Automotive Wiring Harness Market by Application (Engine, Chassis, Cabin, Body & Lighting, HVAC, Battery, Seat, Sunroof, Door), Transmission Type (Data, Electrical), Date Rate, ICE & Electric Vehicle, Component, Material, & Region - Global Forecast to 2026

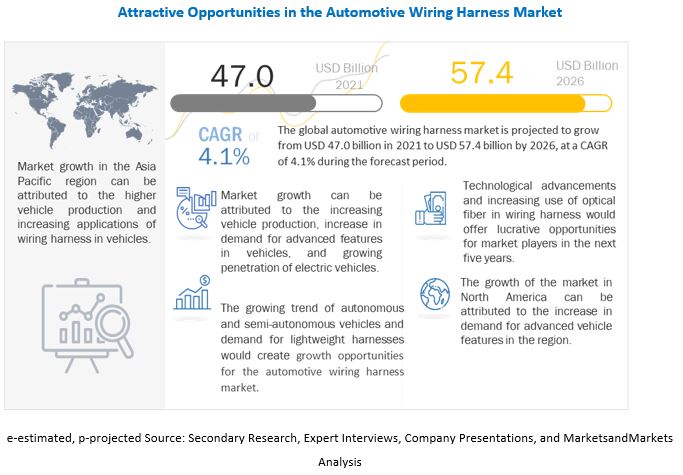

The global automotive wiring harness market size was valued at USD 47.0 billion in 2021 and is expected to reach USD 57.4 billion by 2026, at a CAGR of 4.1 % during the forecast period 2021-2026. The scope of the study considers wiring harness as a bundle of wires performing various functions like transferring signals, data, and power within a vehicle performed by data transmission and electrical wires. The demand for high speed data transmission wiring harness is also observed to have increased in the recent past, which is expected to further pick momentum as the number of electronic features rising up. Asia-Pacific remains the key market for automotive wiring harness, though the demand is also increasing in Europe, and North America.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rise In Advanced Features In Vehicles

The growing awareness about safety and security has fueled the demand for driver assist technologies (ACC, BSD, AFL, and LKA) to integrate advanced features in vehicles. In addition, vehicle manufacturers must comply with safety mandates and provide features such as airbags. The Bharat New Vehicle Safety Assessment Programme (BNVSAP) has mandated the passive safety features. For instance, from July 2019, standard fitment for driver-side airbags and front passenger-side airbags was mandated for all new models from April 2021 and September 2021 for all existing models in India. According to NHTSA (National Highway Traffic Highway Safety Association), in the US, automatic emergency braking systems are expected to be standard in vehicles by 2022. The inclusion of multimedia and security systems has increased the installation rate of cables or wiring harnesses. Comfort features such as voice recognition system, ambient lighting system, heated seat, heated steering wheel, improved functionality of infotainment, digital IP display, cooled cupholder, and additional power steering functions also gained traction among consumers to enhance the driving experience. These functions operate with the help of onboard electronic devices that use control signals through electrical power supplied by the battery. Electronic devices require a wiring harness to transfer data, signal, and power. Along with these circuits, wiring harness bundles are installed in vehicles for the smooth functioning of different features. Designing a vehicle in sync with advanced features requires an increasing number of wiring harnesses and thus drives the growth of the automotive wiring harness market.

The connected car ecosystem, new regulations, electrification, growing demand for 48V high voltage capacity, and rise in comfort and safety features in vehicles raise the demand for automotive wiring harnesses. The electronic control unit (ECU) helps assist the necessary vehicle functions, including steering, throttle control, and braking. The wiring harness helps transmit the signal, power, and data between the actuators, sensors, and ECU. The infotainment and telematics features operate the head-up display, head unit display, head unit, rearseat entertainment, and instrument cluster, which functions with Wi-Fi, Bluetooth, 4G/5G, E-call, Digital radio, TV (broadcast). This feature functions with the increase in demand for high data transfer rates and high-power cables. Furthermore, an advanced driver assisted system (ADAS) is responsible for the increase in the system and components in the vehicles such as rear camera, head unit, both side mirror camera, front camera, multi-sensor fusion, and sensors. The increase in electronic and electrical functions in modern vehicles further increases the dependency on wiring harnesses.

According to government mandates in North America, Europe, and the Asia-Pacific, the growing engine transition such as Euro VI, China VI, BSIII to BSIV electronics engine, BSVI engine increases the integration of electronic devices, sensors, communication devices, ABS, telematics devices, and other safety features. Thus, the growing application of connectivity and data transmission further increases the number of vehicles with wiring harnesses.

The use of active safety systems in vehicles minimizes accidents with the help of onboard sensors, radar, cameras, GPS, and lasers. Anti-lock braking systems (ABS), electronic stability control (ESC), electronic brake-force distribution (EBD), tire pressure monitoring systems (TPMS), lane departure warning systems (LDWS), automatic emergency braking (AEB), blind-spot detection (BSD), forward collision warning (FCW), and traction control systems are some of the common active safety systems used in vehicles.

The rise in demand for safety features would lead to integrating data transmission/electrical wiring in vehicles. As high-end features demand high-speed data transmission, optical cables with their ever-reducing cost, increased bandwidth, extremely high speed, long transmission distance, excellent reliability, and enhanced data security are likely to be used in network transmission and reception.

The growing demand for safety features such as Autonomous Emergency Braking (AEB), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), and Lane Departure Warning System (LDWS) is expected to increase the demand for electronic components in vehicles during the forecast period. The number of electronic components and data transmission wires is expected to increase the number of wiring harnesses in the vehicles. Thus, the number of advanced features in the vehicles is expected to increase the demand for the automotive wiring harness market during the forecast period.

Restraint: Lifespan issues of wiring harness

The vehicle has various electrical failures, such as non-functional front & rear lights, battery, lights, alternator, and ignition failure, which may sometimes occur due to wiring harness failures. The wiring harness sometimes bends due to rapidly changing environments such as extreme hot to extreme cold temperatures and rapid shifts from one temperature to another. These problems may corrode the wiring harness and decreases the lifespan of wiring harnesses. For instance, Sumitomo developed the aluminum wiring harness, which connects the aluminum wires with the copper-based terminals. If this combination of aluminum and copper comes in contact with saltwater or other electrolyte solution causes galvanic corrosion. Such corrosion issue is one of the major factors which hinders the growth of aluminum wiring harnesses.

Corrosion affects the sensor system powered by the wiring harness. Also, excessive corrosion can cause voltage and current flow degradation, which a sensor could interpret as a system fault. The fault can lead to the malfunctioning of safety systems such as airbags and anti-lock braking. This also causes various problems such as wearing out of wires and chances of fire. Vehicles are subjected to maintenance and repair at regular intervals and often use a corrosive lubricant solution, damaging the wiring harness and leading to electronics failure. Corrosion can also affect other wires, and damage may lead to system failure at a large scale. Wiring harness corrosion can, thus, be a major restraint for the automotive wiring harness market.

Furthermore, components used in electrical circuits such as terminals and connectors can deteriorate because of excessive features. The corrosive nature of connectors is the principal factor for their deterioration and can result in improper functioning of associated features. This can hamper the smooth operation of advanced safety features in vehicles. The corrosion in the harness, degradation in current flow, sensor malfunctioning, wearing & humidifying wires, failure of the electronic system will impact the growth of the automotive wiring harness during the forecasted period.

Opportunities: Demand for lightweight harness

The traditional copper wiring harness is high in weight and requires maximum space for integrating into the vehicle. The wiring harness weighs 50-70 kg, and it is the third heaviest component after the engine and chassis. The increase in the number of functions in vehicles increases the number of wiring harnesses day by day. The electric powertrain development alone adds about 30% more weight than an internal combustion engine powertrain. These factors increase the weight of the wiring harness, raise the vehicle's overall weight, and impact the fuel efficiency and performance of the vehicle.

