Automotive Transmission Market by Transmission Type (Manual Transmission, Automatic Transmission, CVT, DCT, AMT), Fuel Type, Vehicle Type, Hybrid Vehicle, Two-Wheeler Transmission, Number of Forward Gears and Region - Global Forecast to 2027

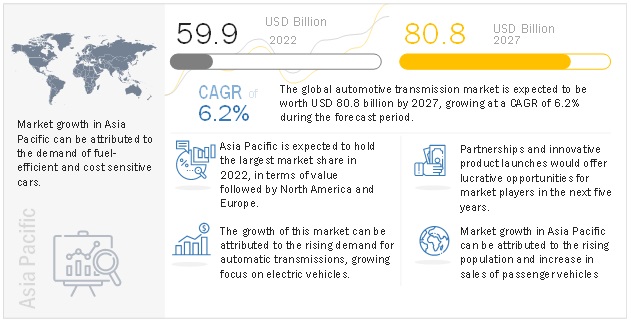

The global automotive transmission market size accounted for $59.9 billion in 2022 and is estimated to achieve a market size of $80.0 billion by 2027, at a CAGR of 6.2 % during the forecast period 2022-2027.

The stringent regulations formulated to reduce C02 emissions are likely to change the automotive sector in the US, China, and Japan over the next decade. While automotive OEMs are focused on the electrification of vehicles, consumers are becoming more aware of the impact of vehicular emissions on the environment. Moreover, governments are also taking effective measures such as tax subsidies to promote the adoption of electric vehicles.

Attractive Opportunities in the Automotive Transmission Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing demand for light weight transmission systems

The introduction of government regulations for safety, carbon emission, and lightweight vehicles is forcing OEMs to use components that will help in an overall weight reduction of the vehicle. There is constant pressure on OEMs to reduce emission levels of the automobiles. Globally, consumers in developed countries, are more inclined towards purchasing modern fuel-efficient, eco-friendly cars with reduced emission levels and enhanced performance. The permissible NOx emissions from a diesel vehicle have dipped ten times through six legislations (Euro 1 to Euro 6), And new emission norms are under development that will be known as Euro 7 likely to be introduced by 2025. Lightweight cars are capable of meeting these requirements. Manufacturers are majorly focusing on weight reduction of various parts of the automobile to further reduce the weight of the entire vehicle.

Restraint: High cost of adoption and frequent maintenance of advanced transmission systems

The latest transmission systems, such as DCT and CVT have a higher cost of installation as compared to conventional transmission systems. These systems are yet to gain acceptance in the high-volume market of small cars, which constitute a major share of the global passenger car market. The high cost of transmission systems is one of the major constraints for the manufacturers to enter the Asia-Pacific market, which is also a major automobile producing region. This is mainly due to the preference of consumers for cost-effectiveness rather than performance. Higher costs of these systems have limited the market in countries, where initial cost of the vehicle is a priority over comfort or efficiency. Thus, companies have to work on their R&D to produce these improved transmission systems for a lesser price, for the small car segment.

Opportunity: Increasing adoption of automatic transmissions and development of hybrid drives

The popularity of automatic cars is on the rise due to the wide adoption of AMT. Better fuel efficiency, worsening traffic conditions, and gradual dispelling of misconceptions about automatic cars have contributed to this trend. Automatic transmission delivers gentle and smooth gear changes, and reduced fuel consumption is delivering additional driving comfort. As drivers can concentrate more on the road and less on driving, automatic transmission is a safer option than manual transmission.

Increasing number of electric and hybrid vehicles is also expected to occupy big share of the manual transmission market. Developments in hybrid automatic transmission technologies to achieve top performances may further erode market share. For instance, in 2019, ZF Friedrichshafen AG designed its new generation 8-speed automatic transmission for hybrid drives. This hybrid system enables mild, full, and plug-in hybrid drives to achieve top performances between 24 kW and 160 kW. ZF will begin manufacturing this 8-speed automatic transmission in Saarbrücken, Germany, by 2022, and launch it in China and the US thereafter.

Challenge: Reduction in costs for light weight and efficient transmissions

The dilemma faced by the automotive industry is between technological innovation and cost reduction. Vehicle weight is inversely proportional to the fuel economy of the vehicle. Many OEMs are currently focusing on the overall weight reduction of their vehicle models in order to achieve the targets set in the coming years. Huge fluctuations in raw materials prices could make the market less competitive. Weight reducing alloys and lightweight materials are expensive but are useful in manufacturing efficient and lightweight transmissions. Lightweight transmission systems proportionately reduce the weight of the automobile which ensure that the vehicle complies with the stringent emission and fuel efficiency norms. However, these weight reducing alloys and lightweight materials are expensive in nature which further increases the cost of manufacturing of lightweight and efficient transmission systems. Along with this, this high price fluctuation can also account for quality deviation that can adversely affect the automotive transmission market all over the world. The challenge therefore is to come up with such transmissions that are efficient and economical at the same time.

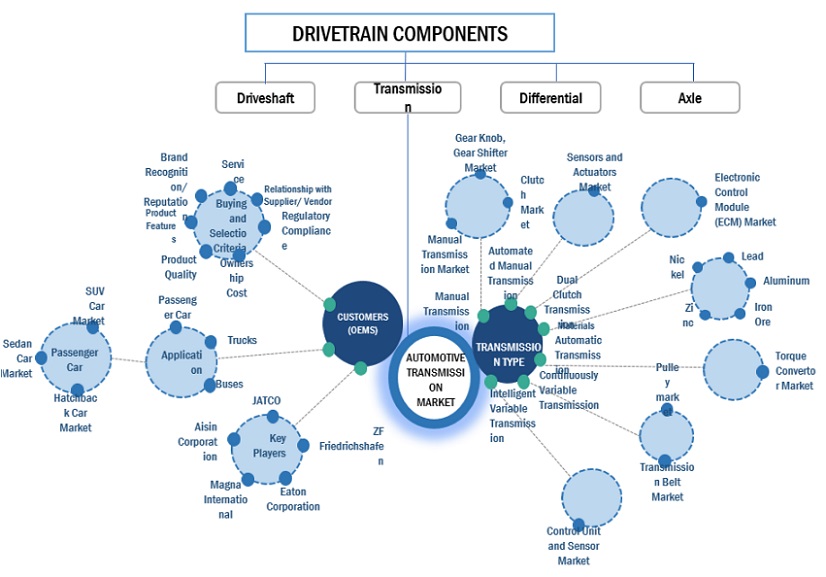

Automotive Transmission Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The Automatic transmission segment is expected to grow at a high CAGR and expected to become the largest segment of automotive transmission market during the forecast period

The overall manual transmission market is declining as it is moving toward automated transmission technologies. The demand for fuel-efficient transmission systems and the elimination of driver’s behavioural impact on the vehicle is creating the demand for automated manual transmissions (AMTs) and automatic transmissions (ATs). An increase in a shift from mechanical to automated driving systems offers a major opportunity for market expansion of advanced transmission technologies.

