Automotive Lighting Market for ICE & EV by Technology (Halogen, LED, Xenon/HID), Position & Application (Head, Side, Tail, Fog, DRL, CHMSL, Dashboard, Glovebox, Reading, Dome, Rear View Mirror), Adaptive Lighting, 2W and Region - Global Forecast to 2027

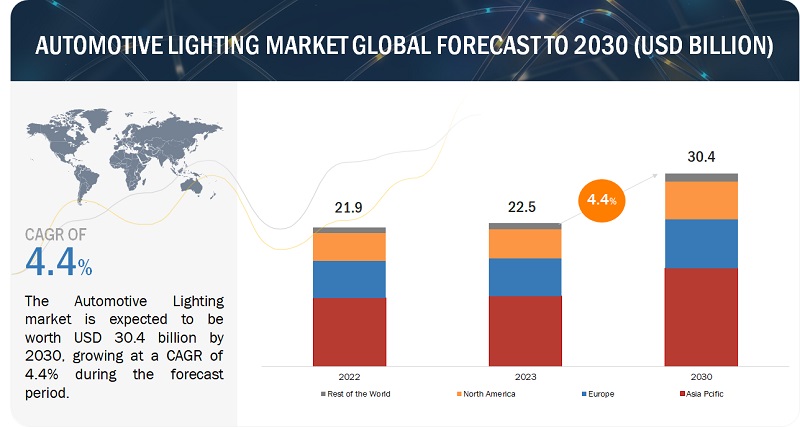

The global automotive lighting market in terms of revenue was estimated to be worth US$ 21.9 billion in 2022 and is poised to reach US$ 28.5 billion by 2027, growing at a CAGR of 5.3% from 2022 to 2027.

Growing demand for premium and luxury cars and SUVs and technological developments in adaptive lighting technology are some of the major factors driving the growth of the automotive lighting industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in demand for premium segment vehicles

An increase in disposable income, improved lifestyle, and changing preferences of consumers have positively impacted the sales of premium cars across the globe. Many of the driver assistance features, such as Blind Spot Detection (BSD), Lane Departure Warning (LDW), Adaptive Cruise Control (ACC), and Forward Collision Warning System (FCWS), are not mandated by laws or regulations. However, some of the premium car manufacturers are offering these features to maintain their position in the market, leading to healthy competition between automobile manufacturers. Car segments such as E, F, SUV-D, and SUV-E are now equipped with many premium features. Premium segment vehicle manufacturers are shifting their product and R&D focus towards electrification. Major OEMs like Ford, Stellantis, and Volkwagen have announced their complete electrification targets by the end of the next decade. As a result, major luxury cars will be launching various EV models. Due to this, advanced lighting technologies, including LEDs, adaptive lights and ambient lights, will be more rapidly incorporated in cars due to their better efficiencies and temperature control than halogen and xenon HID technologies. Thus, premium segment cars along with the rising trend of electrification and sales, especially in countries like China, where one-third of all luxury vehicles produced globally are sold, is expected to boost the automotive headlight market.

Restraint: Semi-conductor chip shortages may affect automotive lighting supply chains

In 2021, the automotive industry lost more than USD 200 billion due to the global microchip shortage. Eleven million fewer vehicles were produced in 2021 till now; manufacturing plants were the idle situation. Major global automakers such as Ford suspended operations at some of their plants to focus on truck assembly, where the profit margins are much better.

Companies that need semiconductors are already reconsidering their long-term procurement strategies due to sustained semiconductor chip shortages. Major carmakers have already announced significant rollbacks in their production, lowering expected revenue for the fiscal year 2021 by billions of dollars. Some companies are realigning their supply chains and shifting to a “just-in-time” ordering model, which helps minimize inventory costs, to one in which they order semiconductors far in advance. For long-term solutions to address shortages, companies are increasing capacity by moving a product to another manufacturing site, usually adding another six months. Also, companies are switching to a different manufacturers. Still, it adds another year or more because the chip’s design requires alterations to match the specific manufacturing processes or suit the requirements of the new manufacturing partner.

Opportunity: Evolution of new technologies

Matrix LED, OLED, and laser lighting are some new and promising technologies for automotive lighting manufacturers. OLED is an emerging solid-state lighting technology that has the potential to emit light across large surfaces. It is a niche technology still in the research and development phase. OLED is likely to be introduced in the premium segment vehicles shortly. However, the technology would require 10 to 15 years to gain a significant market share. Laser lights can produce bright light for headlights with low power consumption. Inorganic LEDs, recently introduced in the market, are now gaining momentum in the global automotive market. The efficient performance of these technologies has attracted the attention of major automakers. Similarly, OLED and laser technology are set to attract automotive OEMs in the coming years.

Challenges: Volatility of raw material prices

The raw materials used in making various lighting systems, such as xenon, halogen, and LED, are tungsten, molybdenum, glass material, niobium, tantalum, phosphorus, and a mixture of inert gases. Developing light sources that consume less power, provide high-intensity light, and have a longer service life requires a combination of different materials and gases. The trend to minimize the use of carbon in automotive components has resulted in a high dependency on rare earth metals and technology metals. For example, LED uses a very small amount of phosphor, a rare earth metal. LED lights result in 80-90% of energy savings due to their service life, which is 5 to 40 times longer than conventional bulbs.

Light manufacturers and suppliers are concerned about the access to rapid incorporation of semiconductors, manufacturing, and AI technologies and associated price volatility due to supply chain disruptions, trade wars, etc. Incorporation and development of such technologies need a larger R&D team and may result in the high price of automotive lighting. Furthermore, manufacturers have long-term supply contracts with major OEMs, which prevents them from capitalizing on decreasing materials prices. If the price of the material reduces, manufacturers do not have the upper hand, and they lose the cost advantage of the material.

Automotive Lighting Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

BEV lighting market is estimated to be the largest market during the forecast period

Global BEV sales increased significantly in recent years and shown good recovery from the impact of the COVID-19 pandemic. The growth is mainly attributed to the expansion of BEV models to new segments in most regions, continued purchase incentives, and stringent emission standards, thereby boosting the electric vehicle lighting market. According to primary respondents and secondary research, BEVs are expected to witness a greater penetration of advanced automotive lighting solutions compared to ICE vehicles. Many American and European vehicle manufacturers are shifting their product and R&D focus toward electrification. Mercedes announced in 2021 that all newly launched vehicles from 2025 would be BEVs. General Motors has set a target for launching 30 EV models and an installed BEV production capacity of 1 million units in North America by 2025.

Similarly, Hyundai Motors has set a target of 1.9 million BEV sales by 2030 to increase its share to 7% of the BEV market. As a result, we will see a large share of cars coming in BEV format. Advanced lighting technologies such as LEDs, adaptive, and ambient lights will be more rapidly incorporated in cars due to better efficiencies and temperature control than halogen and Xenon/HID headlamps. Thus, with the growth of BEV sales, the market for BEV lighting market is projected to grow during the forecast period.

