Automotive Filters Market by Filters Type (Air, Fuel, Oil, Cabin, Coolant, Brake Dust, Oil Separator, Transmission, Steering, Dryer Cartridge, EMI/EMC, Coolant, DPF, GPF, Urea), Vehicle Type, Aftermarket & Region - Global Forecast to 2027

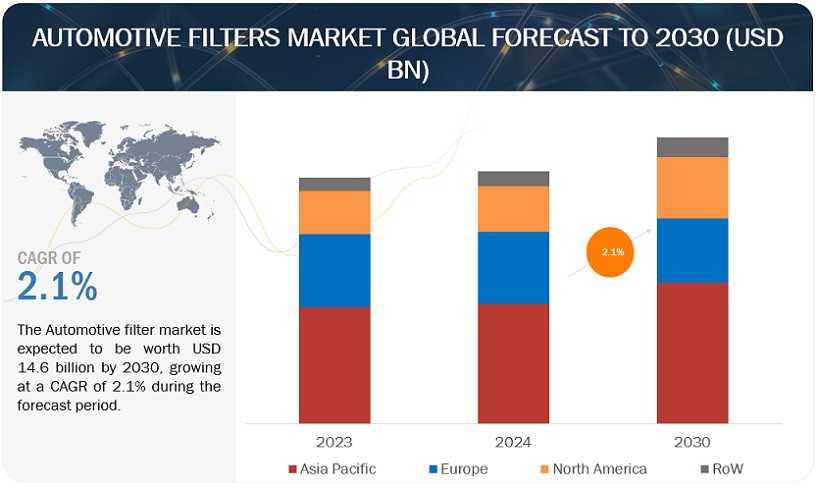

The global automotive filters market in terms of revenue was estimated to be worth $11.1 billion in 2022 and is poised to reach $13.1 billion by 2027, growing at a CAGR of 3.3% from 2022 to 2027.

The growth of the automotive filters market includes increasing stringency of vehicle emission & fuel economy regulations and the development of advanced filtration media, such as synthetic media for air filters and electrostatic material for cabin air filters. Further, the demand for the heavy-duty engine is growing in construction and infrastructure projects; there is a significant growth opportunity for the filters in the heavy trucks segment.

The electric & hybrid vehicle filters market is projected to grow from USD 0.5 billion to USD 1.7 billion by 2027, at a CAGR of 25%. Electric & hybrid vehicle filters market growth can be attributed to the key factors such as rising adoption of battery electric vehicles, and plug-in electric vehicle. According to Marklines & MnM analysis, the sale of BEVs and PHEVs increased by 122.8% and 105.0%, respectively, in 2020 compared to 2019. Technological advancements in filtration media is expected to drive the demand of filters in electric & hybrid vehicle filters market. Thus, rising sales of electric & hybrid vehicles will drive the demand of EMI/EMC, dryer cartridges for batteries, and cooling air particle filters.

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Filters Market Dynamics

Driver: Increase in stringency in emission regulations and fuel economy norms

Regulatory and government bodies around the world have implemented stringent emission norms for vehicles that emit harmful gases such as hydrocarbons (HC), nitrogen oxide (NOx), carbon dioxide (Co2), and others. For instance, in December 2021, US environmental protection agency (EPA) implemented new emission regulations for passenger cars and light trucks for the model years 2023-2026. Similarly, the European Commission has proposed a new emission regulation for vans and passenger cars to reduce the emission of CO2 by 12%. At the same time, the demand for electric vehicles has tripled. Further, Bharat Stage VI (BS VI) has been implemented for passenger cars and two-wheelers in India since Apr 2020, which needs the installation of diesel oxidation catalysts (DOC) and diesel particulate filters (DPF) in cars to achieve the defined emission targets. Thus, to reduce Co2 emissions, regulatory bodies such as EPA and European Commission have mandated installing diesel particulate filters and selective catalysts reductions (SCR) technologies for diesel passenger cars and light trucks.

