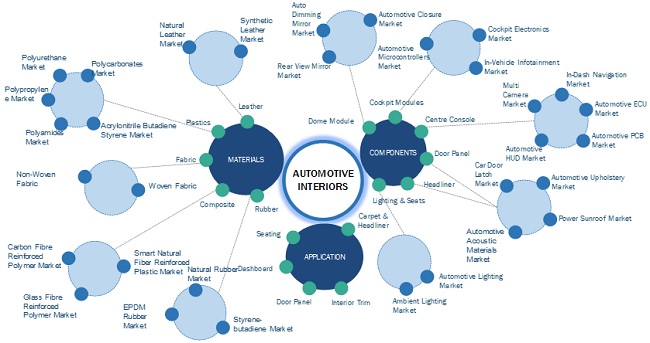

Automotive Interior Market by Component (Automotive Displays, Door Panel, Dome Module, Headliner, Seat, Interior Lighting), Material Type, Level of Autonomy, Electric Vehicle, Passenger Car Class, ICE Vehicle Type and Region - Global Forecast to 2027

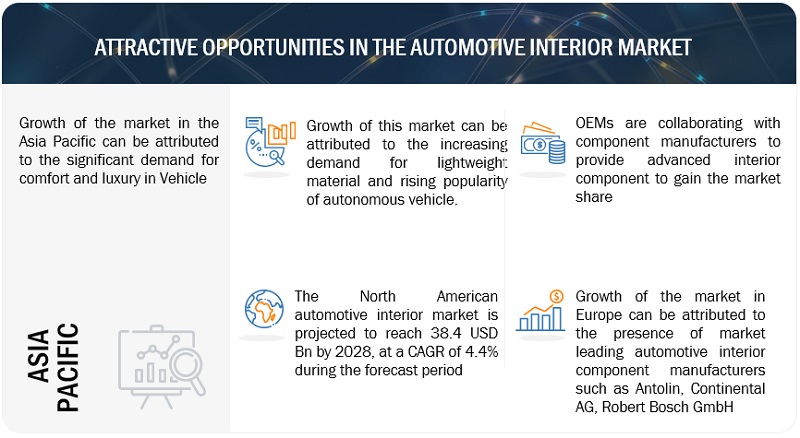

The Automotive Interior Market is estimated to be worth USD 153.5 billion in 2022 and is projected to reach USD 201.2 billion by 2027, at a CAGR of 5.6% during the forecast period. The market is driven Increasing customer preference for convenience, premium features, and advanced safety, Use of variety of lightweight & advanced materials and innovative finish, Integration of smartphone connectivity, Enhanced functionalities in lighting, Rise in demand for SUVs to fuel demand for modular seats in vehicles are expected to play a pivotal role in the adoption of automotive interiors in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Use of variety of lightweight & advanced materials and innovative finish

The introduction of new materials and advanced technologies has enabled manufacturers to reduce vehicle weight and design interiors with greater comfort. In automotive interior components, weight reduction is mostly achieved in the seating system. Adient is one of the many suppliers focusing on developing and providing lightweight interior solutions. For instance, in January 2018, Adient unveiled lightweight solutions for seat structures at the North American International Auto Show (NAIAS).

Lightweight materials are quite beneficial in making vehicles more efficient. According to industry experts, around 5–7% of fuel can be saved on a weight reduction of around 10%. Apart from that, there are a variety of plastic options available for OEMs to use in interiors. For instance, polyvinyl chloride (PVC) is often used in making vehicle doors and instrument panels. Acrylonitrile butadiene styrene (ABS) is often used in dashboards and has a very low production cost as well. OEMs have also been using different finishes for dashboards and seats of vehicles, depending on the segment of the vehicle. In cost-sensitive automotive markets, OEMs prefer low-cost plastics and finishing in interiors. On the other hand, premium car manufacturers prefer high-quality plastics and finishes. Such a variety of options for OEMs and suppliers will drive the automotive interior market.

Restraint: High cost of involved; and volatility in raw material costs

The prices of advanced automotive interior components have decreased in the past few years, but advanced automotive interior electronic components are still at a higher price range. For instance, earlier, the share of the electronic system in a vehicle was just 1–2% of vehicle cost, but due to the rising trend for enhanced user experience and convenience features, the share of such systems has now increased to 8–12% of the total vehicle cost. Hence, high-tech solutions and features are presently offered only in high-end luxury cars due to the high cost. Features such as 8-/10-way adjustable front row seats, middle row captain seats with reclining function, multi-information display, infotainment system with cameras, gesture controls, dual-zone climate control, ventilated seats, and massaging seats are some of the features that have high development costs and are available mostly in premium segment passenger cars. This is because customers who buy luxury cars do not hesitate to pay a higher price for convenience and innovations. Thus, unless the price of these innovative technologies is reduced, they would not find much application in low-end or economic segment cars. This would prove to be a hindrance to the growth of the overall advanced and innovative automotive interior components in the automotive market.

Opportunity: Rising trend of semi-autonomous & autonomous vehicles

The increasing adoption of semi-autonomous and autonomous vehicles will fuel the demand for advanced automotive interior technologies as the need for integrating advanced technologies would be higher than traditional vehicles. In autonomous vehicles, the interior must be designed to enable the switch to a driverless mode. As predicted by Nissan, the penetration of this type of vehicle would be close to 15% by 2030 from the current scenario where no such vehicle is launched commercially. Automobile giants such as Mercedes-Benz, Audi, Ford, Toyota, BMW, and Volkswagen are focusing on this sector.

There has been an increase in the number of semi-autonomous vehicles. Automotive interior applications will increasingly play a greater role in concept cars with the latest technologies and radical designs. The rise in such cars could accelerate the demand for cockpit electronic systems in cars.

Challenge: Long production cycle time

In the automotive industry, the conceptualization of an average vehicle begins five years prior to its production on the assembly line. The automotive interior components need to be integrated during the conceptualization phase or 1–2 years later to ensure that the vehicle is equipped with the required features. Additionally, the product development cycle of automotive interior components is close to two years or more. The advanced automotive interior components are equipped with many safety and security features that make product development a time-consuming process.

The advanced electronic components for vehicles are very similar to consumer electronics, where the product development cycle is less than a year. However, customers expect similar features in a car too, which is exceedingly difficult to provide by an automotive OEM. Therefore, OEMs always face challenges such as coping with the introduction of new navigation systems in the market every year.

To know about the assumptions considered for the study, download the pdf brochure

The seat segment is expected to be the largest automotive interior market during the forecast period

As seats are an integral part of any passenger or commercial vehicle, the seat segment is projected to have the largest share of the automotive interior market during the forecast period. The growth of this market is primarily driven by the increasing vehicle production and rising demand for comfort and luxury. Seat plays a pivotal role in driving and passenger experience. New companies have brought in technologies that allow intelligent seating adjustment, customizable comfort, and a host of other features. For example, Faurecia has come up with a Cover Carving Technology that applies to seat covers. This technology has been implemented in the Renault Talisman sedan and has enabled it to offer 3 cm of extra knee room for rear passengers. Similarly, another new technology is Faurecia’s Active Wellness 2.0 seat concept. This technology encompasses a lot of biological and behavioral data from heart rate, respiration rate, and humidity to blinking, head tilting, facial expression, etc. It enables the seat to detect the mental and physical status of a driver and co-passengers and take active measures to diminish stress and drowsiness.

