Automotive HUD Market by Technology (AR-HUD, Conventional HUD), HUD Type (Combiner, Windshield), PC Class (Economy, Mid-Segment, Luxury), Level of Autonomy, Dimension, Vehicle Type, Sales Channel, EV Type and Region - Global Forecast to 2027

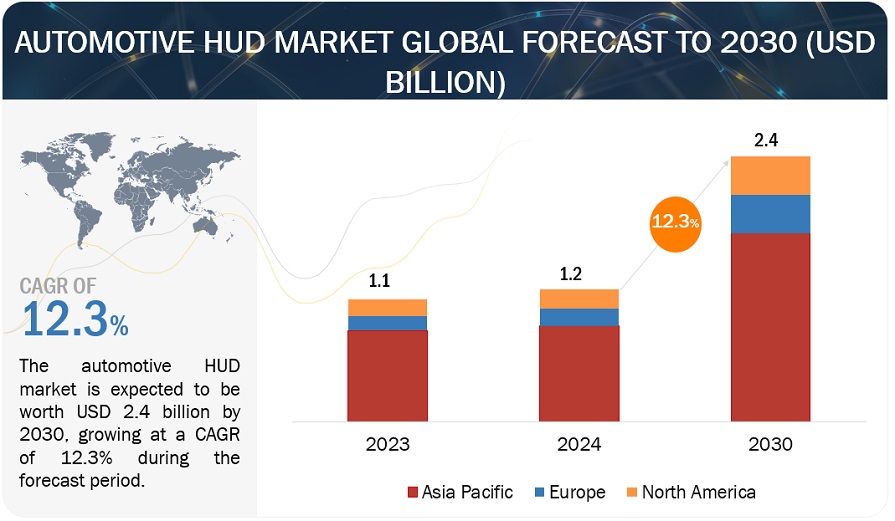

[305 Pages Report] The global automotive HUD market is projected to reach USD 3.9 billion by 2027 from USD 1.0 billion in 2022, at a CAGR of 30.4% during the forecast period. The market is driven by rising awanress of customer about road as well as vehicle safety, growing demand for enhance consumer experience in vehicles, along with high growth in the luxury as well as high-end cars segments, mainly in the emerging markets.

The COVID-19 pandemic has decelerated the growth of the automotive HUD market. Lower vehicle sales are likely to weaken the demand for vehicle and passenger safety features. Nationwide lockdowns and suspension of major business activities by OEMs have delayed the testing of semi-autonomous driving systems and advanced safety features. The lack of interest from OEMs in investing in advanced technologies for the next one or two years will be a major setback for automotive HUD manufacturers, and the automotive HUD market is estimated to witness a dip in 2020.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on automotive HUD market:

Major automotive HUD manufacturers such as Bosch, Continental, Panasonic, DENSO, Nippon Seiki, Garmin, and LG Display have announced either suspension of production or adjustment of production due to the reduced demand and supply chain bottlenecks and to ensure the safety of their employees in China, Europe, and North America during the COVID-19 pandemic. For instance, COVID-19 has forced Continental to put a brake on its operations. As of April 2020, the increased outbreak of the virus has forced the company to temporarily cease production in more than 40% of its 249 production locations across the world. Visteon has taken decisive actions to manage costs and preserve liquidity, including effective cost management due to the COVID-19 pandemic. The company has temporarily suspended or reduced production at certain facilities in the Americas, Europe, and most of Asia outside of China in response to government requirements and lower demand for components due to production suspension by major OEMs. The company proposed a restructuring plan in January 2020 to reduce the number of employees at various sites to lower its cost base and improve financial performance. As a result of these developments, the demand for automotive HUDs is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and Tier I manufacturers. Major automotive HUD manufacturers lost revenues in Q1 2020. For instance, Garmin’s automotive segment recorded a revenue of USD 106 million compared to USD 127 million in Q1 2019. The Automotive segment revenue declined by 17% due to the ongoing Personal Navigation Devices (PND) market contraction and lower year-over-year OEM sales. In addition, the company has withdrawn its fiscal 2020 guidance due to the rapid and unpredictable economic changes caused by the COVID-19 pandemic. LG Display announced its Q1 2020 results in April 2020. Total revenue declined by 22%, from USD 5.0 billion in Q1 2019 to USD 3.9 billion in Q1 2020. Such declines are primarily caused by the COVID-19 pandemic. The company is projected to see a further decline in its revenue in the second quarter of 2020. Automotive HUD manufacturers are facing disruptions in supply chains as major countries are in a state of lockdown to prevent the spread of the disease. Thus, the market for automotive HUDs is projected to undergo a phase of decline in 2020.

Market Dynamics:

Driver: Increase in awareness about passenger and vehicle safety

The safety of passengers and vehicles has become the prime concern for vehicle buyers. Regulatory authorities around the world are aiming to improve vehicle safety. The Global Status Report on Road Safety 2018 estimated that more than 1.35 million road traffic deaths occur each year globally. Studies suggest that road traffic injuries will become the fifth leading cause of death globally by 2030. Driver distraction is one of the major causes of these accidents. According to the National Center for Statistics and Analysis (NCSA), approximately 9 people are killed in the US every day, and more than 1,000 are injured in crashes that are reported to involve a distracted driver. Accidents due to driver distraction caused by monitoring in-vehicle displays can be reduced by using head-up displays.

Often, drivers take their eyes off the road to read an instrument cluster. His vision needs to accommodate for shorter distance for this action. After reading the instrument cluster, the vision again has to readjust to the greater visual distance. Reading a display and concentrating again on the road requires at least half a second with a conventional instrument cluster. It also tires the eyes if done in frequent occurrence. A head-up display, which is placed directly in the line of sight, provides critical information such as speed, navigation, and other data related to driving assistance. The output generated by the HUD reduces the distraction, and the driver is thus able to concentrate more on driving. Owing to these benefits, OEMs are adopting HUD in their vehicles. Thus, safety awareness is expected to fuel the demand for automotive head-up displays.

Restraint: Requirement of greater space in the cockpit for the installation of HUD

The windshield-projected HUD requires a large amount of space in the cockpit of an automotive. Advanced HUDs such as augmented reality head-up displays (AR HUD) help make driving more comfortable and safe by superimposing the exterior view of the traffic conditions in front of the vehicle with virtual information (augmentations) for the driver. The reflected information appears to be part of the driving situation itself. However, augmented reality HUDs take up substantial space on the dashboard.

The hardware associated with full windshield augmented reality HUD takes up greater automotive cockpit space, which would require enormous automotive cockpit re-designing effort from OEMs. The initial AR HUD model developed by Continental AG (Germany) requires 13 liters of cockpit space, which is difficult for the OEMs to incorporate. Reducing the size of the augmented reality head-up display could reduce the clarity of the augmented image, causing it to be less legible to the driver. To make the projection available precisely in the driver’s field of view, iris recognition devices and gesture recognition devices will need to be integrated with the HUD. The large space required for embedding an augmented reality head-up display in the automotive cockpit is a key restraint for OEMs and the automotive HUD market.

