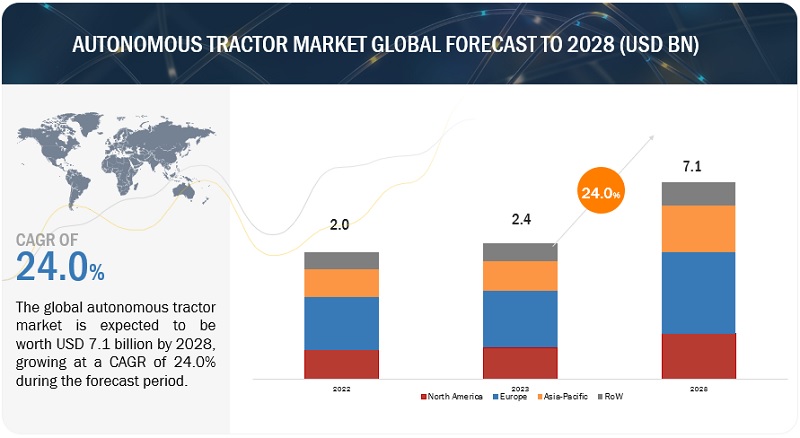

Autonomous Tractors Market by Power Output (Up to 30 HP, 31–100 HP, 101 HP and Above), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Farm Application, Component, and Region - Global Forecast to 2028

Market Segmentation

| Report Metrics | Details |

|

Market size available for years |

2019 - |

|

CAGR % |

0 |

Top 10 companies in Autonomous Tractors Market

Autonomous Tractors Market News

| Publish Date | Autonomous Tractors Market Updates |

|---|---|

| 25-May-2023 | MK-V Tractor: The Tesla of agriculture? |

| 19-May-2023 | John Deere's Autonomous Tractor on Its Farm of the Future - John ... |

Speak to Analyst to get the Global Forecasts Data up to 2028

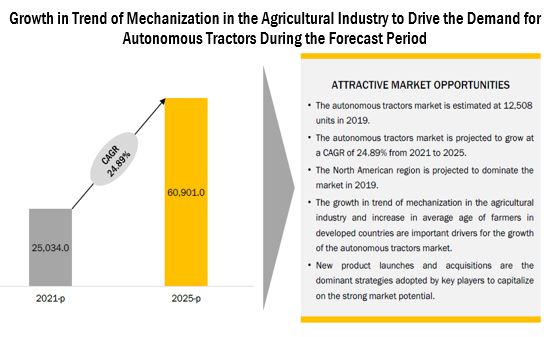

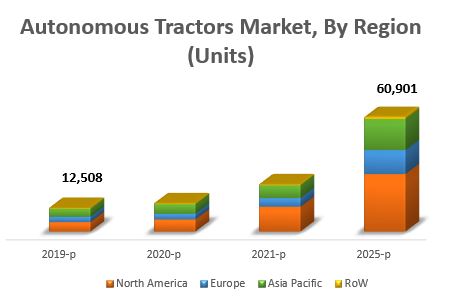

[137 Pages Report] The autonomous tractors market is estimated to witness a demand of approximately 12,508 Units in 2019 and 60,901 Units by 2025, at a CAGR of 24.89%. The basic objective of this report is to define, segment, and project the global market size for autonomous tractors on the basis of power output, component, crop type, farm application, and region. It also helps to understand the structure of the market by identifying its various segments. Other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro and micro indicators of this market to provide factor analysis, and to project the size of the market.

For More details on this research, Request Free Sample Report

This report includes estimations of the market size in terms of value (USD million) and volume (units). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global autonomous tractors market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research; some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The key players that are profiled in the report include AGCO (US), CNH (UK), Mahindra & Mahindra (India), Deere (US), Kubota Corporation (Japan), Yanmar (Japan), and Autonomous Tractor Corporation (US).

This report is targeted at existing stakeholders in the industry, which include the following:

- Government and research organizations

- Associations and industrial bodies

- Raw material suppliers and distributors

- Autonomous tractor component manufacturers

- Autonomous tractors, distributors, and suppliers

- Agriculture equipment and component manufacturing associations

- Agricultural institutes and universities

- Consumers, including farmers

- Logistical service providers

- Technology providers to autonomous tractor component manufacturing companies

- Government, legislative, and regulatory bodies

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

On the basis of Power Output, the market for autonomous tractors has been segmented as follows:

- Up to 30 HP

- 31-100 HP

- 101 HP & above

On the basis of Component, the market for autonomous tractors has been segmented as follows:

- LiDAR

- Radar

- GPS

- Camera/vision systems

- Ultrasonic sensors

- Hand-held devices

On the basis of Crop Type, the market for autonomous tractors has been segmented as follows:

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

On the basis of Farm Application, the market for autonomous tractors has been segmented as follows:

- Tillage (primary & secondary tillage)

- Seed sowing

- Harvesting

- Others (spraying and fertilizing)

On the basis of Region, the market for autonomous tractors has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the Rest of Asia Pacific autonomous tractors market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global autonomous tractors market is projected to witness demand for 12,508 Units in 2019 and 60,901 Units by 2025, at a CAGR of 24.89%. The growth of the market is expected to be driven by the improved efficiency and productivity of crop yield offered by these tractors and growth in initiatives by governments for the adoption of new technologies. The increase in the average age of farmers in developed countries and decline in the availability of labor are also major factors that will drive the demand for autonomous tractors in the near future.

For More details on this research, Request Free Sample Report

On the basis of power output, 101 HP & above will account for the largest share, followed by the 31-100 HP power output segment, in 2019. The demand for medium-powered tractors is expected to grow at a higher rate as compared to high-powered autonomous tractors, owing to the benefits of four-wheeled tractors such as better soil quality maintenance & control, and cultivating capacities at a high fuel economy. These tractors are versatile and can be used for multiple applications on and off the field. Owing to these factors, most farmers prefer tractors in this range.

In terms of component, the market has been segmented into LiDAR, radar, GPS, camera/vision system, ultrasonic sensors, and hand-held devices. The radar segment in the autonomous market is projected to be the largest by 2025. Radar sensors can determine the velocity, range, and angle of moving objects and can work in almost all weather conditions. They are more cost-effective than LiDAR systems but more expensive compared to cameras, which makes them a preferable option to other components considered by manufacturers for incorporation in autonomous tractors.

On the basis of crop type, the market has been studied for cereals & grains (corn, wheat, rice, and others), oilseeds & pulses (soybean, canola, and others), and fruits & vegetables (orange, vineyards, and others). With the increase in the global population, the demand for fruits & vegetables is also increasing at a rapid pace. A trend shows that weeding and harvesting of fruits & vegetables largely rely on hand labor owing to the fact that fragile fruits & vegetables are delicate, and machinery could damage the crops or the trees that produce them. As a result, new technologies such as autonomous tractors are being developed for fruit & vegetable cultivation.

On the basis of farm application, the global market has been segmented into (primary and secondary), seed sowing, and harvesting. The tillage segment will dominate the market with the largest share in 2019. With advancements in technology and various research & development activities by agronomists, tillage activities are increasingly being made autonomous for broad acre and row crop farming.

North America is expected to account for the largest share of the market in 2019. The higher disposable incomes of farmers, lack of trained farm labor, and well-developed technology are the primary reasons for the future expansion of the North American autonomous tractors market. In North America, it being a developed region, the sizes of farms are usually large, and customer loyalty is high. As the arms are large, demand for high-powered tractors in the US is starting to gain traction. The US is the largest market for autonomous tractors in the North American region.

The market is dominated by AGCO (US), CNH (UK), Mahindra & Mahindra (India), Deere (US), Kubota Corporation (Japan), Yanmar (Japan), and Autonomous Tractor Corporation (US).These companies have a strong distribution network at the global level. The key strategies adopted by these companies to sustain their market position are new product development and acquisitions. All the parameters mentioned above have been analyzed to derive the market ranking of these companies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Autonomous Tractors Market

4.2 Market for Autonomous Tractors, By Region, 2019–2025

4.3 Asia Pacific Market for Autonomous Tractors, By Power Output and Country

4.4 Market for Autonomous Tractors, By Crop Type & Region

4.5 Market for Autonomous Tractors Share: Key Countries

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Improved Efficiency and Productivity Through Improved Crop Yields

