Automotive Ceramics Market by Material (Alumina Oxide Ceramic, Titanate Oxide Ceramic, Zirconia Oxide Ceramic), Application (Automotive Engine Parts, Automotive Exhaust Systems, Automotive Electronics), and Region - Global Forecast to 2022

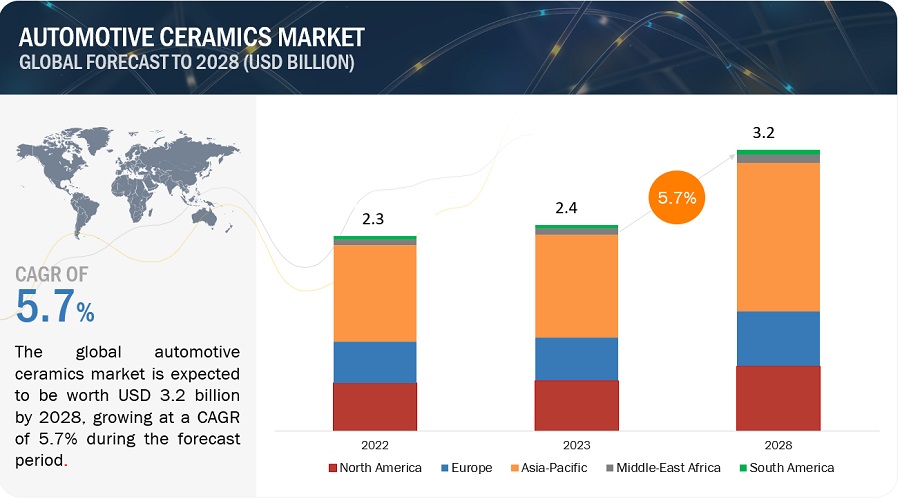

[119 Pages Report] automotive ceramics market was valued at USD 1.51 Billion in 2016 and is projected to reach USD 2.05 Billion by 2022, at a CAGR of 5.2% during the forecast period. In this report, 2016 has been considered as the base year and the forecast period has been considered from 2017 to 2022.

Objectives of this study are:

- To define, describe, and analyze the automotive ceramics market on the basis of material, application, and region

- To forecast and analyze the size of the automotive ceramics market (in terms of value and volume) in 6 key regions, namely, Asia Pacific, Western Europe, Central & Eastern Europe, North America, Middle East & Africa, and South America

- To forecast and analyze the automotive ceramics market at the country level in each region

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the automotive ceramics market

- To analyze opportunities in the automotive ceramics market for stakeholders by identifying high-growth segments of the market

- To identify significant market trends and factors driving or inhibiting the growth of the automotive ceramics market and its submarkets

- To analyze competitive developments, such as expansions, joint ventures, new products launches, and acquisitions in the automotive ceramics market

- To strategically profile key players in the automotive ceramics market and comprehensively analyze their growth strategies

This research study involves extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study on the automotive ceramics market. Primary sources that have been considered mainly include several industry experts from the core and related industries, and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during this research study on the automotive ceramics market:

To know about the assumptions considered for the study, download the pdf brochure

The automotive ceramics value chain includes automotive ceramics manufacturers, such as Kyocera (Japan), CeramTec (Germany), NGK Spark Plug (Japan), CoorsTek (US), and Morgan Advanced Materials (UK), among others that manufacture automotive ceramic materials, such as alumina oxide ceramic, titanate oxide ceramic, zirconia oxide ceramic, and others. These material are used by automotive parts and component manufacturers to develop various types of automotive parts and components, such as spark plugs, glow plugs, catalytic substrate, brakes, etc. that are further used in automobile manufacturing.

Target Audiences for the automotive ceramics market report are as follows:

- Manufacturers of Automotive Ceramics

- Suppliers of Automotive Ceramics

- Component Manufacturers

- Component Suppliers

- Service Providers

- Automotive End-users

- Government Bodies

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

This report categorizes the automotive ceramics market on the basis of material, application, and region.

