Automotive Paints Market by Type (E-coat, Primer, Basecoat, Clearcoat), Resin (PU, Epoxy, Acrylic), Technology (Solvent, Water, Powder), Paint Equipment (Airless, Electrostatic), Texture, Content, ICE & EVs, Refinish, and Region - Global Forecast to 2025

The global automotive paints market in terms of revenue was estimated to be worth USD 8.46 billion in 2017 and is poised to reach USD 10.65 billion by 2025, growing at a CAGR of 2.88% from 2017 to 2025. The automotive paints industry has evolved along with the automotive industry. The demand for automotive paints and advancements in the paint technology are largely influenced by factors such as the demand trends in the automotive industry, environmental regulations, health & safety norms, buyers’ preferences, lifestyle, and growing economy.

Objectives of the study:

- To define, analyze, segment, and forecast the global automotive paints market (2015–2025), in terms of volume (million gallons) and value (USD million)

- To segment and forecast the market size, by value and volume, by paints technology

- To segment and forecast the market for automotive paints, by value and volume, by paint type

- To segment and forecast the market size, by value and volume, by resin type

- To segment and forecast the market size, by volume, by painting equipment

- To segment and forecast the market size, by value and volume, by texture

- To segment and forecast the market size, by value and volume, by vehicle type

- To segment and forecast the market size, by value and volume, by electric and hybrid vehicle type

- To segment and forecast the market size, by volume, by contents

- To segment the market for automotive refinish coatings and forecast the market size, by value and volume, by resin type

- To segment the market for automotive paints and forecast the market size, by value and volume, by region

- To identify the market dynamics and analyze their impact on the global market

The research methodology used in the report involves various secondary sources, including industry associations such as American Coatings Association (ACA), British Coatings Federation (BCF), and The International Council on Clean Transportation (ICCT) as well as paid databases and directories such as Factiva and Hoovers. Experts from related industries have been interviewed to understand the future trends of automotive paints market.

A bottom-up approach was used to estimate and validate the size of the market and to estimate the size of various other dependent submarkets in the global market. The market size, by volume, of the market, has been derived by identifying the country-wise vehicle production and the amount of paint required per vehicle type. The total OE paint market is then further segmented by paint type, technology, and content.

Refinish paints market for automotive is derived through top-down approach. Global refinish paints market for automotive, by value, is derived through secondary sources such as investor presentations and annual reports by PPG, Axalta, and AkzoNobel. The automotive paints market was further segmented by region and resin type.

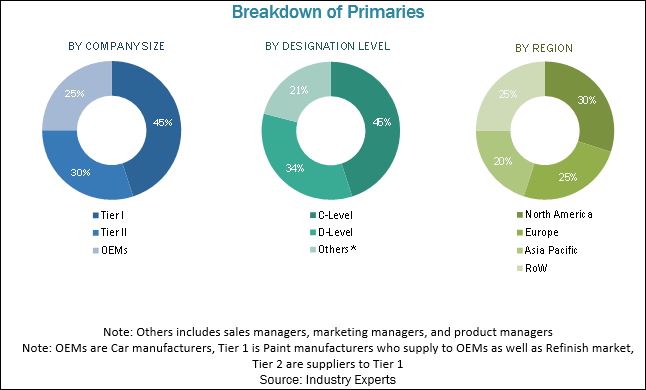

The below figure shows the break-up of the profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Stringent emission regulations and environmental concerns for paint manufacturing process to enhance the market for eco-friendly paints

The demand for automotive paints is driven by the increasing demand for vehicles, whereas technologies and R&D investments are influenced by government regulations. Likewise, the future growth and advancements in the automotive paints market will be driven by stringent emission regulations and norms regarding paint products, manufacturing processes, and the industry’s CO2 footprint. One of the examples for the same is surface pre-treatment of metal, which requires the application of paint on the surface to improve the adhesion of paints and corrosion resistance. Conventionally, chromate and phosphate conversion coatings (CC) were preferred for these pre-treatment activities. These types of coatings emit high VOC emission. However, owing to new non-VOC regulations, these coating chemicals are getting replaced with low- or non-VOC surface pre-treatments. For example, in the United States, the federal rules governing the use of VOCs fall under the umbrella of the Environmental Protection Agency’s National Emission Standards for Hazardous Air Pollutants (NESHAP) guidelines. Due to such regulations, automotive paint technologies are changing to waterborne and powder coating technologies due to their low VOC emission as compared to solvent-borne technology.

Additionally, the majority of the electro-deposition technologies have now shifted to a lead-free process owing to environmental regulations such as Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) in European countries. Also, certain developments in the automotive paints industry such as lower baking temperature type electro-deposition, high-weathering resistance electro-deposition type paints, and thin film electro-deposition paints are introduced in the market to meet the environmental regulations and cater to the varied metal substrates from different OEMs. The paint technology for basecoat and clearcoat has also shifted from solvent-borne to waterborne technology due to the advantages of waterborne technology such as less odor in the work environment and improved air quality without sacrificing color-matching capability and performance. In addition to environment-friendly benefits, waterborne technology has many more advantages such as accurate mixing, easier blending, and less hazardous waste. As developed regions such as North America and Europe have already implemented VOC emission regulations, automotive paint suppliers and OEMs are shifting their focus towards waterborne technology. Waterborne paints contain 70-75% of water and 20-25% other solvents and have almost zero VOC emission. Due to such advantages, waterborne technology is witnessing rapid adoption across the globe. However, due to the price-sensitive nature of the automotive paints market, the automotive industry in Asia Oceania continues to use solvent-borne technology.

