Automotive Coatings Market by Resin Type (Polyurethane, Epoxy, Acrylic, and Others), Technology (Solvent-based, Water-based, and Powder-based), Coat Type (Clearcoat, Basecoat, Primer, and E-coat), and Region - Global Forecast to 2027

Automotive Coatings Market

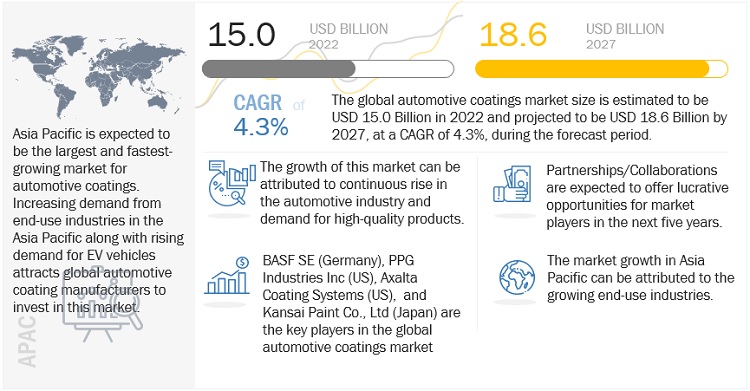

The global automotive coatings market was valued at USD 15.0 billion in 2022 and is projected to reach USD 18.6 billion by 2027, growing at a cagr 4.3% from 2022 to 2027. The automotive coatings sector evolved with the automobile industry. Both businesses are constantly evolving in order to give sophisticated technology and products that are sustainable to their customers. Automobile coatings demand is largely determined by demand patterns in the automotive sector, environmental legislation, health and safety standards, buyer preferences, lifestyle, and the rising economy. These variables have a favourable influence on the automotive coatings business and aid in its growth. Aside from looks, automobile coatings serve a significant function in protecting vehicle metal surfaces against rust and other hazards. Attractive colours, textures, and patterns make automobiles more appealing, which can be a deciding factor for customers.

Attractive Opportunities in Automotive Coatings Market

Source: Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Coatings Market Dynamics

Driver: Green, environment-friendly, and healthier coating systems

According to International Organization of Motor Vehicle Manufacturers (OICA), global vehicle sales have increased from 78.7 million units in 2020 to 82.6 million units in 2021. Of these, the sales of passenger cars were 53.9 million units in 2020, which increased to 56.3 million units in 2021. This demand is increasing at an annual average growth rate (AAGR) of about 4.4% during the aforementioned years. Similar trends are witnessed with increasing population, purchasing power, improving lifestyles & standard of living, and developing infrastructure across the globe that is expected to boost the automotive industry.

According to OICA, the global vehicle production has increased from 77.6 million units in 2020 to 80.1 million units in 2021. The year 2020 did not see a significant increase in overall new internal combustion engine automobile registrations. The global market for all kinds of automobiles was affected due to the COVID-19 pandemic and the subsequent economic collapse. In the midst of the pandemic, the worldwide EV sales were extremely uncertain at the start of the year. However, as time passed, 2020 proved to be a surprisingly good year, with worldwide EV sales increasing by 43% from 2019 and the global electric car industry share reaching a record 4,6%. In 2021, the number of electric vehicles (EVs) sold in September exceeded those sold in entire 2012. EVs are expected to play a key part in the goal of zero-emission objectives set for 2050, for which the industry is preparing.

Emerging markets in Asia Pacific, such as China, India, South Korea, and Southeast Asian countries, are attracting global players to set up their manufacturing bases in this region. The increased investments in various technological, infrastructural, and R&D sectors have necessitated coating manufacturers to supply qualitative products to these end users to capitalize on the increased demand in the region. These markets are also propelled by economic growth and subsequent increase in consumption from end-use industries. The Asia Pacific region is expecting heavy Foreign Direct Investment (FDI) in China, Indonesia, Vietnam, Philippines, Myanmar, Malaysia, Thailand, India, Sri Lanka, and Bangladesh. Hence, the automotive production is expected to boost during the forecast period. In order to sustain the demands of these automobile manufacturers, the coating manufacturers have also started focusing on expansions in these regions.