Furthermore, most passenger cars now run-on gasoline. Many OEMs are shifting their focus from multi-port fuel injector systems to gasoline direct injections (GDI) engines in their vehicle models to produce more power with less fuel. With the rise in the adoption of the GDI system, emission regulatory authorities worldwide have made regulation norms for pollutants emitted from GDI engines. For instance, in 2019, the European Union made it mandatory to install gasoline particulate filters in GDI engine vehicles. Gasoline particulate filters (GPF) have been introduced to reduce particle number emissions from GDI vehicles. Thus, a rise in stringency in emissions regulation from different authorities around the world would create lucrative opportunities for after-treatment filters such as diesel exhaust filters (DPF), gasoline exhaust filters (GPF), urea filters, and crankcase ventilation filters

On the other hand, emission regulations for commercial vehicles are also getting stringent in recent years worldwide. For instance, in March 2022, the EPA proposed new emission regulations for smog, soot, and other air pollutants from on-highway commercial trucks and buses. The proposed standard would significantly reduce the smog and soot which forms the nitrogen oxides (NOx) from heavy-duty commercial vehicles and buses. Similarly, in June 2019, the European Union introduced rules on particulate matters of black carbon from commercial trucks and buses. The new regulation targets reducing particulate matter of 0.1 microns, which is 50% smaller than a human hair. To achieve these emission standards, the US EPA and European Regulation have mandated the installation of diesel particulate filters (DPF) and urea filters within SCR technology in heavy-duty diesel engines.

Further, the EPA has published the crankcase emissions norms for diesel engines. The regulation focuses on diesel particulate matter such as nitrogen oxides, hydrocarbons, and carbon monoxide. The EPA has made it mandatory to install crankcase ventilation filters in heavy-duty trucks to achieve crankcase emissions by either returning them to the intake for re-combustion or sending them ahead of the exhaust emission control systems into the exhaust stream. Hence, mandates from emission regulatory bodies have pushed OEMs to install after-treatment filters such as diesel exhaust filters, crankcase ventilation filters, and urea filters.

Restraint: Use of washable/Non-replaceable filters to impact the demand for aftermarket filters.

Non-replaceable filters are washable and can be used for a longer period. But, to clean the filters, a special cleaning kit is required. The replacement of air filters by K& N engineering lasts up to 50,000 miles between servicing, based on the driving situations. With the help of the K&N air filter cleaning kit, air filters can be easily cleaned and re-oiled to bring them back to a brand-new condition and, thus, prepare them for another 50,000 miles of use. This is a cost-effective option for vehicle owners in the long run since there is no need for replacement. Some of the vehicle models that use OE-fitted non-replaceable filters are Volkswagen Jetta and Toyota Fortuner. K & N Engineering, AIRAID, and AEM induction systems are some of the manufacturers of these non-replaceable automotive filters

In the future, the filter aftermarket would be impacted by the non-replaceable filters since various filters, such as air and cabin filters, need not be changed in the vehicle's entire lifespan. The market for non-replaceable filters is at a very nascent stage. However, in the coming years, these filters will likely have a decent market owing to their various advantages, such as zero replacement and cost savings over conventional filters.

Opportunities : Advancements in filter media/technology

A filter media is a core component of a filter. Filter media in filters is used to collect any foreign and unwanted particles. Different filter media types are used in different filters based on application. Most of the filter manufacturers are using cutting-edge filter media to gain a competitive advantage o

A filter media is the core component of a filter. It is used to capture any unwanted and foreign particles. It comprises cellulose, synthetic, glass fiber, and activated carbon, depending on the applications. Advancements in filter media types or technology will offer a huge opportunity for automotive filter manufacturers in the coming years. Currently, cabin filters are offered to resist dust particles entering the vehicle. Most dust filters stop 100% of all particles that are 3 microns or larger and 95–99% of particles that are 1–3 microns in size. However, there will be a mass market for dust and odor filters in the coming years. The blend of dust and odor filters has a coating of activated charcoal or baking soda to absorb odor and air pollutants.

Nowadays, most vehicles’ air intake filters are made up of cellulose media, which is very cost-effective. However, synthetic media types are gaining popularity and would have a decent market share in the future, mainly due to their various advantages over cellulose media. For instance, synthetic media types offer increased flow area, provide high performance, and are less sensitive to water. These filters can allow better airflow for combustion, resulting in higher fuel efficacy and lower emission. MANN+HUMMEL, for instance, is focusing on developing synthetic ultra-fine fiber media with a high separation efficiency, which is expected to increase the service life of filters.

