Automotive Seats Market by Type & Technology(Heated-Powered, Heated-Ventilated, Heated-Memory, Heated-Ventilated-Memory, Heated-Ventilated-Memory-Massage), Trim & Frame Material, Component, Vehicle(ICE, Electric, OHV, ATV) - Global Forecast to 2030

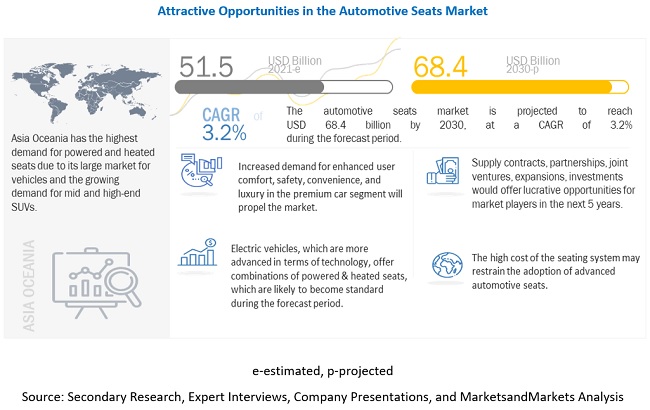

The global automotive seats market in terms of revenue was estimated to be worth $51.5 billion in 2022 and is poised to reach $68.4 billion by 2030, growing at a CAGR of 3.2% from 2022 to 2030. Growing demand for premium vehicles, rising adoption of powered seats in mid-segment cars & SUVs and increasing demand for aftermarket seating solutions are riving the automotive seats market. Asia Oceania and Americas remain top regional markets for this product.

To know about the assumptions considered for the study, Request for Free Sample Report

Pandemic Impact on Market

The most likely scenario takes into consideration the current impact of COVID-19 on the automotive seats market wherein global vehicle sales are impacted during lockdowns. Even after the lockdowns are completely lifted, owing to challenges related to the supply chain, availability of labor, and precautionary guidelines from the governments, production is not likely to resume to 100%. In this scenario, the COVID-19 outbreak is expected to have a moderate impact on the market. Major vehicle manufacturing countries such as China, Japan, Germany, and the UK have been severely impacted by the pandemic. Owing to the pandemic, the market witnessed a decline in demand in 2020. However, to boost the sales of vehicles, the introduction of new safety features has been observed. For instance, Geely Motors in China has introduced an N95-certified Intelligent Air Purification System, which prevents bacteria and viruses from entering the car. Jaguar Land Rover (JLR) is working on special ultraviolet (UV-C) light sanitization units as part of future HVAC systems to kill germs, bacteria, and viruses. Production and sales resumed from the third quarter of 2021, with many countries opening their manufacturing and construction facilities at this time. This would lead to a slow and steady recovery in the production of vehicles, in turn, resulting in the growth in demand for automotive seats.

Market Dynamics

DRIVER: Rising adoption of powered seats in mid-segment cars & SUVs

A drastic shift in preference for bigger cars has almost doubled the share of SUVs over the years. According to IEA, the number of SUVs on the world’s roads increased by more than 35 million in the year 2021. Almost half of all cars sold in the US and one-third of the cars sold in Europe are SUVs. Compared to western countries, India’s SUV sales are currently lower. However, OEMs are launching compact SUVs in a mid-price range, which is attracting buyers. Thus, the Indian market is inclining toward compact SUVs as they are more economical compared to full-size SUVs.

SUVs have a variety of seat combinations. For instance, full-size SUVs usually have a first and second row with bucket seats and a last/third row as a 60/40 split bench/bucket. Compact SUVs have first row seats as bucket seats and second-row seats as bench or bucket (may or may not be split). In terms of technology, seats of full-size SUVs can be powered, heated, and ventilated and could also use leather for seats. With the growing demand for SUVs across the globe, the demand for powered and ventilated/heated seats is also increasing.

RESTRAINT: High cost of advanced modular seats compared to conventional seats

Modular seats such as powered, heated, ventilated, massage, and climate-controlled seats, offer better comfort and convenience as compared to conventional seats. However, due to their high cost, their penetration is limited to high-end cars. Powered, heated, and ventilated applications are now getting commercialized and are being used in most mid-end SUVs, while massage seats are mostly offered in high-end models by OEMs. For instance, automotive OEMs such as Mercedes-Benz, BMW, Jaguar, and Cadillac offer massage seats for front passengers. Most medium and premium passenger car models in developed regions offer memory seats as a standard feature in top-end variants.

Standard seats are usually offered in the A, B, and C segments: small and economy cars. The demand for heated seats is higher in the developed countries of North America and Europe; these seats are offered in most D, E, and F models. Ventilated seats are offered in some premium vehicle segments such as E, F, SUV-D, and SUV E; they are provided for rear seats as well. Massage seats have a limited market and are offered in high-end models by Mercedes-Benz, BMW, and Jaguar, among others. Most medium and premium passenger car models in developed regions offer memory seats as a standard feature in top-end variants. Mercedes-Benz, Audi A8, Porsche, and BMW feature memory seats for the driver. However, the major share of the market is held by the economy segment, especially in developing countries. This might adversely affect the growth of the market for modular seats.

OPPORTUNITY: Growing focus on autonomous cars and increasing preference for ride sharing

The automotive industry is increasing its focus on the development of advanced driver assistance technologies, with the goal of developing and introducing a fully automated driving experience. There has also been an increase in consumer preference for mobility-on-demand services, such as car and ride-sharing. As per a survey conducted by Victoria Transport Policy Institute (VTPI), >70% of fully autonomous cars would be used for ride-sharing, and only 30% of these are likely to be privately owned.

As L4 & L5 autonomous cars would require minimal or no driver intervention, the steering wheel will be replaced by other passenger-centric interiors. With increasing preference for car-sharing, the durability of seats will be most important. With different people commuting in the same car at the same time, privacy will be crucial. Therefore, independent listening zones or noise-canceling systems using speakers attached to each headrest, or multizone climate control will be used. Seats will need to be comfortable and offer safety as well as the latest technological features. This will push seat manufacturers to innovate or acquire new and compelling products that capitalize upon new technologies in response to OEM and consumer preferences. For instance, Adient recently introduced the A118 Concept, which focuses on urban, electrically powered, and autonomously driven cars. This concept presents solutions for four key usage scenarios for autonomous vehicles, namely, Lounge, Communication, Cargo, and Baby Plus. In 2019, Lear Corporation acquired Israel-based EXO Technologies, a leading developer of differentiated GPS technology that provides high-accuracy positioning solutions for autonomous and connected vehicle applications. Since 2016, Hyundai Transys has been developing seats for autonomous cars. These seats are available in 5 modes: Easy Access, Autonomous, Communication, Relax, and Cargo. Each mode offers different positions, made possible by forward-backward tracking on the floor, a 180-degree swivel base, as well as a lighter and slimmer seat that improved space usage.