Opportunity: Introduction of portable HUDs at lower prices in low and middle car segments

Technological advancements are driving the automotive industry to the next level. Features such as driver assists and surround-view cameras that were once available exclusively in luxury vehicles now come as a standard even in some economy cars. The same thing is slowly happening with head-up displays (HUD). For example, the 10-inch HUD in the 2018 Toyota Camry is one of the largest and best HUDs used in any car.

Mazda is another mainstream brand that offers HUDs in several of its vehicles. But instead of embedding expensive components in the dash and using a special windshield, the HUDs in the Mazda3 and Mazda6 use a thin plastic lens that folds down when not in use. MINI has a similar solution, but this low-cost approach has limits in terms of size and position of the images compared to traditional HUDs that use the windshield as a screen.

Challenge: High cost of advanced head-up display systems

Automotive OEMs such as Hyundai (Korea), Suzuki (Japan), Toyota (Japan), and Volkswagen (Germany) face the challenge of installing advanced head-up displays with augmented reality functions in mid-segment vehicles. Over the next decade, these systems are expected to become a standard feature in passenger cars across several countries. AR HUDs with technologically advanced functions are priced higher and thus launched in premium vehicles. The key challenge for automotive OEMs is to lower the cost of these advanced features to overcome the cost constraint. Due to the growing competition in the automotive industry, Tier I companies are installing innovative displays in automotive cockpit electronics systems. Going forward, OEMs will reduce dashboard electronics and equip vehicles with larger augmented displays with integrated advanced driver assistance functions to create product and brand differentiation. However, as electronic features provided in a vehicle impact its total pricing, OEMs try to buy these advanced systems at the lowest prices. The integration of advanced automotive augmented reality and luxurious automotive interiors at a competitive cost poses a tough challenge for OEMs.

Higher costs, coupled with lower demand in the premium segment due to the COVID-19 pandemic, would be a major challenge for HUD manufacturers. Lower demand for new vehicles would discourage OEMs from installing expensive automotive systems that are not essential for driving performance. Hence, the demand for HUDs could be impacted.

To know about the assumptions considered for the study, download the pdf brochure

The passenger car segment is expected to be the largest automotive HUD market during the forecast period

The adoption of advanced technologies continues to be high for passenger cars because of the higher production and sales of passenger cars worldwide, in comparison to commercial vehicles. Also, the increasing demand for convenience and premium features by consumers is pushing OEMs to provide such features in its vehicles.

There are two major types of HUDs used in the automotive industry: windshield and combiner HUDs. Currently, windshield HUDs are mainly used in passenger cars. In passenger car windshield HUD, the HUD projects light onto the interior of the car’s windshield, which reflects toward the driver, enabling the driver to see the critical vehicle and environment information on the windshield. The curvature of the car’s windshield is carefully matched with the projection system component of the HUD system to optimize the display in the driver’s field of view. OEMs place extreme importance on ensuring that the driver sees a distortion-free image directly in the field of view. Tier 1 suppliers ensure HUD systems are manufactured to a precision of thousandths of a millimeter. The HUD is easier to integrate into passenger cars due to the curvature in the passenger car windshield. The windshield of a commercial vehicle is flat and integrating a HUD into it is complex. North America is estimated to be the largest automotive HUD market for passenger cars. It is expected to remain the most dominant market for automotive HUD during the forecast period. The passenger car HUD market in North America and Europe is driven by the increasing adoption of HUDs in the new vehicle models sold in these regions. In 2017, there were more than 25 passenger car models and variants in the US with a standard or optional HUD, up from 10 models a decade ago.

The windshield segment is projected to be the largest automotive HUD market during the forecast period

The windshield HUD type is an advanced form of technology. It is offered as a standard feature in some luxury car variants and as an optional feature in other luxury and mid-segment vehicle variants. Tier-1 suppliers such as Continental, Nippon Seiki, and Denso are focusing on cost reduction of the windshield HUD so the feature can be installed across variants of the larger mid-segment vehicles. OEMs and Tier-1 suppliers are also concentrating their R&D efforts toward developing full-windshield HUDs in future models of the vehicles. A full windshield HUD would occupy greater space in the automotive cockpit. This is a key challenge since the automotive cockpit electronics industry is evolving to have fewer electronics in the automotive cockpit as the automotive industry progresses toward autonomous vehicles.

By 2025, Asia Pacific is estimated to be the largest market for windshield HUD due to the growing demand for advanced in-vehicle technology in advanced markets such as China and India, increasing demand for premium vehicles with advanced in-vehicle safety systems and a significant installation rate of windshield HUDs in mid-segment vehicles. It is followed by the Europe market. Increasing demand for advanced technology in premium LCVs and growing demand for windshield HUD in luxury and mid-segment vehicles is driving the automotive HUD market in this region. The Asia Pacific market is cost-sensitive, and the adoption of advanced technology is higher in developed markets such as Japan. The region is home to India and China, which are key automotive manufacturing hubs of the world. Hence, once adopted, the penetration of advanced automotive technology in these markets is estimated to increase significantly.

“The Asia Pacific automotive HUD market is projected to hold the largest share by 2027.”

The Asia Pacific region is estimated to be the second-largest automotive HUD market in 2022, and it is projected to lead the market in 2027. Japan is a key contributor to the Asia Pacific region. The Japanese automotive industry is a leader in advanced technologies and is a key market for premium vehicles. Also, nearly all major OEMs have invested in the Chinese market, which is inclined toward small and affordable passenger vehicles. China is the largest automotive market in the Asia Pacific region and is witnessing growth in the sales and demand for premium vehicles. The growing automotive production levels in China have raised the demand for premium vehicles with advanced comfort and safety systems.

The Asia Pacific region is home automotive HUD system and components’ key suppliers such as Panasonic (Japan), Yazaki (Japan), and Nippon Seiki (Japan). These companies are continuously investing in research and development to innovate automotive applications. The availability of cheap labor and favorable government policies help to undertake mass production of components, which would result in the low prices of HUDs. The implementation of new technologies, the establishment of additional manufacturing plants, and the creation of value-added supply chain between manufacturers and material providers make the Asia Pacific region a market of immense growth potential for automotive HUD applications.

Key Market Players

Some of the leading manufacturers and suppliers of automotive HUD market are Bosch (Germany), Continental (Germany), Denso (Japan), Visteon (US), Nippon Seiki (Japan), Panasonic (Japan), Pioneer (Japan), Yazaki (Japan), and others. These companies adopted inorganic and organic growth strategies such as new product developments, expansions, supply contracts, collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive HUD market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Volume (Thousand Units), Value (USD million) |

|

Segments Covered |

Technology Type, HUD Type, Dimension Type, Passenger Cars Class, Sales Channel, Vehicle Type, Level of Autonomy, Electric Vehicle Type, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Robert Bosch (Germany), Continental (Germany), Denso (Japan), Visteon (US), Nippon Seiki (Japan), Panasonic (Japan), Pioneer (Japan), and Yazaki (Japan) |

This research report categorizes the automotive HUD market on the basis of technology, HUD type, dimension type, vehicle class, vehicle type, sales channel, and region.

