Automotive Lead Acid Batteries Market by Product (SLI Batteries, Micro Hybrid Batteries), Type (Flooded, VRLA), Customer Segment (OEM, Aftermarket), End Use (Passenger Cars, Light & Heavy Commercial Vehicles), and Region - Global Forecast to 2028

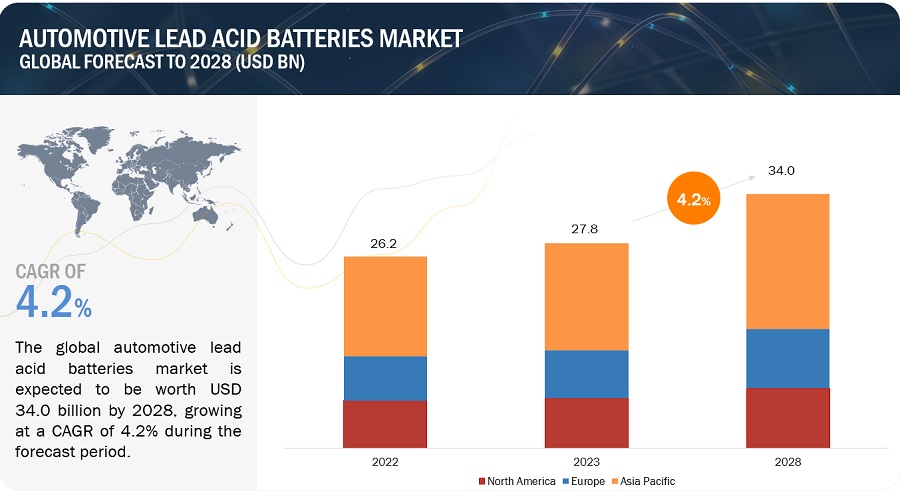

The automotive lead acid batteries market is projected to grow from USD 27.8 billion in 2023 to USD 34.0 billion by 2028, at a CAGR of 4.2%. The automotive lead acid batteries market has observed stable growth throughout the study period and is anticipated to continue with the same trend during the forecast period. Increase in vehicle ownerships with exponentially rising population and rapid urbanization are expected to drive the growth of the market in the upcoming years.

Attractive Opportunities in the Automotive Lead Acid Batteries Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Well established technology and cost-effective energy solution

Lead acid batteries are considered an established and mature technology that has been in use for over 150 years. They are the dominant battery technology for various applications, such as automotive starting batteries, backup power systems, uninterruptible power supplies (UPS), and industrial applications. Besides, lead acid batteries are relatively low-cost compared to other battery technologies like lithium-ion. They are relatively easy to maintain and charge, which contributes to their continued popularity. Hence, the well established infrastructure and cost effectiveness is anticipated to promote the growth of the automotive lead acid batteries.

Restraint: Increasing adoption of lithium-ion batteries

Lithium-ion batteries have gained significant popularity over lead acid batteries in the automotive sector. They offer higher energy density, better power-to-weight ratio, and longer cycle life compared to lead acid batteries. These characteristics make lithium-ion batteries more suitable for the high-performance requirements of electric vehicles, allowing for longer driving ranges and faster acceleration. Thus, increasing adoption of lithium-ion batteries is expected to hamper the growth of automotive lead acid batteries market.

Opportunity: Technological advancements to enhance durability and reduce maintenance requirements.

One focus of research and development is to improve the cycling life of lead acid batteries. This involves optimizing the battery's electrode materials, such as lead alloys, and modifying the battery's design and construction. By enhancing the battery's ability to withstand repeated charge and discharge cycles, the cycling life can be extended, making the battery more durable and long-lasting.

Challenge: Limited usage capacity of lead acid batteries

Lead acid batteries have a limited number of charge-discharge cycles they can endure before experiencing significant degradation in capacity and performance. The cycle life of lead acid batteries is generally lower compared to lithium-ion batteries. This limitation affects the overall usage capacity of lead acid batteries, especially in applications where frequent cycling is required, such as in electric vehicles.