Owing to the rising emissions levels from vehicles, regulatory authorities in many regions have implemented stringent emission standards. The Corporate Average Fuel Economy (CAFE) law in the US has set certain standards for automakers. Stringent emission norms across the globe have compelled OEMs to reduce the overall weight and increase fuel economy, resulting in lower operating costs of transportation. This also provides advantages such as improved mobility, speed and acceleration, and higher payload capacity. Carbon emissions are lowered because of improved fuel efficiency, thereby reducing the environmental impacts caused by emissions. An increase in demand for reduction in CO2 emissions, government mandates for the emission regulations, and the rising trend of weight reduction further raise the demand for weight and cost reduction in vehicles.

There is a growing demand for specialty cables due to reduced weight, cost, and bundle diameter. There will be ample demand for cameras, displays, and other infotainment applications, which creates the developing ways to transmit video and camera signals into one specialty cable, further reducing the weight and cost of wiring harnesses. OEMs prefer aluminum and optical fiber for lightweight and high-speed harnesses. Fiber optic cable is less susceptible to various environmental factors than copper cable. Hence, manufacturers are shifting toward optical fiber for high-speed data transmission. Developing a lightweight aluminum wiring harness, a mixture of aluminum and copper alloys in the harness, usage of high voltage coax, and usage of optical fibers in the wiring harness becomes a potential opportunity for manufacturers.

Challenge: Fluctuating copper costs due to increasing demand

A wiring harness is manufactured using copper, aluminum, and plastic. Copper is used in wiring harnesses due to easy assembly & manufacturing, small bundle size capability, high conductivity, flexibility, and reliability. The imbalance of supply and demand leads to fluctuating copper costs keeping it on an increasing scale. The demand for copper is huge, which primarily governs the price globally. Copper and its alloys are versatile engineering materials with a wide range of valuable properties that make them suitable for a vast number of applications. Many wiring harness manufacturers use aluminum because of its lightweight and low cost, but aluminum has lower conductivity and must be larger than copper wires for the same power rating.

Furthermore, aluminum requires various termination technology to overcome the problems of galvanic corrosion, oxidation, deformation with aging, high thermal expansion, lower flexibility, and tensile strength. Nevertheless, as aluminum poses various challenges, copper remains the first choice for wiring harness applications. Thus, the fluctuating prices of copper can impact the profitability of wiring harness manufacturers.

The average copper weight per vehicle in China has increased from 10.3 kg in 2016 to 14 kg in 2019. This growth impacts the usage of copper in vehicles during the forecast period. Furthermore, prices of copper fluctuate in the market, which in turn causes variation in the price of automotive wiring harnesses. This is expected to act as a challenge in the automotive wiring harness during the forecast period.

Unstable prices of copper have also impacted the demand for optical fiber cables in the market. OEMs focus on incorporating optical fibers that are more durable than copper/aluminum and can withstand tough environments and harsh weather conditions. However, the relatively higher price of optical fiber cables is likely to restrict its penetration. The increasing application of copper in the wiring harness and fluctuating cost of copper is expected to act as a challenge in the automotive wiring harness during the forecast period.

The chassis harness segment is projected to lead the automotive wiring harness application market

Owing to higher demand for automotive wiring harnesses in chassis applications such as frame, air brake pump, suspension systems, and others, this segment is expected to showcase the leading position in automotive wiring harness applications. According to MarketsandMarkets analysis, the chassis harness segment is estimated to hold the largest market share of more than 25% in 2021.

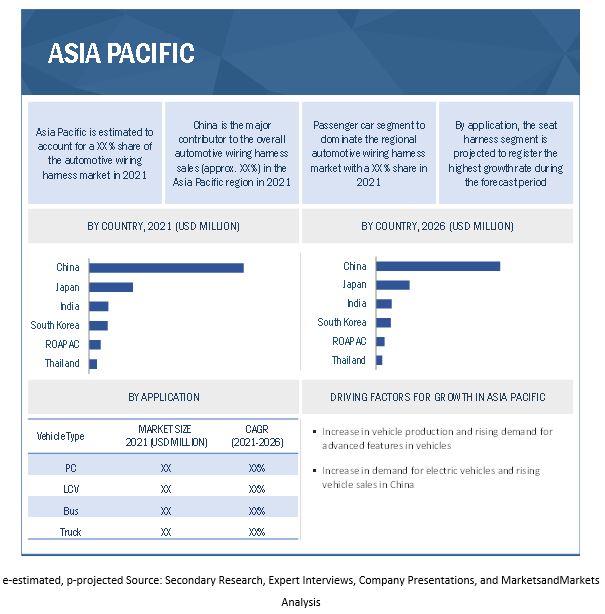

Asia-Pacific is estimated to be the largest market in 2021

The study scope considers Asia-Pacific region comprising of countries - China, India, Japan, South Korea, Thailand, and Rest of Asia-Pacific. In 2021, the Asia-Pacific region accounted for >55% share, in terms of value, of the global automotive wiring harness market. Increased vehicle production in China, India, and Japan contributed to the growth of the market. The China was also the major contributor to the overall automotive wiring harness sales (approximately 60%) in the Asia-Pacific region in 2021.

China is estimated to dominate the Asia-Pacific automotive wiring harness market during the forecast period. China is the world’s largest vehicle manufacturer. Thus, the market for automotive wiring harnesses in China is estimated to grow at a high rate. OEMs based in China are focusing on the adoption of lightweight materials for wiring harnesses. Thus, wiring harness manufacturers are increasingly using materials such as aluminum. Currently, there is limited penetration of aluminum in wiring harnesses. Thus, the region is estimated to dominate the market with a 60.3% share in 2021.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Yazaki Corporation (Japan), Sumitomo Electric Industries (Japan), Aptiv PLC (Ireland), Furukawa Electric (Japan), Leoni AG (Germany), and Nexans (France) are the key companies operating in the automotive wiring harness market. These companies adopted new product launches, partnership, and joint venture to gain traction in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2021 |

USD 47.0 Billion |

|

Estimated Value by 2026 |

USD 57.4 Billion |

|

Growth Rate |

Poised to grow at a CAGR of 4.1% |

|

Market Segmentation |

By application, ICE vehicle type by transmission type and application, Electric vehicle type by transmission type and application, component, material, data transmission harness market, by data rate, and region. |

|

Market Driver |

Demand for lightweight harness |

|

Market Opportunity |

Increasing use of autonomous cars and electric vehicles |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the automotive wiring harness market :

By Application:

- engine harness

- chassis wiring harness

- body & lighting harness

- HVAC harness

- dashboard/ cabin harness

- battery harness

- seat harness

- sunroof harness

- door harness

By Component

- connectors

- terminals

- wires

- others

By Material type

- metallic

- optical fiber

By Transmission type

- electrical wiring

- data transmission

Data transmission harness market by data transfer rate

- <150 Mbps

- 150 Mbps to 1 Gbp

- >1 Gbps

By Region

- Asia Pacific

- North Americ

- Europe

- Rest of the World [RoW]

Recent Developments

- In July 2021, Yazaki Corporation proposed to set up a wire harness manufacturing plant in Manipur, India.

- In July 2021, Furukawa Electric developed a thin ultra-high fiber count 6,912-fiber optical cable which implements thin 16-fiber rollable ribbons and the S124M16 ribbon fusion splicer and its related tools. They reduce the time required for fusion splicing and contribute to the expansion of high-capacity networks. The company developed a thin ultra-high count multi-core optical fiber cable with the world’s highest core density. The 12-core rollable ribbon is made from optical fiber with a thinner outer diameter (200 μm). A drastically thinner cable with an outer diameter of only 29 mm offers extremely high density (6912 cores). This development makes it possible to install ultra-high count multi-core fiber in bulk in existing pipe conduits.

