Automated Storage and Retrieval System (ASRS) Market by Function (Storage, Distribution, Assembly), Type (Unit Load, Mini Load, Vertical Lift Module, Carousel, Mid Load), Micro Fulfilment Center, Dark Stores, Industry and Region - Global Forecast to 2027

ASRS Market

ASRS Market and Top Companies

- Daifuku- Daifuku is involved in consulting, designing, manufacturing, planning and engineering, installation and operation, and after-sales services for logistics systems and material handling equipment. The company’s core businesses comprise factory & distribution automation (FA&DA), e-Factory automation (eFA), automotive factory automation (AFA), airport technologies (ATec), auto washing technologies (AWT), and electronics. The company mainly provides automated storage and retrieval system (ASRS) under the FA&DA business segment.

- Murata Machinery- Murata Machinery is a leading manufacturer of machinery, ranging from industrial machines to office automation products. The company develops, manufactures, and sells products in logistics, automation, clean FA, machine tools, sheet metal machinery, textile machinery, communication equipment, control & sensing, and advanced technology categories. The company provides ASRS in its logistics & automation division. Besides ASRS, the division provides transportation systems, picking systems, sorting systems, and data management systems.

- SSI Schaefer- SSI Schaefer has been recognized as among the world's leading system integrators for all types of automated warehousing and distribution centers. It is a leading provider of intralogistics solutions and products. The company offers product categories such as storage, conveying & transport, picking, handling, and interlinked workstations. SSI Schaefer provides its ASRS products in the storage category. The company has its manufacturing facilities in the US, Mexico, Germany, Austria, Czech Republic, Malaysia, and China, and distribution centers across the world.

- TGW Logistics- TGW Logistics is a supplier of material handling equipment and automated storage and retrieval systems for warehousing, production, picking, and distribution. TGW Logistics is among the leading providers of highly dynamic, automated, and turnkey logistics solutions. The company engineers, produces, and installs material handling solutions in different sizes for various purposes, ranging from conveyor installation to complex distributions centers. The company serves industries such as apparel, grocery, general merchandise, e-commerce & omnichannel, spare parts & components, and 3PL.

- Kardex- The company offers intra-logistic solutions, automated storage solutions, and material handling systems. The company operates through its two independently managed divisions: Kardex Remstar and Kardex Mlog. Kardex Remstar develops and produces shuttles and dynamic storage and retrieval systems; Kardex Mlog provides integrated materials handling systems and automated high bay warehouses. Due to the outbreak of the COVID-19 pandemic, Kardex has made some of its patents free to use in the US and Europe to facilitate rapid restart of production activities. This will help the company keep its financial losses to the minimum.

ASRS Market and Top Industries

Automotive- The automotive industry comprises automotive manufacturers, component providers, and suppliers. These players are striving to bring innovation in the industry with an optimum production plan for manufacturing high-quality automobiles and spare parts. Automotive manufacturing involves manufacturing and assembling activities, which includes a wide variety of spare parts. Suppliers of automotive parts have driven the automotive storage industry to develop innovative new product technologies and enable real-time information to offer excellent order fulfillment in terms of efficient product delivery and quality.

Food & beverages- The food & beverages industry is transforming at a rapid rate owing to changing customer preferences, increasing need for food safety, growing trend of processed food and packaged eatables, and rising number of online food-retailing companies. The industry is constantly under the pressure of meeting the quantitative and qualitative demand of its clients in minimum time. To meet the ever-increasing demand of growing population across the world, food & beverages companies are increasingly adopting automation in food processing, packaging, and storing. Technological advances in cold chain storages and transport, and growing acceptance of frozen foods among consumers are a few of the many factors influencing the growth of the ASRS market. To meet these demands, ASRS is extensively used in food & beverages.

Metals & Heavy Machinery- Metals and heavy machinery implement ASRS in warehouses to facilitate intralogistics movement of heavy goods, which is difficult to be done manually. It is also used for storing a variety of small components that are required on a day-to-day basis to be implemented in larger machines. ASRS is used in production facilities of heavy machinery for assembly and storing function. The demands of this industry are mainly met by unit load ASRS and mini load ASRS.