5.2.1.2 Growth in Trend of Mechanization in the Agricultural Industry

5.2.1.3 Favorable Government Initiatives for Adoption of Modern Agricultural Techniques

5.2.1.4 Introduction of Autonomous Tractors By Leading Market Players in Developing Countries

5.2.1.5 Increase in Average Age of Farmers in Developed Countries

5.2.1.6 Decline in Availability of Labor and Increase in Labor Wages

5.2.2 Restraints

5.2.2.1 High Initial Capital Investment

5.2.2.2 Lack of Technical Knowledge Among Farmers

5.2.3 Opportunities

5.2.3.1 Integration of Smartphones With Agricultural Hardware and Software Applications for Autonomous Tractors

5.2.4 Challenges

5.2.4.1 Lack of Data Management Practices in Agriculture

5.2.4.2 Smaller Land Holdings in Developing Economies

6 Market For Autonomous Tractors, By Component (Page No. - 44)

6.1 Introduction

6.2 LiDAR

6.3 Radar

6.4 GPS

6.5 Camera/Vision Segments

6.6 Ultrasonic Sensors

6.7 Hand-Held Devices

7 Market For Autonomous Tractors, By Power Output (Page No. - 52)

7.1 Introduction

7.2 Up to 30 HP

7.3 31–100 HP

7.4 101 HP & Above

8 Market For Autonomous Tractors, By Crop Type (Page No. - 57)

8.1 Introduction

8.2 Cereals & Grains

8.2.1 Corn

8.2.2 Wheat

8.2.3 Rice

8.2.4 Others

8.3 Oilseeds & Pulses

8.3.1 Soybean

8.3.2 Canola

8.3.3 Others

8.4 Fruits & Vegetables

8.4.1 Orange

8.4.2 Vineyards

8.4.3 Others

9 Market For Autonomous Tractors, By Farm Application (Page No. - 64)

9.1 Introduction

9.2 Tillage (Primary & Secondary Tillage)

9.3 Seed Sowing

9.4 Harvesting

9.5 Other Farm Applications

10 Market For Autonomous Tractors, By Region (Page No. - 69)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Rest of Asia Pacific

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 UK

10.3.5 Turkey

10.3.6 Rest of Europe

10.4 North America

10.4.1 US

10.4.2 Canada

10.4.3 Mexico

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 Russia

11 Competitive Landscape (Page No. - 87)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 New Product Developments

11.3.2 Collaborations

11.3.3 Acquisitions

11.3.4 Expansions

12 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Agco

12.2 CNH

12.3 Mahindra & Mahindra Ltd.

12.4 Deere & Company

12.5 Kubota Corporation

12.6 Yanmar Co., Ltd.

12.7 Autonomous Tractor Corporation

12.8 Trimble, Inc.

12.9 Agjunction, Inc.

12.10 Raven Industries

12.11 AG Leader Technology

12.12 Dutch Power Company

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 128)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (47 Tables)

Table 1 Autonomous Tractors Market Size, By Component, 2019–2025 (‘000 Units)

Table 2 Market for Autonomous Tractors Size, By Component, 2019–2025 (USD Million)

Table 3 LiDAR Market Size, By Region, 2019–2025 (‘Ooo Units)

Table 4 LiDAR Market Size, By Region, 2019–2025 (USD Million)

Table 5 Radar Market Size, By Region, 2019–2025 (‘000 Units)

Table 6 Radar Market Size, By Region, 2019–2025 (USD Million)

Table 7 GPS Market Size, By Region, 2019–2025 (‘000 Units)

Table 8 GPS Market Size, By Region, 2019–2025 (USD Thousand)

Table 9 Camera Vision Systems Market Size, By Region, 2019–2025 (‘000 Units)

Table 10 Camera Vision Systemsmarket Size, By Region, 2019–2025 (USD Million)

Table 11 Ultrasonic Sensors Market Size, By Region, 2019–2025 (‘000 Units)

Table 12 Ultrasonic Sensors Market Size, By Region, 2019–2025 (USD Thousand)

Table 13 Hand-Held Devices Market Size, By Region, 2019–2025 (‘000 Units)

Table 14 Hand-Held Devices Market Size, By Region, 2019–2025 (USD Thousand)

Table 15 By Market Size, By Power Output, 2019–2025 (Units)

Table 16 Up to 30 HP: By Market Size, By Region, 2019–2025 (Units)

Table 17 31-100 HP: By Market Size, By Region, 2019–2025 (Units)

Table 18 101 HP & Above: By Market Size, By Region, 2019–2025 (Units)

Table 19 Market for Autonomous Tractors Size, By Crop Type, 2019–2025 (USD Million)

Table 20 Cereals & Grains: Market for Autonomous Tractors Size, By Region, 2019–2025 (USD Million)

Table 21 Cereals & Grains: By Market Size, By Sub-Crop Type, 2019–2025 (USD Million)

Table 22 Oilseeds & Pulses: Market for Autonomous Tractors Size, By Region, 2019–2025 (USD Million)

Table 23 Oilseeds & Pulses: Autonomous Tractors Market Size, By Sub-Crop Type, 2019–2025 (USD Million)

Table 24 Fruits & Vegetables: Market for Autonomous Tractors Size, By Region, 2019–2025 (USD Million)