Challenges: Availability of Local Products to Hinder Demand for OE Filters

Prominent and well-established players such as a Mann+Hummel (Germany), Mahle GmbH (GmbH), Robert Bosch GmbH (Germany), Donaldson Company, Inc. (US), AHLSTROM-MUNKSJÖ (Finland), and (Italy) offers a wide range of filters and filter media for the OE market. Further, these companies also provide after-sales support for vehicles. With the rise in passenger cars and heavy commercial vehicle production and parc, demand for automotive filters in the aftermarket would also increase.

In addition to these established players, several local and regional players such as Elofic Industries Limited (India), Lucas TVS Limited (India), Dale Filter Systems (India), A.L. Filter (Israel), and UFI Filters (Italy) are also operating in the automotive filters market, catering to all vehicle types of passenger cars, commercial vehicles, and buses. These local and regional players mainly focus on aftermarket demand for automotive filters, creating stiff competition for established companies due to lower cost, easy availability, and can be sold with lower profit margins. These local or regional players offer automotive filters at lower prices, which poses a challenge for established players while replacing OE-recommended filters. Many local suppliers are expected to offer products per OE recommended specifications with comparatively lower prices, which restricts the aftermarket business growth for major suppliers.

Automotive Filters Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Particle Cabin Filter is estimated to be the largest cabin filter market by material type

Particle cabin filters would hold the dominant position in the automotive cabin filter market. Particle cabin filters are cost-effective compared to activated carbon and electrostatic filters and offer above-average performance. Their low cost filter barrier made of fully synthetic non-woven fabric. Synthetic fibers are not hygroscopic; hence, water does not cause the cabin filters to deform. Such advantages are expected to result in steady growth for the particle filter market in the near future.

Further, in Europe and North America, the demand for AC cabins in heavy trucks is growing, followed by government regulations. For instance, the European Commission has mandated the use of cabin AC in all heavy commercial trucks. The Indian government has also made the cabin AC mandatory in heavy trucks, though it is yet to be commercialized. Major commercial vehicle manufacturers of heavy trucks and buses are installing air conditioning systems which will drive the particle cabin filters market in the heavy vehicles segment

Battery Electric Vehicles (BEV) are expected to dominate the electric vehicle filters market by vehicle type during the forecast period

BEVs are predicted to have the largest market share in the electric vehicle filters market by EV type. As per MnM Analysis, global sales of electric & hybrid vehicles are expected to grow from 8,142 thousand units in 2022 to 38,983 thousand units by 2030, of which more than 70% share belongs to BEVs. The BEVs comprise the battery system, traction motor, and other power electronic modules. In BEVs, automotive filters such as cabin filters, dryer cartridges for batteries, EMI/EMC filters, and cooling air particle filters are installed. Further rising development of high voltage batteries will require effective filtration technology to ensure the optimum performance of the battery. In contribution towards the reduction of global CO2 emission level, automotive OEMs have planned to launch a medium to premium range of electric vehicles in the next 2-3 years, which will ultimately accelerate the demand of regular and advanced filters demand in the battery electric vehicles segment.