CHALLENGE: Challenges faced by textile & seat trim material suppliers

Trim material and textiles are used extensively in automotive interiors and have the potential to expand beyond the current applications. Automotive textiles use polyester-based polyamide, rayons, and polypropylenes to make polyester fabrics. Alternative materials such as non-woven polyesters are also being considered as an alternative of foam to laminate composites in body cloth and interiors of vehicles. Such products enhance seat comfort and provide overall seat weight reduction. Consumers are very familiar with the textiles and trim materials they physically come in contact with, specifically the seat upholstery or body cloth, headliners, and fabrics used throughout the interior of the vehicle. According to the Journal of Textile & Apparel, in North America, around 13 million vehicles were produced in the year 2020, using approx. 6 yards of textiles per interior seat which translates to 75 million liner yards annually. Nearly two-thirds of the automobile textiles are for interior trim, i.e. seat covers, carpets, roofs, and door liners. The rest is utilized to reinforce tires., hoses, safety belts, airbags, etc. According to Automotive World magazine insights, the textiles used to upholster a typical vehicle interior weigh around 30kg (65lbs), with seat covers alone accounting for more than 5kg. The demand for polyester fabrics in seat trim material is expected to grow in the future. This growing need for textiles and trim materials is creating a competitive scenario for material suppliers.

Additionally, OEMs and Tier-1 suppliers keep on bringing new seat designs in the market to satisfy customer demand. These new shapes may require new and advanced trim materials and methods for building the seat assembly. Hence, the trim material suppliers are always on their toes to meet the demands from OEMs and seat suppliers.

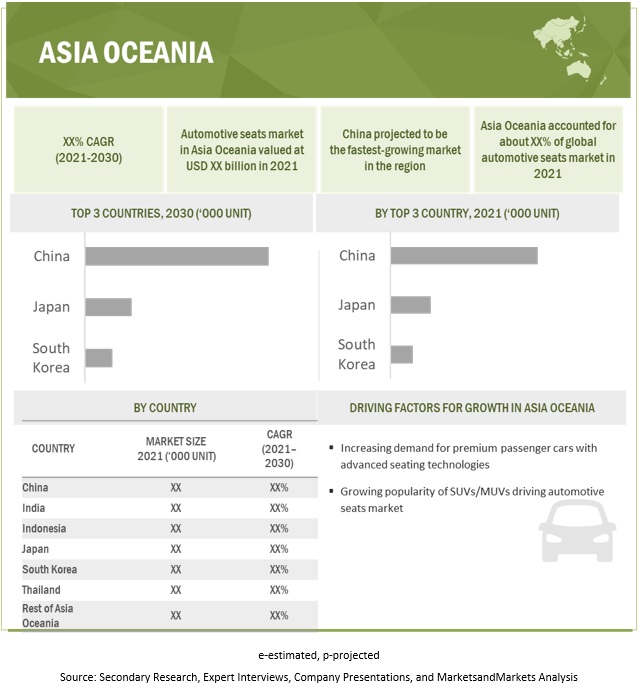

Asia Oceania is estimated to be the largest market in 2021

The market growth in Asia Oceania countries such as China, Japan, and India can be attributed to the increasing demand for vehicles. Due to the increased vehicle production and sales, China is estimated to be the fastest-growing market for automotive seats in this region. The demand for powered and heated seats is expected to grow in this region, owing to the increasing demand for mid and high-end SUVs.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

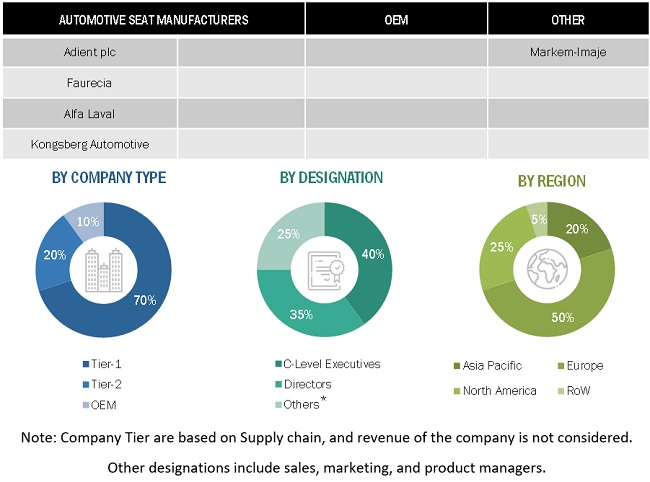

The automotive Seats market is lead by established seat manufacturers such as Adient plc(US), Lear Corporation(US), Faurecia(France), Toyota Boshoku Corporation(Japan), and Magna International Inc.(Canada). These companies adopted several strategies to gain traction in the market. New product development, partnership and joint venture strategy have been the most dominating strategy adopted by major players from 2018 to 2021, which helped them to innovate on their offerings and broaden their customer base.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2030 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments covered |

Automotive seats market By technology, By seat type, By component, By vehicle type, By material, By off-highway vehicle, By Electric & Hybrid Vehicle, By ATV seats market, By region. |

|

Geographies covered |

Asia Oceania, Americas, Europe, and Middle & South Africa |

|

Companies covered |

Adient plc.(US), Lear corporation(US), Faurecia(France), Toyota Boshoku Corporation(Japan) and Magna International Inc.(Canada) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the Automotive Seats Market

By Technology

- Heated Seat/

- Heated & Powered Seat

- Powered, Heated & Memory Seat

- Powered Seat

- Standard Seat

- Powered, Heated & Ventilated Seat

- Powered, Heated, Ventilated & Memory Seats

- Powered, Heated, Ventilated, Memory & Massage Seats

By Trim Material

- Genuine Leather

- Synthetic Leather

-

Fabrics

- Polyester Woven Fabric

- Woven Velour Fabric

- Other Fabrics

- Polyurathane Foam

By Component

- Armrest

- Pneumatic System

- Seat Belt

- Seat Frame And Structure

- Seat Headrest

- Seat Height Adjuster

- Seat Recliners

- Seat Track

- Side/Curtain Airbags

By Vehicle Type

-

Passenger Car

- Sedan

- Hatchback

- Suv/Muv

- Light Commercial Vehicles

- Heavy Trucks

- Bus

By Electric & Hybrid Vehicle

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

By Seat Type

- Bucket Seat

- Split Bench

By Region

- Asia Oceania

- Americas

- Europe

- Middle East And South Africa

By Material

- Steel

- Aluminum

- Carbon-Amide-Metal

By Off-Highway Vehicle Type

- Construction/Mining Equipment

- Agriculture Tractors

By Atv Seating Capacity

- One-Seater

- Two-Seater

Recent Developments

- Adient plc. In September 2021, started integrating Cardyon, a chemical made using Covestro’s CO2 technology, as a sustainable feedstock to produce foam. This supply chain-related sustainability milestone helps to further reduce Adient’s scope 3 emissions as calculated by the Greenhouse Gas protocol

- In May 2021, Toyota Boshoku introduced a cabin space that provides multimodal stimulus of the senses during autonomous driving to revitalize its occupants with a short nap and awaken them comfortably.

- In August 2020, Lear corporation introduced its new solution in intelligent seating, INTU Thermal Comfort with ClimateSense technology, developed in collaboration with Gentherm. It aims to create an ideal personal climate through its intelligent software, using ambient cabin conditions to provide optimized comfort.

Frequently Asked Questions (FAQ):

How big is the automotive seats market?

The automotive seats market is projected to grow from $51.5 Billion in 2021 to $68.4 Billion by 2030, at a CAGR of 3.2% during the forecast period

Which type is currently leading the automotive seats market?

Buckets seat type is currently leading the automotive seat market.

Many companies are operating in the automotive seats market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The automotive seats market is lead by established seat manufacturers such as Adient plc. (US), Lear corporation(US), Faurecia(France), Toyota Boshoku Corporation(Japan) and Magna International Inc.(Canada). These companies adopted several strategies to gain traction in the market. New product development, partnership and joint venture strategy have been the most dominating strategy adopted by major players from 2018 to 2021, which helped them to innovate on their offerings and broaden their customer base.