ASRS Market and Top Types

- Unit Load– Unit load ASRS has a wide range of applications in consumer goods, automotive, publishing, distribution, electronic, food & beverages, pharmaceuticals & medical supplies, retail & apparel, and others. A unit load ASRS offers several benefits; it reduces work-in-progress (WIP) inventory, provides real-time inventory control, improves product quality and productivity, enhances workforce productivity, improves order accuracy and customer services, and ensures high throughput, density storage, and reliability, along with damage-free operations.

- Mini load- A mini load ASRS is generally smaller than a unit load ASRS in terms of material handling capacity. This type of ASRS can handle small loads and can be implemented wherever space is a constraint. Mini load ASRS provides a fast and efficient solution for containers, trays, cases, and bins. Typically, a mini load ASRS has a vertical height of 10–40 feet and is used for storing books and documents, apart from being used in warehouse applications such as kitting, buffering, staging, and sequencing of stock. Mini load ASRSs are easy to integrate into existing automated storage systems.

- VLM- The vertical lift module (VLM) is an enclosed ASRS system that consists of two columns of trays and an inserter/extractor in the center. Based on the input given at the control terminal, the inserter/extractor locates the bin in a particular column of trays and then vertically lifts to the position pulls the entire column, and vertically lowers down the tray to the control terminal. The same procedure is used in reverse order for inserting an item in the VLM. The operator picks or places items from the control terminal. The VLM is designed to deliver stored items to the operator, thereby eliminating walk and search time.

Updated on : April 24, 2023

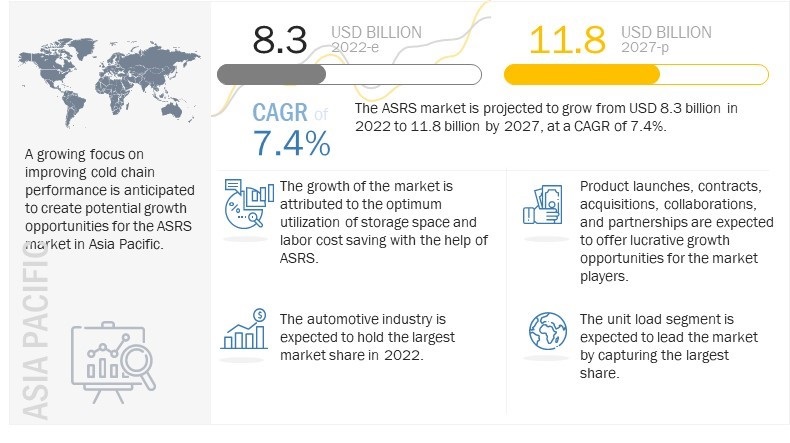

[232 Pages Report] The global ASRS market size is expected to grow from USD 8.3 billion in 2022 to USD 11.8 billion by 2027, at a CAGR of 7.4% from 2022 to 2027. Rising requirements for innovative ASRS solutions due to an increasing need for optimum space utilization, the growing e-commerce industry on account of rising digitalization, and surging demand for ASRS in automotive, food & beverage, and healthcare industries are some of the major factors surging the growth of ASRS Industry.

Automated Storage and Retrieval System (ASRS) Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

The growth of the ASRS market will witness a significant upsurge due to its various applications in several industries, such as e-commerce, automotive, healthcare, aviation, food & beverage, and so on. Rising costs for storage, optimum space utilization, reducing labor costs as well as growing demand for various warehousing technologies such as microfulfilment centers, dark stores, and so on undertaken by major players are expected to drive the market for ASRS. Hence various OEMs are adopting different strategies, including deals such as acquisitions, partnerships, collaborations, sales contracts, and developments such as product launches as well as product enhancements. All these factors are propelling the growth of the ASRS market.