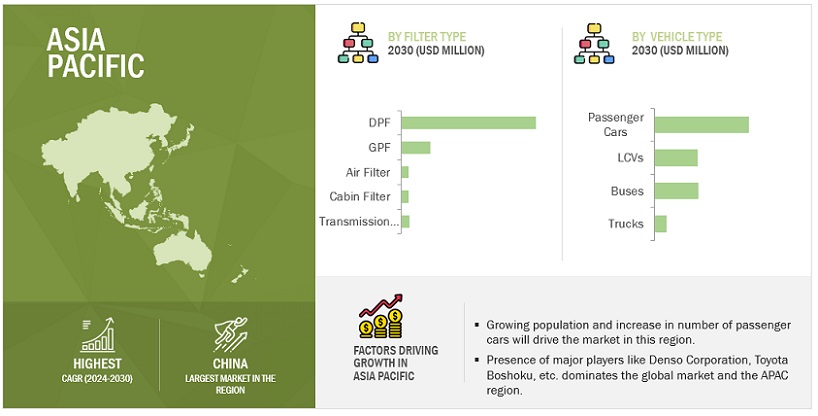

Asia Pacific is projected to dominate the Automotive Filters market by 2027

The Asia Pacific region holds the largest market share in the automotive filters market. China accounts for the largest share owing to shifting consumer preferences, increasing per capita income of the middle-class population, and cost advantages that have led OEMs to increase vehicle production in the region. Thus, strong demand has been noticed in China, India, and Japan, accelerating the automotive filter market growth. In 2021, the demand of economy and mid-range cars was highest, with more than 90% of the share in total passenger car production. The demand for entry-level and medium-price range cars is growing in countries such as India, China, and Thailand. More vehicle models have been product launches with some of the advanced features in this segment at a competitive price bracket. Further, the demand for premium-range cars installed with advanced in-cabin comfort features and powerful engines has shown significant growth. It is anticipated to remain positive in the coming years. Moreover, rising capital infrastructure projects and e-commerce activities in developing countries like China and India have accelerated the growth of the heavy commercial vehicles segment. It will spur the demand for air, oil, fuel, and coolant crankcase ventilation filters and, thus, augment the market size.f

Key Market Players & Start-ups

The automotive filters market is led by globally established players such as Mann+Hummel (Germany), Donaldson Company, Inc. (US), Mahle GmbH (Germany), Robert Bosch GmbH (Germany), and AHLSTROM-MUNKSJÖ (Finland),. These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Filters Type (ICE), by Vehicle Type (ICE), Fuel filters by fuel type (ICE), Air filters by Media type (ICE), Cabin filters by Material type (ICE), Electric & Hybrid vehicle filters by filters type, by Electric and Hybrid Vehicle Type, Aftermarket by filters type (ICE), off-highway by equipment type (ICE), Off-highway by filters type (ICE), and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and RoW |

|

Companies covered |

Mann+Hummel (Germany), Donaldson Company, Inc. (US), MAHLE GmbH (Germany), Robert Bosch GmbH (Germany), Sogefi S.p.A (Italy), Denso Corporation (Japan), Ahlstrom-Munksjö (Finland), Toyota Boshoku Corporation (Japan), Cummins Inc. (Indiana), and Parker Hannifin Corporation (US) |

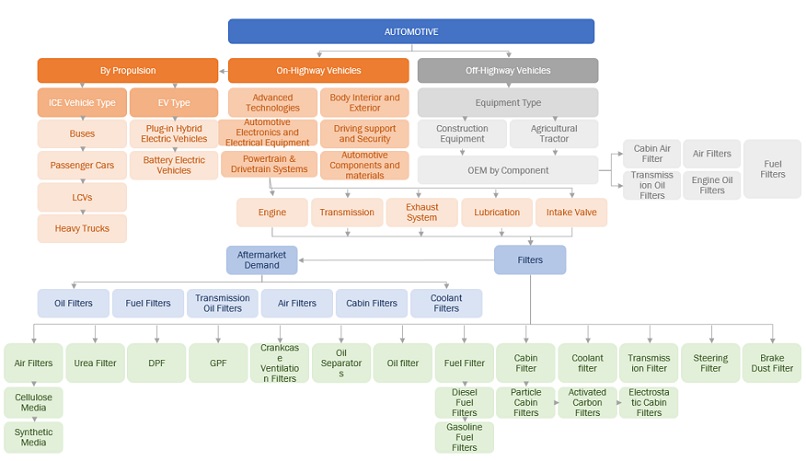

The study categorizes the automotive filters market based on the following segments:

Automotive Filters Market By Filters Type (ICE)

- Air filter

- fuel filter

- oil filter

- cabin filter

- brake dust filtera

- transmission oil filter

- coolant filter

- oil separator

- steering filter

- urea filter

- DPF filter

- GPF filter

- and crankcase ventilation filter

Automotive Filters Market By Vehicle Type

- passenger car

- LCV

- Truck

- and bus

Automotive Filters Market Fuel filters By Fuel type(ICE)

- gasoline filters

- and diesel filters

Automotive Filters Market Air filters By Media type (ICE)

- Cellulose

- and Synthetic

Automotive Filters Market Cabin Filters by Material Type (ICE)