Trucks are expected to witness the fastest growth in the automotive lighting market

Modern trucks generally use new technologies, such as LEDs, for enhanced visibility and safety concerns. Xenon lights have almost negligible penetration in trucks. Launches of premium truck models with advanced lighting systems are expected to drive truck lighting system demand globally. In 2020, Volvo launched its FH series of commercial trucks with adaptive headlights. Bosch also has an “intelligent lighting system” for the heavy commercial vehicle. This shows the increasing adoption of advanced headlights in commercial vehicles, especially trucks. Also, government regulations mandating advanced lighting systems are expected to boost the automotive lighting market strongly. Europe mandated DRLs for trucks in 2012, while the US also legalized adaptive lighting for commercial vehicles in 2022. The Asia Pacific is the largest truck lighting market, with China being the largest market in the region.

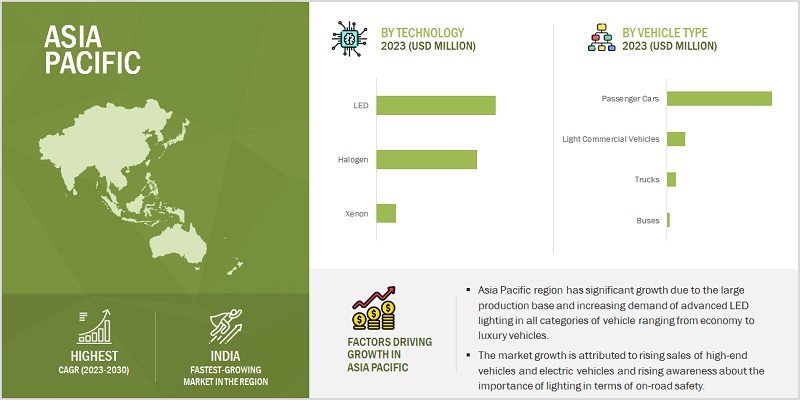

The Asia Pacific is likely to be the largest market during the forecast period

China and Japan dominate the Asia Pacific automotive industry, followed by India and South Korea. Passenger vehicle production in the Asia Pacific accounts for 59% of the global production of passenger vehicles. With the increased disposable income, China has emerged as a key market for premium vehicles. This has boosted the advanced lighting systems market. The key vehicle segment in the Asia Pacific region comprises the economy car segment that features cost-effective specifications. Currently, low-cost halogen technology dominates the automotive lighting market for cars' front, rear, and side lighting systems. However, the LED market has started gaining traction with technological advancements and growing popularity due to its technical advantages. OEMs and tier I companies in the region are now equipping their models with LED lights as they offer better visual effects and longevity. The automotive lighting suppliers in the region include - Varroc (India), Lumax Industries Ltd. (India), Hyundai Mobis (South Korea), Denso Corporation (Japan), Koito Manufacturing Co., Ltd. (Japan), and Keboda (China). The presence of global players is driving the adoption of safety features and advanced lighting technology in vehicle models in the region.

Key Market Players

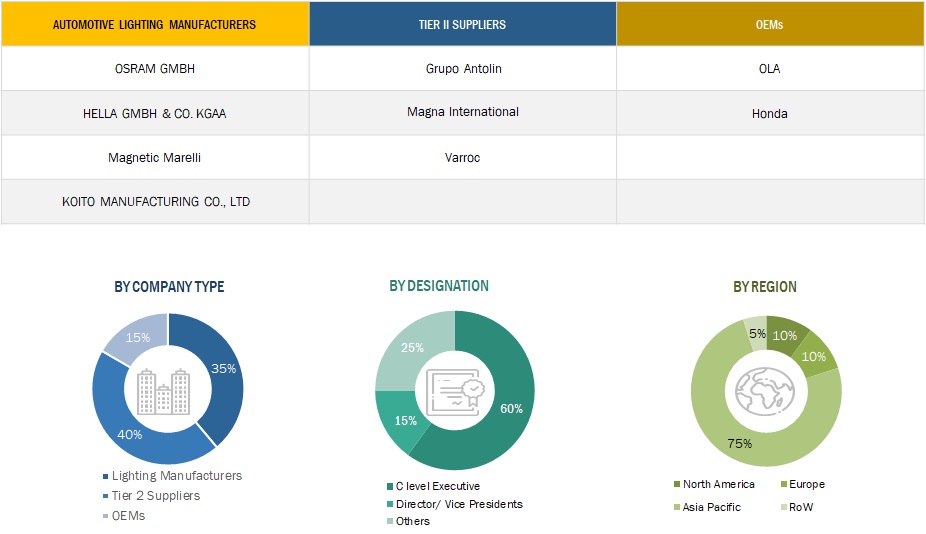

The key players in the automotive lighting market are Hella (Germany), Osram (Germany), Valeo (France), Continental (Germany), Philips (Netherlands), and Bosch (Germany). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Market Growth and Revenue forecast |

USD 28.5 Billion by 2027 at a CAGR of 5.3% |

|

Top Players |

Marelli (Italy), Valeo S.A (Germany), Koito Manufacturing (Japan), Stanley Electric (Hong Kong), Hyundai Mobis (South Korea) |

|

Fastest Growing Market |

RoW |

|

Largest Market |

Asia Pacific |

|

Segments covered |

|

|

By Technology |

Halogen, LED and Xenon/HID |

|

Automotive Adaptive Lighting Market |

Front Adaptive Lightning, Rear Adaptive Lightning, and Ambient Lightning) |

|

By Application |

Front Lightning, Rear Lightning, Side Lightning, Interior Lightning, Sideview Mirror and Rear-view Mirror |

|

By EV Lightning Market, By Technology |

Halogen, LED and Xenon/HID |

|

By Vehicle Type |

Passenger Car, LCV, Bus and Truck |

|

By EV type |

BEV, PHEV and FCEV |

|

By EV Lightning Market, By Application |

Interior and Exterior |

|

Two-wheeler Lightning Market, Position |

Front, Rear and Side |

|

By Region |

North America, Europe, Asia Pacific, Rest of the World |

This research report categorizes the automotive lighting market based on Technology, application, Vehicle Type, EV Lightning Market, By Technology , EV Lightning Market, By Technology, Two-wheeler Lightning Market, Application, and region.

By Technology

- Halogen

- LED

- Xenon/HID

By Automotive Adaptive Lightning Market, By Type

- Front Adaptive Lightning

- Rear Adaptive Lightning

- Ambient Lightning

By Application

- Front Lightning

- Rear Lightning

- Side Lightning

- Interior Lightning

- Sideview Mirror

- Rear-view Mirror

By EV Lightning Market, By Technology

- Halogen

- LED

- Xenon/HID

By Vehicle Type

- Passenger Car

- LCV

- Bus

- Truck

By EV type

- BEV

- PHEV

- FCEV

By EV Lightning Market, By Application

- Interior

- Exterior

By Two-wheeler Lightning Market, Position

- Front

- Rear

- Side

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments by Hella

- In July 2022, HELLA introduced the next Generation of ambient Vehicle Lighting. The new HELLA Slim Light System can indirectly set the interior scene and enable wide-area lighting, such as in the door. The most striking feature of this system is its slim design and lightweight. It can be embedded between several layers, not exceeding a thickness of eight millimeters. By way of comparison, current systems measure around 20 millimeters.