An automatic transmission system makes use of fluid coupling between the engine and clutch. It also and the same gearbox as that of a manual transmission system. The gear shifting operation is usually performed by using hydraulic or vacuum cylinders. This system is generally also called hydramatic transmission. It contains an epicyclic gear arrangement, a fluid coupling, and a torque converter. In these planetary gears, sets are placed in a series for transmission.

Epicyclic Gearing: It is a gear system consisting of one or more outer gears, or planet gears, revolving around a central gear. Different torque-speed ratios can be obtained by using epicyclic gear. It also compacts the size of a gearbox.

The 5-6 Number of gears is projected to achieve significant share in automotive transmission market during the forecast period

Transmissions with 5 to 6-speed forward gears are expected to constitute the bulk of the automotive transmission market. Such gear types are mainly used in passenger cars and LCVs. Fuel efficiency concerns have compelled automotive OEMs to adopt transmissions to increase the number of forward gears in passenger cars. In developed regions, OEMs are adopting 7- and 8-speed gearboxes as they offer comfort and efficiency without compromising on performance. In Europe, transmissions with 9 to 10 speed forward gears are expected to be used in passenger cars.

“The Asia Pacific automotive Transmission market is projected to hold the largest share by 2027.”

Asia Pacific, Europe, and North America are expected to be the key growth markets due to the increasing vehicle production and changing consumer and adoption trends. Asia Pacific is estimated to be the largest and fastest-growing automotive transmission market during the forecast period. With the growth in the global automotive market, the market for transmissions is also projected to grow. The rising demand for vehicles means an increase in emissions from the transportation sector. Thus, the stakeholders in the automotive industry are focusing on optimizing the performance of the vehicles to lower emissions to ensure sustainable transportation. The major focus is on maximizing fuel efficiency and minimizing emissions.

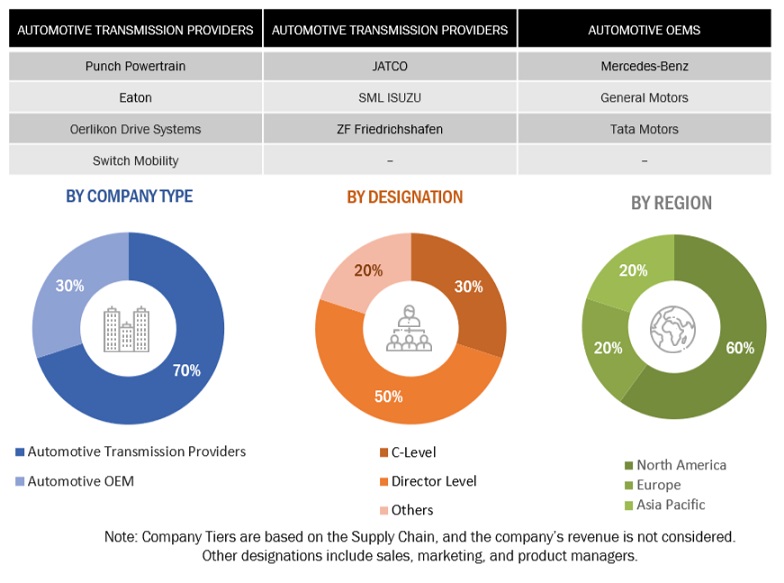

Tier I suppliers, such as Aisin Corporation (Japan), JATCO (Japan), ZF Friedrichshafen (Germany), and Magna International Inc. (Canada), have developed transmission solutions for automotive applications depending on the geographical variances.

Key Market Players

ZF Friedrichshafen (Germany), MAGNA International (Canada), Aisin Corporation (Japan), Eaton Corporation(Japan), Hyundai Transys(South Korea), Allison transmissions(US), Vitesco Technologies(Germany), Schaeffler AG(Germany), BorgWarner(US), GKN Automotive(UK), and Jatco (Japan) and more.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 59.9 billion |

|

Estimated Value by 2027 |

USD 80.0 billion |

|

Growth Rate |

Poised to grow at a CAGR of 6.2% |

|

Market Segmentation |

By transmission type, By Number of forward gears, By vehicle type, By Hybrid Vehicles, By fuel type, By Two-wheeler transmission Type and By Region |

|

Market Driver |

Growing demand for light weight transmission systems |

|

Market Opportunity |

Increasing adoption of automatic transmissions and development of hybrid drives |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

Recent Developments

- In September 2021, ZF developed an The Modular eDrive Kit was displayed at international debut at IAA 2021, according to ZF. It combines ZF's e-mobility team's whole knowledge into systems solutions, components, and software control in a versatile platform. It improves power density, weight, and efficiency by a large amount. Mechanical losses can be reduced by up to 70% using optimized transmissions, as well as highly efficient cooling and lubrication methods. To do so, ZF depends on its extensive experience in the field of transmissions.

- In March 2021, Within the PHEV Magna’s dedicated hybrid transmission with a 120-kW e-motor is installed at its functional core. The system performs in dynamic driving situations, as well as launch and reverse driving, all in electric mode.

- In February 2021, Eaton announced its Vehicle Group is developed gearing solutions for electrified vehicles (EVs). Leveraging its expertise in producing transmissions and contract manufactured gear-sets for passenger and commercial vehicles

- In October 2020, Vitesco launched the world’s first transmission control system with comprehensive overmolding technology. In comparison with conventional control units, the new product, known as overmolding control electronics, excels with around 45% less weight, greater robustness and significantly fewer production stages.