Advancements in automotive safety technologies reduce accidents, thus restricting the refinish market

The increase in the number of road accidents is one of the major concerns for automobile manufacturers and governments. As per the National Highway Traffic Safety Administration (NHTSA), total fatalities due to road accidents in the US only was 37,461 in 2016, which grew by 5.6% from 2015. However, the automotive industry is witnessing a rapid evolution of safety features. The demand for safety features is expected to increase exponentially in the coming years. Due to increasing concerns of vehicle and passenger safety, vehicles are now equipped with advanced and smart features.

Active safety features such as blind spot detection (BSD), advanced emergency braking system (AEBS), and lane departure warning (LDW) now play a major role in the automated driving technology. The government regulatory authorities are also taking necessary steps to improve transportation by considering major challenges such as road accidents, traffic congestion, and the cost of transportation. Several countries have mandated features such as Tire pressure monitoring system (TPMS), Advanced Emergency Braking System (AEBS), Anti-lock braking system (ABS), and Advanced driver-assistance system (ADAS). With increased focus on vehicle safety, North America and Europe have emerged as the largest automotive paints market for ADAS. Thus, automotive safety features and technologies are expected to play a crucial role in reducing the number of road accidents and would lead to a safe, productive, and efficient driving experience. The autonomous technology is expected to evolve from TPMS, AEBS, ABS, and ADAS to a fully autonomous vehicle. However, it will take many years for customers to accept autonomous vehicles. There may come a time when all vehicles on the road are self-driving vehicles. In a fully autonomous future, the rate of vehicle collisions will be dramatically reduced. This would significantly diminish the automotive refinish paint market.

Powder coating to create new opportunities owing to growth in demand for premium and ultra-premium cars

Improving economic status across the globe has changed the overall lifestyle of consumers. With an increase in the disposable income, demands of end-users have changed in line with the new lifestyles, leading to a change in consumer preferences. This has positively affected the sales of ultra-luxurious cars across the globe. The premium car market is dominated by Western Europe, North America and a few Asian countries like Japan and South Korea. Developing countries such as China and India offer huge growth opportunities for premium and luxury cars. In addition, electric and hybrid vehicles are gaining popularity across the globe. These vehicles are considered under premium and ultra-premium vehicles. China, Germany, and the US, which have a significant share of electric and hybrid vehicles, are estimated to be the largest markets for powder coating.

Powder coatings are widely used by OEMs for premium and ultra-premium cars due to its excellent durability and finish and high efficiency. The global ultra-luxurious vehicles production has increased from 670.7 thousand units in 2011 to 1,044.5 thousand units in 2016. These are the E & F segment vehicles as defined by the Euro car segment. The steady rise in the production of ultra-luxurious vehicles can be attributed to the increasing demand for these vehicles, especially in developing economies such as China. In China, the sales of Lincoln have risen 95% while that of Mercedes Benz have risen 35% in 2016. BMW China sales have grown by 39% in 2016. Based on the 2016 sales figures, BMW China plans to double its production capacity by 2020. With the increase in demand for premium and luxury cars, powder coating is expected to gain market share in the automotive paints market. Advanced, pleasant, and environmental hazard proof exterior paint is one of the key highlights of the E & F segment vehicles. Powder coatings are more durable and efficient than solvent-borne and waterborne technology. However, due to its high set up cost, it is limited to premium and ultra-premium cars. The growing demand for premium and ultra-premium cars has thus created an opportunity for automotive paint manufacturers.

Rapid change in consumer preferences is a big challenge for automotive paint manufacturers

The automotive paint industry caters to the demand of OEMs as well as the aftermarket. While the demand for paints from OEMs has increased due to increasing vehicle production, the demand in the aftermarket has increased due to changing consumer preferences and increasing vehicle parc. The consumers are aware of leading paint brands and, as a result, are upgrading from local automotive paint manufacturers to premium paint manufacturers such as Axalta, AkzoNobel, and Sherwin-Williams.

Emerging economies play a vital role in changing consumer preferences. Some of the macro indicators are rapid income growth, increasing urbanization, a larger share of the young population, and mindset of spending rather than savings. All these factors have led to rapid growth of the automotive industry, which reflects in automotive paints market.

Over a period, consumer preferences towards colors are also changing. Customers are now moving towards the organized players as they have become more conscious of brands and quality of products. Consumers are changing the paint on their vehicles simply to create a style statement. As people are demanding more variety in colors, OEMs are providing cars with various pleasant colors. However, it is very difficult for paint manufacturers and OEMs to meet varied demands of customers in different markets. Hence, they have to stick to a limited product portfolio, which may not be able to fulfill the needs of all customers in the market. Hence, catering to the preferences of a large customer base is a challenge for the automotive paint industry.