Market Dynamics

Driver: Greater focus on inventory management and control

The use of ASRS allows an operator to have better control over the inventory. While in the case of manual inventory control, an operator must check the inventory from time to time to obtain relevant information. ASRS solutions house inventory within a fully enclosed system, ensuring safe, secure, and controlled inventory management. The system permits access to stored inventory only to authorized personnel. This allows missing or misplaced goods to be tracked by a specific individual. This enhanced level of accountability and security eliminates inventory shrinking. Thus, the use of ASRS helps keep track of available inventory in real-time, the expiry dates of the stored products, and the requirement for replacing or filling the replenished products. It reduces the labor cost associated with the constant checking of inventory and the costs associated with any errors that may occur

Restraint: Inadequate technical expertise to manage system operations

ASRS is a huge and complex system, including storage racks, automated systems, and software. The system must be implemented with greater accuracy right from the installation phase. Slight miscalculation or inaccuracy may lead to a halt in the entire production process. An operator should have technical knowledge of the ASRS system to maintain accuracy. Besides installation, the ASRS system needs a technical expert to address any errors. Technical expertise adds cost to the company. Further, with constantly updating technology and growth in automation, the ASRS system requires software upgrades. This requires workforce training periodically to handle the updated system efficiently.

Opportunity: Potential growth prospectus in the healthcare industry

The growing healthcare industry involves hospital and medical intralogistics work that should be done within stringent guidelines. The major requirements include handling everyday supplies hygienically and adhering to strict official regulations. This shows the need for efficient ASRS technologies that save time and costs by providing a fast and reliable supply of goods adhering to hospital guidelines. Hospital intralogistics include items such as perishable medication, highly sensitive surgical instruments, or linens and goods that get picked quickly and accurately using automated identification devices. These include RFID chips, pick-to-light tools, and other automated systems. Certain ASRS also provide features that allow the installation of additional temperature and climate control features in healthcare facility centers. Hence, various companies are focusing on providing ASRS to the healthcare industry.

Challenge: Development of flexible and scalable ASRS solutions owing to constant technological advances

With the ever-changing global market scenarios, industries need to adapt to the changes in their operations and processes. Industries such as automotive, electronics, food & beverage, and e-commerce are witnessing major market developments; hence, they demand flexible and scalable ASRS solutions to fulfill their current and future business needs. These needs are related to storage capacity, height limits, control technologies, ease of maintenance, energy efficiency, and ease of integration with existing infrastructure. However, providing a flexible and scalable solution is a challenge for suppliers due to constantly changing technologies in the material handling ecosystem.

Unit load segment is expected to have the largest size of the ASRS market during the forecast period.

Unit load ASRS accounted for the largest market share during the forecast period. A unit load ASRS is a storage-retrieval machine (SRM) or a crane designed to handle large machinery or equipment (i.e., pallets, gaylords, drums, racks, etc.) that typically weigh over 400 lbs. These systems store large articles and provide real-time inventory information, making them preferable in several industries. Moreover, a unit-load ASRS is a high-density, heavy-payload ASRS. This ASRS type provides efficient, safe, accurate, and stable handling of full pallets. It is a particularly helpful option when pallet-level storage is limited and quick retrieval is critical.

The market for the automotive industry to account for the largest market share in 2021

The automotive segment accounted for the largest share of the ASRS market in 2021. The rising demand for electric and autonomous vehicles has prompted automakers to ramp up the production of automobiles and spare parts. Therefore, automotive suppliers must effectively handle many spare parts during manufacturing. Also, these suppliers must improve the storage capacity within the available floor space. Thus, ASRS is used increasingly to fulfill the requirements related to material handling capacity.

Automated Storage and Retrieval System (ASRS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