- Particle Cabin

- Activated Carbon

- and Electrostatic

Automotive Filters Market Electric & Hybrid Vehicle By Filters Type

- Air filter

- fuel filter

- oil filter

- cabin filter,

- brake dust filter

- transmission oil filter

- dryer cartridges for batteries

- EMI/EMC filters

- cooling air particle filter

Automotive Filters Market By Electric & Hybrid Vehicle Type

- Battery Electric Vehicle

- and Plug-in Hybrid Electric Vehicle

Automotive Filters Market Aftermarket By Filters Type

- Oil Filter

- Fuel Filter

- Air Filter

- Cabin Filter

- Coolant Filter

- and Transmission Oil Filter

Automotive Filters Market Off-Highway by Equipment Type

- Construction Equipment

- and Agricultural Tractors

- Automotive Filters Market Off-Highway by Filter Type

- Fuel Filter

- Oil Filter

- Air Filter

- Cabin Air Filter

- and Transmission Oil Filter

Automotive Filters Market By Region

- Asia Pacific

- Europe

- North America

- and RoW

Recent Developments

- In October 2022, Donaldson Company, Inc. extended its iCue Connected Filtration Service to allow remote monitoring of customers' iCue service accounts by Donaldson Product Specialists to allow faster dust collector response and service.

- In June 2022, Mann+Hummel has introduced the new transmission oil filter W7071 for the e-axle. This new transmission oil filter will help for flawless cooling and lubrication of e-axles. This transmission oil filter is mainly for commercial vehicles in aftermarket.

- In December 2021, Ahlstrom-Munksjö has developed new fuel cell air intake filters for fuel cell vehicles. The newly developed filter for fuel cells will protect cells from harmful gases and particulates. The filter will also help increase fuel cell lifetime and minimize catalyst use.

- In September 2021, Sogefi S.p.A has developed new cabin filter called CabinHepa+. This newly developed cabin filter will offer 50 times more protection compared to conventional cabin filters.

- In August 2021, Denso Corporation has expanded its diesel after-treatment product line, , specifically diesel particulate filters and diesel oxidation catalysts, to cover all class eight trucks that were manufactured in 2007.

- In April 2021, Donaldson Company, Inc. has developed its filter Minder Connects Monitoring System for regulating fuel and oil filter condition of heavy duty engines.

Frequently Asked Questions (FAQ):

What is the future size of the global automotive filter market?

The automotive filters market is projected to grow from USD 11.1 billion in 2022 to USD 13.1 billion by 2027, at a CAGR of 3.3% for the same period.

Who are the winners in the global automotive filter market?

The automotive filters market is led by globally established players such as Mann+Hummel (Germany), Mahle GmbH (Germany), Donaldson Commpany, Inc. (US), Robert Bosch GmbH (Germany), and AHLSTROM-MUNKSJÖ (Finland). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth filters market.

Which automotive filters is expected to drive at fastest CAGR during forecast period?

Brake Dust Filter is estimated to drive at fastest CAGR of 47.0% during forecast period owing to rising awareness about pollution caused by disc brake particles.

Which are the filters have market potential in electric & hybrid vehicles during forecast period?

Dryer Cartridges for Batteries, cooling air particle filters, and EMI/EMC filters will have high market potential in electric & hybrid vehicles.

Which region is expected to dominate the automotive filter market?

Asia Pacific is estimated to dominate the automotive filters market during the forecast period.

What are the new market opportunities in the automotive filter market?

The rise in stringency in emission and fuel economy norms

Increasing sales of electric & hybrid vehicles.

A rise in vehicle parc and an increase in miles driven will create the demand for replacement. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

