Automotive Sensors Market by Sales Channel (OEM, Aftermarket), Type (Temperature Sensors, Pressure Sensors, Position Sensors), Vehicle Type, Application (Powertrain Systems, Chassis), Region [2020-2026]

Updated on : April 24, 2023

The global automotive sensors market in terms of revenue was estimated to be worth USD 25.1 billion in 2021 and is poised to reach USD 47.5 billion by 2026, growing at a CAGR of 13.6% from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

Increasing consumer preference for alternative fuel vehicles to reduce greenhouse gas emissions and rising demand for vehicle safety are driving the demand for automotive sensors worldwide. Discover more about the growth prospects and opportunities in the global automotive sensors market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Automotive Sensors Market

The outbreak and the spread of the COVID-19 had a negative effect on the automotive sensors market in 2020, resulting in decreased demand of automotive sensors. This resulted in the declined revenues generated from them. As a result, a dip was witnessed in the growth trend of the market during the first half of 2020. This trend continued to prevail till the first quarter of 2021. The demand for automotive sensors is expected to surge with the increase in the production volume of the passenger cars and hybrid electric vehicles in the second or third quarter of 2021.

Market Dynamics:

Driver: Rising adoption of autonomous vehicles

Autonomous driving is one of the primary factors triggering the demand for automotive sensors. The market for most automotive sensors is growing in line with the overall growth of the automotive market. The high adoption of ADAS and AD systems is the major reason for the elevated demand for automotive sensors. Sensors installed in ADAS/AD systems include image sensors, temperature sensors, position sensors, speed sensors, etc. contribute most to the overall growth of the market for automotive sensors.

Moreover, other sensors, such as powertrain sensors, chassis sensors, and body sensors, also play a crucial role in stimulating the growth of the market for automotive sensors. Powertrain sensors play a critical role in the effective operation of the engine, transmission system, and alternator. Chassis sensors monitor functions such as braking, steering, and suspension. A cluster of sensors is used in ADAS/AD systems, braking systems, and power steering systems of SAE AV Level 3 vehicles. Body sensors measure the condition and performance of the vehicle on several parameters. For instance, body sensors capture and convey information regarding door/roof closure, seat occupancy, and the amount of sunlight/rainfall and can trigger alerts and perform basic functions accordingly. Thus, autonomous vehicles deployed with a wide variety of sensors can reduce drivers’ stress and increase their productivity. Hence, the rising adoption of autonomous vehicles is fueling the growth of the automotive sensors market.

Restraint: Underdeveloped aftermarket for automotive sensors in emerging economies

The automotive sensors’ business is an OEM-dominant business because of the underdeveloped aftermarket for automotive sensors. For various other business segments, such as industrial sensors and home automation electronics, the aftermarket plays a vital role in promoting market growth. However, in terms of automotive sensors, mostly technical specifications for sensors are given by the vehicle manufacturer or a tier 1 supplier, which is the primary reason behind the difficulty in the commercialization of automotive sensors. Similarly, for various new sensors such as radar, lidar, and proximity sensors, the retrofit market is comparatively small due to the lower penetration of these sensors in automobiles. The aftermarket is slightly developed in advanced economies in North America and Europe, but it is significantly underdeveloped in emerging economies of Asia Pacific.

Opportunity: Growing focus on electrification in automotive industry

The high requirement for fuel-efficient cars and the stringent government regulations to lower CO2 emissions led to an increasing number of semiconductors in traditional vehicles and EVs/HEVs. The Government of China introduced the new 6A emission standard in 2020 that helped reduce vehicle emissions. In conventional internal combustion engines, there is a huge potential to lower CO2 emissions.

Advances in EVs/HEVs would lead to the electrification of powertrain systems. Governments in many countries are beginning to ban or are in the process of banning internal combustion engine (ICE)-based cars completely. China-based automakers have increased their EV production (10% of total production from 2019). Many global automakers have also set goals to increase the sales of EVs up to 15–25% of their total sales by 2025, thereby bringing EVs to the masses. As major OEMs pursue their EV goals, the growth of the semiconductor industry will increase proportionally. Thus, there are lots of opportunities for innovations in electronic powertrain technologies that will be used to reduce total emissions, thereby accelerating the demand for automotive sensors.

Challenge: Safety and security threats in autonomous vehicles

In recent years, autonomous cars have gained traction. There have been multiple fatal incidents in Level 3 to Level 5 autonomous vehicles, wherein the vehicle had limited human interaction. Moreover, the EU Agency for Cybersecurity (ENISA) and Joint Research Centre (JRC) released a report that autonomous vehicles carry serious cybersecurity risks. The report noted that autonomous vehicles are susceptible to adversarial machine learning techniques such as evasion or poisoning attacks. This threat model involves spoofing the pattern and facial recognition systems. Evasion attacks manipulate the data fed into the systems to alter the output for the attacker’s benefit. Similarly, poisoning attacks corrupt the training process to cause a malfunction benefiting the attacker. For instance, Tesla autonomous cars were tricked into accelerating from 35 to 85 mph with a modified speed limit sign.

With the development of advanced sensors such as radar, lidar, and image sensors, OEMs are expected to increase their utilization in autonomous cars. However, OEMs and integrators must focus on ensuring the accuracy and reliability of these sensors. Moreover, manufacturers should adopt the security-by-design approaches to guarantee AI security on the roads.

The market for the original equipment manufacturer (OEM) segment is expected to grow at the highest CAGR during the forecast period.

The OEM segment is expected to lead the automotive sensors market during the forecast period due to the rising demand for sensors in modern vehicles. Sensors are an essential component in automotive systems for the safe, comfortable, and economic operation of vehicles. The extreme conditions in automotive applications such as heat, cold, or continuous vibrations create a high demand for sensors that are highly reliable and resilient. Moreover, the newly mandated sensors-based features such as clear surrounding visuals, automatic vehicle speed control, and vehicle location tracking also drive the growth of the OEM segment in the automotive sensors industry.

