Brake System Market by Type (Disc, Drum), Technology (ABS, ESC, TCS, EBD), On & Off-Highway Vehicle (Passenger Car, LCV, HCV, Construction-Mining, Tractor, ATV), OHV Brake (Hydraulic Wet, Hydrostatic, Dynamic), Actuation and Region - Global Forecast to 2027

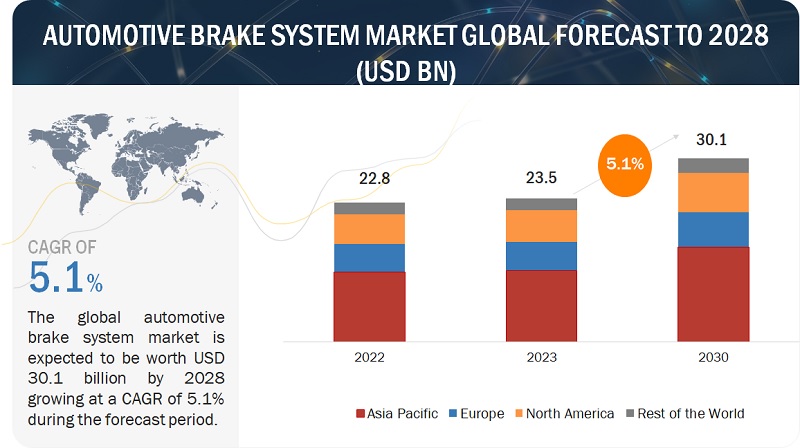

The brake system market was valued at USD 22.2 billion in 2022 and is expected to reach USD 28.1 billion by 2027, at a CAGR of 4.8 % during the forecast period 2022-2027. Factors such as rollout of stringent safety regulations, adoption of high-end and luxury cars, and growing adoption of air disc brakes in commercial vehicles are expected to drive the demand for the brake system market.

To know about the assumptions considered for the study, Request for Free Sample Report

Brake Market Dynamics

Driver: Inclusion of advanced brake systems such as ABS and EBD to enhance vehicle safety

Using electronic braking systems such as Anti-lock Brake Systems (ABS), Brake Assist (BA), and Electronic Brakeforce Distribution (EBD) can help reduce the stopping distance. ABS enables vehicle stability and directional control and helps reduce stopping distance during hard braking. This is one of the major advantages offered by ABS over conventional braking systems. According to the Royal Society for the Prevention of Accidents (ROSPA), ABS ensures the shortest distance in which a vehicle can be brought to rest is achieved. BA is based on the ABS technology of a vehicle and is usually used in combination with ABS. BA helps reduce the stopping distance by 45%. Thus, in the coming years, the adoption of ABS and BA is expected to grow due to the regulatory norms for vehicle safety. EBD is an extension of the ABS and is responsible for distributing equal force to each wheel. EBD offers advantages such as enhanced stability, reduced stopping distance, improved traction on the road, and maximized braking efficiency. Given these advantages, developing countries like India and Mexico have announced their intention to adopt advanced braking systems like EBD and Electronic Stability Control (ESC) in their new vehicles. The Indian automobile industry has already adopted ESC and will make EBD mandatory from 2023. In 2021, the Mexican government announced its plan to install ESC and EBD in selected vehicles produced from 2022.

Restraint: High development and maintenance costs of advanced braking technology

General maintenance of the brake system is expensive; for instance, a periodic brake system service includes replacement of brake fluid, brake shoes, brake pads, resurfacing rotors, and cleaning, adjusting, and lubricating of other braking mechanisms which are expensive. An ABS is expensive to maintain as sensors on each wheel can cost hundreds of dollars. For instance, according to Repair Smith, the average cost of ABS sensor replacement is USD 150–400 and USD 90–USD 200 for brake fluid replacement. Further, the replacement of critical components like master cylinders, rotors, calipers, drums, pads, and cylinders can cost around USD 750–1,000.

In cost-sensitive countries such as India and Brazil, the penetration of advanced electronic systems is mostly restricted to high-end cars. Furthermore, the added cost of maintenance/repair is restraining the adoption of such systems.

Opportunities: Government regulations to make advanced emergency braking systems mandatory

In 2019, more than 40 countries agreed to a draft United Nations Regulation for Advanced Emergency Braking (AEB) systems for cars and light vehicles to reduce vehicle crashes. Under which, the EU has amended its Regulation No. 152-00 for AEB systems for light passenger and commercial vehicles. The regulation expects vehicle manufacturers to compulsorily include AEB in new vehicles. The regulation has also mandated the testing of vehicles at 60 MPH to check the deployment of AEB systems. The Advanced Emergency Braking (AEB) system is gaining popularity, mainly due to government mandates making it a mandatory feature in vehicle models. AEB helps avoid a potential collision, reduces the intensity of collision, enhances the braking force, and is efficient on both urban and highways. In 2016, 20 major automakers agreed to voluntarily make advanced emergency braking a standard feature on nearly all of their new vehicles by September 1, 2022. In December 2021, more than 12 major automakers from China equipped nearly all their 2021 vehicles with AEB. More manufacturers are planning to meet a voluntary commitment to equip nearly all their vehicles with AEB by September 1, 2022. The IIHS estimates that if all automakers meet the agreement, it could prevent 42,000 crashes and 20,000 injuries by 2025.

Challenges: Air brake freeze-ups

Air brake freezing occurs in heavy-duty vehicles such as trucks/trailers. The most common cause of trailer brake freezing is moisture in the lines or brake shoes. Air brake freeze-ups occur mostly in winters and it takes rigorous efforts to get them repaired. And if the vehicle employs ABS, moisture can be a bigger issue for the functioning of the braking system. If there is moisture, the ABS valves can trap moisture, freeze up, and cause brakes to malfunction. As stability control has become a standard in new trucks in developed countries of Europe and North America, managing moisture in the trailer brake lines is of utmost importance. Thus, air brake freeze-ups can be a nuisance in winters, especially for heavy-duty vehicles.

In March 2021, Bendix Commercial Vehicle Systems, LLC notified the National Highway Traffic Safety Administration (NHTSA) that the company will recall 2,090 Bendix SC-3 check valves which are part of an air-brake system, mainly due to manufacturing problems.