Automotive Ceramics Market, by Material:

The automotive ceramics market has been segmented on the basis of material into:

- Alumina Oxide Ceramic

- Titanate Oxide Ceramic

- Zirconia Oxide Ceramic

- Others

Automotive Ceramics Market, by Application:

The automotive ceramics market has been segmented on the basis of application into:

- Automotive Engine Parts

- Automotive Exhaust Systems

- Automotive Electronics

- Others

Automotive Ceramics Market, by Region:

The automotive ceramics market has been studied for the following regions:

- Asia Pacific

- North America

- Western Europe

- Central & Eastern Europe

- Middle East & Africa and

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region to the country level with additional applications and/or types

Country Information

- Additional country information (up to 3)

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The automotive ceramics market is expected to grow from USD 1.59 Billion in 2017 to USD 2.05 Billion by 2022, at a CAGR of 5.2% from 2017 to 2022. Automotive ceramics find application in various automotive applications due to their unique properties. Contrary to conventional materials (metals & plastics), automotive ceramic products are lighter in weight, durable, and have better corrosion resistance properties. These factors are expected to drive the automotive ceramics market during the forecast period.

The automotive ceramics market has been classified on the basis of material into alumina oxide ceramic, titanate oxide ceramic, zirconia oxide ceramic, and others. Among materials, the zirconia oxide ceramic segment is projected to grow at the highest CAGR during the forecast period. Zirconia oxide ceramics are known to have very high resistance to crack propagation and, hence, are preferred over other ceramics for applications requiring superior properties. Automotive components manufactured from zirconia oxide ceramics are expensive than other oxide ceramics. Owing to properties such as their high density, high fracture toughness, high flexural strength, and high chemical resistance properties, leading market players prefer zirconia oxide ceramics to manufacture automotive components and parts.

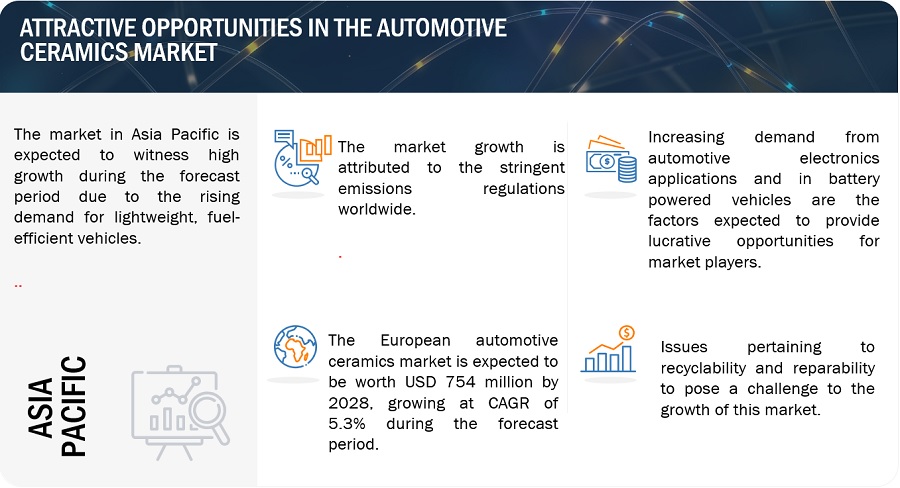

On the basis of application, the automotive ceramics market has been classified into automotive engine parts, automotive exhaust systems, automotive electronics, and others. The automotive engine parts application segment is projected to lead the automotive ceramics market during the forecast period. The growth of this segment can be attributed to the increasing use of automotive ceramics in spark plugs, glow plugs, high-pressure pumps, electronic fuel pumps, valves, sealing & insulation rings, and others. The automotive electronics application is projected to grow at the highest CAGR between 2017 and 2022.

The Asia Pacific region is the largest market for automotive ceramics. The automotive ceramics market in APAC is projected to grow at the highest CAGR between 2017 and 2022. This growth can be attributed to the presence of various key manufacturers of automotive ceramics in the region. The automotive ceramics manufacturers are shifting their base to this region mainly due to developing local markets and greater manufacturing competitiveness of growing APAC economies. The growth of the APAC automotive ceramics market is mainly driven by China, South Korea, and Japan. The demand for these ceramics in China has increased exceptionally and is expected to witness growth in the near future, owing to the continuous shift of the production facilities to this country from around the globe.

The major factor restraining the growth of the automotive ceramics market is their high cost as compared to their metal and plastic alternatives.

