Automotive Fabric Market by Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses & Coaches) & Application (Floor Covering, Upholstery, Pre-assembled Interior Components, Tires, Safety-Belts, Airbags) - Global Forecast to 2021

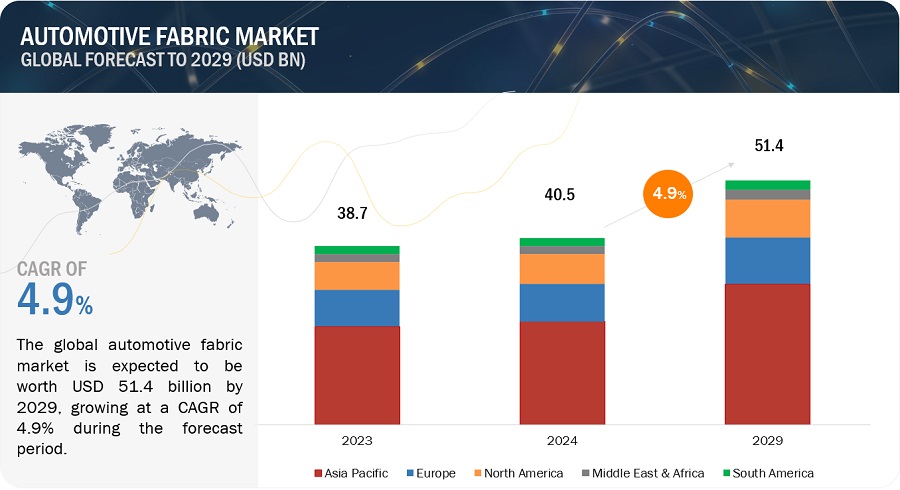

[170 Pages Report] The Automotive Fabric Market size was USD 28.81 Billion in 2015 and is projected to reach USD 34.35 Billion by 2021, registering a CAGR of 3.3% between 2016 and 2021. In this study, 2015 has been considered as the base year, and 20162021 as the forecast period for estimating market size of automotive fabrics.

Objectives of the study:

- To analyze and forecast the market size of automotive fabrics in terms value and volume

- To define, describe, and segment the global automotive fabric market by product, application, and region

- To forecast the sizes of the product and application market segments for regions such as Asia-Pacific, North America, Europe, South America, and Middle East & Africa

- To provide detailed information regarding the important factors influencing the growth of the market (drivers, restraints, challenges, and opportunities)

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, joint ventures, agreements, acquisitions, and new product developments in the global automotive fabric market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology:

In this report, market sizes have been derived using both bottom-up and top-down approaches. First, the market size for vehicle type (passenger cars, light commercial vehicles, heavy trucks, and buses & coaches); application (floor covering, upholstery, pre-assembled interior components, tires, airbags, safety belts, and others) and for various regions (Asia-Pacific, North America, Europe, South America, Middle East & Africa) is identified through both secondary and primary research. The overall automotive fabric market sizes for various regions and countries have been calculated by adding these individual markets. The automotive fabric market has been further segmented based on application, using percentage split gathered during the research. For future growth (CAGRs) trends of the automotive fabrics, the applications floor covering, upholstery, pre-assembled interior components, tires, airbags, safety belts, and others have been analyzed. Secondary resources include annual reports, press releases and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and so on. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The automotive fabrics value chain includes automotive fabrics manufacturers such as Adient Plc (Ireland), Lear Corporation (U.S.), Toyota Boshoku Corporation (Japan), Seiren Co., Ltd. (Japan), Suminoe Textile Co., Ltd. (Japan), SRF Limited (India), Sage Automotive Interiors Inc. (U.S.), Takata Corporation (Japan), Grupo Antolin Irausa, S.A. (Spain), and Tenowo GmbH (Germany). The automotive fabrics are majorly used in floor covering, upholstery, pre-assembled interior components, tires, airbags, safety belts, and others.

Target Audiences:

- Automotive Fabrics Manufacturers

- Distributors

- Industry Associations

- End-use Industries

- Government and Research Organizations

Thisstudy answers several questions for the stakeholders, primarily, which market segments to focus in the next two to five years for prioritizing efforts and investments.

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This report categorizes the global automotive fabric market based on vehicle type, application, and region.