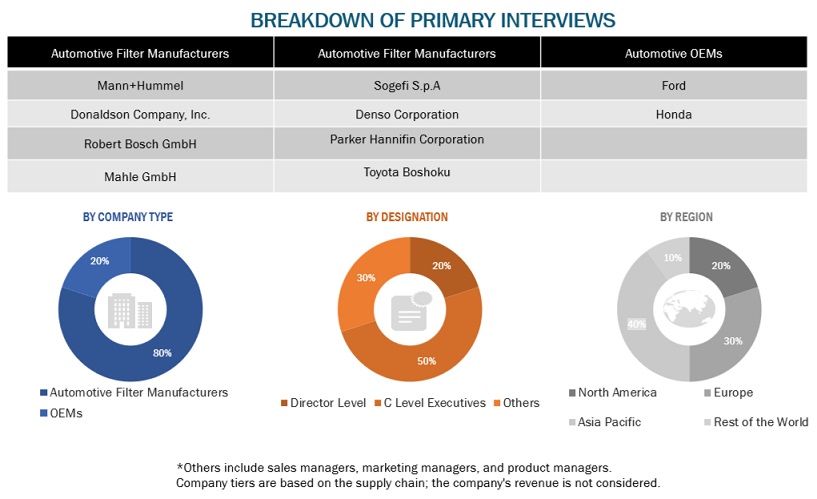

The study involves four main activities to estimate the current size of the automotive filters market. Exhaustive secondary research was done to collect information on the market, such as the automotive filters types, upcoming technologies, filter media types, and automotive filters materials. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A mix of bottom-up and top-down approach was employed to estimate the market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), the International Energy Agency (IEA)European Automobile Manufacturers’ Association, The Institute for Advanced Composites Manufacturing Innovation, corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Marklines and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive filters market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (filters manufacturers) across major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

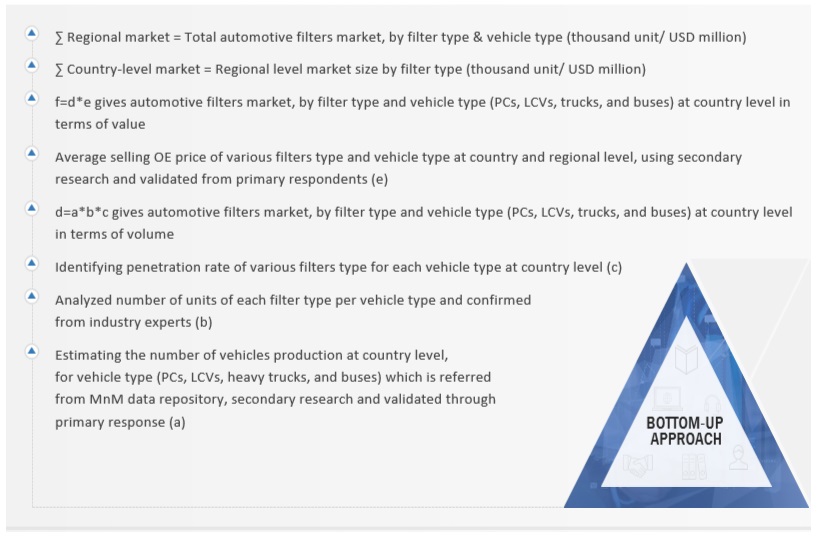

The market size of the filters market, in terms of volume, based on filters type is derived through bottom-up approach by estimating the country-level production (in units) of passenger cars, LCVs, trucks, and buses (a). The next step is to identify the number of units installed of different filter types per vehicle in all considered vehicle types (b) and penetration rate of each filter type in different vehicle types considered (c). ). Multiplying all three factors will provide the country-level market size in terms of volume by filter type and vehicle type. The market size, by value, has been arrived at by multiplying the average selling OE price of filters for each vehicle type at the country level. The summation of the country-level market gives regional and global automotive filters market by filter type and vehicle type. A similar approach is followed for the electric & hybrid vehicle filters market by vehicle type and filter types, off-highway by equipment type and filter type, and aftermarket by filter type in terms of volume and value.

Automotive Filters Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

-

To define, describe, and forecast the automotive filters market in terms of value (USD million/USD Billion) and volume (thousand units), based on the following segments:

- By Filters Type (ICE) (Air filter, fuel filter, oil filter, cabin filter, brake dust filter, transmission oil filter, coolant filter, oil separator, steering filter, urea filter, DPF filter, GPF filter, and crankcase ventilation filter)

- By Vehicle Type (passenger car, LCV, truck, and bus)

- Fuel filters By Fuel type(ICE) (gasoline filters, and diesel filters)

- Air filters By Media type (ICE) (Cellulose, and Synthetic)

- Cabin Filters by Material Type (ICE) (Particle Cabin, Activated Carbon, and Electrostatic)