- In February 2022, Samvardhana Motherson Automotive Systems Group BV (SMRP BV), a Motherson organization, and Valeo have marked a Memorandum of Understanding ("MOU") which plans to make the car vehicle interiors and lighting systems with cutting-edge surface finish.

- In July 2019, At the Geneva Motor Show, Gumpert Airways unveiled a super sports car with lighting technology from OSRAM Continental. The B63R LED dual-function projector has been installed in the “Nathalie” model. It offers bright and uniform light distribution and maximum flexibility for vehicle design due to its compact size.

- In January 2019, Valeo and Cree, Inc. announced that the companies have jointly developed the first complete high-definition (HD) LED array solution for automotive lighting systems. Valeo PictureBeam Monolithic is the first complete high-definition lighting system that provides glare-free and high-beam road marking functions together with high-performance low beam and high beam in a single compact solution. This unique solution incorporates a scalable LED array in which the pixels of the light beam are formed directly at the light source. The module is, therefore, smaller and weighs less than other HD lighting systems on the market, making it easier to integrate into all vehicle classes.

Frequently Asked Questions (FAQ):

How big is the automotive lighting market?

The automotive lighting market is estimated to be $21.9 billion in 2022 to $28.5 billion in 2027, at a CAGR of 5.3% during the forecast period.

What is the current size of automotive lighting market?

The global automotive lighting market is estimated to be USD 21.9 billion in 2022.

What are the key market trends impacting the growth of the automotive lighting market?

Increased R&D by the automakers to develop advanced lighting systems, such as front adaptive lighting with better illumination, enhanced safety and visibility is expected to boost the automotive lighting market. Also, global OEMs continuously collaborate with domestic players in emerging economies to develop products tailored to customer needs.

Which technologies (halogen, LED, xenon) are likely to be implemented the most during the next eight years?

The automotive lighting market for LED technology is estimated to be the fastest-growing market. LED is the most convenient technology for adaptive lighting features, especially in cars. And as the market share of premium cars increases, the demand for LED is expected to grow further. However, cheaper technologies are expected to remain popular in cost-sensitive regions as LED is more expensive than halogen and xenon.

What are the key challenges for the seamless automotive lighting market growth?

Shortages in semiconductor chip production, volatility of raw material prices, growing competitive rivalry from local companies, and comparatively lower penetration of advanced lighting in commercial vehicles are expected to present challenges for the automotive lighting market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 49)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 AUTOMOTIVE LIGHTING MARKET SEGMENTATION

FIGURE 2 MARKET, REGION COVERED

1.4 CURRENCY AND PRICING

TABLE 1 CURRENCY EXCHANGE RATES (WRT PER USD)

1.4.1 YEARS CONSIDERED

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 54)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources for building base numbers

2.1.1.2 Secondary sources for estimating numbers related to lighting market

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3 MARKET SIZE ESTIMATION

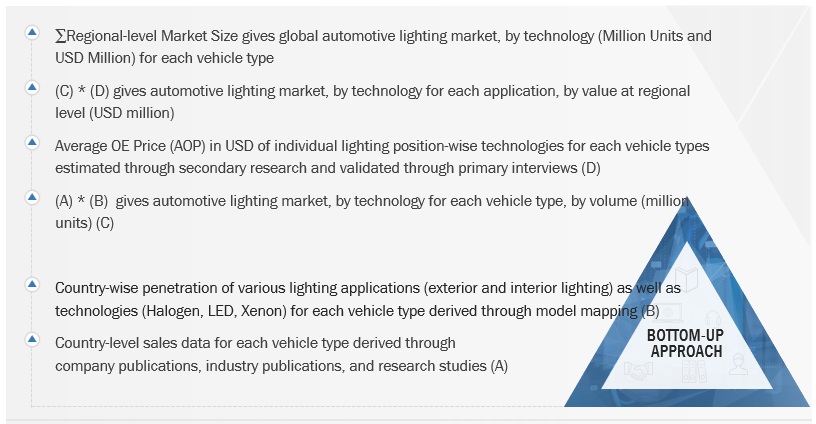

2.3.1 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (ELECTRIC VEHICLE TECHNOLOGY)

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.6.1 ASSUMPTIONS: NUMBER OF LIGHTING UNITS, BY VEHICLE TYPE

2.7 LIMITATIONS/RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 70)

FIGURE 10 AUTOMOTIVE LIGHTING MARKET OUTLOOK

FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 73)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE LIGHTING MARKET

FIGURE 12 GOVERNMENT MANDATES ON SAFETY AND DEVELOPMENTS IN ADVANCED LIGHTING SYSTEMS TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 14 LED EXPECTED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

4.4 MARKET, BY VEHICLE TYPE

FIGURE 15 PASSENGER CAR SEGMENT TO LEAD OVERALL MARKET

4.5 PASSENGER CAR LIGHTING MARKET, BY APPLICATION (MILLION UNITS)

FIGURE 16 INTERIOR SEGMENT TO LEAD PASSENGER CAR MARKET

4.6 LIGHT COMMERCIAL VEHICLES LIGHTING MARKET, BY APPLICATION (MILLION UNITS)

FIGURE 17 INTERIOR SEGMENT TO LEAD LIGHT COMMERCIAL VEHICLES MARKET

4.7 TRUCKS LIGHTING MARKET, BY APPLICATION (MILLION UNITS)

FIGURE 18 INTERIOR SEGMENT TO LEAD TRUCKS MARKET

4.8 BUSES LIGHTING MARKET, BY APPLICATION (MILLION UNITS)

FIGURE 19 INTERIOR SEGMENT TO LEAD BUSES MARKET

4.9 AUTOMOTIVE ADAPTIVE LIGHTING MARKET, BY APPLICATION

FIGURE 20 BENDING/CORNERING LIGHTING TO LEAD MARKET FOR AUTOMOTIVE ADAPTIVE LIGHTING

4.10 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

FIGURE 21 BATTERY ELECTRIC VEHICLE LIGHTING TO DOMINATE EV MARKET DURING FORECAST PERIOD

4.11 ELECTRIC VEHICLE MARKET, BY TECHNOLOGY

FIGURE 22 LED LIGHTING TO DOMINATE EV MARKET DURING FORECAST PERIOD

4.12 ELECTRIC VEHICLE MARKET, BY APPLICATION

FIGURE 23 DRL LIGHTING TO LEAD MARKET FOR EV AUTOMOTIVE LIGHTING

4.13 TWO-WHEELER MARKET, BY POSITION

FIGURE 24 FRONT POSITION LIGHTING EXPECTED TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 80)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 AUTOMOTIVE LIGHTING MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in demand for premium vehicles

TABLE 2 GLOBAL PREMIUM VEHICLE SALES, 2016–2020 (UNITS)

