Ball Valves Market by Type (Trunnion-mounted, Floating, Rising Stem), Material (Stainless Steel, Cast Iron, Alloy-based), Size, Industry (Oil & Gas, Energy & Power, Water & Wastewater) and Region - Global Forecast to 2027

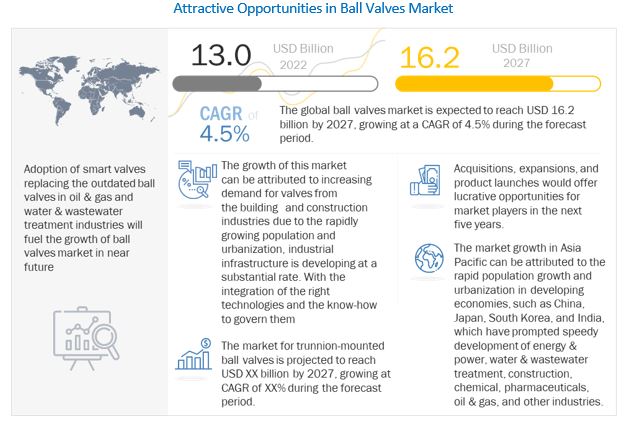

The ball valves market size is projected to reach USD 16.2 billion by 2027, growing at a CAGR of 4.5% during the forecast period.

The market growth is mainly attributed to increasing demand for ball valves in new and upgrades of existing of nuclear power plants. Implementation of 3D printing technologies for manufacturing of ball valves and digital transformation in industrial plants are creating high growth opportunities for the ball valves market. However, intense pricing pressure and lack of standardization are restricting the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rapid industrialization, urbanization, and smart city development

With a rapidly growing population and urbanization, industrial infrastructure is developing at a substantial rate. With the integration of the right technologies and the know-how to govern them, several cities can respond quickly and accurately to problems in the fields of energy, transportation, healthcare, education, as well as to natural disasters while making their communities more inclusive, resilient, and sustainable.

Cities are beginning to and will continue to, integrate technological dynamism into municipal operations, from transportation to infrastructure repair and more. Smart cities use data to manage resources more efficiently. The growing focus on industrial expansion in several industries such as water and wastewater treatment, chemicals, oil & gas, energy & power, among others, is expected to provide lucrative opportunities for the players in the ball valves industry.

Restraints: Lack of standardization and governing policies

Ball valves manufacturers are subjected to different governing policies and standards based on regions. Standardization might also differ based on industries and applications. Ball valves are used in several industries, including energy & power, oil & gas, building & construction, and semiconductor that has distinct standard requirements. This heterogeneity restricts the market growth as manufacturers requirement to adhere to these distinct standards lead to additional fabrication cost. However, to counter this problem, manufacturers are setting up manufacturing facilities in different regions, but incurs additional investments.

Opportunities: Technologies are expected to create growth for the ball valves market

Valves are critical components of various industrial equipment. The failure of valves could lead to disruptions in plant processes. Traditional, schedule-based maintenance methods fail to alert manufacturing companies about impending valve failures, which results in unplanned downtime. However, recent developments in data science, communications, and computing power have enabled companies to leverage Industrial Internet of Things (IIoT) technologies for reducing unplanned downtime due to valve failure.

IIoT enables valve experts to monitor the health of valves in a plant remotely and track the efficiency, life cycle, and potential chances of failure of these valves. Thus, IIoT ensures better valve performance and secures the work environment. Valves equipped with sensors and connected through IIoT can help to reduce maintenance and shutdown costs.

Rise in collaboration activities among players

The valve market is highly fragmented. Mergers and acquisitions are expected to help manufacturers enhance their product portfolios and acquire a larger market share. Due to declining oil prices, large industry players acquired small companies to ensure sustainable growth and profitability. For instance, in 2017, Emerson completed the purchase of the Valves & Controls business from Pentair plc (US) for

USD 3.15 billion. Similarly, in 2018, Emerson acquired Advanced Engineering Valves (Belgium), a leading manufacturer of innovative valve technology. In 2019, Emerson acquired the Spence and Nicholson product lines from CIRCOR International to expand its portfolio of steam system solutions for process industries and commercial buildings.

In April 2022, Neles merged with Valmet (Finland), an automation system provider to operate as Valmet’s Flow Control Business Line. Likewise, in 2019, IMI plc acquired PBM, a manufacturer of valves and specialty valves for both sanitary and industrial applications. All these acquisitions would result in increased competition in the ball valves market.