How is the demand for automotive seats market varies by region?

The market growth in Asia Oceania countries such as China, Japan, and India can be attributed to the increasing demand for vehicles. Due to the increased vehicle production and sales, China is estimated to be the fastest-growing market for automotive seats in this region. The demand for powered and heated seats is expected to grow in this region, owing to the increasing demand for mid and high-end SUVs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: AUTOMOTIVE SEATS MARKET

1.5 SUMMARY OF CHANGES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR VEHICLE PRODUCTION

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH - BY REGION, VEHICLE TYPE, TECHNOLOGY, AND SEAT TYPE

FIGURE 5 BOTTOM-UP APPROACH: AUTOMOTIVE SEATS MARKET, BY REGION, VEHICLE TYPE, TECHNOLOGY, AND SEAT TYPE

2.4.2 TOP-DOWN APPROACH - BY COMPONENT, TRIM MATERIAL, AND MATERIAL

FIGURE 6 TOP-DOWN APPROACH: MARKET, BY COMPONENT

FIGURE 7 TOP-DOWN APPROACH: MARKET, BY TRIM MATERIAL

FIGURE 8 TOP-DOWN APPROACH: MARKET, BY MATERIAL

2.5 FACTOR ANALYSIS

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.7 ASSUMPTIONS & RISK ASSESSMENT

TABLE 1 ASSUMPTIONS & RISK ASSESSMENT

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 PRE- & POST-COVID-19 SCENARIO

FIGURE 10 PRE- & POST-COVID-19 SCENARIO: MARKET, 2018–2030 (USD MILLION)

TABLE 2 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2021 (USD MILLION)

TABLE 3 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2022–2030 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 11 MARKET, BY REGION, 2021 VS. 2030 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE SEATS MARKET

FIGURE 12 CUSTOMER INCLINATION TOWARD COMFORT & LUXURY FEATURES TO DRIVE MARKET

4.2 MARKET, BY SEAT TYPE

FIGURE 13 BUCKET SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021 (USD MILLION)

4.3 MARKET, BY MATERIAL

FIGURE 14 CARBON-AMIDE-METAL SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY TRIM MATERIAL

FIGURE 15 SYNTHETIC LEATHER SEGMENT LED MARKET 2021 (USD MILLION)

4.5 MARKET, BY TECHNOLOGY

FIGURE 16 STANDARD SEGMENT TO LEADMARKET DURING FORECAST PERIOD (‘000 UNITS)

4.6 MARKET, BY COMPONENT

FIGURE 17 SIDE/CURTAIN AIRBAG SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD (USD MILLION)

4.7 MARKET, BY VEHICLE TYPE

FIGURE 18 PASSENGER CAR SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD (USD BILLION)

4.8 MARKET, BY EV TYPE

FIGURE 19 BEV SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD (‘000 UNIT)

4.9 MARKET, BY REGION

FIGURE 20 ASIA OCEANIA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

4.10 MARKET, BY OFF-HIGHWAY VEHICLE

FIGURE 21 AGRICULTURAL TRACTOR SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.11 MARKET, BY ATV SEATING CAPACITY

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AUTOMOTIVE SEATS: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for premium vehicles

FIGURE 23 GLOBAL PREMIUM PASSENGER CAR PRODUCTION, 2018-2021(MILLION UNITS)

TABLE 4 KEY OEMS PREMIUM CARS SALES, 2020 (UNITS)

TABLE 5 MODELS WITH GENUINE LEATHER SEATS, 2020

5.2.1.2 Rising adoption of powered seats in mid-segment cars & SUVs

FIGURE 24 NEW REGISTRATIONS OF SUVS, BY KEY COUNTRY/REGION, 2018-2021 (MILLION UNITS)

5.2.1.3 Increasing demand for aftermarket seating solutions

5.2.2 RESTRAINTS

5.2.2.1 High cost of advanced modular seats compared to conventional seats

TABLE 6 AVERAGE COST OF SEATS, BY TECHNOLOGY, 2020 (USD)

5.2.3 OPPORTUNITIES

5.2.3.1 Growing focus on autonomous cars and increasing preference for ride sharing 63

5.2.3.2 Increasing demand for lightweight seating materials in electric vehicles

5.2.3.3 New anti-microbial seating solutions

5.2.4 CHALLENGES

5.2.4.1 Challenges faced by textile & seat trim material suppliers

5.3 AUTOMOTIVE SEATS MARKET SCENARIO

FIGURE 25 MARKET SCENARIO, 2018–2030 (USD MILLION)

5.3.1 MOST LIKELY SCENARIO

TABLE 7 MOST LIKELY SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 8 MOST LIKELY SCENARIO: MARKET, BY REGION, 2022–2030 (USD MILLION)

5.3.2 LOW COVID-19 IMPACT SCENARIO

TABLE 9 LOW IMPACT SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 10 LOW IMPACT SCENARIO: MARKET, BY REGION, 2022–2030 (USD MILLION)

5.3.3 HIGH COVID-19 IMPACT SCENARIO

TABLE 11 HIGH IMPACT SCENARIO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 12 HIGH IMPACT SCENARIO: MARKET, BY REGION, 2022–2030 (USD MILLION)

5.4 PORTER’S FIVE FORCES

5.4.1 MARKET

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: MARKET

TABLE 13 PORTER’S FIVE FORCES ANALYSIS

5.4.1.1 Intensity of competitive rivalry

5.4.1.2 Threat of new entrants

5.4.1.3 Threat of substitutes

5.4.1.4 Bargaining power of suppliers

5.4.1.5 Bargaining power of buyers

5.5 SUPPLY CHAIN

FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM

FIGURE 28 MARKET ECOSYSTEM

5.7 TRENDS/DISRUPTIONS IMPACTING SEATS MARKET

FIGURE 29 AUTONOMOUS CAR AND RIDE-SHARING PRESENT NEW REVENUE SHIFT FOR AUTOMOTIVE SEAT MANUFACTURERS

5.8 AVERAGE SELLING PRICE ANALYSIS OF AUTOMOTIVE SEATS, BY REGION & TYPE

TABLE 14 AUTOMOTIVE SEATS: AVERAGE PRICE ANALYSIS, 2021 (USD)

5.9 AVERAGE SELLING PRICE ANALYSIS OF AUTOMOTIVE SEATS, BY TRIM MATERIAL

TABLE 15 AUTOMOTIVE SEATS, BY TRIM MATERIAL: AVERAGE PRICE ANALYSIS, 2021 (USD/ METER)

5.10 AVERAGE SELLING PRICE ANALYSIS OF AUTOMOTIVE SEATS, BY SEAT FRAME MATERIAL

TABLE 16 AUTOMOTIVE SEATS, BY SEAT FRAME MATERIAL: AVERAGE PRICE ANALYSIS, 2021 (USD/ METRIC TON)

5.11 TRADE ANALYSIS

TABLE 17 CAR SEAT IMPORTS, SELECT COUNTRIES, 2020-2021 (USD)

5.12 PATENT ANALYSIS

TABLE 18 INNOVATION & PATENT REGISTRATIONS, 2018-2021

5.13 CASE STUDY ANALYSIS

5.13.1 CASE STUDY1

5.13.2 CASE STUDY 2

5.14 REGULATORY LANDSCAPE

TABLE 19 SAFETY REGULATIONS, BY COUNTRY/REGION

5.15 TECHNOLOGY OVERVIEW

5.15.1 ADIENT’S AI18 SEATING SOLUTION FOR RIDE SHARING

5.15.2 GENTHERM CLIMATE CONTROL SEATS (CCS)

5.15.3 FORD’S RECONFIGURABLE SEATS

5.15.4 LEAR’S POWERED & ADAPTABLE SEATING SYSTEM (CONFIGURE+)

5.15.5 LEAR PROACTIVE POSTURE

6 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 83)