5.2.1.2 Lighting regulations for better visibility and safety

TABLE 3 AUTOMOTIVE LIGHTING REGULATIONS FOR US AND EUROPE

5.2.1.3 High demand for adaptive lighting systems in passenger and entry-level SUVs in developing economies

5.2.2 RESTRAINTS

5.2.2.1 High cost of LED lights

5.2.2.2 Low penetration of advanced lighting in hatchbacks, compact sedans, and entry-level SUV

5.2.2.3 Semiconductor chip shortages affecting automotive lighting supply chains

5.2.3 OPPORTUNITIES

5.2.3.1 Partnership between automotive OEMs and lighting system manufacturers

TABLE 4 PARTNERSHIPS AND AGREEMENTS WITH LIGHTING MANUFACTURERS

5.2.3.2 Evolution of new technologies

5.2.4 CHALLENGES

5.2.4.1 Volatility of raw material prices

5.2.4.2 Increase in competition from local companies offering counterfeit/retrofit solutions

5.2.4.3 Less penetration of advanced lighting in commercial vehicles

5.2.4.4 Development of software capabilities to incorporate AI and other technologies in adaptive lighting systems

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 26 REVENUE SHIFT FOR MARKET

5.4 MARKET, SCENARIOS (2018–2027)

FIGURE 27 MARKET SCENARIOS, 2018–2027 (USD MILLION)

5.4.1 MOST LIKELY SCENARIO

TABLE 5 MARKET (REALISTIC SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.4.2 LOW-IMPACT SCENARIO

TABLE 6 MARKET (LOW-IMPACT SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.4.3 HIGH-IMPACT SCENARIO

TABLE 7 MARKET (HIGH-IMPACT SCENARIO), BY REGION, 2021–2027 (USD MILLION)

5.5 MARKET ECOSYSTEM

FIGURE 28 MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 ADAPTIVE DRIVING BEAM

5.6.2 LASER LIGHT

5.6.3 OLED

5.7 CASE STUDY ANALYSIS

5.7.1 CASE STUDY 1

5.8 PATENT ANALYSIS

5.9 AVERAGE SELLING PRICE ANALYSIS

5.9.1 AUTOMOTIVE FRONT LIGHTING AVERAGE SELLING PRICE ANALYSIS, BY TECHNOLOGY, 2021 (USD)

TABLE 8 AVERAGE SELLING PRICE, BY TECHNOLOGY, 2021 (USD)

5.9.2 AUTOMOTIVE FRONT LIGHTING AVERAGE SELLING PRICE ANALYSIS, BY VEHICLE TYPE, 2021 (USD)

TABLE 9 AVERAGE SELLING PRICE, BY VEHICLE TYPE, 2021 (USD)

5.10 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: MARKET

5.11 PORTER'S FIVE FORCES ANALYSIS

FIGURE 30 PORTER'S FIVE FORCES ANALYSIS: MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TRADE ANALYSIS

TABLE 10 TRADE ANALYSIS (VEHICLE PARTS): AUTOMOTIVE LIGHTING, SERVO-AUTOMOTIVE LIGHTING, AND PARTS THEREOF

5.13 REGULATORY LANDSCAPE

5.13.1 VEHICLE SAFETY STANDARDS, BY REGION

5.14 KEY STAKEHOLDERS IN BUYING PROCESS & BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR AUTOMOTIVE LIGHTING TECHNOLOGY

TABLE 11 KEY BUYING CRITERIA FOR TOP THREE AUTOMOTIVE LIGHTING TYPES

5.15 KEY CONFERENCES

5.15.1 MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

6 AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY (Page No. - 104)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS/LIMITATIONS

6.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET, BY TECHNOLOGY, 2022 VS 2027 (USD MILLION)

TABLE 12 MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 13 MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 14 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

6.2 HALOGEN

6.2.1 HALOGEN TO WITNESS DECLINING MARKET SHARE DUE TO GROWING LED POPULARITY

TABLE 16 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 17 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 18 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 LED

6.3.1 CONTINUOUS DEVELOPMENTS AND INNOVATIONS TO DRIVE ADOPTION

TABLE 20 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 21 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 22 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 XENON/HID

6.4.1 ASIA PACIFIC TO REMAIN LARGEST MARKET FOR XENON TECHNOLOGY

TABLE 24 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 25 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 26 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY REGION, 2022–2027 (USD MILLION)

7 AUTOMOTIVE LIGHTING MARKET, BY APPLICATION (Page No. - 113)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

7.2 MARKET DEFINITIONS

7.2.1 FRONT LIGHTING

7.2.1.1 Headlights

7.2.1.2 Fog lights

7.2.1.3 Daytime running lights (DRL)

7.2.2 REAR LIGHTING

7.2.2.1 Taillights

7.2.2.2 Center high-mount stop light (CHMSL)

7.2.2.3 License plate lamp

7.2.3 SIDELIGHTING

7.2.3.1 Sidelights

7.2.3.2 Side rearview mirror indicator

7.2.4 INTERIOR LIGHTING

7.2.4.1 Dashboard

7.2.4.2 Glove box

7.2.4.3 Reading lights

7.2.4.4 Dome lights

7.2.4.5 Rearview mirror interior light

7.2.5 FRONT LIGHTING MARKET, BY VEHICLE TYPE

TABLE 28 FRONT LIGHTING: AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 29 FRONT LIGHTING: MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

7.2.6 REAR LIGHTING MARKET, BY VEHICLE TYPE

TABLE 30 REAR LIGHTING: MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 31 REAR LIGHTING: MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

7.2.7 SIDELIGHTING MARKET, BY VEHICLE TYPE

TABLE 32 SIDELIGHTING: MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 33 SIDELIGHTING: MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

7.2.8 INTERIOR LIGHTING MARKET, BY VEHICLE TYPE

TABLE 34 INTERIOR LIGHTING: MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 35 INTERIOR LIGHTING: MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

7.3 PASSENGER CAR LIGHTING MARKET, BY APPLICATION

FIGURE 33 MARKET, BY APPLICATION, 2022 VS 2027 (MILLION UNITS)

7.4 MARKET, BY APPLICATION

TABLE 36 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 37 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.4.1 DASHBOARD LIGHT

TABLE 38 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 39 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.4.2 GLOVE BOX

TABLE 40 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 41 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.4.3 READING LIGHT

TABLE 42 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 43 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.4.4 DOME LIGHT

TABLE 44 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 45 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.4.5 REARVIEW MIRROR INTERIOR LIGHT

TABLE 46 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 47 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.5 PASSENGER CAR FRONT LIGHTING MARKET, BY APPLICATION

TABLE 48 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 49 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.5.1 HEADLIGHT

TABLE 50 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 51 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.5.2 FOG LIGHT

TABLE 52 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 53 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.5.3 DAYTIME RUNNING LIGHT

TABLE 54 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 55 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.6 PASSENGER CAR REAR LIGHTING MARKET, BY APPLICATION

TABLE 56 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 57 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.6.1 TAIL LIGHT

TABLE 58 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 59 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.6.2 CENTER HIGH-MOUNT STOP LIGHT

TABLE 60 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 61 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.6.3 LICENSE PLATE LIGHT

TABLE 62 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 63 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.7 PASSENGER CAR SIDELIGHTING MARKET, BY APPLICATION

TABLE 64 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 65 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.7.1 SIDELIGHT

TABLE 66 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 67 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.7.2 SIDE REARVIEW MIRRORS INDICATOR LIGHT

TABLE 68 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 69 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.8 LIGHT COMMERCIAL VEHICLE LIGHTING MARKET, BY POSITION

