Autonomous Mobile Robots Market by Offering (Hardware, Software and Services), Payload Capacity (<100 kg, 100-500 kg, >500 kg), Navigation Technology (Laser/LiDAR, Vision Guidance), Industry (Manufacturing, Retail, E-commerce) - Global Forecast to 2028

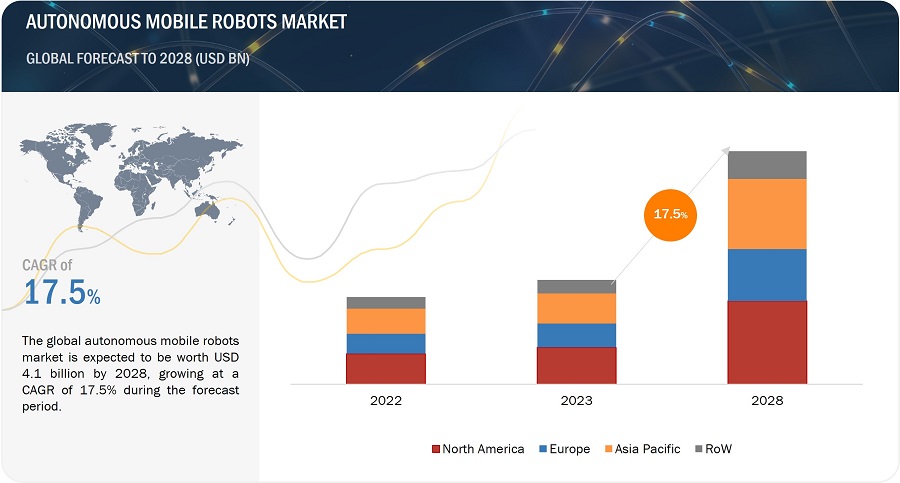

[200 Pages Report] The global autonomous mobile robots market size is estimated to be valued USD 1.8 billion in 2023 and is anticipated to reach USD 4.1 billion by 2028, at a CAGR of 17.5% during the forecast period. The market growth is ascribed to increasing demand for AMRs across several industries, growing need for automation and labor optimization in warehouses, and rising demand for supply chain optimization. Additionally, emerging applications of AMR in a variety of industries are contributing to this market growth.

Autonomous Mobile Robots Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Autonomous Mobile Robots Market Trends