The glass fiber composite segment is projected to be the largest automotive interior market during the forecast period

Glass fiber composite segment is expected to have the largest market during the forecast. It is being widely used in various automotive interior applications such as doors, dashboards, headliners, and insulation. It offers numerous benefits such as high impact resistance, low cost, less brittle, and light in weight. Also, it can be moulded into any shape easily. Glass fiber is a composite material or fiber reinforced plastic material produced from plastic and reinforced by small glass fibers (very fine). To manufacture this, glass is processed under a high temperature until molten state, and then passed through superfine holes. This results in glass filaments that are very fine, and are measured in microns. Glass fiber composite is widely used in instrument panels and door panels.

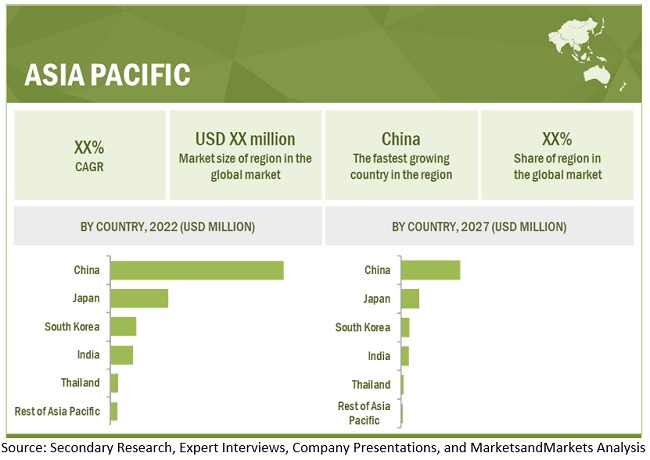

The Asia Pacific automotive interior market is projected to hold the largest share by 2027.

Asia Pacific is estimated to be the largest and fastest-growing automotive interior market during the forecast period. The growth of this market is primarily driven by the increasing vehicle production and rising demand for comfort and luxury. Asia Pacific, being the largest market for vehicle production globally, leads the market for automotive interior components. The market in Asia Pacific is driven by the small/economy car segment, which accounts for higher adoption of interior components. Leading automakers in this region, such as Toyota, Honda, and Hyundai, are embracing the advantages of advanced seating systems, lighting, electronics, and various safety systems, making them essential features across their car models. Major countries in this region, such as China, Japan, India, and South Korea, are anticipated to witness the rapid adoption of new technologies. China, due to its high vehicle production capacity, is expected to significantly contribute to the market growth in Asia Pacific.

Key Market Players

Some of the leading manufacturers and suppliers of automotive interior market are Faurecia (France), Continental (Germany), Grupo Antolin (Spain), Visteon (US), Marelli (Japan), Adient (US), Hyundai Mobis(South Korea) and others. These companies adopted inorganic and organic growth strategies such as new product developments, expansions, supply contracts, collaborations, partnerships, and mergers & acquisitions to gain traction in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Volume (Thousand Units), Value (USD million) |

|

Segments Covered |

Component, Material, Electric Vehicle, Vehicle Type, and Region, Passenger Cars Class, Level of Autonomy |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Robert Bosch (Germany), Continental (Germany), Denso (Japan), Grupo Antolin (Spain), Panasonic (Japan), Pioneer (Japan), Faurecia (France), Hyundai Mobis (South Korea), and many more |

This research report categorizes the automotive interior market on the basis of component, material, electric vehicle, autonomous driving, vehicle type, and region.

Automotive Interior Market, By Component

- Center Stack

- Head-Up Display

- Instrument Cluster

- Rear Seat Entertainment

- Dome Module

- Headliner

- Seat

- Interior Lighting

- Door Panel

- Adhesives & Tapes

- Others

Automotive Interior Market, By Material

- Leather

- Fabric

- Vinyl

- Wood

- Glass Fiber Composite

- Carbon Fiber Composite

- Metal

Automotive Interior Market, By level of autonomy

- Semi-Autonomous

- Autonomous

- Non-autonomous

Automotive Interior Market, By Electric Vehicle

- BEV

- FCEV

- HEV

- PHEV

Automotive Interior Market, By Passenger Car Class

- Economic cars

- Mid Segment Cars

- Luxury Segment cars

Automotive Interior Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Interior Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In November 2021, Continental developed an innovative display solution called ShyTech Display that intelligently supports drivers in keeping an eye on all the important information at all times.

- In September 2021, Continental AG and Horizon Robotics formed a joint venture to focus on delivering better solutions for the Advanced Driver Assistance System (ADAS), which will be done by integrating new hardware, including antennas, radars, and sensors.

- In August 2021, Robert Bosch signed a collaboration agreement with Mahindra & Mahindra for the development of the Mahindra connected vehicle platform “AdrenoXConnect”. This platform will deliver seamless connectivity and enhanced user experience in Mahindra’s flagship SUV XUV700.

- In September 2021, Grupo Antolin inked an international collaboration agreement for the Air Move+ air purification solution with ZONAIR3D, an air purification system innovation firm. The partnership entails combining ZONAIR3D air purification technology with Grupo Antolin's knowledge and skills in the development and integration of novel automotive interior solutions.

- In February 2022, Faurecia acquired 79.5% of Hella shares, including 60% of Hella shares from a pool of family shareholders, for approximately 52.1% in cash, 7.9% in newly issued Faurecia shares, and 19.5% as part of the settlement of the public takeover offer, which ended on November 11, 2021. This transaction implies a total investment of USD 6 billion (cash and shares).

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except autonomous driving and material.

Which countries are considered in the European region?

The report includes European countries such as:

- Germany

- France

- Spain

- Turkey

- Russia

- Italy

- UK

- Rest of Europe

We are interested in regional automotive interior market for electric vehicles? Does this report cover the electric vehicle segment?

Yes, the report covers the automotive interior market for different electric vehicle types at regional level.

Does this report include impact of COVID-19 on the automotive interior market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the automotive interior market.

Does this report further segments seat and interior lighting?