Brake System Market Ecosystem

The market ecosystem comprises raw materials suppliers, component/part manufacturers, brake system manufacturers, and OEMs. Disc and drum brakes are equipped with friction material called brake pads and brake linings. Friction raw materials include phenol resin, aramid fiber, steel fiber, graphite, etc. Parts manufacturers provide components such as ABS control modules, master cylinders, brake boosters, brake pedals, wheel speed sensors, etc. Brake system manufacturers/system integrators then procure these parts/components from suppliers and design a brake system according to OEM requirements, and OEMs directly deploy these systems and install them in their vehicle models.

|

COMPANY |

ROLE IN ECOSYSTEM |

|

Kor-Pak Corporation |

Raw Material Supplier |

|

ProTech Friction Group |

Raw Material Supplier |

|

Trimat Limited |

Raw Material Supplier |

|

Miba |

Raw Material Supplier |

|

TMD Friction |

Raw Material Supplier |

|

Cardollite Corporation |

Raw Material Supplier |

|

TE Connectivity |

Brake Part Manufacturer |

|

KSR International |

Brake Part Manufacturer |

|

PVI Ltd. |

Brake Part Manufacturer |

|

Batz Group |

Brake Part Manufacturer |

|

Continental AG |

Brake Part and System Manufacturer |

|

ADVICS Co., Ltd. |

Brake Part and System Manufacturer |

|

Mando Corporation |

Brake Part and System Manufacturer |

|

Robert Bosch GmbH |

Brake Part and System Manufacturer |

|

Haldex AB |

Brake Part and System Manufacturer |

|

BWI Group |

Brake Part and System Manufacturer |

|

Audi |

OEM |

|

BMW |

OEM |

|

Hyundai |

OEM |

|

Toyota |

OEM |

|

Volkswagen |

OEM |

|

Volvo |

OEM |

|

Chevrolet |

OEM |

|

Ford |

OEM |

|

Freightliner |

OEM |

|

Daimler |

OEM |

The hydraulic brake is expected to be the largest market, by actuation

The growth in production of passenger cars and light commercial vehicles(LCV) is driving the growth of hydraulic brake systems. Advantages such as better heat dissipation than mechanical brakes, better braking power transmission, compact size, and ease of repair due to the readily available brake parts in the aftermarket are instrumental in increasing penetration of hydraulic brake system in global brake system market during the forecast period. Further, recent developments such as the use of Glycol ethers and derivatives in place of mineral oils have been able to reduce the cost and increase the life of brake fluid. As almost all passenger cars and light commercial vehicles are equipped with hydraulic brake system. Asia Pacific is the largest hydraulic brake market. As the hydraulic brake market is directly linked to vehicle production, China and India are expected to hold the largest market shares in Asia Pacific due to higher passenger cars and LCV production. Also, North America and Europe have significant presence in hydraulic brake market, but as the local automobile OEMs outsource their manufacturing to developing countries the brake products aftermarket is expected to show more promising growth in these regions.

Passenger Car brake systems market is expected to be the fastest-growing in the forecast period

As passenger cars employ two braking systems: service brakes and parking brakes. The government mandates is the major driver in brake system market. For instance, New Car Assessment Program (NCAP) initially initiated by US in 1978 to improve road and vehicle safety has encouraged governments around the globe to adopt and implement advanced braking systems by establishing their local NCAPs. Further, the Global NCAP has been established by UN member states to serves as a platform for cooperation among new car assessment programs worldwide and promotes the universal adoption of the United Nation’s most important motor vehicle safety standards worldwide. It aims to make braking technologies such as Electronic Stability Control (ESC) mandatory across the world. ESC includes Anti-lock Braking System (ABS) and Electronic Brakeforce Distribution (EBD). Therefore, this mandate will increase the demand for braking technologies from OEMs. Although advanced brakes are popular in Europe and North America, the increasing penetration of such brakes in Asia Pacific is expected to boost the market. In April 2019, the Ministry of Road Transport & Highways of India announced that India will have safety braking features such as electronic stability control and autonomous braking as mandatory features on passenger cars by 2023. The stringency in passenger vehicle safety regulations is projected to increase the adoption of advanced brake systems. Passenger cars in Europe and North America already have significant penetration of advanced brake systems, and this penetration rate is expected to increase in the coming years. Passenger cars and SUVs with all four-wheel disc brakes are gaining popularity in Asia Pacific and RoW due to stringent safety standards making these braking systems mandatory. Thus, the passenger car brake system market is expected to showcase strong growth.

Agricultural equipment brake system market is expected to be the fastest-growing in the forecast period

By application, the agriculture equipment segment is projected to lead the Off-highway equipment brake system market by volume during the forecast period. This segment’s growth is mainly attributed to the higher sales of agricultural tractors at the global level in comparison to construction equipment. The increasing levels of farm mechanization in the Asia Pacific are expected to significantly drive the Off-highway agricultural equipment market during the forecast period. For instance, the sales of tractors in India during 2020 and 2022 grew by 23%. The growing construction and mining activities due to rapid industrialization are also expected to drive off-highway equipment sales which are expected to contribute to the growth of the Off-highway equipment market. Developing countries like India and Brazil have already relaxed regulations concerning the mining industry to encourage growth in the sector, thereby driving the demand for mining and construction equipment in Asia Pacific and RoW, which will further contribute to the growth of the global Off-highway equipment market.

North America the leading ATV market in coming years

The growing popularity of ATVs for sports/recreational activities, increasing farm mechanization, and rising number of off-road sports events/championships are expected to drive the global market. This growth in ATV sales globally is expected to drive the ATV brake system market. North America contributes to more than 60-62% of total market in the global ATV market. Further, the US and Canada together accounted for around 70-75% of the total ATV production in the region in 2021. The demand for ATVs has witnessed a significant rise in this region. The North American ATV market is dominated by key players such as Polaris Industries, Textron, BRP, Hisun, Bennche, and John Deere. Utility ATVs, which have a high demand in the military and agriculture sectors, dominate the region’s ATV market. This growing ATV production and sales is expected to boost the market in the coming years.

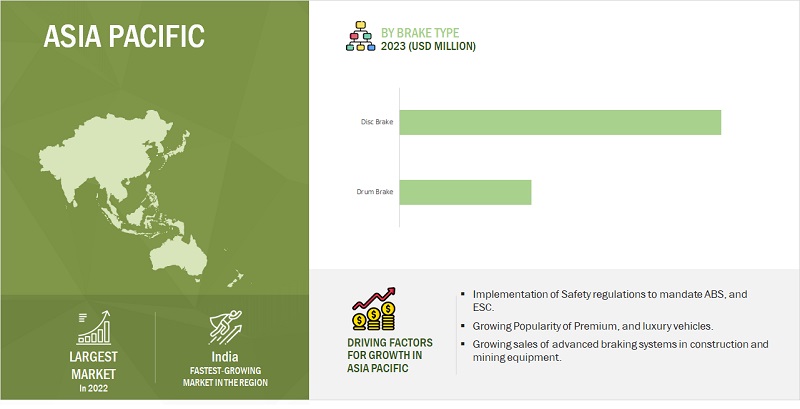

Asia Pacific is expected to lead the market during the forecast period

Asia Pacific has emerged as a hub for automotive production in recent years due to changing consumer preferences, increasing disposable income of the middle-class population, and cost advantages for local automobile OEMs. Manufacturers such as BMW Motors (Germany) and Volkswagen AG (Germany) have already set up their manufacturing units in these countries on a large scale. The rise in automotive production is driving the automotive brake systems market in the region. The growth of the Asia Pacific brake system market can be primarily attributed to upcoming advancements in brake systems and expansions made by brake system manufacturers to cope with the increasing demand for disc brakes in passenger cars and light commercial vehicles. Companies such as Aisin Seiki Co., Ltd. (Japan), Akebono Brake Corporation (Japan), Mando Corporation (South Korea), and Hitachi Automotive Systems Ltd. (Japan) have a strong presence in the region.