Automotive Lead Acid Batteries Market: Ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of lead acid batteries. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Clarios (US), EnerSys (US), East Penn Manufacturing Company (US), GS Yuasa Corporation (Japan), and Exide Industries Ltd. (India).

Based on product, the SLI batteries segment is projected to account for the largest share in 2023.

The SLI batteries segment is estimated to have the largest share of the global automotive lead acid batteries market in 2023. They are widely used in passenger vehicles, commercial vehicles, motorcycles, and other automotive applications. The key drivers for the SLI batteries include the increasing global vehicle production, rising demand for advanced automotive technologies, stricter emission regulations, and the growth of electric and hybrid vehicles.

Based on type, the VRLA batteries segment is projected to account for the largest share in 2023.

The VRLA batteries segment is estimated to have the largest share of the global automotive lead acid batteries market in 2023. VRLA batteries are used in micro-hybrid vehicles, also known as mild hybrids, which incorporate features like start-stop systems, regenerative braking, and energy recuperation. These systems provide some level of hybrid functionality by assisting the internal combustion engine and reducing fuel consumption. Thus, VRLA batteries support the energy storage requirements of these systems which can be boost the automotive lead acid batteries market.

Based on customer segment, the aftermarket segment is projected to account for the largest share in 2023.

The aftermarket segment is estimated to have the largest share of the global automotive lead acid batteries market in 2023. The segment is primarily driven by the need for battery replacements in vehicles that have exhausted the lifespan of their original batteries. As lead-acid batteries have a limited service life, typically ranging from 3 to 5 years, the aftermarket demand for replacement batteries remains steady. Thus, aftermarket segment promotes the growth of the automotive lead acid batteries market.

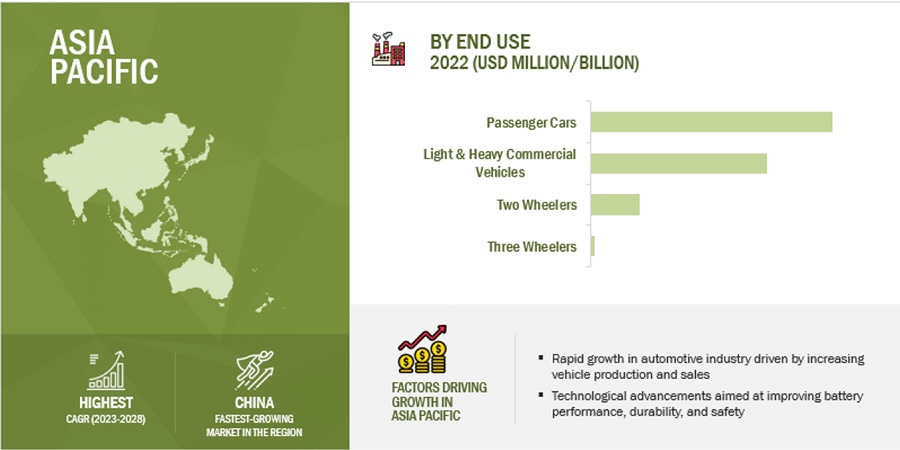

Based on end use, the passenger cars segment is projected to account for the largest share in 2023.

The passenger cars segment is estimated to have the largest share of the global automotive lead acid batteries market in 2023. Economic growth in many regions has resulted in increased disposable income and improved affordability of passenger cars. This has made car ownership more accessible to a larger population, leading to an increase in the number of cars on the road. Thus, the use of passenger cars has been increasing globally promoting the growth of automotive lead acid batteries market.

Based on region, Asia Pacific region is projected to account for the largest share in 2023.