Restraint: Volatility of raw material prices

Price and availability of raw materials are key factors for automotive coating manufacturers in deciding their cost structure and future investments. The key raw materials used in automotive coatings are resins, additives, and solvents obtained through petroleum distillates. The prices of these materials have been highly volatile in recent times. An increase in raw material prices and fluctuating oil prices have been the primary causes for an increase in automotive price, globally. The automotive coating manufacturing industry gets affected by higher transport costs driven by inconsistent fuel prices, and higher manufacturing costs resulting from increasing energy costs. In addition, existing environmental regulations are pushing these coating manufacturers to use eco-friendly and more durable coatings. Such instability in raw material costs with regulatory pressure from governmental organizations poses risks to profit margins of automotive coating manufacturers.

Oil prices showed a drastic downtrend for the first time in history about two years ago during the COVID-19 pandemic. Such a drop in oil prices was not foreseen or witnessed. The economy began to revive as demand across sectors improved due to the resilience of governments throughout the world and actions taken by oil firms. However, when geopolitical conditions changed, oil prices rose beyond USD 110 per barrel in March 2022. Concerns regarding inflation and the broader global economic downturn have begun to develop, despite the positive outlook at the start of the year. More than 1.3 million bpd (barrel per day) of refinery capacity has been shut down in the US since 2019 owing to the impact of COVID-19 on demand, hurricane damage, harsher regulations, and greater operational expenses, among other factors. Owing to current sanctions, the concerns regarding scarcity are adding to the volatility of crude oil prices.

In order to maintain profit margins, the production costs are expected to be transferred to automobile manufacturers and, subsequently, customers. The need for better performance coating has been driven by many factors, such as increasing demand for premium cars, preference for cars with trendy colors, and demand for durable coatings. This has led to higher production costs for both coatings and car manufacturers. Automotive coating manufacturers now have to balance fluctuating raw material prices, innovative products with colour variation, and increased durability with decreased emissions.

Opportunity: Increasing use of powder-based coatings in automotive industry

Investments in the automotive industry in China provide high growth opportunities to powder-based coating manufacturers, as it is one of the main applications of these coatings. The country’s ministry of commerce announced in 2018 that there was a huge demand for new energy vehicles (NEVs) and other automobile products in China. This was due to the automotive market entering a new phase that featured diversified demand and quality-oriented purchases.

The automobile industry in China was increasing year-on-year until recently. According to the China Association of Automobile Manufacturers (CAAM), from 2019 to 2020, automobile production in the country declined by 3.1%. This decline in sales was a result of automobile manufacturers reducing the prices of automobiles due to the tax cuts introduced by the government. Customers, in the hope of more favourable policies, postponed purchasing cars, thus impacting the overall sales in the country. However, with the growing awareness regarding EVs and VOC-free paints, automobile production and sales in the country are expected to grow over the next five years. Powder-based coatings are used for coating automotive engines, chassis, wheels, filters, joysticks, mirrors, wipers, horns, and other parts of vehicles. The transparent powder-based coating is developed as a varnish for car bodies and other vehicles. With the development of new technologies and applications, as well as increasingly stringent environmental requirements, the application of powder-based coatings in the automotive industry is expected to increase in the future.

Challenge: Stringent regulatory policies

Owing to the increasing number of regulatory policies adopted by various governments, automotive coatings producers must constantly improve their processes to comply with the new policies. Products that fail to meet the legal requirements are not allowed in countries that have stringent regulations, especially in Western Europe and North America.

Unfortunately, some legislators continue to limit emission values based only on the concentration of VOC in exhaust gases. This can lead to the approval for high mass emissions from processes, which require high airflows as against low mass emissions that only need very low airflows. The concentration approach also ignores the reduced atmospheric emissions when low-VOC coatings are used.

The polyurethane segment is expected to register the highest CAGR during the forecast period.