FIGURE 34 MARKET, BY POSITION, 2022 VS 2027 (MILLION UNITS)

7.9 LIGHT COMMERCIAL VEHICLE INTERIOR LIGHTING MARKET, BY APPLICATION

TABLE 70 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 71 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.9.1 DASHBOARD LIGHT

TABLE 72 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 73 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.9.2 GLOVE BOX

TABLE 74 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 75 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.9.3 READING LIGHT

TABLE 76 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 77 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.9.4 DOME LIGHT

TABLE 78 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 79 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.9.5 REARVIEW MIRROR INTERIOR LIGHT

TABLE 80 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 81 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.1 LIGHT COMMERCIAL VEHICLE FRONT LIGHTING MARKET, BY APPLICATION

TABLE 82 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 83 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.10.1 HEADLIGHT

TABLE 84 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 85 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.10.2 FOG LIGHT

TABLE 86 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 87 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.10.3 DAYTIME RUNNING LIGHT (DRL)

TABLE 88 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 89 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.11 LIGHT COMMERCIAL VEHICLE REAR LIGHTING MARKET, BY APPLICATION

TABLE 90 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 91 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.11.1 TAIL LIGHT

TABLE 92 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 93 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.11.2 CENTER HIGH-MOUNT STOP LIGHT (CHMSL)

TABLE 94 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 95 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.11.3 LICENSE PLATE LIGHT

TABLE 96 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 97 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.12 LIGHT COMMERCIAL VEHICLE SIDELIGHTING MARKET, BY APPLICATION

TABLE 98 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 99 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.12.1 SIDELIGHT

TABLE 100 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 101 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.13 TRUCK LIGHTING MARKET, BY POSITION

FIGURE 35 MARKET, BY POSITION, 2022 VS 2027 (MILLION UNITS)

7.14 TRUCK INTERIOR LIGHTING MARKET, BY APPLICATION

TABLE 102 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 103 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.14.1 DASHBOARD LIGHT

TABLE 104 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 105 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.14.2 CABIN AND READING LIGHT

TABLE 106 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 107 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.14.3 ENGINE COMPARTMENT LIGHT

TABLE 108 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 109 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.15 TRUCK FRONT LIGHTING MARKET, BY APPLICATION

TABLE 110 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 111 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.15.1 HEADLIGHT

TABLE 112 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 113 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.15.2 FOG LIGHT

TABLE 114 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 115 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.15.3 CLEARANCE LAMP

TABLE 116 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 117 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.15.4 TURN SIGNAL LAMP

TABLE 118 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 119 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.15.5 DAYTIME RUNNING LIGHT

TABLE 120 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 121 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.16 TRUCK REAR LIGHTING MARKET, BY APPLICATION

TABLE 122 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 123 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.16.1 TRUCK STOP LAMP

TABLE 124 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 125 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.16.2 TRUCK TAIL LAMP

TABLE 126 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 127 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.16.3 LICENSE PLATE LAMP

TABLE 128 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 129 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.16.4 TURN SIGNAL LAMP

TABLE 130 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 131 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.17 TRUCK SIDELIGHTING MARKET, BY APPLICATION

TABLE 132 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 133 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.17.1 MARKER LAMP

TABLE 134 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 135 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.18 BUS LIGHTING MARKET, BY POSITION

FIGURE 36 BUS LIGHTING MARKET, BY POSITION, 2022 VS 2027 (MILLION UNITS)

7.19 BUS INTERIOR LIGHTING MARKET, BY APPLICATION

TABLE 136 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 137 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.19.1 DASHBOARD LAMP

TABLE 138 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 139 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.19.2 BUS AREA LIGHT

TABLE 140 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 141 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.19.3 DRIVER AREA LIGHT

TABLE 142 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 143 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.19.4 FOOTWELL LIGHT

TABLE 144 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 145 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.20 BUS FRONT LIGHTING MARKET, BY APPLICATION

TABLE 146 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 147 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.20.1 HEADLAMP UNIT

TABLE 148 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 149 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.20.2 CLEARANCE LAMP

TABLE 150 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 151 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.20.3 INDICATOR

TABLE 152 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 153 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.20.4 IDENTIFICATION LAMP

TABLE 154 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 155 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.20.5 DAYTIME RUNNING LIGHT

TABLE 156 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 157 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.21 BUS REAR LIGHTING MARKET, BY APPLICATION

TABLE 158 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 159 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.21.1 LICENSE PLATE LAMP

TABLE 160 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 161 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.21.2 TAIL LAMP

TABLE 162 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 163 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.21.3 REAR CLEARANCE LAMP

TABLE 164 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 165 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.21.4 REAR IDENTIFICATION LAMP

TABLE 166 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 167 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.21.5 STOP LAMP

TABLE 168 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 169 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

7.22 BUS SIDELIGHTING MARKET, BY APPLICATION

TABLE 170 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 171 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7.22.1 MARKER LAMP

TABLE 172 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 173 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

8 AUTOMOTIVE ADAPTIVE LIGHTING MARKET, BY TYPE (Page No. - 166)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

8.2 FRONT ADAPTIVE LIGHTING

TABLE 174 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 175 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 176 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 177 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.1 AUTO ON/OFF

8.2.1.1 Increasing incorporation of on/off features by automakers to boost demand

TABLE 178 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 179 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 180 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 181 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.2 BENDING/CORNERING LIGHTS

8.2.2.1 Technical benefits such as enhanced visibility and safety to increase penetration

TABLE 182 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 183 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 184 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 185 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.3 HIGH BEAM ASSIST

8.2.3.1 Asia Pacific to dominate market for this segment

TABLE 186 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 187 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 188 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 189 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.4 HEADLIGHT LEVELING

8.2.4.1 Developments in headlight leveling technology driving adoption

TABLE 190 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 191 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 192 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 193 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 REAR ADAPTIVE LIGHTING

8.3.1 FAVORABLE GOVERNMENT REGULATIONS TO INCREASE DEMAND FOR REAR ADAPTIVE LIGHTING

TABLE 194 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 195 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 196 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 197 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AMBIENT LIGHTING

8.4.1 TECHNOLOGICAL DEVELOPMENTS AND INCREASED R&D TO DRIVE AMBIENT LIGHTING MARKET

TABLE 198 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 199 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 200 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 201 MARKET, BY REGION, 2022–2027 (USD MILLION)

9 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE (Page No. - 181)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 38 AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 202 MARKET, BY VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 203 MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 204 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 205 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

9.2 PASSENGER CAR

9.2.1 INCREASING ADOPTION OF ADVANCED LIGHTING SYSTEMS AND GROWING DEMAND FOR LUXURY CARS TO BOOST DEMAND

TABLE 206 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 207 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 208 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 209 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LIGHT COMMERCIAL VEHICLE

9.3.1 GROWING LCV PRODUCTION TO DRIVE AUTOMOTIVE LIGHTING MARKET

TABLE 210 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 211 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 212 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 213 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 TRUCK

9.4.1 INCREASING PENETRATION OF ADVANCED HEADLIGHTS TO BOOST TRUCK LIGHTING MARKET

TABLE 214 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 215 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 216 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 217 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 BUS