Frequently Asked Questions (FAQ):

How big is the automotive transmission market?

The global automotive transmission market stood at USD 59.9 billion in 2022 and expected to reach USD 80.8 billion by 2027 and grow at a CAGR of 6.2%

Which countries are considered in the European region?

The report includes European countries such as:

- Germany

- France

- Spain

- Russia

- Italy

- UK

- Rest of Europe

We are interested in regional automotive transmission market for Hybrid vehicles? Does this report cover the Hybrid vehicle segment?

Yes, the report covers the automotive transmission market for different hybrid vehicle types at regional level.

Does this report include impact of COVID-19 on the automotive transmission market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the automotive transmission market.

Does this report further segments transmission type?

Yes, the report covers the market size of different automatic transmissions at a global level .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENT

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 AUTOMOTIVE TRANSMISSION MARKET DEFINITION AND INCLUSIONS, BY TRANSMISSION TYPE

TABLE 1 MARKET DEFINITION AND INCLUSIONS, BY TRANSMISSION TYPE

1.2.2 MARKET DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

TABLE 2 MARKET DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

1.2.3 MARKET DEFINITION AND INCLUSIONS, BY ELECTRIC VEHICLE TYPE

TABLE 3 MARKET DEFINITION AND INCLUSIONS, BY ELECTRIC VEHICLE TYPE

1.2.4 MARKET DEFINITION AND INCLUSIONS, BY FUEL TYPE

TABLE 4 MARKET DEFINITION AND INCLUSIONS, BY FUEL TYPE

1.2.5 INCLUSIONS & EXCLUSIONS

TABLE 5 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE TRANSMISSION MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 6 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE TRANSMISSION MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 KEY PRIMARY SOURCES

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 6 KEY INDUSTRY INSIGHTS FROM PRIMARY RESPONDENTS

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 8 GLOBAL MARKET SIZE: DETAILED BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 9 GLOBAL MARKET SIZE: TOP-DOWN APPROACH

FIGURE 10 MARKET: RESEARCH APPROACH

FIGURE 11 MARKET: TRIANGULATION APPROACH

FIGURE 12 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF SUPPLY-SIDE REVENUE ESTIMATION

FIGURE 13 MARKET: SEGMENTAL MARKET SIZE RESEARCH DESIGN & METHODOLOGY

2.3 DATA TRIANGULATION

FIGURE 14 DATA TRIANGULATION

2.4 FACTOR ANALYSIS

FIGURE 15 FACTORS IMPACTING THE MARKET

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT & RANGES

TABLE 7 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 16 AUTOMOTIVE TRANSMISSION MARKET OUTLOOK

FIGURE 17 MARKET DYNAMICS

FIGURE 18 MARKET, BY REGION

FIGURE 19 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE TRANSMISSION MARKET

FIGURE 20 MARKET GROWTH CAN BE ATTRIBUTED TO GROWING DEMAND FOR WEIGHT REDUCING MATERIALS IN TRANSMISSIONS

4.2 MARKET, BY TRANSMISSION TYPE

FIGURE 21 AUTOMATIC TRANSMISSION SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY VEHICLE TYPE

FIGURE 22 TRUCKS SEGMENT PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.4 MARKET, BY FUEL TYPE

FIGURE 23 GASOLINE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027 (MILLION UNITS)

4.5 MARKET, BY NUMBER OF FORWARD GEARS

FIGURE 24 5 TO 6 NUMBER OF FORWARD GEARS EXPECTED TO MARKET DURING FORECAST PERIOD (MILLION UNITS)

4.6 MARKET FOR HYBRID VEHICLES, BY REGION

FIGURE 25 MARKET IN NORTH AMERICA PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.7 AUTOMOTIVE TWO-WHEELER TRANSMISSION MARKET, BY TYPE

FIGURE 26 AUTOMATIC TRANSMISSION SEGMENT PROJECTED TO GROW AT HIGHER RATE DURING FROM 2022 TO 2027

4.8 MARKET, BY REGION, 2022

FIGURE 27 ASIA PACIFIC ESTIMATED TO LEAD MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 AUTOMOTIVE TRANSMISSION: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Consumer preference for enhanced driving experience and smooth gear shifting

TABLE 8 COMPARISON BETWEEN AT AND MT SYSTEMS

5.2.1.2 Increase in demand for fuel-efficient cars

FIGURE 29 REDUCTION IN FUEL CONSUMPTION BY 3- TO 8-SPEED AUTOMATIC GEARS

5.2.1.3 Growing demand for lightweight transmission systems

TABLE 9 LIGHTWEIGHT MATERIALS FOR MODERN-DAY VEHICLES

5.2.1.4 Collaboration of leading auto–manufacturers with domestic players

TABLE 10 PRODUCTION VOLUME OF LUXURY CAR MODELS, 2020 VS. 2021

TABLE 11 COLLABORATION OF LEADING AUTO PARTS MANUFACTURERS WITH DOMESTIC PLAYERS

5.2.2 RESTRAINTS

5.2.2.1 High cost of adoption and frequent maintenance of advanced transmission systems

TABLE 12 COST ESTIMATION OF TRANSMISSION COMPONENTS FOR DIESEL VEHICLES, 2025

5.2.2.2 High cost involved and volatility in raw material costs

TABLE 13 COMMODITY PRICES

5.2.3 OPPORTUNITIES

5.2.3.1 Wide acceptance of CVT as a key technology for fuel efficiency and lower emissions

FIGURE 30 SHARE OF SUVS IN TOTAL CAR SALES, 2010-2021 (%)

5.2.3.2 Increasing adoption of automatic transmissions and development of hybrid drives

TABLE 14 TRANSMISSION TECHNOLOGIES AT DIFFERENT DEVELOPMENT STAGES IN CHINA

TABLE 15 HYBRID CAR SALES DATA

5.2.3.3 Growing demand for electric vehicles

FIGURE 31 ELECTRIC VEHICLES SALES

5.2.4 CHALLENGES

5.2.4.1 Decline in vehicle sales and production due to semiconductor shortage and COVID-19

FIGURE 32 PRODUCTION VOLUME LOSS BY OEM DUE TO CHIP SHORTAGE, 2021

5.2.4.2 High costs of lightweight and efficient transmissions

5.2.4.3 Energy-saving during flow of power

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 16 AUTOMOTIVE TRANSMISSION: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 33 PORTER’S FIVE FORCES: AUTOMOTIVE TRANSMISSION MARKET