6.1 ASIA OCEANIA WILL BE KEY MARKET FOR AUTOMOTIVE SEATS

6.2 POWERED AND COMBINATION OF POWERED & HEATED SEATS - KEY FOCUS AREAS

6.3 CONCLUSION

7 AUTOMOTIVE SEATS MARKET, BY TECHNOLOGY (Page No. - 84)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

FIGURE 30 MARKET, BY TECHNOLOGY, 2021 VS 2030 (‘000 UNIT)

TABLE 20 MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 21 MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

7.2 STANDARD

TABLE 22 STANDARD SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 23 STANDARD SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.3 POWERED

TABLE 24 SELECT MODELS WITH POWERED SEATS, 2021

TABLE 25 POWERED SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 26 POWERED SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.4 POWERED & HEATED

TABLE 27 SELECT MODELS WITH HEATED & POWERED SEATS, 2021

TABLE 28 POWERED & HEATED SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 29 POWERED & HEATED SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.5 HEATED

TABLE 30 SELECT MODELS WITH HEATED SEATS, 2021

TABLE 31 HEATED SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 32 HEATED SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.6 POWERED, HEATED, & MEMORY

TABLE 33 SELECT MODELS WITH POWERED, HEATED, & MEMORY SEATS, 2021

TABLE 34 POWERED, HEATED, & MEMORY SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 35 POWERED, HEATED, & MEMORY SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.7 POWERED, HEATED, & VENTILATED

TABLE 36 SELECT MODELS WITH POWERED, HEATED, & VENTILATED SEATS, 2021

TABLE 37 POWERED, HEATED, & VENTILATED SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 38 POWERED, HEATED, & VENTILATED SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.8 POWERED, HEATED, VENTILATED, & MEMORY

TABLE 39 SELECT MODELS WITH POWERED, HEATED, VENTILATED, & MEMORY SEATS, 2021

TABLE 40 POWERED, HEATED, VENTILATED, & MEMORY SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 41 POWERED, HEATED, VENTILATED, & MEMORY SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

7.9 POWERED, HEATED, VENTILATED, MEMORY, & MASSAGE

TABLE 42 SELECT MODELS WITH POWERED, HEATED, VENTILATED, MEMORY, & MASSAGE SEATS, 2021

TABLE 43 POWERED, HEATED, VENTILATED, MEMORY, & MASSAGE SEATS MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 44 POWERED, HEATED, VENTILATED, MEMORY, & MASSAGE SEATS MARKET, BY REGION, 2022–2030 (‘000 UNIT)

8 AUTOMOTIVE SEATS MARKET, BY SEAT TYPE (Page No. - 101)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 31 MARKET, BY SEAT TYPE, 2021 VS. 2030 (USD MILLION)

TABLE 45 MARKET, BY SEAT TYPE, 2017–2021 (MILLION UNITS)

TABLE 46 MARKET, BY SEAT TYPE, 2022–2030 (MILLION UNITS)

TABLE 47 MARKET, BY SEAT TYPE, 2017–2021 (USD BILLION)

TABLE 48 MARKET, BY SEAT TYPE, 2022–2030 (USD BILLION)

8.2 BUCKET

TABLE 49 SELECT MODELS WITH BUCKET SEATING, 2021

TABLE 50 MARKET, BY VEHICLE TYPE, 2017–2021 (MILLION UNITS)

TABLE 51 MARKET, BY VEHICLE TYPE, 2022–2030 (MILLION UNITS)

TABLE 52 MARKET, BY VEHICLE TYPE, 2017–2021 (USD BILLION)

TABLE 53 MARKET, BY VEHICLE TYPE, 2022–2030 (USD BILLION)

8.3 BENCH/SPLIT BENCH

TABLE 54 SELECT MODELS WITH BENCH/SPLIT BENCH SEATING, 2021

TABLE 55 MARKET, BY VEHICLE TYPE, 2017–2021 (MILLION UNITS)

TABLE 56 MARKET, BY VEHICLE TYPE, 2022–2030 (MILLION UNITS)

TABLE 57 MARKET, BY VEHICLE TYPE, 2017–2021 (USD BILLION)

TABLE 58 MARKET, BY VEHICLE TYPE, 2022–2030 (USD BILLION)

9 AUTOMOTIVE SEATS MARKET, BY COMPONENT (Page No. - 110)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

FIGURE 32 MARKET, BY COMPONENT, 2021 VS 2030 (USD MILLION)

9.1.2 ASSUMPTIONS

TABLE 59 MARKET, BY COMPONENT, 2017–2021 (MILLION UNITS)

TABLE 60 MARKET, BY COMPONENT, 2022–2030 (MILLION UNITS)

TABLE 61 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 62 MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

9.2 ARMREST

TABLE 63 MODELS WITH ARMRESTS, 2021

TABLE 64 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 65 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 66 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3 PNEUMATIC SYSTEM

TABLE 68 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 69 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 70 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.4 SEAT BELT

TABLE 72 SEAT BELT MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 73 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 74 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.5 SEAT FRAME & STRUCTURE

TABLE 76 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 77 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 78 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.6 SEAT HEADREST

TABLE 80 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 81 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 82 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 83 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.7 SEAT HEIGHT ADJUSTER

TABLE 84 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 85 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 86 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.8 SEAT RECLINER

TABLE 88 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 89 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 90 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 91 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.9 SEAT TRACK

TABLE 92 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 93 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 94 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2022–2030 (USD MILLION)

9.10 SIDE/CURTAIN AIRBAG

TABLE 96 MARKET, BY REGION, 2017–2021 (MILLION UNITS)

TABLE 97 MARKET, BY REGION, 2022–2030 (MILLION UNITS)

TABLE 98 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 99 MARKET, BY REGION, 2022–2030 (USD MILLION)

10 AUTOMOTIVE SEATS MARKET, BY TRIM MATERIAL (Page No. - 131)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 33 MARKET, BY TRIM MATERIAL, 2021 VS. 2030 (USD MILLION)

TABLE 100 MARKET, BY TRIM MATERIAL, 2017–2021 (‘000 SQUARE METER)

TABLE 101 MARKET, BY TRIM MATERIAL, 2022–2030 (‘000 SQUARE METER)

TABLE 102 MARKET, BY TRIM MATERIAL, 2017–2021 (USD MILLION)

TABLE 103 MARKET, BY TRIM MATERIAL 2022–2030 (USD MILLION)

10.2 SYNTHETIC LEATHER

TABLE 104 MODELS WITH SYNTHETIC LEATHER SEATS, 2021

TABLE 105 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 106 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 107 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.3 GENUINE LEATHER

TABLE 109 MODELS WITH GENUINE LEATHER SEATS, 2021

TABLE 110 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 111 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 112 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 113 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.4 FABRIC

TABLE 114 MODELS WITH FABRIC SEATS, 2021

TABLE 115 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 116 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 117 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 118 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.4.1 POLYESTER FLAT WOVEN FABRIC

TABLE 119 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 120 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 121 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 122 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.4.2 WOVEN VELOUR FABRIC