The market for the position sensors segment is expected to grow at the highest CAGR during the forecast period.

2020, the position sensors segment held the largest share of the automotive sensors market, and a similar trend is expected to be observed during the forecast period. The growth of the market for position sensors can be attributed to the rising demand for autonomous cars and autopilot applications. Advanced technologies are increasingly being adopted in passenger and commercial cars because of the improving standard of living and rising consumer preference for better safety standards and comfort. Position sensors have become an integral part of vehicles, from vehicle seats through pedals to gear shifters, to ensure the safety and proper functioning of all vehicle components. Thus, innovation in automotive technology has increased the use of position sensors in a vehicle.

The passenger car segment held the largest of the automotive sensors market.

In 2021, the passenger car segment is anticipated to hold the largest share of the automotive sensors market, and a similar trend is likely to be observed during the forecast period. The passenger car segment is also expected to record the highest CAGR during the forecast period. The leading position of the passenger car segment can be attributed to the significant demand and high production of automobiles across the world. Passenger cars currently account for the largest shipment of the total automobile production worldwide.

The use of automotive sensors in passenger cars helps improve the car's performance, enhance vehicle safety, and reduce CO2 emissions from vehicles. Improvements in road infrastructure, availability of cheap labor, and increase in purchasing power of consumers have fueled the demand for automobiles in emerging economies such as China, India, and Brazil, which, in turn, stimulates the need for automotive sensors.

The powertrain systems application held the largest share of the automotive sensors market, and this trend is expected to continue during the forecast period.

In 2020, powertrain systems held the largest share of the automotive sensors market, and a similar trend is expected to be observed during the forecast period. Safety and control systems are expected to record the highest CAGR in the automotive sensors market during the forecast period. The growth of the market for powertrain and safety and control systems can be attributed to the rising use of position, speed, gas, pressure, and temperature sensors in them. These sensors are required for the efficient performance of vehicles and safe rides. Stringent regulations by governments regarding fuel efficiency and emission control accelerate the adoption of sensors in powertrain systems. Automotive sensors are used in exhaust systems to monitor and analyze the level of gases emitted through the vehicle.

To know about the assumptions considered for the study, download the pdf brochure

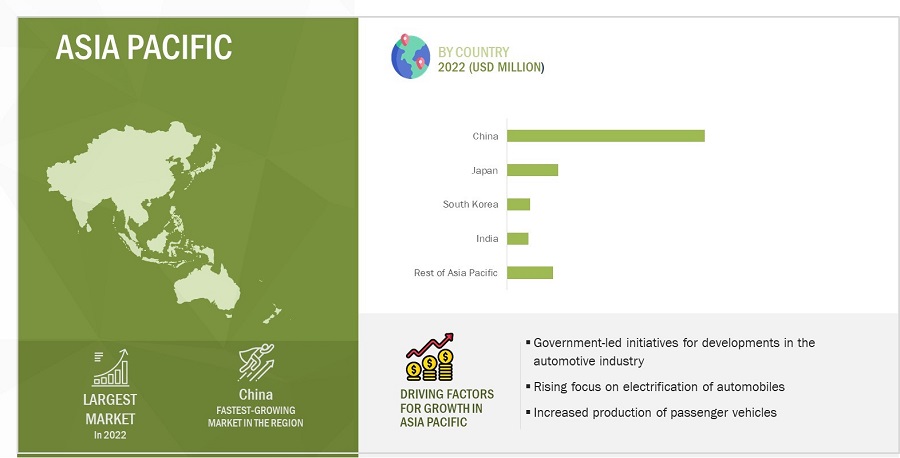

Asia Pacific held the largest share in 2020 and is expected to account for the highest CAGR of the automotive sensors market by 2026

Asia Pacific held the largest share of the automotive sensors market in 2020, and a similar trend is expected to be observed during the forecast period. This growth is attributed to the owing to stringent government norms that mandate the use of advanced technologies to improve vehicle safety and reduce pollution, increased inclination toward electric and hybrid vehicles, and high adoption of ADAS and autonomous cars. Moreover, the increasing purchasing power of consumers, rising investments in infrastructure development for the automotive sector, and surging demand for more efficient and safer vehicles are other key factors accelerating the growth of the automotive sensors market in Asia Pacific.

Key Market Players

Robert Bosch GmbH (Germany), Continental AG (Germany), DENSO Corporation (Japan), Infineon Technologies AG (Germany), BorgWarner, Inc. (US), Sensata Technologies (US), Allegro Microsystems, Inc. (US), Analog Devices, Inc. (US), ELMOS Semiconductor SE (Germany), Aptiv plc (Ireland), are some of the key players in the automotive sensors companies.

Automotive Sensors Market Report Scope

|

Report Metric |

Details |

| Market size value in 2021 | USD 25.1 billion |

| Market size value in 2026 | USD 47.5 billion |

| Growth rate | CAGR of 13.6% |

|

Forecast Period |

2021–2026 |

|

Base Year |

2020 |

|

Market Size Availability for Years |

2017–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

| Market Leaders |

|

|

Top Companies in North America |

|

| Key Market Driver | Rising adoption of autonomous vehicles |

| Key Market Opportunity | Implementation of AI-based technologies for broadcasting |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Passenger Car, Position Sensors |

This research report categorizes the automotive sensors market based on sales channel, sensor type, vehicle type, application, and region

Automotive Sensors Market:

Based on Sales Channel:

- Introduction

- Original Equipment Manufacturer (OEM)

- Aftermarket

Based on Sensor Type:

- Introduction

- Temperature Sensors

- Pressure Sensors

- Oxygen Sensors

- NOx Sensors

- Position Sensors

- Speed Sensors

- Inertial Sensors

- Image Sensors

- Others

Other sensors include radar sensors, ultrasonic sensors, rain sensors, relative humidity sensors, proximity sensors, particulate matter sensors, current sensors, and lidar sensors.