Market for stainless steel ball valves to grow at highest CAGR during the forecast period

Stainless steel is preferred over carbon steel in applications where corrosion resistance is of utmost importance. Stainless steel ball valves typically experience demand from pharmaceuticals, chemicals, oil & gas, and food & beverages industries. In the chemical industry, valves are required to tolerate challenging conditions ranging from high toxicity to medium to aggressive chemical compound ingression due to the corrosive environment found in chemical processing. While carbon steel and basic stainless steel, such as 316s, 329s, and 400s, work well in oil & gas, water & wastewater treatment, pharmaceuticals, building & construction, and pulp and paper industries, more corrosion resistance is often required for these challenging service conditions.

Trunnion-mounted ball valves to dominate ball valves market during the forecast period.

Market for Trunnion-mounted ball valves to account for largest market share during the forecast period. The trunnion-mounted stem absorbs the thrust from the line pressure, avoiding excess friction between the ball and seats. Thus, the operation torque remains low at full pressure. Hence, trunnion-mounted ball valves are preferred over the floating and rising stem ball valves in several applications. This in turn, is expected to drive the growth of the market..

1”– 5” ball valves market to grow at significant rate during the forecast period.

Ball valves of size between 1” and 5” are the most widely manufactured valves. These valves are selected based on flow pressure, noise, media, and vibration. Flowserve Corporation (US), Velan Inc. (Canada), and Neway Valves (China), among others, manufacture these ball valves and supply them to various verticals such as oil & gas, water and wastewater, building and construction, and other general industries such as food & beverages, and pharmaceuticals.

Energy & power industry to offer highest growth opportunities for the ball valves market between 2022 and 2027.

The power sector is the largest industry for ball valves in the world. The energy & power industry utilizes ball valves for ensuring safety in critical applications. Coal is the most important energy source, covering ~37% of the global primary electricity generation. However, industry concerns regarding harmful emissions associated with coal-fired electricity generation are escalating; as a result, the industry is shifting toward renewable or clean and healthy energy.

Ball valves are used for stopping and starting the flow of the media, reducing or increasing flow, controlling flow, regulating flow or processing pressure, or relieving a pipe system from a certain pressure, and for a multitude of other functions. Increasing investments in power plants are driving the market for the energy & power industry.

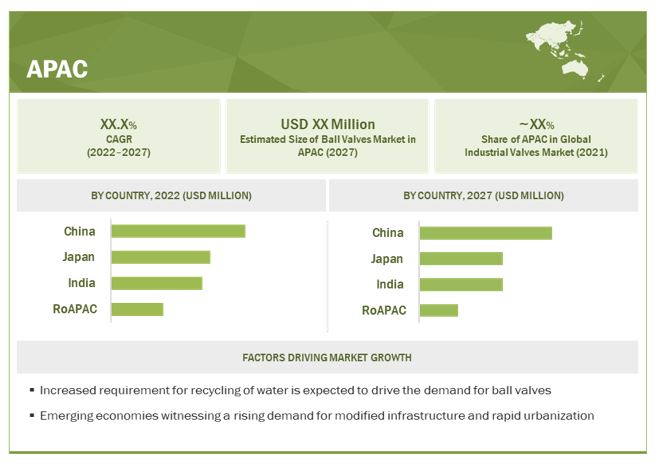

Ball valves market in Asia Pacific to register for largest share of ball valves market.

China is one of the most significant economies in Asia Pacific with a robust industrial base. Process industries, such as chemical production, petroleum refining, and public utilities, including electric power generation, are the major industries in this country. These industries require comprehensive control and monitoring, which are performed by control valves. Japan’s shortage of minerals and energy had a powerful influence on its energy & power industry.

New investment in the energy & power industry will drive the market in Japan during the forecast period. The growth of the market in India is fueled by the rising demand for power in diverse end-use industries, such as oil & gas, power, and petrochemicals. The demand for ball valves in the oil & gas industry in India is likely to be supported by the country’s offshore exploration push. .

