Automotive Actuators Market by Vehicle, Application, On-Highway Vehicle, Actuation, Motion, Product (Brake, Cooling Valve, Power Window, Throttle, EGR, Power Seat, Grille Shutter, HVAC, Headlamp, Piezoelectric), and Region - Global Forecast to 2027

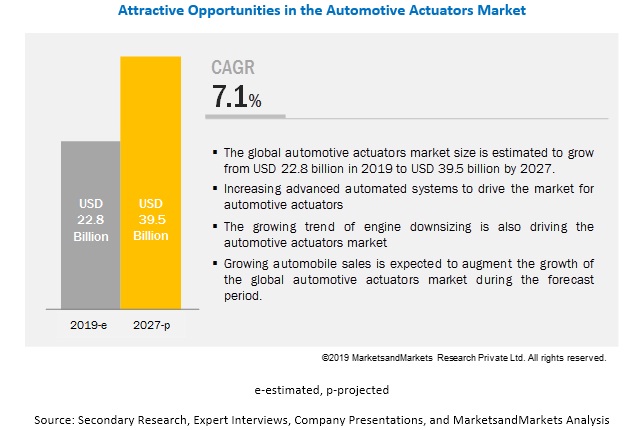

The Global Automotive Actuators Market size is projected to grow at a CAGR of 7.1% during the forecast period, to reach USD 39.5 billion by 2027 from an estimated USD 22.8 billion in 2019. Rising automation and digitalization in the automotive industry are increasing the demand for vehicles with advanced features and connectivity.

The modern passenger vehicle is equipped with more than 120 motors to control various applications such as headlight positioning, seat adjustment, grill shutter, HVAC systems, and coolant and refrigerant valves, among others. Actuators play a key role in activating these applications as they convert an electric signal into the required linear and rotary motion to produce the required physical movement.

With advancements in technology, autonomous vehicles are expected to install various actuators to enhance safety and comfort. The automotive actuators market is growing continuously due to the constant growth in production as well as sales of automobiles (passenger cars, LCVs, HCVs, and off-highway vehicles) across the globe. Sensors, software programs, controller hardware, and actuators are considered to be the backbone of the present and future automotive systems.

Off-highway vehicle segment is estimated to be the fastest during the forecast period

The off-highway vehicle segment is anticipated to be the fastest in the automotive actuators market. Increasing government investments in infrastructural development, thriving agricultural businesses in developing nations, and the emergence of leased/rent-based equipment are driving the off-highway vehicle market. The traditional role of actuators in off-highway vehicles has involved the application of force to perform tasks. As vehicles become complex, OEMs are accumulating features that naturally involve the use of electronic controls to deliver more complex, optimized, and safer motion.

The electric segment is expected to grow at the highest CAGR in the global automotive actuators market

Electric actuators have replaced hydraulic and pneumatic actuators due to lower noise emission, compact and lightweight design, and flexible installation options. Comfort features have become a global requirement in the automotive industry, and OEMs are investing the best possible efforts in enhancing the driving experience by the installation of various actuators.

Electric actuators are widely used in comfort-feature actuators such as window lift drive, power tailgate drive, seat drive, and sunroof drive, among others. Electric actuators are more precise in actuation than hydraulic and pneumatic actuators. Leading automotive actuators manufacturers such as Robert Bosch GmbH, Continental, and Johnson Electric provide electric actuators.

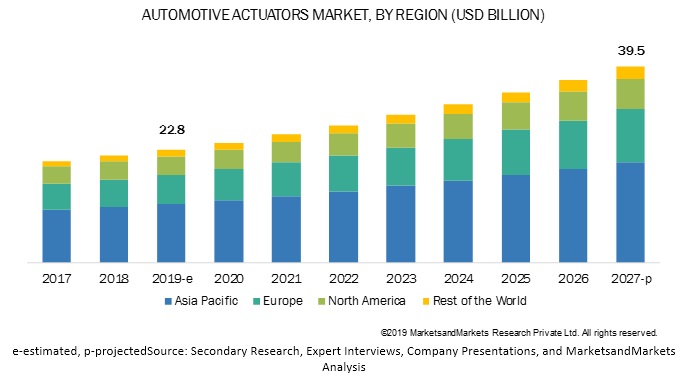

Asia Pacific is expected to be the largest automotive actuators market during the forecast period