Automotive HUD Market, By Technology

- Conventional HUD

- Augmented Reality HUD

Automotive HUD Market, By HUD Type

- Combiner HUD

- Windshield HUD

Automotive HUD Market, By Dimension Type

- 2-D HUD

- 3-D HUD

Automotive HUD Market, By Passenger Class

- Economy Cars

- Mid-segment Cars

- Luxury Cars

Automotive HUD Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive HUD Market, By Electric Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive HUD Market, By Level of Autonomy

- Non-autonomous

- Semi-autonomous

- Autonomous

Automotive HUD Market, By Sales Channel

- OE Market

- Aftermarket

Automotive HUD Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In May 2020, Pioneer and Continental agreed upon a strategic partnership to develop innovative cockpit solutions for the Asian market. Continental would integrate Pioneer’s entire infotainment subdomain into its high-performance computer for vehicle cockpits as part of the agreement.

- In March 2020, Continental has launched the glass free 3D display for HMC Gensesis. The product fearutures autostereoscopic 3D technology on the market in HMC Genesis GV80 high line varient. The technology displays three-dimensional scales, objects and pointers, such as, displaying a stop sign warning in the driver’s line of sight. No requirement of special glasses to see the 3-D warning signal.

- In October 2019, Nippon expanded its development center in Tokyo, Japan, for its HUD business. The new Tokyo R&D center would be responsible for tasks such as integrated cockpit development, next-generation HUD development, and product development enhancement.

- In January 2019, Visteon opened an automotive software development center in Timisoara, Romania. The center primarily focuses on software development for advanced cockpit electronics, including digital instrument clusters and infotainment & information displays, and supports the development of new technologies for connected and autonomous driving.

- In October 2018, Continental revealed an industry-first full-color demonstrator of an automotive-specific Head-up Display (HUD) based on waveguide technology. This demonstrator is the result of the joint development with DigiLens. The Continental AR-HUD with waveguide technology significantly reduces the packaging size. With this new, innovative technology, Continental achieves an augmentation area of 15° x 5° (= 2.60 x 0.87 m at a projection distance of 10 m) while bringing down the device size to a mere 10 l magnitude. Continental’s demonstrator enables augmentations within a field of 2.60 x 0.87 m at a projection distance of 10 m and solves the previous size issue of the AR-HUD.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except sales channel.

Which countries are considered in the European region?

The report includes European countries such as:

- Germany

- France

- Spain

- Russia

- UK

- Rest of Europe

We are interested in regional automotive HUD market different sales/distribution channels? Does this report cover aftermarket HUD solutions?

Yes, automotive HUD market for different sales channels (OEM and Aftermarket) are covered at regional level.

Does this report include impact of COVID-19 on the automotive HUD market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the automotive HUD market.

Does this report contain market size of automotive HUD solutions for luxury vehicles or premium segment vehicles?

Yes, market size of automotive HUD is extensively covered in both value and volume across different vehicle classes (economy cars, mid-segment cars, and luxury cars). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE HUD MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

FIGURE 2 MNM DOWNGRADES ITS FORECAST OF MARKET

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE HUD MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 key secondary sources

2.1.1.2 Key secondary sources for market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 DETAILED ILLUSTRATION OF BOTTOM-UP APPROACH

FIGURE 7 GLOBAL AUTOMOTIVE HUD MARKET SIZE: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 GLOBAL MARKET SIZE: TOP-DOWN APPROACH

FIGURE 9 MARKET: RESEARCH DESIGN & METHODOLOGY

2.3 MARKET BREAKDOWN

FIGURE 10 MARKET: DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.4.1 FACTORS CONSIDERED FOR MARKET FORECAST

TABLE 2 IMPACT OF VARIOUS FACTORS ON GROWTH OF AUTOMOTIVE HUD MARKET

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT & RANGES

TABLE 3 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 61)

FIGURE 11 AUTOMOTIVE HUD: MARKET OUTLOOK

FIGURE 12 AUTOMOTIVE HUD MARKET: MARKET DYNAMICS

FIGURE 13 BY HUD TYPE, WINDSHIELD HUD SEGMENT ESTIMATED TO LEAD MARKET BY 2027

FIGURE 14 BY PASSENGER CAR CLASS, LUXURY CARS SEGMENT ESTIMATED TO HOLD LARGEST SHARE IN MARKET BY 2027

3.1 COVID-19 IMPACT ON MARKET

TABLE 4 MARKET, PRE-COVID-19 AND POST-COVID-19 SCENARIOS, 2018–2027 (USD MILLION)

FIGURE 15 LUXURY AUTOMOTIVE HUD MARKET, PRE-COVID-19 AND POST-COVID-19 SCENARIOS, 2018–2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE HUD MARKET

FIGURE 16 DEMAND FOR IMPROVED IN-VEHICLE EXPERIENCES AND CONNECTED CARS LIKELY TO BOOST MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET SHARE, BY REGION, 2022 (USD MILLION)

FIGURE 17 EUROPE ESTIMATED TO BE LARGEST MARKET IN 2022

4.3 EUROPE MARKET, BY TECHNOLOGY TYPE AND HUD TYPE

FIGURE 18 CONVENTIONAL HUD & WINDSHIELD HUD ESTIMATED TO DOMINATE EUROPEAN AUTOMOTIVE HUD MARKET BY 2027

4.4 MARKET, BY HUD TYPE, 2022 VS 2027 (USD MILLION)

FIGURE 19 WINDSHIELD HUD SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.5 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY TYPE

FIGURE 20 CONVENTIONAL HUD SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY DIMENSION TYPE

FIGURE 21 2-D HUD SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.7 MARKET, BY VEHICLE TYPE

FIGURE 22 PASSENGER CAR SEGMENT ESTIMATED TO HOLD LARGEST SIZE OF MARKET IN 2022

4.8 MARKET, BY PASSENGER CAR CLASS

FIGURE 23 LUXURY CARS SEGMENT ESTIMATED TO HOLD LARGEST SIZE OF MARKET IN 2022

4.9 MARKET, BY SALES CHANNEL

FIGURE 24 OEM SEGMENT EXPECTED TO LEAD AUTOMOTIVE HUD MARKET DURING FORECAST PERIOD

4.10 MARKET, BY LEVEL OF AUTONOMY

FIGURE 25 SEMI-AUTONOMOUS CARS SEGMENT ESTIMATED TO HOLD LARGEST SHARE OF MARKET BY 2027

4.11 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 26 BEVS SEGMENT ESTIMATED TO LEAD AUTOMOTIVE HUD MARKET BY 2027

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 MARKET DYNAMIC: MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing awareness about passenger and vehicle safety