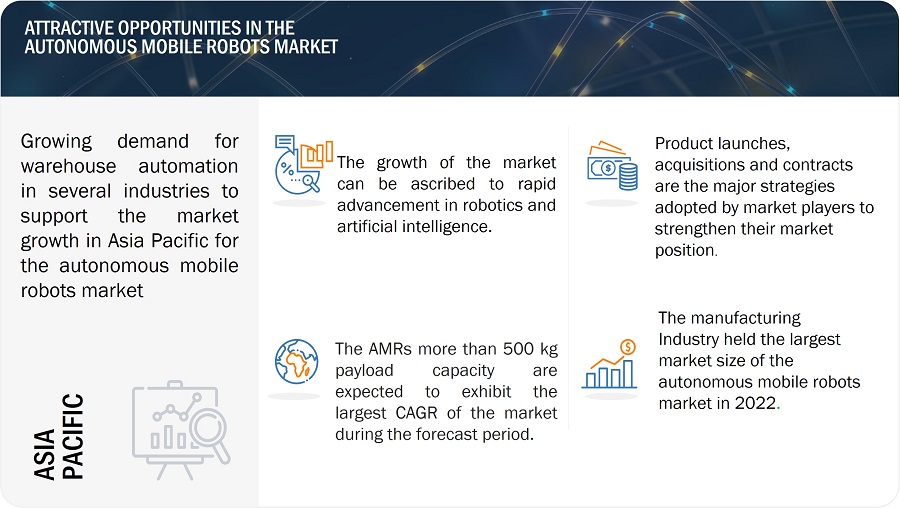

Driver: Rapid advancements in robotics and artificial intelligence

The market for autonomous mobile robots (AMRs) is expanding because of developments in robotics and artificial intelligence (AI) technology, allowing for the creation of sophisticated autonomous mobile robots. These robots are highly effective and versatile for various businesses as they can carry out complicated tasks independently. The development of advanced sensor technologies has greatly enhanced the capabilities of AMRs. Robots can precisely see and navigate their surroundings by using sensors like cameras, ultrasonic sensors, and LiDAR (light detection and ranging) systems. They can detect obstacles, map environments, and make real-time decisions to avoid collisions. For, Instance, Velodyne, which specializes in LiDAR sensors, have made significant advancements in sensor technology, enabling better perception and navigation for AMRs. AI algorithms and machine learning techniques enable AMRs to learn and adapt to their environments. Computer vision allows robots to recognize and interpret objects, people, and gestures, allowing for more sophisticated interaction with the surroundings. For instance, Boston Dynamics have developed AMRs like "Spot" that utilize advanced computer vision algorithms to perform inspection, surveillance, and data collection tasks. Moreover, AMRs are equipped with intelligent navigation systems utilize AI algorithms to plan efficient paths, avoid obstacles, and adapt to dynamic surroundings. And cloud computing enables real-time data processing and analysis and remote monitoring and control of AMRs. For instance, Mobile Industrial Robots offers collaborative AMRs that use AI-based navigation algorithms to optimize routes and avoid collisions in industrial and warehouse settings.

Restraint: High initial investment

The high initial expenditure required for Autonomous Mobile Robots (AMRs) is a key barrier to their implementation. Implementing Autonomous Mobile Robots (AMRs) requires a significant budget allocation for hardware acquisition, infrastructure modifications, and software development. Organizations need to invest in robotics, sensors, and other relevant equipment and make infrastructure changes such as navigation systems and charging stations. Integrating AMRs with existing enterprise systems such as Warehouse management systems or ERP systems necessitates extra software customization. Moreover, organizations must allocate resources for training employees to effectively work with AMRs and cover ongoing operational costs such as maintenance, repairs, and upgrades. These factors contribute to the high initial investment required for AMR implementation, which can be a barrier for some organizations, especially small and medium-sized enterprises with limited budgets.

Opportunity: potential growth in industry-specific applications

Businesses can open new opportunities and promote innovation by customising AMR technology to match particular sectors' distinct requirements and constraints. AMRs offers solutions to various industries including e-commerce, retail, manufacturing, food & beverage, healthcare, and hospitality. In healthcare industry, AMRs can be customized for supporting tasks such as delivery of supplies and medicines, linen and waste management, disinfection and cleaning, remote monitoring, assistance in patent care and in surgery. For instance, Savioke's Relay robot is designed for healthcare settings, delivering medication and supplies autonomously in hospitals. In retail and e-commerce, AMRs improve inventory management, order fulfillment, and customer experiences by navigating store aisles, restocking shelves, and offering personalized recommendations. The increasing digitalization of supply chains with the advent of Industry 4.0, IoT, big data analytics, and cloud computing has positively impacted application of AMRs.

Challenge: Integrating AMRs into existing workflows and systems

Many industries already have established processes, infrastructure, and legacy systems in place. Integrating autonomous mobile robots (AMRs) with existing systems poses challenges such as compatibility issues, data integration complexities, system scalability, system complexity, customization/configuration requirements, security and privacy concerns, and the need for user training and adoption.

Integrating autonomous mobile robots (AMRs) into various industries poses challenges as they need to coordinate seamlessly with existing systems. In warehouse and logistics operations, AMRs must establish communication with WMS and ERP systems, encountering hurdles such as different protocols and real-time synchronization. Similarly, AMRs must integrate with CAD, MES, and PLC systems to synchronize with machinery in manufacturing. For retail applications, AMRs must integrate with POS systems, barcode scanners, and inventory databases to ensure precise tracking. Moreover, in healthcare, integrating AMRs involves coordinating with EHR, medication management, and patient monitoring systems while prioritizing data security and compliance. Addressing these challenges necessitates meticulous coordination and compatibility to achieve successful integration.

To overcome these obstacles, AMR developers, system integrators, and stakeholders must work together, plan carefully, and have technical know-how. Making effective integration plans and ensuring a successful implementation requires understanding the current systems' limits.