Asia Pacific is expected to be the largest market, followed by Europe and North America. China is estimated to dominate the Asia Pacific automotive actuator market with the largest revenue share during the forecast period. China is the world’s largest vehicle manufacturer, which is expected to be a driving factor for the growth of this market in the country. Moreover, China has the potential to produce automotive components in large volumes at a lower cost, which provides it a competitive edge over other countries.

Key Market Players

The global automotive actuators market is dominated by major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation(Japan), and HELLA GmbH & Co. KGaA (Germany). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units) & Value (USD) |

|

Segments covered |

Product Type, Vehicle Type, Application, On-Highway, Actuation, and Motion |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World (RoW) |

|

Companies covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), and Denso Corporation (Japan) |

This research report categorizes the given market based on Product Type, Vehicle Type, Application, On-Highway, Actuation, and Motion and region

Based on product type:

- Brake Actuator

- Cooling Valve Actuator

- EGR Actuator

- Grille Shutter Actuator

- Headlamp Actuator

- Hood Lift Actuator

- HVAC Actuator

- Piezoelectric Actuator

- Power Seat Actuator

- Power Window

- Quick Attach

- Steering Column Adjustment Actuator

- Sunroof Actuator

- Tailgate Actuator

- Telescopic Actuator

- Throttle Actuator

- Turbo Actuator

Based on vehicle type:

- On-Highway

- Off-Highway

Based on On-highway vehicle:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Based on motion:

- Linear

- Rotatory

Based on application:

- Engine

- Body & Exterior

- Interior

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- United Kingdom

- Rest of Europe

-

Rest of the World (Rest of the World)

- Brazil

- Iran

- RoW

Critical Questions:

- Many companies and startups are operating in the automotive actuators space across the globe. Do you know who the front leaders are, and what strategies have been adopted by them?

- Fast paced developments in automotive actuators such as piezoelectric actuators and electric actuators by leading manufacturers will change the dynamics of automotive actuators. How will this transform the overall market?

- The industry is focusing on developing comfort actuators for the automotive actuators market. Which are the leading companies who are working on comfort actuators, and what organic and inorganic strategies have been adopted by them?

- The adoption of electric actuators over hydraulic and pneumatic actuators is expected to change the dynamics of automotive actuators. How will this transform the overall market?

- Analysis of competitors in this market and their impact on the overall automotive actuators market

Frequently Asked Questions (FAQ):

What is the market size of the global automotive actuators market?

Who are the top players in the global automotive actuators market?

Which is the fastest growing vehicle segment in the market and why?

Which is the largest market for automotive actuators and why?

What are the key drivers for this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Product Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.3.1 Years Considered for Study

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources for Automotive Actuators Market

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach: Automotive Actuators Market