Further, China and India are the largest brake system markets in the Asia Pacific region. In China and India, the market for brake systems is driven by the increasing vehicle production in these two countries coupled with regulatory compliance with the UN agreement on approval and recognition for motor vehicle equipment and parts (ECE-R-13). Japan and South Korea already have a significant penetration of electronic braking systems due to their local regulations which comply with advanced braking system regulations stipulated in the US FMVSS105 and European ECE R13-H guidelines. Thus, with the implementation of stringent safety standards, the demand for brake systems is expected to grow further in the coming years

Asia Pacific: Brake System Market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The brake system market is non-fragmented and dominated by a few global players and several regional players. Some of the key players in the brake system market are Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), Continental AG (Germany), Aisin Seiki Co, Ltd. (Japan), Knorr-Bremse AG (Germany), Brembo S.p.A (Italy), Haldex AB (Sweden), Mando Corporation (South Korea), and Hitachi Astemo, Ltd. (Japan). These companies have strong distribution networks at a global level and offer an extensive product range. They have adopted strategies of new product development, acquisition, and contracts & partnerships to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 22.2 Billion |

|

Estimated Value by 2027 |

USD 28.1 Billion |

|

Growth Rate |

Poised to grow at a CAGR of 4.8% |

|

Market Segmentation |

By brake type, vehicle type, technology, actuation, off-highway brake type, off-highway brake system market by application, regenerative brake system, ATV brake system, and region |

|

Market Driver |

Inclusion of advanced brake systems such as ABS and EBD to enhance vehicle safety |

|

Market Opportunity |

Government regulations to make advanced emergency braking systems mandatory |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

This research report categorizes the brake system market based on brake type, vehicle type, technology, actuation, off-highway brake type, off-highway brake system market by application, and region.

Based on Brake Type, the market has been segmented as follows:

- Disc

- Drum

Based on Technology, the market has been segmented as follows:

- Antilock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Traction Stability Control (TCS)

- Electronic Brakeforce Distribution (EBD)

Based on Vehicle Type, the market has been segmented as follows:

- Passenger Car

- Light-commercial Vehicles (LCV)

- Truck

- Bus

Based on Actuation, the market has been segmented as follows:

- Hydraulic

- Pneumatic

Based on Off-highway Brake Type, the market has been segmented as follows:

- Hydraulic Wet Brake

- Dynamic Brake

- Hydrostatic Brake

- Other

Based on Off-highway Application, the market has been segmented as follows:

- Construction Equipment

- Mining Equipment

- Agricultural Tractors

Based on ATV brake system the market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- RoW

Based on the Regenerative brake system the market has been segmented as follows

- BEV

- PHEV

Based on region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

-

Rest of the World

- Brazil

- Russia

- Turkey

- Rest of RoW

Recent Developments

- In July 2019, Continental and Knorr-Bremse entered in partnership towards highly automated commercial vehicle driving for automated platooning (i.e., driving in a column). The cooperation partners show with this Platooning Demonstrator what driving functions they can develop, jointly with the vehicle manufacturers, for automated driving. This includes the formation of platoons, driving together, the emergency braking function, exiting by individual vehicles, and safe splitting up of the entire platoon.

- In March 2020, ZF launched an industry-first Front Electric Park Brake, extending the range of Electric Park Brake (EPB) systems to a wider range of vehicles. With this solution, car manufacturers can now equip smaller vehicles with an advanced braking system and design their interior without the classic handbrake lever or park brake pedal.

- In November 2020, TRW (ZF’s aftermarket brand) product portfolio for the independent aftermarket was further expanded in the two-piece brake disc segment. These brake discs are now also available for various Mercedes-Benz C- and E-Class models. Additional references for S-Class and GLC models of the Stuttgart premium manufacturer will follow in mid-2021.

- In June 2018, Akebono Brake Industry Co., Ltd. developed the world's first "new construction brake caliper." The new brake caliper is based on the construction of the existing product, the AD-Type disc brake, and has been modified extensively to meet specific requirements for automobiles that use electric power sources and to be friendlier to the global environment.

- In March 2021, Brembo introduced its new Brembo Sport | T3 brake disc. ?The new Brembo Sport | T3 disc is a direct replacement for original equipment discs and has two easily recognizable elements that distinguish it from the previous version - the use of Type3 slotting and the Brembo logo engraved on the braking surface. These new technologies and design features are a first for a road disc.

Frequently Asked Questions (FAQ):

How big is the brake system market?

The brake system market was valued at USD 22.2 billion in 2022 and is expected to reach USD 28.1 billion by 2027, at a CAGR of 4.8 % during the forecast period 2022-2027.

Who are the top key players in the brake system market?

The brake system market is dominated by globally established players such as Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), Continental AG (Germany), Aisin Seiki Co, Ltd. (Japan), Knorr-Bremse AG (Germany), Brembo S.p.A (Italy), Haldex AB (Sweden), Mando Corporation (South Korea), and Hitachi Astemo, Ltd. (Japan). These companies focus on developing new products, adopt expansion strategies and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in this growing brake system market.

What are the trends in the brake system market?

North America is experiencing increased adoption of disc brakes in heavy commercial vehicles, but as of now, drum brakes hold majority market share.

Europe has the highest penetration of disc brakes in light- and heavy-duty vehicles.

Adoption of safety features such as ABS and ESC is becoming a mandate in several countries around the world.

What is the future of the brake system market?

Growing popularity of advanced electronic braking systems globally, increasing penetration of air disc brakes in commercial vehicles and growing sales of premium and luxury cars is expected to drive brake system market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 BRAKE SYSTEM MARKET: MARKET SEGMENTATION

FIGURE 2 MARKET: BY REGION

1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY STAKEHOLDER, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE: BOTTOM-UP APPROACH (ON- & OFF-HIGHWAY EQUIPMENT AND REGION)

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE: TOP-DOWN APPROACH (BY ACTUATION)

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.4.1 GLOBAL ASSUMPTIONS

2.4.2 MARKET ASSUMPTIONS

2.5 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.6 FACTOR ANALYSIS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

3.1 MARKET SCENARIO

3.2 REPORT SUMMARY

FIGURE 10 BRAKE SYSTEM MARKET: MARKET OUTLOOK

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BRAKE SYSTEM MARKET

FIGURE 12 STRINGENT SAFETY STANDARDS AND GROWING POPULARITY OF DISC BRAKES TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 14 ABS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2022

4.4 MARKET, BY VEHICLE TYPE

FIGURE 15 PASSENGER CAR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET, BY BRAKE TYPE

FIGURE 16 DISC BRAKE SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.6 MARKET, BY APPLICATION

FIGURE 17 AGRICULTURAL EQUIPMENT SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.7 MARKET, BY TYPE

FIGURE 18 HYDRAULIC WET BRAKE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.8 MARKET, BY ACTUATION

FIGURE 19 PNEUMATIC BRAKE SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.9 ALL-TERRAIN VEHICLE MARKET, BY REGION

FIGURE 20 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.10 NORTH AMERICA BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT

FIGURE 21 BRAKE DRUM SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent safety regulations