Yes, the report covers the market size of different seat types and interior lighting at a global level .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 46)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE INTERIOR MARKET

1.3 MARKET SCOPE

FIGURE 1 AUTOMOTIVE INTERIOR: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 AUTOMOTIVE INTERIOR MARKET – GLOBAL FORECAST TO 2027

FIGURE 2 MNM DOWNGRADES ITS FORECAST OF AUTOMOTIVE INTERIOR MARKET

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE INTERIOR MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key secondary sources for market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 DETAILED ILLUSTRATION OF BOTTOM-UP APPROACH

FIGURE 7 GLOBAL AUTOMOTIVE INTERIOR MARKET SIZE: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR AUTOMOTIVE INTERIOR MARKET: TOP-DOWN APPROACH

FIGURE 9 AUTOMOTIVE INTERIOR MARKET: RESEARCH DESIGN & METHODOLOGY

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.4.1 FACTORS CONSIDERED FOR MARKET FORECAST

TABLE 2 IMPACT OF VARIOUS FACTORS ON GROWTH OF AUTOMOTIVE INTERIOR MARKET

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT & RANGES

TABLE 3 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 69)

FIGURE 11 AUTOMOTIVE INTERIOR MARKET OUTLOOK

FIGURE 12 AUTOMOTIVE INTERIOR MARKET: MARKET DYNAMICS

FIGURE 13 AUTOMOTIVE INTERIOR MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD BILLION)

3.1 COVID-19 IMPACT ON AUTOMOTIVE INTERIOR MARKET

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 AUTOMOTIVE INTERIOR MARKET TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD (2022–2027)

FIGURE 14 INCREASING DEMAND FOR SAFETY AND CONVENIENCE FEATURES IN VEHICLES AND DEMAND FOR ADVANCED INTERIOR COMPONENTS LIKELY TO BOOST MARKET GROWTH

4.2 AUTOMOTIVE INTERIOR MARKET SHARE, BY REGION, 2022

FIGURE 15 ASIA PACIFIC ESTIMATED TO LEAD AUTOMOTIVE INTERIOR MARKET IN 2022

4.3 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE

FIGURE 16 SEAT SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD (USD MILLION)

4.4 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE

FIGURE 17 GLASS FIBER COMPOSITE SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027 (USD BILLION)

4.5 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY

FIGURE 18 SEMI-AUTONOMOUS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE BY 2027 (USD MILLION)

4.6 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS

FIGURE 19 MID-SEGMENT CARS SEGMENT PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD OF 2022 TO 2027

4.7 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 20 BEVS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE BY 2027 (USD MILLION)

4.8 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE

FIGURE 21 PASSENGER CARS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 78)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AUTOMOTIVE INTERIOR MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing customer preference for convenience, premium features, and advanced safety

5.2.1.2 Use of variety of lightweight & advanced materials and innovative finish

TABLE 4 PROPERTIES OF SOME COMMON MATERIALS USED IN AUTOMOTIVE INTERIORS

5.2.1.3 Integration of smartphone connectivity

TABLE 5 GLOBAL NUMBER OF SMARTPHONE USERS OVER THE YEARS

5.2.1.4 Enhanced functionalities in lighting

5.2.1.5 Rise in demand for SUVs to fuel demand for modular seats

FIGURE 23 SHARE OF SUVS IN TOTAL CAR SALES, BY KEY COUNTRY/REGION, 2010-2021 (%)

5.2.2 RESTRAINTS

5.2.2.1 High cost involved, and volatility in raw material costs

5.2.2.2 Significant power consumption in automotive interior electronics

TABLE 6 POWER CONSUMPTION BY INTERIOR APPLICATIONS

5.2.2.3 Increased competition from local companies offering counterfeit/retrofit solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for electric vehicles

TABLE 7 GLOBAL BEV & PHEV SALES, 2018–2021, (‘000 UNITS)

5.2.3.2 Rising trend of semi-autonomous & autonomous vehicles

TABLE 8 RECENT AND ONGOING DEMONSTRATION AND TESTING OF CONNECTED AUTONOMOUS VEHICLES BY KEY COMPANIES

TABLE 9 ECONOMIC IMPACT OF CONNECTED AND AUTONOMOUS VEHICLES AND THEIR BREAKDOWN

TABLE 10 L1: SELF-DRIVING CARS MARKET, BY NEW LAUNCH, 2021

TABLE 11 ROADMAP FOR TECHNOLOGY LEVEL & IMPLEMENTATION OF SEMI-AUTONOMOUS AND AUTONOMOUS DRIVING SYSTEM

5.2.3.3 Growing trend of interior customization in premium vehicles and interior styling

TABLE 12 PRODUCTION VOLUME OF LUXURY CAR MODELS, 2020 VS 2021

5.2.3.4 Advanced lightweight mechanism for automotive seats

5.2.3.5 New entertainment and smart mirror applications

5.2.3.6 Focus on 5G and wireless technology

5.2.4 CHALLENGES

5.2.4.1 Long production cycle time

5.2.4.2 Decline in vehicle sales and production due to semiconductor shortage and COVID-19 pandemic

5.2.4.3 High cost of advanced automotive display systems

5.2.4.4 Presence of unorganized aftermarket

TABLE 13 OEM AMBIENT LIGHTING COST

TABLE 14 AFTERMARKET AMBIENT LIGHTING COST

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 15 AUTOMOTIVE INTERIOR MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 24 PORTER’S FIVE FORCES: AUTOMOTIVE INTERIOR MARKET

5.3.1 THREAT FROM NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITION RIVALRY

5.4 PRICING ANALYSIS

FIGURE 25 AUTOMOTIVE INTERIOR MARKET: AVERAGE PRICE OF AUTOMOTIVE INTERIOR COMPONENTS IN US DOLLARS

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: AUTOMOTIVE INTERIOR MARKET

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 27 AUTOMOTIVE INTERIOR MARKET: SUPPLY CHAIN ANALYSIS (SEATING SYSTEMS)

5.7 ECOSYSTEM

FIGURE 28 ECOSYSTEM: AUTOMOTIVE INTERIOR MARKET

5.8 PATENT ANALYSIS

TABLE 16 AUTOMOTIVE SEATS: INNOVATION & PATENT REGISTRATIONS, 2018-2020

TABLE 17 CENTER STACK: INNOVATION & PATENT REGISTRATIONS, 2018–2021

TABLE 18 SEATS FOR AUTOMOTIVE: INNOVATION & PATENT REGISTRATIONS, 2018-2020

5.9 CASE STUDY

5.9.1 DEVELOPMENT OF MODERN IN-VEHICLE INFOTAINMENT SYSTEM

5.9.2 PLATFORM FOR FUTURISTIC CONNECTED CAR INFOTAINMENT DEMONSTRATION

5.9.3 AUTOMOTIVE HMI INFOTAINMENT SYSTEM

5.9.4 TIER-1 AUTOMOTIVE SOFTWARE PROVIDER CREATES SMARTER IN-CAR INFOTAINMENT SYSTEMS

5.9.5 DESIGN AND DEVELOPMENT OF CAR TELEMATICS PLATFORM

5.10 REVENUE SHIFT DRIVING MARKET GROWTH

FIGURE 29 AUTONOMOUS CAR AND RIDE SHARING PRESENT NEW REVENUE SHIFT FOR AUTOMOTIVE SEAT MANUFACTURERS

FIGURE 30 REVENUE SHIFT FOR CENTER AUTOMOTIVE DISPLAY SYSTEM

5.11 TRADE ANALYSIS

5.11.1 AUTOMOTIVE SEATS: TARIFF RELATED DATA

TABLE 19 CAR SEAT IMPORTS, SELECT COUNTRIES, 2020-2021 (USD)

5.11.2 DISPLAY SYSTEMS: TARIFF RELATED DATA

TABLE 20 DISPLAY SYSTEMS IMPORT TRADE DATA, BY KEY COUNTRIES, 2020 (US DOLLAR THOUSAND)

TABLE 21 DISPLAY SYSTEMS EXPORT TRADE DATA, BY KEY COUNTRIES, 2020 (US DOLLAR THOUSAND)