TABLE 17 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT FROM NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITION RIVALRY

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS, BY TRANSMISSION TYPE

FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.4.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 TYPES OF TRANSMISSIONS

TABLE 19 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.5 VALUE CHAIN ANALYSIS

FIGURE 36 VALUE CHAIN ANALYSIS: MARKET

5.5.1 PROMINENT COMPANIES

5.5.2 SMALL & MEDIUM ENTERPRISES

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 37 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM

FIGURE 38 MARKET ECOSYSTEM

FIGURE 39 ECOSYSTEM MAP FOR MARKET

5.7.1 AUTOMOTIVE EQUIPMENT SUPPLIERS

5.7.2 AUTOMOTIVE TRANSMISSION MANUFACTURERS

5.7.3 OEMS

5.7.4 END USERS

TABLE 20 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

FIGURE 40 PATENT PUBLICATION TRENDS FOR AUTOMOTIVE TRANSMISSION (2011-2022)

5.8.2 DOCUMENT TYPE

TABLE 21 PATENT STATUS

FIGURE 41 PATENTS REGISTERED FOR AUTOMOTIVE TRANSMISSION,2011–2021

5.8.3 LEGAL STATUS OF PATENTS

FIGURE 42 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE TRANSMISSION

5.8.4 INSIGHTS

FIGURE 43 AUTOMOTIVE TRANSMISSION PATENTS, BY GEOGRAPHY

5.8.5 TOP PATENT HOLDERS

FIGURE 44 TOP PATENT HOLDERS

TABLE 22 AUTOMOTIVE TRANSMISSION: INNOVATION & PATENT REGISTRATIONS

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO OF AUTOMOTIVE TRANSMISSION

FIGURE 45 IMPORTS OF AUTOMOTIVE TRANSMISSION, BY KEY COUNTRIES (2012-2021)

TABLE 23 IMPORT TRADE DATA, BY KEY COUNTRIES, 2021 (USD BILLION)

5.9.2 SCENARIO OF EXPORT OF AUTOMOTIVE TRANSMISSION

FIGURE 46 EXPORTS OF AUTOMOTIVE TRANSMISSION, BY KEY COUNTRIES (2012-2021)

TABLE 24 EXPORT TRADE DATA, BY KEY COUNTRIES, 2020 (USD BILLION)

5.10 CASE STUDY

5.10.1 LIFE CYCLE ASSESSMENT OF TRANSMISSION SYSTEM: MAGNESIUM VS. ALUMINUM

5.10.2 DESIGN ANALYSIS AND FABRICATION OF AUTOMOTIVE TRANSMISSION GEARBOX USING HOLLOW GEARS FOR WEIGHT REDUCTION

5.10.3 LIGHTWEIGHT ASSEMBLED GEARS: GREEN DESIGN SOLUTION FOR PASSENGERS AND COMMERCIAL VEHICLES

5.10.4 GLOBAL AUTO TRANSMISSION

5.11 TECHNOLOGY OVERVIEW

5.11.1 INTRODUCTION

5.11.2 HYBRID TRANSMISSION (DHT)

FIGURE 47 DEDICATED HYBRID TRANSMISSION

5.11.3 800-VOLT POWER ELECTRONICS SYSTEM FOR ELECTRIC AXLE

FIGURE 48 SCHAEFFLER’S 800-VOLT POWER ELECTRONICS SYSTEM FOR ELECTRIC AXLE

5.11.4 AUTOMATED MANUAL TRANSMISSION (AMT)

FIGURE 49 AUTOMATED MANUAL TRANSMISSION (AMT)

5.11.5 ELECTRIFICATION OF AUTOMOTIVE TRANSMISSION

5.11.6 TWO SPEED GEARBOX FOR EVS

5.11.7 INNOVATIVE GEARBOX DESIGN FOR ELECTRIC VEHICLES

FIGURE 50 P1320 XTRAC'S ENERGY-EFFICIENT ILEV SERIES TRANSMISSION SYSTEM

5.12 PRICING ANALYSIS

FIGURE 51 PASSENGER CARS: ASP OF AUTOMOTIVE TRANSMISSION, 2018–2027 (USD)

5.13 REGULATORY ANALYSIS

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

TABLE 25 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

TABLE 26 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 27 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

TABLE 28 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

5.14 AUTOMOTIVE TRANSMISSION MARKET: CONFERENCES & EVENTS

TABLE 29 MARKET: LIST OF CONFERENCES & EVENTS

5.15 MARKET SCENARIOS

5.15.1 MOST LIKELY SCENARIO

TABLE 30 MOST LIKELY SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.15.2 OPTIMISTIC SCENARIO

TABLE 31 OPTIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

5.15.3 PESSIMISTIC SCENARIO

TABLE 32 PESSIMISTIC SCENARIO, BY REGION, 2022–2027 (USD MILLION)

6 AUTOMOTIVE TRANSMISSION MARKET, BY TRANSMISSION TYPE (Page No. - 107)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 OPERATIONAL DATA

FIGURE 52 CVT MARKET SHARE BY KEY COMPANIES

TABLE 33 DISTRIBUTION OF DUAL CLUTCH TRANSMISSION SOURCES FOR OEMS IN EUROPE

6.1.3 KEY INDUSTRY INSIGHTS

TABLE 34 AUTOMOTIVE TRANSMISSION MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 35 MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 36 MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 37 MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

6.2 MANUAL TRANSMISSION

TABLE 38 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 39 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 40 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.3 AUTOMATIC TRANSMISSION

6.3.1 PASSENGER CARS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF AUTOMATIC TRANSMISSION MARKET IN 2022

TABLE 42 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 43 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 44 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 45 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.4 AUTOMATED MANUAL TRANSMISSION