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

A few of the key players in the ball valves companies are Emerson Electric Co. (US), Schlumberger (US), Flowserve Corporation (US), IMI plc (US), Valmet (Neles Corporation) (Finland), Spirax Sarco Limited (UK), Crane Co. (US), KITZ Corporation (Japan), Trillium Flow Technologies (US), Bray international (US), and Velan, Inc. (Canada).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Value | USD 13.0 Billion |

| Expected Value | USD 16.2 Billion |

| Growth Rate | CAGR of 4.5% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Geographies Covered |

|

| Market Leaders | Valmet (Neles Corporation) (Finland), Spirax Sarco Limited (UK), KITZ Corporation (Japan), and Velan, Inc. (Canada). |

| Top Companies in North America | Emerson Electric Co. (US), Schlumberger (US), Flowserve Corporation (US), IMI plc (US), Crane Co. (US), Trillium Flow Technologies (US), Bray international (US). |

| Key Market Driver | Rapid Industrialization, Urbanization, and Smart City Development |

|

Key Market Opportunity |

Technologies are expected to create growth for the ball valves market |

| Largest Growing Region | Asia Pacific |

| Highest Growth Opportunities | Energy & Power Industry |

| Highest CAGR Segment | Stainless Steel Ball Valves |

This research report categorizes the ball valves market, by material, type, size, end-user, and region

Based on material:

- Steel

- Cast Iron

- Cryogenic

- Alloy Based

- Others

Based on the types:

- Trunnion-mounted Ball Valves

- Floating Ball Valve

- Rising Stem Ball Valve

Based on the size:

- <1”

- 1”−5”

- 6”–24”

- 25”–50”

- >50

Based on industry:

- Oil & Gas

- Energy & Power

- Water & Wastewater Treatment

- Chemicals

- Building & Construction

- Pharmaceuticals

- Agriculture

- Metals & Mining

- Pulp & Paper

- Food & Beverages

- Others

Based on the region

- North America

- Europe

- APAC

- RoW (South America, Middle East & Africa)

Recent Developments

- In April 2022, Trillium Flow Technologies has announced that it has completed its acquisition of Termomeccanica Pompe Srl (Italy), an expert in highly engineered vertical turbine and split case pumps. The acquisition helps the company in global reach and allow further strengthening its legacy.

- In May 2022, Flowserve Corporation has got a contract to provide control and ball valves to OMV’s chemical recycling demonstration plant in the city of Schwechat, Austria.

- In March 2022, Flowserve Corporation has entered into an agreement with Gradiant (US), a global manufacturer and provider of cleantech water project for water treatment to help address the most challenging problems in water and wastewater treatment.

- In September 2021, KITZ corporation announced the acquisition of common shares of TOA Valve Engineering Inc. (Japan) and signed an agreement of capital and business alliance. This business alliance helps both the companies further boost their corporate value and expand their businesses by mutually sharing strategies, technologies, and strengths related to valves.

Frequently Asked Questions (FAQ):

Which are the major companies in the ball valves market? What are their major strategies to strengthen their market presence?

The major companies in the ball valves market are - Emerson Electric Co. (US), Schlumberger (US), Flowserve Corporation (US), IMI plc (US), Valmet (Neles Corporation) (Finland), Spirax Sarco Limited (UK are the key players in the ball valves market. Players in this market have adopted product launches and developments, expansions, acquisitions, and agreements strategies to increase their market share.

Which is the potential market for ball valves in terms of the region?

APAC held the largest share of the ball valves market in 2021. Rapid population growth and urbanization in developing economies such as China, Japan, and India have led to the growth of the energy & power, water & wastewater treatment, building & construction, chemicals, pharmaceuticals, and oil & gas industries.

What are the opportunities for new market entrants?

There are significant opportunities in the ball valves market application of 3D printing technology in valve manufacturing. The adoption of 3D printing technology in R&D activities and production processes can help in the quick release of designs, fast response to customer inquiries, and accurate weight estimation and prototyping.

Which end-user industries are expected to drive the growth of the market in the next five years?

Major end-user industries for the ball valves market include - oil & gas, water & wastewater treatment, energy & power, food & beverages, metals & mining, chemicals, pharmaceuticals, building & construction, pulp & paper, agriculture, and others. The textiles, glass, and semiconductor manufacturing industries are covered under the “others” category. Ball valves are mainly used in a wide array of process industries. Manufacturers across industries have realized the importance of advanced manufacturing equipment and solutions as they help connect all production processes, provide control over business processes, and enhance the efficiency of operations. Valves help keep control over the flow and pressure of elements used in the manufacturing processes.

