLE 156 KUKA: BUSINESS OVERVIEW

FIGURE 54 KUKA: COMPANY SNAPSHOT

TABLE 157 KUKA: PRODUCT OFFERINGS

TABLE 158 KUKA: DEALS

TABLE 159 KUKA: OTHERS

14.1.6 HYSTER-YALE MATERIALS HANDLING

TABLE 160 HYSTER-YALE: BUSINESS OVERVIEW

FIGURE 55 HYSTER-YALE: COMPANY SNAPSHOT

TABLE 161 HYSTER-YALE: PRODUCT OFFERINGS

TABLE 162 HYSTER-YALE: PRODUCT LAUNCHES

14.1.7 OCEANEERING INTERNATIONAL

TABLE 163 OCEANEERING INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 56 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

TABLE 164 OCEANEERING INTERNATIONAL: PRODUCT OFFERINGS

14.1.8 EK ROBOTICS

TABLE 165 EK ROBOTICS: BUSINESS OVERVIEW

TABLE 166 EK ROBOTICS: PRODUCT OFFERINGS

TABLE 167 EK ROBOTICS: PRODUCT LAUNCHES

14.1.9 SSI SCHAEFER

TABLE 168 SSI SCHAEFER: BUSINESS OVERVIEW

TABLE 169 SSI SCHAEFER: PRODUCT OFFERINGS

TABLE 170 SSI SCHAEFER: OTHERS

14.1.10 SCOTT TECHNOLOGY

TABLE 171 SCOTT TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 57 SCOTT TECHNOLOGY: COMPANY SNAPSHOT

TABLE 172 SCOTT TECHNOLOGY: PRODUCT OFFERINGS

TABLE 173 SCOTT TECHNOLOGY: DEALS

14.2 OTHER COMPANIES

14.2.1 AGV INTERNATIONAL

TABLE 174 AGV INTERNATIONAL: COMPANY OVERVIEW

14.2.2 AMERICA IN MOTION

TABLE 175 AMERICA IN MOTION: COMPANY OVERVIEW

14.2.3 GRENZEBACH

TABLE 176 GRENZEBACH: COMPANY OVERVIEW

14.2.4 MEIDEN AMERICA

TABLE 177 MEIDEN AMERICA: COMPANY OVERVIEW

14.2.5 DANBACH ROBOT JIANGXI

TABLE 178 DANBACH ROBOT JIANGXI: COMPANY OVERVIEW

14.2.6 ECA GROUP

TABLE 179 ECA GROUP: COMPANY OVERVIEW

14.2.7 IKV ROBOT

TABLE 180 IKV ROBOT: COMPANY OVERVIEW

14.2.8 ASSECO CEIT

TABLE 181 ASSECO CEIT: COMPANY OVERVIEW

14.2.9 CASUN

TABLE 182 CASUN: COMPANY OVERVIEW

14.2.10 ECKHART

TABLE 183 ECKHART: COMPANY OVERVIEW

14.2.11 ELETTRIC80

TABLE 184 ELETTRIC80: COMPANY OVERVIEW

14.2.12 IDC CORPORATION

TABLE 185 IDC CORPORATION: COMPANY OVERVIEW

14.2.13 SIMPLEX ROBOTICS

TABLE 186 SIMPLEX ROBOTICS: COMPANY OVERVIEW

14.2.14 SYSTEM LOGISTICS

TABLE 187 SYSTEM LOGISTICS: COMPANY OVERVIEW

14.2.15 ROCLA

TABLE 188 ROCLA: COMPANY OVERVIEW

14.2.16 UNCEASE AUTOMATION

TABLE 189 UNCEASE AUTOMATION: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKET (Page No. - 220)

15.1 RFID MARKET

15.2 INTRODUCTION

FIGURE 58 RFID MARKET, BY PRODUCT

FIGURE 59 TAGS SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE IN RFID MARKET DURING FORECAST PERIOD

TABLE 190 RFID MARKET, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 191 RFID MARKET, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 192 RFID MARKET, BY PRODUCT, 2017–2020 (MILLION UNITS)

TABLE 193 RFID MARKET, BY PRODUCT, 2021–2026 (MILLION UNITS)

15.3 TAGS

15.3.1 TAGS ACCOUNTED FOR LARGEST SHARE OF RFID MARKET IN 2020

15.4 READERS

TABLE 194 RFID MARKET, BY READER TYPE, 2017–2020 (USD MILLION)

TABLE 195 RFID MARKET, BY READER TYPE, 2021–2026 (USD MILLION)

TABLE 196 RFID MARKET, BY READER TYPE, 2017–2020 (MILLION UNITS)

TABLE 197 RFID MARKET, BY READER TYPE, 2021–2026 (MILLION UNITS)

15.4.1 FIXED READERS

15.4.1.1 Ruggedness and cost-effectiveness of readers primarily drive fixed readers market

TABLE 198 FIXED RFID READER MARKET, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 199 FIXED RFID READER MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 200 FIXED RFID READER MARKET, BY FREQUENCY, 2017–2020 (THOUSAND UNITS)

TABLE 201 FIXED RFID READER MARKET, BY FREQUENCY, 2021–2026 (THOUSAND UNITS)

15.4.2 HANDHELD READERS

15.4.2.1 Handheld readers are adopted mainly due to their mobility

TABLE 202 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 203 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 204 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 205 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 206 HANDHELD RFID READER MARKET, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 207 HANDHELD RFID READER MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 208 HANDHELD RFID READER MARKET, BY FREQUENCY, 2017–2020 (THOUSAND UNITS)

TABLE 209 HANDHELD RFID READER MARKET, BY FREQUENCY, 2021–2026 (THOUSAND UNITS)

TABLE 210 HANDHELD RFID READER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 211 HANDHELD RFID READER MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 212 HANDHELD RFID READER MARKET, BY REGION, 2017–2020 (THOUSAND UNITS)

TABLE 213 HANDHELD RFID READER MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

15.5 SOFTWARE AND SERVICES

15.5.1 RECURRING REQUIREMENT OF SERVICES AND GROWING ADOPTION OF CLOUD-BASED MODELS FOR DATA ANALYSIS WOULD DRIVE SOFTWARE AND SERVICES MARKET

TABLE 214 RFID SOFTWARE & SERVICES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 215 RFID SOFTWARE & SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 231)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The study involves four major activities for estimating the size of the automated guided vehicle (AGV) market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the AGV market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as Material Handling Industry of America, Material Handling Equipment Distributors Association, Materials Handling Engineers Association, European Materials Handling Federation, Robotic Industries Association, and International Federation of Robotics have been used to identify and collect information for an extensive technical and commercial study of the AGV market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the AGV market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the AGV market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, and forecast the global automated guided vehicle (AGV) market, in terms of value, by type, navigation technology, region, and industry.

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market, namely, drivers, restraints, opportunities, and industry-specific challenges

- To study and analyze the impact of COVID-19 on the AGV market during the forecast period

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the AGV ecosystem, along with market trends and use cases

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global AGV market

- To strategically profile key players and comprehensively analyze their core competencies2 along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product launches, acquisitions, partnerships, and expansions in the global AGV market

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Guided Vehicle Market