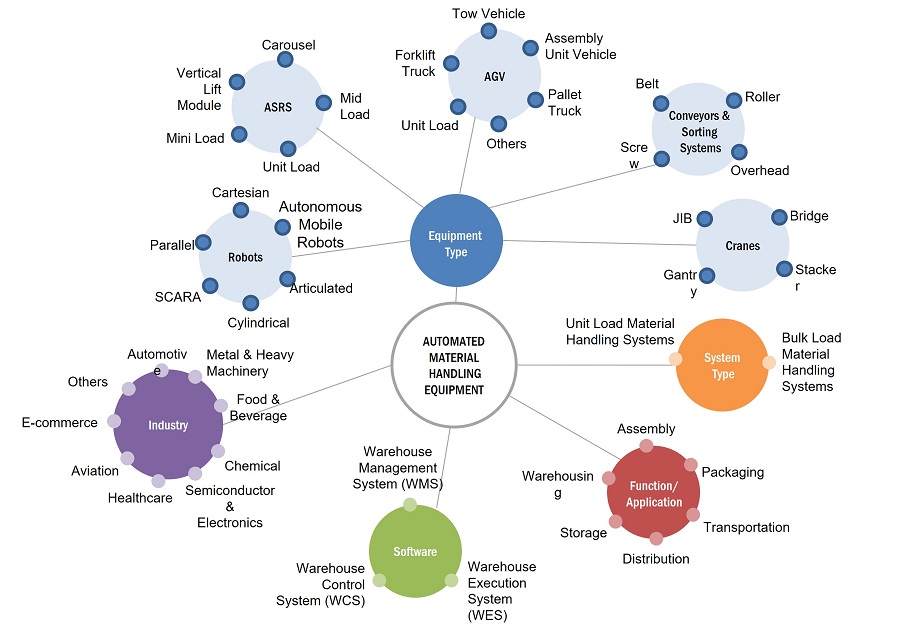

Market Ecosystem

Autonomous Mobile Robots Market: Key Trends

ABB, Omron Automation, Mobile Industrial Robots, Fetch Robotics, OTTO Motors are the top players in the AMR market. These AMR companies with advance robotics and AI technology trends with a comprehensive product portfolio and solid geographic footprint.

Hardware segment accounted for the largest share of autonomous mobile robots market in 2022

Hardware segment accounted for the largest market share in the autonomous mobile robots (AMR) market due to their essential role in enabling robot functionality. Sensors serve as the robot's senses, batteries supply the necessary power, and actuators allow for movement and manipulation. For AMRs to function, reliably, and productively, efficient and long-lasting batteries, precise and dependable sensors, and high-quality actuators are essential. Robots can see their surroundings, navigate, and interact with objects because of the cooperation of these hardware components, which enables autonomous operation. The ongoing development and broad implementation of AMRs across numerous industries are fueled by advancements in battery technology, sensor capabilities, and actuator precision.

Laser/LiDAR navigation technology to account for the largest share in the market during forecast period.

The Laser/ LiDAR navigation technology account for the largest share in the market during forecast period. For autonomous mobile robots (AMRs), laser/LiDAR technology is essential because it provides accurate environmental sensing, obstacle avoidance, navigation, localization, mapping, and object recognition. AMRs are able to sense and navigate their environment precisely because to laser/LiDAR sensors, which produce accurate 3D maps of the surroundings by producing laser pulses and measuring the reflected light. They aid AMRs in real-time obstacle detection, safe path planning, and collision avoidance. AMRs can construct maps and determine their own positions within them thanks to the simultaneous localization and mapping (SLAM) algorithms that incorporate laser/LiDAR sensors.