Which type of valve is expected to hold the largest share of the market by 2027?

Trunnion-mounted ball valve is expected to hold the largest market share of the market by 2027. Trunnion-mounted ball valves are used for critical services in a variety of applications such as transmission and storage, gas processing, dryer sequence, compressor anti-surge, and others. Growth in energy consumption, new production technologies, demand for process safety, increasing focus on sustainability, and environmental regulations are likely to boost the trunnion ball valves market growth. Due to the unavailability of high-performance seat material, floating ball valves are mainly used in medium- or low-pressure applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3 STUDY SCOPE

FIGURE 1 BALL VALVES MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 BALL VALVES MARKET: RESEARCH DESIGN

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.2.1 Key data from secondary sources

2.1.3.1 Breakdown of primaries

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: DEMAND-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 7 BALL VALVES MARKET: 2018–2027 (USD BILLION)

FIGURE 8 STAINLESS STEEL TO CAPTURE LARGEST SHARE OF MARKET, BY MATERIAL, IN 2027

FIGURE 9 TRUNNION-MOUNTED BALL VALVES TO CAPTURE LARGEST SHARE OF MARKET, BY TYPE, IN 2027

FIGURE 10 1”−5” SIZED BALL VALES TO CAPTURE LARGEST SHARE OF MARKET, BY SIZE, IN 2022

FIGURE 11 ENERGY & POWER TO BE FASTEST-GROWING INDUSTRY DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 13 INCREASING DEMAND FOR SMART VALVES FROM OIL & GAS AND WATER & WASTEWATER TREATMENT IS DRIVING MARKET

4.2 MARKET, BY TYPE

FIGURE 14 TRUNNION-MOUNTED BALL VALVES TO HOLD LARGEST MARKET SHARE IN 2027

4.3 MARKET, BY MATERIAL

FIGURE 15 STAINLESS STEEL BALL VALVES TO HOLD LARGEST MARKET SHARE BY 2027

4.4 MARKET, BY SIZE

FIGURE 16 BALL VALVES SIZED FROM 1”−5” TO HOLD LARGEST SHARE OF MARKET BY 2027

4.5 MARKET IN ASIA PACIFIC, BY COUNTRY AND INDUSTRY

FIGURE 17 CHINA AND ENERGY & POWER TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2027

4.6 MARKET, BY COUNTRY

FIGURE 18 US TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 20 BALL VALVES MARKET: DRIVERS AND THEIR IMPACT

5.2.1.1 Growing need for replacement of outdated ball valves and adoption of smart valves

5.2.1.2 Rising focus on industrialization, urbanization, and smart city development

5.2.1.3 Increasing new nuclear power plant projects and upgrade of existing valves

5.2.2 RESTRAINTS

FIGURE 21 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.2.1 Lack of standardized norms and governing policies

5.2.3 OPPORTUNITIES

FIGURE 22 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Utilization of IIoT and digital transformation in industrial plants

5.2.3.2 Application of 3D printing technology in valve manufacturing

5.2.3.3 Focus of industry players on offering improved customer service

5.2.4 CHALLENGES

FIGURE 23 BALL VALVES MARKET: CHALLENGES AND THEIR IMPACT

5.2.4.1 Intense pricing pressure due to availability of local, low-priced valves

5.2.4.2 Rise in collaboration activities among industry players

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 RAW MATERIAL AND COMPONENT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS COLLECTIVELY ADD MAJOR VALUE TO PRODUCTS

5.4 BALL VALVES MARKET: ECOSYSTEM

FIGURE 25 MARKET: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 DIGITIZATION AND INTEGRATION OF ADVANCED TECHNOLOGIES, SUCH AS ARTIFICIAL INTELLIGENCE

5.5.2 IMPACT OF IOT ON MARKET

6 BALL VALVES MARKET, BY MATERIAL (Page No. - 59)

6.1 INTRODUCTION

FIGURE 26 MARKET, BY MATERIAL

FIGURE 27 STAINLESS STEEL BALL VALVES PROJECTED TO HOLD LARGEST SIZE OF MARKET IN 2027

TABLE 2 MARKET, BY MATERIAL, 2018–2021 (USD BILLION)

TABLE 3 MARKET, BY MATERIAL, 2022–2027 (USD BILLION)