6.4.1 COST ADVANTAGES OFFERED BY AUTOMATED MANUAL TRANSMISSION DRIVE ITS DEMAND IN ASIA PACIFIC

TABLE 46 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 47 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 48 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 49 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.5 DUAL CLUTCH TRANSMISSION

6.5.1 ADOPTION OF CVT IS HIGHER IN NORTH AMERICA THAN IN DCT DUE TO CONSUMER PREFERENCES

TABLE 50 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 51 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 52 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 53 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

6.6 CONTINUOUSLY VARIABLE TRANSMISSION

6.6.1 NORTH AMERICA WITNESSED LARGEST ADOPTION RATE OF CVT OWING TO ITS SMOOTHER OPERATION AND HIGHER FUEL ECONOMY

TABLE 54 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 55 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 56 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 57 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

7 AUTOMOTIVE TRANSMISSION MARKET, BY FUEL TYPE (Page No. - 123)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 OPERATIONAL DATA

FIGURE 53 INDIA: DIESEL AND NON-DIESEL CAR MARKET SHARE

7.1.3 KEY INDUSTRY INSIGHTS

FIGURE 54 MARKET, BY FUEL TYPE, 2022 VS. 2027(THOUSAND UNITS)

TABLE 58 MARKET, BY FUEL TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 59 MARKET, BY FUEL TYPE, 2022–2027 (THOUSAND UNITS)

7.2 DIESEL

7.2.1 HIGH FUEL EFFICIENCY AND INTEGRATION OF ADVANCED TRANSMISSIONS WITH DIESEL ENGINES WILL IMPACT MARKET

TABLE 60 DIESEL: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 61 DIESEL: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

7.3 GASOLINE

7.3.1 TRANSMISSION SYSTEMS IN GASOLINE CARS ARE LIGHTER THAN THEIR DIESEL COUNTERPARTS

TABLE 62 GASOLINE: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 63 GASOLINE: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

8 AUTOMOTIVE TRANSMISSION MARKET, BY NUMBER OF FORWARD GEARS (Page No. - 130)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 OPERATIONAL DATA

FIGURE 55 REDUCTION IN FUEL CONSUMPTION BY 3-TO 8-SPEED AUTOMATIC GEARS

8.1.3 INDUSTRY INSIGHTS

FIGURE 56 AUTOMOTIVE TRANSMISSION MARKET, BY NUMBER OF FORWARD GEARS, 2022 VS. 2027 (THOUSAND UNITS)

TABLE 64 MARKET, BY NUMBER OF FORWARD GEARS, 2018–2021 (THOUSAND UNITS)

TABLE 65 MARKET, BY NUMBER OF FORWARD GEARS, 2022–2027 (THOUSAND UNITS)

8.2 LESS THAN 5

8.2.1 ENGINE DOWNSIZING TO REDUCE EMISSIONS HINDERING GROWTH OF TRANSMISSIONS WITH LESS THAN 5 SPEED GEARBOXES

TABLE 66 LESS THAN 5: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 67 LESS THAN 5: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.3 5 TO 6

8.3.1 EXTENSIVE USAGE OF 5 TO 6 SPEED GEARBOXES IN PASSENGER CARS AND LCVS DRIVE THIS SEGMENT

TABLE 68 5-6: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 69 5-6: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.4 44780

8.4.1 FUEL EFFICIENCY DRIVING ADOPTION OF 7 TO 8 SPEED GEARBOXES IN VEHICLES

TABLE 70 7-8: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 71 7-8: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.5 44843

8.5.1 EUROPE EXPECTED TO BE POTENTIAL MARKET FOR TRANSMISSIONS WITH 9-10 GEARBOXES

TABLE 72 9-10: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 73 9-10: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.6 ABOVE 10

8.6.1 HIGH DEMAND FOR HCVS WITH MANUAL TRANSMISSIONS IN ASIA PACIFIC DRIVE DEMAND FOR >10 SPEED TRANSMISSIONS

TABLE 74 ABOVE 10: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 75 ABOVE 10: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.7 CVT

8.7.1 CVT MARKET EXPECTED TO GROW GLOBALLY WITH SMOOTH GEAR SHIFTING AND HIGH FUEL EFFICIENCY

TABLE 76 CVT: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 77 CVT: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9 AUTOMOTIVE TRANSMISSION MARKET, BY VEHICLE TYPE (Page No. - 140)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 OPERATIONAL DATA

FIGURE 57 EX-SHOWROOM PRICE OF AUTOMATIC AND MANUAL MODELS OF INDIAN CARS (USD)

9.1.3 KEY INDUSTRY INSIGHTS

TABLE 78 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 79 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 80 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 81 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

9.2 PASSENGER CARS

9.2.1 DEMAND FOR FUEL-EFFICIENT VEHICLES BOOSTS THIS SEGMENT

TABLE 82 GLOBAL MARKET IN PASSENGER CARS, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 83 GLOBAL MARKET IN PASSENGER CARS, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 84 GLOBAL MARKET IN PASSENGER CARS, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 85 GLOBAL MARKET IN PASSENGER CARS, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

9.3 LIGHT COMMERCIAL VEHICLES

9.3.1 HIGH DEMAND FOR LCVS IN NORTH AMERICA WILL BOOST MARKET

TABLE 86 GLOBAL MARKET IN LIGHT COMMERCIAL VEHICLES, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 87 GLOBAL MARKET IN LIGHT COMMERCIAL VEHICLES, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 88 GLOBAL MARKET IN LIGHT COMMERCIAL VEHICLES, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 89 GLOBAL MARKET IN LIGHT COMMERCIAL VEHICLES, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

9.4 TRUCKS

9.4.1 FUEL-SAVING AND DRIVER RETENTION BENEFITS DRIVE ADOPTION OF AMTS AND ATS BY TRUCK COMPANIES

TABLE 90 GLOBAL MARKET IN TRUCKS, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 91 GLOBAL MARKET IN TRUCKS, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 92 GLOBAL MARKET IN TRUCKS, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 93 GLOBAL MARKET IN TRUCKS, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

9.5 BUSES

9.5.1 DRIVER PREFERENCE FOR ADVANCED & RELIABLE TRANSMISSIONS DRIVE MARKET

TABLE 94 GLOBAL MARKET IN BUSES, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 95 GLOBAL MARKET IN BUSES, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 96 GLOBAL MARKET IN BUSES, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 97 GLOBAL MARKET IN BUSES, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