TABLE 22 PARTS AND ACCESSORIES IMPORT TRADE DATA, BY KEY COUNTRIES, 2020 (US DOLLAR THOUSAND)

TABLE 23 PARTS AND ACCESSORIES EXPORT TRADE DATA, BY KEY COUNTRIES, 2020 (US DOLLAR THOUSAND)

5.11.3 LIGHTING PRODUCTS: TARIFF RELATED DATA

TABLE 24 ELECTRIC LAMPS AND LIGHTING FITTINGS TARIFF DATA FOR MAJOR COUNTRIES IN 2019

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.12.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 26 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 INDUSTRY TRENDS (Page No. - 117)

6.1 TECHNOLOGY OVERVIEW

6.1.1 INTRODUCTION

6.1.2 POLYCARBONATE MATERIAL USAGE

TABLE 27 BENEFITS OF POLYCARBONATE MATERIAL

6.1.3 DOOR PANELS

6.1.4 POWER DRIVE SEATING UNIT

6.1.5 SMART GLASS

6.1.6 AR TECHNOLOGY

6.1.7 FLEXIBLE DISPLAY SOLUTION

6.1.8 APPLICATION OF POLYCARBONATE MATERIAL

6.1.9 KEY TECHNOLOGY TRENDS IN AUTOMOTIVE INTERIOR LIGHTING

TABLE 28 KEY TECHNOLOGY TRENDS IN AUTOMOTIVE INTERIOR LIGHTING

6.1.10 SENSOR FUSION TECHNOLOGY

FIGURE 33 SENSOR FUSION TECHNOLOGY

6.1.10.1 ADAS sensor package and reliability test by Konrad-Technologies

6.1.11 SENSOR TECHNOLOGY COMPARISON

6.1.12 DEVELOPMENT OF IMAGING RADARS

6.1.13 QUANTUM COMPUTING IN AUTOMOTIVE INDUSTRY

6.1.14 DEVELOPMENT OF AI-BASED CAMERAS

6.1.15 ADAS APPLICATIONS

FIGURE 34 ADAS APPLICATIONS

6.1.16 AUTONOMOUS VEHICLES: CYBERSECURITY AND DATA PRIVACY

FIGURE 35 DATA FROM AN AUTONOMOUS VEHICLE

6.1.17 CELLULAR V2X (C-V2X)

TABLE 29 CUMULATIVE GAIN WHILE USING 5G NR (NEW RADIO) C-V2X

6.1.17.1 LTE-V2X

6.1.17.2 5G-V2X

6.2 REGULATORY ANALYSIS

TABLE 30 REGULATIONS FOR DISPLAY SYSTEMS

TABLE 31 AUTONOMOUS VEHICLE REGULATION ACTIVITIES

TABLE 32 STANDARDS RELATED TO AUTOMOTIVE HUD

TABLE 33 SAFETY REGULATIONS RELATED TO AUTOMOTIVE SEATS, BY COUNTRY/REGION

FIGURE 36 REGULATIONS RELATED TO ADAS AND RELATED COMPONENTS

TABLE 34 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 35 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 36 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 37 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.3 AUTOMOTIVE INTERIOR MARKET: CONFERENCES & EVENTS

TABLE 38 AUTOMOTIVE INTERIOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.4 AUTOMOTIVE INTERIOR MARKET, SCENARIOS ANALYSIS

FIGURE 37 AUTOMOTIVE INTERIOR MARKET – FUTURE TRENDS & SCENARIO, 2022–2027 (USD MILLION)

6.4.1 MOST LIKELY SCENARIO

TABLE 39 MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

6.4.2 OPTIMISTIC SCENARIO

TABLE 40 OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

6.4.3 PESSIMISTIC SCENARIO

TABLE 41 PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

7 COVID-19 IMPACT (Page No. - 137)

7.1 INTRODUCTION TO COVID-19

7.2 COVID-19 HEALTH ASSESSMENT

FIGURE 38 COVID-19: GLOBAL PROPAGATION

FIGURE 39 COVID-19 PROPAGATION: SELECT COUNTRIES

7.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 40 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

7.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 41 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 42 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

7.4 AUTOMOTIVE INTERIOR MARKET: COVID-19 IMPACT

7.4.1 IMPACT ON AUTOMOTIVE CHIP PRODUCTION

7.4.2 IMPACT ON VEHICLE SALES

7.4.3 IMPACT ON AUTOMOTIVE INTERIOR MARKET

8 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE (Page No. - 145)

8.1 INTRODUCTION

FIGURE 43 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2022 VS. 2027

TABLE 42 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 43 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 44 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 45 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

8.1.1 OPERATIONAL DATA

TABLE 46 SELECT MODELS WITH POWERED SEATS, 2021

8.1.2 ASSUMPTIONS

TABLE 47 ASSUMPTIONS: BY COMPONENT TYPE

8.1.3 RESEARCH METHODOLOGY

8.1.4 KEY INDUSTRY INSIGHTS

8.2 CENTER STACK

8.2.1 GROWTH IN CONNECTED CAR FEATURES TO DRIVE DEMAND FOR ADVANCED CENTER STACKS

TABLE 48 CENTER STACK: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 49 CENTER STACK: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 50 CENTER STACK: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 CENTER STACK: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 HEAD-UP DISPLAY

8.3.1 OEM’S PUSH TO OFFER HUDS TO CREATE PRODUCT DIFFERENTIATION TO DRIVE THE MARKET

TABLE 52 HEAD-UP DISPLAY: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 53 HEAD-UP DISPLAY: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 54 HEAD-UP DISPLAY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 HEAD-UP DISPLAY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 INSTRUMENT CLUSTER

8.4.1 INCREASING DEMAND FOR DIGITAL INSTRUMENT CLUSTERS TO DRIVE THE MARKET

TABLE 56 INSTRUMENT CLUSTER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 57 INSTRUMENT CLUSTER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 58 INSTRUMENT CLUSTER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 INSTRUMENT CLUSTER: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 REAR SEAT ENTERTAINMENT

8.5.1 GROWTH IN THE SALES OF SUVS TO DRIVE THE DEMAND FOR REAR SEAT ENTERTAINMENT SYSTEMS

TABLE 60 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 61 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 62 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 REAR SEAT ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 DOME MODULE

8.6.1 INCREASING INTEGRATION WITH ELECTRONICS AND MECHANICAL COMPONENTS TO DRIVE THE MARKET

TABLE 64 DOME MODULE: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 65 DOME MODULE: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 66 DOME MODULE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 DOME MODULE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 HEADLINER

8.7.1 ASIA PACIFIC REGION IS ESTIMATED TO BE THE LARGEST

TABLE 68 HEADLINER: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 69 HEADLINER: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 70 HEADLINER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 HEADLINER: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 SEAT

8.8.1 GROWTH IN DEMAND FOR ADVANCED SEATS IN MID AND LUXURY SEGMENT CARS TO FUEL MARKET

TABLE 72 SEAT: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 73 SEAT: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 74 SEAT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 SEAT: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 SEAT: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