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions & Associated Risks

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Automotive Actuators Market

4.2 Automotive Actuators Market Growth Rate, By Region

4.3 Automotive Actuators Market, By Vehicle Type

4.4 Automotive Actuators Market, By Actuation

4.5 Automotive Actuators Market, By Motion

4.6 Automotive Actuators Market, By Application

4.7 Automotive Actuators Market, By On-Highway Vehicle Type

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Fuel-Efficient Vehicles

5.2.1.2 Rise in Demand for Advanced Automation Systems

5.2.2 Restraints

5.2.2.1 Low Preference for Diesel Passenger Cars

5.2.3 Opportunities

5.2.3.1 Wide Array of Applications Employing the Use of Actuators

5.2.3.2 Stringent Government Regulations for Fuel Efficient Vehicles in Developing Nations

5.2.3.3 Growth in Luxury Vehicle Sales

5.2.4 Challenges

5.2.4.1 Rising Labor Expense in Low-Cost Manufacturing Countries

5.2.4.2 Weight and Cost Reduction

5.3 Automotive Actuators Market Analysis, Scenarios (2018–2027)

5.3.1 Automotive Actuators Market Analysis, Most Likely Scenario

5.3.2 Automotive Actuators Market Analysis, Optimistic Scenario

5.3.3 Automotive Actuators Market Analysis, Pessimistic Scenario

5.4 Revenue Shift Driving the Automotive Actuators Industry Growth

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Smart Actuators

6.3 MEMS

7 Automotive Actuators Market, By Product Type (Page No. - 52)

7.1 Introduction

7.2 Operational Data

7.2.1 Assumptions

7.2.2 Research Methodology

7.3 Brake Actuator

7.3.1 Increasing Adoption of Electronic Brake System to Boost Demand

7.4 Cooling Valve Actuator

7.4.1 Increasing Demand for Fuel Efficiency is Expected to Drive Demand

7.5 EGR Actuator

7.5.1 Stringent Emission Regulations to Drive Market Growth

7.6 Grill Shutter Actuator

7.6.1 Advancements in Technology to Drive Market Growth

7.7 Headlamp Actuator

7.7.1 Improvements in Lightening Systems to Drive Market Growth

7.8 Hood Lift Actuator

7.8.1 Ease of Maintenance and Repair to Drive Market Growth

7.9 Hvac Actuator

7.9.1 Advancements in Technology to Drive Market Growth

7.10 Power Seat Actuator

7.10.1 Increase in Demand for Luxury Vehicles to Drive Market Growth

7.11 Power Window Actuator

7.11.1 Increase in Demand for Comfort Features to Drive Market Growth

7.12 Quick Attach Actuator

7.12.1 Need for Ease of Operations to Drive Market Growth

7.13 Steering Column Adjustment Actuator

7.13.1 Growing Trend of Renting Luxury Cars to Drive Market Growth

7.14 Sunroof Actuator

7.14.1 Increase in Demand for Vehicle Comfort and Safety Features to Drive Market Growth

7.15 Tailgate Actuator

7.15.1 Increasing Demand for Premium Cars to Drive the Market

7.16 Throttle Actuator

7.16.1 Advancements in Electronics to Drive Market Growth

7.17 Turbo Actuator

7.17.1 Engine Downsizing Trend and Increased Demand for Low-Emission Vehicles to Drive Market Growth

7.18 Telescopic Nozzle Actuators

7.18.1 Government Mandates and Technological Advancements to Drive Market Growth

7.19 Piezoelectric Actuator

7.19.1 Low Maintenance Cost to Drive Market Growth

7.20 Key Industrial Insights

8 Automotive Actuators Market, By Application (Page No. - 75)

8.1 Introduction

8.2 Operational Data

8.2.1 Assumptions

8.2.2 Research Methodology

8.3 Engine Actuator

8.3.1 Stringent Emission Norms and Increased Demand for Fuel-Efficient Vehicles to Drive the Market

8.4 Body Control & Exterior Actuator

8.4.1 Ease of Operation to Drive the Market Growth

8.5 Interior Actuator

8.5.1 Increased Demand for Comfort Features to Drive the Market

8.6 Key Industrial Insights

9 Automotive Actuators Market, By Actuation (Page No. - 83)

9.1 Introduction

9.2 Operational Data

9.2.1 Assumptions

9.2.2 Research Methodology

9.3 Hydraulic Actuators

9.3.1 Advancements in Automated Driving System to Boost Demand