10 AUTOMOTIVE TRANSMISSION MARKET, BY HYBRID ELECTRIC VEHICLE TYPE (Page No. - 152)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 OPERATIONAL DATA

FIGURE 58 TOP 10 EUROPEAN BRANDS REGISTRATION, BY FUEL TYPE, 2021

10.1.3 KEY INDUSTRY INSIGHTS

FIGURE 59 MARKET FOR HYBRID ELECTRIC VEHICLES, BY REGION, 2022 VS. 2027 (THOUSAND UNITS)

TABLE 98 MARKET FOR HYBRID ELECTRIC VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 99 MARKET FOR HYBRID ELECTRIC VEHICLES, BY REGION, 2022–2027 (THOUSAND UNITS)

10.2 ASIA PACIFIC

TABLE 100 ASIA PACIFIC: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 101 ASIA PACIFIC: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

10.3 NORTH AMERICA

TABLE 102 NORTH AMERICA: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 103 NORTH AMERICA: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

10.4 EUROPE

TABLE 104 EUROPE: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 105 EUROPE: MARKET FOR HYBRID ELECTRIC VEHICLES, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

11 AUTOMOTIVE TWO-WHEELER TRANSMISSION MARKET, BY TYPE (Page No. - 159)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 OPERATIONAL DATA

TABLE 106 TWO-WHEELERS AND THEIR FUEL ECONOMY IN INDIA

11.1.3 INDUSTRY INSIGHTS

FIGURE 60 MARKET, BY TYPE, 2022 VS. 2027 (THOUSAND UNITS)

TABLE 107 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 108 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

11.2 MANUAL TRANSMISSION

11.2.1 END USER PREFERENCE TO USE TWO-WHEELERS WITH CONVENTIONAL MANUAL SHIFTS DRIVE THIS SEGMENT

TABLE 109 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 110 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

11.3 AUTOMATIC TRANSMISSION

11.3.1 PREFERENCE FOR COMFORT AND CONVENIENCE MAY IMPACT AUTOMATIC TRANSMISSION FOR TWO-WHEELERS

TABLE 111 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 112 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

12 AUTOMOTIVE TRANSMISSION MARKET, BY REGION (Page No. - 165)

12.1 INTRODUCTION

FIGURE 61 MARKET, BY REGION, 2020 VS. 2027 (USD MILLION)

TABLE 113 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 114 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 115 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 62 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Increasing traffic congestion and demand for electric vehicles expected to drive market

12.2.1.2 China vehicle production data

TABLE 121 CHINA: VEHICLE PRODUCTION, 2018–2021 (THOUSAND UNITS)

TABLE 122 CHINA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 123 CHINA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 124 CHINA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 125 CHINA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

12.2.2 INDIA

12.2.2.1 Growing demand for passenger vehicles in India expected to drive market

12.2.2.2 India vehicle production data

TABLE 126 INDIA: AUTOMOTIVE TRANSMISSION VEHICLE PRODUCTION, 2018–2021 (THOUSAND UNITS)

TABLE 127 INDIA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 128 INDIA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 129 INDIA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 130 INDIA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

12.2.3 JAPAN

12.2.3.1 Rise in traffic congestion fuels demand for automatic transmissions

12.2.3.2 Japan vehicle production data

TABLE 131 JAPAN: AUTOMOTIVE TRANSMISSION VEHICLE PRODUCTION, 2018–2021 (THOUSAND UNITS)

TABLE 132 JAPAN: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 133 JAPAN: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 134 JAPAN: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Technological developments boost market

TABLE 136 SOUTH KOREA: VEHICLE SALES, 2018–2021 (THOUSAND UNITS)

12.2.4.2 South Korea vehicle production data

TABLE 137 SOUTH KOREA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 138 SOUTH KOREA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 139 SOUTH KOREA: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 140 SOUTH KOREA: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

12.2.5 THAILAND

12.2.5.1 Tax exemption on import duties for raw materials will boost the market

12.2.5.2 Thailand vehicle production data

TABLE 141 THAILAND: VEHICLE PRODUCTION, 2018–2021 (THOUSAND UNITS)

TABLE 142 THAILAND: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 143 THAILAND: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 144 THAILAND: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 145 THAILAND: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

12.2.6 REST OF ASIA PACIFIC

12.2.6.1 Increasing vehicle production will drive market

12.2.6.2 Rest of Asia Pacific vehicle production data

TABLE 146 REST OF ASIA PACIFIC: VEHICLE PRODUCTION DATA, 2018–2021 (THOUSAND UNITS)

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY TRANSMISSION TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 148 REST OF ASIA PACIFIC: MARKET, BY TRANSMISSION TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 149 REST OF ASIA PACIFIC: MARKET, BY TRANSMISSION TYPE, 2018–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET, BY TRANSMISSION TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 184)

13.1 MARKET EVALUATION FRAMEWORK

FIGURE 63 AUTOMOTIVE TRANSMISSION MARKET EVALUATION FRAMEWORK

13.2 OVERVIEW

FIGURE 64 KEY DEVELOPMENTS BY LEADING PLAYERS, 2019–2022

13.3 MARKET SHARE ANALYSIS

TABLE 151 MARKET SHARE ANALYSIS, 2021

13.4 COVID-19 IMPACT ON COMPANIES OPERATING IN MARKET

13.5 COMPETITIVE SCENARIO

13.5.1 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ PARTNERSHIPS/AGREEMENTS

TABLE 152 COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/PARTNERSHIPS/ AGREEMENTS, 2019–2022

13.5.2 NEW PRODUCT DEVELOPMENTS

TABLE 153 NEW PRODUCT DEVELOPMENTS, 2019–2022

13.5.3 MERGERS & ACQUISITIONS, 2019–2022

TABLE 154 MERGER & ACQUISITIONS, 2019–2022

13.5.4 EXPANSIONS, 2019–2022

TABLE 155 EXPANSIONS, 2019–2022

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STAR

13.6.2 EMERGING LEADER

13.6.3 PERVASIVE

13.6.4 EMERGING COMPANIES

FIGURE 65 AUTOMOTIVE TRANSMISSION MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