TABLE 77 SEAT: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

8.8.1.1 Standard seat

8.8.1.2 Powered seat

8.8.1.3 Heated & powered seat

TABLE 78 SELECT MODELS WITH POWERED & HEATED SEATS, 2021

8.8.1.4 Heated seat

TABLE 79 SELECT MODELS WITH HEATED SEATS, 2021

8.8.1.5 Heated & memory seat

TABLE 80 SELECT MODELS WITH HEATED & MEMORY SEATS, 2021

8.8.1.6 Heated & ventilated seat

8.8.1.7 Heated, ventilated, & memory seat

8.8.1.8 Powered, heated, ventilated, memory, & massage seat

8.9 INTERIOR LIGHTING

8.9.1 GROWTH IN DEMAND FOR MOOD AND AMBIENT LIGHTING TO BOOST MARKET

TABLE 81 INTERIOR LIGHTING: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 82 INTERIOR LIGHTING: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 83 INTERIOR LIGHTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 INTERIOR LIGHTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9.2 AUTOMOTIVE LIGHTING APPLICATIONS

TABLE 85 INTERIOR LIGHTING: MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 86 INTERIOR LIGHTING: MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

8.9.2.1 Dashboard lights

8.9.2.2 Glovebox lights

8.9.2.3 Reading lights

8.9.2.4 Dome lights

8.9.2.5 Rearview mirror interior lights

8.9.2.6 Engine compartment lights

8.9.2.7 Passenger area lights

8.9.2.8 Driver area lights

8.9.2.9 Footwell lights

8.10 DOOR PANEL

8.10.1 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET

TABLE 87 DOOR PANEL: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 88 DOOR PANEL: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 89 DOOR PANEL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 DOOR PANEL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.11 OTHERS

8.11.1 ASIA PACIFIC TO LEAD THE MARKET IN 2027

TABLE 91 OTHERS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 92 OTHERS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 93 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.12 ADHESIVES & TAPES

8.13 UPHOLSTERY

9 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY (Page No. - 174)

9.1 INTRODUCTION

FIGURE 44 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY, 2022 VS. 2027

TABLE 95 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY, 2018–2021 (USD MILLION)

TABLE 96 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY, 2022–2027 (USD MILLION)

9.1.1 OPERATIONAL DATA

TABLE 97 TOP FIVE BEST-SELLING PICKUP TRUCKS WITH SEMI-AUTONOMOUS DRIVING FEATURES IN US, 2021

TABLE 98 RECENT & ONGOING DEMONSTRATION & TESTING OF CONNECTED AUTONOMOUS VEHICLES BY KEY COMPANIES

TABLE 99 L1: SELF-DRIVING CARS MARKET, BY NEW LAUNCH, 2021–2022

TABLE 100 L2: SELF-DRIVING CARS MARKET, BY NEW LAUNCH, 2021–2022

TABLE 101 EXPECTED TECHNOLOGY VS CURRENT TECHNOLOGY READINESS LEVEL OF AUTONOMOUS VEHICLE

9.1.2 ASSUMPTIONS

TABLE 102 ASSUMPTIONS: BY AUTONOMOUS DRIVING

9.1.3 RESEARCH METHODOLOGY

9.1.4 KEY INDUSTRY INSIGHTS

9.2 NON-AUTONOMOUS CARS

9.2.1 ASIA PACIFIC TO LEAD THE MARKET FOR NON-AUTONOMOUS CARS SEGMENT

TABLE 103 NON-AUTONOMOUS CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 NON-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 SEMI-AUTONOMOUS CARS

9.3.1 REGULATIONS AND DEMAND FOR SAFETY FEATURES TO DRIVE THE MARKET

TABLE 105 SEMI-AUTONOMOUS CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 SEMI-AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 AUTONOMOUS CARS

9.4.1 INCREASING INVESTMENTS BY GOVERNMENT AND KEY PLAYERS FROM AUTOMOTIVE INDUSTRY TO DRIVE MARKET

TABLE 107 AUTONOMOUS CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE (Page No. - 187)

10.1 INTRODUCTION

FIGURE 45 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE, 2022 VS. 2027

TABLE 108 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

TABLE 109 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

10.1.1 ASSUMPTIONS

TABLE 110 ASSUMPTIONS: BY MATERIAL TYPE

10.1.2 RESEARCH METHODOLOGY

10.1.3 KEY INDUSTRY INSIGHTS

10.2 LEATHER

TABLE 111 SOME MODELS WITH GENUINE LEATHER SEATS, 2022

10.2.1 DEMAND FOR COMPONENTS WITH LEATHER FINISHING GROWING IN ASIAN COUNTRIES

TABLE 112 LEATHER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 LEATHER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 FABRIC

10.3.1 HUGE PRODUCTION VOLUME OF ECONOMIC CARS DRIVE FABRIC MARKET

TABLE 114 FABRIC: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 115 FABRIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 VINYL

10.4.1 SHOCK-ABSORBING ABILITY OF VINYL DRIVING MARKET

TABLE 116 VINYL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 VINYL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 WOOD

10.5.1 USE OF WOOD MAINLY SEEN IN LUXURY CARS

TABLE 118 WOOD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 WOOD: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 GLASS FIBER COMPOSITE

10.6.1 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET

TABLE 120 GLASS FIBER COMPOSITE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 GLASS FIBER COMPOSITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 CARBON FIBER COMPOSITE

10.7.1 EUROPE ESTIMATE TO LEAD MARKET DUE TO HIGH PRODUCTION VOLUME OF LUXURY CARS

TABLE 122 CARBON FIBER COMPOSITE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 123 CARBON FIBER COMPOSITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 METAL

TABLE 124 STRENGTH VS. DENSITY CHART

10.8.1 TREND OF LIGHTING WEIGHTING TO DRIVE DEMAND FOR ALUMINUM

TABLE 125 METAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 METAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS (Page No. - 198)

11.1 INTRODUCTION

FIGURE 46 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2022 VS. 2027

TABLE 127 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2018–2021 (THOUSAND UNITS)

TABLE 128 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2022–2027 (THOUSAND UNITS)

TABLE 129 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2018–2021 (USD MILLION)

TABLE 130 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2022–2027 (USD MILLION)

11.1.1 ASSUMPTIONS

TABLE 131 ASSUMPTIONS: BY PASSENGER CAR CLASS

11.1.2 RESEARCH METHODOLOGY

11.1.3 KEY INDUSTRY INSIGHTS

11.2 ECONOMIC CARS

11.2.1 ASIA PACIFIC REGION IS THE LARGEST PRODUCER OF ECONOMIC SEGMENT CARS

TABLE 132 ECONOMIC CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 133 ECONOMIC CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 134 ECONOMIC CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 135 ECONOMIC CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

11.3 MID-SEGMENT CARS

11.3.1 CONSUMERS ARE DEMANDING FOR LUXURY CAR FEATURES IN MID-SEGMENT CARS

TABLE 136 MID-SEGMENT CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 137 MID-SEGMENT CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 138 MID-SEGMENT CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 139 MID-SEGMENT CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