5.2.1.1.1 Reduction of required stopping distance for light and heavy-duty vehicles through regulations

FIGURE 23 COMPARISON OF STOPPING DISTANCES AT 65 MPH FOR PASSENGER CARS AND TRUCKS IN US

FIGURE 24 TOTAL STOPPING DISTANCES FOR PASSENGER CARS AND TRUCKS

5.2.1.1.2 Inclusion of advanced brake systems such as ABS and EBD to enhance vehicle safety

FIGURE 25 EFFECT OF EBD

5.2.1.2 Integration of ACC in electronic braking systems to enhance vehicle handling

TABLE 1 VEHICLES WITH ADAPTIVE CRUISE CONTROL

FIGURE 26 ANALYSIS OF ELECTRONIC BRAKING SYSTEMS FOR DIFFERENT VEHICLE CLASSES

5.2.1.3 Impact of New Car Assessment Program (NCAP)

TABLE 2 LOCAL NEW CAR ASSESSMENT PROGRAMS (NCAP)

TABLE 3 FACTORS & WEIGHTAGE FOR EURO NCAP RATING

5.2.2 RESTRAINTS

5.2.2.1 High development and maintenance costs of advanced braking technology

TABLE 4 ABS CONTROL MODULE REPAIR COSTS (USD)

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of brake-by-wire systems

FIGURE 27 BRAKE-BY-WIRE MARKET, BY REGION, 2021 VS. 2025 (USD MILLION)

TABLE 5 VEHICLE MODELS WITH BRAKE-BY-WIRE SYSTEMS

5.2.3.2 Government regulations to make advanced emergency braking systems mandatory

5.2.3.3 Increased use of regenerative braking in EV ecosystem

FIGURE 28 ELECTRIC VEHICLE SALES, BY REGION, 2022 VS. 2030 (‘000 UNITS)

5.2.4 CHALLENGES

5.2.4.1 Malfunctioning of electronic braking systems

5.2.4.2 Air brake freeze-ups

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 29 REVENUE SHIFT FOR MARKET

5.4 MARKET, SCENARIOS (2018–2027)

5.5 MARKET ECOSYSTEM

TABLE 6 MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.7 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1

5.7.2 CASE STUDY 2

5.8 PATENT ANALYSIS

5.9 AVERAGE SELLING PRICE ANALYSIS

5.9.1 BY BRAKE TYPE

TABLE 7 AVERAGE SELLING PRICE, BY BRAKE TYPE, 2022 (USD)

5.9.2 BY VEHICLE TYPE

TABLE 8 AVERAGE SELLING PRICE, BY VEHICLE TYPE, 2022 (USD)

5.9.3 BY TECHNOLOGY

TABLE 9 AVERAGE SELLING PRICE, BY TECHNOLOGY, 2022 (USD)

5.10 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: MARKET

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TRADE ANALYSIS

TABLE 10 TRADE ANALYSIS, VEHICLE PARTS; BRAKES, SERVO-BRAKES, AND PARTS THEREOF

5.13 REGULATORY LANDSCAPE

5.13.1 US: FEDERAL MOTOR SAFETY STANDARDS FOR BRAKE SYSTEM PARTS

TABLE 11 US: FEDERAL MOTOR VEHICLE SAFETY STANDARDS

5.13.2 VEHICLE SAFETY STANDARDS, BY COUNTRY/REGION

TABLE 12 VEHICLE SAFETY STANDARDS, BY REGION

5.13.3 ELECTRONIC BRAKE SYSTEM MANDATES, BY REGION

TABLE 13 ELECTRONIC BRAKE SYSTEM MANDATES, BY REGION

5.14 KEY STAKEHOLDERS IN BUYING PROCESS & BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 2 BRAKE TYPES

TABLE 14 KEY BUYING CRITERIA FOR TOP 2 BRAKE TYPES

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ON-HIGHWAY VEHICLE APPLICATIONS (%)

5.15 KEY CONFERENCES

5.15.1 BRAKE SYSTEM MARKET: DETAILED LIST OF UPCOMING CONFERENCES AND EVENTS

6 BRAKE SYSTEM MARKET, BY BRAKE TYPE (Page No. - 92)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS/LIMITATIONS

6.1.3 INDUSTRY INSIGHTS

FIGURE 33 MARKET, BY BRAKE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 16 MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 17 MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 18 MARKET BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

6.2 DISC BRAKE

6.2.1 BETTER HEAT DISSIPATION AND SELF-ADJUSTING FRICTION MATERIAL TO DRIVE DEMAND

TABLE 20 DISC BRAKE MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 21 DISC BRAKE MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 22 DISC MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 DISC MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 DRUM BRAKE

6.3.1 COST-SENSITIVE NATURE OF EMERGING MARKETS EXPECTED TO DRIVE DEMAND

TABLE 24 DRUM MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 25 DRUM MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 26 DRUM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 DRUM MARKET, BY REGION, 2022–2027 (USD MILLION)

7 BRAKE SYSTEM MARKET, BY TECHNOLOGY (Page No. - 99)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (‘000 UNITS)

TABLE 28 MARKET, BY TECHNOLOGY, 2018–2021 (‘000 UNITS)

TABLE 29 MARKET, BY TECHNOLOGY, 2022–2027 (‘000 UNITS)

7.2 ANTI-LOCK BRAKE SYSTEM (ABS)

7.2.1 REGULATIONS TO MANDATE ABS EXPECTED TO DRIVE SEGMENT

TABLE 30 ABS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 31 ABS MARKET, BY REGION, 2022–2027 (‘000 UNITS)

7.3 ELECTRONIC STABILITY CONTROL (ESC)

7.3.1 REDUCTION OF FATALITIES AND TECHNICAL BENEFITS EXPECTED TO DRIVE SEGMENT

TABLE 32 ESC MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 33 ESC MARKET, BY REGION, 2022–2027 (‘000 UNITS)

7.4 TRACTION CONTROL SYSTEM (TCS)

7.4.1 BETTER TRACTION CONTROL AND LIMITED WHEEL SLIPPAGE EXPECTED TO DRIVE SEGMENT

TABLE 34 TCS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 35 TCS MARKET, BY REGION, 2022–2027 (‘000 UNITS)

7.5 ELECTRONIC BRAKE FORCE DISTRIBUTION (EBD)

7.5.1 STRINGENCY IN SAFETY REGULATIONS EXPECTED TO DRIVE SEGMENT

TABLE 36 EBD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 37 EBD MARKET, BY REGION, 2022–2027 (‘000 UNITS)

8 BRAKE SYSTEM MARKET, BY VEHICLE TYPE (Page No. - 106)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 35 BRAKE SYSTEM MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 38 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 39 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 40 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2 PASSENGER CAR

8.2.1 STRINGENT SAFETY STANDARDS EXPECTED TO DRIVE SEGMENT

TABLE 42 PASSENGER CAR MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 43 PASSENGER CAR MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 44 PASSENGER CAR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 PASSENGER CAR MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LIGHT COMMERCIAL VEHICLE (LCV)

8.3.1 GROWING DEMAND FOR ADVANCED BRAKING SYSTEMS EXPECTED TO DRIVE SEGMENT

TABLE 46 LCV MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 47 LCV MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 48 LCV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 LCV MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 TRUCK