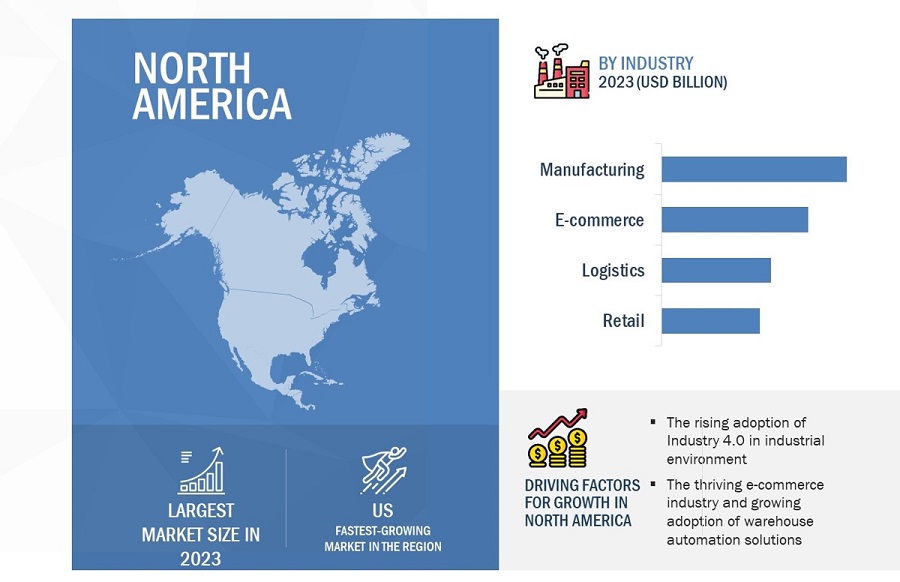

North America held the largest autonomous mobile robots market share in 2022.

AMRs are being increasingly adopted in a diverse range of industries in North America, including manufacturing, logistics, retail, healthcare, and e-commerce. These robots are used for several tasks, such as material handling, picking and packing, inventory management, and even healthcare supply. The versatile nature of AMRs makes them suitable for a wide range of applications, driving their adoption across industries in North America.

Autonomous Mobile Robots Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the Autonomous Mobile Robots market are ABB, Omron Automation, Mobile Industrial Robots, Fetch Robotics, OTTO Motors, Locus Robotics, and Geek+ among others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the Autonomous Mobile Robots market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Offering, Payload Capacity, Navigation Technology, Industry, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

ABB (Switzerland), Omron Automation (US), Mobile Industrial Robots (Denmark), Fetch Robotics (US), OTTO Motors (Canada) |

Autonomous Mobile Robots Market Highlights

In this report, the overall autonomous mobile robots market has been segmented based on Offering, Payload Capacity, Navigation Technology, Industry, and Region

|

Segment |

Subsegment |

|

By Offering |

|

|

By Payload Capacity |

|

|

By Navigation Technology |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In March 2023, Locus Robotics introduced LocusONE, a data science-driven warehouse platform to enable seamless operation and management of large quantities of multiple AMR form factors as a single, coordinated fleet in all sizes of warehouses.

- In January 2023, Geek+ launched RoboShuttle Plus, which combines its storage RoboShuttle robot with both tote-carrying P40 and flagship rack-to-person P800 robots into one operational area.

- In January 2021, Fetch Robotics launched PalletTransport1500 an autonomous mobile robot designed specifically to replace forklift uses in warehouses.

Frequently Asked Questions (FAQ):

What will be the global autonomous mobile robots market size in 2023?

The autonomous mobile robots market is expected to be valued USD 1.8 billion in 2023.

Who are the global autonomous mobile robots market winners?

Companies such as ABB, Omron Automation, Mobile Industrial Robots, Fetch Robotics fall under the winners’ category.

Which region is expected to hold the highest global autonomous mobile robots market share?

North America will dominate the global autonomous mobile robots market in 2023. The region’s growing retail and e-commerce sectors are expected to support substantial market growth.

What are the major drivers of the autonomous mobile robots market?

Surging demand for e-commerce and the growing need for efficient order fulfillment is expected to drive the adoption of AMRs in warehouses.