11.4 LUXURY CARS

11.4.1 OEMS’ EFFORTS TO OFFER INCREASING NUMBER OF AESTHETIC AND CONVENIENCE FEATURES IN LUXURY CARS TO DRIVE MARKET

TABLE 140 LUXURY CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 141 LUXURY CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 142 LUXURY CARS: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 143 LUXURY CARS: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

12 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 211)

12.1 INTRODUCTION

FIGURE 47 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2027

TABLE 144 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 145 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 146 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 147 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

12.1.1 OPERATIONAL DATA

TABLE 148 TAXATION SCHEME FOR ALTERNATE FUEL VEHICLES, BY KEY COUNTRIES

12.1.2 ASSUMPTIONS

TABLE 149 ASSUMPTIONS: BY ELECTRIC VEHICLE

FIGURE 48 TOP 10 EUROPEAN BRANDS REGISTRATION BY FUEL TYPE, 2021

12.1.3 RESEARCH METHODOLOGY

12.1.4 KEY INDUSTRY INSIGHTS

12.2 BEV

12.2.1 GROWTH IN CHARGING INFRASTRUCTURE AND ADVANCEMENTS BATTERY TECHNOLOGY TO DRIVE MARKET

TABLE 150 BEV: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 151 BEV: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 152 BEV: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 153 BEV: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

12.3 FCEV

12.3.1 COUNTRIES SUCH AS JAPAN, SOUTH KOREA, AND US TO PLAY KEY ROLES IN GROWTH OF FCEV MARKET

TABLE 154 FCEV: MARKET, BY COMPONENT, TYPE 2018–2021 (THOUSAND UNITS)

TABLE 155 FCEV: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 156 FCEV: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 157 FCEV: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

12.4 HEV

12.4.1 GROWING NUMBER OF HEV MODELS IN DEVELOPING COUNTRIES TO DRIVE MARKET

TABLE 158 HEV: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 159 HEV: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 160 HEV: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 161 HEV: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

12.5 PHEV

12.5.1 SIGNIFICANT GROWTH IN SALES OF PHEV IN DEVELOPED COUNTRIES IN PAST FEW YEARS TO DRIVE MARKET

TABLE 162 PHEV: MARKET, BY COMPONENT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 163 PHEV: MARKET, BY COMPONENT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 164 PHEV: MARKET, BY COMPONENT TYPE, 2018–2021 (USD MILLION)

TABLE 165 PHEV: MARKET, BY COMPONENT TYPE, 2022–2027 (USD MILLION)

13 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE (Page No. - 229)

13.1 INTRODUCTION

FIGURE 49 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2022 VS. 2027

TABLE 166 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 167 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 168 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 169 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

13.1.1 ASSUMPTIONS

TABLE 170 ASSUMPTIONS: BY ICE VEHICLE TYPE

13.1.2 KEY INDUSTRY INSIGHTS

13.1.3 RESEARCH METHODOLOGY

13.2 PASSENGER CAR

13.2.1 GROWTH IN DEMAND FOR MID-SEGMENT AND LUXURY CARS TO DRIVE MARKET

TABLE 171 PASSENGER CAR: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 172 PASSENGER CAR: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 173 PASSENGER CAR: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 174 PASSENGER CAR: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 LIGHT COMMERCIAL VEHICLE (LCV)

13.3.1 GROWTH IN POINT TO POINT TRANSPORTATION OWING TO INCREASING DELIVERY SERVICE PROVIDERS TO DRIVE MARKET

TABLE 175 LCV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 176 LCV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 177 LCV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 178 LCV: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 HEAVY COMMERCIAL VEHICLE (HCV)

13.4.1 HIGH DEMAND FOR FREIGHT TRANSPORTATION BY ROAD TO DRIVE MARKET

TABLE 179 HCV: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 180 HCV: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 181 HCV: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 182 HCV: MARKET, BY REGION, 2022–2027 (USD MILLION)

14 AUTOMOTIVE INTERIOR MARKET, BY REGION (Page No. - 240)

14.1 INTRODUCTION

FIGURE 50 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2022 VS. 2027

TABLE 183 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 184 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 185 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 186 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 51 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

TABLE 187 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 188 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 189 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.1 CHINA

14.2.1.1 Highest production and advanced innovations will drive market

TABLE 191 CHINA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 192 CHINA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 193 CHINA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 194 CHINA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.2 JAPAN

14.2.2.1 Presence of leading passenger car OEMs will drive market

TABLE 195 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 196 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 197 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 198 JAPAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.3 SOUTH KOREA

14.2.3.1 Increasing export of hybrid models to drive market

TABLE 199 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 200 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 201 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 202 SOUTH KOREA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.4 INDIA

14.2.4.1 Increase in demand for compact SUVs to drive market

TABLE 203 INDIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 204 INDIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 205 INDIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 206 INDIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.5 THAILAND

14.2.5.1 Increase in vehicle manufacturing facilities by OEMs to drive market

TABLE 207 THAILAND: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 208 THAILAND: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 209 THAILAND: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 210 THAILAND: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.2.6 REST OF ASIA PACIFIC

14.2.6.1 Increasing vehicle production will drive market

TABLE 211 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 212 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 213 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 214 REST OF ASIA PACIFIC: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

FIGURE 52 EUROPE: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

TABLE 215 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 216 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 217 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 218 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Presence of major players to drive market

TABLE 219 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 220 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 221 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 222 GERMANY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.2 FRANCE

14.3.2.1 Increase in production of LCVs will drive market

TABLE 223 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 224 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 225 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 226 FRANCE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.3 UK

14.3.3.1 Rising demand for comfort and convenience in vehicles would increase interior components demand

TABLE 227 UK: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 228 UK: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 229 UK: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 230 UK: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.4 SPAIN

14.3.4.1 LCV segment will drive market

TABLE 231 SPAIN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 232 SPAIN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 233 SPAIN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 234 SPAIN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.5 ITALY

14.3.5.1 Increase in LCV production will drive market

TABLE 235 ITALY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 236 ITALY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 237 ITALY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 238 ITALY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.6 RUSSIA

14.3.6.1 Setting of manufacturing facilities and investments are driving market growth

TABLE 239 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 240 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 241 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 242 RUSSIA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.7 TURKEY

14.3.7.1 New manufacturing facilities attribute to market growth

TABLE 243 TURKEY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 244 TURKEY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 245 TURKEY: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 246 TURKEY: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.3.8 REST OF EUROPE

14.3.8.1 Increase in passenger car production will drive market

TABLE 247 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 248 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 249 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 250 REST OF EUROPE: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 53 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

TABLE 251 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000’ UNITS)

TABLE 252 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000’ UNITS)

TABLE 253 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 254 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.1 US

TABLE 255 US: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 256 US: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 257 US: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 258 US: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Growing focus on electric vehicles to drive market

TABLE 259 CANADA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 260 CANADA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 261 CANADA: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 262 CANADA: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Growing demand for HCVs to drive market

TABLE 263 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 264 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 265 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 266 MEXICO: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5 REST OF THE WORLD (ROW)

FIGURE 54 REST OF THE WORLD: AUTOMOTIVE INTERIOR MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 267 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 268 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 269 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 270 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Growing passenger car and commercial vehicle production will drive market