8.4.1 INTRODUCTION OF ELECTRONIC BRAKE SYSTEMS EXPECTED TO DRIVE SEGMENT

TABLE 50 TRUCK MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 51 TRUCK MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 52 TRUCK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 TRUCK MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 BUS

8.5.1 ADOPTION OF EFFICIENT BRAKE SYSTEMS EXPECTED TO DRIVE SEGMENT

TABLE 54 BUS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 55 BUS MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 56 BUS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 BUS MARKET, BY REGION, 2022–2027 (USD MILLION)

9 BRAKE SYSTEM MARKET, BY ACTUATION (Page No. - 117)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 36 MARKET, BY ACTUATION, 2022 VS. 2027 (‘000 UNITS)

TABLE 58 MARKET, BY ACTUATION, 2018–2021 (‘000 UNITS)

TABLE 59 MARKET, BY ACTUATION, 2022–2027 (‘000 UNITS)

9.2 HYDRAULIC BRAKE

9.2.1 LIGHT CONSTRUCTION AND LOW OVERALL WEIGHT TO DRIVE DEMAND

TABLE 60 HYDRAULIC MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 61 HYDRAULIC MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

9.3 PNEUMATIC BRAKE

9.3.1 SAFETY REGULATIONS FOR HEAVY COMMERCIAL VEHICLES TO DRIVE DEMAND

TABLE 62 PNEUMATIC MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 63 PNEUMATIC MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

10 OFF-HIGHWAY EQUIPMENT BRAKE SYSTEM MARKET, BY APPLICATION (Page No. - 122)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 37 OFF-HIGHWAY EQUIPMENT MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 64 MARKET, BY APPLICATION, 2018–2021 (‘000 UNITS)

TABLE 65 MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

TABLE 66 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 67 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 AGRICULTURAL EQUIPMENT

10.2.1 GROWING DEMAND FOR HIGH-POWERED TRACTORS TO DRIVE DEMAND FOR OIL-IMMERSED DISC BRAKES

TABLE 68 AGRICULTURAL EQUIPMENT MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 69 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 70 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 CONSTRUCTION EQUIPMENT

TABLE 72 CONSTRUCTION EQUIPMENT MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 73 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 74 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 MINING EQUIPMENT

TABLE 76 MINING EQUIPMENT MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 77 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 78 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2022–2027 (USD MILLION)

11 OFF-HIGHWAY EQUIPMENT BRAKE SYSTEM MARKET, BY BRAKE TYPE (Page No. - 132)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 38 OFF-HIGHWAY EQUIPMENT MARKET, BY BRAKE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 80 MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 81 MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 82 MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 83 MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

11.2 HYDROSTATIC BRAKE

11.2.1 INCREASING DEPLOYMENT OF MINING EQUIPMENT WITH HYDROSTATIC BRAKING EXPECTED TO DRIVE SEGMENT

TABLE 84 OFF-HIGHWAY EQUIPMENT HYDROSTATIC MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 85 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 86 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 HYDRAULIC WET BRAKE

11.3.1 SAFETY REGULATIONS FOR HEAVY COMMERCIAL VEHICLES EXPECTED TO DRIVE SEGMENT

TABLE 88 OFF-HIGHWAY EQUIPMENT HYDRAULIC WET MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 89 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 90 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 DYNAMIC BRAKE

11.4.1 STRINGENCY IN SAFETY STANDARDS EXPECTED TO DRIVE SEGMENT

TABLE 92 OFF-HIGHWAY EQUIPMENT DYNAMIC MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 93 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 94 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 OTHERS

TABLE 96 OFF-HIGHWAY EQUIPMENT OTHER BRAKE SYSTEMS MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 97 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 98 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 MARKET, BY REGION, 2022–2027 (USD MILLION)

12 NORTH AMERICA BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT (Page No. - 143)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS/LIMITATIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 39 NORTH AMERICA BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

TABLE 100 AFTERMARKET, BY PRODUCT, 2018–2021 (MILLION UNITS)

TABLE 101 AFTERMARKET, BY PRODUCT, 2022–2027 (MILLION UNITS)

TABLE 102 AFTERMARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 103 AFTERMARKET, BY PRODUCT, 2022–2027 (USD MILLION)

13 ALL-TERRAIN VEHICLE BRAKE SYSTEM MARKET, BY REGION (Page No. - 149)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS/LIMITATIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 40 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 104 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 105 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 106 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2022–2027( USD MILLION)

14 REGENERATIVE BRAKING SYSTEM MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 154)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 41 REGENERATIVE BRAKING SYSTEM MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 108 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 109 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 110 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 111 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2 BEV

14.2.1 ATTRACTIVE GOVERNMENT INITIATIVES AND STRINGENT EMISSION STANDARDS TO DRIVE BEV SALES

TABLE 112 BEV REGENERATIVE BRAKING SYSTEM MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 113 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 114 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 PHEV

14.3.1 GROWING SALES DUE TO STRINGENT EMISSION STANDARDS TO DRIVE DEMAND

TABLE 116 PHEV REGENERATIVE BRAKING SYSTEM MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 117 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 118 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 MARKET, BY REGION, 2022–2027 (USD MILLION)

15 BRAKE SYSTEM MARKET, BY REGION (Page No. - 161)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS/LIMITATIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 42 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 120 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 121 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 122 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 123 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.2 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC MARKET SNAPSHOT

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 125 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.2.1 CHINA

15.2.1.1 Growing vehicle production to drive market

TABLE 128 CHINA: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 129 CHINA: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 130 CHINA: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.2.2 INDIA

15.2.2.1 Stringency in safety standards to drive market

TABLE 132 INDIA: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 133 INDIA: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 134 INDIA: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 135 INDIA: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.2.3 JAPAN

15.2.3.1 Rising penetration of automatic braking systems to drive market

TABLE 136 JAPAN: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 137 JAPAN: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 138 JAPAN: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.2.4 SOUTH KOREA

15.2.4.1 Government mandates for implementation of advanced brake systems to drive market

TABLE 140 SOUTH KOREA: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 141 SOUTH KOREA: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 142 SOUTH KOREA: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 143 SOUTH KOREA: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.2.5 REST OF ASIA PACIFIC

TABLE 144 REST OF ASIA PACIFIC: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 145 REST OF ASIA PACIFIC: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 146 REST OF ASIA PACIFIC: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3 EUROPE

FIGURE 44 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027

TABLE 148 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 149 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 150 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.3.1 GERMANY

15.3.1.1 Implementation of advanced emergency braking systems as standard fitment to drive market

TABLE 152 GERMANY: BRAKE SYSTEM MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 153 GERMANY: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 154 GERMANY: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 155 GERMANY: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3.2 FRANCE

15.3.2.1 Increasing penetration of disc brakes to drive market

TABLE 156 FRANCE: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 157 FRANCE: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 158 FRANCE: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 159 FRANCE: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3.3 SPAIN

15.3.3.1 Implementation of AEB in passenger cars to drive market

TABLE 160 SPAIN: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 161 SPAIN: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 162 SPAIN: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 163 SPAIN: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3.4 ITALY

15.3.4.1 Regulations mandating AEB to drive market

TABLE 164 ITALY: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 165 ITALY: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 166 ITALY: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 167 ITALY: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3.5 UK