- Electric & Hybrid Vehicle By Filters Type (air filter, fuel filter, oil filter, cabin filter, brake dust filter, transmission oil filter, dryer cartridges for batteries, EMI/EMC filters, cooling air particle filter)

- By Electric & Hybrid Vehicle Type (Battery Electric Vehicle, and Plug-in Hybrid Electric Vehicle)

- Aftermarket By Filters Type (Oil Filter, Fuel Filter, Air Filter, Cabin Filter, Coolant Filter, and Transmission Oil Filter)

- Off-Highway by Equipment Type (Construction Equipment, and Agricultural Tractors)

- Off-Highway by Filter Type (Fuel Filter, Oil Filter, Air Filter, Cabin Air Filter, and Transmission Oil Filter)

- By Region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market ranking and market share of key players operating in the market

- To understand the dynamics of the market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the automotive filters market.

- To conduct case study analysis, Porter’s five forces analysis, technology analysis, patent analysis, average premium analysis, and revenue analysis of top 5 players

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Electric & Hybrid Filters Market, By Filters Type & Vehicle Type Country-Wise Data

- Air Filter

- Oil Filter

- Fuel Filter

- Cabin Filter

- Brake Dust Filter

- Transmission Oil Filter

- Dryer Cartridges for batteries

- EMI/EMC filters

- Cooling Air Particle Filter

Note: Asia Pacific (China, India, Japan, and South Korea), NA (US & Canada), Europe (Germany, France, Norway, Spain, Sweden, UK)

Automotive Filters Market, By Vehicle Type (Country Level)

- Passenger Cars

- LCVs

- Trucks

- Buses

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Filters Market

Up to date (2017) Off highway filter marketplace Globally and by region for all types - Oil, Fuel, prefuel, hydraulic, transmission

I would appreciate to have a sample of market research of the Brazilian Oil,Fuel,Air and HVAC market, production and market players split

Air , Oil and Fuel filter Market at Canada , who is suppliers what size is it in aoutomotive including buses,trucks and business heavy equipments market

Hello, I am interested in receiving reports for Aftermarket data for filters in the United States. Specifically, I would like to locate Vehicle in Operation information, or demands for Heavy Duty Filters. Any information provided would be much appreciated. Thank you

What is the expected evolution of filter markets considering that the reliability of vehicles and quality of oils is continuously improving and enable to space out visits?

yes Fuel Filters especially the Diesel Market size. I would like to see if you have info specifically units and dollars for the diesel fuel filter market in the u.s

Interested to Know market potential for Fuel Filter Cum Water Separator for Ashok leyland Vehicles and current After market share held by various competetions in India

we are conducting a final career project on filters for motorbikes. Your study migth help us. Regards

I am seeking an air filter market report with a narrow focus. Specifically, the focus is medium and heavy vehicle in the North America markets (US and Canada data). May I please have a quote and a table of contents for a report with this focus? Thank you, Megan

I'm specifically interested in automotive-filter manufacturers based in China and the markets/regions they supply to/support.

I want to get a sense of how Mahle are doing in the UK and Europe within the Aftermarket compared to the leader. If I can get this, I will be able understand the full value of the report

Hi, I am looking for specific information on Capacitive dividers for EVT, Testing, RC Dividers, Grading AIS, Grading GIS, TRV AIS, TRV GIS, Thyristor Valve, HVDC Bypass, Filter capacitor, EVT For the following countries and region - Europe. U.S., Canada, India, China, South America, and Middle East Can you please help me with a quote and timeline for the same?

Diesel and Gasoline Particulate Filters, Catalysts for the automotive industry globally and all vehicle segments(i.e PC HCV). Thanks

Hello, I am a consultant/investor in the North America Automotive Aftermarket space and would like a sample report to determine if it can add value for my filter manufacturer client. Regards, Frank

We would be interested in purchasing the Report on automotive filters. Could you please provide us with some information prior to the purchase: Is there an extended table of content that you can share with us? Could you share with us the forecast model that is underlying the report?

What is the source of the data used in the forecast? (Is it based on IHS data when it comes to volumes for instance?)

Can you give us details regarding the methodology? We would need datapoints going back to 2013. Could you provide these? Many thanks in advance!