9.5.1 GROWING PUBLIC TRANSPORTATION SYSTEM TO DRIVE DEMAND FOR BUS LIGHTING SYSTEM

TABLE 218 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 219 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 220 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 221 MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRIC VEHICLE LIGHTING MARKET, BY TECHNOLOGY (Page No. - 192)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 39 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 222 MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 223 MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 224 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 225 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

10.2 HALOGEN

10.2.1 HALOGEN HOLDS LARGEST MARKET SHARE

TABLE 226 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 227 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 228 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 229 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 LED

10.3.1 GROWING ADOPTION AND TECHNOLOGICAL DEVELOPMENTS TO DRIVE LED MARKET

TABLE 230 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 231 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 232 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 233 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 XENON/HID

10.4.1 DEMAND FOR XENON EXPECTED TO SUFFER DUE TO GROWING POPULARITY OF LED

TABLE 234 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 235 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 236 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 237 MARKET, BY REGION, 2022–2027 (USD MILLION)

11 ELECTRIC VEHICLES LIGHTING MARKET, BY APPLICATION (Page No. - 201)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

11.2 EXTERIOR LIGHTING

FIGURE 40 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 239 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 240 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 241 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.1 HEADLIGHT

TABLE 242 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 243 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 244 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 245 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.2 FOG LIGHT

TABLE 246 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 247 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 248 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 249 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.3 DAYTIME RUNNING LIGHT (DRL)

TABLE 250 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 251 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 252 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 253 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.4 TAIL LIGHT

TABLE 254 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 255 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 256 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 257 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.5 SIDELIGHT

TABLE 258 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 259 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 260 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 261 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2.6 CENTER HIGH-MOUNT STOP LIGHT

TABLE 262 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 263 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 264 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 265 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 INTERIOR LIGHTING

FIGURE 41 MARKET, BY APPLICATION (INTERIOR LIGHTING), 2022–2027 (USD MILLION)

TABLE 266 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 267 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 268 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 269 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.1 DASHBOARD LIGHT

TABLE 270 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 271 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 272 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 273 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.2 GLOVE BOX LIGHT

TABLE 274 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 275 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 276 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 277 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.3 READING LIGHT

TABLE 278 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 279 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 280 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 281 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3.4 DOME LIGHT

TABLE 282 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 283 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 284 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 285 MARKET, BY REGION, 2022–2027 (USD MILLION)

12 ELECTRIC VEHICLE AUTOMOTIVE LIGHTING MARKET, BY VEHICLE TYPE (Page No. - 220)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 42 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 286 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (MILLION UNITS)

TABLE 287 MARKET, BY VEHICLE TYPE, 2022–2027 (MILLION UNITS)

TABLE 288 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 289 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2 BEV

12.2.1 INCREASING INVESTMENT BY AUTOMAKERS TO ELECTRIFY THEIR PRODUCTS TO DRIVE MARKET

TABLE 290 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 291 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 292 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 293 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 PLUG-IN HYBRID ELECTRIC VEHICLE

12.3.1 GROWING SALES OF PHEVS IN EUROPE AND STRINGENT SAFETY STANDARDS TO DRIVE MARKET

TABLE 294 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 295 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 296 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 297 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 FUEL CELL ELECTRIC VEHICLE

12.4.1 LAUNCH OF FCEV MODELS WITH ADVANCED SAFETY FEATURES TO BOOST MARKET

TABLE 298 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 299 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 300 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 301 MARKET, BY REGION, 2022–2027 (USD MILLION)

13 TWO-WHEELER LIGHTING MARKET, BY POSITION (Page No. - 230)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 43 MARKET, BY POSITION, 2022–2027 (USD MILLION)

TABLE 302 MARKET, BY POSITION, 2018–2021 (‘000 UNITS)

TABLE 303 MARKET, BY TECHNOLOGY, 2022–2027 (‘000 UNITS)

TABLE 304 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 305 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

13.2 FRONT

13.2.1 GROWING POPULARITY OF LED HEADLIGHTS TO DRIVE FRONT LIGHTING MARKET

TABLE 306 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 307 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 308 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 309 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 SIDE

13.3.1 GROWING TWO-WHEELER SALES TO BOOST SIDELIGHT MARKET

TABLE 310 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 311 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 312 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 313 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 REAR

13.4.1 REAR LIGHTING IMPORTANT FOR ENHANCED SAFETY AND VISIBILITY

TABLE 314 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 315 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 316 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 317 MARKET, BY REGION, 2022–2027 (USD MILLION)

14 AUTOMOTIVE LIGHTING MARKET, BY REGION (Page No. - 238)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS/LIMITATIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 44 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 318 MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 319 MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 320 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 321 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 322 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 323 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 324 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 325 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.1 CHINA

14.2.1.1 Strong presence of leading vehicle manufacturers to drive automotive lighting market

TABLE 326 CHINA: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 327 CHINA: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 328 CHINA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 329 CHINA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.2.2 JAPAN

14.2.2.1 Country among first to mandate automatic headlamps

TABLE 330 JAPAN: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 331 JAPAN: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 332 JAPAN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 333 JAPAN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.2.3 SOUTH KOREA

14.2.3.1 Developments in autonomous vehicles to boost demand for advanced lighting systems

TABLE 334 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 335 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 336 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 337 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.2.4 INDIA

14.2.4.1 Growing demand for SUVs and MUVs

TABLE 338 INDIA: AUTOMOTIVE LIGHTING MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 339 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 340 INDIA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 341 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.2.5 REST OF ASIA PACIFIC

14.2.5.1 Growing domestic production to drive demand

TABLE 342 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 343 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 344 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 345 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.3 EUROPE

FIGURE 46 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 346 EUROPE: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 347 EUROPE: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 348 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 349 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Government mandates for safety standards to fuel demand

TABLE 350 GERMANY: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 351 GERMANY: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 352 GERMANY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 353 GERMANY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.3.2 FRANCE

14.3.2.1 Increasing sales of premium and luxury vehicles to propel automotive lighting market

TABLE 354 FRANCE: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 355 FRANCE: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS )

TABLE 356 FRANCE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION )

TABLE 357 FRANCE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.3.3 SPAIN

14.3.3.1 Increasing production of passenger cars and LCVs to drive market

TABLE 358 SPAIN: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 359 SPAIN: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 360 SPAIN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 361 SPAIN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.3.4 UK

14.3.4.1 High demand for premium and luxury cars to drive market

TABLE 362 UK: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 363 UK: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 364 UK: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 365 UK: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.3.5 REST OF EUROPE

14.3.5.1 Increasing production of vehicles to drive market

TABLE 366 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 367 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 368 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 369 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 370 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 371 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 372 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 373 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.1 US

14.4.1.1 Government regulations mandating adaptive lighting to boost market

TABLE 374 US: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 375 US: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 376 US: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 377 US: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.4.2 CANADA

14.4.2.1 High demand for advanced vehicles and premium cars to fuel market

TABLE 378 CANADA: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 379 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 380 CANADA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 381 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Government regulations to increase domestic production

TABLE 382 MEXICO: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 383 MEXICO: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 384 MEXICO: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 385 MEXICO: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.5 REST OF WORLD (ROW)