Market Segmentation, by Vehicle Type:

The automotive fabric market has been segmented based on vehicle type into:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Trucks

- Buses & Coaches

Market Segmentation, by Application:

The automotive fabric market has been segmented based on application into:

- Floor Covering

- Upholstery

- Pre-assembled Interior Components

- Tires

- Airbags

- Safety Belts

- Others

Market Segmentation, by Region:

The regional analysis covers the following:

- Asia-Pacific

- North America

- Europe

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional application, and/or type

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The automotive fabric market is projected to reach USD 34.35 Billion by 2021, registering a CAGR of 3.3% between 2016 and 2021. Automotive fabrics are woven, non-woven, knitted, coated, or composite fabrics that are soft, flexible, elastic, lightweight, and durable. In addition, they also possess high strength and are water, fire, and UV resistant. The global automotive fabric market is mainly driven by the increased demand from end-use applications such as upholstery, floor covering, pre-assembled interior components, tires, airbags, and safety belts, among others.

The passenger cars segment accounts for the largest share of the automotive fabric market, by vehicle type. The market for automotive fabrics in passenger cars is estimated to witness significant growth owing to the increasing usage in various applications due to its high strength, elongation capability, and resistance to fire, water, and UV.

Airbags is estimated to be the fastest-growing application segment of the automotive fabric market. The airbags segment is projected to drive the automotive fabric market between 2016 and 2021. This is due to the increasing demand for safety devices in automobiles. In addition, the implementation of stringent safety standards for usage of airbags in automobiles is expected to drive the global demand for automotive fabrics. The automotive industry is already growing at a robust pace, which will contribute towards the growth of the automotive fabrics during the forecast period.

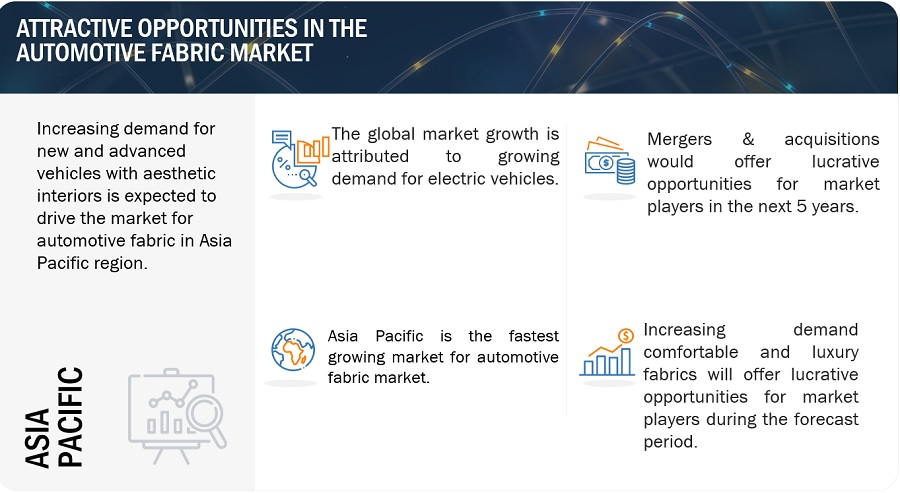

Asia-Pacific is the largest market for automotive fabrics, in terms of both value and volume. Population growth and rapid urbanization in key countries, such as China and India, accompanied by the rising demand for automobiles contribute to the growth of the automotive fabrics market in this region. In addition, major companies such as Takata Corporation (Japan) and Haartz Corporation (U.S.) are expanding their automotive fabrics business in the region. The increasing economic growth rate and heavy investments in industries including automobiles is driving the demand for automotive fabrics. The spending by government to boost public infrastructure including buses & coaches in the region is also boosting the demand for automotive fabrics. The major market players are also setting up their plants in Asia-Pacific due to cheap labor, availability of raw materials, and low cost of production.

North America is estimated to be the fastest growing automotive fabric market between 2016 and 2021. The strong domestic demand and export dynamism for automobiles, stringent automotive regulations and standards regarding the usage of airbags and safety belts by NHSTA, and strong economy accompanied by technological developments in automotive market boost the demand for automotive fabrics in the region.

The availability of non-fabric products such as natural leather, synthetic leather, artificial leather, and PVC leather act as a restraint for the automotive fabric market. Availability of substitutes is estimated to affect the automotive fabric market in the long term as advancements in non-fabric materials are expected.