6.2 STAINLESS STEEL

6.3 CAST IRON

6.3 CAST IRON

6.4 ALLOY-BASED

6.4 ALLOY-BASED

6.5 OTHERS

6.5 OTHERS

6.5.2 BRONZE

6.5.3 PLASTIC

7 BALL VALVES MARKET, BY TYPE (Page No. - 65)

7.1 INTRODUCTION

FIGURE 28 MARKET, BY TYPE

FIGURE 29 TRUNNION-MOUNTED BALL VALVES LIKELY TO HOLD LARGEST SIZE OF MARKET IN 2027

TABLE 4 MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 5 MARKET, BY TYPE, 2022–2027 (USD BILLION)

7.2 TRUNNION-MOUNTED BALL VALVES

7.3 FLOATING BALL VALVES

7.3 FLOATING BALL VALVES

7.4 RISING STEM BALL VALVES

7.4 RISING STEM BALL VALVES

8 BALL VALVES MARKET, BY SIZE (Page No. - 69)

8.1 INTRODUCTION

FIGURE 30 MARKET, BY SIZE

FIGURE 31 1”−5” VALVES TO HOLD LARGEST SIZE OF MARKET BY 2027

TABLE 6 MARKET, BY SIZE, 2018–2021 (USD MILLION)

TABLE 7 MARKET, BY SIZE, 2022–2027 (USD MILLION)

8.2 <1”

8.3 1”−5”

8.3 1”−5”

8.4 6”–24"

8.4 6”–24"

8.5 25”–50”

8.5 25”–50”

8.6 >50”

8.6 >50”

9 BALL VALVES MARKET, BY INDUSTRY (Page No. - 73)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY INDUSTRY

FIGURE 33 OIL & GAS INDUSTRY TO HOLD LARGEST SIZE OF MARKET BY 2027

TABLE 8 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 9 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2 OIL & GAS

TABLE 10 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 10 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 12 MARKET IN NORTH AMERICA FOR OIL & GAS INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 13 MARKET IN NORTH AMERICA FOR OIL & GAS INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 14 MARKET IN EUROPE FOR OIL & GAS INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 15 MARKET IN EUROPE FOR OIL & GAS INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 16 MARKET IN ASIA PACIFIC FOR OIL & GAS INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 17 MARKET IN ASIA PACIFIC FOR OIL & GAS INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 18 MARKET IN ROW FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MARKET IN ROW FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.3 ENERGY & POWER

TABLE 20 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 MARKET IN NORTH AMERICA FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 23 MARKET IN NORTH AMERICA FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 24 MARKET IN EUROPE FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 25 MARKET IN EUROPE FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 26 MARKET IN ASIA PACIFIC FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 27 MARKET IN ASIA PACIFIC FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 28 MARKET IN ROW FOR ENERGY & POWER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET IN ROW FOR ENERGY & POWER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.4 WATER & WASTEWATER TREATMENT

TABLE 30 BALL VALVES MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 MARKET IN NORTH AMERICA FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 MARKET IN NORTH AMERICA FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 MARKET IN EUROPE FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 35 MARKET IN EUROPE FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 36 MARKET IN ASIA PACIFIC FOR WATER & WASTEWATER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET IN ASIA PACIFIC FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 MARKET IN ROW FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET IN ROW FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.5 CHEMICAL

TABLE 40 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 MARKET IN NORTH AMERICA FOR CHEMICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 MARKET IN NORTH AMERICA FOR CHEMICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 44 MARKET IN EUROPE FOR CHEMICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 45 MARKET IN EUROPE FOR CHEMICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 46 MARKET IN ASIA PACIFIC FOR CHEMICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 47 MARKET IN ASIA PACIFIC FOR CHEMICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 MARKET IN ROW FOR CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET IN ROW FOR CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.6 BUILDING & CONSTRUCTION

TABLE 50 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 MARKET IN EUROPE FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MARKET IN EUROPE FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 MARKET IN ASIA PACIFIC FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 MARKET IN ASIA PACIFIC FOR BUILDING & CONSTRUCTION INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 MARKET IN ROW FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MARKET IN ROW FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.7 PHARMACEUTICAL

TABLE 60 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MARKET IN NORTH AMERICA FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 MARKET IN NORTH AMERICA FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 64 MARKET IN EUROPE FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 MARKET IN EUROPE FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET IN ASIA PACIFIC FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET IN ASIA PACIFIC FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET IN ROW FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MARKET IN ROW FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.8 AGRICULTURE