TABLE 123 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 124 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 125 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 126 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.4.3 PVC & OTHER FABRICS

TABLE 127 MARKET, BY REGION, 2017–2021 (‘000 SQUARE METER)

TABLE 128 MARKET, BY REGION, 2022–2030 (‘000 SQUARE METER)

TABLE 129 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 130 MARKET, BY REGION, 2022–2030 (USD MILLION)

10.5 POLYURETHANE FOAM

TABLE 131 MARKET, BY REGION, 2017–2021 (‘000 KGS)

TABLE 132 MARKET, BY REGION, 2022–2030 (‘000 KGS)

TABLE 133 MARKET, BY REGION, 2017–2021 (‘000 USD)

TABLE 134 MARKET, BY REGION, 2022–2030 (‘000 USD)

11 AUTOMOTIVE SEATS MARKET, BY MATERIAL (Page No. - 149)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY MATERIAL, 2021 VS. 2030 (‘000 USD)

TABLE 135 MARKET, BY MATERIAL, 2017–2021 (MT)

TABLE 136 MARKET, BY MATERIAL, 2022–2030 (MT)

TABLE 137 MARKET, BY MATERIAL, 2017–2021 (‘000 USD)

TABLE 138 MARKET, BY MATERIAL, 2022–2030 (‘000 USD)

11.2 STEEL

TABLE 139 STRENGTH VS. DENSITY CHART

TABLE 140 MARKET, BY REGION, 2017–2021 (MT)

TABLE 141 MARKET, BY REGION, 2022–2030 (MT)

TABLE 142 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 143 MARKET, BY REGION, 2022–2030 (USD MILLION)

11.3 ALUMINUM

TABLE 144 ALUMINUM: AUTOMOTIVE SEATS MARKET, BY REGION, 2017–2021 (MT)

TABLE 145 MARKET, BY REGION, 2022–2030 (MT)

TABLE 146 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 147 MARKET, BY REGION, 2022–2030 (USD MILLION)

11.4 CARBON-AMIDE-METAL

TABLE 148 CARBON-AMIDE-METAL: AUTOMOTIVE SEATS MARKET, BY REGION, 2017–2021 (MT)

TABLE 149 MARKET, BY REGION, 2022–2030 (MT)

TABLE 150 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 151 MARKET, BY REGION, 2022–2030 (USD MILLION)

12 AUTOMOTIVE SEATS MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 158)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY ELECTRIC VEHICLE TYPE, 2021 VS. 2030 (‘000 UNIT)

TABLE 152 MARKET, BY ELECTRIC VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 153 MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2030 (‘000 UNIT)

12.2 BATTERY ELECTRIC VEHICLE (BEV)

TABLE 154 BEV SEATS MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 155 BEV SEATS MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

12.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

TABLE 156 PHEV SEATS MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 157 PHEV SEATS MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

12.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

TABLE 158 FCEV SEATS MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 159 FCEV SEATS MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

13 AUTOMOTIVE SEATS MARKET, BY OFF-HIGHWAY VEHICLE (Page No. - 166)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

FIGURE 36 MARKET, BY OFF-HIGHWAY VEHICLE, 2021 VS. 2030 (‘000 UNITS)

TABLE 160 MARKET, BY OFF-HIGHWAY VEHICLE, 2017–2021 (‘000 UNITS)

TABLE 161 MARKET, BY OFF-HIGHWAY VEHICLE, 2022–2030 (‘000 UNITS)

13.2 CONSTRUCTION/MINING EQUIPMENT

TABLE 162 CONSTRUCTION/MINING EQUIPMENT WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 163 MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNITS)

TABLE 164 MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNITS)

13.3 AGRICULTURAL TRACTOR

TABLE 165 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNITS)

TABLE 166 AGRICULTURAL TRACTOR SEATS MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNITS)

14 AUTOMOTIVE SEATS MARKET, BY ATV SEATING CAPACITY (Page No. - 172)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 PRIMARY INDUSTRY INSIGHTS

14.1.3 ASSUMPTIONS

FIGURE 37 MARKET, BY ATV SEATING CAPACITY, 2021 VS. 2030 (UNITS)

TABLE 167 MARKET, BY ATV SEATING CAPACITY, 2017–2021 (UNITS)

TABLE 168 MARKET, BY ATV SEATING CAPACITY, 2022–2030 (UNITS)

14.2 ONE-SEATER

14.2.1 LOWER COST OF ONE-SEAT ATVS DRIVES THIS SEGMENT

TABLE 169 MARKET, BY REGION, 2017–2021 (UNITS)

TABLE 170 MARKET, BY REGION, 2022–2030 (UNITS)

14.3 TWO-SEATER

14.3.1 INCREASED DEMAND FOR RECREATIONAL RIDING AND TRANSPORTING CARGO IN OFF-ROAD APPLICATIONS DRIVES THIS SEGMENT

TABLE 171 MARKET, BY REGION, 2017–2021 (UNITS)

TABLE 172 MARKET, BY REGION, 2022–2030 (UNITS)

15 AUTOMOTIVE SEATS MARKET, BY REGION (Page No. - 178)

15.1 INTRODUCTION

15.2 RESEARCH METHODOLOGY

15.2.1 ASSUMPTIONS

15.2.2 INDUSTRY INSIGHTS

FIGURE 38 MARKET, BY REGION, 2021 VS. 2030 (‘000 UNIT)

TABLE 173 MARKET, BY REGION, 2017–2021 (‘000 UNIT)

TABLE 174 MARKET, BY REGION, 2022–2030 (‘000 UNIT)

15.3 AMERICAS

FIGURE 39 AMERICAS: MARKET SNAPSHOT

TABLE 175 AMERICAS: MARKET, BY COUNTRY, 2017–2021 (000’ UNITS)

TABLE 176 AMERICAS: MARKET, BY COUNTRY, 2022–2030 (000’ UNITS)

15.3.1 US

15.3.1.1 US vehicle production

TABLE 177 US: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017-2021 (‘000 UNIT)

15.3.1.2 Powered seats to be largest market in terms of technology in US

TABLE 178 US: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 179 US: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 180 US: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.3.2 MEXICO

15.3.2.1 Mexico vehicle production

TABLE 181 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.3.2.2 SUV segment expected to boost market in Mexico

TABLE 182 MEXICO: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 183 MEXICO: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 184 MEXICO: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.3.3 CANADA

15.3.3.1 Canada vehicle production

TABLE 185 CANADA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.3.3.2 High demand for luxury vehicles will boost market in Canada

TABLE 186 CANADA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 187 CANADA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 188 CANADA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.3.4 BRAZIL

15.3.4.1 Brazil vehicle production

TABLE 189 BRAZIL: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.3.4.2 Improving standard of living will boost market in Brazil

TABLE 190 BRAZIL: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 191 BRAZIL: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 192 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.3.5 ARGENTINA

15.3.5.1 Argentina vehicle production

TABLE 193 ARGENTINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.3.5.2 Inclination toward comfort features will boost market in Argentina

TABLE 194 ARGENTINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 195 ARGENTINA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 196 ARGENTINA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.3.6 OTHERS IN AMERICAS

15.3.6.1 Others in Americas vehicle production

TABLE 197 OTHERS IN AMERICAS: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.3.6.2 Economic development and improving standards of living drive market in others in Americas

TABLE 198 OTHERS IN AMERICAS: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 199 OTHERS IN AMERICAS: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4 ASIA OCEANIA