5.2.1.2 Demand for improvement of in-vehicle experience

FIGURE 28 HUD BENEFITS FOR END-USERS

FIGURE 29 CATEGORIES OF HUD DESIGNS

TABLE 5 APPLICATIONS THAT BENEFIT FROM HUD

5.2.1.3 Increasing demand for connected vehicles

5.2.1.4 High growth in luxury and high-end car segments, mainly in emerging markets

5.2.1.5 Integration of advanced technologies

5.2.2 RESTRAINTS

5.2.2.1 Requirement of greater space in automotive cockpit

5.2.2.2 Lack of luminance & brightness and high power consumption

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for semi-autonomous and electric vehicles

5.2.3.2 Introduction of portable HUDs at lower prices in low and middle car segments

5.2.3.3 Development of comprehensive voice-operated head-up display systems

5.2.3.4 Increasing investment in automotive head-up displays

5.2.4 CHALLENGE

5.2.4.1 High cost of advanced head-up display systems

5.2.4.2 Required technological update

5.3 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: AUTOMOTIVE HUD MARKET

5.4 PORTER’S 5 FORCES ANALYSIS

TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON AUTOMOTIVE HUD MARKET

FIGURE 31 HIGH THREAT OF NEW ENTRANTS OWING TO ADVANCEMENTS IN SUBSTITUTE TECHNOLOGY

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 THREAT OF NEW ENTRANTS

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 32 AUTOMOTIVE HUD MARKET: SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM ANALYSIS

TABLE 7 ROLE OF COMPANIES IN MARKET ECOSYSTEM

5.7 TRADE ANALYSIS

TABLE 8 IMPORT DATA FOR HS CODE 852691, BY COUNTRY, 2016–2020 (USD THOUSAND)

TABLE 9 EXPORT DATA FOR HS CODE 8708, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.8 PATENT ANALYSIS

TABLE 10 PATENT ANALYSIS: MARKET

5.9 CASE STUDIES

5.9.1 AFTERMARKET HEAD-UP DISPLAY (HUD) DEVICES BY NAVDY

5.9.2 COMPACT HUD SYSTEM FOR AUTOMOTIVE INDUSTRY BY VISTEON

5.9.3 CP INDUSTRIES HUD GLASS TESTING

5.9.4 EMERGING TECHNOLOGIES TO DEVELOP AND EVALUATE IN-VEHICLE INTELLIGENT SYSTEMS (INFOTAINMENT AR HUD)

5.10 REGULATION/STANDARDS FOR HUD

5.11 PRICING ANALYSIS

FIGURE 33 PRICING ANALYSIS: AUTOMOTIVE HUD MARKET (US DOLLARS)

5.12 MARKET SCENARIO

5.12.1 MOST LIKELY SCENARIO

TABLE 11 MARKET: MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.12.2 OPTIMISTIC SCENARIO

TABLE 12 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.12.3 PESSIMISTIC SCENARIO

TABLE 13 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.13 TECHNOLOGICAL OVERVIEW

5.13.1 INTRODUCTION

FIGURE 34 HEAD-UP DISPLAY (HUD) EVOLUTION

5.13.2 CURRENT SENSORS TECHNOLOGIES USED IN HEAD-UP DISPLAY

5.13.2.1 Radar

5.13.2.2 LiDAR

5.13.2.3 Image sensors

5.13.3 TECHNOLOGICAL ADVANCEMENT IN NEAR FUTURE

5.13.4 ADOPTION OF CONNECTED VEHICLE

5.14 EMERGING TRENDS

5.14.1 MOTORCYCLE WINDSHIELD HUD

5.14.2 MOTORCYCLE HELMET HUD

6 COVID-19 IMPACT (Page No. - 98)

6.1 COVID-19 HEALTH ASSESSMENT

FIGURE 35 COVID-19: GLOBAL PROPAGATION

FIGURE 36 COVID-19 PROPAGATION: SELECT COUNTRIES

6.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 37 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 38 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 39 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

6.3 AUTOMOTIVE HUD MARKET: COVID-19 IMPACT

6.3.1 IMPACT ON AUTOMOTIVE CHIP PRODUCTION

6.3.2 IMPACT ON VEHICLE SALES

6.3.3 IMPACT ON GLOBAL MARKET

7 AUTOMOTIVE HUD MARKET, BY HUD TYPE (Page No. - 105)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 KEY INDUSTRY INSIGHTS

FIGURE 40 MARKET, BY HUD TYPE, 2022 VS 2027 (USD MILLION)

TABLE 14 MARKET, BY HUD TYPE, 2018–2021 (‘000 UNITS)

TABLE 15 MARKET, BY HUD TYPE, 2022–2027 (‘000 UNITS)

TABLE 16 MARKET, BY HUD TYPE, 2018–2021 (USD MILLION)

TABLE 17 AUTOMOTIVE HUD MARKET, BY HUD TYPE, 2022–2027 (USD MILLION)

7.2 COMBINER HUD

7.2.1 VOLUME GROWTH OF COMBINER HUD IN MID-SEGMENT CARS IN ASIA PACIFIC EXPECTED TO DRIVE MARKET

TABLE 18 COMBINER HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 19 COMBINER HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 20 COMBINER HUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 COMBINER HUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 WINDSHIELD HUD

7.3.1 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

TABLE 22 WINDSHIELD HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 23 WINDSHIELD HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 24 WINDSHIELD HUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 WINDSHIELD HUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY TYPE (Page No. - 113)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

FIGURE 41 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 26 MARKET, BY TECHNOLOGY, 2018–2021 (‘000 UNITS)

TABLE 27 MARKET, BY TECHNOLOGY, 2022–2027 (‘000 UNITS)

TABLE 28 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.2 CONVENTIONAL HUD

8.2.1 ASIA PACIFIC ESTIMATED TO LEAD CONVENTIONAL HUD MARKET BY 2027

TABLE 30 CONVENTIONAL HUD: AUTOMOTIVE HUD MARKET, BY REGION 2018–2021 (‘000 UNITS)

TABLE 31 CONVENTIONAL HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 32 CONVENTIONAL HUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 CONVENTIONAL HUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 AUGMENTED REALITY-BASED HUD (AR HUD)

8.3.1 EUROPE PROJECTED TO LEAD AR HUD MARKET

TABLE 34 AUGMENTED REALITY-BASED HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 35 AUGMENTED REALITY-BASED HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 36 AUGMENTED REALITY-BASED HUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 AUGMENTED REALITY-BASED HUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE HUD MARKET, BY PASSENGER CAR CLASS (Page No. - 121)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 KEY INDUSTRY INSIGHTS

FIGURE 42 MARKET, BY PASSENGER CAR CLASS, 2022 VS. 2027 (USD MILLION)

TABLE 38 MARKET, BY PASSENGER CAR CLASS, 2018–2021 (‘000 UNITS)

TABLE 39 MARKET, BY PASSENGER CAR CLASS, 2022–2027 (‘000 UNITS)