Based on Vehicle Type

- Introduction

- Passenger Car

- LCV

- HCV

Based on Application

- Introduction

- Powertrain Systems

- Chassis

- Exhaust Systems

- Safety & Control Systems

- Vehicle Body Electronics

- Telematics Systems

- Others

Note: Other applications include vehicle monitoring systems, vehicle tracking systems, and vehicle security systems.

Based on Geography

- Introduction

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

ROW

- Middle East & Africa

- South America

Recent Developments

- In November 2021, Robert Bosch GmbH developed an innovative and advanced driver-assistance system for city rail transportation. In the event of a possible collision, it first warns the tram driver by means of a signal. If the driver does not intervene or does so too late, the system automatically brakes the tram until it comes to a complete stop to prevent an impact or, at least, to reduce it as much as possible

- In October 2021, Infineon Technologies AG launched an automotive current sensor— XENSIV TLE4972. The coreless current sensor uses Infineon’s well-proven Hall technology for precise and stable current measurements

- In July 2021, Continental AG partnered with a LiDAR expert called AEye to integrate the long-range LiDAR technology into its full sensor stack solution and create the first full-stack automotive-grade system for Level 2+ up to Level 4 automated and autonomous driving applications. The solution based on AEye’s LiDAR technology is a substantial part of the sensor setup for high-level automation systems

- In July 2021, Continental AG acquired a minority stake in the industry 4.0 startup Feelit, headquartered in Tel Aviv, Israel. Feelit provides cutting-edge predictive maintenance solutions for various industrial equipment and machinery based on proprietary hardware sensors and dedicated algorithms. The startup is focused on developing a structural sensing technology that is up to 50 times more sensitive than current standard market applications.

Frequently Asked Questions (FAQ):

Which are the major companies in the automotive sensors market? What are their major strategies to strengthen their market presence?

The major companies in the automotive sensors market are – Robert Bosch GmbH (Germany), Continental AG (Germany), DENSO Corporation (Japan), Infineon Technologies AG (Germany), BorgWarner, Inc. (US), Sensata Technologies (US), Allegro Microsystems, Inc. (US), Analog Devices, Inc. (US), ELMOS Semiconductor SE (Germany), Aptiv plc (Ireland). The major strategies adopted by these players are product launches, collaborations, expansions, partnerships, agreements, acquisitions, joint ventures, and contracts.

Which is the potential market for the automotive sensors in terms of the region?

The Asia Pacific region is expected to dominate the automotive sensors market due to the increasing use of electric vehicles and the growing adoption of advanced driver-assistance systems (ADAS) and autonomous cars owing to the stringent vehicle emission standards.

What are the opportunities for new market entrants?

There are significant opportunities in the automotive sensors market for start-up companies. With the rising need to measure marketing effectiveness, the demand for automotive sensors is also rising.

What are the drivers and opportunities for the automotive sensors market?

Factors such as rising adoption of autonomous vehicles and growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions are among the driving factors of the automotive sensors market.

Who are the major applications of the automotive sensors that are expected to drive the growth of the market in the next 5 years?

The major applications of the automotive sensors are powertrain systems, chassis, exhaust systems, vehicle body electronics, and safety and control systems, are expected to have a significant share in this market.

How big is the Automotive Sensors Market?

13.6% Annual growth rate is expected and estimated to reach USD 47.5 billion by 2026.

Which is the fastest growing region of the Automotive Sensors Market?

Asia Pacific held the largest share in 2020 and is expected to account for the highest CAGR of the automotive sensors market by 2026.

What are the Challenges in Automotive Sensors Market?

Safety and security threats in autonomous vehicles.

What are the Restraint in Automotive Sensors Market?

Underdeveloped aftermarket for automotive sensors in emerging economies.

What Company Leading the Noth America Broadcast Equipment Market?

BorgWarner, Inc. (US), Sensata Technologies (US), Allegro Microsystems, Inc. (US), Analog Devices, Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE SENSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF AUTOMOTIVE SENSORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR AUTOMOTIVE SENSORS IN DIFFERENT APPLICATIONS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

3.1 IMPACT OF COVID-19 ON AUTOMOTIVE SENSORS MARKET

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

FIGURE 10 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 12 PRE- AND POST-COVID-19 SCENARIOS OF MARKET

FIGURE 13 OEM SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 14 POSITION SENSORS TO HOLD LARGEST SIZE OF MARKET IN 2021

FIGURE 15 PASSENGER CAR SEGMENT TO DOMINATE MARKET FROM 2021 TO 2026

FIGURE 16 SAFETY & CONTROL SYSTEMS TO EXHIBIT HIGHEST CAGR IN MARKET, BY APPLICATION, FROM 2021 TO 2026

FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR AUTOMOTIVE SENSORS FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 18 GROWING DEMAND FOR AUTOMOTIVE SENSORS IN POWERTRAIN APPLICATIONS TO FUEL GROWTH OF MARKET DURING FORECAST PERIOD

4.2 AUTOMOTIVE SENSORS MARKET, BY SENSOR TYPE

FIGURE 19 IMAGE SENSORS TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY SALES CHANNEL AND VEHICLE TYPE

FIGURE 20 OEM AND PASSENGER CAR SEGMENTS TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY SALES CHANNEL AND VEHICLE TYPE, RESPECTIVELY, IN 2026

4.4 MARKET, BY REGION

FIGURE 21 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET IN 2026

4.5 AUTOMOTIVE SENSORS MARKET, BY COUNTRY

FIGURE 22 CHINA TO RECORD HIGHEST CAGR IN OVERALL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 AUTOMOTIVE SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions

5.2.1.2 Surging consumer demand for vehicle safety, security, and comfort

5.2.1.3 Rising adoption of autonomous vehicles

FIGURE 24 FORECAST: FULLY AUTONOMOUS CAR SHIPMENTS GLOBALLY, 2018–2025 (THOUSAND)