Major manufacturers in the global automotive paints market include PPG (US), Axalta (US), AkzoNobel (Netherlands), BASF (Germany), Sherwin Williams (US), Valspar (US), Solvay (Belgium), DOW Chemical (US), 3M (US), and KCC (South Korea).

Target Audience

- Manufacturers of various types of automotive paints

- Raw material suppliers to automotive paint manufacturers

- Manufacturers of automotive coating technologies

- Dealers and distributors of automotive paints

- Automotive Original Equipment Manufacturers (OEMs)

- Automobile industry as an end-user industry

- Regional manufacturer associations and automobile associations

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

-

By Paint type

- Electrocoat

- Primer

- Basecoat

-

Clearcoat

-

By Technology type

- Solvent borne

- Waterborne

-

Powder Coating

-

By Resin type

- Polyurethane

- Epoxy

- Acrylic

-

Other Resins

-

By Texture type

- Solid

- Metallic

- Matte

- Pearlescent

-

Solar reflective

-

By Electric & Hybrid Vehicle type

- HEV

- PHEV

-

BEV

-

By Vehicle type

- Passenger Car

- LCV

-

HCV

-

By Content type

- (Water, Petroleum-based solvents, Resins and Binders, Silicone Polymers, Pigments and Colorants, and Other additives)

- E-coat

- Solvent-Borne Basecoat

- Solvent-Borne Clearcoat

- Waterborne Basecoat

-

Waterborne Clearcoat

-

By Refinish paints

- Polyurethane

- Epoxy

- Acrylic

-

Other Resins

-

By Painting Equipment

- Airless Spray Gun

-

Electrostatic Spray Gun

-

By Region

- North America

- Asia Oceania

- Europe

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

-

OE Market for Automotive Paints, By Vehicle Type & Country.

- Passenger car

- LCV

-

HCV

-

Electric & Hybrid Vehicle Paints Market, By Country & Vehicle Type

- Battery electric vehicle

- HEV

-

PHEV

-

Refinish Paints Market for Automotive, By Paint Type

- Primer

- Basecoat

-

Clearcoat

-

Automotive Paints Market, By Technology

- Primer

-

Clearcoat

- Market for Autonomous Car

Note: This market will be covered at country level and countries are as follows.

(US, Canada, Mexico, Germany, France, Italy, Spain, Europe Others, China, India, Japan, South Korea and Asia Oceania Others, Brazil, Russia, South Africa and RoW Others)

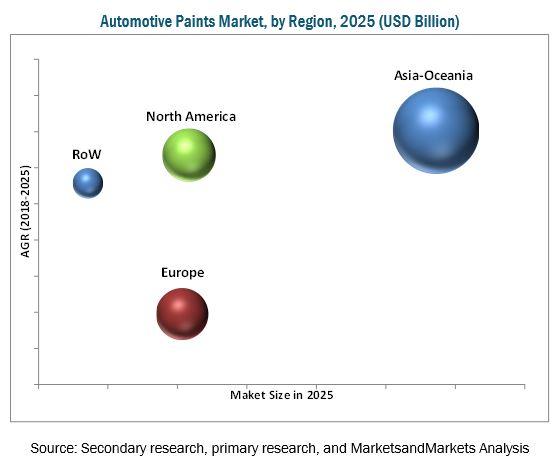

The automotive paints market is estimated to be USD 8.74 Billion in 2018 and is projected to reach USD 10.65 Billion by 2025, at a CAGR of 2.88%, from 2018 to 2025. The growing vehicle production (especially, passenger cars), stringent VOC emission regulations for paint manufacturing, and changing customer preferences for paint textures are projected to drive the automotive paints industry and advancements in the paint technology.

Nowadays, along with engine specifications, quality, and durability, color & texture of the vehicle is also one of the most important factors influencing the buying-decision. Basecoat is expected to grow over the forecast period because it is the only paint type that consists colors. Even though the thickness of the basecoat is minimal, this coat has maximum contribution in terms of value, because it consists of the actual visual properties of color and effects.

Waterborne technology is expected to be the largest segment of automotive paints market, by technology. Earlier, solvent-borne paints were preferred owing to their lesser price and quick drying properties. However, with the growing stringency of emission regulations monitoring paint production, industry stakeholders are preferring eco-friendly paint technologies such as waterborne technology.

The polyurethane automotive coating is expected to be the largest segment of the global automotive paints market, by resin type. This is because polyurethane has increasing use in topcoats (clearcoat and basecoat) to increase the durability of coats, improve appearance, and protect vehicles from scratches.

The refinish paints market for automotive is segmented on the basis of resin type. Polyurethane is the dominant resin type in this market, mainly due to its extensive usage in clearcoat and basecoat. Polyurethane resin accounted for the largest share in the overall automotive refinish coating market. It is preferred in clearcoat and basecoat layers due to its excellent weather-, corrosion-, and mechanical resistance.