Table 25 Fruits & Vegetables: By Market Size, By Sub-Crop Type, 2019–2025 (USD Million)

Table 26 Market for Autonomous Tractors Size, By Farm Application, 2019–2025 (USD Million)

Table 27 Tillage: Market for Autonomous Tractors Size, By Region, 2019–2025 (USD Million)

Table 28 Seed Sowing: By Market Size, By Region, 2019–2025 (USD Million)

Table 29 Harvesting: Market for Autonomous Tractors Size, By Region, 2019–2025 (USD Million)

Table 30 Other Farm Applications: By Market Size, By Region, 2019–2025 (USD Million)

Table 31 Autonomous Tractors Market Size, By Region, 2019–2025 (Units)

Table 32 Asia Pacific: Market for Autonomous Tractors, By Country, 2019–2025 (Units)

Table 33 Asia Pacific: Market for Autonomous Tractors Size, By Crop Type, 2019–2025 (USD Million)

Table 34 Asia Pacific: Market for Autonomous Tractors Size, By Farm Application, 2019–2025 (USD Million)

Table 35 Europe: Market for Autonomous Tractors Size, By Country, 2019–2025 (Units)

Table 36 Europe: By Market Size, By Crop Type, 2019–2025 (USD Million)

Table 37 Europe: Market for Autonomous Tractors Size, By Farm Application, 2019–2025 (USD Million)

Table 38 North America: Market for Autonomous Tractors, By Country, 2019–2025 (Units)

Table 39 North America: Market for Autonomous Tractors Size, By Crop Type, 2019–2025 (USD Million)

Table 40 North America: By Market Size, By Farm Application, 2019–2025 (USD Million)

Table 41 RoW: Market for Autonomous Tractors Size, By Country, 2019–2025 (Units)

Table 42 RoW: Market for Autonomous Tractors Size, By Crop Type, 2019–2025 (USD Million)

Table 43 RoW: Autonomous Tractors Market Size, By Farm Application, 2019–2025 (USD Million)

Table 44 New Product Developments, 2013–2017

Table 45 Collaborations, 2014–2016

Table 46 Acquisitions 2015–2017

Table 47 Expansions, 2013–2017

List of Figures (36 Figures)

Figure 1 Research Design: Autonomous Tractors Market

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market for Autonomous Tractors, By Power Output (Units)

Figure 7 Market for Autonomous Tractors, By Component (000’ Units)

Figure 8 Market for Autonomous Tractors, By Crop Type (USD Million)

Figure 9 Market for Autonomous Tractors, By Farm Application (USD Million)

Figure 10 Market for Autonomous Tractors, By Region (Units)

Figure 11 Growth in Trend of Mechanization in the Agricultural Industry to Drive the Demand for Autonomous Tractors During the Forecast Period

Figure 12 North America is Projected to Dominate the Market Through 2025

Figure 13 China Expected to Lead the Market in 2019

Figure 14 Fruits & Vegetables Segment Projected to Dominate the Market in 2019

Figure 15 US and China: Important Markets for Autonomous Tractors, 2019

Figure 16 Autonomous Tractors Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Average Age of A Principal Farm Operator in the Us

Figure 18 Employment in Agriculture (% of Total Employment)

Figure 19 Average Farm Holding Size: 2015 (Ha/Holding)

Figure 20 Autonomous Tractors Market, By Region, 2021 vs 2025 (Units)

Figure 21 North America is Expected to Account for the Largest Share of the Global Market for Autonomous Tractors

Figure 22 Asia Pacific Market for Autonomous Tractors Snapshot

Figure 23 Europe: Market for Autonomous Tractors, 2021 vs 2025 (Units)

Figure 24 North America: Market for Autonomous Tractors Snapshot

Figure 25 RoW: Market for Autonomous Tractors, 2021 vs 2025

Figure 26 Companies Adopted Expansion as the Key Growth Strategy From 2016 to 2017

Figure 27 Autonomous Tractor Market Ranking: 2017

Figure 28 Agco: Company Snapshot

Figure 29 CNH Industrial N.V.: Company Snapshot

Figure 30 Mahindra & Mahindra Ltd.: Company Snapshot

Figure 31 Deere & Company: Company Snapshot

Figure 32 Kubota Corporation: Company Snapshot

Figure 33 Yanmar Co., Ltd.: Company Snapshot

Figure 34 Trimble, Inc.: Company Snapshot

Figure 35 Agjunction, Inc.: Company Snapshot

Figure 36 Raven Industries: Company Snapshot

Growth opportunities and latent adjacency in Autonomous Tractors Market