TABLE 70 BALL VALVES MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET FOR AGRICULTURE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 MARKET IN NORTH AMERICA FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 MARKET IN EUROPE FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 MARKET IN EUROPE FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 MARKET IN ASIA PACIFIC FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN ASIA PACIFIC FOR AGRICULTURE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 MARKET IN ROW FOR AGRICULTURE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 MARKET IN ROW FOR AGRICULTURE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.9 METALS & MINING

TABLE 80 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA FOR METALS & MINING INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA FOR METALS & MINING INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 MARKET IN EUROPE FOR METALS & MINING INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 MARKET IN EUROPE FOR METALS & MINING INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 MARKET IN ASIA PACIFIC FOR METALS & MINING INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 MARKET IN ASIA PACIFIC FOR METALS & MINING INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 MARKET IN ROW FOR METALS & MINING INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 MARKET IN ROW FOR METALS & MINING INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.10 PULP & PAPER

TABLE 90 BALL VALVES MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 MARKET IN NORTH AMERICA FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN NORTH AMERICA FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 MARKET IN EUROPE FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN EUROPE FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN ASIA PACIFIC FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN ASIA PACIFIC FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 MARKET IN ROW FOR PULP & PAPER INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 MARKET IN ROW FOR PULP & PAPER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.11 FOOD & BEVERAGE

TABLE 100 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 102 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 MARKET IN EUROPE FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 MARKET IN EUROPE FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 MARKET IN ASIA PACIFIC FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 MARKET IN ASIA PACIFIC FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 MARKET IN ROW FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 MARKET IN ROW FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.12 OTHERS

TABLE 110 MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 111 MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 112 MARKET IN NORTH AMERICA FOR OTHER INDUSTRIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 MARKET IN NORTH AMERICA FOR OTHER INDUSTRIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 MARKET IN EUROPE FOR OTHER INDUSTRIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 MARKET IN EUROPE FOR OTHER INDUSTRIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 MARKET IN ASIA PACIFIC FOR OTHER INDUSTRIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 MARKET IN ASIA PACIFIC FOR OTHER INDUSTRIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 118 MARKET IN ROW FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 MARKET IN ROW FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

10 BALL VALVES MARKET, BY REGION (Page No. - 118)

10.1 INTRODUCTION

FIGURE 34 MARKET: GEOGRAPHIC SNAPSHOT

TABLE 120 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 35 ASIA PACIFIC TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

10.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: BALL VALVES MARKET SNAPSHOT

TABLE 122 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 123 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 125 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Fastest-growing market in North America

10.2.2 CANADA

10.2.2.1 Rising energy demand to augment market growth in coming years

10.2.3 MEXICO

10.2.3.1 Holds modest growth opportunities for market

10.3 EUROPE

FIGURE 37 EUROPE: BALLS VALVES MARKET SNAPSHOT

TABLE 126 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 127 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 128 MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 129 MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Water & wastewater treatment industry to favor market growth

10.3.2 GERMANY

10.3.2.1 Export of ball valves in developing countries to drive market

10.3.3 FRANCE

10.3.3.1 Investments in power generation technologies to boost market growth

10.3.4 ITALY

10.3.4.1 Planned investments for water & wastewater treatment industry to accelerate market

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: BALL VALVES MARKET SNAPSHOT

TABLE 130 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 131 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 132 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 133 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to continue to hold largest share of market during forecast period

10.4.2 JAPAN

10.4.2.1 Reintegration of nuclear power plants to boost market growth

10.4.3 INDIA

10.4.3.1 Rising power demand from different industries driving power industry, thereby boosting market growth

10.4.4 SOUTH KOREA

10.4.4.1 Demand from semiconductor and chemical industries driving market

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

TABLE 134 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 135 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 136 MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 137 MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Oil & gas industry to foster market growth

10.5.2 SOUTH AMERICA

10.5.2.1 Market projected to register slower growth compared with other regions during forecast period

10.5.3 AFRICA

10.5.3.1 Oil and gas companies to create demand for ball valves in Africa in coming years

11 COMPETITIVE LANDSCAPE (Page No. - 136)

11.1 INTRODUCTION

11.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 39 TOP 5 PLAYERS IN MARKET, 2017–2021

11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

FIGURE 40 BALL VALVES MARKET: MARKET SHARE ANALYSIS (2021)