9.4 Pneumatic Actuators

9.4.1 Low Maintenance Cost to Drive the Market

9.5 Electric Actuators

9.5.1 Replacement of Hydraulic & Pneumatic With Electric Actuators to Drive the Market

9.6 Key Industrial Insights

10 Automotive Actuator Market, By Motion (Page No. - 89)

10.1 Introduction

10.2 Operational Data

10.2.1 Assumptions

10.2.2 Research Methodology

10.3 Linear Actuator

10.3.1 High Precision and Low Maintenance Cost Will Boost Demand

10.4 Rotary Actuator

10.4.1 High Torque Output and Convenient Installation to Boost Demand

10.5 Key Industrial Insights

11 Automotive Actuators Market, By Artificial Muscles (Page No. - 94)

11.1 Introduction

11.2 Shape Memory Alloy (SMA)

11.3 Smart Polymers

12 Automotive Actuator Market, By Vehicle Type (Page No. - 96)

12.1 Introduction

12.1.1 Assumptions

12.1.2 Research Methodology

12.2 On-Highway Vehicle

12.2.1 Advancements in Actuation Technology to Boost Demand

12.3 Off-Highway Vehicle

12.3.1 Increasing Use of Electrical Actuators in Off-Highway Vehicles Will Drive the Market

12.4 Key Industrial Insights

13 Automotive Actuator Market, By On-Highway Vehicle Type (Page No. - 102)

13.1 Introduction

13.2 Operational Data

13.2.1 Assumptions

13.2.2 Research Methodology

13.3 Passenger Car

13.3.1 Increasing Demand for Comfort Features Will Boost Demand

13.4 Light Commercial Vehicle

13.4.1 Increasing Suv Sales Will Boost the Market

13.5 Heavy Commercial Vehicle

13.5.1 Increasing Demand for Fuel Efficient Heavy Commercial Vehicles Will Drive the Market

13.6 Key Industrial Insights

14 Automotive Actuators Market, By Region (Page No. - 109)

14.1 Introduction

14.2 Asia Pacific

14.2.1 China

14.2.1.1 Rise in Vehicle Production to Drive the Chinese Market

14.2.2 India

14.2.2.1 Increasing Vehicle Sales to Drive the Indian Market

14.2.3 Japan

14.2.3.1 Significant Technology Adoption in Vehicles to Drive the Japanese Market

14.2.4 South Korea

14.2.4.1 Developments in the Field of Autonomous Vehicles to Drive the South Korean Market

14.2.5 Thailand

14.2.5.1 Thailand has the Largest Automotive Production Capacity Among Southeast Asian Countries

14.2.6 Rest of Asia Pacific

14.2.6.1 Increasing Sales of Premium Vehicles to Drive the Rest of Asia Pacific Market

14.3 Europe

14.3.1 Germany

14.3.1.1 Rising Adoption of Modern Technologies to Drive the German Market

14.3.2 France

14.3.2.1 Rising Safety Concerns Among Vehicle Occupants to Drive the French Market

14.3.3 UK

14.3.3.1 Heavy Investments By OEMs are Expected to Drive the UK Market

14.3.4 Spain

14.3.4.1 Stringent Emission Norms to Drive the Growth for the Spanish Market

14.3.5 Russia

14.3.5.1 Continuous Rise in Vehicle Sales to Drive the Russian Market

14.3.6 Italy

14.3.6.1 Increasing Number of Automotive Component Suppliers to Drive the Italian Market

14.3.7 Rest of Europe

14.3.7.1 Continuous Growth of Automotive Industry in Eastern Europe to Drive the Rest of European Market

14.4 North America

14.4.1 Canada

14.4.1.1 Stringent Focus on Environmental Regulation to Drive the Canadian Market

14.4.2 Mexico

14.4.2.1 Low Manufacturing Cost to Drive the Mexican Market

14.4.3 US

14.4.3.1 Presence of Major OEMs in the Country Will Boost Demand

14.5 Rest of the World (RoW)

14.5.1 Brazil

14.5.1.1 Increasing Demand for Passenger Vehicles to Drive the Brazilian Market

14.5.2 Iran

14.5.2.1 Major Applications in Engine Will Drive the Iranian Market

14.5.3 Rest of RoW

14.5.3.1 Large Production of Economy and Mid-Sized Vehicles to Drive the Rest of RoW Market

14.6 Market Leaders

15 Competitive Landscape (Page No. - 139)

15.1 Overview

15.2 Automotive Actuators Market: Market Ranking Analysis

15.3 Competitive Leadership Mapping

15.3.1 Terminology

15.3.2 Visionary Leaders

15.3.3 Innovators

15.3.4 Dynamic Differentiators

15.3.5 Emerging Companies