- In October 2020, Essex Magnet Wire (Essex), and Furukawa Electric, leaders in magnet wire product development and custom solutions, entered into a JV to expand upon a previous magnet wire partnership between the two entities in Europe. Upon executing the definitive agreements and customary regulatory and other approvals, the companies would combine their magnet wire business operations in the next several months.

- In September 2021, Nexans entered into a share purchase agreement with Xignux SA of Mexico to acquire Centelsa, a premium cable maker in Latin America active in producing cables for building and utility applications. The closing of the agreement is subject to regulatory approvals and is expected to take place in the first half of 2022.

- In March 2020, Aptiv (NYSE: APTV) and Hyundai Motor Group formed a 50/50 autonomous driving joint venture (JV) to make mobility more safe, green, connected, and accessible. It is headquartered in Boston, with technology centers across the US and Asia. The JV would leverage Hyundai Motor Group’s design, engineering, and manufacturing expertise and Aptiv’s autonomous driving solutions to commercialize SAE Level 4/5 platform for robotaxi providers, fleet operators, and automotive manufacturers.

FAQs:

How big is the automotive wiring harness market?

The global automotive wiring harness market size was valued at USD 47.0 billion in 2021 and is expected to reach USD 57.4 billion by 2026, at a CAGR of 4.1 %

Which application is currently leading the automotive wiring harness market

Chassis application is leading in the automotive wiring harness market.

Many companies are operating in the automotive wiring harness market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

Yazaki Corporation (Japan), Sumitomo Electric Industries (Japan), Aptiv PLC (Ireland), Furukawa Electric (Japan), and Leoni AG (Germany) are the prominent players in the market. These companies adopted new product launches, acquisition, and joint venture strategies to gain traction in the market.

How is the demand for automotive wiring harness varies by region

Asia-Pacific is estimated to be the largest market for automotive wiring harness during the forecast period, followed by Europe. The growth of the automotive wiring harness market in Asia-Pacific is mainly attributed to the higher demand for automotive wiring harness from China due to higher vehicle production.

What are the growth opportunities for the automotive wiring harness supplier?

The demand for autonomous and semi-autonomous vehicles and lightweight harness would create growth opportunities for the automotive wiring harness market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES

1.2 AUTOMOTIVE WIRING HARNESS MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED IN THE STUDY

1.4 CURRENCY CONSIDERED

1.5 SUMMARY OF CHANGES

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources to estimate automotive wiring harness market

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE: BOTTOM-UP APPROACH (APPLICATION AND REGION)

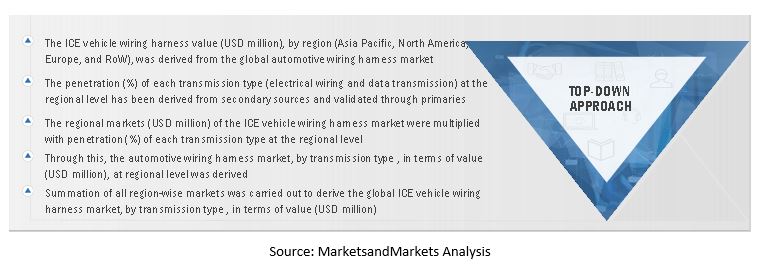

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE: TOP-DOWN APPROACH (ICE VEHICLE, BY TRANSMISSION TYPE)

FIGURE 7 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 8 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF SUMITOMO ELECTRIC INDUSTRIES REVENUE ESTIMATION

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

TABLE 1 ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

3.1 PRE- VS POST-COVID-19 SCENARIO

FIGURE 10 PRE- & POST-COVID-19 SCENARIOS: AUTOMOTIVE WIRING HARNESS MARKET SIZE, 2019–2026 (USD MILLION)

TABLE 2 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2019–2026 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 11 MARKET, BY ICE VEHICLE TYPE, 2021 VS. 2026

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 12 GROWING VEHICLE PRODUCTION AND DEMAND FOR ADVANCED FEATURES IN VEHICLES TO DRIVE MARKET

4.2 AUTOMOTIVE WIRING HARNESS MARKET, BY ICE VEHICLE TYPE

FIGURE 13 PASSENGER CARS PROJECTED TO LEAD ICE WIRING HARNESS MARKET

4.3 MARKET, ICE VEHICLE BY APPLICATION

FIGURE 14 SUNROOF WIRING HARNESS TO SHOWCASE FASTEST GROWTH DUE TO INCREASED USE IN PREMIUM & SUV VEHICLES

4.4 MARKET, ICE BY TRANSMISSION TYPE

FIGURE 15 ELECTRIC WIRING HARNESS TO DOMINATE MARKET BY TRANSMISSION TYPE

4.5 MARKET, ELECTRIC VEHICLE, BY TRANSMISSION TYPE

FIGURE 16 ELECTRICAL WIRING TO DOMINATE DURING FORECAST PERIOD

4.6 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 17 BATTERY ELECTRIC VEHICLES TO LEAD EV WIRING HARNESS SEGMENT

4.7 MARKET, BY COMPONENT

FIGURE 18 WIRES TO LEAD COMPONENT SEGMENT IN TERMS OF VALUE

4.8 MARKET, BY MATERIAL

FIGURE 19 METALLIC WIRING IN ECONOMY PASSENGER CARS TO COMMAND LARGER MARKET SHARE

4.9 DATA TRANSMISSION HARNESS MARKET, BY DATA RATE

FIGURE 20 <150 MBPS SEGMENT EXPECTED TO MAINTAIN TOP POSITION IN FORECAST PERIOD

4.10 MARKET, BY REGION

FIGURE 21 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

FIGURE 22 AUTOMOTIVE WIRING HARNESS MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1 Growing vehicle production and demand for advanced features

5.1.1.2 Vehicle production of conventional vs. premium vehicles

FIGURE 23 PENETRATION OF PREMIUM VEHICLES IN OVERALL PRODUCTION, 2019–2026

5.1.1.3 Rise in advanced features in vehicles

TABLE 3 GROWTH RATE OF AUTOMOTIVE SAFETY FEATURE APPLICATIONS, 2017-2025 (%)

5.1.1.4 Growing penetration of electric vehicles

TABLE 4 GROWTH RATE OF LOW AND HIGH VOLTAGE WIRING HARNESS, 2020-2030 (%)

FIGURE 24 GLOBAL BEV SALES, 2017–2020 ('000 UNITS)

5.1.2 RESTRAINTS

5.1.2.1 Limitations of conventional wiring harness

5.1.2.1.1 Lifespan issues of wiring harness

5.1.2.2 Limited data transfer rate

5.1.3 OPPORTUNITIES

5.1.3.1 Growing trend of autonomous and semi-autonomous vehicles

TABLE 5 LEVELS OF AUTONOMOUS VEHICLES

5.1.3.2 Demand for lightweight harness

TABLE 6 TECHNOLOGY IN USE TO REDUCE NUMBER OF WIRES

5.1.4 CHALLENGES

5.1.4.1 Fluctuating copper costs due to increasing demand

FIGURE 25 INCREASED AVERAGE COPPER WEIGHT PER VEHICLE, BY REGION (2016 VS. 2019) (KG)

FIGURE 26 FLUCTUATING COPPER COSTS, 2016-2021 (USD/KG)

5.1.4.2 Challenges in wire preparation, staging, and crimping

5.2 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 TRADE ANALYSIS

TABLE 8 IMPORT TRADE DATA OF KEY COUNTRIES, 2020 (USD)

TABLE 9 EXPORT TRADE DATA OF KEY COUNTRIES, 2020 (USD)

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 28 REVENUE SHIFT FOR MARKET