11.4 COMPANY EVALUATION QUADRANT, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 41 BALL VALVES MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5 COMPETITIVE SCENARIOS AND TRENDS

11.5.1 PRODUCT LAUNCHES

TABLE 138 MARKET: PRODUCT LAUNCHES, JANUARY 2021−MARCH 2022

11.5.2 DEALS

TABLE 139 MARKET: DEALS, JUNE 2021−APRIL 2022

11.5.3 OTHERS

TABLE 140 MARKET: OTHERS, APRIL 2022

12 COMPANY PROFILES (Page No. - 143)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, Product launches, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats)*

12.1.1 EMERSON ELECTRIC CO.

TABLE 141 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 42 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 142 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

12.1.2 FLOWSERVE CORPORATION

TABLE 143 FLOWSERVE CORPORATION: BUSINESS OVERVIEW

FIGURE 43 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

TABLE 144 FLOWSERVE CORPORATION: PRODUCT OFFERINGS

12.1.3 SCHLUMBERGER LIMITED

TABLE 145 SCHLUMBERGER LIMITED: BUSINESS OVERVIEW

FIGURE 44 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

TABLE 146 SCHLUMBERGER LIMITED: PRODUCT OFFERINGS

12.1.4 IMI PLC

TABLE 147 IMI PLC: BUSINESS OVERVIEW

FIGURE 45 IMI PLC: COMPANY SNAPSHOT

TABLE 148 IMI PLC: PRODUCT OFFERINGS

12.1.5 VALMET (NELES CORPORATION)

TABLE 149 VALMET: BUSINESS OVERVIEW

FIGURE 46 VALMET (NELES CORPORATION): COMPANY SNAPSHOT

TABLE 150 VALMET (NELES CORPORATION): PRODUCT OFFERINGS

12.1.6 BRAY INTERNATIONAL

TABLE 151 BRAY INTERNATIONAL: BUSINESS OVERVIEW

TABLE 152 BRAY INTERNATIONAL: PRODUCT OFFERINGS

12.1.7 CRANE CO.

TABLE 153 CRANE CO.: BUSINESS OVERVIEW

TABLE 154 CRANE CO.: PRODUCT OFFERINGS

12.1.8 KITZ CORPORATION

TABLE 155 KITZ CORPORATION: BUSINESS OVERVIEW

FIGURE 48 KITZ CORPORATION: COMPANY SNAPSHOT

TABLE 156 KITZ CORPORATION: PRODUCT OFFERINGS

12.1.9 NEWAY VALVES CO. LTD.

TABLE 157 NEWAY VALVES CO. LTD.: BUSINESS OVERVIEW

TABLE 158 NEWAY VALVE CO., LTD.: PRODUCT OFFERINGS

12.1.10 SPIRAX SARCO LIMITED

TABLE 159 SPIRAX SARCO LIMITED: BUSINESS OVERVIEW

FIGURE 49 SPIRAX SARCO LIMITED: COMPANY SNAPSHOT

TABLE 160 SPIRAX SARCO LIMITED: PRODUCT OFFERINGS

12.1.11 TRILLIUM FLOW TECHNOLOGIES (WEIR FLOW CONTROL)

TABLE 161 TRILLIUM FLOW TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 162 TRILLIUM FLOW TECHNOLOGIES: PRODUCT OFFERINGS

12.1.12 VELAN INC.

TABLE 163 VELAN INC.: BUSINESS OVERVIEW

FIGURE 50 VELAN INC.: COMPANY SNAPSHOT

TABLE 164 VELAN INC.: PRODUCT OFFERINGS

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Product launches, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ALFA LAVAL