15.3.5.1 Increasing adoption of ABS and ESC to drive market

TABLE 168 UK: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 169 UK: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 170 UK: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 171 UK: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.3.6 REST OF EUROPE

TABLE 172 REST OF EUROPE: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 173 REST OF EUROPE: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 174 REST OF EUROPE: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 175 REST OF EUROPE: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.4 NORTH AMERICA

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 176 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 177 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 178 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 179 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.4.1 US

15.4.1.1 Regulations to reduce stopping distance in commercial vehicles to drive market

TABLE 180 US: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 181 US: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 182 US: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 183 US: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.4.2 CANADA

15.4.2.1 Mandatory features such as ABS and ESC to drive market

TABLE 184 CANADA: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 185 CANADA: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 186 CANADA: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 187 CANADA: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.4.3 MEXICO

15.4.3.1 Free trade agreements promoting domestic production of brake system components to drive market

TABLE 188 MEXICO: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 189 MEXICO: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 190 MEXICO: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 191 MEXICO: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.5 REST OF THE WORLD (ROW)

FIGURE 46 ROW: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 192 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 193 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 194 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 195 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.5.1 BRAZIL

15.5.1.1 Setting up of local plants for brake system components to drive market

TABLE 196 BRAZIL: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 197 BRAZIL: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 198 BRAZIL: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.5.2 TURKEY

15.5.2.1 Lower manufacturing and labor costs to drive market

TABLE 200 TURKEY: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 201 TURKEY: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 202 TURKEY: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 203 TURKEY: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.5.3 RUSSIA

15.5.3.1 Increasing adoption of disc brakes in LCVs to drive market

TABLE 204 RUSSIA: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 205 RUSSIA: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 206 RUSSIA: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 207 RUSSIA: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

15.5.4 OTHERS

TABLE 208 OTHERS: MARKET, BY BRAKE TYPE, 2018–2021 (‘000 UNITS)

TABLE 209 OTHERS: MARKET, BY BRAKE TYPE, 2022–2027 (‘000 UNITS)

TABLE 210 OTHERS: MARKET, BY BRAKE TYPE, 2018–2021 (USD MILLION)

TABLE 211 OTHERS: MARKET, BY BRAKE TYPE, 2022–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 196)

16.1 OVERVIEW

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 212 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGY, 2019–2021

16.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2021

16.4 MARKET SHARE ANALYSIS

TABLE 213 MARKET STRUCTURE, 2021

FIGURE 47 MARKET SHARE ANALYSIS, 2021

16.5 COMPETITIVE LEADERSHIP MAPPING

16.5.1 STARS

16.5.2 EMERGING LEADERS

16.5.3 PERVASIVE PLAYERS

16.5.4 PARTICIPANTS

FIGURE 48 COMPETITIVE LEADERSHIP MAPPING: BRAKE SYSTEM MANUFACTURERS

TABLE 214 MARKET: COMPANY FOOTPRINT

TABLE 215 COMPANY TECHNOLOGY FOOTPRINT

TABLE 216 COMPANY REGION FOOTPRINT (19 COMPANIES)

16.6 COMPETITIVE LEADERSHIP MAPPING: OFF-HIGHWAY EQUIPMENT BRAKE SYSTEM MANUFACTURERS

16.6.1 STARS

16.6.2 EMERGING LEADERS

16.6.3 PERVASIVE PLAYERS

16.6.4 PARTICIPANTS

FIGURE 49 COMPETITIVE LEADERSHIP MAPPING: OFF-HIGHWAY EQUIPMENT BRAKE SYSTEM MANUFACTURERS

TABLE 217 OFF-HIGHWAY EQUIPMENT MARKET: COMPANY FOOTPRINT

TABLE 218 COMPANY INDUSTRY FOOTPRINT (OFF-HIGHWAY EQUIPMENT) (12 COMPANIES)

TABLE 219 COMPANY REGION FOOTPRINT (OFF-HIGHWAY EQUIPMENT) (12 COMPANIES)

16.7 COMPETITIVE SCENARIO

16.8 NEW PRODUCT LAUNCHES

TABLE 220 NEW PRODUCT DEVELOPMENT, 2018–2022

16.9 DEALS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, EXPANSION, AND JOINT VENTURES

TABLE 221 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES, 2018–2022

17 COMPANY PROFILES (Page No. - 216)

(Business overview, Products/Solutions offered, Recent Developments, SWOT analysis, MNM view)*

17.1 KEY PLAYERS

17.1.1 CONTINENTAL AG

TABLE 222 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 50 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 223 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 224 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 225 CONTINENTAL AG: DEALS

17.1.2 ROBERT BOSCH GMBH

TABLE 226 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 51 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 227 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 228 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 229 ROBERT BOSCH GMBH: DEALS

17.1.3 ZF FRIEDRICHSHAFEN AG

TABLE 230 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

FIGURE 52 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 231 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

TABLE 232 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

TABLE 233 ZF FRIEDRICHSHAFEN AG: DEALS

17.1.4 AKEBONO BRAKE INDUSTRY CO., LTD.

TABLE 234 AKEBONO BRAKE INDUSTRY CO., LTD.: BUSINESS OVERVIEW

FIGURE 53 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY SNAPSHOT

TABLE 235 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCTS OFFERED

TABLE 236 AKEBONO BRAKE INDUSTRY CO., LTD.: NEW PRODUCT DEVELOPMENTS

17.1.5 BREMBO S.P.A.

TABLE 237 BREMBO S.P.A.: BUSINESS OVERVIEW

FIGURE 54 BREMBO S.P.A.: COMPANY SNAPSHOT

TABLE 238 BREMBO S.P.A.: PRODUCTS OFFERED

TABLE 239 BREMBO S.P.A.: NEW PRODUCT DEVELOPMENTS

TABLE 240 BREMBO S.P.A.: DEALS

17.1.6 AISIN SEIKI CO., LTD.

TABLE 241 AISIN SEIKI CO., LTD.: BUSINESS OVERVIEW

FIGURE 55 AISIN SEIKI CO., LTD.: COMPANY SNAPSHOT

TABLE 242 AISIN SEIKI CO., LTD.: PRODUCTS OFFERED

TABLE 243 AISIN SEIKI CO., LTD.: DEALS

17.1.7 HITACHI ASTEMO LTD.

TABLE 244 HITACHI ASTEMO LTD.: BUSINESS OVERVIEW

FIGURE 56 HITACHI ASTEMO LTD.: COMPANY SNAPSHOT

TABLE 245 HITACHI ASTEMO LTD.: PRODUCTS OFFERED

TABLE 246 HITACHI ASTEMO LTD.: DEALS

17.1.8 KNORR-BREMSE AG

TABLE 247 KNORR-BREMSE AG: BUSINESS OVERVIEW

FIGURE 57 KNORR-BREMSE AG: COMPANY SNAPSHOT

TABLE 248 KNORR-BREMSE AG: PRODUCTS OFFERED

17.1.9 HALDEX AB

TABLE 249 HALDEX AB: BUSINESS OVERVIEW

FIGURE 58 HALDEX AB: COMPANY SNAPSHOT

TABLE 250 HALDEX AB: PRODUCTS OFFERED

TABLE 251 HALDEX AB: NEW PRODUCT DEVELOPMENTS

TABLE 252 HALDEX AB: DEALS

17.1.10 DENSO CORPORATION

TABLE 253 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 59 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 254 DENSO CORPORATION: PRODUCTS OFFERED