5.5 CASE STUDIES

5.5.1 CASE STUDY: COMPLEXITY IN BASIC CARS SUCH AS SEAT ATECA SUV SOLVED USING 2.2 KM WIRE, 100 SENSORS & CONTROL UNITS

5.5.2 CASE STUDY: TRACKWISE DEVELOPS FLEXIBLE PRINTED CIRCUIT BOARDS TO REDUCE WIRING HARNESS WEIGHT

5.5.3 CASE STUDY: RETROFITTING OF WIRE HARNESS BY MUELLER ELECTRIC

5.5.4 CASE STUDY: RELIABILITY OF VEHICLE-MOUNTED WIRING HARNESS CONNECTOR

5.5.5 A CASE STUDY: CURRENT DEVELOPMENT OF WIRING HARNESS

5.6 PATENT ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS: MARKET

5.8 MARKET ECOSYSTEM

TABLE 10 ROLE OF COMPANIES IN MARKET ECOSYSTEM

5.9 REGULATORY ANALYSIS: AUTOMOTIVE WIRING HARNESS STANDARDS

5.9.1 AUTOMOTIVE WIRING HARNESS STANDARDS

5.9.2 GERMAN STANDARD CAR WIRE PRODUCT CATALOG

5.9.3 JAPANESE STANDARD CAR WIRE PRODUCT CATALOG

5.9.4 AMERICAN STANDARD CAR WIRE PRODUCT CATALOG

5.9.5 AVERAGE SELLING PRICE (ASP) ANALYSIS

TABLE 11 AVERAGE REGIONAL PRICE TREND OF AUTOMOTIVE WIRING HARNESS (USD)

5.1 AUTOMOTIVE WIRING HARNESS: TECHNOLOGY TREND

5.10.1 OPTICAL FIBER CABLES IN AUTOMOTIVE WIRING HARNESS

5.10.2 REDUCTION OF WEIGHT IN WIRING HARNESS

5.11 MARKET SCENARIO

FIGURE 30 MARKET SCENARIO, 2019–2026 (USD MILLION)

5.11.1 REALISTIC SCENARIO

TABLE 12 MARKET (REALISTIC SCENARIO), BY REGION, 2019–2026 (USD MILLION)

5.11.2 LOW IMPACT SCENARIO

TABLE 13 MARKET (LOW IMPACT SCENARIO), BY REGION, 2019–2026 (USD MILLION)

5.11.3 HIGH IMPACT SCENARIO

TABLE 14 MARKET (HIGH IMPACT SCENARIO), BY REGION, 2019–2026 (USD MILLION)

6 AUTOMOTIVE WIRING HARNESS MARKET, BY CATEGORY (Page No. - 92)

6.1 INTRODUCTION

6.2 GENERAL WIRES

6.3 HEAT-RESISTANT WIRES

6.4 SHIELDED WIRES

6.5 TUBED WIRES

TABLE 15 WIRES AND CABLES FOR WIRING HARNESS

7 AUTOMOTIVE WIRING HARNESS MARKET FOR ICE VEHICLES, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

7.2 NUMBER OF HARNESSES IN EACH APPLICATION

TABLE 16 NUMBER OF HARNESSES, BY APPLICATION (GLOBAL AVERAGE)

FIGURE 31 MARKET FOR ICE VEHICLES, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 17 MARKET FOR ICE VEHICLES, BY APPLICATION, 2018–2020 (UNITS)

TABLE 18 MARKET FOR ICE VEHICLES, BY APPLICATION, 2021–2026 (UNITS)

TABLE 19 MARKET FOR ICE VEHICLES, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 20 MARKET FOR ICE VEHICLES, BY APPLICATION, 2021–2026 (USD MILLION)

7.3 ENGINE HARNESS

TABLE 21 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 22 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 23 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 CHASSIS HARNESS

TABLE 25 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 26 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 27 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 28 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 BODY & LIGHTING HARNESS

TABLE 29 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 30 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 31 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 32 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 HVAC HARNESS

TABLE 33 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 34 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 35 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 DASHBOARD/CABIN HARNESS

TABLE 37 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 38 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 39 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.8 BATTERY HARNESS

TABLE 41 BATTERY HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 42 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 43 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.9 SEAT HARNESS

TABLE 45 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 46 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 47 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.10 SUNROOF HARNESS

TABLE 49 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 50 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 51 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.11 DOOR HARNESS

TABLE 53 MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 54 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 55 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2021–2026 (USD MILLION)

8 AUTOMOTIVE WIRING HARNESS MARKET FOR ICE VEHICLES, BY COMPONENT (Page No. - 116)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET FOR ICE VEHICLES, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

TABLE 57 MARKET FOR ICE VEHICLES, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 58 MARKET FOR ICE VEHICLES, BY COMPONENT, 2021–2026 (USD MILLION)

8.2 CONNECTORS

TABLE 59 CONNECTORS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 CONNECTORS: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 WIRES

TABLE 61 WIRES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 WIRES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 TERMINALS

TABLE 63 TERMINALS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 TERMINALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 OTHERS

TABLE 65 OTHER COMPONENTS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 66 OTHER COMPONENTS: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 AUTOMOTIVE WIRING HARNESS MARKET, BY MATERIAL TYPE (Page No. - 126)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

9.2 COMPARISON OF COPPER AND OPTICAL FIBER

TABLE 67 COPPER VS. OPTICAL FIBER

FIGURE 33 MARKET FOR ICE VEHICLES, BY MATERIAL TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 68 MARKET FOR ICE VEHICLES, BY MATERIAL TYPE, 2018–2020 (USD MILLION)

TABLE 69 MARKET FOR ICE VEHICLES, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

9.3 METALLIC

TABLE 70 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 71 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.3.1 COPPER

TABLE 72 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 73 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.3.2 ALUMINUM

TABLE 74 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 75 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.3.3 OTHER MATERIALS

TABLE 76 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 77 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.4 OPTICAL FIBER

TABLE 78 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 79 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4.1 PLASTIC OPTICAL FIBER

TABLE 80 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 81 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

9.4.2 GLASS OPTICAL FIBER

TABLE 82 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 83 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

10 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY MATERIAL TYPE, 2018 VS. 2026 (Page No. - 137)

FIGURE 34 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY MATERIAL TYPE, 2018 VS. 2026 (USD MILLION)

TABLE 84 MARKET, BY MATERIAL TYPE, 2018–2020 (USD MILLION)

TABLE 85 MARKET, BY MATERIAL TYPE, 2021–2026 (USD MILLION)

10.1 METALLIC

TABLE 86 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 87 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.1.1 COPPER

TABLE 88 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.1.2 ALUMINUM

TABLE 90 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 91 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.1.3 OTHER MATERIALS

TABLE 92 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 93 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 OPTICAL FIBER

TABLE 94 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.1 PLASTIC OPTICAL FIBER

TABLE 96 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 97 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.2 GLASS OPTICAL FIBER

TABLE 98 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 99 MARKET, BY REGION, 2021–2026 (USD MILLION)

11 AUTOMOTIVE WIRING HARNESS MARKET FOR ICE VEHICLES, BY TRANSMISSION TYPE (Page No. - 144)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET FOR ICE VEHICLES, BY TRANSMISSION TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 100 MARKET FOR ICE VEHICLES, BY TRANSMISSION TYPE, 2018–2020 (USD MILLION)

TABLE 101 MARKET FOR ICE VEHICLES, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

11.2 DATA TRANSMISSION

TABLE 102 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 103 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

11.3 ELECTRICAL WIRING

TABLE 104 MARKET FOR ICE VEHICLES, BY REGION, 2018–2020 (USD MILLION)

TABLE 105 MARKET FOR ICE VEHICLES, BY REGION, 2021–2026 (USD MILLION)

12 AUTOMOTIVE WIRING HARNESS MARKET, BY ICE VEHICLE TYPE & APPLICATION (Page No. - 150)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

12.2 NUMBER OF HARNESSES IN ICE VEHICLES, BY APPLICATION

TABLE 106 NUMBER OF HARNESSES IN ICE VEHICLES, BY APPLICATION (GLOBAL AVERAGE)