Due to the expanding population, industrialization, urbanization, and rising demand for premium cars, automotive lead acid battery consumption is on the rise in the Asia Pacific region. Also, there is a noticeable shift towards maintenance-free lead acid batteries in the Asian market. These batteries feature advanced designs and technologies that minimize the need for regular maintenance, such as checking electrolyte levels and adding distilled water. Maintenance-free batteries offer convenience to consumers and find increasing acceptance in various applications, including automotive, uninterruptible power supply (UPS) systems, and backup power applications.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Camel Group Co., Ltd. (China), C&D Technologies, Inc. (US), Clarios (US), CSB Energy Technology Co., Ltd. (Taiwan), East Penn Manufacturing Company (US), EnerSys (US), Exide Industries Ltd. (India), Exide Technologies (France), GS Yuasa Corporation (Japan), Koyo Battery Co., Ltd. (Taiwan), Leoch International Technology Limited (China), Mebco (Saudi Arabia), PT. Century Batteries Indonesia (Indonesia), Reem Batteries (Oman), Ritar International Group (China), Robert Bosch GmbH (Germany), Stryten Energy (US), Tai Mao Battery Co., Ltd. (Taiwan), Tianneng (China), and others are among the major players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2017 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Product, Type, Customer Segment, End Use, and Region |

|

Geographies Covered |

Europe, Asia Pacific, North America, South America, and the Middle East & Africa |

|

Companies Covered |

The major market players include Camel Group Co., Ltd. (China), C&D Technologies, Inc. (US), Clarios (US), CSB Energy Technology Co., Ltd. (Taiwan), East Penn Manufacturing Company (US), EnerSys (US), Exide Industries Ltd. (India), Exide Technologies (France), GS Yuasa Corporation (Japan), Koyo Battery Co., Ltd. (Taiwan), Leoch International Technology Limited (China), Mebco (Saudi Arabia), PT. Century Batteries Indonesia (Indonesia), Reem Batteries (Oman), Ritar International Group (China), Robert Bosch GmbH (Germany), Stryten Energy (US), Tai Mao Battery Co., Ltd. (Taiwan), Tianneng (China), and others. |

This research report categorizes the automotive lead acid batteries market based on product, type, customer segment, end use, and region.

Based on product, the automotive lead acid batteries market has been segmented as follows:

- SLI batteries

- Micro hybrid batteries

Based on type, the automotive lead acid batteries market has been segmented as follows:

- Flooded batteries

- VRLA batteries

Based on customer segment, the automotive lead acid batteries market has been segmented as follows:

- OEM

- Aftermarket

Based on end use, the automotive lead acid batteries market has been segmented as follows:

- Passenger cars

- Light & heavy commercial vehicles

- Two wheelers

- Three wheelers

Based on the region, the automotive lead acid batteries market has been segmented as follows:

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- Italy

- France

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

-

South America

- Brazil

- Chile

- Rest of South America

Recent Developments

- In January 2022, Clarios introduced the Smart AGM batteries for application in advanced driver assistance systems of electric vehicles.

- In December 2021, GS Yuasa Corporation signed an agreement with Tata Autocomp GY Batteries Private Limited to double their production of lead acid batteries to more than 8 million units.

Frequently Asked Questions (FAQ):

What is the key driver for the automotive lead acid batteries market?

Well established technology, cost effectiveness, and easy recyclability compare to lithium-ion batteries are the major driving factors for automotive lead acid batteries market.

Which region is expected to hold the largest market share in the automotive lead acid batteries market?

The automotive lead acid batteries market in Asia Pacific is estimated to hold the largest market share. Due to the region's expanding population, industrialization, urbanization, and rising demand for premium cars, automotive lead acid battery consumption is on the rise in the Asia Pacific region.

What is the major end use of automotive lead acid batteries ?

The passenger cars segment with increasing vehicle ownerships worldwide is the major end use of automotive lead acid batteries.

Who are the major manufacturers of automotive lead acid batteries?

The key players operating in the market include Clarios (US), EnerSys (US), East Penn Manufacturing Company (US), GS Yuasa Corporation (Japan), and Exide Industries Ltd. (India).

What is the total CAGR expected to record for the automotive lead acid batteries market during 2023-2028?