17.2 OTHER PLAYERS

17.2.1 MANDO CORPORATION

TABLE 255 MANDO CORPORATION: BUSINESS OVERVIEW

17.2.2 HYUNDAI MOBIS CO., LTD.

TABLE 256 HYUNDAI MOBIS CO., LTD.: BUSINESS OVERVIEW

17.2.3 WUHAN YOUFIN AUTO PARTS CO., LTD.

TABLE 257 WUHAN YOUFIN AUTO PARTS CO., LTD.: BUSINESS OVERVIEW

17.2.4 ADVICS CO., LTD.

TABLE 258 ADVICS CO., LTD.: BUSINESS OVERVIEW

17.2.5 WUHU BETHEL AUTOMOTIVE SAFETY SYSTEM CO., LTD. (WBTL)

TABLE 259 WUHU BETHEL AUTOMOTIVE SAFETY SYSTEM CO., LTD.: BUSINESS OVERVIEW

17.2.6 BERINGER

TABLE 260 BERINGER: BUSINESS OVERVIEW

17.2.7 EBC BRAKES

TABLE 261 EBC BRAKES: BUSINESS OVERVIEW

17.2.8 NIFO SRL

TABLE 262 NIFO SRL: BUSINESS OVERVIEW

17.2.9 BWI NORTH AMERICA INC

TABLE 263 BWI NORTH AMERICA INC: BUSINESS OVERVIEW

17.2.10 MERITOR, INC.

TABLE 264 MERITOR INC.: BUSINESS OVERVIEW

17.3 NORTH AMERICA PLAYERS – COMPANY PROFILES

17.3.1 BRAKE PARTS INC. LLC

TABLE 265 BRAKE PARTS INC. LLC: BUSINESS OVERVIEW

17.3.2 JACOBS VEHICLE SYSTEMS, INC.

TABLE 266 JACOBS VEHICLE SYSTEMS, INC.: BUSINESS OVERVIEW

17.3.3 WAGNER BRAKE

TABLE 267 WAGNER BRAKE: BUSINESS OVERVIEW

17.3.4 BLUDOT MANUFACTURING

TABLE 268 BLUDOT MANUFACTURING: BUSINESS OVERVIEW

17.3.5 CARLISLE BRAKE & FRICTION

TABLE 269 CARLISLE BRAKE & FRICTION: BUSINESS OVERVIEW

17.3.6 AMETEK INC.

TABLE 270 AMETEK INC.: BUSINESS OVERVIEW

17.3.7 AUSCO PRODUCTS, INC.

TABLE 271 AUSCO PRODUCTS, INC.: BUSINESS OVERVIEW

17.3.8 MULLER BRAKES AMERICA INC.

TABLE 272 MULLER BRAKES AMERICA INC.: BUSINESS OVERVIEW

17.3.9 MOMENTUM USA, INC.

TABLE 273 MOMENTUM USA INC.: BUSINESS OVERVIEW

17.3.10 MIDWEST BRAKE

TABLE 274 MIDWEST BRAKE: BUSINESS OVERVIEW

*Details on Business overview, Products/Solutions offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

18 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 259)

18.1 ASIA PACIFIC: POTENTIAL MARKET FOR BRAKE SYSTEMS

18.2 COMPANIES SHOULD FOCUS ON DISC BRAKES

18.3 GROWING DEMAND FOR HYDRAULIC WET BRAKES IN AGRICULTURAL TRACTORS

18.4 CONCLUSION

19 APPENDIX (Page No. - 261)

19.1 CURRENCY & PRICING

TABLE 275 CURRENCY EXCHANGE RATES (WRT PER USD)

19.2 INSIGHTS FROM INDUSTRY EXPERTS

19.3 DISCUSSION GUIDE

19.4 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

19.5 CUSTOMIZATION OPTIONS

19.5.1 ALL-TERRAIN VEHICLES MARKET, BY BRAKE TYPE

19.5.1.1 Drum

19.5.1.2 Disc

19.5.2 HYDRAULIC DISC BRAKE SYSTEM MARKET, BY REGION

19.5.2.1 Asia Pacific

19.5.2.2 Europe

19.5.2.3 North America

19.5.2.4 RoW

19.5.3 HYDRAULIC DRUM BRAKE SYSTEM MARKET, BY REGION

19.5.3.1 Asia Pacific

19.5.3.2 Europe

19.5.3.3 North America

19.5.3.4 RoW

19.5.4 PNEUMATIC DRUM BRAKE SYSTEM MARKET, BY REGION

19.5.4.1 Asia Pacific

19.5.4.2 Europe

19.5.4.3 North America

19.5.4.4 RoW

19.5.5 PNEUMATIC DISC BRAKE SYSTEM MARKET, BY REGION

19.5.5.1 Asia Pacific

19.5.5.2 Europe

19.5.5.3 North America

19.5.5.4 RoW

19.6 RELATED REPORTS

19.7 AUTHOR DETAILS

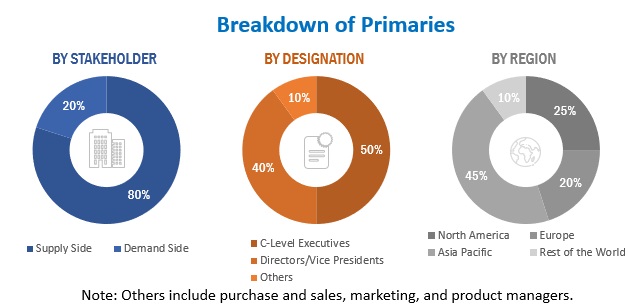

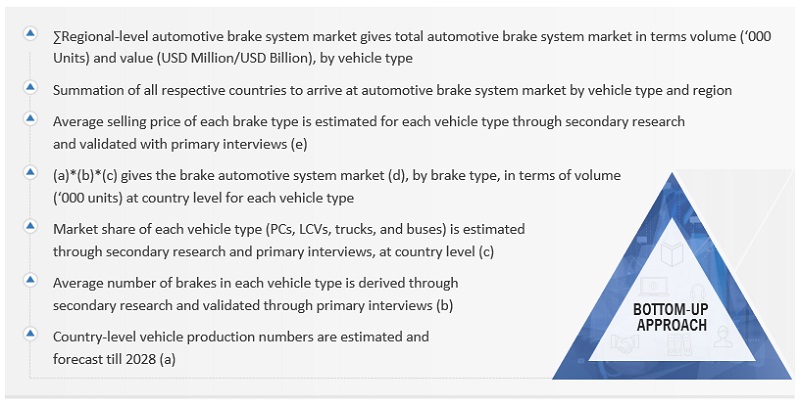

The study involved four major activities to estimate the current size of the brake system market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the brake system market. The secondary sources referred to in this research study include Organisation Internationale des Constructeurs d'Automobiles (OICA), MEMA Brake Manufacturers Council (BMC), Automotive Component Manufacturers Association of India (ACMA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Additionally, secondary research has been carried out to understand the average selling prices of disc and drum brake by vehicle type, historic sales of new vehicles, and vehicle parc. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as ICE vehicle and off-highway equipment sales forecast, disc & drum brake market penetration & forecast, future technology trends, and upcoming technologies in the brake system industry. Data triangulation was then done with the information gathered from secondary research. Stakeholders from demand as well as supply side have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from demand and supply side across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the brake system market and other dependent submarkets, as mentioned below:

- Key players in the brake system market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the brake system were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Brake System Market (On- & Off-Highway): Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends.