FIGURE 36 MARKET FOR ICE VEHICLES, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 107 MARKET, BY ICE VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 108 MARKET, BY ICE VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 109 MARKET, BY ICE VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 110 MARKET, BY ICE VEHICLE TYPE, 2021–2026 (USD MILLION)

12.3 PASSENGER CARSS

TABLE 111 ICE PASSENGER CARS WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 112 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 113 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 114 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 115 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 116 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 117 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 118 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.3.1 ENGINE HARNESS

12.3.2 CHASSIS HARNESS

12.3.3 BODY & LIGHTING HARNESS

12.3.4 HVAC HARNESS

12.3.5 DASHBOARD/CABIN HARNESS

12.3.6 BATTERY HARNESS

12.3.7 SEAT HARNESS

12.3.8 SUNROOF HARNESS

12.3.9 DOOR HARNESS

12.4 LIGHT COMMERCIAL VEHICLES (LCV)

TABLE 119 ICE LIGHT COMMERCIAL VEHICLES WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 120 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 121 ICE LIGHT COMMERCIAL VEHICLES WIRING HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 122 ICE LIGHT COMMERCIAL VEHICLES WIRING HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 123 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 124 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 125 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 126 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.4.1 ENGINE HARNESS

12.4.2 CHASSIS HARNESS

12.4.3 BODY & LIGHTING HARNESS

12.4.4 HVAC HARNESS

12.4.5 DASHBOARD/CABIN HARNESS

12.4.6 BATTERY HARNESS

12.4.7 DOOR HARNESS

12.5 BUS

TABLE 127 ICE BUSES WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 128 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 129 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 130 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 131 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 132 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 133 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 134 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.5.1 ENGINE HARNESS

12.5.2 CHASSIS HARNESS

12.5.3 BODY & LIGHTING HARNESS

12.5.4 HVAC HARNESS

12.5.5 DASHBOARD/CABIN HARNESS

12.5.6 BATTERY HARNESS

12.5.7 DOOR HARNESS

12.6 TRUCKS

TABLE 135 ICE TRUCKS WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 136 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 137 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 138 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 139 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 140 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 141 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 142 ICE TRUCK WIRING HARNESS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.6.1 ENGINE HARNESS

12.6.2 CHASSIS HARNESS

12.6.3 BODY & LIGHTING HARNESS

12.6.4 HVAC HARNESS

12.6.5 DASHBOARD/CABIN HARNESS

12.6.6 BATTERY HARNESS

12.6.7 DOOR HARNESS

13 48V & EV WIRING HARNESS ARCHITECTURE (Page No. - 173)

13.1 GROWING TREND OF VEHICLE ELECTRIFICATION

FIGURE 37 ELECTRIC VEHICLE ECOSYSTEM

FIGURE 38 OEM EV MODELS OVERVIEW

TABLE 143 OEM EV MODEL ANNOUNCEMENTS

TABLE 144 ELECTRIC VEHICLES MARKET DYNAMICS

TABLE 145 GLOBAL KEY DEVELOPMENTS, 2020–2021

13.2 NEED FOR 48V ARCHITECTURE

FIGURE 39 48V: MAIN DRIVERS

FIGURE 40 12V AND 48V ELECTRICAL ARCHITECTURE

13.2.1 REDUCED CO2 EMISSIONS LEAD TO IMPROVEMENT IN FUEL ECONOMY

13.2.2 ENGINE DOWNSIZING IMPROVES DRIVABILITY

13.3 IMPACT OF 48V ARCHITECTURE ON AUTOMOTIVE WIRING HARNESS

13.3.1 IMPACT ON WIRING HARNESS

13.3.2 ELECTRIC VEHICLE WIRING HARNESS

13.3.2.1 Pipe-shielded wiring harness

13.3.2.2 Power cable

13.3.2.3 Direct connector

13.4 48V PASSENGER CAR WIRING HARNESS MARKET, BY REGION

13.4.1 ASIA PACIFIC

13.4.2 EUROPE

TABLE 146 EURO 6 POLLUTANT REGULATION DETAILS

13.4.3 NORTH AMERICA

14 AUTOMOTIVE WIRING HARNESS MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION (Page No. - 184)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

14.1.3 INDUSTRY INSIGHTS

14.2 TOTAL HARNESSES IN ELECTRIC VEHICLES

TABLE 147 TOTAL HARNESSES IN ELECTRIC VEHICLES (GLOBAL AVERAGE)

FIGURE 41 MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 148 MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION, 2018–2020 (UNITS)

TABLE 149 MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION, 2021–2026 (UNITS)

TABLE 150 MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION, 2018–2020 (USD MILLION)

TABLE 151 MARKET, BY ELECTRIC VEHICLE TYPE & APPLICATION, 2021–2026 (USD MILLION)

14.3 BATTERY ELECTRIC VEHICLE (BEV)

TABLE 152 BEV WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 153 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 154 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 155 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 156 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 157 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 158 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 159 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

14.3.1 CHASSIS HARNESS

14.3.2 BODY & LIGHTING HARNESS

14.3.3 HVAC HARNESS

14.3.4 DASHBOARD/CABIN HARNESS

14.3.5 BATTERY HARNESS

14.3.6 SEAT HARNESS

14.3.7 SUNROOF HARNESS

14.3.8 DOOR HARNESS

14.4 PLUG-IN HYBRID ELECTRIC VEHICLES

TABLE 160 PHEV WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 161 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 162 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 163 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 164 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 165 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 166 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 167 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

14.4.1 ENGINE HARNESS

14.4.2 CHASSIS HARNESS

14.4.3 BODY & LIGHTING HARNESS

14.4.4 HVAC HARNESS

14.4.5 DASHBOARD/CABIN HARNESS

14.4.6 BATTERY HARNESS

14.4.7 SEAT HARNESS

14.4.8 SUNROOF HARNESS

14.4.9 DOOR HARNESS

14.5 FUEL CELL ELECTRIC VEHICLES (FCEV)

TABLE 168 FCEV WIRING HARNESS MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 169 MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 170 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 171 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 172 MARKET, BY APPLICATION, 2018–2020 (UNITS)

TABLE 173 MARKET, BY APPLICATION, 2021–2026 (UNITS)

TABLE 174 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 175 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

14.5.1 CHASSIS HARNESS

14.5.2 BODY & LIGHTING HARNESS

14.5.3 HVAC HARNESS

14.5.4 DASHBOARD/CABIN HARNESS

14.5.5 BATTERY HARNESS

14.5.6 SEAT HARNESS

14.5.7 SUNROOF HARNESS

14.5.8 DOOR HARNESS

15 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY TRANSMISSION TYPE (Page No. - 201)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 42 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY TRANSMISSION TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 176 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY TRANSMISSION TYPE, 2018–2020 (USD MILLION)

TABLE 177 ELECTRIC VEHICLE WIRING HARNESS MARKET, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

15.2 DATA TRANSMISSION

TABLE 178 DATA TRANSMISSION: ELECTRIC VEHICLE WIRING HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 179 DATA TRANSMISSION: ELECTRIC VEHICLE WIRING HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 ELECTRICAL WIRING

TABLE 180 ELECTRICAL WIRING: ELECTRIC VEHICLE HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 181 ELECTRICAL WIRING: ELECTRIC VEHICLE HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

16 DATA TRANSMISSION HARNESS MARKET, BY DATA TRANSFER RATE (Page No. - 207)

16.1 INTRODUCTION

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS

16.1.3 INDUSTRY INSIGHTS

FIGURE 43 MARKET, BY DATA TRANSFER RATE, 2021 VS. 2026 (USD MILLION)

TABLE 182 MARKET, BY DATA TRANSFER RATE, 2018–2020 (USD MILLION)

TABLE 183 MARKET, BY DATA TRANSFER RATE, 2021–2026 (USD MILLION)

16.2 <150 MBPS

TABLE 184 <150 MBPS HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 185 <150 MBPS HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