15.4 Strength of Product Portfolio

15.5 Business Strategy Excellence

15.6 Winners vs Tail-Enders

15.7 Competitive Scenario

15.7.1 New Product Developments/Launches

15.7.2 Expansions

15.7.3 Agreements/Partnerships/Joint Ventures/Contracts

16 Company Profiles (Page No. - 150)

(Business Overview, Recent Developments & SWOT Analysis)*

16.1 Robert Bosch GmbH

16.2 Hella GmbH & Co. KGaA

16.3 Continental AG

16.4 Johnson Electric

16.5 Denso Corporation

16.6 Mitsubishi Electric Corporation

16.7 Nidec Motors & Actuators

16.8 Borgwarner Inc.

16.9 Hitachi Automotive Systems, LTD.

16.10 Stoneridge Inc.

16.11 Mahle GmbH

16.12 EFI Automotive

*Details on Business Overview, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

16.13 Other Key Players

16.13.1 North America

16.13.1.1 Nook Industries, Inc.

16.13.1.2 Actus Manufacturing, Inc.

16.13.1.3 Thermotion

16.13.1.4 CTS Corporation

16.13.1.5 APC International, LTD.

16.13.2 Europe

16.13.2.1 Magneti Marelli

16.13.2.2 Hoerbiger Holding Ag

16.13.2.3 Cebi International Sa Group

16.13.2.4 Wabco Holding Inc.

16.13.3 Asia Pacific

16.13.3.1 Minebeamitsumi Group

17 Recommendations By Marketsandmarkets (Page No. - 178)

17.1 Asia Pacific Will Be the Major Market for Automotive Actuators

17.2 Comfort Actuators Can Be A Key Focus for Manufacturers

17.3 Conclusion

18 Appendix (Page No. - 179)

18.1 Key Insights of Industry Experts

18.2 Currency

18.3 Discussion Guide

18.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

18.5 Available Customizations

18.6 Related Reports

18.7 Author Details

List of Tables (154 Tables)

Table 1 Inclusions & Exclusions for Automotive Actuators Market

Table 2 Comparison of Automotive Lightweight Material vs Conventional Material Pricing

Table 3 Automotive Actuators Market Analysis (Most Likely), By Region, 2019–2027 (USD Million)

Table 4 Automotive Actuators Market Analysis (Optimistic), By Region, 2019–2027 (USD Million)

Table 5 Automotive Actuators Market Analysis (Pessimistic), By Region, 2019–2027 (USD Million)

Table 6 Automotive Actuators Market, By Product Type, 2017–2027 (Thousand Units)

Table 7 Automotive Actuators Market, By Product Type, 2017–2027 (USD Million)

Table 8 Brake Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 9 Brake Actuator: Market, By Region, 2017–2027 (USD Million)

Table 10 Cooling Valve Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 11 Cooling Valve Actuator: Market, By Region, 2017–2027 (USD Million)

Table 12 EGR Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 13 EGR Actuator: Market, By Region, 2017–2027 (USD Million)

Table 14 Grill Shutter Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 15 Grill Shutter Actuator: Market, By Region, 2017–2027 (USD Million)

Table 16 Headlamp Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 17 Headlamp Actuator: Market, By Region, 2017–2027 (USD Million)

Table 18 Hood Lift Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 19 Hood Lift Actuator: Market, By Region, 2017–2027 (USD Million)

Table 20 Hvac Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 21 Hvac Actuator: Market, By Region, 2017–2027 (USD Million)

Table 22 Power Seat Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 23 Power Seat Actuator: Market, By Region, 2017–2027 (USD Million)

Table 24 Power Window Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 25 Power Window Actuator: Market, By Region, 2017–2027 (USD Million)

Table 26 Quick Attach Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 27 Quick Attach Actuator: Market, By Region, 2017–2027 (USD Million)

Table 28 Steering Column Adjustment Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 29 Steering Column Adjustment Actuator: Market, By Region, 2017–2027 (USD Million)

Table 30 Sunroof Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 31 Sunroof Actuator: Market, By Region, 2017–2027 (USD Million)