FIGURE 40 ASIA OCEANIA: MARKET SNAPSHOT

TABLE 200 ASIA OCEANIA: MARKET, BY COUNTRY, 2017–2021 (000’ UNITS)

TABLE 201 ASIA OCEANIA: MARKET, BY COUNTRY, 2022–2030 (000’ UNITS)

15.4.1 CHINA

15.4.1.1 China vehicle production

TABLE 202 CHINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.4.1.2 Standard seats estimated to be largest market in China

TABLE 203 CHINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 204 CHINA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 205 CHINA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.2 INDIA

15.4.2.1 India vehicle production

TABLE 206 INDIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.4.2.2 Powered seats expected to be second-largest & fastest-growing segment in India

TABLE 207 INDIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 208 INDIA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 209 INDIA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.3 INDONESIA

15.4.3.1 Indonesia vehicle production

TABLE 210 INDONESIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.4.3.2 Demand for mid and high-end SUVs will boost market in Indonesia

TABLE 211 INDONESIA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 212 INDONESIA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.4 JAPAN

15.4.4.1 Japan vehicle production

TABLE 213 JAPAN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 214 JAPAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

15.4.4.2 Powered seats expected to be second-largest segment in Japan

TABLE 215 JAPAN: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 216 JAPAN: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.5 SOUTH KOREA

15.4.5.1 South Korea vehicle production

TABLE 217 SOUTH KOREA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 218 SOUTH KOREA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

15.4.5.2 Standard and powered seat segments to dominate market in South Korea

TABLE 219 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 220 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.6 THAILAND

15.4.6.1 Thailand vehicle production

TABLE 221 THAILAND: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.4.6.2 Small and mid-end cars expected to drive powered seats market in Thailand

TABLE 222 THAILAND: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 223 THAILAND: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.4.7 REST OF ASIA OCEANIA

15.4.7.1 Rest Of Asia Oceania vehicle production

TABLE 224 REST OF ASIA OCEANIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.4.7.2 Increased vehicle production will drive market in Rest of Asia Oceania

TABLE 225 REST OF ASIA OCEANIA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 226 REST OF ASIA OCEANIA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5 EUROPE

TABLE 227 EUROPE: MARKET, BY COUNTRY, 2017–2021 (‘000 UNIT)

TABLE 228 EUROPE: MARKET, BY COUNTRY, 2022–2030 (‘000 UNIT)

15.5.1 FRANCE

15.5.1.1 France vehicle production

TABLE 229 FRANCE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 230 FRANCE: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

15.5.1.2 Powered seats segment expected to follow standard seats segment, in terms of volume, in France

TABLE 231 FRANCE: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 232 FRANCE: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.2 GERMANY

15.5.2.1 Germany vehicle production

TABLE 233 GERMANY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 234 GERMANY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

15.5.2.2 Combination of heated, ventilated, memory, and massage seats to be in high demand in Germany

TABLE 235 GERMANY: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 236 GERMANY: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.3 ITALY

15.5.3.1 Italy vehicle production

TABLE 237 ITALY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

TABLE 238 ITALY: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

15.5.3.2 Increase in passenger car production will drive market in Italy

TABLE 239 ITALY: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 240 ITALY: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.4 RUSSIA

15.5.4.1 Russia vehicle production

TABLE 241 RUSSIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.5.4.2 Growth in SUV segment will fuel market growth in Russia

TABLE 242 RUSSIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 243 RUSSIA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 244 RUSSIA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.5 SPAIN

15.5.5.1 Spain vehicle production

TABLE 245 SPAIN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.5.5.2 Increase in demand for light commercial vehicles will boost market in Spain

TABLE 246 SPAIN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 247 SPAIN: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 248 SPAIN: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.6 TURKEY

15.5.6.1 Turkey vehicle production

TABLE 249 TURKEY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.5.6.2 Market in Turkey to be driven by mid-end passenger vehicles

TABLE 250 TURKEY: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 251 TURKEY: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.7 UK

15.5.7.1 UK vehicle production

TABLE 252 UK: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.5.7.2 Powered & heated seats to be largest segment in UK

TABLE 253 UK: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 254 UK: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 255 UK: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.5.8 REST OF EUROPE

15.5.8.1 Rest of Europe vehicle production

TABLE 256 REST OF EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.5.8.2 Standard seats to dominate market in Rest of Europe

TABLE 257 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 258 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.6 MIDDLE EAST & AFRICA

TABLE 259 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (‘000 UNIT)

TABLE 260 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2030 (‘000 UNIT)

15.6.1 IRAN

15.6.1.1 Iran vehicle production

TABLE 261 IRAN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.6.1.2 Mid and high-end passenger vehicles boost market in Iran

TABLE 262 IRAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 263 IRAN: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 264 IRAN: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.6.2 SOUTH AFRICA

15.6.2.1 South Africa vehicle production

TABLE 265 SOUTH AFRICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.6.2.2 Increased in premium cars segment will boost market in South Africa

TABLE 266 SOUTH AFRICA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2021

TABLE 267 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 268 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

15.6.3 REST OF MIDDLE EAST & AFRICA

15.6.3.1 Rest Of Middle East & Africa vehicle production

TABLE 269 REST OF MIDDLE EAST & AFRICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2021 (‘000 UNIT)

15.6.3.2 Demand for comfort and safety features will drive market in Rest of Middle East & Africa

TABLE 270 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2017–2021 (‘000 UNIT)

TABLE 271 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNIT)

16 COMPETITIVE LANDSCAPE (Page No. - 233)

16.1 OVERVIEW

16.2 AUTOMOTIVE SEATS MARKET SHARE ANALYSIS, 2020-2021

TABLE 272 MARKET SHARE ANALYSIS, 2020-2021

FIGURE 41 AUTOMOTIVE SEATS: GLOBAL MARKET SHARE ANALYSIS (2020-2021)

FIGURE 42 AUTOMOTIVE SEATS: NORTH AMERICA MARKET SHARE ANALYSIS (2020-2021) 234

FIGURE 43 AUTOMOTIVE SEATS: EUROPE MARKET SHARE ANALYSIS (2020-2021)

FIGURE 44 AUTOMOTIVE SEATS: CHINA MARKET SHARE ANALYSIS (2020-2021)

16.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 45 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2018-2020

16.4 COMPETITIVE EVALUATION QUADRANT

16.4.1 TERMINOLOGY

16.4.2 STAR

16.4.3 EMERGING LEADERS

16.4.4 PERVASIVE

16.4.5 PARTICIPANTS

FIGURE 46 COMPETITIVE EVALUATION MATRIX, 2021: AUTOMOTIVE SEAT MANUFACTURERS

16.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 47 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

16.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 48 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 49 COMPETITIVE EVALUATION MATRIX, 2021: AUTOMOTIVE SEAT COMPONENT SUPPLIERS

16.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 50 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN AUTOMOTIVE SEAT COMPONENT SUPPLIERS MARKET