FIGURE 25 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Underdeveloped aftermarket for automotive sensors in emerging economies

FIGURE 26 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Rising number of partnerships and joint ventures between automobile manufacturers and lidar technology providers

5.2.3.2 Growing focus on electrification in automotive industry

FIGURE 27 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Safety and security threats in autonomous vehicles

FIGURE 28 MARKET CHALLENGES AND THEIR IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN OF MARKET

5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESSES OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

FIGURE 30 REVENUE SHIFT IN MARKET

5.5 AUTOMOTIVE SENSORS ECOSYSTEM

FIGURE 31 ECOSYSTEM OF AUTOMOTIVE SENSORS

TABLE 1 LIST OF AUTOMOTIVE SENSORS MANUFACTURERS AND SUPPLIERS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 AUTOMOTIVE SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 CASE STUDY

5.7.1 DEVELOPMENT OF AUTOMOTIVE SENSOR CHIP FOR ELECTRIC VEHICLES

5.7.2 INTRODUCTION OF PRINTED CIRCUIT BOARD WITH POLARIZED TWISTER FOR AUTOMOTIVE SENSORS

5.7.3 SUPPLY OF PRESSURE SENSOR THAT CAN FUNCTION AT TEMPERATURE OF 150°C

5.8 TECHNOLOGY ANALYSIS

5.8.1 COMPLIMENTARY TECHNOLOGIES

5.8.1.1 Lidar

5.8.1.2 ToF

5.8.2 ADJACENT TECHNOLOGIES

5.8.2.1 CMOS

5.8.2.2 CCD

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 3 AVERAGE SELLING PRICES OF AUTOMOTIVE SENSORS

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

TABLE 4 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

TABLE 5 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS, 2015–2020

FIGURE 33 PATENTS GRANTED WORLDWIDE FROM 2011 TO 2021

TABLE 6 TOP 20 PATENT OWNERS FROM 2011 TO 2021

FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2021

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

5.12.2 REGULATORY COMPLIANCE

5.12.2.1 Regulations

5.12.2.2 Standards

6 AUTOMOTIVE SENSORS MARKET, BY SALES CHANNEL (Page No. - 78)

6.1 INTRODUCTION

FIGURE 35 AUTOMOTIVE SENSORS MARKET, BY SALES CHANNEL

FIGURE 36 ORIGINAL EQUIPMENT MANUFACTURER (OEM) SEGMENT TO COMMAND AUTOMOTIVE SENSORS MARKET DURING FORECAST PERIOD

TABLE 7 MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 8 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 9 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 10 MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

6.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

6.2.1 ORIGINAL EQUIPMENT MANUFACTURERS DEPLOY SENSORS DURING VEHICLE MANUFACTURING FOR ROAD SAFETY, FUEL EFFICIENCY, AND EMISSION CONTROL

TABLE 11 MARKET FOR OEM, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR OEM, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 13 MARKET FOR OEM, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 14 MARKET FOR OEM, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

6.3 AFTERMARKET

6.3.1 AFTERMARKET SERVICES ARE IN DEMAND WITH INCREASING NUMBER OF SENSORS DEPLOYED IN VEHICLE TO ENSURE SAFETY AND SECURITY

TABLE 15 MARKET FOR AFTERMARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR AFTERMARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR AFTERMARKET, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 18 MARKET FOR AFTERMARKET, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

7 AUTOMOTIVE SENSORS MARKET, BY SENSOR TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 37 AUTOMOTIVE SENSORS MARKET, BY SENSOR TYPE

FIGURE 38 IMAGE SENSORS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 20 MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 21 MARKET, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 22 MARKET, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

7.2 TEMPERATURE SENSORS

7.2.1 TEMPERATURE SENSORS FIND APPLICATION IN ENGINE/POWERTRAIN MANAGEMENT AND HVAC SYSTEMS IN AUTOMOBILES

TABLE 23 AUTOMOTIVE TEMPERATURE SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 26 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 27 MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 29 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 30 AUTOMOTIVE TEMPERATURE SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.3 PRESSURE SENSORS

7.3.1 PRESSURE SENSORS ARE CRITICAL FOR IN-VEHICLE SYSTEMS SUCH AS HVAC, SAFETY & CONTROL, AND TIRE PRESSURE MONITORING SYSTEMS

TABLE 31 AUTOMOTIVE PRESSURE SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 34 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 35 MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 36 AUTOMOTIVE PRESSURE SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 37 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 38 AUTOMOTIVE PRESSURE SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.4 OXYGEN SENSORS

7.4.1 OXYGEN SENSORS ARE USED TO MEASURE PROPORTION OF OXYGEN IN AIR-FUEL MIXTURES

TABLE 39 AUTOMOTIVE OXYGEN SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 AUTOMOTIVE OXYGEN SENSORS MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 42 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 43 AUTOMOTIVE OXYGEN SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 44 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 45 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 46 AUTOMOTIVE OXYGEN SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.5 NITROGEN OXIDE (NOX) SENSORS

7.5.1 STRINGENT GOVERNMENT REGULATIONS TO LIMIT NOX EMISSIONS WILL PROVIDE OPPORTUNITIES FOR NOX SENSORS

TABLE 47 AUTOMOTIVE NOX SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 49 AUTOMOTIVE NOX SENSORS MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 50 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 51 AUTOMOTIVE NOX SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 52 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 53 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 54 AUTOMOTIVE NOX SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.6 POSITION SENSORS

7.6.1 POSITION SENSORS ARE USED TO PROVIDE INFORMATION TO ENGINE CONTROL MODULES FOR ENHANCED COMFORT AND IMPROVED FUEL EFFICIENCY

FIGURE 39 ASIA PACIFIC TO LEAD AUTOMOTIVE POSITION SENSORS MARKET DURING FORECAST PERIOD

TABLE 55 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 57 AUTOMOTIVE POSITION SENSORS MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 58 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 59 AUTOMOTIVE POSITION SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 60 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 61 AUTOMOTIVE POSITION SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 62 MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.7 SPEED SENSORS