Table 32 Tailgate Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 33 Tailgate Actuator: Market, By Region, 2017–2027 (USD Million)

Table 34 Throttle Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 35 Throttle Actuator: Market, By Region, 2017–2027 (USD Million)

Table 36 Turbo Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 37 Turbo Actuator: Market, By Region, 2017–2027 (USD Million)

Table 38 Telescopic Nozzle Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 39 Telescopic Nozzle Actuator: Market, By Region, 2017–2027 (USD Million)

Table 40 Piezoelectric Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 41 Piezoelectric Actuator: Market, By Region, 2017–2027 (USD Million)

Table 42 Automotive Actuators Market, By Application, 2017–2027 (Thousand Units)

Table 43 Automotive Actuators Market, By Application, 2017–2027 (USD Million)

Table 44 Engine Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 45 Engine Actuator: Market, By Region, 2017–2027 (USD Million)

Table 46 Body & Exterior Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 47 Body & Exterior Actuator: Market, By Region, 2017–2027 (USD Million)

Table 48 Interior Actuator: Market, By Region, 2017–2027 (Thousand Units)

Table 49 Interior Actuator: Market, By Region, 2017–2027 (USD Million)

Table 50 Automotive Actuators Market, By Actuation Type, 2017–2027 (USD Million)

Table 51 Hydraulic Actuators: Market, By Region, 2017–2027 (USD Million)

Table 52 Pneumatic Actuators: Market, By Region, 2017–2027 (USD Million)

Table 53 Electric Actuators: Market, By Region, 2017–2027 (USD Million)

Table 54 Automotive Actuators Market, By Motion Type, 2017–2027 (USD Million)

Table 55 Linear Actuator: Market, By Region, 2017–2027 (USD Million)

Table 56 Rotary Actuator: Market, By Region, 2017–2027 (USD Million)

Table 57 Automotive Actuators Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 58 Automotive Actuators Market, By Vehicle Type, 2017–2027 (USD Million)

Table 59 On-Highway Vehicle: Market, By Region, 2017–2027 (Thousand Units)

Table 60 On-Highway Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 61 Off-Highway Vehicle: Market, By Region, 2017–2027 (Thousand Units)

Table 62 Off-Highway Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 63 Automotive Actuators Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 64 Automotive Actuators Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 65 Passenger Car: Market, By Region, 2017–2027 (Thousand Units)

Table 66 Passenger Car: Market, By Region, 2017–2027 (USD Million)

Table 67 Light Commercial Vehicle: Market, By Region, 2017–2027 (Thousand Units)

Table 68 Light Commercial Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 69 Heavy Commercial Vehicle: Market, By Region, 2017–2027 (Thousand Units)

Table 70 Heavy Commercial Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 71 Automotive Actuators Market, By Region, 2017–2027 (Thousand Units)

Table 72 Automotive Actuators Market, By Region, 2017–2027 (USD Million)

Table 73 Asia Pacific: Automotive Actuator Market, By Country, 2017–2027 (Thousand Units)

Table 74 Asia Pacific: Automotive Actuator Market, By Country, 2017–2027 (USD Million)

Table 75 China: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 76 China: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 77 India: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 78 India: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 79 Japan: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 80 Japan: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 81 South Korea: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 82 South Korea: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 83 Thailand: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 84 Thailand: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 85 Rest of Asia Pacific: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 86 Rest of Asia Pacific: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 87 Europe: Automotive Actuators Market, By Country, 2017–2027 (Thousand Units)

Table 88 Europe: Automotive Actuators Market, By Country, 2017–2027 (USD Million)

Table 89 Germany: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 90 Germany: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 91 France: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 92 France: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 93 UK: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 94 UK: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 95 Spain: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 96 Spain: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 97 Russia: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 98 Russia: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 99 Italy: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 100 Italy: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 101 Rest of Europe: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 102 Rest of Europe: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 103 North America: Automotive Actuators Market, By Country, 2017–2027 (Thousand Units)

Table 104 North America: Automotive Actuators Market, By Country, 2017–2027 (USD Million)