TABLE 40 MARKET, BY PASSENGER CAR CLASS, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY PASSENGER CAR CLASS, 2022–2027 (USD MILLION)

9.2 ECONOMIC CARS

9.2.1 INEXPENSIVE HUD SOLUTIONS TO DRIVE ECONOMIC CARS SEGMENT

TABLE 42 ECONOMIC CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 43 ECONOMIC CARS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 44 ECONOMIC CARS: MARKET, BY REGION, 2028–2022 (USD MILLION)

TABLE 45 ECONOMIC CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MID-SEGMENT CARS

9.3.1 INCREASING ADOPTION OF HUDS IN MID-SEGMENT VEHICLES TO BE MAJOR GROWTH DRIVER

TABLE 46 MID-SEGMENT CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 47 MID-SEGMENT CARS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 48 MID-SEGMENT CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MID-SEGMENT CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 LUXURY CARS

9.4.1 RISING DEMAND FOR CONNECTIVITY SERVICES TO FUEL LUXURY CARS SEGMENT

TABLE 50 LUXURY CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 51 LUXURY CARS: MARKET, BY REGION, 2021–2030 (‘000 UNITS)

TABLE 52 LUXURY CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 LUXURY CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 AUTOMOTIVE HUD MARKET, BY DIMENSION TYPE (Page No. - 130)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 KEY INDUSTRY INSIGHTS

FIGURE 43 AUTOMOTIVE HUD MARKET, BY DIMENSION TYPE, 2022 VS. 2027 (‘000 UNITS)

TABLE 54 MARKET, BY DIMENSION TYPE, 2018–2021 (‘000 UNITS)

TABLE 55 MARKET, BY DIMENSION TYPE, 2022–2027 (‘000 UNITS)

10.2 2-D HUD

10.2.1 HIGH ADOPTION OF COMBINER HUDS WILL PROPEL 2-D HUD MARKET IN ASIA PACIFIC

TABLE 56 2-D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 57 2-D HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

10.3 3-D HUD

10.3.1 HIGH PRODUCTION OF LUXURY VEHICLES WILL PROVIDE LEVERAGE FOR GROWTH OF 3-D HUD SEGMENT IN EUROPE

TABLE 58 3-D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 59 3-D HUD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

11 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY (Page No. - 135)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 KEY INDUSTRY INSIGHTS

TABLE 60 RECENT AND ONGOING DEMONSTRATION AND TESTING OF CONNECTED AUTONOMOUS VEHICLES BY KEY COMPANIES

TABLE 61 ECONOMIC IMPACT OF CONNECTED AND AUTONOMOUS VEHICLES AND ITS BREAKDOWN

FIGURE 44 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY, 2022 VS. 2027 (USD MILLION)

TABLE 62 MARKET, BY LEVEL OF AUTONOMY, 2018–2021 (‘000 UNITS)

TABLE 63 MARKET, BY LEVEL OF AUTONOMY, 2022–2027 (‘000 UNITS)

TABLE 64 MARKET, BY LEVEL OF AUTONOMY, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY LEVEL OF AUTONOMY, 2022–2027 (USD MILLION)

11.2 SEMI-AUTONOMOUS CARS

11.2.1 LEVEL 1 (L1)

11.2.2 LEVEL 2 (L2)

11.2.3 LEVEL 3 (L3)

TABLE 66 SEMI-AUTONOMOUS CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 67 SEMI-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 68 SEMI-AUTONOMOUS CARS: MARKET, REGION, 2018–2021 (USD MILLION)

TABLE 69 SEMI-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 AUTONOMOUS CARS

TABLE 70 FEW POPULAR AUTONOMOUS VEHICLES FROM COMPANIES ACROSS WORLD

TABLE 71 EXPECTED TECHNOLOGY VS. CURRENT TECHNOLOGY READINESS LEVEL OF AUTONOMOUS VEHICLE

11.3.1 LEVEL 4 (L4)

11.3.2 LEVEL 5 (L5)

11.3.3 EUROPE AND NORTH AMERICA WILL PLAY KEY ROLE IN DEVELOPMENT OF AUTONOMOUS CARS

TABLE 72 AUTONOMOUS CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 73 AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 NON-AUTONOMOUS CARS

TABLE 74 NON-AUTONOMOUS CARS: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 75 NON-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 76 NON-AUTONOMOUS CARS: MARKET, REGION, 2018–2021 (USD MILLION)

TABLE 77 NON-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE (Page No. - 149)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 KEY INDUSTRY INSIGHTS

FIGURE 45 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 78 MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 79 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 80 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 81 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2 PASSENGER CARS

12.2.1 ASIA PACIFIC PROJECTED TO HOLD LARGEST SHARE IN PASSENGER CARS SEGMENT BY 2027

TABLE 82 PASSENGER CARS: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 83 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 84 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 COMMERCIAL VEHICLES

12.3.1 LIGHT COMMERCIAL VEHICLES (LCVS)

12.3.1.1 North America estimated to have largest market share

TABLE 86 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 87 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 88 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3.2 HEAVY COMMERCIAL VEHICLES (HCVS)

12.3.2.1 High vibration and heat are major challenges for growth of automotive HUD market in HCVs segment

TABLE 90 HEAVY COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 91 HEAVY COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 AUTOMOTIVE HUD MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 158)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 KEY PRIMARY INSIGHTS

FIGURE 46 KEY PRIMARY INSIGHTS

FIGURE 47 AUTOMOTIVE HUD MARKET, BY EV TYPE, 2022 VS 2027 (USD MILLION)

TABLE 92 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 93 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 94 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 95 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

13.2 BATTERY ELECTRIC VEHICLES (BEVS)

13.3 FUEL CELL ELECTRIC VEHICLES (FCEVS)

13.4 HYBRID ELECTRIC VEHICLES (HEVS)

13.5 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14 AUTOMOTIVE HUD MARKET, BY SALES CHANNEL (Page No. - 164)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 KEY INDUSTRY INSIGHTS

FIGURE 48 AUTOMOTIVE HUD MARKET, BY SALES CHANNEL, 2022 VS. 2027 (USD MILLION)

TABLE 96 MARKET, BY SALES CHANNEL, 2018–2021 (USD MILLION)

TABLE 97 MARKET, BY SALES CHANNEL, 2022–2027 (USD MILLION)

14.2 OE MARKET

14.2.1 OEM’S INITIATIVES TO OFFER ADVANCED HUD SOLUTIONS TO DRIVE THE SEGMENT

TABLE 98 OE MARKET: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 OE MARKET: MARKET, BY REGION, 2020–2025 (USD MILLION)

14.3 AFTERMARKET

14.3.1 LOW-COST AFTERMARKET HUD SOLUTIONS TO DRIVE THE SEGMENT

TABLE 100 AFTERMARKET: AUTOMOTIVE HUD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 AFTERMARKET: MARKET, BY REGION, 2020–2025 (USD MILLION)