What are the major strategies adopted by AMR companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1. Study Objectives

1.2. Market Definition

1.3. Inclusions and Exclusions

1.4. Study Scope

1.4.1. Market covered

1.4.2. Geographic scope

1.5. Year considered

1.6. Currency

1.7. Limitations

1.8. Stakeholders

2 RESEARCH METHODOLOGY

2.1. Research Data

2.1.1. Secondary Data

2.1.1.1. Major secondary sources

2.1.1.2. Key data from secondary sources

2.1.2. Primary Data

2.1.2.1. Key data from primary sources

2.1.2.2. Breakdown of primaries

2.1.3. Secondary and Primary Research

2.1.3.1. Key Industry Insights

2.2. Market Share Estimation

2.2.1. Bottom-Up Approach

2.2.1.1. Approach of arriving at market size by bottom-up analysis (demand size)

2.2.2. Top-Down Approach

2.2.2.1. Approach of arriving at market size by top-down analysis (supply size)

2.2.3. Market Breakdown and Data Triangulation

2.2.4. Research Assumptions

2.2.5. Research limitations

2.2.6. Risk Assessment

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Supply/Value Chain Analysis

5.4. Ecosystem/Market Map

5.5. Pricing Analysis

5.5.1. ASP analysis of key players

5.5.2. ASP trends

5.6. Trends/Disruptions impacting customer’ business

5.7. Technology Analysis

5.8. Porter’s Five Forces Analysis

5.9. Stakeholders & buying criteria

5.9.1. Key stakeholders in buying process

5.9.2. Buying criteria

5.10. Case Study Analysis

5.11. Trade Analysis

5.12. Patent Analysis

5.13. Key conferences & events in 2022 - 2023

5.14. Regulatory Landscape

5.14.1. Regulatory bodies, government agencies, and other organizations

5.14.2. Regulatory Standards

6 AUTONOMOUS MOBILE ROBOTICS MARKET, BY TYPE

6.1. Introduction

6.2. Goods-to-Person Picking Robots

6.3. Self-Driving Forklifts

6.4. Autonomous Inventory Robots

6.5. Unmanned Aerial Vehicles

7 AUTONOMOUS MOBILE ROBOTICS MARKET, BY COMPONENT

7.1. Introduction

7.2. Hardware

7.2.1. Sensor

7.2.2. Actuator

7.2.3. Power Supply

7.2.4. Control System

7.2.5. Others

7.3. Software

8 AUTONOMOUS MOBILE ROBOTICS MARKET, BY APPLICATION

8.1. Introduction

8.2. Sorting

8.3. Pick and Place

8.4. Tugging

8.5. Warehouse Fleet Management

8.6. Others

9 AUTONOMOUS MOBILE ROBOTICS MARKET, BY END-USER

9.1. Introduction

9.2. Manufacturing

9.3. Warehousing & Logistics

9.4. Healthcare

9.5. Retail & Hospitality

9.6. Smart Cities & Public Sector

9.7. Agriculture

9.8. Military & defense

9.9. Others

10 AUTONOMOUS MOBILE ROBOTICS MARKET, BY GEOGRAPHY

10.1. Introduction

10.2. North America

10.2.1. US

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. UK

10.3.2. Germany

10.3.3. France

10.3.4. Italy

10.3.5. Rest of Europe

10.4. APAC

10.4.1. Japan

10.4.2. China

10.4.3. South Korea

10.4.4. India

10.4.5. Rest of APAC

10.5. Rest of the World (RoW)

10.5.1. South America

10.5.2. Middle East and Africa

11 COMPETITIVE LANDSCAPE

11.1. Overview

11.2. Key Player Strategies/ Right to Win

11.3. Top 5 Company Revenue Analysis

11.4. Market Share Analysis

11.5. Company Evaluation Quadrant

11.5.1. Star

11.5.2. Emerging Leader

11.5.3. Pervasive

11.5.4. Participant

11.6. Startup/SME Evaluation Quadrant

11.6.1. Progressive Companies

11.6.2. Responsive Companies

11.6.3. Dynamic Companies

11.6.4. Starting Blocks

11.7. Company Footprint

11.8. Competitive Benchmarking

11.9. Competitive Scenario & Trends

11.9.1. Product launch

11.9.2. Deals

11.9.3. Others

12 COMPANY PROFILE

12.1. Introduction

12.2. Major Players

12.2.1. ABB

12.2.2. Omron Corporation

12.2.3. Boston Dynamics