Some of the key players operating in the automotive ceramics market are Kyocera (Japan), CeramTec (Germany), NGK Spark Plug (Japan), CoorsTek (US), Morgan Advanced Materials (UK), Saint Gobain Ceramic Materials (US), IBIDEN (Japan), Ceradyne (US), and Corning (US), among others. Competition among these players is high, and they mostly compete with each other on the prices and quality of the products, their product portfolios, after sale services, and customized solutions, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in Automotive Ceramics Market

4.2 Automotive Ceramics Market, By Material

4.3 Automotive Ceramics Market in APAC, By Material and Country

4.4 Automotive Ceramics Market, Developed vs Developing Economies

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Excellent Properties of Automotive Ceramics

5.2.1.2 Increased Use as an Alternative to Metals and Plastics

5.2.1.3 Stringent Gas Emission Regulations Worldwide

5.2.2 Restraints

5.2.2.1 Higher Cost Than the Metals and Alloys

5.2.2.2 Customization Required for Specific Applications

5.2.3 Opportunities

5.2.3.1 Development of Low-Cost Production Technologies

5.2.3.2 Increasing Demand From Automotive Electronics Applications and in Battery-Powered Vehicles

5.2.4 Challenges

5.2.4.1 Issues Pertaining to Recyclability and Reparability

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Introduction

5.4.2 Trends and Forecasts of GDP

5.4.3 Trends of the Automotive Industry

6 Automotive Ceramics Market, By Material (Page No. - 39)

6.1 Introduction

6.2 Alumina Oxide Ceramics

6.3 Titanate Oxide Ceramics

6.4 Zirconia Oxide Ceramics

6.5 Others

7 Automotive Ceramics Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Automotive Engine Parts

7.3 Automotive Exhaust Systems

7.4 Automotive Electronics

7.5 Others

8 Automotive Ceramics Market, By Region (Page No. - 52)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.2.5 Indonesia

8.2.6 Rest of APAC

8.3 North America

8.3.1 US

8.3.2 Mexico

8.3.3 Canada

8.4 Western Europe

8.4.1 Germany

8.4.2 Spain

8.4.3 France

8.4.4 UK

8.4.5 Italy

8.4.6 Rest of Western Europe

8.5 Central & Eastern Europe

8.5.1 Russia

8.5.2 Turkey

8.5.3 Rest of Central & Eastern Europe

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

8.7 Middle East & Africa

8.7.1 South Africa

8.7.2 Iran

8.7.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 86)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 Acquisitions

9.3.3 Agreements & Joint Ventures

9.3.4 New Product Launches

10 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Kyocera

10.2 Ceramtec

10.3 NGK Spark Plug

10.4 Coorstek

10.5 Morgan Advanced Materials

10.6 Saint-Gobain Ceramics Materials

10.7 Ibiden

10.8 Ceradyne

10.9 Corning

10.10 Elan Technology

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Additional Players

10.11.1 Mcdanel Advanced Ceramic Technologies

10.11.2 Dyson Technical Ceramics

10.11.3 Almatis

10.11.4 International Syalons (Newcastle) Limited

10.11.5 PPG

10.11.6 Inmatec Technologies GmbH

10.11.7 Blasch Automotive Ceramics, Inc.

10.11.8 Baikowski Sas

10.11.9 Applied Ceramics, Inc.

10.11.10 Ortech Advanced Ceramics

10.11.11 Anoop Ceramics

10.11.12 Vinayak Techno Ceramics

10.11.13 Khyati Ceramics

10.11.14 Advanced Ceramics Manufacturing

10.11.15 American Elements

11 Appendix (Page No. - 111)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (75 Tables)

Table 1 Trends and Forecast of Per Capita GDP (USD)

Table 2 Automotive Production Data, By Country (2016)

Table 3 Automotive Sales Data, By Region (2016)

Table 4 Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 5 Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 6 Alumina Oxide Ceramics Market Size, By Region, 20152022 (USD Million)

Table 7 Alumina Oxide Ceramics Market Size, By Region, 20152022 (Kiloton)

Table 8 Titanate Oxide Ceramics Market Size, By Region, 20152022 (USD Million)

Table 9 Titanate Oxide Ceramics Market Size, By Region, 20152022 (Kiloton)

Table 10 Zirconia Oxide Ceramics Market Size, By Region, 20152022 (USD Million)

Table 11 Zirconia Oxide Ceramics Market Size By Region, 20152022 (Kiloton)

Table 12 Other Ceramic Materials Market Size, By Region, 20152022 (USD Million)

Table 13 Other Ceramic Materials Market Size, By Region, 20152022 (Kiloton)

Table 14 Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 15 Automotive Ceramics Market Size in Automotive Engine Parts, By Region, 20152022 (USD Million)

Table 16 Automotive Ceramics Market Size in Automotive Exhaust Systems, By Region, 20152022 (USD Million)

Table 17 Automotive Ceramics Market Size in Automotive Electronics, By Region, 20152022 (USD Million)