15 AUTOMOTIVE HUD MARKET, BY REGION (Page No. - 170)

15.1 INTRODUCTION

FIGURE 49 AUTOMOTIVE HUD MARKET, BY REGION, 2022

FIGURE 50 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 102 MARKET, BY REGION, 2018–2021 (’000 UNITS)

TABLE 103 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 104 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.2 ASIA PACIFIC

FIGURE 51 ASIA PACIFIC: AUTOMOTIVE HUD MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (’000 UNITS)

TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY HUD TYPE, 2018–2021 (’000 UNITS)

TABLE 111 ASIA PACIFIC: MARKET, BY HUD TYPE, 2022–2027 (‘000 UNITS)

TABLE 112 ASIA PACIFIC: MARKET, BY HUD TYPE, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY HUD TYPE, 2022–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY DIMENSION TYPE, 2018–2021 (’000 UNITS)

TABLE 115 ASIA PACIFIC: MARKET, BY DIMENSION TYPE, 2022–2027(‘000 UNITS)

TABLE 116 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (’000 UNITS)

TABLE 117 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2022–2027 (‘000 UNITS)

TABLE 118 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2022–2027(USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 121 ASIA PACIFIC: MARKET, BY VEHICLE TYPE , 2022–2027 (‘000 UNITS)

TABLE 122 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.1 COVID-19 IMPACT ON MARKET IN ASIA PACIFIC

15.2.2 CHINA

15.2.2.1 China vehicle production data

TABLE 124 CHINA: VEHICLE PRODUCTION DATA (UNITS)

15.2.2.2 Higher automotive production in China is driving automotive HUD market

TABLE 125 CHINA: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 126 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027(’000 UNITS)

TABLE 127 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 128 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.3 INDIA

15.2.3.1 India vehicle production data

TABLE 129 INDIA: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.2.3.2 Rise in foreign investment due to improved FDI policies expected to foster Indian automotive market in coming years

TABLE 130 INDIA: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 131 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 132 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 133 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.4 JAPAN

15.2.4.1 Japan vehicle production data

TABLE 134 JAPAN: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.2.4.2 Presence of leading HUD manufacturers expected to propel Japanese automotive HUD market

TABLE 135 JAPAN: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 136 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 137 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 138 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.5 SOUTH KOREA

15.2.5.1 South Korea vehicle production data

TABLE 139 SOUTH KOREA: VEHICLE PRODUCTION DATA, 2018-2021(‘000 UNITS)

15.2.5.2 Increasing adoption of HUDs by South Korean OEMs such as Hyundai and KIA expected to drive market

TABLE 140 SOUTH KOREA: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 141 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 142 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 143 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.6 THAILAND

15.2.6.1 Thailand vehicle production data

TABLE 144 THAILAND VEHICLE PRODUCTION, 2018-2021 (UNITS)

15.2.6.2 Favorable government tax policies to encourage foreign investments will drive market

TABLE 145 THAILAND: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 146 THAILAND: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 147 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 148 THAILAND: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.2.7 REST OF ASIA PACIFIC

15.2.7.1 HUD expected to be widely available in luxury segment in Rest of Asia Pacific

TABLE 149 REST OF ASIA PACIFIC: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 150 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3 EUROPE

FIGURE 52 EUROPE: AUTOMOTIVE HUD MARKET SNAPSHOT

TABLE 153 EUROPE: MARKET, BY COUNTRY, 2018–2021 (’000 UNITS)

TABLE 154 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 155 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY HUD TYPE, 2018–2021 (’000 UNITS)

TABLE 158 EUROPE: MARKET, BY HUD TYPE, 2022–2027 (‘000 UNITS)

TABLE 159 EUROPE: MARKET, BY HUD TYPE, 2018–2021 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY HUD TYPE, 2022–2027 (USD MILLION)

TABLE 161 EUROPE: MARKET, BY DIMENSION TYPE, 2018–2021 (’000 UNITS)

TABLE 162 EUROPE: MARKET, BY DIMENSION TYPE, 2022–2027 (‘000 UNITS)

TABLE 163 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (’000 UNITS)

TABLE 164 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2022–2027 (‘000 UNITS)

TABLE 165 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 166 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2022–2027 (USD MILLION)

TABLE 167 EUROPE: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 168 EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 169 EUROPE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 170 EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.1 COVID-19 IMPACT ON AUTOMOTIVE HUD MARKET IN EUROPE

15.3.2 FRANCE

15.3.2.1 France vehicle production data

TABLE 171 FRANCE: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.3.2.2 High presence of luxury car manufacturers expected to drive market

TABLE 172 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021(’000 UNITS)

TABLE 173 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 174 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 175 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.3 GERMANY

15.3.3.1 Germany vehicle production data

TABLE 176 GERMANY: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.3.3.2 Germany is home to leading car manufacturers and HUD manufacturers

TABLE 177 GERMANY: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 178 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 179 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 180 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.4 RUSSIA

15.3.4.1 Russia vehicle production data

TABLE 181 RUSSIA: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.3.4.2 Luxury car segment holds largest market share in Russia

TABLE 182 RUSSIA: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 183 RUSSIA: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 184 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 185 RUSSIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.5 SPAIN

15.3.5.1 Spain vehicle production data

TABLE 186 SPAIN: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.3.5.2 Mid-segment projected to have highest growth rate

TABLE 187 SPAIN: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 188 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 189 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 190 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.6 UK

15.3.6.1 UK vehicle production data

TABLE 191 UK: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.3.6.2 High demand for luxury and high-end cars expected to drive market

TABLE 192 UK: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 193 UK: MARKET, BY VEHICLE TYPE, 2022–2027(’000 UNITS)

TABLE 194 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 195 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.3.7 REST OF EUROPE

15.3.7.1 High demand for advanced features will propel automotive HUD market in Rest of Europe

TABLE 196 REST OF EUROPE: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 197 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 198 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 199 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.4 NORTH AMERICA

FIGURE 53 ASIA PACIFIC: AUTOMOTIVE HUD MARKET SNAPSHOT

TABLE 200 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (’000 UNITS)

TABLE 201 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 202 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 203 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 204 NORTH AMERICA: MARKET, BY HUD TYPE, 2018–2021 (’000 UNITS)

TABLE 205 NORTH AMERICA: MARKET, BY HUD TYPE, 2022–2027 (‘000 UNITS)

TABLE 206 NORTH AMERICA: MARKET, BY HUD TYPE, 2018–2021 (USD MILLION)

TABLE 207 NORTH AMERICA: MARKET, BY HUD TYPE, 2022–2027 (USD MILLION)

TABLE 208 NORTH AMERICA: MARKET, BY DIMENSION TYPE, 2018–2021 (’000 UNITS)

TABLE 209 NORTH AMERICA: MARKET, BY DIMENSION TYPE, 2022–2027 (‘000 UNITS)

TABLE 210 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (’000 UNITS)

TABLE 211 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2022–2027 (‘000 UNITS)

TABLE 212 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

TABLE 213 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2022–2027(USD MILLION)