7.7.1 SPEED SENSORS ARE USED TO MEASURE ENGINE CAMSHAFT AND VEHICLE SPEED

TABLE 63 AUTOMOTIVE SPEED SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 AUTOMOTIVE SPEED SENSORS MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 66 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 67 MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 68 AUTOMOTIVE SPEED SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 69 MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 70 MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.8 INERTIAL SENSORS

7.8.1 INERTIAL SENSORS ARE USED IN ACCELEROMETERS AND GYROSCOPES

7.8.1.1 Accelerometers

7.8.1.1.1 Introduction of electronic stability control (ESC) feature in vehicles drives demand for accelerometers

7.8.1.2 Gyroscopes

7.8.1.2.1 Gyroscope sensors are widely used in efficient braking and suspension systems

TABLE 71 AUTOMOTIVE INERTIAL SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 AUTOMOTIVE INERTIAL SENSORS MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 74 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 75 AUTOMOTIVE INERTIAL SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 76 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 77 AUTOMOTIVE INERTIAL SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 78 MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.9 IMAGE SENSORS

7.9.1 IMAGE SENSORS ARE EXTENSIVELY USED IN ADVANCED DRIVER-ASSISTANCE SYSTEMS

7.9.1.1 CMOS

7.9.1.1.1 CMOS image sensors are increasingly used in autonomous vehicles

7.9.1.2 CCD

7.9.1.2.1 CCD image sensors use global shutter function to capture complete images at once

TABLE 79 AUTOMOTIVE IMAGE SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 82 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 83 MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 84 AUTOMOTIVE IMAGE SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 85 AUTOMOTIVE IMAGE SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 86 MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

7.1 OTHERS

7.10.1 RADAR SENSORS

7.10.2 ULTRASONIC SENSORS

7.10.3 RAIN SENSORS

7.10.4 RELATIVE HUMIDITY SENSORS

7.10.5 PROXIMITY SENSORS

7.10.6 PARTICULATE MATTER SENSORS

7.10.7 LIDAR SENSORS

7.10.8 CURRENT SENSORS

TABLE 87 AUTOMOTIVE OTHER SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 AUTOMOTIVE OTHER SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 90 ARKET, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 91 AUTOMOTIVE OTHER SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 92 MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 93 AUTOMOTIVE OTHER SENSORS MARKET, BY SALES CHANNEL, 2017–2020 (MILLION UNITS)

TABLE 94 AUTOMOTIVE OTHER SENSORS MARKET, BY SALES CHANNEL, 2021–2026 (MILLION UNITS)

8 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE (Page No. - 118)

8.1 INTRODUCTION

FIGURE 40 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE

FIGURE 41 PASSENGER CAR SEGMENT TO RECORD HIGHEST CAGR IN AUTOMOTIVE SENSORS MARKET DURING FORECAST PERIOD

TABLE 95 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 96 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 97 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 98 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

8.2 PASSENGER CAR

8.2.1 PASSENGER CAR SEGMENT IS EXPECTED TO DOMINATE AUTOMOTIVE SENSORS MARKET THROUGHOUT FORECAST PERIOD

TABLE 99 MARKET FOR PASSENGER CAR, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR PASSENGER CAR, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 101 MARKET FOR PASSENGER CAR, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 102 MARKET FOR PASSENGER CAR, BY APPLICATION, 2021–2026 (MILLION UNITS)

FIGURE 42 ASIA PACIFIC TO LEAD MARKET FOR PASSENGER CAR SEGMENT DURING FORECAST PERIOD

TABLE 103 MARKET FOR PASSENGER CAR, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR PASSENGER CAR, BY REGION, 2021–2026 (USD MILLION)

TABLE 105 MARKET FOR PASSENGER CAR, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 106 MARKET FOR PASSENGER CAR, BY REGION, 2021–2026 (MILLION UNITS)

8.3 LCV

8.3.1 MARKET GROWTH IS DRIVEN BY INCREASED FOCUS OF MANUFACTURERS ON ADDING SAFETY FEATURES TO LIGHT COMMERCIAL VEHICLES

TABLE 107 MARKET FOR LCV, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 108 MARKET FOR LCV, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 MARKET FOR LCV, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 110 MARKET FOR LCV, BY APPLICATION, 2021–2026 (MILLION UNITS)

TABLE 111 AUTOMOTIVE SENSORS MARKET FOR LCV, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 MARKET FOR LCV, BY REGION, 2021–2026 (USD MILLION)

TABLE 113 MARKET FOR LCV, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 114 MARKET FOR LCV, BY REGION, 2021–2026 (MILLION UNITS)

8.4 HCV

8.4.1 GOVERNMENT NORMS TO CURB AIR POLLUTION CAUSED BY HEAVY COMMERCIAL VEHICLES ARE LIKELY TO SPUR REQUIREMENT FOR AUTOMOTIVE SENSORS

TABLE 115 MARKET FOR HCV, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 116 MARKET FOR HCV, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 MARKET FOR HCV, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 118 MARKET FOR HCV, BY APPLICATION, 2021–2026 (MILLION UNITS)

TABLE 119 MARKET FOR HCV, BY REGION, 2017–2020 (USD MILLION)

TABLE 120 MARKET FOR HCV, BY REGION, 2021–2026 (USD MILLION)

TABLE 121 MARKET FOR HCV, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 122 MARKET FOR HCV, BY REGION, 2021–2026 (MILLION UNITS)

9 AUTOMOTIVE SENSORS MARKET, BY APPLICATION (Page No. - 132)

9.1 INTRODUCTION

FIGURE 43 AUTOMOTIVE SENSORS MARKET, BY APPLICATION

FIGURE 44 SAFETY & CONTROL SYSTEMS TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 123 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 124 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 125 MARKET, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 126 MARKET, BY APPLICATION, 2021–2026 (MILLION UNITS)