Table 18 Automotive Ceramics Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 19 Automotive Ceramics Market Size, By Region, 20152022 (USD Million)

Table 20 Automotive Ceramics Market Size, By Region, 20152022 (Kiloton)

Table 21 Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 22 Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 23 Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 24 APAC: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 25 APAC: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 26 APAC: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 27 APAC: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 28 China: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 29 Japan: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 30 South Korea: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 31 India: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 32 Indonesia: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 33 Rest of APAC: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 34 North America: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 35 North America: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 36 North America: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 37 North America: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 38 US: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 39 Mexico: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 40 Canada: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 41 Western Europe: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 42 Western Europe: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 43 Western Europe: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 44 Western Europe: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 45 Germany: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 46 Spain: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 47 France: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 48 UK: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 49 Italy: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 50 Rest of Western Europe: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 51 Central & Eastern Europe: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 52 Central & Eastern Europe: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 53 Central & Eastern Europe: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 54 Central & Eastern Europe: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 55 Russia: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 56 Turkey: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 57 Rest of Central & Eastern Europe: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 58 South America: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 59 South America: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 60 South America: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 61 South America: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 62 Brazil: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 63 Argentina: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 64 Rest of South America: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 65 Middle East & Africa: Automotive Ceramics Market Size, By Country, 20152022 (USD Million)

Table 66 Middle East & Africa: Automotive Ceramics Market Size, By Country, 20152022 (Kiloton)

Table 67 Middle East & Africa: Automotive Ceramics Market Size, By Material, 20152022 (USD Million)

Table 68 Middle East & Africa: Automotive Ceramics Market Size, By Material, 20152022 (Kiloton)

Table 69 South Africa: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 70 Iran: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 71 Rest of Middle East & Africa: Automotive Ceramics Market Size, By Application, 20152022 (USD Million)

Table 72 Expansions, 20122017

Table 73 Acquisitions, 20122017

Table 74 Agreements & Joint Ventures, 20122017

Table 75 New Product Launches, 20122017

List of Figures (33 Figures)

Figure 1 Automotive Ceramics Market Segmentation

Figure 2 Automotive Ceramics Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Automotive Ceramics Market: Data Triangulation

Figure 6 Alumina Oxide Ceramics Account for Largest Share of Overall Automotive Ceramics Market

Figure 7 Automotive Electronics to Be Fastest-Growing Application of Automotive Ceramics

Figure 8 APAC Dominated Automotive Ceramics Market in 2016

Figure 9 Automotive Ceramics Market to Grow Significantly During Forecast Period

Figure 10 Alumina Oxide Ceramics to Be the Largest Segment in Overall Automotive Ceramics Market

Figure 11 Alumina Oxide Ceramics Segment Dominated Overall Market in APAC

Figure 12 Automotive Ceramics Market to Register High Growth in China During Forecast Period

Figure 13 Factors Governing Automotive Ceramics Market

Figure 14 Automotive Ceramics Market: Porters Five Forces Analysis

Figure 15 Zirconia Oxide Ceramics to Be Fastest-Growing Segment During Forecast Period

Figure 16 APAC to Be Largest Market for Alumina Oxide Ceramics-Based Automotive Ceramics

Figure 17 Automotive Electronics to Be Fastest-Growing Application of Automotive Ceramics

Figure 18 Automotive Engine Parts to Be Largest Application of Automotive Ceramics in APAC

Figure 19 Automotive Ceramics Market Regional Snapshot

Figure 20 APAC: Automotive Ceramics Market Snapshot

Figure 21 North America: Automotive Ceramics Market Snapshot

Figure 22 Western Europe: Automotive Ceramics Market Snapshot

Figure 23 Central & Eastern Europe: Automotive Ceramics Market Snapshot

Figure 24 South America: Automotive Ceramics Market Snapshot

Figure 25 Middle East & Africa: Automotive Ceramics Market Snapshot

Figure 26 Companies Primarily Adopted Expansion as the Key Growth Strategy Between 2012 and 2017

Figure 27 Automotive Ceramics Market Ranking, 2016

Figure 28 Kyocera: Company Snapshot

Figure 29 Ceramtec: Company Snapshot

Figure 30 NGK Spark Plug: Company Snapshot

Figure 31 Morgan Advanced Materials: Company Snapshot

Figure 32 Ibiden: Company Snapshot

Figure 33 Corning: Company Snapshot

Growth opportunities and latent adjacency in Automotive Ceramics Market