16.3 150 MBPS TO 1 GBPS

TABLE 186 150 MBPS TO 1 GBPS HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 187 150 MBPS TO 1 GBPS HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

16.4 >1 GBPS

TABLE 188 >1 GBPS HARNESS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 189 >1 GBPS HARNESS MARKET, BY REGION, 2021–2026 (USD MILLION)

17 AUTOMOTIVE WIRING HARNESS MARKET, BY REGION (Page No. - 214)

17.1 INTRODUCTION

17.2 RESEARCH METHODOLOGY

17.2.1 INDUSTRY INSIGHTS

FIGURE 44 MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 190 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 191 MARKET, BY REGION, 2021–2026 (USD MILLION)

17.3 ASIA PACIFIC

17.3.1 ASIA PACIFIC VEHICLE PRODUCTION DATA

TABLE 192 ASIA PACIFIC: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2020 (’000 UNITS)

17.3.2 ASIA PACIFIC VEHICLE PRODUCTION DATA

TABLE 193 ASIA PACIFIC: VEHICLE PRODUCTION, BY COUNTRY, 2017–2020 (’000 UNITS)

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 46 ASIA PACIFIC: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 195 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 196 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.3.3 CHINA

17.3.3.1 Increasing production of passenger cars to drive market

TABLE 198 CHINA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 199 CHINA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 200 CHINA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 201 CHINA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.3.4 JAPAN

17.3.4.1 Introduction of advanced technologies and demand for enhanced safety and comfort drive market

TABLE 202 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 203 JAPAN: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 204 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 205 JAPAN: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.3.5 SOUTH KOREA

17.3.5.1 Growing demand for passenger cars to drive market

TABLE 206 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 207 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 208 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 209 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.3.6 INDIA

17.3.6.1 Less penetration of premium vehicles to impact market

TABLE 210 INDIA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 211 INDIA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 212 INDIA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 213 INDIA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.3.7 THAILAND

17.3.7.1 High production of LCVs to drive market

TABLE 214 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 215 THAILAND: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 216 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 217 THAILAND: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.3.8 REST OF ASIA PACIFIC

TABLE 218 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 219 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 220 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4 EUROPE

17.4.1 EUROPE VEHICLE PRODUCTION DATA

TABLE 222 EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2020 (’000 UNITS)

17.4.2 EUROPE VEHICLE PRODUCTION DATA

TABLE 223 EUROPE: VEHICLE PRODUCTION, BY COUNTRY, 2017–2020 (’000 UNITS)

FIGURE 47 EUROPE: MARKET SNAPSHOT

TABLE 224 EUROPE: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 225 EUROPE: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 226 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 227 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.4.3 GERMANY

17.4.3.1 Demand for all vehicle types to drive market

TABLE 228 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 229 GERMANY: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 230 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 231 GERMANY: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.4 FRANCE

17.4.4.1 Incorporation of premium features in buses to drive demand

TABLE 232 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 233 FRANCE: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 234 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 235 FRANCE: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.5 UK

17.4.5.1 Increasing sales of premium cars to drive the market

TABLE 236 UK: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 237 UK: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 238 UK: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 239 UK: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.6 SPAIN

17.4.6.1 Growing demand for luxury vehicles to drive market

TABLE 240 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 241 SPAIN: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 242 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 243 SPAIN: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.7 RUSSIA

17.4.7.1 Demand for LCVs to drive market

TABLE 244 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 245 RUSSIA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 246 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 247 RUSSIA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.8 ITALY

17.4.8.1 Growing ICE vehicle production to drive the market

TABLE 248 ITALY: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 249 ITALY: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 250 ITALY: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 251 ITALY: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.4.9 REST OF EUROPE

TABLE 252 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 253 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 254 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 255 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.5 NORTH AMERICA

17.5.1 NORTH AMERICA VEHICLE PRODUCTION DATA

TABLE 256 NORTH AMERICA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2017–2020 (’000 UNITS)

17.5.2 NORTH AMERICA VEHICLE PRODUCTION DATA

TABLE 257 NORTH AMERICA: VEHICLE PRODUCTION, BY COUNTRY, 2017–2020 (’000 UNITS)

FIGURE 48 NORTH AMERICA: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

TABLE 258 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 259 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 260 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 261 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.5.3 US

17.5.3.1 Increasing number of premium features in passenger cars to drive market

TABLE 262 US: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 263 US: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 264 US: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 265 US: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.5.4 CANADA

17.5.4.1 Growing LCV production to drive market

TABLE 266 CANADA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 267 CANADA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 268 CANADA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 269 CANADA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.5.5 MEXICO

17.5.5.1 Increase in demand for trucks to drive market

TABLE 270 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 271 MEXICO: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 272 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 273 MEXICO: MARKET, BY VEHICLE TYPE, 2021–2026(USD MILLION)

17.6 REST OF THE WORLD (ROW)

FIGURE 49 ROW: MARKET, BY COUNTRY, 2021 VS 2026 (USD MILLION)

TABLE 274 ROW: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 275 ROW: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 276 ROW: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 277 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

17.6.1 BRAZIL

17.6.1.1 Growth of passenger car sales to drive market

TABLE 278 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 279 BRAZIL: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 280 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 281 BRAZIL: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.6.2 SOUTH AFRICA

17.6.2.1 Rising LCV production to drive the market

TABLE 282 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 283 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 284 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 285 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

17.6.3 OTHERS IN ROW

TABLE 286 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 287 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 288 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 289 OTHERS IN ROW: MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

18 COMPETITIVE LANDSCAPE (Page No. - 258)

18.1 OVERVIEW

18.2 MARKET SHARE ANALYSIS, 2020

TABLE 290 MARKET SHARE ANALYSIS, 2020

FIGURE 50 MARKET SHARE, 2020

18.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 51 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2018-2020

18.4 COMPANY EVALUATION QUADRANT: AUTOMOTIVE WIRING HARNESS SUPPLIERS

18.4.1 STAR

18.4.2 EMERGING LEADERS

18.4.3 PERVASIVE

18.4.4 PARTICIPANTS

TABLE 291 AUTOMOTIVE WIRING HARNESS MARKET: COMPANY PRODUCT FOOTPRINT, 2020

TABLE 292 MARKET: VEHICLE TYPE FOOTPRINT, 2020

TABLE 293 MARKET: COMPANY REGION FOOTPRINT, 2020

FIGURE 52 COMPETITIVE EVALUATION MATRIX: AUTOMOTIVE WIRING HARNESS SUPPLIERS, 2020

FIGURE 53 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

18.5 COMPETITIVE SCENARIO

18.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 294 NEW PRODUCT DEVELOPMENTS, 2018–2021