The study segments global automotive paints market by painting equipment as well. The airless spray gun is the widely used painting technique across the globe due to its better spraying efficiency as compared to air spray guns. Due to its low installation cost, it has the largest market across the globe. The study also segmented the market by content types such as pigments, water, resins and solvents.

Asia Oceania is expected to be the largest market for automotive paints due to huge vehicle production and improving economy. The automotive paints industry has evolved along with the automotive industry. Both industries are continuously progressing to provide advanced technologies and eco-friendly products to their customers. Passenger cars hold the largest share of total vehicle production globally and also in Asia Oceania. Passenger cars are expected to be the largest market for automotive paints. Asia Oceania is estimated to be the largest market for electric and hybrid vehicles also. The hybrid vehicle is estimated to be the largest market for automotive paints due to the rapid acceptance of hybrid vehicle across the world.

Advancements in automotive safety technologies reduce accidents, thus restricting the refinish market. This would significantly diminish the refinish paints market for automotive.

Automotive paints market ecosystem consists of manufacturers such as PPG (US), Axalta (US), AkzoNobel (Netherlands), BASF (Germany), Sherwin Williams (US), Valspar (US), Solvay (Belgium), DOW Chemical (US), 3M (US), and KCC (South Korea).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Primary Data

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increasing Vehicle Production

2.4.2.2 Changing Consumer Preferences Shaping the Refinish Market

2.4.3 Supply-Side Analysis

2.4.3.1 Advancements in Paint Technologies

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Market Breakdown & Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 43)

4.1 Attractive Opportunities in the Automotive Paints Market (2017–2025)

4.2 Global Market, By Paint Type

4.3 Global Market, By Technology

4.4 Global Market, By Resin Type

4.5 Global Market, By Texture

4.6 Global Market, By Vehicle Type

4.7 Global Market, By Content

4.8 Global Market, By Electric & Hybrid Vehicle Type

4.9 Global Market, By Region

4.10 Refinish Paints Market for Automotive, By Resin Type

4.11 Global Market, By Painting Equipment Type

4.12 Global Market, By Channel

5 Automotive Paints Market Overview (Page No. - 51)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Emission Regulations and Environmental Concerns for Paint Manufacturing Process to Enhance the Market for Eco-Friendly Paints

5.2.1.2 Increasing Reach of Organized Players in the Refinish Market to Drive the Automotive Refinish Market

5.2.2 Restraints

5.2.2.1 Advancements in Automotive Safety Technologies Reduce Accidents, Thus Restricting the Refinish Market

5.2.3 Opportunity

5.2.3.1 Innovative Paint Technologies to Create Opportunities for Paint Manufacturers

5.2.3.2 Powder Coating to Create New Opportunities Owing to Growth in Demand for Premium and Ultra-Premium Cars

5.2.4 Challenges

5.2.4.1 Reducing Paint Wastage During the Paint Production

5.2.4.2 Rapid Change in Consumer Preferences is A Big Challenge for Automotive Paint Manufacturers

5.2.5 Macro Indicators

5.2.5.1 Introduction

5.2.5.2 Premium Vehicle Sales as A Percentage of Total Sales

5.2.5.3 GDP (USD Billion)

5.2.5.4 GNI Per Capita, Atlas Method (USD)

5.2.5.5 GDP Per Capita PPP (USD)

5.2.6 Us

5.2.7 China

5.2.8 Japan

6 Global Automotive Paints Market, By Paint Type (Page No. - 62)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

6.1 Introduction

6.2 Electrocoat

6.3 Primer

6.4 Basecoat

6.5 Clearcoat

7 Global Automotive Paints Market, By Technology (Page No. - 69)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

7.1 Introduction

7.2 Solvent-Borne

7.3 Waterborne

7.4 Powder Coating

8 Global Automotive Paints Market, By Resin Type (Page No. - 76)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

8.1 Introduction

8.2 Polyurethane

8.3 Epoxy

8.4 Acrylic

8.5 Other Resins

9 Global Automotive Paints Market, By Texture (Page No. - 83)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

9.1 Introduction

9.2 Solid Texture

9.3 Metallic Texture

9.4 Matte Finish Paints

9.5 Pearlescent Paints

9.6 Solar Reflective Paints

10 Global Automotive Paints Market, By Content (Page No. - 89)

Note: The Chapter is Segmented By Electrocoat (Water, Resin, Pigments & Addtives), Basecoat (Solventbourne- Petroleum Based Solvent, Resin & Binder, Pigment & Colorant, Silicone Polymenrs & Additives, Waterbourne - Silicone Polymenrs & Additives, Water, Resin & Binder, Petroleum Based Solvent, Pigment & Colorant) and Clearcoat (Solventbourne - Petroleum Based Solvent, Resin & Binder, Pigment & Colorant, Silicone Polymenrs & Additives , Waterbourne - Silicone Polymenrs & Additives, Water, Resin & Binder, Petroleum Based Solvent, Pigment & Colorant)