TABLE 271 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 272 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 273 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 274 BRAZIL: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5.2 IRAN

14.5.2.1 Entry of global players will drive market

TABLE 275 IRAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 276 IRAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 277 IRAN: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 278 IRAN: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

14.5.3 REST OF ROW

14.5.3.1 Low sales of luxury vehicles might slow down growth

TABLE 279 REST OF ROW: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 280 REST OF ROW: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 281 REST OF ROW: MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 282 REST OF ROW: MARKET, BY ICE VEHICLE TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 283)

15.1 MARKET EVALUATION FRAMEWORK

FIGURE 55 MARKET EVALUATION FRAMEWORK

15.2 OVERVIEW

FIGURE 56 KEY DEVELOPMENTS BY LEADING PLAYERS IN AUTOMOTIVE INTERIOR MARKET

15.3 MARKET SHARE ANALYSIS FOR AUTOMOTIVE INTERIOR MARKET

TABLE 283 MARKET SHARE ANALYSIS, 2021

FIGURE 57 MARKET SHARE ANALYSIS, 2021

15.4 RANKING ANALYSIS FOR AUTOMOTIVE INTERIOR MARKET

FIGURE 58 MARKET RANKING ANALYSIS, 2021

15.5 COVID-19 IMPACT ON AUTOMOTIVE INTERIOR COMPANIES

15.6 COMPETITIVE SCENARIO

15.6.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

TABLE 284 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2019–2022

15.6.2 NEW PRODUCT DEVELOPMENTS

TABLE 285 NEW PRODUCT DEVELOPMENTS, 2019–2022

15.6.3 MERGERS & ACQUISITIONS, 2019–2022

TABLE 286 MERGERS & ACQUISITIONS, 2019–2022

15.6.4 EXPANSIONS, 2019–2022

TABLE 287 EXPANSIONS, 2019–2022

15.7 COMPANY EVALUATION QUADRANT

15.7.1 STAR

15.7.2 EMERGING LEADER

15.7.3 PARTICIPANT

15.7.4 EMERGING COMPANIES

FIGURE 59 AUTOMOTIVE INTERIOR MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

15.8 PRODUCT FOOTPRINT

TABLE 288 COMPANY PRODUCT FOOTPRINT

TABLE 289 COMPANY INDUSTRY FOOTPRINT

TABLE 290 COMPANY APPLICATION FOOTPRINT

TABLE 291 COMPANY REGION FOOTPRINT

15.9 STARTUP/SME EVALUATION MATRIX, 2021

15.9.1 PROGRESSIVE COMPANIES

15.9.2 RESPONSIVE COMPANIES

15.9.3 DYNAMIC COMPANIES

15.9.4 STARTING BLOCKS

FIGURE 60 AUTOMOTIVE INTERIOR MARKET: START-UP MATRIX, 2021

TABLE 292 AUTOMOTIVE INTERIOR MARKET: DETAILED LIST OF KEY STARTUPS

TABLE 293 AUTOMOTIVE INTERIOR MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS]

15.10 WINNERS VS. TAIL-ENDERS

TABLE 294 WINNERS VS. TAIL-ENDERS

16 COMPANY PROFILES (Page No. - 301)

16.1 KEY PLAYERS

(Business Overview, Product Offerings, Recent Developments, MNM VIEW, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

16.1.1 CONTINENTAL AG

TABLE 295 CONTINENTAL AG: KEY CUSTOMERS

TABLE 296 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 61 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 297 CONTINENTAL AG: PRODUCT OFFERINGS

TABLE 298 CONTINENTAL AG: NEW PRODUCT LAUNCHES

TABLE 299 CONTINENTAL AG: DEALS

TABLE 300 CONTINENTAL AG: OTHERS

16.1.2 ROBERT BOSCH GMBH

TABLE 301 ROBERT BOSCH GMBH: KEY CUSTOMERS

TABLE 302 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 62 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 303 ROBERT BOSCH GMBH: PRODUCT OFFERINGS