TABLE 214 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 215 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 216 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 217 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.4.1 COVID-19 IMPACT ON AUTOMOTIVE HUD MARKET IN NORTH AMERICA

15.4.2 CANADA

15.4.2.1 Canada vehicle production data

TABLE 218 CANADA: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.4.2.2 LCVs projected to be fastest-growing segment

TABLE 219 CANADA: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 220 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 221 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 222 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.4.3 MEXICO

15.4.3.1 Mexico vehicle production data

TABLE 223 MEXICO: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.4.3.2 Lower production costs compared to other North American countries driving Mexican automotive market

TABLE 224 MEXICO: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 225 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 226 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 227 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.4.4 US

15.4.4.1 US vehicle production data

TABLE 228 US: VEHICLE PRODUCTION DATA, 2018-2021 (UNITS)

15.4.4.2 High demand for premium features in vehicles expected to drive market

TABLE 229 US: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 230 US: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 231 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 232 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

15.5 REST OF THE WORLD (ROW)

FIGURE 54 ROW: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2022 VS 2027

TABLE 233 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (’000 UNITS)

TABLE 234 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 235 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 236 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.5.1 BRAZIL

15.5.1.1 Projected growth in production of cars to drive Brazil’s market

TABLE 237 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 238 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 239 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 240 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

15.5.2 IRAN

15.5.2.1 Less production of luxury cars restraining market

TABLE 241 IRAN: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 242 IRAN: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 243 IRAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 244 IRAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

15.5.3 REST OF ROW

15.5.3.1 HUDs expected to be available mainly in luxury segment in Rest of RoW

TABLE 245 REST OF ROW: AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 246 REST OF ROW: MARKET, BY VEHICLE TYPE, 2022–2027 (’000 UNITS)

TABLE 247 REST OF ROW: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 248 REST OF ROW: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 229)

16.1 OVERVIEW

TABLE 249 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE HUD MARKET

16.2 MARKET SHARE ANALYSIS

TABLE 250 MARKET SHARE ANALYSIS, 2021

FIGURE 55 MARKET RANKING AND SHARE ANALYSIS: AUTOMOTIVE HUD MARKET

16.3 COMPETITIVE LEADERSHIP MAPPING

16.3.1 STAR

16.3.2 EMERGING LEADERS

16.3.3 PERVASIVE

16.3.4 EMERGING COMPANIES

FIGURE 56 AUTOMOTIVE HUD MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 251 MARKET: COMPANY FOOTPRINT, 2021

TABLE 252 MARKET: SOLUTION FOOTPRINT, 2021

TABLE 253 MARKET: REGIONAL FOOTPRINT, 2021

16.4 START-UP EVALUATION QUADRANT

16.4.1 PROGRESSIVE COMPANIES

16.4.2 RESPONSIVE COMPANIES

16.4.3 DYNAMIC COMPANIES

16.4.4 STARTING BLOCKS

FIGURE 57 AUTOMOTIVE HUD MARKET: START-UP EVALUATION QUADRANT, 2021

16.5 WINNER VS. TAIL-ENDERS

TABLE 254 WINNERS VS. TAIL-ENDERS

17 COMPANY PROFILE (Page No. - 242)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

17.1 KEY PLAYERS

17.1.1 ROBERT BOSCH

TABLE 255 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 58 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 256 ROBERT BOSCH: PRODUCTS OFFERED

TABLE 257 ROBERT BOSCH: SHAREHOLDERS

TABLE 258 ROBERT BOSCH: KEY CUSTOMERS

TABLE 259 ROBERT BOSCH: NEW PRODUCT DEVELOPMENTS

TABLE 260 ROBERT BOSCH: DEALS

17.1.2 CONTINENTAL AG

TABLE 261 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 59 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 262 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 263 CONTINENTAL AG: KEY CUSTOMERS

TABLE 264 CONTINENTAL AG: AUTOMOTIVE HUD SUPPLY CONTRACTS

TABLE 265 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 266 ONTINENTAL AG: OTHERS