10.1 Introduction

10.2 Electrocoat, By Content

10.3 Solvent-Borne Paints, By Content

10.4 Waterborne Paints, By Content

11 Global Automotive Paints Market, By Painting Equipment Type (Page No. - 96)

Note: The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

11.1 Introduction

11.2 Airless Spray Gun

11.3 Electrostatic Spray Gun

12 Global Automotive Paints Market, By Vehicle Type (Page No. - 99)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

12.1 Introduction

12.2 Passenger Car

12.3 Light Commercial Vehicle

12.4 Trucks

12.5 Buses

13 Electric & Hybrid Vehicle Paints Market, By Region (Page No. - 107)

Note - The Chapter is Further Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

13.1 Introduction

13.2 Battery Electric Vehicle (BEV)

13.3 Hybrid Electric Vehicle (HEV)

13.4 Plug-In Hybrid Vehicle (PHEV)

14 Refinish Paints Market for Automotive, By Resin Type (Page No. - 114)

Note: The Chapter is Further Segmented By Resin Type and Further It is Segmented at Regional Level (Asia Oceania, Europe, North America, and RoW)

14.1 Introduction

14.2 Polyurethane

14.3 Epoxy

14.4 Acrylic

14.5 Other Resins

15 Global Automotive Paints Market, By Region (Page No. - 121)

Note: The Chapter is Further Segmented at Country Level and By Paint Type (Electrocoat, Primer, Basecoat and Clearcoat)

15.1 Introduction

15.2 North America

15.2.1 US

15.2.2 Mexico

15.2.3 Canada

15.3 Asia Oceania

15.3.1 China

15.3.2 Japan

15.3.3 South Korea

15.3.4 India

15.3.5 Asia Oceania Others

15.4 Europe

15.4.1 Germany

15.4.2 France

15.4.3 UK

15.4.4 Italy

15.4.5 Spain

15.4.6 Europe Others

15.5 Rest of the World (RoW)

15.5.1 Brazil

15.5.2 Russia

15.5.3 South Africa

15.5.4 RoW Others

16 Competitive Landscape (Page No. - 149)

16.1 Overview

16.2 Automotive Paints Market Share Analysis

16.2.1 OEM Paint Market

16.2.2 Refinish Paint Market

16.3 Competitive Scenario

16.3.1 Expansions

16.3.2 Supply Contracts

16.3.3 New Product Launches/Developments

16.3.4 Partnerships/Joint Ventures

16.3.5 Mergers/Acquisitions

17 Company Profiles (Page No. - 155)

(Overview, Product Offerings, Recent Developments, SWOT Analysis & MnM View)*

17.1 PPG

17.2 BASF

17.3 Axalta

17.4 Akzonobel

17.5 Sherwin Williams

17.6 Kansai

17.7 Solvay

17.8 Valspar

17.9 Covestro

17.10 3M

17.11 DOW Chemical

17.12 KCC

17.13 Nippon Paint

*Details on Overview, Product Offerings, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

18 Appendix (Page No. - 185)

18.1 Insights of Industry Experts

18.2 Discussion Guide

18.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

18.4 Introducing RT: Real-Time Market Intelligence

18.5 Available Customizations

Note: This Market Will Be Covered at Country Level and Countries are as Follows.

(US, Canada, Mexico, Germany, France, Italy, Spain, Europe Others, China, India, Japan, South Korea and Asia Oceania Others, Brazil, Russia, South Africa and RoW Others)

18.5.1 OE Market for Automotive Paints, By Vehicle Type & Country.

18.5.1.1 Passenger Car

18.5.1.2 LCV

18.5.1.3 HCV

18.5.2 Electric & Hybrid Paints Market By Country & Vehicle Type

18.5.2.1 Battery Electric Vehicle

18.5.2.2 HEV

18.5.2.3 PHEV

18.5.3 Refinish Paints Market for Automotive, By Paint Type

18.5.3.1 Primer

18.5.3.2 Basecoat

18.5.3.3 Clearcoat

18.5.4 Automotive Paints Market, By Technology

18.5.4.1 Primer

18.5.4.2 Clearcoat

18.6 Related Report

18.7 Author Details

List of Tables (124 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Global Automotive Paints Market: Research Assumptions

Table 3 Automotive Coatings Voc Content Limits

Table 4 Global Market, By Paint Type, 2016–2025 (Million Gallons)

Table 5 Global Market, By Paint Type, 2016–2025 (USD Million)

Table 6 Electrocoat: Market, By Region, 2016–2025 (Million Gallons)

Table 7 Electrocoat: Market, By Region, 2016–2025 (USD Million)

Table 8 Primer: Market, By Region, 2016–2025 (Million Gallons)

Table 9 Primer: Market, By Region, 2016–2025 (USD Million)

Table 10 Basecoat: Market, By Region, 2016–2025 (Million Gallons)

Table 11 Basecoat: Market, By Region, 2016–2025 (USD Million)

Table 12 Clearcoat: Market, By Region, 2016–2025 (Million Gallons)

Table 13 Clearcoat: Market, By Region, 2016–2025 (USD Million)

Table 14 Global Market, By Technology, 2016–2025 (Million Gallons)

Table 15 Global Market, By Technology, 2016–2025 (USD Million)