TABLE 165 ALFA LAVAL: BUSINESS OVERVIEW

12.2.2 APOLLO VALVES

TABLE 166 APOLLO VALVES: BUSINESS OVERVIEW

12.2.3 AVCON CONTROLS PVT LTD.

TABLE 167 AVCON CONTROLS PVT LTD.: BUSINESS OVERVIEW

12.2.4 AVK HOLDING A/S

TABLE 168 AVK HOLDING A/S: BUSINESS OVERVIEW

12.2.5 DWYER INSTRUMENTS LLC.

TABLE 169 DWYER INSTRUMENTS LLC.: BUSINESS OVERVIEW

12.2.6 FORBES MARSHALL

TABLE 170 FORBES MARSHALL: BUSINESS OVERVIEW

12.2.7 HAM-LET GROUP

TABLE 171 HAM–LET GROUP: BUSINESS OVERVIEW

12.2.8 KLINGER HOLDING

TABLE 172 KLINGER HOLDING: BUSINESS OVERVIEW

12.2.9 PARKER-HANNIFIN CORPORATION

TABLE 173 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

12.2.10 POWELL VALVES

TABLE 174 POWELL VALVES: BUSINESS OVERVIEW

12.2.11 SAMSON AKTIENGESELLSCHAFT

TABLE 175 SAMSON AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

12.2.12 SWAGELOK COMPANY

TABLE 176 SWAGELOK COMPANY: BUSINESS OVERVIEW

12.2.13 XHVAL VALVE CO., LTD.

TABLE 177 XHVAL VALVE CO., LTD.: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKET (Page No. - 190)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 INDUSTRIAL VALVES MARKET, BY FUNCTION

TABLE 178 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2017–2020 (USD BILLION)

TABLE 179 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2021–2026 (USD BILLION)

13.3.1 ON/OFF VALVES

13.3.1.1 On/Off valves accounted for larger market share in 2020

13.3.2 CONTROL VALVES

13.3.2.1 Control valves to witness significant growth during forecast period

14 APPENDIX (Page No. - 193)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the ball valves market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the ball valves market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the ball valves industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the ball valves market based on function, material, size, type, component, end-user industry, and region. It also includes information about the key developments undertaken from both markets- and technology-oriented perspectives.

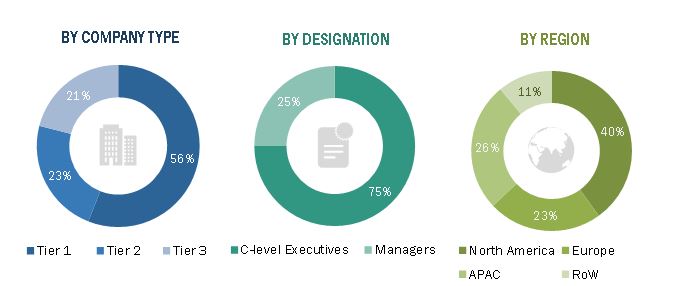

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the ball valves market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the ball valves market.

- Identifying various manufacturing companies that use or are expected to implement ball valves at their production lines and analyzing their implementation patterns

- Estimating the size of the ball valves market based on the demand for ball valves from manufacturing companies in different industries

- Conducting primaries with a few major players operating in the ball valve market for validating the global size of the market

- Validating the market size through secondary sources, including company websites, press releases, research journals, and magazines

- Calculating the CAGR of the ball valve market through historical and future market trend analyses by understanding the industry penetration rate of various types of ball valves and their demand and supply scenario for different industries

- Verifying and cross-checking the estimates at every level through discussions with key opinion leaders such as corporate executives, directors, and sales heads, as well as with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the ball valves market.

- Information related to revenues obtained from key manufacturers and providers of ball valves was studied and analyzed to estimate the global size of the ball valve market.

- Revenues, geographic presence, key industries served, and the different types of offerings of all identified players in the ballvalve market were studied to estimate and arrive at the percentage split of the different segments of the market.

- All major players in each category (type and material) of the ball valve market were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions were conducted with key opinion leaders of all major companies involved in the development of ball valves to validate the market split based on material, size, type, end-user industry, and region.

- Geographic splits were estimated using secondary sources based on various factors, such as the number of players ball valves in a specific country or region and the type of ball valves offered by these players.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the ball valves market.

Report Objectives

- To describe and forecast the ball valves market size, by material, type, size, end-user industry, and geography, in terms of value

- To describe and forecast the market size for various segments with regard to 4 main regions—North America, Asia Pacific (APAC), Europe, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete ball valves value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile key players and provide details of the current competitive landscape

- To analyze strategic approaches adopted by players in the market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ball Valves Market

We are launching a new indigenous valve, which has potential to disrupt the Ball valve/ gate valve industrial market. more specifically in pressure rating - class 1500 and above. we would like to understand the potential market for our product with respect to ball/gate valve.

I want Market forecast & opportunities in Ball valves upto 60 Inch size. Also need to know which type of Valve will have good market in future for pharmaceutical industry.

is there a link or document that can provide the annual procurement for ball valves in the USA market ?