The polyurethane resin type segment is expected to register the highest CAGR during the forecast period. With its pleasing cohesiveness, abrasion resistance, and high glossiness, polyurethane coating is one of the primary kinds having key positions in the coating business. Polyurethane is synthesized by reacting an isocyanate with two or more isocyanate groups with a polyol with two or more hydroxyl groups in the presence of a catalyst or by activation with UV radiation. This resin's raw components include di- and triisocyanates as well as polyols. Polyurethane resin is simple to clean and has features such as great durability, toughness, and gloss. Polyurethane resin is used in a variety of applications around the world because of its properties.

The water-based segment is expected to be the fastest-growing segment, by technology, in the automotive coatings market during the forecast period.

Water-based coating technology is formulated with water as the baser. Water is the main solvent in this technology, but it also contains other solvents, for instance, glycol ethers. There is about 80% water content in the entire formulation of water-based coating. The major advantage of this technology is low toxicity & flammability due to low VOC levels and HAP emissions, which helps reduce air emissions. A coating with this technology has excellent adhesion and greater heat resistance compared to other technologies. The disadvantage of this technology is corrosion to equipment used in the coating process; for instance, water-based paints can corrode plain steel and aluminium. Water-based coatings have a VOC content of fewer than 3.5 pounds per gallon of water. Almost all types of resins, such as vinyl, two-component acrylics, epoxies, polyesters, alkyd, and urethanes, are available in water-based versions.

The automotive coatings market in Asia Pacific is expected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the largest market for automotive coatings, and this dominance is expected to continue during the forecast period. High economic growth rate, growing manufacturing industries, cheap labor, and global shift of consumption and production capacities from the developed markets to the emerging markets in the region are factors attributed to the growth of the automotive coatings market in the Asia Pacific.

Prime manufacturers in this region concentrate on accelerated growth and penetration of online sales to open up newer avenues of revenue generation in untapped markets. Companies are constantly investing in disruptive techniques to enable beneficiary and cost-effective supply chain systems, and market leaders are introducing enterprise risk management systems in their manufacturing ecosystems which enables organizations to identify, assess, quantify, and manage risk on one centralized platform. Owing to the above-discussed factors, the Asia Pacific market is expected to provide a worth USD 10,914 million from 2022 to 2027.

Consumers demand high-quality automotive coatings that are used in the commercial sector but at an economical price, and thus manufacturers are focusing on minimizing miscellaneous expenses to lower operating costs while manufacturing the end product. As a result, profit margins and sales of automotive coatings in the commercial division are expected to achieve significant heights during the forecasted period

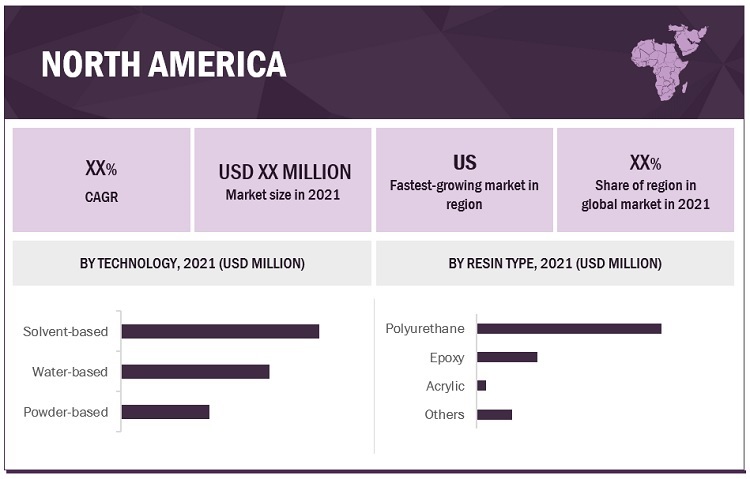

North America shows tremendous growth during the forecast period.

North America is a diversified market and has many automotive coating manufacturing companies. These companies primarily focus on new product developments to cater to the increasing demand from end-users. The North American automotive coatings market is driven by technological advancements in manufacturing and high-quality end product.