Table 16 Solvent-Borne: Market, By Region, 2016–2025 (Million Gallons)

Table 17 Solvent-Borne: Market, By Region, 2016–2025 (USD Million)

Table 18 Waterborne: Market, By Region, 2016–2025 (Million Gallons)

Table 19 Waterborne: Market, By Region, 2016–2025 (USD Million)

Table 20 Powder Coating: Market, By Region, 2016–2025 (Million Gallons)

Table 21 Powder Coating: Market, By Region, 2016–2025 (USD Million)

Table 22 Global Market, By Resin Type, 2016–2025 (Million Gallons)

Table 23 Global Market, By Resin Type, 2016–2025 (USD Million)

Table 24 Polyurethane: Market, By Region, 2016–2025 (Million Gallons)

Table 25 Polyurethane: Market, By Region, 2016–2025 (USD Million)

Table 26 Epoxy: Market, By Region, 2016–2025 (Million Gallons)

Table 27 Epoxy: Market, By Region, 2016–2025 (USD Million)

Table 28 Acrylic: Market, By Region, 2016–2025 (Million Gallons)

Table 29 Acrylic: Market, By Region, 2016–2025 (USD Million)

Table 30 Other Resins: Market, By Region, 2016–2025 (Million Gallons)

Table 31 Other Resins: Market, By Region, 2016–2025 (USD Million)

Table 32 Global Market, By Texture Type, 2016–2025 (Million Units)

Table 33 Solid Texture: Market, By Region, 2016–2025 (Million Units)

Table 34 Metallic Texture: Market, By Region, 2016–2025 (Million Units)

Table 35 Matte Finish: Market, By Region, 2016–2025 (Million Units)

Table 36 Pearlescent Texture: Market, By Region, 2016–2025 (Million Units)

Table 37 Solar Reflective Paints: Market, By Region, 2016–2025 (Million Units)

Table 38 Automotive Electrocoat Market, By Content Type, 2016–2025 (‘000 Gallons)

Table 39 Automotive Solvent-Borne Basecoat Market Size, By Content Type, 2016–2025 (‘000 Gallons)

Table 40 Automotive Solvent-Borne Clearcoat Market Size, By Content Type, 2016–2025 (‘000 Gallons)

Table 41 Automotive Waterborne Basecoat Market Size, By Content Type, 2016–2025 (‘000 Gallons)

Table 42 Automotive Waterborne Clearcoat Market Size, By Content Type, 2016–2025 (Million Gallons)

Table 43 Paints Equipment Market, By Region, 2016–2025 (Units)

Table 44 Airless Spray Gun Market, By Region, 2016–2025 (Units)

Table 45 Electrostatic Spray Gun Market, By Region, 2016–2025 (Units)

Table 46 Global Market, By Vehicle Type, 2016–2025 (‘000 Gallons)

Table 47 Global Market, By Vehicle Type, 2016–2025 (USD Million)

Table 48 Passenger Car: Market, By Region, 2016–2025 (‘000 Gallons)

Table 49 Passenger Car: Market, By Region, 2016–2025 (USD Million)

Table 50 LCV: Market , By Region, 2016–2025 (‘000 Gallons)

Table 51 LCV: Market, By Region, 2016–2025 (USD Million)

Table 52 Trucks: Market, By Region, 2016–2025 (‘000 Gallons)

Table 53 Trucks: Market , By Region, 2016–2025 (USD Million)

Table 54 Buses: Market, By Region, 2016–2025 (‘000 Gallons)

Table 55 Bus: Market, By Region, 2016–2025 (USD Million)

Table 56 Electric & Hybrid Vehicle Paints Market, By Vehicle Type, 2016–2025 (‘000 Gallons)

Table 57 Electric & Hybrid Vehicle Paints Market, By Vehicle Type, 2016–2025 (USD Million)

Table 58 BEV: Market, By Region, 2016–2025 (‘000 Gallons)

Table 59 BEV: Market, By Region, 2016–2025 (USD Million)

Table 60 HEV: Market, By Region, 2016–2025 (‘000 Gallons)

Table 61 HEV: Market, By Region, 2016–2025 (USD Million)

Table 62 PHEV: Market, By Region, 2016–2025 (‘000 Gallons)

Table 63 PHEV: Market, By Region, 2016–2025 (USD Million)

Table 64 Refinish Paints Market for Automotive, By Resin Type, 2016–2025 (Million Gallons)

Table 65 Refinish Paints Market for Automotive, By Resin Type, 2016–2025 (USD Million)

Table 66 Polyurethane: Refinish Paints Market for Automotive, By Region, 2016–2025 (Million Gallons)

Table 67 Polyurethane: Refinish Paints Market for Automotive, By Region, 2016–2025 (USD Million)

Table 68 Epoxy: Refinish Paints Market for Automotive, By Region, 2016–2025 (Million Gallons)

Table 69 Epoxy: Refinish Paints Market for Automotive, By Region, 2016–2025 (USD Million)

Table 70 Acrylic: Refinish Paints Market for Automotive, By Region, 2016–2025 (Million Gallons)