The competitiveness of the automotive fabric market is continuously increasing with expansions and new product launches. Strategic developments are undertaken by major players such as are Adient Plc (Ireland), Lear Corporation (U.S.), Toyota Boshoku Corporation (Japan), Seiren Co., Ltd. (Japan), Suminoe Textile Co., Ltd. (Japan), SRF Limited (India), Sage Automotive Interiors Inc. (U.S.), Takata Corporation (Japan), Grupo Antolin Irausa, S.A. (Spain), and Tenowo GmbH (Germany), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Package Size

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Automotive Fabric Market

4.2 Automotive Fabric Market, By Region, 20162021

4.3 Automotive Fabric Market in Asia-Pacific, By Application and Country

4.4 Automotive Fabric Market Attractiveness

4.5 Automotive Fabric Market, By Vehicle Type

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Vehicle Type

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Impact Analysis for Short, Medium, and Long Term

5.3.2 Drivers

5.3.2.1 Rising Safety Measures in Automotive Application

5.3.2.2 Necessity for Weight Reduction Due to Stringent Co2 Emission

5.3.3 Restraints

5.3.3.1 Availability of Substitutes

5.3.4 Opportunities

5.3.4.1 Increasing Demand for Automobiles

5.3.4.2 Innovative Technological Development in Automotive Fabrics Industry

5.3.4.3 Rising Middle Class Income

5.3.5 Challenges

5.3.5.1 Hap Emissions

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Materials Or Fibers Used

6.2.2 Manufacturing

6.2.3 Final Product

6.2.4 Distribution

6.2.5 End-Use

6.3 Porters Five Forces Analysis:

6.3.1 Threat 0f New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Automotive Fabric Market, By Vehicle Type (Page No. - 49)

7.1 Introduction

7.2 Market Size Estimation

7.2.1 Passenger Cars

7.2.2 Light Commercial Vehicles

7.2.3 Heavy Trucks

7.2.4 Buses & Coaches

8 Automotive Fabric Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Floor Covering

8.2.1 Mainly Covers Carpets

8.2.2 Largest Automotive Fabric Application

8.3 Upholstery

8.3.1 Mainly Used for Seating Fabrics

8.3.2 Comfortable Seats and Aesthetic Design Supporting the Market Growth

8.4 Pre-Assembled Interior Component (PRIC)

8.4.1 Application Includes Seat Backs & Panels, Trunk Liners, Lower Door Panels, and Headliners

8.4.2 Decorative, Functional, Lightweight, Luxurious and Aesthetically Pleasing Interiors Driving the Demand

8.5 Tires

8.5.1 Tire Cord Fabrics are Used as Reinforcing Materials in Tires

8.5.2 Presence of Major Manufacturers to Drive the Growth of Tire Cord Fabrics in Asia-Pacific

8.6 Safety-Belts

8.6.1 Made of Multiple Layers of Woven Polyester Fabric

8.6.2 Stringent Laws in All Regions Regarding the Use of Safety-Belts is Driving the Growth

8.7 Airbags

8.7.1 Usually Made of Woven Nylon 66 Fabric

8.7.2 Stringent Regulation and Public Awareness Driving the Demand

8.8 Other Applications

9 Automotive Fabric Market, By Region (Page No. - 75)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Thailand

9.2.7 Malaysia

9.2.8 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Spain

9.4.3 France

9.4.4 U.K.

9.4.5 Italy

9.4.6 Russia

9.4.7 Poland

9.4.8 Rest of Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Turkey

9.6.2 Iran

9.6.3 South Africa

9.6.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 119)

10.1 Overview

10.2 Growth Strategies Adopted in the Automotive Fabric Market, 20122016

10.3 Market Share Analysis of Key Players

10.3.1 Toyota Boshoku Corporation

10.3.2 Adient PLC (Johnson Controls Automotive Experience)

10.3.3 Lear Corporation

10.3.4 Takata Corporation

10.4 Competitive Benchmarking

10.5 Competitive Situations and Trends

10.5.1 Expansions

10.5.2 New Product Launches

10.5.3 Acquisitions

10.5.4 Agreements

10.5.5 Joint Ventures

11 Company Profiles (Page No. - 131)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Adient PLC (Earlier Johnson Controls Automotive Experience)