13.7 PRODUCT FOOTPRINT

TABLE 156 COMPANY PRODUCT FOOTPRINT

TABLE 157 COMPANY APPLICATION FOOTPRINT

TABLE 158 COMPANY REGION FOOTPRINT

13.8 STARTUP/SME EVALUATION MATRIX, 2021

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 66 MARKET: STARTUP/SME MATRIX, 2021

13.9 WINNERS VS. TAIL-ENDERS

TABLE 159 WINNERS VS. TAIL-ENDERS

14 COMPANY PROFILES (Page No. - 197)

(Business overview, Product offerings, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 ZF FRIEDRICHSHAFEN

TABLE 160 ZF FRIEDRICHSHAFEN: KEY CUSTOMERS

TABLE 161 ZF FRIEDRICHSHAFEN: KEY SHAREHOLDERS

TABLE 162 ZF FRIEDRICHSHAFEN: BUSINESS OVERVIEW

FIGURE 67 ZF FRIEDRICHSHAFEN: COMPANY SNAPSHOT

TABLE 163 ZF FRIEDRICHSHAFEN: PRODUCT OFFERINGS

TABLE 164 ZF FRIEDRICHSHAFEN: NEW PRODUCT LAUNCHES

TABLE 165 ZF FRIEDRICHSHAFEN: OTHERS

14.1.2 MAGNA INTERNATIONAL

TABLE 166 MAGNA INTERNATIONAL: KEY CUSTOMERS

TABLE 167 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 68 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

TABLE 168 MAGNA INTERNATIONAL: PRODUCTS & SERVICES OFFERED

TABLE 169 NEW PRODUCT DEVELOPMENTS

TABLE 170 MAGNA INTERNATIONAL: DEALS

TABLE 171 MAGNA INTERNATIONAL: OTHERS

14.1.3 AISIN CORPORATION

TABLE 172 AISIN CORPORATION: KEY CUSTOMERS

TABLE 173 AISIN CORPORATION: KEY SHAREHOLDERS

TABLE 174 AISIN CORPORATION: BUSINESS OVERVIEW

FIGURE 69 AISIN CORPORATION: COMPANY SNAPSHOT

TABLE 175 AISIN CORPORATION: PRODUCTS OFFERED

TABLE 176 AISIN CORPORATION: NEW PRODUCT LAUNCHES

TABLE 177 AISIN CORPORATION: DEALS

TABLE 178 AISIN CORPORATION: OTHERS

14.1.4 EATON CORPORATION

TABLE 179 EATON CORPORATION: KEY CUSTOMERS

TABLE 180 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 70 EATON CORPORATION: COMPANY SNAPSHOT

TABLE 181 EATON CORPORATION: PRODUCTS OFFERED

TABLE 182 EATON CORPORATION: NEW PRODUCT LAUNCHES

TABLE 183 EATON CORPORATION PLC.: DEALS

14.1.5 VITESCO TECHNOLOGIES

TABLE 184 VITESCO TECHNOLOGIES: KEY CUSTOMERS

TABLE 185 VITESCO TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 186 VITESCO TECHNOLOGIES: PRODUCT OFFERINGS

TABLE 187 VITESCO TECHNOLOGIES: NEW PRODUCT LAUNCHES

TABLE 188 VITESCO TECHNOLOGIES: DEALS

TABLE 189 VITESCO TECHNOLOGIES: OTHERS

14.1.6 SCHAEFFLER AG

TABLE 190 SCHAEFFLER AG: KEY CUSTOMERS

TABLE 191 SCHAEFFLER AG: BUSINESS OVERVIEW

FIGURE 71 SCHAEFFLER AG: COMPANY SNAPSHOT

TABLE 192 SCHAEFFLER AG: PRODUCTS OFFERED

TABLE 193 SCHAEFFLER AG: NEW PRODUCT LAUNCH

TABLE 194 SCHAEFFLER AG: OTHERS

14.1.7 BORGWARNER INC.

TABLE 195 BORGWARNER: KEY CUSTOMERS

TABLE 196 BORGWARNER: BUSINESS OVERVIEW

FIGURE 72 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 197 BORGWARNER: PRODUCTS OFFERED

TABLE 198 BORGWARNER: DEALS

TABLE 199 BORGWARNER: NEW PRODUCTS LAUNCH

TABLE 200 BORGWARNER: OTHERS

14.1.8 JATCO (NISSAN MOTOR CORP.)

TABLE 201 JATCO: KEY CUSTOMERS

TABLE 202 JATCO: KEY SHAREHOLDERS

TABLE 203 JATCO: BUSINESS OVERVIEW

TABLE 204 JATCO: PRODUCT OFFERED

TABLE 205 JATCO: RECENT PRODUCT LAUNCHES

14.1.9 ALLISON TRANSMISSION INC.

TABLE 206 ALLISON TRANSMISSION: KEY CUSTOMERS

TABLE 207 ALLISON TRANSMISSION: BUSINESS OVERVIEW

FIGURE 73 ALLISON TRANSMISSION INC.: COMPANY SNAPSHOT

TABLE 208 ALLISON TRANSMISSION: PRODUCTS OFFERED

TABLE 209 ALLISON TRANSMISSION: DEALS

TABLE 210 ALLISON TRANSMISSION: OTHERS

14.1.10 GKN AUTOMOTIVE

TABLE 211 GKN AUTOMOTIVE: KEY CUSTOMERS

TABLE 212 GKN AUTOMOTIVE: BUSINESS OVERVIEW

FIGURE 74 GKN AUTOMOTIVE: COMPANY SNAPSHOT

TABLE 213 GKN AUTOMOTIVE: PRODUCTS AND SERVICES

TABLE 214 GKN AUTOMOTIVE: NEW PRODUCT LAUNCHES

TABLE 215 GKN AUTOMOTIVE: DEALS

TABLE 216 GKN AUTOMOTIVE: OTHERS

14.1.11 HYUNDAI TRANSYS

TABLE 217 HYUNDAI TRANSYS: KEY CUSTOMERS

TABLE 218 HYUNDAI TRANSYS: KEY SHAREHOLDERS

TABLE 219 HYUNDAI TRANSYS: BUSINESS OVERVIEW

FIGURE 75 HYUNDAI TRANSYS: COMPANY SNAPSHOT

TABLE 220 HYUNDAI TRANSYS: PRODUCTS OFFERED

14.1.12 DANA GRAZIANO S.R.L.

TABLE 221 DANA GRAZIANO S.R.L.: KEY CUSTOMERS

TABLE 222 DANA GRAZIANO S.R.L.: BUSINESS OVERVIEW

FIGURE 76 DANA GRAZIANO S.R.L: COMPANY SNAPSHOT

TABLE 223 DANA GRAZIANO S.R.L: PRODUCTS OFFERED

TABLE 224 DANA GRAZIANO S.R.L: DEALS

*Details on Business overview, Product offerings, Recent developments & MnM View might not be captured in case of unlisted companies.