16.8 BUSINESS STRATEGY EXCELLENCE

FIGURE 51 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN AUTOMOTIVE SEAT COMPONENT SUPPLIERS MARKET

16.9 COMPETITIVE SCENARIO

TABLE 273 EXPANSIONS, 2019-2021

16.9.1 NEW PRODUCT DEVELOPMENTS/LAUNCHES, 2019–2021

TABLE 274 NEW PRODUCT DEVELOPMENTS/LAUNCHES, 2020-2021

16.10 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2021

FIGURE 52 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2021

16.11 RIGHT TO WIN

17 COMPANY PROFILES (Page No. - 249)

17.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

17.1.1 ADIENT PLC

TABLE 275 ADIENT PLC: BUSINESS OVERVIEW

FIGURE 53 ADIENT PLC: COMPANY SNAPSHOT

TABLE 276 ADIENT PLC: PRODUCTS OFFERED

TABLE 277 ADIENT PLC: NEW PRODUCT DEVELOPMENTS

TABLE 278 ADIENT PLC: DEALS

TABLE 279 ADIENT: OTHER DEVELOPMENTS

17.1.2 FAURECIA

TABLE 280 FAURECIA: BUSINESS OVERVIEW

FIGURE 54 FAURECIA: COMPANY SNAPSHOT

TABLE 281 FAURECIA: PRODUCTS OFFERED

TABLE 282 FAURECIA: DEALS

TABLE 283 FAURECIA: OTHER DEVELOPMENTS

17.1.3 LEAR

TABLE 284 LEAR: BUSINESS OVERVIEW

FIGURE 55 LEAR: COMPANY SNAPSHOT

TABLE 285 LEAR: PRODUCTS OFFERED

TABLE 286 LEAR: NEW PRODUCT DEVELOPMENTS

TABLE 287 LEAR: DEALS

TABLE 288 LEAR: OTHER DEVELOPMENTS

17.1.4 TOYOTA BOSHOKU CORPORATION

TABLE 289 TOYOTA BOSHOKU CORPORATION: BUSINESS OVERVIEW

FIGURE 56 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

TABLE 290 TOYOTA BOSHOKU CORPORATION: PRODUCTS OFFERED

TABLE 291 TOYOTA BOSHOKU CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 292 TOYOTA BOSHOKU CORPORATION: DEALS

TABLE 293 TOYOTA BOSHOKU CORPORATION: OTHER DEVELOPMENTS

17.1.5 MAGNA INTERNATIONAL

TABLE 294 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 57 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

TABLE 295 MAGNA INTERNATIONAL: PRODUCTS OFFERED

TABLE 296 MAGNA INTERNATIONAL: NEW PRODUCT DEVELOPMENTS

TABLE 297 MAGNA INTERNATIONAL: DEALS

TABLE 298 MAGNA INTERNATIONAL: OTHER DEVELOPMENTS

17.1.6 TS TECH

TABLE 299 TS TECH: BUSINESS OVERVIEW

FIGURE 58 TS TECH: COMPANY SNAPSHOT

TABLE 300 TS TECH: PRODUCTS OFFERED

TABLE 301 TS TECH: NEW PRODUCT DEVELOPMENT

TABLE 302 TS TECH: OTHER DEVELOPMENTS

17.1.7 AISIN CORPORATION

TABLE 303 AISIN CORPORATION: BUSINESS OVERVIEW

FIGURE 59 AISIN CORPORATION: COMPANY SNAPSHOT

TABLE 304 AISIN CORPORATION: PRODUCTS OFFERED

TABLE 305 AISIN CORPORATION: NEW PRODUCT DEVELOPMENTS

17.1.8 NHK SPRING

TABLE 306 NHK SPRING: BUSINESS OVERVIEW

FIGURE 60 NHK SPRING: COMPANY SNAPSHOT

TABLE 307 NHK SPRING: PRODUCTS OFFERED

TABLE 308 NHK SPRING: OTHER DEVELOPMENTS

17.1.9 TACHI-S

TABLE 309 TACHI-S: BUSINESS OVERVIEW

FIGURE 61 TACHI-S: COMPANY SNAPSHOT

TABLE 310 TACHI-S: PRODUCTS OFFERED

TABLE 311 TACHI-S: OTHER DEVELOPMENTS

17.1.10 GENTHERM

TABLE 312 GENTHERM: BUSINESS OVERVIEW

FIGURE 62 GENTHERM: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17.2 AUTOMOTIVE MARKET – ADDITIONAL PLAYERS

17.2.1 BROSE FAHRZEUGTEILE SE & CO. KG

TABLE 313 BROSE FAHRZEUGTEILE SE & CO. KG: COMPANY OVERVIEW

17.2.2 GRAMMER AG

TABLE 314 GRAMMER AG: COMPANY OVERVIEW

17.2.3 C.I.E.B. KAHOVEC

TABLE 315 C.I.E.B. KAHOVEC: BUSINESS OVERVIEW

17.2.4 PHOENIX SEATING LIMITED

TABLE 316 PHOENIX SEATING LIMITED: COMPANY OVERVIEW

17.2.5 IG BAUERHIN GMBH

TABLE 317 IG BAUERHIN GMBH: BUSINESS OVERVIEW

17.2.6 SABELT

TABLE 318 SABELT: BUSINESS OVERVIEW

17.2.7 GUELPH MANUFACTURING

TABLE 319 GUELPH MANUFACTURING: COMPANY OVERVIEW

17.2.8 CAMACO-AMVIAN

TABLE 320 CAMACO-AMVIAN: COMPANY OVERVIEW

17.2.9 FREEDMAN SEATING COMPANY

TABLE 321 FREEDMAN SEATING COMPANY: COMPANY OVERVIEW

17.2.10 DAEWON KANG

TABLE 322 DAEWON KANG: COMPANY OVERVIEW

17.2.11 TATA AUTOCOMP SYSTEMS

TABLE 323 TATA AUTOCOMP SYSTEMS: COMPANY OVERVIEW

17.2.12 SUMMIT AUTO SEATS

TABLE 324 SUMMIT AUTO SEATS: COMPANY OVERVIEW

17.2.13 HARITA SEATING SYSTEMS LTD.

TABLE 325 HARITA SEATING SYSTEMS LTD: COMPANY OVERVIEW

17.2.14 DELTA KOGYO CO. LTD.

TABLE 326 DELTA KOGYO CO., LTD.: COMPANY OVERVIEW

17.2.15 BHARAT SEATS LIMITED (BSL)

TABLE 327 BHARAT SEATS LIMITED (BSL): COMPANY OVERVIEW

18 APPENDIX (Page No. - 293)

18.1 INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.4.1 AUTOMOTIVE SEATS MARKET, BY OFF-HIGHWAY VEHICLE, BY REGION

18.4.1.1 Asia Oceania

18.4.1.2 Americas

18.4.1.3 Europe

18.4.1.4 RoW

18.4.2 AUTOMOTIVE SEAT MATERIAL MARKET, BY VEHICLE TYPE

18.4.2.1 Passenger Car

18.4.2.2 Light Commercial Vehicle

18.4.2.3 Truck

18.4.2.4 Bus

18.4.3 ATV SEATS MARKET, BY SEATING CAPACITY (VALUE)

18.4.3.1 One-seater

18.4.3.2 Two-seater

18.4.4 AUTOMOTIVE SEATS TECHNOLOGY MARKET, BY VEHICLE TYPE

18.4.4.1 Passenger Car

18.4.4.2 LCV

18.4.4.3 Truck

18.4.4.4 Bus

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

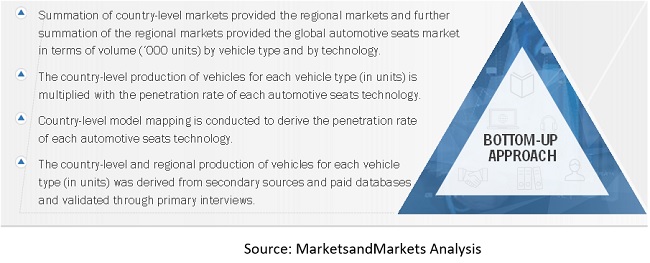

The study involves four main activities to estimate the current size of the automotive seat market.