18.5.2 DEALS

TABLE 295 DEALS, 2018–2021

18.5.3 OTHER DEVELOPMENTS, 2018–2021

TABLE 296 OTHER DEVELOPMENTS, 2018–2021

18.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

TABLE 297 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2018 TO 2021

18.7 COMPANY EVALUATION QUADRANT: ELECTRIC AUTOMOTIVE WIRING HARNESS MANUFACTURERS

18.7.1 STAR

18.7.2 EMERGING LEADERS

18.7.3 PERVASIVE

18.7.4 PARTICIPANTS

FIGURE 54 COMPETITIVE EVALUATION MATRIX, ELECTRIC AUTOMOTIVE WIRING HARNESS MANUFACTURERS, 2020

19 COMPANY PROFILES (Page No. - 278)

19.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

19.1.1 SUMITOMO ELECTRIC INDUSTRIES

TABLE 298 SUMITOMO ELECTRIC INDUSTRIES: BUSINESS OVERVIEW

FIGURE 55 SUMITOMO ELECTRIC INDUSTRIES: COMPANY SNAPSHOT

TABLE 299 SUMITOMO ELECTRIC INDUSTRIES: PRODUCTS OFFERED

TABLE 300 SUMITOMO ELECTRIC INDUSTRIES: DEALS

19.1.2 YAZAKI CORPORATION

TABLE 301 YAZAKI CORPORATION: BUSINESS OVERVIEW

FIGURE 56 YAZAKI CORPORATION: COMPANY SNAPSHOT

TABLE 302 YAZAKI CORPORATION: PRODUCTS OFFERED

TABLE 303 YAZAKI CORPORATION: OTHER DEVELOPMENTS

19.1.3 APTIV PLC

TABLE 304 APTIV PLC: BUSINESS OVERVIEW

FIGURE 57 APTIV PLC: COMPANY SNAPSHOT

TABLE 305 APTIV PLC: PRODUCTS OFFERED

TABLE 306 APTIV PLC: NEW PRODUCT DEVELOPMENTS

TABLE 307 APTIV PLC: DEALS

19.1.4 LEONI AG

TABLE 308 LEONI AG: BUSINESS OVERVIEW

FIGURE 58 LEONI AG: COMPANY SNAPSHOT

TABLE 309 LEONI AG: PRODUCTS OFFERED

TABLE 310 LEONI AG: NEW PRODUCT DEVELOPMENTS

TABLE 311 LEONI AG: DEALS

TABLE 312 LEONI AG: OTHER DEVELOPMENT

19.1.5 FURUKAWA ELECTRIC

TABLE 313 FURUKAWA ELECTRIC: BUSINESS OVERVIEW

FIGURE 59 FURUKAWA ELECTRIC: COMPANY SNAPSHOT

TABLE 314 FURUKAWA ELECTRIC: PRODUCTS OFFERED

TABLE 315 FURUKAWA ELECTRIC: NEW PRODUCT DEVELOPMENT

TABLE 316 FURUKAWA ELECTRIC: DEALS

TABLE 317 FURUKAWA ELECTRIC: OTHER DEVELOPMENTS

19.1.6 NEXANS

TABLE 318 NEXANS: BUSINESS OVERVIEW

FIGURE 60 NEXANS: COMPANY SNAPSHOT

TABLE 319 NEXANS: PRODUCTS OFFERED

TABLE 320 NEXANS: NEW PRODUCT DEVELOPMENTS

TABLE 321 NEXANS: DEALS

TABLE 322 NEXANS: OTHER DEVELOPMENTS

19.1.7 LEAR CORPORATION

TABLE 323 LEAR CORPORATION: BUSINESS OVERVIEW

FIGURE 61 LEAR CORPORATION: COMPANY SNAPSHOT

TABLE 324 LEAR CORPORATION: PRODUCTS OFFERED

TABLE 325 LEAR CORPORATION: DEALS

19.1.8 FUJIKURA LTD

TABLE 326 FUJIKURA LTD: BUSINESS OVERVIEW

FIGURE 62 FUJIKURA LTD: COMPANY SNAPSHOT

TABLE 327 FUJIKURA LTD: PRODUCTS OFFERED

TABLE 328 FUJIKURA LTD: NEW PRODUCT DEVELOPMENTS

TABLE 329 FUJIKURA LTD: DEALS

19.1.9 MOTHERSON SUMI SYSTEMS LIMITED

TABLE 330 MOTHERSON SUMI SYSTEMS LIMITED: BUSINESS OVERVIEW

FIGURE 63 MOTHERSON SUMI SYSTEMS LIMITED: COMPANY SNAPSHOT

TABLE 331 MOTHERSON SUMI SYSTEMS LIMITED: PRODUCTS OFFERED

TABLE 332 MOTHERSON SUMI SYSTEMS LIMITED: DEALS

19.1.10 GEBAUER & GRILLER GROUP

TABLE 333 GEBAUER & GRILLER GROUP: BUSINESS OVERVIEW

FIGURE 64 GEBAUER & GRILLER GROUP: COMPANY SNAPSHOT

TABLE 334 GEBAUER & GRILLER: PRODUCTS OFFERED

TABLE 335 GEBAUER & GRILLER: DEALS

*Details on Business Overview, Products, Recent Developments MnM View might not be captured in case of unlisted companies.

19.2 OTHER PLAYERS

19.2.1 GENERAL CABLE TECHNOLOGIES CORPORATION

TABLE 336 GENERAL CABLE TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

19.2.2 PRESTOLITE WIRE

TABLE 337 PRESTOLITE WIRE: COMPANY OVERVIEW

19.2.3 CYPRESS INDUSTRIES

TABLE 338 CYPRESS INDUSTRIES: COMPANY OVERVIEW

19.2.4 PRYSMIAN GROUP

TABLE 339 PRYSMIAN GROUP: COMPANY OVERVIEW

19.2.5 KROMBERG & SCHUBERT GMBH

TABLE 340 KROMBERG & SCHUBERT GMBH: COMPANY OVERVIEW

19.2.6 DRAXLMAIER

TABLE 341 DRAXLMAIER: COMPANY OVERVIEW

19.2.7 KE ELEKTRONIK

TABLE 342 KE ELEKTRONIK: COMPANY OVERVIEW

19.2.8 FINTALL OY

TABLE 343 FINTALL OY: COMPANY OVERVIEW

19.2.9 COROPLAST FRITZ MÜLLER GMBH & CO. KG

TABLE 344 COROPLAST FRITZ MÜLLER GMBH & CO. KG: COMPANY OVERVIEW

19.2.10 ADAPTRONIC PRÜFTECHNIK GMBH

TABLE 345 ADAPTRONIC PRÜFTECHNIK GMBH: COMPANY OVERVIEW

19.2.11 CZECH REPUBLIC ONAMBA S.R.O.

TABLE 346 CZECH REPUBLIC ONAMBA S.R.O.: COMPANY OVERVIEW

19.2.12 SPARK MINDA

TABLE 347 SPARK MINDA: COMPANY OVERVIEW

19.2.13 THB GROUP

TABLE 348 THB GROUP: COMPANY OVERVIEW

19.2.14 YURA CORPORATION

TABLE 349 YURA CORPORATION: COMPANY OVERVIEW

19.2.15 SAISON ELECTRONICS

TABLE 350 SAISON ELECTRONICS: COMPANY OVERVIEW

19.2.16 SHENZHEN DEREN ELECTRONICS

TABLE 351 SHENZHEN DEREN ELECTRONICS: COMPANY OVERVIEW

19.2.17 UNITED HARNESS LIMITED

TABLE 352 UNITED HARNESS LIMITED: COMPANY OVERVIEW

19.2.18 HESTO HARNESSES

TABLE 353 HESTO HARNESSES: COMPANY OVERVIEW

19.2.19 BRASCABOS

TABLE 354 BRASCABOS: COMPANY OVERVIEW

19.2.20 THAI SUMMIT GROUP

TABLE 355 THAI SUMMIT GROUP: COMPANY OVERVIEW

20 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 322)