14.2 OTHER KEY PLAYERS

14.2.1 GENERAL MOTORS

TABLE 225 GENERAL MOTORS: BUSINESS OVERVIEW

14.2.2 KATE LLC

TABLE 226 KATE LLC: BUSINESS OVERVIEW

14.2.3 MUBEA, INC

TABLE 227 MUBEA INC: BUSINESS OVERVIEW

14.2.4 AW SUZHOU CO., LTD.

TABLE 228 AW SUZHOU CO., LTD.: BUSINESS OVERVIEW

14.2.5 STAR ASSEMBLY SRL

TABLE 229 STAR ASSEMBLY SRL: BUSINESS OVERVIEW

14.2.6 NEMAK ALUMINIO DO BRASIL LTDA

TABLE 230 NEMAK ALUMINIO DO BRASIL LTDA: BUSINESS OVERVIEW

14.2.7 MACLEAN-FOGG COMPONENT SOLUTIONS, LLC.

TABLE 231 MACLEAN-FOGG COMPONENT SOLUTIONS, LLC: BUSINESS OVERVIEW

14.2.8 MAZDA

TABLE 232 MAZDA: BUSINESS OVERVIEW

14.2.9 FORD

TABLE 233 FORD: BUSINESS OVERVIEW

14.2.10 MARUTI SUZUKI

TABLE 234 MARUTI SUZUKI: BUSINESS OVERVIEW

14.2.11 DAIHATSU

TABLE 235 DAIHATSU: BUSINESS OVERVIEW

14.2.12 SUBARU

TABLE 236 SUBARU: BUSINESS OVERVIEW

14.2.13 TREMEC CORPORATION

TABLE 237 TREMEC CORPORATION: BUSINESS OVERVIEW

15 APPENDIX (Page No. - 247)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive transmission market. The primary sources: experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as to assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global automotive transmission market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs/vehicle manufacturers) and supply (component manufacturers, module manufacturers, material providers, and system integrators) side across three major regions, namely, North America, Europe, Asia Pacific. Approximately 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report.

Breakdown of Primaries

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global automotive transmission market. In these approaches, the vehicle production statistics for each vehicle type (passenger vehicles, light commercial vehicles, trucks and buses) at a country level were considered.

- Key players in the global market were identified through secondary research, and their market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

- All major penetration rates, percentage shares, splits, and breakdowns for the automotive transmission market were determined using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources. All parameters affecting the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and project (2022–2027) the cmarket, by volume (thousand units) and value (USD million)

- To define, describe, and forecast the market based on component, material, level of autonomy, passenger car class, electric vehicle type, ICE vehicle type, and region

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze and forecast market size, by volume and value, based on Transmission Type, Number of forwarding gears, vehicle type, fuel type, Two-wheeler transmission type, Electric vehicle type and Region

- To analyze and forecast the market size, by volume and value, based on By transmission type (Automatic Transmission, Manual Transmission, Automated Manual Transmission, Continuously Variable Transmission, and Dual Clutch Transmission)

- To analyze and forecast the market size, by value, based on By Number of forwarding gears (Less Than 5, 5-6, 7-8, 9-10, Above 10, and CVT)

- To analyze and forecast the market size, by volume and value, based on vehicle type (PCs, LCVs, Trucks, Buses)

- To analyze and forecast the market size, by volume and value, based on Hybrid Vehicles (PHEV, HEV)

- To analyze and forecast the market size, by volume and value, based on By fuel type (Diesel, Gasoline)

- To analyze and forecast the market size, by volume and value, based on By Two-wheeler Transmission Type (Manual, Automatic)

- To forecast the market size, by volume and value, with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the market and its stakeholders

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and expansions, in this market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Automotive Transmission Market, by an electric vehicle at the country level

- Automotive Transmission Market, by vehicle type at country level (for countries not covered in the report)

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Transmission Market

Who are the top vendors in the Automotive Transmission Market? What is the competitive scenario among them?

Pls send TOC and can it be customised for 2W AMT market for India and for ASEAN region including after market requirement for 2W AMT for a Bolt on design of AMT for 2W

I am looking for commercial vehicle transmission data at a global level with deep dive into India, China, Brazil, Russia and South Africa. In this database, I am looking for Tier-1 and Tier-2 transmission suppliers mapping by different OEMs and models for the mentioned countries.

I am interested in new technologies relevance in commercial vehicles in developing countries context. Request if you can send me the free sample report portion relevant to only commercial vehicle regions covering other than Europe and North America

I am interested to know just in the Automotive Transmission Market by vehicle and transmission type just in Mexico.

Looking for opportunities to exploit new technologies in the automotive industry in particular for smaller engines and related industries.

Ideally would like to see Program and/or Platform included. Also EVT/Reduction breakouts if possible.

Market share, past, present, forecast (2008-2018) with splits for: Supplier OEM Vehicle Class Technology Type Global Region

LOW CARBON TRANSPORT – 16.67 Co2e g/km Transport, Automotive, Rail, Ship, Missile, JET Plane. Technology: Double Speed, 1/3 Fuel for same Ton-HP-Vehicle. 6 x kmpl; 16.67 Co2e g/km; g/t-km.

Architecture,Transmission,Motor Output,final drive,Drive Type, Power Electronics, Vehicle type, Region-Global Forecast to 2025