11.2 Lear Corporation

11.3 Toyota Boshoku Corporation

11.4 Takata Corporation

11.5 Suminoe Textile Co., Ltd.

11.6 Seiren Co., Ltd.

11.7 SRF Limited

11.8 Sage Automotive Interiors Inc.

11.9 Grupo Antolin Irausa, S.A.

11.10 Tenowo GmbH

11.11 ACME Mills Company

11.12 Martur Automotive Seating Systems

11.13 Glen Raven, Inc.

11.14 Haartz Corporation

11.15 Other Key Market Players

11.15.1 Bmd Private Ltd.

11.15.2 Borgers Se & Co. KGaA (Germany)

11.15.3 Chori Co., Ltd.

11.15.4 CMI Enterprises Inc.

11.15.5 Heathcoat Fabrics Limited

11.15.6 Krishna

11.15.7 Moriden America Inc.

11.15.8 TB Kawashima Co., Ltd.

11.15.9 Trevira GmbH (Germany)

11.15.10 Uniroyal Engineered Products LLC.

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 161)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Related Reports

12.6 Author Details

List of Tables (118 Tables)

Table 1 Automotive Fabrics Market, By Vehicle Type

Table 2 Automotive Fabric Market, By Application

Table 3 Automotive Fabrics Market Size, By Vehicle Type, 2014-2021 (USD Million)

Table 4 Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 5 Automotive Fabrics Market Size in Passenger Cars Segment, By Region, 20142021 (USD Million)

Table 6 Automotive Fabric Market Size in Passenger Cars Segment, By Region, 20142021 (Million Square Meter)

Table 7 Automotive Fabrics Market Size in Light Commercial Vehicles Segment, By Region, 20142021 (USD Million)

Table 8 Automotive Fabric Market Size in Light Commercial Vehicles Segment, By Region, 20142021 (Million Square Meter)

Table 9 Automotive Fabrics Market Size in Heavy Trucks Segment, By Region, 20142021 (USD Million)

Table 10 Automotive Fabric Market Size in Heavy Trucks Segment, By Region, 20142021 (Million Square Meter)

Table 11 Automotive Fabrics Market Size in Buses & Coaches Segment, By Region, 20142021 (USD Million)

Table 12 Automotive Fabric Market Size in Buses & Coaches Segment, By Region, 20142021 (Million Square Meter)

Table 13 Automotive Fabrics Market, By Application, 2014-2021 (USD Million)

Table 14 Automotive Fabric Market, By Application, 2014-2021 (Million Square Meter)

Table 15 Automotive Fabrics Market in Floor Covering Application, By Region, 20142021 (USD Million)

Table 16 Automotive Fabric Market in Floor Covering Application, By Region, 20142021 (Million Square Meter)

Table 17 Automotive Fabrics Market in Upholstery Application, By Region, 20142021 (USD Million)

Table 18 Automotive Fabric Market in Upholstery Application, By Region, 20142021 (Million Square Meter)

Table 19 Automotive Fabrics Market in PRIC Application, By Region, 20142021 (USD Million)

Table 20 Automotive Fabric Market in PRIC Application, By Region, 20142021 (Million Square Meter)

Table 21 Automotive Fabrics Market in Tires Application, By Region, 20142021 (USD Million)

Table 22 Automotive Fabric Market in Tires Application, By Region, 2014-2021 (Million Square Meter)

Table 23 Automotive Fabrics Market in Safety-Belts Application, By Region, 2014-2021 (USD Million)

Table 24 Automotive Fabric Market in Safety-Belts Application, By Region, 2014-2021 (Million Square Meter)

Table 25 Automotive Fabrics Market in Airbags Application, By Region, 2014-2021 (USD Million)

Table 26 Automotive Fabric Market in Airbags Application, By Region, 2014-2021 (Million Square Meter)

Table 27 Automotive Fabrics Market in Other Applications, By Region, 20142021 (USD Million)

Table 28 Automotive Fabric Market in Other Applications, By Region, 2014-2021 (Million Square Meter)

Table 29 Automotive Fabrics Market Size, By Region, 20142021 (USD Million)

Table 30 Automotive Fabric Market Size, By Region, 20142021 (Million Square Meter)

Table 31 Asia-Pacific: Automotive Fabrics Market Size, By Country, 20142021 (USD Million)

Table 32 Asia-Pacific: Automotive Fabric Market Size, By Country, 20142021 (Million Square Meter)