20.1 ASIA PACIFIC EXPECTED TO DOMINATE AUTOMOTIVE WIRING HARNESS MARKET

20.2 OPTICAL FIBER WIRES FOR FUTURE APPLICATIONS - KEY FOCUS AREA

20.3 CONCLUSION

21 APPENDIX (Page No. - 324)

21.1 INSIGHTS OF INDUSTRY EXPERTS

21.2 DISCUSSION GUIDE

21.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

21.4 AVAILABLE CUSTOMIZATIONS

21.4.1 AUTOMOTIVE WIRING HARNESS MARKET, BY APPLICATION & COUNTRY

21.4.1.1 Asia Pacific

21.4.1.1.1 China

21.4.1.1.2 India

21.4.1.1.3 Japan

21.4.1.1.4 South Korea

21.4.1.1.5 Thailand

21.4.1.1.6 Rest of Asia Pacific

21.4.1.2.1 Germany

21.4.1.2.2 France

21.4.1.2.3 UK

21.4.1.2.4 Spain

21.4.1.2.5 Russia

21.4.1.2.6 Italy

21.4.1.2.7 Rest of Europe

21.4.1.3.1 US

21.4.1.3.2 Canada

21.4.1.3.3 Mexico

21.4.1.4.1 Brazil

21.4.1.4.2 South Africa

21.4.1.4.3 Others

21.4.2 AUTOMOTIVE WIRING HARNESS MARKET, BY TYPE & COUNTRY

21.4.2.1 Asia Pacific

21.4.2.1.1 China

21.4.2.1.2 India

21.4.2.1.3 Japan

21.4.2.1.4 South Korea

21.4.2.1.5 Thailand

21.4.2.1.6 Rest of Asia Pacific

21.4.2.2 Europe

21.4.2.2.1 Germany

21.4.2.2.2 France

21.4.2.2.3 UK

21.4.2.2.4 Spain

21.4.2.2.5 Russia

21.4.2.2.6 Italy

21.4.2.2.7 Rest of Europe

21.4.2.3 North America

21.4.2.3.1 US

21.4.2.3.2 Canada

21.4.2.3.3 Mexico

21.4.2.4 RoW

21.4.2.4.1 Brazil

21.4.2.4.2 South Africa

21.4.2.4.3 Others

21.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

21.5 RELATED REPORTS

21.6 AUTHOR DETAILS

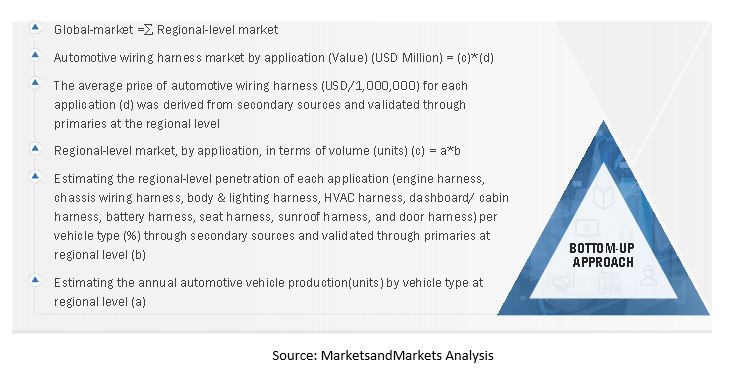

The study involves four main activities to estimate the current size of the automotive wiring harness market.

- Exhaustive secondary research was done to collect information on the market, such as application, transmission type, category, component, material, ICE by transmission type & application & electric vehicle by transmission type & application, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study included the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive wiring harness associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

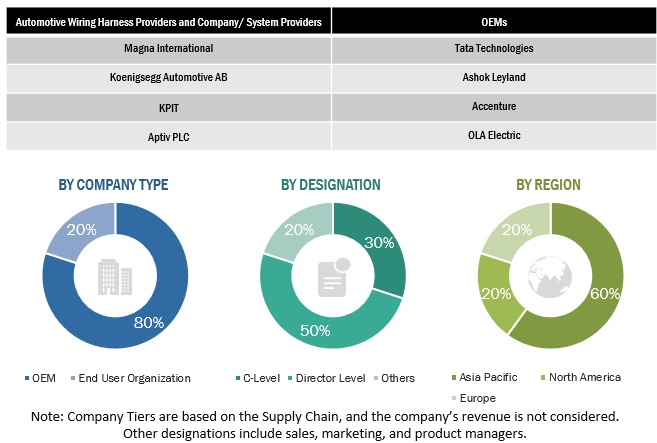

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive wiring harness market scenario through secondary research. Several primary interviews were conducted with market experts from automotive wiring harness providers, component/system providers, and end-user organizations across three major regions, namely, North America, Europe, and Asia Pacific. Approximately 80% of the primary interviews were conducted from the automotive wiring harness providers and component/system providers, and 20% from the end-user organizations. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administrations, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the automotive wiring harness market and other dependent submarkets, as mentioned below:

- The bottom-up approach was used to estimate and validate the size of the market. The market size by application, in terms of volume, was derived by multiplying the region-level breakup for each application (engine harness, chassis wiring harness, body & lighting harness, HVAC harness, dashboard/ cabin harness, battery harness, seat harness, sunroof harness, and door harness) with region-level automotive wiring harness sales.

- The region-level market by application, by volume, was multiplied with the region-level average selling price (ASP) for each application to get this market for each application by value.

- The summation of the region-level market would give the global market, by application (engine harness, chassis wiring harness, body & lighting harness, HVAC harness, dashboard/ cabin harness, battery harness, seat harness, sunroof harness, and door harness). The total value of each region was then summed up to derive the total value of the market by application.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- The top-down approach was used to estimate and validate the market by transmission type in terms of volume and value. The automotive wiring harness market value (USD million) by region (Asia Pacific, North America, Europe, and RoW) was derived from the global market. The penetration of each transmission type (electrical wiring and data transmission) at the regional level was derived from secondary sources and validated through primaries. The penetration of each transmission type (electrical wiring and data transmission) was multiplied by the regional market to get the market value (USD million), by transmission type, for each region. A summation of all region-wise markets was carried out to derive the total market value (USD million) by transmission type. The top-down approach was followed by ICE vehicle by transmission type, material type, data rate, component, and electric vehicle by transmission segments.

Automotive Wiring Harness Market Size: Bottom-Up Approach (Application And Region)

Automotive Wiring Harness Market Size: Top-Down Approach (Transmission Type)

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

-

To define, describe, and forecast the size of the automotive wiring harness market in terms of volume and value

- By application (engine harnesses, chassis harnesses, body & lighting harnesses, HVAC harnesses, dashboard/cabin harnesses, battery harnesses, seat harnesses, sunroof harnesses, and door harnesses)

- By component (connectors, wires, terminals, and others) (in terms of value only)

-

By material type [metallic (copper, aluminum, and other materials) and optical fiber

(glass optical fiber and plastic optical fiber)] (in terms of value only) - ICE & electric vehicles by transmission type (data transmission and electrical wiring) (in terms of value only)

- By data rate (<150 Mbps, 150 MBPS to 1 GBPS, and >1 GBPS) (in terms of value only)

- By ice vehicle type (passenger cars, light commercial vehicles, buses, trucks) & mapped applications (engine harnesses, chassis harnesses, body & lighting harnesses, HVAC harnesses, dashboard/cabin harnesses, battery harnesses, seats, sunroof, and door harnesses)

- By electric vehicle type (BEVs, PHEVs, and FCEVs) & mapped applications (engine harnesses, chassis harnesses, body & lighting harnesses, HVAC harnesses, dashboard/cabin harnesses, battery harnesses, seat, sunroof, and door harnesses)

- By region [Asia Pacific, North America, Europe, and the Rest of the World (RoW)]

- To qualitatively analyze and assess the market for 48V architecture vehicles, by region

- To qualitatively analyze and assess the market, based on category (general wires, heat resistant wires, shielded wires, and tubed wires)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of leading players in the market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue analysis

- To strategically analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend, regulatory analysis, and the COVID-19 impact

- To analyze recent developments, including new product launches, expansions, and other activities, undertaken by key industry participants in the market

Available customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Automotive Wiring Harness Market, By Application & Country

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- South Africa

- Others

Automotive Wiring Harness Market, By Type & Country

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Russia

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- South Africa

- Others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Wiring Harness Market

Automotive Wiring Harness Market comparison (ratings) illustrating the strength of Product portfolio of different companies including Leoni in four parameters: a. Product offerings b. R&D Expenditure c. Inorganic d. Organic 2. Provided ratings chart in terms of Business strategy Excellence on two parameters: a. Product Offerings – Breadth and Depth b. R&D Expenditure Moreover, along with major players in the market, we have provided MNM view and SWOT analysis for Leoni. The same is provided to other major 4 players as well. This includes: 1. Furukuwa Electric 2. Aptiv PLC 3. Yazaki Corporation 4. Sumitomo Electric Industries