Table 71 Acrylic: Refinish Paints Market for Automotive, By Region, 2016–2025 (USD Million)

Table 72 Other Resins: Refinish Paints Market for Automotive, By Region, 2016–2025 (Million Gallons)

Table 73 Other Resins: Refinish Paints Market for Automotive, By Region, 2016–2025 (USD Million)

Table 74 Global Market, By Region, 2016–2025 (Million Gallons)

Table 75 Global Market, By Region, 2016–2025 (USD Million)

Table 76 North America: Market, By Country, 2016–2025 (Million Gallons)

Table 77 North America: Market, By Country, 2016–2025 (USD Million)

Table 78 US: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 79 US: Market, By Paint Type, 2016–2025 (USD Million)

Table 80 Mexico: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 81 Mexico: Market, By Paint Type, 2016–2025 (USD Million)

Table 82 Canada: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 83 Canada: Market, By Paint Type, 2016–2025 (USD Million)

Table 84 Asia Oceania: Market, By Country, 2016–2025 (Million Gallons)

Table 85 Asia Oceania: Market, By Country, 2016–2025 (USD Million)

Table 86 China: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 87 China: Market, By Paint Type, 2016–2025 (USD Million)

Table 88 Japan: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 89 Japan: Market, By Paint Type, 2016–2025 (USD Million)

Table 90 South Korea: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 91 South Korea: Market, By Paint Type, 2016–2025 (USD Million)

Table 92 India: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 93 India: Market, By Paint Type, 2016–2025 (USD Million)

Table 94 Asia Oceania Others: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 95 Asia Oceania Others: Market, By Paint Type, 2016–2025 (USD Million)

Table 96 Europe: Market, By Country, 2016–2025 (Million Gallons)

Table 97 Europe: Market, By Country, 2016–2025 (USD Million)

Table 98 Germany: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 99 Germany: Market, By Paint Type, 2016–2025 (USD Million)

Table 100 France: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 101 France: Market, By Paint Type, 2016–2025 (USD Million)

Table 102 UK: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 103 UK: Market, By Paint Type, 2016–2025 (USD Million)

Table 104 Italy: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 105 Italy: Market, By Paint Type, 2016–2025 (USD Million)

Table 106 Spain: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 107 Spain: Market, By Paint Type, 2016–2025 (USD Million)

Table 108 Europe Others: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 109 Europe Others: Market, By Paint Type, 2016–2025 (USD Million)

Table 110 RoW: Market, By Country, 2016–2025 (Million Gallons)

Table 111 RoW: Market, By Country, 2016–2025 (USD Million)

Table 112 Brazil: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 113 Brazil: Market, By Paint Type, 2016–2025 (USD Million)

Table 114 Russia: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 115 Russia: Market, By Paint Type, 2016–2025 (USD Million)

Table 116 South Africa: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 117 South Africa: Market, By Paint Type, 2016–2025 (USD Million)

Table 118 RoW Others: Market, By Paint Type, 2016–2025 (Million Gallons)

Table 119 RoW Others: Market, By Paint Type, 2016–2025 (USD Million)

Table 120 Expansions, 2017–2018

Table 121 Supply Contracts, 2014–2017

Table 122 New Product Launches/Developments, 2016–2017

Table 123 Partnerships/Joint Ventures, 2014–2018

Table 124 Mergers/Acquisitions, 2015–2017

List of Figures (73 Figures)

Figure 1 Market Segmentation: Automotive Paints

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Global Vehicle Production, 2012–2016 (Million Units)

Figure 5 Global Vehicle Parc, 2013–2016 (Million Units)

Figure 6 Market Size Estimation Methodology for the Global Market: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology for the Automotive Refinish Market: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Global Automotive Paints Market, By Paint Type, 2018 vs 2025 (USD Million)

Figure 10 Global Market, By Technology, 2018 vs 2025 (USD Million)

Figure 11 Global Market, By Resin Type, 2018 vs 2025 (USD Million)

Figure 12 Global Market, By Texture Type, 2018 vs 2025 (Million Units)

Figure 13 Global Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 14 Electric & Hybrid Vehicle Paints Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 15 Refinish Paints Market for Automotive, By Resin Type, 2018 vs 2025 (USD Million)

Figure 16 Global Market, By Painting Equipment, 2018 vs 2025 (Units)

Figure 17 Global Market, By Region, 2018 vs 2025 (USD Million)

Figure 18 Increasing Vehicle Production Will Boost the Demand for Automotive Paints, During the Forecast Period

Figure 19 With the Advancement in Paint Technology Primer Usage is Expected to Decline Over the Forecast Period

Figure 20 Waterborne Technology is Expected to Be the Largest Market During Forecast Period, By Value

Figure 21 Polyurethane is Expected to Hold the Largest Market Share During the Forecast Period, By Value

Figure 22 Metallic Paint is Expected to Be the Largest Segment of this Market During Forecast Period, By Volume

Figure 23 Passenger Car is Expected to Hold the Largest Market Share for Automotive Paints During the Forecast Period, By Value