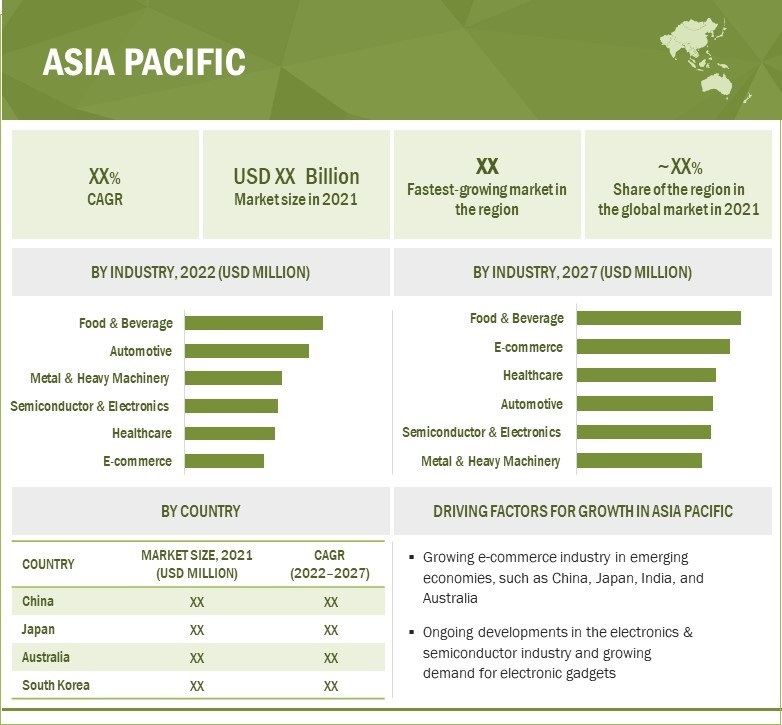

The ASRS market in Asia Pacific to grow at the highest CAGR during the forecast period.

The rapid growth of the automotive, food & beverage, and healthcare industries in emerging economies of China, Japan, Australia, and South Korea is expected to boost the ASRS market in the region. Moreover, governments in the Asia Pacific countries are increasingly emphasizing the safety and security of production floors, which can be achieved by implementing ASRS. The ASRS market is witnessing rapid growth in countries such as China and Japan owing to the increasing investments by manufacturers and suppliers in installing ASRS at warehouses and distribution centers for better space utilization, greater inventory control, and safer operations.

Key Market Players

The ASRS manufactures have implemented organic and inorganic growth strategies in order to remain competitive in the market. These strategies include product launches, product developments, partnerships, and acquisitions. These strategies also assist companies in strengthening product offerings in the market. The major players in the market are Daifuku (Japan), Murata Machinery (Japan), SSI Schaefer (Germany), TGW Logistics (Austria), and Kardex (Switzerland), among others.

The study includes an in-depth competitive analysis of these key players in the ASRS market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

Type, Industry, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies covered |

Daifuku (Japan), Murata Machinery (Japan), SSI Schaefer (Germany), TGW Logistics (Austria), and Kardex (Switzerland), among others, are the top five players in the ASRS market globally. A total of 25 players are covered. |

Automated Storage and Retrieval System (ASRS) Market Highlights

In this report, the overall ASRS market has been segmented based on type, industry, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Industry |

|

|

By Region |

|

See Also:

- Japan Automated Storage and Retrieval System (ASRS) Market to Grow at a CAGR 8.2% from 2022 to 2027

- Germany Automated Storage and Retrieval System (ASRS) Market to Grow at a CAGR 6.4% from 2022 to 2027

Recent Developments

- In October 2022, Cutter & Buck, a leading apparel manufacturer and distributor, selected AutoStore, an automated cube storage technology solution, for the speed and density of the solution empowered by Kardex. The Kardex Control Center software (WCS) will drive the AutoStore goods to a personal fulfillment solution.

- In May 2022, Fashion omnichannel retailer Lojas Renner partnered with KNAPP to automate its new distribution center in Cabreúva, São Paulo. It provides various ASRS solutions, such as OSR Shuttle Evo and overhead conveyor system, along with other automation solutions, to the fashion retailer to automate its distribution center and boost the company’s logistics efficiency, digital transformation, and multichannel integration services.

- In April 2022, TGW Logistics developed a powerful, energy-efficient sorter solution suitable for various uses and industries. The Natrix shoe sorter represents the central building block and offers three capacity levels; the modular design makes it possible to tailor solutions to any client's needs

Frequently Asked Questions (FAQ):

What is the ASRS market size expected to be in 2022?

The ASRS market is expected to be valued at USD 8.3 billion in 2022.

What is the total CAGR expected to be recorded for the ASRS market during 2022-2027?

The global ASRS market is expected to record a CAGR of 7.4% from 2022 to 2027.

What are the current trends and technologies involved in ASRS market?