FIGURE 48 ROW MARKET, 2022 VS 2027 (USD MILLION)

TABLE 386 ROW: MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 387 ROW: MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 388 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 389 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Trade agreements with US boosting automobile production

TABLE 390 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 391 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 392 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 393 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.5.2 IRAN

14.5.2.1 Government programs to boost domestic vehicle production

TABLE 394 IRAN: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 395 IRAN: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 396 IRAN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 397 IRAN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

14.5.3 OTHERS IN ROW

14.5.3.1 Growing vehicle demand and safety mandates to drive market

TABLE 398 OTHERS IN ROW: MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 399 OTHERS: MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 400 OTHERS IN ROW: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 401 OTHERS IN ROW: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 274)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 402 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGY, 2019–2022

FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2021

15.3 MARKET SHARE ANALYSIS, 2021

TABLE 403 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS (2021)

FIGURE 50 AUTOMOTIVE LIGHTING MARKET SHARE ANALYSIS, 2021

15.4 COMPETITIVE LEADERSHIP MAPPING

15.4.1 STARS

15.4.2 EMERGING LEADERS

15.4.3 PERVASIVE PLAYERS

15.4.4 PARTICIPANTS

FIGURE 51 COMPETITIVE LEADERSHIP MAPPING: AUTOMOTIVE LIGHTING MANUFACTURERS

TABLE 404 MARKET: COMPANY FOOTPRINT

TABLE 405 COMPANY TECHNOLOGY FOOTPRINT

TABLE 406 COMPANY REGION FOOTPRINT

15.5 COMPETITIVE LEADERSHIP MAPPING: AUTOMOTIVE ADAPTIVE LIGHTING MANUFACTURERS

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 52 COMPETITIVE LEADERSHIP MAPPING: AUTOMOTIVE ADAPTIVE LIGHTING MANUFACTURERS

15.6 NEW PRODUCT LAUNCHES

TABLE 407 NEW PRODUCT DEVELOPMENT, 2019–2022

15.7 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

TABLE 408 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES, 2019–2022

16 COMPANY PROFILES (Page No. - 287)

(Business overview, Products offered, Recent Developments, MNM view)*

16.1 KEY PLAYERS

16.1.1 KOITO MANUFACTURING CO., LTD.

FIGURE 53 KOITO MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

TABLE 410 KOITO MANUFACTURING CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 411 KOITO MANUFACTURING CO., LTD.: DEALS

16.1.2 HELLA KGAA HUECK & CO.

FIGURE 54 HELLA KGAA HUECK & CO: COMPANY SNAPSHOT

TABLE 413 HELLA KGAA HUECK & CO: NEW PRODUCT DEVELOPMENTS

TABLE 414 HELLA KGAA HUECK & CO: DEALS

16.1.3 VALEO SA

FIGURE 55 VALEO SA.: COMPANY SNAPSHOT

TABLE 416 VALEO SA: NEW PRODUCT DEVELOPMENTS

TABLE 417 VALEO SA: DEALS

16.1.4 OSRAM GMBH

FIGURE 56 OSRAM GMBH: COMPANY SNAPSHOT

TABLE 419 OSRAM GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 420 OSRAM GMBH: DEALS

16.1.5 CONTINENTAL AG

FIGURE 57 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 422 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 423 CONTINENTAL AG: DEALS

16.1.6 MARELLI AUTOMOTIVE LIGHTING

TABLE 424 AUTOMOTIVE MARELLI LIGHTING: COMPANY OVERVIEW

TABLE 425 MARELLI AUTOMOTIVE LIGHTING: DEALS

16.1.7 HYUNDAI MOBIS

FIGURE 58 HYUNDAI MOBIS COMPANY SNAPSHOT

TABLE 427 HYUNDAI MOBIS: DEALS

16.1.8 ICHIKOH INDUSTRIES, LTD.

FIGURE 59 ICHIKOH INDUSTRIES, LTD. COMPANY SNAPSHOT

TABLE 429 ICHIKOH INDUSTRIES, LTD.: DEALS

TABLE 430 ICHIKOH INDUSTRIES, LTD.: OTHERS

16.1.9 ROBERT BOSCH GMBH

TABLE 431 BOSCH: COMPANY OVERVIEW

FIGURE 60 BOSCH: COMPANY SNAPSHOT

TABLE 432 BOSCH: PRODUCT LAUNCHES

16.1.10 STANLEY ELECTRIC CO., LTD.

FIGURE 61 STANLEY ELECTRIC CO., LTD. COMPANY SNAPSHOT

TABLE 434 STANLEY ELECTRIC CO., LTD.: DEALS

16.1.11 KONINKLIJKE PHILIPS N.V.

TABLE 435 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

FIGURE 62 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16.2 OTHER PLAYERS

16.2.1 ZIZALA LICHTSYSTEME GMBH

TABLE 436 ZIZALA LICHTSYSTEME GMBH: COMPANY OVERVIEW

16.2.2 NXP SEMICONDUCTORS

TABLE 437 NXP SEMICONDUCTORS: COMPANY OVERVIEW

16.2.3 GRUPO ANTOLIN

TABLE 438 GRUPPO ANTOLIN: COMPANY OVERVIEW

16.2.4 FEDERAL-MOGUL CORPORATION

TABLE 439 FEDERAL-MOGUL CORPORATION: COMPANY OVERVIEW

16.2.5 INFINEON TECHNOLOGIES

TABLE 440 INFINEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

16.2.6 GENTEX CORPORATION

TABLE 441 GENTEX CORPORATION: COMPANY OVERVIEW

16.2.7 FLEX-N-GATE

TABLE 442 FLEX-N-GATE: COMPANY OVERVIEW

16.2.8 NORTH AMERICAN LIGHTING

TABLE 443 NORTH AMERICAN LIGHTING: COMPANY OVERVIEW

16.2.9 DENSO CORPORATION

TABLE 444 DENSO CORPORATION: COMPANY OVERVIEW

16.2.10 RENESAS ELECTRONICS CORPORATION

TABLE 445 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

16.2.11 KEBODA

TABLE 446 KEBODA: COMPANY OVERVIEW

16.2.12 VARROC

TABLE 447 VARROC: COMPANY OVERVIEW

16.2.13 LUMAX INDUSTRIES

TABLE 448 LUMAX INDUSTRIES: COMPANY OVERVIEW

17 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 336)

17.1 ASIA PACIFIC COUNTRIES HOLD HIGH GROWTH OPPORTUNITIES FOR AUTOMOTIVE LIGHTING SUPPLIERS

17.2 LED TECHNOLOGY TO CREATE LUCRATIVE OPPORTUNITIES FOR LIGHTING MANUFACTURERS

17.2.1 ELECTRIC VEHICLES

17.3 CONCLUSION

18 APPENDIX (Page No. - 338)

18.1 CURRENCY AND PRICING

TABLE 449 CURRENCY EXCHANGE RATES (PER USD)