Table 105 Canada: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 106 Canada: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 107 Mexico: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 108 Mexico: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 109 US: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 110 US: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 111 RoW: Automotive Actuators Market, By Country, 2017–2027 (Thousand Units)

Table 112 RoW: Automotive Actuators Market, By Country, 2017–2027 (USD Million)

Table 113 Brazil: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 114 Brazil: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 115 Iran: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 116 Iran: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 117 Rest of RoW: Market, By On-Highway Vehicle Type, 2017–2027 (Thousand Units)

Table 118 Rest of RoW: Market, By On-Highway Vehicle Type, 2017–2027 (USD Million)

Table 119 Recent Developments

Table 120 Winners vs Tail-Enders

Table 121 New Product Developments/Launches, 2017–2019

Table 122 Expansions, 2018–2019

Table 123 Agreements/Partnerships/Joint Ventures/Contracts, 2017–2019

Table 124 Robert Bosch GmbH : Products Offered

Table 125 Robert Bosch GmbH : New Product Developments

Table 126 Robert Bosch GmbH : Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 127 Robert Bosch GmbH Total Sales, 2015–2018 (USD Million)

Table 128 Profit (After-Tax), 2015–2018 (USD Million)

Table 129 Hella GmbH & Co. KGaA : Products Offered

Table 130 Hella GmbH & Co. KGaA : New Product Developments

Table 131 Hella GmbH & Co. KGaA : Expansions

Table 132 Hella GmbH & Co. KGaA : Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 133 Hella Total Sales, 2015–2018 (USD Million)

Table 134 Continental AG : Products Offered

Table 135 Continental AG : Expansions

Table 136 Continental Total Sales, 2015–2018 (USD Million)

Table 137 Johnson Electric : Products Offered

Table 138 Johnson Electric : Expansions

Table 139 Johnson Electric Total Sales, 2016–2019 (USD Million)

Table 140 Denso Corporation : Products Offered

Table 141 Denso Corporation : Expansions

Table 142 Mitsubishi Electric Corporation : Products Offered

Table 143 Mitsubishi Electric Corporation : New Product Developments

Table 144 Mitsubishi Electric Corporation : Expansions

Table 145 Nidec Motors & Actuators : Products Offered

Table 146 Borgwarner Inc : Products Offered

Table 147 Borgwarner Inc : New Product Developments

Table 148 Borgwarner Inc : Partnerships/Collaborations/Joint Ventures/ Supply Contracts/Agreements/Mergers & Acquisitions

Table 149 Hitachi : Products Offered

Table 150 Hitachi : Expansions

Table 151 Stoneridge Inc : Products Offered

Table 152 Mahle GmbH : Products Offered

Table 153 EFI Automotive : Products Offered

Table 154 Currency Exchange Rates (W.R.T USD)

List of Figures (51 Figures)

Figure 1 Market Segmentation: Automotive Actuators

Figure 2 Automotive Actuator Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Data Triangulation

Figure 6 Automotive Actuators Market Dynamics

Figure 7 Automotive Actuators Market, By Region, 2019–2027

Figure 8 Automotive Actuators Market, By Application, 2019 vs 2027

Figure 9 Increasing Demand for Fuel Efficient Vehicles is Expected to Boost the Automotive Actuators Market

Figure 10 Rest of the World (RoW) is Estimated to Be the Fastest Growing Market

Figure 11 On-Highway Vehicle is Expected to Be the Largest Segment

Figure 12 Electric Actuator is Expected to Be the Largest Segment

Figure 13 Linear Actuator is Expected to Be the Largest Segment

Figure 14 Engine is Expected to Be the Largest Segment

Figure 15 Passenger Car is Expected to Be the Largest Segment

Figure 16 Automotive Actuator: Market Dynamics

Figure 17 Market Survey on Fuel Efficiency

Figure 18 New Passenger Cars, By Fuel Type, in Europe

Figure 19 Major Actuators Installed in Passenger Cars

Figure 20 Government Regulation for Emission Standards

Figure 21 Global Luxury Vehicle Sales, 2017–2018

Figure 22 Mexico vs China: Average Labor Cost Per Hour

Figure 23 Porter’s 5 Force Analysis

Figure 24 Brake Actuators are Expected to Dominate this Market, 2019 vs 2027 (USD Million)