9.2 POWERTRAIN SYSTEMS

9.2.1 POWERTRAIN COMPRISES COMPONENTS THAT GENERATE POWER AND DELIVER IT TO VEHICLE

FIGURE 45 PASSENGER CAR SEGMENT TO LEAD MARKET FOR POWERTRAIN SYSTEMS DURING FORECAST PERIOD

TABLE 127 MARKET FOR POWERTRAIN SYSTEMS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 128 MARKET FOR POWERTRAIN SYSTEMS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 129 MARKET FOR POWERTRAIN SYSTEMS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 130 MARKET FOR POWERTRAIN SYSTEMS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.3 CHASSIS

9.3.1 AUTOMOTIVE SENSORS ARE DEPLOYED IN CHASSIS FOR BRAKING/TRACTION CONTROL, VEHICLE STABILITY, STEERING ASSISTANCE, TIRE CONDITION MONITORING, AND SUSPENSION CONTROL APPLICATIONS

TABLE 131 MARKET FOR CHASSIS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 132 MARKET FOR CHASSIS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 133 MARKET FOR CHASSIS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 134 MARKET FOR CHASSIS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.4 EXHAUST SYSTEMS

9.4.1 STRINGENT AUTOMOBILE EMISSION REGULATIONS TO ACCELERATE NEED FOR EXHAUST SYSTEMS, THEREBY CREATING REQUIREMENT FOR AUTOMOTIVE SENSORS

TABLE 135 MARKET FOR EXHAUST SYSTEMS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 136 MARKET FOR EXHAUST SYSTEMS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 137 MARKET FOR EXHAUST SYSTEMS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 138 MARKET FOR EXHAUST SYSTEMS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.5 SAFETY & CONTROL SYSTEMS

9.5.1 INCREASED DEMAND FOR SAFE, EFFICIENT, AND CONVENIENT DRIVING EXPERIENCE WOULD AUGMENT DEMAND FOR AUTOMOTIVE SENSORS

FIGURE 46 PASSENGER CAR SEGMENT TO LEAD MARKET FOR SAFETY & CONTROL SYSTEMS DURING FORECAST PERIOD

TABLE 139 MARKET FOR SAFETY & CONTROL SYSTEMS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 140 MARKET FOR SAFETY & CONTROL SYSTEMS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 141 MARKET FOR SAFETY & CONTROL SYSTEMS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 142 MARKET FOR SAFETY & CONTROL SYSTEMS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.6 VEHICLE BODY ELECTRONICS

9.6.1 PASSENGER CARS ARE EXPECTED TO DOMINATE MARKET FOR VEHICLE BODY ELECTRONICS

TABLE 143 MARKET FOR VEHICLE BODY ELECTRONICS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 144 MARKET FOR VEHICLE BODY ELECTRONICS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 145 MARKET FOR VEHICLE BODY ELECTRONICS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 146 MARKET FOR VEHICLE BODY ELECTRONICS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.7 TELEMATICS SYSTEMS

9.7.1 TELEMATICS SYSTEMS ARE USED IN INFORMATION AND NAVIGATION, ENTERTAINMENT, AND DIAGNOSTICS APPLICATIONS

TABLE 147 MARKET FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 148 MARKET FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 149 MARKET FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 150 MARKET FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

9.8 OTHERS

TABLE 151 MARKET FOR OTHERS, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 152 MARKET FOR OTHERS, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 153 MARKET FOR OTHERS, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 154 MARKET FOR OTHERS, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

10 GEOGRAPHIC ANALYSIS (Page No. - 149)

10.1 INTRODUCTION

FIGURE 47 REGIONAL SPLIT OF AUTOMOTIVE SENSORS MARKET

FIGURE 48 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 155 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 156 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 157 MARKET, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 158 MARKET, BY REGION, 2021–2026 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 49 SNAPSHOT: AUTOMOTIVE SENSORS MARKET IN NORTH AMERICA

TABLE 159 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 160 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 161 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 162 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

FIGURE 50 US TO LEAD MARKET IN NORTH AMERICA DURING FORECAST PERIOD

TABLE 163 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 164 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 165 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (MILLION UNITS)

TABLE 166 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (MILLION UNITS)

TABLE 167 MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 168 MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 169 MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 170 AUTOMOTIVE SENSORS MARKET IN NORTH AMERICA, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

10.2.1 US

10.2.1.1 US would lead North American market for automotive sensors from 2021 to 2026

10.2.2 CANADA

10.2.2.1 Positive impact of NAFTA agreement on Canadian economy and government initiatives to cut down emissions from vehicles drive demand for automotive sensors

10.2.3 MEXICO

10.2.3.1 Strong presence of production plants of several automobile manufacturers, such as Honda, Nissan, and Mazda, in Mexico would support market growth

10.3 EUROPE

FIGURE 51 SNAPSHOT: AUTOMOTIVE SENSORS MARKET IN EUROPE

TABLE 171 MARKET IN EUROPE, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 172 MARKET IN EUROPE, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 173 MARKET IN EUROPE, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 174 MARKET IN EUROPE, BY TYPE, 2021–2026 (MILLION UNITS)

FIGURE 52 GERMANY TO COMMAND MARKET IN EUROPE THROUGHOUT FORECAST PERIOD

TABLE 175 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 176 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 177 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (MILLION UNITS)

TABLE 178 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (MILLION UNITS)

TABLE 179 MARKET IN EUROPE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 180 MARKET IN EUROPE, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 181 AUTOMOTIVE SENSORS MARKET IN EUROPE, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 182 MARKET IN EUROPE, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