18.2 INSIGHTS FROM INDUSTRY EXPERTS

18.3 DISCUSSION GUIDE

18.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.5 CUSTOMIZATION OPTIONS

18.6 RELATED REPORT

18.7 AUTHOR DETAILS

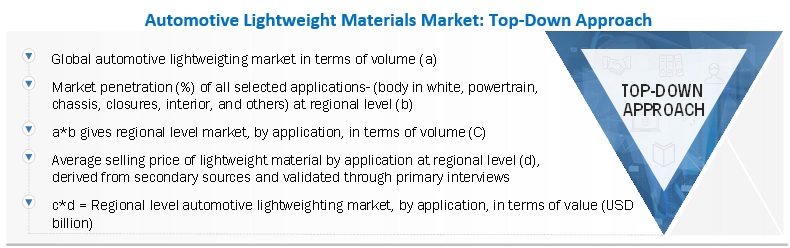

The study involved four major activities in estimating the current size of the automotive lighting market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of vehicle sales’ OEMs, International Organization of Motor Vehicle Manufacturers (OICA), Environmental Protection Agency (EPA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], automotive lighting magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical reports have been used to identify and collect information useful for an extensive commercial study of the automotive lighting market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from different key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as vehicle production forecast, lighting production forecast, future technology trends, and upcoming technologies in the automotive lighting industry. Data triangulation of all these points was done with the information gathered from secondary research as well as model mapping. Stakeholders from demand as well as supply-side have been interviewed to understand their views on the points mentioned above.

Primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (raw material suppliers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% and 60% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive lighting market and other dependent submarkets, as mentioned below:

- Key players in the automotive lighting market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the automotive lighting were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Automotive Lighting Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Lighting Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

-

To define, describe, and forecast the automotive lighting market in terms of volume ('000 Units) and value (USD Million/USD Billion) based on:

- Vehicle type (passenger car, light commercial vehicles, trucks, and buses)

- Technology (halogen, xenon/HID, and light emitting diode (LED))

- Application {exterior (headlights, fog lights, daytime running lights (DRL), tail lights, Center high mount stop lamp (CHMSL), and sidelights) and interior (dashboard, glove box, reading lights, and dome lights)}

- Electric vehicle lighting market, Technology (BEV, PHEV and FCEV)

- Two-wheeler automotive lighting market, by Technology (halogen, xenon/HID, and LED)

- Two-wheeler automotive lighting market, by position (front, rear, and side)

- Adaptive bending lights market, by type (static and dynamic)

- By adaptive lighting, namely, front adaptive lighting (auto on/off, high beam assist, bending/curve lights/cornering lights, and headlight leveling), rear adaptive lighting (brake and hazard lights), and ambient lighting

- Region [Asia Pacific, Europe, North America, and Rest of the World]

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the market

- To conduct a case study analysis, technology analysis, supply chain analysis, trade analysis, market ecosystem analysis, tariff and regulatory landscape analysis, Porter’s Five Forces analysis, and average selling price analysis

- To analyze the market share of key players in the market and conduct a revenue analysis of the top five players

- To formulate the competitive leadership mapping of key players in the market

Ambient Lighting & Its impact on Automotive Lighting Market

A type of illumination called ambient lighting is utilised in cars to improve the mood within the vehicle. It improves the ambience in the automobile and increases how much fun driving may be. The market for ambient lighting has expanded as a result of the rising demand for it in automobiles in recent years. All types of lighting used in automobiles, including as headlights, taillights, interior illumination, and ambient lighting, are included in the automotive lighting industry. Although it is a relatively recent addition to the automotive lighting market, ambient lighting has grown in popularity recently. The need for a more opulent and comfortable driving experience as well as greater safety and visibility within the automobile are two reasons for the rising demand for ambient lighting.

Manufacturers of traditional lighting products for the automotive industry are now also providing ambient lighting options. Automakers now use ambient lighting as a significant differentiator to distinguish their goods from the competition and attract buyers seeking out more luxurious driving experiences.

By extending the reach of Ambient Lighting services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

The top players in the Ambient Lighting market are ZKW Group GmbH, Grupo Antolin, Valeo S.A., Koito Manufacturing Co. Ltd, Philips Lighting, OSRAM GmbH, Hella KGaA Hueck & Co.

Some of the key industries that are going to get impacted because of the growth of Ambient Lighting are,

1. Autonomous Vehicles: As autonomous vehicles become more prevalent, ambient lighting could be used to create a more comfortable and personalized experience for passengers.

2. Hospitality industry: Ambient lighting can be used to create a warm and welcoming atmosphere, as well as to highlight specific areas of a room.

3. Retail industry: Retailers are also using ambient lighting to create a unique shopping experience for their customers.

4. Entertainment industry: Ambient lighting can also be used in the entertainment industry to enhance the atmosphere of a venue.

5. Healthcare industry: Ambient lighting is also being used in healthcare facilities to create a more calming and soothing environment for patients.

Speak to our Analyst today to know more about, "Ambient Lighting Market"

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Adaptive Module Market, By Function And Country

Two-Wheeler Automotive Lighting Market, By Vehicle Type

(Note: Countries included in the study: China, India, Japan, South Korea, Thailand, Germany, UK, France, Spain, Italy, US, Canada, Mexico, Brazil, Russia)

- Increased demand: As more consumers become aware of the benefits of ambient lighting, the demand for this feature is likely to increase.

- Premiumization: Ambient lighting is often associated with luxury and high-end vehicles.

- Safety: Ambient lighting can also play a role in improving safety in cars.

-

Innovation: The inclusion of ambient lighting in cars is driving innovation in the automotive lighting market.

- On/Off Function

- Bending/Cornering

- High Beam Assist

- Headlight Levelling

- Motorcycle

- Scooter/moped

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Lighting Market

We were wondering if the report has historical yearly market sizes from 2010 to the current year (e.g. market sizes for total automotive lighting and LED lighting for 2010, 2011, 2012...2016)?

I am looking for a automotive lighting market analysis for my MMBA thesis. Thanks for any support.

I am looking for a reliable source of clear and conclusive quantitative data. Your report above seems to contain what I need, but also many other items of information that I certainly do not need. Main topics of interest:- Car Interior Lighting Market size and growth - Car Interior technologies and their relative importance over time - Main players (designers and makers of car interior lighting solutions in terms of market share). Supply chain of car interior lighting (for the most common applications/functions). I was wondering if you could offer a customised report with this information and if so, under what conditions. Please contact my by email, phone is not preferred due to frequent traveling and meetings. Thank you in advance!

We are a supplier to the Automotive Lighting Industry and I am interested to see if this report is specific with trends by manufacture and or information on Tier 2 suppliers.

Current status and future outlook of the car lighting market, including a split between different technologies: LED, halogen, Xenon. Ideally also a split by brand (which brand will use which technology)

Understand the automotive light market specifically for India with Global Trends in Automotive Lighting

Hi would require this today for preparation for an interview with Osram Market size in UK and growth area for automotive lighting and online platform how to target

1/In which form is the report delivered? 2/Can we also get the raw data in form a database excel? 3/For passenger car would it be possible to have an analyzis by vehicle segments (A, B, C, D, .....)?

Automotive front lighting technologies, specifically penetration rates of LEDs going forward (e.g. by 2018, 2023, etc.)

Before ordering the report, I would like to get the sample for evaluation. Thanks in advance, Best regards,