The market is expected to record a CAGR of 4.2% from 2023-2028 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

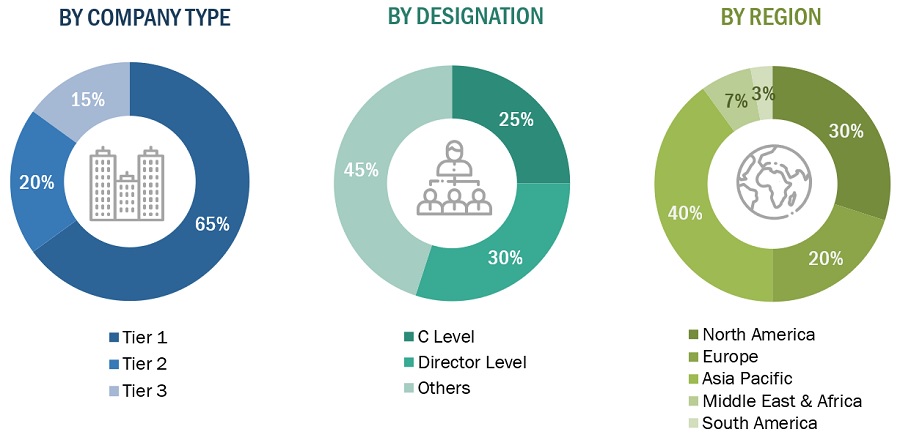

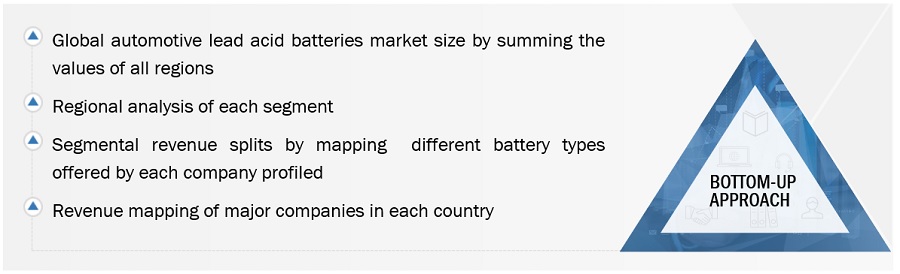

The study involved four major activities in estimating the current market size of automotive lead acid batteries. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of automotive lead acid batteries through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. BusinessWeek, Factiva, World Bank, and Industry Journals, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The automotive lead acid batteries market comprises several stakeholders, such as such as raw material suppliers, processors, battery manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the automotive lead acid batteries market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom- up approaches were used to estimate and validate the total size of the automotive lead acid batteries market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the automotive lead acid batteries market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Automotive Lead Acid Batteries Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Automotive Lead Acid Batteries Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive sector.

Market definition

Automotive lead-acid batteries are a type of rechargeable batteries that utilize lead electrodes and an electrolyte solution of sulfuric acid and water to store and release electrical energy. They are one of the oldest and most widespread types of rechargeable batteries, widely used in various applications, including automotive, marine, and uninterruptible power supply (UPS) systems. They are the most common type of batteries used in the automotive industry due to their reliability, low cost, and ability to provide high starting currents. However, lead-acid batteries have certain limitations. They are relatively heavy and have a lower energy-to-weight ratio compared to other battery types. They also require regular maintenance, including checking the electrolyte level, cleaning terminals, and ensuring proper charging to maximize their lifespan. Additionally, lead-acid batteries contain toxic materials, including lead and sulfuric acid, which require proper handling and recycling.

Key Stakeholders

- Governments and research organizations

- Raw material manufacturers/distributors

- Battery manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

Report Objectives:

- To analyze and forecast the market size of automotive lead acid batteries in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global automotive lead acid batteries market on the basis of product, type, customer segment, end use, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as new product launches, acquisitions, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the automotive lead acid batteries market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Automotive Lead Acid Batteries Market