10.3.1 GERMANY

10.3.1.1 Prominent presence of major automotive OEMs to push market growth in Germany

10.3.2 UK

10.3.2.1 High implementation of automotive sensors in luxury cars to propel market growth

10.3.3 FRANCE

10.3.3.1 Significant focus of government to promote adoption of electric and hybrid vehicles to fuel market growth

10.3.4 SPAIN

10.3.4.1 Stringent vehicle emission norms in Spain to spur demand for automotive sensors

10.3.5 ITALY

10.3.5.1 High demand for small city cars, sports cars, and supercars in country to stimulate market growth

10.3.6 REST OF EUROPE (ROE)

10.4 ASIA PACIFIC

FIGURE 53 SNAPSHOT: AUTOMOTIVE SENSORS MARKET IN ASIA PACIFIC

TABLE 183 MARKET IN ASIA PACIFIC, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 184 MARKET IN ASIA PACIFIC, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 185 MARKET IN ASIA PACIFIC, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 186 MARKET IN ASIA PACIFIC, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

FIGURE 54 CHINA TO LEAD MARKET IN ASIA PACIFIC FROM 2021 TO 2026

TABLE 187 MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 188 MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 189 MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2020 (MILLION UNITS)

TABLE 190 MARKET IN ASIA PACIFIC, BY COUNTRY, 2021–2026 (MILLION UNITS)

TABLE 191 MARKET IN ASIA PACIFIC, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 192 MARKET IN ASIA PACIFIC, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 193 MARKET IN ASIA PACIFIC, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 194 AUTOMOTIVE SENSORS MARKET IN ASIA PACIFIC, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

10.4.1 CHINA

10.4.1.1 Growing use of lidar sensors in modern vehicles to support market growth in China

10.4.2 JAPAN

10.4.2.1 Rising focus of country on producing technologically advanced vehicles to facilitate market growth in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Increasing consumer demand for vehicle safety and comfort to support market growth in South Korea

10.4.4 INDIA

10.4.4.1 Growing interest of foreign direct investors in automotive sector owing to significant production capabilities of country to drive Indian market

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF WORLD (ROW)

TABLE 195 MARKET IN ROW, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 196 MARKET IN ROW, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 197 MARKET IN ROW, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 198 MARKET IN ROW, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

FIGURE 55 SOUTH AMERICA TO LEAD MARKET IN ROW THROUGHOUT FORECAST PERIOD

TABLE 199 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 200 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 201 MARKET IN ROW, BY REGION, 2017–2020 (MILLION UNITS)

TABLE 202 MARKET IN ROW, BY REGION, 2021–2026 (MILLION UNITS)

TABLE 203 MARKET IN ROW, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 204 MARKET IN ROW, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

TABLE 205 MARKET IN ROW, BY VEHICLE TYPE, 2017–2020 (MILLION UNITS)

TABLE 206 AUTOMOTIVE SENSORS MARKET IN ROW, BY VEHICLE TYPE, 2021–2026 (MILLION UNITS)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Middle Eastern and African market is expected to be driven by rise in demand for safer and fuel-efficient cars

10.5.2 SOUTH AMERICA

10.5.2.1 South America is expected to target untapped markets in this region

10.6 COVID-19 IMPACT ON AUTOMOTIVE SENSORS MARKET IN VARIOUS REGIONS

10.6.1 MOST IMPACTED REGION: EUROPE

FIGURE 56 PRE- AND POST-COVID SCENARIO OF AUTOMOTIVE SENSORS MARKET IN EUROPE

10.6.2 LEAST IMPACTED REGION: NORTH AMERICA

FIGURE 57 PRE- AND POST-COVID SCENARIO OF AUTOMOTIVE SENSORS MARKET IN NORTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 183)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 207 OVERVIEW OF STRATEGIES DEPLOYED BY KEY AUTOMOTIVE SENSOR MANUFACTURING COMPANIES

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 208 AUTOMOTIVE SENSORS MARKET: MARKET SHARE ANALYSIS (2020)

11.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 58 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN AUTOMOTIVE SENSORS MARKET, 2016–2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 59 AUTOMOTIVE SENSORS MARKET: COMPANY EVALUATION QUADRANT, 2020

11.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

TABLE 209 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN AUTOMOTIVE SENSORS MARKET

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 60 STARTUP/SME EVALUATION MATRIX

11.7 COMPANY FOOTPRINT

TABLE 210 COMPANY FOOTPRINT

TABLE 211 COMPANY APPLICATION FOOTPRINT

TABLE 212 COMPANY REGION FOOTPRINT

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 213 PRODUCT LAUNCHES, JANUARY 2018–NOVEMBER 2021

11.8.2 DEALS

TABLE 214 DEALS, JANUARY 2018–NOVEMBER 2021

11.8.3 OTHERS

TABLE 215 EXPANSIONS AND INVESTMENTS, JANUARY 2018–NOVEMBER 2021

12 COMPANY PROFILES (Page No. - 209)

(Business overview, Products/solutions offered, Recent developments, SWOT analysis & MnM View)*

12.1 KEY PLAYERS

12.1.1 ROBERT BOSCH GMBH

TABLE 216 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 61 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

12.1.2 CONTINENTAL AG

TABLE 217 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 62 CONTINENTAL AG: COMPANY SNAPSHOT

12.1.3 DENSO CORPORATION

TABLE 218 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 63 DENSO CORPORATION: COMPANY SNAPSHOT

12.1.4 INFINEON TECHNOLOGIES AG

TABLE 219 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 64 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

12.1.5 SENSATA TECHNOLOGIES

TABLE 220 SENSATA TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 65 SENSATA TECHNOLOGIES: COMPANY SNAPSHOT

12.1.6 BORGWARNER, INC. (DELPHI TECHNOLOGIES)

TABLE 221 BORGWARNER, INC. (DELPHI TECHNOLOGIES): BUSINESS OVERVIEW

FIGURE 66 BORGWARNER, INC.: COMPANY SNAPSHOT

12.1.7 ALLEGRO MICROSYSTEMS, INC.

TABLE 222 ALLEGRO MICROSYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 67 ALLEGRO MICROSYSTEMS, INC.: COMPANY SNAPSHOT