12.2.4. Clearpath Robotics Inc.

12.2.5. GreyOrange

12.2.6. Harvest Automation

12.2.7. IAM Robotics

12.2.8. Gizelis Robotics

12.2.9. KUKA AG

12.2.10. Teradyne Inc.

12.3. Other Players

12.3.1. Robotnik

12.3.2. Multiway Robotics (Shenzhen) Company

12.3.3. Mobile Industrial Robots

12.3.4. Addverb Technologies Private Limited

12.3.5. AMS, Inc

12.3.6. Clearpath Robotics, Inc.

12.3.7. Fetch Robotics, Inc.

12.3.8. AutoGuide, LLC:

12.3.9. ASTI Mobile Robotics

12.3.10. Tetrahedron Manufacturing Services Pvt Ltd

12.3.11. IEI Integration Corp.

12.3.12. SESTO Robotics.

12.3.13. Gridbots Technologies Private Limited

12.3.14. KIVNON LOGÍSTICA S.L.U.

12.3.15. Isitec Internationa

Note:

This ToC is tentative and minor changes are possible as the study progresses.

In company profiles section 25 companies will be profiled. 10 companies will have detailed profile and rest 15 will be profiled in tabular format

The study involves four major activities that estimate the size of the autonomous mobile robots market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the autonomous mobile robots market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

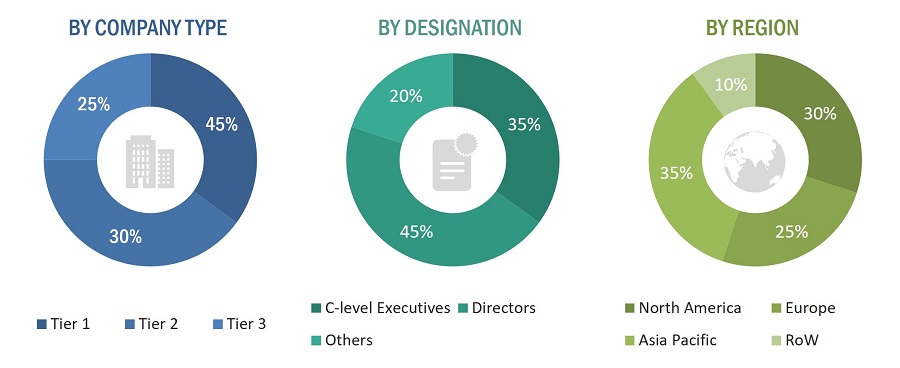

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply-side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from autonomous mobile robots providers, (such as ABB, Fetch Robotics, OTTO Motors) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the autonomous mobile robots market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

An Autonomous Mobile Robot (AMR) is a robotic system having the ability to move and navigate in an industrial environment without human intervention or guidance. These robots are developed to operate autonomously, relying on sensors, artificial intelligence, and advanced software algorithms to perceive their surroundings, make decisions, and further execute tasks.

AMRs are equipped with various sensors, such as cameras, LiDAR, or sensors to perceive and interpret the environment. These sensors enable the robot to detect obstacles, map its surroundings, and further navigate safely and efficiently. This research study majorly considers flat surface AMRs used inhouse logistics activities of several industries such as manufacturing, e-commerce, retail healthcare, among others.

Stakeholders

- Research institutes and organizations

- Original equipment manufacturers (OEMs) of autonomous mobile robots

- Suppliers and distributors

- Hardware and software providers

- Retail service providers

- Technology standard organizations, forums, alliances, and associations

- Associations and industrial bodies

- End-user industries

The main objectives of this study are as follows:

- To define, describe, and forecast the autonomous mobile robots market based on offering, payload capacity, navigation technology, industry, and region

- To describe and forecast the size of the autonomous mobile robots market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To provide a detailed overview of the ecosystem of the autonomous mobile robots market

- To analyze opportunities for stakeholders by identifying high-growth segments of the autonomous mobile robots market

- To study the complete value chain of the autonomous mobile robots market

- To study and analyze the probable impact of the recession on the autonomous mobile robots market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, expansions, and partnerships, in the autonomous mobile robots market

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Autonomous Mobile Robots Market