17.1.3 DENSO

TABLE 267 DENSO: BUSINESS OVERVIEW

FIGURE 60 DENSO: COMPANY SNAPSHOT

TABLE 268 DENSO: PRODUCTS OFFERED

TABLE 269 DENSO: AUTOMOTIVE HUD SUPPLY CONTRACTS

TABLE 270 DENSO: DEALS

TABLE 271 DENSO: OTHERS

17.1.4 PANASONIC

TABLE 272 PANASONIC: BUSINESS OVERVIEW

FIGURE 61 PANASONIC: COMPANY SNAPSHOT

TABLE 273 PANASONIC: KEY SHAREHOLDERS

TABLE 274 PANASONIC: KEY CUSTOMERS

TABLE 275 PANASONIC: SUPPLY CONTRACTS

TABLE 276 PANASONIC: PRODUCTS OFFERED

TABLE 277 PANASONIC: NEW PRODUCT DEVELOPMENTS

TABLE 278 PANASONIC: DEALS

17.1.5 NIPPON SEIKI

TABLE 279 NIPPON SEIKI: BUSINESS OVERVIEW

FIGURE 62 NIPPON SEIKI: COMPANY SNAPSHOT

TABLE 280 NIPPON SEIKI: SHAREHOLDERS

TABLE 281 NIPPON SEIKI: SALES RATIO TO MAJOR CUSTOMERS

TABLE 282 NIPPON SEIKI: SUPPLY CONTRACTS

TABLE 283 NIPPON SEIKI: PRODUCTS OFFERED

TABLE 284 NIPPON SEIKI: DEALS

TABLE 285 NIPPON SEIKI: OTHERS

17.1.6 YAZAKI CORPORATION

TABLE 286 YAZAKI CORPORATION: BUSINESS OVERVIEW

FIGURE 63 YAZAKI CORPORATION: SNAPSHOT

TABLE 287 YAZAKI CORPORATION: KEY CUSTOMERS

TABLE 288 YAZAKI CORPORATION: PRODUCTS OFFERED

TABLE 289 YAZAKI CORPORATION: NEW PRODUCT DEVELOPMENTS

17.1.7 VISTEON CORPORATION

TABLE 290 VISTEON CORPORATION: BUSINESS OVERVIEW

FIGURE 64 VISTEON CORPORATION: SNAPSHOT

TABLE 291 VISTEON CORPORATION: KEY CUSTOMERS

TABLE 292 VISTEON CORPORATION: SALES RATIO BY MAJOR CUSTOMERS

TABLE 293 VISTEON CORPORATION: PRODUCTS OFFERED

TABLE 294 VISTEON CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 295 VISTEON CORPORATION: OTHERS

17.1.8 ALPS ALPINE

TABLE 296 ALPS ALPINE: BUSINESS OVERVIEW

FIGURE 65 ALPS ALPINE: BUSINESS OVERVIEW

TABLE 297 ALPS ALPINE: KEY CUSTOMERS

TABLE 298 ALPS ALPINE: PRODUCTS OFFERED

TABLE 299 ALPS ALPINE: NEW PRODUCT DEVELOPMENTS

TABLE 300 ALPS ALPINE: DEALS

17.1.9 JVCKENWOOD CORPORATION

TABLE 301 JVCKENWOOD CORPORATION: BUSINESS OVERVIEW

FIGURE 66 JVCKENWOOD CORPORATION: COMPANY SNAPSHOT

TABLE 302 JVCKENWOOD CORPORATION: PRODUCTS OFFERED

TABLE 303 JVCKENWOOD CORPORATION: KEY CUSTOMERS

17.1.10 PIONEER CORPORATION

TABLE 304 PIONEER CORPORATION: BUSINESS OVERVIEW

TABLE 305 PIONEER CORPORATION: KEY CUSTOMERS

TABLE 306 DEALS: PIONEER CORPORATION

17.2 OTHER KEY PLAYERS

17.2.1 RENESAS

TABLE 307 RENESAS: BUSINESS OVERVIEW

17.2.2 TOSHIBA

TABLE 308 TOSHIBA: BUSINESS OVERVIEW

17.2.3 JAPAN DISPLAY, INC.

TABLE 309 JAPAN DISPLAY, INC: BUSINESS OVERVIEW

17.2.4 MITSUBISHI ELECTRIC

TABLE 310 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

17.2.5 TEXAS INSTRUMENTSS

TABLE 311 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

17.2.6 MICROVISION

TABLE 312 MICROVISION: BUSINESS OVERVIEW

17.2.7 HUDWAY

TABLE 313 HUDWAY: BUSINESS OVERVIEW

17.2.8 NVIDIA

TABLE 314 NVIDIA: BUSINESS OVERVIEW

17.2.9 MAGNA INTERNATIONAL

TABLE 315 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

17.2.10 HARMAN INTERNATIONAL

TABLE 316 HARMAN INTERNATIONAL: BUSINESS OVERVIEW

17.2.11 VALEO

TABLE 317 VALEO: BUSINESS OVERVIEW

17.2.12 SAINT-GOBAIN

TABLE 318 SAINT-GOBAIN: BUSINESS OVERVIEW

17.2.13 ZF FRIEDRICHSHAFEN

TABLE 319 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 298)

18.1 INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

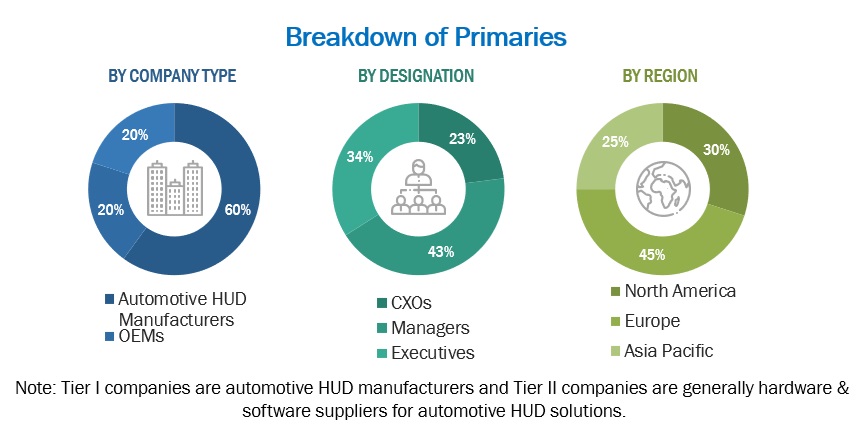

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive head-up display market. The primary sources—experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as to assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the global automotive HUD market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand (OEMs) and supply sides (automotive HUD manufacturers) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 40% of the experts involved in primary interviews were from the demand side, and 60% were from the supply side of the industry. Primary data has been collected through questionnaires, emails, and telephonic interviews. In our canvassing for primaries, we have strived to cover various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in our reports.

After interacting with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings delineated in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

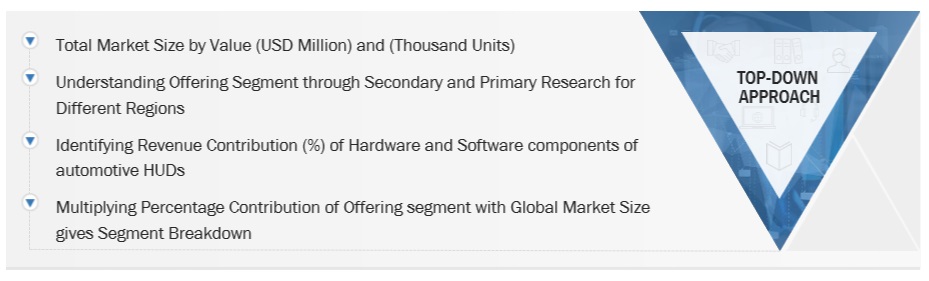

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the global automotive HUD market. In these approaches, the vehicle production statistics for each vehicle type (passenger vehicles, light commercial vehicles, and heavy commercial vehicles) at a country level have been considered.

Automotive HUD Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive HUD Market: Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for the purpose of this study.

Report Objectives

- To define, describe, and project (2022–2027) the automotive head-up display (HUD) market, by volume (thousand units) and value (USD million)

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the market’s growth

- To analyze the market for automotive HUD and forecast the market size, by value, based on technology type (conventional HUD and AR-based HUD)

- To analyze the market for automotive HUD and forecast the market size, by volume and value, based on HUD type (combiner HUD and windshield HUD)

- To analyze the market for automotive HUD and forecast the market size, by volume and value, based on passenger car class (mid-segment cars, luxury cars, and economic cars)

- To analyze the market for automotive HUD and forecast the market size, by value, based on dimension type (2-D HUD and 3-D HUD)

- To analyze the market for automotive HUD and forecast the market size, by volume and value, based on electric vehicle type (battery electric vehicles (BEVs), fuel cell electric vehicles (FCEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs))

- To analyze the market for automotive HUD and forecast the market size, by volume and value, based on level of autonomy (non-autonomous cars, semi-autonomous cars, and autonomous cars)

- To analyze the market for automotive HUD and forecast the market size, by value, based on vehicle type (passenger cars (PCs), light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs))

- To analyze and forecast the market for automotive HUD and forecast the market size, by value, based on sales channel (OE Market and aftermarket)

- To forecast the market size, by volume and value, with respect to 4 regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To track and analyze competitive developments, such as joint ventures, collaborations, partnerships, mergers & acquisitions, new product developments, and expansions, in the automotive HUD market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive HUD Market, By Region (3 Additional countries)

- Electric Vehicle Automotive HUD Market, By HUD Type

- Automotive HUD Market, By Off-highway Vehicle

- Further breakup of automotive HUD Market, By level of autonomy into L1, L2, L3, L4, and L5

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive HUD Market

for this report (HUD) do you have volume forecast breakdown between OEM preinstalled and aftermarket?