12.1.8 ANALOG DEVICES, INC.

TABLE 223 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

FIGURE 68 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

12.1.9 ELMOS SEMICONDUCTOR SE

TABLE 224 ELMOS SEMICONDUCTOR SE: BUSINESS OVERVIEW

FIGURE 69 ELMOS SEMICONDUCTOR SE: COMPANY SNAPSHOT

12.1.10 APTIV PLC

TABLE 225 APTIV PLC: BUSINESS OVERVIEW

FIGURE 70 APTIV PLC: COMPANY SNAPSHOT

*Details on Business overview, Products/solutions offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 CTS CORPORATION

12.2.2 AUTOLIV, INC.

12.2.3 NXP SEMICONDUCTOR N.V.

12.2.4 TE CONNECTIVITY

12.2.5 STMICROELECTRONICS N.V.

12.2.6 ZF FRIEDRICHSHAFEN

12.2.7 QUANERGY

12.2.8 INNOVIZ TECHNOLOGIES

12.2.9 VELODYNE LIDAR

12.2.10 LEDDARTECH

12.2.11 VALEO S.A.

12.2.12 MAGNA INTERNATIONAL

12.2.13 MELEXIS N.V.

12.2.14 ON SEMICONDUCTOR

12.2.15 AMPHENOL ADVANCED SENSORS

13 APPENDIX (Page No. - 270)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

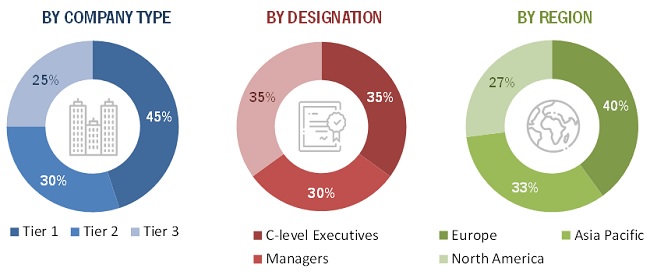

The study involved four major activities in estimating the size of the automotive sensors market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred for identifying and collecting information for this study on the automotive sensors market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the automotive sensors industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the automotive sensors market based on sales channel, sensor type, vehicle type, application, and region. It also includes information about the key developments undertaken from both market and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the automotive sensors market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, and Asia Pacific. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the automotive sensors market.

- Identifying the number of automotive sensors shipped at the global level

- Identifying average selling prices of automotive sensors shipped globally

- Conducting multiple discussion sessions with key opinion leaders to understand different automotive sensors and their deployment in multiple products and applications; analyzing the break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases of the company- and region-specific developments undertaken in the automotive sensors market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the automotive sensors market.

- Focusing initially on the top-line investments and expenditures made in the automotive sensors ecosystem. Further splitting into sensor type, vehicle type, sales channel, application, and listing key developments in key market areas

- Identifying all major players offering a variety of automotive sensors for different vehicle types, and applications through different sales channels, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which automotive sensors are offered by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the automotive sensors market.

Report Objectives

- To describe, segment, and forecast the global automotive sensors market size, by sales channel, sensor type, vehicle type, and application, in terms of value and volume

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific (APAC), and Rest of World (RoW), in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the automotive sensors market

- To provide an overview of the supply chain pertaining to the automotive sensor ecosystem, along with the average selling prices of automotive sensors

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, porter’s five forces, technology trends, regulations, import and export scenarios, trade landscape, and case studies pertaining to the market understudy

- To describe the detailed impact of COVID-19 on the global automotive sensors market

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze competitive developments such as product launches, collaborations, expansions, partnerships, agreements, acquisitions, joint ventures, and contracts in the automotive sensors market

- To profile key players in the automotive sensors market and comprehensively analyze their market ranking on the basis of their revenue, market share, and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Sensors Market

I'd be grateful if I have sample pages on (2.1.1. Automotive Sensor Market Value, By Application) and (2.1.2 Automotive Sensor Market Value, By Product Type)

Dear Sir/Madam...I am a journalist in the process of finalizing an article for the October issue of Electronic Products Magazine (US) on automotive sensors. I would appreciate receiving your forecast for automotive sensors from 2012 to 2020 with the CAGR noted.

Interested in temperature, climate, oxygen, air quality, humidity sensor cluster trends and future technology roadmap.

Hello! I would like to have a sample of this market research report. My company is looking for a high quality market report on automotive sensors.

I know this market well, I want to see if this would be helpful to me. For instance I would be interested in the view of wheel speed sensors or steering angle sensors.

Need information on sensors for auto market, with focus on emissions and fuel econ. Has this report been updated to capture the regulation changes / delays by North America and Europe that occurred late 2018?

We are reviewing where to take our auto sensors business. In particular, we're interested in purchasing a company that can manufacture a full array of automotive sensors. Should we purchase someone with these capabilities or partner with them on the development and marketing of these sensors? Need as much data (up to date). As this is a document using 2016 data, an updated one would be appreciated.

Interested in ME sheet of the report only.

Hi! I'm working on my thesis for my MBA and since it's about the business plan for a company in the US which produces electronic sensors for cars, having access to your report would be very useful. Could you please, share the report with me?

I am looking at: automotive sensor market continuous technological advancements, supportive government and environment regulations, increasing vehicle production, and customer preferences. I am trying to understand end market trends, opportunities for TAM expansion, etc.

Need information on market share analysis of major players.

Hello, I am trying to estimate the effect of electrical autonomous cars would have on the sensor market. To do that I am trying to estimate the cost of different sensors used in cars today.

We are working as automotive interiors. To give new user experience we are adding new features related smart surface. As a part of study and market trend we are analyzing automotive sensors.

I work in a company that produces polyamide compounds for automotive industry. I was interested on this report to check opportunities for polyamide in this market. I wonder if the report contains technical requirements (corrosion resistance, strength, etc.) or what are the CTQ's for this market.

Interested in knowing the recent market trend and upcoming technologies.

Special interested in commercial vehicles (trucks and heavy duty), development trends, sensors price erosion and sensors supply chain analysis.