Special effect pigments offer a distinct appearance regardless of the end-use application. This is witnessed in the automotive industry, where they are used in coatings used on both the interior and exterior of vehicles. In North America, the usage of glass flakes, coloured aluminium, and aluminium pigments with considerably smaller particle size is growing due to the appeal of high sparkle finishes, vividly chromatic hues, and mirror-like finishes on interior components. Many automakers have decided to adopt the new, very reliable powder-based coatings that have been developed. Also, as an extra benefit, powder-based coatings offer the ability to aggressively adhere to environmental regulations. Currently, all primer surfacer operations in North America use powder-based coatings.

Automotive Coatings Market Players

BASF SE (Germany), Axalta Coating Systems (US), PPG Industries, Inc (US), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), KCC Corporation (Korea), The Sherwin-Williams Company (US), AkzoNobel N.V. (The Netherlands), Jotun A/S (Norway), Arkema S.A. (France) are the key players operating in the global market.

Automotive Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Resin Type, Technology, and Coat Type |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), Axalta Coating Systems (US), PPG Industries, Inc (US), Kansai Paint Co., Ltd (Japan), Nippon Paint Holding Co., Ltd (Japan), KCC Corporation (Korea), The Sherwin-Williams Company (US), AkzoNobel N.V. (The Netherlands), Jotun A/S (Norway), Arkema S.A. (France) |

This research report categorizes the automotive coatings market based on resin type, technology, coat type, and region.

Based on resin type, the automotive coatings market has been segmented as follows:

- Polyurethane

- Epoxy

- Acrylic

- Others

Based on technology, the automotive coatings market has been segmented as follows:

- Solvent-based

- Water-based

- Powder-based

Based on coat type, the automotive coatings market has been segmented as follows:

- Clearcoat

- Basecoat

- Primer

- E-coat

Based on the region, the automotive coatings market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In September 2021, Axalta Coating Systems LLC successfully completed the previously announced acquisition of U-POL Holdings Limited (U-POL). The acquisition of U-POL, a leading supplier of paints, protective coatings, and accessories primarily for the automotive aftermarket strengthens Axalta's global refinish leadership position and supports its broader growth strategy.

- In July 2021, AkzoNobel N.V. and Mercedes-Benz extended their partnership agreement for another four years. This entails the continuation of providing vehicle refinish products including automotive and specialty coatings and services in China and a preferred partner in Indonesia.

- In June 2021, PPG announced the expansion of its coatings manufacturing capacity in Europe for packaging applications. The investment is expected to meet the rising customer demand in the region for the latest generation coatings for aluminium and steel cans used in packaging for beverage, food, and personal care items.

- In June 2021, PPG completed the acquisition of Worwag, a global manufacturer of coatings for industrial and automotive applications. The company specializes in developing liquid, powder, and film coatings and operates in Germany, the US, China, South Africa, Mexico, Spain, Switzerland, and Poland. This acquisition is expected to provide further value to the company’s existing or new customers and shareholders.

Frequently Asked Questions (FAQ):

Does this report cover the different resin type of automotive coatings market?

Yes, the report covers the different resin type of automotive coatings.

Does this report covers different technology of automotive coatings?

Yes the report covers different technlogy of automotive coatings.

Does report covers the volume tables in addition to value tables?

Yes, the report covers the market both in terms of volume as well as value.

What is the current competitive landscape in the automotive coatings market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