Figure 25 Engine Actuators are Expected to Dominate this Market, 2019 vs 2027 (USD Million)

Figure 26 Electric Actuators are Expected to Dominate this Market, 2019 vs 2027 (USD Million)

Figure 27 Rotary Actuators are Expected to Dominate this Market, 2019 vs 2027 (USD Million)

Figure 28 On-Highway Vehicles are Expected to Dominate the Automotive Actuators Market, 2019 vs 2027 (USD Million)

Figure 29 Passenger Cars are Expected to Dominate the Automotive Actuators Market, 2019 vs 2027 (USD Million)

Figure 30 Automotive Actuators Market: Asia Pacific is Estimated to Be the Largest Market (2019–2027)

Figure 31 Asia Pacific: Automotive Actuators Industry Snapshot

Figure 32 Europe: Automotive Actuators Industry Snapshot

Figure 33 North America: Automotive Actuators Industry Snapshot

Figure 34 Automotive Actuator Market Ranking Analysis, 2018

Figure 35 Automotive Actuators Market: Competitive Leadership Mapping (2018)

Figure 36 Companies Adopted New Product Development & Partnerships/ Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2017–2019

Figure 37 Robert Bosch GmbH: Company Snapshot

Figure 38 Robert Bosch: SWOT Analysis

Figure 39 Hella GmbH & Co. KGaA: Company Snapshot

Figure 40 Hella GmbH & Co. KGaA: SWOT Analysis

Figure 41 Continental AG: Company Snapshot

Figure 42 Continental AG: SWOT Analysis

Figure 43 Johnson Electric: Company Snapshot

Figure 44 Johnson Electric: SWOT Analysis

Figure 45 Denso Corporation: Company Snapshot

Figure 46 Denso Corporation: SWOT Analysis

Figure 47 Mitsubishi Electric Corporation: Company Snapshot

Figure 48 Borgwarner Inc.: Company Snapshot

Figure 49 Hitachi: Company Snapshot

Figure 50 Stoneridge Inc.: Company Snapshot

Figure 51 Mahle GmbH: Company Snapshot

The study involved four major activities in estimating the current size of the automotive actuators market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as company annual reports/presentations, press releases, industry association publications [such as publications as Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global automotive actuators market.

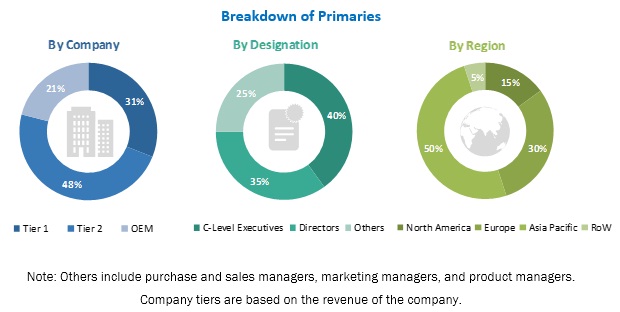

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Asia Pacific, Europe, North America and RoW (Rest of the World). Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global automotive actuators market size in terms of volume and value.

- To define, describe, and forecast the global automotive actuators market based on product type, vehicle type, on-highway vehicle type, application, actuation type, motion, and region

- To segment and forecast the market size by vehicle type (on-highway vehicle and off-highway vehicle)

- To segment and forecast the market size by product type (wastegate, GT, throttle, brake, EGR, grille, HVAC, headlamp leveling, piezoelectric, hood lift, quick attach, and comfort)

- To segment and forecast the market size by on-highway vehicle type (passenger car, light commercial vehicle, and heavy commercial vehicle)

- To segment and forecast the market size by application type (engine, body control & inerior, and exterior)

- To segment and forecast the market size by actuation (hydraulic, pneumatic, and electric)

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and RoW)

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

Automotive Actuators Market, by product type at country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Automotive Actuators Market