Figure 24 Solvent-Based Contents are Expected to Decline During the Forecast Period, By Volume

Figure 25 Hybrid Vehicle Segment is Expected to Be the Largest Market for Automotive Paints During the Forecast Period

Figure 26 Asia Oceania is Expected to Be the Largest Market During the Forecast Period

Figure 27 Polyurethane is Expected to Be the Largest Segment of the Refinish Paints Market for Automotive, By Resin Type, During Forecast Period

Figure 28 Electrostatic Spray is Expected to Gain Market Share During the Forecast Period, By Volume

Figure 29 Asia Oceania to Be the Largest Paint Market, Both By OEM & Refinish, By Value

Figure 30 Automotive Paints: Market Dynamics

Figure 31 Automotive Coat Process: Conventional vs Advanced

Figure 32 E & F Segment Vehicle Production, 2011–2016 (‘000 Units)

Figure 33 US: Macro Indicators Affecting the Market

Figure 34 China: Macro Indicators Affecting the Market

Figure 35 Japan: Macro Indicators Affecting the Market

Figure 36 Automotive Paint Average Thickness, By Layers (µm)

Figure 37 Automotive Paints Market, By Paint Type, 2018 vs 2025 (USD Million)

Figure 38 Market, By Technology, 2018 vs 2025 (USD Million)

Figure 39 Market, By Resin Type, 2018 vs 2025 (USD Million)

Figure 40 Market, By Texture Type, 2018–2025 (Million Units)

Figure 41 Automotive Electrocoat Market Size, By Content Type, 2018 vs 2025 (Million Gallons)

Figure 42 Automotive Solvent-Borne Basecoat Market, By Content Type, 2018 vs 2025 (Million Gallons)

Figure 43 Automotive Solvent-Borne Clearcoat Market Size, By Content Type, 2018 vs 2025 (Million Gallons)

Figure 44 Automotive Waterborne Basecoat Market Size, By Content Type, 2018 vs 2025 (Million Gallons)

Figure 45 Automotive Waterborne Clearcoat Market Size, By Content Type, 2018 vs 2025 (Million Gallons)

Figure 46 Global Paints Equipment Market, By Region, 2018 vs 2025 (Units)

Figure 47 Global Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 48 Electric & Hybrid Vehicle Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 49 Refinish Paints Market for Automotive, By Resin Type, By Region, 2018 vs 2025 (USD Million)

Figure 50 Region Wise Snapshot of Global Market Size, By Value, (2015)- Rapid Growth Markets are Emerging as New Hotspots

Figure 51 North America: Market Snapshot

Figure 52 Asia Oceania: Market Snapshot

Figure 53 Companies Adopted Expansions as the Key Growth Strategy, 2016–2017

Figure 54 OE Market for Automotive Share Analysis, 2017

Figure 55 Refinish Market for Automotive Share Analysis, 2017

Figure 56 PPG: Company Snapshot

Figure 57 PPG: SWOT Analysis

Figure 58 BASF: Company Snapshot

Figure 59 BASF: SWOT Analysis

Figure 60 Axalta: Company Snapshot

Figure 61 Axalta: SWOT Analysis

Figure 62 Akzonobel: Company Snapshot

Figure 63 Akzonobel: SWOT Analysis

Figure 64 Sherwin Williams: Company Snapshot

Figure 65 Sherwin Williams: SWOT Analysis

Figure 66 Kansai: Company Snapshot

Figure 67 Solvay: Company Snapshot

Figure 68 Valspar: Company Snapshot

Figure 69 Covestro: Company Snapshot

Figure 70 3M: Company Snapshot

Figure 71 DOW Chemical: Company Snapshot

Figure 72 KCC: Company Snapshot

Figure 73 Nippon Paint: Company Snapshot

Growth opportunities and latent adjacency in Automotive Paints Market

What is the percentage volume of matt finish vehicles across the globe as of today

I am looking to make contact with a paint manufacturer to supply my company with OEM alloy wheel base coats as well as powder primers. If you could recommend a company we could contact would be much appreciated. If you require further information on our requirements please feel to cont me by above email or telephone. Thank you for your time

More interested in Paints market in India - Architechural, Industrial, Automotive OEM / Refinish and Wood Coatings

Do you have a specific passage about primers? Is there any emphasis on conductive primers? Looking forward to hearing from you ASAP.

Automotive OEM paints but paints in general as well. In Indian, SEA, Taiwan, China, South Africa, Zimbabwe

My group and I are studying self-healing paint for a design class. A part of the project is study the market for all automobile paints, and this report seems to be exactly what we were searching for, though we could not find.

Automotive paint market, paint and equipment technologies, transfer efficiency,powder, bi-funtional coat, paint process, new paint process

I am working in automotive interiors design and development from past 6 years. I am intereseted to know the paint details as I often come accorss it as I work to support aquisition activities.

Does the report contain a review/comment on the manufacturing strategies of the major coatings producers in addressing their end markets?

looking to do a marketing research assignment on automotive paints in general, and specifically the target market for certain paint types

we are looking to optimize our technology for automotive paint lines and looking for help to understand the market size