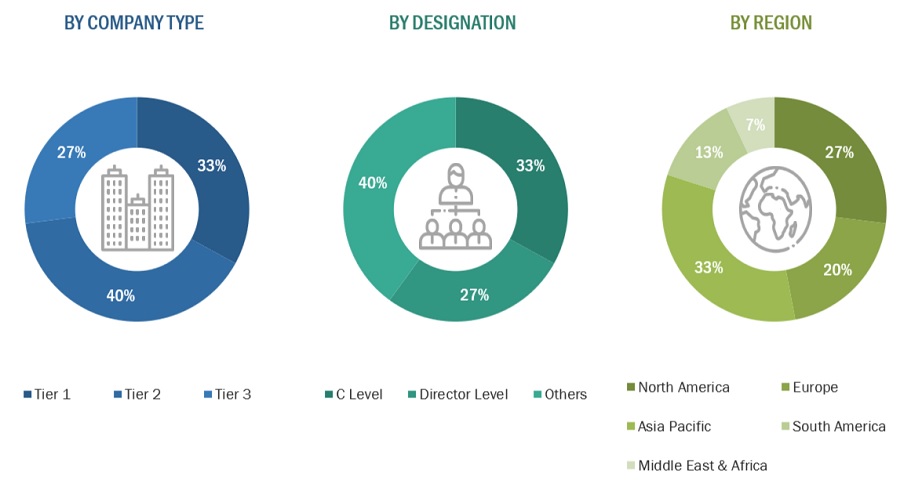

The study involved four major activities in estimating the current market size of automotive coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Automotive Coating Market Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the automotive coatings market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Automotive Coating Market Primary Research

The automotive coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction industry and its end uses such as Furniture, industrial, and packaging. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = <USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

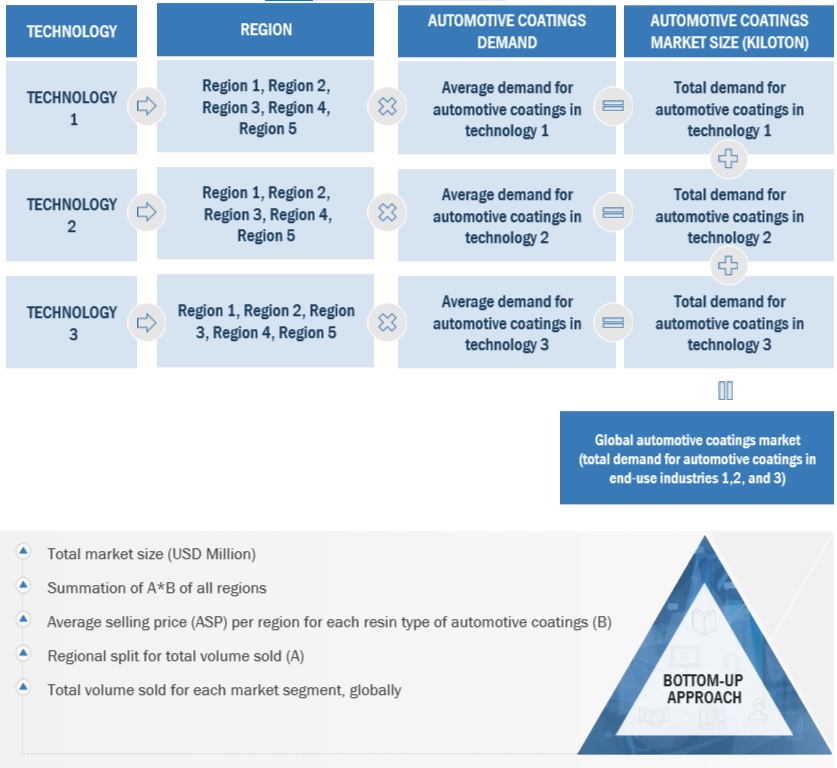

Automotive Coating Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

- The key players in the market were identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined through secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report .

Global Automotive Coatings Market: Top-Down Approach

Source: Secondary Research, and Interviews with Experts

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Coating Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data has been assumed to be correct.

Automotive Coating Market Report Objectives

- To analyze and forecast the size of the automotive coatings market in terms of value

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market and its submarkets

- To define, describe, and forecast the size of the market by resin type, technology, coat type, and region

- To forecast the size of the market and its submarkets with respect to five regions (along with their major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To strategically analyze each micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape of market leaders

- To track and analyze competitive developments such as new product launches, mergers & acquisitions, investment & expansions, and joint ventures in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Automotive Coating Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Automotive Coating Market Regional Analysis

- Further breakdown of a region with respect to a particular country

Automotive Coating Market Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Coatings Market