Automation, digitalization, IoT, AI as well as warehousing technologies such as cold chain storages, microfulfillment centers, darkstores are driving the ASRS market.

Which are the top players in the ASRS market?

The major vendors operating in the ASRS market include Daifuku (Japan), Murata Machinery (Japan), SSI Schaefer (Germany), TGW Logistics (Austria), and Kardex (Switzerland).

Which major countries profiled in the report have been considered in the European region?

The report includes an analysis of France, the UK, and Germany.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

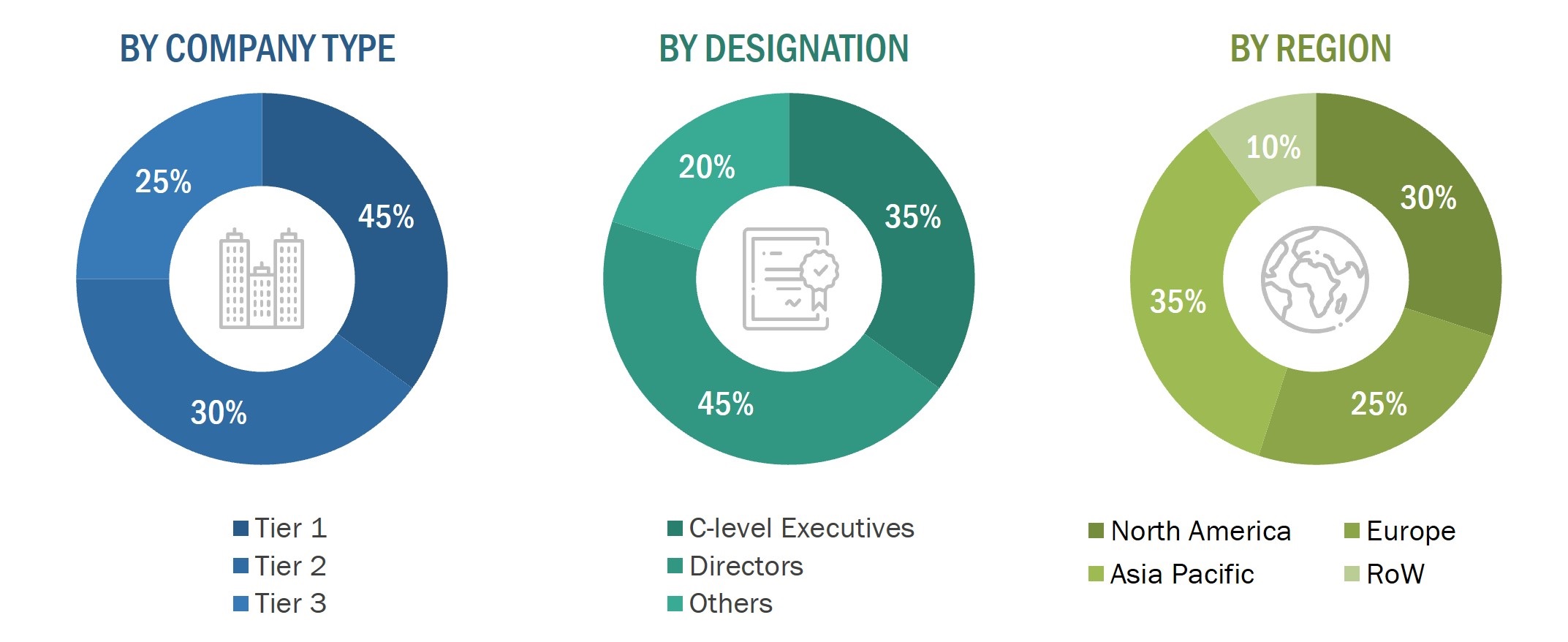

The study involves four major activities for estimating the size of the ASRS market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the ASRS market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the ASRS market through secondary research. Several primary interviews have been conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the ASRS market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the ASRS market size based on type and industry in terms of value

- To describe and forecast the market size of various segments for four regions—North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the ASRS market value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze the strategic approaches adopted by players in the ASRS market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Storage and Retrieval System (ASRS) Market