Table 33 Asia-Pacific: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 34 Asia-Pacific: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 35 Asia-Pacific: Automotive Fabrics Market Size, By Application, 20142021 (USD Million)

Table 36 Asia-Pacific: Automotive Fabric Market Size, By Application, 20142021 (Million Square Meter)

Table 37 China : Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 38 China : Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 39 Japan: Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 40 Japan: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 41 India : Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 42 India : Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 43 South Korea : Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 44 South Korea : Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 45 Indonesia : Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 46 Indonesia : Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 47 Thailand: Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 48 Thailand: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 49 Malaysia : Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand USD)

Table 50 Malaysia: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 51 Rest of Asia-Pacific: Automotive Fabric Market Size, By Product, 20142021 (Thousand USD)

Table 52 Rest of Asia-Pacific: Automotive Fabrics Market Size, By Product, 20142021 (Thousand Square Meter)

Table 53 North America: Automotive Fabric Market Size, By Country, 20142021 (USD Million)

Table 54 North America: Automotive Fabrics Market Size, By Country, 20142021 (Million Square Meter)

Table 55 North America: Automotive Fabric Market Size, By Vehicle Type, 20142021 (USD Million)

Table 56 North America: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 57 North America: Automotive Fabric Market Size, By Application, 20142021 (USD Million)

Table 58 North America: Automotive Fabrics Market Size, By Application, 20142021 (Million Square Meter)

Table 59 U.S.: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 60 U.S.: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 61 Canada: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 62 Canada: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 63 Mexico: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 64 Mexico: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 65 Europe: Automotive Fabrics Market Size, By Country, 20142021 (USD Million)

Table 66 Europe: Automotive Fabric Market Size, By Country, 20142021 (Million Square Meter)

Table 67 Europe: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 68 Europe: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 69 Europe: Automotive Fabrics Market Size, By Application, 20142021 (USD Million)

Table 70 Europe: Automotive Fabric Market Size, By Application, 20142021 (Million Square Meter)

Table 71 Germany: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 72 Germany: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 73 Spain: Automotive Fabrics Market Size, By Vehicle Type, 20142015 (USD Million)

Table 74 Spain: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 75 France: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 76 France: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 77 U.K.: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 78 U.K.: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 79 Italy: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Thousand USD)

Table 80 Italy: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 81 Russia: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 82 Russia: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 83 Poland: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 84 Poland: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 85 Rest of Europe: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 86 Rest of Europe: Automotive Fabric Market Size, By Product, 20142021 (Million Square Meter)

Table 87 South America: Automotive Fabrics Market Size, By Country, 20142021 (USD Million)

Table 88 South America: Automotive Fabric Market Size, By Country, 20142021 (Million Square Meter)

Table 89 South America: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 90 South America: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 91 South America: Automotive Fabrics Market Size, By Application, 20142021 (USD Million)

Table 92 South America: Automotive Fabric Market Size, By Application, 20142021 (Million Square Meter)

Table 93 Brazil: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 94 Brazil: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 95 Argentina: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 96 Argentina: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 97 Rest of South America: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Thousand)

Table 98 Rest of South America: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 99 Middle East & Africa: Automotive Fabrics Market Size, By Country, 20142021 (USD Million)

Table 100 Middle East & Africa: Automotive Fabric Market Size, By Country, 20142021 (Million Square Meter)

Table 101 Middle East & Africa: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 102 Middle East & Africa: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 103 Middle East & Africa: Automotive Fabrics Market Size, By Application, 20142021 (USD Million)

Table 104 Middle East & Africa: Automotive Fabric Market Size, By Application, 20142021 (Million Square Meter)

Table 105 Turkey: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Million)

Table 106 Turkey: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Million Square Meter)

Table 107 Iran: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Thousand)

Table 108 Iran: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 109 South Africa: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Thousand)

Table 110 South Africa: Automotive Fabric Market Size, By Vehicle Type, 20142021 (Thousand Square Meter)

Table 111 Rest of Middle East & Africa: Automotive Fabrics Market Size, By Vehicle Type, 20142021 (USD Thousand)

Table 112 Rest of Middle East & Africa: Automotive Fabric Market Size, By Vehicle Type, 20142021(Thousand Square Meter)

Table 113 Major Automotive Fabric Producers

Table 114 Expansions, 20122016

Table 115 New Product Launches, 20122016

Table 116 Acquisitions, 20122016

Table 117 Agreements, 20122016

Table 118 Joint Ventures, 20122016

List of Figures (46 Figures)