- Exhaustive secondary research was done to collect information on the market, such as, Automotive seats market by seat Type, by Component, by technology, by trim material, by vehicle type, by off-highway vehicle, by electric & hybrid vehicle, by Region, and by ATV seat capacity

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include automotive industry organizations such as the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive seats associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after obtaining an understanding of the automotive seats market scenario through secondary research. Approximately 80% of the primary interviews were conducted from the automotive seats providers and component/system providers, and 20% from the end users across Americas, Europe, and Asia Oceania. The primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administrations, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- BOTTOM UP approach: Was used to estimate and validate the size of the automotive seats market, by region, vehicle type, technology, and seat type. To determine the market size, in terms of volume, for the market, by technology, country-level production numbers of each vehicle type (passenger car, LCV, truck, and bus) were multiplied by the country-level penetration of each seat technology (derived from model mapping) to obtain the country-level seat market, by vehicle type and technology, in terms of volume. The country-level market size, by technology in terms of volume, was added to derive the regional and further, the global market, by technology (powered; standard; heated & powered; powered, heated, & memory; powered, heated, & ventilated; powered, heated, ventilated, & memory; and powered, heated, ventilated, memory, & massage) in terms of volume. A similar approach was followed to derive the market, by seat type (bucket and bench/split bench), by vehicle type (passenger car, LCV, heavy truck, and bus), electric vehicle type (BEV, FCEV, and PHEV), and off-highway vehicle (construction/mining equipment and agricultural tractor). used to estimate and validate the size of the market. The market size by seat type, in terms of volume & value, was derived by multiplying the country-level penetration of bucket and split bench/bench with the production numbers

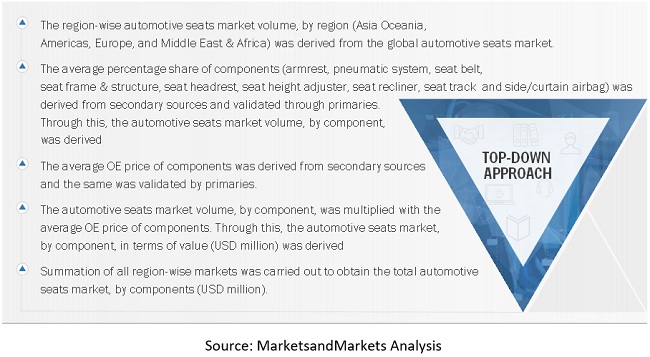

- TOP DOWN approach: While estimating the regional market size for automotive seats, by component, the regional share of armrests, pneumatic systems, seat belts, seat frames & structures, seat headrests, seat height adjusters, seat recliners, seat tracks, and side/curtain airbags were identified and multiplied with the regional market size, in terms of volume. The regional market size, in terms of volume, was then multiplied with the regional-level average OE price (AOP) of components. This resulted in the regional market size of the market, by component, in terms of value.

- A similar approach was followed to obtain the market, by trim material (fabric, genuine leather, and synthetic leather) and by material (steel, aluminum, and caron-amide-metal).

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Seats Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Seats Market Size: Top-Down Approach

Report Objectives

To define, describe, and forecast the size of the automotive seats market in terms of value (USD million) and volume (million units)

- By technology (heated; powered; standard; powered & heated; powered, heated & memory; powered, heated & ventilated; powered, heated, ventilated, & memory; and powered heated, ventilated, memory, & massage) at the country and regional level

- By seat type (bucket and bench/split bench) at the regional level

- By trim material (fabric, genuine leather, and synthetic leather), at the regional level. The fabric material segment is further segmented into polyester woven fabrics, woven velour fabrics, and other fabrics

- By component (armrest, pneumatic system, seat belt, seat frame & structure, seat headrest, seat height adjuster, seat recliner, seat track and side/curtain airbag) at the regional level

- By vehicle type (passenger car, light commercial vehicle, heavy truck, and bus), at the regional level. The passenger car segment is further segmented into sedan, hatchback, and SUV/MUV

- By material (steel, aluminum, and carbon-amide-metal) at the regional level

- By off-highway vehicle (construction/mining equipment and agricultural tractor) at the regional level

- By Electric & Hybrid Vehicle (battery electric vehicle, fuel cell electric vehicle, and plug-in hybrid electric vehicle) at the regional level

- By ATV seats market (one-seater ATV & two-seater ATV) at the regional level

- By region (Asia Oceania, Europe, the Americas, and the Middle East & Africa)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the automotive seats market and to study patent analysis, case study analysis, supply chain analysis, Porter’s Five Force Analysis, and ecosystem analysis

- To analyze the ranking and share of key players operating in the market

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To understand the dynamics of the market competitors and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the market

Powered Seats & Its impact on Automotive Seats Market

Powered seats are a type of car seat that can be adjusted with the help of electric motors and controls. Powered seats are part of the larger automotive seats market, which includes a variety of vehicle seating products. Powered seats in vehicles have grown in popularity over the years due to the convenience and comfort they provide. Powered seats allow drivers and passengers to adjust their seating position easily and precisely, which can improve comfort and reduce fatigue during long trips. Furthermore, powered seats can be adjusted to accommodate different body types, which improves safety and reduces the risk of injury in the event of an accident.

The incorporation of powered seats in vehicles may also have an impact on the automotive seats market in a variety of ways. Increased demand for powered seats, for example, can spur innovation and competition among automotive seat manufacturers, resulting in new and improved products. As a result, the market for powered seats is expected to expand in the coming years, with more and more vehicles outfitted with these seats.

By extending the reach of Powered Seats companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increased demand for powered seats: As more and more consumers become aware of the convenience and comfort provided by powered seats, the demand for these types of seats is expected to increase.

- Higher pricing for powered seats: Powered seats are typically more expensive than traditional manual seats, due to the added complexity and technology required.

- Impact on overall vehicle pricing: The increased demand for powered seats and the higher pricing of these seats is likely to impact the overall pricing of vehicles that are equipped with powered seats.

- Improved safety and comfort: Powered seats can be adjusted more precisely than manual seats, which can improve comfort and reduce fatigue during long trips.

- Impact on the aftermarket: The increased adoption of powered seats in vehicles is likely to impact the aftermarket for automotive seats.

The top players in the Powered Seats Market are Lear Corporation, Faurecia, Magna International, Brose Fahrzeugteile GmbH & Co. KG.

Some of the key industries that are going to get impacted because in the future because of Powered Seats are,

1. Automotive electronics: The increased adoption of powered seats in vehicles requires the integration of electronic systems and controls to operate the seats.

2. Automotive interior design: Powered seats can have a significant impact on the overall design of a vehicle's interior.

3. Advanced manufacturing: The production of powered seats requires advanced manufacturing techniques and materials.

4. Automotive safety: Powered seats can improve safety in vehicles by allowing for more precise adjustments to accommodate different body types.

Speak to our Analyst today to know more about, "Powered Seats Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

Automotive Seats Market, By Off-Highway Vehicle, By Region

- Asia Oceania

- Americas

- Europe

- RoW

Automotive Seat Material Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Truck

- Bus

Atv Seats Market, By Seating Capacity (Value)

- One-seater

- Two-seater

Automotive Seats Technology Market, By Vehicle Type

- Passenger Car

- LCV

- Truck

- Bus

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Seats Market

I would like to explore the various conditions and situations rising in PVC Leather for Automotive (Car Seat ) in UAE and Sudan for official purposes.