TABLE 304 ROBERT BOSCH GMBH: NEW PRODUCT LAUNCHES

TABLE 305 ROBERT BOSCH GMBH: DEALS

TABLE 306 ROBERT BOSCH GMBH: OTHERS

16.1.3 FAURECIA

TABLE 307 FAURECIA: KEY CUSTOMERS

TABLE 308 FAURECIA: BUSINESS OVERVIEW

FIGURE 63 FAURECIA: COMPANY SNAPSHOT

TABLE 309 FAURECIA: PRODUCT OFFERINGS

TABLE 310 FAURECIA: NEW PRODUCT LAUNCHES

TABLE 311 FAURECIA: DEALS

TABLE 312 FAURECIA: OTHERS

16.1.4 HYUNDAI MOBIS

TABLE 313 HYUNDAI MOBIS: KEY CUSTOMERS

TABLE 314 HYUNDAI MOBIS BUSINESS OVERVIEW

FIGURE 64 HYUNDAI MOBIS: COMPANY SNAPSHOT

TABLE 315 HYUNDAI MOBIS: PRODUCT OFFERINGS

TABLE 316 HYUNDAI MOBIS: NEW PRODUCT LAUNCHES

TABLE 317 HYUNDAI MOBIS: DEALS

TABLE 318 HYUNDAI MOBIS: OTHERS

16.1.5 ADIENT

TABLE 319 ADIENT: BUSINESS OVERVIEW

FIGURE 65 ADIENT: COMPANY SNAPSHOT

TABLE 320 ADIENT: PRODUCT OFFERINGS

TABLE 321 ADIENT: DEALS

TABLE 322 ADIENT: OTHERS

16.1.6 GRUPO ANTOLIN

TABLE 323 GRUPO ANTOLIN: KEY CUSTOMERS

TABLE 324 GRUPO ANTOLIN: BUSINESS OVERVIEW

FIGURE 66 GRUPO ANTOLIN: COMPANY SNAPSHOT

TABLE 325 GRUPO ANTOLIN: PRODUCT OFFERINGS

TABLE 326 GRUPO ANTOLIN: NEW PRODUCT LAUNCHES

TABLE 327 GRUPO ANTOLIN: DEALS

TABLE 328 GRUPO ANTOLIN: OTHERS

16.1.7 DENSO

TABLE 329 DENSO: KEY CUSTOMERS

TABLE 330 DENSO: BUSINESS OVERVIEW

FIGURE 67 DENSO: COMPANY SNAPSHOT

TABLE 331 DENSO: PRODUCT OFFERINGS

TABLE 332 DENSO: DEALS

TABLE 333 DENSO: OTHERS

16.1.8 ZF FRIEDRICHSHAFEN

TABLE 334 ZF FRIEDRICHSHAFEN: KEY CUSTOMERS

TABLE 335 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

FIGURE 68 ZF FRIEDRICHSHAFEN: COMPANY SNAPSHOT

TABLE 336 ZF FRIEDRICHSHAFEN: PRODUCT OFFERINGS

TABLE 337 ZF FRIEDRICHSHAFEN: NEW PRODUCT LAUNCHES

TABLE 338 ZF FRIEDRICHSHAFEN: OTHERS

16.1.9 HELLA

TABLE 339 HELLA: KEY CUSTOMERS

TABLE 340 HELLA: BUSINESS OVERVIEW

FIGURE 69 HELLA: COMPANY SNAPSHOT

TABLE 341 HELLA: PRODUCT OFFERINGS

TABLE 342 HELLA: NEW PRODUCT LAUNCHES

TABLE 343 HELLA: DEALS

TABLE 344 HELLA: OTHERS

16.1.10 PANASONIC

TABLE 345 PANASONIC: KEY CUSTOMERS

TABLE 346 PANASONIC: BUSINESS OVERVIEW

FIGURE 70 PANASONIC: COMPANY SNAPSHOT

TABLE 347 PANASONIC: PRODUCT OFFERINGS

TABLE 348 PANASONIC: NEW PRODUCT LAUNCHES

TABLE 349 PANASONIC: DEALS

16.1.11 VALEO

TABLE 350 VALEO: KEY CUSTOMERS

TABLE 351 VALEO: BUSINESS OVERVIEW

FIGURE 71 VALEO: COMPANY SNAPSHOT

TABLE 352 VALEO: PRODUCT OFFERINGS

TABLE 353 VALEO: NEW PRODUCT LAUNCHES

TABLE 354 VALEO: DEALS

TABLE 355 VALEO: OTHERS

16.1.12 DRAXLMAIER

TABLE 356 DRAXLMAIER: KEY CUSTOMERS

TABLE 357 DRAXLMAIER: BUSINESS OVERVIEW

TABLE 358 DRAXLMAIER: PRODUCTS OFFERED

16.2 OTHER KEY PLAYERS

16.2.1 NIPPON SEIKI

TABLE 359 NIPPON SEIKI: BUSINESS OVERVIEW

16.2.2 YAZAKI CORPORATION

TABLE 360 YAZAKI CORPORATION: BUSINESS OVERVIEW

16.2.3 ALPS ALPINE CO., LTD.

TABLE 361 ALPS ALPINE: BUSINESS OVERVIEW

16.2.4 JVCKENWOOD CORPORATION

TABLE 362 JVCKENWOOD CORPORATION: BUSINESS OVERVIEW

16.2.5 RENESAS

TABLE 363 RENESAS: BUSINESS OVERVIEW

16.2.6 TOSHIBA

TABLE 364 TOSHIBA: BUSINESS OVERVIEW

16.2.7 JAPAN DISPLAY, INC.

TABLE 365 JAPAN DISPLAY, INC.: BUSINESS OVERVIEW

16.2.8 MITSUBISHI ELECTRIC

TABLE 366 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

16.2.9 TEXAS INSTRUMENTS

TABLE 367 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

16.2.10 NVIDIA

TABLE 368 NVIDIA: BUSINESS OVERVIEW

16.2.11 MAGNA INTERNATIONAL

TABLE 369 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

16.2.12 HARMAN INTERNATIONAL

TABLE 370 HARMAN INTERNATIONAL: BUSINESS OVERVIEW

16.2.13 SAINT-GOBAIN

TABLE 371 SAINT-GOBAIN: BUSINESS OVERVIEW

16.2.14 PIONEER CORPORATION

TABLE 372 PIONEER CORPORATION: BUSINESS OVERVIEW

16.2.15 TOMTOM INTERNATIONAL

TABLE 373 TOMTOM INTERNATIONAL BV: BUSINESS OVERVIEW

16.2.16 VISTEON CORPORATION

TABLE 374 VISTEON CORPORATION: BUSINESS OVERVIEW

16.2.17 FUJITSU LIMITED

TABLE 375 FUJITSU LIMITED: BUSINESS OVERVIEW

16.2.18 FORD MOTOR COMPANY

TABLE 376 FORD MOTOR COMPANY: BUSINESS OVERVIEW

16.2.19 GENERAL MOTORS

TABLE 377 GENERAL MOTORS: BUSINESS OVERVIEW

16.2.20 AUDI AG

TABLE 378 AUDI AG: BUSINESS OVERVIEW

16.2.21 BMW AG

TABLE 379 BMW AG: BUSINESS OVERVIEW

*Details on Business Overview, Product Offerings, Recent Developments, MNM VIEW, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 373)

17.1 DISCUSSION GUIDE – AUTOMOTIVE INTERIOR MARKET

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive interior market. The primary sources—experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as to assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

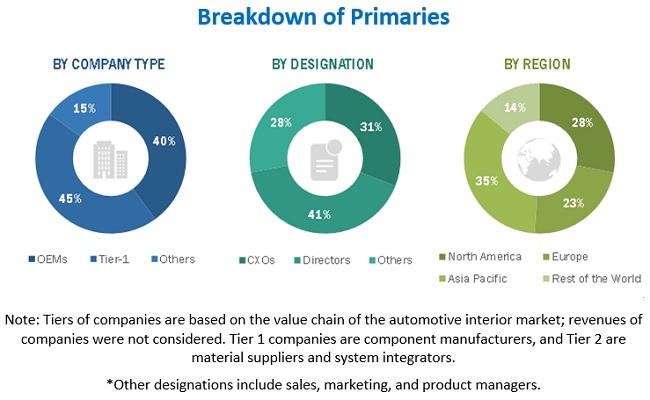

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global automotive interior market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs/vehicle manufacturers) and supply (component manufacturers, module manufacturers, material providers, and system integrators) side across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global automotive interior market. In these approaches, the vehicle production statistics for each vehicle type (passenger vehicles, light commercial vehicles, and heavy commercial vehicles) at a country level were considered.

- Key players in the automotive interior market were identified through secondary research, and their market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

- All major penetration rates, percentage shares, splits, and breakdowns for the automotive interior market were determined using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters affecting the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and project (2022–2027) the automotive interior market, by volume (thousand units) and value (USD million)

- To define, describe, and forecast the market based on component, material, level of autonomy, passenger car class, electric vehicle type, ICE vehicle type, and region

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze and forecast market size, by volume and value, based on component (center stack, instrument cluster, dome module, headliner, seat, interior lighting, door panel, HUD, rear seat entertainment, adhesives & tapes and others)

- To analyze and forecast the market size, by volume and value, based on material (leather, metal, fabric, vinyl, wood, glass fiber composite, and carbon fiber composite)

- To analyze and forecast the market size, by value, based on level of autonomy (semi-autonomous, non-autonomous autonomous)

- To analyze and forecast the market size, by volume and value, based on ICE vehicle type {passenger car, light commercial vehicle (LCV), and heavy commercial vehicle (HCV)}

- To analyze and forecast the market size, by volume and value, based on electric vehicle type (BEV, FCEV, HEV, and PHEV)

- To analyze and forecast the market size, by volume and value, based on passenger car class (economic cars, mid segment cars, luxury cars)

- To forecast the market size, by volume and value, with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the market and its stakeholders

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and expansions, in the automotive interior market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive interior market, by electric vehicle at the country level

- Automotive interior market, by vehicle type at country level (for countries not covered in the report)

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Interior Market

Who are the major automotive players for interior door panels? specifically Asia and North America

I am looking specifically for Reports on European Automotive Interior Coatings Market and European Automotive Metal Components Coatings Market. Thank you for circling back.