Figure 1 Automotive Fabric: Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Automotive Fabric Market: Research Design

Figure 4 Automotive Fabric Market: Data Triangulation

Figure 5 Automotive Fabric Market to Be Driven By the Rising Demand for Passenger Cars, 20162021

Figure 6 Airbags Segment to Register the Highest CAGR Between 2016 and 2021

Figure 7 Asia-Pacific Was the Largest Automotive Fabric Market in 2015

Figure 8 Growth Opportunities in the Automotive Fabric Market, 20162021

Figure 9 Asia-Pacific to Be the Largest Market for Automotive Fabrics Between 2016 and 2021

Figure 10 China Accounted for Major Share of the Asia-Pacific Automotive Fabric Market in 2015

Figure 11 North America to Be the Fastest-Growing Automotive Fabric Market Between 2016 and 2021

Figure 12 Asia-Pacific Was the Major Automotive Fabric Market in 2015

Figure 13 Automotive Fabric Market, By Region

Figure 14 Overview of Factors Governing the Automotive Fabric Market

Figure 15 Decline in Fatalities in Europe & U.S. (2001-2014)

Figure 16 Global Production of Passenger Cars and Light Commercial Vehicles (2011-2015)

Figure 17 Global Production of Cars (2011-2015)

Figure 18 Value Chain Analysis of the Automotive Fabric Market

Figure 19 Porters Five Forces Analysis of the Automotive Fabric Market

Figure 20 Passenger Cars to Dominate Automotive Fabric Market During Forecast Period

Figure 21 Asia-Pacific is Projected to Be the Largest Market for Automotive Fabrics in Passenger Cars Segment Between 2016 and 2021

Figure 22 North America to Continue Dominating the Automotive Fabric Market in Light Commercial Vehicles Between 2016 and 2021

Figure 23 Asia-Pacific is the Largest Market for Automotive Fabrics in Heavy Trucks Segment Between 2016 and 2021

Figure 24 Asia-Pacific to Continue Dominating the Market for Automotive Fabrics in Buses & Coaches Segment Between 2016 and 2021

Figure 25 Floor Covering Application to Dominate the Automotive Fabric Market Between 2016 and 2021

Figure 26 Asia-Pacific to Be the Largest Automotive Fabric Market in Floor Covering Application During Forecast Period

Figure 27 North America to Be the Second-Largest Automotive Fabric Market for Upholstery Application Between 2016 and 2021

Figure 28 Europe to Be the Second-Largest Automotive Fabric Market in PRIC Application Between 2016 and 2021

Figure 29 Asia-Pacific Estimated to Be the Largest Automotive Fabric Market in Tires Application, 20162021

Figure 30 Europe Estimated to Be the Second-Largest Automotive Fabric Market in Safety-Belts Application, 20162021

Figure 31 Asia-Pacific is the Largest Automotive Fabric Market in Airbags Application, 20162021

Figure 32 Asia-Pacific to Be the Largest Automotive Fabric Market in Other Applications Between 2016 and 2021

Figure 33 Regional Snapshot of Automotive Fabric Market: China, Mexico, and U.S. Expected to Drive the Market

Figure 34 Asia-Pacific Automotive Fabric Market Snapshot: China and Japan are the Most Lucrative Markets

Figure 35 North America Market Snapshot: U.S. Accounts for the Largest Share

Figure 36 Europe Automotive Fabric Market Snapshot: Italy to Register High Growth During Forecast Period

Figure 37 Expansion Was the Key Growth Strategy Adopted By Players Between 2012 and 2016

Figure 38 Developmental Market Share: Expansion Was the Key Strategy

Figure 39 Toyota Boshoku Corporation is Among the Top 5 Players in the Automotive Fabric Market

Figure 40 Adient PLC: Company Snapshot

Figure 41 Lear Corporation: Company Snapshot

Figure 42 Toyota Boshoku Corporation: Company Snapshot

Figure 43 Takata Corporation: Company Snapshot

Figure 44 Suminoe Textile Co., Ltd.: Company Snapshot

Figure 45 Seiren Co., Ltd.: Company Snapshot

Figure 46 SRF Limited: Company Snapshot

Growth opportunities and latent adjacency in Automotive Fabric Market