Report Objectives

-

To define, describe, and forecast the brake system market, in terms of value

(USD million), based on the following segments:- Brake type [Disc and Drum]

- Brake Technology [(antilock braking system (ABS), traction control system (TCS), electronic stability control (ESC), and electronic brake-force distribution (EBD)]

- Off-highway Application [agriculture tractor, construction equipment, and mining equipment]

- Vehicle Type [passenger car, LCV, truck and bus]

- Off-highway Brake Type [hydrostatic brake, hydraulic wet brake, dynamic brake, and others]

- Actuation [pneumatic brake and hydraulic brake]

- Regenrative Brake system [ BEV and PHEV]

- ATV Brake system [North America, Europe, Asia Pacific, and the Rest of the World (RoW)]

- Region [North America, Europe, Asia Pacific, and the Rest of the World (RoW)]

- To provide detailed information regarding major factors influencing the brake system market (drivers, restraints, opportunities, and challenges)

-

To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the brake system market

- To conduct:

- Case Study Analysis

-

Technology Analysis

- To Analyze:

- Value Chain Analysis

- Trade Analysis

- Market ecosystem analysis

- Tariff and Regulatory Landscape Analysis

- Porter’s Five Force Analysis

- Average Selling Price Analysis

- To analyze the market share of key players in the brake system market, revenue analysis of top 5 players and competitive evaluation quadrant (on- & off-highway brake system manufacturers)

Electronic Brakes& Its impact on Brake System Market

Electronic brakes, also known as brake-by-wire systems, are increasingly being used as an alternative to traditional hydraulic braking systems in the automotive industry. Instead of the mechanical linkages and hydraulic fluids used in traditional brake systems, these systems use sensors, electronic control units, and electric actuators to control braking force. Electronic brakes are being adopted for a variety of reasons, including increased safety, improved performance, and reduced weight and complexity. Electronic brakes provide faster response times, more precise control, and improved stability control, which is critical in advanced driver assistance systems (ADAS) and autonomous driving applications.

The growing popularity of electronic brakes is expected to have a significant impact on the brake system market, which includes both OEMs and aftermarket suppliers. The global brake system market is expected to reach $26.5 billion by 2025, with a compound annual growth rate (CAGR) of 5.4% from 2020 to 2025, according to MarketsandMarkets.

Several factors are driving the growth of the brake system market, including increased demand for commercial vehicles, rising safety concerns, and increased vehicle production. As OEMs and aftermarket suppliers invest in developing and commercialising new electronic braking technologies, the adoption of electronic brakes is expected to accelerate.

By extending the reach of Electronic Brakes companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increased demand for electronic braking components: As more vehicles use electronic brakes, the demand for electronic braking components such as sensors, electronic control units, and electric actuators will rise.

- Changes in manufacturing processes: Electronic brakes necessitate different manufacturing processes than traditional hydraulic brakes, which will necessitate changes in how brake systems are manufactured.

- New market players: Electronic brake adoption is expected to attract new players to the brake system market, such as electronics companies and software developers with experience developing and integrating electronic systems.

- Increased complexity and cost: Electronic brakes are typically more complex and costly than traditional hydraulic brakes, which may result in higher costs for vehicle manufacturers and consumers.

- Improved safety and performance: Electronic brakes provide faster response times, more precise control, and better stability control than traditional hydraulic brakes, potentially improving vehicle safety and performance.

The top players in the Electronic Brakes Market are Bosch, Continental, ZF Friedrichshafen AG, Delphi Technologies, Knorr-Bremse AG, Hitachi Automotive Systems, WABCO Holdings Inc.

Some of the key industries that are going to get impacted because in the future because of Electronic Brakes are,

- Aerospace industry: The aerospace industry is exploring the use of electronic braking systems in aircraft, which could improve braking performance and reduce weight.

- Railway industry: The railway industry is also exploring the use of electronic braking systems in trains, which could improve braking performance, reduce wear, and tear, and reduce maintenance costs.

- Industrial machinery industry: Electronic braking systems could also be used in industrial machinery, such as cranes and hoists, to provide more precise control and improved safety.

- Medical industry: Electronic braking systems could also be used in medical equipment, such as hospital beds and surgical tables, to provide more precise control and improve safety.

- Robotics industry: Electronic braking systems could also be used in robotics, such as industrial robots and drones, to provide more precise control and improve safety.

Speak to our analyst today to know more about "Electronic Brakes Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- On-highway System Market, by Vehicle Type & Brake Type

- Disc Brake

- Drum Brake

Note: Countries considered in Asia Pacific are: China, Japan, India, South Korea, and Rest of Asia Pacific; North America: US, Canada, and Mexico; Europe: Italy, UK, Germany, France, Spain, and rest of Europe; RoW: Brazil, Russia, Turkey and Rest of RoW

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Brake System Market

We are interested in this document, because we need to write a paper concerning the Knorr-Bremse and Haldex merger commissioned by the University of Leuven, Belgium.

I am a trainee from continental Corporation. We purchased this study a few month ago and have some further questions. Especially some questions in regard to some definitions and some results in the Off-highway area. Please contact me as soon as possible

let me keep this short as I do not have time to waste on this. I am interested in understanding brake manufacturers locations, annual outputs, expected growth and new programs won. Evidence that this report contains 3 out of 4 of these requirements I will buy your report.

OFF HIGHWAY BRAKES FOR CONSTRUCTION, AGRICULTURY, MINING, MILITARY MARKETS). Market share, sales, main customers of each player, main products, etc

Change from Vaccum Systems to electro hydraulic (EHB) Systems. How fast will the Change come into real volume production.

What would be the future market of Air Disc Brake in Commercial Vehicle market. And competition matrix in Brake system.

We are looking for information pertaining to Automotive Electronically Assisted Brake (EAB) System Market.

Car type vehicles M1 and light commercials N1, especially interesting hybrid vehicles. Also an interest in military vehicles

Would like to see the depth of your reports. Maybe you can show that especially for the passcar brakes market

Foundation brake suppliers - market share, awarded programs, plant locations in NAFTA, plant capacities.

Hello Please advise if your report details Automatic Park Brake, Electronic Park Brake Technology future implementation

We are interested in growing our company in Canada. We would like to explore a relationship with a brake manufacturer / supplier that wants to increase their after market share of the Canadian Market. We are looking for Marketing help to determine who, and how, to best accomplish an introduction to this opportunity.

Please share sample which will contain market shares by supplier in AP or EMEA for pads or discs. We have few report to chose from but I want to select the most accurate one - hence my request.